Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Australian Securities and Investments Commission’s Regulation of Registered Company Auditors

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Audited financial statements provide important information for capital markets and are essential for effective corporate governance.

- The Australian Securities and Investments Commission (ASIC) is responsible for regulating registered company auditors who audit the financial reports prepared by entities under the Corporations Act 2001.

- This audit provides assurance to Parliament on the effectiveness of ASIC’s regulation of registered company auditors.

Key facts

- Between 2019–20 and 2023–24, ASIC conducted surveillances of 183 audits of 125,653 financial reports, leading to

six investigations and one enforcement outcome; and - During this time, ASIC completed 95 investigations into registered company auditors with 89 enforcement outcomes, of which 88 per cent were for failure to pay levies or submit annual reporting.

What did we find?

- ASIC’s regulation of registered company auditors is partly effective.

- ASIC has integrated arrangements for regulating registered company auditors into its broader regulatory systems. It is not measuring the achievement of regulatory outcomes.

- Fundamental components of an effective regulatory approach are in place although ASIC’s visibility of audit quality or the impact of its own regulatory actions is narrow, and there is limited follow-through of quality issues identified.

What did we recommend?

- The Auditor-General made two recommendations to ASIC about performance measurement and two related to planning and follow-through of surveillance activities. One recommendation on ministerial statements of intent was made to the Department of the Treasury.

- ASIC and the Department of the Treasury agreed to their respective recommendations.

3,177

Registered company auditors in 2023–24.

84.7%

Auditor resignation applications finalised within 28 days.

80

Auditor registrations ceased or cancelled due to ASIC action from 2019–20 and 2023–24.

Summary and recommendations

Background

1. The Corporations Act 2001 (Corporations Act) requires certain types of regulated entities to have their financial reports audited by a registered company auditor (including registered company auditors operating as an authorised audit company).1 Registered company auditors are required to:

- maintain independence by identifying and mitigating conflict of interest situations and meeting requirements for auditor rotation;

- deliver quality audits that meet auditing standards;

- publish an audit transparency report; and

- lodge certain documents with ASIC, including an annual statement.

2. The Australian Securities and Investments Commission (ASIC) is responsible for regulatory functions designed to ensure registered company auditors meet independence and quality requirements related to audits of financial reports under the Corporations Act.

Rationale for undertaking the audit

3. Audited financial statements provide important information for capital markets and are essential for effective corporate governance. ASIC is responsible for regulatory functions designed to ensure registered company auditors meet independence and quality requirements related to audits of financial reports under the Corporations Act.

4. This audit was conducted to provide assurance to Parliament on the effectiveness of ASIC’s regulation of registered company auditors. This audit was identified as a priority by the Joint Committee of Public Accounts and Audit for the 2024–25 Annual Audit Work Program.

Audit objective and criteria

5. The objective was to assess the effectiveness of ASIC’s regulation of registered company auditors.

6. To form a conclusion against the objective, the ANAO adopted the following high-level criteria:

- Have appropriate arrangements been established to support regulatory activities?

- Is the regulatory approach effective?

Conclusion

7. ASIC’s regulation of registered company auditors is partly effective. While components of an effective regulatory approach and supporting arrangements are in place, ASIC is not measuring its achievement of regulatory outcomes, which is important to demonstrate the effective use of public resources. ASIC allocates the majority of its surveillances resources to individual audit file surveillances without assessing if this is the most effective use of surveillances resources.

8. ASIC has integrated the function of regulating registered company auditors into its broader regulatory systems, including agency governance, cost-recovery levies, probity management, stakeholder communications and staff training. ASIC’s ministerial statement of expectations has not been updated since August 2021 and is overdue to be refreshed. ASIC’s business planning and regulatory targeting is informed by risk. However, while ASIC has linked its registered company auditor regulatory activities to its statutory objectives and strategic priorities, it does not measure or assess whether regulatory outcomes for registered company auditors are being achieved nor whether ASIC’s interventions are contributing to the achievement of those outcomes. Measuring the achievement of outcomes is important to demonstrate the effective use of public resources. As a result, ASIC’s arrangements to support regulatory activities for registered company auditors are partly effective.

9. ASIC’s approach to regulation of registered company auditors is partly effective. Fundamental components of an effective regulatory approach are in place, such as ASIC’s administration of the registration of company auditors, monitoring ongoing compliance obligations such as mandatory reporting and payment of levies, and processing the resignation and removal of auditors from audit engagements. ASIC’s supervision of audit quality is based primarily on a small number of individual audit surveillances targeted at higher-risk entities. There is limited follow-through of quality issues identified in these surveillances other than reporting thematic findings to industry annually. ASIC has not implemented procedures for using the audit deficiency reporting process established by legislation in 2012. As a result of these factors, ASIC’s visibility of audit quality or the impact of its own regulatory actions is narrow. ASIC has taken administrative and criminal enforcement action in the last five years; 88 per cent of cases with an enforcement result related to failure to pay levies or submit mandatory annual reporting rather than issues of audit quality or professional misconduct.

Supporting findings

Arrangements to support regulatory activities

10. ASIC has integrated the function of regulating registered company auditors into its broader regulatory systems (including agency governance, cost-recovery, probity frameworks, stakeholder communications and staff training). This approach is appropriate given the multiple frameworks that apply to ASIC’s regulated populations. ASIC’s ministerial statement of expectations and regulator statement of intent have not been refreshed in accordance with better practice. (See paragraphs 2.1 to 2.44)

11. ASIC assesses strategic regulatory risks through an ongoing threats and harms assessment process. In 2024–25, two out of 90 identified threats and harms related to registered company auditors. The activity to respond to ‘lack of skilled auditors’ was ‘monitoring and engagement with the audit industry’, with all other regulatory activities undertaken in response to the risk of ‘poor auditor quality resulting in declining market confidence and potential investor losses’. ASIC’s business planning for 2024–25 considered the two identified threats and harms. Since 2021–22 ASIC’s primary regulatory activity in response to regulatory risk for registered company auditors (audit surveillances) has been predominantly based on risk-based targeting. (See paragraphs 2.45 to 2.56)

12. ASIC is revising its annual performance statements to address deficiencies in how it reports its achievement of its statutory objectives. ASIC has identified two regulatory outcomes for registered company auditors that contribute to the achievement of one of ASIC’s statutory objectives. ASIC has no mechanism to measure whether these regulatory outcomes are being achieved. ASIC regularly reports activity and output-based performance information for the regulation of registered company auditors. (See paragraphs 2.57 to 2.64)

Effectiveness of regulatory approach

13. ASIC’s procedures and guidance for assessing registered company auditor and authorised audit company applications are consistent with legislative requirements and largely implemented as intended. ASIC monitors registration requirements through annual statements and transparency reports lodged by registered company auditors but does not have a documented process for reviewing transparency reports. ASIC’s publicly reported service charter includes one measure on the timeliness of the assessment of registration applications. There are no service charter measures relevant to ASIC’s interactions with registered company auditors once their registration has been approved. ASIC did not meet its internal performance indicator for the timeliness of processing voluntary cessations between 2019–20 and 2023–24; roughly half of all voluntary cessations processed in 2021–22 and 2022–23 exceeded the 28-day target. ASIC does not report against a target for the finalisation of registered company auditor resignations and removals. (See paragraphs 3.1 to 3.45)

14. ASIC monitors registered company auditors through surveillances of individual audit files and complementary projects such as reviewing audit transparency reporting and examining auditor independence. The number of audit files reviewed each year is small compared to the number of financial statements lodged (183 out of 125,653 from 2019–20 to 2023–24). ASIC conducts audit surveillances largely in line with its documented procedures. ASIC assigns a rating for the quality of the audit file at the conclusion of a surveillance, but these ratings are not used to monitor the impact of audit surveillances on audit quality. ASIC publicly reports thematic findings from its audit surveillances each year but does not measure whether these reports are an effective tool to promote the improvement and maintenance of audit quality. (See paragraphs 3.46 to 3.64)

15. ASIC is not monitoring or reporting on the actions registered company auditors commit to take in response to audit surveillance activities. ASIC has not implemented procedures for using the audit deficiency reporting process established by legislation in 2012. ASIC has entity-wide guidance and procedures for assessing whether to undertake investigations. From 2019–20 to 2023–24, ASIC commenced 95 investigations into registered company auditors, with 68 investigations relating to outstanding annual statement or levy matters. During this period ASIC recorded 89 enforcement results against registered company auditors, 78 of which were voluntary or involuntary cessations of the auditor’s registration due to outstanding annual statement or levy matters. ASIC referred 45 cases to the Companies Auditors Disciplinary Board (CADB) from 2019–20 to 2023–24. ASIC records disciplinary action taken by professional accounting bodies in relation to registered company auditors. ASIC could increase the use of information sharing agreements with international counterparts. (See paragraphs 3.65 to 3.100)

Recommendations

Recommendation no. 1

Paragraph 2.43

The Department of the Treasury advise the Treasurer that the statement of expectations for the Australian Securities and Investments Commission is due to be refreshed.

