Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2023

Please direct enquiries through our contact page.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in May 2023. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of 243 Australian Government entities for the period ended 30 June 2023.

Executive summary

The ANAO publishes an annual audit work program (AAWP) which reflects the audit strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the planned audit coverage for the Australian Government sector by way of financial statements audits, performance audits, performance statements audits and other assurance activities. As set out in the AAWP, the ANAO prepares two reports annually that, drawing on information collected during financial statements audits, provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities. These reports provide Parliament with an independent examination of the financial accounting and reporting of public sector entities.

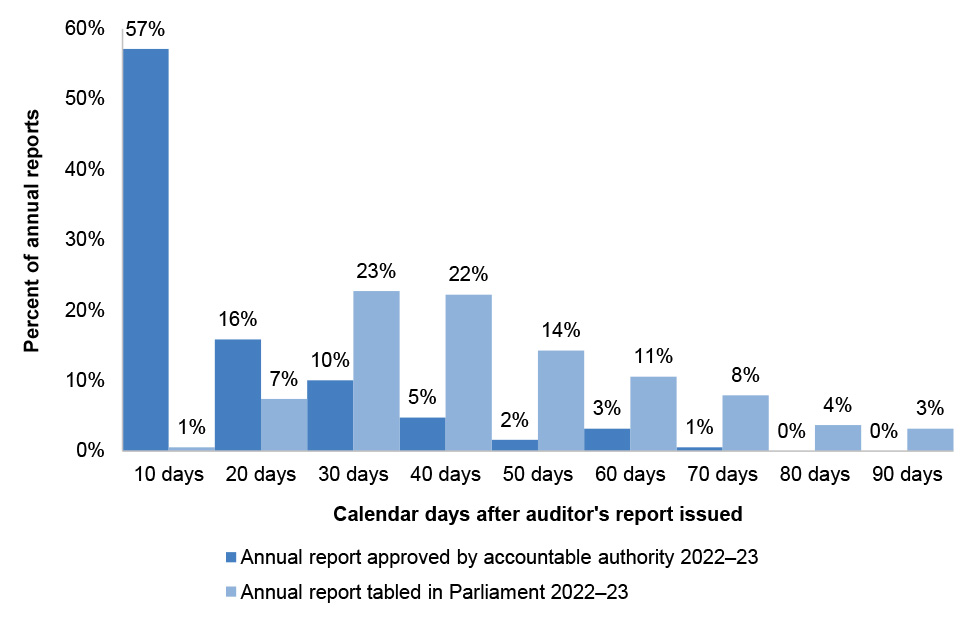

These reports explain how entities’ internal control frameworks are critical to executing an efficient and effective audit and underpin an entity’s capacity to transparently discharge its duties and obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Deficiencies identified during audits that pose either a significant or moderate risk to an entity’s ability to prepare financial statements free from material misstatement are reported.

This report presents the final results of the 2022–23 audits of the Australian Government’s Consolidated Financial Statements (CFS) and 243 Australian Government entities. The Auditor-General Report No. 26 2022–23 Interim Report on Key Financial Controls of Major Entities, focused on the interim results of the audits of 27 of these entities.

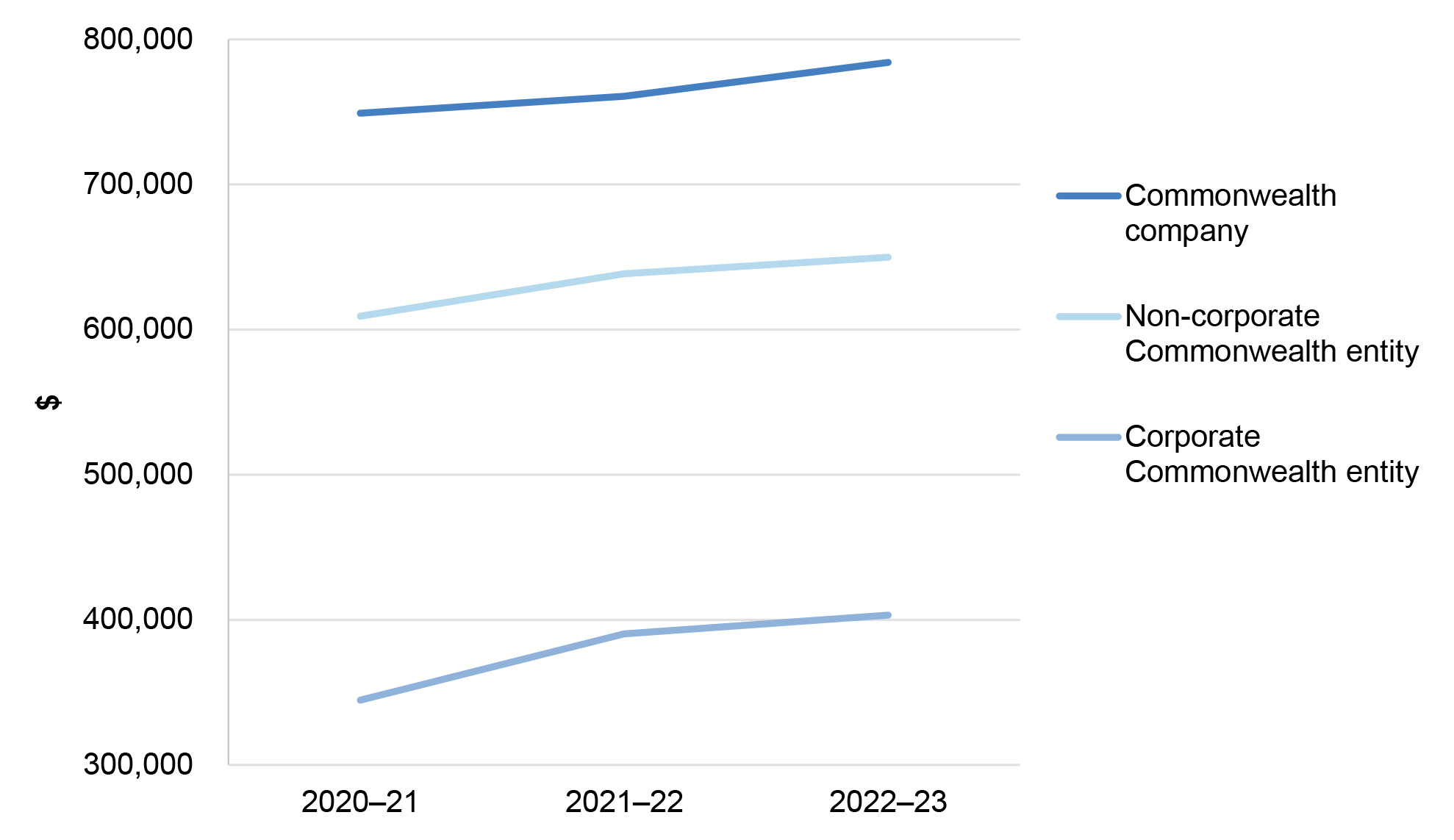

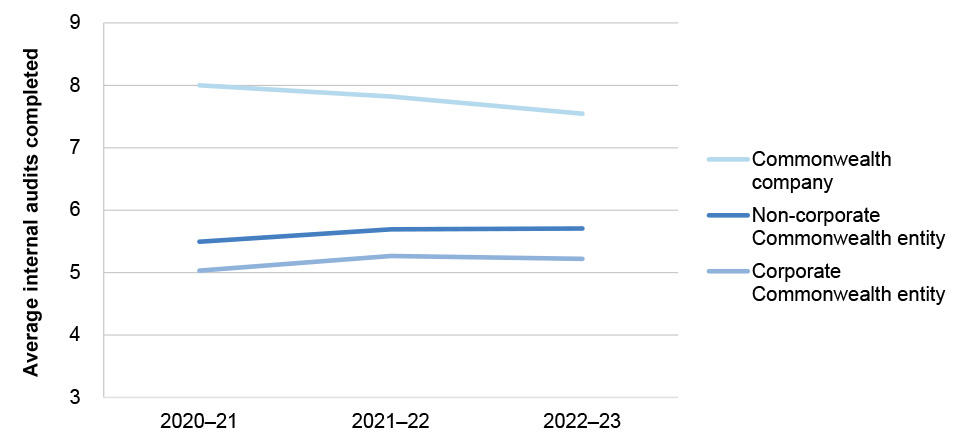

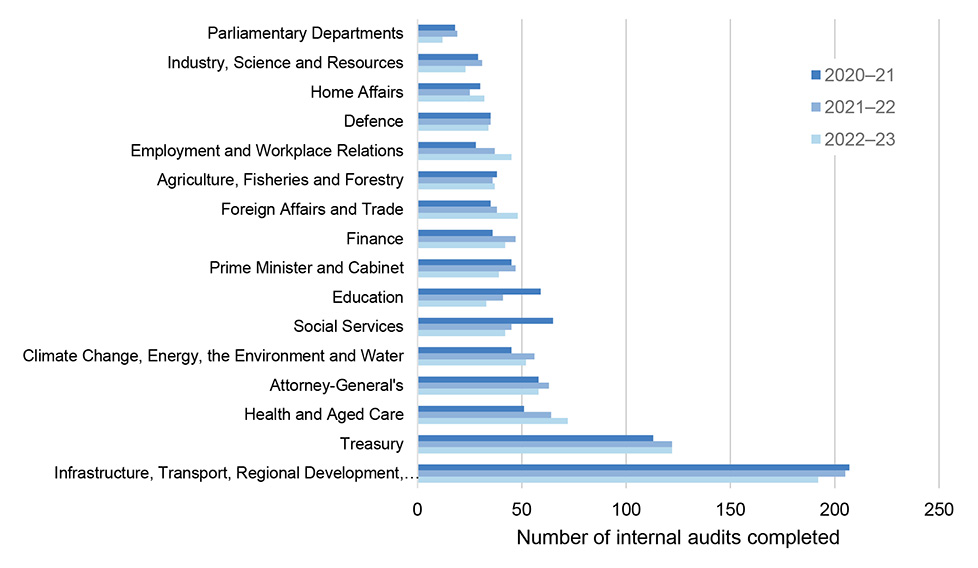

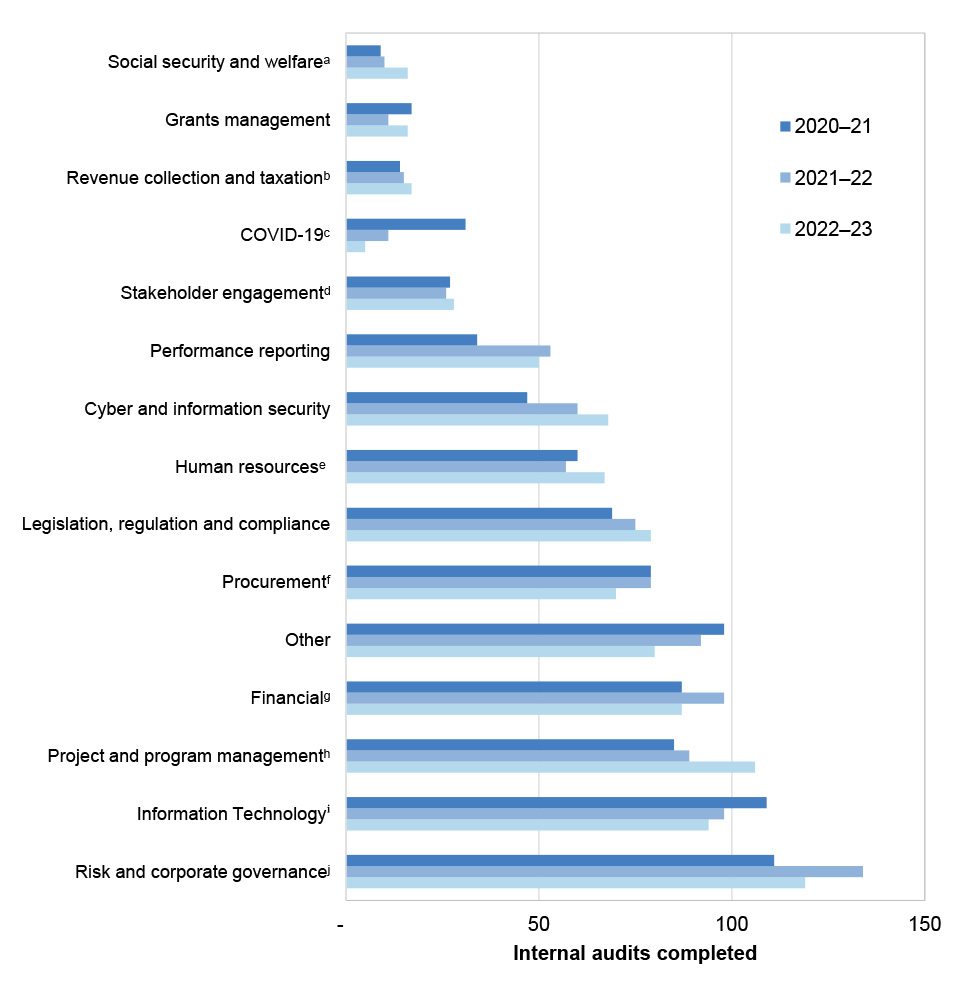

Consolidated financial statements

Audit results

1. The CFS presents the whole of government and the General Government Sector financial statements. The 2022–23 CFS were signed by the Minister for Finance on 15 November 2023 and an unmodified auditor’s report was issued by the Auditor-General on 17 November 2023.

2. There were no significant or moderate audit issues identified in the audit of the CFS in 2022–23 or 2021–22.

Australian Government financial position

3. The Australian Government reported a net operating balance of a surplus of $24.9 billion ($20.6 billion deficit in 2021–22). The Australian Government’s net worth deficiency decreased from $607.2 billion in 2021–22 to $570.2 billion in 2022–23 (see paragraphs 1.7 to 1.27).

