Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Securing Supply Through Onshore Vaccine Manufacturing Capability

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Australian Government stockpiles a strategic reserve of drugs, vaccines and antidotes to ensure that Australia can remain self-sufficient and meet demand during a national health emergency. In the 2017–18 Federal Budget the Australian Government sought to explore onshore manufacturing options.

- During the COVID-19 pandemic the Australian Government competed with other domestic and international jurisdictions for access to critical medical supplies such as vaccines and personal protective equipment.

Key facts

- In November 2020 the Australian Government signed a 10-year agreement with Seqirus to secure supply of antivenoms, Q fever vaccine and pandemic influenza vaccines through onshore manufacturing from a new facility in Melbourne (owned by Seqirus).

- In March 2022 the Australian Government signed a 10-year agreement with Moderna to secure supply of mRNA vaccines through onshore manufacturing from a new facility in Melbourne (owned by Moderna).

What did we find?

- The procurements achieved the objective of establishing onshore facilities that have the potential to improve supply security. There could have been earlier procurement planning and clearer value-for-money conclusions.

- The Department of Health, Disability and Ageing’s (DHDA) procurement and contract management of the 2020 Seqirus agreement is partly effective.

- DHDA and the Department of Industry, Science and Resources’ (DISR) procurement and contract management of the 2022 Moderna agreement is largely effective.

What did we recommend?

- There were eight recommendations to DHDA, DISR and the Department of Finance related to advice to government; procurement planning; limited tender decision-making; management of probity risks and record keeping; contract management planning; planning for the end of the Seqirus agreement; and protocols for setting aside the Commonwealth Procurement Rules.

- Entities agreed to all recommendations.

1

Number of onshore manufacturers of antivenoms, Q fever vaccine and pandemic influenza vaccines in Australia.

$1.007 billion

Cost to the Australian Government of the Seqirus agreement.

$1.5 to $3 billion

Approximate cost to the Australian Government of the Moderna agreement.

Summary and recommendations

Background

1. In 2020 the Australian Government announced it had signed an agreement with Seqirus (Australia) Pty Ltd (Seqirus, a subsidiary of CSL Limited) whereby Seqirus would invest in the construction of a new, high-tech vaccine manufacturing facility in Melbourne:

to secure Australia’s long-term supply of critical health products including pandemic influenza vaccines and life-saving antivenoms … [and provide] the ability to rapidly manufacture vaccines when responding to health pandemics in the future.1

2. In 2022 the Australian Government announced it had signed an agreement with Moderna Australia Pty Ltd (Moderna):

that secures the production of up to 100 million Australian made mRNA doses every year and hundreds of manufacturing jobs too … which will help protect Australian [sic] against future pandemics while supporting local industry … [and] ensure Australia can meet its ongoing COVID-19 vaccine needs, and any other new and innovative respiratory mRNA vaccines.2

3. The Department of Health, Disability and Ageing (DHDA) is responsible for the 2020 Seqirus procurement and contract management. The Department of Industry, Science and Resources (DISR) was responsible for the approach to market and DISR and DHDA were responsible for the contract negotiations for the 2022 Moderna procurement. DHDA executed the 2022 Moderna contract and is responsible for the contract management of Moderna.

4. DHDA and DISR are non-corporate Commonwealth entities, subject to the Public Governance, Performance and Accountability Act 2013 and prescribed by section 30 of the Public Governance, Performance and Accountability Rules 2014 to comply with the Commonwealth Procurement Rules (CPRs).3

Rationale for undertaking the audit

5. The Australian Government stockpiles a strategic reserve of drugs, vaccines and antidotes to ensure that Australia can remain self-sufficient and meet demand during a national health emergency.4 In the 2017–18 Federal Budget the Australian Government provided funding to support the ongoing production and supply of Q fever vaccine and uniquely Australian antivenoms, and to maintain onshore production of pandemic influenza vaccines. The measure included funding to scope long-term supply options.

6. During the COVID-19 pandemic the Australian Government competed with other domestic and international jurisdictions for access to critical medical supplies such as vaccines and personal protective equipment.

7. The Australian Government has since committed over $4 billion in supporting the establishment of onshore vaccine and other health product manufacturing facilities in Australia.

8. In 2023–24, the Australian Government developed the Buy Australian Plan5 and made the Future Made in Australia Act 20246 to increase domestic manufacturing capability. The audit was identified as a Joint Parliamentary Committee of Public Accounts and Audit priority in 2024–25. The audit provides independent assurance to the Parliament on the procurement and contract management of onshore manufacturing capability for antivenoms, Q fever vaccine, pandemic influenza vaccines and mRNA vaccines for respiratory infections.

Audit objective and criteria

9. The objective of the audit was to examine the effectiveness of the procurement and contract management of onshore manufacturing capability to secure supply of antivenoms and vaccines.

10. To form a conclusion against the objective, the following high-level criteria were applied:

- Was the 2020 procurement of Seqirus onshore manufacturing capability for antivenoms, Q fever vaccine, and influenza vaccines effective?

- Was the 2022 procurement of Moderna onshore manufacturing capability for mRNA vaccines effective?

Conclusion

11. The procurements of onshore manufacturing capability for antivenoms and vaccines have achieved the objective of establishing onshore facilities that have the potential of improving security of supply for Australians. The Seqirus procurement did not maximise value for money for the Australian taxpayer in the long term. For both procurements there could have been earlier procurement planning and justification of a limited tender approach, and a clearer value-for-money conclusion when presenting advice to government.

12. DHDA’s 2020 procurement of onshore manufacturing capability for antivenoms, Q fever vaccine and pandemic influenza vaccines was partly effective. Onshore manufacturing capability to secure supply of critical health products was maintained, however the procurement did not maximise value for money for the Australian taxpayer because:

- the option recommended to government (sole sourcing Seqirus for a further ten years) was not identified in scoping research or legal advice as the option providing the best value for money in the long term;

- advice to government did not comprehensively present the scoping research conclusions;

- there was no approach to market to obtain market intelligence on alternative suppliers;

- conducting the procurement as a sole sourced limited tender was justified under the CPRs after the decision had already been made;

- there was no overall value for money conclusion to support the decision to sole source Seqirus because, in part, there was no comparator; and

- a value for money conclusion made at the end of the contract negotiations with Seqirus was not aligned with the original objective for the procurement, which was to consider novel approaches to ensure long-term sustainable supply.

There was limited procurement planning. The evaluation of Seqirus’ proposals and contract negotiations were consistent with the CPRs within the constraints of the non-competitive option. There were weaknesses in probity planning and processes. There is a contract management plan that was largely implemented as of July 2025, which lacked key elements, including planning for the conclusion of the Seqirus contract in ten years’ time.

13. DHDA’s and DISR’s 2022 procurement of onshore manufacturing capability for mRNA vaccines was largely effective. Onshore manufacturing capability to supply mRNA vaccines to Australians was established at an approximate cost of $1.5 to $3 billion. Research was effectively undertaken to identify mRNA manufacturing options and suppliers. Procurement planning occurred late after a decision to procure Moderna had already been made. Tender evaluation and contract negotiations sought to achieve an economical outcome and were effective. Advice to government was detailed, except that it lacked a clear value for money analysis and conclusion. The procurement was conducted in a manner that was largely consistent with ethical principles. Contract management planning and implementation were largely fit-for-purpose as of July 2025. The contract included provisions for pandemic preparedness. Contract management planning would be enhanced by better planning for the conclusion of the Moderna contract in 2032.

Supporting findings

Seqirus procurement

Table S.1: Summary of Seqirus agreement

|

Agreement clause |

Seqirus contract terms |

|

Date of agreement |

16 November 2020 |

|

Term of agreement |

10 years after the commencement of antivenom and Q fever supplies |

|

Overall cost of agreementa |

$1.007 billion |

|

Initial prepayment included in agreement |

Yes |

|

Ongoing capability payments included in agreement |

Yes |

|

Facility build |

|

|

Requires onshore Australian facility |

Yes, in Melbourne |

|

Ownership of facility |

Seqirus |

|

Facility supply commencement date in agreement |

Yes |

|

Actual date facility is ready to supply |

DHDA advised the ANAO in September 2025 that Seqirus is on track to commence manufacture in the new facility of pandemic influenza vaccines from 1 January 2026 and antivenoms and Q fever vaccines from 30 June 2026 |

|

Ongoing supplies |

|

|

Type of products manufactured |

Antivenoms, Q fever vaccine, and pandemic influenza vaccines |

|

Minimum purchase commitment by government |

No |

|

Can supply other countries |

Yes, provided this does not prevent it from fulfilling its obligations to DHDA |

|

Obligation to prepare for a pandemic |

Seqirus is required to maintain a stockpile of input materials, seed against potential influenza pandemic strains and the required experienced personnel |

Note a: GST inclusive, Australian dollars.

