Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess the effectiveness to date of the Department of Defence’s implementation of its Pathway to Change — Evolving Defence Culture 2017–2022 cultural reform strategy.

Please direct enquiries through our contact page.

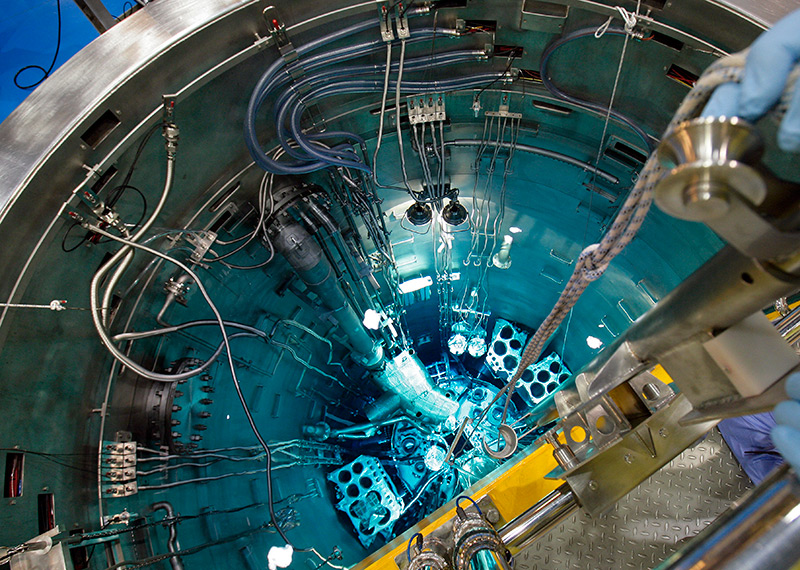

The audit examined the effectiveness of the Australian Nuclear Science and Technology Organisation’s management of assets involved in the manufacture, production and distribution of nuclear medicines.

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2022. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2022.

Please direct enquiries through our contact page.

The objective of this report is to provide a formal conclusion on the review of the Project Data Summary Sheets by the Auditor-General, including comprehensive information on the status of projects as reflected in the PDSSs prepared by the DMO.

The objective of this report is to provide information, prepared by both the ANAO and DMO, on the performance of major projects as well as providing the Auditor-General’s formal conclusion on the review of the Project Data Summary Sheets (PDSSs) prepared by DMO and contained in this report.

Taxation rulings are a key mechanism used by the Australian Taxation Office (ATO) to disseminate the Commissioner of Taxation's interpretative advice on Australian taxation law. The objective of the audit was to:

report to Parliament on the operation of the ATO's administration of taxation rulings (public, private and oral rulings); and where appropriate, make recommendations for improvements, having regard to considerations of: efficiency and effectiveness of the ATO's administration of the rulings system, particularly in relation to the achievement of the objectives set by Parliament for the rulings system; the ATO's systems' capacity to deliver consistency and fairness for taxpayers; and good corporate governance, including the control framework.

The objective of the audit was to assess the effectiveness of Department of Defence's procurement and implementation of the myClearance system to date.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether Defence has a fit-for-purpose framework for the management of materiel sustainment.

Please direct enquiries relating to reports through our contact page.

The ANAO prepares two reports annually that provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities, drawing on information collected during our audits.

This report is the first of the two reports and focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2023–24 financial statements audits. This report examines 27 entities, including all: departments of state; the Department of Parliamentary Services; and other Commonwealth entities that significantly contribute to the revenues, expenses, assets and liabilities within the 2022–23 Australian Government Consolidated Financial Statements (CFS). The National Indigenous Australians Agency is also included in this report given the role it plays working across government with indigenous communities and stakeholders.

Please direct enquiries through our contact page.

The aim of Insights: Audit Lessons (formerly Audit Insights) is to communicate lessons from our audit work and to make it easier for people working within the Australian public sector to apply those lessons.

This edition of Insights: Audit Lessons is targeted at Australian Government officials who are working in governance roles or who have responsibility for ensuring effective oversight and management of probity. Although it is based on audits of financial regulators, the lessons for managing probity risks can be applied across the public sector.

Please direct enquiries through our contact page.