Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

National Disability Insurance Agency’s Management of Claimant Compliance with National Disability Insurance Scheme Claim Requirements

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The National Disability Insurance Scheme (NDIS) funds reasonable and necessary supports for eligible people with disability. The National Disability Insurance Agency (NDIA) pays claims from participants and providers for NDIS supports.

- There has been parliamentary interest in NDIS fraud and non-compliance and its impact on the sustainability of the NDIS. This audit was undertaken to provide assurance on the effectiveness of the NDIA’s management of claimant compliance with NDIS claim requirements.

Key facts

- In 2023–24, the NDIA paid $41.85 billion in NDIS participant plan expenses, covering more than 661,000 participants.

- To combat NDIS fraud and non-compliance, the Australian Government has committed more than $495 million over eight years from 2021–22 to 2028–29.

What did we find?

- The NDIA’s management of NDIS claim compliance is partly effective. Activities being implemented to ‘crack down on fraud and non-compliant payments’ have the potential to improve the financial sustainability of the NDIS.

- The NDIA has partly effective frameworks and processes to manage claim compliance and is implementing a large program of work to remediate identified deficiencies, with a target date of December 2025.

- The NDIA has implemented partly effective arrangements to oversee, monitor and continuously improve claim compliance.

What did we recommend?

- There were four recommendations to the NDIA to establish a fit-for-purpose compliance framework and improve risk management, payment assurance testing and performance reporting.

- The NDIA agreed to all four recommendations.

13 of 17

Tranche one milestones for the Crack Down on Fraud program were delivered on time (the other 4 were delivered within 1–3 months of target dates)

0.4%

Proportion of NDIS claims subject to manual pre-payment review in quarters 1 and 2 of 2024–25 (by dollar value)

53.7%

Proportion of NDIS claims subject to manual pre-payment review in 2024 that were cancelled due to non-compliance (by dollar value)

Summary and recommendations

Background

1. The National Disability Insurance Scheme (NDIS) was established under the National Disability Insurance Scheme Act 2013 (NDIS Act) to fund reasonable and necessary supports for eligible people with disability to assist them in participating in economic and social life. NDIS participants have their supports costed and funded through a participant plan. The National Disability Insurance Agency (NDIA) was established under the NDIS Act to deliver the NDIS, and pays claims from participants and registered providers to fund NDIS supports in participant plans. In 2023–24, NDIS participant plan expenses totalled $41.85 billion, covering more than 661,000 participants. By 2033–34, NDIS expenses are expected to grow to $92.72 billion, covering more than 1,021,000 participants.1

2. The NDIA has defined compliance as ‘following the rules and standards of the NDIS and Australian laws’ and ‘doing the right thing and using NDIS funds in line with NDIS plans’.2 Types of claim non-compliance that have been identified through the NDIA’s fraud and non-compliance activities include: illegitimate or ‘ghost’ participants; claiming from expired plans; claiming from plans of participants who are incarcerated, in hospital or overseas for long periods (and thus ineligible for NDIS supports); claiming for services outside of plans; claiming for services that were not provided; claiming in advance of service delivery; overstating services, overcharging or duplicate charging; and double-dipping across government programs. The government has committed more than $495 million over eight years from 2021–22 to 2028–29 for the NDIA to address NDIS fraud and non-compliance.

Rationale for undertaking the audit

3. The NDIA paid out $41.85 billion for NDIS claims in 2023–24. In September 2023, the NDIA estimated that 6 to 10 per cent of these outlays could be for non-compliant, fraudulent or incorrect claims. The NDIA Board has a duty under section 16 of the Public Governance, Performance and Accountability Act 2013 to establish and maintain appropriate systems of risk oversight and management and internal control for the NDIA. It also has a duty under section 10 of the Public Governance, Performance and Accountability Rule 2014 (the Fraud and Corruption Rule) to take all reasonable measures to prevent, detect and respond to fraud and corruption relating to the NDIA (including deliberate non-compliance). There has been parliamentary interest in NDIS fraud and non-compliance and its impact on the sustainability of the NDIS. This audit was undertaken to provide assurance to the Parliament on the effectiveness of the NDIA’s arrangements for managing NDIS claim compliance.

Audit objective and criteria

4. The objective of the audit was to assess the effectiveness of the NDIA’s management of claimant compliance with NDIS claim requirements.

5. To form a conclusion against this objective, the following high-level criteria were adopted.

- Has the NDIA developed and implemented effective frameworks and processes to manage NDIS claim compliance?

- Has the NDIA implemented effective arrangements to oversee, monitor and continuously improve NDIS claim compliance?

Conclusion

6. The NDIA’s management of claimant compliance with NDIS claim requirements is partly effective. Prior to 2024, the NDIS lacked basic prevention controls for fraud and non-compliance. The NDIA is undertaking work to ‘crack down on fraud and non-compliant payments’, with tranche two of its Crack Down on Fraud program expected to be implemented by December 2025. If this work is delivered as planned, and embedded into business-as-usual activities, it has the potential to improve the financial sustainability of the NDIS.

7. The NDIA has partly effective frameworks and processes in place to manage claimant compliance with NDIS claim requirements and is implementing a large program of work to remediate identified deficiencies, with a target completion date of December 2025. The NDIA has not established a fit-for-purpose framework for managing NDIS claim compliance, although elements that could inform a more robust framework have been included in strategic planning documents for the NDIA’s Crack Down on Fraud program and the Fraud Fusion Taskforce. After identifying in 2023 that the NDIA was implemented with ‘catastrophically weak’ prevention controls, the NDIA has not yet established effective processes for preventing non-compliant claims. The NDIA has established processes to detect and respond to non-compliant claims, which are reviewing a small proportion of claims (0.4 per cent by dollar value) and detecting high levels of non-compliance (over 50 per cent by dollar value). The NDIA is working to improve the effectiveness of NDIS preventative and detective controls through the Crack Down on Fraud program, including introducing identity verification and claim validation processes and enhanced data analytics capabilities. Tranche one of the Crack Down on Fraud program was largely implemented on time and under budget. In April 2025, tranche two had an ‘amber’ status, with two June 2025 milestones identified as ‘at risk’ due to procurement delays.

8. The NDIA has implemented partly effective arrangements to oversee, monitor and continuously improve claimant compliance with NDIS claim requirements. While oversight and monitoring of NDIS claim compliance has been inconsistent, with frequent changes to reporting and oversight arrangements, a range of assurance mechanisms are in place for the Crack Down on Fraud program. The NDIA has not updated its risk assessments at the fraud and operational levels to reflect heightened claim compliance risks and identified gaps in existing controls. The NDIA has been measuring estimated payment error rates and has started reporting against compliance-related savings and benefits commitments. The transparency of its performance reporting to the government and the Disability Reform Ministerial Council could be improved. The NDIA is undertaking IT systems upgrades to improve its capacity to use data analytics to continuously improve NDIS claim compliance.

Supporting findings

Compliance frameworks and processes

9. The NDIA’s Compliance and Enforcement Framework (March 2020) and Fraud and Corruption Control Plan (July 2023) do not provide fit-for-purpose frameworks for managing claim compliance and do not delineate current accountabilities for compliance management. The NDIA Board is non-compliant with the Fraud and Corruption Rule as it has not endorsed an updated Fraud and Corruption Control Plan to meet the requirements of the new whole-of-Australian Government framework. The NDIA has developed a ‘program logic’ for the Crack Down on Fraud program and ‘strategic prevention concepts’ for the Fraud Fusion Taskforce that outline more appropriate control frameworks, as they include coverage of basic preventative controls for government payment schemes and are targeted to key non-compliance risks. The NDIA has not updated its broader compliance frameworks and related policies and procedures to reflect changes in its compliance approach. (See paragraphs 2.3 to 2.18)

10. The NDIS was designed and implemented (up until 2024) without basic prevention controls, such as clear claim requirements and robust identity verification and pre-payment validation processes. The NDIA commenced implementing activities to address these deficiencies in February 2024 through its Crack Down on Fraud program. Early program milestones were largely met, and the first tranche of the program was delivered largely on time and under budget. A large body of work to address prevention control deficiencies was still in progress as of April 2025 with a target completion date for tranche two of December 2025. In April 2025, the NDIA reported an ‘amber’ status for the program, due to procurement delays that had put the timely delivery of two milestones at risk. The NDIA has established other prevention controls, such as undertaking campaigns to improve compliance in targeted areas and providing educational information and guidance to claimants and NDIA staff. (See paragraphs 2.19 to 2.50)

11. The NDIA has established processes to detect and respond to non-compliant claims, including tip-off mechanisms, manual payment review processes and debt recovery. The NDIA has made improvements to its tip-off intake and assessment processes and is continuing to implement a tip-off redesign program. After the NDIA received advice in May 2023 that it was limited in its capacity to recover debts from non-compliant claims when supports were described generally in participant plans, the NDIA shifted its focus in 2024 from post-payment reviews to pre-payment reviews. The NDIA targets its manual pre-payment reviews based on ‘risk profiles’. These reviews cover a small proportion of NDIS outlays (0.4 per cent) and are detecting a high proportion of non-compliance (over 50 per cent of reviewed claims, by dollar value, are cancelled). The NDIA has identified deficiencies in its detection and response IT systems and is progressing work to improve its data analytics capabilities through the Crack Down on Fraud program, with a target completion date of December 2025. (See paragraphs 2.51 to 2.78)

