Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of the OneSKY Contract

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The OneSKY program aims to build and operate a joint civil–military air traffic management system (CMATS) and is a major investment for Airservices Australia (Airservices).

- The ANAO has conducted three audits into the procurement related to CMATS, the most recent in 2019.

- This audit provides assurance to Parliament on the effectiveness of Airservices’ contract management for CMATS.

Key facts

- In February 2018 Airservices entered into contracts for the delivery and support of CMATS with Thales Australia Limited (Thales) and an on-supply agreement with the Department of Defence (Defence). As at 31 December 2024, the contracts with Thales have been varied 47 times.

- In December 2023 Airservices, Defence and Thales negotiated a revised delivery strategy and implementation dates.

What did we find?

- Airservices’ contract management of the OneSKY program has been partly effective.

- Airservices’ governance arrangements to support contract management are partly effective.

- Airservices’ management of the contract has been partly effective.

What did we recommend?

- The ANAO made five recommendations to Airservices relating to its contract management plan, risk management, documentation of contract variation value-for-money assessments, performance management, and guidance and practice for accepting gifts, benefits and hospitality.

- Airservices agreed to four recommendations and partly agreed to one.

$1.2 bn

(AUD equivalent)

paid to Thales for CMATS as at February 2025

$160 m

(AUD equivalent)

in acquisition contract variations executed between February 2018 and December 2024

4½ years

added to project schedule between February 2018 and December 2024

Summary and recommendations

Background

1. Airservices Australia (Airservices) is established under the Air Services Act 1995 to provide air traffic control and other related services to the aviation industry in Australian-administered airspace. The Department of Defence (Defence) provides air traffic management to military aviation in Australia, including at Defence airfields that operate with shared military and civil use.

2. The OneSKY program aims to build and operate a joint civil–military air traffic management system. The program includes the design and delivery of the new Civil Military Air Traffic Management System (CMATS) plus supporting infrastructure for Airservices and Defence. Airservices is the lead agency delivering the CMATS program in collaboration with Defence.

3. In February 2018 Airservices entered into separate acquisition and support contracts with Thales Australia Limited (Thales) and an on-supply agreement with Defence.

Rationale for undertaking the audit

4. Passengers in Australian airspace rely on Airservices to provide critical air traffic control infrastructure safely and efficiently. The OneSKY program is a major change for Airservices, and CMATS is a core component of the program. Airservices has contracted Thales to develop and support CMATS. The ANAO has previously undertaken three performance audits on the procurements for CMATS, the most recent in 2019.1 Procurement and contract management of large-scale IT projects involve elevated risks. The audit provides assurance to Parliament on whether Airservices is managing the contract for CMATS effectively.

Audit objective and criteria

5. The objective of the audit was to assess the effectiveness of Airservices’ contract management for the OneSKY program.

6. To form a conclusion against the audit objective, the audit team applied the following high-level criteria:

- Has Airservices developed appropriate governance arrangements to support contract management?

- Has Airservices managed the contract effectively to achieve value for money?

Conclusion

7. Airservices’ contract management of the OneSKY program is partly effective. It has governance processes in place and has developed procedures to manage the contract. Shortcomings in contract management planning, performance management and probity have limited its effectiveness in managing the contract to minimise cost increases and schedule delays.

8. Airservices has implemented partly appropriate contract management governance arrangements. A contract management plan is in place; however, arrangements did not sufficiently cover provider performance, program risk and probity issues. Risk processes did not completely capture interdependencies between contract management and program risks. An on-supply agreement formalised arrangements between Airservices and the Defence for the delivery of CMATS. It relies on effective collaboration and governance forums for issues escalation. The Defence component of CMATS was declared a Project of Concern in October 2022 outside of the formal governance forums.

9. Airservices is partly effective in managing the contract to achieve value for money. It has a process to manage variations; however, a high number of variations to date have resulted in cost increases and schedule extensions, and the rationale for its value-for-money assessment was not consistently documented when seeking approval. The incentive-based pricing model agreed in the contract between Airservices and Thales has not been fully effective in containing costs, with the target price expected to be met. Airservices’ supplier performance management is not fully developed or utilised. Airservices applies enterprise-wide probity procedures for conflicts of interest and gifts and benefits, but staff did not always follow these.

Supporting findings

Contract management governance

10. Airservices has developed a OneSKY contract management plan. The plan covers elements set out in the Airservices contract management procedure, such as roles and responsibilities, governance arrangements and the variation process. It does not cover contract management risk or probity for CMATS, and does not reference the CMATS risk management plan or probity plan. The contract management plan does not sufficiently cover contractual performance management. The OneSKY program has 12 governance forums that are intended to provide direction and oversight. The OneSKY Strategic Relationship Forum has never met and in October 2022 CMATS was declared a Project of Concern. (See paragraphs 2.3 to 2.21)

11. Airservices applies the OneSKY program risk management process to contract management risks. It has risk management plans and documentation to identify and monitor contract risks; however, controls and treatments are not fully effective and contract management risks have been realised throughout the project. The interdependency between contract management risks (including Thales’ performance) and risk to overall program delivery and objectives is not fully captured — for example, through documentation of specific contract management actions and levers to ensure program-wide deliverables are achieved. (See paragraphs 2.22 to 2.39)

12. The on-supply agreement formalised the relationship between Airservices and Defence for the delivery of CMATS and has been varied 10 times. It covers collaboration between the two entities and governance forums, but does not provide for escalation if issues cannot be resolved within these mechanisms. In August 2021 Defence escalated its concerns about the project to ministerial level and in October 2022 the Minister for Defence Industry declared CMATS a Project of Concern. The Minister for Defence Industry has since held six meetings with principal stakeholders to address project underperformance. These have resulted in the development of a remediation plan to address program-wide issues. As at February 2025 CMATS remains on the Project of Concern list, with exit criteria formulated to demonstrate delivery of Defence capability. The exit criteria are not expected to be met before 2027. (See paragraphs 2.40 to 2.62)

Achievement of value for money

13. The combined impact of 44 variations as at 31 December 2024 has seen the cost of the acquisition contract increased by $160 million (AUD equivalent) and the delivery date extended by 53 months (four-and-a-half years). Airservices has a process in place to support the development and assessment of contract variations. Briefs to the approval delegate did not completely document how the various elements (technical need, risk and cost) collectively justified the value-for-money assessment or the effect of incremental change on the overall contract value for money. (See paragraphs 3.2 to 3.28)

14. The acquisition contract operates under an incentive arrangement where Airservices and Thales share costs and savings. Under the contract agreed in February 2018, Airservices reimburses Thales for actual costs incurred for works performed up to the ceiling cost. Since December 2023 the arrangement has focused on payments based on milestones. Airservices has mechanisms in place to monitor Thales’ performance, but it does not fully utilise these. In February 2024 program-level key performance indicators were introduced as part of Project of Concern remedial action but these do not provide associated consequences for supplier underperformance where relevant. (See paragraphs 3.29 to 3.69)

15. Airservices has procedures for probity management. Airservices utilises enterprise-wide conflict of interest procedures and gifts, benefits and hospitality acceptance procedures, but these are not reflected in OneSKY probity plans. Airservices staff accepted and did not declare gifts, benefits or hospitality, indicating limited compliance with Airservices’ code of conduct requirements and procedures on perceived and actual conflicts. (See paragraphs 3.70 to 3.88)

Recommendations

Recommendation no. 1

Paragraph 2.20

Airservices Australia update the contract management plan to:

- include how contract management risks and probity are managed;

- provide sufficient guidance on the performance management approach; and

- incorporate additional oversight and periodic contract reviews to ensure contract deliverables remain on track and commercial arrangements are fit for purpose.

Airservices Australia response: Agreed.

Recommendation no. 2

Paragraph 2.35

Airservices Australia identify and document how contract management risk connects to risk at the program level and when specific contract management action could be used to mitigate and improve control of program risks.

Airservices Australia response: Agreed.

Recommendation no. 3

Paragraph 3.21

Airservices Australia, when assessing contract variations:

- record the rationale in approval documentation explaining its value-for-money assessment, including against the overall contract cost and program delivery objectives; and

- identify thresholds for when the impact of incremental change warrants a more significant value-for-money assessment or new procurement rather than varying the current contract.

Airservices Australia response: Partially agreed.

Recommendation no. 4

Paragraph 3.62

Airservices Australia identify which program key performance indicators relate to contract management and link the results of these to contract management actions to better ensure Thales’ accountability in delivering under the contract.

