Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Design and Establishment of the National Reconstruction Fund Corporation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The National Reconstruction Fund Corporation (NRFC) was established on

18 September 2023 to facilitate increased flows of finance into priority areas of the Australian economy. - This audit provides assurance to Parliament on the effectiveness of the design and establishment of NRFC.

Key facts

- The Department of Industry, Science and Resources (DISR) led the design and establishment of the NRFC with support from the Department of Finance.

- NRFC’s seven priority investment areas are: value-add in resources; value-add in agriculture, forestry and fisheries; transport; medical science; renewables and low emission technologies; defence capability; and enabling capabilities.

What did we find?

- The design of the NRFC was largely effective and its establishment was partly effective in governance and fund management arrangements.

- The design of NRFC was largely effective by DISR and the Department of Finance.

- NRFC’s governance arrangements are largely sound, with scope to develop a financial strategy and improve oversight of performance reporting.

- NRFC’s fund arrangements are partly effective, with scope to finalise the investment strategy, stakeholder engagement framework; and improve investment procedures, records and compliance monitoring.

What did we recommend?

- There were seven recommendations to NRFC to establish a financial strategy, review its performance reporting and to obtain conflict of interest declarations and confidentiality agreements from suppliers. NRFC should finalise its investment strategy, investment procedures and assurance. NRFC’s Board should be informed of the risks relating to its Embargo Register.

- NRFC agreed with all seven recommendations.

$15 bn

to invest, of which $5 billion credited on establishment and $10 billion to be credited before 2 July 2029

$550 m

investment target in Corporate Plan 2024–25

$434.5 m

across nine investments as at 31 May 2025

Summary and recommendations

Background

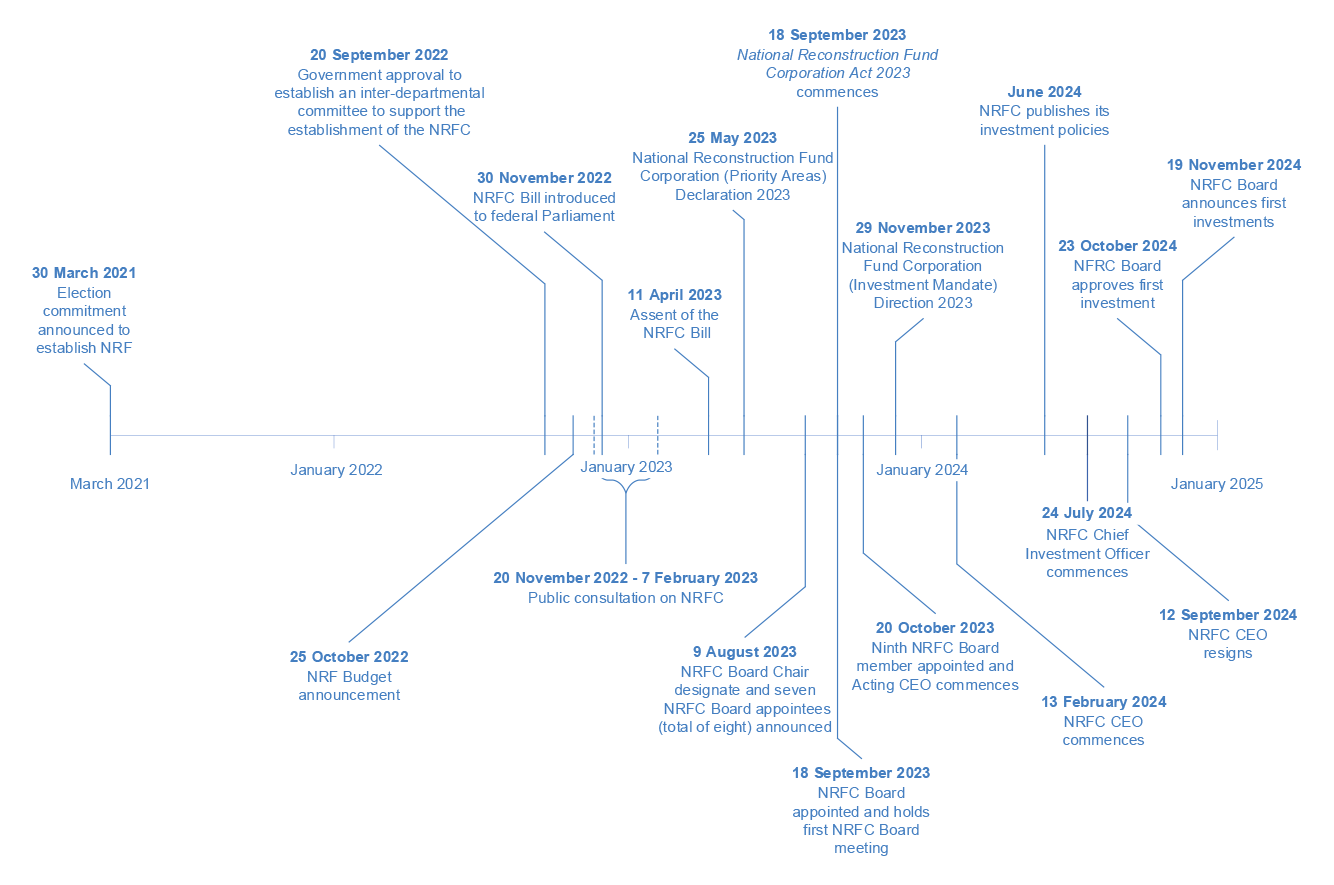

1. The National Reconstruction Fund was announced by the Minister for Industry and Science on 25 October 20221, as part of the 2022–23 Federal Budget, as a $15 billion investment to ‘diversify and transform Australia’s industry and economy.’

2. The Department of Industry, Science and Resources (DISR) took the lead for the design and establishment of the National Reconstruction Fund Corporation (NRFC). The Department of Finance provided support to DISR in the design and establishment of the NRFC.

3. The NRFC is a corporate Commonwealth entity established under the National Reconstruction Fund Corporation Act 2023 (NRFC Act). It commenced on 18 September 2023 and is governed by an independent board. Under the NRFC Act, the Minister for Industry and Science and the Minister for Finance are the responsible ministers. In performing its investment functions, the NRFC Board is required to comply with the NRFC Act, the National Reconstruction Fund Corporation (Investment Mandate) Direction 2023 (NRFC Investment Mandate)2 and the National Reconstruction Fund Corporation (Priority Areas) Declaration 2023.3

4. On 19 November 2024, the NRFC announced its first two investments: a $100 million partnership with Resource Capital Funds, which includes a $40 million investment in Russell Mineral Equipment.4 As at 31 May 2025, the NRFC has announced nine investments totalling $434.5 million.5

5. In December 2024, Parliament passed the Future Made in Australia Act 2024. The Future Made in Australia measure establishes a ‘Front Door for investors with major transformational proposals within the Treasury portfolio’6, an Investor Council to support the Front Door and the involvement of Specialist Investment Vehicles in the Investor Council.7

Rationale for undertaking the audit

6. The NRFC was announced on 25 October 2022 as a $15 billion vehicle through which the Australian Government will ‘facilitate increased flows of finance into priority areas of the Australian economy, through targeted investments to diversify and transform Australian industry, create secure, well-paying jobs and boost sovereign capability.’

7. The audit provides assurance to the Parliament as to whether the design and establishment of the NRFC was effective.

Audit objective and criteria

8. The objective of this audit was to assess the effectiveness of the design and establishment of the NRFC.

9. To form a conclusion against the objective, the following high-level criteria were adopted.

- Was the design process effective?

- Are governance arrangements sound?

- Are the Fund arrangements effective?

Conclusion

10. The design of the NRFC was largely effective, the establishment of the NRFC’s governance and fund arrangements was partly effective. There are opportunities to improve NRFC’s governance by establishing a financial strategy and reviewing its performance reporting. Further, there is scope for the NRFC Board to finalise its investment strategy, stakeholder engagement framework and some investment procedures, and to establish assurance over its investment compliance.

11. The design process for the NRFC was largely effective. Due diligence checks for one member of the NRFC Board were not documented. DISR applied lessons from similar programs and considered stakeholder feedback. Stakeholder engagement was largely consistent with better practice — with opportunities to close the loop with stakeholders, and documenting lessons to improve future engagement activities. Constitutional risks to investments were assessed and approaches to manage these were outlined in advice to government and the NRFC Board. Advice on establishing a new corporate Commonwealth entity was sound. Appointments to the NRFC Board were consistent with the NRFC Act.

