Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Farm Management Deposits Scheme

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the Australian Taxation Office and the Department of Agriculture have effectively administered the Farm Management Deposits (FMD) Scheme.

Summary and recommendations

Background

1. The Farm Management Deposits (FMD) Scheme is designed to assist primary producers deal more effectively with fluctuations in their cash flows. The policy intent of the Scheme, which was established in 1999, is to encourage increased financial self-reliance among primary producers by allowing them to set aside cash reserves earned during high-income years, for use in low-income years.

2. Under the Scheme, primary producers are able to defer — and potentially reduce — their income tax liability for eligible amounts deposited into specific FMD accounts at authorised deposit-taking institutions. Deposits that qualify as ‘deductible’ reduce a primary producer’s taxable primary production income in the year they are made, while amounts withdrawn from FMDs are to be included in assessable income in the year of withdrawal.

3. The balances held in FMD accounts have increased steadily over the past decade and more sharply in recent years. There is a distinct pattern of deposits at the end of each financial year followed by a drawing down of deposits at the beginning of the following financial year. In June 2016, some $5 billion in FMDs were held, rising to over $6.6 billion in June 2018. There are around 45,000 FMD holders participating in the Scheme.

4. On 1 July 2016, three policy changes were introduced to the FMD Scheme as part of the Government’s Agricultural Competitiveness White Paper:

- the deposit limit for FMDs, for each FMD holder, was increased from $400,000 to $800,000;

- primary producers experiencing severe drought conditions can now access FMDs within 12 months of deposit without losing their claimed tax concession; and

- FMDs can now be used to offset a loan or other debt relating to the holder’s primary production business.

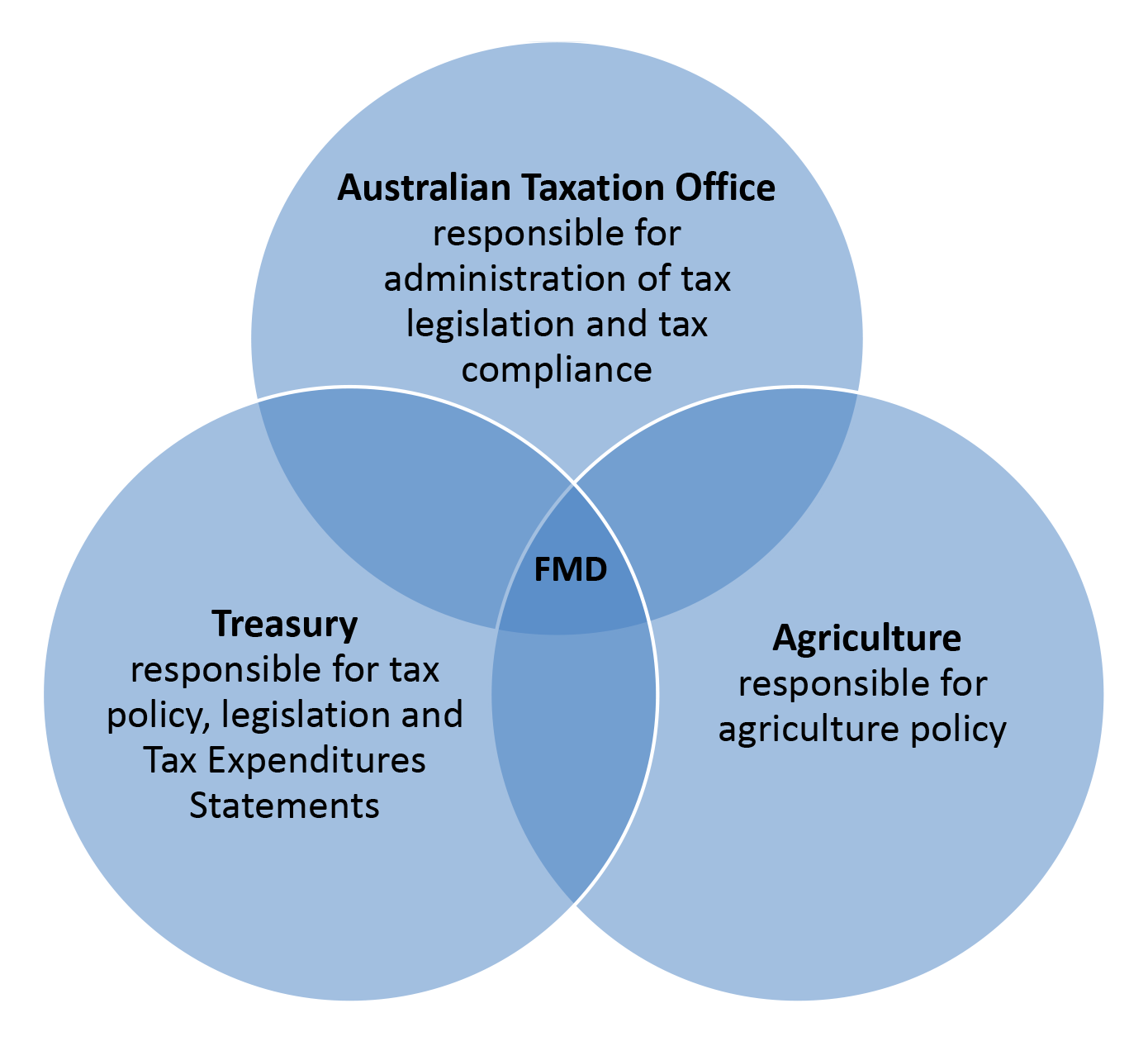

5. Three entities are responsible for the FMD Scheme: the Department of Agriculture (Agriculture); the Australian Taxation Office (ATO); and the Department of the Treasury (Treasury). Agriculture is the policy owner of the FMD Scheme; the ATO is responsible for administering the tax legislation; and Treasury is responsible for tax policy and for preparing tax expenditure estimates.1

Rationale for undertaking the audit

6. The audit was undertaken to provide assurance on whether a key measure delivering tax relief for primary producers is being administered effectively. The audit was also undertaken in light of the steep increase in the estimate of revenue forgone for the FMD Scheme in 2017–18 and the broader scope of the Scheme following the 2016 policy changes.

Audit objective and criteria

7. The objective of the audit was to assess whether the ATO and Agriculture have effectively administered the FMD Scheme.

8. In assessing this objective, the ANAO adopted the following two high-level criteria:

- advice on the policy changes to the FMD Scheme in 2016 was provided on a sound basis to help achieve the Scheme’s objectives; and

- effective risk identification and compliance arrangements are in place to support the integrity of the FMD Scheme.

Conclusion

9. The administration of the FMD Scheme has not been fully effective.

10. Largely sound advice was provided to Government on the limited extent to which the proposed changes to the FMD Scheme were expected to help achieve the Scheme’s objectives. Agriculture proposes to assess the impact of the 2016 policy changes through a broader evaluation of the Scheme within the next two years. Current data indicates that take-up rates of the three policy measures have been low, especially for the loan offset measure.

11. Risk identification and compliance arrangements to support the integrity of the FMD Scheme have not been fully effective. The ATO’s compliance arrangements reflect its assessment that risks to revenue are relatively low, and its approach of managing risks at the sector level (for example, small business risks). However, the compliance arrangements and risk assessment processes have not fully captured key elements of the Scheme’s design. As the policy owner of the Scheme, Agriculture should work with the ATO to be satisfied that risk assessment and compliance processes are appropriate.

Supporting findings

Policy changes introduced in 2016

12. Largely sound advice and evidence was provided to Government on the assessed costs, benefits and implementation risks associated with the three 2016 policy changes to the FMD Scheme. None of the proposals were assessed to provide a strong case for change. The rationale for increasing the deposit limit to $800,000 could have been better explained, and consultation undertaken earlier on the loan offset measure.

13. Appropriate available data was used by Treasury to prepare the Budget costings for the 2016 policy changes and the tax expenditure estimates for the FMD Scheme.

14. Mechanisms of variable reliability have been established to monitor the uptake of the 2016 policy changes and to collect qualitative data through farm surveys. Agriculture proposes to undertake an evaluation of the Scheme within the next two years. Current data indicates that take-up rates have been low, especially for the loan offset measure — suggesting modest impacts to date for the changes.

Risk identification and compliance arrangements

15. Compliance and other risks to the operation of the FMD Scheme have not been sufficiently assessed and reviewed. A joint risk assessment between Agriculture and the ATO was last drafted (but not finalised) in 2012 and has not since been revised despite several changes to the Scheme and a significant increase in the estimated tax expenditure. The ATO’s last FMD risk assessment was undertaken in 2010 and had a number of limitations. In recent years, FMD Scheme risks have been incorporated into the ATO’s broader Small Business risk assessment processes. These broader processes need to be strengthened to better reflect the key compliance elements of the Scheme’s design.