Department of the Treasury response: Agreed.

Recommendation no. 2

Paragraph 2.63

The Australian Securities and Investments Commission develop measures to report on the performance of regulatory outcomes for registered company auditors.

Australian Securities and Investments Commission response: Agreed.

Recommendation no. 3

Paragraph 3.44

The Australian Securities and Investments Commission publicly report on the timeliness of processing registered company auditor resignations and removals against nominated performance targets.

Australian Securities and Investments Commission response: Agreed.

Recommendation no. 4

Paragraph 3.54

The Australian Securities and Investments Commission reviews and improves its registered company auditor surveillance activities to ensure surveillance activities are risk-based, data driven and achieve their intended outcomes. This includes reviewing if the allocation of surveillance resources between individual audit file surveillances and thematic surveillances is the most effective allocation to achieve its outcomes.

Australian Securities and Investments Commission response: Agreed.

Recommendation no. 5

Paragraph 3.75

The Australian Securities and Investments Commission:

- monitor and report on whether registered company auditors follow through on voluntary commitments to take remedial action in response to audit surveillance activities; and

- implement procedures for the audit deficiency process established by the Australian Securities and Investments Commission Act 2001.

Australian Securities and Investments Commission response: Agreed.

Summary of entity response

16. The proposed audit report was provided to ASIC and an extract of the proposed audit report was provided to the Department of the Treasury (Treasury). Summary responses from the entities are provided below. Full responses are in Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Australian Securities and Investments Commission

ASIC acknowledges the findings in the Auditor General’s report and agrees to action the recommendations and opportunities for improvement.

ASIC is committed to strong oversight of auditors and enhancing the integrity and quality of financial reporting and auditing in Australia. We use the full range of regulatory tools available to us to improve financial reporting and audit quality. This includes our proactive surveillance of financial reports and audits, and our pursuit of enforcement action where appropriate – this work is critical to upholding public trust and confidence in our financial system.

The ANAO’s recommendations that we measure and report on the outcomes of our regulation of registered company auditors and review our auditor surveillance activities represent an opportunity for ASIC to continue to evolve and enhance its regulation of auditors.

We will review our surveillance of registered company auditors to ensure we are continuing to undertake surveillance activities that are risk-based, data driven and achieve our intended outcomes. We will develop and report on measures to demonstrate how we are achieving our outcomes for registered company auditors. We will also commence reporting on the actions auditors propose to take in response to our surveillance findings and the timeliness of our processing of registered company auditor resignation and removals.

Department of the Treasury

Treasury welcomes the report from the ANAO. Treasury agrees with Recommendation no. 1. Treasury will advise the Treasurer that the statement of expectations for the Australian Securities and Investments Commission is due to be refreshed.

Key messages from this audit for all Australian Government entities

17. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Policy/program implementation

Performance and impact measurement

1. Background

Introduction

1.1 The Corporations Act 2001 (Corporations Act) requires certain types of companies, registered schemes, and bodies that hold enhanced disclosure securities to have their financial reports audited by a registered company auditor or an authorised audit company.2

1.2 In 2004 the Corporations Act and other laws were amended by the Corporate Law Economic Reform Program (Audit Reform and Corporate Disclosure) Act 2004 (CLERP 9 Act) to establish a broad regulatory framework governing audit oversight and independence arrangements.3 The explanatory memorandum stated:

Audited financial statements are an important part of the financial information that is available to the capital markets and an essential element of effective corporate governance. Auditor independence is fundamental to the credibility and reliability of auditors’ reports and in turn independent audits perform an important function in terms of capital market efficiency. There has been widespread concern about the efficacy of the audit function, including the independence of auditors, as a result of major corporate collapses in Australia and overseas, including HIH.4

1.3 The auditing of financial reports is intended to support market integrity and provide confidence in the reliability of financial reporting to users such as investors and regulators. A registered company auditor’s report provides an opinion to users of regulated entities’ financial reports as to whether the financial report:

- has been prepared in compliance with applicable accounting standards; and

- shows a true and fair view of the company’s financial position for the relevant financial year.5

1.4 The Corporations Act establishes a regulatory framework for registered company auditors in relation to independence and audit quality. Under this regulatory framework:

- the Australian Securities and Investments Commission (ASIC) is the regulator of the financial reporting and auditing requirements of the Corporations Act;

- the Auditing and Assurance Standards Board (AUASB) is responsible for issuing standards detailing the requirements and responsibilities of the auditors; and

- registered company auditors are responsible for:

- maintaining independence by identifying conflict of interest situations and meeting requirements for auditor rotation;

- ensuring audit quality by following recognised auditing standards;

- publishing an audit transparency report;

- lodging certain documents with ASIC, including an annual statement; and

- complying with any additional conditions of registration set by ASIC.

1.5 ASIC defines audit quality in the following terms:

Audit quality refers to matters that contribute to the likelihood that the auditor will:

- achieve the fundamental objective of obtaining reasonable assurance that the financial report as a whole is free of material misstatement, and

- ensure material deficiencies detected are addressed or communicated through the audit report.

This includes appropriately challenging key accounting estimates and treatments that can materially affect the reported financial position and results.6

About registered company auditors

1.6 The Corporations Act requires registered company auditors to hold relevant qualifications, appropriate skills and be a capable, fit and proper person.7 Relevant qualifications comprise at least three years of accounting and auditing studies and at least two years of commercial law studies. Appropriate skills are demonstrated by either:

- meeting the Auditor Competency Standard for Registered Company Auditors over a three-to-five-year period of continuous assessment8; or

- undertaking appropriate practical experience involving at least 3,000 hours work in auditing under the direction of a registered company auditor, including undertaking audits required under the Corporations Act and 750 hours supervising audits of companies.

1.7 Authorised audit companies allow individual registered company auditors to incorporate. Incorporation supports individual registered company auditors to manage professional liability risks. To be registered as an authorised audit company under the Corporations Act:

- all directors of the company must be registered company auditors;

- the company’s ownership structure and voting rights must meet certain requirements; and

- adequate professional indemnity insurance must be held by the company.

1.8 Registered company auditors are not required to work at an authorised audit company. Registered company auditors may also work as an individual or as a partnership formed under state or territory legislation.

1.9 Registered company auditors are typically the most senior auditor on an audit engagement, and may supervise teams of auditors who are not registered company auditors.

1.10 Audits of financial reports completed by registered company auditors under the Corporations Act are one type of external auditing. Not all types of external audit and assurance work are required to be completed by a registered company auditor.

1.11 Between 2019–20 and 2023–24 there was a 16.8 per cent decline in the number of individual registered company auditors, while the number of authorised audit companies increased by 4.4 per cent (Table 1.1).

Table 1.1: Number of registered company auditors

|

|

2019–20 |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

Change (%) |

|

Registered company auditors |

3,817 |

3,657 |

3,413 |

3,337 |

3,177 |

-16.8 |

|

Authorised audit companies |

204 |

214 |

217 |

208 |

213 |

4.4 |

Source: ANAO presentation of ASIC information.