12. NRFC’s governance arrangements are largely sound. The NRFC Board and CEO appointments, Board meetings and remuneration arrangements have been established under the NRFC Act. Investment Policies have been published pursuant to section 75 of the NRFC Act. NRFC’s reporting arrangements for its annual report, corporate plan, budget estimates, performance measures and statements have been established, with 2024–25 performance to be reported against ‘at least three identified areas of the economy’ out of seven under the National Reconstruction Fund Corporation (Priority Areas) Declaration 2023. NRFC’s risk management, fraud and corruption control arrangements, and accountable authority instructions are underway and progressing as at March 2025. NRFC’s corporate policies are progressing as at March 2025. The NRFC Audit and Risk Committee (ARC) reviewed NRFC’s arrangements for risk management, internal controls, financial reporting except it did not review NRFC’s performance reporting arrangements for 2023–24 in line with the ARC charter and section 17 of the PGPA Rule. Recruitment is continuing, with the asset management function for investments underway as at March 2025. NRFC Board is yet to develop a financial strategy. NRFC has processes for managing procurement, recruitment, declaring gifts and benefits, and Freedom of Information (FOI). Access to NRFC’s released information under FOI is not consistent with guidelines from the Australian Information Commissioner.

13. NRFC’s fund management arrangements are partly effective. The NRFC Board has approved investments without finalising its investment strategy and stakeholder engagement framework. NRFC’s investment strategy and stakeholder engagement framework, listed as outputs within NRFC’s Corporate Plan 2023–24, were not completed. A draft investment strategy, draft stakeholder engagement framework, and the absence of a plan to evaluate them, limits the effectiveness of the NRFC Board’s fund promotion.

14. NRFC’s processes to assess investments against its legislative requirements are developing and partly effective. NRFC’s existing procedures relating to due diligence, risk management and assessing concessionality need clearly defined requirements for officials. NRFC is developing investment procedures relating to: credit risk, national security assessments, and investment impact. Investment assessment processes have gaps in: due diligence, risk management, and considerations of concessionality. NRFC’s Board has not received its Embargo Register to manage associated risks. NRFC did not obtain conflict of interest declarations and confidentiality agreements from suppliers who assisted with investment due diligence.

15. NRFC has established investment targets; and as at 31 May 2025, NRFC had announced investments totalling $434.5 million of a target of $550 million. At at 31 March 2025, NRFC’s Board has not developed a financial strategy and aligned it to its draft investment strategy and stakeholder engagement framework, to inform and support the timely deployment of its investments.

Supporting findings

Design process

16. Lessons from similar programs were considered and addressed in the design and establishment of the NRFC. DISR assessed external reviews of Specialist Investment Vehicles (SIVs), prior ANAO audits and engaged with stakeholders to identify lessons on the design and establishment of the NRFC. A key lesson relating to the need for investment-ready projects for the NRFC, and steps to address this were outlined in advice to government. (See paragraphs 2.4 to 2.11)

17. Stakeholder input on key design parameters of the NRFC was considered and included in advice to government. DISR undertook a structured approach to consulting stakeholders and analysing feedback received. Stakeholder engagement was largely consistent with the APS framework for engagement and participation — with opportunities to close the loop with all stakeholders who have contributed, and documenting lessons to improve future engagement activities being identified. (See paragraphs 2.12 to 2.18)

18. DISR established an appropriate framework for providing advice to government. Advice was based on lessons learned from other SIVs, stakeholder input, and understanding the policy context of the election commitment. Advice outlined risks and approaches to manage risks. Advice on a corporate Commonwealth entity (CCE) being the preferred vehicle to establish the NRFC was based on DISR’s assessment that a CCE provided the most effective way to achieve policy objectives, and was most closely aligned with the election commitment of the NRFC being modelled on the Clean Energy Finance Corporation. Appointments to the NRFC Board were consistent with NRFC Act, except that due diligence checks were not documented for one member appointed to the NRFC Board in October 2023. (See paragraphs 2.19 to 2.55)

Governance arrangements

19. NRFC Board and CEO appointments, Board meetings and the Board and CEO’s remuneration arrangements have been established under the NRFC Act. A Board skills matrix was developed for commencement appointments. NRFC Board members, NRFC CEOs and acting CEO made conflicts of interest declarations and maintain conflicts of interest registers. NRFC experienced leadership changes in the 16 months from its commencement to January 2025, with two CEO appointments and two acting CEO appointments. NRFC has established its risk management, fraud and corruption risk management and reporting arrangements under the PGPA Act, with some elements in progress. The NRFC ARC reviewed NRFC’s arrangements for risk management, internal controls, financial reporting except for NRFC’s performance reporting. Corporate policies continue to be in progress as at March 2025. The NRFC Board has yet to develop a financial strategy to support its financial sustainability and return on investment. Processes are in place for managing procurements, recruitment, declaring gifts and benefits, and managing Freedom of Information, with an opportunity to make available released information for downloading from its website. (See paragraphs 3.2 to 3.57)

20. NRFC has established its Investment Policies under section 75 of the NRFC Act. The NRFC Board has established the Board Investment Committee to provide oversight of investment decision processes, including investment delegations and policies for managing conflicts of interest and personal trading. Recruitment for roles supporting investments management was continuing as at March 2025, and the investments were made prior to establishing the investment asset management function. (See paragraphs 3.58 to 3.71)

21. NRFC has established and published its performance measures in its Corporate Plan 2023–24 and Corporate Plan 2024–25. NRFC reported in its 2023–24 performance statement that it had achieved its performance measure of finalising its core corporate, risk and investment policies. These ‘core’ policies were not defined and there were 39 policies and related documents outstanding at June 2024. NRFC’s performance measures in 2024–25 incorporate measures to report that investments meet at least three of the seven economic priority areas, there is an opportunity to ensure that measures in future years report against all seven economic priority areas. Controls for performance information and methodologies for performance reporting are in development as at March 2025. (See paragraphs 3.72 to 3.79)

Fund arrangements

22. NRFC’s Board and senior executives have engaged with Commonwealth entities, industry stakeholders and prospective applicants. NRFC’s Corporate Plans for 2023–24 and 2024–25 have set out objectives and performance measures for partnering and engaging with stakeholders. In October 2023, the NRFC Board decided to formalise engagement activities. NRFC’s investment strategy and stakeholder engagement framework were in draft and not finalised in 2023–24. A Stakeholder Engagement Strategy was approved by the NRFC Executive Leadership Team in May 2025. NRFC does not have a plan to periodically evaluate the effectiveness of its engagement activities. NRFC’s outputs relating to its investment strategy and stakeholder engagement framework outlined in its Corporate Plan 2023–24 were not completed. NRFC has made investment decisions and engaged with stakeholders without an endorsed investment strategy and stakeholder engagement framework. A draft investment strategy and stakeholder engagement framework limit the effectiveness of the NFRC Board’s fund promotion activities to achieve the performance measures it has set to deliver NRFC’s performance outcomes. (See paragraphs 4.2 to 4.9)

23. NRFC’s processes and controls to assess and approve applications are developing as at March 2025. NRFC’s existing investment procedures address its legislative requirements except for national security and First Nations impact, which are under development. NRFC’s approach to assessing investments has gaps in due diligence, investment risk assessment, and concessionality. These gaps impact the consistency of investment assessments, completeness of risk advice provided to the NRFC Board, and the NRFC Board’s assurance over compliance with its legislative requirements. The NRFC Board has not received updates on the Embargo Register to prevent members from inadvertently dealing in entities on whom the NRFC holds inside information. NRFC has not obtained confidentiality agreements or conflict of interest declarations from suppliers undertaking due diligence on investments. There is scope to improve the consistency of documenting how NRFC’s investments crowd-in and do not crowd-out other market participants. (See paragraphs 4.12 to 4.62)

24. NRFC’s budget estimates and performance measures establish investment targets across the current and forward years from 2024–25 to 2027–28. As at 31 May 2025, NRFC had announced investments totalling $434.5 million against a target of $550 million for 2024–25. The NRFC Board has established quarterly monitoring arrangements for its investment target through its ‘Operating Plan FY2025.’ NRFC took between six and nine months to assess and approve investments reviewed by the ANAO. As at 31 March 2025, NRFC’s Board has not developed a financial strategy that links with its investment strategy and stakeholder engagement framework to support it to deploy investments in a timely manner, and to generate returns to fund its operating expenses. (See paragraphs 4.67 to 4.71)