16. Agriculture and the ATO’s arrangements to use the data provided by financial institutions have been partially effective. In line with Scheme design, financial institutions provide considerable information on FMD accounts. Agriculture uses the information for reporting purposes but the ATO could use the available data in a more complete and systematic way to support risk and compliance activities.

17. The ATO has undertaken minimal specific compliance activity on the FMD Scheme, reflecting its assessment that risks to revenue are low and other controls and broader compliance processes sufficiently address serious risks. As the ATO’s risk assessment and identification processes do not sufficiently capture FMD risks, it is unclear whether this level of compliance activity is appropriate.

Recommendations

Recommendation no.1

Paragraph 2.49

In line with the policy intent of the Scheme, the Department of Agriculture’s planned evaluation of the Farm Management Deposits Scheme includes:

- a focus, with specific questions, on the extent to which the Scheme assists primary producers to become more financially self-reliant; and

- the findings from this analysis in the evaluation report, which draws out implications for the administration of the Scheme and for related policies and programs that provide financial support to primary producers.

Department of Agriculture response: Agreed.

Recommendation no.2

Paragraph 3.19

Consistent with their respective roles and responsibilities:

- the Department of Agriculture completes an overarching risk assessment for the Farm Management Deposits Scheme that includes issues raised in this audit, with the Australian Taxation Office providing input on tax risks; and

- both entities work collaboratively and in a timely way on identified issues such as data integrity and data sharing.

Department of Agriculture response: Agreed.

Australian Taxation Office response: Agreed.

Recommendation no.3

Paragraph 3.34

The Department of Agriculture and the Australian Taxation Office:

- each review the quality of the Farm Management Deposits Scheme data provided to them by financial institutions to ensure the data is fit for purpose; and

- consider options to improve the use of the data, to increase the net benefits of the data collection and/or reduce costs on financial institutions or within government.

Department of Agriculture response: Agreed.

Australian Taxation Office response: Agreed.

Recommendation no.4

Paragraph 3.47

The Australian Taxation Office:

- extends its use of data matching to support compliance with the Farm Management Deposits Scheme; and

- maintains visibility over the nature and extent of compliance activities conducted on the Scheme to ensure these are commensurate with the assessed level of risk.

Australian Taxation Office response: Agreed.

Summary of entity responses

18. The summary response provided by the ATO and Treasury is provided below, while the full response of each of the three audited entities is provided at Appendix 1.

Australian Taxation Office

The ATO welcomes the review of the administration of the Farm Management Deposits Scheme and notes that it raises several areas that the ANAO believes would further enhance our approach to data quality and risk assessment processes.

The risks posed by this Scheme are low in comparison to, and when considered in the context of, the many other risks managed by the ATO. We are supportive of efforts to improve compliance with this legislation, but believe our current risk management and compliance processes for assuring compliance with this scheme are adequate and commensurate with the level of relative risk to the system.

We will continue working collaboratively with the Department of Agriculture to refine our approaches to administration of the Scheme including a focus on seeking to realise potential benefits from improved data quality.

Department of the Treasury

The Treasury notes the overall conclusions and findings of the audit.

While the report does not contain any recommendations for the Treasury, we will consider the learnings identified within the report in the context of the Treasury’s responsibilities in relation to the Farm Management Deposits Scheme.

Key learnings for all Australian Government entities

Below is a summary of key learnings, including instances of good practice, which have been identified in this audit that may be relevant for the operations of other Commonwealth entities.

Governance

1. Background

About the Farm Management Deposits Scheme

1.1 The Farm Management Deposits (FMD) Scheme is described as a ‘tax-linked financial risk management tool’2, designed to assist primary producers deal more effectively with fluctuations in their cash flows. The policy intent of the Scheme, which was established in 1999, is to encourage increased financial self-reliance among primary producers by allowing them to set aside cash reserves earned during high-income years, for use in low-income years.

1.2 Under the tax legislation3, primary producers are able to defer — and potentially reduce — their income tax liability for eligible amounts deposited into specific FMD accounts at authorised deposit-taking institutions.4 Deposits that qualify as ‘deductible’, and are claimed, reduce a primary producer’s taxable primary production income in the year they are made, while amounts withdrawn from FMDs are to be included in assessable income in the year of withdrawal.

1.3 As illustrated in Figure 1.1, the balances held in FMD accounts have increased steadily over the past decade and more sharply in recent years. There is a distinct pattern of deposits at the end of each financial year, followed by a drawing down of deposits at the beginning of the following financial year. In June 2016 around $5 billion in FMDs were held, rising to over $6.6 billion in June 2018. There are around 45,000 FMD holders participating in the Scheme.

Figure 1.1: Farm Management Deposit holdings, June 2008 to December 2018

Source: ANAO, based on the Department of Agriculture’s analysis of monthly FMD holdings data provided by financial institutions.

1.4 The FMD Scheme results in forgone tax revenue, which the Department of the Treasury estimated to be $500 million in 2017–18 (up from $245 million in 2016–17); and $370 million in 2018–19.

Eligibility and Scheme rules

1.5 The FMD Scheme is open only to individuals carrying on a primary production business, including as a partner in a partnership or a beneficiary of a trust. The Scheme cannot be used by companies or trusts. Other eligibility requirements and rules that apply to the deposit, deduction and withdrawal of FMDs are set out in Table 1.1.

Table 1.1: Key legislative requirements for the FMD Scheme

|

Scheme rules |

|

Eligibility requirements |

|

To be eligible to claim a FMD deduction, the person must:

|

|

Obtaining the concessional tax treatment |

|

To benefit from the concessional tax treatment:

|

|

Withdrawing FMDs and repaying previously claimed deductions |

|

A repayment of a deductible FMD:

|

Note a: Section 393-10 of the Income Tax Assessment Act 1997.

Source: ANAO, based on requirements set out in Division 393 of the Income Tax Assessment Act 1997 and information reported on the ATO website.

1.6 There are no restrictions on the length of time a deposit can be held in a FMD account.

How the Scheme operates

1.7 In simple terms, the operation of the FMD Scheme involves three main steps:

- FMD holders can deposit funds into FMD accounts with one or more financial institutions throughout the income year;

- FMD holders can withdraw part or all of their FMD deposits at any time throughout the income year; and

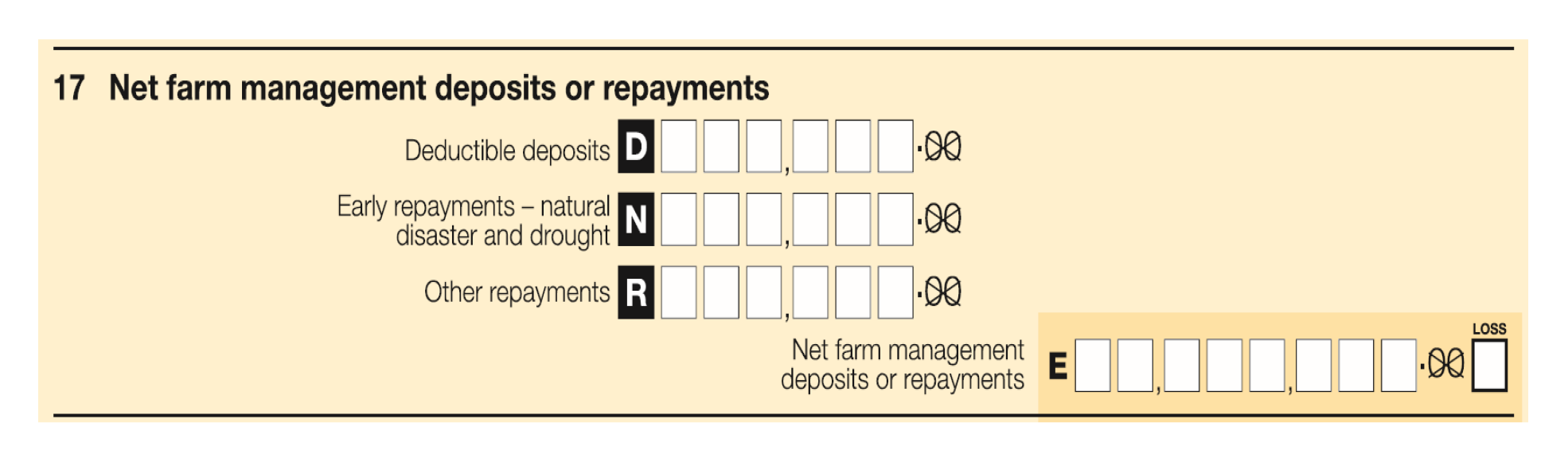

- FMD holders report their FMD activity in their tax return5, recording the deposits for which a tax deduction is claimed, any early repayments where the natural disaster or drought provisions applied, and other repayments (where deposits were held for 12 months or more).

