Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Report on Key Financial Controls of Major Entities

Please direct enquiries through our contact page.

Summary

Introduction

1. This report presents the results of the interim phase of the ANAO’s 2024–25 financial statements audits. The results include the ANAO’s assessment of the effectiveness of internal controls in 27 of the largest Australian Government sector entities.

2. The assessments included in this report are as at 31 March 2025 and the entity names, responsibilities and portfolio allocations used in this report reflect the Administrative Arrangements Orders (AAOs) in place as at that date. Revised AAOs were made on 13 May 2025.

Interim audit results

3. At the completion of the interim audits for the 27 entities included in this report, the key elements of internal control were assessed as operating effectively for 13 entities. For the remaining 14 entities, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement, except for particular finding/s outlined in Chapter 4 of this report.

4. In three entities where significant audit findings were identified these findings reduced the level of confidence and assurance that could be placed on key elements of internal control. These significant audit findings related to compliance and quality assurance frameworks, and legislative breaches. These entities were the Department of Health and Aged Care, the Department of Social Services, and Services Australia (refer to paragraphs 2.10 to 2.11 and Chapter 4).

Interim audit findings

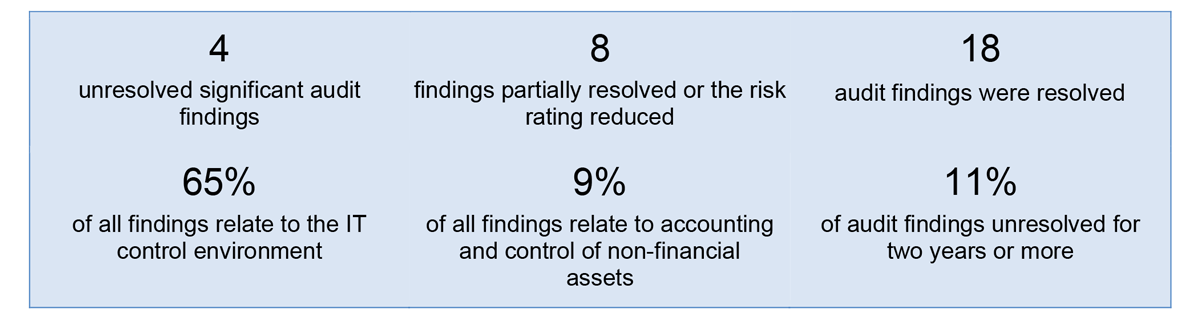

5. A total of 118 findings were reported to the entities included in this report at the conclusion of 2024–25 interim audits, comprising: 4 significant, 31 moderate, and 83 minor.

6. Seventy-eight per cent of audit findings reported at the 2024–25 interim phase were findings that were first raised in earlier financial years. Entities should take action to address outstanding audit findings in a manner which is timely and commensurate with the level of risk identified (refer to paragraphs 2.18 to 2.21).

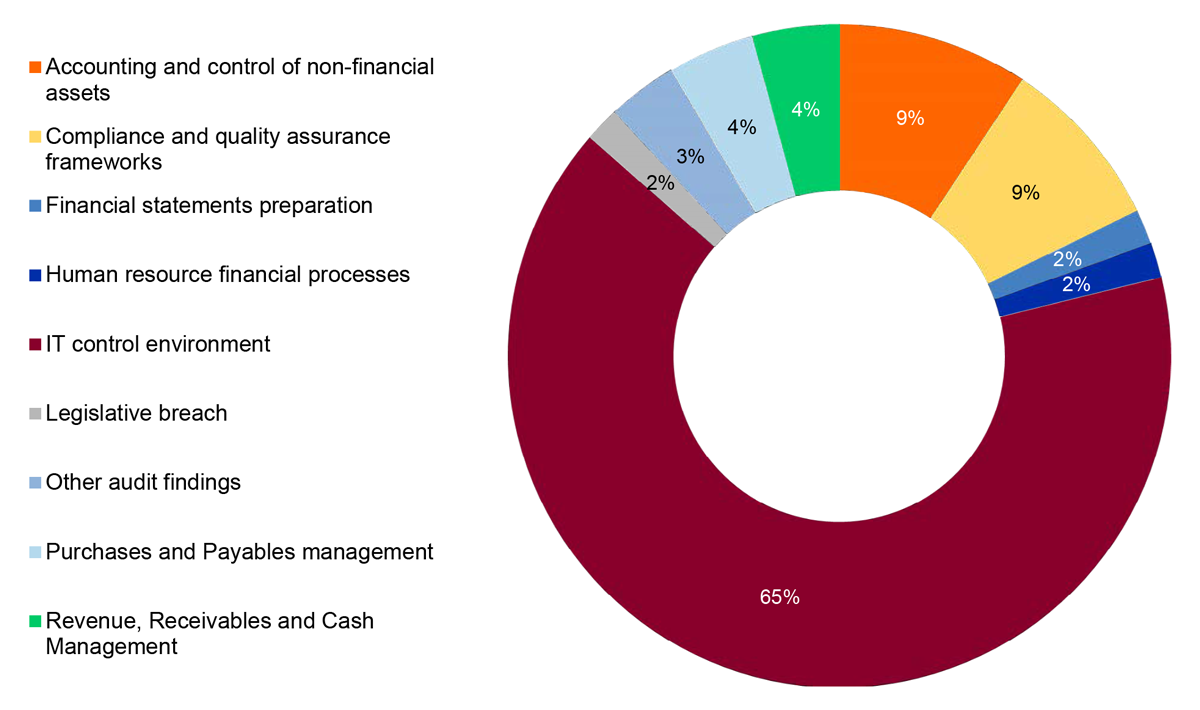

7. Sixty-five per cent of all findings related to the IT control environment (2023–24: 65 per cent), including the removal of user access on termination, assignment of user access and monitoring of privileged user activities. The number of findings identified by the ANAO indicate that there remains substantial room for improvement across the sector to enhance governance processes supporting the design, implementation and operating effectiveness of IT security controls.

8. Eight significant or moderate audits findings were reduced to minor audit findings to reflect action taken by entities to reduce the associated risk. One significant finding and five moderate findings were reassessed to minor findings.

9. Maturing financial reporting processes across the Australian Government sector continue to be observed through the ANAO’s financial statements audits. Effective audit committees, internal governance arrangements and financial reporting functions support the effective preparation of annual financial statements, providing accountability and transparency over the financial management of those entities.

1. Introduction

Introduction

1.1 The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Australian Government entities, drawing on information collected during our audits. This report is the first of the two reports for the 2024–25 financial statements audits. It focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls.

Entities included in this report

1.2 This report examines 27 of the largest Australian Government entities, across the General Government Sector (GGS)1, Public Non-Financial Corporation (PNFC)2 sector and Public Financial Corporation (PFC)3 sector. Collectively, these 27 entities contribute to 95 per cent of the Australian Government’s assets, liabilities, income and expenditure, and deliver diverse and essential services to the Australian community.

1.3 The assessments included in this report are as at 31 March 2025 and the entity names, responsibilities and portfolio allocations used in this report reflect the Administrative Arrangements Orders (AAOs) in place as at that date.4 Revised AAOs were made on 13 May 2025.5 Table 1.1 details the 27 entities6 included in this report.

Table 1.1: Entities included in this report, reflecting the AAOs in place at 31 March 2025

|

Portfolio |

Entity |

Sector |

Type of entity |

|

Agriculture, Fisheries and Forestry |

Department of Agriculture, Fisheries and Forestry |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Attorney-General’s |

Attorney-General’s Department |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Climate Change, Energy, the Environment and Water |

Department of Climate Change, Energy, the Environment and Water |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Snowy Hydro Limited |

Public Non-financial Corporation Sector |

Commonwealth Company |

|

|

Defence |

Department of Defence |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Department of Veterans’ Affairs |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

|

Education |

Department of Education |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Employment and Workplace Relations |

Department of Employment and Workplace Relations |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Finance |

Department of Finance |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Future Fund Management Agency |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

|

Foreign Affairs and Trade |

Department of Foreign Affairs and Trade |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Health and Aged Care |

Department of Health and Aged Care |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Home Affairs |

Department of Home Affairs |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Industry, Science, and Resources |

Department of Industry, Science and Resources |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Infrastructure, Transport, Regional Development, Communications and the Arts |

Department of Infrastructure, Transport, Regional Development, Communications and the Arts |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Australian Postal Corporation |

Public Non-financial Corporation Sector |

Corporate Commonwealth Entity |

|

|

NBN Co Limited |

Public Non-financial Corporation Sector |

Commonwealth Company |

|

|

Parliamentary Departments |

Department of Parliamentary Services |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Prime Minister and Cabinet |

Department of the Prime Minister and Cabinet |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

National Indigenous Australians Agency |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

|

Social Services |

Department of Social Services |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

Services Australia |

General Government Sector |

Non-Corporate Commonwealth Entity |

|

|

National Disability Insurance Agency |

General Government Sector |

Corporate Commonwealth Entity |

|

|

Treasury |

Department of the Treasury |

General Government Sector |

Corporate Commonwealth Entity |

|

Australian Office of Financial Management |

General Government Sector |

Corporate Commonwealth Entity |

|

|

Australian Taxation Office |

General Government Sector |

Corporate Commonwealth Entity |

|

|

Reserve Bank of Australia |

Public financial Corporation Sector |

Corporate Commonwealth Entity |

|

Source: Department of Finance, PGPA Act Flipchart and List, Finance, March 2025, available from https://www.finance.gov.au/government/managing-commonwealth-resources/structure-australian-government-public-sector/pgpa-act-flipchart-and-list [accessed 31 March 2025].

ANAO Financial Statements Audits

1.4 The Auditor-General Act 1997 establishes the mandate for the Auditor-General to undertake financial statement audits of all Australian Government entities.

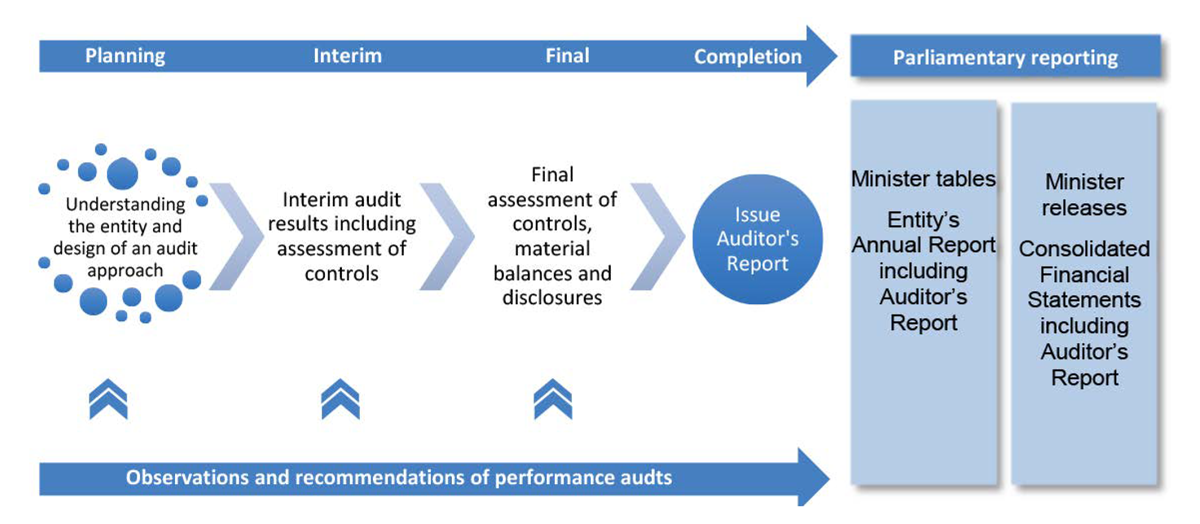

1.5 The ANAO conducts its financial statements audits in four phases: planning, interim, final and completion. Figure 1.1 outlines the key elements of each phase.

Figure 1.1: ANAO financial statements audit process

Source: ANAO data.

1.6 This report focuses on the results of the interim audit phase of 27 entities including an assessment of key internal controls supporting the preparation of 2024–25 financial statements. The assessment includes a review of the governance arrangements related to entities’ financial reporting responsibilities and the design and implementation of key internal controls relating to significant business processes.

Engagement Risk

1.7 The ANAO assesses engagement risk for each audited entity on an annual basis. Engagement risk includes the risks of material misstatement relating to a financial statements audit engagement, and other professional risks such as reputational and litigation risks. The determination of engagement risk provides a basis to assess whether additional quality management responses, in accordance with the Auditing Standards, are required.

1.8 Seven of the 27 entities included in this report have been assessed as having a high engagement risk for 2024–25 (2023–24: seven entities).

Key Areas of Financial Statements Risk

1.9 The ANAO’s risk assessment process identifies key areas that have the potential to materially impact an entity’s financial statements. The ANAO’s risk assessment process considers the nature of the financial statements items, the results of recent ANAO performance audits and an understanding of the entity’s environment and governance arrangements, including its financial reporting regime and system of internal control.

1.10 The ANAO undertakes appropriate audit procedures on all material items and focusses audit effort on those areas that are assessed as having a higher risk of material misstatement. The ANAO also assesses the IT general and application controls for key systems that support the preparation of an entity’s financial statements.

Audit Findings

1.11 Audit findings are raised in response to the identification of a potential business or financial risk posed to an entity. Weaknesses in internal controls increase the possibility that a material misstatement of an entity’s financial statements will not be prevented or detected in a timely manner. The ANAO rates audit findings according to the potential business or financial management risk posed to the entity. The rating scale is presented in Table 1.2.

Table 1.2: Findings rating scale

|

Rating |

Description |

|

Significant (A) |

Issues that pose a significant business or financial management risk to the entity. These include issues that could result in a material misstatement of the entity’s financial statements. |

|

Moderate (B) |

Issues that pose a moderate business or financial management risk to the entity. These may include prior year issues that have not been satisfactorily addressed. |

|

Minor (C) |

Issues that pose a low business or financial management risk to the entity. These may include accounting issues that, if not addressed, could pose a moderate risk in the future. |

|

Significant legislative breach (L1) |

Instances of significant potential or actual breaches of the Constitution; and instances of significant non-compliance with the entity’s enabling legislation, legislation that the entity is responsible for administering, and the PGPA Act. |

|

Other non-compliance with legislation (L2) |

Other instances of non-compliance with legislation the entity is required to comply with. |

|

Non-compliance with subordinate legislation (L3) |

Instances of non-compliance with subordinate legislation, such as the PGPA Rule. |

Source: ANAO reporting policy.

2. Interim audit results

Background

2.1 The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits.

2.2 This report is the first of the two reports and focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2024–25 financial statements audits. This report examines 27 entities, including: all departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the Australian Government Consolidated Financial Statements.

2.3 The assessments and the entity names, responsibilities and portfolio allocations used in this report reflect the Administrative Arrangements Orders (AAOs) in place as at 31 March 2025.7 Revised AAOs were made on 13 May 2025.8

2.4 Deficiencies identified during the interim audits that pose a significant or moderate risk to entities’ ability to prepare financial statements free from material misstatements are presented in this report. Entities’ actions that have fully or partially addressed a significant or moderate risk audit finding and other observations of good practices supporting the preparation of financial statements are also highlighted.

Snapshot

2.5 For the 27 entities included in this report, the ANAO has identified the following.

Figure 2.1: Key matters identified in this report

Source: ANAO analysis.

Audit findings

2.6 Audit findings are raised when the ANAO identifies business or financial risks affecting an entity. Often these risks arise from deficiencies within an entity’s internal control processes or frameworks.

2.7 Audit findings identified by the ANAO reflect the ANAO’s risk-based audit approach and are in response to an entity’s operating environment, which can change over time. The ANAO’s rating scale is presented in Chapter 1 at Table 1.3.

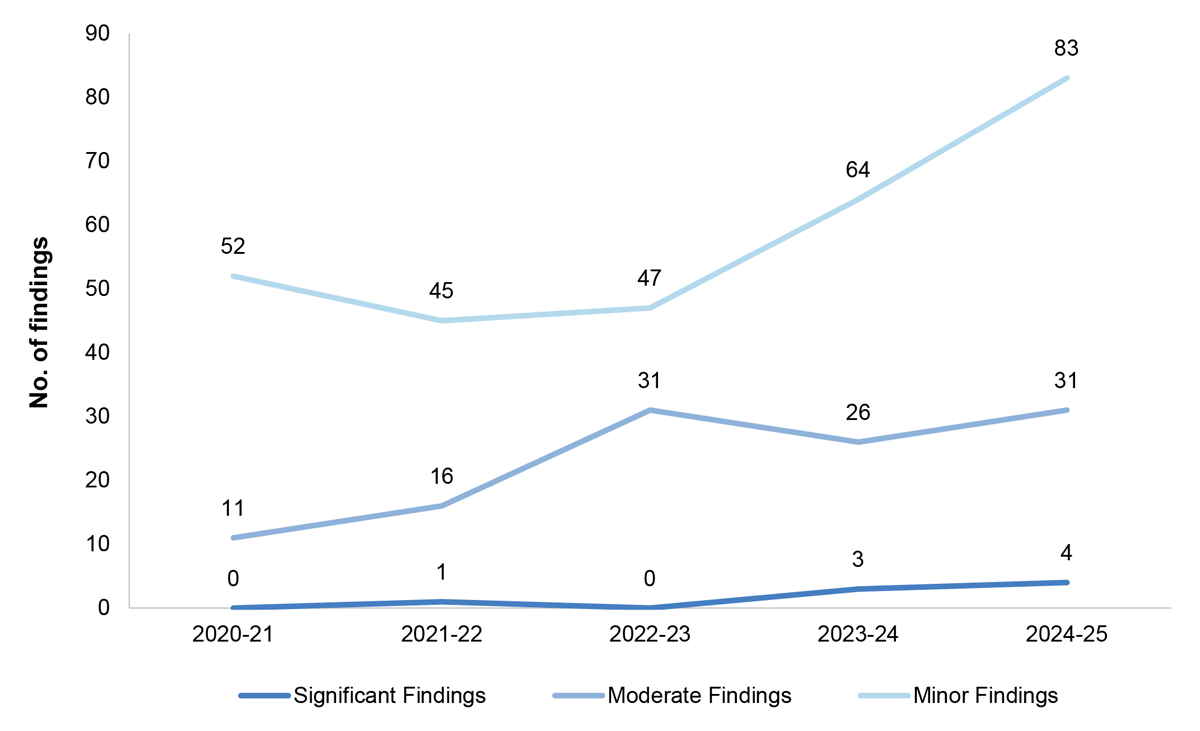

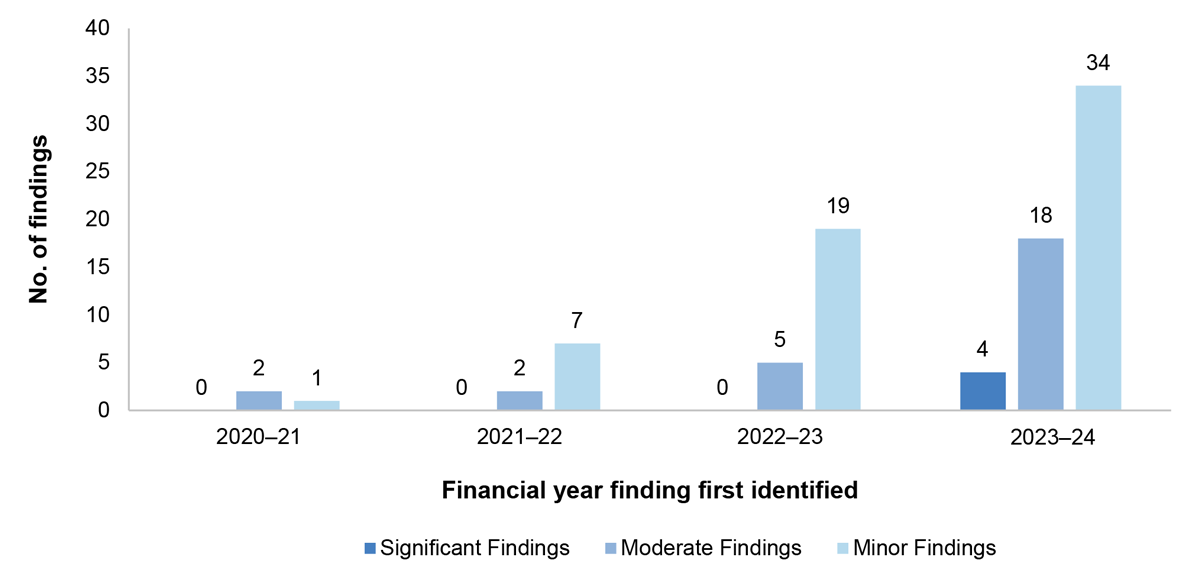

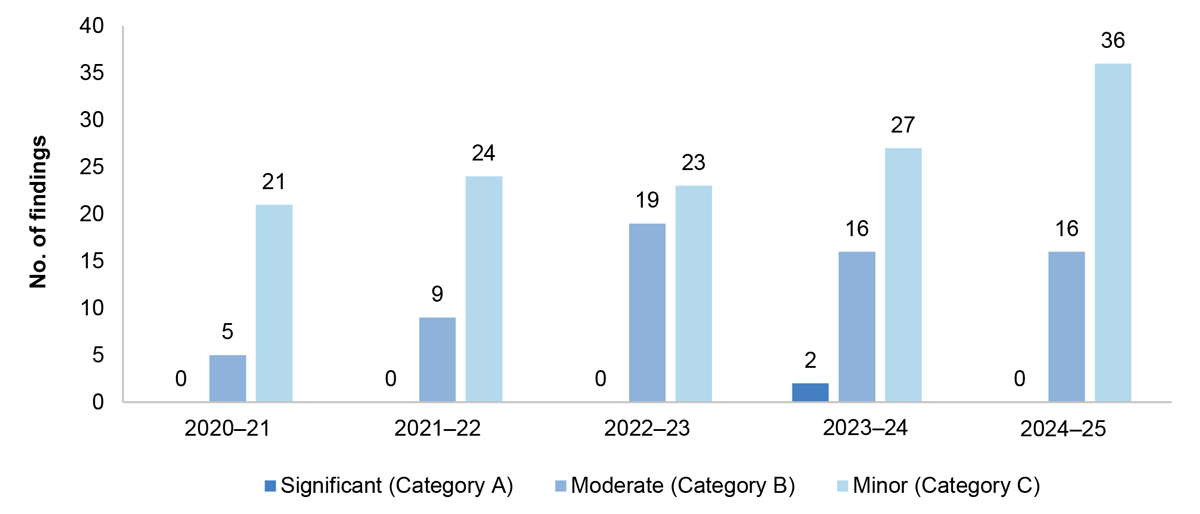

2.8 Figure 2.2 shows a summary of all significant, moderate, minor and legislative findings identified by the ANAO at the completion of the interim audit phase for the period 2020–21 to 2024–25. For the 2020–21 and 2021–22 reporting periods this covered 25 entities. The 2022–23, 2023–24 and 2024–25 reporting periods covers 27 entities. A total of 118 findings are being reported by the ANAO at the 2024–25 interim audit phase (2023–24: 93).