Recommendations

Recommendation no. 1

Paragraph 3.23

The National Reconstruction Fund Corporation Board establish a financial strategy to support its activities to maintain financial viability and return on investment.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 2

Paragraph 3.35

The National Reconstruction Fund Corporation Board ensure that the Audit and Risk Committee review all future performance reporting arrangements in accordance with its charter and to ensure its compliance with paragraph 17(2)(b) of the PGPA Rule.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 3

Paragraph 4.10

The National Reconstruction Fund Corporation Board finalise its investment strategy and stakeholder engagement framework and develop a plan to evaluate effectiveness.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 4

Paragraph 4.35

The National Reconstruction Fund Corporation:

- obtain conflict of interest declarations from its suppliers who assist with investment due diligence and re-validate declarations when the due diligence report is finalised, as part of the monitoring of conflicts of interests; and

- execute confidentiality agreements with suppliers who assist it with its investments.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 5

Paragraph 4.45

The National Reconstruction Fund Corporation Board should be informed of the risks associated with its Embargo Register.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 6

Paragraph 4.63

The National Reconstruction Fund Corporation Board:

- ensure existing procedures outline the roles and responsibilities of relevant officials and executives and set out the minimum requirements for due diligence, risk management, assessing concessionality and record keeping; and

- finalise and endorse investment procedures that are under development to assess, approve and manage investments.

National Reconstruction Fund Corporation response: Agreed.

Recommendation no. 7

Paragraph 4.64

The National Reconstruction Fund Corporation Board establish assurance arrangements and assign responsibilities to ensure the consistent:

- application of investments in accordance with the National Reconstruction Fund Corporation Act 2023 and National Reconstruction Fund Corporation (Investment Mandate) Direction 2023; and

- storage of records for investment assessment processes, assessments and decisions.

National Reconstruction Fund Corporation response: Agreed.

Summary of entity responses

25. Relevant parts of the proposed audit report were provided to the National Reconstruction Fund Corporation, the Department of Industry, Science and Resources, and the Department of Finance. Summary responses are reproduced below and full responses are at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

National Reconstruction Fund Corporation

The NRFC welcomes the ANAO’s report and its finding that the NRFC’s governance arrangements are largely sound. As the report notes, the NRFC was established on 18 September 2023, with the performance audit commencing less than a year into its operations. This early assessment of the Corporation’s governance processes provides assurance of the direction taken and offers useful insights to inform the Corporation’s commitment to continuous improvement.

The NRFC agrees with all recommendations and is committed to their implementation in a timely manner. We note that in all areas identified by the ANAO, active steps are being taken to ensure effective governance processes, including a number of areas where the recommended actions are already complete or where significant progress has already been achieved. Further work is underway to fully implement the remaining recommendations. The NRFC’s Audit and Risk Committee will oversee this implementation.

Department of Industry, Science and Resources

The department acknowledges the opportunity to comment on the report, noting it only had access to extracts relevant to the department.

In 2022, the Australian Government committed to establishing the National Reconstruction Fund (NRF) to support, diversify and transform Australia’s industry and economy.

To inform the NRF’s design, the department conducted extensive stakeholder engagement and public consultation. This included input from government and external stakeholders. Participants included representatives from business, unions, financial institutions, First Nations communities, regional groups, government and the public. This comprehensive process informed the NRFC’s structure, legislation, and successful establishment by September 2023.

In response to the one identified opportunity for improvement, the department acknowledges the release of RMG 127 in July 2024 and has updated its processes to ensure alignment with this latest guidance.

Department of Finance

The Department of Finance (Finance) welcomes ANAO’s performance audit report on the Design and Establishment of the National Reconstruction Fund Corporation (Report). The report concludes that the implementation and governance of the NRFC was largely effective. Finance notes that the due diligence documentation did not meet the standard of Resource Management Guide 127 – Specialist Investment Vehicles (RMG 127), however this guide was not in place at the time of the appointment.

Finance agrees with the ANAO’s suggested area for improvement to document NRFC board appointment processes. Consistent with guidance in RMG 127, Finance commits to ensuring that all board appointment processes and considerations are thoroughly and accurately documented. This includes retaining all relevant records to ensure transparency and accountability. Finance has already implemented these measures to support the effective governance and oversight of the National Reconstruction Fund Corporation (NRFC).

Key messages from this audit for all Australian Government entities

26. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Transparency of reporting

1. Background

Introduction

1.1 The National Reconstruction Fund was announced by the Minister for Industry and Science on 25 October 20228, as part of the 2022–23 October Federal Budget, as a $15 billion investment to ‘diversify and transform Australia’s industry and economy’ with ‘$50 million provided over two years to establish the framework for the fund.’

1.2 The Department of Industry Science and Resources (DISR) took the lead in the design and establishment of the NRFC. The Department of Finance provided support to DISR in the design and establishment of the NRFC.

1.3 The NRFC is a corporate Commonwealth entity established under the National Reconstruction Fund Corporation Act 2023 (NRFC Act). It commenced on 18 September 2023 and is governed by an independent board that reports to Parliament through the Minister for Industry and Science and the Minister for Finance (the responsible ministers).

1.4 The 2023–24 Federal Budget provided NRFC with $53.2 million9 in appropriations to support NRFC’s operations. The 2025–26 Federal Budget outlines that appropriations for NRFC’s operations are allocated until 2025–26, after which the NRFC is funded through own-sourced revenue.10 The $15 billion investment is provided through the NRFC special account created under subsection 51(1) of the NRFC Act, with $5 billion credited at commencement11 and $10 billion to be credited before 2 July 2029.12 The NRFC special account is administered by DISR.13 Section 54 of the NRFC Act provides that NRFC may request a payment from the special account for its liabilities and expenses. Section 55 of the NRFC Act provides that the payment to NRFC requires the written authorisation by the nominated Minister.

1.5 The NRFC is governed by the NRFC Act, National Reconstruction Fund Corporation (Investment Mandate) Direction 2023 (NRFC Investment Mandate), and the National Reconstruction Fund Corporation (Priority Areas) Declaration 2023.14 These documents require NRFC’s investments to be:

- constitutionally-supported and not prohibited15, in priority areas16 of the Australian economy, and solely or mainly Australian-based (see Appendix 4)17;

- subject to due diligence18 and risk management19 of investments, Australia’s national security, 20 and the Commonwealth’s reputation21;

- assessed for environmental, labour, social and governance matters22;

- assessed for the desirability of transforming industry by attracting private sector finance23 and avoid displacing alternative public and private finance,24 creating jobs25, improving Australian industry participation26 and economic participation of historically underrepresented groups27, improving sustainability and circular economy principles28; and

- subject to limits on concessional financial accommodation, limits on equity investments and limits on guarantees.29

1.6 On 12 July 2021, the Joint Committee of Public Accounts and Audit (JCPAA) resolved to inquire into the use of alternative financing mechanisms in government expenditure.30 The inquiry report recommended that the Minister for Finance ‘improve transparency for equity investments to budget reporting’.31 On 30 September 2022, the Department of Finance advised the JCPAA that ‘options for enhancing the transparency of equity investments will be considered by the Government ahead of the 2023–24 Budget.’32

1.7 In July 2024, the Department of Finance (Finance) advised NRFC that, as part of the 2023–24 Federal Budget, a ‘new centralised oversight and governance function for Specialist Investment Vehicles (SIVs)’ was being established within Finance. The advice provided by Finance to NRFC was that it was developing ‘an agreed Joint Minister Oversight Model (Model), establishing a consistent role for the Minister for Finance across all existing and future SIVs’ and ‘a resource management guide (RMG) for SIVs outlining principles of best practice’ to be published in July 2024. Finance further advised NRFC that ‘to allow SIVs time to implement the Model and consider the usefulness of the RMG, a transitional year is being provided, with the expectation the Model is adopted in full by SIVs before 1 July 2025.’

