Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The audit examined ATSIS' implementation of recommendations from Audit Report No.39, 1998-1999 National Aboriginal Health Strategy - Delivery of Housing and Infrastructure to Aboriginal and Torres Strait Islander Communities (the previous audit). In addition to assessing ATSIS' progress in implementing the recommendations of the previous audit, this follow-up audit examined ATSIS' performance reporting of the NAHS program, and concluded that the current level of aggregation of performance reporting makes it difficult to identify the particular contribution that the NAHS Program makes in improving services to Indigenous communities.

The Auditor-General responded on 27 June 2017 to correspondence from Mr Andrew Wilkie MP dated 26 May 2017, requesting that the Auditor-General conduct an audit of Centrelink's automated debt recovery programs.

Please direct enquiries relating to requests for audit through our contact page.

Response completed as a limited scope assurance review.

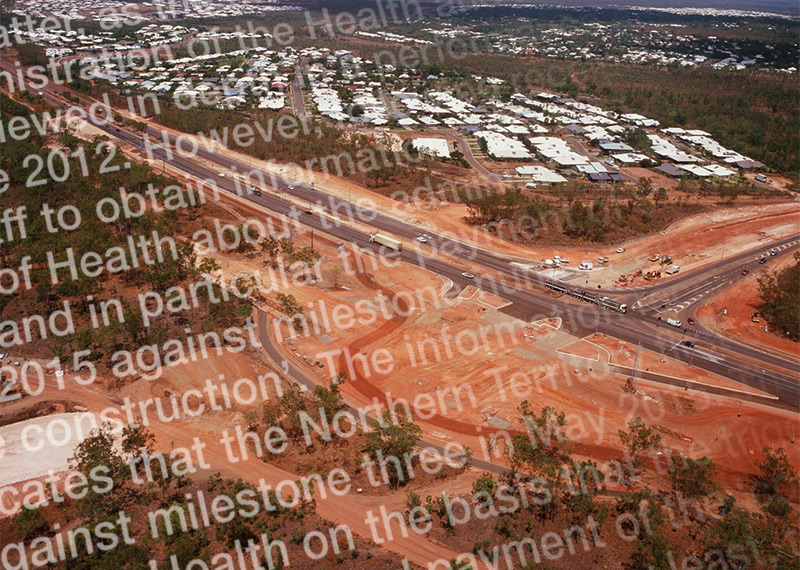

The Auditor-General responded on 14 January 2016 to correspondence from the Hon Catherine King MP on 22 October 2015, on the project agreement for the Health and Hospitals Fund – 2010 Regional Priority Round Project in Palmerston.

Please direct enquiries relating to requests for audit through our contact page.

The audit examined agency approaches to the management of intellectual property under its control, and identified themes common to the management of all types of intellectual property. The audit objective was to:

(i) form an opinion on whether Commonwealth agencies have systems in place to efficiently, effectively and ethically manage their intellectual property assets; and

(ii) identify areas for better practice in intellectual property management by those agencies.

The objective of the audit was to examine the effectiveness of the Australian Government Reconstruction Inspectorate, supported by the National Disaster Recovery Taskforce, in providing assurance that value for money is being achieved in respect to Queensland reconstruction projects.

Please direct enquiries relating to reports through our contact page.

The objective of this follow-up audit was to examine the ATO's implementation of the 20 recommendations in: The Administration of Petroleum Excise Collections (Audit Report No.17, 2001(02); and The Administration of Tobacco Excise (Audit Report No. 55, 2001(02), having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations. The audit also aimed to identify scope for improvement in the ATO's administration of petroleum and tobacco excise. Follow-up audits are recognised as an important element of the accountability processes of Commonwealth administration. The Parliament looks to the Auditor-General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow-up audits keep the Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

The Acting Auditor-General responded on 11 May 2017, and the Auditor-General followed-up on 19 July 2017, to correspondence from Ms Cathy McGowan AO MP dated 10 April 2017. Ms McGowan had requested that the Auditor-General conduct an audit of the Regional Australia Impact Statement process, which is administered by the Department of Infrastructure and Regional Development.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to express an opinion on the effectiveness of HOP management having regard to: compliance with applicable Australian Government policies; compliance with internal guidelines to assist loans officers to assess applications and manage loans; and programme performance reporting.

The objective of the audit was to assess the effectiveness of procedures and processes used by DEST and the ATO to record HECS–HELP student loans. To achieve this, the ANAO assessed the performance of DEST and the ATO against three criteria as follows:

- DEST monitored student contributions set by higher education providers for consistency with Australian Government policy;

- DEST paid HECS–HELP advance payments to higher education providers based on sound estimates, and recorded, reconciled and reported these payments; and

- the ATO has established procedures and processes to correctly record HECS–HELP loans against student tax records.

The objective of this audit was to assess whether selected organisations had effective security risk management programs, including whether a selection of protective security risk treatment controls was working as designed.