Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Australian Taxation Office’s Procurement of IT Managed Services

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Australian Taxation Office (ATO) procured services for a material portion of its IT contract arrangements that were reaching end of life. These contracts affect all ATO staff, clients and service delivery.

- A previous ANAO audit identified issues with ATO's IT procurement, including that ATO did not have evidence of market research, provide advice regarding risks to achieving value for money to the delegate, or have sufficient documentation of value for money and risk management, including probity risks.

- This audit will provide assurance to Parliament about the ATO's compliance with the Commonwealth Procurement Rules (CPRs).

Key facts

- In February 2021 the ATO established the IT Strategic Sourcing Program to procure IT managed services at the end of life of five existing contracts.

- The ATO approached the market in three waves, with seven requests for tender, between March and November 2022. The final contract was signed in June 2024.

What did we find?

- The ATO’s procurement of IT managed services has been largely effective.

- The ATO established largely sound governance arrangements for the IT managed services procurements. The design of the program of procurements was supported by applying lessons learned and market research.

- The ATO conducted the procurements largely in compliance with the CPRs and other requirements. The IT managed services procurements demonstrated value for money. Key probity risks, including a senior officer’s conflict of interest were not appropriately managed.

What did we recommend?

- There were four recommendations to the ATO relating to the approval of chief executive instructions, decision-making arrangements, management of conflicts of interest and value for money.

- The ATO agreed to the recommendations.

$2.5 bn

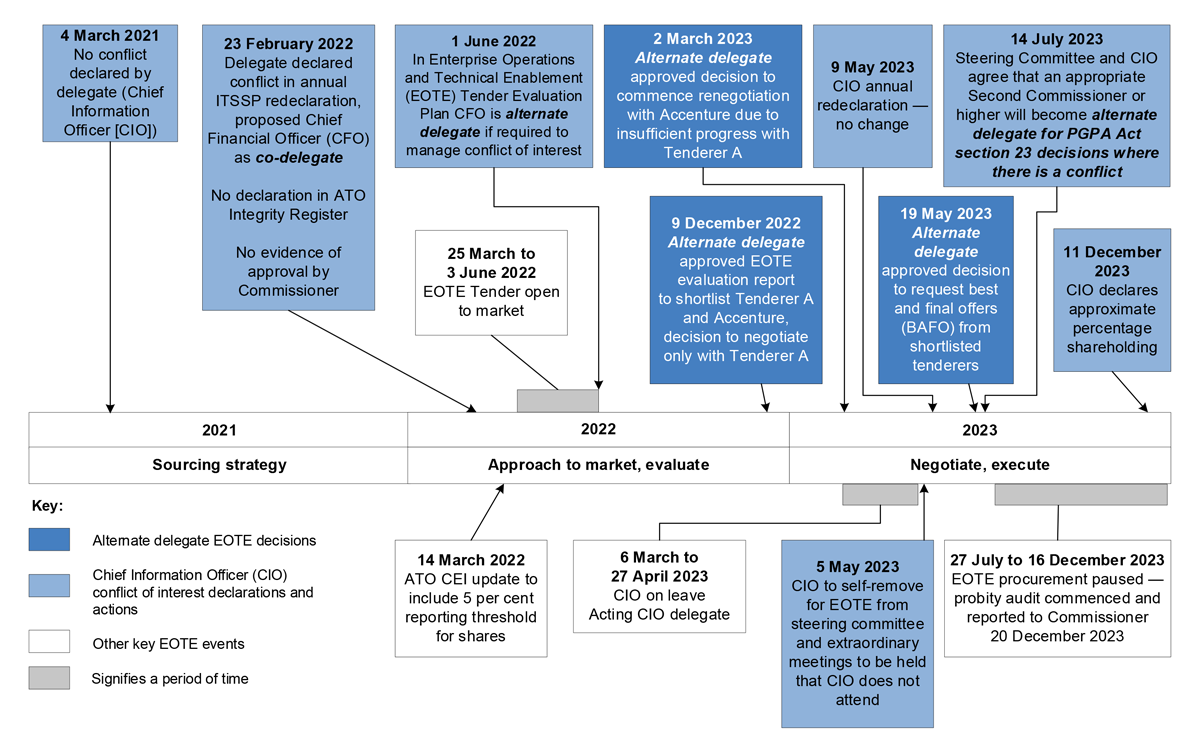

value of eight new IT managed services contracts over 10 years.

1,274

number of staff and contractors asked to confirm if they did or did not have a conflict of interest.

$88.11 m

value of six advisor contracts supporting the IT managed services procurements.

Summary and recommendations

Background

1. The Australian Taxation Office (ATO) is the principal revenue collection agency of the Australian Government. Its purpose is ‘to contribute to the economic and social wellbeing of Australians by fostering willing participation in the tax, superannuation and registry systems.’1 Having strong organisational capability, including information and communication technology (ICT) capability, directly contributes to delivering the ATO’s purpose and activities. An action that the ATO is taking to manage strategic technology risks is investment across its technology environment, including procurement for a range of IT managed services between 2022–2024.2

2. As a non-corporate Commonwealth entity, the ATO must comply with the Commonwealth Procurement Rules (CPRs)3 and the Australian Government Digital Sourcing Contract Limits and Reviews Policy. Achieving value for money is the core rule of the CPRs. The Australian Government Digital Sourcing Contract Limits and Reviews Policy’s three main requirements for contracts signed from 1 February 2020 are: contracts must not exceed $100 million exclusive of GST (including all extensions); contracts must not exceed a three-year initial term; and contract extension options must not exceed three years and can only be used after a review of contractor performance and deliverables.

3. The IT Strategic Sourcing Program (ITSSP) was established in February 2021 to strategically plan how the ATO would procure services to replace five ICT contracts with an estimated value of $3,748.7 million, with contracts due to expire between November 2023 and December 2025. The ATO approached the market in three waves, for seven requests for tender, between March and November 2022. It entered into eight contracts for IT managed services between December 2022 and June 2024.

4. Each of the ITSSP procurement processes were supported by external advisors. The ATO engaged six external advisors. The total value of the advisor contracts is estimated to be $88.11 million. The six advisor contracts commenced between April 2021 and February 2022. The contracted services were for advice relating to strategic sourcing, technical, probity, legal, financial assurance and project management.

Rationale for undertaking the audit

5. The ATO was procuring IT managed services as a material portion of its IT contract arrangements are due to expire. It was estimated that the new contracts would be valued at $2,536 million over 10 years if contract extension options are used (see paragraph 1.15). These contracts affect all ATO staff, clients and service delivery.

6. A cross entity audit of Establishment and Use of ICT Related Procurement Panels and Arrangements that included ATO was tabled in August 2020. That audit identified issues with ATO’s IT procurement, including that ATO did not meet the conditions for limited tender (including that there was no evidence of market research and that advice regarding risks to achieving value for money was not provided to the delegate), and that there was no or insufficient documentation of value for money and risk management, including probity risk management.

7. This audit provides assurance to Parliament about the ATO’s compliance with the CPRs for the procurement of IT managed services.

Audit objective and criteria

8. The objective of the audit was to assess the effectiveness of ATO’s procurement of IT managed services.

9. To form a conclusion against the objective, the following criteria were adopted.

- Has the ATO established sound governance arrangements for the IT managed services procurements?

- Has the ATO conducted the procurements in compliance with Commonwealth Procurement Rules and other requirements?

Conclusion

10. The ATO’s procurement of IT managed services was largely effective. Procurement activities for IT managed services were largely in line with the CPRs, including market engagement and soundings, and demonstrating value for money. There were, however, some shortcomings such as the ATO failing to observe core elements of the CPRs when conducting the legal services procurement, and not appropriately managing probity risks including declaring and managing conflicts of interest of the IT Strategic Sourcing Program delegate.

11. The ATO established largely sound governance arrangements for the IT managed services procurements. It established governance and oversight arrangements, procurement policies and procedures, and undertook market research to inform the design of its procurement strategy and plans. During planning, the program governance arrangements did not sufficiently distinguish endorsement and decision-making roles when seeking approvals. There were instances where the delegate, who was also the chair of the steering committee, provided approval to procurement planning related documentation and not separate delegate approval. Contrary to finance law in some instances Chief Executive Instructions (CEIs) were not consistently issued and approved by the accountable authority.

12. The ATO largely met core requirements of the CPRs except for probity management and conflict of interest. Mainframe Services and Hardware, Enterprise Operations and Technical Enablement (EOTE) and strategic sourcing partner procurements were largely in compliance with CPRs and other requirements. The approach to market and evaluation of the legal services procurement were not consistent with the intent of the CPRs4, and all required records were not maintained. The effectiveness of ATO’s management of probity risks could have been improved by ensuring that incumbent provider probity plans were approved by the ATO, and probity register records were effectively maintained. In addition, conflict of interest processes could have been better managed, including to address risks in a timely manner. Demonstration of value for money for the six advisor procurements was deficient with the cost of advisor contracts increasing from a total estimated value when approving the initial contracts of $19.06 million to a total value of $88.11 million, as at February 2025.

Supporting findings

Procurement governance and planning

13. A governance framework was implemented for the IT Strategic Sourcing Program (ITSSP), with the Chief Information Officer (CIO) as the delegate and senior accountable officer. Program risks were identified, assessed and managed. The initial planned completion including transition for the ITSSP was June 2024, this has been revised to December 2025. All procurements were completed and contracts signed by 20 June 2024 and transition is anticipated to be completed by December 2025. The steering committee considered options and risks to manage delays and impact on budget and timeframe. In some instances, consensus decision-making arrangements that were established through a steering committee led to a lack of clarity about when the delegate was exercising their delegation to make decisions. Over a period of 41 months there were 34 versions of the Chief Finance Officer’s (CFO’s) delegation schedules. (See paragraphs 2.4 to 2.31)

14. CEIs, procedures and guidance support ATO officials to undertake procurement in accordance with the CPRs. The ATO’s policy framework establishes arrangements where officers, other than the Commissioner, can approve and issue CEIs under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999 (PS Act). This has led to some instances where the Commissioner has not approved and issued CEIs that were required to be made under section 20A of the PGPA Act. The ATO’s CEIs, procedures and guidance align with the CPRs. The ITSSP applied the existing ATO procurement framework to the IT managed services and advisor procurements. (See paragraphs 2.32 to 2.50)

15. The ATO conducted redesign and planning activities in 2021 and 2022. Its annual procurement plan provided advance notice to the market of the planned ITSSP procurement. Market research supporting the procurement strategy included early market engagement through a request for information (RFI), a technology horizon scan, a market comparison report and like-sized agency comparison. For each of these activities there was clear advice to the steering committee and delegate about outcomes and how they inform the procurement approach. A procurement plan for the ITSSP set out the procurement strategy. Procurement plans were developed for the selected ITSSP and advisor procurements, except for the legal services procurement. (See paragraphs 2.51 to 2.71)