1.8 In July 2024, the Department of Finance published RMG 127 — Specialist Investment Vehicles.33 RMG 127 provides guidance to existing SIVs on ‘Planning and reporting’ noting that data on investment composition, policy impact, commercial performance, operational performance and treasury function/liquidity will be captured. Further, RMG 127 states that:

A consolidated view of the SIV landscape, including the Commonwealth’s exposure to risk, SIV performance, deployment of capital and liquidity needs is required to ensure the continued accountability and effectiveness of the SIVs portfolio. It also assists with key government policy decisions (including at Budget and MYEFO). To support this, SIVs will provide half yearly reporting to Finance on key commercial and policy metrics.34

1.9 On 19 November 2024, the NRFC announced its first two investments: a $100 million partnership with Resource Capital Funds which includes a $40 million investment in Russell Mineral Equipment.35 As at 31 May 2025, the NRFC has announced nine investments totalling $434.5 million.36

1.10 In December 2024, Parliament passed the Future Made in Australia Act 2024. The Future Made in Australia measure establishes a ‘Front Door for investors with major transformational proposals within the Treasury portfolio,’37 an Investor Council to support the Front Door38 and the involvement of Specialist Investment Vehicles in the Investor Council.39

Rationale for undertaking the audit

1.11 The NRFC was announced on 25 October 2022 as a $15 billion vehicle through which the Australian Government will ‘facilitate increased flows of finance into priority areas of the Australian economy, through targeted investments to diversify and transform Australian industry, create secure, well-paying jobs and boost sovereign capability.’40

1.12 The audit provides assurance to the Parliament as to whether the design and establishment of the NRFC was effective.

Audit approach

Audit objective, criteria and scope

1.13 The objective of this audit was to assess the effectiveness of the design and establishment of the National Reconstruction Fund Corporation (NRFC).

1.14 To form a conclusion against the objective, the following high-level criteria were adopted.

- Was the design process effective?

- Are governance arrangements sound?

- Are the Fund arrangements effective?

Audit methodology

1.15 The audit methodology involved:

- reviewing records of DISR, Finance and the NRFC;

- meetings with relevant staff/contractors; and

- walkthroughs of relevant processes and systems.

1.16 The ANAO has co-operative evidence gathering arrangements in operation with entities. On 11 April 2025 NRFC advised the ANAO that it was unable to voluntarily provide certain information requested by the ANAO due to legislative restrictions on the disclosure of requested information. On 24 April 2025, the Acting Auditor-General issued NRFC and KPMG (a service provider to NRFC) with notices to provide information and produce documents pursuant to section 32 of the Auditor-General Act 1997 to enable them to provide the requested information taking account of legislative requirements. NRFC and KPMG provided the information requested within the specified time, following receipt of the notice.

1.17 The audit was open to contributions from the public. The ANAO received and considered one submission from the public.

1.18 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $406,000.

1.19 The team members for this audit were Will Tse, Christian Coelho, Samuel Skelton, Nick Adamson, Nathan Callaway, and David Tellis.

2. Was the design process effective?

Areas examined

This chapter examines the effectiveness of the design process to establish the National Reconstruction Fund Corporation (NRFC), implemented by the Department of Industry, Science and Resources (DISR) with support from the Department of Finance.

Conclusion

The design process for the NRFC was largely effective. Due diligence checks for one member of the NRFC Board were not documented. DISR applied lessons from similar programs and considered stakeholder feedback. Stakeholder engagement was largely consistent with better practice — with opportunities to close the loop with stakeholders, and documenting lessons to improve future engagement activities. Constitutional risks to investments were assessed and approaches to manage these were outlined in advice to government and the NRFC Board. Advice on establishing a new corporate Commonwealth entity was sound. Appointments to the NRFC Board were consistent with National Reconstruction Fund Corporation Act 2023 (NRFC Act).

Area for improvement

The ANAO suggested that, consistent with guidance in RMG 127 — Specialist Investment Vehicles, NRFC board appointment processes and considerations should be accurately and fully documented with records retained.

2.1 The Australian Public Service (APS) Commission’s Delivering Great Policy Advice model sets out four elements41 of delivering great policy advice:

- clear on intent — clarity on policy intent and role of those providing advice;

- well informed — advice is informed through past lessons and feedback from stakeholders;

- practical to implement — advice provides practical solutions and an evaluation plan; and

- influential — the right stakeholders have been engaged in the process.

2.2 The Delivering Great Policy Advice model fits in with other policy advice processes such as the cabinet process, budget process, impact analysis and legislation process.42 The APS framework for engagement and participation provides better practice principles and standards on stakeholder engagement to improve policy advice, impact and outcomes.43

2.3 As the portfolio department, DISR took the lead in the design and establishment of the NRFC. The Department of Finance supported DISR with the design and establishment of the NRFC, in particular with: financial modelling and appointments to the NRFC Board.

Were lessons from similar programs considered?

Lessons from similar programs were considered and addressed in the design and establishment of the NRFC. DISR assessed external reviews of Specialist Investment Vehicles (SIVs), prior ANAO audits and engaged with stakeholders to identify lessons on the design and establishment of the NRFC. A key lesson relating to the need for investment-ready projects for the NRFC, and steps to address this were outlined in advice to government.

Lessons considered from prior ANAO audits

2.4 In November 2022, DISR identified and considered lessons learned from five44 prior ANAO performance audits of SIVs relevant to the design and establishment of the NRFC. The lessons DISR identified were:

- NRFC’s record keeping processes for all levels of meetings where potential projects to be funded are discussed.

- Alignment between (investment) assessment criteria and the Investment Mandate, and making these publicly available ‘so applicants are able to assess whether their projects fits [sic] the NRFC’s mandate before applying’.

- The NRF [National Reconstruction Fund] will make sure the information governance framework and electronic data and records management system is NAA [National Archives of Australia]—compliant.

- Annual performance reporting to enable a comprehensive assessment of overall progress against its purpose.

- NRFC to develop and implement the required policies and procedures for risk management, compliance and assurance, and performance indicators to assess applications.

Lessons considered from other reviews and international government-backed funds

2.5 DISR reviewed a 2021 Boston Consulting Group (BCG) report on SIVs prepared for the Department of Finance. The BCG report assessed ‘whether SIVs are collectively operating in the most efficient, transparent and outcome-orientated manner possible.’ The BCG report outlined the three guiding principles for the creation of any new SIVs. These principles covered the: rationale and policy issue the new SIV would address; clearly defined and delineated mandates ‘to ensure efficient and effective alignment’; and the operating model. These principles were considered and addressed in advice to government on the design of the NRFC.

2.6 DISR analysed international government-backed funds from: Canada, Singapore, New Zealand, Israel, United States of America, and Ireland. Lessons identified from the BCG report and analysis of international funds covered:

- investment teams drawing on inter-connected structures across topic-specific investment teams, including governance approaches and centralised back-office functions;

- well-defined processes for collaboration and sharing best practice (amongst SIVs and industry groups);

- transparent and consistent metrics to track and assess performance; and

- well-defined mandates to manage and grow deal pipelines.

2.7 DISR considered how the Australian Renewable Energy Agency’s A-Lab Incubate45 model could be adapted to address a lesson about potential delays in investment-ready projects for the NRFC. In February 2025, DISR advised the ANAO that it had considered submissions to the Senate Economics References Committee Inquiry into the Australian Manufacturing Industry46 and reviewed the Independent Review of the Regional Investment Corporation.47

Lessons considered from stakeholder engagement

2.8 DISR engaged with stakeholders and SIVs and identified and considered the following lessons on the design of the NRFC:

- The nexus between the rate of return and achievement of the policy objectives i.e., a high rate of return could impact projects that would be selected by the board at the expense of higher risk projects. This could also result in investment selection not addressing the market gap.

- Investment caps on concessional finance and that these could impact effectiveness of the NRFC.

- Potential competition between SIVs as was experienced when the Northern Australian Infrastructure Facility was established, and due to the focus of the NRFC on renewables, and agriculture, forestry and fisheries.

- Appropriate controls over concessional finance so that funding recipients do not benefit from concessional finance at the expense of returns for the NRFC and its policy objectives.

Lessons considered in advice to government

2.9 Advice to government in September 2022 identified and considered a lesson from other SIVs relating to significant delays to investment if a dedicated approach to pipeline development was not undertaken in designing and establishing the NRFC.