Airservices Australia response: Agreed.

Recommendation no. 5

Paragraph 3.89

Airservices Australia strengthen guidance, education and process around accepting gifts, benefits and hospitality during contract management to address probity risks.

Airservices Australia response: Agreed.

Summary of entity responses

16. The proposed audit report was provided to Airservices and Defence. An extract was provided to Thales. Airservices’ and Defence’s summary responses are provided below and their full responses are provided at Appendix 1.2

Airservices Australia

Airservices acknowledges the report’s findings and appreciates its thorough analysis. While some findings do not fully align with the recommendations, the latter primarily focus on documentation improvements rather than significant deficiencies in existing practices. There are substantial differences between the previously shared report preparation paper (RPP) and the S19 proposed report, specifically noting that the newly added ‘Conclusion’ section presents a more negative view than the broader findings suggest.3 It is pertinent to note Airservices has swiftly implemented corrective actions, addressing all recommendations reflecting its commitment to the OneSKY program and national airspace management harmonization.

Key responses to the recommendations include updating the OneSKY Program Contract Management Plan to enhance guidance on risk management, performance monitoring, and periodic contract reviews. Contract management risks have been integrated into the broader program risk framework, while the Evaluation Report Template has been refined to further clarify value-for-money assessments. The in-practice structured set of approved KPIs have also been linked with contract management plan for cross-reference, and a new procedure has been introduced to strengthen probity awareness regarding hospitality, gifts, and benefits.

These promptly implemented actions demonstrate Airservices’ dedication to continuous improvement in successfully delivering the complex OneSKY program.

Department of Defence

Defence welcomes the ANAO Audit Report into the Management of the OneSKY contract and acknowledges the findings. Defence notes the five recommendations contained in the audit report relate to Airservices Australia’s (Airservices) contract management processes.

Defence is committed to strengthening and standardising processes and controls for contract management. Whilst the audit recommendations are against Airservices’ processes, as part of the collaboration between Airservices and Defence on the OneSKY Program, Defence will work with Airservices and assist, where required and appropriate, to apply the audit recommendations.

Key messages from this audit for all Australian Government entities

17. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Contract management

1. Background

Introduction

1.1 Airservices Australia (Airservices) is established under the Air Services Act 1995 (Airservices Act) to provide air traffic control and other related services to the aviation industry in Australian-administered airspace — 11 per cent of world airspace. Airservices is responsible for the safe and orderly flow of aircraft carrying 150 million passengers a year. Airservices’ functions include:

- providing facilities and services such as air traffic control, aeronautical information, aviation communication and aviation rescue firefighting services;

- promoting and fostering civil aviation;

- carrying out activities to protect the environment from the effects of aircraft operations;

- cooperating with the Australian Transport Safety Bureau; and

- other general functions such as those required by regulation under the Air Navigation Act 1920 and the Aviation Transport Security Act 2004.

1.2 Under the Airservices Act, Airservices must prioritise safety in carrying out these functions.

1.3 Airservices is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2023 (PGPA Act) and is in the Infrastructure portfolio.4 The Airservices Board is the governing body and accountable authority under the PGPA Act.5 The Chief Executive Officer (CEO) is responsible for the management of Airservices under direction from the Airservices Board.

1.4 Airservices is funded through revenue from industry (charges to aircraft operators for en-route air traffic control services, terminal navigation, and aviation and rescue firefighting services) and borrowing from debt markets. Airservices’ prices are regulated by the Australian Competition and Consumer Commission (ACCC).6

1.5 Airservices is delivering a significant change program and OneSKY is a key part of this. Airservices advised the ANAO in May 2025 that the OneSKY program currently represents one third of its capital investment program.

1.6 The Department of Defence (Defence) provides air traffic management to military and civil aviation in Australia, including at Defence and joint user airfields that operate with shared military and civil use. Defence is a non-corporate Commonwealth entity under the PGPA Act.

OneSKY program

1.7 The OneSKY program aims to build and operate a joint civil–military air traffic management system.7 The program includes the design and delivery of the new Civil Military Air Traffic Management System (CMATS) as well as supporting infrastructure for Airservices and Defence. Airservices is the lead agency for CMATS, being delivered under the OneSKY Program, in collaboration with Defence.

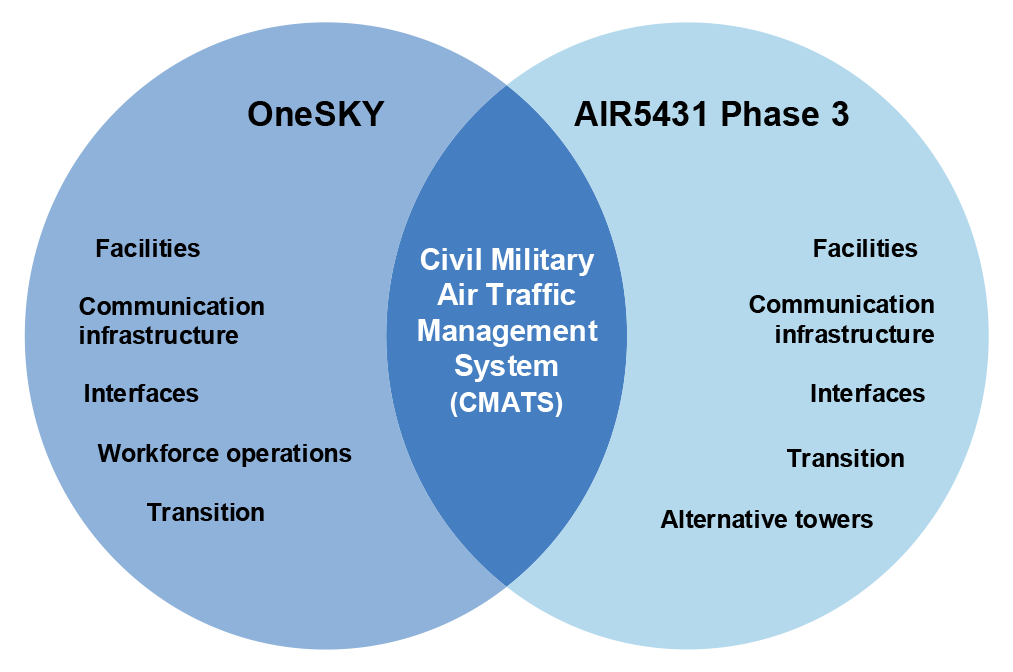

1.8 Figure 1.1 sets out the relationship between the OneSKY program, CMATS and AIR5431 Phase 3 (the related Defence project), and shows the work packages (as at January 2025) established by Airservices and Defence to support the implementation of the program.

Figure 1.1: OneSKY program, CMATS and Defence project relationship

Source: Airservices documentation.

Civil Military Air Traffic Management System

1.9 CMATS is the IT system that, once operational, will support air traffic services at specific Airservices and Defence sites.8 CMATS will replace the currently independent civil and military IT systems, both of which had been due to reach their nominal end of life in 20159:

- civil air traffic control system — the Australian Advanced Air Traffic System (TAAATS) — built and supported by Thales Australia Limited (Thales); and

- military air traffic control system — the Australian Defence Air Traffic System (ADATS) — built and supported by Raytheon.

1.10 CMATS is being delivered through two contracts with Thales:

- the supply of system capability through the acquisition contract (to develop and provide the CMATS hardware and software); and

- the ongoing sustainment of CMATS through the support contract (to provide support services to CMATS once operational).

1.11 As the lead agency, Airservices entered into the contracts with Thales and manages the CMATS program and contracts. Airservices will on-supply to Defence the system and support for CMATS delivered by Thales. Airservices and Defence have entered into an on-supply agreement to govern these arrangements. Table 1.1 sets out the primary arrangements to support the delivery of CMATS.10

Table 1.1: Summary of primary arrangements for CMATS delivery

|

Title |

Parties |

Start date |

End date |

Description |

|

Contract (Acquisition) |

Airservices and Thales |

February 2018 |

Based on final acceptance as outlined in the contracta |

The contract covers the delivery of CMATS including design, development, integration, testing and installation. It establishes scope of requirements and supporting contractual arrangements. It includes attachments that provide additional detail on key parts of the contract. |

|

Contract (Support) |

February 2018 |

Initial term of seven years from operative date.b Three options for five-year extensions are available |

The contract covers the services to enable CMATS to operate such as maintenance. It includes other support arrangements such as updates and contractual elements like pricing/payments. |

|

|

On-supply agreement |

Airservices and Defence |

February 2018 |

Termination or expiry of the support contract |

Agreement covers the on-supply of CMATS to Defence. It includes governance arrangements, scope of services being provided and payments. |

|

Air Traffic Management System Commonwealth Collateral Deed |

Airservices, Defence and Thales |

February 2018 |

Expiry of the support contract |

Noting that Defence is not a party to the acquisition or support contract, the deed creates a contractual relationship between the three parties and sets out obligations and rights of the parties relating to Defence deliverables under the CMATS contracts. |

Note a: The acquisition contract also has provisions that extend past the end of the contract covering intellectual property and the right of Airservices to recover money.