Source: ANAO analysis.

14. A 2015 contract with Seqirus for the supply of Australian antivenoms, Q fever vaccine and pandemic influenza vaccines was due to expire on 30 June 2018. A 2017–18 Federal Budget measure funded scoping of options to ensure long-term supply through sustainable arrangements. Reflecting the long lead times required for market adjustments, between 2016 and 2019 DHDA undertook research that considered pre-existing arrangements, non-procurement alternatives, and costs and benefits of different options, including continuing the arrangement with Seqirus. A 2018 commissioned review stated that a government operator or an open approach to market would provide the greatest economic benefit.

15. In 2019, after an extension of the 2015 Seqirus contract to 2024, DHDA recommended an option to government (sole sourcing of Seqirus) that legal advice, market intelligence and scoping research suggested would not represent the best value for money in the long term. Although there was some analysis of the market’s capacity to competitively respond, DHDA did not approach the market through a formal request for information or other process to obtain market intelligence. Although scoping identified alternative potential suppliers, particularly for pandemic influenza vaccines, the advice justified the recommended option by stating that only Seqirus could deliver the required level of secure onshore supply over the next decade. Advice to government did not comprehensively set out the original objectives or conclusions of the scoping work. Only options involving the extension of the 2015 Seqirus arrangement were recommended to government and pursued.

16. There was a lack of procurement planning (including a clear statement of procurement objectives, a milestone schedule and procurement risk assessment), which could have assisted DHDA to remain focused on the original long-term objectives and to have paced the work effectively. Advice to government and key decisions were not appropriately documented. A decision to conduct the procurement as a sole sourced limited tender was justified under the CPRs after the procurement was already well advanced and decisions had already been made. (See paragraphs 2.3 to 2.35)

17. Although a DHDA business case considered value for money of the Seqirus proposal for ongoing supply, it did not provide an overall value for money conclusion because, in part, there was no alternative provider to test Seqirus’ pricing against. There was no overall value for money conclusion made in tender evaluation. A ‘fair price’ for the goods was provided to government at its request to justify the negotiated value of the contract, however, in part, the ‘fair price’ was based on a Seqirus estimate and not independently verified. Negotiations were informed by due diligence over the Seqirus proposal, and supported by appropriate governance arrangements and expert advice. The value for money conclusion made at the end of the contract negotiations was based on the status quo and not aligned with the original objective for the procurement, which was to consider novel approaches. The value for money conclusion relied in part on research that had been commissioned by Seqirus. The contract was appropriately negotiated and developed, and the expenditure was appropriated authorised and supported by legislation. Procurement outcomes were appropriately reported on AusTender. (See paragraphs 2.36 to 2.50)

18. DHDA did not complete any probity risk assessments. There was no probity plan and a limited conflict of interest declaration process in place prior to July 2020; by this time many decisions had been made, including the decision to sole source Seqirus. In July 2020, as negotiations commenced, DHDA engaged a probity advisor to develop a probity plan and put in place probity arrangements, including a process for declaring potential conflicts of interest. Declaration of interests for the Seqirus procurement was incomplete. A decision against ‘de-bundling’ the different products favoured Seqirus compared to other potential providers. (See paragraphs 2.51 to 2.60)

19. DHDA developed a contract management plan, which lacked key elements, including consideration of ongoing contract risk management and planning for contract transition. As of July 2025 DHDA had largely implemented relevant aspects of its contract management plan. DHDA monitors contract performance through regular reporting from Seqirus. Contract performance management could be improved through consideration of the establishment of performance measures addressing quality, cost, responsiveness/timeliness and/or customer satisfaction. DHDA’s contract with Seqirus has provisions to prepare for an influenza pandemic. (See paragraphs 2.61 to 2.77)

Moderna procurement

Table S.2: Summary of Moderna agreement

|

Agreement clause |

Moderna contract terms |

|

Date of agreement |

Facility establishment agreement signed on 24 March 2022 Non-pandemic supply agreement signed on 12 December 2024 Pandemic advance purchase agreement to be signed in the event of a pandemic if Moderna has a candidate vaccine |

|

Term of agreement |

Until 24 August 2032 |

|

Overall cost of agreementa |

Approximately $1.5 to $3 billionb |

|

Initial prepayment included in agreement |

No |

|

Ongoing capability payments included in agreement |

Yes |

|

Facility build |

|

|

Requires onshore Australian facility |

Yes, in Victoria |

|

Ownership of facility |

Moderna |

|

Facility supply commencement date in agreement |

Yes |

|

Actual date facility is ready to supply |

DHDA advised the ANAO in June 2025 that the facility build is completed and Moderna is seeking final approval from the Therapeutic Goods Administration |

|

Ongoing supplies |

|

|

Type of products manufactured |

mRNA vaccines for respiratory viral infections and other conditionsc |

|

Minimum purchase commitment by government |

Yes, required to purchase a minimum annual dollar value for non-pandemic supply |

|

Can supply other countries |

Yes, provided this does not prevent Moderna from meeting binding orders for pandemic or non-pandemic vaccines placed by the Australian Government |

|

Obligation to prepare for a pandemic |

A pandemic risk management plan outlines operational processes, including how Moderna will obtain input supplies and upscale production if a pandemic is declared |

Note a: GST inclusive, Australian dollars.

Note b: Based on United States to Australian dollar exchange rate 2 July 2025. Range is dependent on a number of factors including the volume purchased.

Note c: As of July 2025, Moderna had two approved mRNA vaccines (COVID-19, Respiratory Syncytial Virus) and 40 in clinical trials.

Source: ANAO analysis.

20. In 2020–21, during the COVID-19 pandemic, DISR and DHDA planned for the ongoing supply of COVID-19 mRNA vaccines. Research included consideration of options, pre-existing arrangements, costs and benefits. In August 2020, DHDA used an open request for information process to obtain market intelligence. In March 2021, DISR and DHDA began negotiating with Moderna to establish an onshore mRNA manufacturing facility for COVID-19 and other vaccines. In May 2021, the government approved finalising negotiations with Moderna and, taking into account the outcomes of negotiations with Moderna, an open approach to market. There was a business plan and draft procurement plan, which defined the goals of the procurement, included some consideration of procurement risk, and estimated the economic benefits. The draft procurement plan was developed after an approach to market had commenced and did not include consideration of any risks related to the unusual parallel procurement process with Moderna. Paragraph 2.6 of the CPRs was used to set the rules aside for the procurement after negotiations with Moderna had commenced. Prior to this time there was no documented consideration of which CPR condition or exemption would apply to justify this limited tender approach. DISR transparently published evaluation criteria for the open approach to market. (See paragraphs 3.5 to 3.32)

21. Fourteen tenders provided a response to the approach to market and were assessed in accordance with a plan and criteria. Moderna did not submit a tender and was included in the assessment as a ‘comparator’ using incomplete and different information to the other proposals. Following the assessment process, which recommended several options, including negotiating with both Moderna and another manufacturer, the government decided to finalise negotiations with both companies. DISR developed a plan and risk assessment for the negotiations and engaged experts. Advice to government was detailed, except that it lacked a clear value for money analysis and conclusion. The options had divergent risks and costs, and the final advice to government was to pursue both options. The government decided to establish an arrangement solely with Moderna at an approximate cost of $1.5 to $3 billion. Following this decision, the Moderna facility establishment agreement and expenditure was appropriately developed, authorised and supported by legislation. In the event of a pandemic, DHDA has the option to order any candidate vaccine developed by Moderna for the relevant infection, after which the parties are required to promptly enter into an advance purchase agreement for pandemic supplies, subject to the negotiation of product price and operational terms. (See paragraphs 3.33 to 3.53)