Figure 2.2: Aggregate audit findings 2020–21 to 2024–25

Source: Compilation of ANAO interim audit findings.

2.9 Figure 2.3 shows unresolved findings by category at the conclusion of the 2024–25 interim audit.

Figure 2.3: Percentage of audit findings by category at the completion of 2024–25 interim audits

Source: ANAO data.

Significant audit findings

2.10 Significant audit findings indicate issues that pose a significant business or financial management risk to the entity or are instances of significant non-compliance with legislation. This includes issues that could result in a material misstatement of the entity’s financial statements.

2.11 There were four unresolved significant audit findings at the conclusion of the 2024–25 interim audit phase for the entities included in this report (see Table 2.1). Details of these significant audit findings are included in Chapter 4.

Table 2.1: Unresolved significant audit findings

|

Entity |

First identified |

Type of finding |

Description |

|

Department of Health and Aged Care |

2023–24 |

Compliance and quality assurance frameworks |

Risk assessments relating to compliance with legislation. |

|

Department of Social Services |

2023–24 |

Significant legislative breach |

Matters relating to income apportionment in the calculation of social security payments. |

|

Services Australia |

2023–24 |

Compliance and quality assurance frameworks |

Compliance with legislative requirements for the identification and recovery of debts relating to Medicare Compensation Recovery. |

|

Services Australia |

2023–24 |

Significant legislative breach |

Breach of, and inconsistent application of, legislation that Services Australia is responsible for administering. |

Source: ANAO data.

IT control environment

2.12 IT control environment findings continue to represent the highest proportion of all findings identified by the ANAO in financial statements audits. Findings related to the IT control environment represent 66 per cent of total findings identified during the completion of the 2024–25 interim audits.

2.13 IT control environment findings relate mostly to IT security. IT security is concerned with protecting an entity’s information assets from internal and external threats and includes controls to prevent or detect unauthorised access to systems, programs and data.

2.14 Further information on IT control environment findings and observations identified by the ANAO are included in Chapter 3.

Accounting and control of non-financial assets

2.15 Australian Government entities manage a unique suite of non-financial assets which includes the Australian Government’s holdings of land and buildings, plant, equipment and infrastructure, heritage and cultural assets, investment properties and intangibles.

2.16 The entities included in this report manage approximately 95 per cent ($285.1 billion)9 of the Australian Government’s non-financial assets, including specialised military equipment, water entitlements, communications, electricity and transport infrastructure, and computer software.

2.17 At the conclusion of the 2024–25 interim audits, the ANAO is observing that the management of non-financial assets is an emerging issue across the sector. Nine per cent of findings identified by the ANAO relate to the accounting and control of non-financial assets, reflecting the ANAO’s risk-based audit approach and response to an entity’s operating environment.

Unresolved findings

2.18 Unresolved audit findings are those findings that have been identified by the ANAO in previous audits and are yet to be resolved. When reporting an audit finding to an entity the ANAO details the implications, risk and recommendations to the entity for resolution.

2.19 Each audit finding reported is classified by the level of risk that may be posed to the entity, or the entity’s financial statements, if unaddressed. As a result, entities should take action to address unresolved audit findings, and the weakness in internal control identified, in a timely manner which is commensurate with the level of risk identified.

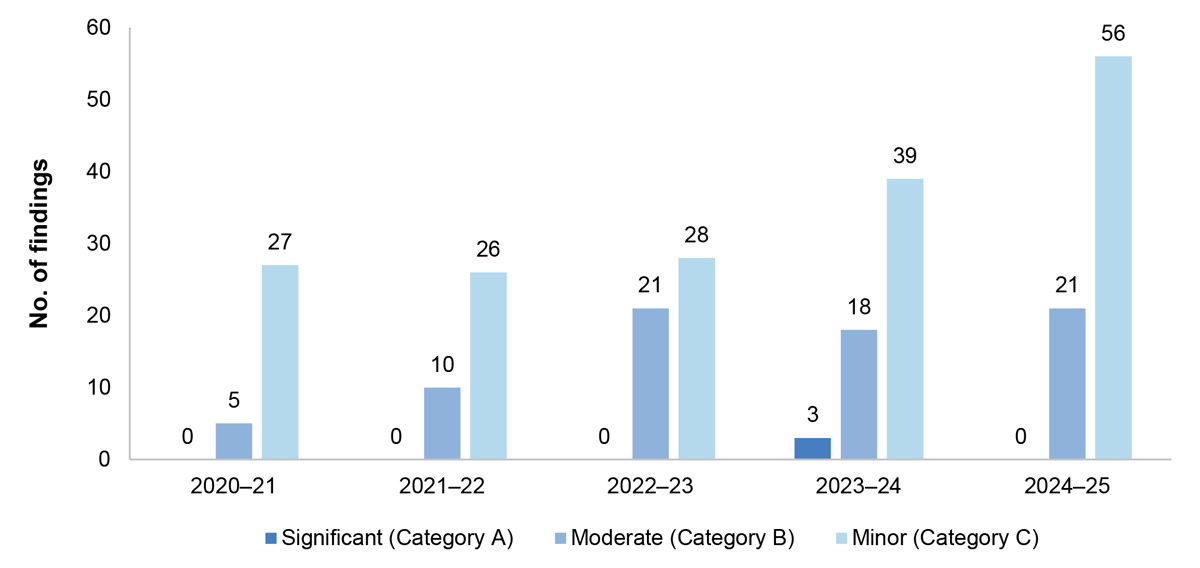

2.20 Seventy-eight per cent of audit findings (92 findings) reported at the 2024–25 interim phase were findings unresolved from prior audits.

2.21 Figure 2.4 provides an analysis of the period in which the 92 unresolved audit findings were first identified by ANAO. Of the unresolved findings three per cent were first identified in 2020–21, ten per cent in 2021–22, 26 per cent in 2022–23, and 61 per cent in 2023–24.

Figure 2.4: Number of unresolved audit findings by period first identified by the ANAO

Source: ANAO data.

Audit findings partially resolved, or the risk rating reduced

2.22 The ANAO may reassess the associated risk rating attributed to an audit finding when significant progress has been made to address the risks identified, and the reassessed risk rating better represents the overall risk to an entity.

2.23 During the 2024–25 interim audit, the ANAO reassessed eight significant or moderate audit findings by reducing the associated risk rating (see Table 2.2). One significant finding and five moderate findings were reassessed to minor findings. One significant finding was reassessed to a moderate finding, and another significant finding was reassessed and split into two moderate findings.

2.24 Eighteen minor audit findings were fully resolved. The ANAO considers audit findings to be resolved when entities effectively address the risks identified.

Table 2.2: Significant and moderate findings partially resolved, or the rating reduced

|

Entity |

First identified |

Change in Risk Rating |

ANAO observations |

|

Department of Defence |

2021–22 |

Significant to Minor |

|

|

Department of Home Affairs |

2023–24 |

Moderate to Minor |

|

|

Department of Health and Aged Care |

2023–24 |

Moderate to Minor |

|

|

NBN Co Limited |

2023–24 |

Moderate to Minor |

|

|

Services Australia |

2022–23 |

Significant to Moderate |

|

|

Australian Taxation Office |

2022–23 |

Significant to Moderate |

|

|

National Disability Insurance Agency |

2023–24 |

Moderate to Minor |

|

Source: ANAO 2024–25 interim audit results.

2.25 Details on audit findings for all entities included in this report is included in Chapter 4.

Other observations

2.26 Across the Australian Government sector, the ANAO continues to observe a maturing of financial reporting processes that support the effective preparation of annual financial statements. In particular:

- Effective audit committees support the preparation of reliable financial reports, the effective and efficient operation of internal controls and the follow-up of unresolved audit findings. Some audit committees are further supported by a sub-committee dedicated to risk, performance or financial statements.

- Comprehensive registers for issues, risks and legislative compliance support managing emerging risks and internal governance arrangements, including reporting to agency audit committees.

- Financial reporting position papers and workpapers that document management’s considerations and judgements, particularly for valuations and accounting estimates. These have been effective when consulted during the planning and interim audit phases.

3. Information technology control environment

Summary of results

3.1 The Information Technology (IT) control environment is an essential part of the performance and integrity of Australian Government entities. IT controls are important to maintain effective operation of the IT environment throughout each financial reporting period.

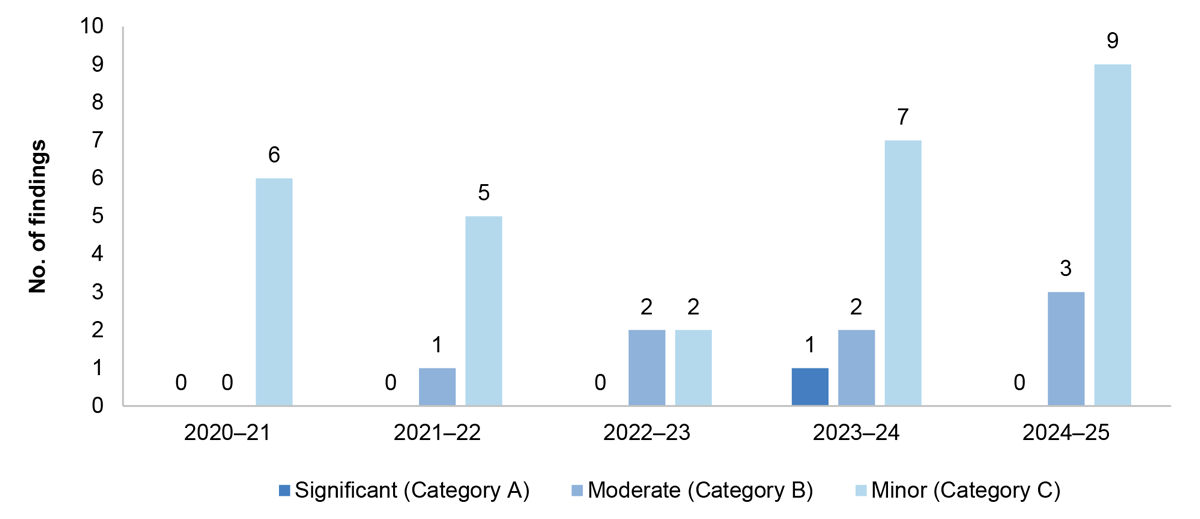

3.2 Findings related to the IT control environment have continued to represent the majority of audit findings in ANAO interim audits, with 77 total IT control findings in 2024–25 or 65 per cent of total findings. Figure 3.1 illustrates the trends in interim audit findings relating to entities’ overall IT control environments from 2020–21 to 2024–25.

Figure 3.1: IT control environment interim findings 2020–21 to 2024–25

Source: ANAO data.

3.3 In the 2024–25 interim audits, no significant findings were identified relating to the IT control environment. Prior year significant findings relating to Australian Taxation Office (ATO), Department of Defence, and Services Australia were downgraded during the 2024–25 interim audit phase following the ANAO’s assessment of the action taken by these entities to address the identified issues.

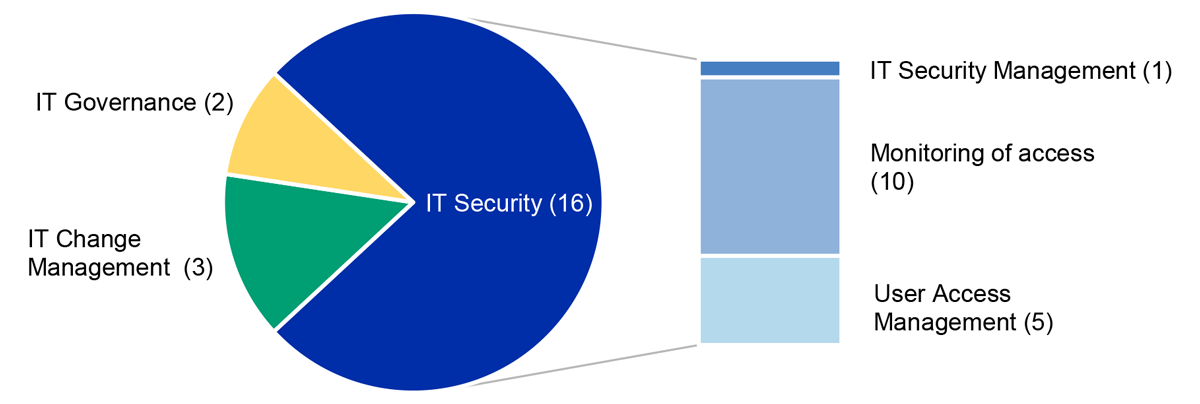

3.4 Twenty-one moderate findings relating to the IT control environment were reported in 2024–25. Consistent with previous years, the majority of control deficiencies identified related to IT security. Figure 3.2 provides an overview of the categorisation of moderate-level audit findings relating to the IT control environment, and key themes relating to IT security findings.

Figure 3.2: Categorisation of moderate-level 2024–25 interim audit findings for IT control environments

Source: ANAO data.

3.5 Table 3.1 lists all entities with moderate audit findings relating to the IT control environment at the conclusion of the 2024–25 interim audits. Further information as to the entities with moderate audit findings is provided in Chapter 4.

Table 3.1: Moderate IT control environment findings by entity as at interim 2024–25

|

Entity |

Number of Moderate Findings |

|

Services Australia |

7 |

|

Department of Veterans’ Affairs |

4 |

|

National Disability Insurance Agency |

3 |

|

Australian Taxation Office |

2 |

|

Department of Social Services |

2 |

|

Department of Climate Change, Energy, the Environment and Water |

1 |

|

Department of Health and Aged Care |

1 |

|

Snowy Hydro Limited |

1 |

|

Total |

21 |

Source: ANAO data.

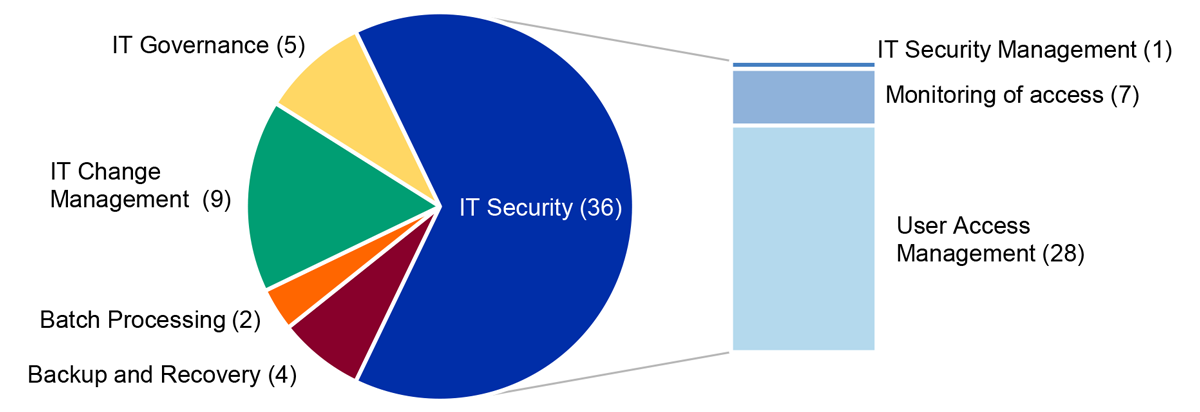

3.6 Additionally, the 2024–25 interim audits saw an increase (of 17, or 44 per cent) in reported minor findings relating to the IT control environment compared to the 2023–24 interim audits. Figure 3.3 illustrates that, consistent with trends in moderate findings, the majority (64 per cent) of minor findings related to IT security. IT security findings also represented the most numerous category of minor findings.

Figure 3.3: Categorisation of minor-level 2024–25 interim audit findings for IT control environments

Source: ANAO data.

3.7 The operation of the majority of IT controls continued to support the preparation of financial statements that are free from material misstatement. Consistent with observations made by the ANAO in previous years, IT security continues to be an area requiring improvement, particularly in regard to monitoring and managing the risk of inappropriate access to systems and data.

Key Themes and Issues

3.8 In the 2024–25 interim audits, a number of key themes in findings were identified. Themes in common with prior audit cycles are:

- IT Security and IT Change Management, discussed in paragraphs 3.11 and 3.19 respectively; and

- Backup and recovery, which relates to entities’ ability to restore data and recover from critical incidents when needed. Backup and recovery findings were raised at a minor level for four entities, consistent with trends in 2023–24.

3.9 New themes identified in 2024–25 are:

- IT Governance, discussed further in paragraph 3.22; and

- Batch processing, which relates to controls around how large volumes of financial transactions are processed in scheduled tasks. Four batch processing findings were raised with two entities, regarding inappropriate access to the scheduling of batch jobs, and timely resolution of batch job errors.

3.10 Further information on entity findings is available in Chapter 4.

IT Security

3.11 IT security controls are primarily designed to protect entities’ assets from unauthorised access (both internal and external). In the context of financial statements audit, IT security controls considered relate to financially significant systems and data only.

3.12 At the conclusion of the 2024–25 interim audit phase 52 IT control environment findings (68 per cent) related to IT security. This represents an increase from 2023–24, primarily driven by additional minor findings. Significant findings reduced compared to the prior year, with a significant IT security finding at the Department of Defence (Defence) downgraded as a result of action taken by Defence including the reconciliation of data on terminated staff, internal audit activity and the implementation of new user access controls. An additional significant finding at Services Australia has been downgraded following Services Australia’s implementation of multiple initiatives, including updates to policies, testing to confirm adherence to policies, staff training, updates to disaster recovery plans and changes to governance committees.10

3.13 Figure 3.4 illustrates trends in IT security findings over the past five interim audit phases.

Figure 3.4: IT security interim findings 2020–21 to 2024–25

Source: ANAO data.

3.14 Moderate IT security interim findings were concentrated in six entities, shown in Table 3.2. Additional detail regarding findings for individual entities is provided in Chapter 4.

Table 3.2: Moderate IT security findings by entity as at interim 2024–25

|

Entity |

Number of Moderate Findings |

|

Services Australia |

6 |

|

Department of Veterans’ Affairs |

3 |

|

National Disability Insurance Agency |

3 |

|

Department of Social Services |

2 |

|

Department of Climate Change, Energy, the Environment and Water |

1 |

|

Department of Health and Aged Care |

1 |

|

Total |

16 |

Source: ANAO data.

Key Issues — IT security

3.15 Weaknesses in IT security controls have the potential to compromise an entity’s ability to maintain business operations and maintain the integrity and confidentiality of sensitive data. As entity environments grow more complex through the adoption of emerging technologies, effective IT security control frameworks will be critical to ensuring that IT control environments remain trustworthy and secure.

Safeguarding data from cyber threats

3.16 Within the Australian Government, the Protective Security Policy Framework (PSPF)11 and Information Security Manual (ISM)12 establish policy requirements and provide guidance on strategies to protect information and systems from evolving cyber threats.

3.17 The Australian Signals Directorate (ASD) has developed prioritised mitigation strategies to help protect against cyber threats, with the strategies that ASD considers to be most effective referred to as the ‘Essential Eight’. The Essential Eight outlines a maturity framework for individual mitigation strategies, with requirements for entities at each maturity level. These requirements evolve over time in response to changes in the cyber threat landscape. The PSPF requires that non-corporate Commonwealth entities implement the Essential Eight mitigation strategies to the standard of Maturity Level Two, and that these entities conduct an annual self-assessment of their compliance with policy requirements.13

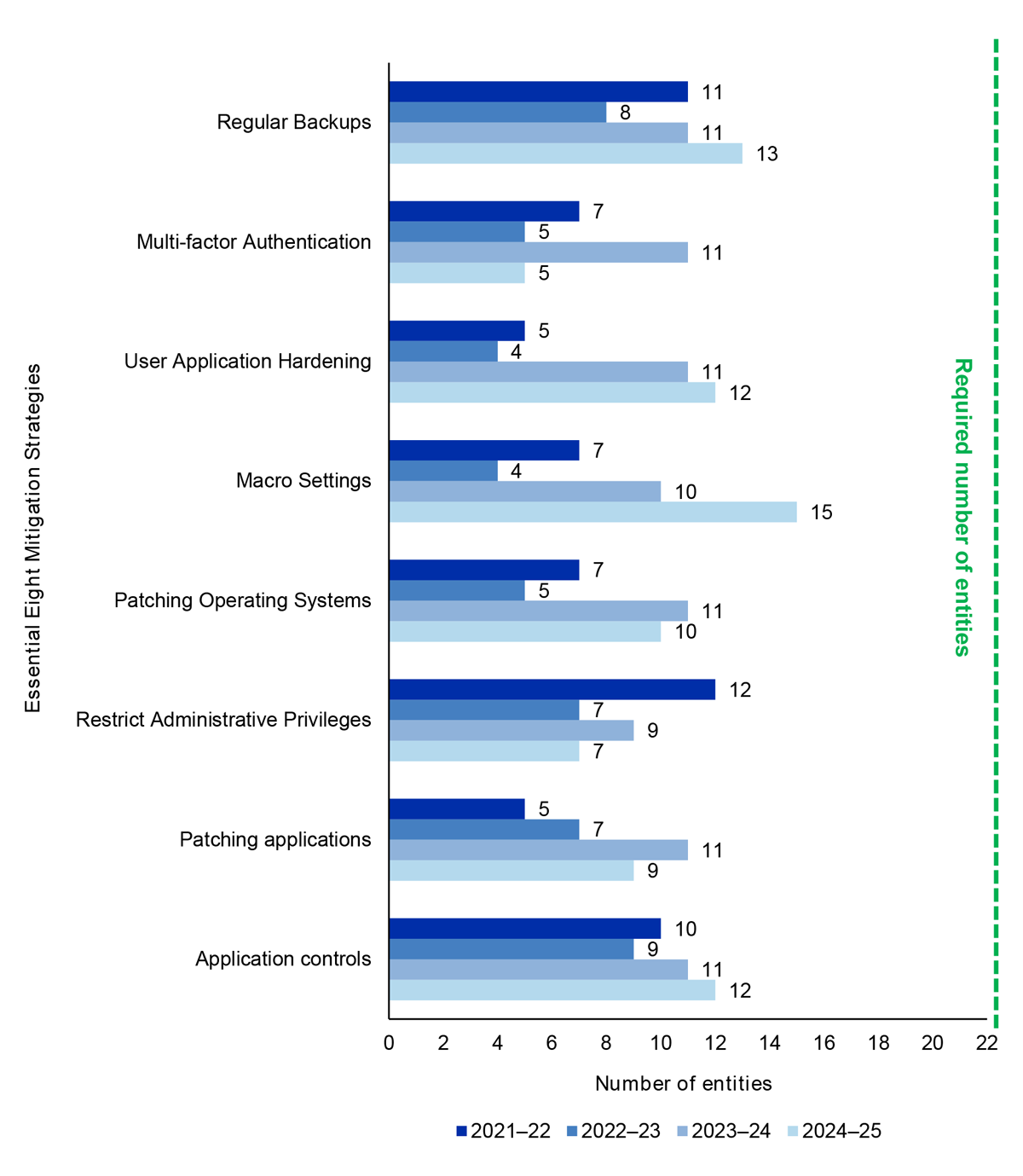

3.18 Figure 3.5 summarises self-reported compliance with Maturity Level Two of the Essential Eight mitigation strategies (as at October 2024). Self-assessed compliance increased across four strategies and four strategies saw decreases in the number of entities reporting the required maturity. Decreases in reported maturity can occur for a number of reasons, including changes in the entity environment, changes in the approach taken by entities to self-assess, and changes in the maturity level requirements.14

Figure 3.5: Reported compliance with Essential Eight mitigation strategies for the period 2021–22 to 2024–25

Source: ANAO analysis of entity self-assessment.

3.19 Of the 22 entities that are required to comply, five (23 per cent) reported full compliance across all Essential Eight Mitigation Strategies. Of the 17 entities (77 per cent) that did not report full compliance across all Essential Eight mitigation strategies, 15 were lead security entities. A lead security entity supports portfolio entities to achieve and maintain protective security through advice and guidance on government security.15 Three lead security entities reported full compliance across all Essential Eight Mitigation Strategies.

IT Change Management

3.20 IT change management refers to how entities assure themselves that changes to key systems are tested and authorised. Change management has been a continuing theme from previous audit cycles, with 12 findings observed in the 2024–25 interim audits and 10 findings observed in 2023–24, including a significant finding relating to the ATO. Figure 3.6 illustrates trends in change management findings across recent audit cycles.

Figure 3.6: IT change management interim findings 2020–21 to 2024–25

Source: ANAO data.

3.21 In 2024–25, the ATO’s significant finding was downgraded to two moderate findings, following a strengthening of relevant controls and partial implementation of automated deployment tools. Table 3.3 shows those entities with moderate findings relating to change management at the conclusion of the 2024–25 interim audits.

Table 3.3: Moderate IT change management findings by entity as at interim 2024–25

|

Entity |

Number of Moderate Findings |

|

Australian Taxation Office |

2 |

|

Department of Veterans’ Affairs |

1 |

|

Total |

3 |

Source: ANAO data.

Key Issues — IT Change Management

3.22 Effective change management controls maintain the integrity of key IT systems. In the absence of an effective change management framework, untested and unauthorised changes may be made to key business systems, limiting the ability to senior management to assure themselves that these systems are operating as intended.

IT Governance

3.23 IT governance concerns the processes by which entities ensure their IT operations are aligned with business objectives. In 2024–25, the ANAO raised seven findings (two moderate, five minor) related to IT governance. Those entities receiving moderate findings are listed in Table 3.4 below.

Table 3.4: Moderate IT governance findings by entity as at interim 2024–25

|

Entity |

Number of Moderate Findings |

|

Services Australia |

1 |

|

Snowy Hydro Limited |

1 |

|

Total |

2 |

Source: ANAO data.

3.24 Of these seven findings, six related to the processes by which entities assured themselves of the effectiveness of the controls of third-party IT services on which they rely. Increasingly, entities are relying on services such as cloud environments to support their operations, and in these instances third parties may provide reports that attest to the integrity of their cyber security and other controls. The six entities with findings were found to have received these reports but not adequately reviewed them or otherwise sought appropriate assurance. Accordingly, there was a risk that had those third-parties advised of control deficiencies that might have impacted the relevant entities, those entities would have remained unaware.

Key Issues — IT Governance

3.25 When the provision of digital services is outsourced to external providers, accountability for the good or service and associated delivery outcomes (including managing security risks) remains with the entity. As entities incorporate increasingly advanced emerging technologies into their operations and leverage a variety of delivery models to optimise costs, the importance of effective governance and oversight arrangements becomes increasingly critical in ensuring the integrity of IT operations.

4. Results of the interim audit phase by entity

4.1 Department of Agriculture, Forestry and Fisheries

4.1.1 The Department of Agriculture, Forestry and Fisheries (DAFF) is responsible for developing and implementing policies and initiatives to promote more sustainable, productive, internationally competitive and profitable Australian agricultural, food and fibre industries; safeguarding Australia’s animal and plant health status to maintain overseas markets and protect the economy and environment from exotic pests and diseases.

Engagement risk rating

4.1.2 The engagement risk for DAFF’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- multiple pieces of legislation governing DAFF’s import and export functions, affecting DAFF’s departmental revenue;

- the self-assessment regime for administered levies collected from primary producers and agents; and

- judgement required by management to determine significant financial statements balances.

Interim audit results

4.1.3 At the 2024–25 interim audit phase, the ANAO has not identified any findings that pose a significant or moderate business or financial risk to DAFF. Two minor findings were identified.

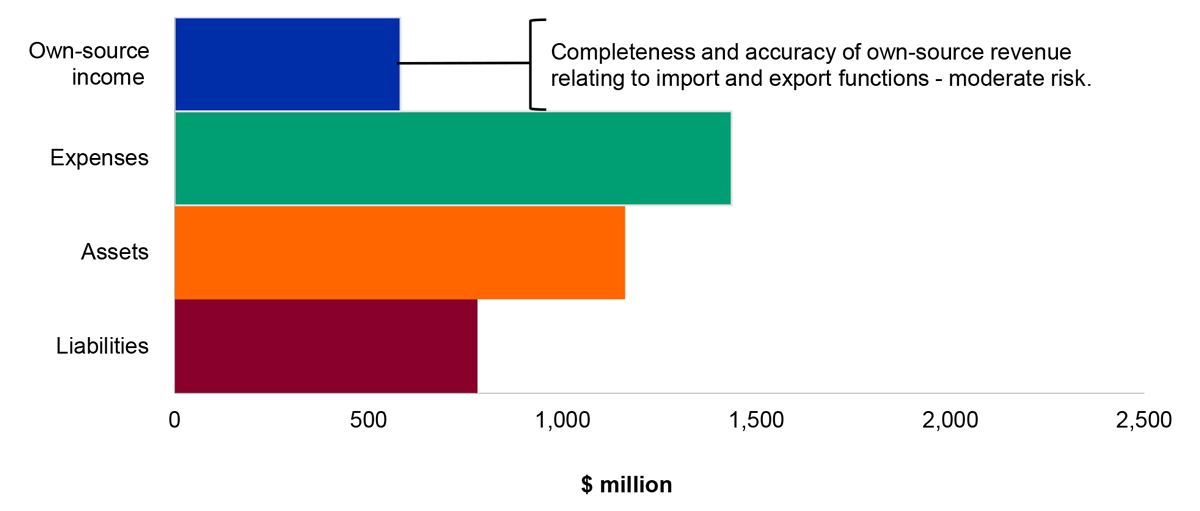

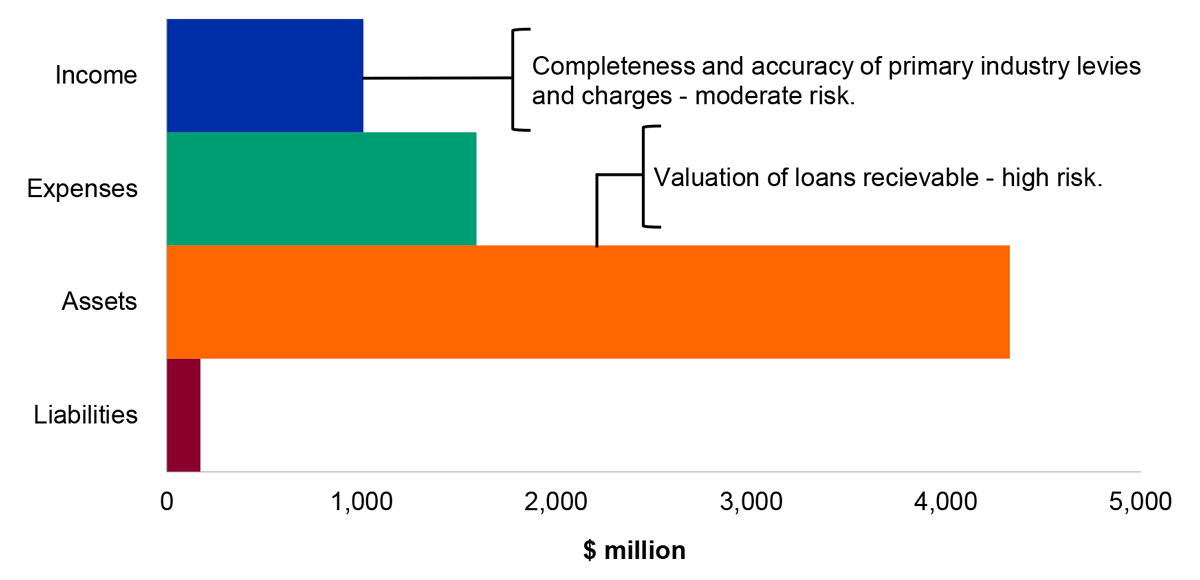

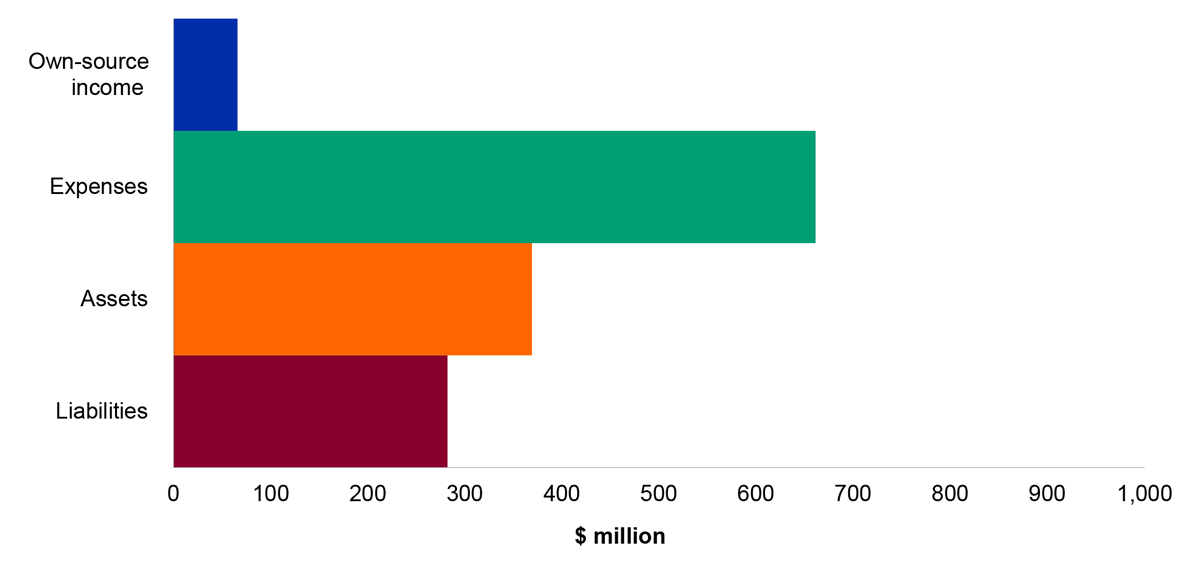

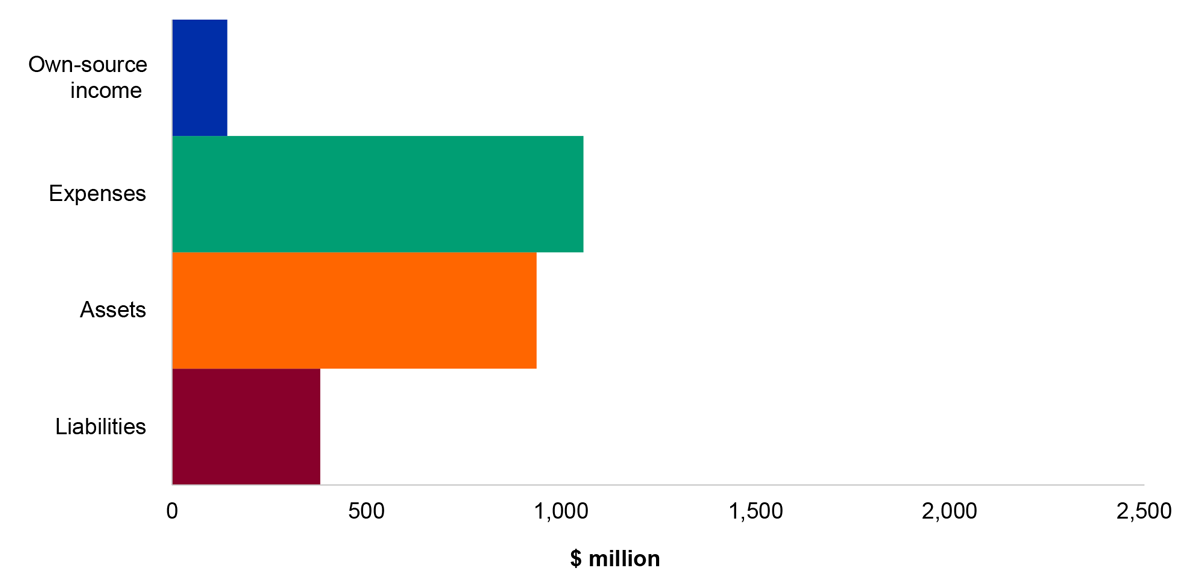

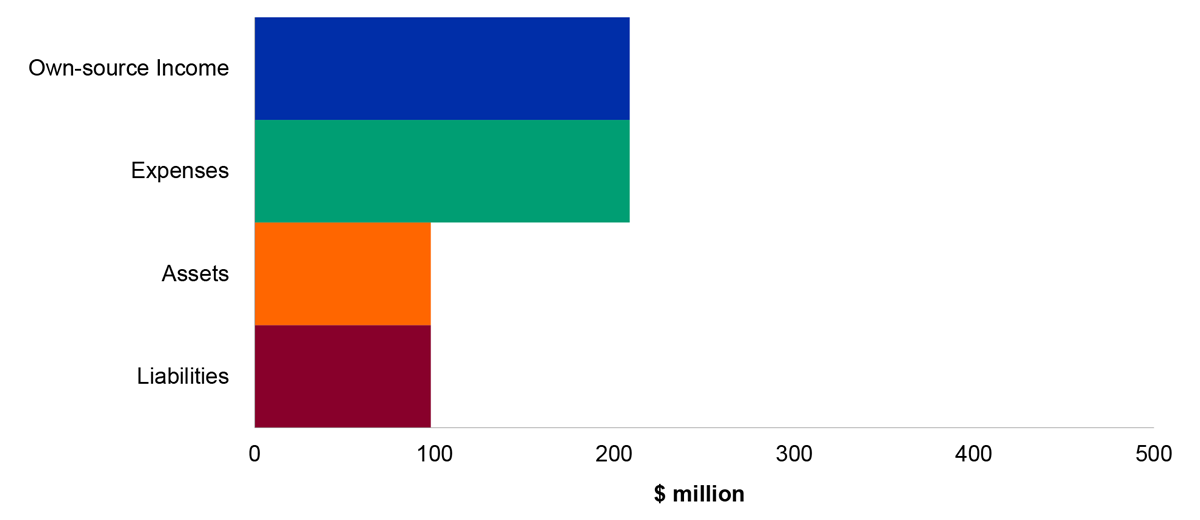

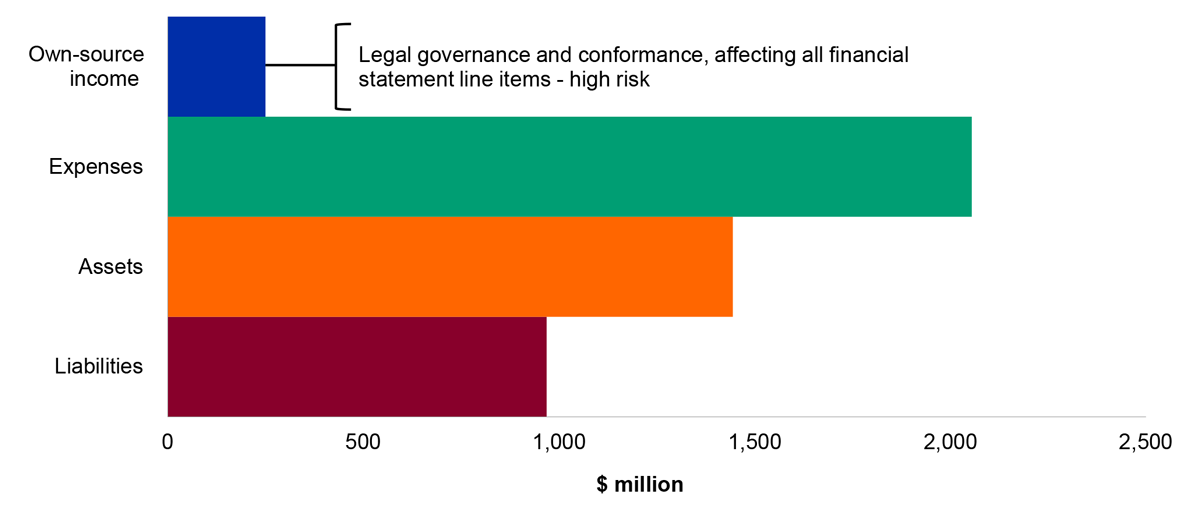

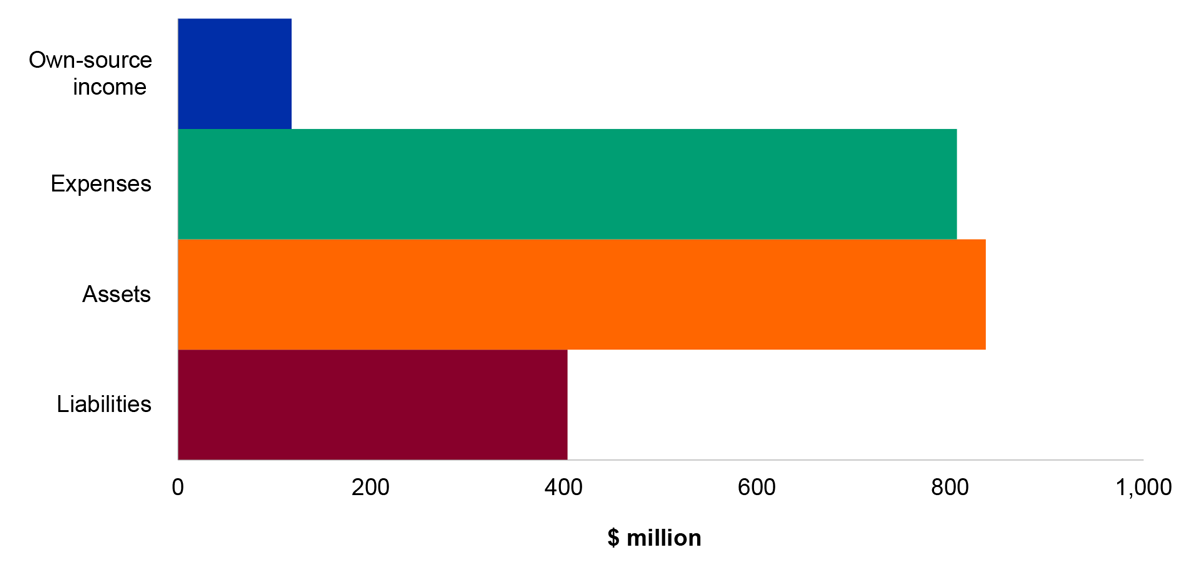

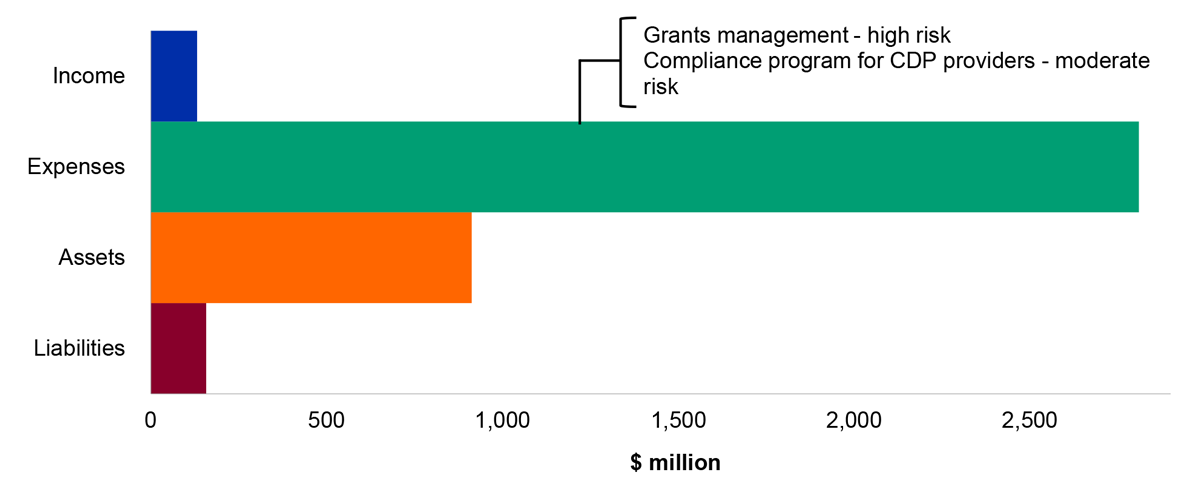

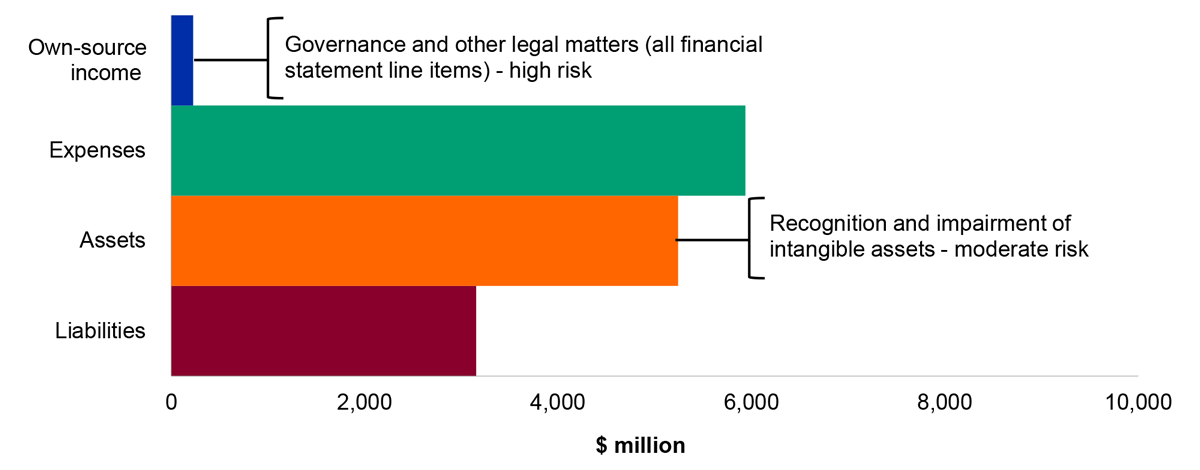

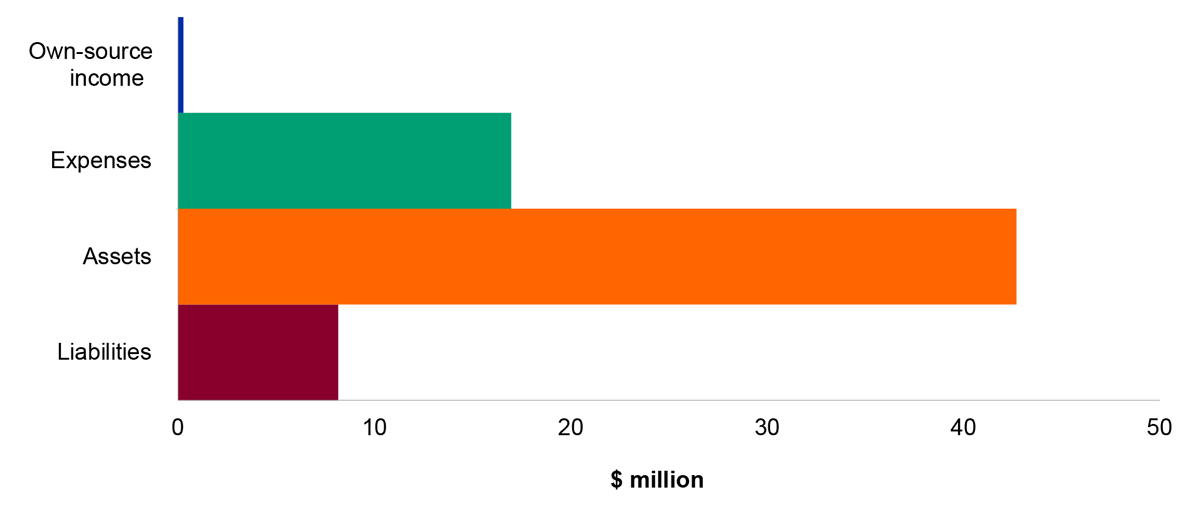

Key financial balances and areas of financial statements risk

4.1.4 Figures 4.1.1 and 4.1.2 show the key financial statements items reported by DAFF and the key areas of financial statements risk.

Figure 4.1.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and DAFF’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Figure 4.1.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and DAFF’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.1.5 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that DAFF will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.2 Attorney-General’s Department

4.2.1 The Attorney-General’s Department (AGD) supports the Attorney-General through the provision of expert advice and services on a range of law, justice, integrity, and national security issues.16

Engagement risk rating

4.2.2 The engagement risk for AGD’s 2024–25 financial statements audit has been assessed as low. Key factors contributing to this rating include:

- no significant changes to the structure and operations of AGD; and

- low complexity of transactions and balances in AGD’s financial statements.

Interim audit results

4.2.3 At the 2024–25 interim audit phase, the ANAO has not identified any findings that could pose a significant or moderate business or financial risk to AGD. One minor finding was identified.

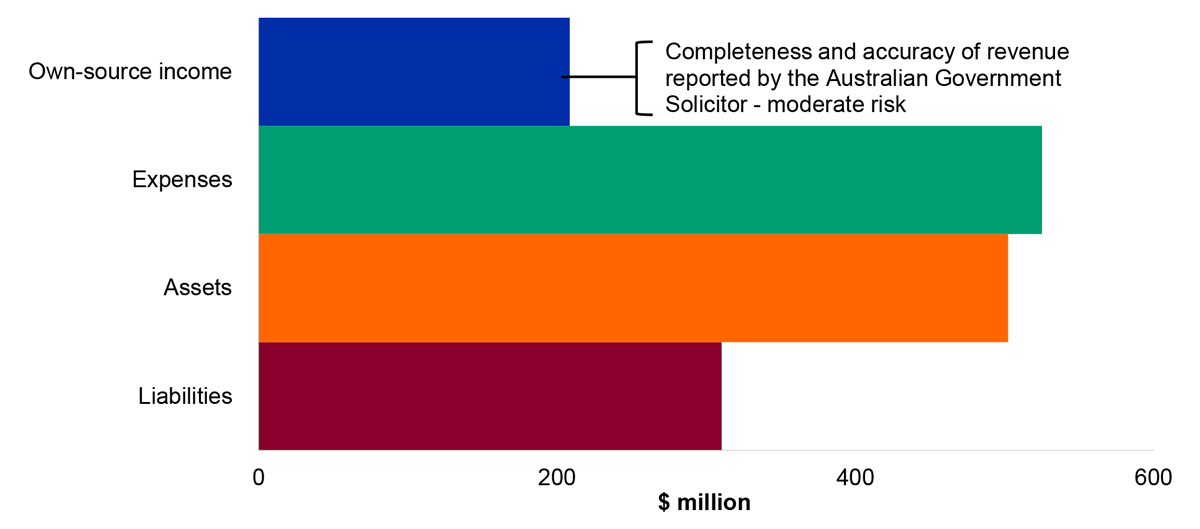

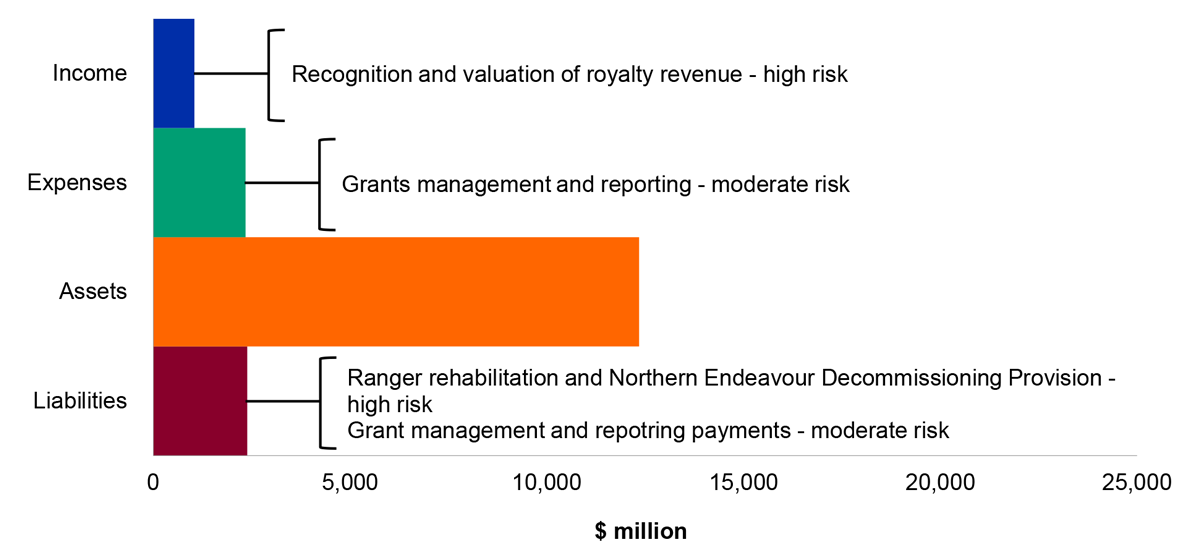

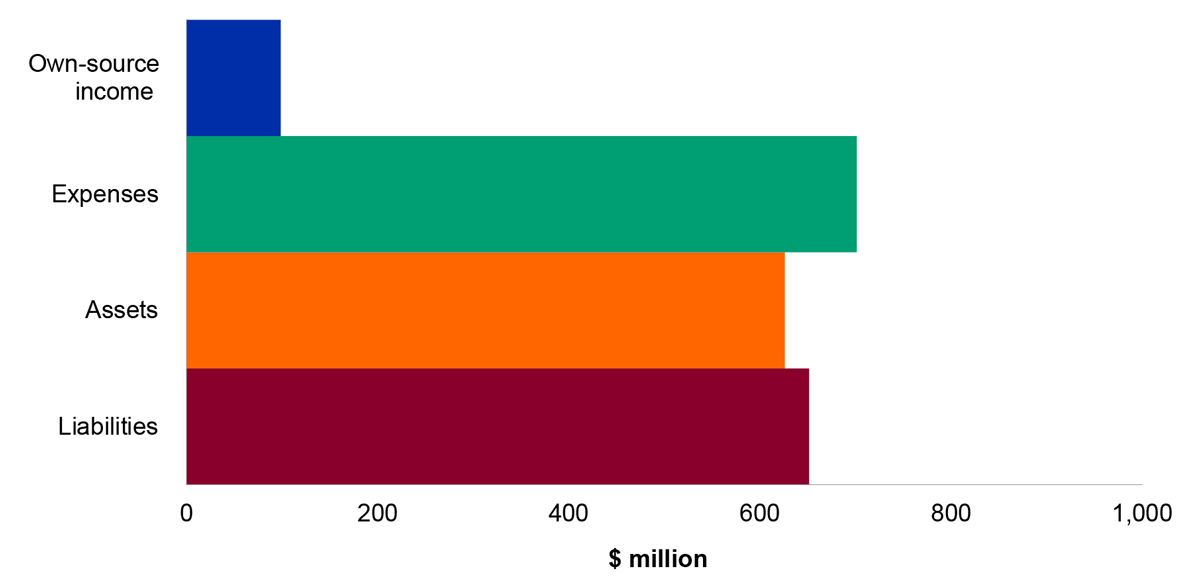

Key financial balances and areas of financial statements risk

4.2.4 Figures 4.2.1 and 4.2.2 show the key financial statements items reported by AGD and the key areas of financial statements risk.

Figure 4.2.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and AGD’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Figure 4.2.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and AGD’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.2.5 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that AGD will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.3 Department of Climate Change, Energy, the Environment and Water

4.3.1 The Department of Climate Change, Energy, the Environment and Water (DCCEEW) is responsible for developing and implementing policies and initiatives to protect Australia’s environment, biodiversity and heritage; helping Australia respond to and address climate change; and managing Australia’s water and energy resources.

Engagement risk rating

4.3.2 The engagement risk for DCCEEW’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- DCCEEW’s broad strategic direction across several diverse functions that have a high level of public interest and Parliamentary scrutiny;

- the complexity of some financial statements balances which require increased management judgement, are reliant on external advice, and impact the Australian Government’s consolidated financial statements;

- shared services arrangements with other Commonwealth entities that support key financial statements balances; and

- a financial reporting function, internal control environment and governance arrangements that have matured since DCCEEW was established on 1 July 2022.

Interim audit results

4.3.3 At the 2024–25 interim audit phase, one finding that poses a moderate business or financial risk to DCCEEW and three minor findings remain unresolved.

4.3.4 During the 2024–25 final audit the ANAO will undertake further procedures and assess action taken by DCCEEW to address the weaknesses identified.

Audit findings

Table 4.3.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

– |

– |

– |

– |

|

B |

1 |

– |

– |

1 |

|

L1 |

– |

– |

– |

– |

|

Total |

1 |

– |

– |

1 |

Source: ANAO 2024–25 interim audit results.

Unresolved moderate audit finding

TechOne privileged user activity monitoring

4.3.5 Maintaining and supporting IT systems requires some user accounts, both at the network and the application level, to have extensive access rights (privileged access). Privileged user accounts can be used to circumvent security controls to make direct changes, either to system settings or systems data, or to access files and accounts used by others.

4.3.6 During the 2023–24 interim audit, the ANAO identified weaknesses in the effectiveness of DCCEEW’s monitoring of privileged user activities within the TechOne Financial Management Information System (FMIS).

4.3.7 The ANAO recommended that DCCEEW update the privileged user access monitoring policy to regularise these reviews, including the requirement to retain evidence to support that the reviews had been appropriately undertaken in accordance with the policy.

4.3.8 During the 2024–25 interim audit, the ANAO confirmed that DCCEEW is working with TechOne to develop reporting on privileged users to address this recommendation. Once reporting is developed, DCCEEW has advised the ANAO that it will formalise a privileged user monitoring policy.

4.3.9 The ANAO will continue to assess progress against this audit finding and consider ongoing implications to the financial statements as DCCEEW continues to progress addressing this audit finding.

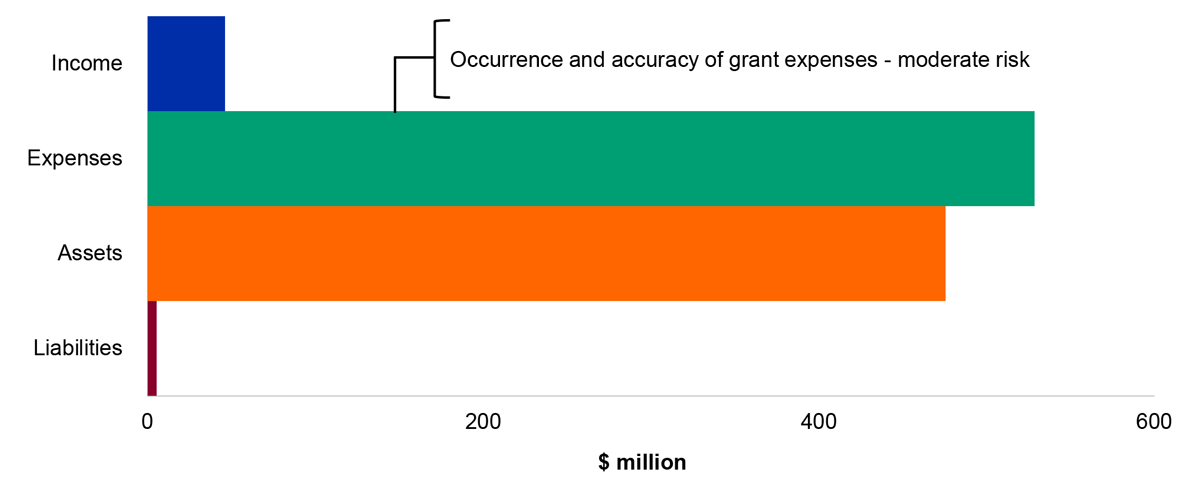

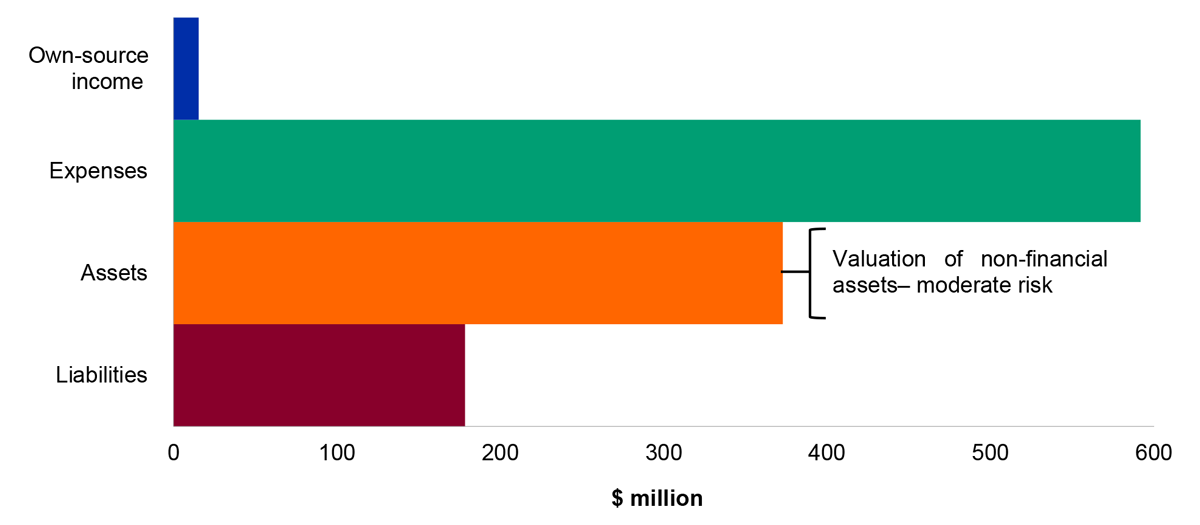

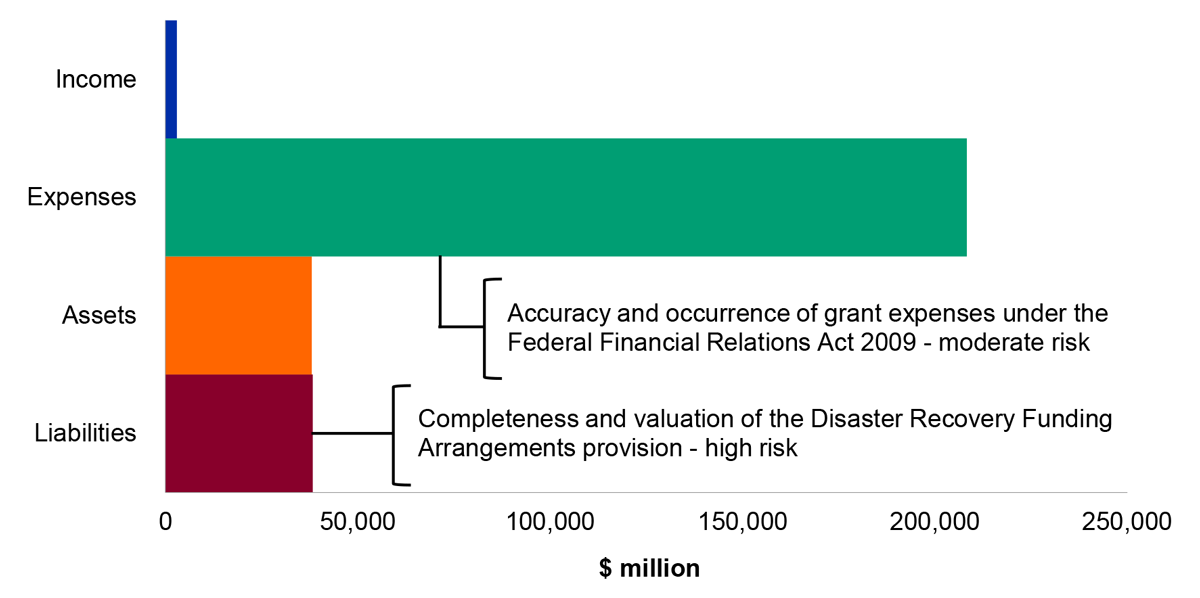

Key financial balances and areas of financial statements risk

4.3.10 Figures 4.3.1 and 4.3.2 below show the key financial statements items reported by DCCEEW and the key areas of financial statements risk.

Figure 4.3.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and DCCEEW’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

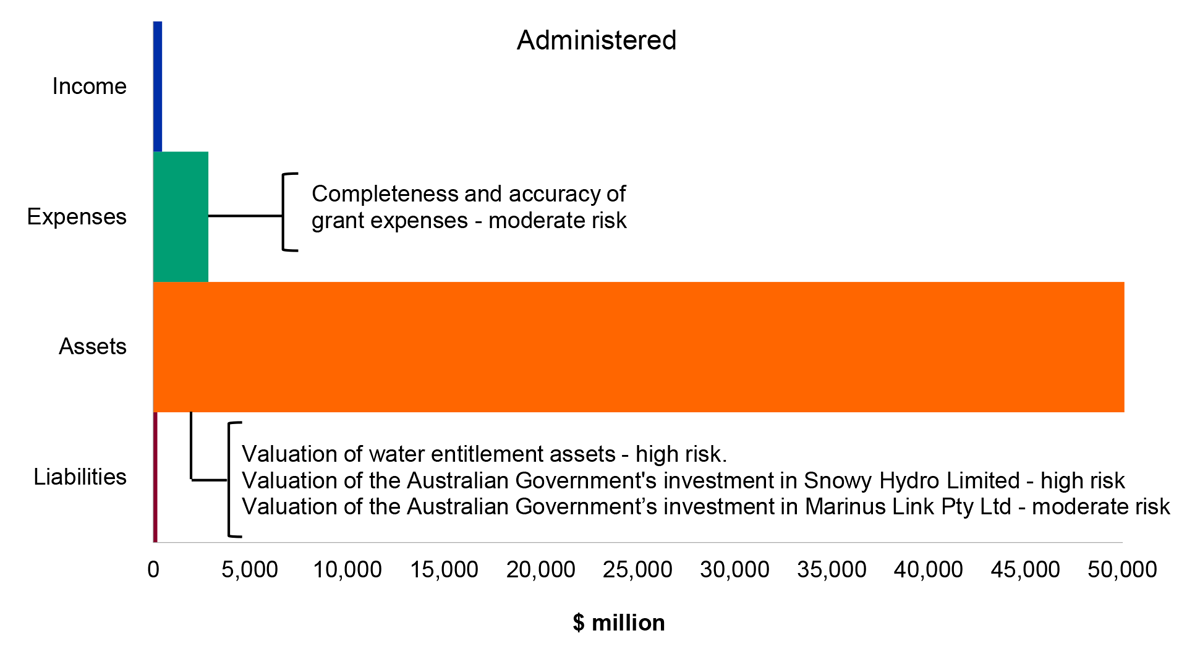

Figure 4.3.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and DCCEWW’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.3.11 At the completion of the interim audit, and except for the finding outlined above, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that DCCEEW will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.4 Snowy Hydro Limited

4.4.1 Snowy Hydro Limited (Snowy Hydro) is a government business enterprise responsible for energy generation activities to supply the National Electricity Market as well as operating as a retail energy provider through the Red Energy and Lumo Energy brands.

Engagement risk rating

4.4.2 The engagement risk for Snowy Hydro’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- the value of and complexity of delivery of the long-term infrastructure developments relating to the Snowy 2.0 and Hunter Power projects;

- Snowy Hydro’s dynamic and complex operating and regulatory environment and level of competition for customers for the supply of electricity; and

- the complexity of and judgement required in determining the fair value of the energy derivatives portfolio.

Interim audit results

4.4.3 At the 2024–25 interim audit phase, one finding that poses a moderate business or financial risk to Snowy Hydro remains unresolved.

4.4.4 During the 2024–25 final audit the ANAO will undertake further procedures and assess action taken by Snowy Hydro to address the weaknesses identified.

Audit findings

Table 4.4.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

– |

– |

– |

– |

|

B |

1 |

– |

– |

1 |

|

L1 |

– |

– |

– |

– |

|

Total |

1 |

– |

– |

1 |

Source: ANAO 2024–25 interim audit results.

Unresolved moderate audit finding

IT general controls for the financial management information system

4.4.5 Snowy Hydro’s financial management information system (FMIS) is provided under a cloud computing arrangement. Snowy Hydro’s service provider is largely responsible under contract for system administration activities, including designing and implementing appropriate IT general controls supporting user access management, including for privileged users, and change management processes. Under the terms of the contract, the service provider is required to provide assurance to Snowy Hydro, via a Service Organisation Control (SOC) report prepared by an independent auditor, that these controls are designed, implemented and operating effectively.

4.4.6 In 2023–24, the service provider provided a qualified SOC report which identified several weaknesses in the operating effectiveness of IT general controls for the FMIS, particularly in relation to the timely termination and monitoring of user access, including privileged users. Inadequate security measures for timely removal of user access increases the risk of unauthorised access to sensitive information. Additionally, Snowy Hydro did not have a formalised process to review and respond to the SOC report in a timely manner.

4.4.7 The ANAO recommended that Snowy Hydro establish a formal control for the periodic review of SOC reports from all critical service providers and perform mitigating procedures over any deficiencies noted.

4.4.8 At the time of preparing this report, the interim audit of Snowy Hydro was in progress. The ANAO will assess progress against the risks identified at the 2024–25 final audit.

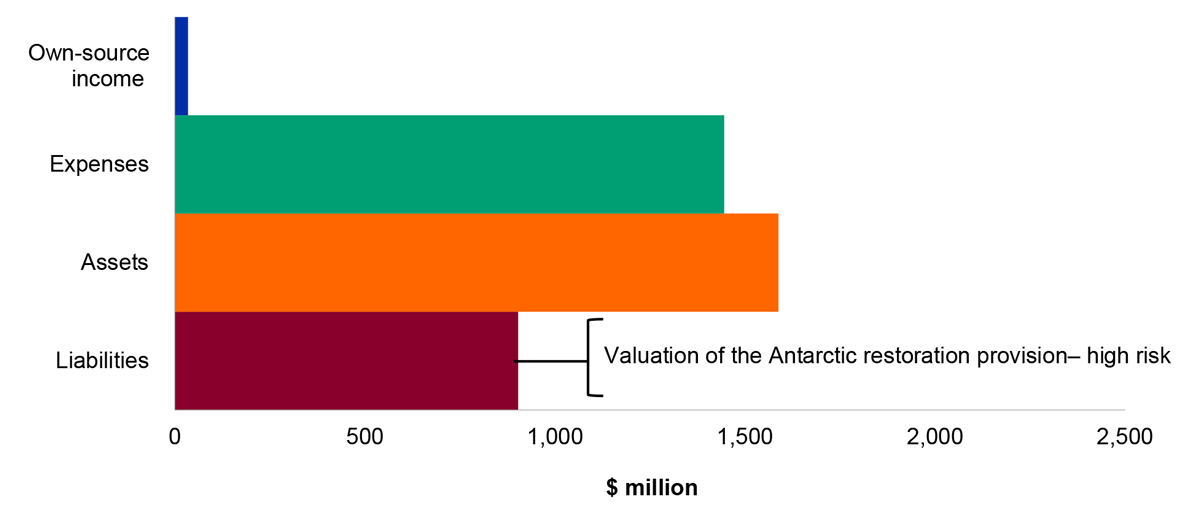

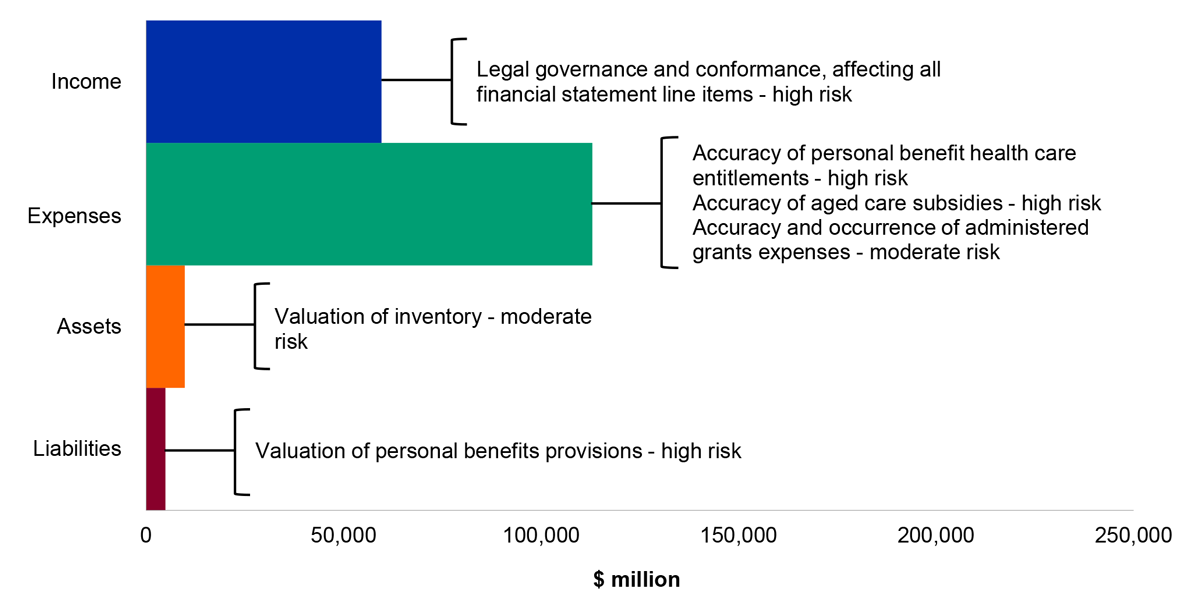

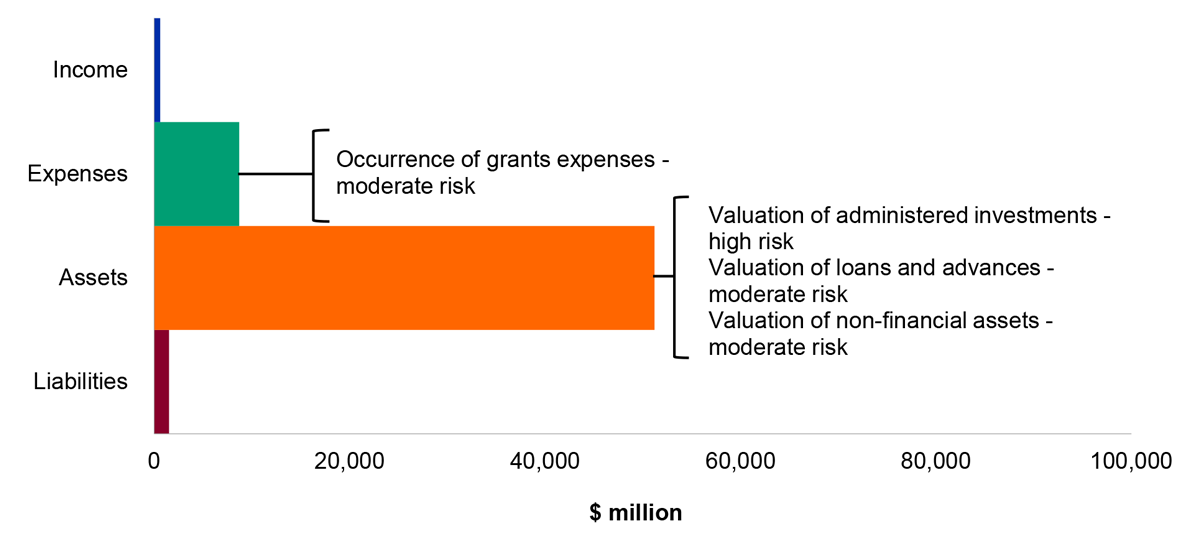

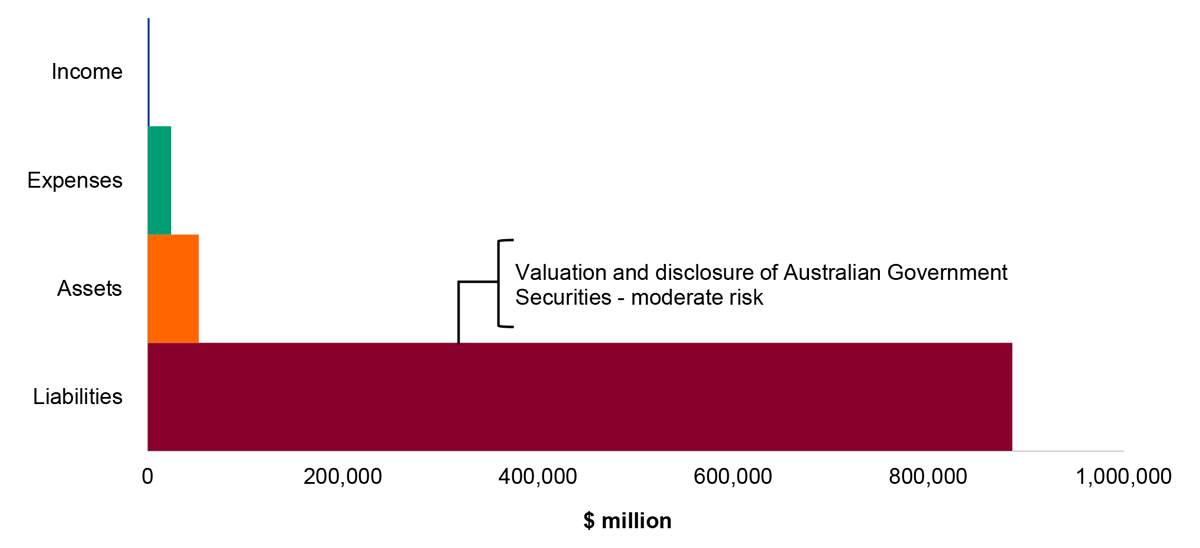

Key financial balances and areas of financial statements risk

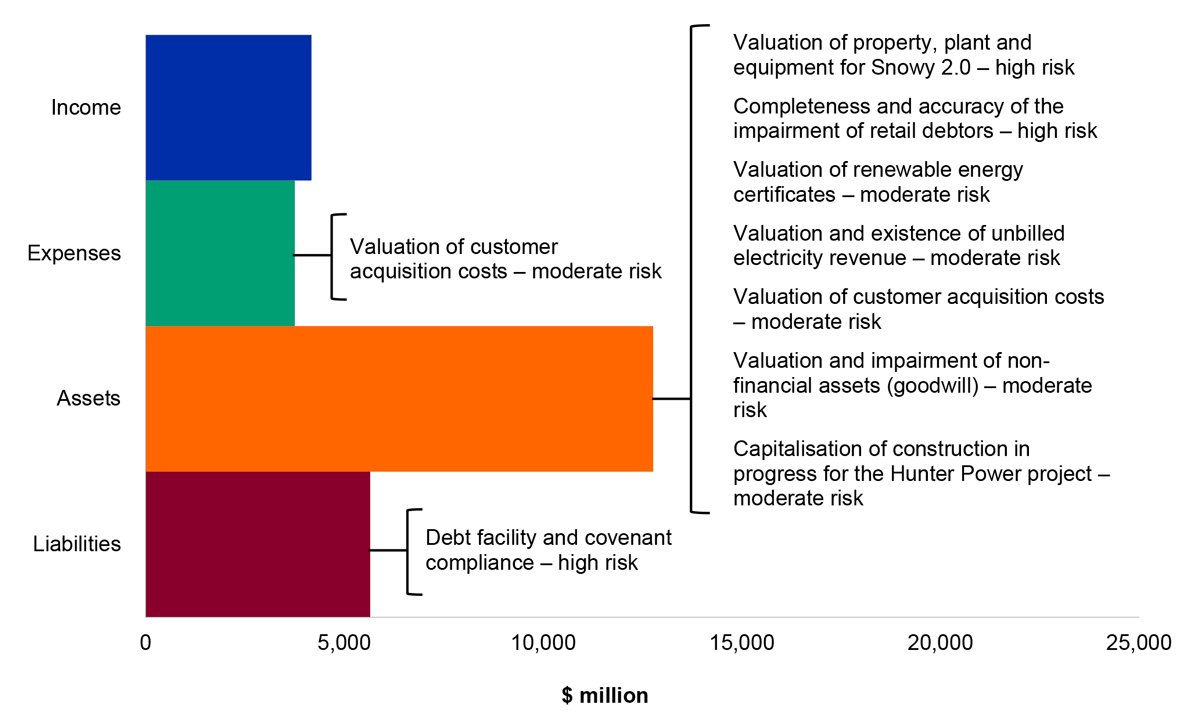

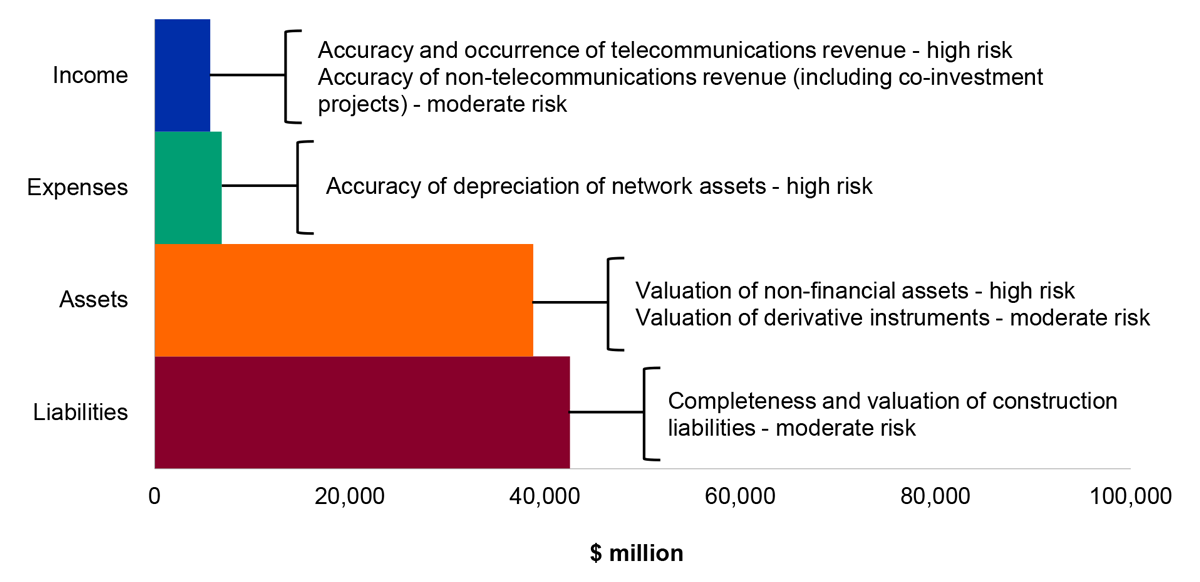

4.4.9 Figure 4.4.1 below shows the key financial statements items reported by Snowy Hydro and the key areas of financial statements risk.

Figure 4.4.1: Key financial balances and areas of financial statements risk

Source: ANAO analysis and Snowy Hydro’s 2023–24 audited financial statements.

Conclusion

4.4.10 At the interim audit phase, and except for the finding outlined above, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that Snowy Hydro will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.5 Department of Defence

4.5.1 The Department of Defence (Defence) is responsible for protecting and advancing Australia’s strategic interests through the promotion of security and stability, the provision of military capabilities to defend Australia and its national interests, and the provision of support for the Australian community and civilian authorities as directed by the Australian Government.

Engagement risk rating

4.5.2 The engagement risk for Defence’s 2024–25 financial statements audit has been assessed as high. Key factors contributing to this rating include:

- the nature, scale and complexity of Defence’s operations and strategic environment;

- a high level of public interest and Parliamentary scrutiny of Defence’s activities;

- the complexity and uniqueness of some financial statements balances, such as specialist military equipment (SME), that require increased management judgement and are subject to high levels of estimation uncertainty;

- the implementation of an Enterprise Resource Planning (ERP) system replacing the functionality of numerous Defence IT systems.

Interim audit results

4.5.3 At the 2024–25 interim audit phase, the ANAO has not identified any findings that pose a significant or moderate business or financial risk to Defence. One previously reported audit finding posing a significant business or financial risk was downgraded to a minor audit finding during the ANAO’s 2024–25 interim audit.

Audit findings

Table 4.5.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

1 |

– |

1a |

– |

|

B |

– |

– |

– |

– |

|

L1 |

– |

– |

– |

– |

|

Total |

1 |

– |

1a |

– |

Note a: The significant audit finding relating to the removal of system access for Defence personnel and contractors was identified during the 2021–22 audit. The audit finding has been reclassified to a minor audit finding.

Source: ANAO 2024–25 interim audit results.

Resolved significant audit finding

Removal of system access for Defence personnel and contractors

4.5.4 During previous financial statements audits, the ANAO identified weaknesses in Defence’s IT control environment which resulted in former Defence employees and contractors retaining access to Defence’s ICT systems after their exit from Defence.

4.5.5 The absence of effective of controls over the removal or monitoring of user access post-termination increases the risk of inappropriate activity occurring in systems that have significant and sensitive data holdings.

4.5.6 In response to this audit finding, Defence established a dedicated project team, developed a user data reconciliation environment and engaged internal audit to address the risks identified by the ANAO. The ANAO undertook additional audit procedures to verify the design, implementation and operating effectiveness of those procedures and has assessed that Defence has addressed the ANAO’s recommendation regarding the termination of systems access for former employees and contractors.

4.5.7 The audit finding was downgraded to a minor audit finding as Defence implements further procedures to strengthen the management of user access to key systems, specifically, the implementation of role-based position access.

4.5.8 During the 2024–25 final audit the ANAO will undertake further procedures and assess action taken by Defence to address the audit finding.

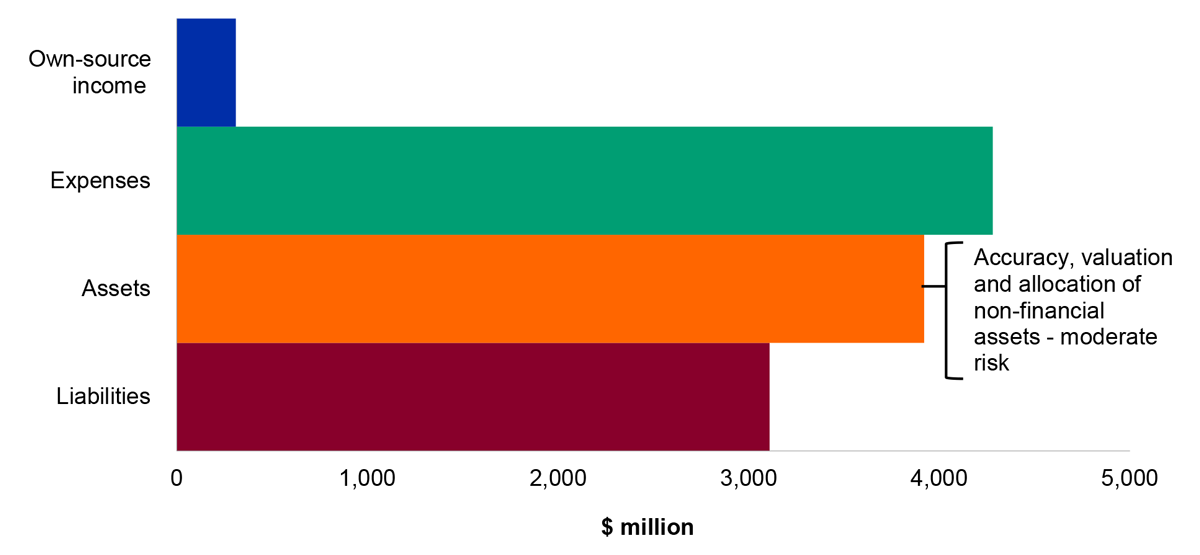

Key financial balances and areas of financial statements risk

4.5.9 Figures 4.5.1 and 4.5.2 show the key financial statements items reported by Defence and the key areas of financial statements risk.

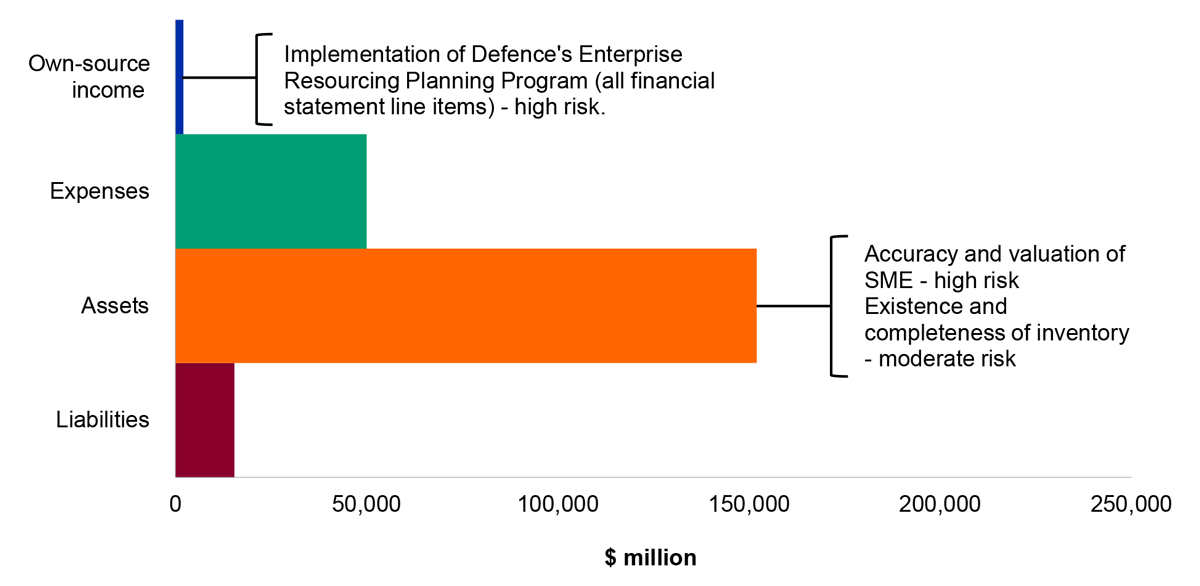

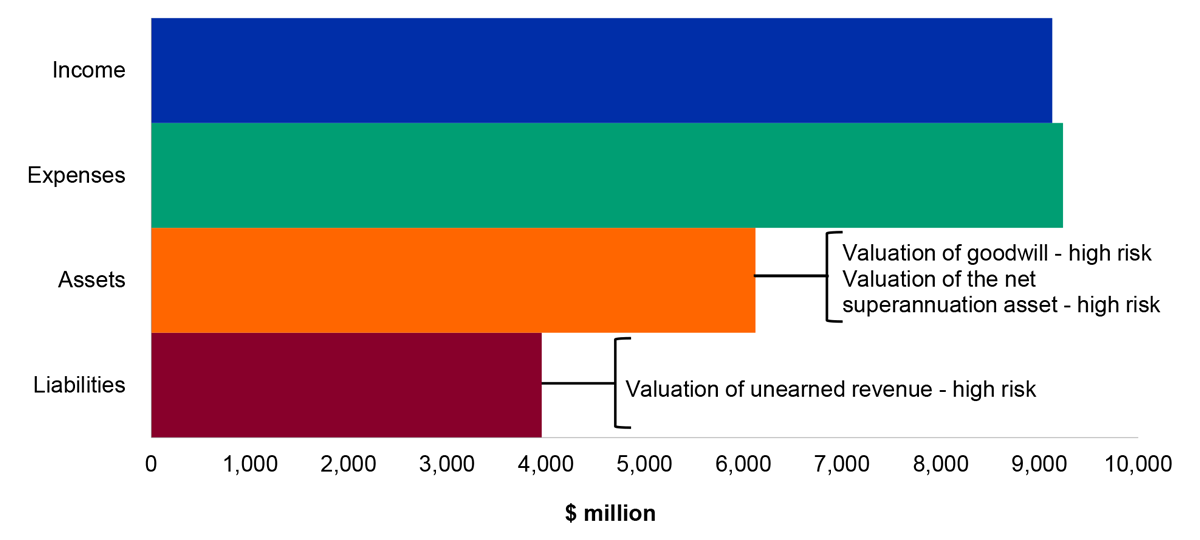

Figure 4.5.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and Defence’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statement.

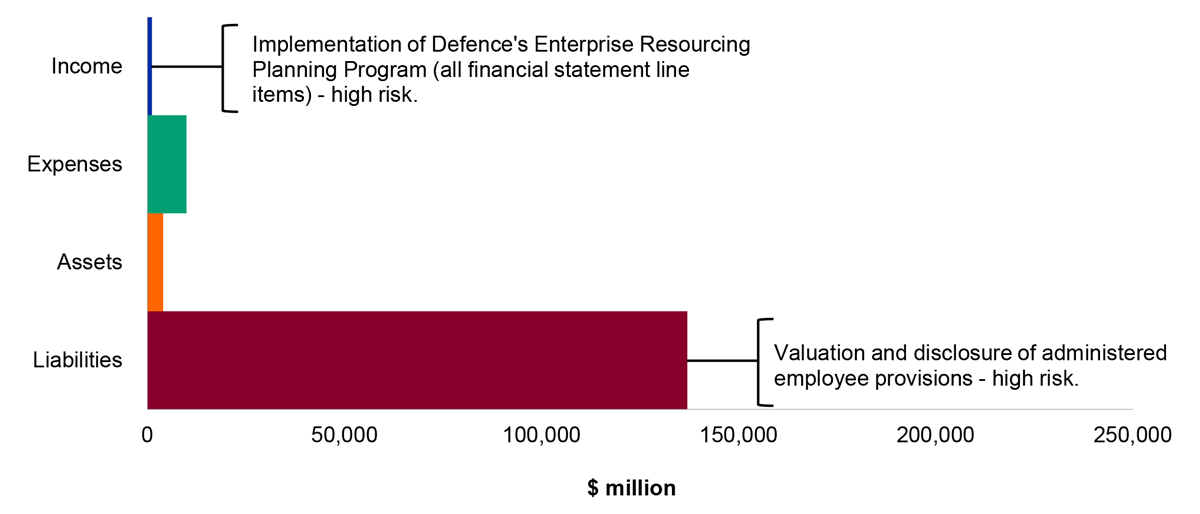

Figure 4.5.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and Defence’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statement.

Conclusion

4.5.10 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that Defence will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.6 Department of Veterans’ Affairs

4.6.1 The Department of Veterans’ Affairs (DVA) is responsible for developing and implementing programs to assist the veteran and ex-service communities. This includes granting pensions, allowances and other benefits, and providing treatment under the Veterans’ Entitlements Act 1986; the administration of benefits and arrangements under the Military Rehabilitation and Compensation Act 2004; determining and managing claims relating to defence service under the Safety, Rehabilitation and Compensation (Defence-related Claims) Act 1988; administering the Defence Service Homes Act 1918, the War Graves Act 1980; and conducting commemorative programs to acknowledge the service and sacrifice of Australian servicemen and women.

Engagement risk rating

4.6.2 The engagement risk for DVA’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- the complexity of personal benefit and healthcare claims, the IT systems used to process these claims, and the associated legislation which is administered by DVA;

- the significance of the backlog of claims and the changes to claims processing at DVA as a result of the Royal Commission into Defence and Veteran suicide; and

- the complexity of the calculation of key financial balances including the provision for military compensation.

Interim audit results

4.6.3 At the 2024–25 interim audit phase, five findings posing a moderate business or financial risk to DVA and five minor findings remain unresolved. One minor finding was resolved.

4.6.4 The ANAO will focus on the action taken by DVA in response to these findings as part of the 2024–25 final audit.

Audit findings

Table 4.6.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

– |

– |

– |

– |

|

B |

5 |

– |

– |

5 |

|

L1 |

– |

– |

– |

– |

|

Total |

5 |

– |

– |

5 |

Source: ANAO 2024–25 interim audit results.

Unresolved moderate audit findings

Security Governance — Monitoring Implementation of Controls

4.6.5 During previous financial statements audits, the ANAO identified that DVA’s information technology governance and monitoring processes were not fully effective to address identified business risks. The ANAO recommended an effective governance and assurance framework be developed over security governance to ensure controls were implemented and operating effectively.

4.6.6 During 2023–24, DVA advised the ANAO that it is planning to implement an assurance framework that addresses IT governance encompassing DVA’s own and outsourced arrangements. The assurance framework will set out the cadence of reporting on the effectiveness of IT controls to the DVA Security Committee. This assurance framework is expected to be finalised and presented to the DVA Security Committee for endorsement in 2025–26.

Process Direct security risk management

4.6.7 In previous audits, the ANAO identified weaknesses relating to the management of security risks as part of an upgrade to the claims processing ICT system Process Direct, implemented in November 2020.

4.6.8 DVA affirmed that the accreditation of Process Direct was finalised in August 2021 and all required security documentation developed. The ANAO’s inspection of the accreditation documents, including the Process Direct System Security Plan, identified that two of the three self-identified risks remained untreated. DVA acknowledged that the untreated risks were accepted when the interim approval to operate was issued.

4.6.9 During 2023–24, DVA approved an updated Interim Authority to Operate for Process Direct which included a risk assessment and a targeted risk remediation plan. The risk assessment highlighted three unmitigated high risks relating to Process Direct. During the 2024–25 interim audit, the ANAO noted that remediation work had been completed for two of the three risks, and that DVA is in the process of remediating the final unmitigated risk.

Monitoring of Privileged Activity, Process Direct & ISH

4.6.10 Process Direct and ISH are ICT systems utilised by DVA for processing claims. The ANAO identified weaknesses in DVA’s monitoring of privileged user activity for both systems and raised individual findings for each.

4.6.11 Users with administrative privileges, commonly referred to as privileged users, are able to make significant changes to IT systems’ configuration and operation, bypass critical security settings and access sensitive information. To reduce the risks associated with this access, the Information Security Manual requires that privileged user access be appropriately restricted and when provided, that the access is logged, regularly reviewed and monitored.

4.6.12 DVA was not able to demonstrate activities performed to monitor privileged user transactions or activities in the Process Direct & ISH claim processing IT systems. DVA advised the ANAO that the entity relied on the activities undertaken by Services Australia under the Shared Services Agreement which exists between the two entities. While Services Australia produces a report on user activity which covers all IT platforms (including Process Direct and ISH) and provides the report to DVA, Services Australia does not undertake any monitoring activities on DVA’s behalf.

4.6.13 The ANAO recommended that DVA implement a process to monitor the activities of privileged users in Process Direct and ISH. DVA are working with Services Australia to develop an appropriate monitoring process.

Bank reconciliations — identification of reconciling items — relating to DVA’s cash management processes

4.6.14 During the 2023–24 interim audit, the ANAO raised a minor finding on bank reconciliations due to the process not being able to identify reconciling amounts on a timely basis. During the 2023–24 final audit, the weaknesses identified by the ANAO had not been rectified. The ANAO’s review of the 30 June 2024 bank reconciliation performed by DVA identified $714.5 million in unpresented payments and $586.7 million in un-receipted deposits.

4.6.15 The ANAO’s analysis of these reconciling amounts identified a $64.2 million adjustment required to the balance of cash and cash equivalents reported by DVA at 30 June 2024. This adjustment was due to a timing difference, which would have otherwise been identified by DVA if the weaknesses identified by the ANAO relating to bank reconciliations and reconciling items were addressed by DVA as recommended.

4.6.16 During the 2024–25 interim audit, the ANAO noted that DVA had undertaken procedures to remediate the risks identified by the ANAO, including the preparation of quarterly bank reconciliations and the provision of an audit finding closure pack to the ANAO. The ANAO will assess the design, implementation and operating effectiveness of those procedures during the 2024–25 final audit phase.

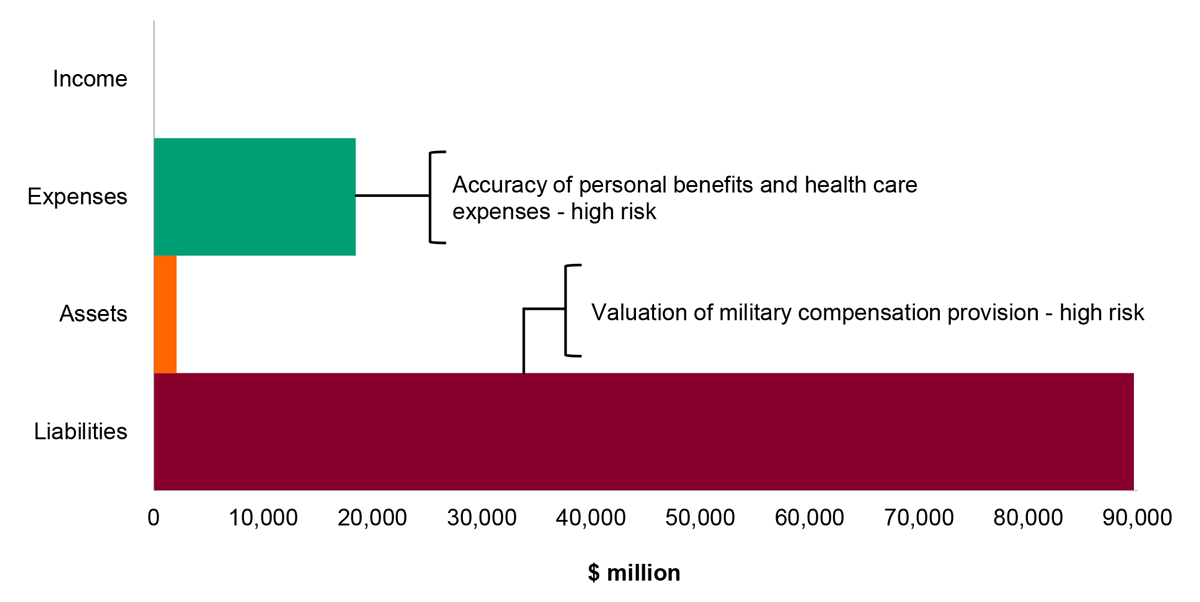

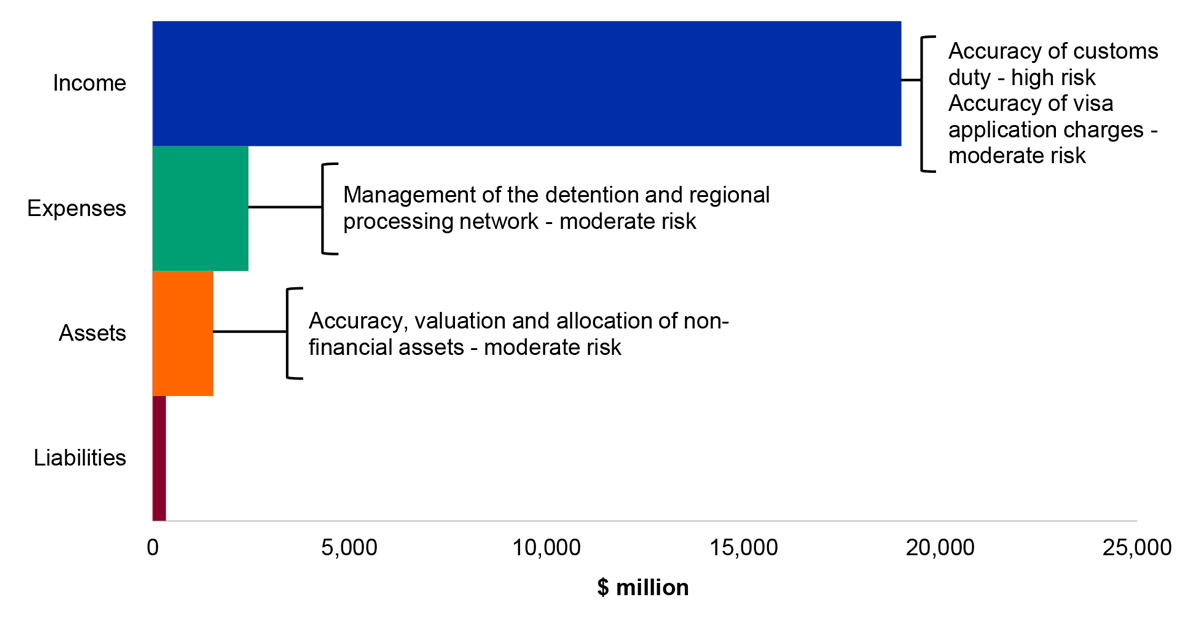

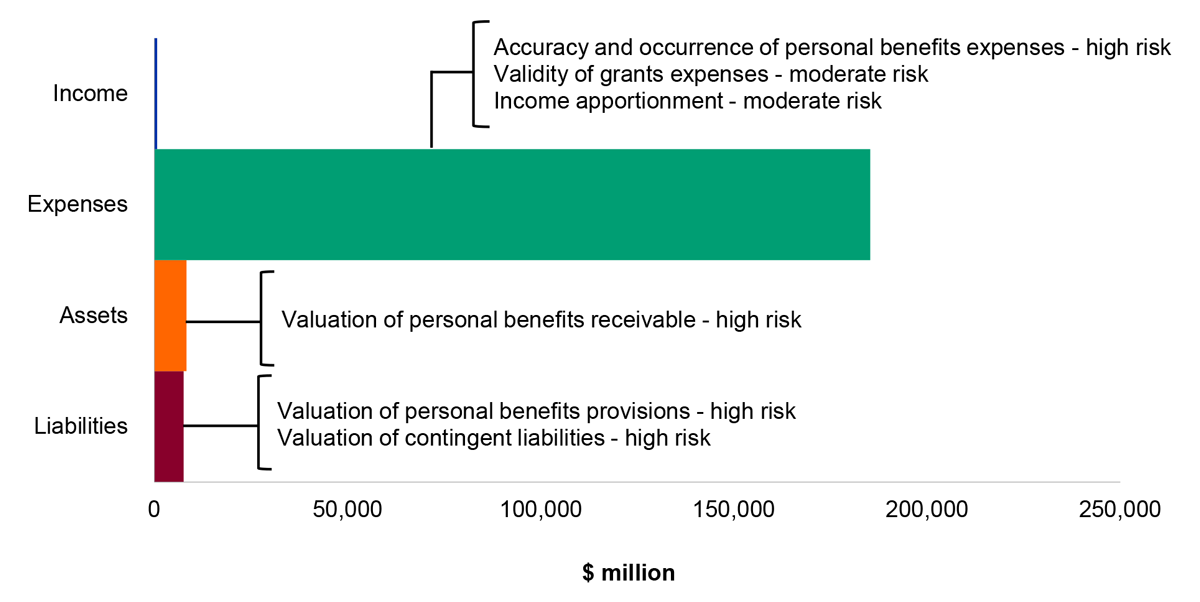

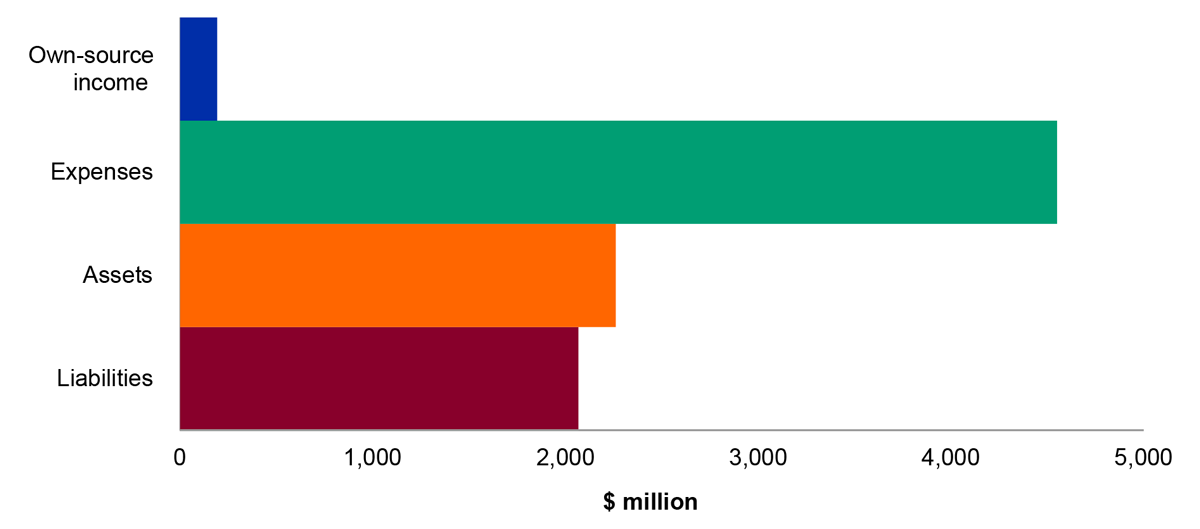

Key financial balances and areas of financial statements risk

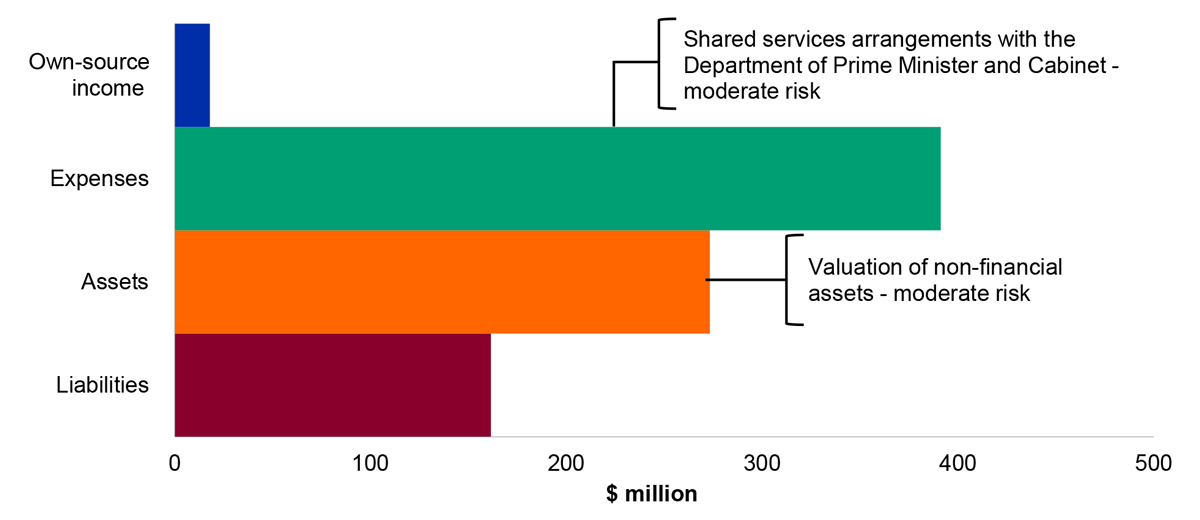

4.6.17 Figures 4.6.1 and 4.6.2 show the key financial statements items reported by DVA and the key areas of financial statements risk.

Figure 4.6.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and DVA’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statement.

Figure 4.6.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and DVA’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statement.

Conclusion

4.6.18 At the completion of the interim audit, the ANAO has reported several areas where improvements are required. These audit findings reduce the level of confidence that can be placed on the key elements of internal control that support the preparation of the financial statements that are free from material misstatement.

4.6.19 Action against the audit findings identified will be assessed by the ANAO, in conjunction with additional audit procedures, during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.7 Department of Education

4.7.1 The Department of Education (Education) contributes to Australia’s economic prosperity and social wellbeing by creating opportunities and driving better outcomes through access to quality education. Investment in early childhood, schools, youth and higher education creates the foundation for a resilient and equitable society. The department aims to deliver an education system that is inclusive, accessible, and affordable for all Australians.

Engagement risk rating

4.7.2 The engagement risk for Education’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- Education’s role in administering programs across Australia’s education system, including the Higher Education Loan Program (HELP) and the Higher Education Superannuation Program (HESP);

- a complex IT environment used for making payments to schools, universities, and other education providers; and

- the complexity of some financial statements balances, such as the valuation of loans under HELP, and valuation of the HESP provision, that require management judgement and involve estimation uncertainty.

Interim audit results

4.7.3 At the interim audit phase, the ANAO has not identified any findings that could pose a significant or moderate business or financial risk to Education. One minor finding was identified, and one minor finding was resolved.

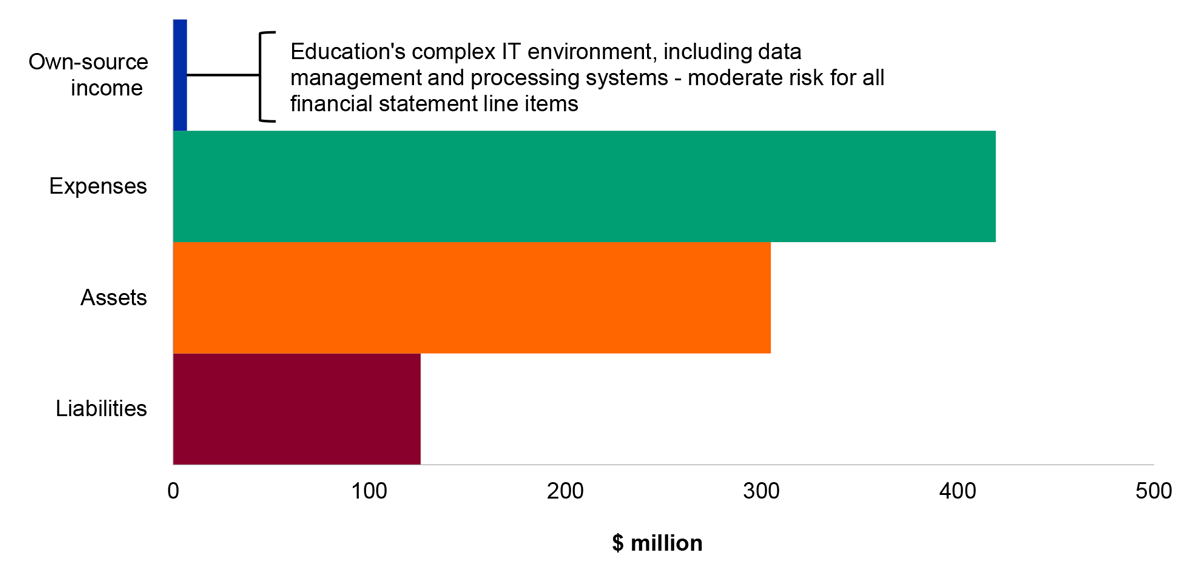

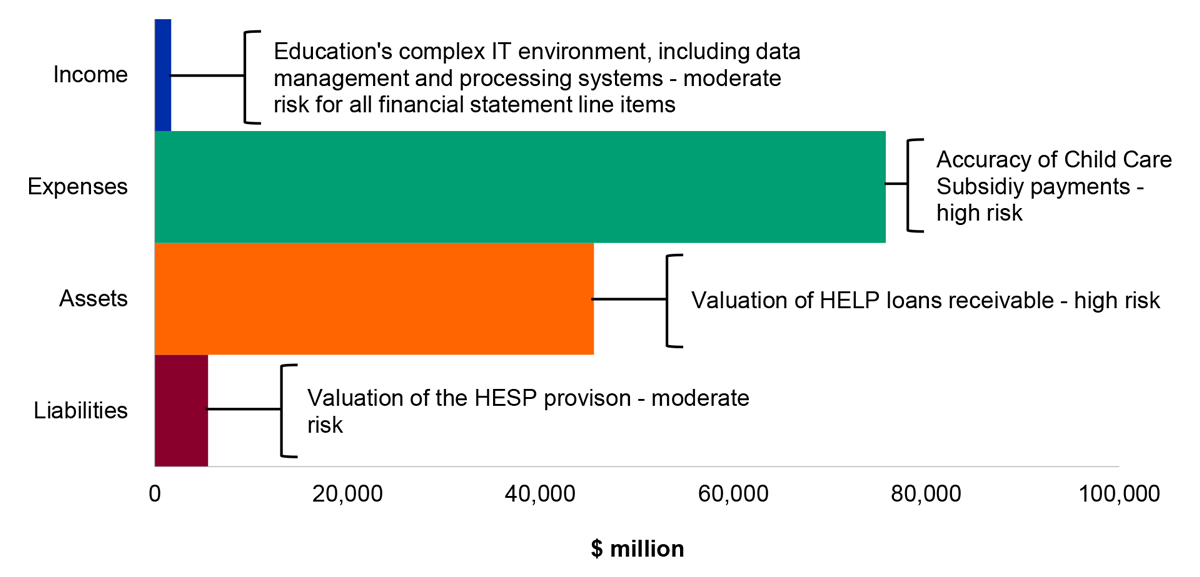

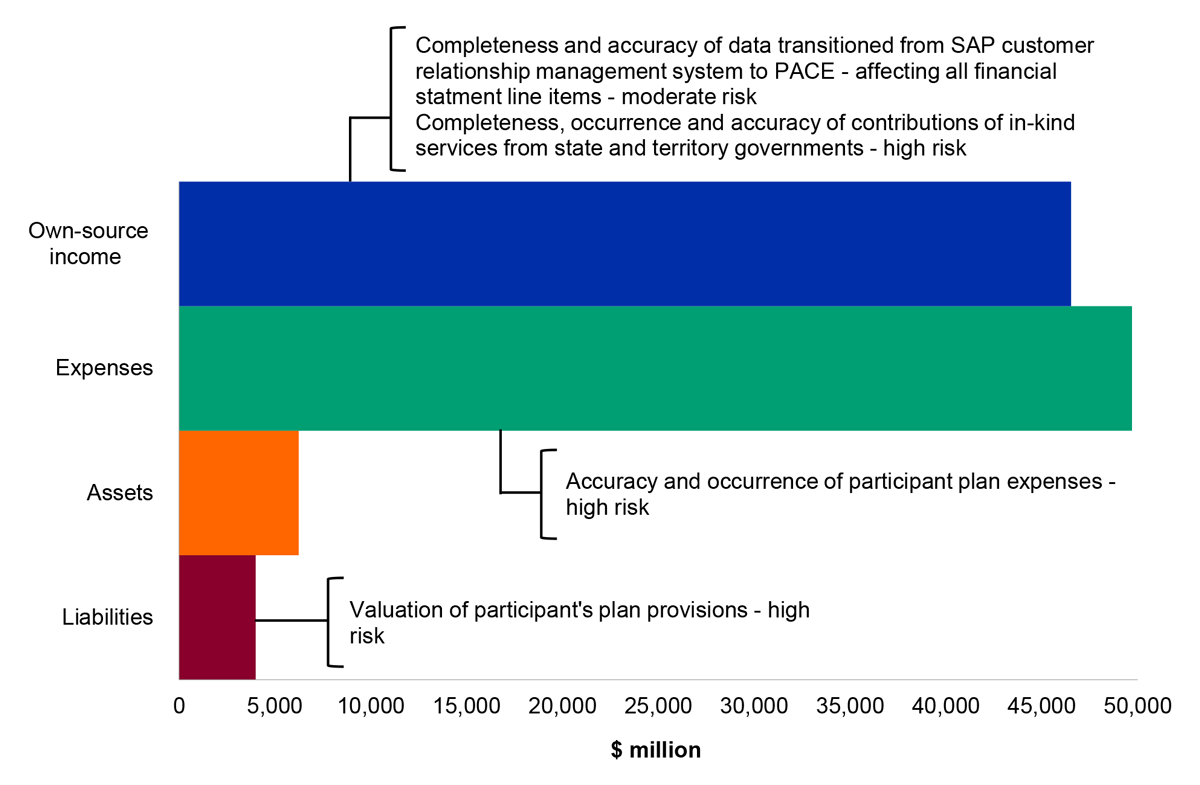

Key financial balances and areas of financial statements risk

4.7.4 Figures 4.7.1 and 4.7.2 below show the key financial statements items reported by Education and the key areas of financial statements risk.

Figure 4.7.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and Education’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Figure 4.7.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and Education’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.7.5 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that Education will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.8 Department of Employment and Workplace Relations

4.8.1 The Department of Employment and Workplace Relations (DEWR) is responsible for ensuring Australians can experience the social wellbeing and economic benefits that training, and employment provide. DEWR is also responsible for workplace relations and work health and safety, rehabilitation and compensation.

Engagement risk rating

4.8.2 The engagement risk for DEWR’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- DEWR’s administration and regulation of a complex legislative framework that underpins various significant payments; and

- financial statements balances, such as the valuation of the Vocational Student Loans, and Australian Apprenticeship Support Loans, which require significant management judgement and are subject to estimation uncertainty.

Interim audit results

4.8.3 At the 2024–25 interim audit phase, one audit finding that poses a moderate business or financial risk to DEWR has been identified and two minor findings remain unresolved.

4.8.4 The ANAO will focus on the action taken by DEWR in response to these findings as part of the 2024–25 final audit.

Audit findings

Table 4.8.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

– |

– |

– |

– |

|

B |

– |

1 |

– |

1 |

|

L1 |

– |

– |

– |

– |

|

Total |

– |

1 |

– |

1 |

Source: ANAO 2024–25 interim audit results.

New moderate audit finding

Governance of legal and other matters

4.8.5 During the 2023–24 audit, the ANAO made requests for information relating to known or suspected instances of non-compliance with laws and regulations including legal matters, whose effects should be considered in the preparation of DEWR’s financial statements.

4.8.6 DEWR’s 2023–24 Management Assurance Certificate survey included a question on legislative non-compliance. DEWR reported to its Accountable Authority and its Audit and Risk Committee that there were no significant matters identified from the results of the 2023–24 Management Assurance Certificate survey.

4.8.7 On 26 February 2025, the Secretary advised the Senate Education and Employment Committee and published on DEWR’s website, details of decisions made under the Social Security Administration Act 1999, which may not have been valid. Around the same time DEWR advised the ANAO of the matter. The Social Security Administration Act 1999, in so far as it relates to mutual obligations requirements and compliance for some social security payments, are administered by DEWR. The Secretary explained IT systems and decision-making processes were not operating in alignment with the legal framework.

4.8.8 Across the legal and business areas of DEWR, SES officials were aware of the potential legislative validity issues at the time of the Accountable Authority and Chief Financial Officer signing the financial statements and written representations. However, there was no documented consideration of this matter through the Management Assurance Certificate survey, nor communication to the ANAO in response to enquiries made.

4.8.9 As the responses in the 2023–24 Management Assurance Certificate were incomplete, there is a risk that legal and other matters are not sufficiently considered for financial reporting purposes, including supporting the written representations made by the Accountable Authority and Chief Financial Officer for the financial statements audit.

4.8.10 The ANAO recommends that DEWR should reinforce the importance of the centralised Management Assurance Certificate process and SES officers’ responsibilities in terms of reporting complete and accurate financial information, effectiveness of existing controls, and identification of any legal and financial non-compliance. The results of the Management Assurance Certificate survey should support timely communication of any potential or systemic legal matters. This includes responding to the ANAO’s enquiries and supporting the written representations signed as part of the preparation of the annual financial statements.

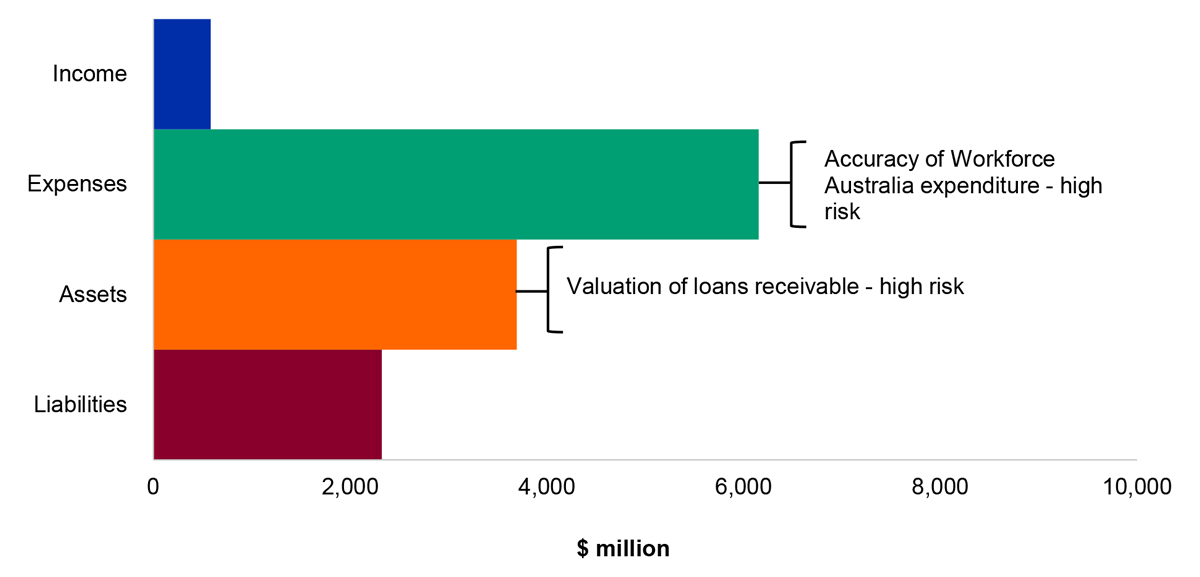

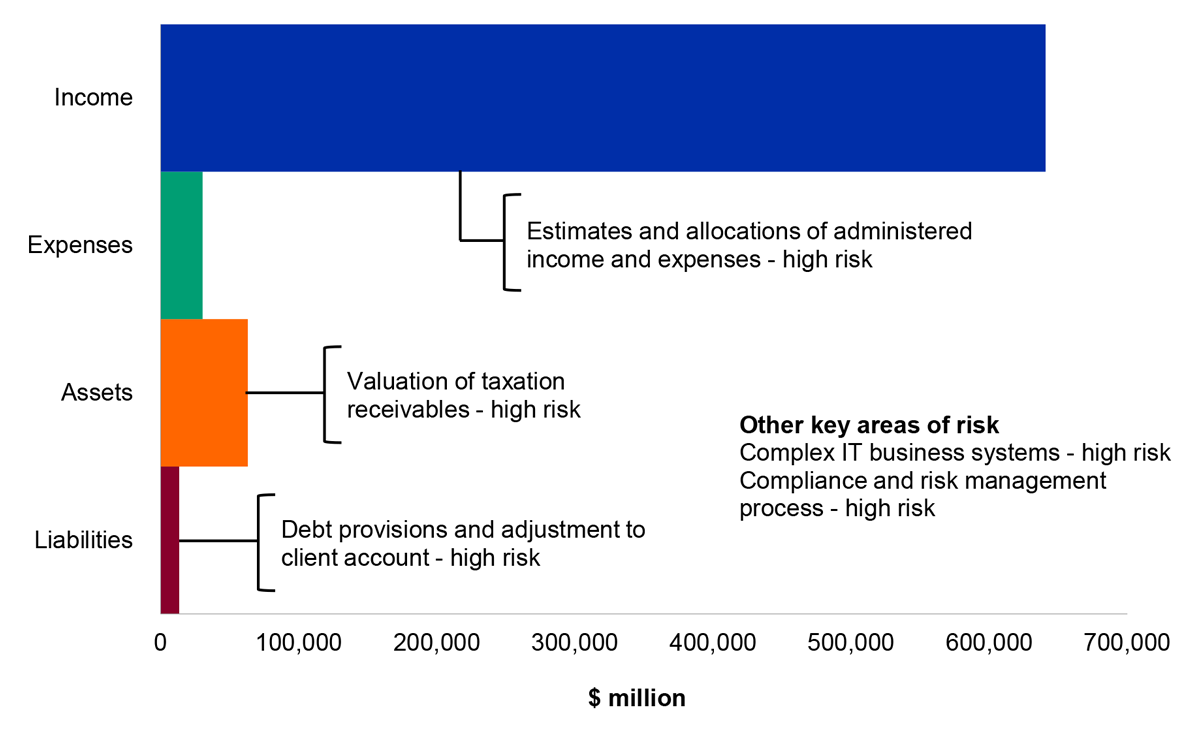

Key financial balances and areas of financial statements risk

4.8.11 Figures 4.8.1 and 4.8.2 show the key financial statements items reported by DEWR and the key areas of financial statements risk.

Figure 4.8.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and DEWR’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Figure 4.8.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and DEWR’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.8.12 At the completion of the interim audit, and except for the finding outlined above, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that DEWR will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.9 Department of Finance

4.9.1 The Department of Finance (Finance) is responsible for supporting the government’s budget process and oversight of public sector resource management, and for governance and accountability frameworks, as well as the production of the Australian Government’s consolidated financial statements. Financial also provides shared services through the Service Delivery Office.

Engagement risk rating

4.9.2 The engagement risk for Finance’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- the complexity of some financial statements balances which require increased management judgement and involve estimation uncertainty; and

- the significance of Finance’s administered financial statements to the Australian Government’s consolidated financial statements.

Interim audit results

4.9.3 At the 2024–25 interim audit phase, the ANAO has not identified any findings that pose a significant or moderate business or financial risk to Finance. One minor finding remains unresolved.

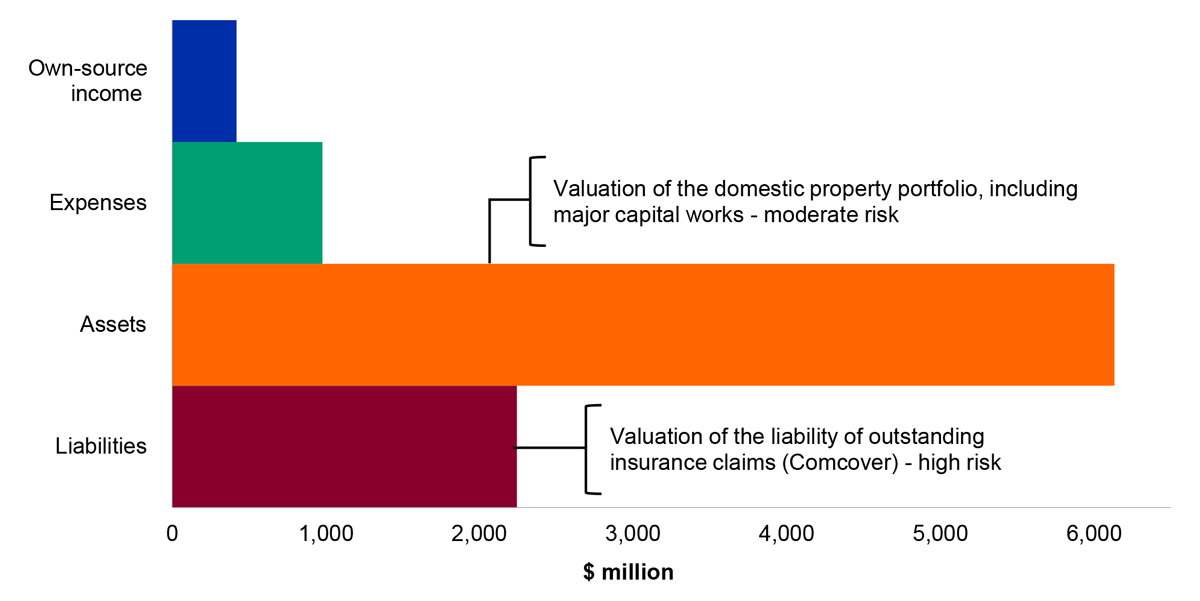

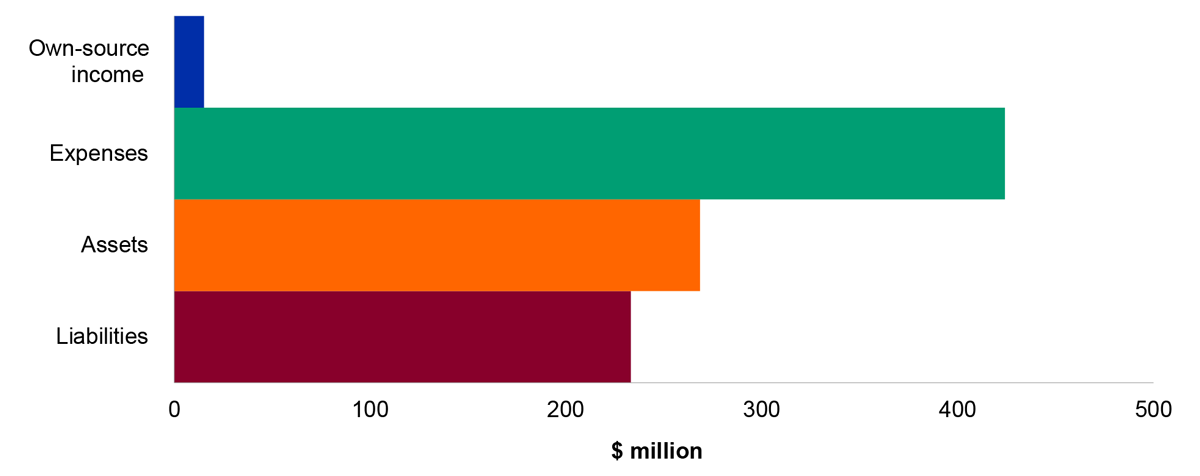

Key financial balances and areas of financial statements risk

4.9.4 Figures 4.9.1 and 4.9.2 below show the key financial statements items reported by Finance and the key areas of financial statements risk.

Figure 4.9.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and Finance’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Figure 4.9.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and Finance’s 2024–25 revised budget as reported in the 2024–25 Portfolio Additional Estimates Statements.

Conclusion

4.9.5 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that Finance will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

4.10 Future Fund Management Agency

4.10.1 The Future Fund Board of Guardians, supported by the Future Fund Management Agency (together the Future Fund), is responsible for investing the assets of the Future Fund under the Future Fund Act 2006, and other investment funds, managed on behalf of the Department of Finance.

Engagement risk rating

4.10.2 The engagement risk for the Future Fund’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- significant judgements required by management to value the investments of the Future Fund for financial reporting purposes, which are subject to estimation uncertainty;

- the significance of the Future Fund’s investment portfolio to the Australian Government’s financial position; and

- the reliance on external parties, particularly the valuation undertaken by the investment custodian.

Interim audit results

4.10.3 At the 2024–25 interim audit phase, the ANAO has not identified any findings that could pose a significant or moderate business or financial risk to the Future Fund.

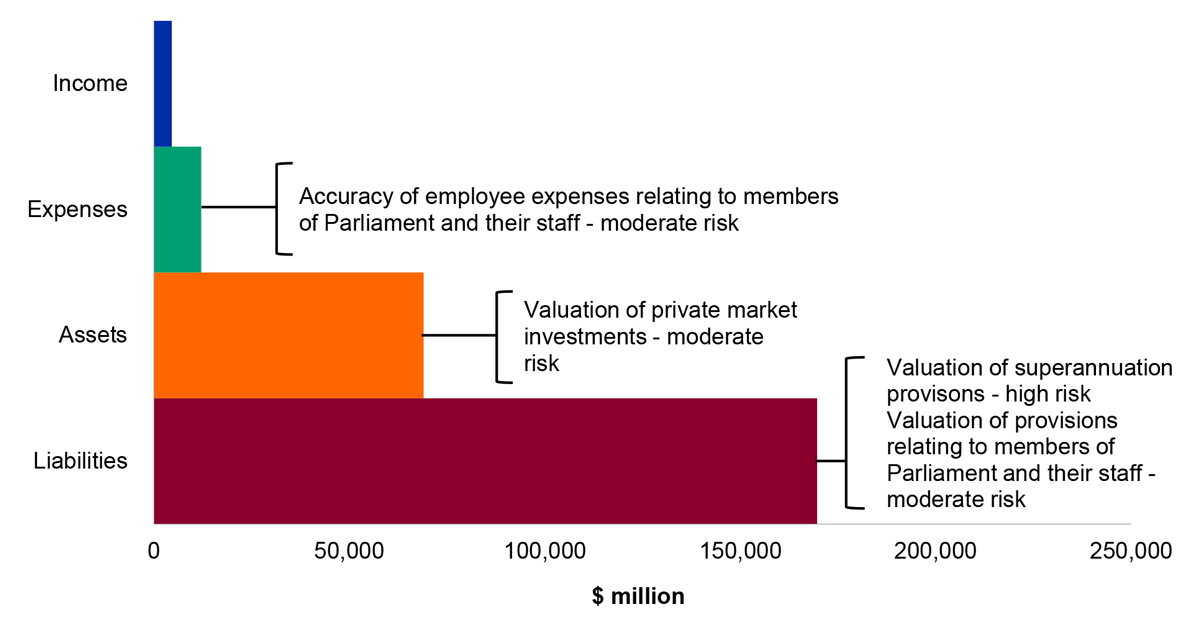

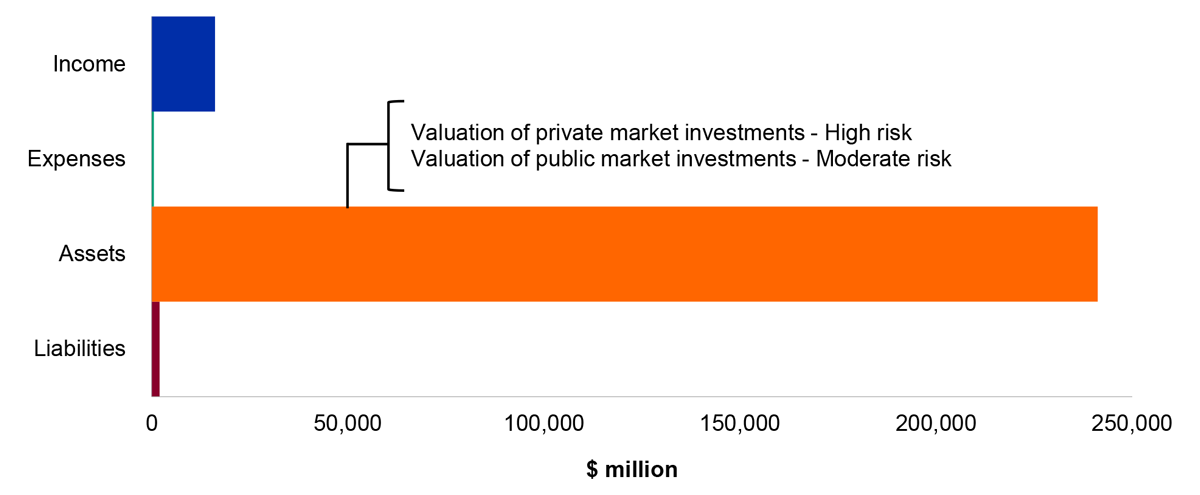

Key financial balances and areas of financial statements risk

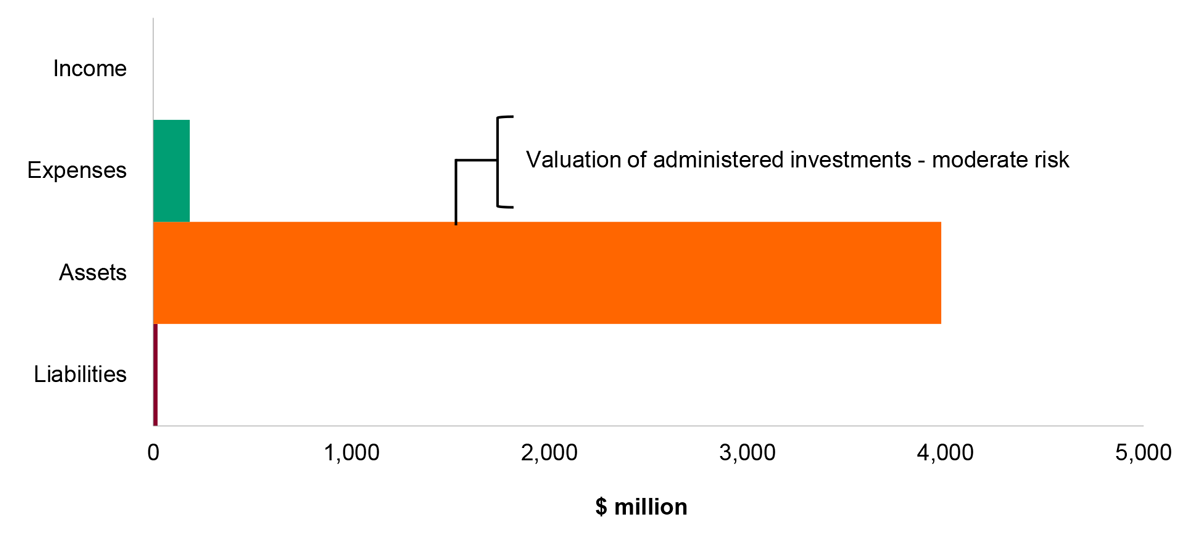

4.10.4 Figures 4.10.1 and 4.10.2 below show the key financial statements items reported by the Future Fund and the key areas of financial statements risk.

Figure 4.10.1: Key departmental financial balances and areas of financial statements risk

Source: ANAO analysis and the Future Fund’s 2024–25 Portfolio Budget Statements.

Figure 4.10.2: Key administered financial balances and areas of financial statements risk

Source: ANAO analysis and the Future Fund’s 2024–25 Portfolio Budget Statements.

Conclusion

4.10.5 At the completion of the interim audit, the ANAO identified that key elements of internal control were operating effectively to provide reasonable assurance that the Future Fund will be able to prepare financial statements that are free from material misstatement. The effective operation of these controls for the full financial year will be assessed by the ANAO in conjunction with additional audit procedures during the 2024–25 final audit and reported in the ANAO’s Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2025, expected to table in December 2025.

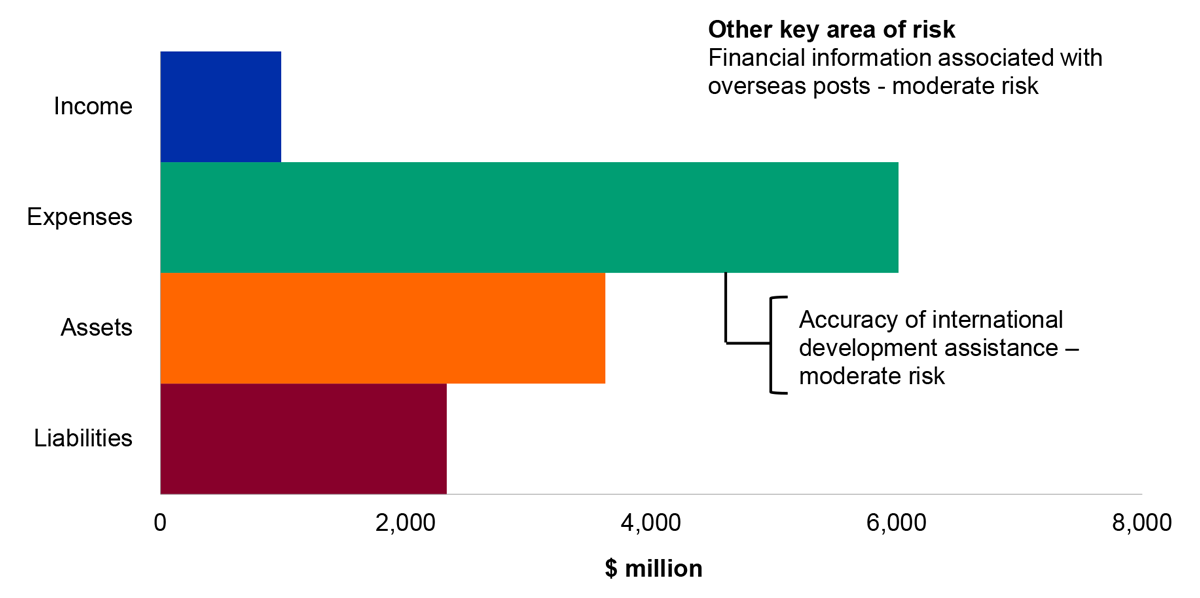

4.11 Department of Foreign Affairs and Trade

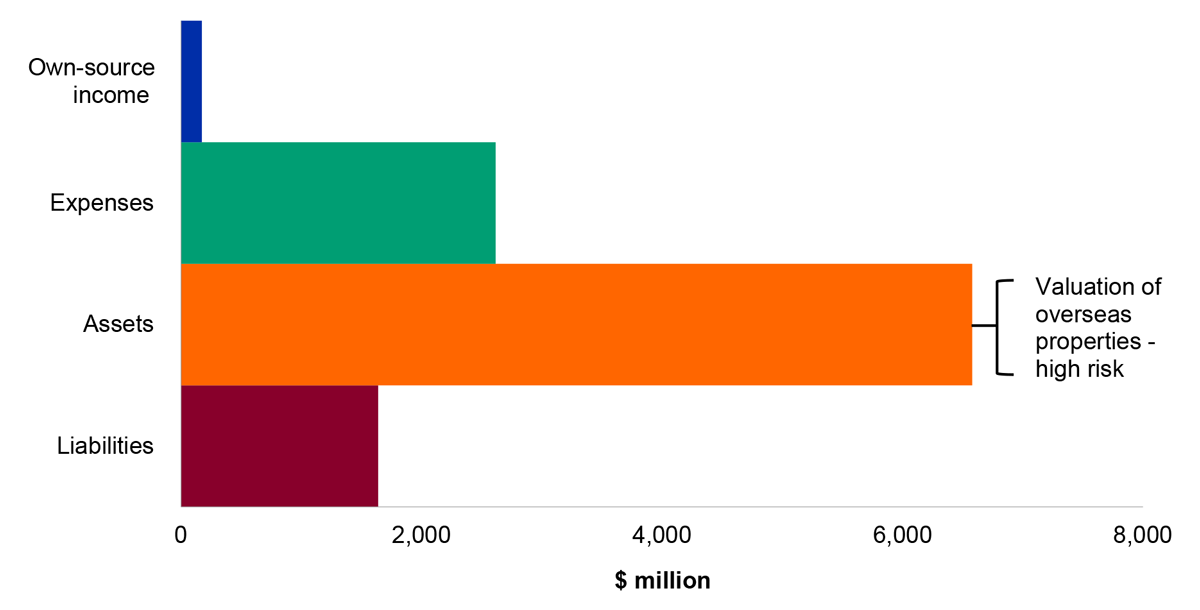

4.11.1 The Department of Foreign Affairs and Trade (DFAT) is responsible for the administration of Australia’s foreign, trade, international development and international security policies.

Engagement risk rating

4.11.2 The engagement risk for DFAT’s 2024–25 financial statements audit has been assessed as moderate. Key factors contributing to this rating include:

- the complexity of DFAT’s business operations arising from a decentralised control framework;

- the degree of professional judgement and estimation required to determine the fair value of land and buildings recognised in the financial statements; and

- the degree of reliance on third parties for the provision of services associated with the delivery and maintenance of the overseas property portfolio and provision of international development assistance.

Interim audit results

4.11.3 At the 2024-25 interim audit phase, one finding that poses a moderate business or financial risk to DFAT and one minor finding remain unresolved. One minor finding was identified.

4.11.4 During the 2024-25 final audit the ANAO will undertake further procedures and assess action taken by DFAT to address the weaknesses identified.

Audit findings

Table 4.11.1: Status of audit findings raised by the ANAO

|

Category |

Closing position (2023–24 final) |

New findings (2024–25 interim) |

Resolved findings (2024–25 interim) |

Closing position (2024–25 interim) |

|

A |

– |

– |

– |

– |

|

B |

1 |

– |

– |

1 |

|

L1 |

– |

– |

– |

– |

|

Total |

1 |

– |

– |

1 |

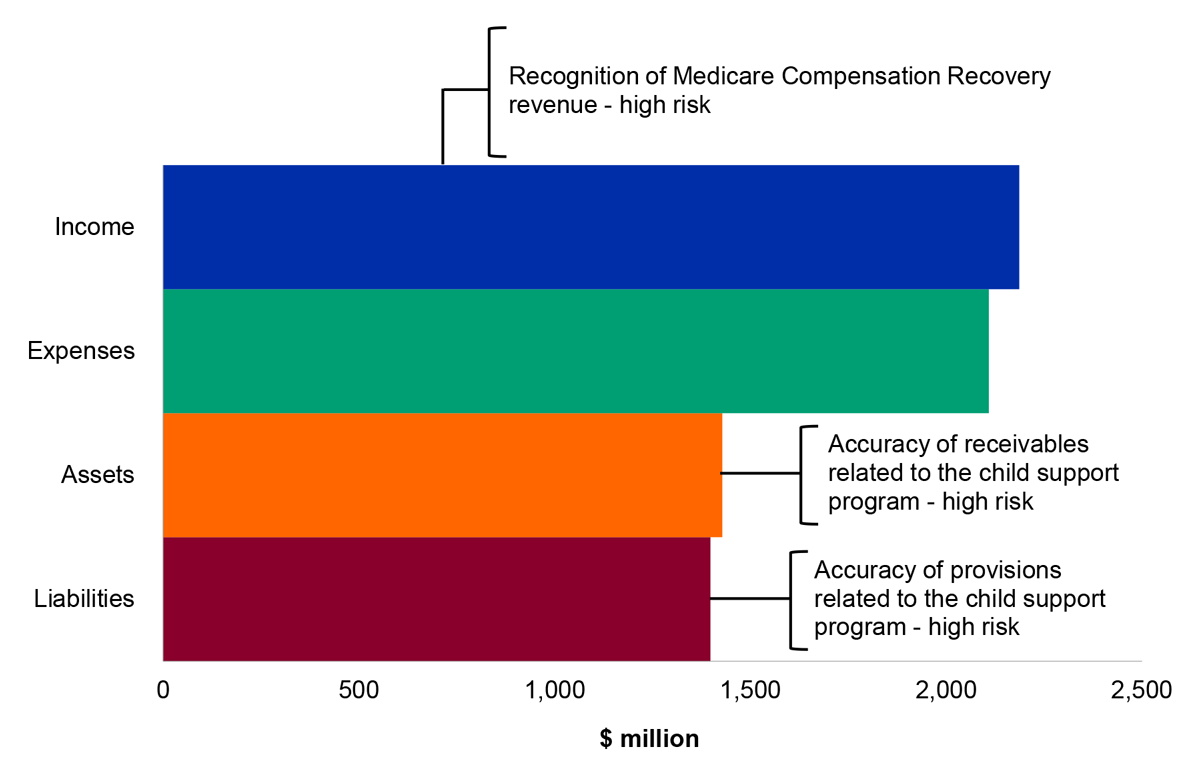

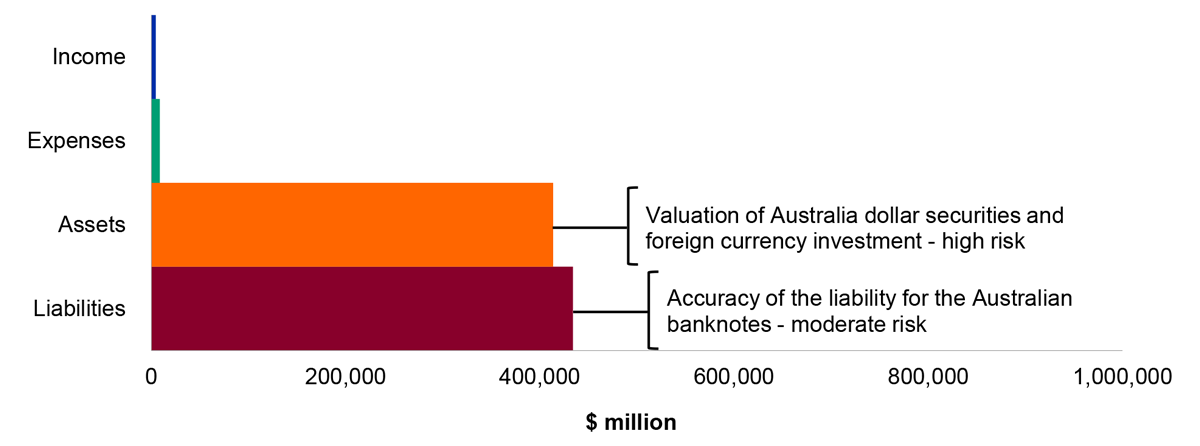

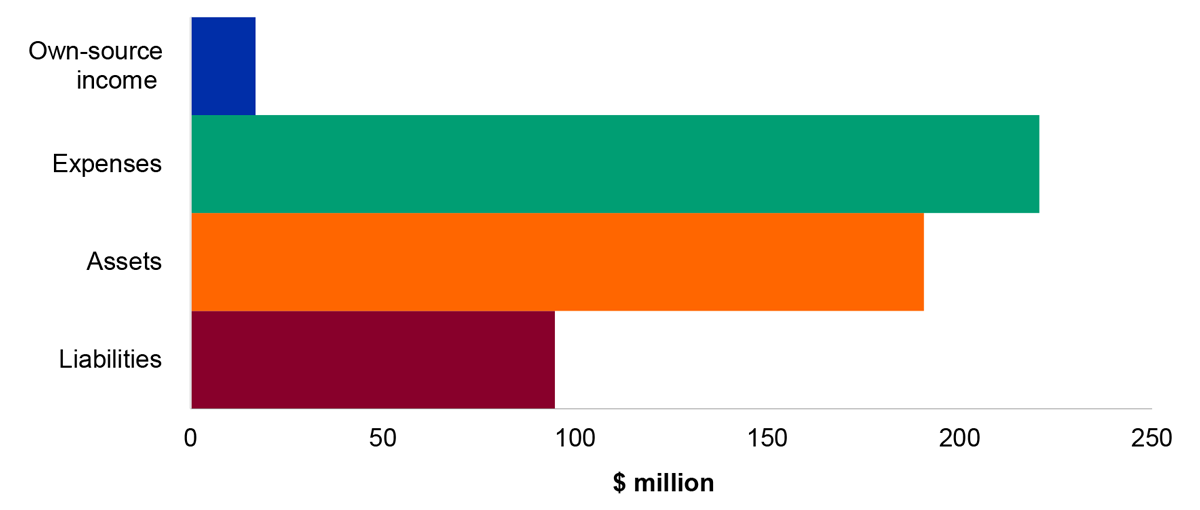

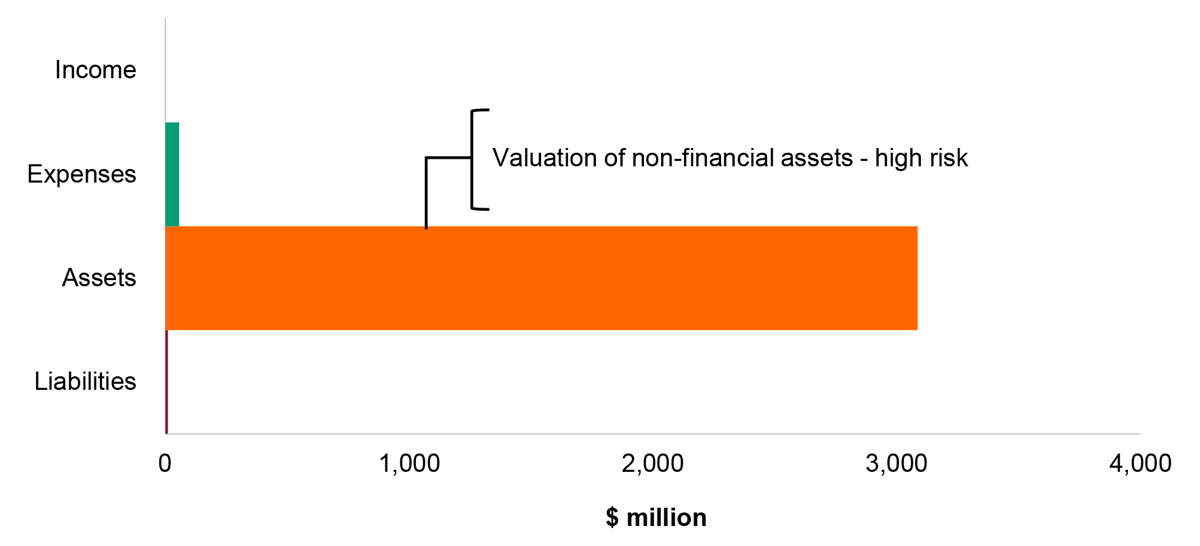

Source: ANAO 2024–25 interim audit results.