Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess whether the contractual arrangements that have been put in place for the delivery of the Moorebank Intermodal Terminal (MIT) will provide value for money and achieve the Australian Government’s policy objectives for the project.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Office of the Registrar of Indigenous Corporations (ORIC) supports good governance in Indigenous corporations consistent with the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI).

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the efficiency and effectiveness of Australian Human Rights Commission’s handling of complaints.

Please direct enquiries through our contact page.

The Auditor-General undertook a limited assurance review of the Department of Finance’s reporting and administration of the Advances to the Finance Minister (AFM) for the Period 27 June 2020 to 31 July 2020.

Please direct enquiries through our contact page.

The objective of the audit was to examine whether the National Capital Authority’s procurement activities are complying with the Commonwealth Procurement Rules and demonstrating the achievement of value for money.

Please direct enquiries through our contact page.

The Auditor-General responded on 19 November 2021 to correspondence from Senator Malcolm Roberts dated 28 October 2021, requesting that the Auditor-General clarify issues relating to the Disaster Recovery Funding Arrangements.

The Auditor-General received further correspondence about this matter from the Chief Executive Officer of the Queensland Reconstruction Authority, Mr Brendan Moon on 6 June 2022.

Please direct enquiries through our contact page.

The objective of the audit was to assess the completeness and reliability of the estimates reported in Tax Expenditures Statement 2006 (TES 2006). That is, the audit examined the development and publication of the detailed statement of actual tax expenditures required by Division 2 of Part 5 of the CBH Act. The development and publication of aggregated information on projected tax expenditures included in the Budget Papers pursuant to Division 1 of Part 5 of the CBH Act was not examined.

The objective of this audit was to examine the effectiveness of Medicare Australia's administration of the PBS. In assessing the objective, the audit considered three key areas:

- Medicare Australia's relationship with the PBS policy agency (DoHA) and service delivery policy agency (Department of Human Services (DHS));

- the management arrangements and processes underpinning Medicare Australia's delivery of the PBS (including the means by which Medicare Australia gains assurance over the integrity of the PBS); and

- how Medicare Australia undertakes its three main responsibilities relating to the delivery of the PBS, namely: approving pharmacies; approving authority prescriptions; and processing PBS claims.

The audit examined the process of identifying the ADC Weston Creek property for sale and leaseback and the management of the sale process. The objective of the performance audit was to examine the efficiency and effectiveness of the management of the sale process by Defence, including assessing whether the sale and long term leaseback arrangements adequately protect the Commonwealth's interests.

The objective of this audit was to examine whether the selected entities within the Attorney-General’s portfolio have implemented all agreed recommendations from parliamentary committee and Auditor-General reports within the scoped timeframe.

Please direct enquiries through our contact page.

The audit objective was to assess Health's administration of primary care funding, with a focus on the administrative practices of the Primary Care Division and Health's State and Territory Offices. In forming an opinion on the audit objective, the ANAO reviewed 41 agreements, with a combined value of $252 million. The ANAO also reviewed relevant documentation and files, interviewed programme officers and met with a number of stakeholders. The audit comments on a range of issues, including the utility of funding agreements, monitoring, payments, and support for administrators.

The audit objective was to assess the effectiveness of the Department of Veterans’ Affairs management of complaints and other feedback to support service delivery. The audit criteria were that DVA has:

- a well-designed framework for managing complaints and other feedback;

- effective processes and practices to manage complaints; and

- appropriately analysed complaints to inform service delivery.

The objective of the audit was to assess the effectiveness of the Clean Energy Regulator’s crediting and selection of carbon abatement to purchase under the Emissions Reduction Fund.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Competition and Consumer Commission in managing compliance with fair trading obligations.

Please direct enquiries relating to reports through our contact page.

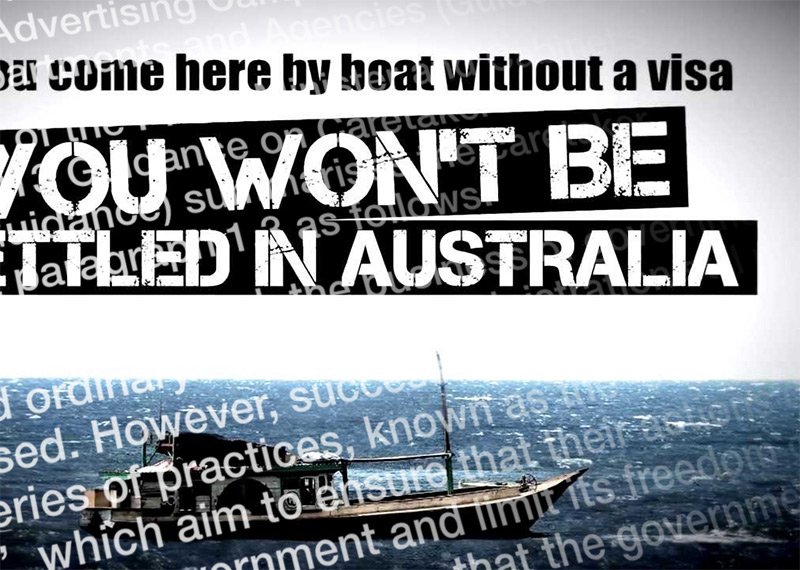

The Auditor-General responded on 1 August 2013 to correspondence from Senator Nick Xenophon of 22 July 2013 on the By boat, no visa advertising campaign.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the selection, implementation, operation and monitoring of FRCs by AGD and FaHCSIA. The three main criteria for this audit assessed whether AGD and FaHCSIA had effectively:

- planned and implemented the FRC initiative, including the FRC selection and funding processes;

- undertaken administration activities to guide the operation and progress of the FRC initiative towards meeting its objectives; and

- monitored, evaluated and reported on the performance of FRCs.