2.10 In September 2022, DISR prepared an Issues Paper ‘to support the development and continuity’ of a pipeline of projects for the NRFC upon commencement. The paper mapped over 80 industry support programs from state, territory and Commonwealth agencies to the seven priority areas using public information. The assessment included a Technology Readiness Level48 and Commercial Readiness Index.49 This analysis identified priority areas that had more industry support than others, potential funding gaps in support for projects at the commercial trial and scale-up stage, and ‘this is likely to impact project development and the pipeline of projects available for consideration by the NRFC in the short and longer term.’ Paragraph 2.25 discusses the NRFC Pipeline project.

2.11 Lessons on the design of the NRFC relating to the rate of return, risks of competition between SIVs, and limits on concessional finance were considered and addressed through the NRFC Act and the NRFC Investment Mandate.

Was stakeholder input considered?

Stakeholder input on key design parameters of the NRFC was considered and included in advice to government. DISR undertook a structured approach to consulting stakeholders and analysing feedback received. Stakeholder engagement was largely consistent with the APS framework for engagement and participation — with opportunities to close the loop with all stakeholders who have contributed, and documenting lessons to improve future engagement activities being identified.

2.12 The principles within the APS framework for engagement and participation50, state that ‘aspiring to the principles will help ensure engagements go beyond seeking buy-in, and instead tap the public’s expertise and lead to better policy, programs and services.’51

2.13 DISR’s stakeholder engagement framework and approach for the design and establishment of the NRFC was approved by government in September 2022. The proposed stakeholder engagement framework aimed to identify market gaps in each priority area and options to transform and scale-up Australian industry, through:

- a National Reconstruction Fund Reference Group — an advisory group comprising investment and industry experts who would advise on the NRFC’s overarching design and Investment Mandate;

- Industry Working Groups — to engage with industry and receive advice on how to support the objectives of the NRFC in each priority area;

- an Inter-departmental Committee — to support consultation across the Commonwealth on specific policy issues; and

- Senior Officials Meetings — for consulting states and territories.

2.14 DISR’s draft Collaborative Stakeholder Plan (June 2022) outlined the department’s role, scope of engagement activities and engagement tactics for engaging with: departmental stakeholders, Commonwealth entities, ministerial stakeholders, states and territories, the proposed National Reconstruction Fund Reference Group52, proposed Industry Working Groups, and the NRFC Pipeline team. Commonwealth and ministerial stakeholders were categorised into tiers and by priority areas.

2.15 DISR developed a Communication Plan (November 2022) which outlined: communication objectives, key messages, target audiences and a table of communication activities. Two of the six objectives of communication activities were to ‘increase awareness of the NRFC, its goals and objectives, and its critical role in transforming Australia’s industry and economy to guide communication and stakeholder engagement activities’ and ‘raise awareness of the consultation process, helping to increase engagement and make it more meaningful, comprehensive, inclusive and effective.’

2.16 An assessment of DISR’s stakeholder engagement activities against the ten standards within the APS framework for engagement and participation is presented in Table 2.1. DISR’s approach to engaging with stakeholders was largely consistent with the APS standards, except for closing the loop with stakeholders who contributed to the public consultation and having a documented feedback loop for capturing lessons from stakeholder engagement activities.

Table 2.1: Assessment of stakeholder engagement against APS standards for engaging with stakeholders

|

# |

Australian Public Service (APS) standards for engaging with stakeholders |

ANAO assessment |

|

1 |

Define the objective. Clearly define the engagement’s objectives, which may include understanding the problem and what expertise should be tapped. |

● |

|

2 |

Choose the right approach. Make sure the way of engaging matches the problem at hand. |

● |

|

3 |

Manage expectations. Be honest about what is on the table. That is, what is yet to be decided and what has already been decided. |

● |

|

4 |

Choose the right people for the job. Ensure participants with suitable expertise, skills and knowledge are being engaged for the problem. |

● |

|

5 |

Be transparent. Explain the objectives and process to participants at the outset. |

● |

|

6 |

Provide sufficient information. Ensure information that is essential to participants’ roles is made available to them. |

● |

|

7 |

Provide opportunities to be heard. Be inclusive and ensure diverse voices are heard — not just the loudest. |

● |

|

8 |

Understand all views. Ensure the views presented are fairly considered at the decision-making stage. |

● |

|

9 |

Close the loop. Explain how participants’ contributions were taken into account in a timely manner. |

◑a |

|

10 |

Continuous improvement based on feedback. Ensure that there is a feedback mechanism to capture lessons learnt. |

◯b |

Key: ● Activities were consistent with the APS standards for engaging with stakeholders.

◑ Activities were partly consistent with the APS standards for engaging with stakeholders.

◯ No evidence of activities undertaken per the APS standards for engaging with stakeholders.

Note a: Stakeholders who participated in public consultation received an email acknowledging their contributions and were provided a link to register to stay informed of updates. Stakeholders were not informed of how their feedback had been considered and incorporated into the design of the NRFC.

Note b: Stakeholder engagement activities did not have a feedback mechanism to capture lessons learnt.

Source: ANAO analysis of DISR information.

2.17 Stakeholder feedback covered the investment mandate, priority areas of investment and the NRFC legislation. The National Reconstruction Fund Reference Group considered consultation insights. The National Reconstruction Fund Reference Group’s report was provided to, and noted by the Minister for Industry and Science and the Minister for Finance.

2.18 Advice to government on the NRFC’s design parameters, Investment Mandate, Priority Areas and enabling legislation, included insights and feedback from consultation, as well as options to address stakeholder feedback. Broadly, this covered: the rate of return, risk of competition and duplication between SIVs, concessional loan facilities, and environmental, social and governance requirements.

Was sound advice provided to the government on establishing the NRFC?

DISR established an appropriate framework for providing advice to government. Advice was based on lessons learned from other SIVs, stakeholder input, and understanding the policy context of the election commitment. Advice outlined risks and approaches to manage risks. Advice on a corporate Commonwealth entity (CCE) being the preferred vehicle to establish the NRFC was based on DISR’s assessment that a CCE provided the most effective way to achieve policy objectives, and was most closely aligned with the election commitment of the NRFC being modelled on the Clean Energy Finance Corporation. Appointments to the NRFC Board were consistent with NRFC Act, except that due diligence checks were not documented for one member appointed to the NRFC Board in October 2023.

Framework for providing advice

2.19 DISR led the design and establishment of the National Reconstruction Fund with assistance from the Department of Finance. A timeline of key events is presented in Appendix 3.

2.20 Advice to government was delivered on two separate occasions. The initial advice in September 2022 focused on the entity structure options, risks and sensitivities including constitutional risks and high-level financial implications. The initial advice indicated that detailed costings and advice on the investment mandate would be provided in the later advice as part of the 2023–24 Federal Budget, following stakeholder consultation. On 20 September 2022, government approved the establishment of an Inter-departmental Committee53 to support the establishment of the NRFC, develop its investment mandate, and establish framework legislation for the NRFC.

2.21 DISR established a framework to provide advice. This comprised a Secretaries Inter-departmental committee (IDC) which met on two occasions and a National Reconstruction Fund (NRF) IDC54 chaired by the Head of Division, Manufacturing, DISR.55 The NRF IDC held 10 meetings between August 2022 and February 2023. The NRF IDC coordinated feedback on the NRFC’s design parameters, investment mandate and priority areas and the Cabinet submissions.

2.22 Following the second advice to government in April 2023 which sought approval for establishing the NRFC, DISR began developing an Establishment Project Plan in May 2023. The Project Plan stated that the ‘project has accountability that spans two ministers and two departments.’ The Project Plan identified Single Accountable Officers in the departments for project delivery as:

- DISR — Head of Division, Manufacturing and NRF division56;

- DISR — Chief Financial Officer, for the Export Finance Australia agreement; and

- Department of Finance — First Assistant Secretary, Commercial Investments.

2.23 The Establishment Project Plan outlined 11 workstreams: Project Management and Governance; Contract — Back Office Operational and Investment Services; NRFC Board; NRF Reference Group; NRFC Governance and Reporting; Investment Policies; NRFC Staffing; Investment Opportunities; NRFC Legislation; Investment Mandate; and Communications.

2.24 The project team assessed risks and documented four risks in a risk register, tracked issues and actions and maintained traffic light updates for each weekly meeting. The project’s risk assessment process was appropriate for the timely establishment of the NRFC. Ministerial stakeholders were informed of project progress via a Priority and Delivery Committee57 update. Following the establishment of the NRFC in September 2023, DISR prepared a project closure report. The project closure report is discussed at paragraph 2.55.

