Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess the Commonwealth's administration of the Automotive Competitiveness and Investment Scheme (ACIS) . The audit reviewed program governance, scheme promotion and registration, management of credit allocations, and compliance processes.

The audit objective was to assess the effectiveness of the Department of Human Services’ administration of the Assistance for Isolated Children Scheme.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether the National Library of Australia and National Film and Sound Archive (NFSA) have implemented effective collection management practices.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of Creative Australia’s fraud and corruption control arrangements.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether Civil Aviation Safety Authority has effective arrangements to comply with domestic and international travel legislative and entity requirements.

Please direct enquiries through our contact page.

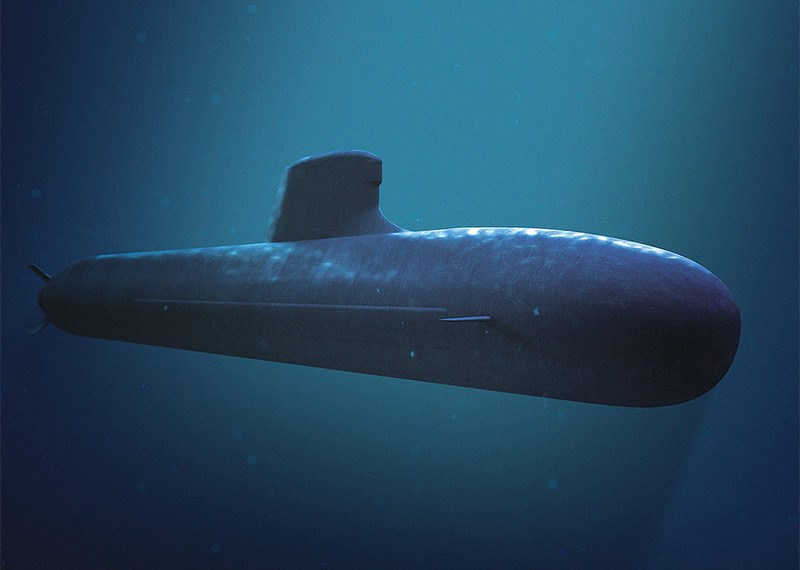

The audit objective was to examine the effectiveness of the Department of Defence's administration of the Future Submarine Program to date.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of controls being implemented and/or developed by the National Disability Insurance Agency (NDIA) to ensure National Disability Insurance Scheme (NDIS) access decisions are consistent with legislative and other requirements.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to review the operation of the ATO's Tax Agent and Business Portals. In conducting the audit the ANAO examined three key areas: governance – the governance arrangements supporting ongoing management of the Portals; portals development, user satisfaction and realisation of expected benefits – the ATO's processes for involving users in developing the Tax Agent and Business Portals, assessing user satisfaction, and evaluating business benefits arising from uptake of the Portals; and information technology (IT) security and user access controls – the ATO's IT security environment and user access controls supporting the operation of the Tax Agent and Business Portals.

The report objective is to provide the Auditor-General’s independent assurance over the status of 30 selected Major Projects, as reflected in the Statement by the Chief Executive Officer Defence Materiel Organisation (DMO), and the Project Data Summary Sheets prepared by the DMO, in accordance with the Guidelines endorsed by the Joint Committee of Public Accounts and Audit.

The objective of this audit was to assess the effectiveness of the Australian Taxation Office’s (ATO) and Treasury’s management of compliance with foreign investment obligations for residential real estate.

Please direct enquiries through our contact page.