Financial audit results and other matters

Quality and timeliness of financial statements preparation

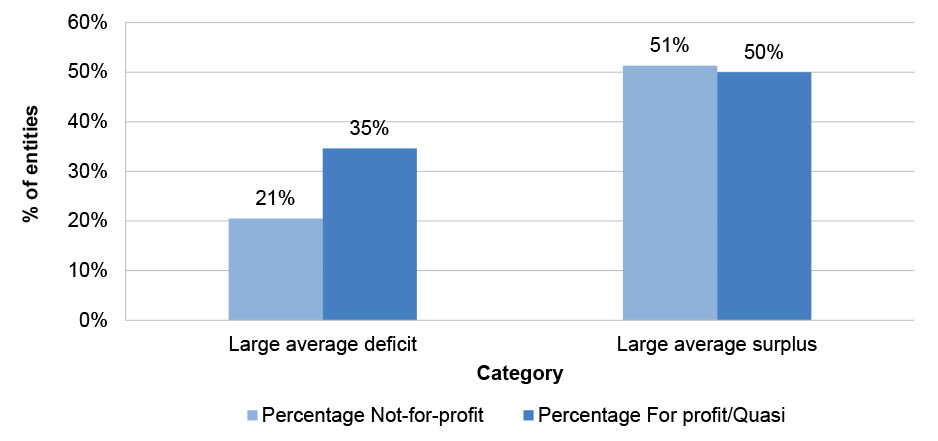

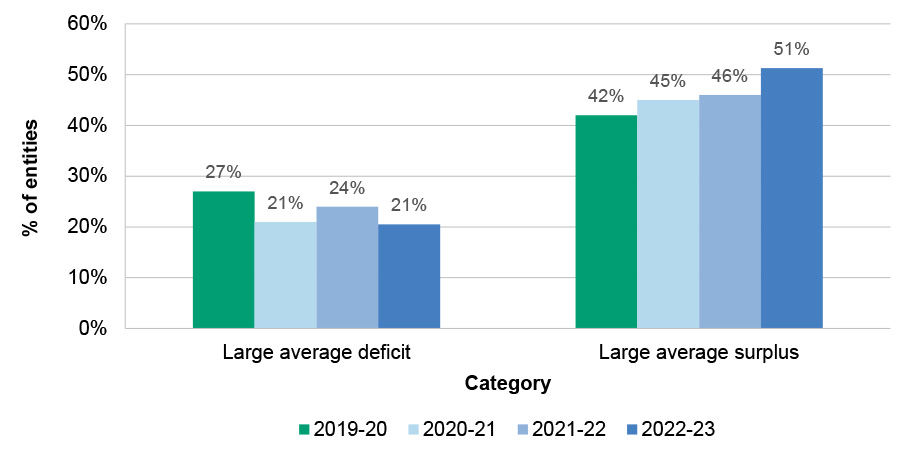

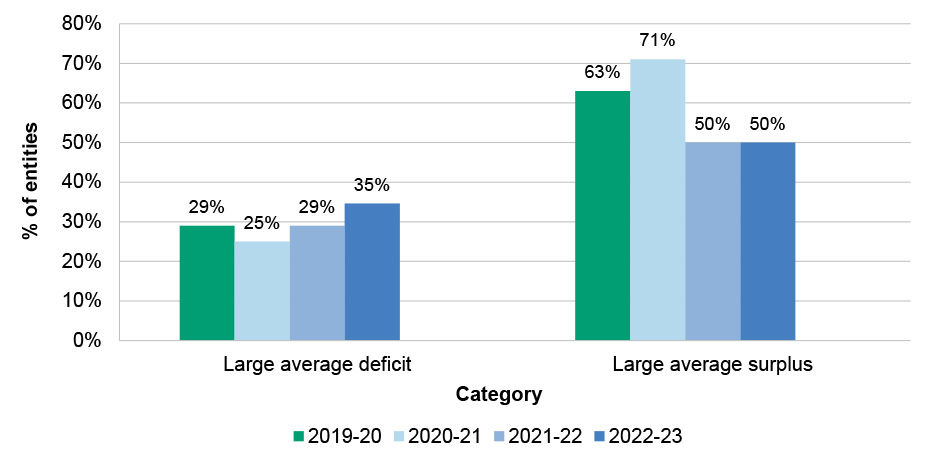

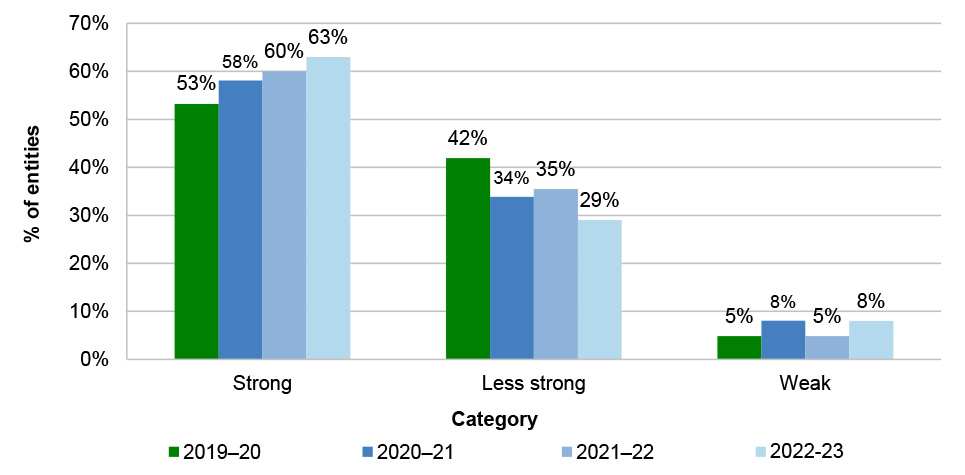

4. The ANAO issued 241 unmodified auditor’s reports as at 30 November 2023, including the CFS. The financial statements were finalised and auditor’s reports issued for 91 per cent (2021–22: 86 per cent) of entities within three months of financial year-end.

5. A quality financial statements preparation process will reduce the risk of inaccurate or unreliable reporting. Seventy-two per cent of entities delivered financial statements in line with an agreed timetable, an increase compared with 2021–22 (65 per cent). The total number of adjusted and unadjusted audit differences decreased during 2022–23, although 50 per cent of audit differences remained unadjusted. The quantity and value of adjusted and unadjusted audit differences indicate there remains an opportunity for entities to improve quality assurance frameworks over financial statements preparation processes (see paragraphs 2.146 to 2.163).

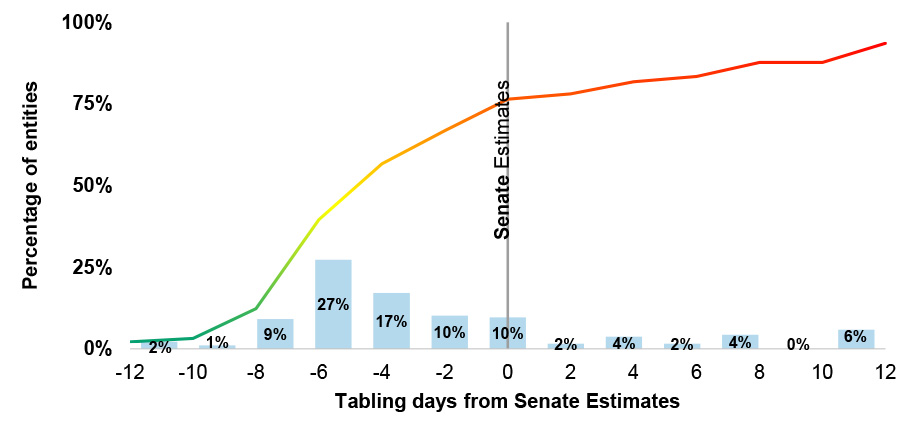

Timeliness of financial reporting

6. Annual reports that are not tabled in a timely manner before budget supplementary estimates hearings decrease the opportunity for the Senate to scrutinise an entity’s performance. There has been a decline in the number of entities that tabled an annual report prior to the portfolio’s Senate estimates hearing. Sixty-six per cent of entities that are required to table an annual report in Parliament tabled prior to the date that the portfolio’s Senate estimates hearing commenced (2021–22: 74 per cent). Of the entities required to table an annual report, 13 per cent (2021–22: 8 per cent) had not tabled an annual report as at 30 November 2023 (see paragraphs 2.164 to 2.174).

Internal audit

7. Internal audit plays an important role in providing assurance over an entity’s system of risk management and internal control. Although not mandated, the majority of entities had established an internal audit function. The ANAO reviewed the structure of and coverage provided by internal audit. Identified areas for improvement include: adopting formal audit committee charters; developing and monitoring internal audit budgets to determine they are fit for purpose and considering appropriate organisational structure for the officer overseeing the internal audit function (see paragraphs 2.35 to 2.58).

8. Twenty-one per cent of entities decreased their internal audit budget in the period 2020–21 to 2022–23. There were 2,687 internal audits undertaken by Commonwealth entities between 2020–21 and 2022–23. Most internal audits completed focused: systems of risk management and governance; information, communications and technology, project and program management; and financial controls. Over this period there was a decrease in internal audits completed on procurement and information, communications and technology, but an increase in internal audits completed on cyber security and performance reporting (see paragraphs 2.59 to 2.76).

9. There is an opportunity for the Australian Government to consider whether guidance relating to the implementation and delivery of internal audit would be beneficial to enhance the Australian Government’s system of internal control.

Emerging technology

10. Use of emerging technologies in the sector requires governance thinking. Emerging technologies, such as Artificial Intelligence, Machine Learning and Robotic Process Automation present opportunities for improvement and innovation, and risks. Thirty-six entities advised the ANAO that they had adopted some form of emerging technology. The majority of entities adopting these technologies did not create policies or a governance framework to support their use of these technologies, or have regard to external policies guidance such as Australia’s eight Artificial Intelligence Ethics Principles. The lack of governance frameworks for managing the use of emerging technologies could increase the risk of unintended consequences (see paragraphs 2.27 to 2.31).

Summary of audit findings

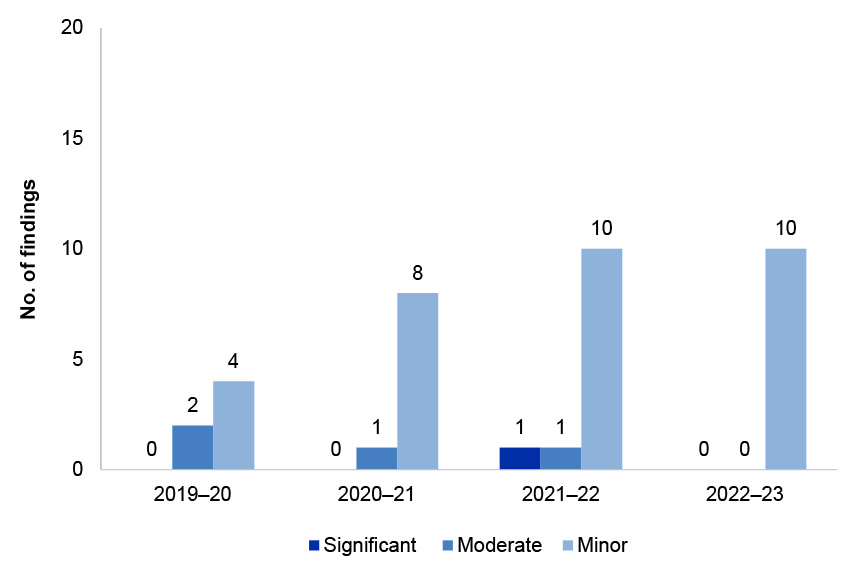

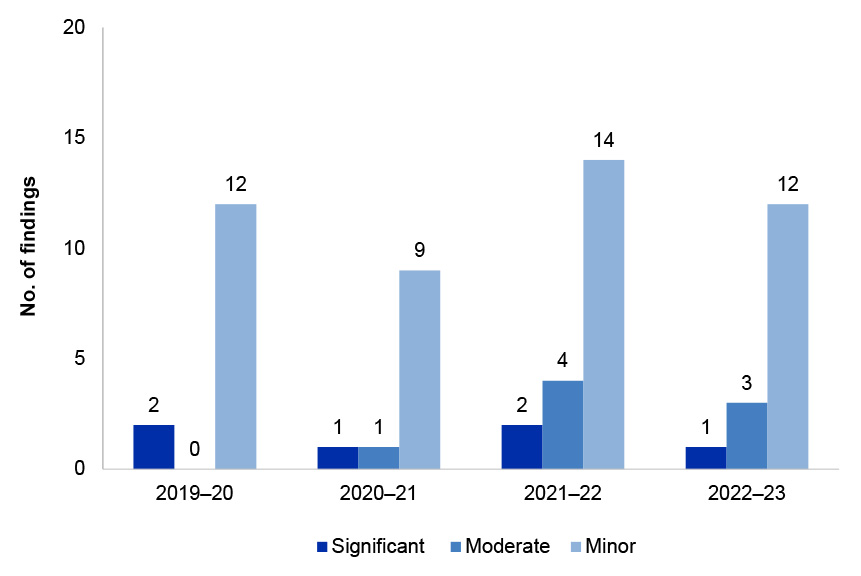

11. Total number of findings identified by the ANAO has decreased. A total of 196 findings were reported to entities as a result of the 2022–23 financial statements audits (a decrease from 2021–22). These comprised nine significant, 36 moderate, 137 minor findings and 14 legislative breaches. The highest number of findings are in the categories of:

- governance of legal and other matters impacting entity financial statements;

- IT governance including security, change management and user access; and

- accounting and control of non-financial assets.

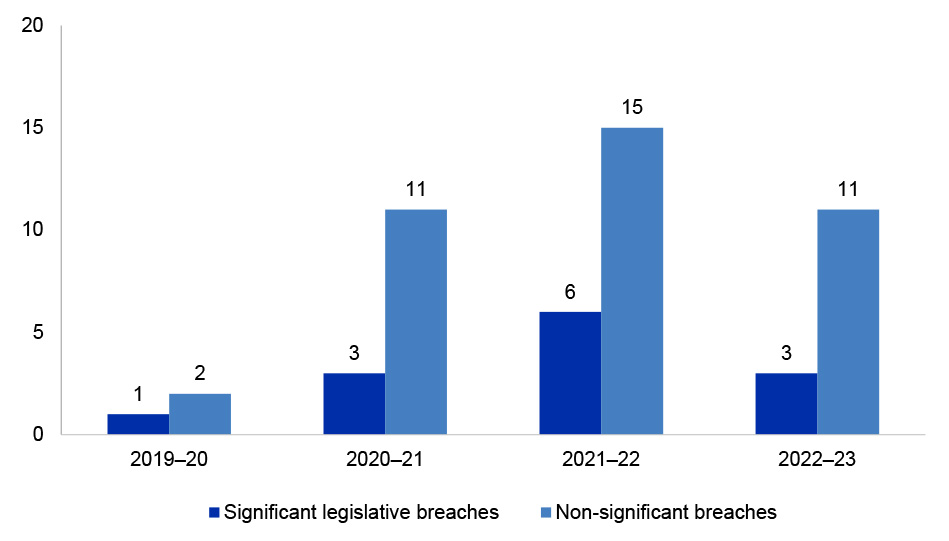

12. These audits findings included three significant legislative breaches, one of which was first identified since 2012–13. The majority of legislative breaches relate to incorrect payments of remuneration to key management personnel and/or non-compliance with determinations made by the Remuneration Tribunal. It is important that entities have a robust framework in place to govern payments made to executives to ensure that they are consistent with policy or legal requirements (see paragraphs 2.77 to 2.145).

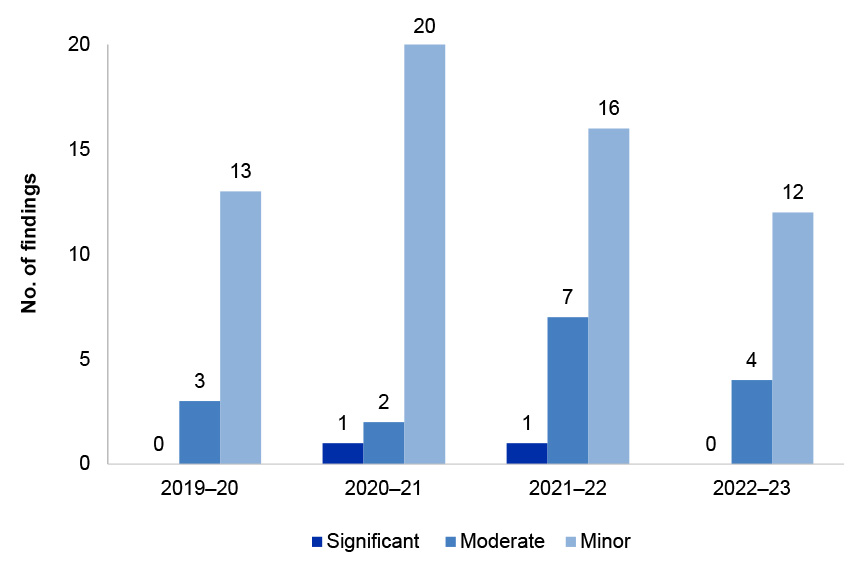

Governance of legal and other matters impacting financial statements

13. During 2022–23 the ANAO identified four significant audit findings across four entities in relation to weaknesses in financial statement preparation processes with respect to consideration of legal matters. These audit findings indicate a failure in governance supporting the preparation of the financial statements. These weaknesses included the assessment of the impact of the receipt of legal advice or recently determined legal matters which has the potential to affect an entity’s administration, financial management and financial reporting obligations. These findings highlighted instances where information on legal matters was not referred to entity Chief Financial Officers, or was not otherwise assessed for impact on the financial statements. In other instances evidence identified by the ANAO during the course of the audits did not accord with management representations and additional audit work was required to be undertaken by the ANAO. The ANAO recommended that the entities design, document and implement processes to ensure legal and other matters are considered when preparing financial statements and that all matters identified for consideration are communicated to the ANAO (see paragraphs 2.110 to 2.111).

Information Technology governance

14. In 2022–23 there was an increase in the number of audit findings relating to weaknesses in change management policies and controls for IT systems. The ANAO found that 78 per cent of entities assessed do not have an effective control to monitor access or activity in entities’ systems after user cessation (see paragraphs 2.89 to 2.101).