22. Probity advisers developed probity plans and managed risk. Probity advisors oversaw the management of conflicts of interest. The declaration of interests for the Moderna procurement was incomplete in both DHDA and DISR. DHDA employees declared gifts and benefits appropriately; DISR employees did not. Ethics in procurement includes the equitable treatment of tenderers. There was transparency over the parallel process of conducting an open approach to market while finalising negotiations with one supplier. No tenders were removed from consideration for inconsequential reasons and all tenderers were appropriately informed throughout the process. (See paragraphs 3.56 to 3.70)

23. DHDA has completed contract risk assessments and updates the government on risks and issues. There is a contract management plan, relevant aspects of which DHDA has largely implemented as of July 2025. Contract performance management could have been enhanced through the establishment of specific and direct performance measures that go to quality, cost, responsiveness and/or customer satisfaction. DHDA’s contract with Moderna has provisions to require Moderna to prepare for a pandemic. (see paragraphs 3.71 to 3.83)

Recommendations

Recommendation no. 1

Paragraph 2.18

When advising government on funding options, the Department of Health, Disability and Ageing establish controls to ensure that the advice, if based on research and evidence, is comprehensive and provides an accurate, evidence-based justification for recommending or not recommending options.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 2

Paragraph 2.26

The Department of Health, Disability and Ageing review and improve controls to ensure that officials undertaking procurements remain focused on the procurement objectives and adhere to an appropriate procurement schedule that enables the achievement of the objectives. This includes the development of procurement plans that clearly set out the objective of the procurement, include procurement risk assessments, and establish appropriate milestones and timeframes.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 3

Paragraph 2.33

The Department of Health, Disability and Ageing review and improve internal controls on limited tender decision-making, including ensuring that controls support:

- consideration prior to a procurement decision being made about which conditions or exemptions listed in the Commonwealth Procurement Rules justify a limited tender;

- procurement delegates being informed about legal advice; and

- appropriate documentation in record keeping systems of limited tender justifications and related evidence.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 4

Paragraph 2.58

The Department of Health, Disability and Ageing review and improve controls to ensure:

- probity risks, including potential conflicts of interest, are identified and managed from the early stages of procurements and prior to major procurement decisions being made; and

- appropriate records are kept of relevant meetings with parties to a procurement process, which includes contract management.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 5

Paragraph 2.65

The Department of Health, Disability and Ageing improve Seqirus contract management planning by: including a fit for purpose risk management plan that is regularly reviewed and incorporating regular review of the contract management plan.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 6

Paragraph 2.68

The Department for Health, Disability and Ageing commence planning for the conclusion of the Seqirus contract, to ensure sufficient lead time for consideration and (if determined to be value for money) implementation of alternative models for the sustainable long-term supply of antivenoms, Q fever vaccine and pandemic influenza vaccines.

Department of Health, Disability and Ageing: Agreed.

Recommendation no. 7

Paragraph 3.54

The Department of Finance improve guidance to Australian Government entities on:

- the appropriate use of paragraph 2.6 of the Commonwealth Procurement Rules, including how it should be used and revoked for short- and long-term procurements; appropriate timing for its use; and requirements for how its use should be reported on AusTender; and

- how contracts exempt from AusTender reporting should be dealt with under Senate Order 13.

Department of Finance: Agreed.

Recommendation no. 8

Paragraph 3.60

The Department of Industry, Science and Resources implement procurement planning, including probity plans, at the early stages of procurements prior to decisions being made that will determine the direction and influence the outcome of the procurement.

Department of Industry, Science and Resources: Agreed.

Summary of entity response

24. The proposed audit report was provided to DHDA. Extracts of the proposed audit report were provided to DISR, Seqirus, Moderna, the Department of Finance and the Attorney-General’s Department. Summary responses from DHDA and DISR are reproduced below and full responses are provided in Appendix 1. Responses from the Department of Finance and Moderna are provided in Appendix 1. Seqirus and the Attorney-General’s Department did not provide a letter of response. Improvements made by DHDA and DISR observed by the ANAO during the course of this audit are listed at Appendix 2.

Department of Health, Disability and Ageing

The Department of Health, Disability and Ageing (department) welcomes the report’s findings and accepts the recommendations directed to the department. The department is committed to the effective implementation of Australian National Audit Office (ANAO) recommendations and has already taken steps to address the issues identified in this audit.

The department is pleased that the ANAO concluded the Moderna procurement was largely effective. The Seqirus procurement, while only partly effective, was consistent with the Commonwealth Procurement Rules (within the constraints of the non-competitive option) for the evaluation of Seqirus’ proposals and subsequent contract negotiations.

The audit identified areas for improvement in record-keeping, procurement planning, probity and risk management, and the need for clearer value-for-money justifications in advice to government. In response, the department will review and update its internal funding frameworks and guidance to staff developing New Policy Proposals and Ministerial Submissions. This will ensure that funding options presented to government are clearly justified, well evidenced, and properly documented. These actions will reinforce high standards of integrity, accountability, and value for public money in all future procurement activities.

Department of Industry, Science and Resources

The Department of lndustry, Science and Resources (the department) welcomes the ANAO’s finding that the department’s role in securing onshore vaccine manufacturing capability was largely effective. This work occurred at a time when governments across the world were operating at unprecedented speed and scale in uncertain times. The department played an important role in securing the future manufacture of mRNA vaccines in Australia through the Moderna Partnership. The Department acknowledges the importance of early planning, including probity considerations and has implemented several improvements over the past few years. Since 2022, the Department has invested significant time and effort to improve the skills and capabilities of our staff. This includes the establishment of an Integrity Branch, improved guidance and increased support for procurement projects, and improved systems and practices.

Key messages from this audit for all Australian Government entities

25. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

Contract management

1. Background

Introduction

1.1 The World Health Organization’s (WHO) 2006 Global pandemic influenza action plan to increase vaccine supply sought to increase influenza vaccine production capacity through building new manufacturing facilities in developing and industrialised countries.7 In 2020 the Australian Government announced it had signed an agreement with Seqirus (Australia) Pty Ltd (Seqirus, a subsidiary of CSL Limited) whereby Seqirus would invest $800 million in the construction of a new, high-tech vaccine manufacturing facility in Melbourne.8

1.2 The Australian Government’s coronavirus disease (COVID-19) Response Inquiry9 found that ‘Australia’s lack of onshore manufacturing capability for vaccines other than AstraZeneca left us reliant on international providers and supply chains when issues with this treatment emerged.’10 In many countries, the onshore manufacture of health products, including medicines and vaccines, expanded in response to the COVID-19 pandemic.11 In 2022 the Australian Government announced it had signed an agreement with Moderna Australia Pty Ltd (Moderna) ‘that secures the production of up to 100 million Australian made mRNA doses every year.’12

Seqirus procurement

1.3 Commonwealth Serum Laboratories (CSL) was established as a Commonwealth entity to provide health services to Australians during World War I. CSL has been manufacturing antivenoms since the 1930s, influenza vaccines since the 1940s and Q fever vaccine since 1989 in manufacturing facilities in Melbourne, the United States of America (USA), Switzerland, the United Kingdom (UK) and Germany. In 1993–94 CSL was sold to private investors. In 2012–13 CSL restructured antivenom and Q fever vaccine manufacture into a new subsidiary called bioCSL. bioCSL was renamed Seqirus in 2013.

1.4 In November 2020, the Prime Minister, Minister for Industry, Science and Technology, and the Minister for Health announced an agreement with Seqirus, which was executed after the commencement of the COVID-19 pandemic in early 2020. The announcement stated that:

A new high-tech vaccine manufacturing facility will be developed in Melbourne to secure Australia’s long-term supply of critical health products including pandemic influenza vaccines and life-saving antivenoms. The $1 billion agreement … also provides the ability to rapidly manufacture vaccines when responding to health pandemics in the future.13

1.5 The products referred to in the agreement comprised antivenoms, Q fever vaccine and influenza vaccines.

- Antivenoms — In Australia, on average each year approximately 8,000 people attend hospital with venomous injuries from snakes, spiders and marine creatures, and two to four people die. As of July 2025, 11 creature-specific antivenoms, all manufactured exclusively by Seqirus, were available in Australia.

- Q fever — Q fever is a bacterial infection found worldwide14 and transmitted via aerosols from cattle, sheep and goats. There are approximately 500 cases of Q fever each year in Australia.15 Australia is the only country with a human Q fever vaccine, which is manufactured exclusively by Seqirus.

