Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Effectiveness of the Board of the National Disability Insurance Agency

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Boards play a key role in the effective corporate governance of an entity, by maintaining a focus on organisational performance and conformance with relevant requirements such as the Commonwealth finance law and enabling legislation.

- The National Disability Insurance Agency (NDIA) is a corporate Commonwealth entity, and the Board of the NDIA (the Board) is its accountable authority with duties under the Public Governance, Performance and Accountability Act 2013.

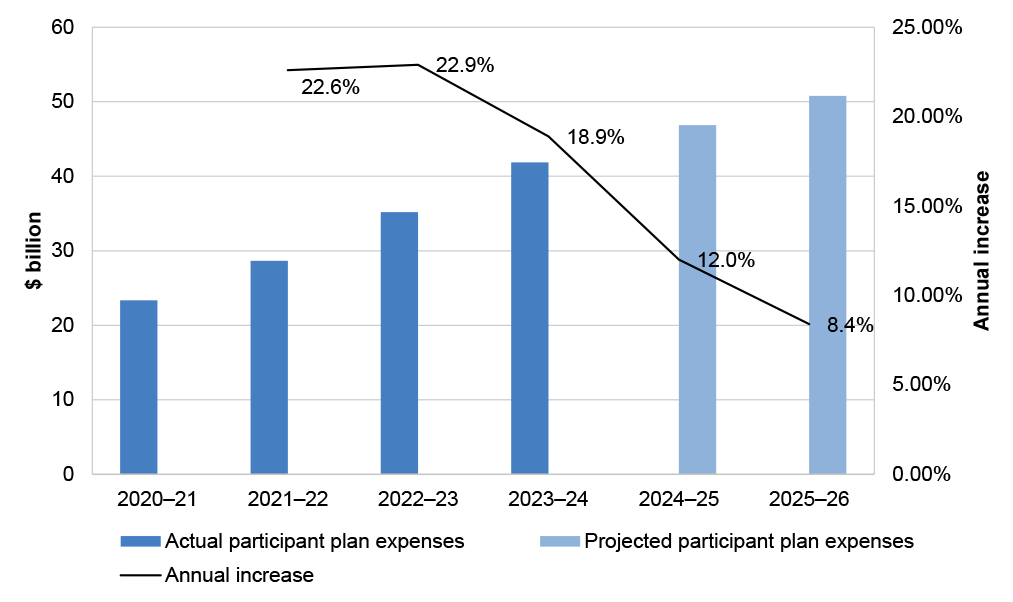

- This audit was conducted to give assurance to the Parliament that the Board has effective governance and oversight practices.

Key facts

- The Board may include a chair and up to 11 other members under the National Disability Insurance Scheme Act 2013.

- The Board Chair and eight members have lived experience with disability.

What did we find?

- The governance of the Board of the NDIA was largely effective.

- The Board’s governance arrangements are largely consistent with relevant legislative requirements.

- The Board has established partly fit-for-purpose arrangements to oversee the entity’s operations.

What did we recommend?

- There were three recommendations to the NDIA, relating to managing conflicts of interest, the frequency of NDIA Risk Management Framework reviews, and strengthening Board oversight of NDIA performance by more consistently seeking further information or assurance from management where relevant.

- The NDIA agreed to all three recommendations.

$41.85 bn

NDIS participant plan expenses in 2023–24; a 46% increase from $28.63 billion in 2021–22

46

Number of Board meetings held between 1 July 2021 and 30 June 2024

29

Number of appointments to the Board from 1 July 2021 to 1 January 2025, including 18 reappointments

Summary and recommendations

Background

1. Corporate organisations, including in the public sector, often have a board responsible for their governance. The Australian Institute of Company Directors (AICD) refers to governance as the systems that direct and control — or govern — an organisation1:

Governance enables authority to be exercised appropriately and for the people who exercise it to be held to account. Good governance is about the effective way decisions are made and power is exercised within an organisation.

2. In March 2025, 74 Australian Government organisations have a body corporate status — known as corporate Commonwealth entities (CCEs). The governing board of a CCE is often the entity’s accountable authority with specific responsibility for ‘leading, governing and setting the strategic direction’ for the entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

3. Boards of Australian Government entities must govern in a way that complies with the requirements of any enabling legislation, the Commonwealth finance law (which includes the PGPA Act and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule)), and other applicable laws and requirements.

4. Organisations, including CCEs, with governance boards vary significantly by function, and governance boards may also vary in their composition, operating arrangements, independence and subject-matter focus, depending on the specific requirements of their enabling legislation and other applicable laws.

5. The National Disability Insurance Scheme (NDIS), established in 2013 under the National Disability Insurance Scheme Act 2013 (NDIS Act), provides funding for planned supports for NDIS participants — people with permanent and significant disability. Commonwealth, state, and territory governments jointly fund the NDIS under bilateral arrangements.

6. The National Disability Insurance Agency (NDIA) is responsible for delivering the NDIS under the NDIS Act and is a CCE. The Board of the NDIA (the Board) is the accountable authority of the NDIA.

Rationale for undertaking the audit

7. The NDIS is a demand-driven program. In 2023–24, the NDIA’s participant plan expenses were $41.85 billion, 19 per cent higher than in 2022–23, making this the largest area of Australian Government expenditure managed by the board of a CCE and also the fastest growing Australian Government payment. In May 2024, Budget Paper No. 1 for the 2024–25 Budget stated, ‘NDIS Commonwealth funded participant payments growth is expected to average 9.2 per cent per year over the projections period’ (to 2034–35).23 With over 692,000 Australians registered as NDIS participants as at 31 December 2024, the NDIA is also an organisation with a direct impact on the lives of a major cohort of vulnerable Australians.

8. This audit topic provides independent assurance to Parliament on the effectiveness of the Board of the NDIA’s governance.

Audit objective and criteria

9. The objective of the audit was to assess the effectiveness of the governance of the Board of the NDIA.

10. To form a conclusion against the objective, the ANAO examined:

- Are the Board’s arrangements consistent with relevant legislative requirements for effective governance?

- Does the Board have fit-for-purpose arrangements to support sufficient oversight of the entity’s operations?

11. The ANAO analysed the Board’s governance for the period 1 July 2021 to 30 June 2024.

Conclusion

12. The Board’s governance was largely effective. The Board could strengthen its overall governance of the NDIA and the NDIS by setting clear requirements for additional strategic reporting to it on the progress of the implementation of financial sustainability initiatives. The Board’s practice of seeking further information and assurance from management where results are below targets, or other issues or risks are reported, was maturing but not consistent across the Board’s and its committees’ meetings.

13. The Board’s governance and administrative arrangements are largely consistent with relevant legislative requirements for effective governance. Board appointments are in accordance with legislative requirements and Board meetings are properly constituted. Management plans are not consistently developed for Board members’ declared real or apparent conflicts of interest.

14. The Board has a largely fit-for-purpose charter and has established committees that support it though reviewing relevant management reports and products before these are submitted to the full Board. A Sustainability Committee provides support for the oversight of actuarial reporting and NDIS financial sustainability. The Strategic Directions and Participant Outcomes Committee did not provide the Board sufficient advice against its broad charter functions, including advice on NDIA priorities.

15. Prior to March 2024, the Audit Committee structure limited its ability to provide the required range of independent advice and assurance to the Board, with risk oversight managed by a separate Risk Committee and reliance placed on the committees and Board informally sharing information. A combined Audit and Risk Committee (ARC), in place since March 2024, supports the Board by reviewing all required areas of reporting on NDIA finance, performance, risk and internal control. None of the committees provide written advice to the Board.

16. The Board has established partly fit-for-purpose arrangements to oversee NDIA operations. The Board had regard to advice and reports from the Scheme Actuary, the Independent Advisory Council and the ARC. Decision records did not always show the Board’s consideration of relevant legislative criteria. As reporting on regulatory compliance was aggregated, it lacked detail, and the Board did not always respond to indicators of non-compliance. Requirements of the National Disability Insurance Scheme—Risk Management Rules 2013 were not all met. The Board monitored and received reporting from the NDIA on NDIS sustainability and fraud risk. The Board has not directed strategic reporting on reforms to assure itself that the NDIA will fulfil the Australian Government’s commitments to moderate growth in NDIS expenses.