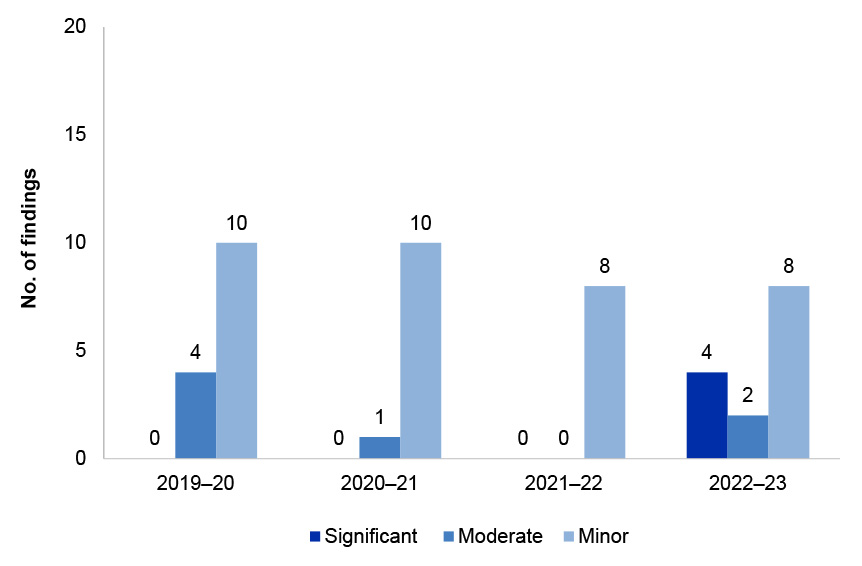

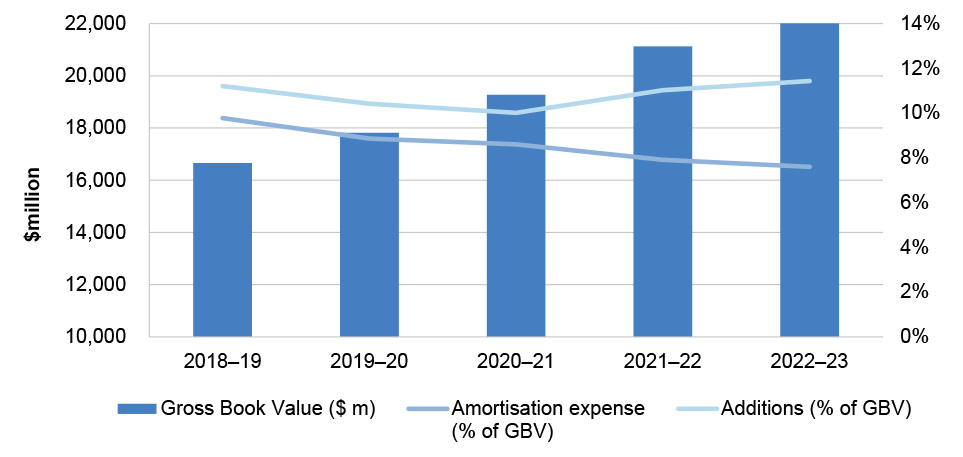

Accounting for computer software

15. Accounting for computer software requires improvement. The value of computer software recognised by entities totalled $22.1 billion at 30 June 2023. Entities have recorded a cumulative write-downs and impairment of $789.1 million in the period 2019–20 to 2022–23. During 2022–23 the ANAO identified an increase in weaknesses in entity processes for accounting for computer software, particularly with respect to Software as Service, impairment and software under construction. The significance of the investment in computer software and the nature of the findings identified indicate that there are opportunities for entities to improve quality assurance frameworks supporting accounting for computer software (see paragraphs 2.118 to 2.125).

Financial sustainability

16. An assessment of an entity’s financial sustainability can provide an indication of financial management issues or signal a risk that the entity will require additional or refocused funding. The ANAO’s analysis concluded that the financial sustainability of the majority of entities was not at risk. There would be benefit in the Australian Government developing financial sustainability performance targets or benchmarks. This would enable an entity to assess its own financial sustainability against agreed parameters over time, and against like entities (see paragraphs 2.175 to 2.205).

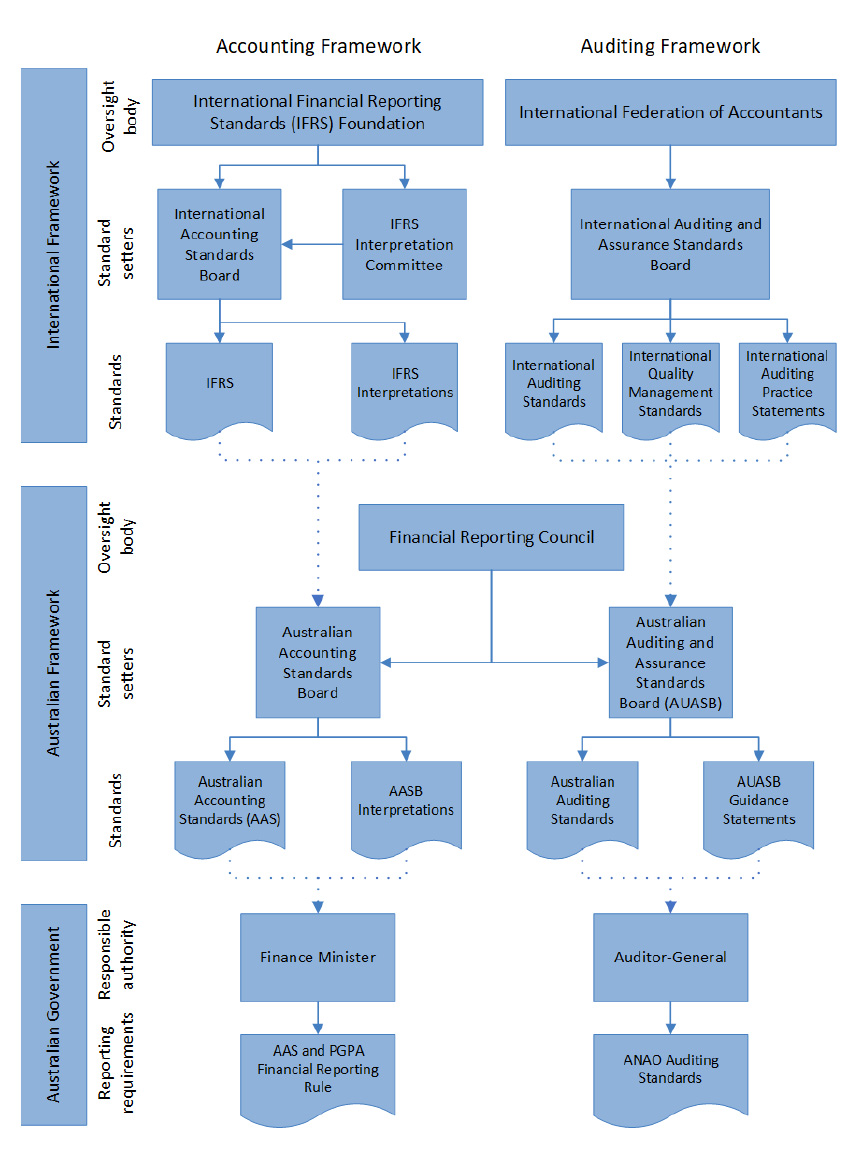

Reporting and auditing frameworks

Changes to the Australian public sector reporting framework

17. There are no significant changes to accounting standards affecting the Commonwealth for 2022–23. The revised requirements for Australian Auditing Standard ASA 315 Identifying and Assessing the Risks of Material Misstatement effective for financial years commencing 2022–23 have been incorporated into the ANAO’s audit methodology. The application of ASA 315 by the ANAO has resulted in the identification of an increased number of areas of weakness in entities’ use of and reliance on IT (see paragraphs 3.6 to 3.8).

18. Sustainability reporting is also a rapidly emerging area of interest, and the ANAO is contributing to discussions as reporting and assurance standards. Key developments in sustainability reporting and assurance included the issuance of international sustainability reporting and assurance standards and release of exposure drafts of Australian sustainability reporting and assurance standards. The Department of the Treasury commenced development of a broad sustainable finance reporting framework for Australia which includes climate-related financial disclosures, and the Department of Finance commenced related work to implement appropriate arrangements for Commonwealth public sector entities and companies to disclose exposure to climate-related risks develop (see paragraphs 3.12 to 3.18).

19. The ANAO quality assurance framework has been updated to ensure compliance with the new and revised Australian Quality Management Standards effective 15 December 2022. The revised standards introduce a framework for quality management that is focused on proactively identifying and responding to quality risks (see paragraphs 3.25 to 3.31).

20. Data analytics continues to be a focus for the ANAO, and audits undertaken in 2022–23 have continued to build on previous initiatives to enhance audit quality and efficiency (see paragraphs 3.32 to 3.39).

Cost of this report

21. The cost to the ANAO of producing this report is approximately $430,000.

1. The Consolidated Financial Statements

Chapter coverage

This chapter outlines the results of the audit of the Consolidated Financial Statements (CFS) of the Australian Government, which includes the Whole of Government (Australian Government) and the General Government Sector (GGS) financial statements for the year ended 30 June 2023.

This chapter also includes:

- the key audit matters (KAM) reported for the Australian Government;

- an analysis of the Australian Government’s financial outcome and financial position; and

- an analysis of other matters identified during the audit of the CFS.

Audit results

The 2022–23 CFS was signed by the Minister for Finance on 15 November 2023 and the Auditor-General’s unmodified auditor’s report was issued on 17 November 2023.

There were no significant or moderate audit findings identified in the audit of the CFS in 2021–22 or 2022–23.

The Australian Government reported a net operating balance of a surplus of $24.9 billion ($20.6 billion deficit in 2021–22). The surplus is mainly due to growth in taxation revenue. Revenue grew by $73.2 billion (11.9 per cent) while expenses grew by $27.7 billion (4.4 per cent).

The Australian Government’s net worth deficiency decreased from $608.7 billion in 2021–22 to $570.2 billion in 2022–23 mainly due to the operating surplus and revaluation gains recorded during the year.

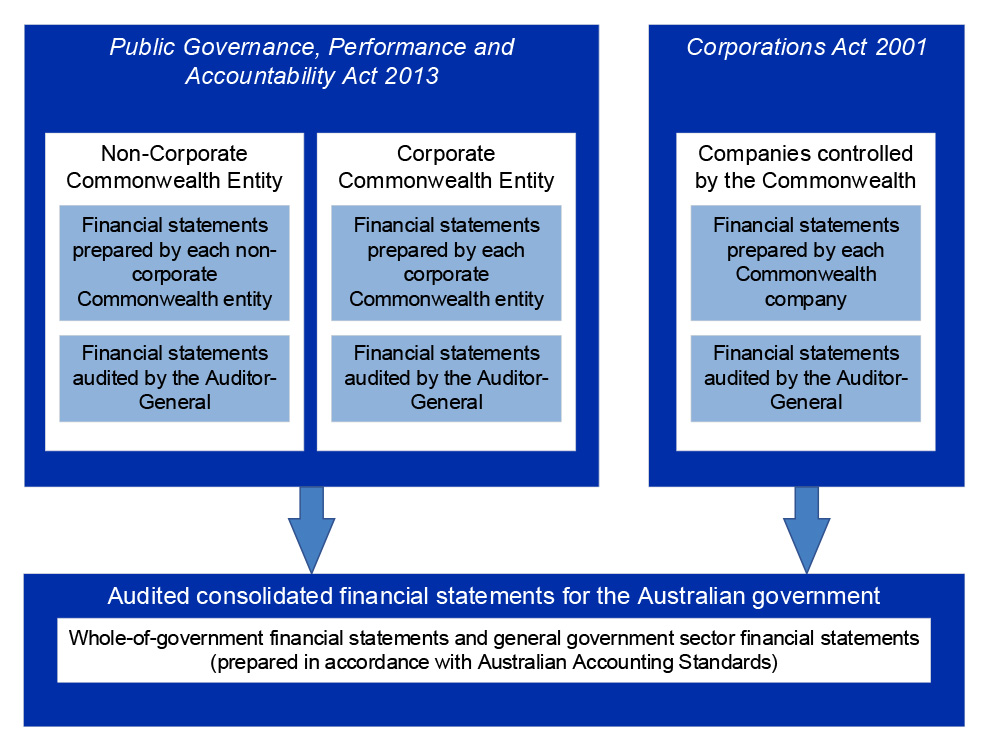

Background

1.1 Government accountability and transparency is supported by the preparation and audit of the Australian Government’s CFS. The CFS and the associated financial analysis provide information to assist users in assessing the financial performance and position of the Australian Government. The CFS is prepared by the Department of Finance (Finance) and issued by the Minister for Finance.

1.2 The CFS presents the consolidated whole of government financial results which includes the results of all Australian Government controlled entities, as well as the GGS financial statements. The 2022–23 CFS is prepared in accordance with section 48 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the requirements of the Australian Accounting Standards, particularly AASB 1049 Whole of Government and General Government Sector Financial Reporting (AASB 1049).

1.3 AASB 1049 requires, with limited exceptions, the principles and rules in the Australian Bureau of Statistics’ Government Finance Statistics (GFS) Manual to be applied in the preparation of the CFS where compliance with the GFS Manual would not conflict with Australian Accounting Standards.

Key areas of financial statements risk

1.4 The ANAO’s 2022–23 audit approach identified six key areas of financial statements risk that had the potential to impact the Australian Government and which were considered Key Audit Matters (KAM).

Table 1.1: Key areas of financial statements risk

|

Relevant financial statement itema |

Key audit matters |

Audit risk rating |

Factors contributing to the risk assessment |

|

Taxation revenue $617.4 billion Australian Taxation Office |

Accuracy of taxation revenue |

Higher |

|

|

Personal benefits expense $142.8 billion Department of Education Department of Health and Aged Care Department of Social Services |

Accuracy and occurrence of personal benefits expense |

Higher |

|

|

Superannuation liabilitiesb $313.1 billion Department of Defence Department of Finance |

Valuation of superannuation liabilities |

Higher |

|

|

Collective investment vehicles (component of investments, loans and placements) $114.8 billion Future Fund Management Agency Department of Finance |

Valuation of collective investment vehicles |

Moderate |

|

|

Specialist Military Equipment (SME) $84.6 billion Department of Defence Other plant, equipment and infrastructure $78.8 billion Numerous entities |

Valuation of specialist military equipment and other plant, equipment and infrastructure assets |

Moderate |

|

|

Australian Government Securities $574.0 billion Australian Office of Financial Management (AOFM) |

Valuation and disclosure of Australian Government Securities |

Moderate |

|

Note a: Figures presented in Table 1.1 may differ from the financial statements of individual entities because of eliminations and adjustments at the CFS level or where the entities identified contribute a majority to the balance of the financial statement line item.

Note b: These are the main government entities responsible for administration and reporting of Australian Government superannuation liabilities. Liabilities also include schemes managed by other entities, such as the Australian Postal Corporation.

Source: ANAO 2022–23 audit results, and the CFS for the year ended 30 June 2023.

Audit results

1.5 The 2022–23 CFS was signed by the Minister for Finance on 15 November 2023 and the Auditor-General’s unmodified auditor’s report was issued on 17 November 2023.

1.6 There were no significant or moderate audit findings arising from the 2021–22 or 2022–23 financial statements audits of the CFS.

Australian Government’s financial outcome

1.7 The following provides analysis of key financial balances for the Australian Government.

Operating result

1.8 The following key financial measures were reported for 2022–23:

- net operating balance was a surplus of $24.9 billion (compared to a deficit of $20.6 billion in 2021–22);

- operating result was a surplus of $13.7 billion (compared to a surplus of $28.3 billion in 2021–22); and

- comprehensive result (change in net worth) was an increase in net worth of $38.4 billion (compared to an increase of $135.8 billion in 2021–22).

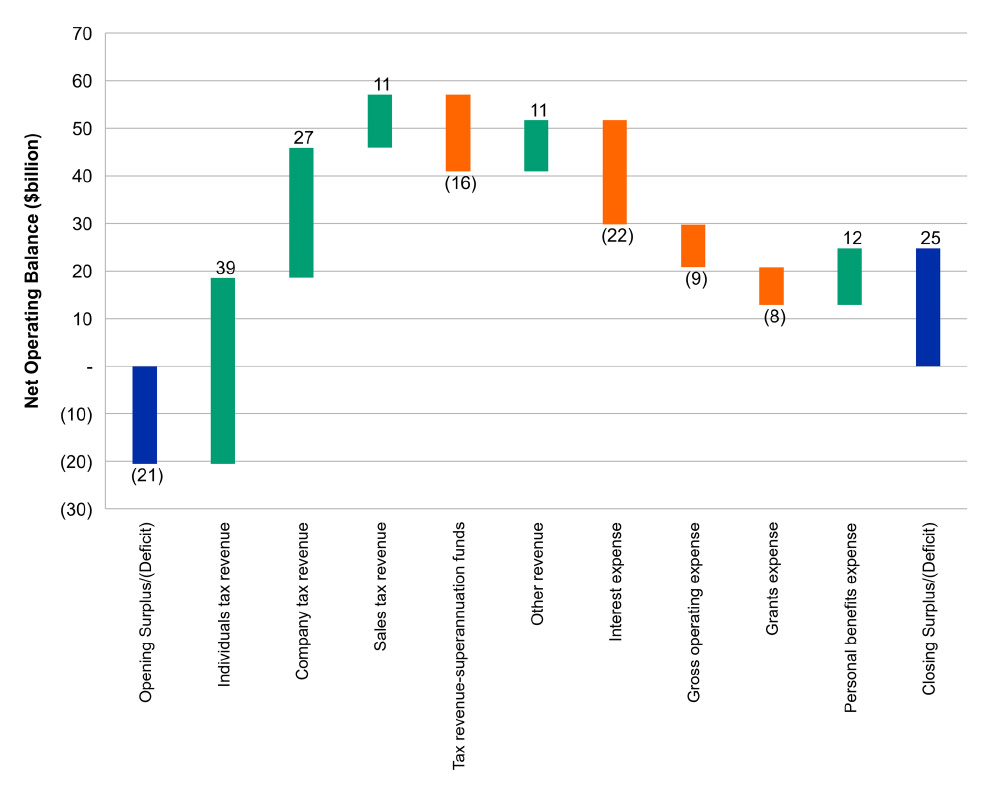

1.9 Figure 1.1 presents the changes in the Australian Government’s net operating balance from 1 July 2022 to 30 June 2023.