- Influenza — Influenza is a respiratory tract infection caused by the influenza virus that has caused millions of deaths. There have been four notable influenza pandemics since 1900: the 1918 Spanish flu; the 1957 Asian flu; the 1957 Hong Kong flu; and the 2009 Swine flu.

1.6 The influenza vaccine has been manufactured in eggs for over 70 years. An alternative cell-based technology, available in the USA since 2012, enhances the speed of manufacture, minimises supply chain delays and improves efficacy.16 Seqirus owns egg-based production facilities in Liverpool UK and Melbourne. In 2015 Seqirus acquired Novartis AG’s influenza vaccine business, including a cell-based facility in Holly Springs, North Carolina, USA. The Holly Springs facility can produce 150 million doses of pandemic influenza vaccine within six months of a pandemic being declared, which are controlled by the USA Government.

1.7 In March 2017 the Department of Health, Disability and Ageing (DHDA) advised government that:

- antivenoms and Q fever vaccine manufacture will never be commercially viable and that without ongoing government funding, Seqirus’ production would potentially cease; and

- guaranteed access to pandemic influenza vaccines requires onshore manufacturing capability with government funding ensuring capability and priority access.

1.8 Between 2015 and 2025, the Australian Government provided Seqirus with funding to support its onshore manufacture of antivenoms, Q fever vaccine and pandemic influenza vaccines.

- In 2012–13 CSL sought funding from the Australian Government through a ‘Biosecurity Partnership’ to ensure the ongoing manufacture of antivenoms and Q fever vaccine from its Melbourne facility.

- The 2014–15 Federal Budget Measure ‘Ensuring the supply of antivenoms, Q fever vaccine and Pandemic Influenza vaccines’ provided funding over four years to test the global market for the guaranteed timely supply of Australian antivenoms, Q fever vaccine and pandemic influenza vaccines.

- In 2014–15 Seqirus was the only tenderer in response to a request for tender to supply on the open market antivenoms and Q fever vaccine and maintain onshore manufacturing capability to supply pandemic influenza vaccines. In 2015 the Australian Government signed a three-year contract with Seqirus to secure the onshore manufacture of antivenoms, Q fever vaccine and pandemic influenza vaccines to 30 June 2018. The three-year contract was valued at $140 million.17

- The 2015 contract was extended two times: in 2018 to 30 June 2024; and in 2020 to the point in time that a new manufacturing facility was fully operational (see paragraph 1.9). In total over $545 million will be provided to Seqirus, as reported on AusTender, under the 2015 contract.

1.9 The November 2020 announcement of the agreement with Seqirus18 stated that it required Seqirus to build a new facility in Melbourne19 that is owned by Seqirus, the objective of which is to:

ensure that a timely and assured supply of Supplies is maintained in Australia, in which:

(a) Antivenom Supplies of a range, type and quantity suitable and adequate for the treatment of envenomation peculiar to Australia are available to meet Australian open market demand;

(b) Q Fever Supplies of a type and quantity suitable and adequate for the testing and prevention of Q Fever in Australia are available to meet Australian open market demand; and

(c) Pandemic Supplies of a type and quantity suitable and adequate in the event of a Pandemic, or the threat of a Pandemic, in Australia can be made available for purchase by Health to provide for full Australian population coverage.

1.10 This agreement does not include the supply of pandemic influenza vaccines. The agreement seeks to ensure that Australia has priority rights to pandemic vaccines in the event of an influenza pandemic. The facility is to have the capability to manufacture population scale doses of vaccines in the event of an influenza pandemic. The agreement allows Seqirus to enter into advance purchasing agreements with other countries so long as these will not prevent it from fulfilling its obligations to DHDA. The agreement includes provisions giving the Australian Government a level of priority and certain rights in the event that the supply of Seqirus’ manufacturing facilities cannot meet overall demand for Seqirus’ vaccine supplies.

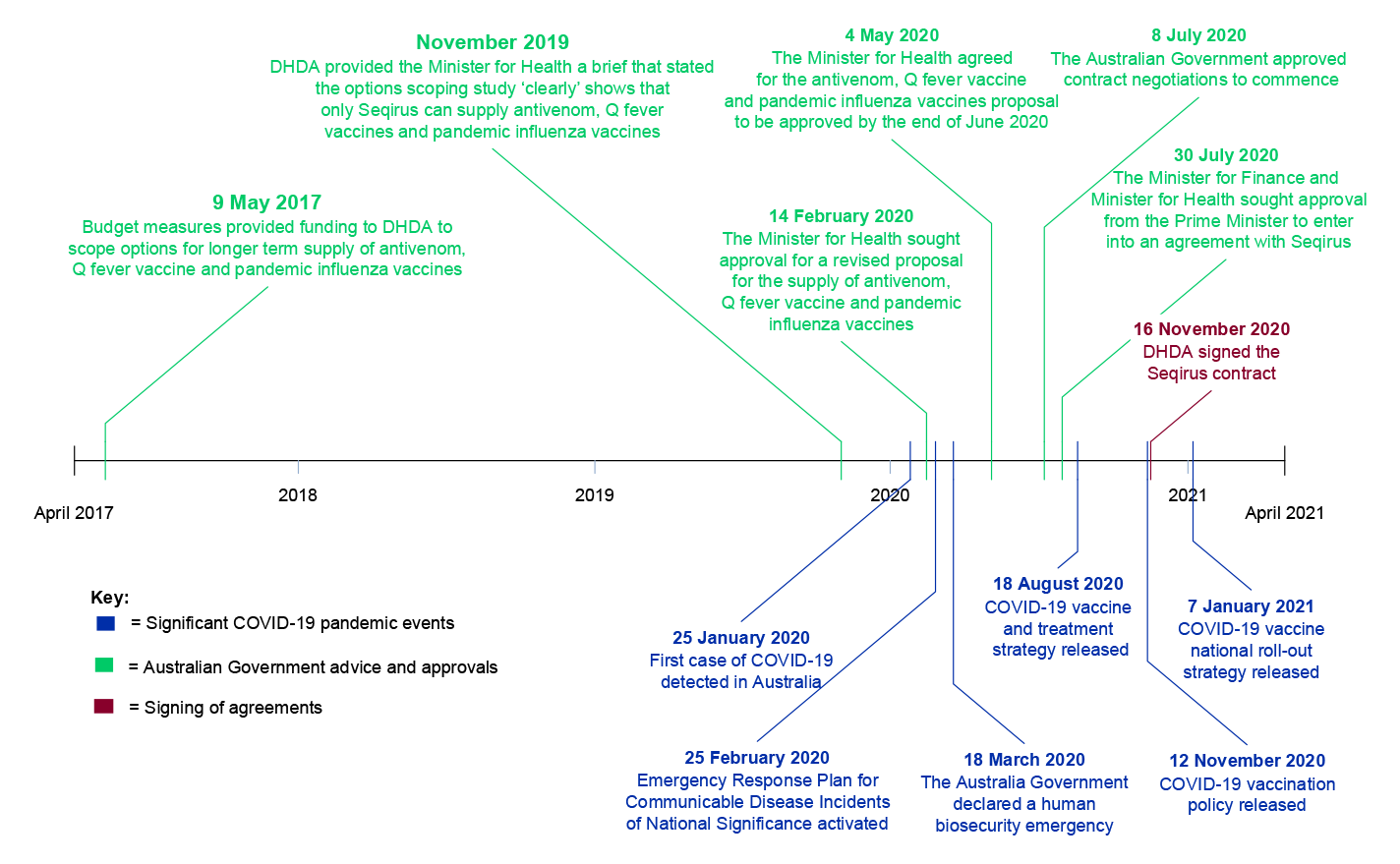

1.11 As of July 2025 the Melbourne facility build was complete for the manufacture of pandemic influenza vaccines, and Seqirus was in the process of obtaining approvals to commence manufacture. DHDA advised the ANAO in June 2025 of the intention for cell-based influenza vaccine manufacture to commence from 1 January 2026, ahead of the original schedule, and antivenoms and Q fever vaccine from 30 June 2026. Appendix 3 details the timeline of the Seqirus procurement. Most decisions relating to the procurement of Seqirus were made prior to the onset of the COVID-19 pandemic.

Moderna procurement

1.12 Moderna Inc. is an American-owned pharmaceutical company founded in 2010, with manufacturing or research facilities in Australia, Canada, Japan, the UK and the USA.

1.13 COVID-19 is a respiratory tract infection caused by the severe acute respiratory syndrome coronavirus 2 virus. The virus emerged in December 2019 and was declared a pandemic by the WHO in March 2020. As of 5 July 2025 in Australia there had been over 12.2 million cases of COVID-19 and 25,791 deaths from or with COVID-19.20

1.14 The Australian Government’s COVID-19 Response Inquiry noted that ‘in 2020 it was difficult to predict the impact [the pandemic] would have on Australians, or on the health system.’21 There was uncertainty about when or if a vaccine would be developed. By December 2021, COVID-19 vaccines were available in Australia and the Australian Government entered into advance purchasing agreements22 with AstraZeneca PLC (AstraZeneca), the COVID-19 Vaccines Global Access (COVAX) Facility23, Moderna Inc., Novavax Inc. (Novavax), Pfizer Inc. (Pfizer), and the University of Queensland.24

1.15 The three types of COVID-19 vaccines available during the COVID-19 pandemic were25: viral vector, messenger ribonucleic acid (mRNA), and protein subunit.26 AstraZeneca’s COVID-19 vaccine was a viral vector vaccine. The AstraZeneca viral vector vaccine (approved in Australia in February 2021) was the only COVID-19 vaccine manufactured in Australia during the pandemic. Pfizer and Moderna’s COVID-19 vaccines are mRNA vaccines (approved in Australia in January 2021 and August 2021, respectively). Novavax’s COVID-19 vaccine (approved in Australia in January 2022) is a protein subunit vaccine.

1.16 The WHO declared the end of the COVID-19 pandemic in May 2023. By this time, nearly 67 million doses of COVID-19 vaccines had been administered in Australia (Figure 1.1). In June 2021 thrombotic side-effects were associated with the AstraZeneca vaccine and the Australian Technical Advisory Group on Immunisation (ATAGI)27 recommended the Pfizer mRNA vaccine for people aged 16 to 60 years old.28 The Australian Government’s COVID-19 Response Inquiry found that Australia did not have adequate reserves of the Pfizer vaccine onshore, resulting in intermittent supply shortages.29 In total, the Australian Government purchased 28 million doses of Moderna’s COVID-19 mRNA vaccine between May 2021 and July 2024, all of which were manufactured overseas.

Figure 1.1: COVID-19 vaccine doses administered in Australia by brand, February 2021 to May 2023

Note: Data is to 10 May 2023. WHO declared the end of the pandemic on 5 May 2023.

Source: Adapted by ANAO from DHDA, COVID-19 Vaccine Rollout, Canberra, May 2023, available from https://www.health.gov.au/sites/default/files/2023-05/covid-19-vaccine-rollout-update-12-may-2023.pdf [accessed 30 April 2025].

1.17 In 2021 the Australian Government commenced a procurement to: ensure priority access to mRNA vaccines as soon as they are available; provide security of vaccine supply in future pandemics; and strengthen Australia’s biopharmaceutical sector. In March 2022 the Australian Government signed a 10-year ‘facility establishment’ agreement with Moderna to establish an onshore mRNA vaccine manufacturing facility that is owned by Moderna.30 The agreement is in force to August 2032 and comprises: an annual ‘pandemic preparedness facility fee’ paid to Moderna to maintain the mRNA facility; and an annual minimum purchase commitment for mRNA vaccines.

1.18 The facility establishment agreement enables the Australian Government to exercise an option to enter into a pandemic supply agreement provided the Commonwealth orders the vaccines within the contractually-designated window after pandemic declaration.31 Upon exercising this option, the parties must promptly enter into a pandemic supply agreement, which is subject to the negotiation of product price and operational terms. Moderna may supply third parties provided that such supply would not prevent Moderna from meeting binding orders for pandemic or non-pandemic vaccines placed by the Australian Government.

1.19 In December 2024 DHDA signed a ‘non-pandemic supply’ agreement with Moderna, as a sub-agreement to the facility establishment agreement. The non-pandemic supply agreement provides for the purchase of Moderna’s Spikevax COVID-19 mRNA vaccine. Other approved vaccines for respiratory viral infections may be added to the non-pandemic supply agreement.

1.20 The Moderna facility opened in Melbourne on 4 December 2024. DHDA advised the ANAO in June 2025 that the facility is due to begin vaccine output in the second half of 2025, once approval is received from the Therapeutic Goods Administration. Appendix 4 details the timeline of the Moderna procurement.

1.21 As of July 2025 other mRNA manufacturing or research and development facilities were being built in Australia by BioNTech SE (in partnership with Pfizer), the New South Wales Government and BioCina.

Departmental responsibilities for the procurements

1.22 DHDA is responsible for the 2020 Seqirus procurement and contract management. As the Australian Government entity responsible for ‘enabling a productive, resilient and sustainable economy, enriched by science and technology’32, the Department of Industry, Science and Resources (DISR) was responsible for the approach to market and DISR and DHDA were responsible for the contract negotiations for the 2022 Moderna procurement. DHDA executed the 2022 Moderna contract and is responsible for the contract management of Moderna.

1.23 DHDA and DISR are non-corporate Commonwealth entities, subject to the Public Governance, Performance and Accountability Act 2013 and prescribed by section 30 of the Public Governance, Performance and Accountability Rules 2014 to comply with the Commonwealth Procurement Rules.33

Rationale for undertaking the audit

1.24 The Australian Government stockpiles a strategic reserve of drugs, vaccines and antidotes to ensure that Australia can remain self-sufficient and meet demand during a national health emergency.34 In the 2017–18 Federal Budget the Australian Government provided funding to support the ongoing production and supply of Q fever vaccine and uniquely Australian antivenoms, and to maintain onshore production of pandemic influenza vaccines. The measure included funding to scope long-term supply options.

1.25 During the COVID-19 pandemic the Australian Government competed with other domestic and international jurisdictions for access to critical medical supplies such as vaccines and personal protective equipment.

1.26 The Australian Government has since committed over $4 billion in supporting the establishment of onshore vaccine and other health product manufacturing facilities in Australia.

1.27 In 2023–24, the Australian Government developed the Buy Australian Plan35 and made the Future Made in Australia Act 202436 to increase domestic manufacturing capability. The audit was identified as a Joint Parliamentary Committee of Public Accounts and Audit priority in 2024–25. The audit provides independent assurance to the Parliament on the procurement and contract management of onshore manufacturing capability for antivenoms, Q fever vaccine, pandemic influenza vaccines and mRNA vaccines for respiratory infections.

Audit approach

Audit objective, criteria and scope

1.28 The objective of the audit was to examine the effectiveness of the procurement and contract management of onshore manufacturing capability to secure supply of antivenoms and vaccines.

1.29 To form a conclusion against the objective, the following high-level criteria were applied:

- Was the 2020 procurement of Seqirus onshore manufacturing capability for antivenoms, Q fever vaccine, and influenza vaccines effective?

- Was the 2022 procurement of Moderna onshore manufacturing capability for mRNA vaccines effective?

Audit methodology

1.30 The audit methodology included:

- examination of DHDA and DISR documentation;

- review of nine public contributions to the audit from four individuals, three pharmaceutical manufacturing companies, and two peak bodies;

- meetings with officials and staff from DHDA, DISR, Seqirus and Moderna; and

- visits to the new Seqirus and Moderna manufacturing facilities in Melbourne.

1.31 Australian Government entities largely give the ANAO electronic access to records by consent, in a form useful for audit purposes. For the purposes of this audit, DHDA advised the ANAO that it would not voluntarily provide certain information requested by the ANAO due to concerns about its obligations under the Privacy Act 1988, secrecy provisions in DHDA portfolio legislation, confidentiality provisions in contracts and the Public Interest Disclosure Act 2013. To provide comfort to the Secretary regarding DHDA’s obligations under portfolio legislation, on 14 October 2024 the acting Auditor-General issued the Secretary of DHDA with a notice to provide information and produce documents pursuant to section 32 of the Auditor-General Act 1997. Under this notice, DHDA agreed to provide the requested information and documents.