Note b: The operative date is the first handover from Thales.

Source: ANAO analysis of Airservices documentation.

CMATS project delays and revised delivery strategy

1.12 When Airservices and Thales entered into two contracts in February 2018, CMATS was to be delivered in three phases:

- release zero — initial minimum software functionality at Defence sites operational in mid-2022;

- release one — minimum functionality at Airservices sites operational in 2024; and

- release two — full scope of CMATS ready for deployment by February 2025, with final acceptance by August 2025.

1.13 The project has experienced delays. In 2019 the first CMATS design milestone was completed, which found engineering design deficiencies that were expected to be addressed prior to the next design milestone — the critical design review. In 2020 the critical design review milestone was partially completed and found a series of significant defects and omissions. In 2022 Thales began experiencing technical integration issues. Airservices conducted integrated baseline reviews in July 2018, March 2020 and February 2023.11

1.14 In October 2022 the Minister for Defence Industry declared the Defence project for CMATS (Project AIR5431 Phase 3) a Project of Concern due to cost, schedule and technical issues. In December 2022 Airservices, Defence and Thales agreed on remediation goals and in March 2023 on a remediation plan and actions, including to jointly examine opportunities to revise the delivery strategy and schedule.

Standstill deed, settlement deed and contract variation

1.15 In July 2023 Airservices, Defence and Thales entered into a ‘standstill deed’ to pause and preserve certain rights under the contracts (such as maintaining some aspects of Thales’ work) while they negotiated a revised delivery strategy. In December 2023, Airservices and Thales resolved the standstill deed when they executed:

- a settlement deed — closing and giving effect to the agreements negotiated during the standstill period and providing the basis for a revised delivery strategy; and

- a contract variation to implement the revised delivery strategy.

1.16 The contract variation made changes to the acquisition contract by updating:

- delivery sequence from release zero, release one and release two to remove release zero from the sequence and prioritise delivery to Airservices sites followed by Defence sites12;

- milestone delivery dates; and

- the payment structure to give greater weight to milestone payments.

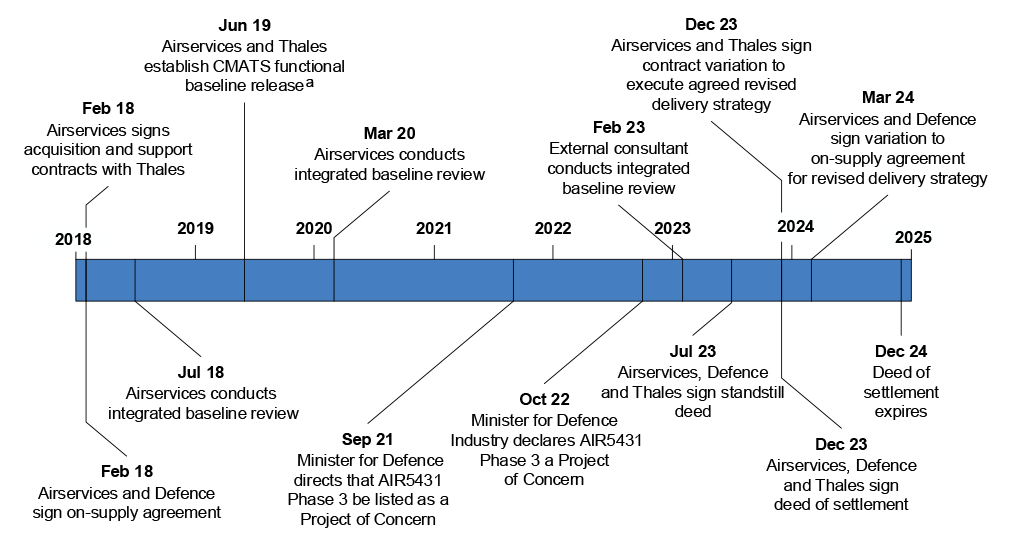

1.17 On 1 March 2024 Defence and Airservices executed a corresponding variation to the on-supply agreement. Figure 1.2 shows key dates for the negotiation of the revised delivery strategy.

Figure 1.2: Timeline of key events for the negotiation of the revised delivery strategy

Note a: The functional baseline is the agreed functionality and performance of the CMATS system.

Source: ANAO analysis of Airservices documentation.

1.18 As at January 2025, release one (Airservices capability) is due for system acceptance in June 2028, release two (full CMATS capability) in August 2029 and final acceptance in February 2030. Table 1.2 shows the key system acceptance dates at contract signing in February 2018 compared with January 2025.

Table 1.2: Contract delivery schedule for key milestones

|

Milestone |

Original contract — February 2018 |

As at January 2025 |

|

Release zero |

August 2022 |

Milestone removed as part of contract variation for revised delivery strategy in December 2023 (see paragraph 1.16) |

|

Release one |

July 2024 |

June 2028 |

|

Release two |

February 2025 |

August 2029 |

|

Final acceptance |

August 2025 |

February 2030 |

Source: ANAO analysis of acquisition contract and variations.

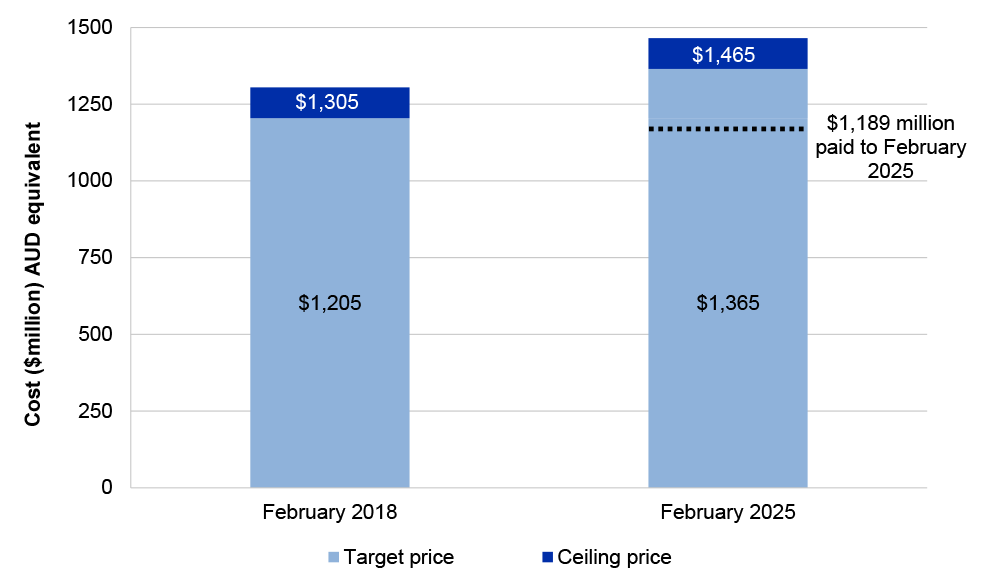

1.19 As at 31 December 2024, since February 2018 the acquisition contact has been varied 44 times and the support contract three times. The current acquisition contract target price is $1.365 billion (AUD equivalent) and ceiling price $1.465 billion (AUD equivalent) (see Figure 1.3).13

Figure 1.3: Acquisition contract payments and impact of variations

Note: As at 31 December 2024 acquisition contract variations had increased target and ceiling prices by $160 million.

Source: ANAO analysis of Airservices documentation and contract variation deeds of execution.

Previous ANAO audits

1.20 The procurement for CMATS was conducted through a phased approach. In June 2013 Airservices issued a request for tender and proceeded through tender evaluation phases. In September 2014 Airservices selected Thales as the successful tenderer, and protracted negotiations followed. Thales submitted offers in October and December 2014, which expired in October 2015. In June 2016 and September 2017 Thales submitted further offers. Airservices and Thales then further negotiated scope, price and commercial terms — ultimately agreeing on important changes after Airservices had selected the successful tenderer. In 2017 and 2019 the ANAO audited the tender evaluations and contract negotiations. The 2019 ANAO report found that Airservices had established an appropriate governance framework to evaluate contract value for money and assessment of Thales’ 2016 offer was appropriate (which was rejected for not providing value for money) but there were shortcomings in the application of the governance arrangements for the final (accepted) offer in September 2017 (see footnote 1).