Figure 1.1: Changes in the Australian Government’s net operating balance from 1 July 2022 to 30 June 2023

Source: ANAO analysis of the 2022–23 CFS.

1.10 Table 1.2 provides commentary on the main contributors to the change in net operating balance of the Australian Government identified in Figure 1.1.

Table 1.2: Explanation of key movements in net operating balance

|

Relevant financial statement item |

Explanation for key movements in net operating balance |

|

Individuals tax revenue |

There has been a $39.1 billion increase in individual taxation revenue as a result of stronger growth in employment and wages, interest rates and capital gains. |

|

Company tax revenue |

Company income tax revenue increased by $27.3 billion across various industries, particularly the mining sector due to higher commodity prices during the year. |

|

Sales tax revenue |

Sales taxes comprise the Goods and Services Tax (GST), wine equalisation and luxury car taxes. The increase was due mainly to increased GST of $11.0 billion due to strong collections from various industries and a stronger economy leading to increased consumption. |

|

Superannuation funds tax revenue |

Superannuation funds tax revenue has decreased by $16.2 billion. The prior year revenue saw an increase due to higher contributions and returns from a stronger economy. The gains were not reflected in 2022–23 due to lower investments returns and higher foreign exchange losses. |

|

Other revenue |

Other revenue has increased by $11.0 billion as a result of:

|

|

Interest expense (including superannuation interest) |

There was an increase of $21.9 billion in interest and superannuation interest expenses for:

|

|

Gross operating expense |

The increase in gross operating expenses was largely driven by an increase in benefits to households of $9.0 billion as a result of:

|

|

Grants expense |

Grants expenses has increased by $7.8 billion mainly to:

|

|

Personal benefits expense |

Personal benefits have decreased by $11.7 billion as a result of the following offsetting factors:

|

Source: ANAO analysis of 2022–23 CFS.

1.11 There were instances of expenditure brought forward into 2022–23 that impacted on the underlying cash balance. The cash payments in 2022–23 were as a result of decisions by the Australian Government to make payments before 30 June 2023. The impact of these payments was to reduce the underlying cash balance (surplus) at 30 June 2023, however, except for the last item, they have not impacted the net operating balance, as disclosed in the CFS as discussed below:

- $2.3 billion in prepayments under the Disaster Recovery Funding Arrangement made by the Department of Treasury. This decreased the provision for disaster recovery payments but resulted in a decrease in the underlying cash balance;

- $0.5 billion in prepayments relating to foreign military sales, the procurement of ICT hardware and the purchase of additional marine diesel fuel by the Department of Defence. These payments reduced the underlying cash balance; and

- $0.4 billion increase in Financial Assistance Grants under national recovery payments, as a result of a bring-forward amount from 75 per cent in 2021–22 to 100 per cent in 2022–23 to assist with the national recovery from COVID-19 and natural disasters. These payments reduced the operating result and underlying cash balance.

Classification of expenses by the functions of Government

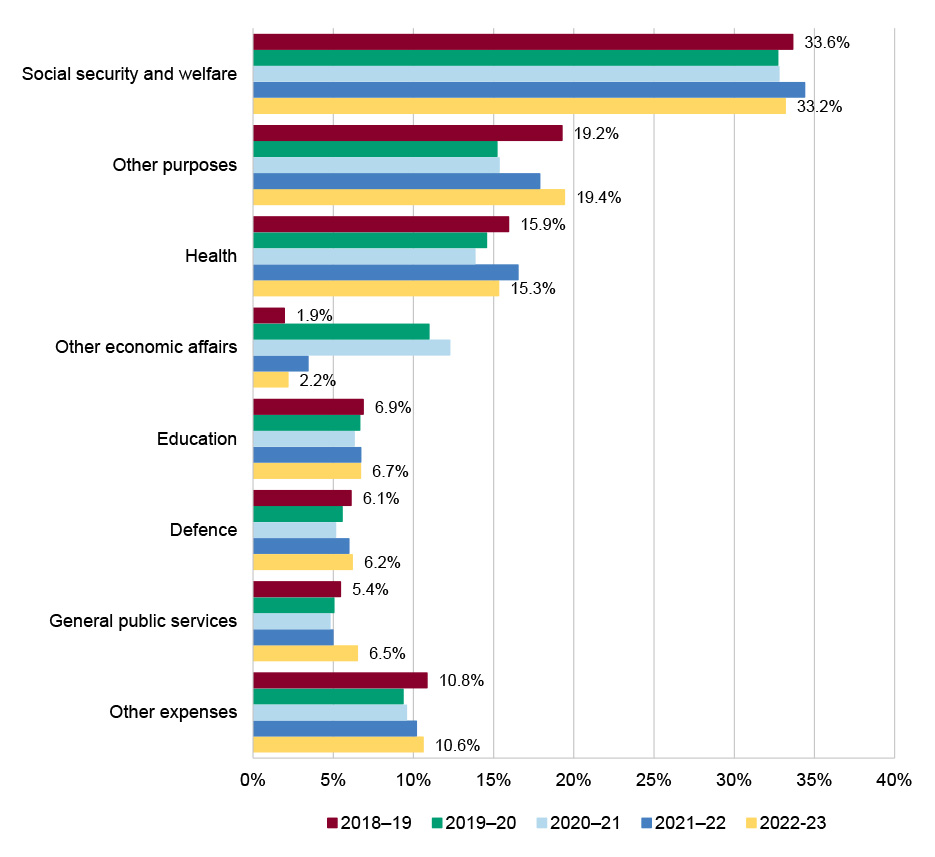

1.12 Figure 1.2 provides an analysis of the Australian Government’s expenses by function from 1 July 2018 to 30 June 2023. As a percentage of total expenses, each function has remained stable during this period, except for:

- ‘Other purposes’: Payments to States – Increased due to additional General Revenue Assistance from Treasury for increased payments under national partnership agreements and for GST distribution;

- ‘Other economic affairs’: During 2019–20 and 2020–21 the ‘Other economic affairs’ function included higher expenses due to the JobKeeper and cashflow boost payments which supported businesses and individuals impacted by the effects of the COVID-19 pandemic. The percentage of expenditure has returned to pre-pandemic levels by 2022–23; and

- ‘General public services’: The movement is the result of a $12.3 billion increase in interest paid by RBA for the exchange settlement accounts as discussed in Table 1.2.

Figure 1.2: Proportion of expenses of Government by function from 2018–19 to 2022–23

Note a: The ‘Other purposes’ function includes interest on Australian Government debt.

Note b: The ‘Other economic affairs’ function represents non-standard payments including storage, tourism promotion, labour market assistance to industry and industrial relations.

Note c: ‘Other expenses’ includes payments to: agriculture, forestry and fishing; fuel and energy; housing and community amenities; mining, manufacturing and construction; public order and safety; recreation and culture; transport and communications.

Source: ANAO analysis of the CFS from 2018–19 to 2022–23.

Australian Government’s financial position

Net worth

Changes in the Australian Government’s net worth from 1 July 2022 to 30 June 2023

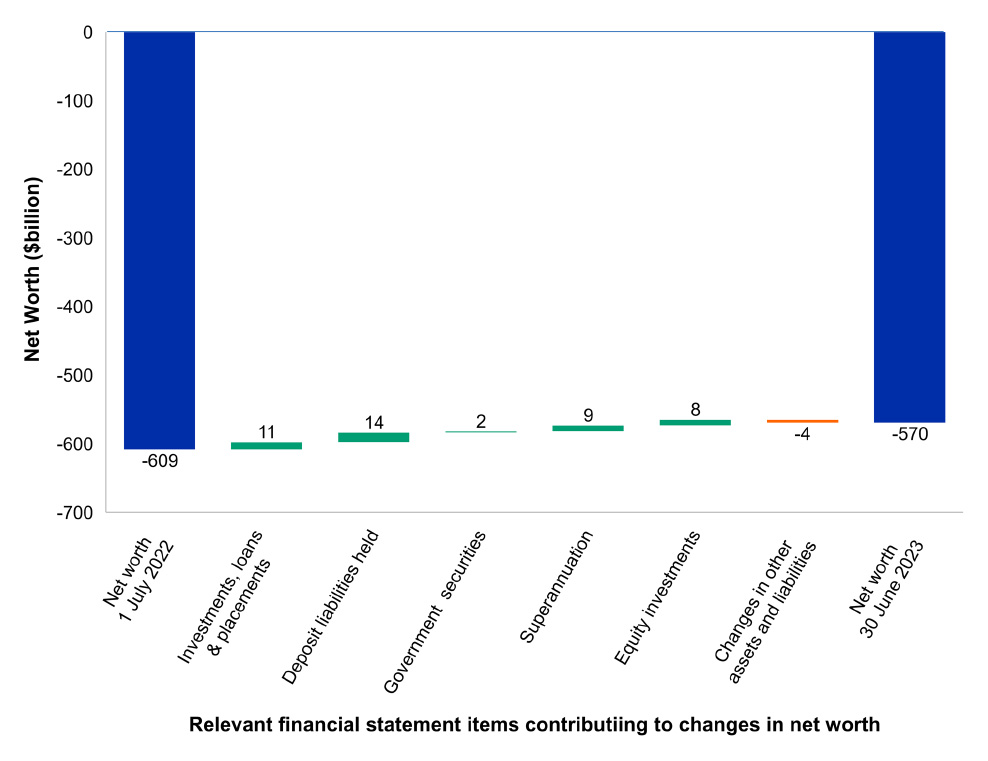

1.13 The Australian Government’s net worth deficiency reduced from $608.7 billion in 2021–22 to $570.2 billion in 2022–23. Figure 1.3 provides an analysis of the movement in net worth from 1 July 2022 to 30 June 2023.

Figure 1.3: Changes in the Australian Government’s net worth from 1 July 2022 to 30 June 2023

Source: ANAO analysis of the 2022–23 CFS.

1.14 Table 1.3 provides commentary on the main contributors to the change in net worth of the Australian Government identified in Figure 1.3.

Table 1.3: Explanation of key movements in net worth

|

Relevant financial statement item |

Explanation for key movements in net worth |

|

Investments, loans & placements |

There has been an $11.1 billion increase in investments, loans and placements mainly due to an increase in non-Australian government securities held by RBA for monetary policy objectives and International Monetary Fund (IMF) funding commitments. |

|

Deposit liabilities held |

The RBA operates an exchange settlement account (deposits) which are provided to financial institutions to settle financial obligations arising from the clearing of payments, while state and foreign governments may also hold deposits at RBA. The decrease of $13.5 billion is primarily due to scheduled maturities of the Term Funding Facility (TFF). The TFF was established by the RBA as a response to the pandemic to offer low-cost three-year funding to authorised deposit-taking institutions (ADIs). The facility was closed to new drawdowns on 30 June 2021 and will continue to decrease until 2023–24. |

|

Government securities |

There has been a $1.6 billion decrease1 in government securities (and similar decrease in face value of securities on issue) during the year reflecting the requirement for less securities to be issued due to the Australian Government’s operating surplus. |

|

Superannuation liabilities |

The valuation of the Australian Government’s defined benefit superannuation liability decreased by $8.9 billion primarily due to an increase in the discount rate that has been applied in the calculation of the liability. The discount rate applied in the calculation of superannuation liabilities is consistent with the long-term Australian Government bond rate which increased during the period. |

|

Equity investments |

Equity investments primarily comprise of the Future Fund’s holdings of listed equities and listed managed investment schemes. There was an $8.2 billion increase in the value of these investments due to an overall increase in amounts invested and the improvements in the performance of underlying equity markets. |

|

Changes in other assets and liabilities |

There has been a net decrease of $4.5 billion from movements of other assets and liabilities, the key drivers are:

|

Source: ANAO analysis of 2022–23 CFS.

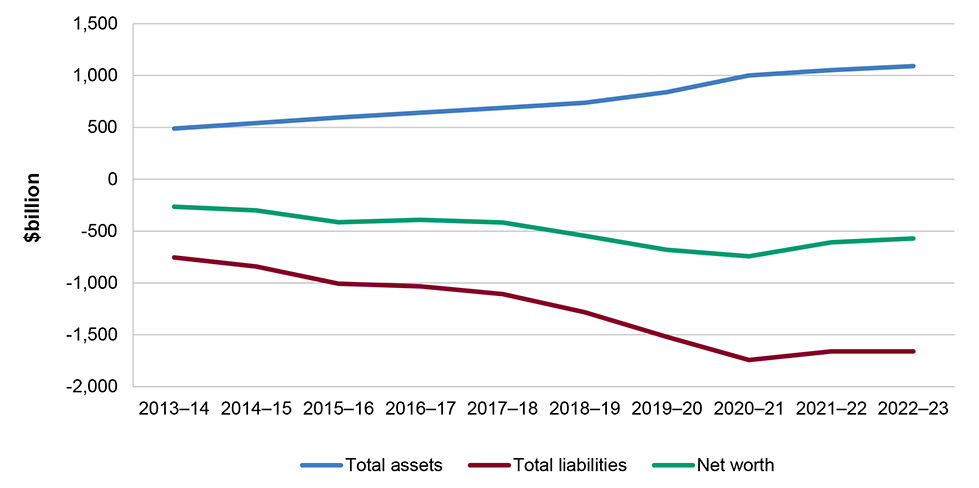

Changes in the Australian Government’s net worth from 2013–14 to 2022–23

1.15 Figure 1.4 illustrates the total assets, total liabilities and net worth of the Australian Government since 2013–14. During the period:

- Total assets: increased from $489.8 billion to $1,090.3 billion;

- Total liabilities: increased from $754.1 billion to $1,660.6 billion; and

- Net worth: net worth position decreased, from a deficit of $264.3 billion to a deficit of $570.2 billion.

Figure 1.4: Australian Government’s total assets, total liabilities and net worth, from 2013–14 to 2022–23

Source: ANAO analysis of the 2013–14 to 2022–23 CFS.

Government securities

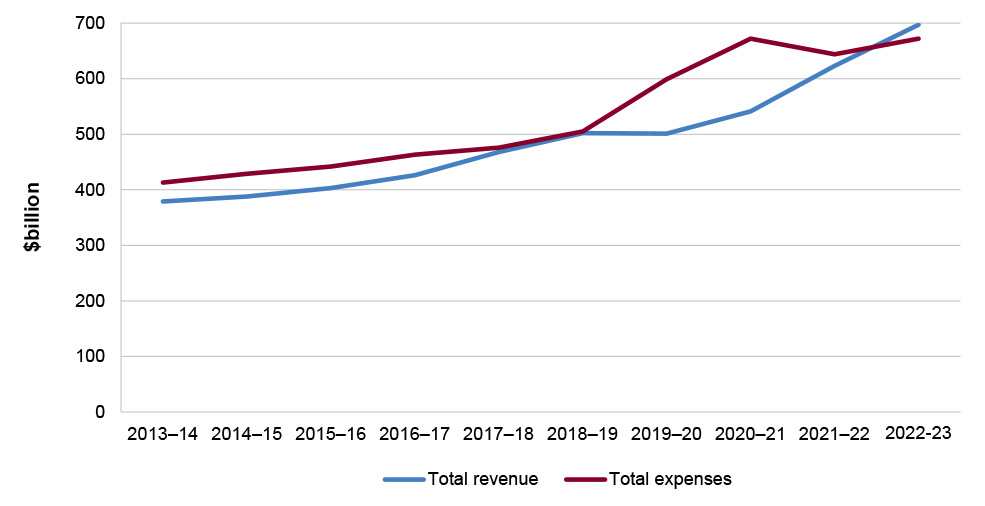

1.16 Government securities are primarily issued to meet the financing needs to the Australian Government and are issued to fund the operations of the Australian Government because over the period from 2013–14 to 2021–22, the Australian Government’s expenses have been greater than revenue it received. During 2022–23, this trend has been reversed with revenue exceeding expenses for the first time in 15 years. Figure 1.5 below illustrates the trend of Australian Government revenue and expenses over the period 2013–14 to 2022–23.

Figure 1.5: Australian Government revenue and expense for the period 2013–14 to 2022–23

Source: ANAO analysis of the 2013–14 to 2022–23 CFS.

