Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Official Residences and Other Assets

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Office of the Official Secretary to the Governor-General (the Office) has three overarching responsibilities, one of which is the management and maintenance of two historic properties of national interest: Government House in Canberra and Admiralty House in Sydney.

- This audit provides assurance to the Parliament on the effectiveness of the Office’s management of the official residences and other non-financial assets.

Key facts

- The Government House property comprises about 53 hectares including 25 buildings.

- The Admiralty House property comprises about two hectares including nine buildings.

What did we find?

- The Office’s asset management practices were largely effective in sustaining the condition of two historic properties of national interest. The Office could do more to prioritise and use its resources strategically and improve its approach to performance measurement and reporting.

- The Office’s asset management framework is partly fit for purpose.

- The Office’s management, including maintenance, of non-financial assets is largely effective, with most key property elements assessed as being in good condition.

- Asset-related performance measurement, monitoring and reporting is partly effective.

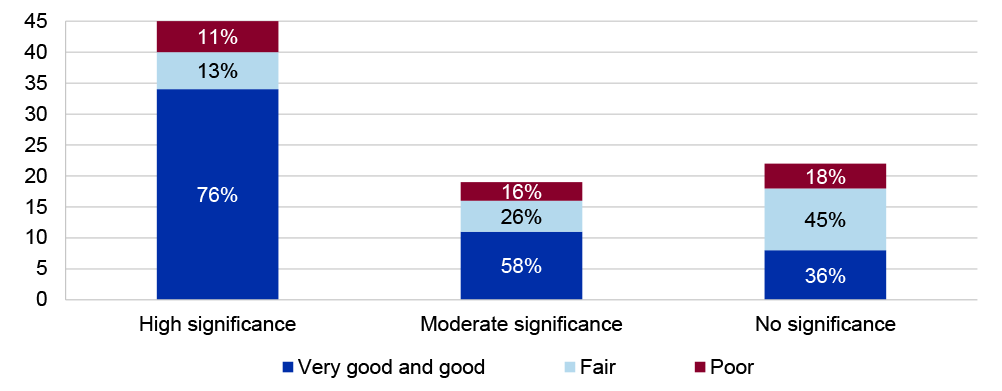

What did we recommend?

- There were five recommendations to the Office to strengthen risk management, asset and heritage management planning and policies, management of gifted assets, budget prioritisation, and performance measures.

- The Office agreed with four recommendations and partially agreed with one recommendation.

$184.75m

The total value of non-financial assets, including the two official residences, managed by the Office, at 30 June 2024.

45

Number of property elements of high heritage significance managed by the Office.

76%

Percentage of property elements of high heritage significance that were assessed by the Office as being in good or very good condition, at 30 June 2024.

Summary and recommendations

Background

1. The Office of the Official Secretary to the Governor-General (the Office) supports the Governor-General in the performance of his or her responsibilities. An office to support the Governor-General has existed since 1901. The planned outcome for the Office is the facilitation of the performance of the Governor-General’s role through the organisation and management of official duties, management and maintenance of the official households and properties, and administration of the Australian Honours and Awards system.1

2. The Office manages non-financial assets valued at $184.75 million. Of this, $174.97 million relates to land and buildings for two properties: Government House in Canberra and Admiralty House in Sydney. Government House and Admiralty House were added to the Commonwealth Heritage List2 in 2004.

Rationale for undertaking the audit

3. One of the Office’s three overarching responsibilities is the maintenance and upkeep of two historic properties of national interest: Government House in Canberra and Admiralty House in Sydney. The properties: are of significant heritage value; receive thousands of visitors each year, including foreign leaders, diplomats, dignitaries, school children and the general public; and host events of national importance including Australian honours, award and citizenship ceremonies. This audit provides assurance to the Parliament on the effectiveness of the Office’s management of the official residences and other non-financial assets.

Audit objective and criteria

4. The audit objective was to assess the effectiveness of the Office’s management of official residences and other assets.

5. To form a conclusion against the objective, the ANAO adopted the following high-level criteria:

- Has a fit-for-purpose asset management framework been established?

- Have non-financial assets been effectively managed?

- Has asset management performance been effectively measured, monitored and reported on?

Conclusion

6. The Office’s asset management practices were largely effective in sustaining the condition of two historic properties of national interest. The Office met its 2023–24 target of maintaining at least 70 per cent of high heritage significance property elements in ‘good’ or ‘very good’ condition. In 2024–25, the Office reduced this target to 65 per cent by 2027–28 due to ‘available resource allocation’.

7. The Office could do more to prioritise and use its resources strategically through a stronger asset management framework and consistent application of risk management and budget prioritisation principles. The Office could improve its approach to performance measurement and reporting.

8. The Office’s asset management framework is partly fit for purpose. The Office has governance arrangements that support asset management. Records management and risk management are deficient, reducing the ability of the Office to efficiently manage the impact of uncertainty on asset condition. The Office is operating outside its risk tolerance in relation to property management. Asset and heritage management planning arrangements are out of date and not aligned with legislative requirements.

9. The Office’s management of the official residences and other non-financial assets is largely effective, with most key property elements assessed by the Office to be in good condition (including the main Government House building (‘good’ condition) and Admiralty House (‘very good’ condition)). Assets have been registered largely appropriately. The maintenance practices for Government House and Admiralty House buildings and grounds are largely appropriate.

10. The Office’s asset-related performance measurement and monitoring is partly effective. Performance results are not fully verifiable. Results for one key asset-related performance measure were inaccurately reported in 2023–24 and should be corrected. The Office’s performance targets for the condition of heritage properties have been reduced.

Supporting findings

Asset management framework

11. The Office has a management and committee structure to execute and oversee asset management and an internal audit program to provide assurance over governance and asset management arrangements. Elements of the Office’s records management practices are not fit for purpose, which reduces transparency over the Office’s work and can impact the Office’s business continuity, preparedness, decision-making capability and efficiency. (See paragraphs 2.4 to 2.16)

12. An enterprise risk management framework incorporates asset-related risks and largely aligns with Australian Government requirements. A fraud and corruption control plan identifies asset-related fraud and corruption risks, and is not fully aligned with Australian Government requirements. The Office’s monitoring and management of risks associated with official residences and other assets could be strengthened. The Office has been operating outside its tolerance for a ‘properties risk’ since at least July 2023. There was insufficient documentation to support assessments that controls are effective for enterprise risks, including the ‘properties risk’. Risk treatments for the high-rated ‘properties risk’ have not been consistently implemented. Management of enterprise risks shared with other entities is incomplete. Eighteen specific property risks (including three rated high) are identified at the program level; however, these are not considered by the relevant governance committee. (See paragraphs 2.17 to 2.35)

13. The Office has established asset management policies, plans and procedures, which are out of date and not aligned with current asset management practice. The Office has a heritage management strategy and heritage management plans, which are not aligned with requirements under the Environment Protection and Biodiversity Conservation Act 1999, including being overdue for review and not appropriately registered. A review of a 2015 heritage strategy was due in 2018. The Office completed its review of the strategy in 2025 and as at 31 July 2025 had submitted a draft strategy to the Department of Climate Change, Energy, the Environment and Water for consultation. (See paragraphs 2.38 to 2.55)

Asset management

14. The Office has asset registers, which have been appropriately updated, except in relation to gifts received by Office staff or the Governor-General. Official gifts are not registered as portable and attractive items in accordance with Office policy. Record-keeping for gifts could be improved. The Office’s gifts and benefits policy could be strengthened to consider security. In 2024–25, the Office did not publicly report the giver of gifts, despite Australian Public Service Commission guidance to do so. (See paragraphs 3.2 to 3.17)

15. In 2023–24, the Office self-assessed that 76 per cent of elements of high heritage significance were in good or very good condition, which was higher than its performance target. For eight key property elements of high heritage significance, assessed condition remained stable or improved between 2009 and 2023–24. Despite the positive outcome relating to condition assessments, there are ways in which the Office could improve its conservation and maintenance of properties.

- The Office has not fully implemented its heritage management plans.

