Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Auditor-General, Grant Hehir, delivered a presentation to the 15th Biennial Australasian Council of Public Accounts Committees (ACPAC) Conference held at Parliament House, Canberra, on 7 November 2019. The presentation was titled Maintaining Trust in the Parliamentary Process — PACs and Officers of the Parliament.

Please direct enquiries through our contact page.

The objectives of the audit were to provide assurance that Artbank was effectively meeting its charter of: acquiring art by contemporary artists; expanding the number of public places that Artbank's collection is rented and displayed; and managing its collection and rental scheme. The audit also examined Artbank's governance arrangements, and its programmes for marketing, client development, performance management, budgeting, debt management and also sought client feedback on Artbank's operations via a survey.

The audit process involved an assessment of the payroll arrangements in Commonwealth organisations. The objectives of the audit were to determine whether organisations have established internal control frameworks for the management of payroll operations, assess whether payment of salaries and related expenditures is made in accordance with the relevant terms and conditions of employment, and identify better practices in the management and operations of payroll systems.

Mr P.J. Barrett (AM) - Auditor-General for Australia, addressed the Senior Women in Management (SWIM) 2000 Group, PSMPC, Canberra

This audit examined the effectiveness of the National Archives of Australia’s implementation of the Building Trust policy and selected entities’ management of information assets (records, information and data).

Please direct enquiries through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the 'Ensuring Accountability and Ethics with Corporate Governance in the Public Sector' - IIR Conference, Canberra

The objective of the audit was to assess the efficiency and effectiveness of the National Registration Authority's strategic and operational management, particularly the assessment and registration activities. The audit criteria took into account the scope for the application of risk management principles which are integral to strategic and operational management.

The audit reviewed the management of trust monies in five Commonwealth organisations. The objectives of the audit were to:

- assess whether selected Commonwealth organisations were managing trust monies in accordance with legal and administrative requirements and better practice principles;

- identify better practices in the management of trust monies; and

- recommend improvements in the controls and practices relating to the management of trust monies.

This report presents the results of the interim phase of the 2007-08 financial statement audits of all portfolio departments and other major General Government Sector (GGS) agencies that collectively represent some 95 per cent of total GGS revenues and expenses. The results of the final audits of these departments and agencies will be included in a second report to be tabled in the Parliament in December 2008 following completion of the financial statement audits of all entities for 2007-08.

The objective of the audit was to assess whether DEWR's management and oversight of Job Placement and matching services is effective, in particular, whether: DEWR effectively manages, monitors and reports the performance of JPOs in providing Job Placement services; DEWR effectively manages the provision of matching services (including completion of vocational profiles and provision of vacancy information through auto-matching) to job seekers; Job seeker and vacancy data in DEWR's JobSearch system is high quality and is managed effectively; and DEWR effectively measures, monitors and reports Job Placement service outcomes.

This report outlines the ANAO’s assessment of the internal controls of major agencies, including governance arrangements, information systems and control procedures. The findings summarised in this report are the results of the interim phase of the financial statement audits of 23 major General Government Sector agencies that represent some 95 per cent of total General Government Sector revenues and expenses.

Please direct enquiries relating to reports through our contact page.

The objective of the follow-up audit was to assess how well the ATO has implemented the recommendations of Audit Report No.3 of 2001-2002, The Australian Taxation Ofiice's Administration of Taxation Rulings. As part of the audit we also considered the ATO's progress in addressing the JCPAA's suggestions resulting from its review of Report No.3 of 2001-2002.

This report outlines the ANAO’s assessment of the internal controls of major agencies, including governance arrangements, information systems and control procedures. The findings summarised in this report are the results of the interim phase of the financial statement audits of 24 major General Government Sector agencies that represent some 95 per cent of total General Government Sector revenues and expenses.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to provide assurance about the Australian Taxation Office's risk management approach and to add value to its administration by analysing the economy, efficiency, administrative effectiveness, equity and accountability of the related processes employed within the organisation. The ANAO reviewed the formal risk management process that the ATO uses to deal with all sources of risk for the organisation.

The audit objective was to assess whether the Department of Immigration and Border Protection adopted sound contract management practices for the delivery of garrison support and welfare services for offshore processing centres in Nauru and Manus Island.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the National Blood Authority’s management of the manufacture and supply of domestic fractionated blood plasma products.

Please direct enquiries through our contact page.

The objective of this audit was to examine if Social Services and Human Services drive improvements in the Disability Support Pension program using data and information from multiple sources, including agreed Auditor-General and parliamentary committee recommendations.