2.25 DISR also developed an NRFC Pipeline project plan and engaged with potential proponents for the NRFC. The purpose of the project was to ‘facilitate engagement of potential NRF projects and investments during the establishment phase and ultimately enable early NRF investments once it is up and running.’ DISR developed an NRFC Pipeline Tracker that listed over 90 general investment prospects and tracked the Pipeline project’s interactions with 20 entities. The tracker considered the entity’s alignment with the NRF, priority area and where possible, a brief description of the project. In November 2024, DISR advised the ANAO that the NRF Pipeline tracker was provided to the NRFC.

Entity structure

2.26 In March 2021, the Australian Labor Party’s election commitment on establishing the NRF was:

The Fund will be legislated and be governed by an independent Board using the successful model which Labor created through the Clean Energy Finance Corporation.

It will provide $15 billion of investment through a combination of loans, equity, co-investment and guarantees. The Fund will be administered on the basis that it will achieve a return to cover borrowing costs, with an expected positive underlying cash impact.58

2.27 Advice to government on the preferred entity structure for the NRFC was based on the policy objective of modelling the NRF on the Clean Energy Finance Corporation (CEFC), which was the stated election commitment. In this context, the advice was to establish a new corporate Commonwealth entity as the preferred option as it provided control over policy outcomes and was most closely aligned to the election commitment of the NRF being modelled on the CEFC.

2.28 The advice to government included the risks and benefits, excluding costings, of three other options:

- branded function within DISR with the NRF a statutory board supported by a new division of DISR; or

- expanding the function of an existing SIV as an existing Corporate Commonwealth Entity; or

- consolidating existing SIVs to incorporate the NRF objectives and deliverables.

2.29 The advice to government indicated that the costs for three options could be provided if government chose to explore them.

2.30 Advice to government on the design and establishment of the NRFC:

- set out the policy context within which the NRFC was to be designed and established;

- was based on lessons from other SIVs, stakeholder feedback and consultation with other Commonwealth entities;

- covered key categories of risks: constitutional, delivery, financial, policy and reputational. Outlined approaches to address and manage risks;

- was based on the evidence and analysis, for example, the financial modelling considered data and information from existing SIVs; and

- presented different options to achieve the NRFC’s stated policy objectives and considered the longer-term SIV policy objectives.

Entity costings

2.31 The Australian Labor Party’s 2021 election commitment stated that the ‘Fund will be administered on the basis that it will achieve a return to cover borrowing costs, with an expected positive underlying cash impact’.59

2.32 DISR was allocated $9 million (for 2022–23) and $34.5 million (for 2023–24) for establishing the NRFC in the October 2022–23 Federal Budget.60 DISR transferred $14.2 million for capital expenses to the NRFC on 6 February 2024.61

2.33 DISR and the Department of Finance engaged Ernst & Young (EY)62 to develop a 15-year financial model for the NRFC to ‘support the Investment Mandate development and budget costing (balance sheet, cash flow, operating and income statements).’ DISR and the Department of Finance used the financial model to inform advice to government in April 2023. The financial model was developed using information from other SIVs, EY’s proprietary Intellectual Property and information from Moody’s, Bloomberg, and Pitchbook (2022).

2.34 The financial modelling outlined two different scenarios for the investment outlay over a seven year period. The key categories of assumptions in the model covered: investment allocation by instrument (debt, equity and guarantees); concessional versus non-concessional terms; priority area; business lifecycle stage; rates of return; default rates; tenor; margin; operating and capital costs and minimum cash balances (i.e., cash available for investment each year).

2.35 A key assumption of the financial modelling based on CEFC was that NRFC’s investment profile would comprise about 85 per cent in debt investments, 10 per cent in equity and five per cent in guarantees over the medium to long term. Paragraph 4.21 discusses NRFC’s current investment profile based on investment applications.

2.36 Based on the financial model, advice to government identified a risk that the NRFC may not generate sufficient returns to cover expenses for the first three years. The 2023–24 Federal Budget allocated $53.2 million to the NRFC.63 Advice to government set out that a positive cumulative return over the medium to long-term would support the NRFC being financially sustainable, covering its operating expenses, and delivering a small positive return. Paragraph 3.22 discusses the NRFC’s financial strategy.

Management of constitutional and other risks

2.37 The Commonwealth of Australia Constitution Act 1901 (the Constitution) establishes the authority and powers of the Commonwealth to undertake its activities.

2.38 Advice to government outlined that there are limitations on NRFC’s ability to make equity investments under the Constitution. Section 63 of the NRFC Act sets out the investment functions of the NRFC and allows the NRFC to provide financial accommodation relating to priority areas of the Australian economy to constitutional corporations to assist them in carrying out their activities (paragraph 63(1)(a)); individuals or entities (other than constitutional corporations and states or territories) to assist them to carry out constitutionally-supported activities (paragraph 63(1)(b)); and states and territories by way of a grant of financial assistance (paragraph 63(1)(d)).

2.39 Paragraph 63(1)(c) of the NRFC Act provides that the NRFC may ‘acquire equity interests’ where ‘any of the entity’s activities are in a priority area of the Australian economy’ and ‘all of the entity’s activities are constitutionally-supported activities.’

2.40 DISR prepared a Board Information Pack to induct and inform NRFC Board members of their legislative obligations. The Board Information Pack stated that the NRFC Board should seek ‘advice whenever it is performing its investment function under s63(1)(b) and s63(1)(c).’ Paragraphs 4.22 to 4.24 discuss the NRFC’s Board approach to seeking legal advice and assessing constitutional risks for its investments.

2.41 DISR’s advice to government also outlined the following risks and potential mitigations: delivery risks; potential overlap with other SIVs; international trade and investment law risks; gender equality risk; national security risks; and financial, policy and reputational risks. DISR engaged Maddocks64 as a probity advisor during the design and establishment of the NRFC. Maddocks developed a probity framework that was approved and maintained by DISR. As required by the probity framework, DISR maintained an NRF probity and conflict of interest register. DISR also incorporated Maddocks advice on the probity risk register for Industry Working Group members.

Appointments to the NRFC Board

2.42 The Australian Government established the Review of Public Sector Board Appointments Processes65 in February 2023 ‘to ensure appointments are based on merit.’66 The review’s final report to the government was ‘expected to be published in late 2023’67 and it has not been released. The report was provided to the APS Commissioner on 4 August 2023.68 On 13 September 2023, the Secretaries Board received an update on the Review of Public Sector Board Appointments.69

2.43 In July 2024, the Department of Finance published Resource Management Guide (RMG) 127 Specialist Investment Vehicles70 (SIVs) which provides guidance to SIV entities in meeting the requirements of the PGPA framework, including appointments to a board. RMG 127 Specialist Investment Vehicles sets out ‘a suggested appointment process’ for entities where ‘ministers do not wish to reappoint or do not express a view’ on the process for board appointments.71

2.44 On 3 April 2023, in consultation with the Department of Finance, DISR agreed the approach for the Board appointment process. The agreed process involved engaging NGS Global72 to prepare nominations briefs; complete due diligence on each ministers’ preferred candidates; ministers would receive appointments briefs along with supporting information; and the Board and Chair would be appointed after the ‘Prime Minister and/or Cabinet’ approved the appointees proposed by the ministers.

2.45 Section 18 of the NRFC Act requires the NRFC Board to consist of a Chair and at least six, and no more than eight members. Subsection 19(2) of the NRFC Act requires the ministers to be satisfied that board appointees have substantial experience or expertise and professional credibility and significant standing in one of 10 fields, or a field the ministers consider appropriate.73 In appointing members, the NRFC Act also requires the ministers to ensure the board members collectively have an appropriate balance of experience or expertise, professional credibility and significant standing in the required fields74 and are not an employee of the Commonwealth, or the holder of a full-time office under the law of the Commonwealth.75 None of the nine members were Commonwealth employees or held a full-time office under the law of the Commonwealth.

2.46 Following the executive search process undertaken by NGS Global, the Minister for Industry and Science and the Minister for Finance appointed the Chair and seven members to the NRFC Board on 9 August 2023.76 In appointing the NRFC Board members, for each proposed appointee, the ministers were provided with the curriculum vitae, interests declarations and details of due diligence checks.77

2.47 The responsible ministers were also provided with a Board Skills Matrix which presented the skills and experience of the Board members against groupings of fields required in the NRFC Act and each Priority Area.

