Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess the effectiveness of the Australian Fisheries Management Authority’s administration of its Domestic Fishing Compliance Program.

The audit objective was to assess the effectiveness of the development and administration of the Fifth Community Pharmacy Agreement (5CPA), and the extent to which the 5CPA has met its objectives.

Please direct enquiries relating to reports through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ended on 30 June 2019. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013; the Public Governance, Performance and Accountability Rule 2014; the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s Portfolio Budget Statements 2018–19 and the ANAO Corporate Plan 2018–19, and annual reporting requirements set out in other relevant legislation.

Please direct enquiries relating to annual reports through our contact page.

The objective of this audit is to assess the effectiveness of the Department of Climate Change, Energy, the Environment and Water's (DCCEEW) corporate plan as its primary planning document in accordance with the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

The slides and video from the Chief Financial Officer Forum held on Friday 8 July 2022 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

For any enquiries, please contact External.Relations@anao.gov.au

The slides and video from the Chief Financial Officer Forum held on Friday 26 November 2021 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

Please direct enquiries through our contact page.

The slides and video from the Chief Financial Officer Forum held on Friday, 27 November 2020 are now available. Please also provide any feedback you’d like to see incorporated in future forums.

Please direct enquiries through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 2 September 2015 to correspondence from Senator Nick Xenophon of 3 June 2015 on the Australian bid for the football World Cup.

Please direct enquiries relating to requests for audit through our contact page.

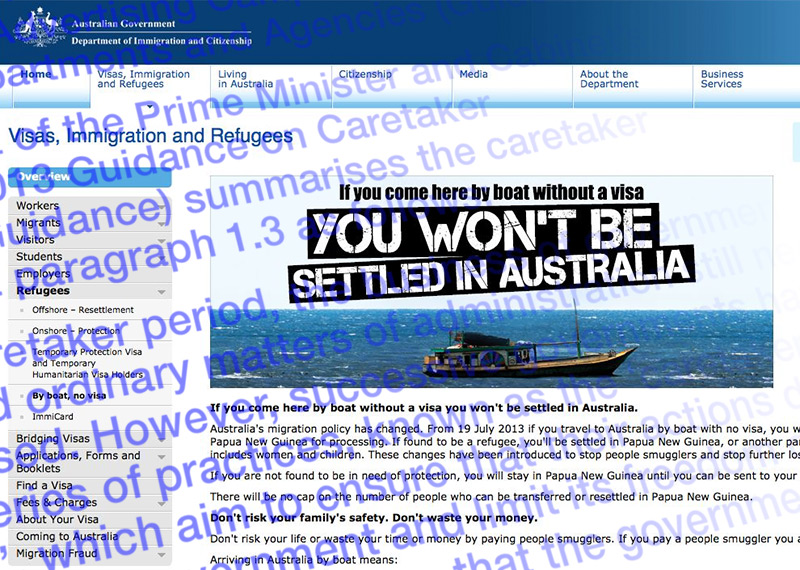

The Auditor-General responded on 14 August 2013 to correspondence from Senator Nick Xenophon of 12 August 2013 on the continuation of the Australian Government’s By boat, no visa advertising campaign during the caretaker period.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to assess whether the National Disability Insurance Agency has appropriate controls to ensure supports in participant plans are ‘reasonable and necessary’.

Please direct enquiries through our contact page.

The slides and video recording from the Chief Financial Officer Forum held on Friday 2 December 2022 are now available.

If you have any feedback you’d like to see incorporated in future forums, please contact External.Relations@anao.gov.au

The objective of the audit was to examine the effectiveness of the administration of the Gateway review process by Finance and FMA Act agencies. The audit also examined the extent to which those Gateway reviews that have been conducted have contributed to improvements in the delivery of major projects undertaken by FMA Act agencies.

The objective of the audit was to evaluate the Tax Office's corporate management of data matching, including analytics.

The ANAO examined the Tax Office's strategic goals and governance arrangements for data matching and analytics, its compliance with privacy requirements and whether the Tax Office is achieving intended results, which include revenue collection, optimised compliance and provision of improved services to taxpayers.

Tax Office executives have been increasingly drawing on the interrelationships and conceptual commonalities of Tax Office data matching and analytics activity. Accordingly, the audit included these relationships and conceptual commonalities within the scope of the audit. The audit was guided, therefore, by a broader definition of ‘data matching': meaning ‘finding relationships and patterns in large volumes of data'. This includes the more traditional idea of data matching as ‘bringing together data from different sources and comparing it'.

The objective of this audit was to assess the effectiveness of the Department of Defence’s design process and implementation to date of the Defence Export Strategy.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure, Transport, Regional Development and Communications’ design and implementation of measures to support the aviation sector in response to the COVID-19 pandemic.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the administration of the Commonwealth Scientific and Industrial Research Organisation's (CSIRO's) Gift to the Science and Industry Endowment Fund.

Please direct enquiries relating to reports through our contact page.

This audit examined the effectiveness of the National Archives of Australia’s implementation of the Building Trust policy and selected entities’ management of information assets (records, information and data).