Rationale for undertaking the audit

1.21 Passengers in Australian airspace rely on Airservices to provide critical air traffic control infrastructure safely and efficiently. The OneSKY program is a major change for Airservices, and CMATS is a core component of the program. Airservices has contracted Thales to develop and support CMATS. The ANAO has previously undertaken three performance audits on the procurements for CMATS, the most recent in 2019. Procurement and contract management of large-scale IT projects involve elevated risks. The audit provides assurance to the Parliament on whether Airservices is managing the contract for CMATS effectively.

Audit approach

Audit objective, criteria and scope

1.22 The objective of the audit was to assess the effectiveness of Airservices’ contract management for the OneSKY program.

1.23 To form a conclusion against the audit objective, the audit team applied the following high-level criteria:

- Has Airservices developed appropriate governance arrangements to support contract management?

- Has Airservices managed the contract effectively to achieve value for money?

Audit methodology

1.24 The audit methodology involved:

- reviewing Airservices’ procurement and contract management frameworks and governance;

- examining project and contract documentation — for example, contract management plans, contract variations, and risk management plans and registers;

- reviewing internal and external reporting on CMATS; and

- meetings with Airservices, Defence and Department of Infrastructure, Transport, Regional Development, Communications, Sports and the Arts staff.

1.25 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $716,213.

1.26 The team members for this audit were Jane Wiles, Thea Ingold, Caitlin Williams, Maggie Lee, Renina Boyd, Anne Rainger and Michelle Page.

2. Governance arrangements

Areas examined

This chapter examines whether Airservices Australia (Airservices) had appropriate governance arrangements in place to support contract management.

Conclusion

Airservices has implemented partly appropriate contract management governance arrangements. A contract management plan is in place; however, arrangements did not sufficiently cover provider performance, program risk and probity issues. Risk process did not completely capture interdependencies between contract management and program risks. An on-supply agreement formalised arrangements between Airservices and the Department of Defence (Defence) for the delivery of the Civil Military Air Traffic Management System (CMATS). It relies on effective collaboration and governance forums for issues escalation. The Defence component of CMATS was declared a Project of Concern in October 2022 outside of formal governance forums.

Areas for improvement

The ANAO made two recommendations: that Airservices update the OneSKY CMATS contract management plan and contract review mechanisms; and that Airservices identify and document where contract management actions could mitigate overall program delivery risks.

2.1 As a corporate Commonwealth entity, Airservices is not required to comply with the Commonwealth Procurement Rules.14 Airservices has developed its own procurement and contract management policies and procedures to assist it to meet its general obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) to promote the proper use and management of public resources.

2.2 Sound contract management frameworks, governance and risk management help ensure intended contractual benefits are realised and value-for-money outcomes achieved. A fit-for-purpose contract management plan enables the customer/purchaser to hold the contractor to account. The plan should enable the customer/purchaser to identify performance issues, provide levers to manage performance and set out how and when such levers should be used.

Has Airservices developed a fit-for-purpose contract management plan and supporting governance?

Airservices has developed a OneSKY contract management plan. The plan covers elements set out in the Airservices contract management procedure, such as roles and responsibilities, governance arrangements and the variation process. It does not cover contract management risk or probity for CMATS, and does not reference the CMATS risk management plan or probity plan. The contract management plan does not sufficiently cover contractual performance management. The OneSKY program has 12 governance forums that are intended to provide direction and oversight. The OneSKY Strategic Relationship Forum has never met and in October 2022 CMATS was declared a Project of Concern.

Enterprise-wide contract management procedure

2.3 Airservices has an enterprise-wide contract management procedure. Its purpose is to ‘set out the minimum requirements and processes for the management of all contracts entered into by Airservices’. It establishes:

- a contract management plan is required for contracts that have a high impact on Airservices’ core business;

- that the structure of a contract management plan can vary depending on the contract management approach and complexity of the contract; and

- the mandatory requirements for a contract management plan.

OneSKY contract management plan

2.4 In November 2018 the OneSKY Program Executive approved the first OneSKY contract management plan.15 This was seven months after Airservices and Thales signed the acquisition and support contracts. Airservices advised the ANAO in October 2024 that the delay was due to workloads of key staff at the time and the need to analyse and extract the obligations of each contract to include in the plan.

2.5 The contract management plan states that it will be reviewed annually. A second version of the contract management plan was approved in April 2021 and a third version in October 2024.16 Airservices advised the ANAO in October 2024 that informal reviews of the contract management plan had occurred with updates released formally when necessary.

2.6 The purpose of the contract management plan is to describe how Airservices will govern, manage and administer all OneSKY contracts, including the CMATS acquisition and support contracts. Table 2.1 summarises the main components of the contract management plan applying to the CMATS acquisition and support contracts.

Table 2.1: Contract management plan key components

|

Component |

Summary |

|

Roles and responsibilities |

The plan outlines the key personnel and program governance forum responsibilities. See paragraphs 2.9 and 2.10 for description of roles and responsibilities. |

|

Risk |

Airservices has a separate risk management plan, and program and project risk registers for OneSKY (see paragraph 2.23). The contract management plan does not reference the risk management plan to capture how CMATS contract management risks are managed. |

|

Probity |

The plan identifies Commercial and Legal Team as responsible for implementing commercial and legal frameworks including probity in the CMATS program. Airservices has a separate OneSKY CMATS probity plan. The contract management plan does not reference the probity plan. |

|

Performance |

The plan outlines the role of the Program Review Board and use of the ledger system, schedule, pricing models, contract remedies and meetings between Airservices, Defence and Thales (for example, contractor performance reviews). See paragraph 3.51. |

|

Milestones |

The plan sets out a schedule of key contract milestones. The first version of the contract management plan (2018) provided dates associated with these milestones. Dates were removed from subsequent versions.a |

|

Payments |

The plan includes a summary of the CMATS payment structure and provides a glossary of key pricing terms (for example, actual costs, ceiling price and target price). It provides that the Finance and Procurement Team are responsible for payments. |

|

Variations |

The plan lists key controls over the contract variation process. It describes the variation process in brief and references the OneSKY CMATS Program Technology Change Management Plan for more detail. Previous versions (2021 and 2018) described the variation process in full. |

|

Relationship management |

The plan describes relevant governance forums, communication protocols (for example, use of an authorised repository to share formal documentation and official communication through letters) and dispute resolution.b The plan also covers the relationship with Defence, including through the on-supply agreement, governance forums and financial management. |

|

Contract remedies |

The plan lists some of the acquisition contract clauses relating to remediation activities. |

Note a: The acquisition contract includes the delivery milestone dates.

Note b: A separate OneSKY stakeholder management plan covers OneSKY stakeholders including Defence, suppliers, airline customers, regulators and internal business groups. The plan states that engagement with suppliers is conducted in ‘accordance with the governance arrangements set out in respective contracts and agreements’.

Source: ANAO analysis of Airservices documentation.

2.7 The contract management plan includes a range of information consistent with the Airservices enterprise-wide contract management procedure. It does not address how contract management risks for the CMATS contracts are managed through the OneSKY program risk management process (see paragraphs 2.23 to 2.34) or how probity is intended to be managed through the OneSKY probity management plan or enterprise-wide policies and procedures (see paragraph 3.71).

2.8 The contract management plan briefly covers performance. It does not include a comprehensive description of a coordinated approach to contract performance management, monitoring and reporting, or when to use certain levers if underperformance occurs and how these relate to contract remedies. It does not list all remediation activities available under the contract — for example, postponement or schedule recovery (see paragraph 3.65 to 3.66).

Contract management roles and responsibilities

2.9 The Program Executive reports to the Chief Executive Officer (CEO) and is the Airservices executive responsible for strategic oversight of the OneSKY program. As at March 2025, this is the Airservices Deputy CEO.17

2.10 The contract management plan sets out other contract management roles:

- Head of Transformation OneSKY/OneSKY Portfolio Lead — senior responsible officer for the overarching OneSKY program and co-chair of the CMATS Review Group (see Appendix 3). The Head of Transformation — OneSKY position was created following the Project of Concern remediation, when the former Program Director function was split.