2.48 On 6 October 2023, the ministers through their offices advised DISR and the Department of Finance of their wish to appoint a specified ninth member to the NRFC Board. The proposed appointee was not shortlisted by the executive search process. On 13 October 2023, DISR submitted an appointment brief to the Minister for Industry and Science. The brief included the Board skills matrix; the appointee’s curriculum vitae, private interests declaration; and letter to the Prime Minister seeking his, or at his discretion, Cabinet’s approval of the proposed appointment of the ninth member. The ninth member was appointed to the NRFC Board on 16 October 2023.

2.49 DISR’s appointment brief to the Minister for Industry and Science outlined that while there was no legislative requirement to undertake a process that was similar to the members that were appointed in August, the ninth appointment may attract scrutiny. The ASX Corporate Governance Council has issued Corporate Governance Principles and Recommendations.78 The Corporate Governance Principles and Recommendations ‘apply to all entities admitted to the ASX official list as an ASX listing’ and are considered best practice for other entities to adopt as ‘they reflect a contemporary view of appropriate corporate governance standards.’79 Recommendation 1.2(a) of the Corporate Governance Principles and Recommendations states that listed entities should undertake appropriate checks before appointing a director or senior executive or putting someone forward for election as a director.80

2.50 The Department of Finance, in its appointment brief to the Minister for Finance on the ninth NRFC Board appointee, stated that formal due diligence with an external provider was not undertaken due to time constraints, the department conducted desktop due diligence and was satisfied the appointment did not present significant risk.

2.51 Desktop due diligence checks were not documented by the Department of Finance and DISR on the ninth NRFC Board appointee. On 17 December 2024, DISR advised the ANAO that due diligence was undertaken consistent with other candidates and included ‘google [sic] and desktop and media searches’, and that due to ‘compressed timeframes this was all verbal’.

2.52 The external executive search firm took one business day to provide due diligence checks and supporting reports for five members appointed in August 2023.

2.53 The skills matrix provided to the ministers to inform their decisions is summarised in Table 2.2 below. The NRFC Board’s appointees’ skills and experience were appropriately reflected in the skills matrix presented to the ministers.

Table 2.2: Number of Board appointees who meet the required skills as at October 2023

|

Board members |

Fields listed under subsection 19(2) of the NRFC Act |

Priority areas |

|||||||||

|

|

A |

B |

C |

D |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Number of members |

6 |

9 |

7 |

8 |

2 |

2 |

1 |

2 |

2 |

2 |

1 |

Key: Fields listed under subsection 19(2) of the NRFC Act:

A — Industry / Manufacturing (Industrial Relations paragraph 19(2)(j) and Industry Growth paragraph 19(2)(k));

B — Commercial / Financial (Banking and Finance paragraph 19(2)(c), Venture Capital, Private Equity or investment by way of lending or provision of credit paragraph 19(2)(d), Economics paragraph 19(2)(e), Accounting paragraph 19(2)(g), and Commercialisation of Innovative research paragraph 19(2)(ka));

C — Legal & Governance (Law paragraph 19(2)(h));

D — Government (Government funding programs or bodies paragraph 19(2)(f)).

Priority areas:

1 — Renewables & low emission technologies, 2 — Medical Science, 3 — Transport, 4 — Value-add in agriculture, forestry and fisheries sectors, 5 — Value-add in resources, 6 — Defence capability, 7 — Enabling capabilities.

Note: Some NRFC Board appointees have skills across multiple fields and priority areas.

Source: ANAO analysis.

Opportunity for improvement

2.54 Consistent with guidance in RMG 127 — Specialist Investment Vehicles, NRFC board appointment processes and considerations should be accurately and fully documented with records retained.

Project closure report

2.55 DISR’s project closure report assessed the outcomes of the establishment project, status of remaining activities, and lessons learned. The closure report outlined the status of nine of 11 project workstreams. Two workstreams relating to Investment Policies and Investment Opportunities were not referred to. For completeness, the project closure report should have linked outcomes and any post project activities to each of the 11 workstreams outlined in the Establishment Project Plan.

3. Are governance arrangements sound?

Areas examined

This chapter examines whether governance arrangements for the National Reconstruction Fund Corporation (NRFC) are sound.

Conclusion

NRFC’s governance arrangements are largely sound. The NRFC Board and CEO appointments, Board meetings and remuneration arrangements have been established under the NRFC Act. Investment Policies have been published pursuant to section 75 of the National Reconstruction Fund Corporation Act 2023 (NRFC Act). NRFC’s reporting arrangements for its annual report, corporate plan, budget estimates, performance measures and statements have been established, with 2024–25 performance to be reported against ‘at least three identified areas of the economy’ out of seven under the National Reconstruction Fund Corporation (Priority Areas) Declaration 2023. NRFC’s risk management, fraud and corruption control arrangements, and accountable authority instructions are underway and progressing as at March 2025. NRFC’s corporate policies are progressing as at March 2025. The NRFC Audit and Risk Committee (ARC) reviewed NRFC’s arrangements for risk management, internal controls, financial reporting except it did not review NRFC’s performance reporting arrangements for 2023–24 in line with the ARC charter and section 17 of the PGPA Rule. Recruitment is continuing, with the asset management function for investments underway as at March 2025. NRFC Board is yet to develop a financial strategy. NRFC has processes for managing procurement, recruitment, declaring gifts and benefits, and Freedom of Information (FOI). Access to NRFC’s released information under FOI is not consistent with guidelines from the Australian Information Commissioner.

Areas for improvement

The ANAO made two recommendations for the NRFC Board to develop a financial strategy, and ensure that its ARC provides oversight of performance reporting arrangements in line with the PGPA Rule. Further, the ANAO suggests that NRFC make its FOI-released information available for download on its website and to ensure its performance measures reflect all economic priority areas in future reporting periods.

3.1 The NRFC Act establishes governance arrangements for the appointment of the NRFC Board, the appointment of the Chief Executive Officer (CEO), and the operational arrangements of the NRFC Board among other requirements. As the accountable authority under the PGPA Act, the NRFC Board must comply with the requirements applicable to corporate Commonwealth entities. The Department of Finance published Resource Management Guide (RMG) 127 Specialist Investment Vehicles81 (SIVs) which provides guidance to SIV entities in meeting the requirements of the PGPA framework.

Are there appropriate corporate structures and supporting policies in place?

NRFC Board and CEO appointments, Board meetings and the Board and CEO’s remuneration arrangements have been established under the NRFC Act. A Board skills matrix was developed for commencement appointments. NRFC Board members, NRFC CEOs and acting CEO made conflicts of interest declarations and maintain conflicts of interest registers. NRFC experienced leadership changes in the 16 months from its commencement to January 2025, with two CEO appointments and two acting CEO appointments. NRFC has established its risk management, fraud and corruption risk management and reporting arrangements under the PGPA Act, with some elements in progress. The NRFC ARC reviewed NRFC’s arrangements for risk management, internal controls, financial reporting except for NRFC’s performance reporting. Corporate policies continue to be in progress as at March 2025. The NRFC Board has yet to develop a financial strategy to support its financial sustainability and return on investment. Processes are in place for managing procurements, recruitment, declaring gifts and benefits, and managing Freedom of Information, with an opportunity to make available released information for downloading from its website.

Governance arrangements under the NRFC Act

3.2 The NRFC Act establishes governance arrangements for establishing the NRFC Board and its operations, the appointment of Board members and the Chief Executive Officer.

Appointment and commencement of the NRFC Board

3.3 Subsection 19(1) of the NRFC Act requires that the Minister for Industry and Science and Minister for Finance (‘responsible ministers’)82 appoint NRFC Board members through written instruments of appointment. Section 21 of the NRFC Act provides that the period of appointment of NRFC Board members must not be more than four years. Section 18 of the NRFC Act provides that the NRFC Board is to consist of a Chair and at least six and no more than eight members.

3.4 At NRFC’s commencement on 18 September 2023, the responsible ministers appointed eight members to the NRFC Board through written instruments of appointment. The ninth member of the NRFC Board was appointed on 16 October 2023. The instruments of appointment for NRFC Board members provide that the terms of appointment for all Board members have been made for three or four years (see Table 3.1).