1.12 Between 2019–20 and 2023–24, an average of 25,131 financial reports were lodged each financial year with ASIC (Table 1.2). Roughly 95 per cent of lodged financial reports are audited each year.

Table 1.2: Number of financial reports lodged with the Australian Securities and Investments Commission

|

|

2019–20 |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

Total |

|

Financial reports lodged |

26,344 |

25,487 |

25,222 |

24,984 |

23,616 |

125,653 |

Source: ANAO presentation of ASIC information.

About the Australian Securities and Investments Commission

1.13 ASIC is Australia’s corporate, markets, financial services, and consumer credit regulator. It is an independent statutory authority, established by the Australian Securities and Investments Commission Act 2001 (ASIC Act) and carries out most of its work under the Corporations Act. ASIC is a body corporate prescribed as a non-corporate Commonwealth entity for the purposes of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). ASIC staff are engaged under the ASIC Act, not the Public Service Act 1999.

1.14 ASIC regulates registered company auditors in its role as Australia’s corporate regulator. These regulatory functions include:

- administering auditor registration, including registration applications, annual statements and de-registration;

- receiving registered company auditors’ breach notifications and contravention reporting;

- undertaking financial reporting and audit surveillances; and

- investigating potential non-compliance and taking enforcement action or referring matters to the disciplinary processes managed by the Companies Auditors Disciplinary Board (CADB).

1.15 ASIC’s total financial resourcing and staffing is summarised in Table 1.3. The equivalent of roughly 35 full-time staff, see paragraphs 2.2 to 2.6, is allocated to the regulation of registered company auditors.

Table 1.3: Australian Securities and Investments Commission’s total resourcing 2019–20 to 2024–25

|

|

2019–20 |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

2024–25 |

|

Total resourcinga ($m) |

662.3 |

763.5 |

820.7 |

836.8 |

978.0 |

1,131.7 |

|

Average staffing level |

1,982 |

1,972 |

1,947 |

1,846 |

1,709 |

2,188 |

Note a: Total resourcing includes departmental and administered resourcing. For example, total resourcing includes appropriation for administrative special appropriations. These are for payments of unclaimed monies, and refunds on administered revenue. These funds are not available to ASIC for regulatory activities that are eligible for cost recovery.

Source: ANAO presentation of ASIC portfolio budget statements.

1.16 Pursuant to an industry funding model, the Australian Government imposes a cost-recovery levy to recover costs for regulatory activities delivered to industry in the preceding year. The levy may not exceed the sum of all amounts appropriated9 by the Parliament for the relevant financial year, and certain regulatory activities (such as operating and maintaining a public register under the Corporations Act) are excluded by law from the calculation of costs to be recovered.10 Between 2021–22 and 2023–24 ASIC annually recovered between 73 and 89 per cent of its regulatory costs across all cost recovery activities (including registered company auditors). Table 1.4 summarises ASIC’s recovery of costs related to the regulation of registered company auditors.

Table 1.4: Australian Securities and Investments Commission cost recovery related to registered company auditors 2019–20 to 2023–24

|

|

2019–20 |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

|

ASIC costs recovereda ($m) |

10.3 |

9.6 |

8.3 |

6.1 |

10.2 |

Note a: Costs recovered from ‘registered company auditors’ and ‘auditors of disclosing entities’ industry subsectors, see paragraph 2.12.

Source: ANAO presentation of ASIC data.

1.17 Under the industry funding model, ASIC also charges fees to recover expenses associated with processing regulatory forms. Between 2019–20 and 2023–24 ASIC charged $426,004 for the processing of forms relevant to the regulation of registered company auditors. ASIC estimated the cost of processing these forms was $723,047.

Previous audits, inquiries and reviews

Auditor-General Report

1.18 In June 2023 Auditor-General Report No. 36 2022–23 Probity Management in Financial Regulators — Australian Securities and Investments Commission concluded ‘[p]robity management at the Australian Securities and Investments Commission (ASIC) was largely effective’.11 ASIC agreed to a recommendation that it review the financial thresholds for declaring hospitality in its internal register of gifts, benefits and hospitality, and assessed in November 2023 that it had implemented this recommendation.

Parliamentary inquiries

1.19 In November 2024 the Parliamentary Joint Committee on Corporations and Financial Services (PJCCFS):

- recommended ASIC re-establish a program of random audit inspections, review audit files where conflicts of interest are identified, and increase resources to surveillance activities12;

- made six recommendations to the Australian Government for legislative reform including: requiring ASIC to publish inspection reports for individual audit firms; and enhancing ASIC’s power to take enforcement action against audit firms, not just individual registered company auditors13; and

- made two recommendations to the Australian Government to reform the CADB.14

1.20 The PJCCFS’s 2024 inquiry followed a completed inquiry into the regulation of auditing in 2020.15 The 2020 inquiry made 10 recommendations and published a dissenting report containing two additional recommendations. In July 2024 the Australian Government responded to all recommendations with this statement:

The Government notes this recommendation. However, given the passage of time since this report was tabled, a substantive Government response is no longer appropriate.16

1.21 The PJCCFS’s 2024 inquiry report assessed actions taken in response to the 2020 inquiry.17

1.22 As of September 2025, the Australian Government had not responded to the PJCCFS’s November 2024 recommendations.

Reviews by Australian Government entities

The Financial Reporting Council

1.23 In March 2019 the Financial Reporting Council18 published a report on Auditor Disciplinary Processes.19 This provided 18 recommendations, including that ASIC should be given the power to compel remediation of defective audits.20

1.24 In April 2019 the Financial Reporting Council and the Auditing and Assurance Standards Board published a report on the perceptions of professional investors in 2019. The report concluded based on survey results that ‘professional investors do not consider audit quality as a matter of concern’.21

1.25 The Financial Reporting Council and the Auditing and Assurance Standards Board published reports on audit committee chairs’ perceptions of audit quality in 2018, 2021 and 2022. The reports relied on surveys of audit committee chairs from Australian Securities Exchange listed companies, not for profit entities, public sector entities and superannuation funds. The surveys indicated that audit committee chairs were ‘very satisfied with the quality of their external auditor’. The 2022 report also reported audit committee chairs’ views on ASIC audit surveillance activities (known as audit inspections at the time):

The general sentiment of the [audit committee chairs] was that some form of oversight and inspection process is a good thing …

However, many were critical of the inspection process and its subsequent reporting by ASIC and financial journalists.22

1.26 The Financial Reporting Council’s November 2023 Oversight of Audit Quality in Australia — A Review report found:

auditors are subject to a robust set of professional standards designed to support the performance of high audit quality audits. However, the FRC considers that the system could benefit from more independent oversight to ensure all auditors are complying with the required standards.23

1.27 The Financial Reporting Council made six recommendations. Two recommendations were directed to ASIC to expand audit surveillance activities and publish strategic plans for audit surveillances with key performance indicators. One recommendation was made to the professional accounting bodies in relation to their surveillance and disciplinary processes. Three recommendations were made to the Australian Government to make legislative reforms related to audit quality and auditor independence.

The Financial Regulator Assessment Authority

1.28 In July 2022 the Financial Regulator Assessment Authority24 (FRAA) concluded an effectiveness and capability review of ASIC, which examined ASIC’s strategic prioritisation, planning, decision-making and its surveillance and licensing functions. The FRAA reported:

The FRAA considers that ASIC is generally effective and capable in the areas reviewed, although there are important opportunities to enhance its performance.25

1.29 The FRAA report made recommendations for ASIC to improve its data capability, stakeholder engagement, performance monitoring and skill sets.26

The Department of the Treasury

1.30 In June 2023, the Department of the Treasury (Treasury) concluded a review of ASIC’s industry funding model, and reported:

broadly the settings of the ASIC [industry funding model] remain appropriate and substantial changes to the model should not be made … the costs recovered through the [industry funding model] (including enforcement costs) remains appropriate and should not be removed from the model to be budget-funded instead.27

Australian Law Reform Commission

1.31 In November 2023 the Australian Law Reform Commission (ALRC) issued the final report for its inquiry into the simplification of the legislative framework for corporations and financial services regulation. The inquiry found ‘corporations and financial services legislation is unnecessarily complex’.28 Across three reports, the ALRC presented 58 recommendations to the Australian Government to reform corporations and financial services legislation.