1.8 The design of the Scheme means that some FMD deposits may not be fully tax deductible or, if so, may not be claimed against the FMD holder’s taxable primary production income. The tax legislation provides a formula for determining how much of a deposit should be included in assessable income when withdrawn.6 Box 1 illustrates the application of the formula for repayments involving deductible and non-deductible deposits.

|

Box 1: Repayments of deductible and non-deductible deposits |

|

On 1 January 2015, a primary producer made a $100,000 deposit into a FMD account. In their 2015 income tax return the primary producer claimed a FMD deduction of $70,000 — within their taxable primary production income for the year. The non-deductible portion of the deposit is $30,000. The primary producer made three separate repayments over three income years:

As the non-deductible portion of the deposit ($30,000) is treated as having being repaid first, the first repayment of $20,000 in 2016 is not assessable income and is not required to be declared in the FMD holder’s 2016 income tax return. Only $20,000 of the second repayment ($30,000) is assessable income and required to be included in the 2017 income tax return. All of the third repayment ($50,000) is assessable income and is to be included in the 2018 income tax return. |

Source: ANAO, based on the Income Tax Assessment Act 1997 and information reported on the ATO website.

Policy changes introduced on 1 July 2016

1.9 On 1 July 2016, three policy changes were introduced to the FMD Scheme as part of the Government’s Agricultural Competitiveness White Paper:

- the deposit limit for FMDs, for each FMD holder, was increased from $400,000 to $800,000;

- primary producers experiencing severe drought conditions can now access FMDs within 12 months of deposit without losing their claimed tax concession; and

- FMDs can now be used to offset a loan or other debt relating to the holder’s primary production business.

1.10 There were also other changes to the FMD Scheme in 2012 and 2014, including allowing primary producers to hold FMDs at different financial institutions.

Other assistance to primary producers

1.11 The FMD Scheme is one of many forms of Australian Government assistance available to primary producers. Examples of other support measures include:

- income tax averaging, which allows primary producers to even out income and tax payable over a maximum of five years;

- the Farm Household Allowance, which provides support to farming families in financial hardship; and

- concessional farm business loans — farm investment loans and drought loans.

1.12 A range of assistance is also available to primary producers at state government level, including to deal with the effects of drought and natural disasters. 7

Scheme administration

1.13 Three entities are responsible for the FMD Scheme — the Department of Agriculture (Agriculture), the Australian Taxation Office (ATO), and the Department of the Treasury (Treasury). Each entity is responsible for different aspects of the Scheme (Figure 1.2).8

Figure 1.2: Entities responsible for the FMD Scheme

Note: In 2019, Treasury changed the name of the Tax Expenditures Statement to the Tax Benchmarks and Variations Statement. For simplicity, the term Tax Expenditures Statement is used throughout this report.

Source: ANAO.

Rationale for undertaking the audit

1.14 The audit was undertaken to provide assurance on whether a key measure delivering tax relief for primary producers is being administered effectively. The audit was also undertaken in light of the steep increase in the estimate of revenue forgone for the FMD Scheme in 2017–18 and the broader scope of the Scheme following the 2016 policy changes.

Audit approach

Audit objective, criteria and scope

1.15 The objective of the audit was to assess whether the ATO and Agriculture have effectively administered the FMD Scheme.

1.16 In assessing this objective, the ANAO adopted the following two high-level criteria:

- advice on the policy changes to the FMD Scheme in 2016 was provided on a sound basis to help achieve the Scheme’s objectives; and

- effective risk identification and compliance arrangements are in place to support the integrity of the FMD Scheme.

1.17 For the first criterion, the scope of the audit is limited to the three 2016 policy changes. For the second criterion, the audit examined the risk identification and compliance arrangements that have been established by the ATO and Agriculture, including prior to the 2016 policy changes.

Audit methodology

1.18 The audit included the following methods for gathering and assessing audit evidence:

- review of advice and briefing material provided to government;

- examination of FMD Scheme documentation provided by Agriculture, the ATO and Treasury;

- analysis of FMD Scheme data provided by financial institutions to Agriculture and the ATO for 2014 to 2017;

- interviews with key staff responsible for administering the FMD Scheme; and

- discussions with registered tax agents on the operation of the Scheme.

1.19 The methodology included observations about the status of agreed recommendations from the ANAO’s previous audit of the FMD Scheme in 2003.9

1.20 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $315,000. The team members for this audit were Amanda Reynolds, Erica Sekendy and Andrew Morris.

2. Policy changes introduced in 2016

Areas examined

This chapter examines whether advice on the three policy changes to the Farm Management Deposits (FMD) Scheme in 2016 was provided on a sound basis to help achieve the Scheme’s objectives.

Conclusion

Largely sound advice was provided to Government on the limited extent to which the proposed changes to the FMD Scheme were expected to help achieve the Scheme’s objectives. Agriculture proposes to assess the impact of the 2016 policy changes through a broader evaluation of the Scheme within the next two years. Current data indicates that take-up rates of the three policy measures have been low, especially for the loan offset measure.

Areas for improvement

This chapter includes a recommendation that Agriculture’s intended evaluation of the FMD Scheme includes a focus on the extent to which the policy intent is being achieved (paragraph 2.49).

Was sound advice and evidence provided to Government on the basis to establish the 2016 policy changes?

Largely sound advice and evidence was provided to Government on the assessed costs, benefits and implementation risks associated with the three 2016 policy changes to the FMD Scheme. None of the proposals were assessed to provide a strong case for change. The rationale for increasing the deposit limit to $800,000 could have been better explained, and consultation undertaken earlier on the loan offset measure.

Policy development process

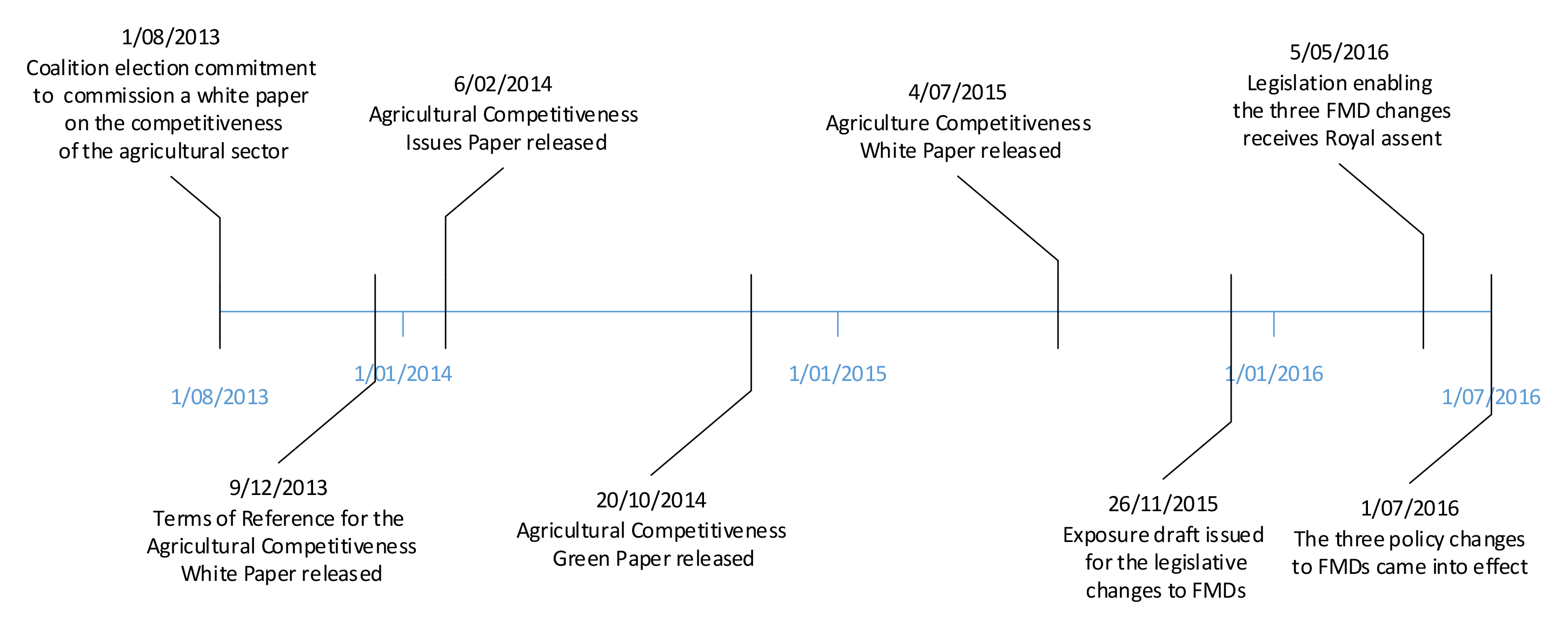

2.1 The three policy changes introduced to the FMD Scheme on 1 July 2016 were developed in the context of the Agricultural Competitiveness White Paper process. This process was undertaken over a three-year period from August 2013 to July 2016 (Figure 2.1), and was managed by a taskforce set up within the Department of the Prime Minister and Cabinet, which included representatives from Agriculture and Treasury.