IT and advisor procurement processes

16. Approaches to market were fair and transparent for the selected procurements, except for the legal services procurement. Approach to market documentation apart from the legal services procurement was compliant with the CPRs with a few exceptions. For example, the request documentation was not a complete description in compliance with paragraph 10(6)(d) of the CPRs as there were instances where changes were subsequently made to the request for tender (RFT) evaluation criteria (such as the relative importance of the criteria) in the evaluation plan or report. The legal services advisor procurement did not demonstrate good practice as the ATO approached one supplier to quote for services and did not include evaluation criteria, with costs increasing from an initial quote of $665,500 to $10.9 million. (See paragraphs 3.3 to 3.18)

17. Tender evaluation plans were prepared for the selected ITSSP procurements prior to tenders closing. While a tender evaluation plan was prepared for the strategic sourcing partner procurement, it was not finalised prior to quotes closing. Instances of inconsistencies between evaluation criteria weightings presented in procurement plans, RFTs, evaluation plans and those applied during evaluation were: sub-criteria weightings were not included in the procurement plan or RFT; and priority rankings set were not included in the evaluation report. Non-compliant and unsuccessful tenderers were not notified promptly of outcomes of the evaluation phase for both of the selected ITSSP procurements. The legal services procurement did not develop an evaluation plan, involve an evaluation or meet mandatory reporting timeframes for contract notices on AusTender. (See paragraphs 3.19 to 3.48)

18. To support the management of probity risks for the ITSSP, the ATO appointed an external probity advisor, developed a probity plan and probity protocols, maintained a register of probity briefings, maintained a probity register, and maintained a register of probity cleared personnel (ATO staff and advisors). Some probity requirements, such as approval and review of incumbent provider management plans, were not fully implemented and records in registers were incomplete, impacting the ATO’s ability to manage probity, including conflicts of interest. Probity arrangements, including the management of conflict of interest, were established and largely implemented for one of the two selected advisor procurements. (See paragraphs 3.49 to 3.100)

19. The ATO has an established process for the management of conflict of interest, with additional processes introduced for the ITSSP. Not all elements of the process were followed, including for key personnel exercising delegation. Not all conflict of interest declarations were made (for example, a delegate was not asked to complete an initial conflict of interest declaration for the ITSSP) or were not made in a timely manner (for example, the ITSSP delegate did not declare a conflict for the first 12 months of the program), did not contain sufficient detail for the approver to make an informed decision (for example, three of the four officers that declared a shareholding did not report the quantum or value of the shareholding in all declarations), and did not contain a detailed management plan to support monitoring and assessment of their implementation. Record keeping was incomplete. (See paragraphs 3.75 to 3.100)

20. Advice was provided to the decision-maker at key stages throughout the selected procurements and approvals were documented, apart from the legal services procurement. The ATO documented value for money assessments for the selected ITSSP procurements and strategic sourcing partner procurement. An assessment of value for money was not documented for the legal services procurement. The ATO considered how the unit price of IT professional services changed over the period of the EOTE procurement process when assessing value for money, it did not consider other potential changes to the market such as new entrants and how this might impact value for money. The value of advisor procurements increased significantly throughout the life of the program without ongoing assessment of whether the services continued to represent value for money. (See paragraphs 3.103 to 3.123)

Recommendations

Recommendation no. 1

Paragraph 2.14

When establishing program governance arrangements which includes procurement, the Australian Taxation Office ensure that: decision-making responsibilities are clearly set out, including to separate endorsement and decision-making roles; and processes support the appropriate decision-maker to make a decision.

Australian Taxation Office response: Agreed.

Recommendation no. 2

Paragraph 2.42

Consistent with section 20A and paragraph 110(2)(aa) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) the Commissioner for Taxation should issue and approve all accountable authority instructions. To achieve this, the Australian Taxation Office should:

- review its policy framework to ensure compliance with the PGPA Act and Public Service Act 1999;

- refer to instructions made under section 20A of the PGPA Act as accountable authority or Commissioner’s instructions; and

- where instructions are made for conflict of interest and security they be issued under section 20A of the PGPA Act.

Australian Taxation Office response: Agreed.

Recommendation no. 3

Paragraph 3.100

When declaring and managing conflicts of interest in relation to procurement, the Australian Taxation Office:

- ensure conflicts of interest are declared in a timely manner and declarations contain sufficient detail about the conflict to support an assessment of its nature and risk;

- apply treatments to declared conflicts that are commensurate with the nature and risk associated with the conflict, and provide sufficient detail about the actions to be taken and when they should be taken to support implementation and monitoring;

- have regard to previous declarations and management plans to ensure consistency and completeness; and

- ensure when new resources are added to a procurement, including senior executives, and when new suppliers tender or quote, that personnel complete the conflict of interest declaration process.

Australian Taxation Office response: Agreed.

Recommendation no. 4

Paragraph 3.119

For ancillary services, the Australian Taxation Office apply an appropriate amount of rigour when assessing value for money. Consistent with the Commonwealth Procurement Rules (CPRs) the assessment should be commensurate with the scale, scope and risk of a procurement (CPRs paragraphs 4.4 and 6.2), and must consider whole of life costs (CPRs paragraph 4.5).

Australian Taxation Office response: Agreed.

Summary of entity response

21. The proposed audit report was provided to ATO, with an extract being provided to the former CIO. The ATO’s summary is provided below, and its full response is included at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Australian Taxation Office

The ATO welcomes the audit findings that the ATO conducted largely effective and compliant procurements for IT managed services with largely sound governance.

We accept all 4 recommendations and have commenced or completed improvements prior to, throughout, and subsequent to, the audit. Over the past three years, the ATO has made improvements to our procurement processes, Chief Executive Instructions, probity processes and policies to maintain the integrity of procurement outcomes. We will continue to strengthen our governance processes and ensure alignment with best practice.

The procurements examined through this audit set out to break-down and replace 5 contracts of significant scale and complexity prior to expiry. These contracts underpin the delivery of the ATO’s digital and ICT services to all Australians. We established 8 new contracts through open, transparent and competitive tenders that have delivered better outcomes.

Large IT procurements are challenging, needing robust governance, and forecasting of market trends and organisational demands while carefully balancing stability against transformation. The ATO is proud of the work the organisation has done in conjunction with the market to deliver this outcome.

Key messages from this audit for all Australian Government entities

22. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Program design

Procurement

Conflicts of interest

1. Background

Introduction

1.1 The Australian Taxation Office (ATO) is the principal revenue collection agency of the Australian Government. Its purpose is ‘to contribute to the economic and social wellbeing of Australians by fostering willing participation in the tax, superannuation and registry systems.’5

1.2 Having strong organisational capability, including information and communication technology (ICT) capability, directly contributes to delivering the ATO’s purpose and activities. The ATO’s 2024–25 Corporate Plan outlined six key activities including that ‘Our technology and digital services deliver a reliable and contemporary client experience.’ The Corporate Plan also identified six key areas of focus including ‘enhancing cyber security’ and ‘strengthening the value of data and digital’.6

1.3 The ATO has identified strategic risks related to technology and data including where ATO cannot develop and maintain a contemporary suite of technologies for the community and staff.7 To manage these technology risks the ATO is taking a number of actions, including investment, across its technology environment. This included procurements for a range of IT managed services between 2022–2024.

Legislative and policy requirements for procurement

1.4 The ATO is a non-corporate Commonwealth entity, that operates under the PGPA Act. The ATO must comply with the Commonwealth Procurement Rules (CPRs) and Digital Sourcing Contract Limits and Reviews Policy.

Commonwealth Procurement Rules

1.5 Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the Minister for Finance issues the CPRs, which govern how entities buy goods and services.8 Achieving value for money in procurements is the core rule of the CPRs. The CPRs include specific requirements for: planning (including defining goals, estimating value and managing procurement risks); encouraging competition, including approaching the market with open tenders except in specific circumstances; conducting tender processes; acting ethically, including managing conflict of interest and treating tenderers equitably and fairly; and public reporting.

1.6 When undertaking procurement non-corporate Commonwealth entities:

- must comply with a procurement-connected policy (such as the Environmentally Sustainable Procurement Policy9 or the Indigenous Procurement Policy10) where the policy indicates that it is applicable to the procurement process (CPRs paragraph 4.9)11;

- must use coordinated procurement arrangements (CPRs paragraph 4.12)12; and

- can procure cooperatively from an existing contract such as a standing offer notice for a panel arrangement where certain conditions are satisfied (CPRs paragraphs 4.13 to 4.15).13

Digital sourcing policies

1.7 The Australian Government Digital Sourcing Contract Limits and Reviews Policy was introduced in February 2020 and aimed to break up large contracts across government to reduce risk in digital programs; increase competition in the market; include access for various sized business; and to increase flexibility. The policy applies to non-corporate Commonwealth entities and contains three main requirements for contracts signed from 1 February 2020:

- contracts must not exceed $100 million exclusive of GST (including all extensions);

- contracts must not exceed a three-year initial term; and

- contract extension options must not exceed three years and can only be used after a review of contractor performance and deliverables.

IT Strategic Sourcing Program

1.8 Five of the ATO’s largest IT managed services contracts (worth $225 million a year) were due to expire between 2023 and 2025. These contracts represented about 50 per cent of ATO’s annual IT spend. The contracts were progressively put in place from 2009 with no further extension options past 2024 for four contracts, and 2025 for one contract. Table 1.1 provides an overview of these contracts, including their term, value and number of extensions and amendments as at 17 February 2025. The contracts are presented in the order that they were due to expire.

Table 1.1: Expiring IT managed services contracts, as at 17 February 2025

|

Contract |

Supplier and AusTender Contract Notice Number |

Start date |

End date |

Value ($ million) |

Extensions and amendments |

|

Technical Helpdesk |

Probe Contact Solutions Australia Pty Ltd CN1497441a |

1 December 2013 |

30 November 2023 |

45.2 |

6 |

|

Monitoring and Automation Services |

Epicon IT Solutions Pty Ltd CN3941033b |

1 January 2023 |

30 June 2025c |

8.4 |

4 |

|

End User Technology Services |

Leidos Australia Pty Ltd CN337567d |

10 September 2010 |

31 December 2024 |

756.1 |

76 |

|

Enterprise Service Management Centre |

Leidos Australia Pty Ltd CN337578e |

10 September 2010 |

31 December 2024 |

409.2 |

24 |

|

Provision of Centralised Computing Services |

DXC Enterprise Australia Pty Ltd CN358778f |

15 December 2010 |

31 December 2025 |

2,529.8 |

81 |

|

Total |

3,748.7 |

191 |

|||

Note a: Available from https://www.tenders.gov.au/Cn/Show/644e4468-a7f9-7c14-61a3-2389cb361bc1 [accessed 17 February 2025].