1.32 The ALRC inquiry recommended reforms to provisions of the Corporations Act relating to registered company auditors:

A range of other provisions in corporations and financial services legislation have an incoherent legislative hierarchy, with excessively prescriptive primary legislation and poorly designed delegated legislation. This makes them suitable candidates for reform in accordance with the recommended legislative model. In particular, provisions regulating financial reports and audit in Chapter 2M of the Corporations Act could be restructured to move material into a Scoping Order and to create what may be known as the ‘Financial Reporting and Audit Rules’. This would help reduce the prescriptiveness of the primary legislation and better highlight the core norms and obligations in Chapter 2M of the Act.29

Rationale for undertaking the audit

1.33 Audited financial statements provide important information for capital markets and are essential for effective corporate governance. ASIC is responsible for regulatory functions designed to ensure registered company auditors meet independence and quality requirements related to audits of financial reports under the Corporations Act.

1.34 This audit was conducted to provide assurance to Parliament on the effectiveness of ASIC’s oversight of registered company auditors. This audit was identified as a priority by the Joint Committee of Public Accounts and Audit for the 2024–25 Annual Audit Work Program.

Audit objective, criteria and scope

1.35 The audit objective was to assess the effectiveness of ASIC’s oversight of registered company auditors.

1.36 To form a conclusion against the objective, the ANAO adopted the following high-level criteria:

- Have appropriate arrangements been established to support regulatory activities?

- Is the regulatory approach effective?

1.37 The audit did not assess:

- policy or regulatory design matters, including those in the scope of the Australian Government’s review of the regulation of accounting, auditing and consulting services being led by Treasury30;

- matters not directly related to ASIC’s regulation of registered company auditors performing audits of financial reports under the ASIC Act and the Corporations Act, such as other forms of auditing31 or consulting activities provided by entities who are also registered company auditors; and

- the effectiveness of ASIC’s regulation of the preparers of financial reports.

Audit methodology

1.38 The audit methodology included:

- examination and analysis of ASIC’s internal records;

- meetings with ASIC officials and professional accounting bodies; and

- analysis of publicly available material from Australian Government bodies, professional accounting bodies and proceedings of the Australian Parliament.

1.39 Australian Government entities largely give the ANAO electronic access to records by consent, in a form useful for audit purposes. On 2 July 2025 ASIC advised the ANAO that it was unable to voluntarily provide certain information requested by the ANAO due to privacy obligations. On 3 July 2025, the ANAO exercised powers pursuant to section 33 of the Auditor-General Act 1997 to enable ASIC to provide the requested information.

1.40 The audit was open to contributions from the public between December 2024 and June 2025. The ANAO received and considered matters raised in contributions from six entities and five individuals.32

1.41 The ANAO instituted arrangements for this audit to manage risks to independence arising from ASIC’s role as a quality reviewer of ANAO financial statements audits between 2018 and 2024. These arrangements are outlined in Appendix 3.

1.42 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $671,176.

1.43 The team members for this audit were Joshua Francis, Michael McGillion, Renae Lowden, Liset Campos-Manrique, Yu Wen Wong, Madigan Paine, Zhou Li, Li Lin and David Tellis.

2. Arrangements to support regulatory activities

Areas examined

This chapter examines whether the Australian Securities and Investments Commission (ASIC) has established appropriate arrangements to support regulatory activities for registered company auditors.

Conclusion

ASIC has integrated the function of regulating registered company auditors into its broader regulatory systems, including agency governance, cost-recovery levies, probity management, stakeholder communications and staff training. ASIC’s ministerial statement of expectations has not been updated since August 2021 and is overdue to be refreshed. ASIC’s business planning and regulatory targeting is informed by risk. However, while ASIC has linked its registered company auditor regulatory activities to its statutory objectives and strategic priorities, it does not measure or assess whether regulatory outcomes for registered company auditors are being achieved nor whether ASIC’s interventions are contributing to the achievement of those outcomes. Measuring the achievement of outcomes is important to demonstrate the effective use of public resources. As a result, ASIC’s arrangements to support regulatory activities for registered company auditors are partly effective.

Areas for improvement

The ANAO made one recommendation to ASIC to develop and report on performance measures for the achievement of regulatory outcomes for registered company auditors. The ANAO additionally made one recommendation to the Department of the Treasury aimed at refreshing ASIC’s ministerial statement of expectations and regulator statement of intent. The ANAO identified an opportunity for ASIC to improve the accessibility of its publication of information related to gifts, benefits and hospitality.

2.1 The Australian Government’s Regulatory Policy, Practice & Performance Framework provides six principles for the implementation of regulation and regulatory management, including that regulation should be integrated into existing regulatory systems; be targeted and risk-based; and be outcomes-focused.

Are appropriate governance arrangements in place?

ASIC has integrated the function of regulating registered company auditors into its broader regulatory systems (including agency governance, cost-recovery, probity frameworks, stakeholder communications and staff training). This approach is appropriate given the multiple frameworks that apply to ASIC’s regulated populations. ASIC’s ministerial statement of expectations and regulator statement of intent have not been refreshed in accordance with better practice.

Organisational structure and oversight

2.2 ASIC does not administer regulatory functions for registered company auditors as a discrete business area within the agency. Instead, ASIC is structured into functional work areas and the regulation of registered company auditors is divided between these areas on a functional basis. Key functions relating to the regulation of registered company auditors are undertaken by the Regulation and Supervision Group and the Enforcement and Compliance Group.

2.3 The Regulation and Supervision Group includes:

- licensing and registration business units, administering registered company auditors and other licensing and registration frameworks that apply to ASIC’s regulated population; and

- financial reporting and audit business units, responsible for activities including monitoring and surveillance of registered company auditors, stakeholder engagement and providing subject matter expertise on registered company auditors to other business units within ASIC.

2.4 Table 2.1 depicts the total nominal staffing of the Regulation and Supervision Group, as well as the level of staffing allocated to three branches to perform regulatory activities relating to registered company auditors, as recorded in ASIC’s 2024–25 business plan.

Table 2.1: Regulation and Supervision Group full time equivalent staff allocations — 2024–25

|

Branch recorded in the business plan |

Business activity relevant to registered company auditors |

FTE allocated to registered company auditors |

Total FTE allocated to the branch |

|

Companies and Small Businessa |

Financial reporting and audit surveillance program (CSB607) |

17b |

70.5 |

|

Auditor registrations and resignations (CSB599) |

1 |

||

|

Strategic Surveillance and Data |

Audit quality surveillance (SSD651) |

4 |

35.2 |

|

Licensing |

Professional registration assessments (auditor, SMSF, liquidator 24/25) (LIC510) |

2.5b |

34.6 |

|

Other branches |

N/A |

0 |

206 |

|

Regulation and Supervision Group |

24.5 |

346.3 |

|

Note a: This branch was renamed Sustainability, Financial Reporting and Audit in February 2025.

Note b: These staff members have duties that extend beyond registered company auditors.

Source: ANAO analysis of ASIC business planning information from June 2024.

2.5 ASIC provided the ANAO with analysis of the number of staff that have worked on the financial reporting and audit surveillance program over the past five financial years, taking into account restructures that occurred during that period. ASIC’s analysis indicated that the function currently has lower staff numbers than previous years (Table 2.2).33

Table 2.2: Australian Securities and Investments Commission analysis of staff working on financial reporting and audit surveillance 2020–21 to 2024–25

|

|

2020–21 |

2021–22 |

2022–23 |

2023–24 |

2024–25a |

|

Actual ASL |

28 |

27 |

21 |

15 |

16 |

|

Budgeted ASL |

29 |

27 |

21 |

14 |

19 |

Note a: Average staffing levels (ASLs) for 2024–25 are reported as at January 2025.

Source: ANAO presentation of ASIC information.

2.6 Within the Enforcement and Compliance Group, a team of nine staff are responsible for progressing investigations or enforcement actions in response to suspected registered company auditor misconduct.

2.7 Both the Regulation and Supervision Group and Enforcement and Compliance Group are overseen by the Commission, which is a non-executive governing body comprising the ASIC Chair, Deputy Chair and three Commissioners. The Commission sets ASIC’s regulatory strategy and oversees ASIC’s performance against the strategy. The Commission’s oversight of regulatory activities is undertaken in part through three ancillary committees (whose membership comprises the full Commission assisted by other attendees).34 Table 2.3 depicts the number and nature of decisions taken by the Commission in relation to registered company auditors between July 2019 and February 2025.

Table 2.3: Commission committee meetings recorded outcomes between July 2019 and February 2025

|

Outcome related to registered company auditors |

Approve |

Note |

Nominate |

Total |

|

Changes to regulatory activities |

4 |

3 |

– |

7 |

|

Resource allocation and business planning |

– |

1 |

– |

1 |

|

Public reporting or communications |

2 |

7 |

– |

9 |

|

Nominate Executive Director for public reporting approval |

– |

– |

5 |

5 |

|

Total |

6 |

11 |

5 |

22 |

Source: ANAO analysis of ASIC provided committee papers.

2.8 The Commission, together with the Chair in the Chair’s capacity as Accountable Authority for ASIC, is responsible for setting ASIC’s annual corporate plan. ASIC’s corporate plans from 2019–20 to 2023–24 integrated ASIC’s regulation of registered company auditors into ASIC’s broader strategic plans:

- in 2024–25, as a key activity contributing to the achievement of a strategic priority ‘drive consistency and transparency across markets and products’;

- in 2023–24, 2022–23 and 2019–20 as a key activity not connected to any specific strategic priority; and

- in 2021–22 and 2020–21, as a key activity contributing to the achievement of strategic priorities relating to maintaining financial system resilience and stability during the COVID-19 pandemic and promoting the subsequent economic recovery.

Budgeting and cost recovery

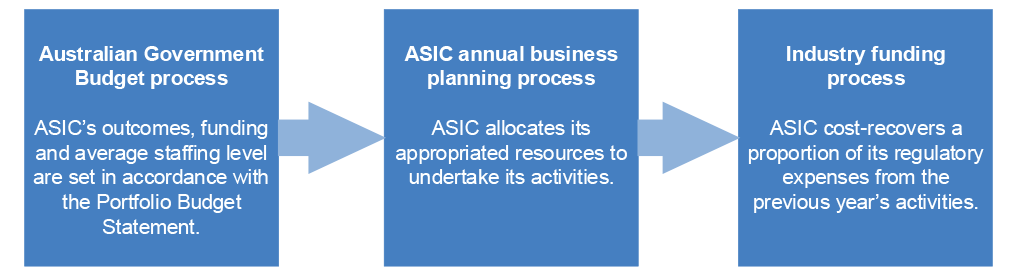

2.9 As depicted in Figure 2.1, ASIC’s resourcing is determined each year by the Australian Government through the Budget, allocated pursuant to ASIC’s portfolio budget statements, and partially recovered retrospectively through a cost-recovery levy.35

Figure 2.1: The Australian Securities and Investments Commission’s resourcing cycle

Source: ANAO presentation of ASIC information.

2.10 Between 2018–19 and 2023–24 ASIC made efforts to secure additional funding specifically to support regulatory activities for registered company auditors.

- ASIC received approval for an additional $2.2 million in regulatory activities in relation to registered company auditors over four years from 2018–19 to 2021–22 and to recover this through ASIC’s industry funding model36; and

- ASIC worked with the Department of the Treasury (Treasury) to develop a proposal for additional funding for registered company auditors regulatory activities for the 2024–25 Federal Budget, however the Australian Government decided to defer the proposal.

2.11 ASIC has an internal business planning process that allocates resourcing for the purpose of regulating registered company auditors to business units on a functional basis alongside resourcing for similar regulatory activities undertaken by that business unit.

Cost recovery

2.12 ASIC’s cost-recovery levy37 is applied to two subsectors related to registered company auditors depicted in Table 2.4. Submissions received by the ANAO from stakeholders in these sectors expressed views that the link between ASIC’s regulatory activities and the levy charged could be more transparent.

Table 2.4: Cost-recovery subsectors related to registered company auditors

|

Name of subsector |

Who is charged |

How the levy is calculated |

|

Auditors of disclosing entities |

A subset of registered company auditors, being those that have consented to be an audit entity for a disclosing entity with quoted securities. |

A proportion of revenue derived from auditing and review of relevant financial reports. |

|

Registered company auditors |

Any entity that has been a registered company auditor at any time in the financial year. |

A flat levy for each entity. |

Source: ANAO presentation of ASIC information.

2.13 ASIC primarily calculates the regulatory expenditure to be cost-recovered from these subsectors based on ASIC timesheet data that records staff time directly spent on regulating registered company auditors and a cost allocation model that attributes indirect costs for these regulatory activities. Between 2019–20 to 2023–24, ASIC levied $44.5 million in regulatory expenses upon the two subsectors relating to registered company auditors. Indirect costs of $19.1 million accounted for 42.9 per cent of total expenses recovered (Table 2.5, note c).

Table 2.5: Regulatory expenses recovered from registered company auditors and auditors of disclosing entities from 2019–20 to 2023–24

|

Regulatory activity |

2019–20 ($m) |

2020–21 ($m) |

2021–22 ($m) |

2022–23 ($m) |

2023–24 ($m) |

Total ($m) a |

|

Supervision and surveillance |

2.8 |

3.0 |

2.7 |

1.4 |

2.8 |

12.7 |

|

Enforcement |

1.8 |

2.0 |

1.6 |

1.8 |

2.5 |

9.8 |

|

Other regulatory activitiesb |

0.3 |

0.2 |

0.4 |

0.3 |

1.0 |

2.3 |

|

Indirect costsc |

5.1 |

4.4 |

3.6 |

2.4 |

3.8 |

19.1 |

|

Adjustment for prior year |

0.3 |

0.1 |

0.0 |

0.1 |

0.1 |

0.6 |

|

Total costs levied to company auditor subsectorsc |

10.3 |

9.6 |

8.3 |

6.1 |

10.2 |

44.5 |

Note a: Totals may not sum due to rounding.

Note b: Other regulatory activities include industry engagement, education, guidance and policy advice.

Note c: Indirect costs include governance, central strategy and legal, IT support, operations support, property and corporate services and capital expenditure, less costs funded by own-source revenue.

Source: ANAO analysis, based on ASIC documentation.

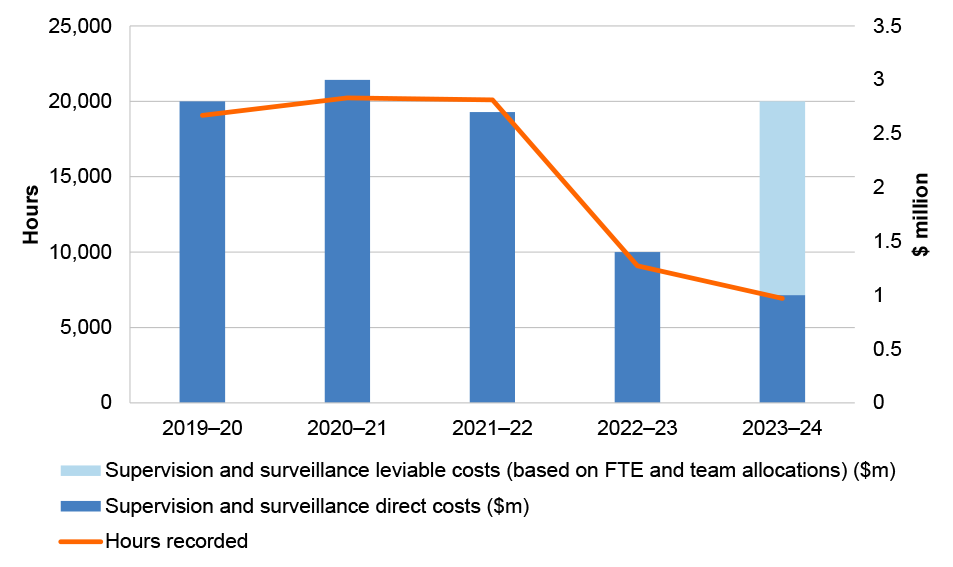

2.14 ASIC also advises on its website that direct costs may be attributed by analysing team structures and output.38 As shown in Figure 2.2, ASIC data showed a decrease in timesheet hours for supervision and surveillance activities for registered company auditors in 2022–23 and 2023–24 while direct costs increased in 2023–24. In August 2025, ASIC advised the ANAO that following an organisational restructure it was able to ‘reprofile’ $1.8 million previously accounted as indirect costs39 to direct costs for supervision and surveillance. ASIC further advised that the figure of $1.8 million was calculated based on full-time equivalent positions rather than individual time recording.

Figure 2.2: Hours recorded for registered company auditor supervision and surveillance activities 2019–20 to 2023–24

Source: ANAO presentation of ASIC data.

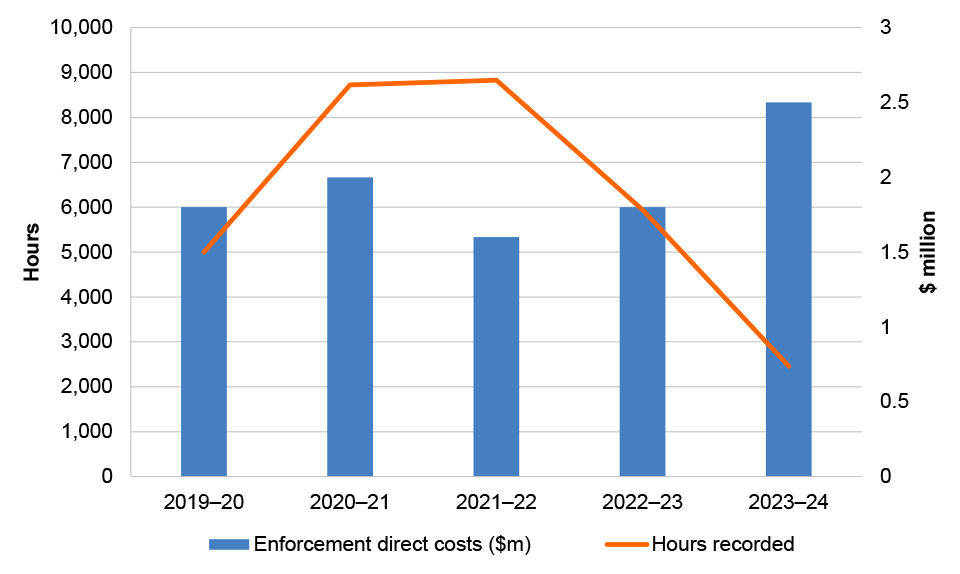

2.15 Similarly, ASIC data showed a decrease in timesheet hours for ‘enforcement’ for registered company auditor activities in 2022–23 and 2023–24 compared to previous years while direct costs increased (see Figure 2.3). In August 2025 ASIC advised the ANAO that supplier expenses made up a higher proportion of direct costs for enforcement in 2023–24.

Figure 2.3: Hours recorded for registered company auditor enforcement activities 2019–20 to 2023–24

Source: ANAO presentation of ASIC data.

2.16 The cost-recovery levy is estimated at the start of the year and may be adjusted if actual costs differ due to variations in the activities performed by ASIC and the size of the regulated population.40 Submissions received by the ANAO from stakeholders expressed a desire for ASIC to provide greater transparency around the reasons for variance between estimated and actual levies.

2.17 Prior to 2025, ASIC reported publicly on the main drivers of variance for subsectors where the variance from the previous year was both greater than 10 per cent and exceeded $2 million. Regulatory cost variations for registered company auditors prior to 2025 have not been the subject of public reporting because, while the variations have exceeded 10 per cent each year, the total variance did not exceed the $2 million threshold.

2.18 ASIC advised the ANAO in May 2025 that annual variance reporting would use a reduced variance reporting threshold of $1 million for the 2024–25 variance reporting cycle. Based on previous variances, this change will result in information on variance drivers being reporting for registered company auditors.41

2.19 ASIC also charges a fee to lodge four forms relevant to the regulation of registered company auditors, such as an application to become a registered company auditor (see paragraph 3.2). ASIC estimates its costs for processing the four registered company auditor regulatory forms covered by fees for service between 2019–20 and 2023–24 were $723,047. The fees collected by ASIC for these forms were $426,004.

2.20 Treasury’s 2023 review of ASIC’s industry funding model found generally that:

Fee amounts no longer align with government policy that fees are set to recover the efficient cost to ASIC. Total fee revenue now only partially recovers ASIC’s costs of providing these services, with the shortfall being taxpayer funded.42

2.21 ASIC confirmed in August 2025 that costs for registered company auditor forms are under-recovered, but advised it is a decision for the Australian Government whether to introduce legislation to change the fee structure.

Probity management

Entity level arrangements

2.22 ASIC’s entity level probity arrangements apply to the regulation of registered company auditors.43 ASIC completed three internal audits in 2024–25 regarding ASIC’s management of conflicts of interest, trading on the restricted entity list, and gifts, benefits and hospitality. These reports identified issues with ASIC’s policy framework, internal disclosure reporting system, guidance and training for staff and a lack of detective controls. ASIC’s internal audits made 43 recommendations44:

- 36 of which were agreed to by ASIC management;

- four recommendations were partially agreed to; and

- three recommendations were disagreed.

2.23 In response to the internal audit reports ASIC is reviewing its policies and training, developing a plan to use detective controls and considering a redesign of the disclosure reporting system. As at June 2025, ASIC had updated its internal gifts, benefits and hospitality policy, and other actions to address the internal audit findings were ongoing.

2.24 ASIC’s probity arrangements include a process for monitoring gifts, benefits and hospitality. ASIC’s internal gifts, benefits and hospitality register from September 2023 to March 2025 recorded 340 declarations. The ANAO reviewed this register and identified six declarations related to entities which were considered to have a link to the regulation of registered company auditors. These declarations were all for attendance at catered events. The six declarations were managed in accordance with ASIC’s conflict of interest policy on gifts, benefit and hospitality.

2.25 ASIC publicly reports on gifts, benefits and hospitality that have been accepted. For each three-month period since December 2019 to March 2025 ASIC has published 44 Portable Document Format (PDF) documents listing the gifts, benefits and hospitality valued over $100 accepted by ASIC Commissioners and ASIC staff.45

2.26 Publishing information in separate PDFs is not consistent with the Office of the Australian Information Commission’s Principles on open public sector information Principle 5: Discoverable and useable information.46 Presenting this information in separate PDFs results in the information about gifts, benefits and hospitality not being easily discovered or searchable, which limits stakeholders’ ability to review this information.

Opportunity for improvement

2.27 ASIC could publish information related to gifts, benefits and hospitality in a more discoverable and usable format.

Arrangements specific to regulation of registered company auditors

2.28 ASIC additionally maintains a list of staff in the Regulation and Supervision Group (responsible for performing audit surveillances) who have disclosed conflicts of interests such as having previously worked for a regulated entity. As at 27 January 2025, this list recorded 31 declarations made by 17 staff in relation to 13 regulated entities.

2.29 The list is used informally by ASIC’s senior managers to ensure staff do not review audit files for regulated entities which previously employed the staff member (within five years if a partner, and within two years otherwise) or regulated entities that employ a close family member as a partner. These parameters are specified in an internal policy that has not been in force since November 2022. ASIC advised the ANAO the same process is still observed in practice as it is consistent with ASIC’s conflict of interest policy.

2.30 ANAO tested whether case officers who had conducted audit surveillances of a regulated entity were recorded in the Regulation and Supervision Group conflict of interest list in relation to that entity. Between 2019–20 to 2023–24, 10 out of the 17 staff that declared a conflict of interest were case officers of regulated entities that were the subject of the declaration. Further review showed that for nine of the ten staff sufficient time had passed to avoid a conflict of interest, and for the remaining staff member there was insufficient documentation to demonstrate whether the staff member had been a partner in the regulated entity (in which case a conflict could have arisen) or not (in which case sufficient time had passed).

2.31 Prior to October 2025, ASIC did not document consideration of independence and conflicts of interest when conducting audit file surveillances. ASIC advised ANAO in August 2025 that consideration of conflicts of interest was conducted verbally during the planning of each individual audit surveillance. In October 2025, ASIC updated its audit file surveillance templates so that consideration of conflicts of interest would be documented for each surveillance.

Stakeholder communications

2.32 ASIC’s 2021 Statement of Intent includes statements about: providing clear guidance and communications; guidance to regulated populations about good practice; and taking feedback into account.

2.33 ASIC publishes three types of guidance material on its website:

- regulatory guides, which provide information on how ASIC exercises its powers, interprets the law and guidance for regulated entities;

- information sheets, which provide concise guidance on a specific process or compliance issue or an overview of detailed guidance; and

- reports, which describe ASIC activities, including research, surveillance and compliance.

2.34 At May 2025, ASIC’s website contained 87 pieces of guidance related to registered company auditors (Appendix 5, Table A.3) and 134 media releases, articles or speeches related to registered company auditors (Appendix 5, Table A.4).

Workforce training and qualifications

2.35 Principle one of the Department of Finance’s Resource Management Guide 128: Regulator Performance (RMG 128) requires regulators to actively build staff capability, including ensuring staff have the relevant knowledge and capacity to complete their duties.

2.36 ASIC maintains a capability framework for staff training which consists of three complementary capability sets (core, technical and leadership). Under this framework:

- ASIC staff are assigned seven focus core capabilities and two to five technical capabilities based on their role and can choose to add additional capabilities for development;

- ASIC staff complete mandatory capability checkpoints which track their proficiency level against the capabilities assigned to their role;

- checkpoint data is collated into organisational, group and team capability snapshots with the aim to identify ASIC’s organisational strengths and gaps, inform workforce planning and learning strategies, and enable ongoing measurement of ASIC’s capability development; and

- ASIC staff can also join internal professional networks, including the Accountant and Auditor Network, to share knowledge and skills. ASIC advised the ANAO in June 2025 that this network has 171 registered members as at 3 June 2025.

2.37 ASIC maintains an online learning and development platform with training resources designed to align to the capability framework. This framework includes an ‘Accountant/Auditor’ capability set which requires capabilities in industry and ethical standards, financial reporting and audit practice, and insolvency law and practice. ASIC provides continuing professional development opportunities for accounting and audit professionals within ASIC, including an annual audit standards update which has had 211 completions between 1 July 2019 and 3 June 2025.

2.38 ASIC provided the ANAO with June 2024 position descriptions for roles in financial reporting and audit business area which included the following requirements:

- a tertiary qualification in accounting;

- a professional accounting body qualification (CA ANZ, CPA or IPA), or progression towards this for lower-level officers;

- practical auditing experience47; and

- knowledge of corporate law, accounting and auditing standards.

2.39 ASIC advised the ANAO in October 2025 that these requirements are tested during ASIC’s recruitment process and are monitored through annual staff performance and development discussions.

Ministerial Statements of Expectations and Regulator Statements of Intent

2.40 ASIC’s most recent Ministerial Statement of Expectations was issued in 2021.48 ASIC responded to the Statement of Expectations with a Regulator Statement of Intent, and both statements are published on ASIC’s website.49 The Statement of Intent commits ASIC to actions that are in line with principles set out in RMG 128, including:

- identifying and reducing misconduct risk through well-targeted and proportionate supervision, surveillance and enforcement activities;

- engaging with stakeholders openly and transparently;

- providing appropriate guidance so that regulated entities have clarity and certainty about how ASIC will exercise its powers; and

- complying with relevant Australian Government policies, frameworks and guidance.

2.41 The 2021 Statements of Expectations and Intent do not contain any specific reference to the regulation of registered company auditors.

2.42 RMG 128 sets out that ‘[Statements of expectations] should be refreshed with every change in minister, change in regulator leadership, change in Commonwealth policy or every two years’.50 By this standard, ASIC’s Statements of Expectations and Intent have been due to be refreshed since 2022. ASIC advised the ANAO in October 2024 that it was working with Treasury on draft refreshed statements but had no visibility on discussions between Treasury and the Minister’s office.51 As at October 2025, Treasury was yet to advise the Minister to issue a new statement of expectations for ASIC.

Recommendation no.1

2.43 The Department of the Treasury advise the Treasurer that the statement of expectations for the Australian Securities and Investments Commission is due to be refreshed.

Department of the Treasury response: Agreed.

2.44 Treasury will advise the Treasurer that the statement of expectations for the Australian Securities and Investments Commission is due to be refreshed.

Is the regulatory approach informed by assessments of compliance and regulatory risks?

ASIC assesses strategic regulatory risks through an ongoing threats and harms assessment process. In 2024–25, two out of 90 identified threats and harms related to registered company auditors. The activity to respond to ‘lack of skilled auditors’ was ‘monitoring and engagement with the audit industry’, with all other regulatory activities undertaken in response to the risk of ‘poor auditor quality resulting in declining market confidence and potential investor losses’. ASIC’s business planning for 2024–25 considered the two identified threats and harms. Since 2021–22 ASIC’s primary regulatory activity in response to regulatory risk for registered company auditors (audit surveillances) has been predominantly based on risk-based targeting.

Threats and harms risk assessments

2.45 ASIC maintains a threats and harms register which is used to track strategic regulatory risks. On an ongoing basis, ASIC staff identify emerging regulatory risks and submit them to the register including an assessment of the risk. The threats identified (or carried over) each financial year are compiled into a report annually which is used to inform business planning for the following financial year. Table 2.6 illustrates the number of risks identified and assessed by ASIC each financial year.

Table 2.6: Number of active risks registered in the threats and harms risk register as at February 2025

|

Type of risk |

2022–23 |

2023–24 |

2024–25 |

|

Relates to registered company auditors |

2 |

2 |

2 |

|

Other risks |

58 |

81 |

88 |

|

Total |

60 |

83 |

90 |

Source: ANAO analysis of ASIC data.

2.46 Over the past three years ASIC has tracked two risks relating to registered company auditors: a lack of skilled auditors resulting in poor audit quality and a decline in market confidence and investor losses; and poor audit quality resulting in declining market confidence and potential investor losses. Both risks align with ASIC’s regulatory outcomes for registered company auditors (see paragraph 2.60). The actions ASIC is taking to manage these two risks are summarised in Table 2.7.

Table 2.7: Australian Securities and Investments Commission 2024–25 risk ratings and controls for threats and harms related to the regulation of registered company auditors

|

Risk |

Short term risk rating |

Medium term risk rating |

Long term risk rating |

ASIC identified controls |

|

Lack of skilled auditors |

Medium |

Medium |

High |

Monitoring issue and discussing with stakeholders |

|

Poor audit quality |

High |

High |

High |

Audit file surveillances Ad hoc audit file reviews |

Source: ANAO presentation of ASIC documentation.

Strategic business planning

2.47 Prior to 2025–26, to decide on its annual business plan ASIC itemised business-as-usual and project activities proposed to be conducted in the coming financial year. ASIC used the list to prioritise activities and allocate agency resources based on considerations such as whether activities are connected to a strategic priority set out in the ASIC Corporate Plan, whether sufficient resources are available, whether the activity is required by law, and an assessment of the risk of not conducting the activity.

2.48 The assessment of risk for each activity did not explicitly incorporate risk ratings determined in the threats and harms register, but the list could record a unique identifier for a specific threat or harm against a specific proposed activity. The ANAO reviewed business activities planned for 2024–25 to see if the two threats or harms identified for registered company auditors were recorded against any proposed business activities. Both threats or harms were linked to a 2024–25 business activity.

