Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Award of Funding under the Mobile Black Spot Program

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Department of Infrastructure, Transport, Regional Development, Communications and the Arts administers the Mobile Black Spot Program (MBSP) on behalf of the Australian Government.

- $40 million was allocated to the Improving Mobile Coverage Round (IMCR) of the MBSP in the 2022–23 October Budget to deliver election commitments made during the 2022 federal election.

- The audit assessed if the IMCR was designed effectively and whether funding was awarded in line with relevant frameworks.

Key facts

- The MBSP objectives are to extend and improve mobile phone coverage and competition in regional and remote Australia, by co-funding new or upgraded telecommunications infrastructure.

- On 19 October 2023, the Minister for Communications announced 41 grants servicing 42 target locations under the IMCR, totalling $37.2 million in funding.

What did we find?

- The department’s design and award of funding for the IMCR was largely effective.

- The department advised the government on potential mobile coverage issues at 54 IMCR target locations but fell short in advising the government on the relative merits of selecting these target locations over other mobile black spots.

- The department was largely effective in its assessment of IMCR grant applications and made funding recommendations to the decision-maker consistent with the grant opportunity guidelines.

- The award of funding was consistent with the Commonwealth Grants Rules and Guidelines 2017.

What did we recommend?

- There were three recommendations to the department aimed at strengthening data collection and the strategic analysis of mobile black spot locations and evaluating the MBSP to ensure it meets its intended objectives.

- The department agreed, and agreed in part, to the recommendations.

42

out of 54 target locations receiving new or improved mobile coverage under the Improving Mobile Coverage Round.

$37.2m

awarded to Mobile Network Operators under the Improving Mobile Coverage Round.

>975km2

amount of new handheld mobile coverage assessed to be delivered across 42 target locations.

Summary and recommendations

Background

1. The Mobile Black Spot Program (MBSP) provides funding for telecommunications infrastructure to improve handheld mobile coverage across regional and remote Australia. The Department of Infrastructure, Transport, Regional Development, Communications and the Arts administers the program on behalf of the Australian Government.

2. The Improving Mobile Coverage Round (IMCR) forms round six of the MBSP and was designed to improve mobile coverage and quality of service in 54 target locations. Locations were identified by the Australian Labor Party as part of election commitments announced during the 2022 federal election.

3. The IMCR is a targeted competitive grant opportunity subject to the Commonwealth Grants Rules and Guidelines 2017 (CGRGs). Applications for the IMCR opened on 2 February 2023 and closed on 13 April 2023. Three applications were received from mobile network operators for funding under the program.

4. On 12 September 2023, the Minister for Communications (the minister) awarded 41 grants servicing 42 target locations, totalling $37.2 million in funding.1 Grant outcomes were publicly announced by the minister on 19 October 2023.

Rationale for undertaking the audit

5. During the 2022 federal election campaign, the Australian Labor Party announced commitments to improve mobile coverage and quality of service across target locations. Round six of the MBSP, also referred to as IMCR, was designed to deliver these election commitments and allocated $40 million in the 2022–23 October Budget.2

6. Previous grant administration audits in the department have identified risks where assessment criteria have not been applied in line with program guidelines and funding recommendations to the decision-maker have not been consistent with assessment outcomes.3

7. This audit will provide assurance to the Parliament on the effectiveness of round six’s design and that the award of grant funding is being managed appropriately.

Audit objective and criteria

8. The objective of the audit was to assess the effectiveness of the design and award of funding for round six of the Mobile Black Spot Program.

9. To form a conclusion against the objective, the following criteria were applied.

- Was the design of round six of the Mobile Black Spot Program effective and consistent with the Commonwealth Grants Rules and Guidelines?

- Were round six applications assessed in accordance with the approach set out in the grant opportunity guidelines?

- Were round six funding decisions informed by clear advice and consistent with the grant opportunity guidelines?

Conclusion

10. The Department of Infrastructure, Transport, Regional Development, Communications and the Arts (the department) was largely effective in the design and award of funding for the IMCR.

11. The department was largely effective in designing the IMCR. The department advised the government on potential mobile coverage and quality of service issues at 54 target locations but did not advise the government on the relative merits of prioritising these target locations over other mobile black spots. The department does not maintain data that enables it to undertake strategic analysis of priority areas across Australia to direct government investment in delivering new and improved mobile coverage. The IMCR grant opportunity guidelines were largely consistent with the CGRGs except that the department did not clarify that major urban areas were eligible for funding in the guidelines when they were ineligible under most MBSP rounds. The department has used lessons learned from previous MBSP rounds to inform the design of the IMCR. It has not implemented a 2016–17 ANAO recommendation to develop a MBSP evaluation framework and has not evaluated whether the program is achieving its intended objectives. The department has processes in place to mitigate probity risks but could improve practices to record actions taken to manage conflict-of-interest declarations.

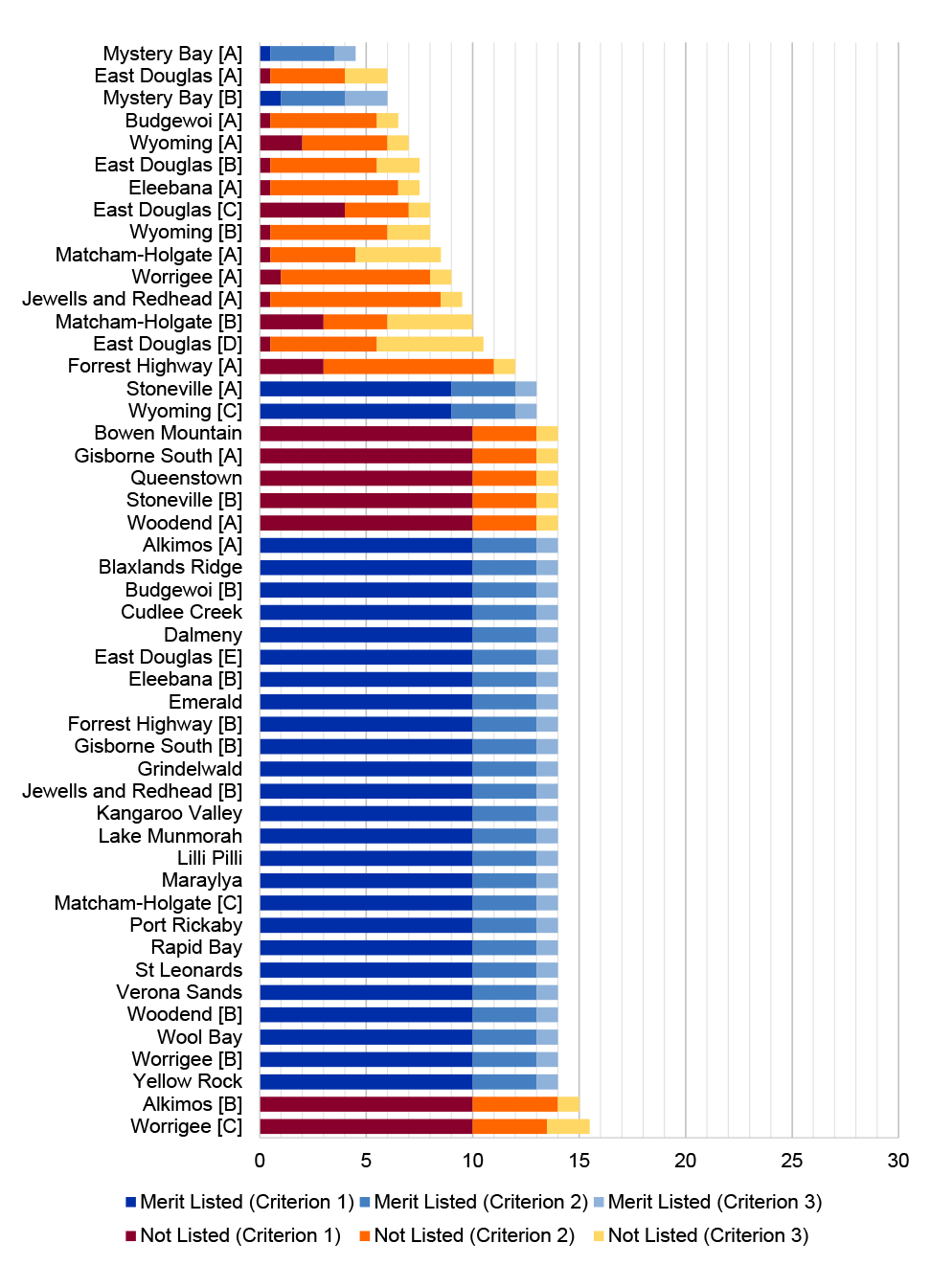

12. The department assessed all applications against the lodgement, eligibility and minimum technical requirements as outlined in the grant opportunity guidelines, with eligible solutions proceeding to assessment and ineligible solutions set aside. Its assessment of applications against the assessment criteria was largely effective in identifying solutions that demonstrated value for money. The department could improve its planning processes as the department lacks a risk-based approach to verifying claims made in applications and did not fully consider the limitations of its assessment methodology for improved coverage solutions. The department recorded merit lists in line with the grant opportunity guidelines and the evaluation committee’s decisions.