- Joint Program Director (also called Joint Program Lead) — senior manager responsible for the day-to-day management and delivery of the CMATS program. Also responsible for all joint Airservices–Defence program activities. As at February 2025, the Joint Program Director is also the ‘customer representative’, who represents Airservices with Thales on contract matters. The contract management plan states that the customer representative is ‘responsible for the full administration of the contract’.

- Commercial and Legal Manager — manager ‘accountable for the implementation and maintenance of an effective commercial and legal framework’ including the development of contracting frameworks and ensuring OneSKY contracts are updated with contract variations. The contract management plan states that ‘in addition to the Customer Representative’ the Commercial and Legal Manager is ‘responsible for the management of the project contracts’.

- Finance and Procurement Team — responsible for all OneSKY contract-specific finance and procurement for the program.

OneSKY CMATS governance forums

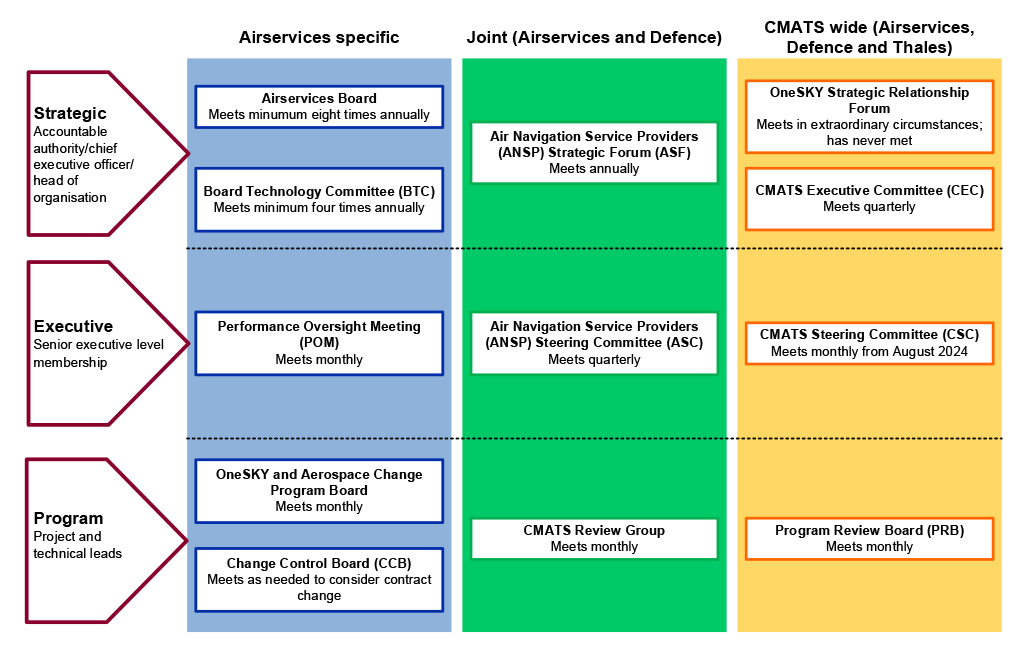

2.11 As at January 2025, the OneSKY program has 12 governance forums, split into three streams based on membership: Airservices specific; joint Airservices and Defence; and tri-party Airservices, Defence and Thales (see Figure 2.1). OneSKY CMATS program and contract documentation (for example, the acquisition contract, contract management plan and on-supply agreement) outlines the governance arrangements, membership and meeting frequency for these forums. Ten of the 12 governance forums have terms of reference outlining roles and functions (see Appendix 3).18

Figure 2.1: OneSKY governance forums

Note: Prior to March 2024 the Air Navigation Service Providers Strategic Forum was known as the Joint Strategic Forum and the Air Navigation Service Providers Steering Committee as the Joint Executive Committee.

Source: ANAO analysis of Airservices documentation.

2.12 In October 2022, Defence project AIR5431 Phase 3 was declared a Project of Concern, outside the formal program governance arrangements (see paragraph 2.50). Prior to this the project had experienced delays and cost increases, and governance forums discussed these issues. At the August 2021 CMATS Executive Committee meeting, Defence indicated that project delays had exceeded Defence’s tolerance and that it intended to escalate the project to ministerial level. Airservices supported this intervention.

2.13 In September 2022 Airservices and Defence engaged Mr Andrew Pyke to review the efficiency and effectiveness of the governance arrangements supporting the on-supply agreement.19 The report (finalised December 2022 and submitted to the Joint Executive Committee) listed opportunities for improvement, including by clarifying lead agency arrangements and revising the escalation of issues within the governance framework.20

2.14 In March 2023 Airservices, Defence and Thales agreed on actions as part of the Project of Concern remediation plan to review OneSKY governance arrangements (see paragraphs 2.55 to 2.56). The action items included pursuing opportunities to maximise efficiencies and strengthen governance, ‘taking into account the recommendations from the 2022 Governance Review’.

2.15 Following these reviews OneSKY program governance was changed and an additional CMATS Steering Committee governance forum established — with Airservices, Defence and Thales SES Band 2/2-star military equivalent representatives (see Appendix 3). Airservices advised the ANAO on 20 January 2025 that other changes made in response to these governance reviews included updating Air Navigation Service Providers strategic documentation and the ‘active and regular participation of Defence Executives in governance forum/s with Thales’.21

2.16 The ANAO reviewed a sample of 55 papers and minutes across the forums from between February 2023 and October 2024 plus whenever a contract variation went to the Board Technology Committee and Airservices Board.22 Project updates, risks, schedule and issues were consistently discussed. The forums discussed contract management issues as part of broader program delivery and focused on what was occurring in the project at the time (for example, the Project of Concern remediation plan and subsequent actions; see paragraphs 2.49 to 2.58).

2.17 The OneSKY Strategic Relationship Forum membership comprises the Airservices, Defence and Thales accountable authorities and has not met despite the requirement to meet in ‘extraordinary circumstances’.

Contract reviews

2.18 Airservices’ enterprise-wide contract management procedure provides that Airservices must review:

- contract effectiveness annually, including by comparing existing and alternative suppliers and testing to ensure the contract remains on track to realise benefits; and

- contracts covering a period of more than seven years periodically to ensure value for money is maintained.

2.19 Airservices has not conducted a dedicated review of contract management practice or the suitability of the acquisition contract outside the value-for-money assessment of the December 2023 contract variation to support the revised delivery strategy (see paragraphs 3.25 to 3.27).

Recommendation no.1

2.20 Airservices Australia update the contract management plan to:

- include how contract management risks and probity are managed;

- provide sufficient guidance on the performance management approach; and

- incorporate additional oversight and periodic contract reviews to ensure contract deliverables remain on track and commercial arrangements are fit for purpose.

Airservices Australia response: Agreed.

2.21 The OneSKY Program Contract Management Plan has been updated to:

- provide additional guidance on the management of contract management risks and probity (including references to the OneSKY Risk Management Plan and OneSKY CMATS Probity Requirements document)

- provide additional guidance on the performance management approach

- incorporate additional periodic contract reviews.

Are appropriate processes in place to monitor contract management risks?

Airservices applies the OneSKY program risk management process to contract management risks. It has risk management plans and documentation to identify and monitor contract risks; however, controls and treatments are not fully effective and contract management risks have been realised throughout the project. The interdependency between contract management risks (including Thales’ performance) and risk to overall program delivery and objectives is not fully captured — for example, through documentation of specific contract management actions and levers to ensure program-wide deliverables are achieved.

Risk management documentation

2.22 Airservices has enterprise-wide risk management frameworks and processes including a risk appetite statement; a governance, risk and compliance policy; a governance, risk and compliance framework; a risk management standard; a risk management procedure; and an IT system for documenting enterprise-wide risk known as the Corporate Integrated Reporting and Risk Information System (CIRRIS).

2.23 Airservices has established risk management documentation and artefacts specific to the OneSKY program.

- Risk management plan — describes the risk management process, procedures and roles and responsibilities in relation to risk management for the program.23 The plan broadly aligns with the risk management processes described in Airservices’ enterprise-wide documents. Three risk assessment tools described in the OneSKY risk management plan have been tailored for the OneSKY program.

- Program risk register — captures program-level risks to the OneSKY program.24 The register contains fields to record information on the individual risk identity (description, context, and causes or threats), risk assessment outcomes and other operational information on the risk such as risk owner, risk trend, last and next risk review date and risk status.

- Project risk register — records project-level risks. The project risk register contains fields to record individual risk identity, risk assessment outcomes and other operational information.