Figure 2.1: Timeline for the Agricultural Competitiveness White Paper process

Source: ANAO, based on public records.

2.2 Proposals to increase the deposit limit for FMDs and to re-establish early access provisions in times of drought (which ceased in July 2014 with the repeal of the exceptional circumstances legislation10) were both included in the Green Paper. The policy to allow FMDs to offset business loans was first announced in the White Paper in July 2015. This proposal (or variations of) was not included in the earlier Green Paper or Issues Paper.

2.3 Of the published submissions on the Green Paper that specifically commented on the FMD Scheme11, the ANAO identified 15 responses that were in favour of the early access provisions, 20 in favour of increasing the deposit limit, and two expressing caution on this change. In addition, two respondents made suggestions on using FMDs for offset purposes.

2.4 All three proposals were presented to Government for decision in April 2015.12 The advice included: the financial and budget implications; a description of the proposal; an assessment of the policy case; implementation and delivery considerations; an assessment of the regulatory impacts; and associated checklists and risk assessments. The stated rationale for each of the proposed measures is summarised in Table 2.1.

Table 2.1: Stated policy rationale for the 2016 changes to the FMD Scheme

|

Policy proposal |

Rationale |

|

Raising the deposit limit for FMDs to $800,000 |

|

|

Early access provisions |

|

|

Permitting FMDs to offset holders’ business loans |

|

Note a: The advice did not identify who these stakeholders were, noting that this proposal was not included in the Agricultural Competitiveness Green Paper.

Source: Advice to Government on the package of Agricultural Competitiveness White Paper proposals, April 2015.

2.5 Overall, the advice provided to Government included a balanced assessment of the costs, benefits and implementation risks associated with each of the proposals. Two areas where the advice could have been improved are discussed below.

Rationale for increasing the deposit limit

2.6 No clear rationale or options were provided for the size of the proposed increase in the deposit limit for FMDs.

2.7 While the advice noted that increasing the deposit limit to $800,000 would assist primary producers to ‘better manage’ fluctuations in cash flows, it did not include any specific reasons why it was appropriate to double the size of the cap, or provide other deposit limit options for Government to consider. Agriculture’s records indicate that the proposal to increase the deposit limit to $800,000 came from the Minister for Agriculture’s office in April 2015. Prior to this, Treasury was preparing a Budget costing for a deposit limit of $500,000.13

2.8 The advice noted that a deposit limit of $800,000 would likely benefit a small number of primary producers. No assessment was made as to how the higher limit would support the policy objective of increasing financial self-reliance. Consequently, it was difficult to assess whether the benefits of the proposal were likely to exceed the estimated additional Budget cost of $20 million over the forward estimates.

Consultation on the loan offset proposal

2.9 There was no evidence that public consultation was undertaken on the loan offset proposal before it was presented to Government for decision in April 2015.

2.10 Correspondence from the Minister for Agriculture’s office to Agriculture in January 2015 indicated that the Minister wanted the loan offset measure included in a future drought support package or the White Paper.

2.11 The first public consultation on the loan offset proposal occurred in November 2015 when Treasury released the draft legislation. Six stakeholders responded to the proposed legislation, with five specifically supporting the loan offset proposal. The Australian Bankers’ Association14 raised a number of concerns including on: guidance for industry; transition arrangements and implementation timeframes; red tape and potential costs for farmers; and potential capital requirements. Other stakeholders highlighted the various business structures under which primary producers operate and the potential difficulty in offsetting FMDs in the names of individuals.

2.12 In August 2015, prior to Treasury’s public consultation on the draft legislation for the Scheme, Agriculture consulted directly with stakeholders from the finance and banking sector on proposed changes to the FMD Scheme and other matters. Agriculture advised that those stakeholders were critical of the proposed loan offset changes, and stated that had the change been canvassed in the Green Paper, they would have taken opportunities to express their concerns in relation to implementation risks.

2.13 Ultimately only one financial institution elected to provide loan offset facilities to FMD account holders in the first two years after the policy change took effect. In June 2018, the Minister for Agriculture publicly encouraged the ‘big banks’ to provide loan offsets. Several more financial institutions have since offered particular financial arrangements for FMD customers.15

Treasury’s assessment of the policy proposals

2.14 Treasury’s advice to Government was that none of the proposals provided a strong case for change. A common theme in the advice was that the proposals were likely to benefit a relatively small number of primary producers.

Was appropriate data used to estimate the Budget costs of the policy changes and the tax expenditure for the Scheme as a whole?

Appropriate available data was used by Treasury to prepare the Budget costings for the 2016 policy changes and the tax expenditure estimates for the FMD Scheme.

2.15 The approach taken to estimate the Budget impacts of the three 2016 policy changes was distinct from the approach taken to estimate the tax expenditure for the FMD Scheme as a whole. The respective estimates are based on different methodologies and benchmarks (or bases), and are not intended to be directly comparable.

Budget costings for the changes

2.16 Treasury prepared the Budget costings for the three policy changes in consultation with the ATO. The costings were included in the advice to Government in April 2015.

2.17 The three proposals were assessed to have a $10 million overall net cost to revenue over the forward estimates period to 2018–19. This comprised a:

- $20 million cost to revenue for doubling the deposit limit to $800,000;

- $10 million gain to revenue for allowing FMDs to offset business loans; and

- negligible cost to revenue for the early access proposal.

2.18 Treasury prepared a costing minute for each estimate, which included a description of the methodology, data and assumptions used. The costings for the increased deposit limit and loan offset proposals drew on individual tax return data and census data.16 Treasury assessed the early access proposal mainly on the basis that taxpayer behaviour was reflected in the existing tax base. The proposed measure would largely replace the previous exceptional circumstances provisions that were repealed in July 2014.

2.19 The methodology for the increased deposit limit proposal sought to identify FMD holders in the Scheme who held balances between $350,000 and $400,000, and were more likely to make additional deposits into the Scheme over coming years. The methodology for the loan offset proposal sought to identify FMD holders who had declared business income; it also included analysis of interest rates for FMD account deposits compared to interest rates on business loans. The estimated gain to revenue for this costing was on the basis that FMD holders would claim lesser tax deductions on the interest costs of their loans.

2.20 The costings for increasing the deposit limit and loan offset proposals were assessed by Treasury to provide a ‘very low’ level of reliability because they were highly reliant on assumptions made during the costing process and were generated from incomplete data. The costing minutes did not indicate what additional or other data would have improved the reliability of the estimates. Treasury assessed the costing for the early access provisions to have a ‘medium’ reliability, based on the expectation that the tax base would remain unchanged by this measure.

Tax expenditure estimates for the FMD Scheme

2.21 The estimated tax expenditure17 for the FMD Scheme is reported in the Tax Expenditures Statement published annually by Treasury. The Tax Expenditures Statement notes that the estimates for the FMD Scheme are prepared using the ‘revenue forgone’ method18 and are assigned a reliability rating of ‘medium’. The estimated tax expenditure for the FMD Scheme in the last two years ($370 million and $500 million respectively), constitutes a sizable increase from previous years (Figure 2.2).

Figure 2.2: Estimated tax expenditures for the FMD Scheme

Note: The tax expenditure estimate for 2018–19 is based on Agriculture’s published data required to be provided by financial institutions. Previous estimates are based on the ATO’s tax return data and are revised according to the data. See also Table 2.2.

Source: ANAO, from published Tax Expenditures Statements 2013 and 2016 and the 2018 Tax Benchmarks and Variations Statement.

2.22 Treasury advised the ANAO that the main drivers for the FMD estimate are economic factors and general industry conditions that influence the amount of FMD deposits and withdrawals in any given year. Treasury further advised that the increase in the estimated tax revenue forgone reported in 2017–18 resulted from a large net increase in FMD deposits.

Data used for the estimates

2.23 Two main sets of data are used to prepare and report on the tax expenditure estimates for the FMD Scheme — FMD data provided by financial institutions, and tax return data.

2.24 For the estimate that is initially published in the Tax Expenditures Statement, the ATO and Treasury use the FMD data reported publicly on Agriculture’s website. This data comes from the monthly reports provided to Agriculture by financial institutions, and includes the balance of FMD holders’ accounts. The cost of the concession is deferred by one year to coincide with the year the concession is received by the taxpayer (being the year after FMDs are deposited or withdrawn).

2.25 There are some limitations with the data provided by financial institutions to Agriculture, which reduce its reliability in supporting tax expenditure estimates. In particular, the data provided on deposits and FMD balances is not tax data and may not be reflective of the amounts that FMD holders elect to deduct when completing tax returns.

2.26 Once the tax return data for FMD holders is available (commonly around 16 months after the initial estimate is published), the ATO and Treasury re-calculate the tax expenditure estimate. The previous year’s estimate is then amended to reflect the more accurate position provided by the tax return data. In recent years, these have involved a movement (typically a reduction) in the original revenue forgone estimates (Table 2.2).