Table 3.1: NRFC Board members’ commencement and term

|

Board member |

Commencement |

End of term |

Term of appointment (years) |

|

Martijn Wilder AM (Chair) |

18 September 2023 |

17 September 2027 |

4 |

|

Ahmed Fahour AO |

18 September 2023 |

17 September 2026 |

3 |

|

Dr Katharine Giles |

18 September 2023 |

24 November 2024a |

4a |

|

The Hon Kelly O’Dwyer |

18 September 2023 |

17 September 2027 |

4 |

|

Daniel Petre AO |

18 September 2023 |

17 September 2026 |

3 |

|

Kathryn Presser AM |

18 September 2023 |

17 September 2026 |

3 |

|

Karen Smith-Pomeroy |

18 September 2023 |

17 September 2026 |

3 |

|

Daniel Walton |

18 September 2023 |

17 September 2027 |

4 |

|

Glenn Thompson |

16 October 2023 |

15 October 2027 |

4 |

|

Kellie Benda |

4 March 2025 |

3 March 2028 |

3b |

Note a: Dr Katharine Giles resigned from her position on the NRFC Board effective 25 November 2024.

Note b: DISR advice to the Minister for Industry and Science in February 2025 on the NRFC Board vacancy and the potential new candidate for the NRFC Board outlined candidates in four categories for the minister’s decision. These categories of candidates were: candidates ‘from the previous search process’; candidates who were ‘suggested by Dr Giles/NRFC Chair’; a candidate who was ‘put forward by the Minister’; and candidates ‘put forward by the department from desktop research.’ The selected candidate was the only candidate ‘put forward by the Minister’ in DISR’s advice.

Source: Information from the Department of Industry, Science and Resources and the NRFC.

3.5 Subsection 28(3) of the NRFC Act requires the NRFC Board to convene at least six meetings each calendar year. The NRFC Board convened its first meeting on the date of NRFC’s commencement on 18 September 2023. The NRFC Board convened seven meetings in 2023 and nine meetings in 2024. Further, the Board had convened out of session for nine items in 2023 and 26 items in 2024.

Board performance and skills matrix

3.6 As outlined at paragraphs 2.47 and 2.53, a skills matrix was developed for the first eight appointments to the NRFC Board in line with subsection 19(2) of the NRFC Act (see Table 2.2). The skills matrix was subsequently updated in the advice to the Minister for Industry and Science on the ninth appointment to the NRFC Board.

3.7 In July 2024, the Department of Finance (Finance) advised NRFC that, as part of the 2023–24 Federal Budget, it was developing a ‘Joint Minister Oversight Model (Model) … for the Minister for Finance across all existing and future SIVs’ and ‘a resource management guide (RMG) for SIVs outlining principles of best practice.’ The advice provided that consideration of the RMG be undertaken ‘by SIVs before 1 July 2025.’

3.8 RMG 127 — Specialist Investment Vehicles83 provides that ‘a formal and regular performance evaluation process should be in place to instil confidence in the responsible minister(s), Finance Minister, the Parliament and the public that the board is effective in performing its functions and delivering on the strategic objectives set out by the Government,’84 and that ‘it is good practice for performance evaluations of the board and its members to be conducted at least annually.’ In relation to the skills matrix, it provides that the ‘board skills matrix should be reviewed at least annually following board performance evaluations.’85

3.9 The NRFC Board Charter86 provides that ‘the Board will review its performance … no less than biennially [once every two years].’ At its March 2025 meeting, the NRFC Board approved a paper on ‘RMG 127 alignment.’ In relation to the Board skills matrix, NRFC plans to ‘develop an approach to design and implementation of [sic] a Board skills assessment/mapping process’ by 7 March 2025. The process would then be incorporated into the ‘Board Information Pack’ by 30 June 2025.

Board remuneration

3.10 Section 23 of the NRFC Act provides that NRFC Board members’ remuneration is to be determined by the Remuneration Tribunal. The determination87 provides that the NRFC Board Chair’s remuneration to be $132,610 and for other NRFC Board members to be $65,920.

Appointment and remuneration of the Chief Executive Officer

3.11 In the 16 months from its commencement to 31 January 2025, NRFC experienced leadership changes in the CEO position, with two CEO appointments and two acting CEO appointments (including two extensions). Section 36 of the NRFC Act establishes the position of the NRFC CEO. Section 38 of the NRFC Act provides that the NRFC CEO may be appointed by the NRFC Board after consultation with the responsible ministers and within six months of the commencement of the NRFC Act.88 Section 40 of the NRFC Act provides that the Board may appoint an acting CEO by written instrument and after consultation with the responsible ministers.

3.12 The NRFC Board appointed an acting CEO on 20 October 2023 for a term of three months (ending 20 January 2024), supported by the responsible ministers. The acting CEO term was extended, following a referral to the Prime Minister, on 19 December 2023 in accordance with the Cabinet Handbook.89 The extension term was the earlier of the commencement of the substantive CEO or 17 March 2024.

3.13 The NRFC Board commenced its recruitment process for the NRFC CEO in September 2023. In relation to the process, the NRFC Board provided to the Minister for Industry and Science and Minister for Finance on 23 December 2023 that:

[The Board commenced] a comprehensive search process in September 2023. The process included a combination of public advertisement, direct approaches and research and engagement activities and was supported by search firm Johnson Partners. The NRF Board insisted the search process delivered a diverse range of highly qualified candidates for consideration.

The search process identified a list of over 200 candidates. A shortlisting process, along with appropriate due diligence and background checks, was undertaken. A subgroup of the Board interviewed seven prospective candidates, recommending two for final interview and consideration by the full Board.

After careful assessment, the Board’s preferred candidate is Mr Ivan Power.

3.14 The responsible ministers referred the matter for the Prime Minister’s approval under paragraph 114 of the Cabinet Handbook90, which was confirmed on 30 January 2024. The NRFC CEO commenced91 on 13 February 2024 for a five-year term, within six months of the NRFC commencing as required by subsection 38(4) of the NRFC Act. The NRFC CEO took ‘extended leave … [from] late May 2024’92 and resigned on 12 September 2024.

3.15 An acting CEO appointment took effect from 3 June 2024, following consultation and support from the responsible ministers for the term of three months (ending on 2 September 2024). An extension to the acting CEO’s term was sought by the NRFC Board, which was referred to the Prime Minister for decision on 4 September 2024. On 8 October 2024, the Prime Minister provided his decision for the acting CEO to continue until 2 December 2024. From the date when the acting CEO’s term ended on 2 September 2024 until the Prime Minister approved the extension of the acting CEO arrangement, 36 days had lapsed.

3.16 The responsible ministers were consulted on a further extension to the acting CEO’s term and the appointment of the new CEO by the NRFC Board on 24 November 2024. On 10 December 2024, the Department of Industry, Science and Resources advised NRFC that, following ‘government processes,’ the ‘permanent appointment and the acting arrangement for the CEO have been agreed as proposed,’ with the acting arrangement ending on 27 January 2025 and the new CEO commencing on 28 January 2025.93

3.17 NRFC advised the ANAO in February 2025 that the ‘position of the Chief Executive Office of the NRFC has not been vacant at any time,’ and that CEO appointments are made by the NRFC Board and by consultation with the government under section 40 of the NRFC Act (see paragraph 3.11). Further, it advised the ANAO in March 2025 that CEO delegations were not exercised during the periods between government approvals.

3.18 Section 41 of the NRFC Act provides that the NRFC CEO’s remuneration is to be determined by the Remuneration Tribunal. The Remuneration Tribunal determined that the NRFC CEO is a ‘Principal Executive Office’ (PEO) at the PEO Band E.94 Further, it provided to the NRFC Board that the NRFC CEO position would receive ‘a Total Remuneration Reference Rate (TRRR) of $832,000; maximum ‘at risk’ performance pay of 40 per cent of total remuneration; and a total maximum achievable remuneration outcome of $1223,040 [sic].’95

NRFC staff remuneration

3.19 The NRFC Board approved the NRFC Remuneration Policy at its September 2024 meeting. The meeting minutes noted that NRFC’s remuneration strategy was underway. NRFC advised the ANAO that ‘current salaries are derived by industry benchmarking using data from the Financial Industry Remuneration Group (FIRG).’

Strategy and planning