1.32 On 19 September 2025 the acting Secretary of the Department of Health, Disability and Ageing requested, under paragraph 37(1)(a) of the Auditor-General Act 1997 (the Act), that the Auditor-General not include particular information contained within the report because it would unfairly prejudice the commercial interests of bodies mentioned in the report. On 22 October 2025 the Executive Director, Commercial Operations, Seqirus (Australia) Pty Ltd requested, under paragraph 37(1)(a) of the Act, that the Auditor-General not include particular information contained within the report for reasons of unfair commercial prejudice. Paragraph 37(1)(a) of the Act sets out that the Auditor-General must not include particular information in a public report if the Auditor-General is of the opinion that disclosure of the information would be contrary to the public interest for any of the reasons set out in subsection 37(2). Paragraph 37(2)(e) of the Act states that a reason that information should not be disclosed is if it would unfairly prejudice the commercial interests of any body or person. The Auditor-General did not form an opinion that there were public interest grounds under section 37 of the Act to omit the particular information from the report and therefore no information was omitted under section 37. Some editorial changes were however made.

1.33 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $596,000.

1.34 The team members for this audit were Dr Vivian Turner, Mahkaila Sansom, Bezza Wolba, Maggie Lee and Christine Chalmers.

2. Seqirus procurement

Areas examined

This chapter examines whether the Department of Health, Disability and Ageing’s (DHDA) 2020 procurement of manufacturing capability for antivenoms, Q fever vaccine and influenza vaccines was effective.

Conclusion

DHDA’s 2020 procurement of onshore manufacturing capability for antivenoms, Q fever vaccine and pandemic influenza vaccines was partly effective. Onshore manufacturing capability to secure supply of critical health products was maintained, however the procurement did not maximise value for money for the Australian taxpayer because:

- the option recommended to government (sole sourcing Seqirus (Australia) Pty Ltd (Seqirus) for a further ten years) was not identified in scoping research or legal advice as the option providing the best value for money in the long term;

- advice to government did not comprehensively present the scoping research conclusions;

- there was no approach to market to obtain market intelligence on alternative suppliers;

- conducting the procurement as a sole sourced limited tender was justified under the Commonwealth Procurement Rules (CPRs) after the decision had already been made;

- there was no overall value for money conclusion to support the decision to sole source Seqirus because, in part, there was no comparator; and

- a value for money conclusion made at the end of the contract negotiations with Seqirus was not aligned with the original objective for the procurement, which was to consider novel approaches to ensure long-term sustainable supply.

There was limited procurement planning. The evaluation of Seqirus’ proposals and contract negotiations were consistent with the CPRs within the constraints of the non-competitive option. There were weaknesses in probity planning and processes. There is a contract management plan that was largely implemented as of July 2025, which lacked key elements, including planning for the conclusion of the Seqirus contract in ten years’ time.

Areas for improvement

The ANAO made six recommendations to DHDA aimed at providing comprehensive advice to government; improving procurement planning and risk management; documentation of decisions to undertake limited tenders; probity and record keeping in procurements; contract management planning; and planning for the end of the Seqirus contract.

2.1 The CPRs sets out requirements and better practice principles for Australian Government entities undertaking procurement.

- Planning and approach to market — Value for money considerations begin through clearly understanding whether a procurement will deliver best value for money37 and expressing the goals and purpose of the procurement.38 To maximise value for money from a procurement, encouraging competition is a key element of the CPRs.39

- Tender evaluation, contract negotiations and procurement decision-making — Value for money considerations must include financial and non-financial costs and benefits.40

- Probity and ethics — Officials must act ethically throughout a procurement.41

- Record keeping — Documentation commensurate with the scale, scope and risk of the procurement must be maintained.42

2.2 The Australian Government Contract Management Guide (Contract Management Guide) provides the best practice framework for the establishment and management of contracts, which it defines as: ‘all the activities undertaken by an entity, after the contract has been signed or commenced, to manage the performance of the contract (including any corrective action) and to achieve the agreed outcomes.’ 43

Were planning and approach to market consistent with the Commonwealth Procurement Rules?

A 2015 contract with Seqirus for the supply of Australian antivenoms, Q fever vaccine and pandemic influenza vaccines was due to expire on 30 June 2018. A 2017–18 Federal Budget measure funded scoping of options to ensure long-term supply through sustainable arrangements. Reflecting the long lead times required for market adjustments, between 2016 and 2019 DHDA undertook research that considered pre-existing arrangements, non-procurement alternatives, and costs and benefits of different options, including continuing the arrangement with Seqirus. A 2018 commissioned review stated that a government operator or an open approach to market would provide the greatest economic benefit.

In 2019, after an extension of the 2015 Seqirus contract to 2024, DHDA recommended an option to government (sole sourcing of Seqirus) that legal advice, market intelligence and scoping research suggested would not represent the best value for money in the long term. Although there was some analysis of the market’s capacity to competitively respond, DHDA did not approach the market through a formal request for information or other process to obtain market intelligence. Although scoping identified alternative potential suppliers, particularly for pandemic influenza vaccines, the advice justified the recommended option by stating that only Seqirus could deliver the required level of secure onshore supply over the next decade. Advice to government did not comprehensively set out the original objectives or conclusions of the scoping work. Only options involving the extension of the 2015 Seqirus arrangement were recommended to government and pursued.

There was a lack of procurement planning (including a clear statement of procurement objectives, a milestone schedule and procurement risk assessment), which could have assisted DHDA to remain focused on the original long-term objectives and to have paced the work effectively. Advice to government and key decisions were not appropriately documented. A decision to conduct the procurement as a sole sourced limited tender was justified under the CPRs after the procurement was already well advanced and decisions had already been made.

2.3 A 2015 $140 million contract with Seqirus (a subsidiary of CSL Limited) for the supply of Australian antivenoms, Q fever vaccine and pandemic influenza vaccines was due to expire on 30 June 2018 (see paragraph 1.8). DHDA’s 2015 contract with Seqirus was extended twice (in 2018 to 30 June 2024 and in 2020 to the point in time that a new manufacturing facility was fully operational) at a total cost of $545 million. A 2014–15 Federal Budget measure provided funding to DHDA to test the global market for the guaranteed timely supply of these products to ensure efficiency in communicable disease prevention and control.

Procurement planning

Consideration of pre-existing arrangements, non-procurement alternatives and the market’s capacity to competitively respond

2.4 The CPRs state that when a business requirement arises, officials should consider whether a procurement will deliver the best value for money, taking into account factors such as stakeholder input, obligations and opportunities under other existing arrangements.44 In August 2016, internal advice was sought regarding a potential extension of the 2015 Seqirus arrangement beyond 30 June 2018 (the original expiry date). Five options were put forward for further scoping (Table 2.1), which included procurement and non-procurement alternatives. The option of establishing a new Commonwealth entity to manufacture supplies was described as likely to be the most sustainable and cost-effective in the long term.

Table 2.1: Options for the supply of antivenoms, Q fever vaccine and pandemic influenza vaccines, August 2016

|

Option |

Reasoning behind advice |

|

Recommended for further scoping |

|

|

Reform Seqirus arrangement (status quo) |

Continue arrangement with Seqirus but seek to implement changes to increase the long-term sustainability and satisfaction with the arrangement including exploring increased governance, transparency and reporting. |

|

Engage new onshore and offshore suppliers |

Needs to be carefully scoped so that control of the supply arrangement stays with the Commonwealth and cannot be compromised by commercial factors. Requires significant funds to establish capability and meet regulatory requirements. May be made faster if Seqirus agreed to sell some of the technology to a new provider. |

|

New public-private partnership |

Could take many forms and result in shared risk and costs. |

|

Establish a new Commonwealth entity to manufacture supplies |

Likely to be the most sustainable and cost-effective long-term. |

|

Hybrid option for each supply requirement (unbundling of products) |

Could identify the best supply option for each of the three products (antivenoms, Q fever vaccine and pandemic influenza vaccines). |

|

Not recommended for further scoping |

|

|

Doing nothing and allow the market to respond to demand |

Not feasible given the importance of the products. |

|

Engage a vendor to manage the supply chain |

Not recommended as it would be an add on to other options, would need new suppliers with a vendor sitting over the top and would not represent value for money. |

|

DHDA to manage the supply chain |

Not consistent with the role of DHDA and would set a precedent for engaging in commercial activities for high-risk supply requirements. |

|

Acquisition of Seqirus manufacturing sites |

Not recommended given the outdated technology at the sites and the high value of the land. |

|

A joint venture with Seqirus |

Not recommended given the size of Seqirus following the acquisition of Novartis AG’s (see paragraph 1.6), although might have been a viable option with bioCSL. |

Source: Adapted by ANAO from DHDA documentation.

2.5 DHDA received funding through the 2017–18 Federal Budget measure ‘Improving access to medicines — antivenoms, Q fever and pandemic influenza vaccine supply’ to: extend DHDA’s 2015 contract with Seqirus for six years while scoping alternative models of supply. DHDA planned to scope the five policy options described in Table 2.1 from July 2017 to August 2018 and was due to report back to government in the 2019–20 Federal Budget cycle.

2.6 In December 2017 KPMG produced a report evaluating pharmaceutical supply arrangements for pandemic influenza vaccine, Q fever vaccine and uniquely Australian antivenoms (KPMG review), which had been commissioned by DHDA in July 2014.45 The KPMG review examined whether a procurement would deliver best value for money, taking into account a range of considerations: the pre-existing arrangements with Seqirus including its ‘successful features’ and ‘challenges’; and a health economic analysis which compared the costs of the Seqirus arrangement to ‘a more efficient program or another use of the funds invested.’ The KPMG review identified procurement and non-procurement options comprising: a public private partnership; a joint venture; a new Commonwealth entity; prime vendor arrangements; co-funding; and purchaser-provider relationships (similar to the 2015 Seqirus supply option). The December 2017 report concluded that:

Arrangements with Seqirus are effective and appropriate, however they come at an economic loss to the Commonwealth … the outcome for the Australian population’s health would have been better had the Australian Government invested in an alternative, more cost effective opportunity … In practical terms, however, the current purchaser-provider arrangements can be considered to be the only viable approach option to the Commonwealth at this time … evidence suggests that without considerable initial investment from the Commonwealth, an alternative model could not be realised.

2.7 Four further scoping reviews were undertaken in 2018 and 2019 that involved some engagement with other Australian Government entities, technical experts, academics, industry bodies and manufacturers. The four reviews considered the existing arrangement with Seqirus, other procurement options and non-procurement alternatives (Appendix 5).46

- May 2018 — Certara, Therapeutic needs and opportunities assessment.47

- August 2018 — PharmOut, Biopharmaceutical manufacturing facility study.48

- September 2018 — Biointelect and the University of Melbourne, Evidence base to inform policy development regarding future long-term supply arrangements for pandemic influenza vaccine.49

- December 2018 — Ernst and Young (EY), Supply options and business advisory project50 (EY review), updated July 2019.

2.8 The EY review considered risks and benefits, regulatory context, contractual arrangements and modelling and concluded that: no industry organisations were interested in a new public-private partnership with the Australian Government to manufacture all three products; the existing supply model for antivenoms and Q fever vaccine was unsustainable; the bundling together of the different products, while ensuring continued production by Seqirus, was creating a perceived barrier to entry among other suppliers; through its status quo approach, the government did not leverage market intelligence regarding other potential supply solutions; and while the market for Australian antivenoms and Q fever vaccine was limited, there was competition in the provision of influenza vaccines offshore. It listed 14 options, of which five were ‘viable’.

- Option 1 (offshore status quo) — Reform the arrangement with Seqirus using combined onshore and offshore production for the three products, with new technology and onshore facilities.

- Option 2 (onshore status quo) — Reform the arrangement with Seqirus using onshore production for the three products, with new technology and onshore facilities.

- Option 3 (government operator) — Re-establish a Commonwealth entity or task an existing onshore entity (e.g. Commonwealth Scientific and Industrial Research Organisation (CSIRO)).

- Option 4 (onshore market solution) — Separate contracted supply per product category, onshore using new technologies.

- Option 5 (hybrid market solution) — Separate contracted supply per product category, onshore using new technologies, except for antivenoms (which would be supplied offshore).

2.9 The EY review concluded that:

- options 3 (government operator) and 5 (hybrid market solution) had the potential for greatest net benefits;

- while continuity of supply between 2024 and 2028 depended on Seqirus (that is one of the ‘status quo’ options 1 and 2), options 3, 4, and 5 were possible from 2028 onwards; and

- options 3 and 4 had the potential to generate the most favourable outcomes, with option 4 having the benefit of:

[facilitating] new entrants into the Australian market by removing a perceived barrier to entry created by bundling the three product categories. This barrier has been seen to provide preference to the incumbent sole supplier in the tender process based on the feedback from the industry … A direct sourcing arrangement [with Seqirus] as an interim measure while [sic] an open and transparent sourcing process is likely to stimulate considerable interest in the market and produce better outcomes for the government in the longer term.

2.10 The CPRs state that when a business requirement arises, officials should consider whether a procurement will deliver the best value for money, taking into account factors such as the market’s capacity to competitively respond to a procurement.51 The EY review recommended evaluating whether CSIRO or a new government entity could develop new technology for antivenoms and pandemic influenza vaccines; unbundling the product lines; and a stepped procurement through an open request for information, selective or open request for tender (in January–February 2019) and competitive negotiation process. The stepped approach to facilitate the gathering of market intelligence is described in the CPRs as a multi-stage procurement.52 EY noted that this could be conducted in parallel to negotiating an extension of existing supply from Seqirus in the short term.

2.11 In August 2019 DHDA collated information from the 2017, 2018 and 2019 reviews and listed five options, which were mapped back to the options identified for further scoping in August 2016 (see Table 2.1) and were largely aligned with the five EY options.

Figure 2.1: DHDA analysis of viable supply options, August 2019

Source: ANAO based on DHDA documentation.

2.12 Options A and B involved Seqirus establishing onshore facilities, with the main difference between the two options being whether or not the arrangement involved the Australian Government making an upfront capital investment. While DHDA’s analysis favoured option B (upfront capital investment in Seqirus for onshore production of all products) on the basis that it was the ‘most cost effective option in the short term’ and ‘the only option to guarantee continuity of supply’, the analysis also stated that option B ‘may not represent appropriate value for money to the Commonwealth.’ It was ‘highly’ recommended that if option B was selected there should be more robust financial and performance management of Seqirus.

2.13 Option C (new Commonwealth entity) was not recommended due to the high risks associated with government manufacturing pharmaceutical products and DHDA anticipated that establishing a new Commonwealth entity would take six to 10 years. In July and October 2018 CSIRO had provided to DHDA two discussion papers on producing antivenoms and a strategy to improve Q fever vaccine production and diagnostics. DHDA advised the ANAO in February 2025 that it was unable to explain why discussions with CSIRO did not progress.

2.14 In relation to options D and E (debundling the product lines and exploring arrangements with other potential suppliers for one or more of the products), DHDA’s analysis listed potential suppliers for antivenoms, Q fever vaccine, and pandemic influenza vaccines; stated a competitive response might be possible after 2034; and noted that industry consultations identified interest in private-public partnerships and joint ventures. DHDA received proposals from Seqirus during the scoping stage (see paragraphs 2.37 and 2.37), but did not otherwise approach the market to assess the market’s capacity to competitively respond as part of the 2020 procurement. Option E (debundling with some offshore supply arrangements) was not recommended unless adopted as a further risk mitigation in addition to onshore production.

2.15 DHDA’s analysis did not conclude on which option would provide the greatest value for money.

2.16 In November 2019 DHDA provided the Minister for Health and Aged Care (the Minister) a brief on funding options, which stated that a Commonwealth facility carried very high investment, schedule and safety risk; and that options scoping ‘clearly’ showed that only Seqirus could deliver the required level of secure onshore supply over the next decade. The ideas of unbundling the products, seeking proposals from other potential market suppliers for one or more products, directly negotiating with Seqirus for short-term supply while undertaking an approach to market for longer-term supply, or conducting a multi-stage procurement, were not presented to the Minister. Internal planning documentation referred to the possibility of seeking research and development (R&D) funding (including potentially to CSIRO) to stimulate and identify viable market alternatives for antivenoms and Q fever vaccine supply before the end of the next Seqirus arrangement, and to help reduce Seqirus’ ‘monopoly leverage’ in the long term. R&D funding to stimulate the market and increase competition was referred to in the advice to the Minister. The November 2019 advice stated R&D for new generation antivenoms and Q fever vaccine would help ensure greater competition and reduction of the ‘monopoly leverage’ of Seqirus in the longer term.

2.17 In November 2019 the government agreed to the Minister providing advice on a long-term contract with Seqirus, including options A or B (which involved an upfront loan to Seqirus in 2020 and then annual funding) to be considered in the context of the 2020–21 Federal Budget. The approval did not include consideration of new R&D funding.

Recommendation no.1

2.18 When advising government on funding options, the Department of Health, Disability and Ageing establish controls to ensure that the advice, if based on research and evidence, is comprehensive and provides an accurate, evidence-based justification for recommending or not recommending options.

Department of Health, Disability and Ageing response: Agreed.

2.19 The Department of Health, Disability and Ageing will update its internal funding frameworks and guidance documentation to ensure advice to Government about funding options is clearly explained and justified. These changes will recognise the various structured mechanisms through which public funds can be allocated to achieve policy objectives.

Specifying procurement goals, risk, value and benefits

2.20 Resource Management Guide (RMG) 411 Grants, Procurement and other financial arrangements assists non-corporate Commonwealth entities to identify a grant, procurement or other financial arrangement.53 RMG 411 states that the arrangement is more likely to be a grant if it involves financial assistance to build capacity. The 2020 Seqirus financial arrangement had characteristics of a grant.54 Entities are required to document the reason for using a particular financial arrangement and apply the relevant framework. DHDA did not document a rationale for treating the financial arrangement as a procurement.

2.21 DHDA internal guidance dated 2019 states that a procurement plan should be prepared for procurements estimated at $10,000 or more. No procurement plan was developed during the planning stage for the 2020 Seqirus procurement.

2.22 The CPRs state that a thorough consideration of value for money begins by officials ‘clearly understanding and expressing the goals and purpose of the procurement.’55 There was no procurement plan or other authoritative document clearly stating the goals of the procurement. It can be derived from DHDA’s terms of reference for scoping activities funded under the 2017–18 Federal Budget measure (see paragraph 2.5) that the goal was to ensure the long-term supply of antivenoms, Q fever vaccine, and pandemic influenza vaccines through sustainable arrangements that fit with government and public health requirements.

2.23 The Commonwealth Risk Management Policy and CPRs require risk to be considered when making decisions.56 DHDA guidance requires staff to assess risk as early as possible when planning a procurement. Although the scoping work broadly considered risk related to the policy requirement and the different options, no structured risk assessment was developed for the Seqirus 2015 contract extension or 2020 procurement.

2.24 The CPRs state that the expected value of a procurement must be estimated before a decision on the procurement method is made.57 The intent of this requirement is to ensure that the chosen procurement method is consistent with the CPRs and represents value for money. The EY review estimated the total cost of each of the shortlisted options (see Appendix 5). The options of ensuring supply through Seqirus (options 1 and 2) had the highest cost estimates and the option of a government operator (option 3) had the lowest. The November 2019 advice to government did not specify costs.

2.25 The 2020 CPRs required entities to consider economic benefits to the Australian economy for procurements over $4 million.58 The Biointelect study and EY review considered the economic benefit of onshore and offshore supply options (see Appendix 5). Biointelect determined onshore manufacturing to be cost saving in most scenarios through reductions in health care utilisation and preventable deaths. EY identified that continued supply by Seqirus (options 1 and 2) had the lowest gross domestic product increase whilst a new Commonwealth entity (option 3) had the highest.

Recommendation no.2

2.26 The Department of Health, Disability and Ageing review and improve controls to ensure that officials undertaking procurements remain focused on the procurement objectives and adhere to an appropriate procurement schedule that enables the achievement of the objectives. This includes the development of procurement plans that clearly set out the objective of the procurement, include procurement risk assessments, and establish appropriate milestones and timeframes.

Department of Health, Disability and Ageing response: Agreed.

2.27 The Department of Health, Disability and Ageing remains committed to strengthening its procurement guidance and procedural documentation. This includes updating the procurement plan template, to ensure officials use procurement risk assessments and remain focused on the procurement objectives.

Approach to market

Justification of limited tender

2.28 The CPRs and DHDA’s procurement guidance state that for procurements at or above the relevant procurement threshold, limited tender can only be conducted in accordance with conditions listed in paragraph 10.3 or exemptions listed in Appendix A of the CPRs.59 The relevant procurement threshold is $80,000 for non-construction contracts.60

2.29 DHDA’s analysis (see paragraph 2.11) did not explicitly refer to which CPR exemption to open tender would be justified or applicable. DHDA did not provide advice to government on which limited tender condition would apply when recommending the sole sourcing of Seqirus.

2.30 In July 2017 DHDA engaged MinterEllison to provide legal advice61 on the options for future supply of the products following the conclusion of EY’s work. The December 2018 advice stated that there was no major legal impediment to any of the five EY options, subject to DHDA complying with legal and regulatory requirements, including the open tender requirements of the CPRs. The advice stated that:

- divisions 1 and 2 of the CPRs would apply to the procurement as the estimated value was above the relevant threshold;

- the most relevant potential exemptions were set out in paragraphs 10.3.d.ii. and 10.3.d.iii62 of the CPRs, however neither of those tests would be satisfied as the draft EY reports had noted the existence of other entities globally that have access to the relevant technology, know-how, intellectual property (IP) and proprietary rights to produce equivalent products;

- directly engaging with Seqirus was not permitted under the CPRs; and

- if DHDA pursued any procurement option except re-establishing a Commonwealth entity as government operator, it was likely that every time the arrangements expired and it undertook a new procurement, DHDA would find itself in a position where the service provider was able to exert heightened commercial negotiating pressure to maximise its commercial position.

2.31 In August 2020, to inform a brief in which the DHDA Secretary was to be asked to execute a heads of agreement63 with Seqirus, the Australian Government Solicitor (AGS), which had been engaged to provide probity advice (see paragraphs 2.42 and 2.51), sought to understand the background to the decision to sole source Seqirus. DHDA was unable to identify documentation of the decision to proceed with a limited tender. Correspondence between the commercial legal services area, other DHDA officials, AGS and MinterEllison indicates that DHDA was relying on individual officials with ‘corporate memory’ to understand the decision. AGS advised that the information supported DHDA conducting the process as a limited tender under CPR paragraph 10.3(d)(iii) and that this decision needed to be documented, with detail from the ‘market engagement work’ and 2014 tender process. In August 2020 the Secretary for DHDA was informed that negotiations with Seqirus were being progressed as a limited tender under CPR paragraph 10.3.d.iii (due to an absence of competition for technical reasons). The technical reasons were not explained except for a statement that Seqirus was the only manufacturer of antivenoms and Q fever vaccine globally and the only organisation with capability to manufacture pandemic influenza vaccines in Australia.

2.32 For each contract awarded through limited tender, the CPRs require entities to prepare and file in their records management system a written report that includes the value and type of goods and services procured, a statement indicating the circumstances and conditions used to justify the use of limited tender, and a record of how value for money was achieved in the circumstances.64 No report was prepared and filed. In November 2020, following contract negotiations with Seqirus, a minute to the Secretary included these elements.

Recommendation no.3

2.33 The Department of Health, Disability and Ageing review and improve internal controls on limited tender decision-making, including ensuring that controls support:

- consideration prior to a procurement decision being made about which conditions or exemptions listed in the Commonwealth Procurement Rules justify a limited tender;

- procurement delegates being informed about legal advice; and

- appropriate documentation in record keeping systems of limited tender justifications and related evidence.

Department of Health, Disability and Ageing response: Agreed.

2.34 The Department of Health, Disability and Ageing will review and update internal procurement guidance and procedural documentation to improve limited tender decision making and record keeping in line with the Commonwealth Procurement Rules.

Evaluation plan and risk assessment

2.35 The CPRs state that entities should include relevant evaluation criteria in request documentation to enable the proper identification, assessment and comparison of submissions on a fair, common and appropriately transparent basis.65 The Commonwealth Risk Management Policy, CPRs and DHDA internal guidance all emphasise the importance of engaging with risk in a procurement.66 No tender evaluation criteria, evaluation plan or related risk assessment were developed for the 2020 Seqirus procurement.

Were tender evaluation and contract negotiations consistent with the Commonwealth Procurement Rules?