17. The Board has arrangements to meet PGPA Act requirements relating to governing the NDIA, systems of risk control, cooperation with others and reporting to the Minister for the NDIS. When reports on areas of poor performance or other issues are provided, the Board and its supporting committees could improve its governance by consistently seeking further information or assurance from management. Consistently seeking additional information would support the Board to mature further into a strategic role.

Supporting findings

Board governance and structure

18. Board member appointments between July 2021 and June 2024 complied with relevant NDIS Act requirements. The Department of Social Services (DSS) maintained records of appointments and advised the minister on current and upcoming vacancies. (See paragraphs 2.2 to 2.22)

19. Board meetings were properly constituted, and sufficiently frequent, with records maintained. The Board had not set guidance for the use and records of ‘in camera’ sessions. Inaccurate remuneration payments were made to Board members in 2022–23 and 2023–24. (See paragraphs 2.23 to 2.39)

20. A register of Board member interests was updated regularly. Of the seven declared interests identified by members as potential or actual conflicts, one had a documented management strategy. Conflict of interest procedures were largely followed for scheduled Board meetings; they were not consistently followed for out of session meetings or decisions without meetings. (See paragraphs 2.40 to 2.57)

21. The Board has established committees to support the governance of the NDIA. The charters for committees could be improved to set out voting requirements, the extent of delegated authority, and specify requirements for making decisions without meetings. The ARC charter could be improved by specifying who cannot be a member of the committee. The Board has not documented which NDIA policies require its approval. (See paragraphs 2.58 to 2.84)

22. The role of the committees is to provide advice to the Board on: the financial sustainability of the NDIS (Sustainability Committee); and the objectives, strategies, and policies to be followed by the NDIA, with a dedicated focus on participant outcomes (Strategic Direction and Participant Outcomes Committee). In March 2024, the Audit Committee and Risk Committee were merged into the ARC — its role is to review and advise on the appropriateness of the NDIA’s financial and performance reporting, systems of risk oversight and management, and systems of internal control. Committee membership was largely consistent with charter requirements. (See paragraphs 2.85 to 2.121)

23. Each committee receives relevant reporting according to its function and gave verbal updates and meeting minutes to the Board. The committees have not always provided written advice on critical and high-risk areas that require further Board consideration and direction, and it is unclear if the committees’ verbal updates and meeting minutes provided assurance and assisted with informing decision-making and the efficient running of the Board. (See paragraphs 2.85 to 2.121)

Oversight of compliance and performance

24. The Board has issued Accountable Authority Instructions and guidance to NDIA officials to support legislative compliance. The Board made CEO appointments and had regard to advice from the Independent Advisory Council, Scheme Actuary and ARC, consistent with NDIS Act requirements. (See paragraphs 3.3 to 3.19)

25. Reporting to the Board on regulatory compliance is aggregated which reduced the Board’s visibility of the adequacy of internal controls. The Board did not respond to senior executive advice that they could not give full assurance over their regulatory compliance obligations. The Board provided annual risk management declarations, as required by the NDIS Risk Management Rules 2013. The Board did not review its Risk Management Framework or receive sufficient reporting on NDIA risk culture, resourcing and control effectiveness, as required. (See paragraphs 3.20 to 3.47)

26. The Board has monitored NDIS financial sustainability and NDIS fraud risk. This included consideration of draft reform initiatives proposed to address increasing NDIS expenses. It is not clear if the Board provided NDIA management with direction on reform initiatives proposed before these were included in advice to government. The Board receives regular updates on the progress of reform activities. It is not clear if the Board has been active in directing reporting on reform deliverables to assure itself that the NDIA will fulfil the Australian Government’s NDIS Financial Sustainability Framework commitments. (See paragraphs 3.48 to 3.83)

27. Corporate plans largely complied with PGPA Rule requirements, and the Board approved the performance measures in corporate plans prior to their publication. Eleven of the NDIA’s 19 measures for the 2023–24 Annual Performance Statements satisfied relevant PGPA Rule requirements. The performance measures for 2023–24 did not reflect the NDIA function of managing NDIS financial sustainability, although new measures in the 2024–25 corporate plan relate to this function. (See paragraphs 3.84 to 3.114)

28. The Board received and discussed regular reporting on results against corporate plan performance measures, although it did not consistently seek further detail or assurance where internal reporting indicated poor results or potential issues with reporting mechanisms. (See paragraphs 3.84 to 3.114)

Recommendations

Recommendation no. 1

Paragraph 2.56

The Board of the National Disability Insurance Agency document how it manages conflicts of interest, including those arising from members who declared personal interests as NDIS participants, family members of participants, members of disability organisations, and/or employment with NDIS providers or consultancies providing services to the NDIA.

National Disability Insurance Agency response: Agreed.

Recommendation no. 2

Paragraph 3.37

The Board of the National Disability Insurance Agency define the frequency of review of the Risk Management Framework having regard to the size and complexity of the NDIA’s operations and implement mechanisms to ensure the reviews are conducted within these timeframes.

National Disability Insurance Agency response: Agreed.

Recommendation no. 3

Paragraph 3.113

The Board of the National Disability Insurance Agency, including through its committees, strengthen its oversight of entity performance by more consistently responding to management reporting with requests for relevant further information, reporting or assurance from management where results are below targets, assumptions are unclear, or other issues or risks are raised.

National Disability Insurance Agency response: Agreed.

Summary of entity responses

29. Copies of the proposed report were provided to the NDIA and DSS. The summary responses are provided below, and the full responses are included at Appendix 1. Improvements observed by the ANAO during the audit are listed in Appendix 2.

National Disability Insurance Agency

The National Disability Insurance Agency (NDIA) welcomes the ANAO’s assessment that NDIA Board’s governance is largely effective. We note the ANAO conclusions that governance arrangements are largely consistent with its legislative requirements; that Board appointments are in accordance with legislative requirements; and Board meetings are properly constituted.

The NDIA Board acknowledges the importance of having clear and specific guidance and governance processes in relation to the Board’s responsibilities, including how these are executed. The Board has recently updated key artefacts that relate to Board practices and processes that the ANAO has identified as areas for improvement. This includes updating the Board and/or Committee charter to include clarification on the use of in camera sessions, management of conflicts of interest, and how the Audit and Risk committee provides advice to the Board.

As noted in the report, the Board approved a workplan for 2025 which identifies key artefacts required to fulfill the Board’s statutory obligations. The Board also has standing items for areas that Board has identified as either requiring monitoring or of particular interest to the Board. The Board acknowledges there is an opportunity to provide management with clarity regarding the Board’s expectations regarding strategic reporting on key programs, additional reporting where targets are not being met, and the policies and documents that the Board should approve or have oversight over.

Department of Social Services

The Department of Social Services (the Department) welcomes the Australian National Audit Office (ANAO) report on the Effectiveness of the Board of the National Disability Insurance Agency.

The Department notes the report’s three recommendations refer to the Board of the National Disability Insurance Agency.

The Department notes the key messages from this audit for all Australian Government entities, including considering whether key stakeholders and decision makers have specific accessibility requirements and producing relevant documents in accessible formats.

Key messages from this audit for all Australian Government entities

30. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 The governing board of a corporate Commonwealth entity (CCE) is often the accountable authority for the entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), with responsibility for ‘leading, governing and setting the strategic direction’ for the entity.

1.2 As at February 2025, 74 Australian Government entities have a body corporate status. CCEs and companies with governance boards vary significantly by function, and governance boards may also vary in their composition, operating arrangements, independence and subject-matter focus, depending on the specific requirements of their enabling legislation and other applicable laws.

Duties and roles

1.3 As the accountable authority, members of CCE governing boards are officials under the PGPA Act and subject to the general duties of officials in sections 25–29 of the PGPA Act (see Box 1). Sections 15 to 19 of the PGPA Act impose additional duties on accountable authorities in relation to governing the Australian Government entity for which they are responsible (see Box 1). Guidance issued to accountable authorities by the Department of Finance (Finance) aims to support accountable authorities ‘to fulfil the important role of governing your entity and contributing to the priorities and objectives of the government.’4

|

Box 1: Department of Finance, Duties of Accountable Authorities (Resource Management Guide (RMG 200) — May 2024 |

|

Your duties as an accountable authority Sections 15 to 19 of the PGPA Act prescribe the following duties imposed on you as an accountable authority:

General duties You are an official under the PGPA Act and subject to the general duties of officials as well as the duties as an accountable authority of a Commonwealth entity.

|

1.4 Board governance involves two dimensions:

Performance — monitoring the performance of the organisation and CEO. This also includes strategy — setting organisational goals and developing strategies for achieving them, and being responsive to changing environmental demands, including the prediction and management of risk. The objective is to enhance organisational performance;

Conformance — compliance with legal requirements and corporate governance and industry standards, and accountability to relevant stakeholders.