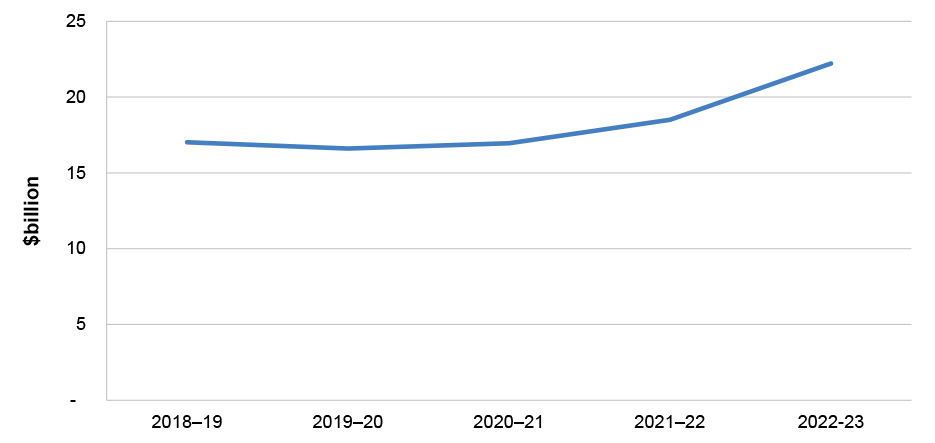

1.17 AOFM is responsible for managing the Australian Government Securities which totalled $825.5 billion in Government Securities for the GGS, comprised of Treasury Bonds, Treasury Indexed Bonds and Treasury Notes, at 30 June 2023. The value of the Australian Government’s Debt is $574.7 billion due largely to the RBA holding a portion of Government Securities on issue. Figure 1.6 shows that the interest paid by AOFM for Australian Government securities on issue, with an increasing interest expenses and an expectation that it will continue to increase in the short term.

1.18 Yields have increased which has had an impact on the interest cost on AOFM issued debt. Figure 1.6 demonstrates the interest paid by AOFM on Government Securities over the period five year period from 2018–19 to 2022–23. Interest repayments are forecast to grow over time as new bonds are issued at higher interest rates.

Figure 1.6: AOFM Government Securities Interest Paid from 2018–19 to 2022–23

Source: ANAO analysis of AOFM from 2018–19 to 2022–23.

Net debt

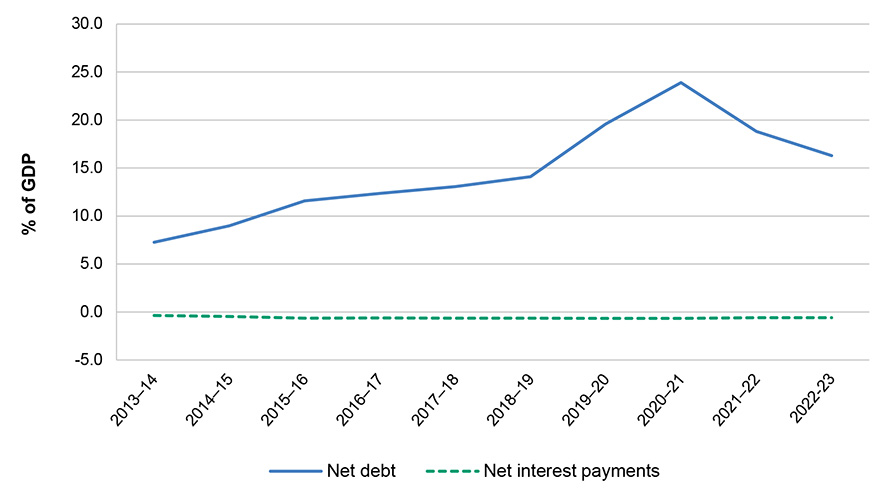

1.19 There was a steady growth in net debt as a percentage of Gross Domestic Product (GDP) since 2013–14, growing from 7.3 per cent and peaking in 2020–21 at 23.9 per cent due to the COVID-19 pandemic. Since this time there has been a decrease in the net debt position to 16.3 per cent of GDP in 2022–23. This improvement was the result of:

- the decrease of $13.4 billion in the fair value of Australian Government debt on issue due to rising interest rates;

- the decrease of $13.5 billion at the RBA primarily due to scheduled maturity of the Term Funding Facility following the COVID-19 pandemic; and

- the Australian Government’s surplus in 2022–23, for which the Government Securities on issue from the AOFM decreased by $1.6 billion.

1.20 Net interest payments were $14.9 billion in 2022–23 compared to $9.5 billion in 2021–22.2 Due to the size of the Australian Government’s debt portfolio and an environment of rising interest rate it is expected that there will be an increase in interest payments in the future.

1.21 Figure 1.7 illustrates the change in the indicators of the net financial position and net interest payments of the Australian Government from 2013–14 to 2022–23 as a percentage of GDP.

Figure 1.7: Australian Government net debt position as per cent of GDP, from 2013–14 to 2022–23

Source: ANAO analysis of 2022–23 commentary on the CFS.

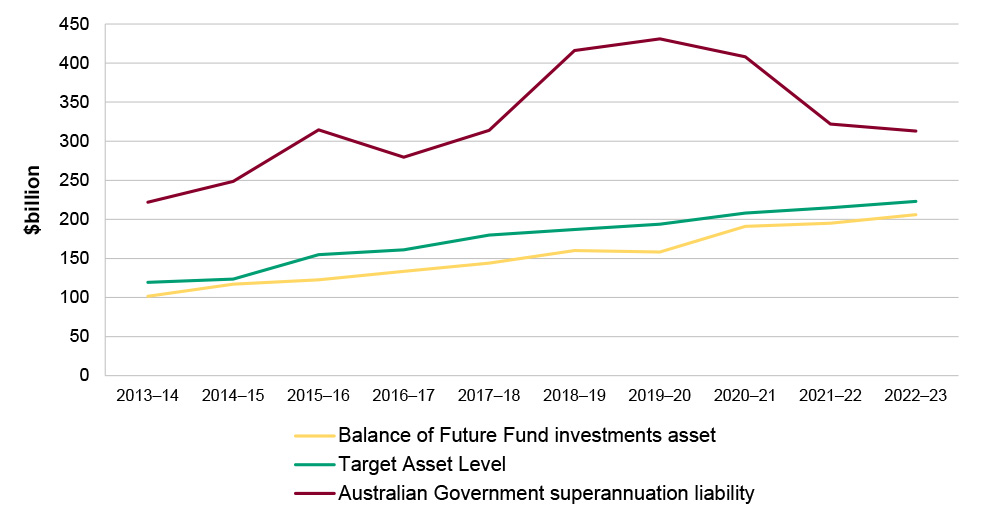

Superannuation liabilities and the Future Fund

1.22 The Australian Government has superannuation liabilities arising from obligations to employees for defined benefit superannuation schemes. Note 9C of the CFS provides information on the nature of these schemes. The total superannuation net liability for these schemes was $313.1 billion as at 30 June 2023 ($322.0 billion as at 30 June 2022). The significant balances of the reported net liability relate to the following schemes that are closed to new members:

- Commonwealth Superannuation Scheme ($69.5 billion);

- Public Sector Superannuation Scheme ($103.2 billion);

- Military Superannuation Benefits Scheme ($100.1 billion); and

- Defence Force Retirement and Death Benefits Scheme ($33.8 billion).

1.23 The primary reason for the decrease in the liability is the increase in the discount rate used in valuing the superannuation liability between 30 June 2022 and 30 June 20233. The long term nature of the superannuation liability means that small changes to the discount rate can have a large impact on the estimation of the value of the liability.

1.24 The Future Fund was established by the Future Fund Act 2006 to strengthen the Australian Government’s long-term financial position through the acquisition of financial assets and investments to assist in the discharge of the Australian Government’s superannuation liabilities. The Future Fund Board of Guardians is responsible for deciding how to invest the assets of the Future Fund through balancing the risk aspects of each investment mandate to maximise returns.

1.25 Figure 1.8 provides an overview of the balances of the Australian Government superannuation liabilities, the net investment balance of the Future Fund and the target asset level (TAL) from 2013–14 to 2022–23.

Figure 1.8: Total value of Australian Government superannuation liabilities and Future Fund investments, and the target asset level, from 2013–14 to 2022–23

Source: ANAO analysis of 2022–23 CFS and the Target Asset Level Declaration issued by the designated actuary of the Future Fund on 25 June 2021.

1.26 The TAL represents the best estimate of the assets required, together with investment earnings on those assets, which would be sufficient to meet unfunded superannuation benefit payments accrued up to the start of the financial year. The discount rate used to calculate the present value of future payments for TAL purposes represents the expected investment return on Future Fund assets. The Australian Government’s superannuation liability included in Figure 1.8 reflects the present value of future unfunded superannuation benefits payments discounted using the Commonwealth bond rate, in accordance with Australian Accounting Standards.

1.27 Figure 1.8 shows that the 2022–23 estimate of the TAL is $222.7 billion4, which is above the current Future Fund investment asset balance of $202.9 billion (2022: $195.1 billion). The Future Fund Act 2006 permits drawdowns when the balance of the Future Fund equals or exceeds the TAL. The Australian Government has previously announced it would delay drawdowns from the Future Fund until at least 2026–27.

Investments for policy purposes

1.28 The Australian Government reports fiscal aggregates including net operating balance and underlying cash. These aggregates exclude cash or accounting movements that are of an investment or financing nature, such as investments made for policy purposes and the fair value losses on these investments.

1.29 Investments made for policy purposes have elements of economic and social benefits in addition to providing commercial returns to the Australian Government. These investments are also referred to as alternative financing arrangements.

1.30 The Parliamentary Budget Office (PBO) has noted that — ‘under successive governments there has been a shift toward delivering more government policies using alternative financing arrangements rather than direct payments’.5 The Joint Committee of Public Accounts and Audit (JCPAA) conducted an inquiry into Alternative Financing Mechanisms and released its report in March 2022.6

1.31 The JCPAA recommended that the Minister for Finance ‘consider changes to improve transparency for equity investments’ consistent with proposed improvements identified by the PBO to budget documents to assist Parliament in scrutinising investments for policy purposes.

1.32 Segregating the commercial and non-commercial portions (economic and social benefits) of the investments to better reflect the implications on key fiscal aggregates in the financial statements would also be beneficial. This would better reflect the initial cost and/or losses expected on investments made for policy purposes where a sufficient rate of return is not expected, as losses in subsequent years would not be reflected in underlying cash balances.

1.33 This would improve transparency on where the Government for policy purposes, is investing and seeking a sufficient rate of return on equity compared with those circumstances where the Government is not investing to make a sufficient rate of return.

1.34 In response to the JCPAA’s recommendations, the Department of Finance introduced improvements to the transparency and disclosure in budget reporting of balance sheet items as part of the 2023–24 Budget. These improvements were made to enhance the understanding of the Australian Government’s financial position by parliamentarians and the public. These included:

- the disclosures of investments, loans and placements have been disaggregated in the 2023–24 budget papers to provide estimates for collective investment vehicles, residential mortgage-backed securities, and other interest-bearing securities. These disclosures correspond with the Consolidated Financial Statements;

- enhanced disclosure and analysis to show composition of balance sheet assets and liabilities and movements over time. The additional disclosures provide detail on the estimated balances of the Australian Government’s investment funds and superannuation schemes and the asset allocation of the Future Fund; and

- narrative disclosures on the definitions of equity investments have also been included in the budget papers and more guidance and resources have been published on the Department of Finance website7.

1.35 The Department of Finance has advised the JCPAA that it will continue to look for opportunities to improve the level of transparency and disclosure contained in the Budget Papers.8

1.36 The ANAO has reviewed the recommendation regarding better segregation of the commercial and non-commercial portions (economic and social benefits) of the investments to better reflect the implications on key fiscal aggregates (of underlying cash and net operating balance) in the financial statements. The impact of the equity injections on operations of these entities is not reflected in the net operating balance unless dividends are received from the entities. The ongoing valuations of these entities are reflected in net worth. If the valuation of these entities deteriorates (for example as a result of accumulating losses or the valuation of future cash flows associated with assets procured through equity injections being less than their purchase costs), the deterioration in the position will be reflected in the GGS’ net worth but not impact on the net operating balance even if the deterioration was a predictable result of a non-commercial policy decision. The Department of Finance should review the appropriateness of its return-on-investment forecast model to improve guidance on the accounting treatment of equity injections when the investment has elements of economic and social benefits.

|

Case study 1. Case study Australian Rail Track Corporation – Equity injections for the Inland Rail project |

|

The Australian Government provides financing for the Inland Rail project through the Australian Rail Track Corporation (ARTC). At 30 June 2023 the Australian Government was committed to invest a substantial amount of equity funding into ARTC to deliver the project (which is in early construction phases) with $1.0 billion in equity contributions provided in 2022–23. This is an example of alternative financing arrangements that requires an assessment of whether a sufficient rate of return can be generated from the investment to determine what portion reflects an economic transaction (equity investment) and which portion is for social benefits (grants expense). ARTC’s accounting policy for the assets constructed in relation to the Inland Rail Line is to impair the expenditure based on the forecast net present value of the project to nil value on the construction of Inland Rail. This impairment is based on the judgement that the discounted future net cash flows from the operation on the Inland Rail are less than the cost of construction. Impairment of the expenses relating to the Inland Rail assets amounted to $866.5 million in 2022–23. As the injection is made to an existing entity that achieves a real rate of return from existing operations, the injection of equity is treated as an investment asset. As a result, changes in value of the entity are reflected as a change in GGS net worth, but the cost of making the investment (if there is a social benefit portion) is not reflected in the GGS’s net operating balance or underlying cash balance. |

Definitions used in this chapter

1.37 Table 1.4 below provides a glossary of the key fiscal aggregates and other terminology used in this chapter to explain the Australian Government’s net worth and financial performance.

Table 1.4: Definitions of terms used

|

Name |

Definition |

|

Net operating balance |

This is calculated as income from transactions minus expenses from transactions. It is equivalent to the change in net worth arising from transactions. |

|

Operating result |

Income less expenses, excluding the components of other comprehensive income. Also known as ‘profit or loss’. The operating result includes the net operating balance plus items including net write-down of assets, net gains/(losses) from the sale of assets, net foreign exchange gains/(losses), net interest on derivatives gains/(losses), net fair value gains/(losses) and net other gains/(losses). |

|

Comprehensive result |

Total change in net worth before transactions with owners in their capacity as owners. Also known as ‘total change in net worth’. |

|

Fiscal balance |

The financing requirement of government, calculated as the net operating balance less the net acquisition of non-financial assets. A positive result reflects a net lending position and a negative result reflects a net borrowing position. Also known as net lending/ (borrowing). |

|

Net worth |

The net worth of the Australian Government is defined as assets less liabilities. |

|

Net debt |

Net debt is equal to gross debt minus the stock position in financial assets corresponding to debt instruments. The Department of Finance define net debt in the preface to the CFS as ‘the sum of deposits held, government securities, loans and lease liabilities less the sum of selected financial assets (cash and deposits, advances paid and investments, loans and placements). |

|

Government securities |

All securities issued by the Australian Government at tenders conducted by the AOFM. They comprise Treasury Bonds, Treasury Notes and Treasury Indexed Bonds. |

|

Investments for policy purposes |

Acquisitions of financial assets for policy purposes are distinguished from investments by the underlying government motivation for acquiring the assets. Where assets are acquired for the purpose of implementing or promoting government policy (e.g. loans to assist industry development), the acquisition of the assets is treated as being for policy purposes. Acquisition of financial assets for policy purposes includes government policies encouraging the development of certain industries or assisting citizens affected by natural disaster. |

|

Underlying cash balance |

Net cash receipts from operations (excluding net Future Fund earnings), less net capital investment (including by finance lease). |

Source: Australian Bureau of Statistics (2015). Australian System of Government Finance Statistics: Concepts, Sources and Methods; AASB 101 Preparation of Financial Statements, paragraph 5 and 7; AASB 1049 Whole of Government and General Government Sector Financial Reporting, Appendix A; and Reserve Bank of Australia (2017). Glossary RBA. [Internet], available from https://www.rba.gov.au/glossary/ [accessed 9 November 2023].

2. Financial audit results and other matters

Chapter coverage

This chapter provides a summary of the:

- 2022–23 auditor’s reports issued by the ANAO;

- observations regarding entities’ internal control environments;

- unadjusted and adjusted audit differences reported to entities during 2022–23;

- findings identified during the course of the 2022–23 financial statements audits of entities.

This chapter also provides analysis of the:

- quality and timeliness of financial statements preparation;

- timeliness of entities’ financial reporting;

- financial sustainability of material entities; and

- observations across the sector relating to: internal audit; adoption of emerging technologies by entities; removal of user access; IT change management; accounting for computer software and cost recovery arrangements.