Risk identification, assessment and monitoring

2.24 The OneSKY CMATS risk management plan categorises risk as:

- tier 1 — enterprise-wide;

- tier 2 — program-level; and

- tier 3 — project-level.

2.25 As at February 2025, Airservices has an enterprise risk in CIRRIS, rated medium, for the OneSKY program: ‘the OneSKY program not being delivered and benefits enabled on time and within budget’.25 One cause of the risk identified is ineffective OneSKY CMATS commercial or contract framework management (see paragraph 2.28). Airservices noted in CIRRIS that controls and treatments are in place to mitigate this enterprise-wide risk and that these cover ‘oversight of scheduling and additional assurance activities including, corrective actions as part of Project of Concern mitigations’.26

2.26 The OneSKY program and project risk registers also capture tier 2 and tier 3 risks. Risks rated high and medium for the program relate to system security, schedule delays, eroded program benefits, Thales’ and Airservices’ resource profile and capability, cost overruns, fitness for purpose, technology maturity and technology operations.

Contract management risks

2.27 The Airservices contract management procedure includes a list of contract management risks — for example, contract management capability, benefits realisation, supplier performance, stakeholder relationships and supply chain problems.

2.28 Airservices has grouped key contract management risks into one program risk — ineffective OneSKY CMATS commercial or contract framework management. Table 2.2 sets out the key details for this risk recorded in the program risk register.

Table 2.2: Contract management risk recorded in the program risk register

|

Field |

Risk register detail |

|

Risk description |

|

|

Risk rating before treatment |

|

|

Risk rating after treatment |

|

|

Cause/threat |

|

|

Controls |

|

|

Treatments |

|

|

Consequences |

|

Note: Airservices’ OneSKY risk management plan defines a control as an ‘existing or pre-emptive measure used to modify a risk, opportunity or issue’. The plan sets out that a treatment addresses the causes, consequences or likelihood of a risk, opportunity or issue event.

Source: ANAO analysis of Airservices records.

2.29 Airservices documented the contract management risk in the risk registers consistent with the OneSKY risk management plan tools/matrix. It rated the risk treatments overall as ‘substantially effective’, with monitoring Thales’ performance ‘partially effective’ and reviewing the operations of the Commercial and Legal team ‘not yet effective’. Performance monitoring is further discussed in paragraphs 3.52 to 3.69 and the contract management plan in paragraphs 2.4 to 2.8.

2.30 The OneSKY risk assessment tools set out how frequently risks should be reviewed according to risk rating:

- ‘low’ twice each year;

- ‘medium’ each quarter;

- ‘high’ each month; and

- ‘extreme’ continuously.

2.31 Airservices has a monthly risk review process to monitor risks associated with the OneSKY program. It maintains a risk review log and version history for each risk identified in the register. The Program Risk and Opportunity Forum meets monthly and reviews risks that are identified as high, have an increasing trend or are due for review.27 Airservices maintains a record of its meeting minutes and presentation slides. The OneSKY Program Board (see Appendix 3) discusses risk profiles and artefacts.

2.32 Airservices reviewed the contract management risk consistent with its risk rating (see paragraph 2.30) and updated the risk register as necessary. The risk registers recorded the reviewer, whether the risk had been reviewed at the Program Risk and Opportunity Forum and any changes including treatment plans, risk trend and rating.

2.33 The program and project risk registers identify linkages between risks. Airservices has linked the contract management risk to the following CMATS program risks:

- technology is not fit for purpose;

- CMATS requirements change; and

- CMATS will not be transitioned into operational service within schedule or will not deliver all elements of the OneSKY business case in a timely manner.

2.34 For these risks, the identified controls and treatments related to contract management are high-level — for example, the acquisition contract, development of a contract management plan, the remediation plan and the revised delivery strategy. Airservices has not recorded detail on how it would utilise these controls or other contract management levers to effectively mitigate these risks — for example, by actively monitoring Thales’ performance, using the contract variations process to assess value for money when program requirements change or expanding on treatments following the revised delivery strategy to ensure achievement of contract deliverables and program objectives remain on track.

Recommendation no.2

2.35 Airservices Australia identify and document how contract management risk connects to risk at the program level and when specific contract management action could be used to mitigate and improve control of program risks.

Airservices Australia response: Agreed.

2.36 The OneSKY Program Contract Management Plan has been updated to reflect how program and project level risks, including contract management risks, are managed. Contract management risks are managed within the program level framework and risks. Contract management risks now have a dedicated category within the OneSKY Project Risk Register which identifies specific actions for mitigation and control.

Issues register

2.37 Airservices records and tracks program and project issues through a register. The issues register contains fields for issue description, rating, trend, resolution actions and other operational details such as manager and review date. The risk management plan sets out that issues should be reported, discussed and reviewed at program-level boards including the OneSKY Program Board as relevant, and the issues register captures when this occurs. The issues register does not go to other governance forums.

2.38 The issues register recorded 36 administrative, technical and project issues from 2020 to 2024. As at 14 January 2025, the issues register has one open issue related to contract management: the support contract ‘does not reflect all of the CCPs [contract change proposals] signed for [the] acquisition [contract]’. Airservices has recorded information including actions to be taken and review dates against this issue.

Defence risks

2.39 Airservices’ program- and project-level risk register identifies risks specific to Airservices and risks that collectively impact Airservices and Defence. In Auditor-General Report No. 20 2024–25, 2023–24 Major Projects Report, Defence states that it maintains a separate risk register for Defence-specific or unique risks and issues, and summarises risks to AIR5431 Phase 3 as being ‘contractor performance, schedule, workforce, [Defence] customer furnished (materials, supplies, services, data), and program delivery’.28 It notes that it is mitigating the risks through implementing the Project of Concern remediation plan, the revised delivery strategy, program governance arrangements and updates of joint strategic plans. Defence concludes that overall risk has reduced since 2022–23 as a result of implementation of Project of Concern remediation plan actions.29

Has Airservices Australia established a fit-for-purpose arrangement with Defence?

The on-supply agreement formalised the relationship between Airservices and Defence for the delivery of CMATS and has been varied 10 times. It covers collaboration between the two entities and governance forums, but does not provide for escalation if issues cannot be resolved within these mechanisms. In August 2021 Defence escalated its concerns about the project to ministerial level and in October 2022 the Minister for Defence Industry declared CMATS a Project of Concern. The Minister for Defence Industry has since held six meetings with principal stakeholders to address project underperformance. These have resulted in the development of a remediation plan to address program-wide issues. As at February 2025 CMATS remained on the Project of Concern list, with exit criteria formulated to demonstrate delivery of Defence capability. The exit criteria are not expected to be met before 2027.

2.40 As the lead agency, Airservices has entered into contracts with Thales for the acquisition and support of CMATS on behalf of Airservices and Defence. The acquisition and support contracts include common elements, Airservices-unique deliverables and Defence-unique deliverables. The acquisition contract provides that Airservices may at any time partially novate the contract so that Defence and Airservices would each proceed with separate contracts with Thales and own the relevant CMATS components.

2.41 Airservices will on-supply to Defence the CMATS capability and support required by Defence as formalised through an on-supply agreement signed on 22 February 2018.

On-supply agreement

2.42 The on-supply agreement is a contract that covers the CMATS capability and support services to be delivered, the relationship between the parties and Defence’s contribution to CMATS and other OneSKY sub-programs.30

2.43 The on-supply agreement includes:

- program scope — describes the CMATS elements (services and goods/supplies) covered by the on-supply agreement and to be provided to Defence;

- governance — outlines Joint Airservices/Defence governance forums (see Appendix 3) and Defence’s role in CMATS contract variations;

- agreement management — describes how the agreement can be amended with variations;

- financing and payments — describes the invoicing arrangements;

- termination of the agreement — outlines the exit terms for each party; and

- associated payment schedules — outlines payments including cost allocation across financial years and milestones.

2.44 The on-supply agreement sets out that Airservices and Defence will work collaboratively, be transparent, act in good faith to achieve program objectives and ‘resolve any future management, technical, operational and commercial issues that may arise, through the governance forums’. The on-supply agreement also sets out that Airservices and Defence will work collaboratively with Thales to resolve any conflicts. Although the on-supply agreement and governance arrangements were in place, CMATS was listed as a Project of Concern at the request of Defence (see paragraph 2.50) in order to remediate the program and contract.