Note b: Available from https://www.tenders.gov.au/Cn/Show/ae7046f3-9a1c-435f-be77-24de7b9018cd [accessed 17 February 2025].

Note c: Amendments made between September and December 2024 extended the contract end date from 31 December 2024 to 30 June 2025.

Note d: Available from https://www.tenders.gov.au/Cn/Show/8927561b-9e05-723d-5479-9ce74a45d38b [accessed 17 February 2025].

Note e: Available from https://www.tenders.gov.au/Cn/Show/896c317c-ec22-8479-e83c-147480f1dfe0 [accessed 17 February 2025].

Note f: Available from https://www.tenders.gov.au/Cn/Show/81e6bf0c-998e-8b80-d311-e04d85837b19 [accessed 17 February 2025].

Source: ANAO analysis of AusTender records.

1.9 These contracts provided and operated the technology that underpinned the ATO’s core business of revenue collection, superannuation systems, future business registry services and staff access. The contracts related to systems and services that support almost every part of the ATO’s business internally, and the services that the ATO provides to its clients such as IT infrastructure, hardware, software, and services.

1.10 The IT Strategic Sourcing Program (ITSSP) was established in February 2021 to strategically plan how the ATO would procure services at end of life of these contracts to best support and deliver a reliable and contemporary digital experience for clients and staff. The ATO did not seek additional funding for the program through the Federal Budget.

1.11 On 4 May 2021, the ATO announced on its website and AusTender that ‘it would soon be approaching the market to procure a significant range of IT managed services’ through the ITSSP. The ATO conducted redesign and planning activities in 2021 and 2022, including market research and a request for information (RFI).14

IT Strategic Sourcing Program procurements

1.12 When procuring services at end of life of IT contracts, the ATO was required to comply with the Digital Sourcing Contract Limits and Review Policy. On 23 November and 6 December 2021 the Assistant Treasurer (ATO portfolio minister) and the Minister for Employment, Workplace, Skills, Small and Family Business (minister responsible for the Digital Transformation Agency), respectively, granted the ATO an exemption from the capped value policy requirement of the Whole of Government Digital Sourcing Contract Limits and Review Policy, which requires all IT contracts to be under $100 million exclusive of GST (see paragraph 1.7).15 A condition of the exemption was ‘that the ATO provides [to the Digital Transformation Agency] an assessment of how value for money has been delivered in the initial term of each contract, prior to exercising the relevant extension option’.

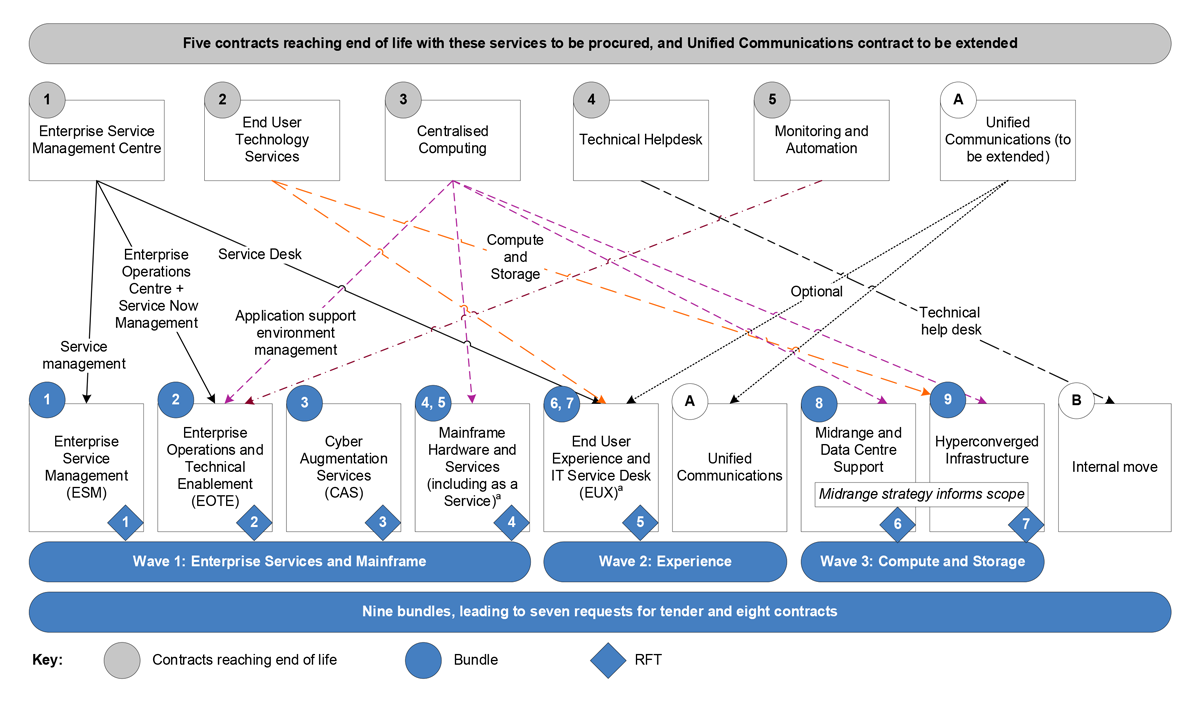

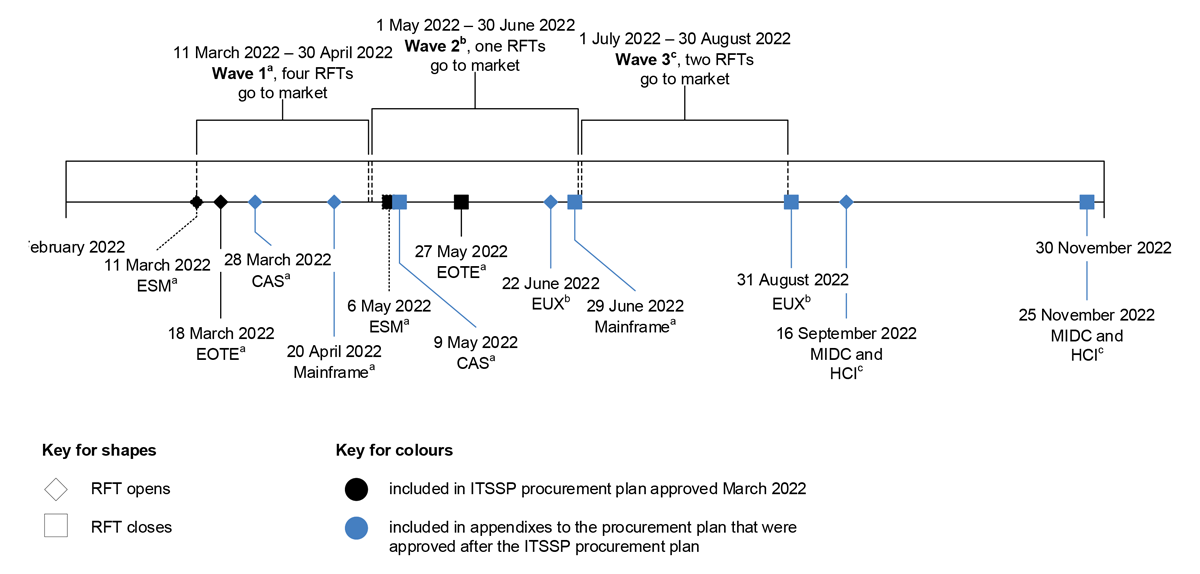

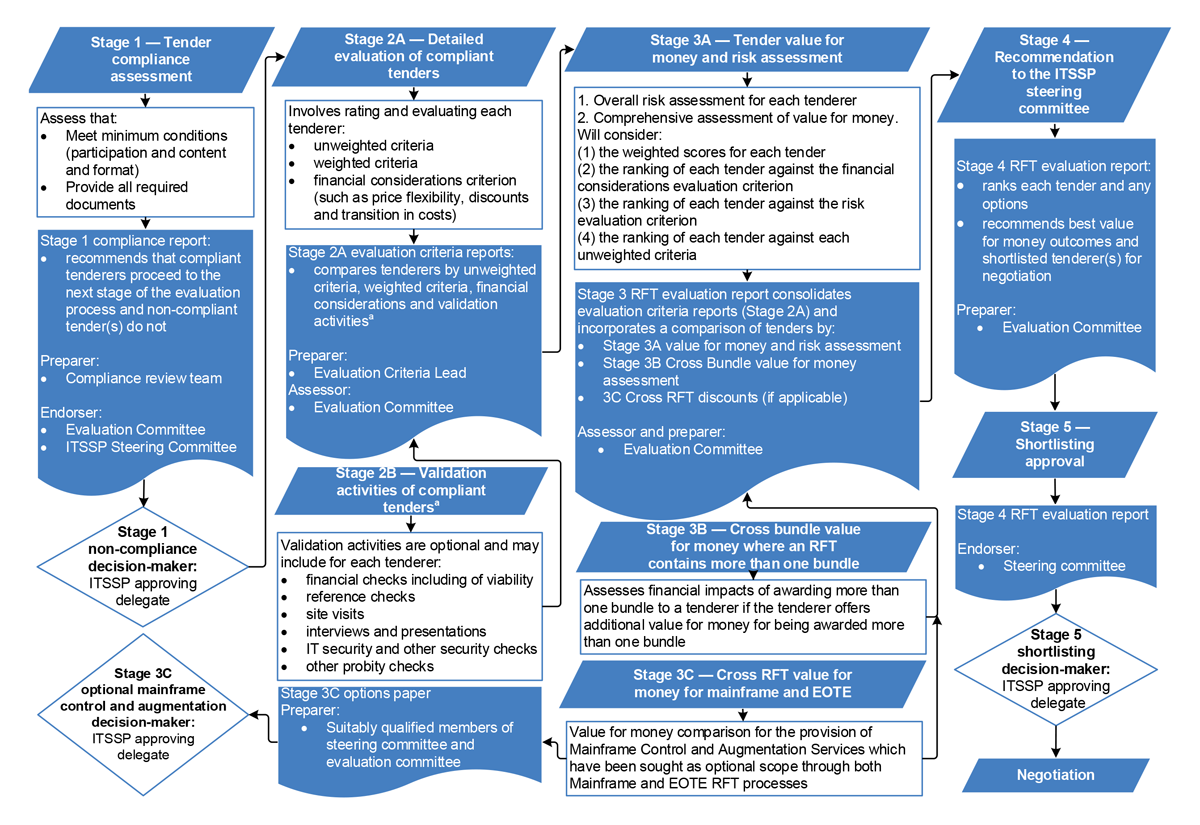

1.13 A notice was issued on AusTender on 24 February 2022 to invite industry participants to a strategic industry briefing, held on 9 March 2022. Industry was advised that the five expiring contracts had been broken into nine market aligned service bundles, and that these bundles would be taken to market across seven requests for tender (RFTs), see Figure 1.1.16 The RFTs would be released in three waves.17

Figure 1.1: IT managed services procurements transform services from five contracts reaching end of life to nine bundles, and seven requests for tender

Note a: Each of these bundles can be broken into two.