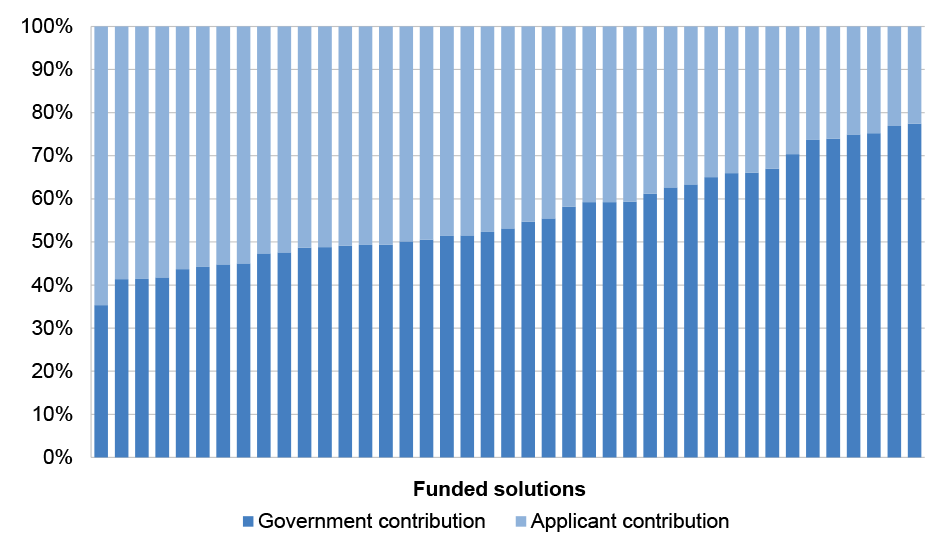

13. The department complied with relevant frameworks during the funding approval process and provided clear and accurate advice to the decision-maker. The minister, as the decision-maker, complied with relevant frameworks when awarding grant funding and in recording their decisions. Funding outcomes were proportionate to the target locations’ electoral and geographic distribution. The department demonstrated good practice in providing advice to the minister on the assessment process and in recording interactions with the minister through their office.

Supporting findings

Program design

14. The department undertook analysis of mobile coverage issues in 54 target locations to categorise sites into one of three coverage solutions: new mobile coverage, improved mobile coverage or new highway coverage. The department does not maintain data that enables it to undertake strategic analysis of priority areas to direct government investment and could not advise the government on the relative merits of prioritising the IMCR target locations over other mobile black spots. The department did not update the grant opportunity guidelines to clarify that target locations in major urban areas were eligible for funding, when ineligible under most of the previous MBSP rounds. (See paragraphs 2.4 to 2.43)

15. The department has not implemented a 2016–17 ANAO recommendation agreeing to develop a MBSP evaluation framework. The department monitors performance information but has not evaluated the MBSP prior to initiating further grant opportunities to ensure the program is achieving its intended objectives. (See paragraphs 2.44 to 2.61)

16. The department established grant opportunity guidelines that complied with all relevant provisions in the CGRGs, except fell short in updating the guideline objectives. The program guidelines outlined IMCR governance arrangements and the assessment and decision-making processes. The department’s internal processes and procedures were designed consistently with the guidelines and other relevant frameworks; but the department could take steps to ensure internal documentation is finalised, regularly reviewed and updated as required. (See paragraphs 2.62 to 2.74)

17. The department established arrangements to manage probity risks to ensure officials declared and managed conflicts of interest. The department had appropriate separation of duties in place and the IMCR assessment process was supported by an external probity adviser. All department officials involved in the assessment process received a probity briefing, considered conflicts of interests, and completed a declaration form. The department did not regularly review its risk and conflict-of-interest registers and the probity plan and final probity report were not finalised in a timely manner. The department could improve its processes to update its conflict-of-interest register to document actions taken to manage conflict-of-interest declarations. (See paragraphs 2.75 to 2.95)

Application assessment

18. The department assessed all applications against the lodgement, eligibility and minimum technical requirements of the grant opportunity guidelines, with eligible solutions proceeding to assessment and ineligible solutions set aside. (See paragraphs 3.2 to 3.17)

19. The department undertook assurance activities to manage risks associated with applicant proposals, although its planning for the use of these assurance checks could be improved to verify claims made by applicants. Applications were assessed against the assessment criteria set out in the grant opportunity guidelines. Scoring outcomes for improved coverage solutions in some target locations meant that the evaluation committee relied on judgement to recommend that some solutions be included on the merit list. Where clarifying information was required, the department sought information from applicants and documented correspondence. Decisions made during the application assessment stage were recorded. (See paragraphs 3.18 to 3.50)

20. The department developed and recorded merit lists in line with the grant opportunity guidelines and the evaluation committee’s decisions. The department considered the proposed solutions’ potential to demonstrate value for money when making its recommendations to the decision-maker. (See paragraphs 3.51 to 3.57)

Funding decision

21. The department provided funding recommendations to the decision-maker that complied with the requirements and better practice elements of the CGRGs and accurately reflected the results of the assessment process. The department kept records of meetings with the minister through their office to discuss the funding recommendations and asked that requests for advice be in writing. (See paragraphs 4.3 to 4.8)

22. The funding approval process was conducted in line with the grant opportunity guidelines and the CGRGs. The decision-maker recorded the basis for funding decisions relative to the grant opportunity guidelines and the key principle of achieving value with relevant money. The award of funding under the program was transparent and funding decisions were proportionate to the target locations’ electoral and geographic distribution. (See paragraphs 4.9 to 4.30)

Recommendations

Recommendation no. 1

Paragraph 2.14

The Department of Infrastructure, Transport, Regional Development, Communications and the Arts:

- collect data and undertake strategic analysis on gaps in mobile coverage and quality of service issues in regional and remote Australia; and

- provide advice to government on the relative merits for selecting targeted locations over other mobile black spot areas.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: 1(a) Agreed, and 1(b) Agreed in part.

Recommendation no. 2

Paragraph 2.33

The Department of Infrastructure, Transport, Regional Development, Communications and the Arts review program objectives and update the grant opportunity guidelines for each new round of the Mobile Black Spot Program.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: Agreed.

Recommendation no. 3

Paragraph 2.59

The Department of Infrastructure, Transport, Regional Development, Communications and the Arts:

- develop an evaluation plan to assess the extent to which the MBSP is achieving its objectives and to identify future enhancements to the MBSP; and

- commence an evaluation of the MBSP within 12 months.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: Agreed.

Summary of entity response

23. The proposed audit report was provided to the Department of Infrastructure, Transport, Regional Development, Communications and the Arts. The department’s summary response is reproduced below. Their full response is included at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed at Appendix 2.

The department agrees and agrees in part with the recommendations and acknowledges the areas of improvement. The audit findings concluded the design of the IMCR round was largely effective; the assessment of the IMCR applications was largely effective; grant funding recommendations to the decision maker were consistent with the grant opportunity guidelines; and the award of funding was consistent with the CGRGs.

The IMCR was announced as part of the 2022–23 Budget and was a competitive Target Locations round of the MBSP, used to deliver on the Government’s election commitments. Over multiple rounds, the department has developed robust processes to ensure the design of the program is continually improving, supporting officials and decision makers to administer the program in accordance with the relevant statutory and policy requirements, and deliver the intended objectives of each round.

The department is confident in its approach to implementing the Government’s priorities, including election commitments, through well considered grant opportunities to deliver on policy objectives, such as was done through the IMCR.

The department acknowledges the opportunity the audit provides to improve our processes as part of our continuous approach to grants administration and to address the areas for improvement raised in the report.

Key messages from this audit for all Australian Government entities

24. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy and program design

Record keeping

1. Background

Introduction

1.1 The 2021 Regional Telecommunications Review highlighted the importance of reliable and modern digital connectivity to regional communities to support the growth and resilience of the Australian economy and in accessing essential services such as health, education and emergency services.4

1.2 The review noted that despite strong demand for mobile services across regional and rural Australia, there are often limited commercial incentives to invest in these areas due to high costs and low revenues because of a dispersed population base. The Australian Government supports commercial investment in regional and remote telecommunications to expand mobile coverage through grant programs.

Mobile Black Spot Program

1.3 The Mobile Black Spot Program (MBSP) provides funding for telecommunications infrastructure to improve handheld mobile phone coverage across regional and remote Australia. The Department of Infrastructure, Transport, Regional Development, Communications and the Arts (the department) administers the program on behalf of the Australian Government. The program is supported by co-contributions from state and local governments, mobile network operators and infrastructure providers, businesses and local communities.

1.4 The Australian Government has the legislative authority to make grants under the MBSP by section 32B of the Financial Framework (Supplementary Powers) Act 1997 and item 211 of Schedule 1AB to the Financial Framework (Supplementary Powers) Regulations 1997.

1.5 Between 2014 and 2023, the Australian Government has awarded $271.4 million in funding across MBSP rounds one to 5A. As at December 2023, a total of 1,118 base stations have been activated under the program. Table 1.1 outlines the funding outcomes of MBSP rounds one to seven.

Table 1.1: Overview of Mobile Black Spot Program Rounds 1–7

|

MBSP Round |

Application opening date |

Application closing date |

Date funding announced |

Funding outcomesa |

|

Round 1 |

8 December 2014 |

16 April 2015 |

24 June 2015 |

499 solutions $100 million |

|

Round 2 |

26 February 2016 |

14 July 2016 |

1 December 2016 |

266 solutions $52 million |

|

Priority Locations Round (round 3)b |

22 November 2017 |

20 December 2017 |

4 April 2018 |

102 solutions $41.3 million |

|

Round 4 |

15 October 2018 |

10 January 2019 |

18 March 2019 |

180 solutions $25.7 million |

|

Round 5 |

5 April 2019 |

26 September 2019 |

21 April 2020 |

182 solutions $33.4 million |

|

Round 5A |

18 November 2020 |

5 March 2021 |

21 July 2021 |

68 solutions $18.9 million |

|

Improving Mobile Coverage Round (round 6)b |

2 February 2023 |

13 April 2023 |

19 October 2023 |

41 solutions $37.2 million |

|

Round 7 |

20 March 2023 |

11 August 2023 |

11 December 2023 |

62 solutions $49.9 million |

Note a: Funding provided by the Australian Government, excluding GST (Goods and Services Tax). A solution is a mobile base station to address a mobile black spot issue.