Conclusion

The ANAO issued 241 unmodified auditor’s reports, including the Australian Government’s Consolidated Financial Statements (CFS). The financial statements were finalised and auditor’s reports issued for 91 per cent (2021–22: 86 per cent) of entities within three months of financial year-end.

For the majority of entities, at the completion of the final audits, key elements of internal control were operating effectively to provide reasonable assurance that the entities were able to prepare financial statements that were free from material misstatement. In 10 entities where significant audit findings were identified these findings reduced the level of confidence and assurance that could be placed on key elements of internal control. These significant audit findings mainly related to: governance of legal and other matters; and IT governance and controls.

Timeliness of tabling of entity annual reports declined

Sixty-six per cent (2021–22: 74 per cent) of entities that are required to table an annual report in Parliament tabled prior to the date that the portfolio’s supplementary budget Senate estimates hearing commenced. Twelve per cent of entities, a decrease from 2021–22, tabled annual reports one week or more before the hearing (2021–22: 52 per cent). Of the entities required to table an annual report, six per cent (2021–22: eight per cent) had not tabled an annual report as at 30 November 2023.

Timeliness of completed financial statements presented improved

Seventy-two per cent of entities delivered financial statements in line with an agreed timetable — an increase compared with 2021–22 (65 per cent). The total number of adjusted and unadjusted audit differences decreased during 2022–23, although 50 per cent of audit differences remained unadjusted. The quantity and value of adjusted and unadjusted audit differences indicate there remains an opportunity for entities to improve quality assurance frameworks over financial statements processes.

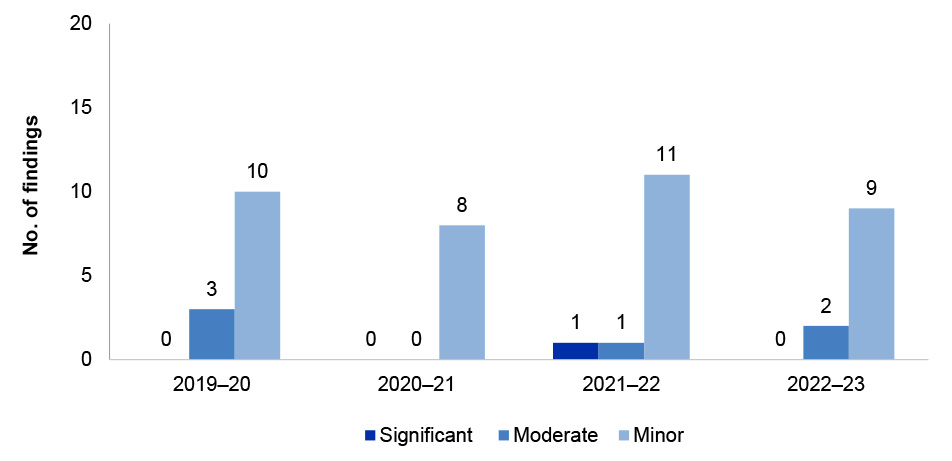

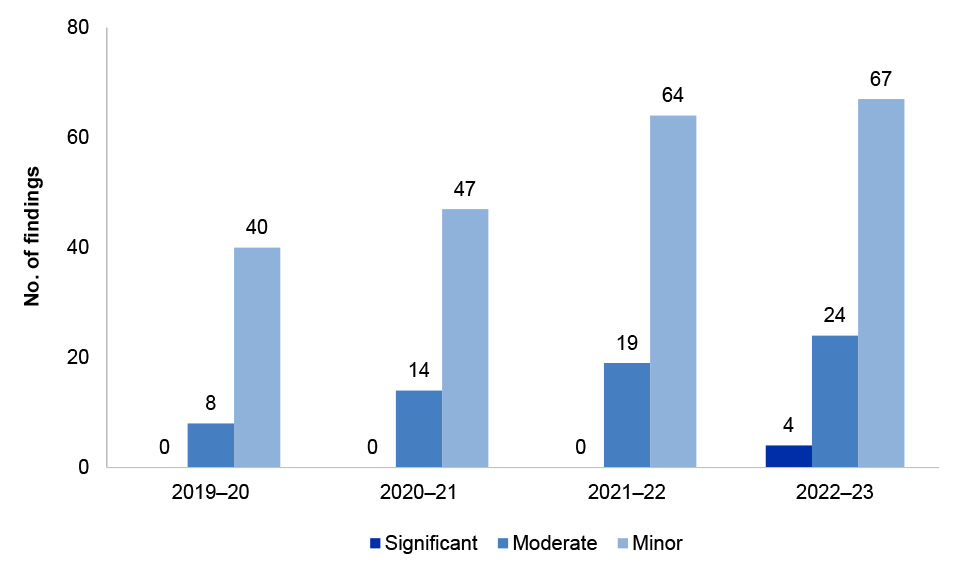

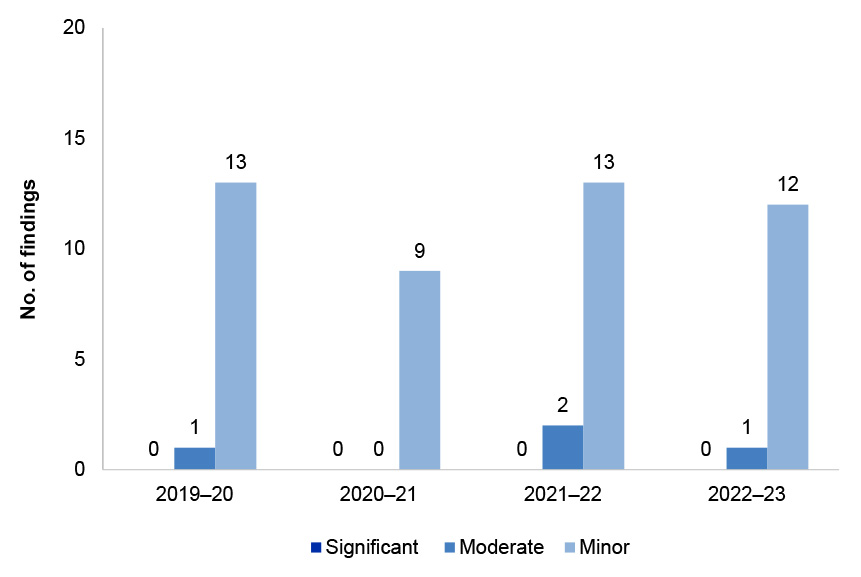

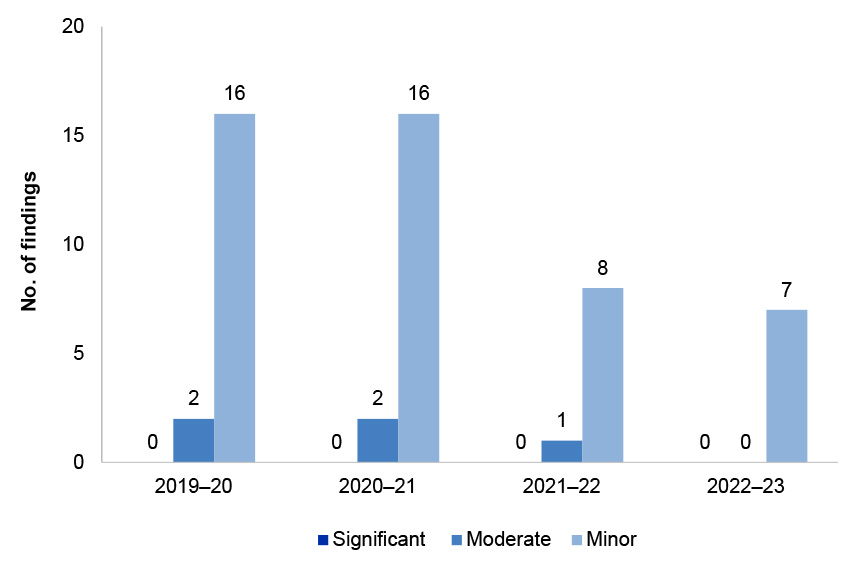

Total number of audit findings decreased

A total of 196 audit findings were reported to entities as a result of the 2022–23 financial statements audits (2021–22: 205). These comprised 9 significant (2021–22: 5), 36 moderate (2021–22: 35), 137 minor findings (2021–22: 144) and 14 legislative breaches (2021–22: 21). The highest number of significant and moderate findings are in the categories of: Governance of legal and other matters impacting entity financial statements; IT governance including security, change management and user access; and accounting and control of non-financial assets (including computer software).

IT controls remain a key issue

In 2022–23 there was an increase in the number of audit findings relating to weaknesses in change management policies and controls for IT systems.

The ANAO found that 78 per cent of entities assessed do not have an effective control to monitor access or activity in entities’ systems after user cessation.

Findings on governance

The ANAO identified four significant audit findings in relation weaknesses in four entities’ financial statement preparation process with respect to consideration of legal matters. These findings highlighted instances where information on legal matters was not referred to entity Chief Financial Officers, or was not otherwise assessed for impact on the financial statements.

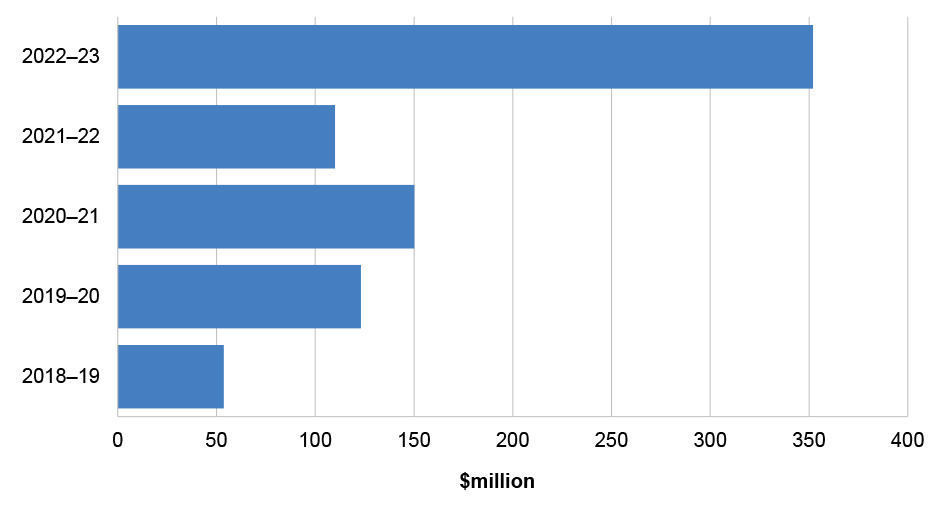

Accounting for computer software needs improvement

The value of computer software recognised by entities totalled $22.1 billion at 30 June 2023. Entities have recorded a cumulative write-downs and impairment of $789.1 million in the period 2019–20 to 2022–23. During 2022–23 the ANAO identified an increase in weaknesses in entity processes for accounting for computer software. and made and increased number of findings. There are opportunities for entities to improve quality assurance frameworks supporting accounting for computer software (particularly in relation to Software as a Service).

Legislative breaches

The majority of legislative breaches identified by the ANAO in 2022–23 relate to incorrect payments of remuneration to key management personnel and/or non-compliance with determinations made by the Remuneration Tribunal.

Internal audit

Eighty-four per cent of entities had established an internal audit function in 2022–23. Twenty-one per cent of entities decreased their internal audit budget in the period 2020–21 to 2022–23. There were 2,687 internal audits undertaken between 2020–21 and 2022–23. Identified areas for improvement include: adopting formal audit committee charters; developing and monitoring internal audit budgets to determine they are fit for purpose and considering appropriate organisational structure for the officer overseeing the internal audit function. There is an opportunity for the Australian Government to consider whether additional guidance relating to the implementation and delivery of internal audit would be beneficial to enhance the Australian Government’s system of internal control.

Use of emerging technologies in the sector requires governance thinking

Emerging technologies, such as Artificial Intelligence, Machine Learning and Robotic Process Automation present opportunities for improvement and innovation, as well as risks. Thirty-six entities advised the ANAO that they had adopted some form of emerging technology. The majority of entities adopting these technologies did not create policies or a governance framework to support their use of these technologies, or have regard to external policies guidance such as Australia’s eight Artificial Intelligence Ethics Principles. The lack of governance frameworks for managing the use of emerging technologies could increase the risk of unintended consequences

Financial sustainability in material entities remains sound

An analysis of the operating results and balance sheet positions for material entities concluded that the financial sustainability for the majority of those entities was not at risk. There would be benefit in the Australian Government developing performance targets or benchmarks. This would enable an entity to assess its own financial sustainability against agreed parameters over time, and against like entities.

Cost recovery impact statement compliance is largely in order

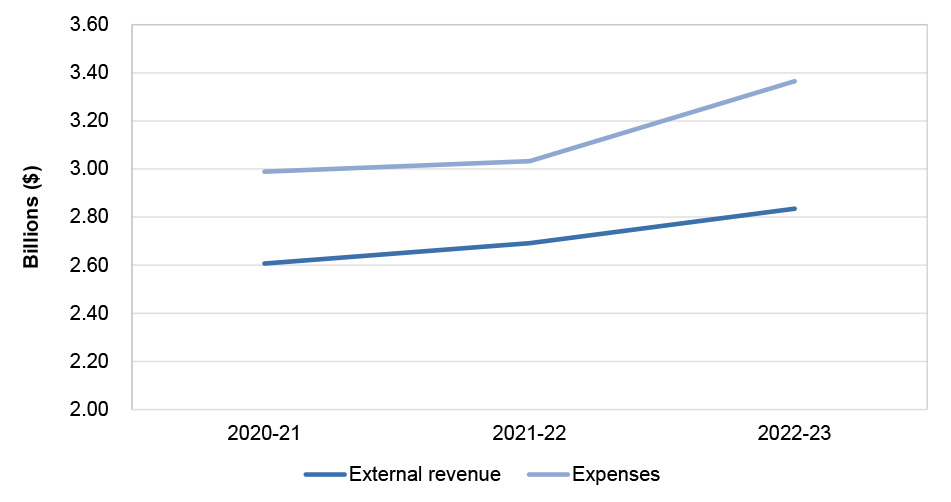

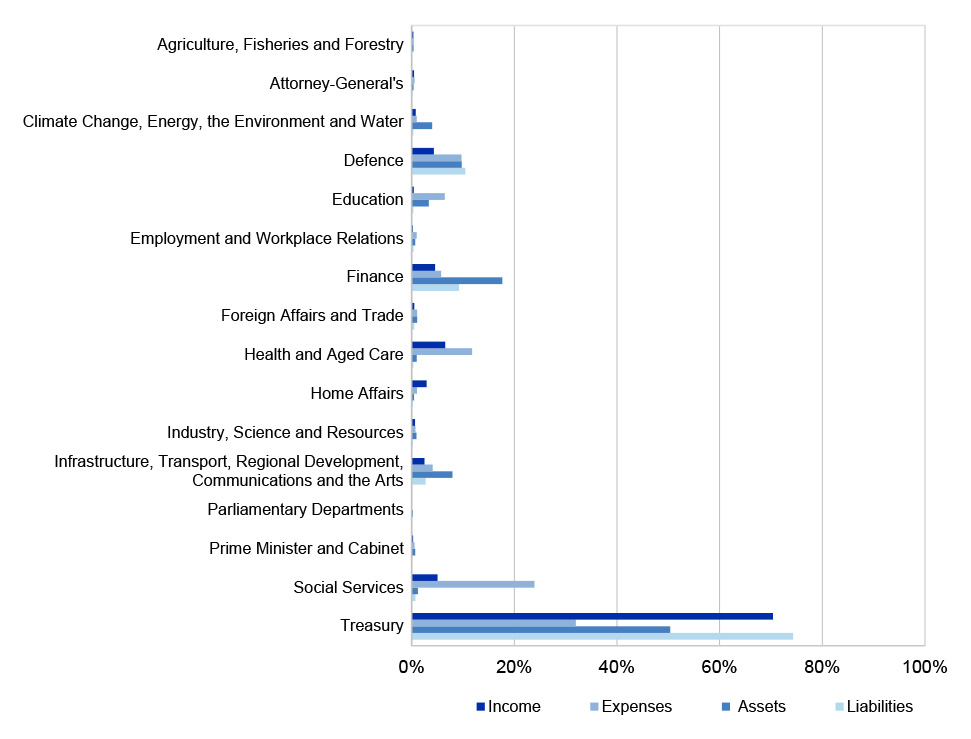

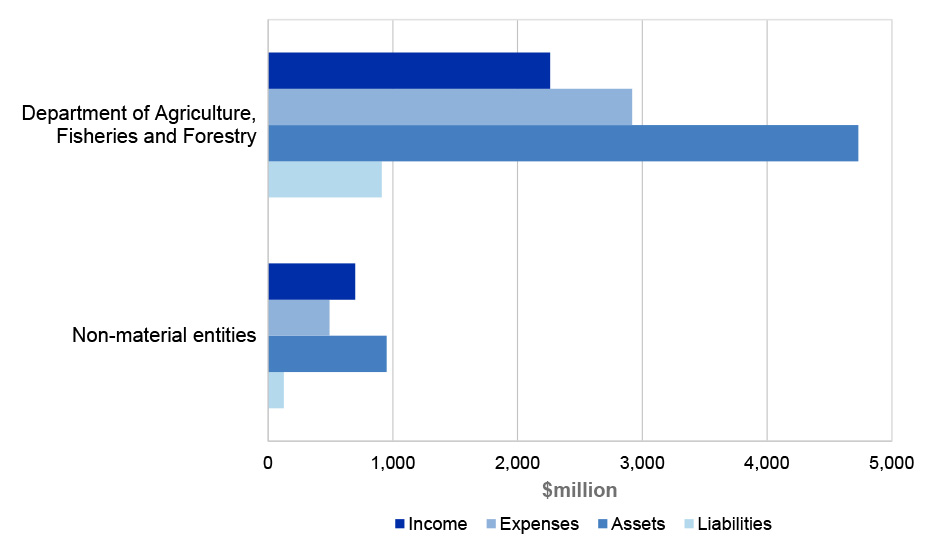

The ANAO’s analysis of cost recovered activities identified that entities largely complied with the requirements to prepare cost recovery implementation statements (CRIS) for each cost recovered activity in accordance with the Australian Government’s Cost Recovery Policy. Fifty-two per cent of entities had not updated their CRIS to include estimates of the 2022–23 financial year or the outcomes of the performance of the activity of the previous period. Expenses incurred in delivering cost recovered activities exceeded external revenue received for the period 2020–21 to 2022–23. Expenses in delivering cost recovered activities grew by 13 per cent over this period, while revenue increased by 9 per cent (net of partial funding from the Australian Government). There is an opportunity to for the Department of Finance to review current disclosure practices and provide additional guidance to Commonwealth entities to enhance relevant disclosures. Improvements in disclosures would enhance transparency of cost recovery financial performance.