Please direct enquiries through our contact page.

Mr P.J. Barrett (AO) - Auditor-General for Australia, presented at the National Institute for Governance Seminar, Canberra

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the Australian Communications Authority's Business Planning Workshop

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the MinterEllison Seminar Series

The objective of the audit was to assess the economy, efficiency and administrative effectiveness, including accountability, of the management of boat people by the Department and the providers of major related services to DIMA such as: the Coastwatch Service within the Australian Customs Service and the Australian Protective Service within the Attorney-General's portfolio. The audit examined key issues in the management of boat people largely from a risk management perspective. The audit conclusions are presented in terms of: the economy, efficiency and administrative effectiveness, including the accountability, of operations; and the administrative functions which support the management of boat people, such as detection, reception of boats and costs.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Comcover Seminar

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the 1999 ACPAC Biennial Conference Commercial Confidentiality - Striking the Balance

An Audit Committee Chairs Forum was held on Friday 6 December 2024. The text on this page is the communique from the forum.

For any enquiries, please contact External.Relations@anao.gov.au

The purpose of the report was to report to the Parliament on how effectively and efficiently the Australian Taxation Office administers the Tax File Number System, and to identify opportunities for improvement of that system. The ANAO developed a methodological framework for the evaluation of the efficiency and effectiveness of the ATO's administration of the TFN system. The framework examined the TFN system; individuals and their TFNs; TFN withholding tax arrangements; and TFN information matching.

An Audit Committee Chairs Forum was held on Wednesday, 14 June 2019 from 10am until 12:30pm. The venue was the Galambany Centre, Department of Finance, One Canberra Avenue, Forrest ACT. The agenda, slides and communique from the forum are available on this events page.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of DFAT's implementation of biometric technology to meet international requirements for enhanced passport security. In particular, the audit examined whether:

- Australian ePassports meet international requirements, and coordination with Australian stakeholders is effective;

- Australian biometric passport technology is fit for purpose and has enhanced passport security;

- personal data on the passport microchip is secure and DFAT maintains an appropriate focus on both protecting privacy and client satisfaction; and

- arrangements are in place to evaluate the effectiveness of the ePassport and to monitor risks.

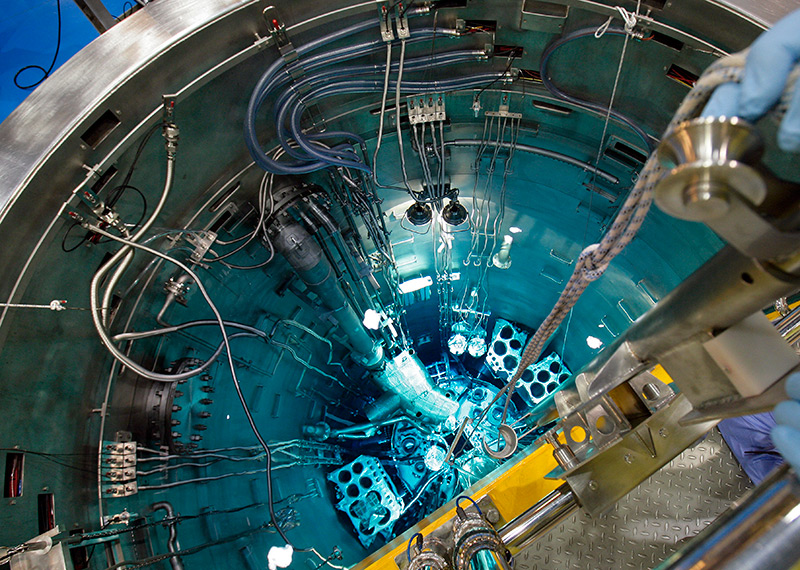

The audit examined the effectiveness of the Australian Nuclear Science and Technology Organisation’s management of assets involved in the manufacture, production and distribution of nuclear medicines.

Please direct enquiries through our contact page.

The audit sought to assess the efficiency of Defence property management; provide assurance that probity and compliance requirements are being met; and make practical recommendations for enhancing property operations. It focused on Infrastructure Division's property management, with recognition that other areas manage certain property service contracts, such as those for electricity supply and cleaning.

The Performance Audit Services Group (PASG) volume of the ANAO Audit Manual applies to the performance audit activity performed by PASG in collaboration with the Systems Assurance and Data Analytics (SADA) group. Relevant policies and guidance from the PASG volume are also applied to assurance reviews performed by PASG. Policies and guidance in the PASG volume address the planning, execution and reporting stages of the performance audit process.

Please direct enquiries through our contact page.