Table 2.2: Variations in the tax expenditure estimates for the FMD Scheme

|

|

TES 2018 $m |

TES 2017 $m |

TES 2016 $m |

TES 2015 $m |

TES 2014 $m |

|

2018–19 |

370# |

– |

– |

– |

– |

|

2017–18 |

500 |

560# |

– |

– |

– |

|

2016–17 |

250 |

245 |

285# |

– |

– |

|

2015–16 |

240 |

245 |

240 |

290# |

– |

|

2014–15 |

170 |

170 |

170 |

170 |

245# |

|

2013–14 |

– |

145 |

145 |

145 |

145 |

|

2012–13 |

– |

– |

150 |

150 |

150 |

Note: The tax expenditure estimates highlighted by the hashtag symbol (#) are based on Agriculture’s published data. Previous estimates are based on the ATO’s tax return data and are revised according to the data.

Source: ANAO, based on Tax Expenditures Statements (TES) 2014 to 2017 and the 2018 Tax Benchmarks and Variations Statement.

2.27 The Tax Expenditures Statements do not specifically indicate the revisions to the past estimates or explain the extent of or reasons for the revisions. Rather, the Statements include a general caution that estimates of the same tax benchmark should not be compared to previous publications because they can be affected by changes in policy, benchmarks, methodology, data or assumptions.

2.28 Treasury initially uses the data published by Agriculture as it is more current. More reliable tax return data is not available until after the Tax Expenditures Statement is published in January each year.

2.29 Treasury uses a rating scale to inform readers of the reliability of published tax expenditure estimates. The rating scale ranges from very low to high, with estimates based on an aggregate rating scale from 0–9 as assessed against three criteria:

- reliability of available data;

- underlying assumptions made where no or insufficient data is available; and

- other relevant factors (for example, the volatility of growth rates over time).

2.30 Treasury considers that the reliability rating for the data criterion is appropriate. This is because tax data (which is considered highly reliable) is used for all but one year (the current year) of the estimates for the FMD Scheme. Treasury advised that the overall reliability rating of the tax expenditure estimates for the FMD Scheme would not change even if the data criterion was downgraded to the lowest rating of ‘very low’.

Have mechanisms been established to monitor the implementation of the policy changes and assess their contribution to Scheme objectives?

Mechanisms of variable reliability have been established to monitor the uptake of the 2016 policy changes and to collect qualitative data through farm surveys. Agriculture proposes to undertake an evaluation of the Scheme within the next two years. Current data indicates that take-up rates have been low, especially for the loan offset measure — suggesting modest impacts to date for the changes.

2.31 As the policy owner of the FMD Scheme, Agriculture has the principal responsibility for monitoring the implementation of the 2016 policy changes and assessing their contribution to Scheme objectives.

Uptake of the policy changes

2.32 Agriculture relies on the ATO to provide data on the uptake of the three policy changes.

2.33 The ATO has put mechanisms in place to monitor the uptake of the three 2016 policy changes (Table 2.3), but there are limitations with the data that can be obtained and reported on through these mechanisms.

Table 2.3: Mechanisms in place to monitor the uptake of the 2016 policy changes to the FMD Scheme

|

Policy measure |

Monitoring mechanism |

|

Increasing the deposit limit |

Financial institutions who offer FMDs are required to report the balances held in FMD holders’ accounts to the ATO annually. |

|

Early access provisions |

Taxpayers who used the FMD Scheme are required to report in their tax return (at Label 17 — Net farm management deposits or repayments) whether they have made early withdrawals due to natural disasters or drought. |

|

Loan offset |

In the Annual Investment Income Reporta provided to the ATO, financial institutions are required to indicate either Y or N whether a loan offset arrangement has been established by the account holder for that particular institution. |

Note a: Investment bodies are required to lodge an Annual Investment Income Report with the ATO if any of the following occur: the total amount of income paid or credited to an investment is $1 or more and the total number of investments accepted by the investment body during the year is 10 or more; an amount has been withheld from an investment because a tax file number, Australian business number or an exemption was not quoted; non-resident withholding has occurred; or an investment is a farm management deposit.

Source: ANAO, based on records provided by the ATO.

2.34 In all three cases, the ATO relies on information provided by individual taxpayers or financial institutions, which it is unable to verify without directly approaching the relevant institutions or taxpayers. Agriculture and the ATO advised that some financial institutions are offering products that may not necessarily be traditional loan offsets but offer some form of interest relief to FMD holders.19 The ATO advised that the 2017 and 2018 Annual Investment Income Reports showed that only one financial institution reported FMD loan offset arrangements had been established. The reports indicated that 276 taxpayers (with 308 accounts) were using offsets in 2017; and 424 taxpayers (with 495 accounts) in 2018 — which equates to about one per cent of the total FMD holders in the Scheme.

2.35 For the early access measure, the tax return does not distinguish between the two categories for which early withdrawal is allowed: natural disaster; and drought (Figure 2.3).20

Figure 2.3: Data items to be provided by FMDs holders in their tax returns

Source: Reproduced from the hard-copy tax return form for individuals (supplementary section) 2018.

2.36 The ATO advised that some reporting on early access to FMDs is known to be an input error by taxpayers — for instance, declaring an early withdrawal when a deduction had not been claimed in the previous year. The ATO undertook some preliminary analysis but was unable to provide a reliable figure on how many times the early access provisions have been used since the change took effect.

2.37 The ATO has the ability to compare balances for individual FMD holders across financial institutions to identify the total balances held in holders’ FMD accounts, but has not undertaken this analysis or provided advice to Agriculture. Agriculture has undertaken some analysis of FMD holdings, but to date this analysis has compared holdings within particular financial institutions, not across financial institutions, limiting its value.21 As a result, there has not been any reliable estimates of the total balances held by individuals in their FMD accounts.

Further data and analysis required

2.38 For all three 2016 policy changes, additional years of data will enable Agriculture, in consultation with the ATO, to make a more informed assessment of the uptake and whether it is consistent with expectations — and contributing towards the achievement of Scheme objectives. In particular, the uptake of the higher deposit limit may take a number of years. It will also be important for reliable figures to be maintained on the balances held by FMD holders and the deductions claimed, to inform any further consideration of the appropriate FMD deposit limit, and to support compliance arrangements.

Farm surveys

2.39 The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES)22 conducts annual surveys of different farming sectors. Two of these annual surveys include standard questions on the opening and closing balances of FMD accounts held by the survey respondents.

2.40 At the request of Agriculture’s policy team for the FMD Scheme, ABARES’ surveys of broadacre farms and dairy farms in 2017–18 included 22 additional questions on the FMD Scheme. The questions covered various aspects of the Scheme, including in relation to the 2016 policy changes. Specific questions were asked about the use of loan offset accounts, and the incidence of withdrawals under the early access arrangements. The surveys also sought information on the balances of FMD accounts. Some 2000 primary producers were surveyed.

2.41 The two 2017–18 surveys showed that the average amount held in a FMD account was around $274,000 per farm at 30 June 2018, an increase of around two per cent from 30 June 2017. Figure 2.4 shows the average amount, by industry type, held in FMDs for primary producers surveyed by ABARES.

Figure 2.4: Average balances held in FMDs as at 30 June 2018

Source: ABARES.

2.42 Findings of the two 2017–18 surveys also revealed:

- 26 per cent of farms held a FMD account;

- an estimated 43 per cent of FMD holdings were held by large farms (turnover $1 million to $5 million);

- risk management strategies used by farmers to manage risks and downturns in income were access to debt facilities (50 per cent), off-farm wages or contracting (32 per cent), while 27 per cent used FMDs for risk management; and

- an estimated 63 per cent of farmers holding a FMD regularly used it for tax management purposes and 19 per cent for personal or retirement savings.

2.43 Agriculture considers that the relatively high reported use of FMDs for tax management purposes is consistent with the objectives of the Scheme. Agriculture advised that the tax concession encourages a change in behaviour and results in improved self-reliance by encouraging primary producers to make deposits in good years, which they can then draw on in lean years.

2.44 The survey results also indicated that the average FMD balances are significantly below the $800,000 deposit limit introduced in 2016 (and in most cases below the previous deposit limit of $400,000).

Proposed evaluation of the FMD Scheme

2.45 Agriculture proposes to undertake an evaluation of the FMD Scheme within the next two years.23 The proposed evaluation is set out in a Monitoring and Evaluation Plan, which Agriculture began drafting in August 2017. The first version of the Plan was finalised in March 2019, and included input from the ATO and Treasury.

2.46 In the Plan, Agriculture has identified two key evaluation questions:

- How well is the Scheme meeting its defined policy objectives?

- How well is the Scheme being administered?

2.47 The specific evaluation matters to be considered include a focus on the continuing appropriateness of the three policy changes introduced in 2016. There is also an intention to examine the interaction and overlap of the FMD Scheme with other tax policy measures such as income averaging.