Note b: The Priority Locations Round and the Improving Mobile Coverage Round were both established to deliver mobile coverage election commitments at targeted locations.

Source: ANAO analysis of MBSP award of funding outcomes.

1.6 At the time of the 2022 federal election in May 2022, $79.1 million of administered funding allocated to a future round six of the MBSP was uncommitted. In the 2022–23 October Budget, the government agreed to reallocate this funding to implement the Improving Mobile Coverage Round (IMCR) ($40 million terminating on 30 June 2025) and towards delivering additional rounds of the Peri-Urban Mobile Program5 ($39.1 million over three years from 2022–23).

Improving Mobile Coverage Round

1.7 The IMCR formed round six of the MBSP and was designed to provide funding to improve mobile coverage and quality of service to 54 target locations. Locations were identified by the Australian Labor Party in election commitments announced during the 2022 federal election.

1.8 Forty of these 54 target locations were in electorates held by the Australian Labor Party (74 per cent), 11 were in electorates held by the Liberal Party of Australia (20 per cent), two in an electorate held by the Centre Alliance (four per cent) and one in an electorate held by Katter’s Australian Party (two per cent) at the time of the election.

1.9 The IMCR is a targeted competitive grant opportunity subject to the Commonwealth Grants Rules and Guidelines 2017. Design of the IMCR was based on the Priority Location Round (MBSP round three) and the Peri-Urban Mobile Program (PUMP), lessons learned from prior MBSP rounds and feedback from stakeholders on the draft grant opportunity guidelines.

1.10 In November 2022, the department consulted publicly with stakeholders on the draft guidelines. A total of 108 submissions were received from industry and other stakeholders during the consultation period.

1.11 Applications for the IMCR opened on 2 February 2023 and closed on 13 April 2023. Three eligible applications were received for the IMCR, proposing a total of 79 solutions across 49 of the 54 target locations.

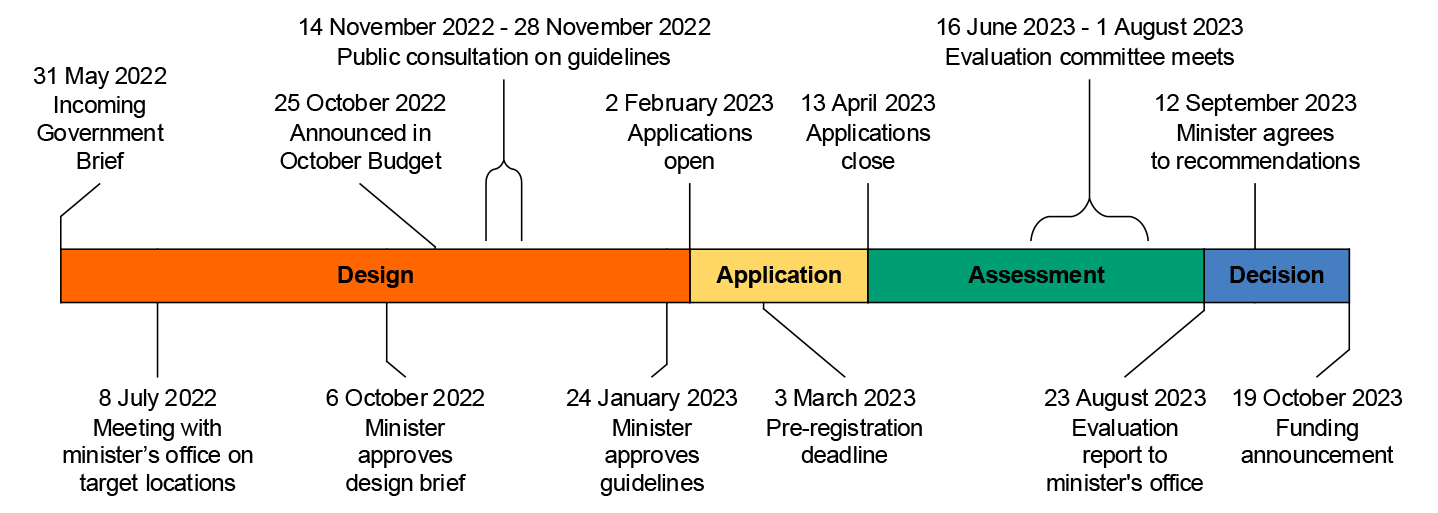

1.12 On 12 September 2023, the Minister for Communications awarded 41 grants servicing 42 target locations, totalling $37.2 million in funding.6 Grant outcomes were announced by the minister on 19 October 2023. Figure 1.1 illustrates IMCR timeframes and key milestones.

Figure 1.1: Improving Mobile Coverage Round timeframes and key milestones

Source: ANAO analysis of IMCR records and department emails.

1.13 Two out of three applicants were awarded funding under the IMCR:

- Telstra was awarded $36,549,536 for 40 solutions.

- TPG Telecom was awarded $680,000 for one solution.7

1.14 The 41 solutions funded under the IMCR were assessed by the department as providing:

- over 975 km2 of new handheld mobile coverage;

- 296 km2 of overlapping handheld mobile coverage with existing mobile coverage in a target location;

- 19.49 kilometres of new and overlapping highway mobile coverage (included in total figures for new and overlapping coverage above); and

- mobile coverage to 12,688 new premises.

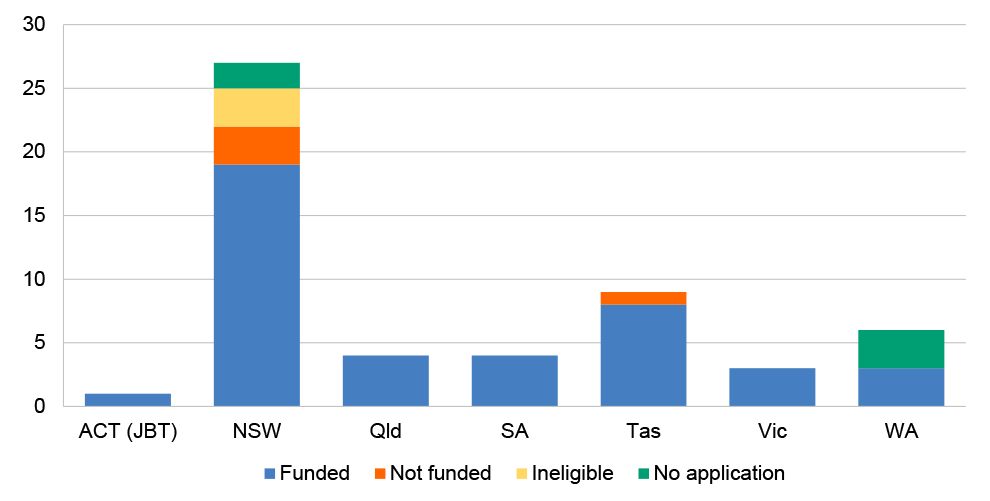

1.15 The number of IMCR solutions funded in each state and territory is outlined in Table 1.2.

Table 1.2: Number of mobile coverage solutions funded by jurisdiction

|

State or territorya |

Total number of funded solutions |

Telstra funded solutions |

TPG Telecom funded solutions |

Government contribution ($) |

|

Australian Capital Territory (Jervis Bay Territory) |

1 |

1 |

0 |

958,982 |

|

New South Wales |

19 |

19 |

0 |

16,288,500 |

|

Queensland |

4 |

4 |

0 |

3,731,973 |

|

South Australia |

4 |

4 |

0 |

4,876,700 |

|

Tasmania |

7 |

7 |

0 |

6,793,882 |

|

Victoria |

3 |

2 |

1 |

2,207,273 |

|

Western Australia |

3 |

3 |

0 |

2,372,227 |

|

Total |

41 |

40 |

1 |

37,229,537 |

Note: Funding contribution is GST exclusive.

Note a: The Northern Territory did not have any target locations.

Source: ANAO analysis of IMCR award of funding outcomes.

Auditor-General reports

1.16 The department’s8 award of funding under the first round of the program was audited in Auditor-General Report No. 10 2016–17 Award of Funding under the Mobile Black Spot Programme.

1.17 The report concluded that the department had established the key elements expected of a competitive, merit-based grants program and it made three recommendations to improve the program’s assessment criteria, assessment methodology and performance measurement and program evaluation.

Rationale for undertaking the audit

1.18 During the 2022 federal election campaign, the Australian Labor Party announced commitments to improve mobile coverage and quality of service across target locations. Round six of the MBSP was designed to deliver these election commitments and allocated $40 million in the 2022–23 October Budget.

1.19 Previous grant administration audits in the department have identified risks where assessment criteria are not applied in line with program guidelines and funding recommendations to the decision-maker are not consistent with assessment outcomes.9

1.20 This audit will provide assurance to the Parliament on the effectiveness of round six’s design and that the award of grant funding is being managed appropriately.

Audit approach

Audit objective, criteria and scope

1.21 The objective of the audit was to assess the effectiveness of the design and award of funding for round six of the Mobile Black Spot Program.

1.22 To form a conclusion against the objective, the following high-level criteria were applied.

- Was the design of round six of the Mobile Black Spot Program effective and consistent with the Commonwealth Grants Rules and Guidelines?

- Were round six applications assessed in accordance with the approach set out in the grant opportunity guidelines?

- Were round six funding decisions informed by clear advice and consistent with the grant opportunity guidelines?