The objectives of this audit were to assess the progress of the M113 Armoured Personnel Carrier Upgrade Project against stated schedule, cost and technical performance objectives; and Defence Materiel Organisation's (DMO's) progress in implementing the recommendations and addressing the findings of ANAO Audit Report No. 3 2005–06, Management of the M113 Armoured Personnel Carrier Upgrade Project.

The objectives of the audit were to provide assurance that Artbank was effectively meeting its charter of: acquiring art by contemporary artists; expanding the number of public places that Artbank's collection is rented and displayed; and managing its collection and rental scheme. The audit also examined Artbank's governance arrangements, and its programmes for marketing, client development, performance management, budgeting, debt management and also sought client feedback on Artbank's operations via a survey.

The objective of the audit was to assess the effectiveness of DFAT's management of the overseas leased estate. In particular, the audit examined whether DFAT:

- has effective governance, reporting and funding arrangements in place to support the sound management and oversight of the overseas leased estate;

- effectively manages overseas leased chancery and residential property on a day-to-day basis; and

- manages relationships with landlords and attached agencies effectively and adequately consults with stakeholders.

The Auditor-General responded on 28 April 2025 to correspondence from Senator the Hon Anne Ruston dated 31 March 2025, requesting that the Auditor-General conduct an investigation to examine a grant awarded to the Gallipoli Turkish Cultural Foundation.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether, in relation to appeals to the SSAT and the AAT, Centrelink undertakes its role effectively, so as to support the timely implementation of the Tribunals' decisions about customers' entitlements. In assessing Centrelink's performance, the ANAO examined whether:

- the information provided by Centrelink, in relation to appeals to the SSAT and the AAT, effectively supported customers' and Tribunals' decision-making;

- the relationships and administrative arrangements between Centrelink, DEEWR and FaHCSIA supported the effective management of the appeal process and the capture of issues that may have broader implications for legislation, policy and service delivery; and

- Centrelink implemented SSAT and AAT decisions in an effective and timely manner.

The audit focused on the external review and appeal mechanisms and completes the cycle of audits on Centrelink's review and appeal system. The audit examined those appeals where an implementation action was required and did not consider SSAT and AAT appeals that were dismissed, withdrawn or were not within the Tribunals' jurisdiction.

The objective of the audit is to assess the effectiveness of the ADF’s mechanisms for learning from its military operations and exercises. In particular, the audit focused on the systems and processes the ADF uses for identifying and acting on lessons, and for evaluating performance. The ANAO also examined the manner in which information on lessons is shared within the ADF, with other relevant government agencies, and with international organisations. Reporting to Parliament was also considered.

The objective of the audit was to assess the effectiveness of DHS' management of the tender process for a replacement BasicsCard to support the delivery of the income management scheme.

In conducting the audit, the Australian National Audit Office (ANAO) assessed the following five key areas of the replacement BasicsCard procurement process, which are described in the Department of Finance and Deregulation's (Finance) Guidance on the Mandatory Procurement Procedures :

• planning for the procurement;

• preparing to approach the market;

• approaching the market;

• evaluating tender submissions; and

• concluding the procurement, including contract negotiation.

The overall objective of the audit was to assess CrimTrac's progress in achieving the key deliverables it was established to provide, given that the agency had been in operation for some three years. The Australian Government provided $50 million for the implementation of CrimTrac, with an expectation that significant progress would be made within the first three years. The audit further examined whether CrimTrac had progressed the key deliverables efficiently and effectively, and whether the data either held by CrimTrac, or accessed through CrimTrac, for matching purposes is secure.

The objective of the audit was to provide assurance to Parliament concerning the adequacy of Defence preparedness management systems and to identify possible areas for improvement. The audit focused on the systems and processes that Defence uses to manage preparedness. We did not review the preparedness levels of specific capabilities, nor did we cover capital acquisition processes. The audit included coverage of: - preparedness systems architecture; - control and direction of preparedness; - coordination among contributors to preparedness; and - performance management and preparedness.

The objective of this performance audit was to assess whether DIMIA's information systems and business processes are effective in supporting APP to meet its border security and streamlined clearance objectives. In particular, the audit focused on the following: Mandatory APP - Stage 1 (MAPP1) project management; MAPP1 IT development and system performance; APP performance reporting; contract management; and financial management.

The objective of this audit was to assess the Private Health Insurance Administration Council's (PHIAC's) administrative effectiveness as a regulator of private health insurance. In making this assessment, the Australian National Audit Office (ANAO) addressed the following criteria: whether PHIAC monitored compliance with its legislative requirements and analysed related data; whether PHIAC addressed and managed non-compliance with its legislative requirements; and whether PHIAC's governance and organisation supported the performance of its legislative functions. Although the Department of Health and Ageing (Health) also has a role in the regulation of the private health insurance industry under the National Health Act 1953 (Health Act), Health's regulatory activities were outside the scope of this audit.

The objective of this audit was to assess whether the Australian Maritime Safety Authority is effectively managing the Search and Rescue Aircraft contract.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether FaCSIA administers grants effectively, according to better practice guidelines, and consistently across geographic areas and the range of programmes included in the scope of the audit. The scope of the audit included grants administered by FaCSIA between 1 July 2002 and 30 June 2005, relating to programmes falling within four of the five groups of programmes providing funding for families and communities namely: Community Support; Family Assistance; Childcare Support; and Youth and Student Support. In total, these groups involved total expenditure of some $533 million in 2004–05.

The objective of the audit was to assess the effectiveness of management of the procurement of a major, replacement capability for the Australian Defence Force (ADF) by the DMO, and Defence. The audit reviewed the initial capability requirements and approval process; analysed the acquisition agreements for elements of the project; and examined the interim through-life support arrangements being put in place to support the capability.