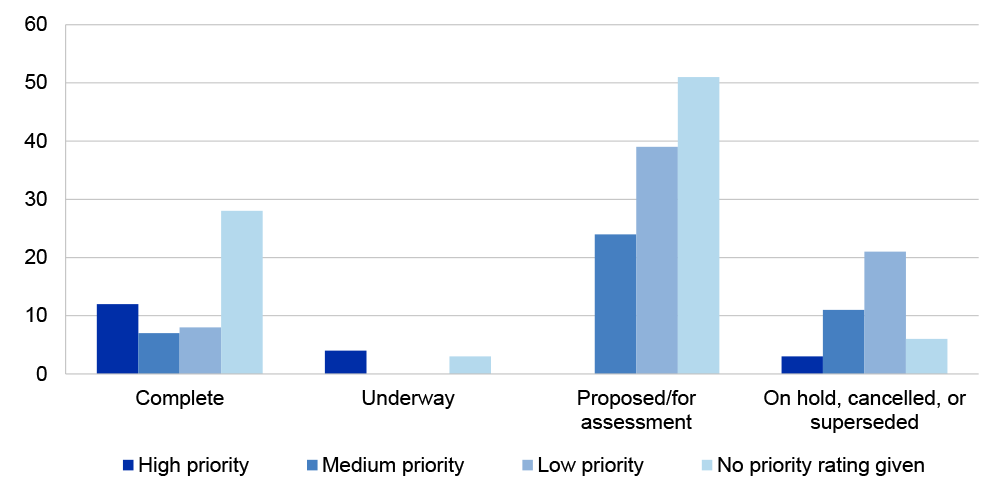

- There are weak budget prioritisation practices for capital and maintenance projects.

- The Office does not provide heritage training to staff and none of its staff are trained in heritage management.

- A tree management plan for Government House was first established in June 2025. There is no tree management plan for Admiralty House.

16. The Office uses a property service provider for reactive and preventative maintenance and provided feedback on the property service provider’s performance to the property service provider and the Department of Finance. Reporting arrangements with the property service provider could be improved to better enable the Office to monitor timeliness and value for money of maintenance services. (See paragraphs 3.20 to 3.58)

Asset management performance

17. The Office has established relevant measures and targets for public reporting and regular monitoring of asset performance. The Office’s 2024–25 property condition measure and targets were unclear. The target was reduced from 80 per cent in 2024–25 to 65 per cent in 2027–28, which the Office attributed to a lack of resources. Internal targets did not align with external targets for this measure and were lower. Reliability and verifiability of data sources and methodologies could be improved. The Management Committee and Property Sub-committee monitor asset-related performance. (See paragraphs 4.2 to 4.14)

18. The 2023–24 and 2024–25 corporate plans and 2023–24 annual performance statements explained the Office’s purpose, key activities and targets for specified performance measures in accordance with the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). The performance measures did not fully meet the requirements of section 16EA of the PGPA Rule. Public reporting was partly inaccurate and should be corrected, with the 2023–24 annual performance statements reporting that 100 per cent of high heritage significance property elements were in ‘good’ or ‘better’ condition, instead of the actual result of 76 per cent. (See paragraphs 4.15 to 4.22)

Recommendations

Recommendation no. 1

Paragraph 2.36

The Office of the Official Secretary to the Governor-General strengthen its risk management arrangements by:

- ensuring risks that exceed its risk appetite and tolerance levels are considered by the Management Committee in accordance with its risk policy, and that appropriate treatments are applied to these risks;

- to assist with forward planning and resource allocation to risk, documenting the basis upon which risk controls are assessed to be effective;

- documenting responsibilities for risks that are shared with other entities; and

- establishing management arrangements and oversight through the Property Sub-committee and the Management Committee for property-specific risks.

Office of the Official Secretary to the Governor-General response: Agreed.

Recommendation no. 2

Paragraph 2.56

The Office of the Official Secretary to the Governor-General:

- review and update its asset management policy and ensure practices are implemented in accordance with the agreed policy; and

- update its heritage management plans, in compliance with the Environment Protection and Biodiversity Conservation Act 1999.

Office of the Official Secretary to the Governor-General response: Agreed.

Recommendation no. 3

Paragraph 3.18

The Office of the Official Secretary to the Governor-General strengthen:

- controls to ensure gifts retained by the Office are appropriately registered as ‘portable and attractive items’ and managed in accordance with Office policy; and

- public reporting on gifts and benefits, by disclosing the gift giver.

Office of the Official Secretary to the Governor-General response: Partially agreed.

Recommendation no. 4

Paragraph 3.33

The Office of the Official Secretary to the Governor-General strengthen its processes and practices for property works budget prioritisation.

Office of the Official Secretary to the Governor-General response: Agreed.

Recommendation no. 5

Paragraph 4.7

To provide better accountability and transparency to the Parliament on its performance, the Office of the Official Secretary to the Governor-General strengthen:

- clarity of the descriptions of performance measures and targets; and

- reliability and verifiability of the information and methodologies supporting the measures.

Office of the Official Secretary to the Governor-General response: Agreed.

Summary of entity response

19. The proposed audit report was provided to the Office. The Office’s summary response to the audit is provided below and its full response is at Appendix 1.

The Office of the Official Secretary to the Governor-General (the Office) acknowledges the findings presented in the Australian National Audit Office report. The Office is committed to implementing the recommendations and identified opportunities for improvement and will endeavour to address what is appropriate and possible within existing resource constraints.

The Office welcomes the ANAO’s feedback on its core functions, which are primarily support for the Governor-General, management and maintenance of official residences, and administration of the Australian Honours and Awards system. In response, the Office will, to the best of its abilities within existing resource constraints, continue to: strengthen its risk management framework; improve transparency; and enhance governance arrangements to support more effective decision-making.

Key actions include refining risk management processes, updating asset and heritage management policies, improving the reporting of gifts and benefits, strengthening property works budget prioritisation, and enhancing the clarity and reliability of performance reporting.

The Office remains committed to continuous improvement and accountability and will actively monitor progress against these actions. Through these measures, the Office will continue to uphold its responsibilities and ensure the effective management of assets, including the official residences of the Governor-General, in service of the Australian people.

20. Extracts of the proposed report were provided to the Australian Federal Police, the Department of Home Affairs, the Department of the Prime Minister and Cabinet and Jones Lang LaSalle (ACT) Pty Ltd. Responses to the audit, where provided, are at Appendix 1.

Key messages from this audit for all Australian Government entities

21. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 The Office of the Official Secretary to the Governor-General (the Office) supports the Governor-General in the performance of his or her responsibilities. An office to support the Governor-General has existed since 1901. The Office, in its current form, was established in 1984 by an amendment to the Governor-General Act 1974.3 The planned outcome for the Office is the facilitation of the performance of the Governor-General’s role through:

the organisation and management of official duties, management and maintenance of the official households and properties, and administration of the Australian Honours and Awards system.4

1.2 The Office manages non-financial assets valued at $184.75 million (Table 1.1).

Table 1.1: Non-financial assets of the Office, at 30 June 2024

|

Type of asset |

Description |

Value ($ million) |

|

Administered non-financial assets |

Land and buildings (Government House and Admiralty House) |

174.968 |

|

Property, plant and equipment |

1.329 |

|

|

Inventories (medals) |

6.085 |

|

|

Subtotal |

|

182.381 |

|

Departmental non-financial assets |

Property, infrastructure and equipment (e.g. for gardening and IT) |

1.992 |

|

Intangibles (software) |

0.051 |

|

|

Inventories (liquor) |

0.030 |

|

|

Other non-financial assets, representing pre-payments made by the Office |

0.293 |

|

|

Subtotal |

|

2.366 |

|

Total |

|

184.747 |

Source: ANAO presentation of information from Office of the Official Secretary to the Governor-General, Annual Report 2023–24, pp. 74 and 79.

1.3 In 2023–24, the Office had 79 ongoing staff employed under the Governor-General Act 1974, comprising 76 employees located at Government House in Canberra, and three employees located at Admiralty House in Sydney. The Office is a non-corporate Commonwealth entity and subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The accountable authority for the Office is the Official Secretary to the Governor-General.

Official residences and properties

1.4 The properties of Government House (‘Yarralumla and Surrounds’) and Admiralty House (‘Admiralty House’ and ‘Admiralty House Garden and Fortifications’) were added to the Commonwealth Heritage List5 in 2004.6 The Government House property comprises around 53 hectares, including gardens, Government House and 24 other buildings (Figure 1.1).

Figure 1.1: Government House

Source: ANAO, 2 April 2025.

1.5 The statement of heritage significance for this property states:

[It] dates from the nineteenth century and is historically highly significant … Acquired by the Commonwealth following the selection of Canberra as the site for the national capital, Yarralumla was chosen as the residence of Australia’s Governor General and has operated in this role since 1927 when Parliament opened in Canberra … Yarralumla, on account of its central and direct association with the [Monarch]’s representative in Australia, has played a highly important role in Australia’s political life over many decades. … Yarralumla, through open days and other functions and through its media presence, has acquired a high degree of social significance for the Australian community.7

1.6 The Admiralty House property comprises around two hectares, including gardens, Admiralty House, the Marine Barracks and seven other buildings and fortifications (Figure 1.2).