1.23 The scope of this audit focused on round six program design and the award of funding to applicants. The audit did not examine subsequent stages in the grants management process, including the development and management of round six grant agreements.

1.24 The government also opened round seven of the MBSP, round three of the Regional Connectivity Program10 and round two of the Peri-Urban Mobile Program in 2023. These activities are not in scope for this audit.

Audit methodology

1.25 The audit methodology included:

- review of departmental records related to the design of round six of the MBSP, advice to the minister, assessment of grant applications and the decision to award funding;

- analysis of mobile black spot data sets, including grant applications and spatial data to assess eligibility requirements and the allocation of funding under the program;

- meetings with departmental staff to discuss relevant aspects of the program; and

- walkthroughs of the departmental design and assessment process.

1.26 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $372,000.

1.27 The team members for this audit were Lauren Dell, Kai Clark, Danielle Page, Nathan Daley, Renina Boyd and Michelle Page.

2. Program design

Areas examined

This chapter examines the Department of Infrastructure, Transport, Regional Development, Communications and the Arts’ (the department) approach to designing the Improving Mobile Coverage Round (IMCR) of the Mobile Black Spot Program (MBSP), including whether appropriate grant opportunity guidelines were developed in line with the Commonwealth Grants Rules and Guidelines 2017 (CGRGs).

Conclusion

The department was largely effective in designing the IMCR. The department advised the government on potential mobile coverage and quality of service issues at 54 target locations but did not advise the government on the relative merits of prioritising these target locations over other mobile black spots. The department does not maintain data that enables it to undertake strategic analysis of priority areas across Australia to direct government investment in delivering new and improved mobile coverage. The IMCR grant opportunity guidelines were largely consistent with the CGRGs except that the department did not clarify that major urban areas were eligible for funding in the guidelines when they were ineligible under most MBSP rounds. The department has used lessons learned from previous MBSP rounds to inform the design of the IMCR. It has not implemented a 2016–17 ANAO recommendation to develop a MBSP evaluation framework and has not evaluated whether the program is achieving its intended objectives. The department has processes in place to mitigate probity risks but could improve practices to record actions taken to manage conflict-of-interest declarations.

Areas for improvement

The ANAO made three recommendations for the department aimed at strengthening data collection to undertake strategic analysis of mobile black spot locations, advising the government on the relative merits of prioritising target locations, and evaluating the MBSP to ensure it meets its intended objectives. The ANAO also suggests that the department could regularly review and update key program documentation and ensure records are approved in a timely manner.

2.1 The delivery of election commitments through a grants program must be consistent with the Public Governance, Performance and Accountability Act 2013 (PGPA Act), Public Governance Performance and Accountability Rule 2014 and the CGRGs.

2.2 The CGRGs require accountable authorities to establish practices and procedures to ensure the key principle of robust planning and design is met.11 Accountable authorities should also adhere to guidance in Part 4 of Resource Management Guide No. 41212 when implementing election commitments through a grant program.

2.3 Capturing lessons learned throughout the implementation of government programs contributes to continuous improvement in policy and program design as well as supporting enhanced organisational effectiveness. Entities should develop an evaluation strategy when designing a grant program as a part of a broader set of assurance mechanisms to support accountability, understand risk and determine how well grant opportunity objectives are being achieved.13

Was appropriate analysis carried out to inform target locations for round six?

The department undertook analysis of mobile coverage issues in the 54 target locations to categorise sites into one of three coverage solutions: new mobile coverage, improved mobile coverage or new highway coverage. The department does not maintain data that enables it to undertake strategic analysis of priority areas to direct government investment and could not advise the government on the relative merits of prioritising the IMCR target locations over other mobile black spots. The department did not update the grant opportunity guidelines to clarify that target locations in major urban areas were eligible for funding, when ineligible under most of the previous MBSP rounds.

Target location identification

2.4 During the 2022 federal election, the Australian Labor Party announced commitments to improve mobile coverage and quality of service in various electorates across Australia. The department maintained a register of election commitments publicly announced by all parties during the election.

2.5 The department used information within the election commitments to compile an initial list of 47 target locations with potential mobile coverage issues. When briefing the new government in June 2022, the department recommended that a dedicated competitive grant funding round was the most efficient and effective way to deliver against improving mobile coverage election commitments.

2.6 On 8 July 2022, the Minister for Communications (the minister) through their office informed the department of an additional 10 locations that were not on the department’s list of election commitments. The minister through their office requested the following sites be included for a combined list of 57 target locations:

- Kuranda West, Upper Stone and East Douglas (Queensland);

- Herne Hill, Brigadoon, Stoneville North, Breera (Brand Highway) and Alkimos North (Western Australia); and

- Port Rickaby and Wool Bay (South Australia).

2.7 The department located election commitments for four of the 10 additional target locations identified by the minister through their office, but could not identify any public announcements for the following six locations:

- Breera, in the electorate of Durak;

- East Douglas, in the electorate of Herbert;

- Kuranda West, in the electorate of Leichhardt;

- Port Rickaby, in the electorate of Grey;

- Upper Stone, in the electorate of Kennedy; and

- Wool Bay, in the electorate of Grey.

2.8 On 11 July 2022, the department requested information from the minister through their office to verify the election commitments and potential mobile coverage issues in these six locations. The department did not receive a response from the minister for this request.

2.9 On 5 February 2023, the department sent a follow-up request to the minister through their office to seek advice of any announcement details for the six target locations which did not have identified commitments. On 7 February 2023, the minister through their office advised the department that ‘I [have] checked and confirmed these locations were approved for announcement in early May 2022.’ The office provided details on the funding amounts committed against the six locations. The office did not provide the department with information verifying potential mobile coverage issues at these sites or that the commitments were publicly announced during the 2022 federal election campaign.

2.10 During the development of the grant opportunity guidelines, the target locations list was reduced from 57 to 54 target locations following discussions between the department and the minister through their office.

- A site identified by the department in North Harbour was removed from the list, with advice from the minister through their office that it was not an election commitment.

- The Yarramalong election commitment was assessed by the department as a resilience upgrade project to be progressed through a separate grants process and was removed from the list.

- The Killcare–Hardys Bay election commitment was identified by the department as a current project under the MBSP Priority Locations Round, and subject to appeal in the New South Wales Land and Environment Court. It was removed from the list.

2.11 On 6 October 2022, the minister approved the list of 54 target locations and the department consulted on the draft opportunity guidelines in November 2022 (see paragraphs 2.63 to 2.70). In seeking the minister’s approval of the final grant opportunity guidelines in December 2022, the department noted to the minister that some community and industry stakeholders had expressed concern during the consultation period that other mobile black spot locations were ineligible. The department also advised the minister that ‘consultation on the guidelines for the next general round of the Regional Connectivity Program (including a Mobile Black Spot component) will have commenced before IMCR opens, which will help address community concerns’.14

2.12 On 2 February 2023, the department released the grant opportunity guidelines on GrantConnect with the list of the 54 IMCR target locations as an appendix, including details on the specific mobile coverage issues at the target locations.

2.13 The department could not inform government of the relative merits of selecting the list of 54 IMCR target locations over other mobile black spots in regional and remote Australia. The department does not maintain data that enables it to undertake strategic analysis of priority areas across Australia to direct government investment in delivering new and improved mobile coverage.

Recommendation no.1

2.14 The Department of Infrastructure, Transport, Regional Development, Communications and the Arts:

- collect data and undertake strategic analysis on gaps in mobile coverage and quality of service issues in regional and remote Australia; and

- provide advice to government on the relative merits for selecting targeted locations over other mobile black spot areas.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: 1(a) Agreed, and 1(b) Agreed in part.

2.15 1 (a) The department agrees to the recommendation to collect data and undertake strategic analysis on gaps in mobile coverage and quality of service issues in regional and remote Australia. The department implements appropriate measures to collect data, identify mobile coverage gaps and quality of service issues across Australia during each round of the MBSP. The department has systems and processes in place to collect robust coverage modelling data from mobile network operators as part of the grant application process and sophisticated geospatial mapping tools to assess and analyse coverage and quality of service issues claimed. The department also requires grantees to provide evidence of the provision of services and coverage information at asset completion to confirm outcomes have been achieved as contracted. The department has undertaken random sampling of on-ground mobile coverage outcomes of completed sites to verify delivery outcomes.

2.16 The coverage modelling data provided by applicants under program rounds, as well as other confidential and public sources of relevant information such as ACCC Regional Mobile Infrastructure Reports, is used to inform ongoing strategic policy development and the design of future program rounds. For example, the MBSP Round 7 design included a new, additional funding incentive that recognised the higher costs and commercial barriers to deploying base station in remote, very remote and First Nations communities; Round 2 of the Peri-Urban Mobile Program introduced the use of coverage heat maps to enhance the assessment of coverage and quality of service issues. The department is also delivering and/or supporting a number of relevant initiatives including:

- the National Audit of Mobile Coverage (under the Better Connectivity Plan for Regional and Rural Australia) which will help the Government to better identify mobile coverage black spots, target future investment and help assess the accuracy of carrier coverage map; and

- the 2024 Regional Telecommunications Review which will provide the opportunity for community consultation with Australians across rural, regional and remote communities and will also work with industry to consider regulatory settings and to map solutions to improve regional communications.

2.17 These initiatives will provide additional data, insights and information to support the department’s existing processes and measures to collect data and identify mobile coverage gaps and quality of services across Australia. The outcomes of these initiatives will also assist the department by contributing to future program design and informing future policy advice.

2.18 1 (b) The department agrees in part with the recommendation to provide advice to government on the relative merits of selecting target locations over other mobile black spot areas. The Target Locations in the IMCR were identified during the election campaign by the then Opposition, prior to forming government. Once in Government, delivery of these commitments was funded as a decision of Government during the October 2022–23 Budget.

2.19 The Commonwealth Grants Policy Framework (which includes the CGRGs) and Resource Management Guides (RMGs) do not require officials to provide advice to government on the merits of their election commitments, rather to provide fair and transparent administration, support the minister, and comply with regulations, frameworks and statutory requirements when administering grants to deliver the Government’s policy outcomes. As discussed in the June 2023 Joint Committee of Public Accounts and Audit’s report (JCPAA)15, officials of Commonwealth entities that are delivering grant programs under the CGRGs framework have responsibilities to provide accurate, timely, and impartial advice to the relevant minister on matters related to these programs. The Department of Finance also reaffirmed in the report, the applicability of the existing grants framework to election commitments. The report also counsels officials and decision makers under the CGRGs framework to support the minister in understanding the guidelines, policies, and processes governing the administration and management of grants.

2.20 The department recommended that the Government undertake a competitive, merit-based grant opportunity to deliver on the relevant election commitments, and this recommendation was accepted. This approach was supported by the Department of Finance together with a low risk rating for the program round. The department complied with the CGRGs, the PGPA Act and Rule, and the Department of Finance-issued accountable authority guidance for officials in the RMGs, including RMG 412 (4. Election commitments), relevant to accountable authorities and officials involved in grants administration.

2.21 The department notes it did provide advice to the Government on the 54 Target Locations when designing the IMCR. The department undertook a detailed desktop analysis of the Target Locations and the mobile coverage issues and, in the grant opportunity guidelines, classified them into one of three categories based on the most appropriate type of infrastructure solution for the mobile service issues at each location. The department then undertook public consultation on the draft grant opportunity guidelines, and included locally-reported issues at the Target Locations in the final guidelines. Following the application process, and consistent with the guidelines, the CGRGs and the PGPA Act, the department applied robust scrutiny when assessing and recommending applications for the IMCR, resulting in the department recommending against grants at several Target Locations. These recommendations were accepted by the Government.

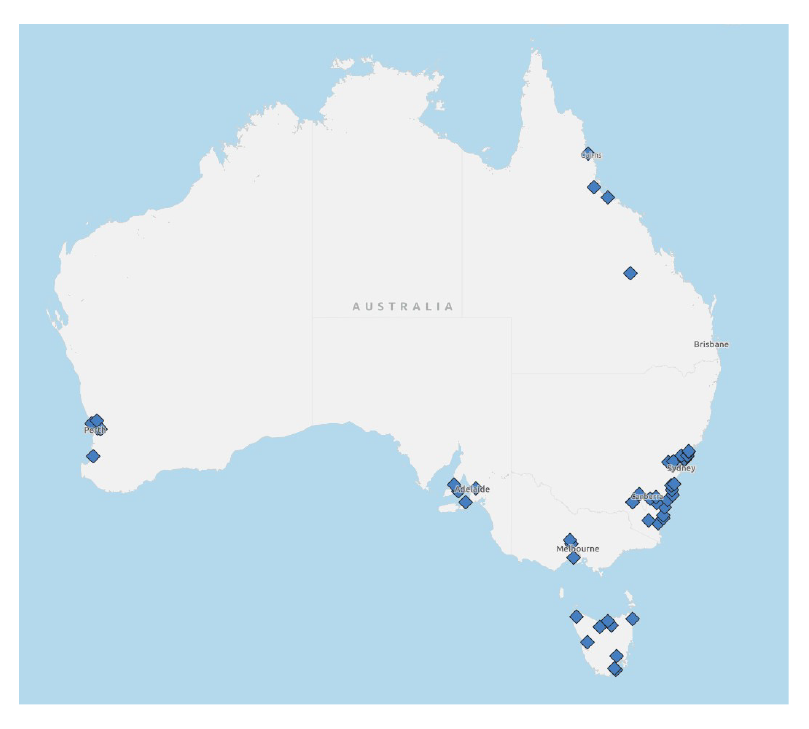

Target location analysis

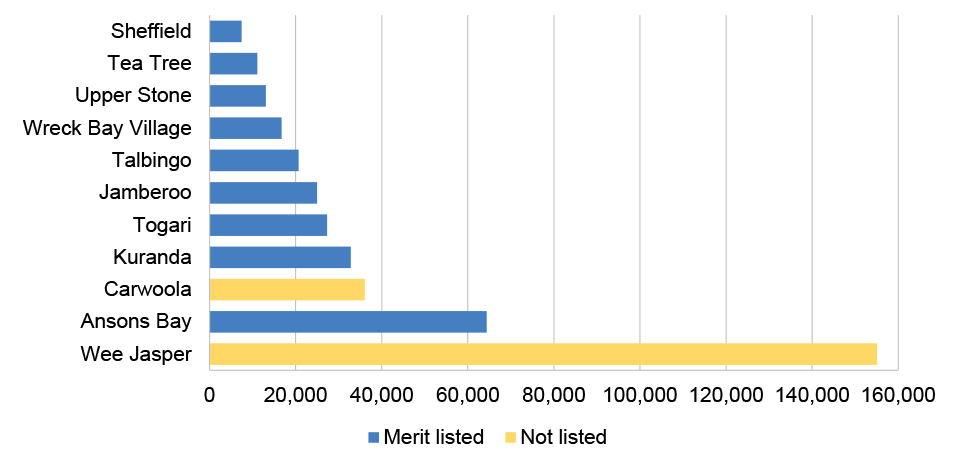

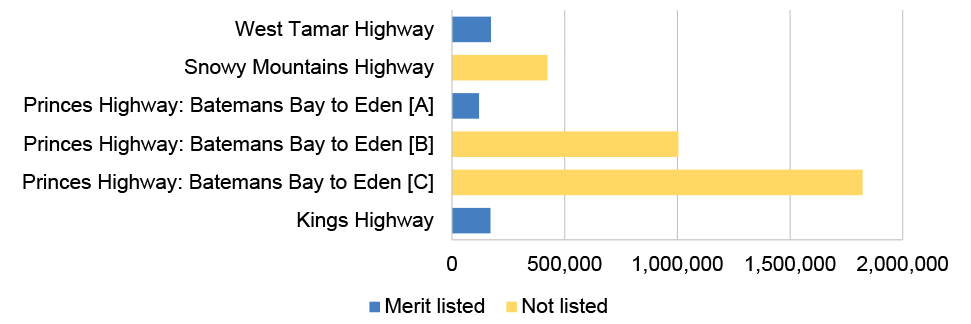

2.22 Twenty-seven target locations were in New South Wales, nine in Tasmania, six in Western Australia, four each in Queensland and South Australia, three in Victoria and one in the Australian Capital Territory (Jervis Bay Territory). Figure 2.1 shows the distribution of IMCR target locations across Australia.

Figure 2.1: Map of the 54 Improving Mobile Coverage Round target locations

Source: ANAO analysis of IMCR target locations.

2.23 To determine mobile coverage issues in the 54 target locations, the department reviewed information contained in the election commitments and existing mobile coverage maps. The department also carried out mobile coverage surveys of targeted highways and reviewed complaints of poor mobile access or coverage at the target locations.

2.24 The department advised the ANAO on 18 August 2023 that this desktop analysis was not the most effective method to identify localised capacity or dominance issues that could affect user experience at the target locations.

2.25 The department determined that the market would be best placed to determine potential solutions and shifted to classifying each target location into one of three categories:

- new mobile coverage — where coverage issues appeared to primarily relate to poor or no mobile coverage across the target location;

- new highway coverage — where issues primarily relate to stretches of highway with poor or no mobile coverage; or

- improved mobile coverage — where issues appear to primarily relate to either mobile capacity, poor indoor coverage or both.

2.26 In total, 14 target locations were identified as new mobile coverage, six locations as new highway coverage and 34 locations as improved mobile coverage.

National Mobile Black Spot Database

2.27 For round one of the MBSP, the department developed a national mobile black spot database to inform applicants of potential locations to help develop their grant applications for that round. The database contained mobile black spot locations reported by members of the public or nominated by members of parliament, however the reported mobile black spot issues were not independently verified by the department or updated as issues were rectified.

2.28 The department advised the ANAO on 30 August 2023 that this database did not inform the design of the IMCR as it was discontinued in 2018 and no longer in use. The department noted that the database represented a point in time, could not be validated and was no longer accurate.

Target location eligibility

2.29 The grant opportunity guidelines state that the objectives of the MBSP are to extend and improve mobile phone coverage and competition in regional and remote Australia, by co-funding new or upgraded telecommunications infrastructure. In most MBSP rounds, except for the Priority Locations Round, major urban areas16 have been ineligible for funding consistent with the grant opportunity guidelines.

2.30 In September 2022, the department advised the minister that the design of the IMCR was based on the Priority Locations Round. This round of the MBSP targeted 125 pre-announced priority locations, including major urban areas, with solutions funded through a targeted competitive grant program.17

2.31 Nine IMCR target locations were in areas classified as major urban. The department advised the ANAO on 5 October 2023 that it determined major urban areas were eligible under the IMCR to streamline the grant application process for industry and to reduce inefficiencies of administering multiple grant programs. The legislative and policy authority for the MBSP does not restrict funding to regional and remote Australia.18

2.32 The department did not advise the government that major urban areas had been ineligible under previous MBSP rounds (except for the Priority Locations Round), and did not update the grant opportunity guideline objectives to clarify that major urban areas were eligible for grant funding under the IMCR.

Recommendation no.2

2.33 The Department of Infrastructure, Transport, Regional Development, Communications and the Arts review program objectives and update the grant opportunity guidelines for each new round of the Mobile Black Spot Program.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: Agreed.

2.34 The department reviews program objectives and updates grant opportunity guidelines. The department reviews, consults on and updates the program guidelines for each new round of the program. The program guidelines (including program objectives) are reviewed and updated based on multiple factors, which can vary for each round. These can include updated policy objectives, election commitments, public consultation community feedback, telecommunications industry feedback, new and emerging technologies, lesson learned, risks and best practice in the delivery of other programs. The evolution of the program is evidenced in the body of program guidelines published for all eight rounds of the MBSP, copies of which can be found on the department’s website.19

2.35 The program guidelines and objectives were reviewed and updated for the IMCR, including consideration of feedback from public consultation. The reference to regional and remote Australia is not a constraint of the program’s policy or legislative authority20; it is a program design feature which can change between rounds. The department acknowledges its oversight in not removing a reference to regional and remote locations in the program objective for this particular round, noting that some Target Locations were identified in major cities and were eligible under the IMCR. This administrative oversight did not have any material impact on the outcomes of the program as the eligible 54 Target Locations were clearly identified in the program guidelines, as included in Appendix A.

Target locations previously funded through Australian Government grant programs

2.36 The department advised the government that some election commitments were in locations that had received grant funding under existing government programs. Seventeen target locations had received funding under earlier grant program rounds.

2.37 In January 2023, the department advised the minister through their office that the market should be tested again as some sites could not be built at the time or may have had conditions change to warrant additional telecommunication infrastructure investment. The department stated that previously funded sites may require further coverage or capacity upgrades to address localised black spot issues.

Target location risks

2.38 The department advised the minister through their office in July 2022 that some target locations might be challenging to deploy coverage solutions or might not be of commercial interest to mobile network operators. The department stated these issues could result in some locations not attracting funding applications and that there was a higher risk of infrastructure not being completed at the Kangaroo Valley, Carwoola, St Leonards, Mt Tomah and Bowen Mountain target locations.

2.39 The department also advised the minister that specifying target locations for investment could reduce the competitive incentive for applicants and state and territory governments to offer funding co-contributions.

2.40 The department identified in its draft program risk register that its award of grant funding may contribute to an increase in Telstra’s incumbent market share throughout regional Australia. The draft risk register stated that poor program design could limit market competition in regional areas due to reduced investment incentives from other providers.

2.41 The department identified the following controls to manage the risk:

- assessment criteria within the grant opportunity guidelines factored in solutions that provide new mobile coverage in an applicant’s network but not wholly new coverage to an area;

- grant opportunity guidelines targeted mobile network operators and mobile network infrastructure providers with high incentives to be seen investing in regional areas; and

- the government evaluates former rounds of the program for effectiveness, including effects on market incentives and competition, and program rounds are designed using evidence-based policy research.

2.42 The department assessed the likelihood of the reduced competition risk occurring as rare in the risk register, resulting in an overall low risk rating. The department advised the ANAO on 12 February 2024 that it did not raise the reduced competition risk with the government in the development of the IMCR as the department classified the potential risk as low.

Analysis of highway target locations

2.43 The department engaged Ventia as an external technical adviser to carry out mobile coverage testing21 for the identified highway locations to detect mobile coverage issues, which was completed in June 2022. The testing resulted in the reclassification of one highway target location to the ‘improved mobile coverage’ category. All other highway target locations remained in the ‘new highway coverage’ category.

Were lessons learned from previous mobile black spot rounds effectively used to inform the design of round six?

Lessons learned from previous funding rounds were used to inform program design and development of the IMCR grant opportunity guidelines. The department has not implemented a 2016–17 ANAO recommendation agreeing to develop a MBSP evaluation framework. The department monitors performance information but has not evaluated the MBSP prior to initiating further grant opportunities to ensure the program is achieving its intended objectives.

Using lessons learned to design the Improving Mobile Coverage Round

2.44 The department advised the government that a targeted competitive grants program was the most effective way to deliver against its improving mobile coverage election commitments, consistent with the Department of Finance’s Resource Management Guide 412.22

2.45 When developing the IMCR, the department modelled the grant opportunity on the MBSP Priority Location Round to deliver election commitments and considered lessons learned from previous rounds of the MBSP, the Peri-Urban Mobile Program and feedback from public consultation to update the grant opportunity guidelines (see Table 2.1).

Table 2.1: Lessons learned and applied into the design of the Improving Mobile Coverage Round

|

Lesson learned |

Source of lesson learned |

Detail of lesson learned |

IMCR design feature |

|

Assessment scoring methodology |

Priority Locations Round (PLR)

|

Previous MBSP rounds used a points-based system to assess applications. The department introduced a weighted formula in the PLR to assess new coverage and improved coverage solutions which differentiated between solutions on a cost against mobile coverage outcome basis. |

The IMCR guidelines retained the weighted scoring methodology to assess new coverage and new highway coverage solutions. The guidelines outlined three criterion for improved coverage solutions. |

|

Third-party contributions |

The department advised the minister in October 2022 it was unlikely third-party contributions would be received for the IMCR as no third-party contributions were received under the PLR, driven primarily by the pre-determined location selection. |

The IMCR guidelines were updated to clarify third-party engagement as a factor in the department’s value for money assessment of proposed solutions. |

|

|

Operational cost funding |

Round 5A

|

Applicants previously excluded from applying for grant funding to cover operational expenses. The department received feedback from applicants that recovery of operational costs was required to make remote locations commercially viable. Operational costs were eligible for funding for trial solutions under MBSP round 5A. |

IMCR guidelines adopted the ability for applicants to claim operational costs for proposed solutions. |

|

Capital cost caps for multi-carrier solutions |

Round 5A removed a $500,000 cap for capital costs for ‘multi-carrier solutions’ to encourage more applications following feedback from stakeholders. |

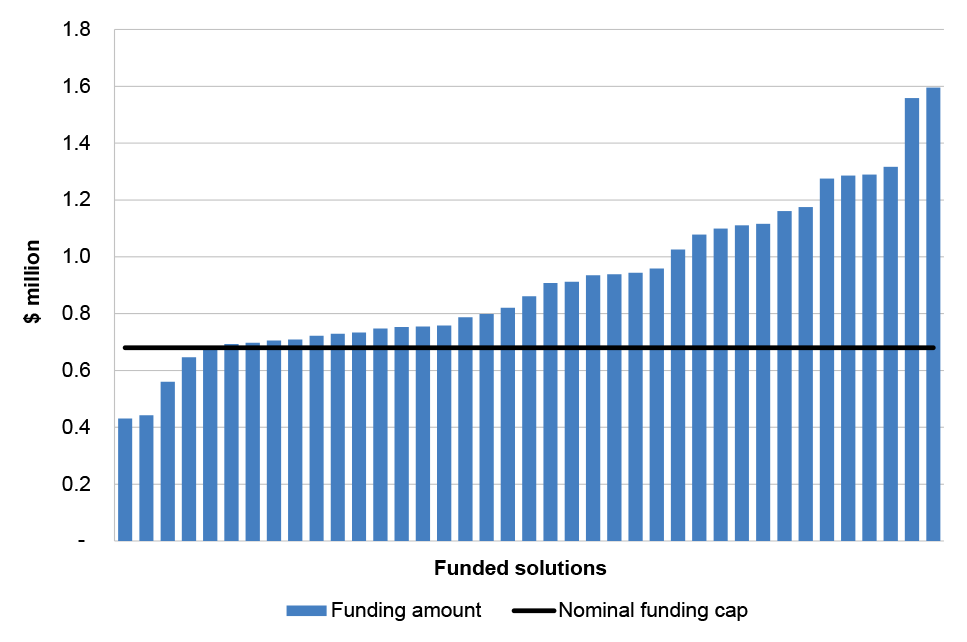

The guidelines did not specify a funding cap on capital costs for any solution. Nominal funding cap on total solution cost introduced at $680,000 for macrocell solutions and $250,000 for small cell solutions.a The department advised the Minister in October 2022 there was a risk that proposed solutions may exceed the funding caps due to inflationary and supply cost pressures. |

|

|

Conservative coverage metrics |

Peri-Urban Mobile Program (PUMP) |

Conservative signal thresholds were adopted in PUMP to better demonstrate proposed mobile coverage outcomes at a higher confidence level, particularly for indoor mobile reception. |

The IMCR guidelines also adopted conservative signal thresholdsb to assess coverage outcomes. |

|

Co-location and multi-carrier outcomes |

2021 Regional Infrastructure Reviewc |

The review notes that consumers in regional and remote Australia have less choice in mobile providers and can experience higher costs when living, travelling and working in these areas. |

The IMCR guidelines included requirements for applicants to provide active sharing or co-locationd to other providers where technically feasible. |

Note a: Macrocell solutions provide mobile coverage to a wide area over several kilometres, while a small cell solution has a smaller mobile coverage range (hundreds of meters) and a lower power output to that of a macrocell.

Note b: To assess the mobile coverage claims made by applicants under the Improving Mobile Coverage Round, the department uses Reference Signals Received Power (RSRP) to model signal strength proposed at a location at 90 per cent confidence. For the 4G (LTE) service mode, an RSRP measured at -85 decibel-milliwatts should provide strong signal strength with good data speeds. Decibel-milliwatts (dBm) is the amount of power that an antenna can produce or how much signal is available at a site. The RSRP is a measurement of this power spread over the full bandwidth and narrowband and is indicated by a negative dBm value. The closer the negative dBm measurement is to zero, the stronger the signal.

Note c: Regional Telecommunications Independent Review Committee, 2021 Regional Telecommunications Review: a step change in demand, RTIRC, Canberra, 2021, available from https://www.infrastructure.gov.au/sites/default/files/documents/2021-rtirc-report-a-step-change-in-demand.pdf [accessed 17 January 2024].

Note d: Communications equipment can be installed on a range of physical infrastructure such as a mobile tower, rooftops of commercial and residential buildings, or light poles and bus stops (known as passive infrastructure). Co-location occurs when a Mobile Network Operator (MNO) installs their equipment on the infrastructure as another MNO in a passive sharing arrangement. Active sharing involves the sharing of electronic infrastructure such as radiocommunications spectrum and radio access network between MNOs.

Source: ANAO analysis of MBSP lessons learned captured by the department.

Performance monitoring and reporting

2.46 The PGPA Rule and the Department of Finance Resource Management Guide 131 requires entities to have meaningful performance information that is measurable, reliable and related to entity’s purpose and objectives.23

2.47 Outcome 5 in the department’s Portfolio Budget Statements 2023–24 is to:

Promote an innovative and competitive communications sector, through policy development, advice and program delivery, so all Australians can realise the full potential of digital technologies and communications services.

2.48 A key activity under Outcome 5 is to implement and administer programs that expand digital connectivity, including the MBSP. The objective of the MBSP is to extend and improve mobile phone coverage and competition across Australia, with a focus on regional and remote areas, by co-funding new or upgraded telecommunications infrastructure.

2.49 The department monitors MBSP implementation through the following key performance indicators (KPIs) set out in the grant agreements:

- amount of new and upgraded handheld coverage achieved (km2);

- new external antenna coverage (km2);

- new coverage proved to major transport routes (kms); and

- number of premises receiving new handheld coverage.

2.50 The department requires that grantees provide KPI baseline data for each funded solution in the grant agreements. The department uses this data to monitor implementation and report progress against the MBSP objective of extending and improving mobile coverage. The grant agreements also require grantees to provide asset completion reports and data on total contracted versus actual mobile coverage outcomes for delivered infrastructure.

2.51 Performance measure 25 in the department’s 2023–27 Corporate Plan is the ‘Total amount of new and improved mobile coverage delivered through the Mobile Black Spot Program and the Peri-Urban Mobile Program’.24 The department reports against this performance measure using the MBSP KPI data (see paragraph 2.49).

2.52 The 2023–24 target for performance measure 25 is mobile coverage that is equal to or greater than 90 per cent of total contracted coverage delivered by assets where completion reports are received and approved in the financial year, for both the MBSP and Peri-Urban Mobile Program.25

2.53 For the MBSP in 2022–23, the department reported it had met the target against performance measure 25, with 6,420km2 of new handheld mobile coverage delivered across 79 base stations representing 158 per cent of the total contracted coverage from these assets.26 The ANAO audited the department’s performance statements for the year ending 30 June 2023 and did not find any non-compliance with the PGPA Act and Rule for this performance measure. The department does not have a target for competition objectives or whether mobile telecommunication users in regional and remote Australia are provided with a greater choice of mobile network operators.

Program evaluation

2.54 The Commonwealth Evaluation Policy sets a framework to assess implementation and to measure the impact of government programs. Resource Management Guide 412 states that the evaluation of grant programs should focus on the extent to which the government’s policy outcomes have been achieved. Australian Government entities should also adopt an early focus on evaluation during the design phase of a grant opportunity.27

2.55 In 2022, the Minister for Communications asked the Standing Committee on Communications and the Arts to inquire into the experiences, opportunities and challenges for co-investment in multi-carrier regional mobile infrastructure. In its report released in November 2023, the standing committee recommended:

the Australian Government review the policy intent, objectives, and guidelines of the Mobile Black Spot Program to ensure it remains fit for purpose. The review should be completed within 12 months and have regard to other relevant recommendations made in this report.28

2.56 Auditor-General Report No. 10 2016–17 Award of Funding under the Mobile Black Spot Programme, recommended that the department implements a performance measurement and evaluation framework for the MBSP.29 The department agreed to this recommendation.

2.57 In February 2024, the department advised the ANAO that it was developing a MBSP evaluation strategy and planning an approach to market for external evaluation services.

2.58 As at March 2024, the department does not have a MBSP evaluation framework in place and has not evaluated the program prior to initiating further grant opportunities. Without an effective evaluation, the department is unable to provide assurance that the MBSP contributes to improving mobile phone coverage and competition in regional and remote Australia.

Recommendation no.3

2.59 The Department of Infrastructure, Transport, Regional Development, Communications and the Arts:

- develop an evaluation plan to assess the extent to which the MBSP is achieving its objectives and to identify future enhancements to the MBSP; and

- commence an evaluation of the MBSP within 12 months.

Department of Infrastructure, Transport, Regional Development, Communications and the Arts response: Agreed.

2.60 The department is committed to continuous learning and improvement in its programs and has taken steps to evaluate the MBSP. The department reviews each round of the program to determine how the administration of the program can be improved. Lessons from previous rounds provide enhancements to new rounds of the program, to continue to deliver on the program, and each round’s, objectives. The department has also undertaken random sampling of mobile coverage of sites delivered across multiple rounds of the program, to identify and verify mobile coverage outcomes for the MBSP.

2.61 The department agrees a more formal evaluation of the program would provide additional benefits and opportunities for improvement. The department has developed an internal evaluation plan for the MBSP, undertaken a procurement process and engaged an external contractor to undertake an evaluation of the MBSP. The evaluation will measure and assess the effectiveness of the program in delivering its policy intent, program objectives and to inform future policy and program design. The evaluation is expected to be completed in the latter half of 2024.

Has the department established appropriate grant opportunity guidelines?

The department established grant opportunity guidelines that complied with all relevant provisions in the CGRGs except fell short in updating the guideline objectives. The program guidelines outlined IMCR governance arrangements and the assessment and decision-making processes. The department’s internal processes and procedures were designed consistently with the guidelines and other relevant frameworks; but the department could take steps to ensure internal documentation is finalised, regularly reviewed and updated as required.

Design of the grant opportunity guidelines

2.62 The CGRGs require accountable authorities to develop grant opportunity guidelines for all new grant opportunities.30 Officials should develop clear and consistent guidelines to effectively communicate the program’s intended outcomes to applicants.

2.63 On 14 November 2022, the department published the draft guidelines for public comment. The draft guidelines were updated with input from public consultation, and feedback from state and territory governments, and mobile network operators.

2.64 The department received 108 submissions across industry, non-government organisations and the public as part of the consultation process. Sixty-five submissions (60 per cent) identified a mobile coverage issue in one or more target locations. The department advised the minister through their office that stakeholder engagement identified the impact of poor connectivity across target locations, including issues with ‘EFTPOS, communications during natural disasters or medical emergencies, working and studying from home, and receiving two-factor authentication codes for banking and government services.’

2.65 The department wrote to three mobile network operators on 14 November 2022 to notify of the consultation period and offered to discuss the draft grant opportunity guidelines. Telstra and TPG Telecom requested meetings with the department which were held on 22 November 2023 and 29 November 2023 respectively. The consultation meetings covered the program timeframes, types of coverage issues at target locations, assessment coverage metrics and multi-carrier provisions. Optus did not request a meeting with the department.

2.66 Following consultation with all parties, the department made three key updates to the guidelines:

- identified additional areas with poor connectivity in target locations;

- clarified that eligible costs for supporting additional mobile network operators in a proposed solution can be included at the lead applicant’s cost; and

- clarified the nominal cap and expected levels of co-contribution from applicants.

2.67 As required by the Commonwealth Grants Policy Framework, the department conducted a self-assessment risk analysis of the grant opportunity guidelines and applied a low-risk rating. In January 2023, the department consulted with the Department of Finance and the Department of the Prime Minister and Cabinet on the risk rating, with both departments agreeing with the low-risk rating.

2.68 In September 2020, the Minister for Communications, Cyber Safety and the Arts wrote to the Minister for Finance seeking agreement for MBSP rounds 5A and six to be exempt from using the government’s grants hubs. On 4 October 2020, the Minister for Finance agreed to the exemption due to the ‘complex nature of the programs and the need to have consistency for stakeholders.’ Given this exemption, the department administered the IMCR directly.

2.69 The minister approved the guidelines on 24 January 2023 and the guidelines were published on GrantConnect on 2 February 2023.

2.70 The guidelines largely aligned to the requirements and better practice principles of the CGRGs (see Table 2.2).

Table 2.2: Alignment of the Improving Mobile Coverage Round grant opportunity guidelines with better practice principles

|

CGRG principle |

CGRG alignment |

ANAO analysis |

|

Robust planning and design |

Guidelines designed to have regard to all planning issues and risks identified in the CGRGs (paragraph 7.5). |

|

|

Collaboration and partnership |

Guidelines are clear, consistent, well-documented and effectively communicated. Officials are encouraged to seek input from non-government stakeholders. (paragraphs 8.1, 8.2, 8.5, 8.6 and 8.7). |

|

|

Proportionality |

Guidelines have been designed to be proportionate to the applicants’ capabilities (paragraph 9.3). |

|

|

An outcomes orientation |

Guidelines have a clear and specific operational objective (paragraph 10.3). |

|

|

Achieving value with relevant money |

Guidelines designed to achieve value with relevant money and addressed necessary factors for consideration (paragraph 11.4). |

|

|

Governance and accountability |

Guidelines outlined a robust governance framework and identify the responsibilities of all program participants (paragraphs 12.3 and 12.4). |

|

|

Probity and transparency |

Guidelines outlined transparent and systematic processes for assessments and conflicts of interests (paragraphs 13.5, 13.8, 13.9 and 13.14). |

|

Note a: Australian Government, Department of Infrastructure, Transport, Regional Development, Communications and the Arts 2023–24 Portfolio Budget Statement, Commonwealth of Australia, Canberra, 2023, available from: https://www.infrastructure.gov.au/about-us/corporate-reporting/budgets/budget-2023-24/portfolio-budget-statements-2023-24 [accessed 15 January 2024].

Source: ANAO analysis of the IMCR grant opportunity guidelines against CGRG requirements.

Eligibility requirements and assessment criteria

2.71 Eligibility requirements were outlined in the IMCR guidelines. To be eligible for IMCR funding, applicants need to be a registered mobile network operator or mobile network infrastructure provider.31 Proposed solutions must provide new or improved mobile coverage at the identified target locations to be eligible for funding, meet the technical requirements set out in the guidelines and provide a minimum standard of service in the target locations.

2.72 In response to Auditor-General Report No. 10 2016–17 Award of Funding under the Mobile Black Spot Programme, the department agreed to the Auditor-General’s recommendation for the department to ‘implement an appropriately detailed assessment methodology tailored to the objectives of the programme.’

2.73 The guidelines outlined the assessment criteria which consisted of formulas to determine the cost per coverage outcome of each proposed solution. The assessment criteria for improved coverage solutions also included scope to assess the material improvement of a solution proposed for a target location (see paragraph 3.45). The department also outlined the key factors it would consider in assessing a proposed solution’s potential to demonstrate value for money (see paragraph 3.51).

Internal processes and procedures

2.74 The department’s internal processes were consistent with the published grant opportunity guidelines and the CGRGs. Officials were supported by internal process documents, which include standard operating procedures, checklists, geospatial mapping tools, and probity and evaluation plans. The MBSP project management plan and IMCR risk register remained in draft form (see opportunity for improvement at paragraph 2.96).

Are appropriate arrangements in place to manage probity risks?

The department established arrangements to manage probity risks to ensure officials declared and managed conflicts of interest. The department had appropriate separation of duties in place and the IMCR assessment process was supported by an external probity adviser. All department officials involved in the assessment process received a probity briefing, considered conflicts of interests, and completed a declaration form. The department did not regularly review its risk and conflict-of-interest registers and the probity plan and final probity report were not finalised in a timely manner. The department could improve its processes to update its conflict-of-interest register to document actions taken to manage conflict-of-interest declarations.

2.75 The department had a range of measures in place to manage IMCR probity risks:

- department-level risk management policy and framework, and associated risk appetite and tolerance statement;

- overarching departmental probity framework;

- IMCR probity plan;

- IMCR draft risk register identifying probity risks, controls and mitigations; and

- individual conflict-of-interest declarations made by program participants and a conflict-of-interest register.

Internal controls to manage probity risks

2.76 The department has a Risk Management Policy and Framework in place to guide its approach to managing and engaging with risk. The department outlines in its risk appetite and tolerance statement that it has a very low appetite for unethical behaviour and no tolerance for fraud or corruption.

2.77 The department developed a draft IMCR risk register which identified probity not being managed appropriately during the application, assessment and contract negotiation periods as a key program risk. The department rated this risk for the IMCR as ‘Low.’

2.78 Two controls were identified by the department to manage probity risk: program participants were required to complete conflict-of-interest declarations; and the department engaged an external probity adviser to support the program. The IMCR risk register was not finalised by the department and remained in draft form as at 8 March 2024.

2.79 The department had an IMCR probity plan to identify and seek to manage probity risks. This plan provided detail on:

- IMCR background and probity plan application;

- roles and responsibilities, including the role of the probity adviser;

- procedures for the handling of gifts and benefits and managing actual, perceived and potential conflicts of interest;

- procedures for communication with applicants in the course of evaluation activities;

- protecting confidential and commercially sensitive information;

- handling complaints; and

- processes to monitor compliance with the probity plan.

2.80 In February 2023, the department engaged Sparke Helmore Lawyers as its probity adviser for a number of communications grant programs, including the IMCR. The probity adviser reviewed the draft probity plan on 28 March 2023 and provided feedback which was incorporated into the probity plan. The project director reviewed the probity plan in April 2023 and the final plan was presented to the evaluation committee on 16 June 2023. The probity plan was not signed by the project director until 18 August 2023.

2.81 Two members of the evaluation committee, including the Chair, attended a probity briefing delivered by Sparke Helmore Lawyers on 1 May 2023. A new member was nominated to participate on the evaluation committee in June 2023 and provided with a probity briefing on 11 July 2023. A probity briefing was also delivered by Sparke Helmore Lawyers to two officers within the minister’s office on 7 August 2023.

2.82 Sparke Helmore Lawyers submitted its review of the draft evaluation report and summary of assessment on 18 August 2023 and, following amendments made by the department, the probity adviser found ‘there are no other probity concerns.’ The department submitted the evaluation report to the minister on 23 August 2023 and advised that ‘the Program’s Probity Adviser, Sparke Helmore Lawyers, had provided clearance of the Evaluation Report.’ The department did not receive formal probity sign-off on the IMCR assessment process from Sparke Helmore Lawyers until 11 December 2023.

Separation of duties

2.83 The CGRGs state that accountable authorities should establish appropriate internal control mechanisms for grants administration, which can include the separation of duties.32

2.84 There were appropriate oversight arrangements and separation of duties for the IMCR. Key roles and duties were outlined in the IMCR grant opportunity guidelines and evaluation plan:

- the department was responsible for eligibility checks, evaluating applications against minimum requirements, assessing proposed solutions, and preparing merit lists for each target location; and

- the Minister for Communications, as the decision-maker, was responsible for the award of funding under the IMCR.

Evaluation committee

2.85 An evaluation committee was established within the department to assess and evaluate each application to form a merit list of proposed solutions. The evaluation committee also carried out an assessment on whether each proposed solution demonstrated value for money. The evaluation committee consisted of three officials from within the department (see paragraphs 3.33 to 3.36 for the evaluation committee’s role in assessing applications).

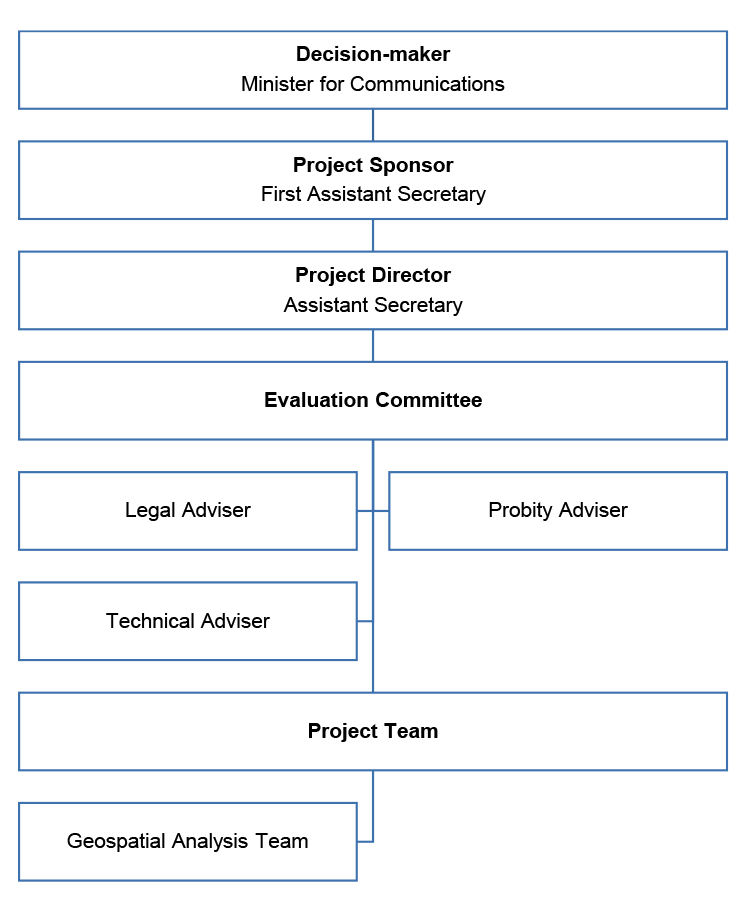

2.86 The evaluation committee convened 12 times between June and August 2023 and recorded its outcomes in meeting minutes (see paragraphs 3.37 to 3.57). An overview of the department’s governance arrangements is provided at Figure 2.2.

Figure 2.2: Governance structure for the Improving Mobile Coverage Round

Source: ANAO analysis of the IMCR evaluation plan, probity plan and grant opportunity guidelines.

Identifying and managing conflicts of interest

2.87 The CGRGs state that accountable authorities should put in place appropriate mechanisms for identifying and managing conflicts of interest for grant opportunities.33 The CGRGs define a conflict of interest as:

where a person makes a decision or exercises a power in a way that may be, or may be perceived to be, influenced by either material personal interests (financial or non-financial) or material personal associations.

2.88 The probity plan applied to all departmental personnel, contractors and advisers involved in the evaluation process for the IMCR. The probity plan required all personnel to complete a conflict-of-interest declaration as soon as possible after commencing work on the program.

2.89 In March 2023, the department developed a register of conflict-of-interest declarations made by officials which it maintained during the IMCR assessment process. All members of the evaluation committee and other officials involved in the IMCR assessment process completed conflict-of-interest declarations in line with probity plan requirements.

2.90 Conflict-of-interest declarations made by department officials and employees of the probity adviser included personal mobile phones connected to an applicant’s network, family or friends employed by an applicant, or their own intention to seek employment with an applicant.