Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

This report summarises audit and other related activities of the Australian National Audit Office in the period July to December 1999.

The Audit Activity Report: July to December 2004 summarises the activity and outputs of the Australian National Audit Office for the first half of the 2004-05 reporting year. The Report outlines the key findings of performance and financial control audits, and summarises audits tabled and better practice guides during July to December 2004.

The purpose of the report was to report to the Parliament on how effectively and efficiently the Australian Taxation Office administers the Tax File Number System, and to identify opportunities for improvement of that system. The ANAO developed a methodological framework for the evaluation of the efficiency and effectiveness of the ATO's administration of the TFN system. The framework examined the TFN system; individuals and their TFNs; TFN withholding tax arrangements; and TFN information matching.

The objective of this audit was to assess the effectiveness of the actions taken by AQIS and BA to strengthen the administration of quarantine. The audit focussed on progress in implementing the recommendations from the previous ANAO audit, and recommendations made in the JCPAA's inquiry. (The audit did not address four JCPAA recommendations that were either not supported by the Government, or were policy matters for the Government to consider. See Appendix 1.)

The objective of the follow-up audit was to report on the action taken by the Australian Customs Service to address the recommendations of the 1996 Audit Report. The audit also reviewed key areas of the Passenger Movement Charge administration identified in the 1996 audit, including the appropriateness of formal arrangements between the ACS and Regular Public Transport airlines and assessed the proposed arrangements being developed by the ACS. The arrangements with RPT airlines were a particular focus in the follow-up report (as they were in the 1996 Audit Report), because of the significance of that category of carrier in revenue terms

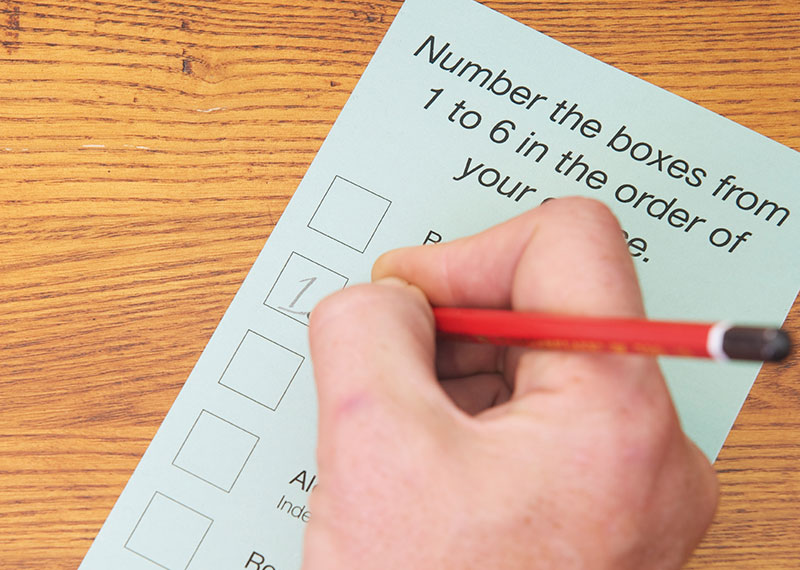

The objective of this audit was to assess the adequacy and effectiveness of the Australian Electoral Commission’s implementation of those recommendations relating to improving the accuracy and completeness of the electoral roll and other matters from Audit Report No.28 2009–10 that have not previously been followed-up by the ANAO.

Please direct enquiries relating to reports through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the 2nd Annual New Directions in Australian Auditing Accounting Standards Conference

The objective of this audit was to assess the effectiveness of the Australian Taxation Office’s (ATO’s) management of small business tax debt arising from compliance activities.

Please direct enquiries through our contact page.

This first Assurance Report on the status of selected Defence equipment acquisition projects, which has the support of the Parliament and the Government, represents a substantial step towards improving transparency and public accountability in major Defence procurement projects. It is the pilot of an annual Defence Materiel Organisation (DMO) Major Projects Report, and was developed in conjunction with the DMO. It covers the cost, schedule and capability progress achieved by nine DMO projects, which had an approved budget totalling $13.535 billion as at 30 June 2008.

This report is organised into three parts. Part 1 comprises an ANAO overview and Auditor–General's Foreword. Part 2 comprises the Major Projects Report prepared by DMO, including an overview reflecting DMO's perspective on their business and on the nine projects included in the. Part 3 incorporates the Auditor-General's Review Report, the statement by the CEO DMO, and the information prepared by DMO in the form of standardised Project Data Summary Sheets covering each of the nine pilot projects.

In the next 12 months, the ANAO will review 15 DMO projects planned for inclusion in the 2008-09 DMO Major Projects Report, with the number of projects rising to 30 projects in subsequent years. The ANAO will also work with DMO to refine the approach adopted for providing assurance on each project's progress toward achieving Final Operational Capability. The ANAO will also consider the inclusion of an analysis of each project's emerging trends, as appropriate, to complement DMO's intention to provide improved analysis of project management performance regarding all projects included in the Major Projects Report.

The objective of this audit was to assess whether the National Disability Insurance Agency (NDIA) is effectively managing the use of corporate credit cards for official purposes in accordance with legislative and entity requirements.

Please direct enquiries through our contact page.