2.45 The on-supply agreement provides that Defence can terminate it with approval from the Secretary of the Department of Defence, the Chief of the Defence Force and the Chair of the Airservices Board. On termination of the agreement, Airservices would be required to provide Defence all deliverables existing at the time, including software and hardware.

2.46 The Joint Program Team is comprised of Airservices and Defence personnel and was established to manage the CMATS program. Its role and functions are outlined in the on-supply agreement.

2.47 Since February 2018 Airservices and Defence have varied the on-supply agreement 10 times, largely in response to CMATS acquisition contract variations (see Table 2.3). Airservices and Defence signed and dated all variations to the on-supply agreement.

Table 2.3: On-supply agreement variations

|

Variation number |

Execution date |

Additional cost to Defence |

Reason for change |

|

1 |

12 July 2019 |

✔ |

In response to a contract variation to update a radio interface. |

|

2 |

21 December 2020 |

✔ |

In response to a contract variation to add a console to a Defence site. |

|

3 |

21 December 2020 |

✔ |

Clarification of contract requirements, including supplementary funding. |

|

4 |

1 April 2021 |

✔ |

In response to a contract variation to incorporate additional CMATS scope required to support secure communications. |

|

5 |

18 July 2022 |

✔ |

In response to a contract variation including an additional system element to CMATS. |

|

6 |

19 August 2023 |

✔ |

In response to a contract variation, for additional CMATS requirements. |

|

7 |

29 September 2023 |

✔ |

In response to contract variations for additional console, uplift of security standards and additional training to meet requirements. |

|

8 |

13 December 2023 |

✔ |

In response to contract variations for additional CMATS software updates required to update the software to ensure compliance with regulatory standards and changes to governance framework. |

|

9 |

1 March 2024 |

✘ |

In response to the revised delivery strategy contract variation, to split remaining Defence payments to Airservices into seven payments including five at key milestones that include Defence capability delivery (see Table 2.6). |

|

10 |

13 August 2024 |

✔ |

In response to a contract variation, for additional funding for ADOT software changes to align the system with regulatory standards. |

Key: ✔ Yes ✘ No.

Source: ANAO analysis of on-supply agreement variations.

2.48 Defence and Airservices have commenced work to update on-supply arrangements to better reflect the services required for the ongoing sustainment and business-as-usual support of CMATS once operational.31

Project of Concern

2.49 The Defence Project of Concern and Interest framework provides for ministerial oversight of Defence projects and development of remediation for Defence projects that are not meeting targets. The Minister for Defence Industry lists projects on advice from Defence.

2.50 The Minister for Defence and the Minister for Defence Industry first jointly declared CMATS a Project of Concern in August 2017, following protracted negotiations that led to a delay in the execution of the acquisition contract.32 The project was removed from the list in May 2018 and managed as a Project of Interest.33 In August 2021 Defence wrote to the Minister for Defence and the Minister for Defence Industry recommending that AIR5431 Phase 3 be declared a Project of Concern. In September 2021 the Minister of Defence directed that CMATS be returned to the Projects of Concern list. On 27 October 2022 the Minister for Defence Industry declared CMATS a Project of Concern due to ‘significant schedule, technical and cost challenges’.34

2.51 Through the Project of Concern process the Minister for Defence Industry holds meetings (called summits) with the principal stakeholders of listed projects to remediate performance. As at February 2025 the Minister for Defence Industry has held six summits on CMATS (see Table 2.4).

2.52 Attendees at these summits were the Minister for Defence Industry, the Minister for Infrastructure, Transport, Regional Development and Local Government (8 December 2023 summit only), senior Defence officials, senior global and Australian Thales representatives, Airservices executives and the Deputy Secretary, Transport Group, Department of Infrastructure, Transport, Regional Development, Communications, Sports and the Arts. Table 2.4 sets out summit dates and outcomes. The next summit is expected to be held in August 2025.

Table 2.4: CMATS Project of Concern summits

|

Date |

Discussion and outcomes |

|

2 December 2022 |

Meeting outcomes were not prepared or signed for this summit. A summary of actions was prepared and provided to the Minister for Defence Industry via their office. Action items from the meeting outlined in the summary document included a review of key documentation, a review of the schedule and governance arrangements and preparation of a remediation plan. |

|

31 March 2023 |

The meeting noted that the remediation plan was agreed — although high risks remained on schedule and resourcing. Updates were provided on the Joint Program Team, action items and integrated baseline review outcomes.a Agreed actions included developing a credible contract master schedule and progressing an update on revised costings and understanding of contract changes required. |

|

19 September 2023 |

An update on the project was provided including on actions relating to the contract master schedule review, performance metrics and improved working relationships. Concern was expressed regarding the success of the next software demonstration. Agreed actions included negotiating contract updates, developing exit criteria and further developing the integrated master delivery schedule. |

|

8 December 2023 |

An update on the project was provided including that a successful software demonstration had been completed, preparation for contract changes to the acquisition contract was underway and remediation plan actions were progressed. Exit criteria were agreed. Other agreed actions included updating the schedule, updating the support contract to reflect changes in the acquisition contract and reviewing the suitability of performance metrics. |

|

8 July 2024 |

Progress was noted on executing the acquisition contract variations, and Thales’ positive performance. The schedule, the completion of a test readiness review and commencement of software testing were discussed. Agreed actions were: maturing the integrated master schedule; continuing the governance documentation update; and executing an updated support contract. |

|

26 November 2024 |

Cyber security requirements for CMATS, the schedule, Airservices Defence OneSKY Towers (ADOT, see footnote 10) and progress on software releases were discussed. It was noted that action on the support contract was ongoing with negotiation occurring, Thales’ performance was positive and the new governance forum (the CMATS Steering Committee; see paragraph 2.15) was working well. Progress against the agreed exit criteria was noted. |

Note a: In December 2022 Airservices contracted TBH Consultancy (Contract CW47386, 29 March 2023 to 8 May 2023, $172,000) to conduct an integrated baseline review of the Thales schedule to deliver CMATS. TBH Consultancy advised Airservices in February 2023 that it could not provide assurance over the schedule and that ‘significant work [was] required for the program to develop credible, defensible and achievable cost and schedule baselines’. The findings of the review were incorporated into the development of the remediation plan.

Source: ANAO analysis of Project of Concern summit minutes and outcomes.

Remediation plan

2.53 The Project of Concern process involves the development and monitoring of dedicated remediation plans. At the December 2022 summit it was agreed that a remediation plan for CMATS would be developed by February 2023.

2.54 On 20 March 2023 Defence approved the remediation plan, with endorsement from Airservices and Thales.35 The purpose of the plan was to remediate the project across requirements, schedule, governance oversight and cost efficiency through a revised delivery strategy. While the Project of Concern process is led by Defence, the remediation plan included actions that impacted the whole CMATS program.

2.55 The plan listed high-level actions across three focus areas, an ‘action plan’ (discrete tasks to achieve the overarching action) together with ‘action owner’, expected outcome, evidence of completion and deadline. The focus areas and high-level actions were:

- capability and cost objectives — review strategic documents that cover the relationship between Airservices and Defence as Air Navigation Service Providers and confirm the program delivery strategy for CMATS;

- schedule objectives — Thales to develop a credible, executable and resourced schedule for delivery and Airservices to develop an integrated master schedule for delivery of CMATS across the program for planning purposes; and

- governance objectives — pursue opportunities to maximise efficiencies and strengthen governance and pursue tools to track progress and provide an accurate assessment in the delivery of CMATS.

2.56 At the December 2023 summit it was agreed that the majority of the remediation plan actions from the first version of the remediation plan had been achieved. Key actions implemented were a revised delivery strategy and delivery dates — executed through a contract variation in December 2023 (see paragraph 3.27) and development of program-level key performance indicators (see paragraph 3.58).

2.57 In July 2024 Defence approved a second version of the remediation plan, with endorsement from Airservices and Thales. The actions had a greater focus on Defence, with the incorporation of the exit criteria (see Table 2.5). Actions listed in the second version of the plan were:

- three residual items from the first version of the plan (development of an integrated master schedule, review of strategic documents and finalisation and use of the program-level key performance indicators);

- a new item on updating the support contract to reflect changes made to the acquisition contract as a result of the revised delivery strategy contract variation; and

- new items relating to the exit criteria.