… it is important to understand that governing is not the same as managing. Broadly, governance involves the systems and processes in place that shape, enable and oversee management of an organisation. Management is concerned with doing–with co-ordinating and managing the day-to-day operations of the business.5 [emphasis in original]

The National Disability Insurance Agency

1.5 The National Disability Insurance Scheme (NDIS), established in 2013 under the National Disability Insurance Scheme Act 2013 (NDIS Act), provides funding for supports for people with permanent and significant disability. Commonwealth, state and territory governments jointly fund the NDIS under bilateral arrangements. The National Disability Insurance Agency (NDIA) is responsible for delivering the NDIS under the NDIS Act and is a CCE under the PGPA Act.

1.6 The key functions of the NDIA are set out in section 118 of the NDIS Act. As well as its core function of delivering the NDIS to support the independence, and social and economic participation, of people with disability6, the NDIA is also to:

- manage, advise and report on, the financial sustainability of the NDIS; and

- prevent, detect, investigate and respond to misuse of, abuse of, or criminal activity involving, the NDIS.

1.7 The NDIA also has functions relating to developing and enhancing the disability sector, building community awareness of disabilities, data on disabilities and supports, and disability research. In performing all its functions, the NDIA must, under subsection 118(2) of the NDIS Act, use its best endeavours to:

- act in accordance with any relevant intergovernmental agreements;

- act in a proper, efficient and effective manner; and

- ensure the financial sustainability of the NDIS.

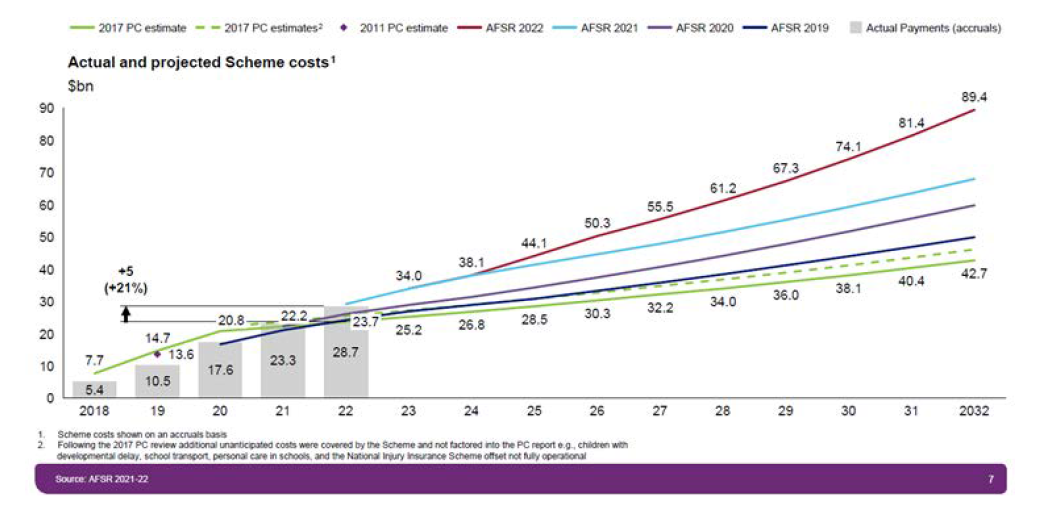

1.8 Following completion, in July 2021, of the five-year transition period from state and territory-based supports to national NDIS operation, NDIS costs continued to rise. In October 2021, the 2021 NDIS Annual Financial Sustainability Report (AFSR) was published, showing total projected participant costs were expected to almost double from $29.2 billion in 2021–22 to $59.3 billion in 2029–30. The 2022 AFSR included a baseline forecast of NDIS expenses for 2031–32 of $89.4 billion. This forecast growth was greater than previously expected — in the first year of transition (2016–17) the baseline forecast for total participant costs in 2030 was $41.8 billion.

1.9 The NDIA’s operating environment has been subject to review and change since 2021 including the Independent Review into the National Disability Insurance Scheme7 (NDIS Review), the Royal Commission into Violence, Abuse, Neglect and Exploitation of People with Disability8, and legislative reform.9 In April 2023, the Minister for the NDIS announced that National Cabinet10 had agreed to an NDIS Financial Sustainability Framework which sets an annual NDIS growth target of 8 per cent by July 2026. The minister also announced Budget funding for 10 supporting initiatives.11

1.10 In March 2024, the Australian Government introduced the National Disability Insurance Scheme Amendment (Getting the NDIS Back on Track No. 1) Bill 2024 (the Bill) to Parliament. In May 2024, the 2024–25 Federal Budget Strategy and Outlook stated that the Bill and subsequent amendments to NDIS rules and other legislative instruments:

will moderate growth in NDIS expenditure, by determining NDIS participant plan budgets more consistently based on participant need and supporting participants to spend in accordance with their plans. The realisation of the financial projections for the NDIS is dependent on the successful implementation of the Financial Sustainability Framework, including the passage of the Bill and subsequent changes to NDIS rules and other legislative instruments.12

The Bill was passed in August 2024 and took effect in October 2024.

The Board of the National Disability Insurance Agency

1.11 The Board is the accountable authority of the NDIA. The Board must comply with its enabling legislation — the NDIS Act, the PGPA Act and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). Under section 124 of the NDIS Act, the Board is responsible for ensuring the proper, efficient and effective performance of the NDIA’s functions and determining the objectives, strategies and policies of the NDIA.

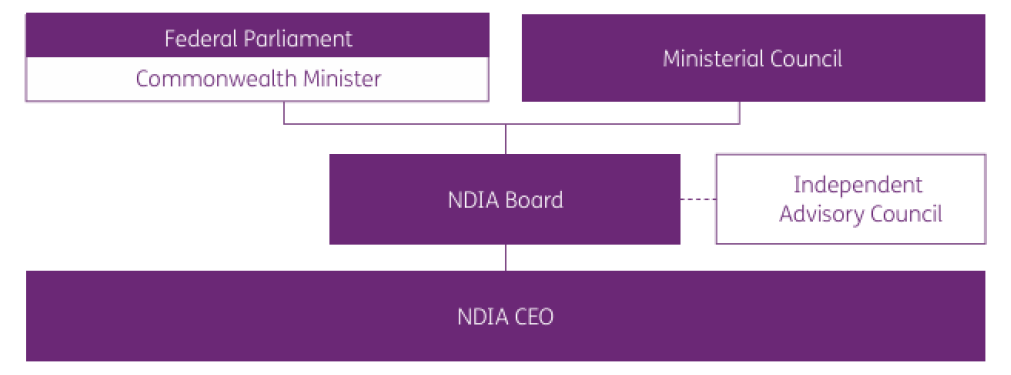

1.12 Figure 1.1 sets out the governance structure of the NDIA.

Figure 1.1: NDIA governance

Source: National Disability Insurance Agency, National Disability Insurance Agency Annual Report 2023–24, NDIA, n.d., p. 100, available from https://www.ndis.gov.au/publications/annual-report#annual-report-2023-24 [accessed November 2024].

1.13 The NDIS Act provides that the minister, with agreement of states and territories, has the power to make delegated legislation in the form of NDIS Rules, to direct the NDIA and to appoint Board members. The Department of Social Services (DSS), as the portfolio department responsible for the NDIS, manages the process that supports the minister to make appointments to the Board.13

1.14 The NDIS Act establishes a Ministerial Council, that meets as the Disability Reform Ministerial Council, to consider policy matters and advise the minister and report to National Cabinet.

1.15 The Independent Advisory Council provides independent advice, on its own initiative or at the Board’s request, on matters prescribed in section 144 of the NDIS Act including about how the NDIA performs its functions relating to the NDIS.

1.16 Changes in Board membership and senior NDIA executives between 2022 and January 2025 include the appointment of a new Board Chair in October 2022, new CEO in October 2022, four new deputy CEOs in early 2023, three new Board members in 2023, one further member in 2024, and one in January 2025.