Source: ANAO adaption of presentation to ATO Executive in April 2022.

1.14 The first RFT was released on 11 March 2022, the final RFT closed on 25 November 2022. From the seven RFTs, eight contracts were executed with seven suppliers between 15 December 2022 and 20 June 2024.18 The Mainframe RFT resulted in two separate contracts for Mainframe Hardware and Mainframe Services.19 Four contracts have been varied.20 As at 24 February 2025, the total value of amendments made was $33.23 million, with $22.20 million attributable to Cyber Augmentation Services.21

1.15 The contracts have an initial term of three years, except for Mainframe Hardware which has an initial term of five years.22 As at 24 February 2025 on AusTender the total reported contract value for these eight contracts is $548.57 million for the initial term. The total estimated value for the ITSSP contracts is $2,536 million if extension options to 10 years are exercised.

1.16 Table A.1 in Appendix 3 provides an overview of the RFTs and resulting contracts, including timing, value of the contracted services, successful suppliers and type of procurement.

1.17 Once each new contract was executed, the ATO, the new supplier and the previous supplier entered a transition period. Transition periods were 15 months per wave, with transition to be completed before 1 January 2025. As outlined in the ATO’s internal Transition Strategy, transition was expected to cost between $70 million and $121 million in total for the ITSSP.

Advisor procurements

1.18 Each of the ITSSP procurement processes was supported by external advisors. The ATO engaged six external advisors, referred to as ‘advisor contracts’ in this report. The total value of the advisor contracts is estimated to be $88.11 million.

1.19 Table 1.2 provides an overview of the resulting contracts, including timing, value of the contracted services, successful suppliers, panel and standing offer details and type of procurement. The table presents the advisor procurements in the order the services commenced.

Table 1.2: Advisor procurements

|

Type of advisor |

Panel accessed and standing offer notice useda |

Services commenced under work order |

Supplier and AusTender contract notice number |

Contract value ($ million) |

Number of amendments |

|

Sourcing Partner |

Digital Marketplace Panel 1.0 SON3413842 |

6 April 2021 |

ISG Information Services Group AME CN3761916b |

42.27 |

8 |

|

Technical |

PNL1104 SON3280319 |

3 May 2021 |

PriceWaterhouseCoopers Consulting Australia Pty Ltd CN3779726c |

14.94 |

3 |

|

Probity |

PNL1587 SON3580065 |

1 July 2021 |

Galent Pty Ltd CN3791154d |

1.63 |

2 |

|

Financial Assurance |

PNL2331 SON3520191 |

1 October 2021 |

ITNewcom CN3819463e |

16.70 |

10 |

|

Legal |

Legal Services — Whole of Australian Government SON3622041 |

13 October 2021f |

Sparke Helmore Lawyers CN3821777g |

10.90 |

11 |

|

Project Manager |

Digital Marketplace Panel 1.0 SON3413842 |

1 February 2022

|

Law Consulting Services Pty Ltd Trading as Tullius CN3858095h |

1.67 |

3 |

|

Total |

88.11 |

37 |

|||

Note a: The Legal Services Panel is a coordinated procurement and is mandatory under the CPRs (see paragraph 1.6). All other procurements were cooperative procurements where ATO was listed as an entity that could procure goods and services from the panel (see paragraph 1.6).

Note b: Available from https://www.tenders.gov.au/Cn/Show/f67b6955-0794-4f59-b2ee-ace8ca123553 [accessed 17 February 2025].

Note c: Available from https://www.tenders.gov.au/Cn/Show/2a37fa22-4329-46cd-b9a5-0855e0516298 [accessed 17 February 2025].

Note d: Available from https://www.tenders.gov.au/Cn/Show/06539e9f-a2eb-4828-a764-aefec44e1ab1 [accessed 17 February 2025].

Note e: Available from https://www.tenders.gov.au/Cn/Show/6ea1dc69-d86e-4237-9ce0-27f8890d97f2 [accessed 17 February 2025].

Note f: The ATO advised the legal services provider on 6 August 2021 that the ATO had approved the quote for services up to $250,000. The first contract notice for these services published on AusTender referred to a subsequent approval for $900,000 in October 2021 for legal services (see paragraph 3.14).

Note g: Available from https://www.tenders.gov.au/Cn/Show/d55cd1e4-b1d6-4876-8896-4894c233a4b8 [accessed 17 February 2025].

Note h: Available from https://www.tenders.gov.au/Cn/Show/7c6727ff-689e-4956-977c-c12bec75f938 [accessed 17 February 2025].

Source: ANAO analysis of AusTender and ATO records.

Rationale for undertaking the audit

1.20 The ATO was procuring IT managed services as a material portion of its IT contract arrangements are due to expire. It was estimated that new contracts would be valued at $2,536 million over 10 years if contract extension options are used (see paragraph 1.15). These contracts affect all ATO staff, clients and service delivery.

1.21 A cross entity audit of Establishment and Use of ICT Related Procurement Panels and Arrangements that included ATO was tabled in August 2020. That audit identified issues with ATO’s IT procurement, including that ATO did not meet the conditions for limited tender (including that there was no evidence of market research and that advice regarding risks to achieving value for money was not provided to the delegate), and that there was no or insufficient documentation of value for money and risk management, including probity risk management.

1.22 This audit provides assurance to Parliament about the ATO’s compliance with the Commonwealth Procurement Rules for the procurement of IT managed services.

Audit approach

Audit objective, criteria and scope

1.23 The objective of the audit was to assess the effectiveness of ATO’s procurement of IT managed services.

1.24 To form a conclusion against the objective, the following criteria were adopted.

- Has the ATO established sound governance arrangements for the IT managed services procurements?

- Has the ATO conducted the procurements in compliance with Commonwealth Procurement Rules and other requirements?

1.25 The audit focused on the procurements of: Enterprise Operations and Technical Enablement (Accenture); Mainframe Hardware (IBM) and Mainframe Services (DXC); the sourcing partner (ISG); and legal advisor (Sparke Helmore). The audit did not examine ATO’s administration or management of its IT or advisor contracts.

Audit methodology

1.26 The audit methodology involved:

- examining ATO records23;

- reviewing AusTender records; and

- meetings with relevant ATO officers and personnel contracted by ATO to support the procurement of IT managed services.

1.27 The audit was open to public contributions. The ANAO did not receive any contributions.

1.28 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $489,600.

1.29 The team members for this audit were Tracey Martin, Sonya Carter, Alexandra Collins and Corinne Horton.

2. Procurement governance and planning

Areas examined

This chapter examines whether the Australian Taxation Office (ATO) established sound governance arrangements for the IT managed services procurements.

Conclusion

The ATO established largely sound governance arrangements for the IT managed services procurements. It established governance and oversight arrangements, procurement policies and procedures, and undertook market research to inform the design of its procurement strategy and plans. During planning, the program governance arrangements did not sufficiently distinguish endorsement and decision-making roles when seeking approvals. There were instances where the delegate, who was also the chair of the steering committee, provided approval to procurement planning related documentation and not separate delegate approval. Contrary to finance law Chief Executive Instructions (CEIs) were not consistently issued and approved by the accountable authority.

Areas for improvement

The ANAO made two recommendations relating to decision-making (paragraph 2.14) and accountable authority approval of CEIs (paragraph 2.42).

2.1 Sound governance and oversight arrangements help ensure that procurements are undertaken effectively and ethically and achieve value for money outcomes. Governance includes systems and processes for decision-making, risk management, oversight arrangements and reporting.

2.2 Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), an accountable authority of an Australian Government entity has a duty to establish and maintain appropriate systems of risk oversight and management, and internal controls, including measures to ensure that officials comply with the finance law, such as the Commonwealth Procurement Rules (CPRs).24

2.3 Adequate planning assists in achieving the efficient, effective, ethical and economical procurement practices required under the PGPA Act and the CPRs (CPRs paragraphs 6.1 to 6.5). Market research and sounding can provide valuable information to assist in developing insights about what the market can offer, to make the subsequent procurement process more focussed and efficient, and to deliver improved outcomes. Market research and sounding should be commensurate with the scale, scope and risk of a procurement (CPRs paragraph 6.2).

Has the ATO established appropriate oversight arrangements for the IT managed services procurements?

A governance framework was implemented for the IT Strategic Sourcing Program (ITSSP), with the Chief Information Officer (CIO) as the delegate and senior accountable officer. Program risks were identified, assessed and managed. The initial planned completion including transition for the ITSSP was June 2024, this has been revised to December 2025. All procurements were completed and contracts signed by 20 June 2024 and transition is anticipated to be completed by December 2025. The steering committee considered options and risks to manage delays and impact on budget and timeframe. In some instances, consensus decision-making arrangements that were established through a steering committee led to a lack of clarity about when the delegate was exercising their delegation to make decisions. Over a period of 41 months there were 34 versions of the Chief Finance Officer’s (CFO’s) delegation schedules.

Governance arrangements

2.4 The ITSSP applied the ATO’s program management methodology, which requires a:

- senior accountable officer (SAO)25 to be assigned to a program;

- program manager26 to be appointed; and

- program management office27 to be established.

2.5 A governance structure may also include a program board (for complex programs)28 and reporting to ATO Executive and Finance29 committees, and other committees. A core design team (with capabilities required to support delivery)30 may be formed to support the program manager. The ATO’s guidance indicates that the most appropriate governance structure depends on the risk and complexity of the change being delivered.

2.6 Consistent with the ATO’s program management methodology, the governance structure for the ITSSP included a delegate (the Chief Information Officer (CIO)) as the senior accountable officer, supported by a steering committee31, program manager, program management office and core design team. There were also a series of working groups at the project level.

2.7 The governance structure and supporting policies and procedures changed for each stage of the program32: planning, procurement and transition to business as usual. Appendix 4 provides an overview of the ITSSP governance structure for the transition stage.

2.8 During the planning stage a probity governance structure was set out in the probity plan (July 2021). Probity governance is discussed further in paragraph 3.58 of this report.

2.9 During the procurement stage the ATO determined that additional governance arrangements were necessary, consistent with procurement guidance.33 The ATO determined that as the nature of the ITSSP procurements were complex, evaluation and negotiation governance structures were developed.