Table 2.5: CMATS Project of Concern exit criteria

|

Exit criteria |

Due date |

|

Successful achievement of RAAF Base East Sale de-risking and demonstration activitiesa |

20 August 2026 |

|

Achievement of CMATS release 1.8 system verificationb |

26 February 2027 |

|

Site acceptance of the first Airservices Defence OneSKY tower site (ADOT)c |

31 March 2027 |

|

Advice from an independent review that the project is forecast to successfully complete (conducted after the completion of all other exit criteria) |

30 June 2027 |

Note a: CMATS is due to be deployed at multiple military air bases including RAAF Base East Sale (see footnote 8). Additional work is required to consider the security accreditation required for access to Defence networks and to demonstrate successful software integration.

Note b: Release 1.8 is a software release. To confirm this milestone, Airservices and Defence will endorse that testing for this component has taken place.

Note c: The OneSKY program includes other contracts such as the one with SAAB for the supply and support of replacement tower systems for four regional Defence sites known as ADOT (see footnote 10).

Source: Second version of the Project of Concern remediation plan.

2.58 In November 2024 Defence prepared a status report on the second version of the remediation plan. It set out that:

- the residual items from the first version of the remediation plan were completed and the new item to update the support contract was ‘work-in-progress’; and

- three of four actions linked to the exit criteria were ‘work-in-progress’ and one was ‘yet to start’.

2.59 Defence reports monthly on CMATS to the Minister for Defence Industry under the Project of Concern process. The reporting includes an overall summary of the progress of the project against milestones and remediation plan actions. At the February 2025 update, Defence reported that project progress was positive.

Defence payments

2.60 Under the original on-supply agreement the Defence component of the project was to be supplied at a fixed price of $521 million (OSA AUD equivalent).36 Variations made from July 2019 to January 2025 increased the fixed price to $564 million (OSA AUD equivalent).

2.61 Defence paid Airservices quarterly from 2017–18 to 2024–25, and the total paid as at February 2025 was $509 million (OSA AUD equivalent).37

2.62 In March 2024, following the December 2023 implementation of the revised delivery strategy, Airservices and Defence executed a variation to the on-supply agreement. This variation changed the payment structure so that the funds remaining after Defence’s final quarterly payment (quarter 2, 2024–25) would be assigned to achievement of future milestones that included Defence elements of CMATS, as shown in Table 2.6. Defence advised the ANAO on 7 March 2025 that it expects to recognise milestone completion when it is supported by evidence — for example, a milestone acceptance certificate.

Table 2.6: Estimated future Defence milestone payments, by financial year

|

Milestones |

Estimated financial year |

Defence payment ($) |

|

System verification |

2025–26 |

10,114,620 |

|

Defence base acceptance |

2028–29 |

11,916,912 |

|

First provisional acceptance at a military site |

2028–29 |

21,291,973 |

|

CMATS release two system acceptance |

2028–29 |

5,677,794 |

|

Final acceptance of CMATS system |

2029–30 |

5,677,794 |

|

Total |

54,679,093 |

|

Note: Amounts are shown in OSA AUD equivalent.

Source: On-supply agreement (August 2024).

3. Contract management

Areas examined

This chapter examines whether Airservices Australia (Airservices) has effectively managed the contract for the Civil Military Air Traffic Management System (CMATS).

Conclusion and findings

Airservices is partly effective in managing the contract to achieve value for money. It has a process to manage variations; however, a high number of variations to date have resulted in cost increases and schedule extensions, and the rationale for its value-for-money assessment was not consistently documented when seeking approval. The incentive-based pricing model agreed in the contract between Airservices and Thales has not been fully effective in containing costs, with the target price expected to be met. Airservices’ supplier performance management is not fully developed or utilised. Airservices applies enterprise-wide probity procedures for conflicts of interest and gifts and benefits, but staff did not always follow these.

Areas for improvement

The ANAO made three recommendations aimed at improving contract variation value-for-money assessments, better ensuring Thales’ accountability against key performance indicators and strengthening probity guidance and practice.

The ANAO identified two opportunities for improvement for Airservices: to update its probity plan and reconcile its conflicts of interest and probity registers.

3.1 The Department of Finance (Finance) defines contract management as ‘all the activities undertaken by an entity, after the contract has been signed or commenced, to manage the performance of the contract (including any corrective action) and to achieve the agreed outcomes’.38 Effective contract management facilitates delivery of the contract consistent with the terms agreed at contract execution and value for money.

Have contract variations been approved and documented in line with the contract management plan and procedures?

The combined impact of 44 variations as at 31 December 2024 has seen the cost of the acquisition contract increased by $160 million (AUD equivalent) and the delivery date extended by 53 months (four-and-a-half years). Airservices has a process in place to support the development and assessment of contract variations. Briefs to the approval delegate did not completely document how the various elements (technical need, risk and cost) collectively justified the value-for-money assessment or the effect of incremental change on the overall contract value for money.

Civil Military Traffic Management System contract variations

3.2 Between 22 February 2018 and 31 December 2024, Airservices and Thales agreed 44 contract variations for the acquisition contract and three for the support contract. The combined impact of the variations on the acquisition contract target and ceiling prices was around $160 million (AUD equivalent) and a delivery delay of 53 months (four-and-a-half years). One support contract variation increased the support contract by around $14 million (AUD equivalent).39 Additional acquisition contract costs resulting from variations are allocated from the OneSKY program budget (see paragraph 3.29).

3.3 The number of contract variations fluctuated each year. Table 3.1 sets out acquisition contract variations executed by year, number executed per year, cost per year and effect on scheduled delivery.

Table 3.1: CMATS acquisition contract variations and impacta

|

Year |

No. variations executed |

Target and ceiling price change ($) |

Extension (months) |

|

2018 |

2 |

(8,240,499.92)b |

6 |

|

2019 |

4 |

35,823,041.65 |

– |

|

2020 |

4 |

4,260,539.33 |

– |

|

2021 |

5 |

412,624.00 |

– |

|

2022 |

8 |

42,290,797.01 |

19 |

|

2023 |

16 |

74,194,075.33 |

28 |

|

2024 |

5 |

11,342,833.93 |

– |

|

Total |

44 |

160,083,411.33 |

53 |

Note: Amounts are shown in AUD equivalent.

Note a: Contract variations with cost implications change the target and ceiling price by the same amount.

Note b: The second contract variation reduced the cost of the contract overall by reducing scope for the Department of Defence (Defence) component (by $38.6 million AUD equivalent) and increasing scope for the Airservices component (by $30.4 million AUD equivalent). This resulted in a net reduction to the contract price of $8.2 million (AUD equivalent) but an overall increase to Airservices of $30.4 million (AUD equivalent). Airservices advised the ANAO on 29 November 2024 that these changes were anticipated at contract signing and resolved after additional technical work to align the contract and engineering requirements.

Source: Airservices records.

3.4 Primary drivers of the acquisition contract variations were scope change (19 variations), technical change (13 variations), administrative change (11 variations) and delivery schedule change (three variations).40 None of the administrative variations increased cost or affected the delivery schedule.

3.5 Airservices measures the amount of scope change through a ‘requirements stability score’ key performance indicator (KPI), and this is reviewed by the Program Review Board.41 From August to November 2024 Airservices rated this KPI as ‘requires monitoring’ (see Table 3.9). Program Review Board discussion indicates that it considered the key driver of the rating to be the 22 engineering (technical) variations to be incorporated into a contract variation (subsequently executed on 19 January 2025).

3.6 Airservices, Defence or Thales can initiate a contract variation. Of the 47 contract variations executed to the acquisition and support contracts between 22 February 2018 and 31 December 2024, Airservices advised the ANAO on 3 February 2025 that it initiated 18 variations, Thales initiated 18, Airservices and Thales jointly initiated five, and Defence initiated six. If Airservices and/or Defence identify the need for a variation, the acquisition contract allows for Thales to be paid ‘reasonable costs’ to develop the contract change proposal.42 Airservices advised the ANAO on 7 March 2025 that it paid Thales $4,913,045 (AUD equivalent) for preparation of contract variations between 22 February 2018 and 30 June 2024, and Defence contributed $1,030,029 (AUD equivalent).43

Contract variation guidance

3.7 Airservices’ enterprise-wide contract management procedure sets out requirements for contract variations, including that potential variations should be assessed against the Airservices procurement policy and financial obligations, recognising that they may not always be appropriate.

3.8 The Airservices procurement policy states that Airservices is ‘not required to comply with the Commonwealth Procurement Rules [but] adopts its high-level principles; the main principle being the achievement of value for money.’ It provides that value for money must be assessed and achieved for all procurements, provides a list of value-for-money considerations and states that delegates must be provided with sufficient information.