Rationale for undertaking the audit

1.17 The NDIS is a demand-driven program. In 2023–24, the NDIA’s participant plan expenses were $41.85 billion, 19 per cent higher than in 2022–23, making this the largest area of Australian Government expenditure managed by the board of a CCE and also the fastest growing Australian Government payment. In May 2024, Budget Paper No. 1 for the 2024–25 Budget stated, ‘NDIS Commonwealth funded participant payments growth is expected to average 9.2 per cent per year over the projections period’ (to 2034–35).14 With over 692,000 Australians registered as NDIS participants as at 31 December 2024, the NDIA is also an organisation with a direct impact on the lives of a major cohort of vulnerable Australians.

1.18 This audit provides independent assurance to Parliament on the effectiveness of the governance of the Board of the NDIA.

Audit approach

Audit objective, criteria and scope

1.19 The objective of the audit was to assess the effectiveness of the governance of the Board of the NDIA.

1.20 To form a conclusion against the objective, the following high-level criteria were adopted:

- Are the Board’s arrangements consistent with relevant legislative requirements for effective governance?

- Does the Board have fit-for-purpose arrangements to support sufficient oversight of the entity’s operations?

1.21 The ANAO’s analysis of the effectiveness of the Board of the NDIA related to the period 1 July 2021 to 30 June 2024, with fieldwork conducted between March 2024 and September 2024.

Audit methodology

1.22 The audit methodology involved:

- examining NDIA records;

- meetings with Board members;

- meetings with officials of the NDIA and the Department of Social Services;

- observing Board and committee meetings; and

- reviewing the four citizens’ contributions received.

1.23 The ANAO has co-operative evidence gathering arrangements with entities. On 20 May 2024 the NDIA advised the ANAO that it was unable to voluntarily provide certain information requested by the ANAO due to legislative restrictions on the disclosure of requested information.

1.24 On 28 May 2024 the acting Auditor-General issued the NDIA a notice requiring it to provide information and produce documents pursuant to section 32 of the Auditor General Act 1997, to enable the NDIA to provide the requested information taking account of legislative requirements. The NDIA provided the information requested within the specified time.

1.25 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $697,606.

1.26 The team members for this audit were Barbara Das, Sophie Capel, Rory Tredinnick, Alexandra Collins, and Corinne Horton.

2. Board governance and structure

Areas examined

This chapter examines whether the governance and administrative arrangements of the National Disability Insurance Agency (NDIA) Board (the Board) are consistent with relevant legislative requirements for effective governance.

Conclusion

The Board’s governance and administrative arrangements are largely consistent with relevant legislative requirements for effective governance. Board appointments are in accordance with legislative requirements and Board meetings are properly constituted. Management plans are not consistently developed for Board members’ declared real or apparent conflicts of interest.

The Board has a largely fit-for-purpose charter and has established committees that support it though reviewing relevant management reports and products before these are submitted to the full Board. A Sustainability Committee provides support for the oversight of actuarial reporting and NDIS financial sustainability. The Strategic Directions and Participant Outcomes committee did not provide the Board sufficient advice against its broad charter functions, including advice on NDIA priorities.

Prior to March 2024, the Audit Committee structure limited its ability to provide the required range of independent advice and assurance to the Board, with risk oversight managed by a separate Risk Committee and reliance placed on the committees and Board informally sharing information. A combined Audit and Risk Committee, in place since March 2024, supports the Board by reviewing all required areas of reporting on NDIA finance, performance, risk and internal control. None of the committees provide written advice to the Board.

Areas for improvement

The ANAO made one recommendation aimed at strengthening the Board’s management of members’ declared real or apparent conflicts of interest.

The ANAO also identified six opportunities for improvement: that the Board develop a policy on its use and records of ‘in camera’ sessions; update committee charters; specify key policies requiring Board approval; strengthen the induction process for new Board members; strengthen committee advice to the Board by requiring this to be in writing; and monitor implementation of parliamentary recommendations.

2.1 Board governance and administration encompasses how a board is established and managed in accordance with its legislated duties and responsibilities — including the board’s enabling legislation, the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). The Board is established under the National Disability Insurance Scheme Act 2013 (the NDIS Act) and is the NDIA’s accountable authority.

Are the Board’s governance and administrative arrangements consistent with relevant legislative requirements?

Board member appointments between July 2021 and June 2024 complied with relevant NDIS Act requirements. The Department of Social Services (DSS) maintained records of appointments and advised the Minister for the National Disability Insurance Scheme (NDIS) on current and upcoming vacancies. Board meetings were properly constituted, and sufficiently frequent, with records maintained. The Board had not set guidance for the use and records of ‘in camera’ sessions. Inaccurate remuneration payments were made to Board members in 2022–23 and 2023–24.

A register of Board member interests was updated regularly. Of the seven declared interests identified by members as potential or actual conflicts, one had a documented management strategy. Conflict of interest procedures were largely followed for scheduled Board meetings; they were not consistently followed for out of session meetings or decisions without meetings.

Board appointments

2.2 Section 126 of the NDIS Act requires the Board to consist of a chair and up to 11 members, with no minimum specified. The number of members, including the Chair, concurrently serving on the Board did not exceed nine in 2021–22, 12 in 2022–23, 11 in 2023–24 and 2024–25 (as at January 2025). Board appointments, as at 1 January 2025, are listed at Appendix 3.

2.3 Section 127 of the NDIS Act prescribes how a Board member may be appointed. The legislative requirements include15 that:

- Board members are to be appointed by the minister, by written instrument, on a part-time basis (subsection 127(1));

- the minister must be satisfied that they are a person with disability, have lived experience with disability, or have skills, experience or knowledge in the provision or use of disability services, the operation of insurance schemes (or compensation schemes or schemes with long-term liabilities), financial management, or corporate governance (subsection 127(2));

- state and territory disability ministers must be consulted over appointments (subsection 127(3));

- non-Chair appointments must be supported by the Commonwealth and a majority of the Commonwealth and the host jurisdictions (subsections 127(4)–(4D)); and

- a Board member cannot hold certain positions, such as being a member of a state or Commonwealth parliament, to be eligible for appointment (subsection 127(5)).

2.4 The Cabinet Handbook16 also requires, where a significant full time or part-time appointment to a board (such as a board chair or members) is proposed, that:

the responsible minister must write to the Prime Minister seeking approval of the appointment before any action is finalised. While significant appointments will require Cabinet approval, the Prime Minister may determine that Cabinet consideration is not required and authorise the appointment.17

2.5 DSS, as the portfolio department responsible for the NDIS, manages the process for appointments to the Board.

2.6 Between 1 July 2021 and 30 June 2024, 15 people were appointed to serve on the Board. Following audit fieldwork, as at 1 January 2025, a further two people were appointed, bringing the total to 17, including 18 re-appointments and 11 new appointments.18 All members were appointed by the minister, by written instrument and on a part-time basis in compliance with subsection 127(1) of the NDIS Act. All appointment terms were for three years or less as required by section 128 of the NDIS Act.

2.7 The ANAO examined five new appointments and assessed their compliance with additional legislative requirements. All five appointments:

- were supported by evidence that the minister was satisfied the person had the characteristics required by subsection 127(2) of the NDIS Act, such as lived experience with disability, and advice from DSS that the proposed candidates were not ineligible for appointment based on other positions held, under subsection 127(5) of the NDIS Act; and

- were consulted with, and supported by, the state and territory disability ministers and the Commonwealth, in compliance with subsections 127(3)–(4D) of the NDIS Act.

2.8 All five of the above appointments were agreed to by the Australian Government as required by the Cabinet Handbook.

2.9 Subsection 127(6) of the NDIS Act requires the minister to ensure that the Board collectively holds an appropriate balance of the characteristics set out in paragraph 2.3. DSS advised the minister on the balance of skills and attributes of current Board members.

2.10 Remuneration for members of the Board is set in determinations under the Remuneration Tribunal Act 1973. Controls for key management personnel remuneration were found to be effective during 2021–22. In 2022–23 there were instances of inaccurate payments made to one Board member. In 2023–24 there were further instances of inaccurate payments made to five Board members. The incorrect payments related to NDIA delays and errors in updating payroll arrangements following changes in Board committee membership. The NDIA advised the ANAO in June and December 2024 that it was rectifying the errors, had since updated relevant procedures, and that overpaid amounts were being repaid and underpayments resolved.

Acting arrangements and resignations

2.11 Where a board position becomes vacant, or where a member will be absent, or unable to perform their duties for a time, the NDIS Act allows the minister to appoint an acting Board Chair or member by written instrument.

2.12 Section 129 of the NDIS Act prescribes how a person may be appointed, including that:

- an acting Chair may be appointed, for a period of not more than 12 months;

- an acting Board member may be appointed for a period up to 150 days during a vacancy, after consultation with the states and territories;

- an acting Board member may be appointed during any periods where a member is absent from, or unable to perform, their duties; and

- the person meets the same eligibility requirements as substantive Board members in that they possess certain characteristics and do not hold certain positions.

2.13 Between 1 July 2021 and 30 June 2024, the minister made three acting appointments, including one acting member and two acting chair appointments. All of these appointments complied with section 129 of the NDIS Act. The acting appointments all related to existing Board members.

2.14 Between 1 July 2021 and 30 June 2024, two Board members resigned their appointment by giving the minister a written resignation, in accordance with section 133 of the NDIS Act.

2.15 Under section 134 of the NDIS Act, the minister may terminate the appointment of a Board member for various reasons including misbehaviour, bankruptcy, unsatisfactory performance, or absence (except for a leave of absence) from more than three consecutive Board meetings. Between 1 July 2021 and 30 June 2024, the minister did not terminate any Board member appointments.

Board positions

Department of Social Services advice

2.16 Between 1 January 2023 and 30 June 2024, DSS monitored and provided advice to the minister on current and upcoming Board member departures.

- DSS complied with Standing Senate Order 15 reporting.19

- Available Board positions were included in talking points for regular meetings between the DSS Secretary and the minister.

- DSS advised the minister of available Board positions on seven occasions, providing more than six months’ advance notice of upcoming term expiry dates. On four occasions, advice also related to a skills matrix of the current Board members.20

- DSS did not propose potential candidates to fill available Board positions.

2.17 As discussed at paragraph 2.2, the NDIS Act does not specify a minimum number of Board members. Table 2.1 sets out the number of Board members from 1 July 2021 to 1 January 2025.

Table 2.1: Number of Board members from 1 July 2021 to 1 January 2025

|

Dates |

Number of Board members |

|

1 July 2021 to 31 December 2021 |

8 |

|

1 January 2022 to 17 October 2022 |

9 |

|

18 October 2022 to 31 December 2022 |

12 |

|

1 January 2023 to 31 March 2023 |

11 |

|

1 April 2023 to 30 June 2023 |

12 |

|

1 July 2023 to 23 November 2023 |

10 |

|

24 November 2023 to 27 August 2024 |

11 |

|

28 August 2024 to 31 December 2024 |

12 |

|

1 January 2025 |

11 |

Source: ANAO analysis of DSS and NDIA documentation.

2.18 Since 1 July 2021, five appointments were made within a week and four within a day of existing appointments ending and nine reappointments of existing members occurred before the end of an appointment term.

2.19 In the 18 months prior to 30 June 2024, DSS conducted assessments of Board composition using skills matrices to advise the minister on Board positions soon to become available and to support the minister in ensuring that the Board collectively held an appropriate balance of characteristics, as required by subsection 127(6) of the NDIS Act.

2.20 The skills matrices outlined the requirements of Board member appointments set out at subsection 127(2) of the NDIS Act as well as appointment information including term expiry dates and vacancies, gender, location, identification with Aboriginal and Torres Strait Islander peoples, and leadership experience. DSS advised the ANAO that, in drafting the matrices, it uses publicly sourced information as well as information provided by Board members as part of their appointment process, including information contained in curricula vitae and Private Interests Declarations.

National Disability Insurance Agency advice

2.21 The Board’s Charters21 for 2021–22 and 2022–23 stated that:

Six months prior to a director’s term of appointment ending the Board will undertake a board skills and competencies analysis and provide advice to the Commonwealth Minister on the mix of skills and competencies of the Board.

2.22 Between July 2021 and June 2024, the Board conducted skills and competencies reviews using skills matrices in November 2022 and March 2024. In May 2024, the Board Chair advised the minister of the Board’s skills and ‘need for financial accounting and management experience among the Board membership’. The Board Chair’s May 2024 advice to the minister was issued more than six months ahead of three members’ terms expiring in December 2024. The Board did not give advice to the minister six months prior to other members’ terms expiring in December 2022, March 2023 and June 2023, as required by the Board’s charter.

Board meetings

2.23 Section 136 of the NDIS Act provides that the Board should hold the meetings that are necessary for the efficient performance of its functions and the Chair must convene at least four meetings each calendar year. Between 1 July 2021 and 30 June 2024, the minimum annual meeting frequency requirements were met: the Board held 30 scheduled meetings, 16 out of session meetings, and made 10 decisions without meetings. The ANAO examined 16 of the 30 scheduled Board meetings to assess whether they were properly constituted in accordance with NDIS Act requirements.

- Approved minutes were recorded for all 16 meetings in accordance with section 141 of the NDIS Act.

- Minutes recorded Board approval of the previous meeting minutes, which included decisions made, actions to be taken, and the Board’s deliberations or considerations of agenda items.

- The Chair presided at all 16 meetings in accordance with section 137 of the NDIS Act.

- Quorum requirements (a majority of the Board members) of section 138 of the NDIS Act were met.

2.24 For 15 of the 16 meetings, all agenda items presented to the Board by NDIA management were accompanied by supporting papers.22 For the one significant item that was presented to the Board verbally without a paper, the Board requested that management present a paper in future, noting the quantity of information being presented and the accessibility needs of the Board.

2.25 As required at section 139 of the NDIS Act, Board resolutions are to be passed with a majority of the votes of the members present and voting. The voting requirements were met for the two meetings the ANAO observed in person.

2.26 Agenda items across the Board’s eight scheduled meetings during 2023–24 related to essential board functions, met broader administrative requirements or provided environmental or progress updates. The Board has a structured agenda with: standing items (declaration of material interests, CEO Report, review of prior minutes, matters arising, updates from the Independent Advisory Council (IAC)); cyclical items (such as quarterly risk and actuarial updates, annual reporting); and a variety of matters reported as needed relating to NDIA operations and board functions.

2.27 Agenda items often covered multiple board functions or sought multiple outcomes, for example, to seek Board discussion as well as a decision. Across the eight meetings reviewed, the Board considered 156 agenda items, including 50 that sought a decision, 69 that sought discussion, and 40 that asked the Board to note an action or advice.

2.28 Of the 50 agenda items in 2023–24 that sought a Board decision:

- 21 items involved consideration of aspects of the NDIA’s strategic direction, for example its approach to remote service delivery, consideration of strategic risks, or IT reform;

- 17 items related to NDIA performance, for example, considering NDIS projections, approving release of the Quarterly Report to Disability Ministers, or management responses to service delivery performance topics in ‘matters arising’ reports;

- 19 items related to risk management, or involved consideration of risk, for example, the quarterly Chief Risk Officer Report, the NDIS Annual Financial Sustainability Report (AFSR), or the Board’s Risk Management Declaration (see paragraph 3.44);

- 33 items directly related to compliance or had a compliance element, for example, approving minutes of prior meetings, the Board’s charter and annual review, or an update to Accountable Authority Instructions;

- 15 items related to resources, for example, procurement, the AFSR or NDIS projections; and

- eight items related to accountability, for example, financial and performance statements for the annual report, the AFSR and the Quarterly Report to Disability Ministers.

2.29 A written CEO Report was provided to the Board at all eight scheduled meetings in 2023–24 with updates on: significant management resource decisions or actions (such as organisation structure, senior staffing changes, procurement update); performance matters (such as service delivery issues and reform implementation progress); risks (such as updates on actions to address fraud and serious non-compliance); and follow up to matters queried by Board members in prior meetings. The CEO Report also provided the Board with key strategic information on the priorities of the minister, Ministerial Council direction, Budget process outcomes, as well as providing broader updates such as on recent parliamentary activity.

2.30 Australian Institute of Company Directors (AICD) guidance is that the purpose of ‘in camera’ meetings is for members to meet confidentially without management. Of the 16 Board meetings from July 2021 to June 2024 that the ANAO reviewed, minutes record that the Board held an ‘in camera’ session with Board members and the CEO on all occasions. A Board member-only ‘in camera’ session was held on five occasions.23 Seven ‘in camera’ sessions were held with non-Board members including NDIA senior management (other than the CEO), the minister, the NDIS Quality and Safeguards Commissioner, the DSS Secretary and co-chairs of the NDIS Independent Review Panel. Agendas scheduled between 30 and 90 minutes for ‘in camera’ sessions. Meeting minutes did not state the duration of these sessions.

2.31 The Board does not have a policy on the use of, or the records for, ‘in camera’ sessions. AICD guidance is that minutes of ‘in camera’ meetings are not mandatory, and that it is advisable to record formal actions that are agreed in such sessions. Of the 16 meetings examined, three sets of minutes record details of the discussion of ‘in camera’ sessions including CEO appointment, remuneration and recruitment, Scheme Actuary appointment, and issues raised by the Board’s committees. Nine sets of minutes recorded action items or resolutions passed during ‘in camera’ sessions.

2.32 Minutes record that the CEO Report was presented at ‘in camera’ sessions at all of the 16 meetings examined, although some reports included matters also in separate Board papers and discussions were not recorded. The CEO report was in meeting papers and included matters such as fraud, provider and participant risks, NDIA and NDIS expenditure, and NDIS Reform. These matters related to the Board’s duties as an accountable authority under the PGPA Act (discussed further at 3.63). The NDIA advised the ANAO that the Board has a practice of advising the secretariat of any actions or resolutions following ‘in camera’ sessions. The ANAO was not present for ‘in camera’ sessions during field work to assess the communications to the secretariat. The Board had a practice of recording in its minutes a summary of other agenda items discussed.

Opportunity for improvement

2.33 The Board could consider developing a policy on its use and records of ‘in camera’ sessions to support the balance between confidentiality and documentation of the Board’s consideration of matters relating to its duties as an accountable authority under the PGPA Act (see Box 1, below paragraph 1.3).

Out of session meetings

2.34 The ANAO examined six of the 16 out of session (OOS) meetings to assess whether they were properly constituted.

- The Chair presided at, and quorum requirements were met for, all six OOS meetings.

- All six OOS meetings were recorded in approved minutes, with the minutes recording decisions and actions to be taken. Minutes recorded Board agreement to all resolutions. On one occasion a Board member did not vote in favour of a resolution.

- For all OOS meetings, minutes recorded the Board’s deliberations or considerations of the items presented to it.

- Board papers were prepared for all six OOS meetings and there were supporting papers for all agenda items.

2.35 In September 2023, for one of the six OOS meetings, a Board member had not been provided meeting papers due to a conflict of interest. The same Board member was excluded from two decisions without meetings on the basis of the same conflict. In 2023–24 the Board considered OOS papers relating to annual reporting, a fraud update, Quarterly Report to Disability Ministers, Board nomination of the reviewing actuary, advice on managing conflicts of interest, indemnity for the CEO in relation to a participant matter and an update on indicative results against corporate plan performance measures.

Decisions without meetings

2.36 The charters that the Board operated under between 1 July 2021 and 30 June 2024 outlined a procedure for making decisions without meetings:

Members are to indicate agreement to a decision by providing written advice to the Board Chair and Board Secretariat of their agreement to the proposed decision. This can be done by electronic signature or by email.

2.37 Between 1 July 2021 and 30 June 2024, the Board made 10 decisions without meetings. The ANAO examined five of the 10 decisions to assess whether the Board had followed its procedure for handling decisions without meetings and complied with notice and voting requirements of section 142 of the NDIS Act. For all five decisions without meetings:

- there was a record that the majority of members entitled to vote on proposed decisions indicated agreement;

- Board members indicated agreement by providing advice to the Chair and Board secretariat via email or electronic signature; and

- there was a record of the decision.

2.38 Paragraph 142(1)(c) of the NDIS Act requires all Board members be informed of the proposed decision or reasonable efforts made to inform them. On one of the five occasions, there was no evidence that one Board member had been informed of the proposed decision, or that reasonable efforts had been made to inform that member. On a further two occasions, one member was not notified of a proposed decision to be made without a meeting due to a conflict of interest.

Record keeping

2.39 Between 1 July 2023 and 30 June 2024, papers and approved minutes for Board meetings and decisions without meetings were not saved in the approved system required by NDIA policy and were instead saved in SharePoint.24 The NDIA advised the ANAO in May 2025 that it is in the process of transitioning to a new record management system.

Conflicts of interest

Policies and procedures

2.40 The Board’s current conflict of interest policy, set out in its 2023–24 Board Charter, was largely consistent with the PGPA Act, PGPA Rule and NDIS Act.

2.41 Table 2.2 sets out the ANAO’s assessment of the extent to which the Board’s conflict of interest policy, contained in charters the Board operated under from July 2021 to June 2024, was consistent with the legislative requirements.

Table 2.2: ANAO assessment of the Board’s conflict of interest policy

|

Legislative requirement |

2023–24 Charter |

2022–23 Charter |

2021–22 Charter |

|

PGPA Act — section 29 Duty to disclose interests |

◆ |

◆ |

◆ |

|

PGPA Rule — section 12 When duty to disclose does not apply |

◆ |

■ |

■ |

|

PGPA Rule — section 14 How and when to disclose interests |

◆ |

▲ |

▲ |

|

PGPA Rule — section 15 Consequences of disclosing interest |

◆ |

▲ |

▲ |

|

NDIS Act — section 132a Outside employment |

■b |

◆ |

◆ |

Key: ◆ Fully addresses requirements ▲ Partly addresses requirements ■ Does not address requirements.

Note a: Section 132 of the NDIS Act prohibits Board members from paid employment that, in the minister’s opinion, conflicts or may conflict with the proper performance of the member’s duties.

Note b: In June 2024 the Board endorsed an interim Board Charter that addressed section 132 of the NDIS Act. The interim charter was not in effect in 2023–24.

Source: ANAO analysis of the Board’s charters.

2.42 Auditor-General Report No. 43 2022–23 Effectiveness of the National Disability Insurance Agency’s Management of Assistance with Daily Life Supports25, tabled in June 2023, concluded that Board member conflicts of interest were largely effectively managed, noting:

The ANAO observed that members who declared personal interests as NDIS participants (or family members of participants) and/or members of disability organisations receive all Board papers and are present for discussion of all agenda items. The Board has not documented how it manages conflicts arising from such interests.

2.43 The NDIA agreed to recommendation no.6(a) in that report: ‘The National Disability Insurance Agency (NDIA) improve its management of conflicts of interest by implementing: (a) procedures for how the Board manages conflicts arising from declared interests of members’.26

2.44 The Board has made changes to its policies and procedures for managing conflicts of interest.

- In July 2023, October 2023 and February 2024, the Board obtained legal advice relating to declarations of material interest, conflicts of interest, gifts, benefits, hospitality, invitations and outside employment. The Board incorporated guidance on material personal interests into new member induction information.

- The Board adopted a new declaration template prompting identification of the nature and extent of material personal interests, how these relate to NDIA affairs, and how these could give rise to real or apparent conflicts of interest and impact the performance of Board member duties. In February 2024, the Board directed the secretariat to schedule a conflict of interest refresher at the start of each year.

- In May 2024, the Board directed the secretariat to seek updated declarations from members three weeks prior to Board meetings.

- In June 2024, the Board endorsed an interim Board Charter that addressed section 132 of the NDIS Act, established a mechanism for managing member disagreement on conflict-of-interest matters, and gave direction on managing conflicts in meetings. In September 2024, the NDIA advised the ANAO that the interim charter was undergoing further development and was not yet in operation.

- In July 2024, the secretariat finalised an internal procedure for supporting Board members to identify, record, manage and mitigate any real or perceived conflicts of interest.

2.45 The changes to the Board’s policies and procedures do not include how the Board manages declared real or apparent conflicts of interest arising from members declaring personal interests as NDIS participants (or family members of participants) or members of disability organisations in accordance with the agreed ANAO recommendation.

Board management of conflicts of interest

2.46 The Board maintains a ‘Register of Board Members Interests’ (the Register) to record members’ declared material interests and conflicts of interest. Board charters required members to disclose material personal interests upon commencement, as changes occur, and annually after commencement. Between July 2021 and June 2024 the Register was updated on 22 occasions (and each update may have consisted of multiple changes to member interests).

2.47 Between July 2021 and June 2024, seven real or apparent conflicts of interest were declared by Board members and recorded in the Register. During Board meetings, the standing agenda item for discussions of declared interests is allocated for Board members to collectively consider what, if any, actions are required to manage declared interests. An agreed management strategy was documented for one of the seven declared conflicts. There were 22 other personal interests recorded in the register that may have represented, and were not declared as, real or apparent conflicts. These included declared interests as NDIS participants, family members of participants, members of disability organisations and employment with NDIS providers or consultancies providing services to the NDIA.

2.48 In considering how to manage any Board members’ declared conflicts, the Board Chair may write to the minister if the Board decides a member’s paid employment potentially conflicts with their member duties. Between July 2021 and June 2024, the NDIA advised there was no correspondence between the Board and the minister, under section 132 of the NDIS Act, regarding matters of paid employment that may conflict with Board member duties.

2.49 Of the 16 Board meetings the ANAO examined between July 2021 and June 2024, meeting minutes showed that declarations of material interest were called for at each meeting, and minutes recorded declarations that were made. In half of those meetings, minutes showed this occurred before the ‘in camera’ sessions. At four meetings, Board members recused themselves from discussions and voting that related to disclosed interests.

2.50 At both meetings observed in person by the ANAO, a member recused themself from discussions and voting on an agenda item that related to their disclosed interests. The minutes for these meetings recorded that the member was not present and the minutes did not state this was due to a conflict of interest. As a result, there was no record of how the conflict of interest was managed in these meetings.

2.51 On four occasions, one member recused themself from discussions and voting on a certain matter due to a potential conflict of interest arising from a past employment relationship. The potential conflict was registered in previous versions of the Board’s Register and was removed in January 2024. The member subsequently recused themself from related agenda items in February and June 2024. The Register did not identify the basis for the member’s continued recusal.

2.52 Of the six OOS meetings the ANAO examined between July 2021 and June 2024, the minutes of five meetings did not record whether declarations of material interest were called for or whether Board members recused themselves from discussions and voting that related to disclosed interests. For the five decisions without meetings the ANAO examined between July 2021 and June 2024, there was no record of the Board having considered conflicts of interest.

2.53 In September 2024, the NDIA advised the ANAO that a Board member was not provided meeting papers for one OOS meeting and had been excluded from two decisions without meetings due to an employment-related conflict of interest. The NDIA advised the ANAO that these Board decisions related to the NDIS Annual Financial Sustainability Report and the corporate plan which presented a material conflict of interest for the member.

2.54 The relevant interest had not been documented as a conflict, there was no documented strategy for managing that conflict, and there was no evidence of Board Chair or member agreement to exclude the member on the basis of the conflict on these occasions. There was no correspondence between the Board and the minister under section 132 of the NDIS Act addressing the member’s employment that gave rise to the potential conflict of interest.

2.55 The Board’s 2021–22 and 2022–23 charters stated that members would not receive Board papers for agenda items where a conflict of interest exists. The Board’s 2023–24 charter is silent as to Board member access to meeting papers that relate to a declared conflict of interest.27 The secretariat restricts Board member access to papers in the online portal28 where they relate to a declared conflict of interest. In August 2024 the NDIA advised the ANAO this practice started in May 2023. The decision to restrict access is made by the secretariat and not documented in any management strategies approved by the Chair.

Recommendation no.1

2.56 The Board of the National Disability Insurance Agency document how it manages conflicts of interest, including those arising from members who declared personal interests as NDIS participants, family members of participants, members of disability organisations, and/or employment with NDIS providers or consultancies providing services to the NDIA.

National Disability Insurance Agency response: Agreed.

2.57 As detailed in the report, the NDIA Board is conscious of the importance of appropriate Conflict of Interest procedures and processes and agrees to fully implement this recommendation by updating the Board’s conflict of interest policy to provide guidance to Board members who are also participants of the NDIS, noting that individual mitigations strategies will vary depending on a Board member’s circumstances.

Has the Board structured its own operations in a manner that supports effective governance?

The Board has established committees to support the governance of the NDIA. The charters for committees could be improved to set out voting requirements, the extent of delegated authority, and specify requirements for making decisions without meetings. The ARC charter could be improved by specifying who cannot be a member of the committee. The Board has not documented which NDIA policies require its approval.

The role of the committees is to provide advice to the Board on: the financial sustainability of the NDIS (Sustainability Committee); and the objectives, strategies, and policies to be followed by the NDIA, with a dedicated focus on participant outcomes (Strategic Direction and Participant Outcomes Committee). In March 2024, the Audit Committee and Risk Committee were merged into the Audit and Risk Committee (ARC) — its role is to review and advise on the appropriateness of the NDIA’s financial and performance reporting, systems of risk oversight and management, and systems of internal control. Committee membership was largely consistent with charter requirements.

Each committee receives relevant reporting according to its function and gave verbal updates and meeting minutes to the Board. The committees have not always provided written advice on critical and high-risk areas that require further Board consideration and direction, and it is unclear if the committees’ verbal updates and meeting minutes provided assurance and assisted with informing decision-making and the efficient running of the Board.

Board Charter

2.58 AICD guidance states that:

A board charter is defined as a written policy document that clearly sets out the respective roles, responsibilities and authorities of the board of directors (both individually and collectively) and management in setting the direction, the management and the control of the organisation.29

2.59 The Board had a charter in place between July 2021 and June 2024; the Board reviewed and approved updated versions of its charters in 2021–22, 2022–23 and 2023–24. The charters identified the legislation under which the NDIA was established and that the Board has responsibilities under the NDIS Act and the PGPA Act.

2.60 The Board’s charters were consistent with the key governance elements of the NDIS Act30 and set out requirements for the Board’s composition, operation (including meeting requirements and record keeping) and functions. The charters set out: the distinct roles of the Board and the CEO under the NDIS Act; the Board’s ability to direct the CEO on the performance of their duties; and the Board’s ability to instruct NDIA officials in relation to finance law. The 2021–22 and 2022–23 Board charters stated that ‘the Board will establish clear delegations for management, including indicating which powers it reserves to itself. Such delegations will be in written form.’ This was not in the 2023–24 charter.

2.61 The 2023–24 Board Charter required the CEO and relevant members of the NDIA’s Strategic Leadership Team31 (SLT) to attend all Board meetings (except where a conflict of interest arose). Prior to this, SLT members attended on an invitation-only basis.

2.62 The Board did not record in charters, or elsewhere, its expectations for NDIA management on the quality or content of meeting papers or protocols. At the end of scheduled Board meetings, a nominated Board member provides feedback on the quality and timeliness of papers as part of a standing agenda item.

2.63 The charters set out expectations for the secretariat including recording meeting minutes, developing agendas, distributing agendas, papers and minutes, and updating the Register of Board Member Interests. The 2023–24 Board Charter required the secretariat to ensure meeting papers were in a format accessible to those with a disability and ‘maintain a work plan for the Board and its committees.’

2.64 A board workplan should set out a board’s forward schedule and priorities for the coming year for member planning purposes as well as providing assurance that board responsibilities will be met in the coming year.32 Between July 2021 and June 2024, the secretariat maintained various workplans that scheduled Board and committee meeting dates, agenda items and periodic reports. The workplans did not map Board priorities or legislative requirements to agendas or meetings and were not approved by the Board. In September 2024, the Board agreed to a forward workplan for 2025.

Committee charters

2.65 Between July 2021 and June 2024, the Board had seven committees, including the:

- People and Remuneration committee — assisted the Board ‘in managing people and remuneration matters’;

- Information and Communications Technology and Digital (ICTD) committee — assisted the Board ‘in the management and oversight of the Agency’s ICT solution, including providing input to the Board on the design, development, delivery and performance of the ICT strategy and systems’;

- Audit committee — assisted the Board ‘in the management and oversight of the quality and integrity of the accounting, auditing and financial reporting of the NDIA’;

- Risk committee — assisted the Board ‘in the management and oversight of the NDIA’s approach to risk management’;

- Sustainability committee — ‘provides advice on assessing, monitoring, reporting on and managing the financial sustainability of the Scheme’;

- Strategic Direction and Participant Outcomes (SDPO) committee — assisted the Board ‘to determine the objectives, strategies and policies to be followed by the Agency, with a dedicated focus on participant outcomes’; and

- Audit and Risk committee (ARC) — provided ‘independent advice and assurance to the Board, as the Agency’s accountable authority, in accordance with the [PGPA Act, PGPA Rule, NDIS Act], and National Disability Insurance Scheme—Risk Management Rules 2013’.

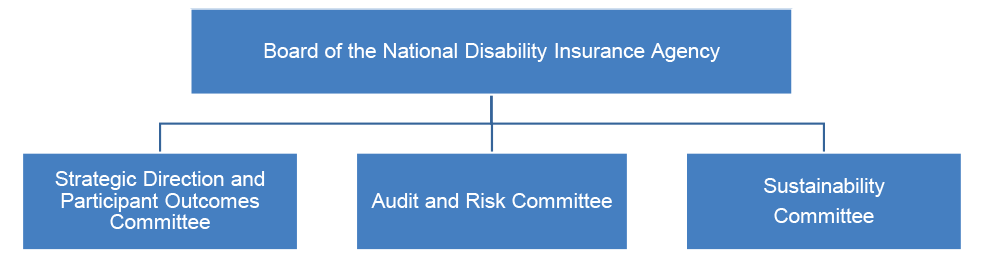

2.66 In March 2023, the Board ceased the People and Remuneration Committee, created the SDPO Committee and incorporated the ICTD Committee into the Risk Committee. In March 2024, the Board consolidated its separate Audit and Risk committees into a single Audit and Risk Committee (ARC). The Board’s committee structure is set out in Figure 2.1.

Figure 2.1: NDIA Board committee structure, as at 30 June 2024

Source: ANAO analysis of the Board committee structure.

2.67 Between July 2021 and June 2024 each of the Board’s committees listed at paragraph 2.65 had charters in place. Committee charters included a requirement to be reviewed annually. The Board reviewed all committee charters each financial year, with the exception in 2022–23 of the People and Remuneration and ICTD committees, which ceased in March 2023.

2.68 Committee charters set out member composition requirements, including a maximum number of members, and membership was largely consistent with these requirements. On three occasions committees exceeded the membership limit.

- In January 2023, the People and Remuneration and ICTD committees exceeded the number of members allowed by one member each. Only the ICTD committee met in 2023 before ceasing and while membership was oversubscribed.33

- In January 2023, the Sustainability Committee exceeded the number of members allowed under its charter by one member. Between January 2023 and July 2023, the Sustainability Committee met twice and all its members were remunerated for this role. In July 2023, the Board updated the Sustainability Committee’s charter to increase the membership by one Board member.

2.69 Subsection 17(3) of the PGPA Rule requires that audit committees consist of at least three persons who have appropriate qualifications, knowledge, skills or experience to assist the committee to perform its functions. Minutes and papers for Board appointments to the Audit Committee in 2021–22 and 2022–23 did not record the Board’s consideration of whether members had these attributes. Committee charters largely set out other key elements of committee operation including whether any authority had been delegated by the board. The charters did not include all relevant content.

- The 2023–24 charters for the Audit, Risk, Sustainability, SDPO committees and ARC were silent on voting requirements.

- The 2023–24 ARC and former Audit Committee charters did not establish a method for making decisions without meetings. Decisions without meetings were made.

- The charters did not set expectations around the content or scope of committee reporting to the Board.

2.70 Section 17 of the PGPA Rule prescribes minimum requirements for audit committees of Commonwealth entities to help ensure the committee provides independent advice and assurance to its entity’s accountable authority. The Board’s Audit Committee and ARC charters were largely consistent with section 17 of the PGPA Rule, except they did not fully reflect the requirements of subsections 17(4A) and 17(5) relating to membership exclusions.

2.71 The Department of Finance’s ‘A guide for corporate Commonwealth entities on the role of audit committees’ also provides guidance on audit committee charters.34 The Audit committee and ARC charters largely incorporated this guidance.

Opportunity for improvement

2.72 There is an opportunity for the Board to improve committee charters so that:

- all charters set out voting requirements;

- all charters specify the extent to which authority has been delegated from the Board;

- where committees intend to make decisions without meetings, the charter includes a method for doing so; and

- the ARC charter reflects the minimum requirements of section 17 of the PGPA Rule.

Board oversight of key policies and expectations of management

2.73 The NDIA advised the ANAO in June 2024 that:

The Board oversights Agency-level policies that link directly to its responsibilities … In addition the Board approves policies that it has recommended the Agency to develop (such as the Recovery Framework or where a policy responds to IAC advice (such as the Participant Safeguarding Policy).

2.74 Between July 2021 and December 2024, the Board reviewed:

- Psychosocial Disability Recovery Oriented Framework — approved September 2021;

- Modern Slavery Statement — approved November 2021, October 2022, November 2023 and December 2024;

- Risk Management Strategy — endorsed June 2022, November 2023, and December 2024;

- Accountable Authority Instructions and Financial Authorisations — new versions approved June 2022, July 2023 and October 2024;

- Supported Decision Making Policy — approved January 2023;

- Participant Safeguarding Policy — approved March 2023;

- Fraud and Corruption Control Plan — approved September 202335;

- NDIS Participant Employment Strategy Refresh 2024–2026 — endorsed November 2023;

- NDIA Innovate Reconciliation Action Plan — endorsed September 2024;

- the NDIA’s strategic risk settings, including its Risk Appetite Statement — approved May 2022, November 2023, and September 2024; and

- Agency Disability Action Plan — endorsed October 2024.

2.75 Board approval of key policies and frameworks, such as those relating to financial delegations, risk management, work health and safety, and fraud, can assist board members to gain assurance that they are effectively discharging their duties as the accountable authority by setting the framework for compliance with relevant legislation. The Board did not document, in its charters or elsewhere, expectations for its oversight of NDIA policies, including identifying the key policies that require Board approval.

Opportunity for improvement

2.76 The Board could specify in its charter the key entity policies, or types of policies, that require Board review and approval.

Board member induction

2.77 The NDIA has a draft Board member induction policy.

The Board Secretariat is responsible for supporting the Chairman and CEO to co-ordinate the induction of newly appointed board members. The Chairman ensures that new board members receive a comprehensive, structured and tailored induction on joining the board.

2.78 Between 1 July 2021 and 30 June 2024, 10 new members were appointed to the Board. The ANAO reviewed the inductions of two members who joined in 2023 — these were partly consistent with the draft induction policy.

- Both Board members met with the Board Chair prior to their first Board meeting and received an induction pack containing a Board operational overview, Board and committee charters, and key NDIA policies.

- Neither Board member received other background information on the NDIA including organisation charts, relevant legislation or recent corporate, annual or performance reports.

- Neither Board member was allocated a mentor or provided briefings from senior NDIA executives at the commencement of their appointment.36

Opportunity for improvement

2.79 There is opportunity for the Board to strengthen its process for inducting new Board members with:

- a Board-approved induction policy, including clearly identifying the operational information to be included in induction packs; and

- expectations around the briefings provided by NDIA officials.

Board performance assessment

2.80 The AICD states:

A board’s effectiveness can only be gauged if it regularly evaluates its performance. A good evaluation provides objective performance measures, indicates performance gaps, and agrees strategies for improving board effectiveness.

2.81 The Board’s 2021–22 and 2022–23 charters set out performance evaluation requirements: ‘The Board will conduct a board review on an annual basis. This review will be conducted by an external party at least once every three years.’ Committee charters in 2021–22 and 2022–23 also included committee performance evaluation requirements. The 2023–24 Board and committee charters did not include performance evaluation requirements.

2.82 The NDIA’s Annual Reports for 2021–22 and 2022–23 both reported Board performance as having been reviewed annually in accordance with the charter.

2.83 Between July 2021 and June 2023, the Board discussed performance on two occasions.

- The Board’s November 2022 meeting agenda included a relevant item, but no accompanying paper. Minutes referred to the Board’s discussion of the need to improve the accessibility of Board papers for members with disabilities. The minutes do not refer to an assessment of skills, competencies or performance.

- In February 2023, the Board discussed the effectiveness and purpose of its committees and agreed to a committee restructure.

2.84 Board and committee charters for 2023–24 did not include performance evaluation requirements and the 2023–24 Annual Report did not report on the Board’s performance. In February 2024, the Board resolved to ‘undertake a substantive review of committee structures and performance in 2025.’ The NDIA contracted a service provider37 in October 2024 to assess and evaluate the Board’s and its committees’ performance.

Sustainability and Strategic Direction and Participant Outcomes committees

2.85 As discussed at paragraph 2.65, the Board established committees to help it fulfil its duties. As at September 2024, the Board was supported by three committees, its: Sustainability Committee; Strategic Direction and Participant Outcomes (SDPO) committee; and ARC (separately discussed from paragraph 2.95).

2.86 The Board’s Sustainability and SDPO committees’ charters’ outline their roles.