Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Auditor-General responded on 19 November 2021 to correspondence from Senator Malcolm Roberts dated 28 October 2021, requesting that the Auditor-General clarify issues relating to the Disaster Recovery Funding Arrangements.

The Auditor-General received further correspondence about this matter from the Chief Executive Officer of the Queensland Reconstruction Authority, Mr Brendan Moon on 6 June 2022.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Defence's management of the disposal of specialist military equipment.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 21 August 2020 to correspondence from the Hon Mark Butler MP dated 26 July 2020, requesting that the Auditor-General review the integrity of the Supporting Reliable Energy Infrastructure Program, in particular with reference to the grant to Shine Energy. The Auditor-General provided a follow-up response on 16 September 2020.

Please direct enquiries relating to requests through our contact page.

The Auditor-General responded on 21 March 2025 to correspondence from Ms Kylea Tink MP dated 28 February 2025, requesting that the Auditor-General conduct an investigation to examine the defence export permit approvals process.

Please direct enquiries through our contact page.

The Auditor-General responded on Thursday 27 February 2020 to correspondence from senators Janet Rice and Larissa Waters dated 7 February 2020, requesting that the Auditor-General investigate the decision-making process under the Community Sport Infrastructure — female facilities and water safety program, and the conduct of any relevant parties in relation to this matter. The Auditor-General provided a follow-up response to senators Rice and Waters on 24 July 2020.

Please direct enquiries relating to requests through our contact page.

The Auditor-General responded on 27 October 2025 to correspondence from Senator Andrew Bragg dated 10 October 2025, requesting that the Auditor-General undertake a performance audit into the Housing Australia Future Fund availability payments.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of Health's implementation of the Diagnostic Imaging Review Reform Package, some three years into the five year reform period.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 14 January 2020 to correspondence from the Hon Catherine King MP, requesting that the Auditor-General conduct an investigation to examine programs supporting regional development and jobs growth. The Auditor-General also responded on 2 April 2020 to follow-up correspondence from the Hon Catherine King MP dated 3 March 2020, alerting the Auditor-General to evidence given in Senate estimates that relates to the original correspondence. The Auditor-General provided a follow-up response to the Hon Catherine King MP on 24 July 2020.

Please direct enquiries relating to requests through our contact page.

The Auditor-General responded on 27 November 2018 to correspondence from Senator Hanson-Young dated 26 October 2018, requesting that the Auditor-General conduct an investigation to examine the use of grant funding from the Connections Project.

Please direct enquiries relating to requests for audit through our contact page.

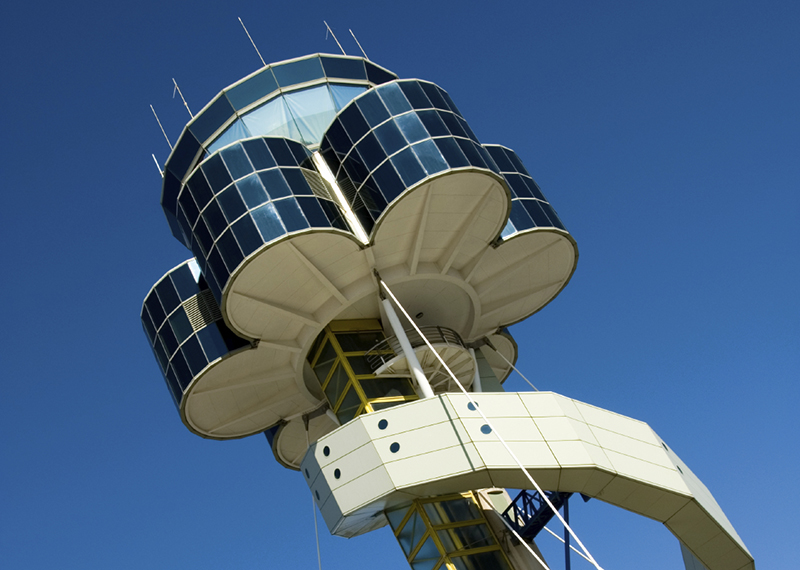

The audit objective was to examine whether Airservices Australia has effective procurement arrangements in place, with a particular emphasis on whether consultancy contracts entered into with International Centre for Complex Project Management (ICCPM) in association with the OneSKY Australia project were effectively administered.

Please direct enquiries relating to reports through our contact page.