Oversight, monitoring and evaluation

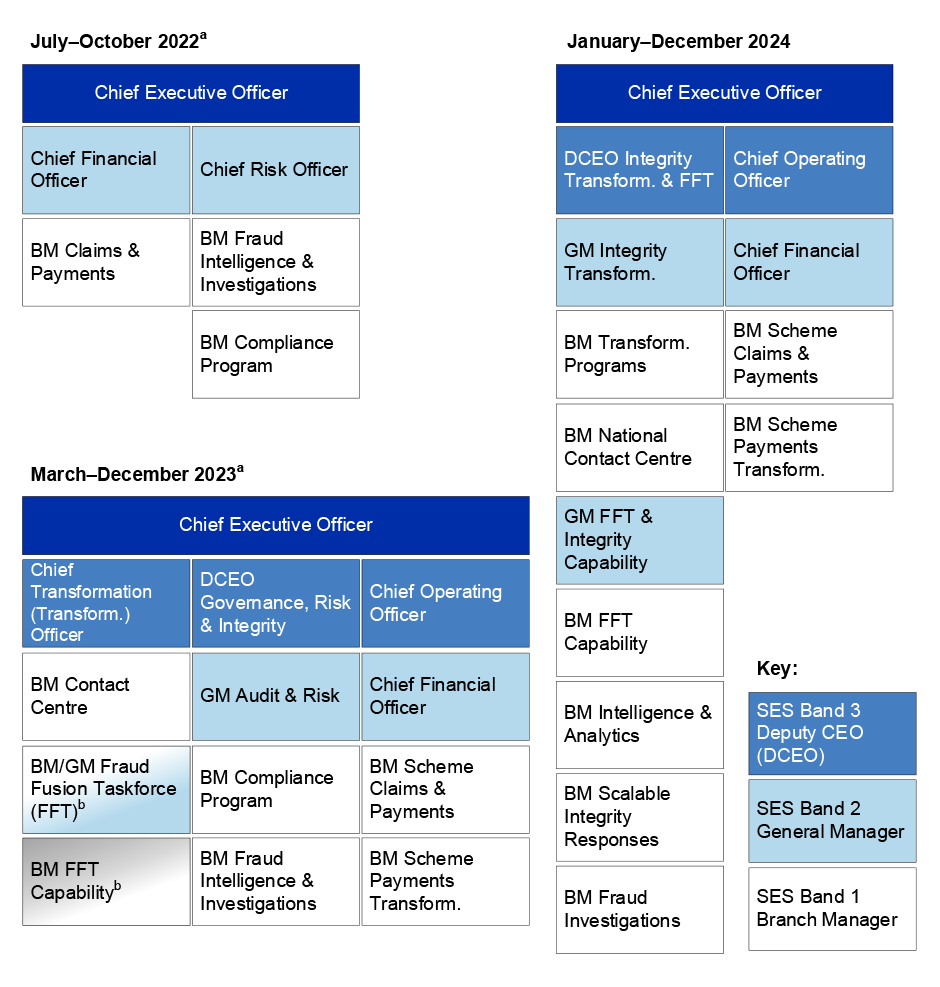

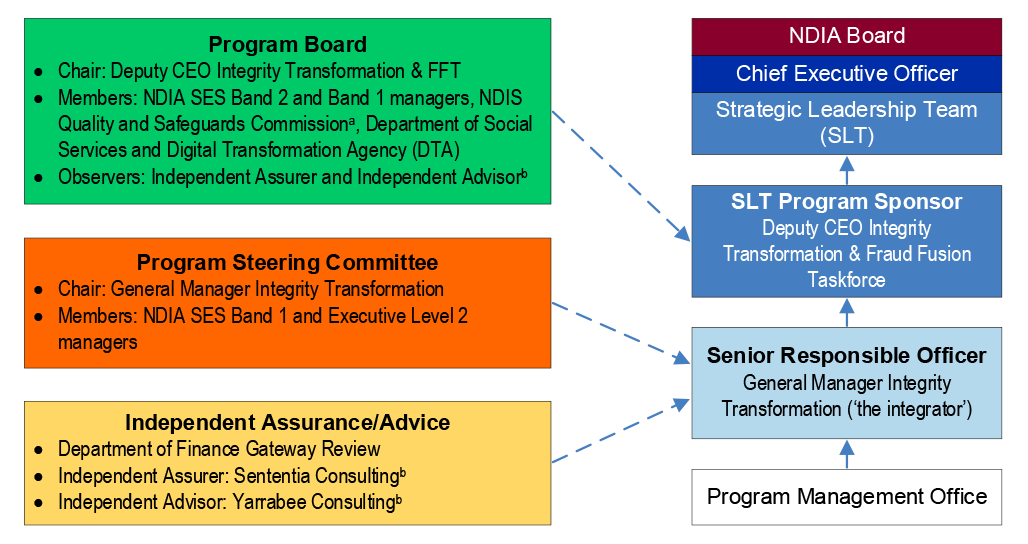

12. The NDIA’s oversight and monitoring of claim compliance has been inconsistent, with frequent changes to reporting and oversight arrangements. The NDIA consolidated integrity functions within a single group from January 2024 and established a Strategic Leadership Team sub-committee from October 2024 to March 2025 to oversee integrity functions, including claim compliance. Briefing on the status of integrity initiatives has been provided with varying frequency to the NDIA Board, other decision-makers and oversight committees. The NDIA has put in place a range of assurance mechanisms for the Crack Down on Fraud program, including regular assurance activities conducted by the program’s independent assurer. The NDIA has identified heightened claim compliance risks and significant gaps in existing controls. It has not updated its control assessments at the fraud and operational levels to reflect these identified control weaknesses. (See paragraphs 3.3 to 3.33)

13. The NDIA conducts assurance testing to estimate payment error rates and identify opportunities for continuous improvement. It does not have robust processes to monitor the implementation of identified improvement opportunities, and it has acknowledged that measured error rates underestimate fraud and non-compliance losses. In October 2023, the NDIA made commitments to the government to achieve savings and benefits from the Crack Down on Fraud program. The NDIA has not provided reporting against these commitments to the government or the Disability Reform Ministerial Council. The NDIA is implementing IT systems upgrades through the Crack Down on Fraud program, with a target completion date of December 2025, which aim to increase its capacity to use data analytics to support continuous improvement in claim compliance. (See paragraphs 3.34 to 3.60)

Recommendations

Recommendation no. 1

Paragraph 2.17

The National Disability Insurance Agency update its corporate compliance frameworks and related policies and procedures to reflect its compliance approach, delineate accountabilities for compliance management and outline how compliance activities are targeted to addressing key non-compliance risks.

National Disability Insurance Agency response: Agreed.

Recommendation no. 2

Paragraph 3.25

The National Disability Insurance Agency update its risk assessments at the fraud and operational levels to reflect known fraud and non-compliance risks and control weaknesses.

National Disability Insurance Agency response: Agreed.

Recommendation no. 3

Paragraph 3.40

The National Disability Insurance Agency:

- further expand the scope of its payment assurance testing to estimate the financial impacts of more complex fraud and non-compliance; and

- establish processes to monitor the implementation of recommendations from its root cause analysis of thematic issues identified through payment assurance testing.

National Disability Insurance Agency response: Agreed.

Recommendation no. 4

Paragraph 3.54

The National Disability Insurance Agency:

- report to the government and the Disability Reform Ministerial Council on progress against committed savings, benefits and performance measures from compliance initiatives; and

- in any reporting on savings and benefits from compliance initiatives, separately report estimated actual financial impacts and projected financial impacts and include explanatory notes on the assumptions underpinning projected figures.

National Disability Insurance Agency response: Agreed.

Summary of entity response

14. The proposed audit report was provided to the NDIA. The NDIA’s summary response is reproduced below. The full response from the NDIA is at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed at Appendix 2.

The NDIA appreciates the work of the ANAO in assessing the NDIA’s management of claimant compliance with NDIS claim requirements.

Over the last 2 years, the NDIA has been implementing an accelerated transformation to significantly improve the NDIA’s management of claimant compliance from a low level of maturity.

Committed to deliver integrity outcomes that detect, respond to, and prevent fraud and non-compliance against the NDIS, the NDIA secured and is implementing programs funded by the Fraud Fusion Taskforce and the Crack Down on Fraud Program. Our integrity transformation programs are focused on uplifting NDIA system capability, making it easier to get it right, and harder to get it wrong.

The scope of change has required agility and responsiveness, at scale and as the NDIA progressively implements transformation, it is building new capability through changes to law reform, technology uplifts, process uplifts and whole of government collaboration. The NDIA appreciates the ANAO’s acknowledgement of this progressive maturity journey, and the integrity outcomes that the NDIA continues to deliver.

The NDIA will continue to progressively implement transformational change to safeguard the NDIS and protect participants’ plans, safety and wellbeing. The changes aim to ensure participants have a positive NDIS experience and that the NDIS remains available to support Australians with disability when they need it.

Key messages from this audit for all Australian Government entities

15. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy/program design and implementation

Governance and risk management

1. Background

Introduction

The National Disability Insurance Scheme

1.1 The National Disability Insurance Scheme (NDIS) was established under the National Disability Insurance Scheme Act 2013 (NDIS Act) to fund reasonable and necessary supports for eligible people with disability to assist them in participating in economic and social life. To participate in the NDIS, individuals must meet age, residency and disability or early intervention access requirements.3 NDIS participants have their supports costed and funded through a participant plan.4 Funded NDIS supports can include help with household tasks, personal care, transport, therapy, training, assistive technology and home modifications.5

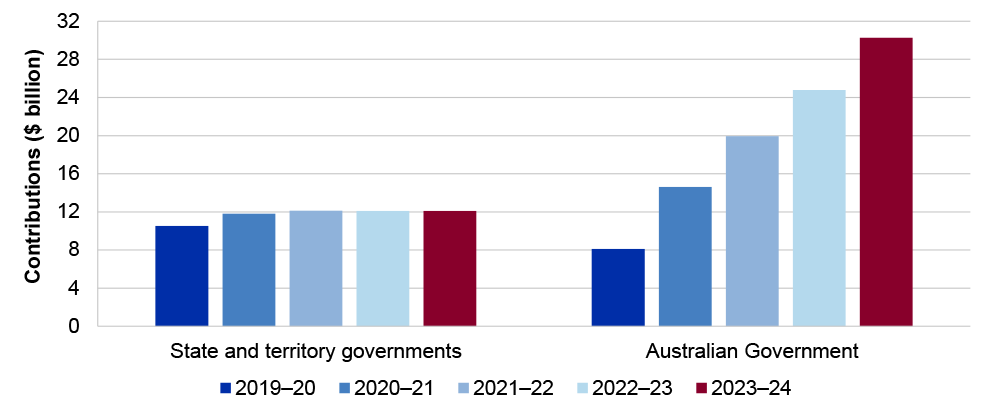

1.2 The NDIS is an uncapped, demand-driven scheme jointly funded by the Australian, state and territory governments under bilateral agreements (Figure 1.1 shows Australian, state and territory government contributions since 2019–20). In 2023–24, NDIS participant plan expenses totalled $41.85 billion, covering more than 661,000 participants.6 By 2033–34, NDIS expenses are expected to increase to $92.72 billion, covering more than 1,021,000 participants.7

Figure 1.1: NDIS contributions by jurisdiction (2023–24 dollars), 2019–20 to 2023–24

Source: Productivity Commission, Report on Government Services 2025, Part F, Section 15, 30 January 2025, Table 15A.1, available from https://www.pc.gov.au/ongoing/report-on-government-services/2025/community-services/services-for-people-with-disability [accessed 31 January 2025].

1.3 The Australian Government Minister for the NDIS (NDIS Minister) administers the NDIS Act and exercises statutory powers with the agreement of states and territories. The Disability Reform Ministerial Council, which comprises ministers responsible for disability from the Australian, state and territory governments, makes decisions on NDIS policy issues.

The National Disability Insurance Agency

1.4 The National Disability Insurance Agency (NDIA) was established under the NDIS Act to deliver the NDIS. It is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Its accountable authority is the NDIA Board, which comprises a chair and up to 11 members appointed by the NDIS Minister in consultation with state and territory members of the Disability Reform Ministerial Council.

1.5 The NDIA’s purpose, as set out in its corporate plan outcomes statement, is to:

Improve the independence, and the social and economic participation of eligible people with disability through the management of a financially sustainable National Disability Insurance Scheme with proper, efficient and effective use of resources.8

1.6 As at 30 June 2024, the NDIA reported a total workforce of 16,192 (made up of 7,846 Australian Public Service (APS) employees, 2,143 contractors and 6,203 outsourced workers9) at over 150 locations across Australia. In the 2024 APS Census, 22 per cent of NDIA staff identified as having disability.

Paying claims for NDIS supports

1.7 The NDIA receives claims from registered providers and participants with self-managed plans to fund NDIS supports outlined in participant plans.10 Participant plan expenses represented 95.1 per cent of the NDIA’s total expenses in 2023–24 (with the balance of the NDIA’s total expenses being operating costs and grants).

1.8 There are three arrangements for managing participant plan funding:

- self-managed — participants (or their plan nominee or child representative11) manage their own funding, pay providers directly, and claim reimbursement from the NDIA;

- plan-managed — registered providers (plan managers) manage participants’ funding, purchase NDIS supports from other providers (or reimburse participants when they have directly paid for supports), and claim the costs from the NDIA; and

- NDIA-managed — the NDIA manages participants’ funding, with registered providers making claims directly to the NDIA for NDIS supports provided.

1.9 Participants can choose a combination of these three plan management arrangements, including self-managing part of their plan and having the rest of the plan managed by a plan manager or by the NDIA. Table 1.1 outlines key differences between the participant plan management arrangements.

Table 1.1: Differences between participant plan management arrangements

|

|

Self-managed |

Plan-managed |

NDIA-managed |

|

Proportion of participants using arrangement (as at 31 December 2024)a |

22% (fully) 5% (partly) |

65% |

7% |

|

Value (and proportion) of payments made under each arrangement in Q2 2024–25a |

$1.2 billion (11%) |

$6.8 billion (60%) |

$3.4 billion (30%) |

|

Unregistered providers can be usedb |

✔ |

✔ |

✘ |

|

Prices paid can exceed NDIS price limitsc |

✔ |

✘ |

✘ |

|

Responsibility for bookkeeping and keeping records of spending |

Participant |

Plan manager |

NDIA |

|

Claims for payment lodged through |

my NDIS participant portal and app |

myplace provider portal my NDIS provider portal

|

|

Key: ✔ Yes ✘ No.

Note a: Proportions do not sum to 100% due to rounding. Q2 2024–25 covers the period 1 September 2024 to 31 December 2024. The proportions have largely remained stable over the past two financial years.

Note b: Some NDIS supports (such as disability accommodation, behaviour support services, and supports that use or are likely to use restrictive practices) can only be provided by registered providers.

Note c: The NDIA publishes the NDIS Pricing Arrangements and Price Limits which lists a catalogue of supports for which providers can lodge claims and maximum prices registered providers can charge for specific supports.

Source: ANAO analysis of NDIA information.

Payment processing systems

1.10 Since 2016, the NDIA has used a client relationship management (CRM) system delivered by Services Australia to manage NDIS participant plans and claims. The NDIA has stated that, for its purposes, the Services Australia CRM system is ‘slow’, ‘clunky’, ‘inefficient’, ‘inflexible’ and ‘at the end of its life’, noting that it has contributed to ‘poor participant experience and NDIS operations’.12

1.11 Since 2021, the NDIA has been working on implementing a replacement system called PACE, built on a Salesforce CRM platform in NDIA’s IT environment. After piloting the PACE system in Tasmania from November 2022 to March 2023, the NDIA began rolling out PACE across Australia from 30 October 2023, with the full rollout initially forecast to take up to 18 months. In February 2025, the NDIA removed the forecast timeframe from its website. The NDIA informed the ANAO in June 2025 that, while the delivery of the PACE system has been completed, the migration of participant plans from the previous CRM system to the PACE system is still in progress. It has not set a revised date for the migration process to be completed.

Managing claimant compliance with NDIS claim requirements

1.12 The NDIA has defined compliance on its website as ‘following the rules and standards of the NDIS and Australian laws’ and ‘doing the right thing and using NDIS funds in line with NDIS plans’. It states that compliant activities can include:

- Keeping complete and accurate records, such as invoices and service agreements.

- Making sure claims for payment are complete, truthful and accurate.

- Checking NDIS plans for any mistakes or anything else that doesn’t look right.13

1.13 The NDIA has outlined four types of non-compliant activity on its website.

- An error or mistake: when a person does the wrong thing without meaning to and without hoping to gain something for themselves.

- Misuse: when a person uses NDIS funds in ways that are not in line with the participant’s plan or the law.

- Conflict of interest: when a person or organisation has an opportunity to put what will benefit them (their own interests) ahead of in [sic] the interests of the people they support.

- Dishonest behaviour: when someone uses NDIS funds when they know it’s the wrong thing to do. When someone behaves dishonestly, they are taking advantage of participants, their families or carers.14

1.14 Other types of claim non-compliance that have been identified through the NDIA’s fraud and non-compliance activities include: illegitimate or ‘ghost’ participants; claiming from expired plans; claiming from plans of participants who are incarcerated, in hospital or overseas for long periods (and thus ineligible for NDIS supports); claiming for services outside of plans; claiming for services that were not provided; claiming in advance of service delivery; overstating services, overcharging or duplicate charging; and double-dipping across government programs.

1.15 In 2023–24, the NDIA reported that its compliance integrity activities included:

- [reviewing] 14,531 pre-payment and 66,759 post-payment claims resulting in $57 million in payment cancellations due to noncompliance in 2023–24 (compared with $49 million in 2022–23)

- an enhanced review process for claims received after a plan has expired and increased pre-payment checks on cash reimbursements …

- identifying and stopping claims from participants who have been overseas for more than 6 weeks …

- implementing a new web-based form as part of a redesigned tip-off process …

- changing the claiming process for self-managed claims to require a description for every claim [and]

- conducting integrity campaigns focused on thematic issues.15

1.16 In October 2024, the NDIS Act was amended to include a new statutory function for the NDIA to ‘prevent, detect, investigate and respond to misuse or abuse of, or criminal activity involving, the [NDIS] (whether systemic or otherwise)’.16

NDIS Review

1.17 The 2023 Independent Review into the National Disability Insurance Scheme found:

Current NDIS processes and systems don’t provide governments with sufficient information to protect the integrity of the scheme and allow governments to monitor and steward the market …

Incomplete data and limited market visibility also make it difficult to understand the nature and scale of non-compliance, sharp practice and fraud occurring across the scheme.17

1.18 The review recommended that the Australian Government:

Invest in digital infrastructure for the NDIS to enable accessible, timely and reliable information and streamlined processes that strengthen NDIS market functioning and scheme integrity.18

Fraud and non-compliance budget measures

1.19 In the 2021–22 Mid-Year Economic and Fiscal Outlook, the Australian Government provided the NDIA $26.5 million funding over two years from 2021–22 for a pilot program ‘to develop and test new compliance capabilities, targeting fraudulent and unethical provider behaviours.’

1.20 In the October 2022 federal Budget, the Australian Government committed $126.3 million over four years from 2022–23 (including $58.4 million for the NDIA) to establish a cross-agency Fraud Fusion Taskforce to address fraud and serious non-compliance in the NDIS, expected to recover $291.5 million in debts from non-compliant NDIS providers. Replacing the previous NDIS Fraud Taskforce, which had been established in 2018, the Fraud Fusion Taskforce is co-led by the NDIA and Services Australia with 19 other entities participating (as at January 2025).

1.21 On 11 April 2023, the National Cabinet committed to ‘an annual growth target in the total costs of the Scheme of no more than 8 per cent by 1 July 2026, with further moderation of growth as the scheme matures.’19 The Australian Government subsequently committed $732.9 million in the 2023–24 federal Budget to improving the effectiveness and sustainability the NDIS, including $48.3 million over two years from 2023–24 to ‘crack down on fraud and non-compliant payments in the Scheme and to develop a business case for new IT platforms and systems to detect and prevent fraud and non-compliant payments’.20 The government provided a further $83.9 million for the Crack Down on Fraud program in February 2024 and a further $110.4 million in December 2024, bringing the total funding allocation for the program to $242.6 million. In the 2025–26 federal Budget, the government committed a further $151.0 million over four years from 2025–26 for the Crack Down on Fraud program (with ongoing funding of $43.8 million per year from 2029–30) and $17.1 million in 2025–26 to maintain the NDIA’s payment integrity workforce.

1.22 In total, the government has committed more than $495 million over eight years from 2021–22 to 2028–29 for the NDIA to address NDIS fraud and non-compliance.

Rationale for undertaking the audit

1.23 The NDIA paid out $41.85 billion for NDIS claims in 2023–24. In September 2023, the NDIA estimated that 6 to 10 per cent of these outlays could be for non-compliant, fraudulent or incorrect claims. The NDIA Board has a duty under section 16 of the PGPA Act to establish and maintain appropriate systems of risk oversight and management and internal control for the NDIA. It also has a duty under section 10 of the Public Governance, Performance and Accountability Rule 2014 (the Fraud and Corruption Rule) to take all reasonable measures to prevent, detect and respond to fraud and corruption relating to the NDIA (including deliberate non-compliance). There has been parliamentary interest in NDIS fraud and non-compliance and its impact on the sustainability of the NDIS. This audit was undertaken to provide assurance to the Parliament on the effectiveness of the NDIA’s arrangements for managing NDIS claim compliance.

Audit approach

Audit objective, criteria and scope

1.24 The objective of the audit was to assess the effectiveness of the NDIA’s management of claimant compliance with NDIS claim requirements.

1.25 To form a conclusion against this objective, the following high-level criteria were adopted.

- Has the NDIA developed and implemented effective frameworks and processes to manage NDIS claim compliance?

- Has the NDIA implemented effective arrangements to oversee, monitor and continuously improve NDIS claim compliance?

1.26 The ANAO focused on the NDIA’s management of NDIS claim compliance from July 2022 to December 2024. The audit did not examine the effectiveness of the NDIA’s broader fraud and corruption controls, the NDIA’s management of serious fraud investigations, or the NDIS Quality and Safeguard Commission’s regulation of compliance by NDIS providers.

Audit methodology

1.27 The audit methodology included:

- review of NDIA data, documentation, policies, procedures and training materials;

- walkthroughs of NDIA systems;

- a site visit to the NDIA’s Adelaide office, South Australia;

- review of contributions from three NDIS providers and one provider organisation made to the audit contribution facility on the ANAO website; and

- meetings with NDIA staff.

1.28 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $748,700.

1.29 The team members for this audit were Daniel Whyte, Steven Meyer, Scott Lang, Tim Fuller, Mary Potter, Nathan Daley, Alexandra Collins and Corinne Horton.

2. Compliance frameworks and processes

Areas examined

This chapter examines whether the National Disability Insurance Agency (NDIA) has developed and implemented effective frameworks and processes to manage claimant compliance with National Disability Insurance Scheme (NDIS) claim requirements.

Conclusion

The NDIA has partly effective frameworks and processes in place to manage claimant compliance with NDIS claim requirements and is implementing a large program of work to remediate identified deficiencies, with a target completion date of December 2025. The NDIA has not established a fit-for-purpose framework for managing NDIS claim compliance, although elements that could inform a more robust framework have been included in strategic planning documents for the NDIA’s Crack Down on Fraud program and the Fraud Fusion Taskforce. After identifying in 2023 that the NDIA was implemented with ‘catastrophically weak’ prevention controls, the NDIA has not yet established effective processes for preventing non-compliant claims. The NDIA has established processes to detect and respond to non-compliant claims, which are reviewing a small proportion of claims (0.4 per cent by dollar value) and detecting high levels of non-compliance (over 50 per cent by dollar value). The NDIA is working to improve the effectiveness of NDIS preventative and detective controls through the Crack Down on Fraud program, including introducing identity verification and claim validation processes and enhanced data analytics capabilities. Tranche one of the Crack Down on Fraud program was largely implemented on time and under budget. In April 2025, tranche two had an ‘amber’ status, with two June 2025 milestones identified as ‘at risk’ due to procurement delays.

Areas for improvement

The ANAO made one recommendation aimed at ensuring the NDIA has a fit-for-purpose framework for claim compliance. The ANAO also identified four opportunities for improvement relating to Crack Down on Fraud milestone completion, project management processes for integrity campaigns and tip-off redesign, and documentation for manual pre-payment reviews.

2.1 The NDIA Board has a duty under section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) to establish and maintain appropriate systems of risk oversight and management and internal control for the NDIA. It also has a duty under the 2024 Fraud and Corruption Rule21 to ensure the NDIA has appropriate mechanisms for preventing, detecting and responding to fraud and corruption (paragraphs 10(e) and (f)).

2.2 Having a fit-for-purpose framework to ensure claimants comply with legislative and policy requirements is a countermeasure to help prevent fraud and corruption. Foundational prevention controls for government payment schemes include clear and specific claim requirements, robust systems and processes to verify claims, and education and training arrangements for claimants and entity staff. Detection and response controls relevant to claim compliance include data analysis and review processes, tip-off mechanisms, and referral for follow-up action.22

Has the NDIA established a fit-for-purpose framework for managing NDIS claim compliance?

The NDIA’s Compliance and Enforcement Framework (March 2020) and Fraud and Corruption Control Plan (July 2023) do not provide fit-for-purpose frameworks for managing claim compliance and do not delineate current accountabilities for compliance management. The NDIA Board is non-compliant with the Fraud and Corruption Rule as it has not endorsed an updated Fraud and Corruption Control Plan to meet requirements of the new whole-of-Australian Government framework. The NDIA has developed a ‘program logic’ for the Crack Down on Fraud program and ‘strategic prevention concepts’ for the Fraud Fusion Taskforce that outline more appropriate control frameworks, as they include coverage of basic preventative controls for government payment schemes and are targeted to key non-compliance risks. The NDIA has not updated its broader compliance frameworks and related policies and procedures to reflect changes in its compliance approach.

Compliance and Enforcement Framework (March 2020)

2.3 The NDIA has a Compliance and Enforcement Framework, which was endorsed by the NDIA Board in March 2020 and is published on its website.23 The framework describes the NDIA’s compliance actions, grouped under four categories:

- prevention strategies — targeted education and outreach campaigns, and broader engagement and communication with the disability sector;

- detection strategies — phone and email tip-offs, data matching and analytics, and intelligence and information sharing;

- compliance monitoring — proactive contact with participants to confirm delivery of supports, targeted and desktop compliance reviews, and investigations; and

- enforcement strategies — criminal sanctions, civil penalties, and administrative actions, including debt recovery and referral to the NDIS Quality and Safeguards Commission (NDIS Commission).

2.4 The framework does not include a description of accountability arrangements for compliance management or performance measures and targets. Further, the compliance actions outlined in the framework do not reflect the NDIA’s current compliance approach. In particular, the prevention strategies do not cover foundational prevention controls for government payment schemes (which are now being implemented through the NDIA’s Crack Down on Fraud program), such as clear and specific claim requirements and robust systems and processes to verify claims prior to payment, including confirming claimants’ identity and validating invoice details.

Fraud and Corruption Control Plan (July 2023)

2.5 The NDIA’s Fraud and Corruption Control Plan was last updated in July 2023 and was endorsed by the NDIA Board in September 2023. A new Commonwealth Fraud and Corruption Control Framework came into effect on 1 July 2024 following amendments to section 10 of the Public Governance, Performance and Accountability Rule 2014 (the Fraud and Corruption Rule).24 As at April 2025, the NDIA Board was non-compliant with the Fraud and Corruption Rule as it had not endorsed an updated Fraud and Corruption Control Plan to meet requirements of the new framework.

2.6 The July 2023 control plan states that the NDIA has ‘zero tolerance for fraud against the Scheme, participants, and the NDIA’. Three of six ‘key fraud risks’ outlined in the plan relate to NDIS claim compliance: ‘financial misappropriation (trusted insiders)’; ‘financial misappropriation (scheme stakeholders)’; and ‘financial misappropriation (external threats)’.25 The plan notes that ongoing monitoring and review of risks and treatments is undertaken through the fraud and corruption risk register (discussed further at paragraph 3.24). The plan outlines ‘key fraud and corruption detection and response strategies’, including: addressing serious and organised fraud through the Fraud Fusion Taskforce and engagement with other agencies; proactive data analytics and intelligence; identity management; and staff integrity risk management. The plan also replicates compliance actions in the 2020 Compliance and Enforcement Framework. While accountability arrangements are outlined in the plan, as of April 2025 they were no longer current.

2.7 In August 2024 the NDIA’s Audit and Risk Strategic Leadership Team Sub-Committee was briefed that the NDIA was non-compliant with six out of eight elements of the 2024 Commonwealth Fraud and Corruption Control Framework, including fraud and corruption control plan requirements. The NDIA Board Audit and Risk Committee was subsequently advised of this non-compliance in November 2024. The NDIA has developed a remediation plan to update its fraud and corruption control framework, with progress reporting being provided to the NDIA Board Audit and Risk Committee. Full compliance is expected to be achieved by 31 December 2025.

Other frameworks relevant to claim compliance

Crack Down on Fraud business case (September 2023)

2.8 A March 2022 review of the NDIA’s fraud intelligence and investigation functions, conducted by Deloitte Touche Tohmatsu (Deloitte)26, found the NDIA had an imbalanced focus on serious and organised crime over opportunistic fraud and non-compliance, and an almost exclusive reliance on tip-offs for monitoring and detection of fraud and non-compliance. Deloitte recommended that the NDIA procure and implement fit-for-purpose IT systems for intelligence analysis, fraud and non-compliance detection, and case management. The NDIA engaged Deloitte in April 2022 to develop a business case for IT upgrades to address these recommendations.27 In early 2023, the NDIA provided a draft business case, based on the Deloitte proposal, to the Department of Finance and Digital Transformation Agency (DTA) for feedback. Feedback from the DTA in March 2023 indicated further work would be needed to meet the standards of a ‘first pass’ business case (under the DTA’s whole-of-Australian Government ICT Investment Approval Process).28

2.9 In March 2023 responsibility for business case development shifted within the NDIA to the Fraud Fusion Taskforce (which had been established in November 2022) and a different IT solution was proposed. A revised proposal for foundational IT platforms to ‘crack down on fraud and non-compliant payments’ was presented to the government in April 2023. The Department of Finance and DTA advised that the proposal did not meet the requirements of the ICT Investment Approval Process. The government decided to provide $48.3 million over two years (from 2023–24) for the NDIA to continue its NDIS claim compliance activities and develop a combined pass business case for further consideration.29 The government also decided that the business case would be subject to the Department of Finance’s gateway review process.30

2.10 In July 2023, the NDIA engaged Boston Consulting Group to project manage and draft the Crack Down on Fraud business case, including drafting any supporting submissions to the government.31 The Department of Finance completed a ‘first stage’ gateway review of the program in September 2023, which found there was a clear need for the work proposed and it was aligned with NDIA and government priorities, but a ‘considerable amount of work’ was needed to improve the business case and planning for all stages of implementation was at an early stage.

2.11 The business case for the Crack Down on Fraud program was completed in September 2023.

- The business case provided a detailed description of the business problem to be addressed, which highlighted that:

- ‘serious gaps’ in the NDIA’s IT systems and controls had left the NDIS vulnerable to non-compliance and misuse and made it a target for fraud; and

- this had led to participants being targeted by ‘unscrupulous providers’, ‘committed providers’ struggling to compete with ‘unscrupulous providers’, diminishing public trust in the scheme, low motivation and disempowerment of NDIA staff and partners, and challenges to overall scheme sustainability.

- It estimated that the level of fraud, non-compliance and payment error in the NDIS was in the range of 6 to 10 per cent, which equated to ‘leakage’ of $2.0–3.5 billion in 2022–23 and was forecast to increase to $3.6–6.0 billion by 2027–28.32

- The business case outlined a proposed program to ‘uplift’ the NDIA’s IT capabilities in relation to:

- strengthened identity and authority controls for interactions with NDIS systems;

- transparent and consistent ‘omnichannel’ (for example, app, portal and call centre) experiences for participants and providers;

- secure ‘natural systems’ to facilitate transfer of payment and service data;

- systems for validating payments in real-time against external data sources;

- a centralised, integrated ‘data lake’ to enable real-time data analysis;

- use of advanced analytics and insights tools for fraud detection;

- a fit-for-purpose, end-to-end fraud case management system;

- access to payments data for debt and financial management; and

- cyber resilience to identify security threats and respond to incidents.

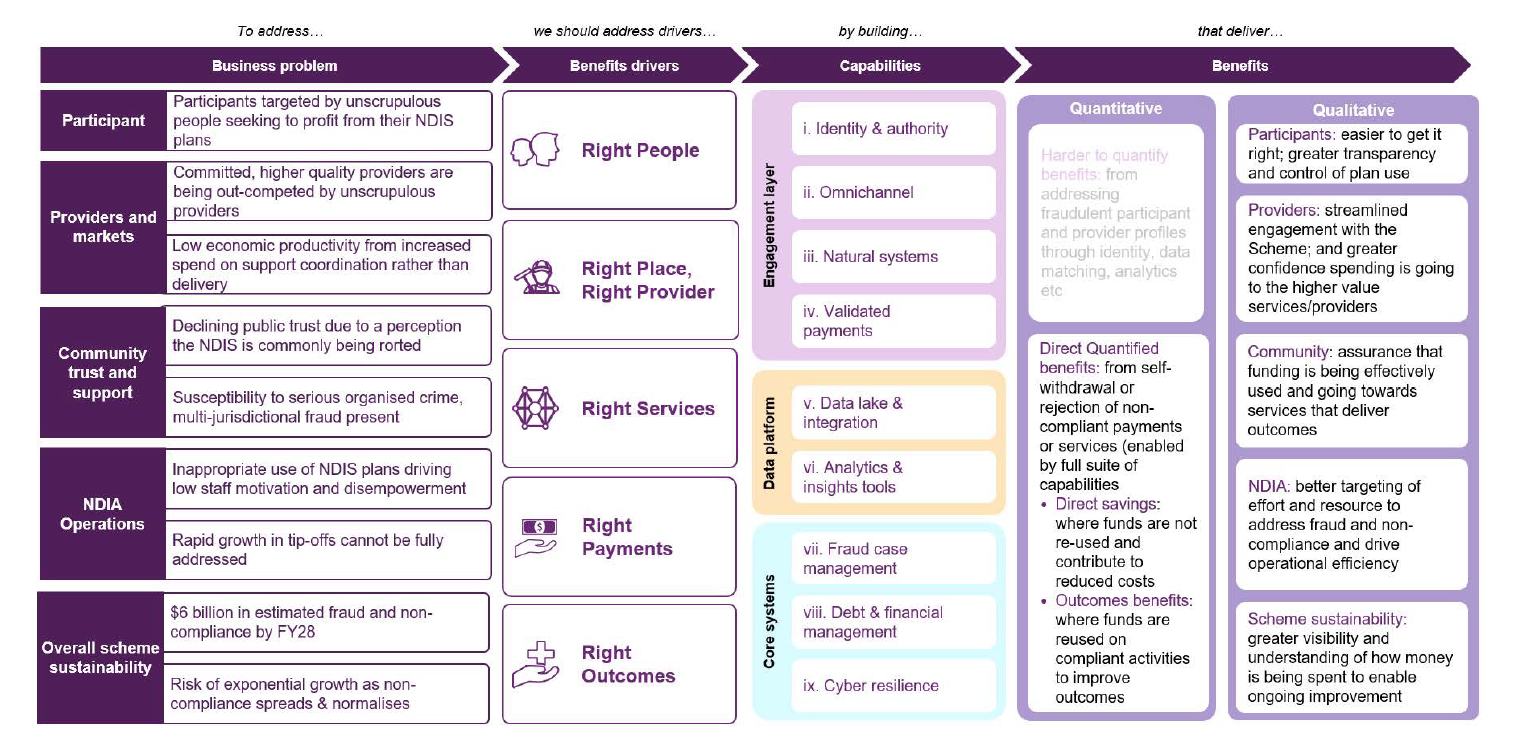

- The business case also included a ‘program logic’33 for ‘making it easier to get it right & harder to get it wrong’, framed around ensuring the ‘right people’, at the ‘right place’ and with the ‘right provider’, get the ‘right services’, ‘right payments’ and ‘right outcomes’ (see Figure 2.1).

Figure 2.1: Crack Down on Fraud program logic

Note: Harder to quantify qualitative benefits were included in the program logic in a lighter shade of text, which states ‘Harder to quantify benefits: from addressing fraudulent participant and provider profiles through identity, data matching, analytics etc’.

Source: NDIA documentation.

2.12 The program of work to ‘uplift’ the NDIA’s IT capabilities outlined in the business case was designed to embed basic preventative controls for a government payment scheme (such as processes to confirm claimants’ identity and validate invoice and payment details) and to establish more advanced detective controls to monitor claiming patterns and identify potential fraud and non-compliance. These capabilities were designed to target significant risks that had been realised in the rollout of the NDIS — namely, that the loose control environment created at the outset enabled ‘unscrupulous people’ and ‘serious organised crime’ to target NDIS participants on a large scale and undermine the financial sustainability of the NDIS.

2.13 The NDIA’s Crack Down on Fraud business case was presented to the government in October 2023. The NDIA’s Crack Down on Fraud program subsequently commenced in February 2024 with the aim of developing new IT platforms and systems to prevent and detect fraud and non-compliance in the NDIS.34 The program envisages a substantial uplift in the NDIA’s prevention and detection controls for NDIS claim compliance. Strategic planning documents for the Crack Down on Fraud program (including the business case) outline a more appropriate control framework than the NDIA’s March 2020 Compliance and Enforcement Framework and July 2023 Fraud and Corruption Control Plan, as they include coverage of basic prevention controls for a government payment scheme. As of April 2025, the NDIA had not updated its corporate frameworks to reflect this change in its compliance approach.

Fraud Fusion Taskforce strategic prevention concepts (October 2023)

2.14 The NDIA co-leads (with Services Australia) the cross-agency Fraud Fusion Taskforce, which was established in November 2022 to address fraud and serious non-compliance in the NDIS (see paragraph 1.20). The NDIA received $58.4 million over four years from 2022–23 for its involvement in the Fraud Fusion Taskforce.

2.15 In October 2023, the Fraud Fusion Taskforce Inter-Departmental Committee35 endorsed 16 ‘strategic prevention concepts’ developed by the NDIA in consultation with the NDIS Commission and Australian Taxation Office (ATO) (see Table 2.1). The NDIA undertook a maturity self-assessment against these concepts in September 2023, rating its ‘current state’ as ‘nil’ and/or ‘ad hoc’ for 15 of the 16 concepts. It also used the framework and maturity assessment to identify seven priority focus areas to ‘uplift’ fraud and non-compliance prevention capability across the ‘NDIS ecosystem’ (six of which overlap with elements of the Crack Down on Fraud program). The NDIA’s self-assessed maturity levels, goal states and priority focus areas are identified in Table 2.1.

Table 2.1: NDIA’s September 2023 self-assessment against strategic prevention conceptsa and priority focus areasb

|

Strategic prevention concept (P = priority focus area) |

Description |

NDIA self-assessment |

NDIA goal state |

|

1. Identity and authority (P) |

Knowing who people are and validating their authority to act |

Nil/Ad hoc |

Embedded |

|

2. Entity attributes |

Global view of interacting entities prevents bad actors |

Nil/Ad hoc |

Embedded |

|

3. Payment data (P) |

Real-time, aggregated view of claim and payment data |

Ad hoc |

Managing |

|

4. Other integrity flags (P) |

Integrity risk flags are shared and manageable across whole-of-government |

Ad hoc |

Managing |

|

5. System flags (P) |

Smart systems analyse cyber behaviour, anticipate and prevent fraud |

Nil |

Embedded |

|

6. Enhanced tax data (P) |

Programs and payments fully integrated into tax system |

Ad hoc |

Embedded |

|

7. Interesting structures |

Active blocks on using interesting structures (charities, trusts) to hide fraud |

Nil |

Managing |

|

8. Fusion capability and loops |

Fraud Fusion Taskforce = whole-of-government fraud capability and intelligence |

Ad hoc |

Managing |

|

9. Interplay of strategy and cases |

Closed-loop feedback between operations and strategy drives continuous improvement |

Ad hoc |

Embedded |

|

10. Spectrum of treatments (P) |

A fulsome treatment menu with fast intervention pathways |

Ad hoc |

Embedded |

|

11. Withholding models |

Payment withholding mimics tax system and supports self-managed participants and providers to report income |

Ad hoc |

– |

|

12. Client experience |

Participants-first approach to fraud prevention supports the participant experience |

Ad hoc/ Developing |

Embedded |

|

13. Ethics and stewardship |

Ethics and human oversight is central to fraud prevention |

Ad hoc |

Embedded |

|

14. Communications and engagement (P) |

Segmented communications and engagement with appropriate channels for all users |

Ad hoc |

Embedded |

|

15. Whole of government |

‘One government’ reuses credentials and systems, and collectively prevents fraud |

Nil/Ad hoc |

Embedded |

|

16. Legislative issues |

Appropriate legislative authority to request and access information, make decisions and uphold integrity |

Ad hoc |

Embedded |

Note a: From lowest to highest, the maturity assessment ratings are: nil; ad hoc; developing; managing; and embedded.

Note b: Priority focus areas for capability uplift. Priority concepts 1, 2, 4, 5, 6 and 10 relate to capabilities being built through the Crack Down on Fraud program.

Source: NDIA documentation.

2.16 Similar to the program logic developed for the Crack Down on Fraud program, the Fraud Fusion Taskforce’s strategic prevention concepts outline a more appropriate control framework than the NDIA’s March 2020 Compliance and Enforcement Framework and July 2023 Fraud and Corruption Control Plan. As of April 2025, the NDIA had not updated its corporate frameworks to reflect these concepts.

Recommendation no.1

2.17 The National Disability Insurance Agency update its corporate compliance frameworks and related policies and procedures to reflect its compliance approach, delineate accountabilities for compliance management and outline how compliance activities are targeted to addressing key non-compliance risks.

National Disability Insurance Agency response: Agreed.

2.18 As part of a program of work the NDIA is undertaking to improve alignment with the 2024 Commonwealth Fraud and Corruption Policy, the NDIA will be updating relevant compliance frameworks policies, procedures and current practices to address key non-compliance risks.

Has the NDIA established processes for preventing non-compliant NDIS claims?

The NDIS was designed and implemented (up until 2024) without basic prevention controls, such as clear claim requirements and robust identity verification and pre-payment validation processes. The NDIA commenced implementing activities to address these deficiencies in February 2024 through its Crack Down on Fraud program. Early program milestones were largely met, and the first tranche of the program was delivered largely on time and under budget. A large body of work to address prevention control deficiencies was still in progress as of April 2025 with a target completion date for tranche two of December 2025. In April 2025, the NDIA reported an ‘amber’ status for the program, due to procurement delays that had put the timely delivery of two milestones at risk. The NDIA has established other prevention controls, such as undertaking campaigns to improve compliance in targeted areas and providing educational information and guidance to claimants and NDIA staff.

Identified weakness in NDIS prevention controls

2.19 The March 2022 review of the NDIA’s fraud intelligence and investigation functions (see paragraph 2.8) observed that:

Since inception in 2013, the NDIS has been primarily focussed on transitioning participants into the Scheme from state and territory funded support. As a result, participant growth was rapid, notably growing from 29,719 in 2016 to 466,619 by 30 June 2021, with payments also rising rapidly, from $4 billion in 2016–17 to more than $23 billion by 2020–21. This focus on participant transition has meant that there was insufficient attention on the commensurate growth of a robust control environment and associated systems expected of a scheme of this size and complexity today.

2.20 In undertaking business analysis for the September 2023 Crack Down on Fraud business case, the NDIA identified that its identity and authority controls for individuals and organisations interacting with NDIA systems were ‘catastrophically weak’. It also identified in the business case that its IT systems created a ‘loose control environment’, which included:

- Little or no transparency of what a significant proportion of payments are being used for due to legacy systems that do not allow additional data to be requested from claimants …

- The NDIA immediately paying 98% of claims with no automated pre-payment validation against legislative, regulatory or administrative rules or known risk flags due to a lack of the technology to automatically test claims against those rules and a lack of consolidated data to validate claims (e.g., previous claims to match for duplication)

- Reliance on highly manual processes for all pre-payment and post-payment validation, such that only 0.02% of total NDIS claims are reviewed pre-payment per year and 0.04% are reviewed post-payment per year, due to a lack of automated rules testing and rudimentary validation tools.

2.21 The Crack Down on Fraud business case acknowledged that ‘rudimentary’ pre-payment checks existed within the NDIA’s PACE payment system. These checks, which were introduced in 2022 and 2023, include system-based checks to confirm that the claim service date is in the past, the claim is not a duplicate, and there is sufficient budget in the participant’s plan. Similar checks were also introduced over the same period in the NDIA’s SAP CRM system.36

Crack Down on Fraud ‘uplifts’ to NDIS prevention controls

2.22 In November 2023, the government decided to fund the Crack Down on Fraud program in three tranches in early 2024, 2025 and 2026, subject to advice from the DTA on project delivery status. Between November 2023 and January 2024, the NDIA worked with the DTA to complete ‘pre-start’ activities, including developing a schedule of 34 outcomes or milestones to be delivered over the first two years of the program to support the release of tranche two funding in 2025 and tranche three funding in 2026 (see Appendix 3). In February 2024, the government decided to release tranche one funding of $83.9 million37, and decided that future tranches could be approved through correspondence with the Prime Minister and Minister for Finance, informed by advice from DTA and the Department of Finance.

Crack Down on Fraud ‘tranche one’ project delivery

2.23 The NDIA developed a ‘tranche one baseline plan’ in May 2024, which outlined a suite of 11 projects to deliver the capabilities proposed under the Crack Down on Fraud program (see Appendix 4 for tranche one project details). In June 2024, the NDIA developed a ‘program roadmap’ and ‘project on a page’ plans for the 11 projects. Each ‘project on a page’ plan included: a project description; related program milestones; a project scope; a change impact assessment; risks; dependencies; an outline of project leadership and governance; delivery milestones; and a Gantt chart outlining the delivery schedule.

2.24 Of the 11 projects initiated for tranche one, seven relate to prevention controls for claim non-compliance. These projects are delivering capabilities relating to:

- strengthened identity and authority controls and improved ‘omnichannel’ experiences;

- secure ‘natural systems’ to facilitate transfer of data between the NDIA, providers and other entities;

- cyber resilience to identify security threats and respond to incidents; and

- enhanced systems for validated payments, including ‘integrity uplifts’ for the NDIA’s client relationship management systems.

2.25 Since August 2024 the NDIA has provided monthly project status reports to Crack Down on Fraud oversight committees.38 Project status reporting covering the period of July 2024 to February 2025 indicates implementation challenges emerged with projects relating to identity and authority, natural systems and cyber resilience, including: capacity constraints and prioritisation issues within the NDIA’s Chief Information Officer Division39; and delays in undertaking necessary procurement activities. No significant challenges were reported for the projects relating to validated payments.

2.26 The NDIA reported in February 2025 that 15 of 17 tranche one milestones had been delivered by December 2024 and two milestones had been ‘partially delivered’ (see Appendix 5). To support the closure of program milestones, the NDIA has established a process that involves preparing milestone acceptance briefs. Briefs prepared for milestones due in June 2024 included sections for: due dates and completion dates; acceptance criteria; endorsement by the project owner, business owner and technical owner; and final endorsement by the Crack Down on Fraud program senior responsible officer (General Manager, Integrity Transformation Division). For December 2024 milestones, two additional sections were included in acceptance briefs outlining evidence that the milestone had been delivered and an assurance assessment by the Crack Down on Fraud independent assurer (Sententia Consulting).40

2.27 Of the 17 tranche one milestones (see Appendix 5 for milestone details), 10 milestones related to prevention controls for claim non-compliance. As of March 2025:

- three milestones (M1, M2 and M5) had been signed off by the senior responsible officer in January 2025 without supporting evidence or an assurance assessment;

- three milestones (M6, M7 and M8) had been signed off by the senior responsible officer in March 2025 following an assurance assessment of supporting evidence;

- for two milestones (M4 and M9), the independent assurer had requested additional supporting evidence of milestone completion and the milestones had not been signed off by the senior responsible officer; and

- for two milestone (M15 and M17), acceptance briefs had not been completed.

2.28 Prior to undertaking the milestone assurance process, the NDIA had not developed guidance on what types of evidence would be sufficient to support the completion of milestones. Supporting evidence for milestone completion briefs included: screenshots of systems; governance forum papers; technical documentation; online public communications; communications with providers; PowerPoint presentations; emails (for example, confirming the completion of testing); and test completion reports.

Opportunity for improvement

2.29 The NDIA could develop additional guidance on what types of evidence would be sufficient to support the completion of milestones. In addition, when reporting on the delivery status of Crack Down on Fraud program milestones, the NDIA could indicate whether an assurance assessment has been completed and the milestone has been formally signed off by the senior responsible officer.

2.30 Tranche one of the Crack Down on Fraud program was delivered largely on time, with 13 of the 17 milestones delivered before their target completion dates and the remaining four delivered within one to three months of their target completion dates. Tranche one was also delivered substantially under budget, with total expenditure of $30.1 million against a budget of $82.1 million (the NDIA attributed the underspend to a three-month delay in the release of funding, which impacted high-cost procurement activities).

Crack Down on Fraud ‘tranche two’ project delivery

2.31 In November 2024, the NDIA developed a ‘tranche two baseline plan’, which included status updates for the initial 11 projects (continuing from tranche one) and outlined two new projects to commence in 2025.

2.32 The Department of Finance completed a ‘mid-stage’ gateway review of the Crack Down on Fraud program in November 2024, which found that the overall delivery confidence assessment for tranche two of the program was ‘amber’. The report stated:

The Crack Down on Fraud (CDoF) Program (Program) has delivered some significant achievements and benefits ahead of time in Tranche 1 and has demonstrated through these achievements that the NDIA is capable of adopting a ‘can do’ mindset and approach to deliver government outcomes.

The Agency has been given a substantial and complex reform agenda to deliver in an ambitious timeframe. Unless the Agency’s ability to deliver and embed multiple reforms in parallel increases, including alleviating capacity constraints and system stress points, then it is unlikely Tranches 2 and 3 will be delivered in their entirety as scheduled.

2.33 The report made three recommendations relating to its findings on capacity constraints and system stress points, which were classified as ‘Essential (Do by Q1 2025)’.

- Complete and implement the strategic prioritisation framework to support decision-making across the Agency.

- Establish a critical path identifying the most important activities, including all dependencies and constraints – program, organisation and stakeholder, to better capture program progress and an understanding of risk impacts.

- Conduct an analysis of the end-to-end production line to identify stress points and constraints. Where possible remediate these constraints.

2.34 In December 2024, the NDIA’s Scheme Integrity and Debt Governance Strategic Leadership Team Sub-Committee was briefed on the report and was advised it would be provided with an update on implementation of recommendations in February 2025.41 As of March 2025, when the sub-committee was dissolved, no briefing on implementation progress had been provided to the sub-committee. In March 2025, the NDIA Board and the Board Audit and Risk Committee were provided updates on the Crack Down on Fraud program, which included brief summaries of the November 2024 gateway review findings and work underway to address recommendations.

2.35 In April 2025, the NDIA reported that the Crack Down on Fraud program had shifted from ‘green’ status in February 2025 to ‘amber’ status in March 2025.42 The shift in program status was attributed to two milestones with target completion dates of June 2025 (one of which related to prevention controls) being ‘at risk’ as a result of procurement delays.

ATO vulnerability assessment

2.36 As a component of the Fraud Fusion Taskforce measure, the ATO received $11 million in funding over four years (from 2022–23) to support cross-government fraud prevention capability. Since December 2022 the ATO has worked with the NDIA to scope and commence a vulnerability assessment of the NDIS. The assessment is being conducted in nine tranches covering the participant and provider ecosystems as well as the NDIA’s compliance mechanisms.

2.37 The ATO completed its first tranche assessment of NDIS participant access and authority controls in December 2024, which identified 80 potential or actual vulnerabilities and made 67 recommendations to strengthen controls. While the NDIA has uplifted its access and authority controls through the Crack Down on Fraud program, the findings of the ATO assessment demonstrate that further work is needed to mitigate fraud and non-compliance risks. As of April 2025, the NDIA Board and relevant oversight committees had not been briefed on the findings of the assessment. Further, the NDIA had not responded to the 67 recommendations in the ATO’s first tranche vulnerability assessment or developed an action plan for responding to them. The NDIA informed the ANAO in June 2025 that it would develop an action plan and undertake gap analysis to address the recommendations.

Integrity campaigns

2.38 In parallel with Crack Down on Fraud program activities, the NDIA has implemented ‘campaigns’ relating to NDIS fraud and non-compliance (integrity campaigns). The NDIA describes integrity campaigns as time-limited operational activities targeting specific high-priority integrity vulnerabilities through a mix of interventions. NDIA internal procedural documents outline a five-stage process for conducting an integrity campaign, covering:

- discovery — undertake research to understand the problem being addressed;

- design — explore potential treatments, seek feedback from stakeholders, and develop a proposal (cleared by the Branch Manager, Scalable Integrity Responses);

- build — create artefacts, such as work instructions, templates or talking points;

- execute — apply interventions and manage project, including tracking and reporting on progress and outcomes of activities; and

- review — formally review outcomes and complete a closure report (endorsed by the Branch Manager, Scalable Integrity Responses).

2.39 Between July 2023 and December 2024, the NDIA completed five integrity campaigns. These campaigns were largely used as small-scale trials to gather information on non-compliance risks and test potential preventative and detective approaches to addressing these risks. Table 2.2 provides a description of these campaigns and a summary of their reported outcomes.

Table 2.2: Completed integrity campaigns, July 2023 to December 2024

|

Name/timeframe |

Description |

Reported outcomes |

|

Unable to contact (UTC) (Phase 1) Sep 2023–Aug 2024 |

Participants are classified as UTC after five unsuccessful attempts to contact. UTC participants have high participant welfare and scheme integrity risks. Campaign trialled a new approach to managing UTC participants by conducting ‘agency initiated plan reviews’. |

|

|

Plan-manager reimbursements Oct–Dec 2023 |

Plan-manager reimbursements were being used to withdraw cash from the NDIS in non-compliant or fraudulent way. Campaign focused on assessing whether reimbursements were compliant; generating savings through self-corrections and debts raised; and informing policy and system redesign. |

|

|

Overseas participants and visas Oct 2023–Dec 2024 |

Residency is an eligibility requirement for the NDIS (NDIS Act section 23). Campaign focused on conducting immigration checks on participants whose Centrelink records showed their income support payments as suspended due to being overseas. |

|

|

School leavers employment supports (SLES) Feb–Aug 2024 |

Concerns were raised by providers regarding SLES claims. Campaign involved post-payment reviews of SLES claims to assess compliance with progress reporting requirements and integrity of claims. |

|

|

Short notice cancellations (SNC) Apr–Sep 2024 |

Analysis identified that many providers were not claiming for SNCs correctly. Campaign focused on: educating providers on SNC claiming; and testing the viability of integrity responses for providers with high frequency of SNC claims. |

|

Source: ANAO analysis of NDIA documentation.

2.40 The NDIA created an integrity campaign tracking spreadsheet, which was incomplete and not up to date. For several integrity campaigns, project management documentation was incomplete and/or there was insufficient evidence of review, clearance or endorsement. While outcomes of integrity campaigns have been reported to governance bodies, closure reports were not prepared for two completed campaigns (plan-manager reimbursements and overseas participants and visas) and closure reports for other campaigns were not endorsed by a senior manager or oversight body.

Opportunity for improvement

2.41 The NDIA could establish more consistent project management processes for integrity campaigns that ensure documentation on campaign commencement and closure is endorsed by an appropriate senior manager or oversight body, and campaign progress and outcomes are tracked and reported consistently.

Other prevention controls

Legislative changes

2.42 Prior to the introduction of the Crack Down on Fraud program, little or no evidence was requested from claimants to substantiate NDIS claims. The September 2023 Crack Down on Fraud business case noted that preventing fraudulent or non-compliant claims based on substantiation may require legislative or regulatory change. In October 2023, the NDIA advised the government that legislative changes to the National Disability Insurance Scheme Act 2013 (NDIS Act) would be needed to require claimants to retain records of expenditure and provide information on request.

2.43 On 3 October 2024 the National Disability Insurance Scheme Amendment (Getting the NDIS Back on Track No. 1) Act 2024 came into effect, which amended the NDIS Act to strengthen the legislative basis for the NDIA’s compliance activities by:

- defining NDIS supports (section 10 of the NDIS Act)43;

- introducing the need for a claim to receive payments for NDIS supports (section 45A of the NDIS Act);

- requiring participants to spend money only on NDIS supports and in accordance with their plan (section 46 of the NDIS Act); and

- introducing a new statutory function for the NDIA to prevent, detect, investigate and respond to misuse or abuse of the NDIS relating to payment claims (section 118 of the NDIS Act).

NDIS website content

2.44 The NDIA maintains a website with detailed information about the NDIS for applicants, participants, providers, other stakeholders and the public, including Our Guidelines which explains how the NDIA makes regulatory decisions.44

2.45 The 2023 Independent Review into the National Disability Insurance Scheme was critical of the information provided to participants and providers on NDIS supports, including through the NDIS website, stating:

Current information on what supports can be purchased, what supports are available, and the prices and quality of supports is often hard to find or understand. This affects their ability to exercise informed choice and control over their supports …45

2.46 The October 2024 legislative changes to the NDIS Act (see paragraph 2.43) enabled the NDIA Chief Executive Officer to make rules about what are and are not NDIS supports. The NDIA made updates to its website and guidelines in late 2024 to reflect these changes.

2.47 The NDIS website also has webpages on fraud and non-compliance, including:

- pages for participants titled What you need to know about non-compliance, What you need to know about fraud, How to protect your NDIS plan and What are scams?46;

- pages for providers titled Provider compliance and Conflicts of interest in the NDIS provider market47; and

- pages for a general audience on Improving integrity and preventing fraud, Crack Down on Fraud, Fraud Fusion Taskforce and Useful contacts (for reporting other integrity matters).48

Internal education and training

2.48 The NDIA has a mandatory learning policy that requires all staff, contractors and partners in the community49 to complete courses listed in the NDIA’s mandatory learning matrix.50 The matrix includes a 45-minute e-learning course called ‘Good Compliance Practices’, which must be completed by all staff, contractors and partners in the community within three months of commencement, with refresher training required every two years.

2.49 The learning objectives of the ‘Good Compliance Practices’ course are to: explain the importance of good compliance practice; identify, prevent and report non-compliant behaviours; and identify common warning signs for participants, providers, and staff. The course has sections on non-compliant behaviours such as: error, misuse, conflict of interest, sharp practice, fraud and corruption. It also includes sections on the importance of reporting internal and external fraud, and includes a link to the NDIA’s fraud reporting webform (discussed at paragraph 2.51) and the contact number for the NDIA’s fraud reporting and scams helpline.

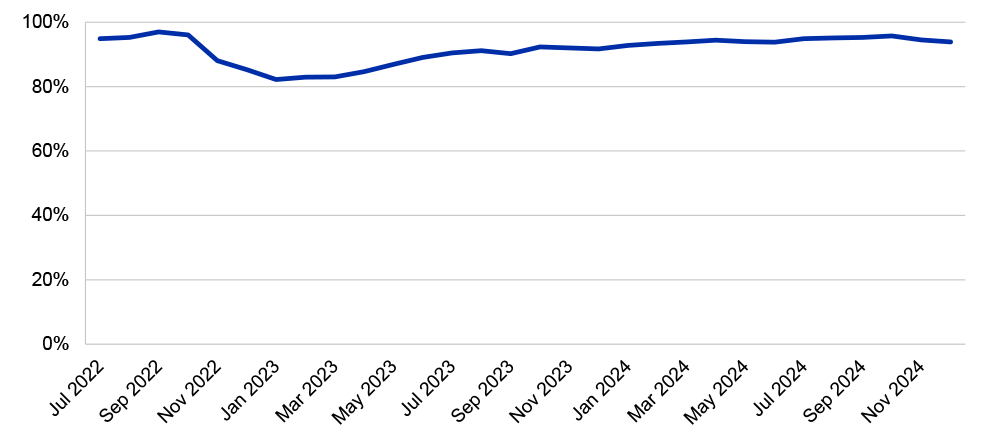

2.50 Training completion data provided by the NDIA indicates that completion rates for the ‘Good Compliance Practices’ course were consistently over 80 per cent between July 2022 and December 2024 (see Figure 2.2).

Figure 2.2: Good Compliance Practices completion rates, July 2022 to December 2024

Source: NDIA training completion data.

Has the NDIA established processes to detect and respond to non-compliant NDIS claims?

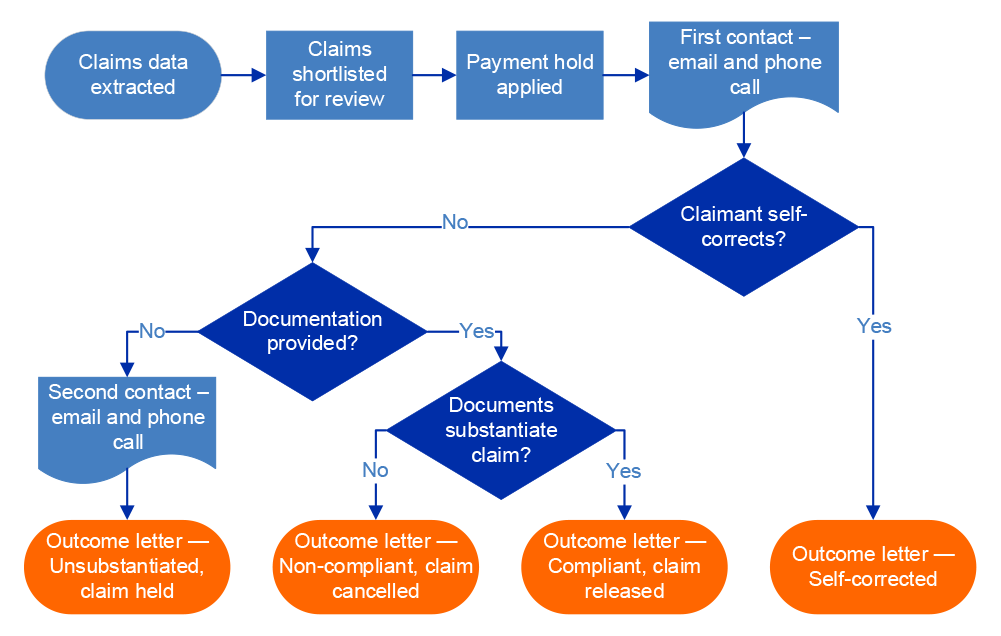

The NDIA has established processes to detect and respond to non-compliant claims, including tip-off mechanisms, manual payment review processes and debt recovery. The NDIA has made improvements to its tip-off intake and assessment processes and is continuing to implement a tip-off redesign program. After the NDIA received advice in May 2023 that it was limited in its capacity to recover debts from non-compliant claims when supports were described generally in participant plans, the NDIA shifted its focus in 2024 from post-payment reviews to pre-payment reviews. The NDIA targets its manual pre-payment reviews based on ‘risk profiles’. These reviews cover a small proportion of NDIS outlays (0.4 per cent) and are detecting a high proportion of non-compliance (over 50 per cent of reviewed claims, by dollar value, are cancelled). The NDIA has identified deficiencies in its detection and response IT systems and is progressing work to improve its data analytics capabilities through the Crack Down on Fraud program, with a target completion date of December 2025.

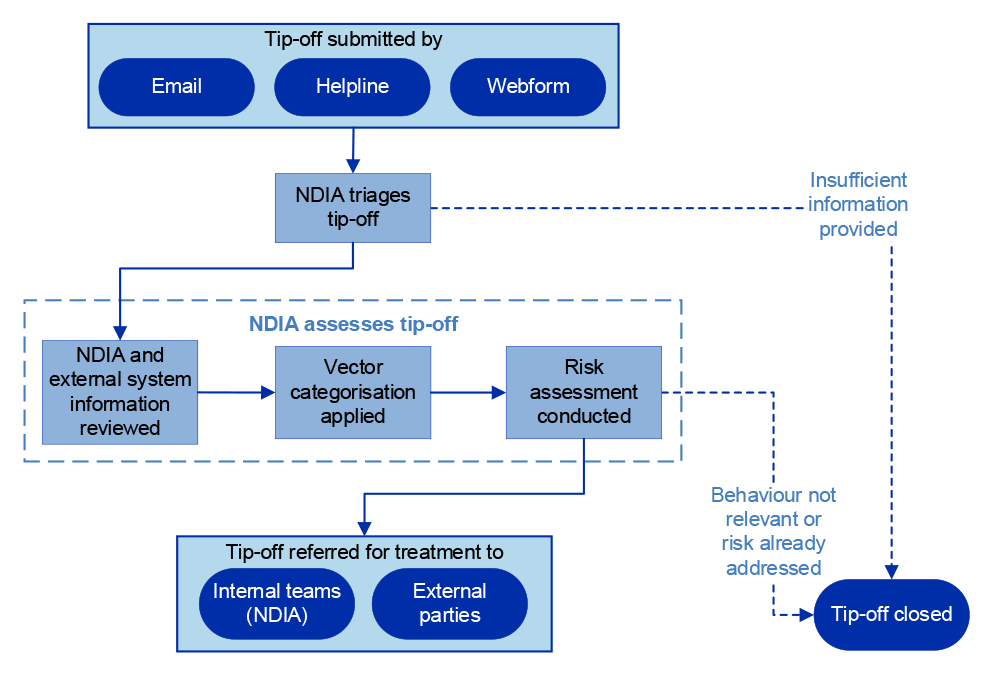

Tip-off mechanisms

2.51 Tip-offs are a means by which members of the public can report suspected fraud or non-compliant behaviour from NDIS participants, providers or third parties. Tip-offs can be made by phone, email or by completing NDIA’s fraud reporting webform.51 The NDIA uses tip-offs to inform its fraud and non-compliance prevention, detection and response activities.

2.52 Two internal reviews completed in 2022 identified issues with the NDIA’s tip-off processes.

- The March 2022 review of fraud intelligence and investigation functions (see paragraph 2.8) recommended that the NDIA ‘assess, review and reform its current tip-off assessment process to ensure effective and timely resolution of tip-offs received’, with a view to developing and implementing a new tip-off assessment model. The review also proposed a future case management system where tip-offs could be linked to existing cases and related parties.

- A November 2022 review of the NDIA’s tip-off intake and assessment process, conducted by a consulting firm called Quantium, found:

- information on tip-offs lacked structure, was often incomplete and was stored in multiple systems;

- risk-based prioritisation targeted only some risks, with little further analysis to understand broader trends;

- governance arrangements were informal, with limited reporting of tip-off trends to oversight committees and limited feedback on outcomes and referrals; and

- manual processes increased assessment time, duplication and the number of inaccurate records.

Tip-off numbers and backlog

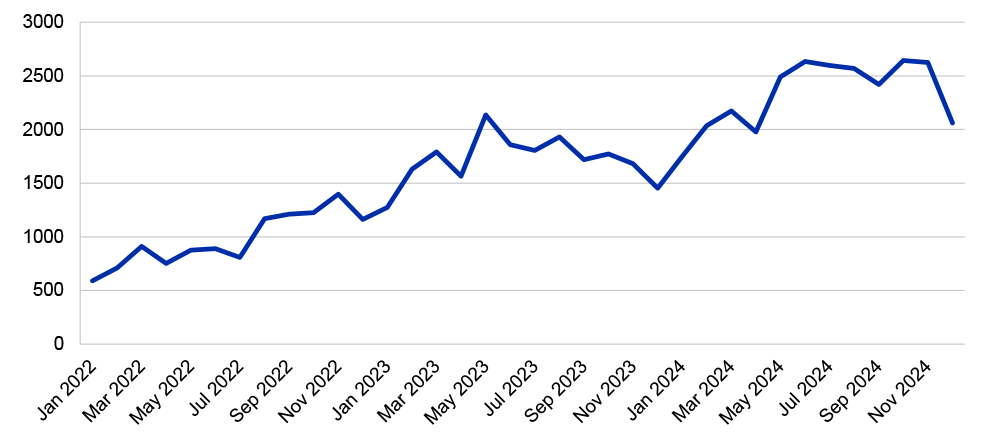

2.53 The March 2022 review noted an increasing number of tip-offs were being received, a backlog of unassessed tip-offs had developed, and the NDIA could not address this backlog with its existing resources and systems. The number of tip-offs the NDIA receives has continued to grow since 2022 (see Figure 2.3).

Figure 2.3: Number of tip-offs received by month, January 2022 to December 2024

Source: ANAO analysis of NDIA tip-off data.

2.54 In August 2022, the NDIA reported to the NDIA Board Risk Committee that a ‘backlog strategy’ had been approved by the Chief Risk Officer in May 2022. In the September 2023 Crack Down on Fraud business case, the NDIA noted that existing systems and processes were unable to address the growth in tip-off numbers. In January 2024, the NDIA prepared a ‘proposed remediation plan’ to address the tip-off backlog. After peaking at 6,597 in October 2024, the NDIA has recorded a 34 per cent reduction in tip-off backlog numbers to 4,360 in March 2025.

Tip-off intake and assessment process

2.55 The NDIA has made improvements to its tip-off intake and assessment process since 2022.

- A new webform for fraud tip-offs was launched in February 2024. The webform prompts tip-off reporters to provide details about the person of interest, their fraud or non-compliance concern and to attach any relevant evidence.