Introduction

2.1 The Auditor-General is mandated by the Public Governance, Performance and Accountability Act 2013 (PGPA Act) to audit and form an opinion on the financial statements of all Commonwealth entities and companies (and their controlled subsidiaries).9 This chapter summarises the results of the 2022–23 financial statements audits and provides commentary on specific topics which relate to the governance and administration of entities.

Summary of 2022–23 auditor’s reports

At 30 November 2023 the ANAO issued 241 unmodified auditor’s reports, including the Australian Government’s Consolidated Financial Statements (CFS). There were no modified auditor’s reports in 2022–23 (2021–22: one). Ninety-one per cent of auditor’s reports were signed within three months of year-end compared to 86 per cent in 2021–22.

In 2022–23 a total of 58 (2021–22: 57) Key Audit Matters (KAM) were included across the 27 entities included in Auditor-General Report No. 26 of 2022–23 Interim Report on Key Financial Controls of Major Entities. These KAM mainly related to the valuation of the Australian Government’s assets and liabilities, including listed and unlisted equity investments, loans and receivables, non-financial assets (including specialist military equipment and infrastructure), defined benefit superannuation liabilities, Australian Government securities and personal benefit provisions.

Auditor’s reports issued

2.2 A comparison of the number and type of auditor’s reports issued by the Auditor–General and his delegates in 2021–22 and 2022–23 (as at 30 November 2023), including the CFS is summarised at Table 2.1.

Table 2.1: Summary of auditor’s reports issued and outstanding as at 30 November 2023

|

Auditor’s report |

2022–23 |

2021–22 |

|

Unmodified |

241a |

237 |

|

15a |

15 |

|

0 |

0 |

|

Modified |

0 |

1 |

|

Auditor’s reports issued |

241 |

238 |

|

Not yet issued |

3b |

10c |

|

Total number of financial statements auditsd |

244d |

248d |

Note a: Fifteen of the unmodified auditor’s reports included an emphasis of matter.

The auditor’s report for eight entities included an emphasis of matter to draw users’ attention to the basis of preparation of the financial statements or restrictions on the distribution or use of the auditor’s report. These entities are: Australia Post Licensee Advisory Council Ltd, Australian Sports Foundation Charitable Trust, Darwin Hotel Partnership, Gagudju Lodge Cooinda Trust, IBA Retail Property Trust, Ikara Wilpena Holdings Trust, Performance Bond Fund Trust and Tennant Creek Land Holding Trust.

An emphasis of matter was included in the auditor’s report for two entities to draw user’s attention to a material uncertainty associated with the operations of the entity. These entities are: Gagudju Lodge Cooinda Trust and Kakadu Tourism (GLC) Pty Ltd.

The auditor’s report for seven entities included an emphasis of matter to draw to users’ attention a particular matter in the financial statements. These entities are: ANSTO Nuclear Medicine Pty Ltd, Australian Scientific Instruments Pty Ltd, Australian Securities and Investments Commission, Bureau of Meteorology, Creative Partnerships Australia Ltd, Department of Veterans’ Affairs and Seafarer’s Safety, Rehabilitation and Compensation Authority. For details of each of matters included in the auditor’s report refer to Chapter 4.

Note b: As at 30 November 2023, the 2022–23 financial statements audits had not been finalised for the following entities: Bundanon Trust, Royal Australian Navy Central Canteens Board and Wreck Bay Aboriginal Community Council.

Note c: As at 2 December 2022, the 2021–22 financial statements audits had not been finalised for 10 entities. The results of these audits are included at Appendix 5.

Note d: The Consolidated Financial Statements is included in the total number of financial statements audits.

Source: 2021–22 and 2022–23 ANAO auditor’s reports.

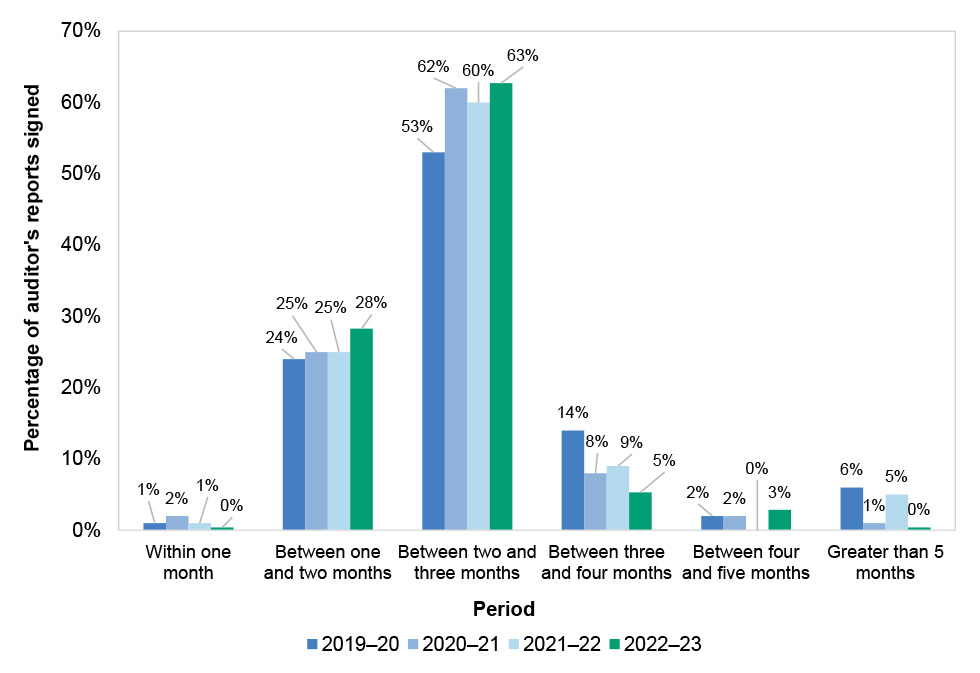

2.3 The finalisation of a financial statements audit is marked by the signing of the auditor’s report. Figure 2.1 shows that the percentage of entities with financial statements and the associated auditor’s report signed within three months of the reporting year-end has increased from 2021–22. Ninety-one per cent of auditor’s reports were signed within three months of year-end compared to 86 per cent in 2021–22.

Figure 2.1: Timeframes for auditor’s report signing from the end of financial year

Source: ANAO analysis.

2.4 The ANAO issued 99 per cent of auditor’s reports within two business days of the signing of the financial statements by the accountable authority (2021–22: 98 per cent).

Key audit matters

2.5 While ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report (ASA 701) only requires Key Audit Matters (KAM) reporting for listed entities, the Auditor-General considers including KAM to be good practice for financial statements auditing in the public sector and includes KAM in certain audit reports. Communicating KAM helps users of financial statements better understand those matters that, in the auditor’s professional judgement, were of the most significance in the audit of the financial statements.

2.6 The ANAO has reported KAM in 2022–23 for the entities included in Auditor-General Report No. 26 of 2022–23 Interim Report on Key Financial Controls of Major Entities (ANAO Report No. 26) and the Consolidated Financial Statements (CFS). In 2022–23, a total of 58 KAM were reported across 27 entities (compared with 57 KAM reported across 25 entities in 2021–22). The majority of KAM related to the valuation, allocation and accuracy of assets and liabilities, including:

- advances, loans and other receivables, including accounting for concessional loans;

- non-financial assets including property, plant and equipment and specialist military equipment;

- investments in listed or unlisted entities or other financial products;

- intangibles, including computer software;

- leases; and

- provisions, including defined benefit superannuation funds and personal benefits.

2.7 Other KAM included: completeness and accuracy of expenses relating to personal benefits and other payments; and completeness and accuracy of revenue relating to taxation, royalty and other revenue arising from fees and charges. Further details of the KAM reported are included in the discussion of results of financial statements audits in Chapter 4 of this report.

Assessment of entities’ internal control environment supporting the preparation of financial statements

For the majority of entities, at the completion of the final audits, key elements of internal control were operating effectively to provide reasonable assurance that the entities were able to prepare financial statements that were free from material misstatement. In ten entities where significant audit finding were identified these findings reduced the level of confidence and assurance that could be placed on key elements of internal control. These significant audit findings mainly related to: Governance of legal and other matters; and IT governance and controls.

Emerging technologies, such as Artificial Intelligence, Machine Learning and Robotic Process Automation present opportunities for improvement and innovation, as well as risks. Appropriate governance structures are critical to achieving the ethical and responsible use of emerging technologies. Entity governance structures should consider usage of the technologies, an understanding of the operation of the technologies and consider both business and technology perspectives. Thirty-six entities advised the ANAO that they had adopted some form of emerging technology. The majority of entities adopting these technologies did not create policies or a governance framework to support their use of these technologies, or have regard to external policies guidance such as Australia’s eight Artificial Intelligence Ethics Principles. The lack of governance frameworks for managing the use of emerging technologies could increase the risk of unintended consequences.

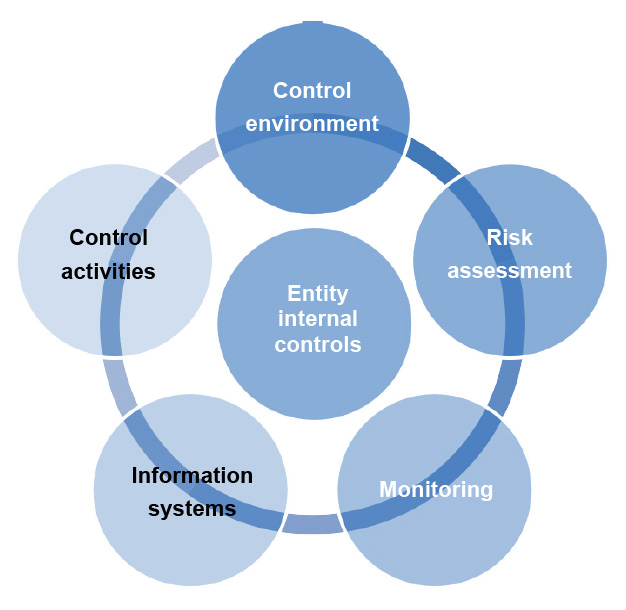

2.8 The ANAO applies the framework in ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of elements of an entity’s internal controls supporting the preparation of financial statements. This approach provides a basis for designing and implementing responses to the assessed risk of material misstatement. Figure 2.2 below outlines these elements.

Figure 2.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraphs 4 to 21.

2.9 An effective internal control framework provides a level of assurance that entities are able to prepare financial statements that are free from material misstatement. For the majority of entities in 2022–23, key elements of internal control were operating effectively, providing the ANAO with reasonable assurance that the prepared financial statements were free from material misstatement.

2.10 Except for particular finding/s outlined in Chapter 410, key elements of internal control were operating effectively to provide reasonable assurance that entities are able to prepare financial statements that are free from material misstatement. These particular findings reported to entities’ represented moderate business or financial management risk to the entity.

2.11 For entities where audit findings were reported, the ANAO was required to undertake additional audit procedures to obtain sufficient and appropriate audit evidence that provided reasonable assurance the entity’s financial statements were not materially misstated.

2.12 Table 2.2 details the assessment of the effectiveness of the elements of internal control at the conclusion of the final audit for the entities included in this report.

Table 2.2: Assessment of the effectiveness of the elements of internal control

|

Overall assessment of effectiveness of elements of internal control supporting the preparation of financial statements |

Percentage of entities |

|

Effective, with no significant or moderate audit findings identified |

84% |

|

Effective, with the exception of particular moderate audit findings identified |

12% |

|

Reduced level of reliance due to significant audit findings identified |

4% |

Source: ANAO analysis of 2022–23 audit results.

2.13 There were 12 significant audit findings reported for 10 entities during 2022–23 which reduced the level of reliance which could be placed on the effective operation of internal control supporting the preparation of the financial statements. The audit findings reported to these entities presented a significant business or financial management risk to each entity. These included issues that could result in a material misstatement of the entity’s financial statements.

2.14 The ten entities are: Army and Air Force Canteen Service; the Australian Taxation Office; Bundanon Trust, the Departments of: Defence; Education; Health and Aged Care; and Social Services, the National Archives of Australia; Royal Australian Navy Central Canteens Board and Services Australia.

Control environment

2.15 The PGPA Act sets out the requirements to establish and maintain systems relating to risk and control. Section 16 of the PGPA Act states that:

The accountable authority of a Commonwealth entity must establish and maintain:

(a) an appropriate system of risk oversight and management for the entity; and

(b) an appropriate system of internal control for the entity;

including by implementing measures directed at ensuring officials of the entity comply with finance law.11, 12

2.16 An effective control environment is underpinned by a fit-for-purpose governance structure. Indicators of an effective governance structure include whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and their importance in the entity. The main elements reviewed included: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; systems of authorisation; and processes for recording financial transactions.

2.17 Clear lines of accountability and reporting are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels in an entity understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions and delegation instruments.

Audit committees

2.18 Except for the seven entities below, entities had established audit committees that met the membership requirements outlined in section 1713 or section 2814 of the PGPA Rule. The PGPA Rule requires that the Accountable Authority (or head of the Accountable Authority in the case of a board), Chief Executive and Chief Financial Officer must not be members of the Audit Committee. The PGPA Rule also requires that:

- for non-corporate Commonwealth entities there is at least three members who are independent of the entity and a majority of the members must not be officials of any Commonwealth entity; and

- for corporate Commonwealth entities all members must not be employees of the entity.

2.19 These entities were: AAF Company; Australian Broadcasting Corporation; Australian Institute of Health and Welfare; Australian Strategic Policy Institute Ltd; Bundanon Trust and Royal Australian Air Force Veterans’ Residences Trust Fund.15

Risk assessment processes

2.20 Section 16 of the PGPA Act sets out an accountable authority’s responsibilities regarding the establishment of appropriate risk oversight and management in an entity. An understanding of an entity’s process to identify and manage risk is essential to an effective and efficient financial statements audit. A review of this process is completed to assist the ANAO to understand how entities identify and manage risks relating to financial statements and assess the risk of material misstatement to an entity’s financial statements.

2.21 One significant legislative breach has been reported by the ANAO in relation to non-compliance with section 16 of the PGPA Act relating to the Tiwi Land Council, which has not established a formal risk management policy.

Fraud control

2.22 Section 10 of the PGPA Rule details the minimum standards for accountable authorities of Commonwealth entities for managing the risk and incidence of fraud. The accountable authority of an entity must take all reasonable measures to prevent, detect and deal with fraud relating to the entity. This includes conducting fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity.16 The ANAO’s assessment of entities’ fraud risk assessment procedures identified that 13 entities had not conducted a fraud risk assessment within the past two years.