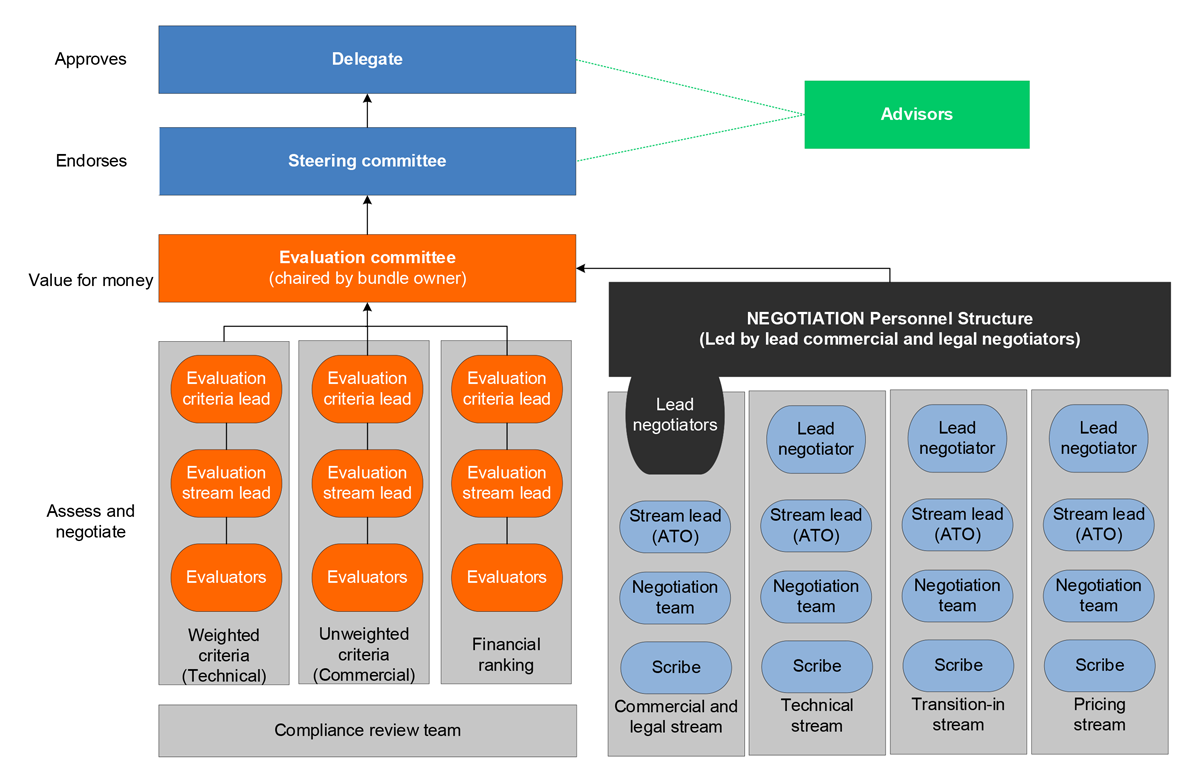

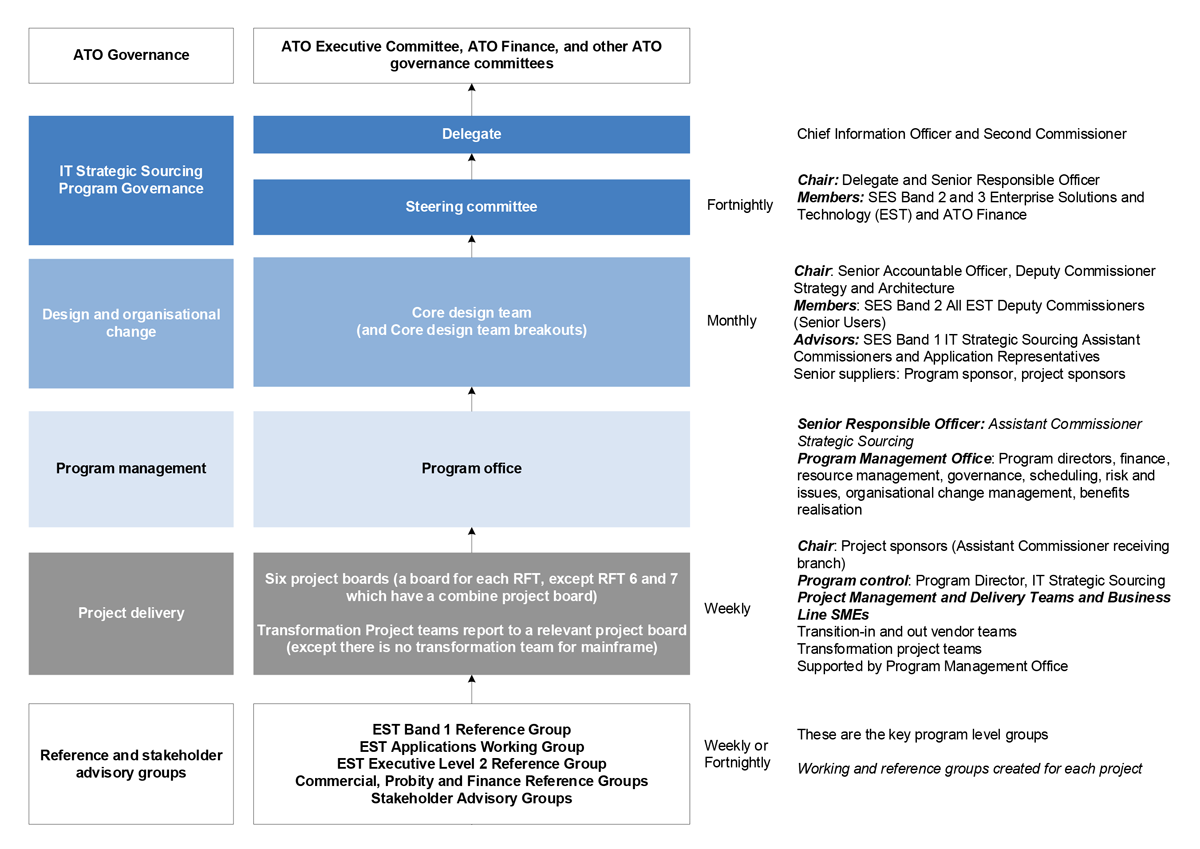

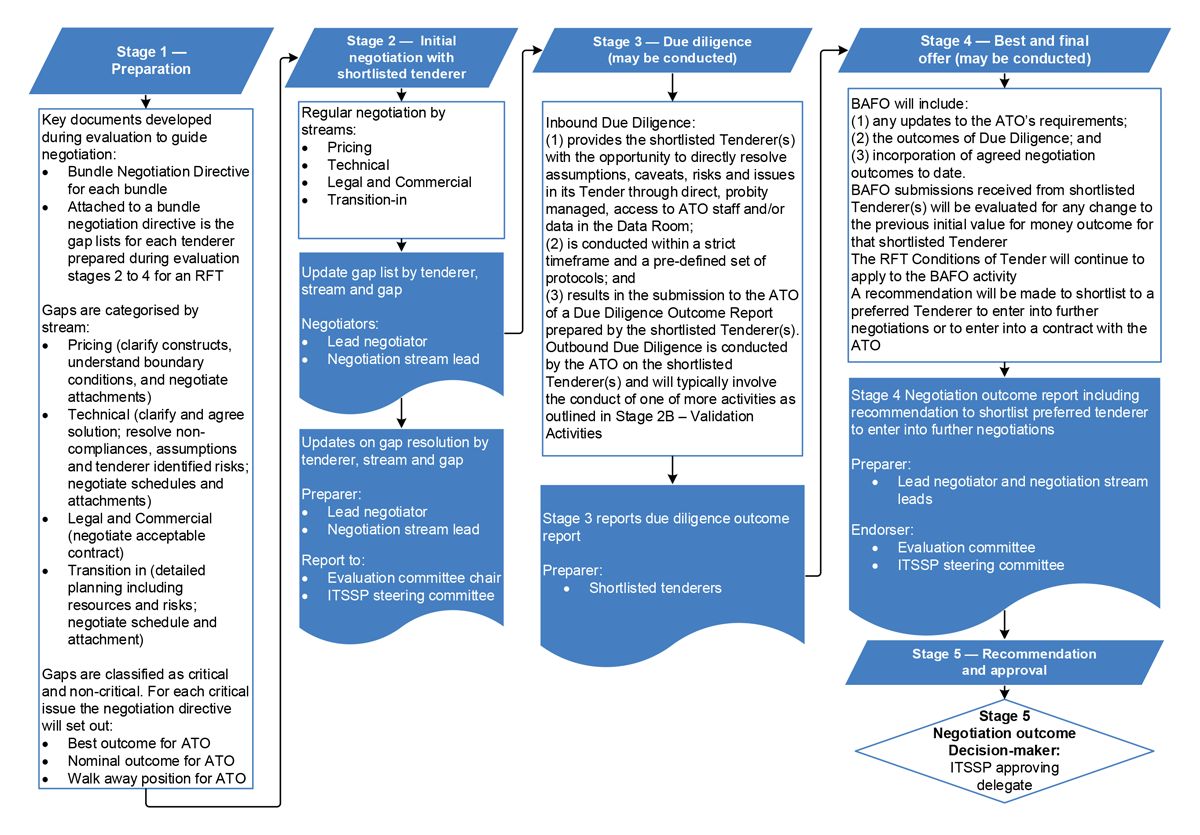

- The evaluation governance structure, depicted in Figure 2.1, comprised evaluation teams reporting to an evaluation committee, and the evaluation committee reporting to the delegate through the steering committee.

- The negotiation structure, depicted in Figure 2.1, comprised negotiation teams reporting to negotiation leads who reported to the evaluation committee, and the evaluation committee reports to the delegate through the steering committee.

Figure 2.1: Procurement evaluation governance and negotiation personnel structure

Note: Advisors include the Program Sponsor and Program Directors. Advisory roles for the evaluation included the evaluation coordinator, bundle facilitator, procurement lead, procurement advisor, probity advisor, sourcing advisor, legal advisor, technical advisor and financial advisor.

Source: ATO’s Evaluation Plan June 2022 and ITSS Negotiation Plan Final V1.0 2022Aug25.

2.10 The ATO applies a single Contract Management Plan to all contracts managed by IT Commercial Services. The plan sets out governance arrangements including roles and responsibilities, contract administration and financial management arrangements. All ITSSP contracts are listed as in scope in the Contract Management Plan.34 For each individual contract, a contract overview is developed and attached to the Contract Management Plan.35 Contract overviews were available for all ITSSP contracts.

Steering committee

2.11 In February 2021 a steering committee was formed to support the delegate in overseeing the ITSSP.36 The ATO developed and updated the terms of reference for the committee as necessary to ensure they remained fit for purpose.37 Committee membership changed over time, with a core membership of the Chief Information Officer (CIO) as chair, and other members at the SES Band 2 level including the Chief Financial Officer (CFO) and Deputy Commissioners with IT responsibilities. Until May 2023 a senior executive from the Digital Transformation Agency was also a member.38 Between February 2021 and September 2024 the steering committee met 84 times.

2.12 The delegate is the decision-maker for a procurement. Documents such as the market engagement plan and procurement plans were addressed to the delegate for approval.39 The steering committee was to endorse documents prior to seeking delegate approval. In some cases it was not clear from approvals sought and provided whether the delegate was approving reports and other ITSSP documentation as a member of the steering committee or as the delegate (see paragraphs 2.54, 3.92 and 3.17). For example, when seeking approval for documents such as the market engagement and procurement plans an email was sent to the steering committee asking for approval (not endorsement), the delegate was included in these emails as a member and chair of the steering committee. The delegate responded to the emails sent providing approval. By comparison, for the selected ITSSP procurements, for commitments to spend money and contract approval minutes the delegate was not asked to respond to steering committee emails, a separate email was sent after steering committee endorsement had been provided.

2.13 All versions of the steering committee terms of reference also included provisions that indicated decisions would be made by consensus. For example, the chair’s responsibilities included ‘Facilitating Decision making as the Program Senior Responsible Officer and Delegate. Decisions will be made by consensus. Where a consensus is not possible, the Chair will coordinate a decision’. Consensus decision-making is inconsistent with the delegate exercising their decision-making powers in accordance with the PGPA Act.

Recommendation no.1

2.14 When establishing program governance arrangements which includes procurement, the Australian Taxation Office ensure that: decision-making responsibilities are clearly set out, including to separate endorsement and decision-making roles; and processes support the appropriate decision-maker to make a decision.

Australian Taxation Office’s response: Agreed.

2.15 The ATO has reviewed existing guidance to ensure that roles and responsibilities are clearly defined. We will continue to strengthen governance processes to ensure our practice fully aligns to the guidance.

Core design team

2.16 At the March 2021 steering committee meeting the CIO asked that a design authority be established to oversee the operating model, with Deputy Commissioner oversight of what services were to be outsourced. At the April 2021 meeting the steering committee established a terms of reference for the core design team that set out its purpose, membership, meeting frequency, forward meeting schedule and team. Its purpose was to act as a design authority for the future outsourcing model, and was assigned a program of work. The team was a recommendation and endorsement body; it did not have decision-making authority.

Working groups

2.17 The ATO established working groups at the project level (for example, for individual procurements and legal and commercial services) to support project delivery through the three stages of the ITSSP.

Delegations

2.18 The Commissioner for Taxation delegated the powers of PGPA Act subsection 23(3) (the power to make a commitment to spend money) and section 110 (the power to delegate that commitment) to the CFO.40 In May 2020, the CFO sub-delegated their powers under subsection 23(3) of the PGPA Act to ‘spending delegates’.41 ATO’s Chief Executive Instructions (CEIs) sets out the role and scope of the spending delegate.

- ‘Only certain officials (referred to as “spending delegates”) have been delegated the power to approve spending on behalf of the ATO by the CFO. Spending delegates cannot sub-delegate their spending delegation power to anyone else.’

- ‘Delegations are attached to the spending delegate’s position number. The scope of delegation is limited to a specific spending power (category of expenditure), direction (additional instructions) and spending limit (inclusive of GST).’

2.19 Between 16 December 2020 and 29 May 2024, there were 34 versions of the schedules to the CFO’s May 2020 delegation instrument.42

2.20 All officials have the power to enter into and vary a contract or arrangement. Prior to entering into or varying a contract or arrangement, the official must obtain approval from the appropriate ‘spending delegate’.

Roles and responsibilities clearly specified and implemented

2.21 Roles and responsibilities were set out across a range of documents.

- Overarching roles and responsibilities for the program were set out at a high level in the ATO project management methodology and in the ITSSP structure diagram for the planning stage of the ITSSP presented in steering committee papers.

- Roles and responsibilities for the steering committee were set out in the terms of reference.

- The procurement plan (including probity roles and responsibilities in the probity plan), evaluation plans, negotiation plans and a transition roles and responsibilities document (and transition plan) set out roles and responsibilities for the ITSSP (referring to the program management methodology roles and responsibilities for further information).

Risk management

2.22 The ATO’s program management methodology requires program risk and issue management to operate within the ATO Risk Management Framework. The ATO’s risk management policy and procedures includes the Risk Management Chief Executive Instruction (see paragraph 2.36), an Enterprise Risk Management Framework (1 June 2020) and supporting guidance. For procurement, additional guidance includes risk assessment templates, a risk help card and supporting tools. A risk assessment must be attached to the procurement plan.

2.23 The ITSSP Risk Management Plan (August 2023) established arrangements for managing risk in accordance with the ATO’s Enterprise Risk Management Framework and Risk Management CEI. ITSSP and transition risk registers were maintained for the program.43 Table A.2 in Appendix 5 provides an overview of risk approaches and assessments for the ITSSP by stage.

2.24 The approach to risk management and its evolution though the stages of the procurement may have benefited from establishing a risk framework and management plan for the program during the planning stage (a risk register was in place during planning).

Oversight and reporting arrangements

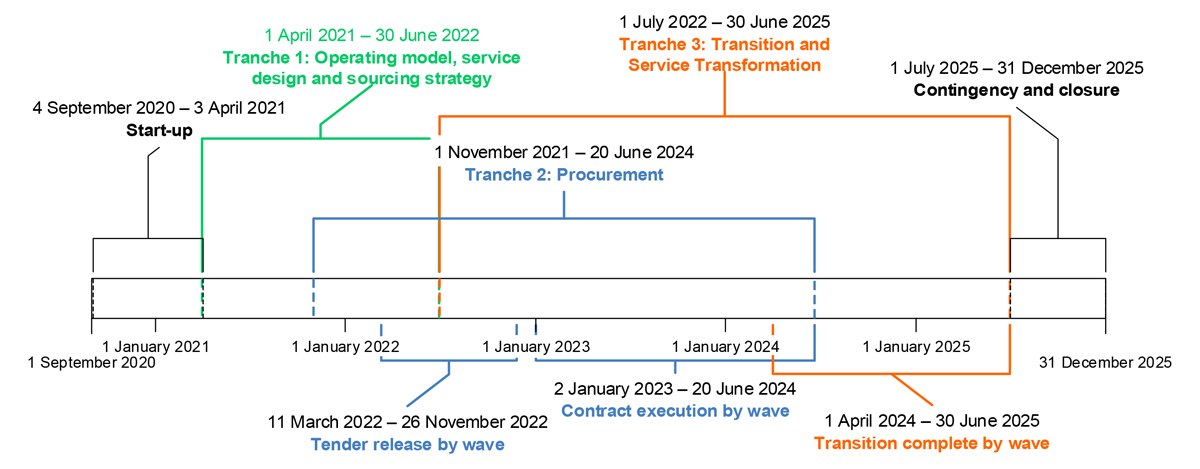

2.25 To support management of the ITSSP, the steering committee monitored a program schedule. An initial schedule was developed in March 2021 to plan start-up, tranche 1 (operating model, service design and sourcing strategy), tranche 2 (procurement) and tranche 3 (transition and service transformation). The schedule covered the period 2021–21 to 2024–25; it was expected that the transition and transformation of ITSSP would be complete by June 2024.

2.26 The schedule was refined and updated over time.44 ITSSP timeframes for tranche 2 (procurement) and tranche 3 (transition and transformation) were extended, with program closure scheduled for December 2025. All procurements were completed by 20 June 2024. Figure 2.2 provides an overview of the ITSSP schedule as at 6 May 2024.

Figure 2.2: Program timeline by tranche, five-year view as at 6 May 2024

Source: ANAO analysis.

Status reporting

2.27 The ATO’s program management methodology requires program status reporting to occur at a minimum on a monthly basis and to be endorsed by the program board (for the ITSSP the steering committee was a sub program board, see footnote 31). Except for March and May 2022, at least one program status report was provided to the steering committee every month between April 2021 and September 2024 consistent with the minimum monthly requirement.

2.28 The ITSSP risk management plan (August 2023) requires fortnightly reporting of risk and treatments to the steering committee for residual risks rated high and above (from August 2023).45 The steering committee was provided with fortnightly extracts of risks from the ITSSP program level risk register where risks were rated at or above high. The ITSSP risk management plan reporting requirements were met, with fortnightly reporting occurring between September 2023 and September 2024. The steering committee played a role in the treatment of some severe risks. Some risk treatments included the ITSSP reporting about readiness to the Tax Time Steering Committee. Risks were not required to be escalated to Enterprise Solutions and Technology (EST) leadership group to be completed, as after treatment risks were at a level that could be managed by the steering committee. Since 17 May 2024 the overall status of the ITSSP has been tracking at ‘amber’ or ‘red’ with key risks and pressures relating to resources, budget and defects.

Financial reporting

2.29 The ATO’s program management methodology requires program and project financials to be reviewed regularly, projected overspends to be escalated early and appropriate action taken, and financial verification to be sought through ATO Finance for financial matters.

2.30 Funding for the program was released for a program tranche by financial year. The ATO Finance Committee approved program budgets. The steering committee monitored the program budget and received reporting on cost estimates and budget versus actual expenditure. Projected overspends were escalated through the steering committee to the Finance Committee when additional funds were needed and cost reduction strategies were not sufficient. As at 24 December 2024, the estimated cost for the program between 2020 and 2025, was $182.2 million.46 The ATO funded the program through its annual departmental appropriation.

2.31 The steering committee received reports on estimated cost savings. For example, in May 2024 the steering committee was advised that the new contracts represented a cost saving of $15.4 million over 3 years and $105.9 million over six years.

Has the ATO established a fit-for-purpose procurement framework?

CEIs, procedures and guidance support ATO officials to undertake procurement in accordance with the CPRs. The ATO’s policy framework establishes arrangements where officers, other than the Commissioner, can approve and issue CEIs under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999 (PS Act). This has led to some instances where the Commissioner has not approved and issued CEIs that were required to be made under section 20A of the PGPA Act. The ATO’s CEIs, procedures and guidance align with the CPRs. The ITSSP applied the existing ATO procurement framework to the IT managed services and advisor procurements.

Chief Executive Instructions

2.32 Section 20A of the PGPA Act states:

The accountable authority of a Commonwealth entity may, by written instrument, give instructions to an official of the entity about any matter relating to the finance law.

2.33 The ATO policy framework sets out that CEIs are issued47:

- under section 20A of the PGPA Act by the Commissioner; and

- for the purpose of subsection 13(5) of the Public Service Act 1999 (PS Act) by Second Commissioners, the Chief Operating Officer, Chief Information Officer and Deputy Commissioners.48

2.34 The policy framework notes that business line content owners (relevant Executive Level 2 officers or Assistant Commissioners) are responsible for maintaining currency of CEIs and provide approval of non-material updates for CEIs. ‘Non-material updates include: grammatical changes, rewording for clarity, movement of content between CEI and guidelines and repairing broken links.’

2.35 A procurement CEI was issued in July 2014. It was approved by the Commissioner on 30 June 2014. The Commissioner approved an updated and renamed CEI for procurement and contract management in March 2023. Purchasing obligations and requirements are set out in the procurement and contract management CEI and the committing money and approving spending CEI.49

2.36 Other CEIs also address procurement.

- The conflicts of interest CEI was updated five times between May 2020 and April 2024. Four versions of the CEI were approved at an Executive Level 2 level and one by a Deputy Commissioner. Under this CEI officials are required to manage conflicts of an ongoing or temporary nature for procurement activities. An official’s interests should be assessed and reassessed to identify conflicts.

- A security CEI was updated in July 2020 and October 2023. Three deputy commissioners approved each version of the CEI. Under this CEI, when conducting a procurement ATO officials must engage with security areas to manage security supply chain risks.

- A risk management CEI was updated in December 2018, it was approved by the Commissioner in November 2018. The Commissioner approved an update to the CEI in January 2023. It requires risk management to be embedded into all ATO activities. The procurement and contract management CEI provides a link to the risk management CEI.

2.37 The procurement and contract management, risk management and committing money and approving spending CEIs state they were issued under the section 20A of the PGPA Act. The conflict of interest and the security CEIs state that they were issued for the purpose of the PS Act subsection 13(5).

2.38 Paragraph 110(2)(aa) of the PGPA Act states ‘However, the accountable authority of a non-corporate Commonwealth entity may not delegate any of the accountable authority’s powers, functions or duties under: … (aa) section 20A (which is about accountable authority instructions)’. CEIs that are not issued and approved by the accountable authority have not been appropriately authorised or approved.

2.39 Section 29 of the PGPA Act and sections 12 to 16A of the PGPA Rule impose requirements relating to conflict of interest. Under section 20A of the PGPA Act the Commissioner has the power to give written instructions about any matter relating to finance law. The Commissioner has the authority to give directions relating to conflict of interest. Subsection 13(5) of the PS Act is an obligation imposed on employees to comply with directions and not a power to issue directions or instructions.50

2.40 To avoid confusion, instructions made under section 20A of the PGPA Act should be called accountable authority instructions or Commissioner’s instructions. Directions made under the PS Act should be named to be clearly distinguishable from accountable authority instructions.

2.41 The ATO’s procurement and contracts CEI aligns with the CPRs.

Recommendation no.2

2.42 Consistent with section 20A and paragraph 110(2)(aa) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) the Commissioner for Taxation should issue and approve all accountable authority instructions. To achieve this, the Australian Taxation Office should:

- review its policy framework to ensure compliance with the PGPA Act and Public Service Act 1999;

- refer to instructions made under section 20A of the PGPA Act as accountable authority or Commissioner’s instructions; and

- where instructions are made for conflict of interest and security they be issued under section 20A of the PGPA Act.

Australian Taxation Office response: Agreed.

2.43 The ATO is currently undertaking a review of all Chief Executive Instructions to ensure compliance with the PGPA Act and will ensure any updates are made as required, including to the instructions for conflict of interest and security. The review also includes within its scope updating the naming conventions of the instructions so they properly match either with the PGPA Act or the Public Service Act.

Procedures and guidance

2.44 The ATO’s officials must follow guidelines issued by the CFO that support the procurement and contract management CEI, and ATO’s procurement guidance and direction provided by Strategic Procurement and Contracts (SPC) branch.51 The ATO’s risk-based approach to procurement requires that all procurements valued at $80,000 and above must be undertaken in conjunction with the SPC branch.

2.45 The CEIs, and procurement guidance and templates, are available to staff on the ATO intranet. The ATO intranet instructs staff that where there is an existing arrangement in place, it must be used.52 Guidance and templates are available to staff for procurements below $80,000. If a procurement exceeds $80,000, staff are required to contact SPC branch. To determine which approach applies to a procurement, ATO’s guidance provides a process flow to support decision-making (see Figure 2.3).

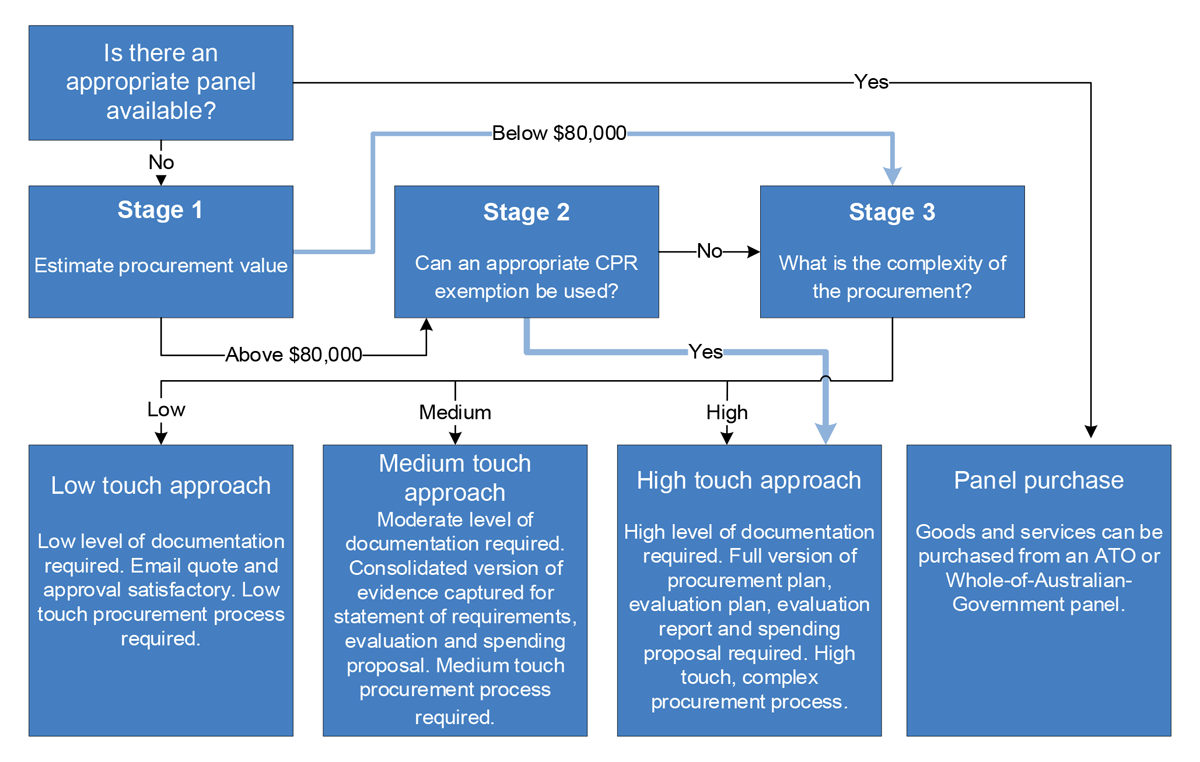

Figure 2.3: ATO process flow for selecting a procurement method

Source: ATO, Determine your procure approach guidance, p. 2.

2.46 The ATO has developed a suite of procurement procedures, guidance and templates for low, medium and ‘high touch’ procurements and panel arrangements. The high touch procedures and guidance applied to the IT managed services procurements (see Table A.1 in Appendix 3), and the purchase from a panel procedure applied to the advisor procurements (see Table 1.2). The panel and high touch procedures align with the CPRs.

2.47 Procedures and guidance cover the four stages of a procurement: planning, approach to market, evaluation of suppliers and entering into an arrangement to procure the goods and services. At each stage procedures and guidance provided opportunities for delegates and staff to make decisions that reflected the scale, scope and risk of the procurement. Table 2.1 provides an overview of key procedures and guidance for high touch and panel procurements.

Table 2.1: Key procedures and guidance for high touch and panel procurements

|

Procurement stage |

High touch procurement |

Panel procurement |

|

Selecting a procurement approach |

Determine your procurement approach guidance |

|

|

Planning the procurement procedure |

High touch procurement approach procedures Phase 1 |

Purchase from a panel procedure |

|

Approaching to market procedure |

High touch procurement approach procedures phase 2 |

|

|

Evaluate responses procedure |

High touch procurement approach procedures phase 3 |

|

|

Execute contract procedure |

High touch procurement approach procedures phase 4 |

|

Source: ATO documentation.

2.48 To support staff undertaking procurement the ATO developed checklists of key steps to undertake and records to keep for low, medium and high touch and panel procurements.

Procurement framework for IT managed services procurements

2.49 The ITSSP Procurement Plan approved in March 2022 articulated the procurement approach and how the IT managed services procurements would be managed during the approach to market phase. The ITSSP steering committee, established in February 2021, managed IT strategic sourcing at the program level and oversaw the implementation of the plan to meet procurement objectives, outcomes and timelines. The ITSSP applied the existing ATO procurement framework to the IT managed services procurements, tailoring its approach based on the scale, scope and risk of the ITSSP.

2.50 When procuring services at end of life of IT contracts, the ATO was required to comply with the Digital Sourcing Contract Limits and Review Policy. On 23 November and 6 December 2021 the Assistant Treasurer (ATO portfolio minister) and the Minister for Employment, Workplace, Skills, Small and Family Business (minister responsible for the Digital Transformation Agency), respectively, granted the ATO an exemption from the capped value policy requirement of the Whole of Government Digital Sourcing Contract Limits and Review Policy which requires all IT contracts to be under $100 million (see paragraphs 1.7 and 1.12).53

Did the ATO undertake appropriate planning to inform the design of the IT managed services procurements?

The ATO conducted redesign and planning activities in 2021 and 2022. Its annual procurement plan provided advance notice to the market of the planned ITSSP procurement. Market research supporting the procurement strategy included early market engagement through a request for information (RFI), a technology horizon scan, a market comparison report and like-sized agency comparison. For each of these activities there was clear advice to the steering committee and delegate about outcomes and how they inform the procurement approach. A procurement plan for the ITSSP set out the procurement strategy. Procurement plans were developed for the selected ITSSP and advisor procurements, except for the legal services procurement.

2.51 The CPRs include specific requirements for planning including defining goals, estimating value and managing procurement risks. There are also requirements for approaching the market.

Annual procurement plan

2.52 To provide the market with early advice of potential procurement opportunities, the CPRs require that an entity must maintain on AusTender a current annual procurement plan (APP). An APP was in place at the time of the ITSSP commencement which generally complied with the CPRs. By publishing the advance notice on 4 May 2021 on AusTender the ATO provided the market notice of the upcoming ITSSP procurements. The ATO complied with paragraphs 7.8 and 7.9 of the CPRs in relation to the APP addressing the ITSSP.