2.48 Despite its broad objectives, the planned evaluation does not explicitly consider how the FMD Scheme assists primary producers to become more financially self-reliant — the policy intent of the Scheme. The relationship between the holdings of FMDs and other forms of government assistance would be a useful line of enquiry, especially with the higher deposit limit now operating.

Recommendation no.1

2.49 In line with the policy intent of the Scheme, the Department of Agriculture’s planned evaluation of the Farm Management Deposits Scheme includes:

- a focus, with specific questions, on the extent to which the Scheme assists primary producers to become more financially self-reliant; and

- the findings from this analysis in the evaluation report, which draws out implications for the administration of the Scheme and for related policies and programs that provide financial support to primary producers.

Department of Agriculture response: Agreed.

3. Risk identification and compliance arrangements

Areas examined

This chapter examines whether effective risk identification and compliance arrangements are in place to support the integrity of the Farm Management Deposits (FMD) Scheme.

Conclusion

Risk identification and compliance arrangements to support the integrity of the FMD Scheme have not been fully effective. The ATO’s compliance arrangements reflect its assessment that risks to revenue are relatively low, and its approach of managing risks at the sector level (for example, small business risks). However, the compliance arrangements and risk assessment processes have not fully captured key elements of the Scheme’s design. As the policy owner of the Scheme, Agriculture should work with the ATO to be satisfied that risk assessment and compliance processes are appropriate.

Areas for improvement

This chapter includes three recommendations aimed at: conducting a risk assessment for the FMD Scheme (paragraph 3.19); reviewing the collection of FMD data from financial institutions (paragraph 3.34); and strengthening compliance arrangements for the Scheme (paragraph 3.47).

Have risks to the Scheme been identified and reviewed?

Compliance and other risks to the operation of the FMD Scheme have not been sufficiently assessed and reviewed. A joint risk assessment between Agriculture and the ATO was last drafted (but not finalised) in 2012 and has not since been revised despite several changes to the Scheme and a significant increase in the estimated tax expenditure. The ATO’s last FMD risk assessment was undertaken in 2010 and had a number of limitations. In recent years, FMD Scheme risks have been incorporated into the ATO’s broader Small Business risk assessment processes. These broader processes need to be strengthened to better reflect the key compliance elements of the Scheme’s design.

3.1 Agriculture and the ATO share responsibility for identifying and reviewing risks to the FMD Scheme, reflecting their respective roles in administering the Scheme.

Whole-of-Scheme risk assessment

3.2 The ANAO’s previous audit of the FMD Scheme in 2003 recommended that Agriculture24 conducts a risk assessment of the FMD Scheme in consultation with the ATO, and develops an appropriate risk management strategy including risk treatments, monitoring and review, as well as consideration of whole-of-government risks. Both entities agreed to this recommendation.

3.3 A joint risk assessment for the FMD Scheme was prepared by Agriculture and the ATO in December 2004. The risk assessment noted that Agriculture has overall responsibility for the policy objective of the FMD Scheme, while the ATO has responsibility for the administration of the relevant tax legislation. The document states that ‘Each agency has a role in identifying the key risks to the Scheme, assess their likelihood and potential impact and implement an appropriate risk management strategy’. Both entities identified and assessed their respective risks to the Scheme.

3.4 The 2004 joint risk assessment was subsequently reviewed by Agriculture in early 2012 and sent to the ATO for input and clearance in July 2012, but there was no evidence that this document was formally approved by both entities. There is evidence, however, that risk management matters have been discussed as a standing item at periodic meetings between the entities.

3.5 The entities’ agreement to undertake a further joint risk assessment was repeatedly deferred over many years. In October 2017, Agriculture and the ATO agreed not to proceed with the joint risk assessment until data sharing and data integrity issues could be resolved. These issues relate to the quality and completeness of the data provided to each entity by financial institutions (see paragraphs 3.21 to 3.23), and the restrictions in the law on the ATO disclosing sensitive taxpayer data to third parties.25

3.6 In April 2018, Agriculture and the ATO agreed not to renew the latest memorandum of understanding between them until the data integrity and data sharing issues could be resolved. In place of the lapsed memorandum of understanding, both entities signed a letter of understanding in November 2018. The letter has the stated objective of ‘resolving data sharing issues between the entities’ and lists five key activities to be progressed by the entities including ‘… to agree on a way forward to resolve critical Annual Investment Income Report data gaps resulting from privacy restrictions’ by the end of January 2019. While a resolution has not been agreed between the entities, Agriculture advised that some banks began making corrections to their FMD data in response to Agriculture’s March 2019 letter (see paragraph 3.28).

3.7 As the policy owner of the FMD Scheme, it is important that Agriculture informs itself of key risks to the Scheme, including compliance risks, so that it can take or recommend appropriate action to improve the administration of the Scheme. This will support its responsibility for ensuring the effective and efficient implementation of agricultural policies, including when there is joint provision of services with other government entities.

3.8 A comprehensive risk assessment is overdue and should be undertaken in the near-term. A focus for the risk assessment should be the issues identified by both entities with the completeness and quality of FMD data provided by financial institutions, and arrangements that enable Agriculture to obtain ATO data to inform its policy monitoring processes.

Clarifying the intended operation of the Scheme

3.9 During the audit, the ANAO raised a number of issues about the operation of the FMD Scheme, which had implications for: primary producers’ understanding of FMD rules; public reporting on the Scheme; and the ATO’s compliance arrangements. In this regard, the ATO and Agriculture advised in April 2019 that:

- funds deposited into a FMD account do not need to come from primary production income — the taxpayer must simply have primary production income in the relevant year;

- amounts greater than the FMD cap (currently $800,000) can be deposited in FMD accounts. The law operates to deny a deduction for any amounts in excess of the cap;

- individuals who are not primary producers in a particular year are not able to claim FMD deductions in that year but are not precluded from opening FMD accounts; and

- primary production income for FMD purposes is calculated before allowing for any deduction for a farm management deposit. Such a deduction will be taken into account for income averaging purposes.

3.10 Both entities should ensure that their published guidance material on the FMD Scheme is consistent, including with the issues raised in paragraph 3.9, and is communicated clearly to primary producers and other stakeholders, including tax agents.26 As well, Agriculture should ensure that its public reporting on the Scheme reflects the advice provided, in particular that some FMD accounts may be held by persons other than primary producers (potentially inflating the reported number of FMD holders and total FMD holdings). Similarly, the ATO should ensure that its compliance arrangements for the Scheme reflect the interpretations provided.

Compliance risks

3.11 Separate to the joint risk assessment, the ATO conducted a risk assessment for the FMD Scheme in 2010, which was documented in a ‘risk profile’ report.27 The report focused on two main risks to the Scheme:

The risk to the ATO is that individual taxpayers who are primary producers may not be complying with FMD scheme requirements by either understating their taxable income (failing to return income when deposits are withdrawn from the scheme thus avoiding tax) and/or incorrectly claiming a tax deduction in the year deposits are made into the scheme (resulting in a timing or marginal tax benefit).

3.12 The report considered that taxpayers failing to disclose FMD withdrawals as income is the higher risk, mainly because there are no restrictions on the length of time a deposit can be held in the Scheme.

3.13 The report’s conclusion that the risk rating for the FMD Scheme was ‘low’ was not well-supported. There were limitations with the scope of the review, which did not address a large number of the Scheme’s eligibility and operational requirements. The review did not examine whether: the deposit has been held for 12 months; deposit and withdrawal limits were met; and withdrawals related to deposits that were previously claimed as deductions. The report did not specify the legislative requirements tested to support its main finding that 56 of the 68 taxpayers examined were ‘compliant’. There were also limitations with the data used to support this rating, including known problems with the transaction data provided by financial institutions.

3.14 The ATO did not review or revise the risk rating assigned in 2010 regularly over time or in response to the policy changes to the Scheme in 2012, 2014 and 2016. These changes, designed to provide more flexibility to FMD holders, have also broadened the scope of administration. Since 2012, a number of legislative changes have meant that FMD holders can now: hold FMD accounts at more than one financial institution; consolidate their FMDs without facing adverse tax consequences; and establish loan offset arrangements (where these are offered by financial institutions). As discussed in Chapter 2, the estimated tax expenditure has increased substantially in recent years (see Figure 2.2).

Revised risk arrangements and February 2019 risk analysis

3.15 In February 2019, the ATO advised the ANAO that it was ‘now producing comprehensive risk assessments at a domain level rather than for specific legislative provisions’. Rather than being subject to specific risk processes, the ‘FMD risk is now covered by the broader Small Business risk framework under the Expenses and Entitlements risk domain, which considers the risk of over and under claiming business expenses and entitlements available to small business’.28 The ATO expected the Small Business Expense and Entitlement assessment to be finalised by the end of June 2019.

3.16 Under the risk domain approach, the FMD Scheme would, at a high level, be covered by the risk categories dealing with the disclosure of small business income and the correct claiming of expenses and entitlements. The ATO advised of the low materiality of the FMD Scheme within its overall risk management arrangements.

3.17 In response to this performance audit, the ATO specifically undertook a desk-based analysis of a sample of 297 FMD holders to examine compliance with a number of Scheme rules. The aim was to identify any discrepancies between net farm management deductions and assessable income that favoured the taxpayer. The ATO reported that around five per cent of the sample showed an indication of potential risk and advised that further analysis (for example, taxpayer contact) would likely reduce this to lower levels. The ATO advised that this result, along with the broad controls in place (see paragraph 3.38), indicates that the ‘low’ risk rating assigned to the Scheme in 2010 has not increased.

3.18 Similar to the ATO’s risk assessment in 2010, there were limitations with the more recent analysis that reduced its value in determining the level of risk on the FMD Scheme. The analysis did not involve contact with taxpayers (or their tax agents) to resolve any of the potential discrepancies identified. The analysis highlighted known problems with the quality and completeness of the data provided by financial institutions, requiring assumptions to be made about the nature or reasons for some initially-identified discrepancies. Also, the analysis highlighted the difficulties, within the design of the FMD Scheme, of easily matching the data provided by financial institutions to individual taxpayer data.29 Nevertheless, the overall approach taken is indicative of analysis that can be built on to refine the ATO’s risk assessments and controls for the FMD Scheme.

Recommendation no.2

3.19 Consistent with their respective roles and responsibilities:

- the Department of Agriculture completes an overarching risk assessment for the Farm Management Deposits Scheme that includes issues raised in this audit, with the Australian Taxation Office providing input on tax risks; and

- both entities work collaboratively and in a timely way on identified issues such as data integrity and data sharing.

Department of Agriculture response: Agreed.

Australian Taxation Office response: Agreed.

3.20 The ATO is committed to working collaboratively with the Department of Agriculture to support their overarching risk assessment for the Farm Management Deposits Scheme and to resolve data integrity and data sharing issues.

Have effective arrangements been established to use the data provided by financial institutions?

Agriculture and the ATO’s arrangements to use the data provided by financial institutions have been partially effective. In line with Scheme design, financial institutions provide considerable information on FMD accounts. Agriculture uses the information for reporting purposes but the ATO could use the available data in a more complete and systematic way to support risk and compliance activities.

Reporting requirements

3.21 Under tax legislation, financial institutions that offer FMD accounts are required to provide specified data to Agriculture on a monthly basis (Box 2) and annually to the ATO.30

|

Box 2: Monthly FMD data to be provided by financial institutions to Agriculture |

|

Note a: The Australian and New Zealand Standard Industrial Classification Code is the standard classification used in Australia and New Zealand for the collection, compilation and publication of statistics by industry type.

Source: ANAO, based on section 398-5 of the Taxation Administration Act 1953 and Part 7A of the Taxation Administration Regulations 1976.

3.22 The data required to be provided to the ATO includes most of the same material provided to Agriculture as well as additional details — such as the transaction dates of deposits, transfers and withdrawals of FMDs. Financial institutions are also required to provide the FMD owner’s tax file number to the ATO (where this has been given by FMD owners). The tax file number allows the ATO to uniquely identify FMD holders in the Scheme, including those that hold FMD accounts at more than one financial institution.

3.23 The number of financial institutions that are required to report to Agriculture and the ATO can change over time due to commercial decisions on whether to offer FMD accounts or a change in ownership arrangements such as mergers between banks. In February 2019, 19 financial institutions provided monthly data to Agriculture.31

Data limitations

3.24 The FMD data provided monthly to Agriculture and annually to the ATO relies heavily on the integrity of the financial institutions’ data collection and reporting systems, and on the data provided by FMD holders in the first instance. None of the data is verified against the financial institutions’ source documentation such as FMD transactions or FMD agreements with FMD holders.32 In addition, there has been little substantive compliance checking undertaken on the Scheme by the ATO, including to determine whether holders of FMDs meet eligibility requirements.

3.25 A broader issue with the data provided by financial institutions, related to the design of the Scheme, is that financial institutions report on amounts deposited and withdrawn by FMD holders, not on the amounts that FMD holders include in their tax returns (which can be different, as highlighted in Box 1).

3.26 In addition, Agriculture and the ATO are aware of problems with the FMD data provided by financial institutions, including:

- inconsistent reporting of FMD deposits, repayments and transfers;

- missing transaction dates and incorrect FMD holders’ birth dates;

- personal identification numbers being assigned to more than one FMD holder and reported inconsistently to the two entities; and

- incorrect reporting of industry codes.

3.27 During the audit, the ATO advised that even where issues are identified with FMD data33 during the validation process to receive this data, the data is not typically rejected and sent back to financial institutions for correction. The ATO accepts this FMD data from financial institutions (providing warning messages about data issues where appropriate) because this data is often packaged in one report with interest data used for pre-filling taxpayer returns. The ATO considers that the interest data has greater value in administering the tax system.

3.28 In response to ongoing problems with the completeness and accuracy of the FMD data provided, Agriculture wrote to financial institutions in late March 2019 raising concerns about integrity issues with FMD data and requesting review and correction of the data as soon as possible. The ATO advised that it intends to consider options for improving the data provided by financial institutions after the completion of this performance audit.

Use of data provided by financial institutions

3.29 Agriculture publishes the monthly FMD data provided by financial institutions on its website34, and circulates the data, and its observations of the data, within government. The public reporting provides total FMD holdings, broken down by jurisdiction and industry sector. Some caveats are placed on the monthly reports including that ‘these statistics may, due to the complex nature of FMDs, include a level of discrepancy, leading to a minor overstatement or understatement of the actual holdings eligible for the FMD taxation concessions.’

3.30 Given the inherent quality limitations with FMD data reported by financial institutions, Agriculture should reconsider the basis on which it publishes monthly FMD statistics. In the near-term, this should include stronger and more explicit caveats on the quality of the data reported. Consideration should also be given to the timeframe for publishing the data, including whether an annual reporting process would be more appropriate, once more thorough data checks had occurred with the FMD data provided to the ATO.

Compliance checking by the ATO

3.31 In line with the design of the FMD Scheme, the financial institutions’ data reported annually to the ATO is intended to support the integrity of the Scheme. However, the ATO does not use this data in a fully systematic manner to identify non-compliance with Scheme rules.35 Notably, the ATO does not routinely compare financial institutions’ data, which includes transactional details on FMD deposits, withdrawals and year-end balances, against data provided by FMD holders in their tax returns to identify anomalies and potential instances of non-compliance. While some enquiries have been undertaken from time to time by ATO staff using the financial institutions’ data, there is no evidence that this has been extensive.

3.32 Currently, the main purpose for which the ATO uses the FMD data provided by financial institutions is to provide registered tax agents with ‘pre-fill’ information to assist in preparing tax returns for their clients. For instance, tax agents receive deposit and repayment particulars, and an indication of whether the FMD is linked to an interest offset account. The ATO advises tax agents not to rely exclusively on this information.

3.33 Overall, the ATO’s use of financial institutions’ data is not effective or efficient. The mandatory collection of data imposes costs, but has not provided clear and measurable benefits. The ATO and Agriculture should review the quality and use of FMD data provided by financial institutions to increase the net benefits associated with the data collection.

Recommendation no.3

3.34 The Department of Agriculture and the Australian Taxation Office:

- each review the quality of the Farm Management Deposits Scheme data provided to them by financial institutions to ensure the data is fit for purpose; and

- consider options to improve the use of the data, to increase the net benefits of the data collection and/or reduce costs on financial institutions or within government.

Department of Agriculture response: Agreed.

3.35 Noting that legislative changes may be required to amend the data collected from financial institutions.

Australian Taxation Office response: Agreed.

3.36 The ATO remains committed to working with financial institutions to improve the quality of the data provided to the ATO and to increase our use of the improved data when it is available.

Have effective compliance activities been conducted to address Scheme risks?

The ATO has undertaken minimal specific compliance activity on the FMD Scheme, reflecting its assessment that risks to revenue are low and other controls and broader compliance processes sufficiently address serious risks. As the ATO’s risk assessment and identification processes do not sufficiently capture FMD risks, it is unclear whether this level of compliance activity is appropriate.

3.37 Australia’s income tax system is based on self-assessment, with the onus on taxpayers to declare all assessable income and claim only the available deductions and offsets, with penalties applying where appropriate.

3.38 The ATO has a range of controls in place for the FMD Scheme that include support for taxpayers such as advice and guidance, and pre-filling messages for tax agents. It also has compliance processes to identify and address potential non-compliance, including automated edit checks that draw on taxpayer and third-party information, FMD data incorporated in some risk models, and programs of review and audit.

Broader compliance activities

3.39 The ATO advised that it uses various data-matching systems, compliance models, and overarching controls to identify and manage compliance risks in the Small Business market. This includes an Income Matching and Analysis System, which includes matching of interest on FMD accounts36, but does not check compliance with other requirements of the FMD Scheme — including eligibility requirements, and rules relating to deductions and repayments of FMDs.

3.40 One of the ATO’s broader compliance models — the Liability Model — includes FMD data provided by financial institutions on the Annual Investment Income Reports, along with other data, to estimate the amount of tax payable or refundable. The potential discrepancies identified by this model, along with other compliance models used by the ATO37, are not reported at a sufficiently granular level to identify whether the discrepancies related to the FMD Scheme. The ATO advised that providing this level of detail would require intensive analysis. Accordingly, the ATO is not able to advise the number of compliance cases where risks relating to the FMD Scheme have been addressed.

FMD edit checks

3.41 The ATO advised that its first line of checking under the FMD Scheme consists of an edit check as part of the income tax return lodgement process. It noted that return processing has the following built-in edit checks, to check conformance with key legislative requirements:

- deductions are not allowed if taxable non-primary production income exceeds the current threshold of $100,000;

- deductions are not allowed to the extent they exceed taxable primary production income; and

- deductions are not allowed to the extent they exceed the FMD cap (currently $800,000).

3.42 The edit checks provide scrutiny over an important aspect of the tax return process (FMD deductions). However, the edit check aimed at preventing primary producers from exceeding the $800,000 deposit limit for FMDs applies to a single income year only; the check does not identify the sum of deductions claimed over multiple income years, which is the more likely pattern for FMD holders. The ATO should investigate whether the edit check could be broadened to address this risk.

3.43 There is currently no equivalent edit check process to verify that taxpayers are correctly disclosing all previously deducted FMD withdrawals (and not deliberately or otherwise understating assessable income) — a risk that the 2010 risk report considered to be the greatest risk to the integrity of the Scheme. The design of the Scheme, allowing FMD holders to hold both deductible and non-deductible FMD amounts, adds a level of complexity to verifying the net FMD amount reported in a tax return.

3.44 The ATO has advised that the vast majority of taxpayers with primary production income use registered tax agents and that it provides information to those tax agents about farm management deposits made by (or repaid to) their clients. The ATO considers that the provision of FMD data to tax agents provides strong support for taxpayers to correctly complete the FMD elements in the tax return. While this may be the case, no routine compliance activity has been undertaken to test or confirm this proposition. Periodic liaison by the ATO with tax agents that manage a larger number of FMD clients38 may provide a cost-effective means of assessing whether the legislative framework for the Scheme is being applied correctly — allowing corrective action to be taken as appropriate.

Specific FMD compliance arrangements

3.45 The ATO has not developed a specific compliance strategy for the FMD Scheme, or plan for how it intends to use the annual data required to be provided by financial institutions.39 As previously mentioned, the ATO does not have embedded processes to use the annual data provided by financial institutions for compliance checking purposes; and there was no evidence that this data has been used in a fully systematic or focused manner to identify non-compliance with Scheme rules. This includes the absence of any specific compliance checking on the 2016 policy changes, including the rules associated with the loan offset requirements.40

3.46 Other than for FMD interest payments, which were not identified as a key risk for the Scheme, the ATO was unable to provide any instances where reviews or audits had addressed issues of potential non-compliance with FMD Scheme requirements. The ATO therefore was unable to demonstrate that any FMD holder has been subject to formal action in relation to their FMD deductions or repayments or other aspects of the Scheme.

Recommendation no.4

3.47 The Australian Taxation Office:

- extends its use of data matching to support compliance with the Farm Management Deposits Scheme; and

- maintains visibility over the nature and extent of compliance activities conducted on the Scheme to ensure these are commensurate with the assessed level of risk.

Australian Taxation Office response: Agreed.

3.48 The ATO is supportive of increasing our use of the data provided to the ATO (including increased data matching) once the improved data is available. Improved data will better inform our existing controls and the broader risk and compliance processes already in place.

Appendices

Appendix 1 Entity responses

Department of Agriculture

Australian Taxation Office

Department of the Treasury

Footnotes

1 The estimates are now reported in the Tax Benchmarks and Variations Statement (previously called the Tax Expenditures Statement).

2 Second reading speech Thursday 28 May 1998 of the Taxation Laws Amendment (Farm Management Deposits) Bill 1998, page 4066, [Internet], https://parlinfo.aph.gov.au/parlInfo/search/display/display.w3p; query=Id%3A%22chamber%2Fhansardr%2F1998-05-28%2F0004%22 [accessed 18 March 2019].

3 Principally the Income Tax Assessment Act 1997 and also the Income Tax Assessment Regulations 1997, the Taxation Administration Act 1953 and the Taxation Administration Regulations 1976.

4 These are financial institutions such as banks and credit unions.

5 The ATO advised that the vast majority of FMD holders engage tax agents to assist with their tax affairs.

6 See section 393–10 of the Income Tax Assessment Act 1997.

7 Some of these assistance measures, particularly for natural disasters, are either co-funded or fully funded by the Commonwealth.

8 Agriculture and the ATO have assessed their combined Average Staffing Level for administering the Scheme to be 1.02, almost all of which comes from Agriculture.

9 The FMD Scheme was examined as part of a broader performance audit of the Administration of Three Key Components of the Agriculture – Advancing Australia (AAA) Package. The audit report is available from https://www.anao.gov.au/work/performance-audit/administration-three-key-components-agriculture-advancing-australia-aaa [accessed 6 March 2019].

10 The exceptional circumstances provisions were repealed following wider changes to income support for primary producers, which replaced earlier forms of income support with the Farm Household Allowance.

11 The Green Paper submissions are published at https://agwhitepaper.agriculture.gov.au/supporting-information/published-submissions-green-paper [accessed 8 March 2019].

12 The Minister for Agriculture presented the broader package of White Paper proposals. Treasury provided input on the three 2016 proposals, reflecting its responsibility for tax policy.

13 The earlier Green Paper listed a possible deposit limit of $1 million.

14 Now called the Australian Banking Association.

15 For example, loan interest rate adjustments.

16 Interest rate data from some financial institutions was also used in costing the loan offset proposal.

17 A tax expenditure is the provision of a benefit by way of a preferential taxation treatment. It arises where the taxation of an activity or group of taxpayers is applied differently from the taxation usually incurred by similar taxpayers.

18 ‘Revenue forgone’ is the difference in revenue between the existing revenue (or cost) of the Scheme and the revenue that would be collected (or costs incurred) under the usual taxation applied without the Scheme, assuming taxpayer behaviour is the same.

19 That is, some institutions are understood to be offering credit adjustments on loan rates rather than a traditional offset account.

20 In addition to being able to withdraw FMDs within 12 months of deposit due to drought without losing the tax concessions claimed, FMD holders are also able to withdraw if they have received primary producer Category C assistance under the Natural Disaster Relief and Recovery Arrangements.

21 Agriculture does not have access to FMD holders’ tax file numbers, making it difficult to uniquely identify FMD holders who hold accounts at different financial institutions.

22 A division within Agriculture.

23 An evaluation was originally scheduled for 2018–19, but was deferred pending the outcome of this performance audit of the FMD Scheme.

24 At that time known as the Department of Agriculture, Fisheries and Forestry—Australia.

25 Tax privacy laws prevent the ATO from disclosing individual taxpayer data to other entities unless specific exceptions are in place (such as for law enforcement). Agriculture has not been identified as an entity to which the disclosure of taxpayer data can be made and is therefore not able to receive individual taxpayer data.

26 Guidance material on Agriculture’s website previously stated that farm management deposits must come from primary production income.

27 The report notes that until 2010, the ATO had not undertaken a formal risk assessment of the FMD Scheme, relying instead on ad hoc processes to gather intelligence.

28 The revised risk approach for small business reflects changes to the ATO’s enterprise risk management framework, which requires risk to be assessed at an integrated client behaviour level rather than at the level of specific legislative provisions such as the FMD Scheme.

29 In many cases, the amounts deposited and withdrawn from FMD accounts were not the same — and were not required to be the same — as the amounts claimed in tax returns.

30 For Agriculture, the required data is specified in the Taxation Administration Act 1953 and the Taxation Administration Regulations 1976; and for the ATO the data is set out in an Instrument of Approval issued under the Taxation Administration Act 1953.

31 The Australian Prudential Regulation Authority maintains a list of financial institutions (technically, authorised deposit-taking institutions) on its website — see https://www.apra.gov.au/register-authorised-deposit-taking-institutions, [accessed 12 March 2019].

32 Section 393-35 of the Income Tax Assessment Act 1997 (and related regulations) sets out the requirements on financial institutions in signing agreements with FMD holders.

33 That is, the FMD data included within the Annual Investment Income Reports provided to the ATO.

34 See http://www.agriculture.gov.au/ag-farm-food/drought/assistance/fmd/statistics [accessed 5 March 2019].