Information systems and communication

2.23 The information system relevant to the preparation of the financial statements consists of activities and policies, and accounting and supporting records, designed and established to initiate, record and process entity transactions (as well as to capture, process and disclose information about events and conditions other than transactions).

2.24 An entity’s business processes include activities that are designed to record information, including accounting and financial reporting information and to ensure compliance with laws and regulations.

2.25 Ninety-five audit findings have been reported to entities in 2022–23 relating to the IT control environment, accounting for 48 per cent of all audit findings identified by the ANAO. The most common findings identified related to weaknesses in: privileged and other user access and change management. Further information relating to these findings is available in paragraphs 2.84 to 2.108.

2.26 Two moderate audit findings have also been reported relevant to the activities designed to record financial information:

- National Blood Authority – weaknesses identified in relation to the classification and allocation of funding expenditure between departmental and administered funds; and

- Bureau of Meteorology – weaknesses in the management of records supporting the recognition and measurement of property, plant, equipment and intangibles; leases; and revenue.

Emerging technologies

2.27 Emerging technologies17 are new technologies or the further development of existing technologies. Key emerging technologies include robotic process automation18 (RPA) and artificial intelligence19 (AI), including generative AI and machine learning (ML).

2.28 Government organisations around the world are adopting emerging technologies to help them achieve their public purpose or mission.20

2.29 Emerging technologies present opportunities for improvement and innovation, and risks. Some of the risks include a lack of transparency, bias and discrimination, security and privacy concerns, legal and regulatory challenges, misinformation, manipulation and unintended consequences.

2.30 Appropriate governance structures are critical to achieving the ethical and responsible use of emerging technologies. Entities governance structures should consider usage of the technologies, an understanding of the operation of the technologies and consider both business and technology perspectives.21

2.31 The Digital Transformation Agency (DTA) has released an initial Data and Digital Government Strategy outlining its vision to deliver simple, secure, and connected public services for all people and business through world class data and digital capabilities.22 In addition, the Department of Industry, Science and Resources (DISR) has designed Australia’s eight Artificial Intelligence Ethics Principles to ensure AI23 is safe, secure and reliable.

|

Case study 2. Adoption of emerging technologies by entities |

|

The ANAO analysed adoption of emerging technologies by Commonwealth entities and companies in 2022–23. Thirty-six entities advised the ANAO that they had adopted some form of emerging technology. AI was the most widely reported as being adopted. Some entities advised the ANAO of the use of multiple types of emerging technology. Twenty-seven entities adopted AI, including commercially available products, chatbots and supporting advanced data analysis. These entities advised the ANAO that the purposes for which AI was adopted included media related, administrative and entity specific tasks. Entities advised that AI is being used for social media posts, financial processing, research and development, threat detection, monitoring and data analysis. Fourteen entities adopted RPA. Entities are using RPA for administrative purposes, including invoice processing, archiving, scanning and forms processing. Among those that advised the ANAO that they used emerging technologies, a number of entities reported not implementing governance frameworks to manage their adoption. Of the 27 entities that adopted AI, 15 did not create policies to support their use of AI. Of the 12 entities that reported implementing governance policies, one entity did not consider external policies and procedures. Four of the 14 entities implementing RPA did not create polices to support implementation of RPA. Of the ten entities which created policies, four did not consider external policies and procedures before implementation. An absence of frameworks governing the use of emerging technologies could increase the risk of unintended consequences, particularly as the adoption of these technologies become more prevalent. |

Control activities

2.32 The control activities component of an entities’ system of internal control are primarily direct controls which are designed to prevent, detect or correct misstatements.24 Auditors are required to evaluate the design of the controls and determine whether the controls have been implemented. Controls include authorisations and approvals, reconciliations, verifications (such as edit and validation checks or automated calculations), segregation of duties, and physical or logical controls, including those addressing safeguarding of assets.

2.33 Where the ANAO identifies one or more control deficiencies, the ANAO assesses whether, individually or in combination, the deficiencies constitute a significant deficiency and reports these to accountable authorities as audit findings. The ANAO applies professional judgement in determining whether a deficiency represents a significant control deficiency. Information relating to the audit findings identified by the ANAO during 2022–23 is available at paragraphs 2.77 to 2.145.

Monitoring of controls

2.34 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audit. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities’ application to the preparation of the financial statements.

2.35 Internal audit can provide accountable authorities with independent and objective assurance, particularly in relation to the design and operating effectiveness of an entity’s system or risk management and internal control. The ANAO has reviewed the structure of and coverage provided by entity internal audit functions in 2022–23 (see paragraphs 2.36 to 2.76).

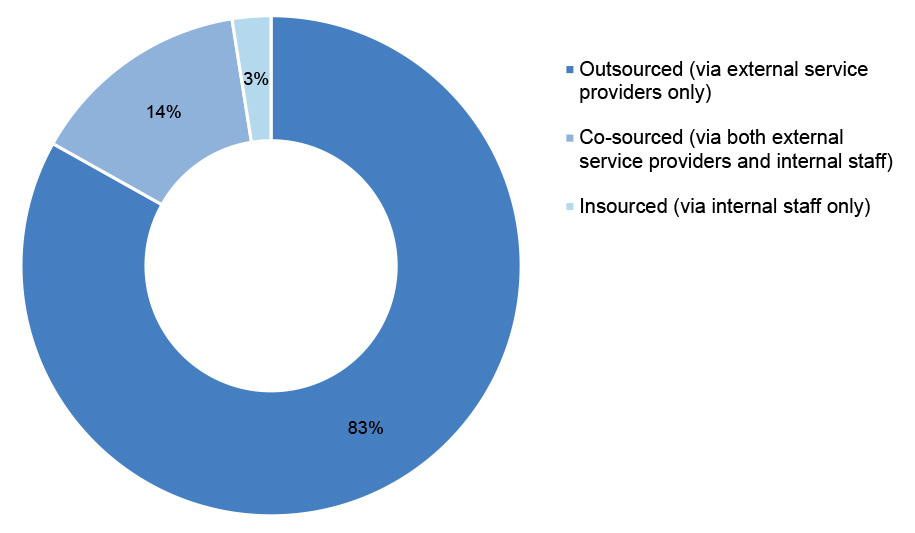

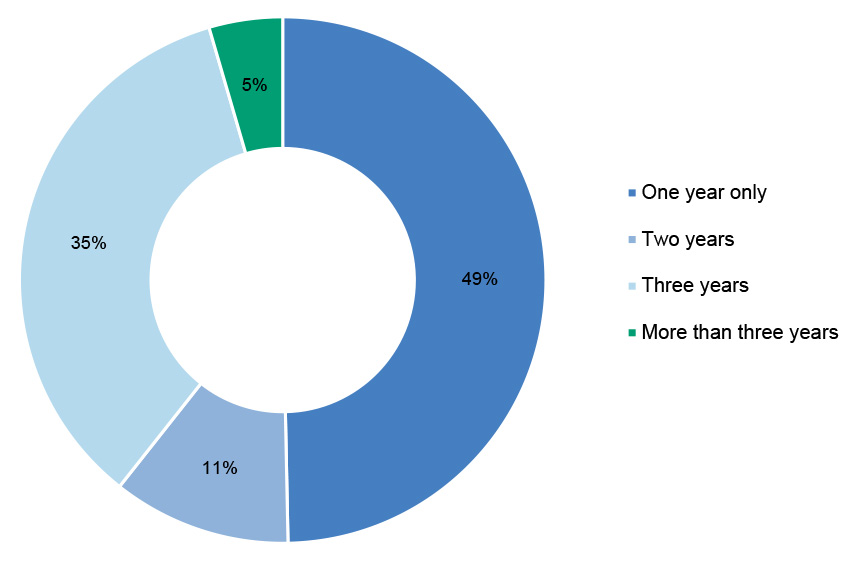

Internal audit

Internal audit plays an important role in providing assurance over an entity’s system of risk management and internal control. During 2022–23 84 per cent of entities had an established internal audit function. The ANAO has reviewed the structure of and coverage provided by internal audit during 2022–23. Identified areas for improvement include: adopting formal audit committee charters; developing and monitoring internal audit budgets to determine they are fit for purpose and considering appropriate organisational structure for the officer overseeing the internal audit function.

Internal audit charters provide a mechanism to clearly communicate an accountable authority’s expectations of internal audit’s mandate, authority and scope. Fifty-five per cent of entities had internal audit charters. In the absence of a charter, there is a risk that the internal audit function’s mandate, authority and independence are not well understood with an entity, potentially limiting the effectiveness of the function.

Twenty-one per cent of entities decreased their internal audit budget in the period 2020–21 to 2022–23. A safeguard to the independence and objectivity of the internal audit function is regular consideration of the appropriateness of the internal audit function’s budget by an entity’s audit committee (in providing advice on the function). Seventy-three per cent shared the budget with the audit committee.

In 77 per cent of entities the officer responsible for internal audit had shared responsibilities (including for financial management, or the system of internal control and risk management). Accountable authorities should be mindful of the potential for impairments to objectivity and implement appropriate safeguards in determining the organisational structure for internal audit.

The majority of internal audit plans were approved by the Accountable Authority with advice from an audit committee and considered entity strategic risks. There were 2,687 internal audits undertaken by Commonwealth entities between 2020–21 and 2022–23. Most internal audits completed was focused on: systems of risk management and governance; information, communications and technology, project and program management; and financial controls. Over this period there was a decrease in internal audits completed on procurement and information, communications and technology, but an increase in internal audits completed focusing on cyber security and performance reporting.

There is an opportunity for the Australian Government to consider whether additional guidance relating to the implementation and delivery of internal audit would be beneficial to enhance the Australian Government’s system of internal control.

2.36 The Institute of Internal Auditors (IIA) defines an internal audit function as being:

A department, division, team of consultants, or other practitioner(s) that provides independent, objective assurance and consulting services designed to add value and improve an organization’s operations. The internal audit activity helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes.25

2.37 There is no mandated requirement for Commonwealth entities or companies to establish an internal audit function. However, Section 16 of the PGPA Act requires the accountable authority to establish and maintain an appropriate system of risk oversight and management; and appropriate system of internal control.

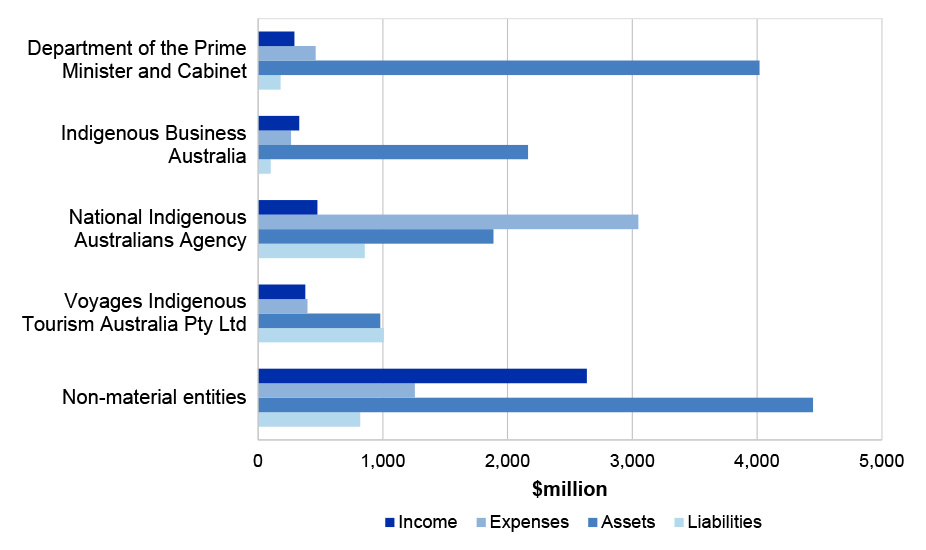

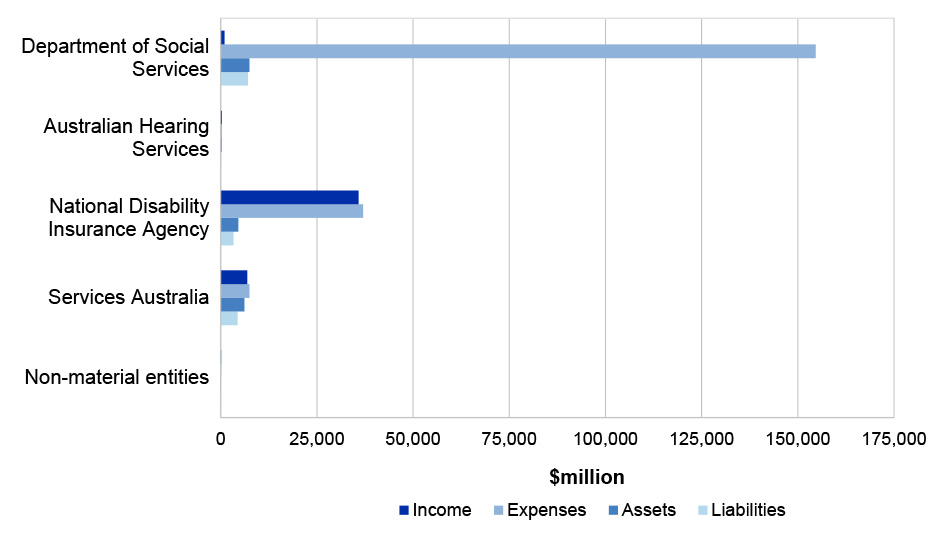

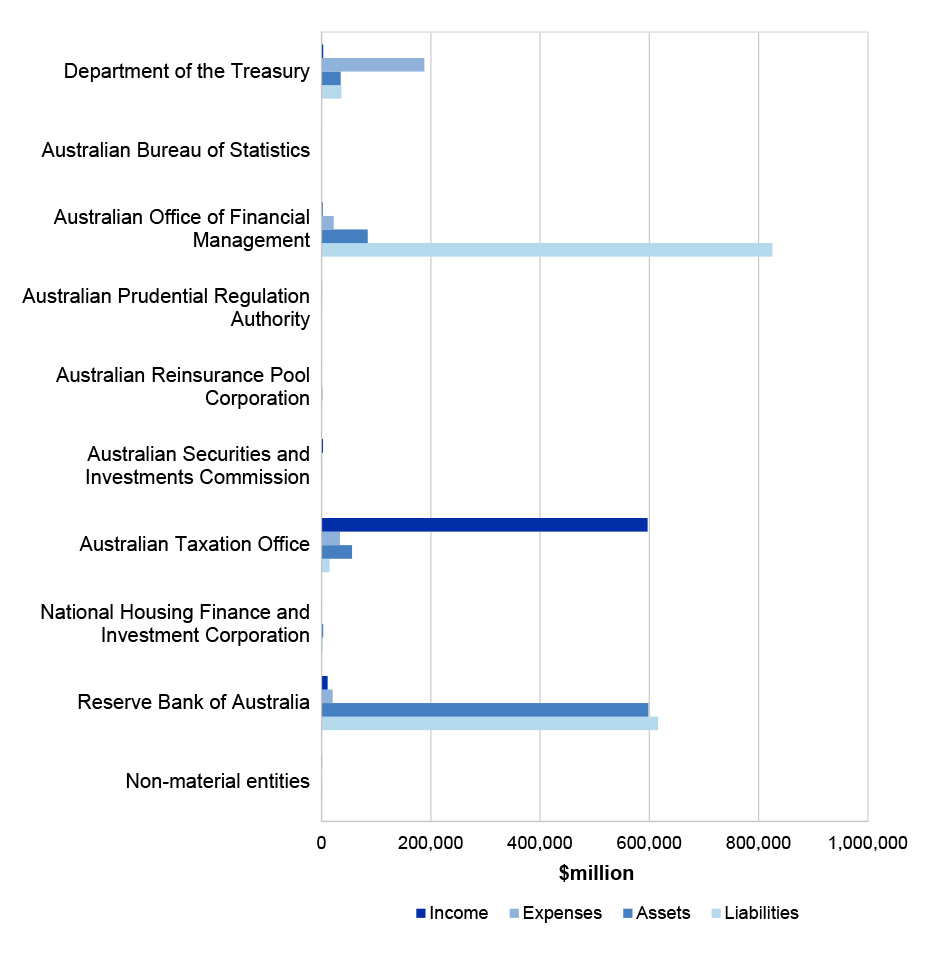

2.38 An appropriately designed and resourced internal audit can assist the accountable authority of an entity to obtain assurance over the design, implementation and operating effectiveness of the system of risk management and internal control within an entity. The Australian Securities and Investments Commission notes that: