Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of the Age Pension

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The age pension is the government’s means tested income support for eligible seniors.

- It is a significant component of Australian Government expenditure, comprising 8.4 per cent of the Federal budget and 42.5 per cent of social security payments in 2024–25.

- This audit provides assurance to Parliament on the Department of Social Services’ (DSS) and Services Australia’s administration of the age pension.

Key facts

- Between July 2021 and June 2024, estimated age pension payment inaccuracy was $5 billion. This includes $1.33 billion in underpayments to seniors eligible for higher benefits and $3.67 billion in overpayments.

- For the same period, the timeliness performance target (at least 80 per cent of claims are completely assessed within 49 days) was not met.

What did we find?

- DSS’ oversight of the age pension is partly effective.

- Services Australia’s processes to assess and review applicants’ and recipients’ age pension eligibility are partly effective.

- Services Australia does not fully use the information it has to improve its engagement with seniors.

What did we recommend?

- There were four recommendations to DSS on effective oversight and reporting on program effectiveness, six recommendations to Services Australia including on enhanced claims verification and compliance activities, and one to the Department of Veterans' Affairs (DVA) on program implementation.

- Services Australia and DVA agreed to all recommendations. DSS agreed to three and agreed in principle to one recommendation.

2.67 million

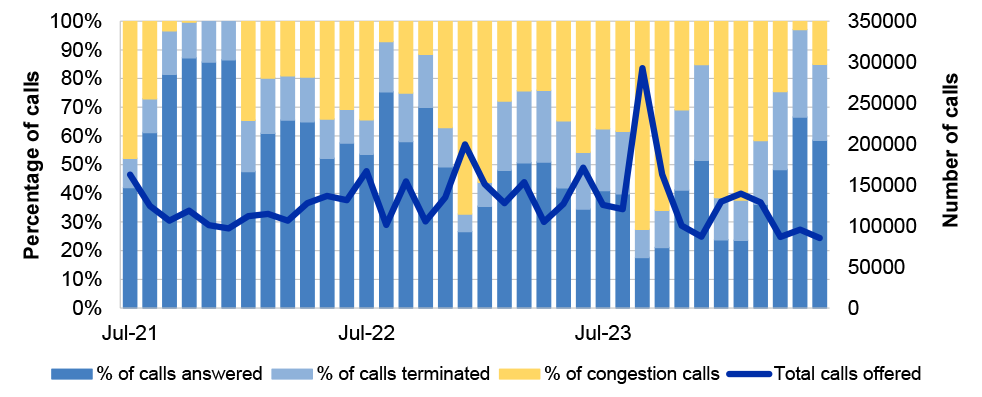

seniors receive the age pension (June 2025).

66.41%

of recipients receive the full age pension payment rate (June 2025).

$62.2 billion

age pension outlay for 2024‒25 (8.4 per cent of the Federal budget).

Summary and recommendations

Background

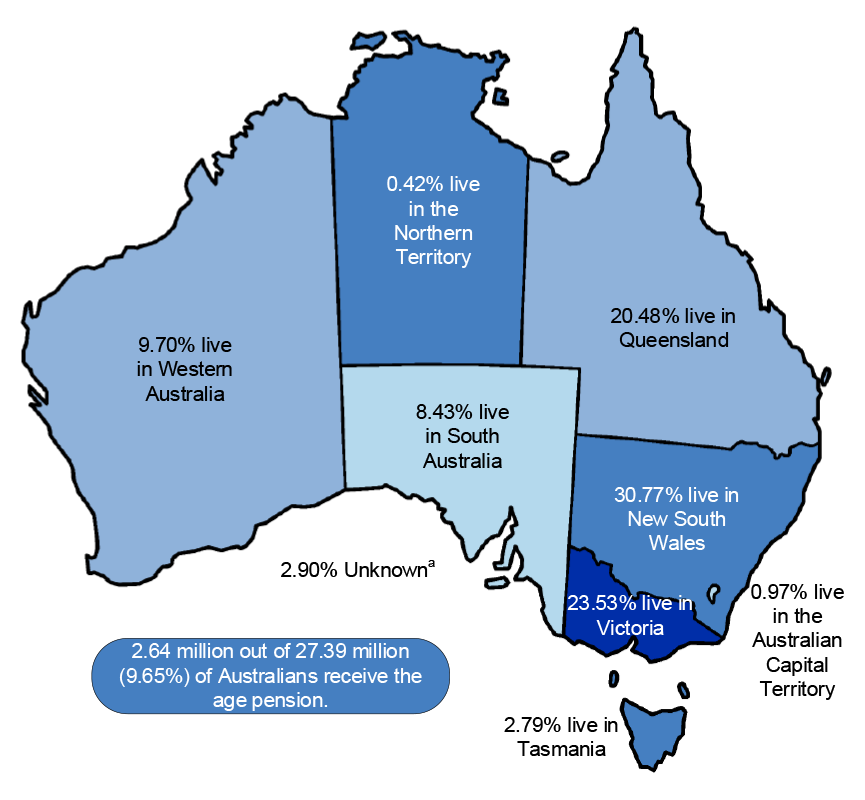

1. Introduced in 1909, the age pension is a means tested income support for eligible seniors. In 2024–25, age pension expenditure was $62.2 billion. It was the second largest Australian Government program expenditure (8.4 per cent of the Federal budget)1 and the biggest component of social security payments (42.5 per cent).2

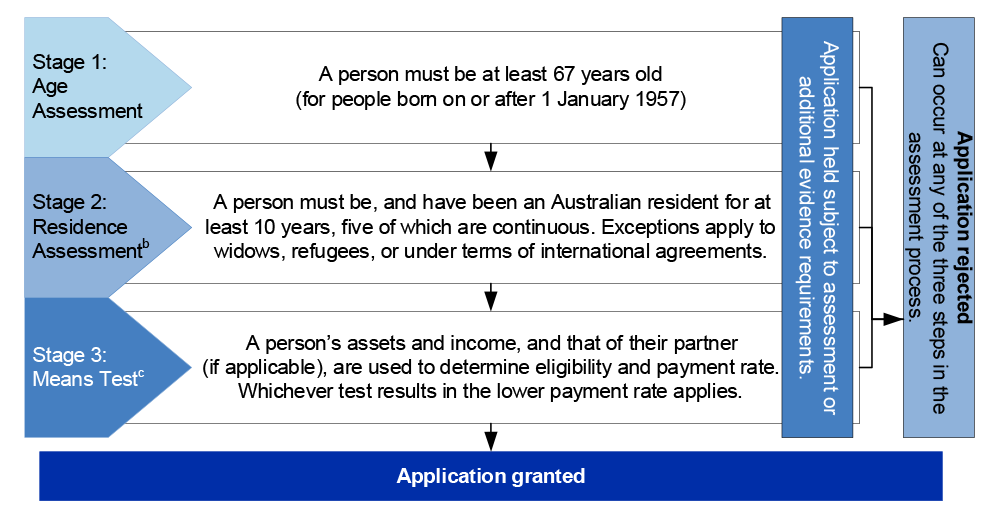

2. There were 2.67 million age pension recipients as at June 2025. An applicant must meet the following requirements to receive the age pension:

- age: at least 67 years for people born on or after 1 January 19573;

- residence: must be, and have been an Australian resident4 for at least 10 years, five of which are continuous; and

- means test: the applicant’s and their partner’s assets and income are within legislated thresholds.

3. Services Australia administers the age pension program on behalf of the Department of Social Services (DSS) under an appropriated partnership arrangement. Services Australia receives departmental appropriation5 from government to deliver programs and services, including the age pension. DSS receives special appropriations for social security payments, including for the fortnightly age pension payments, and retains policy responsibility for program outcomes.

4. The Department of Veterans’ Affairs (DVA) has a purchaser-provider arrangement with DSS to administer the age pension. Under this arrangement, DSS pays DVA to deliver the program within agreed expectations and service levels. As at June 2024, DVA delivered the age pension to 3,818 veterans and their partners.

Rationale for undertaking the audit

5. The age pension is a significant component of Australian Government expenditure. In 2024–25, program outlay comprised 8.4 per cent of the Federal budget and 42.5 per cent of social security payments. DSS estimated that in 2023–24, $1.79 billion in age pension payments were incorrectly provided to recipients as underpayments ($0.44 billion) and overpayments ($1.35 billion). This audit was conducted to provide assurance to the Parliament on DSS’ and Services Australia’s administration of the age pension.

Audit objective and criteria

6. The audit objective was to assess the effectiveness of the Department of Social Services’ and Services Australia’s administration of the age pension.

7. To form a conclusion against the objective, the ANAO adopted the following high-level criteria.

- Does the Department of Social Services have effective oversight of the age pension?

- Does Services Australia have effective processes for assessing eligibility of age pension applicants and recipients?

- Does Services Australia effectively communicate and manage its engagement with age pension applicants and recipients?

Conclusion

8. The administration of the age pension is partly effective. Effectiveness could be improved by tightening processes to verify recipients’ eligibility and pension rates, simplifying and expediting access for applicants and recipients, and reporting on program effectiveness. Between 2021–22 and 2023–24, process deficiencies led to an estimated $5 billion in incorrect payments, including $1.33 billion (26.6 per cent) in underpayments to recipients eligible for higher benefits and $3.67 billion (73.4 per cent) in overpayments. For the same period, complex procedures and limited staffing resulted in seniors waiting an average of 48 days for claims to be processed. Maximum wait times for phone calls to be answered exceeded one hour in 435 days or 57.3 per cent of total days during the period.

9. DSS’ oversight of the age pension program is partly effective. DSS oversees program delivery and has ensured ongoing fortnightly income support to seniors. It has not promptly addressed issues to ensure that performance standards are met, IT systems supporting Services Australia’s claims assessment operate as intended, and DVA is set up to administer the program consistent with legislation. DSS evaluates and reports on age pension payment accuracy and the proportion of senior Australians receiving income support. DSS does not evaluate the program’s impact as required by the Social Security (Administration) Act 1999.

10. Services Australia’s claims assessment processes are partly effective. Gaps in Services Australia’s verification of assets and income, compliance activities and risks associated with the use of IT systems to assess claims limit Services Australia’s ability to correctly assess and confirm applicants’ and recipients’ age pension eligibility and payment rate.

11. Services Australia’s communication and engagement with age pension applicants and recipients is partly effective. Services Australia engages with seniors through a variety of channels (face to face, telephony and digital) and collects information on the quality of its engagement. Services Australia has not fully used the information it collects to address the needs of seniors for simpler claims processes, support with digital technology and shorter wait times for claims to be completed and phone calls to be answered.

Supporting findings

The Department of Social Services’ oversight of the age pension

12. DSS has not made full use of oversight arrangements to ensure that performance standards are met and issues that impact service delivery are promptly managed. (See paragraphs 2.5 to 2.58)

13. DSS has not reviewed the 2013 Memorandum of Understanding — which governs DVA’s administration of the age pension to veterans and their partners — since its execution. DSS’ oversight has not ensured that performance meets agreed standards and DVA is set up to administer the age pension consistent with legislation. (See paragraphs 2.59 to 2.72)

14. DSS evaluates the accuracy of age pension payments and the proportion of senior Australians supported in their retirement through the age pension or other income support. DSS does not evaluate program impact on recipients as required by the Social Security (Administration Act) 1999. (See paragraphs 2.79 to 2.99)

15. DSS advises government, including on age pension coverage, payment accuracy, proposed age pension policy and their potential impact such as equity across cohorts. DSS’ advice currently does not include information on program impact on recipients. (See paragraphs 2.100 to 2.103)

Services Australia’s age pension eligibility assessments

16. Services Australia has processes to assess applicants’ age pension eligibility and applicable payment rate. Services Australia relies primarily on assets and income information declared by applicants and does not make full use of available data sources to verify this information. The calculation of fortnightly pension rates is automated through Services Australia’s Income Security Integrated System (ISIS). Services Australia is yet to fully assess the risks associated with its reliance on ISIS automations, including system reliability and service officers’ limited training on manual calculations. ( See paragraphs 3.2 to 3.30)

17. When informed of changes to recipients’ circumstances, Services Australia updates their records to reassess continued eligibility and payment rates. Services Australia has not been able to update recipients’ records in a timely manner. Services Australia has processes to review recipients’ circumstances, including through data gathering arrangements with third parties such as the Australian Taxation Office and superannuation income stream providers. (See paragraphs 3.36 to 3.51)

18. Services Australia did not meet the 97 per cent age pension payment accuracy target in 2022–23 and 2023–24. Quality checks of service officers’ completed work (between 2021–22 to 2023–24) were below Services Australia’s 95 per cent correctness target. Services Australia’s compliance activities are not in line with risks that contribute the most to age pension payment inaccuracy. Services Australia does not evaluate its compliance activities to determine if intended outcomes (for example estimated savings) are being achieved. (See paragraphs 3.53 to 3.81)

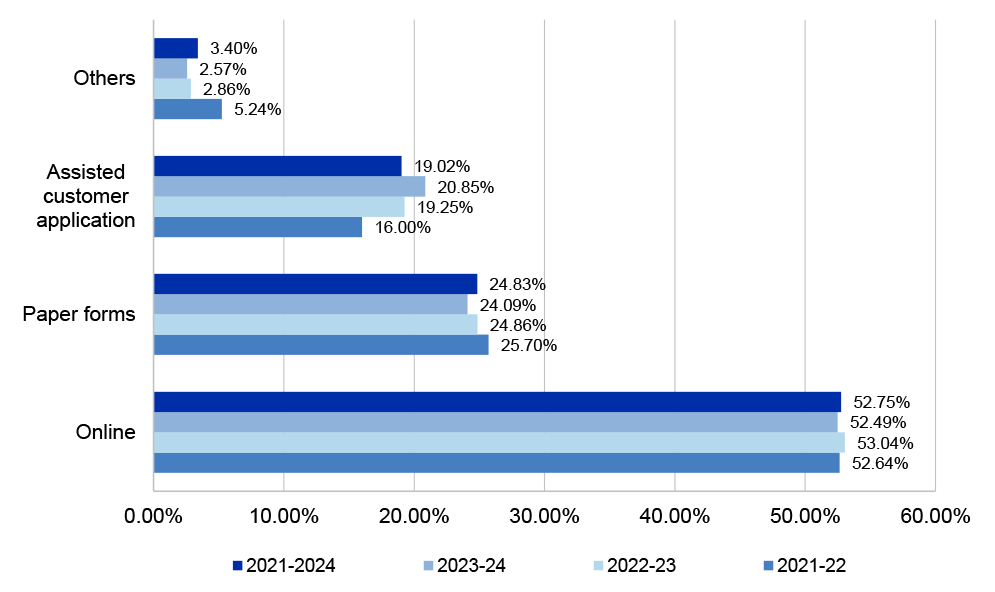

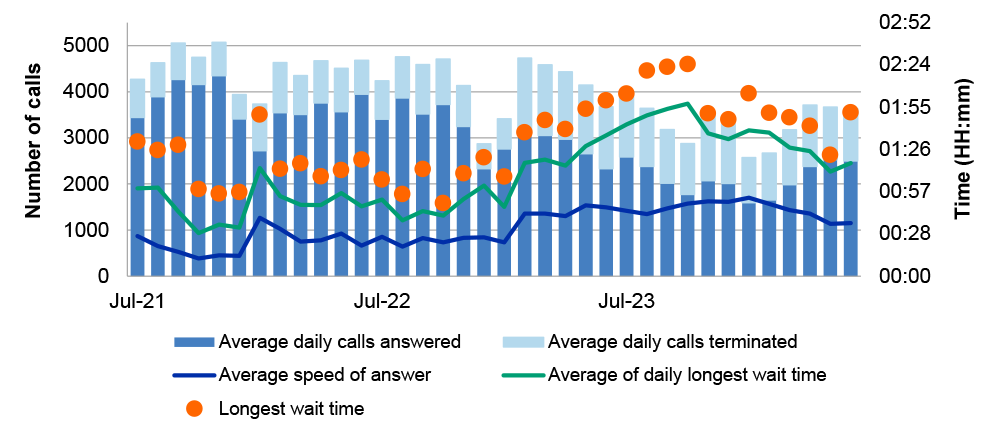

Services Australia’s engagement with applicants and recipients

19. Services Australia has arrangements to engage with age pension applicants and recipients. This includes face to face communications, digital channels, telephony and letter correspondence. Services Australia’s debt letters do not always explain the rationale or basis for the debt. Age pension related complaints increased by 79.77 per cent (the number of recipients increased by 2.05 per cent) between 2021–22 to 2023–24. Maximum wait times for phone calls to be answered exceeded one hour in 435 days or 57.31 per cent of total days during the same period. (See paragraphs 4.3 to 4.37)

20. Services Australia collects information relevant to its engagement with age pension applicants and recipients. This information points to the needs of seniors for simpler and clearer claims processes, support with accessing digital technology and shorter wait times for claims to be completed and phone calls to be answered. Services Australia has not yet acted to improve the age pension application process or make digital services more accessible to older Australians. (See paragraphs 4.38 to 4.54)

Recommendations

Recommendation no. 1

Paragraph 2.32

In line with their joint responsibility to review payment assurance controls and ensure they are effective and appropriate:

- Department of Social Services requires Services Australia to disclose in the annual assurance statements the limitations and risks associated with Services Australia’s payment integrity assurance, and to advise of IT system issues in a timely manner;

- Services Australia fully discloses in its annual assurance statement the basis for, and limitations and risks associated with, its payment integrity assurance, and informs Department of Social Services as soon as practicable when it (Services Australia) identifies IT system errors impacting payment correctness; and

- Services Australia promptly rectifies issues identified in the IT systems which support the assessment of age pension, and implement controls to ensure IT systems are operating as intended.

Department of Social Services response: Agreed.

Services Australia response: Agreed.

Recommendation no. 2

Paragraph 2.54

Department of Social Services addresses payment accuracy and timeliness performance results by developing and implementing an approach to ensure that Services Australia’s assessment and compliance processes address risks to payment accuracy and timeliness.

Department of Social Services response: Agreed.

Recommendation no. 3

Paragraph 2.73

Department of Social Services and Department of Veterans’ Affairs complete the refresh of the 2013 Memorandum of Understanding to ensure that the Department of Veterans’ Affairs is set up to administer the program consistent with legislation, and establishes:

- arrangements for the Department of Social Services to oversee the Department of Veterans’ Affairs’ administration of the age pension;

- performance assurance arrangements that include reporting on performance and ensuring the effectiveness of strategies to address risks;

- methodology to monitor, measure and report on performance;

- regular reviews of processes and systems to administer the age pension to ensure they are operating as intended; and

- risk management processes and reporting.

Department of Social Services response: Agreed in principle.

Department of Veterans’ Affairs response: Agreed.

Recommendation no. 4

Paragraph 2.104

Department of Social Services revises the age pension program logic to support evaluation and reporting to government on program delivery with an emphasis on its impact on recipients.

Department of Social Services response: Agreed.

Recommendation no. 5

Paragraph 3.16

Services Australia develops and implements an approach to verify applicants’ assets and income to reduce risks to the correctness of age pension claims assessments.

Services Australia response: Agreed.

Recommendation no. 6

Paragraph 3.31

Services Australia develops and implements an approach to identify and manage risks arising from all its automated processes (to assess age pension claims), including by:

- documenting business rules that govern the assessment of age pension claims; and

- quality checking and reporting on the correctness of automation-derived age pension payment rates.

Services Australia response: Agreed.

Recommendation no. 7

Paragraph 3.73

In its stewardship of the age pension, Services Australia develops and implements an approach to ensure that:

- its Compliance Assurance Program includes activities to sufficiently address the risks of undeclared, incorrectly declared or incorrectly assessed assets and income from investments (other than income streams);

- the Automated Income Stream review, Proof of Life and other activities are being implemented as intended, are effective in addressing payment accuracy risks, and achieving intended savings; and

- its Compliance Assurance Program includes activities to identify and report on underpaid recipients.

Services Australia response: Agreed.

Recommendation no. 8

Paragraph 4.18

Services Australia reviews and as appropriate revises its letters notifying recipients on their possible debt to ensure that these specify the rationale or basis for the decision.

Services Australia response: Agreed.

Recommendation no. 9

Paragraph 4.55

Informed by the data it collects and the engagement needs and preferences of older Australians, Services Australia develops and implements an approach to:

- enable applicants to understand and confidently complete application forms and processes in a timely manner;

- consistent with its performance measures, reduce older Australians’ wait time for claims processes to be completed and phone calls to be answered; and

- provide older Australians targeted support for digital coaching and more access to service officers who have been trained on the needs of older Australians.

Services Australia response: Agreed.

Summary of entity responses

21. Entities’ summary responses to the report are provided below and their full responses are at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed at Appendix 2.

Department of Social Services

The Department of Social Services (the department) notes the ANAO’s conclusion that the department’s oversight of the Age Pension is partly effective.

The department agrees, or agrees in principle, to all 4 recommendations and acknowledges the suggested opportunities for improvement. Steps have been taken to address some matters, with further work planned for coming months.

Department of Veterans’ Affairs

DVA supports the review of the 2013 MOU with a particular focus on performance assurance, performance measures and monitoring. DVA has been reviewing the administration of Age Pension having regard to the Social Security (International Agreements) Act 1999. DSS has provided an options paper, and after review, DVA acknowledges the issues with DVA undertaking the functions and administering the payment for veterans receiving an Age Pension in accordance with the provisions of an International Agreement. DVA will work with DSS to 1) develop a strategy (including communications) to resolve this issue, and 2) review the 2013 MOU.

DVA will complete a review of associated risks consistent with the Commonwealth Risk Management Policy. This work will better inform the review of performance measures and targets. DVA notes the requirement to monitor ongoing eligibility and consider that this should be covered under ongoing entitlement reviews. DVA is supportive of measures that are consistent with current Services Australia methodology.

DVA and DSS currently hold regular meetings to monitor performance. DSS and DVA initiated the process of reviewing the MOU with a meeting in April 2025. The review going forward will include the development of an agreed quantitative and qualitative methodology for monitoring performance.

Services Australia

The Agency welcomes the report and notes the report’s findings. The Agency’s focus is on efficiently and effectively delivering payments and services to the Australian community, and administration of payments to older Australians is an important aspect of this work.

The Agency is committed to continually improving the timeliness of services for Age Pension customers and providing support to staff to ensure the integrity of the Age Pension.

Key messages from this audit for all Australian Government entities

22. Below is a summary of key messages which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management, program implementation, policy design, performance and impact measurement

1. Background

Introduction

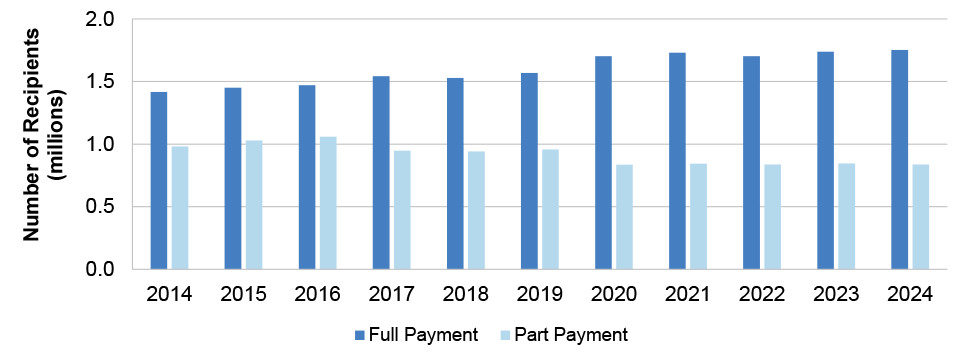

1.1 Introduced in 1909, the age pension is the government’s means tested income support to eligible seniors. In 2024–25, program outlay was $62.2 billion. It was the second largest Australian government program expenditure (8.4 per cent of the Federal budget)6 and biggest component of social security payments (42.5 per cent).7

1.2 Based on June 2024 data, the Australian Government Actuary estimates the age pension program’s lifetime cost at $3.95 trillion, comprising 57.7 per cent of the $6.84 trillion estimated total social security cost.8 On average, a person new to the age pension is estimated to remain on the payment for 17 years.

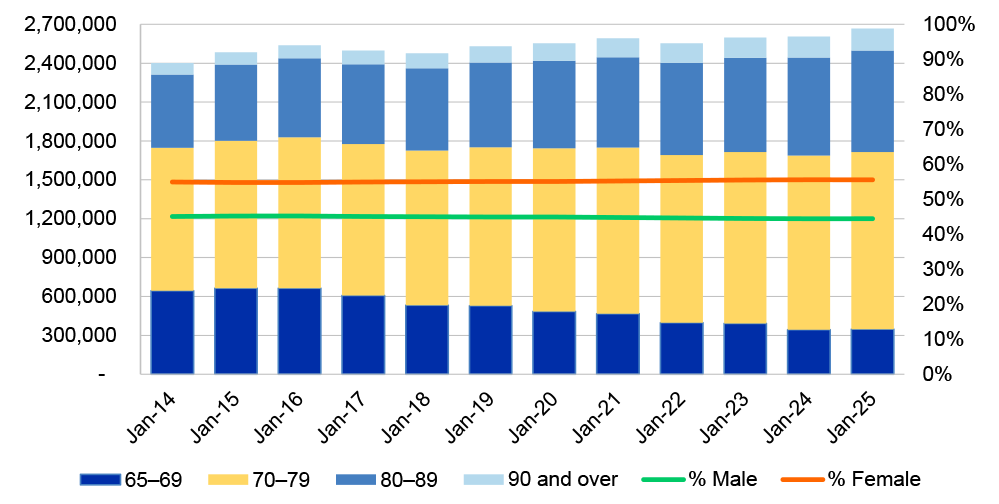

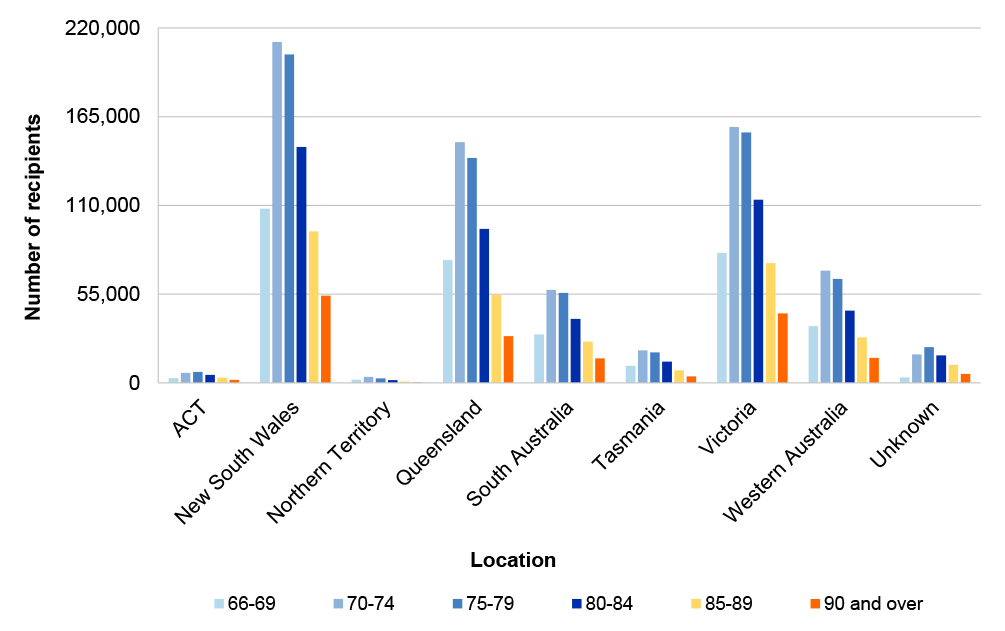

1.3 There were 2.67 million age pension recipients as at June 2025. Figure 1.1 shows recipients by age group and gender. See Appendix 3 for more demographic information.

Figure 1.1: Total age pension recipients, by age group

Source: ANAO analysis of DSS demographic information.

1.4 The Australian Government appropriates funding to the Department of Social Services (DSS) for social security payments (including the age pension) and separately appropriates funding to Services Australia for program delivery.

Eligibility requirements

1.5 The age pension is administered under the Social Security Act 1991, the Social Security (Administration) Act 1999 and the Social Security (International Agreements) Act 1999.

1.6 A person must meet the following requirements to get the age pension:

- age: at least 67 years for people born on or after 1 January 19579;

- residence: must be, and have been an Australian resident10 for at least 10 years, five of which are continuous; and

- means tests: an applicant’s and their partner’s assets and income meet legislated thresholds. See Appendix 4 for age pension thresholds.

1.7 International social security agreements11 between Australia and partner countries enable shared responsibility for supporting seniors who move and reside between countries.

Department of Social Services’ role as program and policy owner

1.8 The purpose of DSS is to improve ‘the economic and social wellbeing of individuals, families and vulnerable members of Australian communities’.12 Specific to the age pension, DSS’ Corporate Plan 2024–25 states:

[DSS] is responsible for designing and implementing the Age Pension, including providing advice to government on policy and legislation, program implementation and management, program performance, monitoring and meeting all relevant deliverables, setting guidelines and providing guidance and advice to Services Australia on the administration of the program.13

1.9 The Social Security (Administration) Act 1999 section 8 states that:

In administering the social security law, the Secretary is to have regard to the desirability of achieving the following results: …

- (iii) the delivery of services under the law in a fair, courteous, prompt and cost-efficient manner;

- (iv) the development of a process of monitoring and evaluating delivery of programs with an emphasis on the impact of programs on social security recipients.

Services Australia’s role in program delivery

1.10 Services Australia is an executive agency within the Finance portfolio.14 It delivers the age pension on behalf of DSS under an ‘appropriated partnership’ arrangement. Services Australia receives departmental appropriation from government to deliver the program. DSS retains policy responsibility for program outcomes.

1.11 To manage the partnership, DSS and Services Australia15 have bilateral management arrangements (BMA) which outline how they will work to achieve social security outcomes.16

Department of Veterans’ Affairs’ role in program delivery

1.12 The Department of Veterans’ Affairs (DVA) is responsible for developing and implementing programs to assist veteran and ex-service communities. In 1998, the then Department of Social Security17, DVA and Centrelink signed a Memorandum of Understanding (MOU) for DVA to administer the age pension to veterans and their partners. This arrangement continues and is governed by a January 2013 MOU between DVA and the then Department of Families, Housing, Community Services and Indigenous Affairs.18

1.13 Under a ‘purchaser-provider’ relationship, services are delivered and costs recovered under the Public Governance, Performance and Accountability Act 2013 section 74.19 DSS purchases services from DVA to administer the age pension within agreed expectations.

Rationale for undertaking the audit

1.14 The age pension is a significant component of Australian Government expenditure. In 2024–25, program outlay comprised 8.4 per cent of the Federal budget and 42.5 per cent of social security payments. DSS estimated that in 2023–24, $1.79 billion in age pension payments were incorrectly provided to recipients as underpayments ($0.44 billion) and overpayments ($1.35 billion). This audit was conducted to provide assurance to the Parliament on DSS’ and Services Australia’s administration of the age pension.

Audit approach

Audit objective, criteria and scope

1.15 The audit objective was to assess the effectiveness of the Department of Social Services’ and Services Australia’s administration of the age pension.

1.16 To form a conclusion against the objective, the ANAO adopted the following high level criteria:

- Does the Department of Social Services have effective oversight of the age pension?

- Does Services Australia have effective processes for assessing eligibility of age pension applicants and recipients?

- Does Services Australia effectively communicate and manage engagement with age pension applicants and recipients?

1.17 The ANAO examined DSS’ and Services Australia’s administration of the age pension with a focus on performance results from July 2021 to June 2024. The audit did not examine debt management or other programs to support seniors such as the Home Equity Access Scheme, or the Commonwealth Senior Health Card. The audit did not examine DVA’s processes to administer the age pension.

Audit methodology

1.18 The audit methodology included:

- reviewing DSS, Services Australia and DVA data and documentation;

- meeting with DSS and Services Australia staff;

- walkthroughs of Services Australia’s systems;

- visiting Services Australia’s Glen Waverley call centre, Victoria; and

- reviewing contributions made to the ANAO website’s audit contribution facility and in response to the ANAO’s request for stakeholder contributions.

1.19 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $927,686.

1.20 The team members for this audit were Elsie Alcordo, James Carrington, Magdalena Carrasco, Alexandra McFadyen, Nathan Daley, Alex Collins and Corinne Horton.

2. The Department of Social Services’ oversight of the age pension

Areas examined

This chapter examined the effectiveness of the Department of Social Services’ (DSS) oversight of the age pension.

Conclusion

DSS’ oversight of the age pension program is partly effective. DSS oversees program delivery and has ensured ongoing fortnightly income support to seniors. It has not promptly addressed issues to ensure that performance standards are met, IT systems supporting Services Australia’s claims assessment operate as intended and the Department of Veterans’ Affairs (DVA) is set up to administer the program consistent with legislation. DSS evaluates and reports on age pension payment accuracy and the proportion of senior Australians receiving income support. DSS does not evaluate the program’s impact on recipients as required by the Social Security (Administration) Act 1999.

Areas for improvement

The ANAO made four recommendations aimed at ensuring that: IT systems supporting the assessment of age pension operate as intended; payment accuracy and timeliness performance are addressed; DVA’s administration of the age pension is consistent with legislation and DSS evaluates and advises government on age pension program effectiveness. The ANAO identified an opportunity for improvement to expand bilateral governance bodies’ discussions to cover all components of age pension administration.

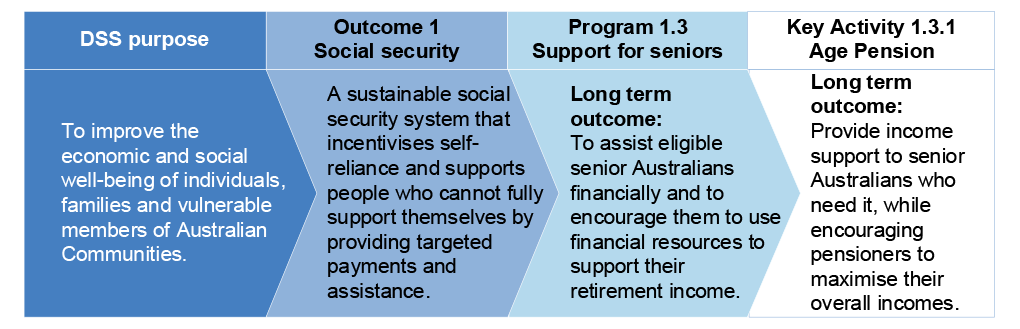

2.1 DSS is responsible for delivering ‘a sustainable social security system that incentivises self-reliance and supports people who cannot fully support themselves by providing targeted payments and assistance’.20 To contribute to this outcome, DSS’ age pension program is designed to provide fortnightly income support payments to eligible seniors.

2.2 As program and policy owner, DSS is accountable to government for age pension outcomes and all functions delegated to Services Australia and DVA to deliver the program. In these arrangements — where policy responsibility is separate from service delivery — effective oversight is critical to ensure the proper use and management of public resources.21

2.3 Effective oversight gives policy owners line of sight to determine if implementation is consistent with legislation, and to know about service delivery issues that should be managed to ensure the achievement of program outcomes.

2.4 Governance arrangements that support effective oversight include defined roles and responsibilities, performance and assurance22 reporting and risk management.

Does the Department of Social Services have oversight of Services Australia’s administration of age pension eligibility criteria?

DSS has not made full use of bilateral oversight arrangements to ensure that performance standards are met and issues that impact service delivery are promptly managed.

2.5 Services Australia administers age pension eligibility criteria by:

- assessing applicants’ age pension eligibility and payment rate;

- reviewing recipients’ ongoing eligibility and payment rate;

- implementing programs and activities to address risks to incorrect payments (overpayments and underpayments) such as incorrectly assessed assets and income; and

- monitoring its performance against agreed payment accuracy and timeliness standards.

Bilateral management arrangement

2.6 DSS’ and Services Australia’s Bilateral Management Arrangement (BMA) comprises three levels of agreements:

- The Head Agreement outlines the purpose of the BMA, defines roles and responsibilities and establishes governance and operational arrangements. In April 2023, DSS and the then Department of Human Services23 signed the Head Agreement relating to DSS programs delivered by Services Australia, including the age pension. DSS and Services Australia signed a revised Head Agreement in January 2025.

- Protocols outline frameworks and guidelines which subordinate services schedules must adhere to.

- Services schedules (operational arrangements) provide program details, including key performance measures, review procedures, and risk management.

2.7 Nine BMA agreements which include content relevant to Services Australia’s administration of age pension eligibility criteria are set out in Table 2.1.

Table 2.1: BMA agreements with content relevant to the administration of age pension eligibility criteria

|

Agreement |

Relevant content |

|

Head Agreement (2025) |

Provides governance framework for bilateral arrangements and risk management and outlines relevant governance bodies. Requires Services Australia to provide annual assurance statements to DSS on policy and service delivery, program delivery outcomes, systems, data continuity and interoperability, payment accuracy and timeliness, and key performance measures reporting. |

|

Corporate Services Protocol (2024) |

Requires both entities to share with each other their internal audit and management assurance reports. |

|

Joint Data Protocol ( 2024) |

Governs the collection, use, retention, disclosure and destruction of information between DSS and Services Australia. |

|

Services Schedule for Social Security and Family Payments (2024) |

Outlines roles and responsibilities, including on risk management and quarterly performance reporting. |

|

Services Schedule for Payment Accuracy Review Program (PARP) (2024) |

Provides for the mechanics of the PARP which is the primary assurance mechanism for the age pension. Outlines roles and responsibilities in implementing PARP. |

|

Shared risk management protocol (2024) |

Sets out how DSS and Services Australia will implement arrangements to manage shared risks consistent with the Commonwealth Risk Management Policy 2023. |

|

Payment Assurance Protocol (2024) |

Outlines roles and responsibilities in providing assurance to government that payments are delivered to eligible people at the right time and at the right rate. |

|

Indexation protocol (2024) |

Covers processes and procedures for implementing rates and threshold indexation for social security payments, including the age pension. |

|

Automation protocol (2023) |

Sets out automation objectives, governance arrangements, business principles, processes and guidelines. |

Note a: Senior Executive Service (SES).

Source: ANAO analysis of DSS’ and Services Australia’s BMA documents.

2.8 The BMA agreements listed in Table 2.1 provide arrangements for DSS to oversee Services Australia’s administration of age pension eligibility criteria.

Roles and responsibilities

2.9 The BMA’s Services Schedule for Social Security and Family Payments, Payment Assurance Protocol and Shared Risk Management Protocol define roles and responsibilities for DSS and Services Australia (see Appendix 5). For example, the Payment Assurance Protocol provides for responsibilities to ensure that payment assurance controls in assessing applicants and recipients’ eligibility are effective and appropriate.

Bilateral governance bodies

2.10 The Head Agreement established governance bodies for social security programs, including the age pension:

- Executive Portfolio meetings (EPM) (Senior Executive Service (SES) Band 3). Its purpose is to provide oversight and support the delivery of social security payments, set the strategic direction for social security payments, resolve program issues and escalate risks to the Secretary and Chief Executive Officer.

- Strategic Business Discussions (SBD) (SES Band 2). Its purpose is to provide oversight of operational matters, including payment integrity and payment accuracy, resolve program issues and escalate risks to the EPM.

- Program Managers’ meetings (SES Band 1). Its purpose is to support EPM and SBD by discussing operational issues and service delivery.

2.11 The Head Agreement provides that the DSS Secretary and Services Australia’s CEO will meet at least twice each year to discuss portfolio risks, cross-cutting strategic matters and the performance of services delivered under the BMA.

2.12 In meetings for the three-year period 2021–22 to 2023–24, EPM and SBD meetings focused on performance reporting, payment accuracy risks, progress in implementing recommendations to improve the PARP24 methodology and updates to BMA arrangements. Relevant to the administration of age pension eligibility criteria, the EPM and SBD meeting discussed:

- Payment accuracy performance results, the contribution of assets and income to incorrect payments and the program’s contribution to overall social security payment inaccuracy.

- Payment timeliness performance results and factors contributing to quarterly performance below agreed targets such as greater use of paper claims and redirection of older Australian staff to support other priorities of Services Australia.

2.13 According to their Terms of Reference, SBD and EPM members are responsible for providing operational guidance, monitoring and mitigating risks and ensuring achievement of performance outcomes. The EPM and SBD were unable to ensure achievement of performance targets for payment accuracy (2022–23 and 2023–24) and payment timeliness (2021–22 to 2023–24).

2.14 Program Managers met twice in 2022–23 and once in 2021–22 and 2023–24. The Head Agreement does not specify a required number of meetings. Meeting minutes outlined discussions on performance results and policy issues (in all four meetings) and service delivery issues (in three of the four meetings). Program managers did not raise issues for escalation to SBD at any of the four meetings. The minutes did not include detailed record of the issues discussed, such as their causes, impacts or required actions. Program managers’ meeting minutes indicate that SES Band 1 officers did not attend the meeting in 2023–24. DSS and Services Australia advised the ANAO in July 2025 that age pension SES Band 1 managers meet fortnightly on policy and operations, and consult weekly on means tests issues. There are no recorded minutes or evidence that these discussions inform EPM or SBD. DSS advised the ANAO in October 2025 that:

The Bilateral Management Arrangement Head Agreement states “Regular ongoing discussions and working groups between program owners at SES Band 1 level”, there is no requirement for discussions to be minuted.

2.15 In December 2025, DSS advised the ANAO that there is a:

myriad of exchanges of information between the department and Services Australia about functions directly and indirectly related to the Age Pension, such as public enquiries, ministerial correspondence, means testing (treatment of income and assets, deeming, compensation, etc.), supplementary payments (Rent Assistance, Remote Area Allowance, etc.), administrative appeals, residency, international agreements, debt policy, data, concession cards, the Home Equity Access Scheme, the Pension Bonus Scheme, etc. These functions are often decentralised to specialist teams across the department, where informal engagement and issues management takes place on a daily basis.

The department also notes that additional to the two meetings between the DSS Secretary and Services Australia’s CEO set out in the BMA Head Agreement, these 2 officials meet monthly to discuss cross-cutting strategic matters and the performance of services delivered under the BMA.

2.16 While DSS and Services Australia have arrangements for regular and ongoing exchange of information across the different areas of each entity that support the administration of the age pension, without documentation and systemic follow-up, valuable insights may be lost, duplicated, or fail to inform strategic decision-making.

Opportunity for improvement

2.17 To support EPM and SBD, Program managers could discuss all aspects of program delivery with a focus on continuous improvement, including compliance activities, planned and actual staff resourcing and work levels, service delivery issues and stakeholder feedback.

Assurance statements

2.18 Services Australia provides annual assurance statements to DSS. Auditor-General Report No. 4 2023–24, Accuracy and Timeliness of Welfare Payments found the statements do not provide ‘an objective and independent assessment of governance, risk management and controls processes’.25 The report recommended DSS and Services Australia establish ‘processes to exchange relevant internal audit and management assurance reports and a robust bilateral assurance framework’.

2.19 In response to this recommendation, DSS and Services Australia signed the:

- BMA Corporate Services Protocol in February 2024. This protocol requires both entities to share with each other their internal audit and management assurance reports (relevant to social security payments, including the age pension).

- BMA Payment Assurance Protocol in March 2024. This Protocol outlines payment assurance objective, governance arrangements and their respective roles and responsibilities.

Payment integrity assurance

2.20 Services Australia relies on its processes and IT systems to assess age pension eligibility and calculate payment rates. Its core system, the Income Security Integrated System (ISIS), automates many steps of the assessment process, including applying the means test and calculating fortnightly payment rates.

2.21 DSS is responsible for assuring government that there are effective payment assurance controls to manage social security payment risks, including for the age pension, and is jointly responsible with Services Australia for reviewing payment assurance controls to ensure they are effective and appropriate. The BMA Payment Assurance Protocol defines assurance as:

how entities obtain confidence that program structures and processes are designed, implemented, and operate as intended. It is represented by effective and efficient controls to manage risks and achieve payment assurance and payment integrity objectives.

2.22 Services Australia’s annual assurance statements for 2021–22 to 2023–24 included its payment integrity assurance for the age pension and other program, which states:

The following has been implemented and is operational for all listed DSS administered programs:

- Risk Management Plan

- Risks managed to an acceptable level

- Controls are in place and operating effectively

- Payment testing undertaken as per schedule.

2.23 Payment integrity is defined by the annual assurance statements as:

a measure of the extent to which payments made on behalf of the government are managed correctly and appropriate controls are in operation to minimise the likelihood of processing and system errors. Payment integrity does not consider the role of customer non-compliance in outcomes — that is a factor considered in payment accuracy.

2.24 Services Australia’s payment integrity assurance demonstrates its confidence that effective controls are in place to mitigate risks associated with process and IT systems errors. The ANAO examined Services Australia’s basis for its age pension payment integrity assurance for 2023–24:

- Services Australia’s 2023–24 age pension risk management plan identified the risk of incorrect payment due to IT system error. The controls and treatments indicated to address the risk include detection of fraud and corruption, compliance activities, staff training and customer education. The risk management plan included access controls to verify users. There were no other IT-specific controls or treatments indicated (for example regular systems testing) to detect or monitor IT system errors.

- The 2023–24 risk age pension management plan was not reviewed quarterly as required by Services Australia’s processes.

- No age pension post payment transaction testing was conducted in 2023–24.

2.25 Services Australia advised the ANAO in July 2025 that it has internal assurance processes to audit, monitor and assess its various IT systems and, ‘these processes have some gaps and could be strengthened to ensure the IT systems supporting the administration of age pension claims are operating as intended’.

2.26 Services Australia commissioned an August 2019 internal audit on age pension payment assurance which found that:

The Age Pension program relies on some detective measures to identify system errors … [T]hese activities do not provide coverage to identify errors during business-as-usual operations. Mechanisms sighted provide assurance over controls in place to specifically identify errors in relation to the implementation of new system functionality. Consequently, the department does not have sufficient mechanisms in place to provide assurance that instances of system errors for existing systems or functionality for the Age Pension program would be identified. This gap poses a risk of non-compliance with the requirements of the AAIs [Accountable Authority Instructions26] and non-identification of incorrect payments …

In relation to detecting ongoing system errors, the Age Pension Program Team relies on several mechanisms including staff raising issues with Information and Communications Technology (ICT), issues raised by other business areas and analysis of Level 2 and Level 3 Helpdesk queries. This would not proactively detect system errors that may occur, particularly in relation to uncommon scenarios. … Additionally, customer feedback and complaints can provide an indication of system errors. However, this relies on the customer advising that their payment is incorrect, and then it is investigated thoroughly. The program does not have arrangements in place to provide full assurance that system errors would be identified.

2.27 Case Study 1 describes an IT system error that incorrectly excluded certain applicants’ superannuation when assessing age pension eligibility and payment rate.

|

Case study 1. Superannuation excluded from age pension eligibility assessment |

|

In May 2019, when an applicant transferred to the age pension from another social security payment, their superannuation details which Services Australia already had, were incorrectly excluded in assessing their age pension eligibility. Services Australia considered the issue resolved when it released a system fix in December 2019. The problem continued with similar incidents (involving multiple applicants) raised in April 2021, May 2021 and April 2022. In April 2021, Services Australia formally identified an IT system issue as the cause of the incorrect assessments and fixed it in December 2022 with no subsequent incidents reported. In January 2023, Services Australia identified 175,032 age pension recipients impacted by the issue since 2010 and estimated the potential overpayment at $37 million. Services Australia advised the ANAO in August 2025 that it waived all 26,409 overpayments ($19.8 million) which resulted from the IT system error. These overpayments were not identified through the sample cases reviewed from 2010 to 2022 under the Payment Accuracy Review Program and not included in reported payment inaccuracy estimates. Services Australia’s January 2025 post implementation review of this IT system error stated that the problem likely started in June 2010 following a systems release which automated transfers to age pension for some eligible existing recipients, and that:

The review noted that Services Australia is reliant on non-ICT channels such as complaints, concerns raised by front-line staff, helpdesk escalations and analysis of debt reasons, to identify IT system issues. The review referred to key systemic factors which contributed to the delay in identifying and treating the superannuation systems issue, including:

The review identified the following measures as critical to ensure early identification and monitoring of IT system issues:

The review reported that Services Australia met with DSS about the issue in November 2022 to discuss the potential waiver of the overpayments. |

2.28 Case Study 1 shows how an IT system error which resulted in incorrect age pension payments27 remained unresolved for more than ten years. Gaps in Services Australia’s processes and IT system controls limit Services Australia’s ability to promptly identify and address IT systems error. Other IT systems issues discussed in the BMA’s age pension Program managers’ meeting minutes involve recipients’ entitlement to work bonus and partners’ joint claim applications.

2.29 Paragraphs 3.20 to 3.30 discuss Services Australia’s reliance on automation through its IT system (ISIS) to apply the means test and calculate age pension payment rates. Services Australia’s June 2024 internal audit on management of automation found that it ‘has not taken timely action to remediate risks associated with its use of legacy automations’ and recommended that:

[Services Australia] should, as a matter of priority, finalise the risk assessment of all automations in use across the agency.

2.30 In 2022–23 and 2023–24, the ANAO’s Financial Statements audits reported a significant (category A)28 finding on Services Australia’s IT governance. In particular, the ANAO identified IT control issues which indicates that Services Australia’s IT governance and monitoring processes are not providing appropriate assurance that policy requirements have been implemented and are operating effectively. In 2024–25, the ANAO downgraded this significant (Category A) finding to a moderate (Category B)29 finding to reflect Services Australia’s progress in implementing remediation activities. Despite these efforts, most IT findings remain open and the ANAO has continued to raise new IT findings. The moderate finding will be closed when Services Australia demonstrates that controls are operating effectively, evidenced through a significant reduction in IT findings.

2.31 DSS is jointly responsible with Services Australia for reviewing payment assurance controls ‘to ensure they are effective and appropriate’. DSS should be aware of IT system errors impacting age pension payment correctness, as well as the limitations and risks associated with Services Australia’s payment integrity assurance.

Recommendation no.1

2.32 In line with their joint responsibility to review payment assurance controls and ensure they are effective and appropriate:

- Department of Social Services requires Services Australia to disclose in the annual assurance statements the limitations and risks associated with Services Australia’s payment integrity assurance, and to advise IT system issues in a timely manner;

- Services Australia fully discloses in its annual assurance statements the basis for, and limitations and risks associated with, its payment integrity assurance, and informs Department of Social Services as soon as practicable when it (Services Australia) identifies IT system errors impacting payment correctness; and

- Services Australia promptly rectifies issues identified in the IT systems which support the assessment of age pension, and implements controls to ensure IT systems are operating as intended.

Department of Social Services response: Agreed.

2.33 The department will work with Services Australia to strengthen the existing processes under the Bilateral Management Arrangement to improve the payment integrity assurance provided by Services Australia.

Services Australia response: Agreed.

2.34 Services Australia will review its annual assurance statements. It will also rectify issues identified in the IT system which support assessment of age pension and implement effective IT controls.

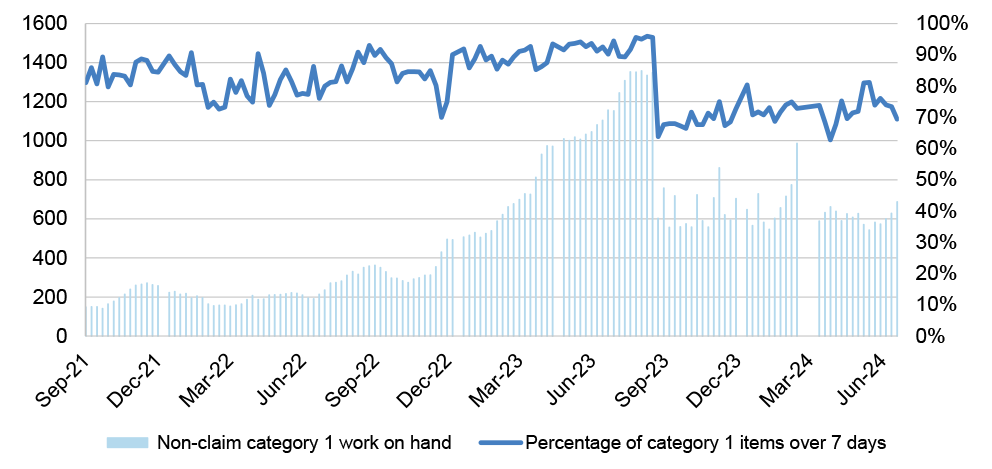

Monitoring performance

2.35 Services Australia is responsible for assessing age pension performance against the following measures:

- payment accuracy: 97 per cent of total outlay is accurately paid; and

- payment timeliness: 80 per cent of claims is processed within 49 days.

Payment accuracy

2.36 The Payment Accuracy Review Program (PARP) is the primary assurance mechanism for social security payment outlays, including the age pension. Through PARP, Services Australia reviews sampled recipients’ circumstances (such as income, assets and relationship status), and reassesses their payment rates to determine if they were paid correctly, underpaid or overpaid on a particular fortnight.

2.37 Table 2.2 shows that Services Australia met the age pension payment accuracy target of 97 per cent in 2021–22. It did not meet the target in 2022–23 and 2023–24. The estimated dollar value of incorrectly paid age pension for the three-year period was $5 billion or 3.03 per cent of total age pension outlay of $165.02 billion.

Table 2.2: Age pension PARP results 2021–22 to 2023–24

|

Year |

Total age pension outlay ($m) |

Age pension payment accuracy (%)a |

Age pension payment inaccuracy (%) |

Estimated payment inaccuracy ($m)b |

Target met / not met |

|

2021–22 |

51,117.4 |

97 |

3.00 |

1,533.5 |

✔ |

|

2022–23 |

54,746.4 |

96.95 |

3.05 |

1,668.3 |

✘ |

|

2023–24 |

59,156.4 |

96.97 |

3.03 |

1,794.1 |

✘ |

|

2021–2022 to 2023–24 |

165,020.2 |

96.97 |

3.03 |

5,000.0 |

– |

Key: ✔ Met performance target ✘ Did not meet performance target – Not applicable

Note a: DSS advised the ANAO in October 2025 that age pension payment accuracy results have 95 per cent confidence intervals that include the 97 per cent benchmark — performance was between 96.60 to 97.40 per cent (2021–22), 96.56 to 97.34 per cent (2022–23) and 96.52 to 97.42 per cent (2023–24). In dollar terms, this means that estimated age pension payment inaccuracy was between $1,329 million to $1,738 million (2021–2022), $1,456 million to $1,883 million (2022–23) and $1,526 million to $2,059 million (2023–24) or a total estimated payment inaccuracy of between $4.31 billion to $5.68 billion for the three-year period.

Note b: Estimated payment inaccuracy is determined by dividing the sum of weighted overpayments and underpayments on a particular fortnight by the sum of weighted payments to all sampled customers on the same fortnight and applying the resulting percentage to the total age pension outlay for the financial year.

Source: ANAO analysis of DSS and Services Australia PARP results.

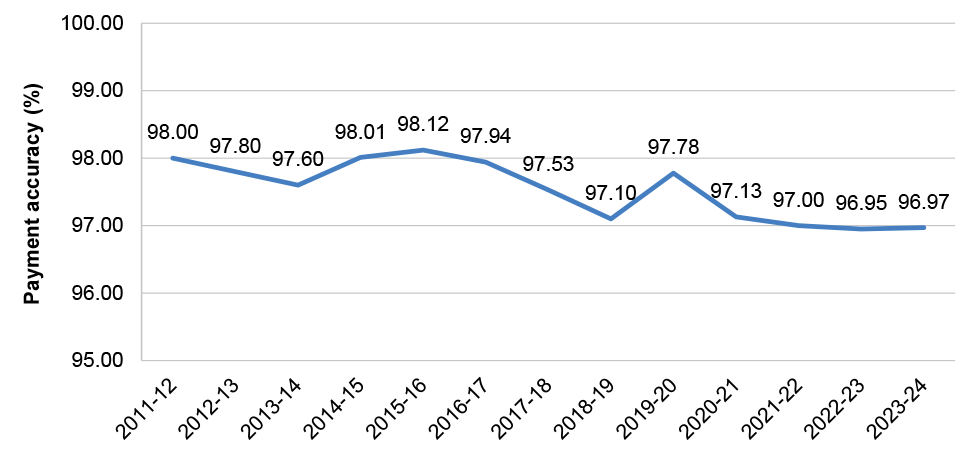

2.38 Available data from 2011–12, shows that age pension payment accuracy was above 97 per cent before 2021–22 (see Figure 2.1).

Figure 2.1: Age pension payment accuracy: 2011–12 to 2023–24a

Note a: For clarity, the Y-axis (vertical axis) starts at 95 per cent.

Source: ANAO analysis of DSS data.

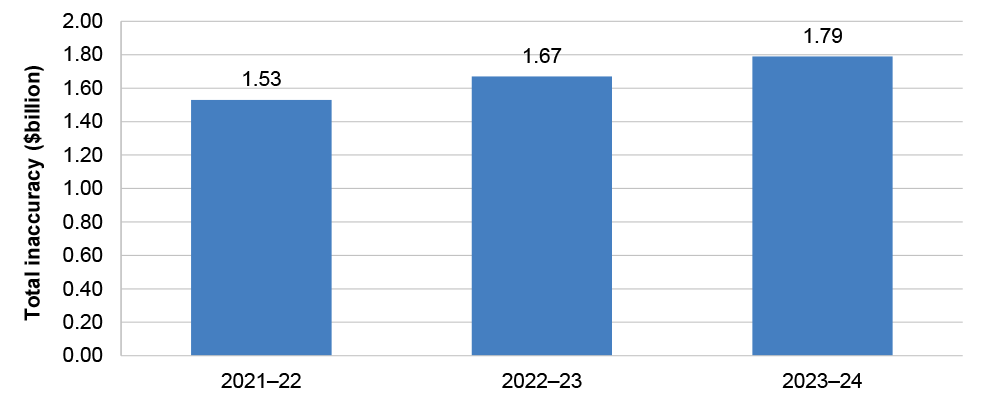

2.39 The estimated value of age pension payment inaccuracy rose by 16.99 per cent from $1.53 billion in 2021–22 to $1.79 billion in 2023–24 (see Figure 2.2). This aligned with the 15.73 per cent increase in the total age pension outlay for the same period.

Figure 2.2: Total dollar value of age pension payment inaccuracy: 2021–22 to 2023–24

Source: ANAO analysis of DSS data.

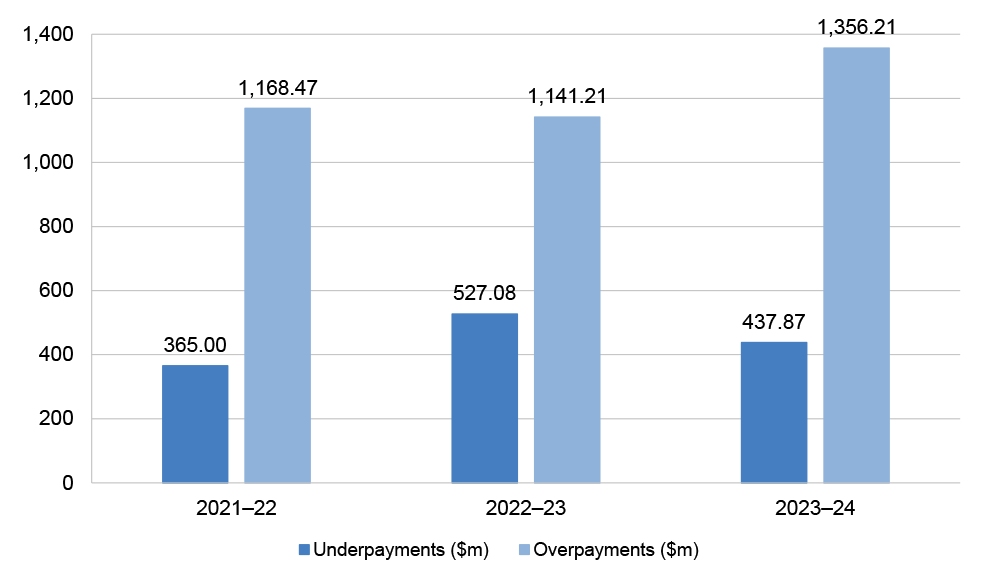

2.40 Figure 2.3 shows that of the estimated $5 billion incorrectly paid age pension from 2021–22 to 2023–24, age pension recipients were underpaid by $1.33 billion and overpaid by $3.67 billion.

Figure 2.3: Age pension payment inaccuracy: overpayments and underpayments

Source: ANAO’s analysis of DSS data.

2.41 Table 2.3 shows that for 2021–22 to 2023–24, 29.82 per cent of sampled recipients were incorrectly paid or received the wrong age pension payment rate.

Table 2.3: Proportion incorrectly paid age pension recipients: 2021–22 to 2023–24

|

Year |

Sampled recipients (no) |

Recipients incorrectly paid (no) |

Proportion of recipients incorrectly paid (%) |

|

2021–22 |

3,545 |

1,068 |

30.13 |

|

2022–23 |

3,908 |

1,189 |

30.42 |

|

2023–24 |

3,311 |

953 |

28.78 |

|

2021–2022 to 2023–24 |

10,764 |

3,210 |

29.82 |

Source: ANAO’s analysis of Services Australia data.

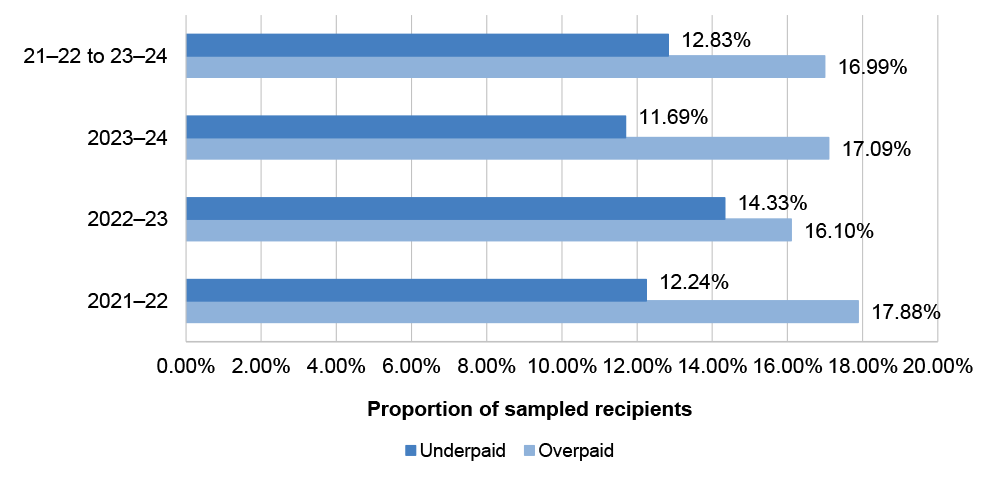

2.42 Figure 2.4 breaks down incorrectly paid recipients (29.82 per cent) to those who received less than they were entitled to (underpaid, 12.83 per cent) and those who received more than what they should have (overpaid, 16.99 per cent).

Figure 2.4: Proportion underpaid/overpaid age pension recipients: 2021–22 to 2023–24

Source: ANAO analysis of DSS data.

2.43 Services Australia informed the ANAO in August 2025 that:

when there is an underpayment (arrears) a recipient will be paid in line with the date of effect for a favourable determination under Social Security Law for Age Pension payments. Noting that if a recipient has a current debt, the arrears may be used to repay the debt on a case-by-case basis.

2.44 The risks that contribute the most to incorrect age pension payments are undeclared, incorrectly declared or incorrectly assessed assets and income from investments. Paragraphs 3.61 to 3.64 discuss these risks in further detail. Table 3.4 provides a breakdown of inaccurate payments resulting from recipient and administrative (Services Australia) error.

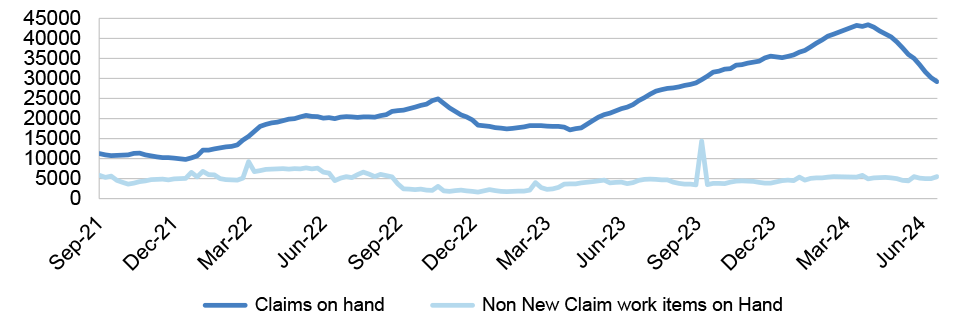

Payment timeliness

2.45 Services Australia provides quarterly reporting to DSS on payment timeliness results. Table 2.4 shows that Services Australia did not meet the payment timeliness performance target between 2021–22 to 2023–24. The quarterly average number of days to complete claims ranged from 29 to 84 days and there were between 9,788 and 42,232 claims outstanding at quarter end. The maximum number of days to complete claims was 1,527 calendar days or 4.2 years (see Note C in Table 2.4).

Table 2.4: Payment timeliness: 2021–22 to 2023–24

|

Quarter Financial year |

Claims finalised within 49 days (%) |

80% target met |

Average days to processa |

Minimum days to processb |

Maximum days to processc |

Number of claims outstanding at end of the quarter |

|

Q1 2021–22 |

68.19 |

✘ |

38 |

0 |

963 |

10,692 |

|

Q2 2021–22 |

71.40 |

✘ |

35 |

0 |

658 |

9,788 |

|

Q3 2021–22 |

79.40 |

✘ |

30 |

0 |

575 |

17,727 |

|

Q4 2021–22 |

66.83 |

✘ |

39 |

0 |

448 |

19,842 |

|

Q1 2022–23 |

70.52 |

✘ |

37 |

0 |

1,403 |

22,481 |

|

Q2 2022–23 |

69.16 |

✘ |

36 |

0 |

988 |

18,384 |

|

Q3 2022–23 |

72.05 |

✘ |

29 |

0 |

521 |

18,034 |

|

Q4 2022–23 |

75.77 |

✘ |

31 |

0 |

505 |

23,475 |

|

Q1 2023–24 |

51.61 |

✘ |

64 |

0 |

644 |

30,610 |

|

Q2 2023–24 |

47.30 |

✘ |

80 |

0 |

1,527 |

34,885 |

|

Q3 2023–24 |

38.64 |

✘ |

84 |

0 |

649 |

42,232 |

|

Q4 2023–24 |

52.74 |

✘ |

74 |

0 |

523 |

29,224 |

Key: ✔ Met performance target ✘ Did not meet performance target

Note a: Rounded to the nearest whole.

Note b: Claims assessment was completed on the day of receipt.

Note c: Calculation is based on the date a claim is received and when it is finalised. Where a claim has been rejected and later reassessed on appeal, it retains the original date of receipt.

Source: Services Australia data.

2.46 In its 2022–23 Annual Assurance Statement, Services Australia reported that it did not meet the payment timeliness target as:

- Age pension claims are complex and it takes time for staff to gain proficiency in processing these claims.

- Staff resources were diverted to other priorities. Staff that process age pension claims are responsible for other tasks in several program and service areas and their work is prioritised to ‘maximise available resource efficiency and balance the performance of programs, focusing on areas of greatest benefit to customers’.

2.47 In 2023–24, the Australian Government provided $228 million to increase Services Australia’s frontline staffing and operations. In its 2023–24 Annual Assurance Report to DSS, Service Australia said that it:

- hired 6,000 staff30 from October 2023 to improve access to services and help reduce the backlog of claims, including for the age pension; and

- was able to reduce the backlog of claims by 68 per cent as at June 2024.

2.48 The reduction was not observed across all payments. In the case of the age pension, outstanding claims increased by 24.5 per cent from the fourth quarter of 2022–23 to the fourth quarter of 2023–24 (see Table 2.4). Services Australia met the timeliness performance target in the second (84.8 per cent) and fourth (82 per cent) quarters of 2024–25. The yearly timeliness performance result was 76 per cent against the 80 per cent target.31

Addressing performance results

2.49 The BMA’s purpose for monitoring payment accuracy and timeliness performance results is to determine whether social security payments, including the age pension ‘are delivered to the right eligible people at the right time and at the right rate’. The BMA’s Payment Assurance Protocol provides that DSS is responsible for ‘monitoring, reviewing, and addressing payment assurance performance results and outcomes to ensure that strategies employed are proving effective’.

2.50 DSS receives quarterly results for payment timeliness and trimester results for payment accuracy. DSS and Services Australia SES officers discuss the results at EPM and SBD meetings. In November 2022, September 2023, March 2024 and December 2024, the DSS Secretary expressed concern about the results to the Services Australia CEO. From 2023–24 to 2024–25, DSS routinely advised the Minister for Social Services and Assistant Minister for Services on the results.

2.51 In November 2024, DSS facilitated a meeting between the Assistant Minister for Social Security and the Minister for Government Services. This meeting resulted in action items for DSS and Services Australia to work together to further understand age pension waiting time and conduct an end-to-end review of age pension policies and procedures. DSS advised the ANAO in August 2025 that these items continue to be monitored in SBD and EPM meetings.

2.52 In May 2025, DSS advised the incoming Minister of Social Services that legislation for social security programs, including the age pension is complex:

The underpinning legislation on which almost all social security policy is based is vast and complex. The last overhaul of the Social Security Act 1991 was 34 years ago, and it has been amended hundreds of times since. This complexity, and the sustained demand for social security, have led to service delivery challenges and claim backlogs.

2.53 Services Australia noted in its January 2025 post implementation review of an IT system error (see Case Study 1) that legislative complexity makes it difficult for seniors and service officers to understand age pension requirements (particularly income and asset assessments) and increases the risk of IT system errors that lead to incorrect assessments and payments. Services Australia’s 2022–23 annual assurance statement said that legislative complexity impacts service officers’ ability to process claims in a timely manner.

Recommendation no.2

2.54 Department of Social Services addresses payment accuracy and timeliness performance results by developing and implementing an approach to ensure that Services Australia’s assessment and compliance processes address risks to payment accuracy and timeliness.

Department of Social Services response: Agreed.

2.55 The department will continue to build upon work already undertaken to strengthen the approaches documented in the Bilateral Management Arrangement protocols and schedules to ensure performance and risk is understood.

Managing risks

2.56 DSS had an age pension risk register which it updated in January 2019. The ANAO assessed DSS’ age pension risk register and found that it did not comply with the mandatory requirements of the Commonwealth Risk Management Policy (see Table 2.5).

Table 2.5: ANAO assessment of DSS’ age pension risk register

|

Commonwealth Risk Management Policy requirements |

ANAO assessment |

|

|

Clear definition of risk management responsibilities |

✘ |

Risk register does not indicate who is responsible for the risks. |

|

Periodic review of the effectiveness of risk controls |

✘ |

DSS last reviewed the risks and controls in January 2019. |

|

Formalised approach to risk management |

✘ |

DSS does not have a risk management plan for the age pension. |

|

Arrangement to identify, manage and escalate risks |

✘ |

DSS does not have this arrangement. |

Key: ✔ Consistent with Commonwealth Risk Management Policy (CRP) ✘ Not consistent with CRP

Source: ANAO analysis of DSS documentation.

2.57 The BMA’s Shared Risk Management Protocol outlines the following responsibilities for managing shared risks for social security programs, including the age pension:

- DSS is responsible and accountable for managing risks related to social services policies and programs;

- Services Australia is responsible for managing risks related to the payments and services it delivers under the BMA; and

- DSS and Services Australia are jointly responsible for shared risks, including managing and maintaining a shared risk register which summarises all identified shared operational and strategic risks.

2.58 DSS advised the ANAO in July 2025 that together with Services Australia, it developed a shared risk plan and shared risk register for social security payments including the age pension.

Does the Department of Social Services have oversight of the Department of Veterans’ Affairs’ administration of age pension eligibility criteria?

DSS has not reviewed the 2013 Memorandum of Understanding — which governs DVA’s administration of the age pension to veterans and their partners — since its execution. DSS’ oversight has not ensured that performance meets agreed standards and that DVA is set up to administer the age pension consistent with legislation.

Oversight arrangements

2.59 DVA administers the age pension program to 3,818 veterans and their partners as at June 2024. This represents 0.15 per cent of all age pension recipients as at June 2024. The arrangement commenced in 1998 and is currently governed by the 2013 MOU between DVA and the then Department of Families, Housing, Community Services and Indigenous Affairs.

2.60 The MOU provides for the following governance arrangements:

- designated roles and responsibilities; and

- half-yearly performance assurance reporting — relevant to the administration of age pension eligibility criteria, the MOU requires these reports to cover performance results for payment correctness, ongoing assessments to ensure correct payment and service delivery issues.

2.61 The MOU does not provide for periodic meetings between DSS and DVA to discuss policy, service delivery issues and performance results. Beginning December 2024, DSS established an age pension program managers meeting with DVA.

2.62 DSS has not reviewed the MOU since its execution in 2013. The MOU sets out a requirement to review it annually ‘to ensure good governance, currency of information and scope of services’. DSS advised the ANAO in July 2025 that it commenced working with DVA to refresh the MOU in April 2025.

2.63 DSS does not identify and manage risks relative to DVA’s administration of the age pension.

Roles and responsibilities

2.64 Table 2.6 shows the roles and responsibilities as prescribed by the MOU.

Table 2.6: Roles and responsibilities per the MOU: DSS and DVA

|

DSS |

DVA |

|

|

Source: 2013 MOU between DSS and DVA.

Performance assurance reports

2.65 DVA is responsible for assessing its performance against:

- payment correctness: 95 per cent of total outlays are correctly paid; and

- payment timeliness: 80 per cent of claims are processed within 28 days.

2.66 Table 2.7 outlines DVA’s payment correctness performance results for the period May 2021 to April 2024. The limited number of assessments reviewed per performance cycle does not provide a representative sample of total claims completed. The MOU does not establish performance monitoring processes, including minimum sampling rates.

Table 2.7: Payment correctness: May 2021 to April 2024

|

Reporting period |

No. of claims completed |

No. of claims checked for correctness |

No. of claims correctly assessed (%) |

Performance target (95%) met |

|

May to October 2021 |

209 |

5 |

3 (60.0) |

✘ |

|

November 2021 to April 2022 |

178 |

2 |

2 (100.0) |

✔ |

|

May to October 2022 |

227 |

13 |

5 (38.5) |

✘ |

|

November 2022 to April 2023 |

222 |

15 |

15 (100.0) |

✔ |

|

May to October 2023 |

233 |

24 |

14 (58.3) |

✘ |

|

November 2023 to April 2024 |

180 |

17 |

8 (47.1) |

✘ |

|

Total |

1,249 |

76 |

47 (61.8) |

✘ |

Key: ✔ Met performance target ✘ Did not meet performance target

Source: ANAO analysis of DVA documentation.

2.67 Table 2.8 outlines DVA’s payment timeliness performance results for the period May 2021 to April 2024. The performance target was not met.

Table 2.8: Payment timeliness: May 2021 to April 2024

|

Reporting period |

Percentage of claims assessed within 28 days (%) |

Performance target (95%) met |

|

May to October 2021 |

11.0 |

✘ |

|

November 2021 to April 2022 |

21.3 |

✘ |

|

May to October 2022 |

15.4 |

✘ |

|

November 2022 to April 2023 |

22.1 |

✘ |

|

May to October 2023 |

38.2 |

✘ |

|

November 2023 to April 2024 |

33.9 |

✘ |

Key: ✔ Met performance target ✘ Did not meet performance target

Source: ANAO analysis of DVA documentation.

2.68 Consistent with the MOU, the six performance assurance reports included sections on: DVA’s strategies to ensure payment correctness and processes to confirm recipients’ ongoing eligibility. The six reports enumerated the same strategies and processes without explaining if and how they address payment accuracy risks such as undeclared, incorrectly declared or incorrectly assessed assets and income.

Administration inconsistent with legislation

2.69 DVA is not set up to support its age pension recipients who may be eligible under international social security agreements as required by the Social Security (International Agreements) Act 1999.32 DVA estimates that this issue potentially impacts 17.5 per cent of its age pension recipients (650 of 3,717 as at December 2022).

2.70 DSS learned about DVA’s non-compliance with the Social Security (International Agreements) Act 1999 in 2022 — 24 years after it first authorised DVA to administer the age pension in 1998. This occurred when an age pension recipient informed DVA in May 2022 that a pension they were receiving from another country was cancelled when they switched from Services Australia to DVA as administrator. On investigation, the pension from the other country was discontinued because DVA is not set up to deliver the age pension consistent with the Social Security (International Agreements) Act 1999:

- DVA is not specified as a liaison agency in Australia’s international social security agreements; and

- DVA does not have processes and IT systems to exchange data and information with partner countries for the assessment and payment of claims.

2.71 Unlike DVA, Services Australia is set up to administer the age pension in accordance with international social security agreements. As the liaison agency for Australia’s 32 international social security agreements, Services Australia’s Centrelink International Services can advise recipients on potential benefits, such as foreign payments or higher rates while overseas, and co-process claims and share information with partner countries.

2.72 DSS is yet to resolve this issue (as at December 2025). DSS documentation shows that while the issue remains unresolved, the Australian Government is paying the recipient the pension they should otherwise be receiving from the other country.

Recommendation no.3

2.73 Department of Social Services and Department of Veterans’ Affairs complete the refresh of the 2013 Memorandum of Understanding to ensure that the Department of Veterans’ Affairs is set up to administer the program consistent with legislation, and establishes:

- arrangements for the Department of Social Services to oversee the Department of Veterans’ Affairs’ administration of the age pension;

- performance assurance arrangements that include reporting on performance and ensuring the effectiveness of strategies to address risks;

- methodology to monitor, measure and report on performance;

- regular reviews of processes and systems to administer the age pension to ensure they are operating as intended; and

- risk management processes and reporting.

Department of Social Services response: Agreed in principle.

2.74 The department has commenced work with the Department of Veterans’ Affairs to review the Memorandum of Understanding between the two departments.

2.75 This work will consider a range of mechanisms to improve current administrative arrangements for the Age Pension, including those identified in Recommendation 3.

Department of Veterans’ Affairs response: Agreed.

2.76 DVA supports the review of the 2013 MOU with a particular focus on performance assurance, performance measures and monitoring. This review will be done in conjunction with DSS. DVA has been reviewing the administration of Age Pension having regard to the Social Security (International Agreements) Act 1999. DSS has provided an options paper and after review of the options put forward, DVA acknowledges the issues with DVA undertaking the functions and administering the payment for veterans receiving an Age Pension in accordance with the provisions of an International Agreement. DVA will work with DSS to develop a strategy to resolve this issue. The agreed approach will incorporate a communication strategy.

2.77 DVA will complete a review of associated risks consistent with the Commonwealth Risk Management Policy. This work will better inform the review of performance measures and targets. DVA notes the requirement to monitor ongoing eligibility and consider that this should be covered under ongoing entitlement reviews. DVA is supportive of measures that are consistent with current Services Australia methodology.

2.78 DVA and DSS currently hold regular meetings to monitor performance. DSS and DVA initiated the process of reviewing the MOU with a meeting in April 2025. The review going forward will include the development of an agreed quantitative and qualitative methodology for monitoring performance.

Does the Department of Social Services appropriately evaluate the age pension program?

DSS evaluates the accuracy of age pension payments accuracy and the proportion of senior Australians supported in their retirement through the age pension or other income support. DSS does not evaluate program impact on recipients as required by the Social Security (Administration Act) 1999.

2.79 Reporting on program performance promotes trust and confidence in the public sector.33 It is the primary means by which public entities demonstrate to Parliament and the Australian community how well they have used taxpayers’ money to deliver services and whether and to what extent they have achieved government outcomes.

2.80 The Social Security (Administration) Act 1999 section 8 states that the DSS Secretary should have a process to monitor and evaluate program delivery ‘with an emphasis on the impact of programs on social security recipients’.34

2.81 The government’s Commonwealth Evaluation Policy states that:

Commonwealth entities and companies are expected to deliver support and services for Australians by setting clear objectives for major policies, projects and programs, and consistently measuring progress towards achieving these objectives.

2.82 DSS’ 2023 Evaluation Manual: Introduction to Evaluation at the Department of Social Services: How to improve program design, performance and outcomes (the Evaluation Manual) is consistent with the Commonwealth Evaluation Policy. The Evaluation Manual states that evaluation should be designed ‘for the purposes of continuous improvement, accountability and decision-making’ and that evaluation is about determining ‘the progress it has made towards achieving its planned policy/program objectives’.

The Department of Social Services’ program logic for the age pension

2.83 The Evaluation Manual explains that to prepare a program for evaluation, DSS should have a program logic which sets out the change the program aims to achieve and how the program’s resources and activities will lead or contribute to planned outcomes. The Evaluation Manual states that ‘the program logic process will carefully define the outcomes to ensure that they can be monitored and valuated properly and will generate useful evidence’.

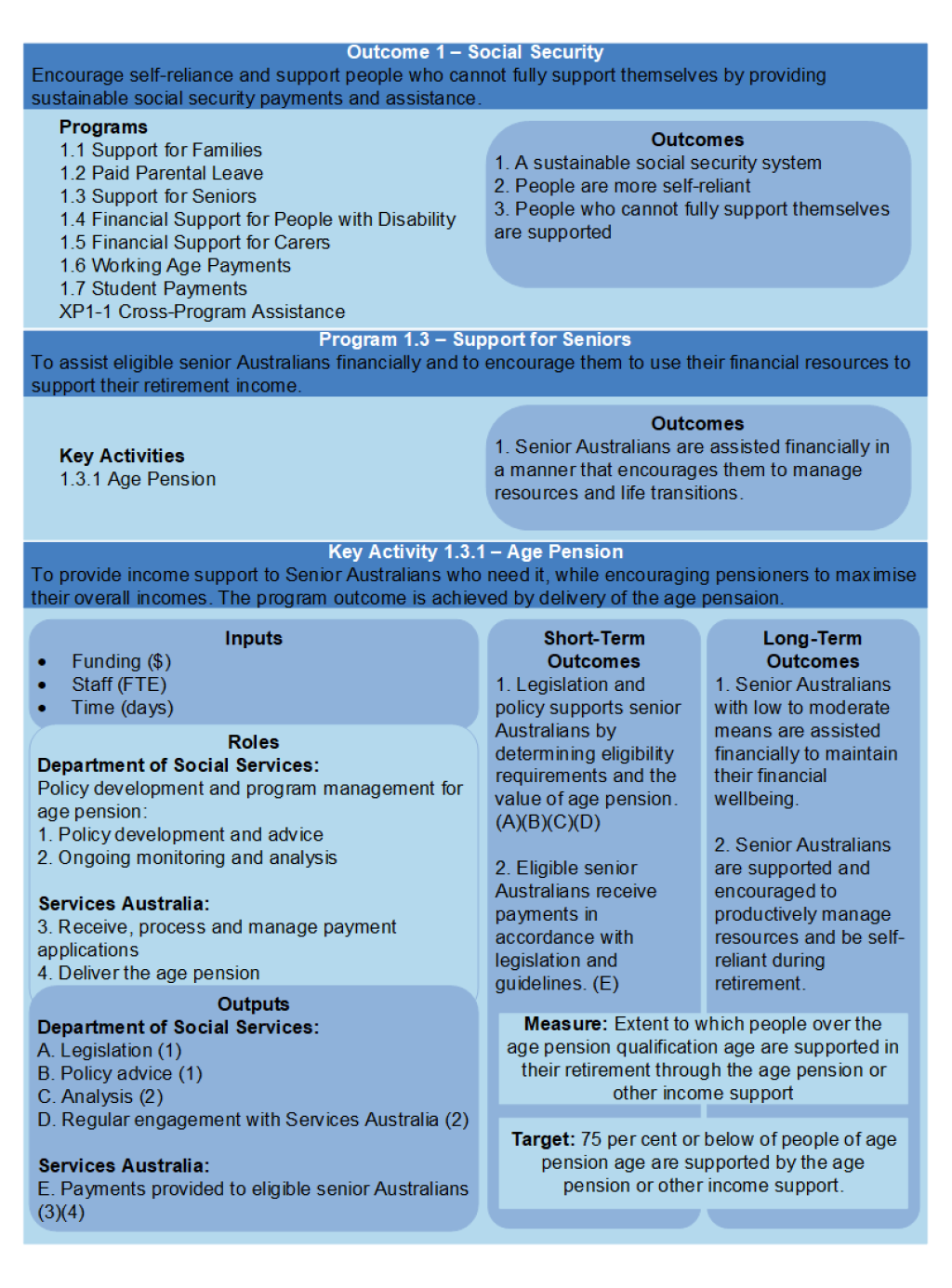

2.84 Figure 2.5 shows how DSS links its purpose to the age pension performance measure and key activity.

Figure 2.5: Department of Social Services age pension performance measure overview

Source: DSS’ Age pension program logic.

2.85 DSS’ 2024–25 program logic (Appendix 6) provides for age pension outcomes and a performance measure (Table 2.9).

Table 2.9: Age pension program logic: outcomes and performance measure

|

Program outcome |

Performance measure |

|

Key activity 1.3 age pension outcome To provide income support to Australians who need it, while encouraging pensioners to maximise their overall income. The program outcome is achieved by the delivery of the age pension. |

Extent to which people over the age pension qualification age are supported in their retirement through the age pension or other income support. Target: 75 per cent or below of age pension age are supported by the age pension or other income support. |

|

Long-term outcomes

|

|

|

Short-term outcomes

|

|

Source: DSS’ age pension program logic.

Intended outcome

2.86 When introduced in 1909, the age pension was subject to a means test to target the pension to those most in need. There have been changes to the calculation of the means test, its purpose has remained the same:

While the essential nature of the means test (ie the assessment of a pensioner’s eligibility for a pension based on their accumulated wealth) has not changed markedly since its introduction, the way in which the means test affects an individual’s pension rate has undergone significant change.35

2.87 DSS’ 2023 submission to the Senate Community Affairs References Committee’s Inquiry into the Extent and Nature of Poverty in Australia, referred to the aim of the age pension program to provide recipients an acceptable standard of living, accounting for prevailing community living standards.36

2.88 The age pension program logic identifies short term and long term outcomes that refer to the provision of financial assistance to eligible senior Australians to maintain their financial wellbeing.

Performance measure

2.89 DSS’ performance measure — the proportion of people over the age pension qualification age who are supported in their retirement through the age pension or other income support — does not measure the program’s impact on recipients. DSS is not evaluating the age pension program to assess the impact on recipients as required by the Social Security (Administration) Act 1999 section 8.37