Please direct enquiries through our contact page.

The audit objective was to examine whether the design and conduct of the procurement process for delivery partners for the Entrepreneurs’ Programme complied with the Commonwealth Procurement Rules, and whether the signed contracts are being appropriately managed.

Please direct enquiries through our contact page.

The Auditor-General responded on 9 May 2016 to correspondence from Ms Catherine King MP on 22 April 2016 regarding comments made by Ms Sophie Mirabella in relation to Commonwealth funding for Wangaratta Hospital.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 6 April 2016 to correspondence from Senator Hanson-Young on 30 March 2016 regarding Refugee resettlement deal established between the Commonwealth Government of Australia and the Kingdom of Cambodia in September of 2014.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 15 September 2015 to correspondence from the Hon Dr Sharman Stone MP on 11 September 2015 regarding Murray-Darling Basin Authority's (MDBA) implementation of the Basin Plan.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 2 December 2016 to correspondence from Senator the Hon Stephen Parry, President of the Senate, on 14 October 2016, regarding a resolution agreed by the Senate requesting that the Auditor-General conduct a performance audit assessing the procurement of services related to the National Cancer Screening Register.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 8 September 2015 to correspondence from Senator Lee Rhiannon on 10 August 2015 regarding the WestConnex road building project in NSW.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to examine the effectiveness of Centrelink's approach to investigating and responding to external fraud. The ANAO's assessment was based on four key criteria. In particular, the ANAO assessed whether Centrelink:

- had established a management framework, business systems and guidelines, that support the investigation, prosecution and reporting of fraud;

- had implemented appropriate case selection strategies and controls to ensure resources are targeted to the cases of highest priority;

- complied with relevant external and internal requirements when investigating fraud and referring cases for consideration of prosecution; and

- had implemented an effective training program that supports high quality investigations and prosecution referrals.

The objective of the audit was to assess whether APS agencies had sound approaches to recruitment, to assist in providing the workforce capability to deliver government programs effectively. Sound approaches to recruitment involve agencies:

- establishing and implementing strategic approaches to recruitment to address current and future workforce priorities and goals;

- managing and supporting recruitment activities through the provision of expert advice and support, legislative and procedural guidance material, and training for staff involved in recruitment activities;

- conducting recruitment activities effectively and in compliance with legislative and administrative requirements; and

- systematically monitoring and evaluating the effectiveness and efficiency of recruitment strategies, policies and activities.

The Auditor-General responded on 27 June 2017 to correspondence from Mr Andrew Wilkie MP dated 26 May 2017, requesting that the Auditor-General conduct an audit of Centrelink's automated debt recovery programs.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Mr Tim Watts MP on 28 August 2015 regarding Liberal Party misappropriation of parliamentary entitlements.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Ms Julie Collins MP on 1 September 2015 regarding parliamentary entitlements paid to Liberal MPs and Senators.

Please direct enquiries relating to requests for audit through our contact page.

The Proceeds of Crime Act 2002 establishes a scheme to confiscate proceeds of crime and allows for confiscated proceeds of crime to be re-invested in programs for relevant purposes, including crime prevention and law enforcement. Auditor-General Report No. 43 2016–17 Proceeds of Crime concluded that:

- effective processes had been established by the Attorney-General’s Department to identify the possible use of funds from the Confiscated Assets Account;

- appropriate advice was being provided to the Minister to inform decision-making; and

- the main beneficiaries of funding from the Confiscated Assets Account have been Commonwealth criminal intelligence or law enforcement entities with significant funds also approved for non-government, community organisations or local council’s projects, including through the Safer Streets Programme (examined in Auditor-General Report No. 41 2014–15 The Award of Funding under the Safer Streets Programme). In addition, the initial allocation to the Safer Communities Fund (examined in Auditor-General Report No. 16 2021–22) included unspent Safer Streets program funding (sourced from the Confiscated Asset Fund, under the Proceeds of Crime Act).

This audit would examine the processes through which funding allocations are identified, the appropriateness of the advice provided by the Attorney-General’s Department to inform funding decisions.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of the Department of Finance’s administration of the governance and accountability framework for Government Business Enterprises (GBE), including its support and advice to the Minister for Finance, who is a GBE shareholder minister. The audit may also review entities’ implementation of framework requirements and expectations set out in the GBE guidelines.

A GBE is a Commonwealth entity or Commonwealth company that is prescribed pursuant to the Public Governance, Performance and Accountability Act 2013 and related Public Governance, Performance and Accountability Rule 2014. Nine GBEs have been prescribed. Two GBEs are corporate Commonwealth entities: Australian Postal Corporation; and Defence Housing Australia. Seven GBEs are Commonwealth companies: ASC Pty Limited; Australian Naval Infrastructure Pty Ltd; Australian Rail Track Corporation Limited; National Intermodal Corporation Limited; NBN Co Limited; Snowy Hydro Limited; and WSA Co Limited. The Department of Finance provides advice to the Australian Government relating to its GBEs and other commercial entities.

Please direct enquiries through our contact page.