Request for information and research supporting strategy development

Request for information

2.53 Market research and sounding can provide valuable information to assist in developing insights about what the market can offer, to make the subsequent procurement process more focussed and efficient and to deliver improved outcomes. Market research and sounding should be commensurate with the scale, scope and risk of a procurement (CPRs paragraph 6.2), be properly planned and have a clear outcome in mind, as it incurs costs for the entity and suppliers.

2.54 In early April 2021 the ATO commenced planning for early market engagement. On 17 June 2021, the steering committee and delegate approved the Market Engagement Plan. The plan recommended conducting a market engagement process for ITSSP by issuing an RFI via AusTender. It set out a market engagement method, timetable54, analysis process, risk management arrangements, probity arrangements and the RFI to be released via AusTender.55 The purpose of the RFI was:

to inform the sourcing strategy and bundling options. The RFI will allow the ATO to consider how best to bundle the required services and subsequently approach the market in order to take advantage of best offerings in the marketplace, thereby maximising value for money to the Commonwealth.

2.55 The RFI was open to the market between 18 June and 15 July 2021, with 179 suppliers downloading the RFI material, 74 attending a virtual industry briefing, and 32 providing responses within the comment period. Of the 32 responses, 11 were from incumbent suppliers and 21 from organisations that were not existing suppliers to the ATO. Twelve respondents were invited to workshops with the ATO.

2.56 Prior to the RFI closing, the RFI analysis plan was approved on 13 July 2021 by the ITSSP delegate. The plan set out the arrangements for probity, ethics and fair dealing, roles and responsibilities of analysis personnel, and the analysis and reporting process. The purpose of the plan included analysing responses to ‘inform the services bundling strategy, leading to the production of appropriately scoped Requests For Tender (RFT)s.’

2.57 On 8 October 2021, the Early Market Engagement Summary Report was circulated to the steering committee for approval. The early market engagement process was closed following the steering committee approval of the report on 28 October 2021. The report presented the outcomes of the analysis in relation to: bundling; insourced, outsourced or hybrid models; governance; security; flexible infrastructure; hybrid infrastructure; field services; service desk; end user experience; commercial alignment; and as-a-service pricing models.

2.58 The Early Market Engagement Summary Report informed bundling decisions including the services that may be sought and bundle composition. The steering committee members including the delegate were briefed on the report prior to approval. The report provided sufficient advice to the delegate on RFI outcomes to inform procurement planning.

Other research activities

2.59 To support the development of the procurement strategy the ATO undertook other research activities.

- ‘Like-sized’ agency analysis — Its purpose was to understand how a selection of large corporates56 and other Australian Government agencies57 approach their sourcing eco-system.

- A market comparison report — The purpose of the report was for ‘in-scope contracts to identify what ATO could reasonably expect the prices to be if they were to take the services to market as they are currently prescribed in the contract. Savings outlined in the report will be used as key inputs into the ISG base case.’

- ATO Future State Services Model (High Level Design) Report — To develop ‘a high-level design for the Future Services Model (FSM) which proposes a re-defined portfolio of services for consumption by the ATO.’ The proposed bundling in the FSM will be used to develop the requests for tender for the ITSSP.

- ATO Strategic Sourcing Program Horizon Scan — The scan was conducted to inform the ITSSP target state options. Its purpose included: identifying ‘anticipated and emerging trends in the broader technology environment that may influence the ATO’s sourcing decisions’; and providing an ‘initial analysis on key considerations (including risks and opportunities) relevant to the ATO’s sourcing program’.

- Base case summary and savings estimate — To reconcile the financial base case for the ITSSP with the five-year IT sustainment forecast determined in March 2021.

- Traceability — ‘A traceability matrix from the old contracts was created to ensure that no existing requirements were accidentally omitted’.

2.60 Reports from these research activities supported decision-making for the procurement strategy. The steering committee, and delegate, received walk throughs and copies of these reports during the planning phase. These research reports were attached to the ITSSP procurement plan (see paragraph 2.67).

Lessons learned

2.61 When planning for the procurement the ATO considered and applied lessons learned from the Managed Network Services (MNS) procurement. Lessons considered included:

- allowing more time for large procurements to define clear requirements and allow sufficient time for the market to respond (to be incorporated in the tranche plan);

- seconding or recruiting service owners early to inform a clear tender scope, and support evaluation, negotiation and transition;

- conduct an initial probity risk assessment to clearly set out controls such as for information security and incumbent probity plans (this includes reference to a program funded probity advisor); and

- set savings targets as part of the base case (to be delivered by the sourcing partner).

Procurement strategy and plans

2.62 A procurement strategy and a procurement plan are both essential components of a procurement process. The procurement plan is a key document used for endorsement of the procurement and approval of approach to market. It sets out the procurement objectives and method, the process to be followed, and risks to be addressed.58 ATO guidance requires that a procurement plan must be completed for panel and high touch procurements, and approved by the PGPA delegate.59

Procurement strategy

2.63 The procurement strategy was informed by market testing and other research. On 9 October 2021, the steering committee, which includes the delegate, discussed the adoption of a phased approach to taking bundles to market. In support of the phased approach the committee referenced lessons learned (from MNS and ATO’s previous experience following implementation of these contracts where significant rework was required) and the market engagement and technology horizon research. The committee also discussed the need to balance the costs of administering more contracts, where there are more bundles. The steering committee approved the strategy to take nine bundles to market on 26 October 2021.

2.64 The procurement strategy was set out in the ITSSP procurement plan. The ITSSP procurement plan was approved on 10 March 2022 (prior to the first approach to market being released).

2.65 The strategy set out the procurement approach for the ITSSP procurement bundles. The procurement approach includes an open approach to market for each bundle, with the bundles to be released in three waves. The ITSSP plan covers the approach for all bundles (see Figure 2.4), with bundle specific information included in an appendix for each bundle. Appendices for two of the nine bundles were approved as part of the ITSSP plan; appendices for the remaining bundles were to be approved prior to the bundle being released to market.

Figure 2.4: February 2022 ITSSP procurement plan timeline for requests for tender

Note a: The wave 1 Requests for Tender (RFTs) were to include five bundles: Enterprise Service Management (ESM), Enterprise Operations and Technical Enablement (EOTE), Cyber Augmentation Services (CAS), and Mainframe comprising Mainframe Hardware (MFH), Mainframe Services (MFS) and Mainframe as a Service (MaaFS).

Note b: The wave 2 RFT was to include two bundles End User Experience (EUX) and IT Service Desk (SD).

Note c: The wave 3 RFTs were to include two bundles Midrange and Data Centre (MIDC) and Hyper-Converged Infrastructure (HCI).

Source: ANAO analysis.

2.66 The ITSSP plan provided:

- an overview of the market research completed;

- policy requirements (including PGPA Act and the CPRs, Indigenous Procurement policy, public interest certificates, the digital sourcing framework and exemption for the ITSSP, whole of government panels60, modern slavery, ATO policy61, ministerial updates and advance notice);

- an overview of the evaluation process, noting that an evaluation plan was being developed;

- for maintenance and regular review of the risk register;

- an overview of probity arrangements including reference to the attached probity plan;

- quality assurance arrangements; and

- other considerations.

2.67 Attachments to the ITSSP procurement plan included market research reports, ITSSP key risks and their treatments and an ITSSP probity plan. The probity plan was separately approved (discussed at paragraph 3.57).

Procurement plans for individual procurements

2.68 The EOTE procurement plan was included as an appendix to the ITSSP procurement plan approved in March 2022 (prior to the first approach to market being released). The Mainframe procurement appendix was added in April 2022, and approved by the delegate prior to the Mainframe approach to market in April 2022.

2.69 The procurement plan appendices describe key elements such as: the bundle background including estimated contract value for three- and 10-year terms; an overview of the statement of requirements; a proposed timetable; and evaluation criteria (weighted62 and unweighted63). Attachments to the plan appendices included in principle budget approval; IT Procurement Government Forum (ITPGF) approval; the public interest certificate; the full statement of bundle requirements and bundle owner endorsement; and bundle owner approval for evaluation criteria.

2.70 The ITSSP procurement plan states that ‘the evaluation will use separate Evaluation Teams for the technical, commercial and financial evaluations for each bundle RFT. For RFTs containing more than one bundle, the evaluation of each bundle may have two pricing outcomes; one based on the pricing for that bundle only; and one for bundled pricing where offered’ (evaluation is discussed further at paragraphs 3.19 to 3.48).

2.71 For the strategic sourcing advisor procurement, a procurement plan was approved in November 2020. There was no procurement plan developed for the legal services procurement.

3. IT and advisor procurement processes

Areas examined

This chapter examines whether the Australian Taxation Office (ATO) had conducted procurements in compliance with Commonwealth Procurement Rules (CPRs) and other requirements.

Conclusion

The ATO largely met core requirements of the CPRs except for probity management and conflict of interest. Mainframe Services and Hardware, Enterprise Operations and Technical Enablement (EOTE) and strategic sourcing partner procurements were largely in compliance with CPRs and other requirements. The approach to market and evaluation of the legal services procurement were not consistent with the intent of the CPRs64, and all required records were not maintained. The effectiveness of ATO’s management of probity risks could have been improved by ensuring that incumbent provider probity plans were approved by the ATO, and probity register records were effectively maintained. In addition, conflict of interest processes could have been better managed, including to address risks in a timely manner. Demonstration of value for money for the six advisor procurements was deficient with the cost of advisor contracts increasing from a total estimated value when approving the initial contracts of $19.06 million to a total value of $88.11 million, as at February 2025.

Areas for improvement

The ANAO made two recommendations aimed at improving the declaration and management of conflicts of interest so that they are commensurate with the nature and risk associated with the conflict (paragraph 3.100) and applying an appropriate amount of rigour to the assessment of value for money of ancillary services procurements (paragraph 3.119).

The ANAO also identified three opportunities for improvement aimed at providing updates on the status of procurement processes and timely advice where a supplier is non-compliant or unsuitable for longer procurements (paragraph 3.45); maintaining the independence of the external probity advisor role (paragraph 3.55); and strengthening controls around the application of delegate financial limits when approving variations to contracts (paragraph 3.111).

3.1 The CPRs govern how entities buy goods and services, including requirements and recommendations for approaching the market, conducting evaluations and achieving value for money.

3.2 To assess whether the IT managed services procurements were conducted in compliance with CPRs and other requirements, the ANAO examined a selection of IT managed service procurements (see Table A.1 in Appendix 3) and advisor procurements (see Table 1.2). The procurements selected were (see paragraph 1.25):

- Mainframe: this includes mainframe hardware and services, as well as Mainframe as a service;

- Enterprise Operations and Technical Enablement (EOTE);

- Strategic sourcing partner procurement65; and

- Legal services partner.

Did the ATO conduct the approach to market processes in compliance with the CPRs?