Figure 1.2: Admiralty House

Source: ANAO, 1 April 2025.

1.7 Admiralty House has two listings with statements of significance on the Commonwealth Heritage List: ‘Admiralty House and Lodge’; and ‘Admiralty House Gardens and Fortifications’.

Admiralty House is historically significant … as the Sydney residence of the Governor-General [and] for its association with a substantial number of significant individuals and families … Admiralty House and Lodge are aesthetically significant … The House and Lodge have architectural importance; the house as an extension in the Italianate style (1891–2) of the house Wotonga (1842–44); and the Lodge as a gothic style lodge designed as an embellishment to the house … Admiralty House and Lodge have social value, occupying a place in Sydney’s popular consciousness, due to their: visibility and status as the Sydney residence of the Governor General; harbour position; use as a venue for private recreation and outdoor social functions; and periodic accessibility to the general public.8

Admiralty House garden is historically significant as the garden of Admiralty House … The garden and fortifications are aesthetically significant, [having] long been a landmark and feature of … [Sydney] Harbour. The garden is a rare surviving example of a late 19th century garden on Sydney Harbour, and retains its original form with only minor changes. … The Kirribilli Point barracks and battery, built for the Royal Artillery in 1857–59, are historically significant as evidence of the fortification works in Sydney Harbour which were constructed or improved in the mid nineteenth century, with only Kirribilli Point and Fort Denison surviving substantially intact.9

1.8 The Office reported that in 2023–24, 620 events were hosted and around 33,000 guests and visitors were received at Government House and Admiralty House.10 The Office advised the ANAO in July 2025 that in 2024–25, 487 events were hosted and around 28,000 guests and visitors were received at Government House and Admiralty House.

Rationale for undertaking the audit

1.9 One of the Office’s three overarching responsibilities is the maintenance and upkeep of two historic properties of national interest: Government House in Canberra and Admiralty House in Sydney. The properties: are of significant heritage value; receive thousands of visitors each year, including foreign leaders, diplomats, dignitaries, school children and the general public; and host events of national importance including Australian honours, award and citizenship ceremonies. This audit provides assurance to the Parliament on the effectiveness of the Office’s management of the official residences and other non-financial assets.

Audit approach

Audit objective, criteria and scope

1.10 The audit objective was to assess the effectiveness of the Office’s management of official residences and other assets.

1.11 To form a conclusion against the objective, the ANAO adopted the following high-level criteria:

- Has a fit-for-purpose asset management framework been established?

- Have non-financial assets been effectively managed?

- Has asset management performance been effectively measured, monitored and reported on?

1.12 The audit scope included the management and maintenance of the Governor-General’s two official residences and properties (Government House and Admiralty House) and other non-financial assets. The ANAO did not examine the Office’s management of: financial assets; inventories (such as medals and liquor stocks); contracts; or payment systems related to asset management.

Audit methodology

1.13 The audit methodology involved:

- examination and analysis of relevant documentation and data held by the Office;

- walkthroughs of Office systems and processes;

- meetings with Office staff and other Commonwealth officers; and

- site visits to Government House in Canberra and Admiralty House in Sydney.

1.14 The audit was open to public contributions. The ANAO did not receive any contributions.

1.15 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $366,000.

1.16 The team members for this audit were Jennifer Eddie, Jake Farquharson, Lily Engelbrethsen, Ayli Chong and Christine Chalmers.

2. Asset management framework

Areas examined

This chapter examines whether the Office of the Official Secretary to the Governor-General (the Office) has established a fit-for-purpose asset management framework.

Conclusion

The Office’s asset management framework is partly fit for purpose. The Office has governance arrangements that support asset management. Records management and risk management are deficient, reducing the ability of the Office to efficiently manage the impact of uncertainty on asset condition. The Office is operating outside its risk tolerance in relation to property management. Asset and heritage management planning arrangements are out of date and not aligned with legislative requirements.

Areas for improvement

The ANAO made two recommendations aimed at strengthening risk management and asset and heritage management planning. The ANAO also suggested that the Office revise its fraud and corruption plan and update standard operating procedures.

2.1 The primary outcomes of effective asset management are the realisation of value and achievement of objectives.11 The implementation of a fit-for-purpose asset management framework can contribute to better governance, accountability, risk management and planning.

2.2 The Australian and international standard on asset management (AS ISO 55000:2024) establishes key principles of asset management, which include a focus on establishing clear roles and responsibilities and transparent decision-making processes.12

2.3 The Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires the accountable authorities of entities to: govern the entity in a way that promotes the proper use and management of public resources (section 15); and establish and maintain appropriate systems of risk oversight and management and internal control for their entity (section 16). Specific to asset management, entities should develop processes to assess: asset-related risks; their management of assets; and their asset management systems.13

Have fit-for-purpose governance arrangements been established?

The Office has a management and committee structure to execute and oversee asset management and an internal audit program to provide assurance over governance and asset management arrangements. Elements of the Office’s records management practices are not fit for purpose, which reduces transparency over the Office’s work and can impact the Office’s business continuity, preparedness, decision-making capability and efficiency.

Management and committee structure

2.4 The Office has established roles and responsibilities for the management of properties. The Property and Projects Branch is managed by the Director, Property and Projects, who reports to the Deputy Official Secretary to the Governor-General. The Property and Projects Branch had 21 positions as at 29 January 2025, with one position vacant.

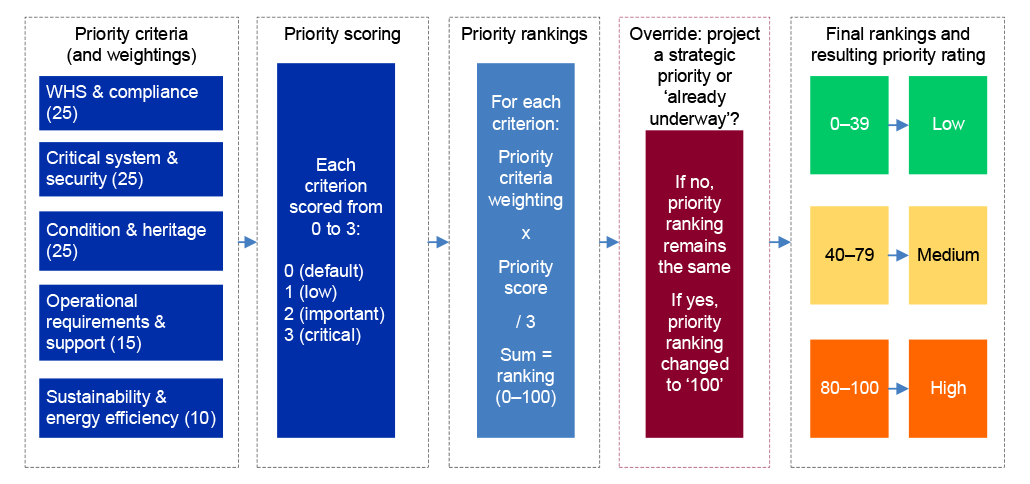

2.5 The Office has working groups and committees to support and oversee its work, including its management of official residences and other assets. The relationships between key committees and working groups referred to in this report are presented in Figure 2.1.

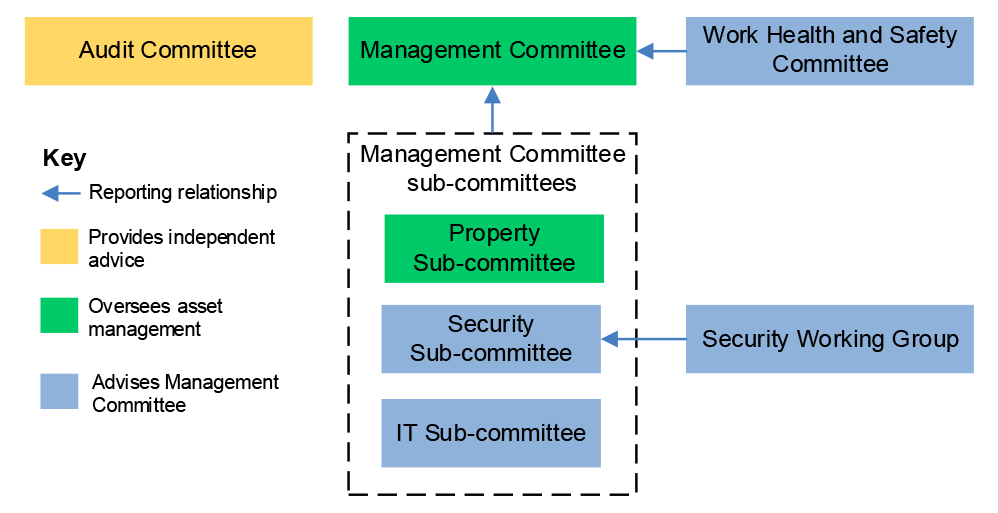

Figure 2.1: Asset management-related working groups and committees

Source: ANAO.

2.6 Two committees have oversight of the management of official residences and other assets.

- Management Committee — The Management Committee comprises the Official Secretary, Deputy Official Secretary, Chief Financial Officer, and directors. The Office’s 2024–25 corporate plan states the committee ‘monitor[s] performance outcomes and consider[s] strategic issues including emerging or ongoing risks’. Terms of reference for the Management Committee were prepared and endorsed in May 2025. Between 1 July 2023 and 30 April 2025, the Management Committee met at least monthly (sometimes fortnightly).

- Property Sub-committee — The sub-committee comprises the Deputy Official Secretary, the Chief Finance Officer, and members of the Property and Projects Branch, including the Director of Property and Projects, the Manager of Property and Services and project managers. The Office’s 2024–25 corporate plan states that the sub-committee ‘provides governance oversight of the property works plan’. Terms of reference were established in May 2025. Between 1 July 2023 and 30 April 2025, the Property Sub-committee met approximately monthly.

2.7 The Work, Health and Safety (WHS) Committee considers and addresses some specific issues related to assets and property management, including safety. Terms of reference for the WHS Committee were in draft as at July 2025. They state that the WHS Committee provides oversight of WHS matters and comprises the Deputy Official Secretary, Director of People and Services, Manager of Human Resources, Manager of Work Health and Safety, and elected staff representatives. A draft WHS Policy requires the WHS Committee to meet every three months. In 2023–24 and 2024–25, the WHS Committee met less frequently than required (five times, at intervals of between two and nine months).

2.8 The Office has an Audit Committee, in accordance with section 45 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).14 An Audit Committee Charter establishes the functions of the Audit Committee, including that the Audit Committee will provide written advice on the appropriateness of the Office’s: financial and performance reporting; system of risk oversight and management; and system of internal control. The Audit Committee met four times in each of 2023–24 and 2024–25, in accordance with its Charter.

Shared asset management arrangements

2.9 The entity has a services schedule with the Department of the Prime Minister and Cabinet (PM&C) for the maintenance of the Kirribilli House property15, which adjoins the Admiralty House property. The Office is paid by PM&C to maintain the grounds of Kirribilli House under the shared services arrangement.

2.10 The Security Sub-committee and Security Working Group, which include members from the other relevant Commonwealth entities, consider shared security arrangements. A draft letter of exchange for security arrangements at official establishments was circulated by the Department of Home Affairs (Home Affairs) to the Office, the Australian Federal Police (AFP), and PM&C in October 2024 and discussed at a meeting of the Security Working Group in November 2024. Some entities provided comments to Home Affairs in December 2024. As at July 2025, the letter was not endorsed by all four parties and further revisions remained outstanding. The Office wrote to Home Affairs in July 2025 stating that the Office’s business as usual arrangements with the AFP and Home Affairs aligned with the draft letter and suggested that if endorsement could not be obtained from all four parties, that Home Affairs consider separating the arrangements for PM&C into a different letter of exchange. Home Affairs advised the ANAO in October 2025 that it had received additional edits from the Office and PM&C and was actively working to finalise the letter of exchange.

Internal audit

2.11 Internal audit is an important tool in providing assurance over an entity’s execution of its functions and management of risks. Between 2019 and 30 June 2025, the Office engaged service providers16 to undertake internal audits and reviews, which included two directly related to asset management in 2024 and 2025 (for an accommodation project) and six covering governance topics that impact asset management: procurement and contract management (2024), performance measurement and reporting (2023), risk management (2023), legislative obligations (2022), business continuity arrangements (2021), and records management (2019).

Governance and management of records

2.12 Records management obligations are set out in the Archives Act 1983, in the PGPA Act, and by the National Archives of Australia (NAA). The NAA’s Building trust in the public record: managing information and data for government and community policy (Building Trust policy) replaced the Digital Continuity 2020 policy on 1 January 2021. The Building Trust policy identifies key requirements for managing Australian Government information assets (records, information and data).

2.13 The Office has an Information and Record Management Policy (June 2024) (Record Management policy). The Record Management policy states that the Office is ‘committed to ensuring it is meeting policies and standards mandated by [NAA] and other relevant agencies’ and that ‘all office records should be captured into the approved Records Management System for the Office and support its use over time’. The NAA defines fit-for-purpose information management processes, practices and systems as those that ‘meet identified needs for accurate information creation and use’, noting that this includes that systems maintain the availability and integrity of data and that information assets have adequate metadata.17

2.14 Between 2016 and 2024, the Office used Content Manager, an Electronic Document and Records Management System (EDRMS), as its main records management system. In August 2021, the Management Committee decided the Office would investigate changing its main records management system to SharePoint.18 The Management Committee stated SharePoint would be supplemented with a RecordPoint ‘plugin’ that would enable compliance with NAA requirements.19 In 2022, the Management Committee postponed the RecordPoint plugin.

2.15 The Office advised the ANAO in July 2025 that it had been using SharePoint as its records management system for new records since July 2024 while Content Manager was still active on a read-only basis. As at June 2025, the Office’s records management arrangements and systems partly aligned with NAA policies and guidance, with issues around metadata, sentencing20 and record availability. The Office advised the ANAO in July 2025 that migration of records from Content Manager to SharePoint/RecordPoint had occurred on 18 July 2025, meaning that the Office’s records management system was not configured to meet Australian Government records management requirements, particularly in relation to metadata, between July 2024 and July 2025.21 The ANAO also found instances were records were incomplete, inaccurate or not held electronically (for example, paragraphs 3.12–3.14, 3.54, 4.13, and 4.19 and Table 4.3).

2.16 In addition to being required by law, the effective management of government records impacts Australian Government performance (including responsive service delivery), integrity, accountability and transparency. Benefits of effective records management include improved decision-making capability using a reliable evidence base to support decisions.22

Have fit-for-purpose risk management arrangements been established?

An enterprise risk management framework incorporates asset-related risks and largely aligns with Australian Government requirements. A fraud and corruption control plan identifies asset-related fraud and corruption risks, and is not fully aligned with Australian Government requirements. The Office’s monitoring and management of risks associated with official residences and other assets could be strengthened. The Office has been operating outside its tolerance for a ‘properties risk’ since at least July 2023. There was insufficient documentation to support assessments that controls are effective for enterprise risks, including the ‘properties risk’. Risk treatments for the high-rated ‘properties risk’ have not been consistently implemented. Management of enterprise risks shared with other entities is incomplete. Eighteen specific property risks (including three rated high) are identified at the program level; however, these are not considered by the relevant governance committee.

Risk and fraud management framework

2.17 The Office has a risk management framework (May 2024), which covers all nine mandatory elements of the Commonwealth Risk Management Policy.23

2.18 The Office has a fraud and corruption control plan (last updated May 2025), in accordance with the Commonwealth Fraud and Corruption Control Framework 2024.24 The plan identifies ‘the management and maintenance of the properties and administration of the honours system with administered funds’ as one of four factors that may increase the inherent risk of fraud and corruption. The plan includes a risk register with eight fraud and corruption risks, including ‘misuse of physical assets by misappropriation or theft’. The plan aligns with assessed mandatory requirements of the Fraud and Corruption Rule, except that it does not describe how fraud and corruption risks are taken into account in planning and conducting the Office’s activities. The plan partly aligns with the mandatory requirements of the Fraud and Corruption Policy.25

Opportunity for improvement

2.19 The Office could revise its fraud and corruption control plan to fully align with all mandatory requirements of the Commonwealth Fraud and Corruption Control Framework.

Monitoring and management of asset-related risks

2.20 The Office’s 2024–25 corporate plan states that the Office applies ‘risk management principles to property management through the identification of property related risks in the Office Risk Register … Property Risk Register and individual project risk assessments.’26

Enterprise property risk management

2.21 ‘Failure to manage and maintain the property portfolio’ has been identified as a strategic risk in the Office’s 2023–24 and 2024–25 corporate plans. The Office has an enterprise risk register, which does not include this strategic risk but includes a similar risk: ‘The properties are degraded because of inadequate management and resourcing leading to the Office not delivering its required outcome’ (the ‘properties risk’).

2.22 The ‘properties risk’ is described as having five potential impacts: financial; reputational; work health and safety; compromising the integrity of the property; and disruption to the wider program and the Office’s capacity to achieve outcomes.

2.23 In its risk management framework, the Office sets its risk appetite as low and states that the Office’s risk tolerance is lower in relation to core activities, including managing and maintaining properties. Between 1 July 2023 and 30 April 2025, the ‘properties risk’ was reviewed four times. The risk rating for the ‘properties risk’ was outside the Office’s risk tolerance at all four reviews, meaning the Office has been operating outside its risk tolerance since at least July 2023. In November 2024, the pre-treatment risk rating was upgraded from ‘medium’ to ‘high’, with the post-treatment rating remaining at ‘medium’.

2.24 In November 2024, the Office identified 13 controls for the ‘properties risk’, including a landscape management plan, annual condition audits and surveys, capital projects identified in a property works plan, and reviews of Government House heritage values. Despite the Office operating outside its risk tolerance, controls were assessed as effective. The Office advised the ANAO in June 2025 that controls’ effectiveness is assessed by the Management Committee at biannual meetings to review the enterprise risk register. The Office did not retain minutes from these biannual meetings or other evidence to demonstrate the basis upon which effectiveness was determined.

2.25 The Office documented planned risk treatments at each review of the ‘properties risk’ to reduce the rating of the ‘properties risk’ to ‘medium’, with minor amendments and additions. Examples of treatments include seeking additional funding, reviewing Admiralty House heritage values and reviewing heritage management plans.

2.26 The Office’s management of the ‘properties risk’ partly aligns with its risk management framework.

- Some Office risk documentation states that the ‘properties risk’ is ‘within the acceptable risk tolerance level for this category of risk’ and that no additional treatments are required. The treatments identified by the Office do not reduce the residual risk rating to within the Office’s risk appetite of low.

- The risk management framework states that: risks rated high or above require Management Committee attention and are unacceptable risks that require reviews, strategies and mitigations. Management Committee papers and minutes from 1 July 2023 to 30 April 2025 do not document that the ‘properties risk’ received Management Committee attention, with one exception: the Property and Projects report to the April 2025 Management Committee meeting stated that one treatment (sourcing additional funding) was underway. This was five months after the rating increased to high.

- The treatments identified by the Office in November 2024 were retained from the previous review, where the target implementation date was 31 December 2024. None of the treatments had been implemented as at July 2025. The Office advised the ANAO in July 2025 that ‘risks cannot be treated due to resourcing constraints’.

2.27 Effective risk management leads to improved financial management, informed decision-making and improved organisational performance. A strong risk culture supports entities to effectively manage risks in an environment of resource constraints and competing priorities. Taking appropriate and timely action for risks outside of tolerance is an attribute of a positive risk management culture.27

2.28 The Office’s system of documentation of enterprise risks requires risks that are shared with other entities to be identified. For Audit Committee meetings held between 1 July 2023 and 31 December 2023, where enterprise risk registers were provided to the committee, the Office recorded on the register whether or not enterprise risks were shared. For meetings from March 2024, this practice was discontinued. The ‘properties risk’ was not considered to be shared. Two other shared enterprise risks were identified, one of which was property-related28: damage to people or property caused by physical security incident activity leads to failure to comply with legislation and workplace obligations. The Office considered that it shares this risk with the Attorney-General’s Department (AGD) and the Australian Federal Police (AFP). Respective responsibilities for the management of this risk have not been documented.

Property Risk Register

2.29 The Office’s ‘Program Risk Register’ contains 18 risks and states that it was last reviewed by the ‘Property Project Team’ on 1 March 2025. Three of 18 risks have a residual rating of high following implementation of treatments. The risks relate to the deferral of projects, changes in COVID work restrictions, and the failure to deliver property works program projects quickly enough, due to funding, to address ‘the diminishing condition of the heritage buildings and other facilities due to insufficient maintenance over the asset lifecycle.’ The Office identified treatments for the risks, which included seeking additional funding, closer engagement with stakeholders, improving project planning and closer attention to property condition monitoring. Treatments were partly implemented for the three risks with a residual rating of high.

2.30 The Office advised the ANAO in August 2025 that the Program Risk Register would be discontinued.

Risk oversight and assurance

2.31 Between 1 July 2023 and 30 April 2025, the Management Committee considered risk reporting at its meetings and provided oversight of risk management (Table 2.1).

Table 2.1: Risk oversight by the Management Committee

|

Type of reporting |

Frequency |

Information provided |

|

People and Services report |

Approximately monthly at Management Committee meetings held between 1 July 2023 and 31 December 2023. |

The People and Services Branch update included a section on risk management containing the risk description, the mitigation strategy and the risk rating. During the period examined, three asset-related risks were raised relating to the impact of external resourcing on the property works program and administered capital budget (ACB), and of scheduling conflicts on the ACB. |

|

Director surveys |

Monthly at ‘discussion’ meetings (April 2024 to July 2024)a Monthly at ‘performance’ meetings (February 2024 to April 2025). |

Branch directors responded to survey questions about changes in risk assessments and the identification of emerging risks and whether risks were within acceptable tolerance levels or had treatments. |

Note a: Following the July 2024 meeting, the Official Secretary decided to cease ‘discussion’ meetings.

Source: ANAO analysis covering the period 1 July 2023 to 30 April 2025.

2.32 For Property Sub-committee meetings held between 1 January 2024 and 30 April 2025, available draft minutes29 show that there was no standing agenda item on risk and the Property Risk Register was not tabled or discussed.30

2.33 The Office commissioned an internal audit on risk management in 2023, which concluded that the Office had a developing level of maturity and identified weaknesses relating to risk ownership; risk context setting; risk analysis; assessment of controls; and risk evaluation. Nine recommendations were made, of which the Office agreed to two and ‘agreed in principle’ to seven. When the Office presented the internal audit report to the Audit Committee in March 2024, the Office noted concerns with ‘the appropriateness of recommendations when considering the scale of the Office’s resources and activities’. The Office does not produce closure reports for recommendations. The Office advised the ANAO in June 2025 that all nine recommendations were closed and that it considered that: what it already had in place was largely sufficient to address five recommendations; and the revised risk framework resolved the remaining four recommendations.

2.34 The Audit Committee Charter (August 2024) states that one of the committee’s responsibilities is to provide advice to the Official Secretary on the appropriateness of the Office’s system of risk oversight and management. The Office regularly provided to the Audit Committee: the enterprise risk register, which includes the Office’s ‘properties risk’; and papers from other governance bodies that include items on risk. During the course of its activities, the Audit Committee commented on or sought further information on aspects of the Office’s risk management arrangements. The Office did not consistently record these action items or act on the Audit Committee’s observations and requests.

2.35 The Audit Committee provided the Office’s accountable authority with letters of advice regarding the Office’s system of risk oversight and management. The Audit Committee concluded that the Office’s system of risk oversight and management as a whole was appropriate and complied with Section 16(a) of the PGPA Act for 2022–23 and 2023–24.

Recommendation no.1

2.36 The Office of the Official Secretary to the Governor-General strengthen its risk management arrangements by:

- ensuring risks that exceed its risk appetite and tolerance levels are considered by the Management Committee in accordance with its risk policy, and that appropriate treatments are applied to these risks;

- to assist with forward planning and resource allocation to risk, documenting the basis upon which risk controls are assessed to be effective;

- documenting responsibilities for risks that are shared with other entities; and

- establishing management arrangements and oversight through the Property Sub-committee and Management Committee for property-specific risks.

Office of the Official Secretary to the Governor-General response: Agreed.

2.37 The Office agrees to this recommendation noting that these are largely already in place and completed as recommended for enterprise risks. Management arrangements and oversight of property-specific risks will be further strengthened.

- All risks and treatments, including those rated medium to high, are and have previously been considered by Management Committee at their regular meetings.

- The effectiveness of risk controls are and have previously been regularly formally reviewed, assessed and documented. The basis of that assessment will be captured.

- Shared risks are and have been previously noted on the risk register along with the other entities.

- Property-specific risks will be transferred to the online risk system to facilitate consideration by the Property Sub-committee and Management Committee.

Is there fit-for-purpose planning for asset and heritage management?

The Office has established asset management policies, plans and procedures, which are out of date and not aligned with current asset management practice. The Office has a heritage management strategy and heritage management plans, which are not aligned with requirements under the Environment Protection and Biodiversity Conservation Act 1999, including being overdue for review and not appropriately registered. A review of a 2015 heritage strategy was due in 2018. The Office completed its review of the strategy in 2025 and as at 31 July 2025 had submitted a draft strategy to the Department of Climate Change, Energy, the Environment and Water for consultation.

2.38 An asset management policy should: be fit-for-purpose, documented and communicated to staff; establish an asset management framework; and include a commitment to meet applicable requirements.31 An asset management plan should specify the key activities, resources, costs and timelines required to achieve an entity’s asset management objectives.32

Asset management policy and plans

2.39 The Office has: Accountable Authority Instructions on managing public property; an asset management policy (2015); and asset management-related standard operating procedures. The Office also has a strategy and plans related to heritage management.

Accountable Authority Instructions

2.40 The Official Secretary’s Accountable Authority Instructions (AAIs) on managing public property outline responsibilities and include procedures for procurement and acquisition (including through receipt of gifts and benefits), use and management, loss and recovery, and disposal of property. There are references to Commonwealth policies and other relevant internal policies and instructions on topics such as gifts, risk management, accountability, insurance and fraud control.

Asset management policy

2.41 The Office’s asset management policy was established in January 2015. The policy applies to all non-financial assets managed by the Office and covers registering, using, acquiring and disposing of assets. It is available to all staff on the Office’s intranet along with asset management flowcharts and training slides, which are based on the 2015 policy. The Office does not have a separate asset management plan; however, the policy largely meets the definition of a plan contained in AS ISO 55000:2024 (see paragraph 2.38).

2.42 The Office’s asset management policy aligns with the key elements outlined in AS ISO 55000:2024. However, as the policy has not been updated since 2015, some references to applicable requirements are outdated. The policy contains 34 requirements for managing non-financial assets. Of these, the ANAO found current practices: aligned with 23 requirements (68 per cent); partly aligned with nine requirements (26 per cent); and did not align with two requirements (six per cent). As an example of partial alignment, the policy states ‘portable and attractive’ assets must be added to a register for control purposes. This was not being done consistently (see paragraphs 3.12–3.15). The ANAO also observed instances of approvals being made by different responsible officers than those identified in the policy. The two areas where current practices did not align with the asset management policy are outlined below.

- The policy states inventory stocktakes will occur every six months each financial year. In practice, the Office conducts stocktakes once annually.

- The policy states that branches are to develop branch operational plans and team plans to complement the strategic plan. This was not being done.

Asset management procedures

2.43 The Office has 70 asset management-related standard operating procedures. Procedures relate to work health and safety (WHS) practices (22), property use and asset management (12), general maintenance and cleaning (10), heritage management (6), use of vehicles (5), and other (such as security, IT and management of contractors).

2.44 The oldest asset maintenance standard operating procedure was established in 2004 and the most recent was established in 2021, with 99 per cent (69 of 70) more than 10 years old. The procedures do not contain a requirement to be reviewed. Reviewing procedures at appropriate intervals helps ensure that an entity’s procedures are contemporary and meet regulatory requirements. Many of the procedures included the names and contact details of specific personnel rather than positions, increasing the chance that the information in the procedures will become outdated and inaccurate and lead to inefficiencies or errors.

Opportunity for improvement

2.45 To help ensure that standard operating procedures remain relevant, the Office could: include in its standard operating procedures the expected review date and relevant positions, rather than the names of individual officials; and review the procedures at set intervals.

Heritage management strategy and plans

Heritage strategy

2.46 As mentioned at paragraph 1.4, Government House and Admiralty House were added to the Commonwealth Heritage List in 2004 as ‘Commonwealth owned or controlled places with significant heritage value’.33 The Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act) (s341ZA) requires agencies to prepare a written heritage strategy for managing places to protect and conserve Commonwealth heritage values.34 The Environment Protection and Biodiversity Conservation Regulations 2000 (EPBC Regulations) contain further requirements.

2.47 The Office prepared its first heritage strategy in 2006. As the EPBC Act requires a heritage strategy to be reviewed every three years, the 2006 strategy was due for review in 2009. The review was undertaken in 2015, when a revised heritage strategy was prepared covering the period 2015 to 2018. Of 18 required components under the EPBC Regulations, the 2015 heritage strategy fully addressed 13 and partly addressed five.

2.48 A review of the 2015 strategy was due in 2018. The Office started a review of the strategy in 2020, which was not finalised. The Office recommenced a review of the strategy in 2025. The Office submitted its 2025 draft heritage strategy for consultation to the Department of Climate Change, Energy, the Environment and Water (DCCEEW) on 31 July 2025.

2.49 Under the EPBC Act, entities are required to prepare a report for the Minister for the Environment and Water (the Minister) every three years35 on their review of the heritage strategy. If the reviews of the heritage strategy had been prepared on schedule, the Minister would have received six reports from the Office between 2009 and 2025. The Office prepared a report on its unfinished 2020 review of the 2015 heritage strategy; however, the report was not finalised or submitted to the Minister. The Office has not prepared any reports for the Minister on the heritage strategy since the first strategy was prepared in 2006.

Heritage management plans

2.50 The EPBC Act requires agencies to establish a heritage management plan for Commonwealth Heritage places.36 The EPBC Regulations set out requirements for heritage management plans, including what must be addressed and that plans must be reviewed every five years. In addition, according to the EPBC Regulations and the DCCEEW guide Working Together: Managing Commonwealth Heritage Places, A guide for Commonwealth Agencies:

Heritage management plans for Commonwealth Heritage listed places are legislative instruments for the Purposes of the [Legislation Act 2003]. This means that once a plan is made by a responsible Commonwealth agency under section 341S, it must be registered as a legislative instrument on the Federal Register of Legislation (Register) as soon as practicable (s.4 of the Legislation Act). Otherwise, the [entity] may not be compliant with its obligations under the EPBC Act.

2.51 The Office established heritage management plans for Government House and Admiralty House in 2009 and 2010, respectively.37 Although plans existed, there were deficiencies.

- The Office had not reviewed the plans since they were established.

- The 2009 and 2010 plans addressed most of the content requirements, but did not explain how implementation would be monitored for Admiralty House, or how guidance to manage heritage values could be improved.

- Some of the information in the plans was no longer relevant, particularly relating to the condition of heritage values, management goals, and policies.

- The plans were not established under section 341S as they were not reviewed by DCCEEW or endorsed by the Australian Heritage Council.

- The plans had not been registered on the Federal Register of Legislation.

|

Box 1: Heritage management plan compliance with the EPBC Acta |

|

2.52 DCCEEW reviews and reports on the status of heritage management plans for all Commonwealth Heritage- and National Heritage-listed places every five years. Review of the National Heritage List and Commonwealth Heritage List: 1 July 2018 to 30 June 2023 outlined that, as at June 2023, there were 388 places on the Commonwealth Heritage List, of which 372 required a heritage management plan.b 2.53 For the 372 places that required a heritage management plan, none were reported as meeting all EPBC requirements.

|

Note a: Department of Climate Change, Energy, the Environment and Water, Review of the National Heritage List and Commonwealth Heritage List: 1 July 2018 to 30 June 2023, 2023.

Note b: Since June 2023, four places had been delisted. As at April 2025 there were 384 places on the Commonwealth Heritage List.

Note c: Percentages do not add up to 100 per cent due to rounding.

Source: ANAO analysis of Department of Climate Change, Energy, the Environment, and Water, Review of the National Heritage List and Commonwealth Heritage List: 1 July 2018 to 30 June 2023, Canberra, 2024, pp. 34–35.

Landscape heritage management plans

2.54 The Office has a landscape heritage management plan for Government House that was established in 2010, covering the period 2010 to 2015. As at July 2025, it had not been updated. The plan comprises 13 topics including a ‘garden master plan’, tree management, memorial plantings, garden bed management, turf management, irrigation, hard landscape features, parking, and a long term works plan.

2.55 The Office does not have a landscape heritage management plan for Admiralty House, but it does have a ‘landscape program’, established in 2006 (of no set duration). The Admiralty House landscape program outlines, at a higher level than for Government House, the maintenance works to be undertaken each year for each precinct of the property. It states that it sets ‘landscape principles’ for the ‘conservation and heritage values’ of Admiralty House, but it does not outline principles or values and has not been updated, including since the heritage values for Admiralty House were set out in the 2010 heritage management plan.

Recommendation no.2

2.56 The Office of the Official Secretary to the Governor-General:

- review and update its asset management policy and ensure practices are implemented in accordance with the agreed policy; and

- update its heritage management plans, in compliance with the Environment Protection and Biodiversity Conservation Act 1999.

Office of the Official Secretary to the Governor-General response: Agreed.

2.57 The Office agrees to this recommendation and notes it has already been progressed as outlined below, noting resource constraints have impeded progress.

- Asset management policy and accompanying procedures have been reviewed and updated, and will be released by December 2025. Implementation of asset management procedures to be reviewed periodically by the Finance and Property team, to ensure compliance.

- Heritage management plans will be reviewed and updated by 30 June 2026 to ensure compliance with the Environment Protection and Biodiversity Conservation Act 1999. Future reviews will be conducted on an annual basis to ensure ongoing compliance.

3. Asset management

Areas examined

This chapter examines whether the Office of the Official Secretary to the Governor-General (the Office) has effectively managed non-financial assets.

Conclusion

The Office’s management of the official residences and other non-financial assets is largely effective, with most key property elements assessed by the Office to be in good condition (including the main Government House building (‘good’ condition) and Admiralty House (‘very good’ condition)). Assets have been registered largely appropriately. The maintenance practices for Government House and Admiralty House buildings and grounds are largely appropriate.

Areas for improvement

The ANAO made two recommendations aimed at strengthening management of gifted assets and its processes and practices for budget prioritisation. The ANAO also suggested that the Office strengthen its gifts and benefits policy, provide heritage management training to staff, and improve property service provider performance reporting arrangements.

3.1 The Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires the proper use and management of public resources, including assets and property. ‘Proper use’ is defined as ‘efficient, effective, economical and ethical’. The ANAO examined whether assets, including the official properties, have been registered, conserved and maintained effectively.

Have assets been registered appropriately?

The Office has asset registers, which have been appropriately updated, except in relation to gifts received by Office staff or the Governor-General. Official gifts are not registered as portable and attractive items in accordance with Office policy. Record-keeping for gifts could be improved. The Office’s gifts and benefits policy could be strengthened to consider security. In 2024–25, the Office did not publicly report the giver of gifts, despite Australian Public Service Commission guidance to do so.

3.2 In order to effectively manage assets, an entity needs an inventory or register outlining which assets it is managing, with details on the attributes of these assets. An effective asset register keeps financial and non-financial information over each asset’s life cycle for the purposes of planning; accounting and legislative compliance; and performance monitoring.

Non-current assets

3.3 The Office’s asset management policy defines ‘non-current assets’ as items expected to be used in more than one financial year, with an initial cost of at least $3,000. The policy states that all non-current assets must be maintained on an asset register and for the asset register to be managed on an accurate and timely basis.

3.4 The Office maintains a fixed asset register that lists non-current assets by category and asset number and includes financial information for accounting purposes. The fixed asset register includes the Office’s land and buildings, IT equipment38, furniture, kitchen and gardening equipment, tableware and motor vehicles (Figure 3.1).

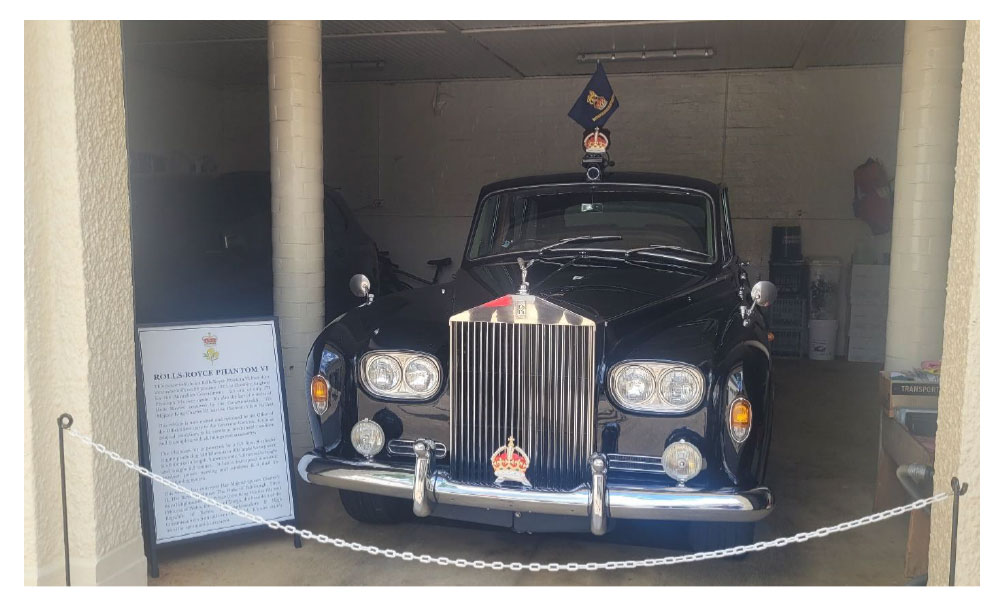

Figure 3.1: Fixed asset example, 1970 Rolls-Royce (Phantom VI)

Source: ANAO, 13 February 2025.

Portable and attractive items

3.5 The asset management policy states that ‘the Office shall maintain a separate category of items which, by virtue of their attractiveness and portability are at risk of being stolen, are classified as portable and attractive’. This includes ‘items such as IT equipment, other electronic devices, cameras, power tools, artwork, antiques, etc’. The Office’s gifts and benefits policy states ‘any gifts or benefits surrendered will be considered to be property of the Office and will be treated as portable and attractive items’. The Office maintains a portable and attractive items register, which contains items whose initial cost was between $250 and $3,000. While a portable and attractive items register is maintained, it is incomplete (see paragraph 3.14).

Third party assets

3.6 The Office has paintings, sculptures, furniture and other items for public display at Government House and Admiralty House that are on loan from the Australiana Fund39, the National Gallery of Australia, the Australian Institute of Aboriginal and Torres Strait Islander Studies, the Australian War Memorial, and the Department of Parliamentary Services (Figure 3.2: Yarralumla (‘Dad’s’) cabinet, on loan from the Australiana Fund). The Office keeps a record of these pieces in a database and through individual loan agreements.

Figure 3.2: Yarralumla (‘Dad’s’) cabinet, on loan from the Australiana Fund

Source: ANAO, 13 February 2025.

Gifted assets

Gifts policy

3.7 The Office’s Accountable Authority Instructions (2019) include gifts in the definition of ‘relevant property’ that is covered by Public Governance, Performance and Accountability Act 2013 (PGPA Act) (section 15) ‘proper use of public resources’ requirements. The instructions state that all assets and portable and attractive items must be reported internally through an ‘asset addition form’ at the time of acquisition.

3.8 The Office established a gifts and benefits policy in 2015, which was updated in July 2020, July 2024, October 2024 and April 2025. The July 2020 gift policy stated that for gifts retained by the Office, the Office should ‘assign [an] asset number (if to be registered as a portable and attractive item or otherwise registered as an asset)’. The October 2024 and April 2025 gift policies state any gifts or benefits surrendered to the Office by the Governor-General or staff of the Office will be considered to be property of the Office and will be treated as portable and attractive items.40

3.9 The gift policy does not discuss security in relation to gifts, other than for gifted electronic devices, which it states should be destroyed. The Australian Security Intelligence Organisation (ASIO) Annual Threat Assessment 2025 stated:

multiple countries are relentlessly seeking information about our military capabilities. Defence personnel are being targeted in person and online. Some were recently given gifts by international counterparts. The presents contained concealed surveillance devices.41

Opportunity for improvement

3.10 As the Governor-General is the Commander-in-Chief of the Australian Defence Force and conducts high-level meetings at Government House and Admiralty House, precautions should be taken with gifts accepted overseas and retained and displayed by the Office. The Office could amend its gifts and benefits policy to consider security risks from all types of gifts.

Registering gifts

3.11 The July 2020 version of the gifts and benefits policy, which applied to gifts received in 2023–24, included an ‘official gift reporting form’ for gifts (worth over $100) presented to the Governor-General (or spouse). The form required a description of the gift, date of receipt, name of giver, and estimated value. The form contained a workflow for approval, which included that the Chief Financial Officer assign gifts (that were retained by the Office) an asset number.

3.12 A key requirement of the National Archives of Australia’s (NAA’s) 2021 Building Trust policy (see paragraph 2.12) is that entities ‘reduce areas of information management inefficiency and risk’ which includes that entities ‘work digitally by default and manage information in digital format’.42 The Office did not hold digital records of gift forms for 2023–24. The ANAO reviewed the Office’s hardcopy gift forms for 2023–24 and found that these records, in addition to not meeting NAA policy for being in a digital format, were incomplete and inaccurate.

3.13 Hardcopy gift forms and gift registers showed that 11 gifts over $100 had been retained by the Office in 2023–24 and seven gifts over $100 were retained by the Office in the first two quarters of 2024–25. The two highest value gifts received in 2023–24 were a Legacy ceremonial torch, valued at $10,000, and a Herend tea set, valued at $5,000. There were hardcopy gift forms for both items, which were incomplete and did not include asset numbers. The hardcopy gift forms stated that the gifts were retained by the Office (with the Legacy torch on public display and the Herend tea set in storage). In July 2025, the ANAO confirmed the Legacy torch was on display at Government House. The Office advised the ANAO in July 2025 that contrary to the hardcopy gift form, the Herend tea set was not in storage. The Office produced email records that showed that the tea set had been purchased by the former Governor-General. The purchase was in accordance with the gifts and benefits policy.

3.14 None of the gifted assets retained by the Office (during the period examined) were recorded in the fixed asset register or the register for portable and attractive items.

Gift reporting

3.15 Officials have a duty under the PGPA Act to not improperly use their position to gain, or seek to gain, a benefit or an advantage (section 27) and to disclose details of personal interests (section 29). Acceptance of a gift or benefit can create a real or apparent conflict of interest that should be disclosed.43

3.16 The October 2024 and April 2025 policies state that the Office had adopted Australian Public Service Commission (APSC) guidance on gifts and benefits. The July 2020 gifts policy (current in 2023–24) required that gifts to the Governor-General valued at over $100 be publicly disclosed annually. The October 2024 and April 2025 policies required that gifts and benefits over $100 be publicly disclosed: on a quarterly basis for gifts to the Official Secretary and staff; and annually for gifts to the Governor-General and spouse.

3.17 The Office has published on its website registers of gifts and benefits received by: the Official Secretary and Office staff since January 2020; and the Governor-General (and spouse) since July 2024. There was no public reporting on Governor-General gifts and benefits between 2019–20 and 2023–24.44 To meet the policy intent, information on the giver of a gift or benefit should be included when disclosing a gift or benefit and APSC guidance includes a gift register template containing a column to report the gift giver.45 The public registers for 2023–24 (which were for the Official Secretary and staff) included a column to disclose who the gift was ‘presented by’, which aligns with APSC guidance. The public registers for 2024–25 (for the Governor-General and/or spouse, the Official Secretary and staff) do not disclose the giver.

Recommendation no.3

3.18 The Office of the Official Secretary to the Governor-General strengthen:

- controls to ensure gifts retained by the Office are appropriately registered as ‘portable and attractive items’ and managed in accordance with Office policy; and

- public reporting on gifts and benefits, by disclosing the gift giver.

Office of the Official Secretary to the Governor-General response: Partially agreed.

3.19 Action to be taken:

- It is not practicable that all gifts retained by the Office are to be recorded in the asset register as “portable and attractive items”. This will create an administrative burden and could make future valuations of the Office’s assets more complex in nature. The Office acknowledges this requirement was shown on the previous manual gift and benefit registration form but notes it was not included in the current system or process – i.e. the Office is adhering to current policies and processes. It is also noted that the Office has in place a standalone governance system which includes a module focused purely on gifts i.e. there is a high degree of confidence in the recording and approval of gifts per the Office policy which is publicly available.

- Gifts and benefits will continue to be regularly reported on the Office’s website. Details of the gift giver were shown on the most recent report and will be included going forward.

Have properties been conserved and maintained appropriately?

In 2023–24, the Office self-assessed that 76 per cent of elements of high heritage significance were in good or very good condition, which was higher than its performance target. For eight key property elements of high heritage significance, assessed condition remained stable or improved between 2009 and 2023–24. Despite the positive outcome relating to condition assessments, there are ways in which the Office could improve its conservation and maintenance of properties.

- The Office has not fully implemented its heritage management plans.

- There are weak budget prioritisation practices for capital and maintenance projects.

- The Office does not provide heritage training to staff and none of its staff are trained in heritage management.

- A tree management plan for Government House was first established in June 2025. There is no tree management plan for Admiralty House.

The Office uses a property service provider for reactive and preventative maintenance and provided feedback on the property service provider’s performance to the property service provider and the Department of Finance. Reporting arrangements with the property service provider could be improved to better enable the Office to monitor timeliness and value for money of maintenance services.

Conservation of heritage properties

3.20 The Office undertakes an annual condition assessment of property elements with high, moderate and no heritage significance. For 2023–24: 53 (62 per cent) of all 86 property elements were assessed as being in ‘good’ or ‘very good’ condition, with the remaining 33 elements (38 per cent) in ‘fair’ or ‘poor’ condition. Of the 45 property elements of high heritage significance, 34 (76 per cent) were self-assessed as being in very good or good condition (Figure 3.3). This includes the main Government House building, which was assessed as being in ‘good’ condition and the main Admiralty House building, which was assessed as being in ‘very good’ condition.

Figure 3.3: Condition of property elements, by heritage significance, 2023–24

Source: ANAO analysis.

3.21 A heritage management plan commissioned by the Office in 2009 for Government House included a condition assessment conducted by Lovell Chen Architects and Heritage Consultants for 14 property elements, including eight of high heritage significance. A 2010 Admiralty House plan did not include condition ratings by element. For the eight high heritage items in the 2009 Government House heritage management plan, the assessed condition has stayed at the same level or improved between 2009 and 2023–24. The full list of elements of high heritage significance in 2023–24, the Office’s self-assessed condition in 2023–24, and the 2009 heritage condition of Government House elements (where assessed) is at Appendix 3.

3.22 The Office forecasts the condition of its property elements will deteriorate in forward years. The Office’s 2024–25 corporate plan had declining targets for the condition of property elements, with the target for the condition of all property elements set at 65 per cent being in good (or better) condition by 2027–28 (see paragraph 4.5).

3.23 An independent review of the Office, which was commissioned by PM&C and released in August 2025, concluded in relation to property management:

The property team manage complexities very well within current constraints, but given current funding levels and limitations in capacity, the focus is understandably on patching existing problems rather than taking a strategic view. While the current activity is sufficient to allow such planning to be postposed year to year, delay does increase the risk of further significant degradation.46

3.24 The Office advised the ANAO in February 2025 that its maintenance approach (see paragraphs 3.46–3.47) has meant it reacts to issues when they arise, rather than investing to conserve heritage values, and that it intends to adopt a more considered approach in 2025.

Implementation of heritage strategy and heritage management plans

3.25 As set out at paragraphs 2.46–2.56, the Office has a heritage strategy (2015) and heritage management plans (2009 and 2010). The Office advised the ANAO in February 2025 that its heritage management plans have not been fully implemented, but that it uses information in the plans as a ‘reference’ (for example, to identify the ‘level of significance’ of the properties’ features and structures). The Office has partly implemented the heritage management plans. For example, the 2010 heritage management plan for Admiralty House made six recommendations for the Marine Barracks, of which one was implemented (Case Study 1).

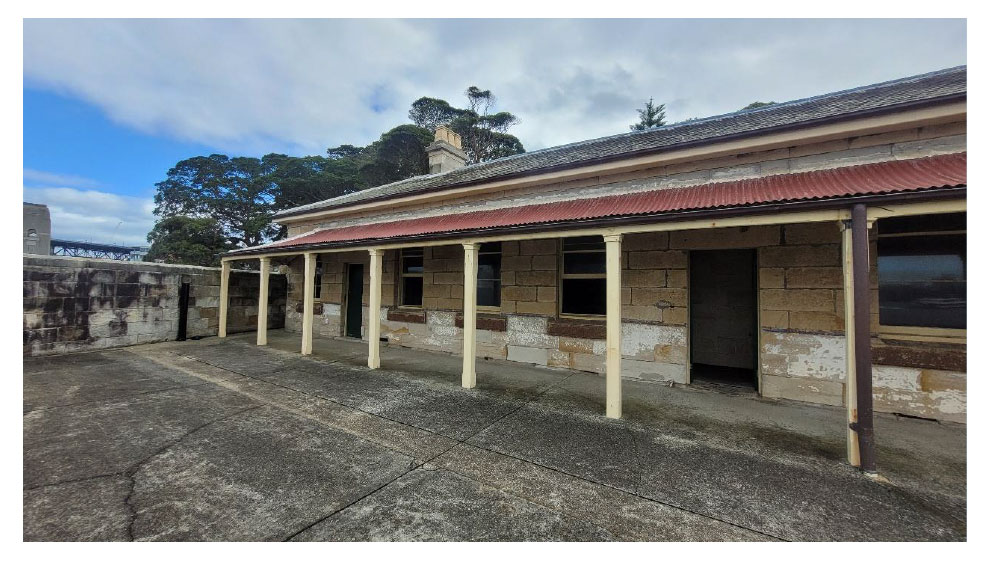

|

Case study 1. Admiralty House Marine Barracks |

|