2.49 The assessment of risk for each activity extended beyond regulatory risks to include operational, reputational and other risks. ASIC business planning guidance did not specify the type of risk to be assessed. Five activities related to registered company auditors in the 2024–25 business planning process, including two that were linked to specific threats and harms for registered company auditors, assessed regulatory risks such as ‘ongoing issues with audit quality and conduct of audit firms’. These risks were categorised as ‘reputational’ (three activities), ‘effectiveness’ (one activity) or ‘financial’/’compliance and integrity’ (one activity).

2.50 ASIC introduced a streamlined business planning approach for 2025–26.

2.51 The ANAO did not assess the streamlined business planning process as this was not implemented before the ANAO’s audit fieldwork concluded. ASIC advised the ANAO in November 2025 that the revised approach compiled risk information at a group (i.e. less granular) level, rather than activity level (more granular). ASIC advised this change was based on an assessment, endorsed by the Chief Risk Officer, that compiling more granular risk information in the business planning tool was duplicative of the threats and harms process (see paragraph 2.45) and not useful in practice for agency-level strategic planning.

2.52 The resource management framework also tracked whether the effort applied to a proposed activity will be increasing, maintaining, or decreasing.

|

Box 1: Redesign of Australian Securities and Investments Commission financial reporting and audit surveillance activities — decreasing effort within a continuing activity |

|

ASIC changed its approach to financial reporting and audit surveillance in 2022–23. ASIC combined previously separate financial reporting and audit surveillance activities into a single program, with the rationale that52:

This change was informed by an internal review undertaken during 2021–22 which aimed to consider ‘whether the financial reporting and audit inspection programs should continue to be conducted and if so in what form or whether the limited resources of [the responsible business area] would be better utilised undertaking other types of programs’. ASIC’s internal review identified a reduction in resourcing would occur in 2022–23 due to lapsing budget measures53 and changes to ASIC’s regulatory priorities. The internal review considered three options for changing ASIC’s approach to surveillance of individual audit files:

ASIC decided to implement option 2 with the main modifications being:

|

Risk-based targeting of regulatory monitoring

2.53 ASIC selects audit files for individual surveillances based on the following risk factors:

- ASIC’s current focus areas;

- current accounting and auditing issues;

- ASIC regulatory intelligence, including mandatory reporting of suspected contraventions of the Corporations Act 2001 lodged by registered company auditors55; and

- findings from ASIC’s financial reporting surveillances.56

2.54 ASIC records the primary reason for selecting an audit file for a surveillance. As shown in Table 2.8, since 2021–22 between 71 per cent to 87 per cent of ASIC’s audit surveillances have targeted entities identified as high risk (labelled as ‘Audit Surveillance Program Targeted or Intel’) compared to previous years which involved a mix of risk-based and thematic targeting.

Table 2.8: Primary reason for targeting individual audit files for surveillance

|

Reason |

2019–20 |

2020–21 |

2021–22 |

2022–23 |

2023–24 |

Total |

|

Audit Surveillance Program Targeting or Intela |

12 |

14 |

32 |

13 |

11 |

82 |

|

Partner Spread |

17 |

9 |

2 |

– |

– |

28 |

|

Industry focus |

7 |

10 |

1 |

– |

– |

18 |

|

Significant Public Interest |

– |

– |

6 |

– |

– |

6 |

|

Superannuation |

6 |

– |

– |

– |

– |

6 |

|

Market Intelligence — Entity |

4 |

1 |

– |

– |

– |

5 |

|

Another nominated reason not listed aboveb |

10 |

4 |

3 |

2 |

3 |

22 |

|

Otherc |

7 |

7 |

1 |

– |

1 |

16 |

|

Total |

63 |

45 |

45 |

15 |

15 |

183 |

Note a: These audit files are selected on information from financial reporting surveillances or alignment with focus areas of the Audit Surveillance Program.

Note b: These reasons are: Australian Financial Services License; Significant Market Capitalisation; High Risk Industry; Flagship Client; Going Concern Issue; Small firm, Target as not cover by Audit Surveillance Program; Internal Referral; Previous Audit Surveillance; New Accounting Standards; US Issuer; Market Intelligence; and Media.

Note c: These are recorded as ‘Other’ by ASIC.

Source: ANAO presentation of ASIC data.

2.55 In May 2025 ASIC announced that it would increase the number of audit files reviewed in 2025–26 and would include some audit files selected on a random basis.57

2.56 Other than the concepts presented in Information Sheet 224: ASIC financial reporting and audit surveillance program58, ASIC does not have internal procedural documentation that guides how ASIC operationalises this approach for selecting individual audits for surveillance.

Has performance monitoring and reporting of regulatory outcomes been established?

ASIC is revising its annual performance statements to address deficiencies in how it reports its achievement of its statutory objectives. ASIC has identified two regulatory outcomes for registered company auditors that contribute to the achievement of one of ASIC’s statutory objectives. ASIC has no mechanism to measure whether these regulatory outcomes are being achieved. ASIC regularly reports activity and output-based performance information for the regulation of registered company auditors.

Annual performance statements

2.57 ASIC is required to prepare annual performance statements which provide information about ASIC’s performance in achieving its purposes, pursuant to the Public Governance, Performance and Accountability Act 2013. The measurement and assessment of performance must be in accordance with the method set out in ASIC’s corporate plan for that year, and ASIC’s portfolio budget statements.59 As discussed in paragraph 2.8, ASIC’s corporate plans since 2019–20 have incorporated the regulation of registered company auditors as a key activity, but not always in connection with ASIC’s strategic priorities.

2.58 In December 2024, ASIC’s audit and risk committee received an internal audit report which concluded that changes to ASIC’s performance reporting framework were necessary to ensure ASIC adequately reported its performance against its statutory objectives set out in the Australian Securities and Investments Commission Act 2001.60 ASIC advised the ANAO in June 2025 that a program of work to respond to the report’s findings was underway and that ASIC’s 2025–26 Corporate Plan would contain revised performance measures to address the findings of the internal audit report, with implementation expected to be complete by the 2026–27 reporting period. ASIC further advised the ANAO:

However, we have concerns with specific performance reporting measures for individual subsectors such as registered company auditors [as it] would be impractical to have a range of performance measures for each of the 52 subsectors that ASIC regulates. Introducing individual measures for each of these sectors goes against the guidance material that quality should be emphasised over quantity. Department of Finance guidance (RMG 131) states the best performance information will be provided by the smallest set of measures that is comprehensive enough to cover the main things that affect an activity’s performance. Further, although guidance material does not specify a best practice number of measures, the guidance does state that the number should be manageable and meaningful, for the size and complexity of the entity. In our view developing and reporting on measures for each of our 52 sub sectors would not meet this guidance.

2.59 ASIC’s 2025–26 Corporate Plan was published in August 2025. ASIC advised the ANAO in October 2025:

- consistent with previous advice to ANAO, the Corporate Plan would not provide specific performance information in relation to the achievement of regulatory outcomes for registered company auditors;

- certain performance measures under Key Activity 1 (Enforcement and Compliance) and 2 (Regulation and Supervision) will measure performance in 2025–26 in relation to the regulation of registered company auditors together with other regulatory functions; and

- ASIC intends to report additional performance information beyond the performance measures detailed in the Corporate Plan in the appendices of its 2025–26 Annual Report or in other public reporting.

Program-level performance monitoring

2.60 ASIC has articulated its regulatory outcomes for registered company auditors in public facing guidance, which articulates two aims that contribute to ASIC’s statutory purpose of promoting the confident and informed participation of investors and consumers in the financial system:

The objective of our financial reporting and audit surveillance program is to promote confident and informed participation by investors and consumers in the financial system. Our aim is to improve the quality of financial reporting to ensure financial reports have been prepared in accordance with the law. We also aim to promote the improvement and maintenance of audit quality.61

2.61 ASIC does not have mechanisms to assess whether financial report quality and audit quality are being improved and maintained, or whether such improvement and maintenance is attributable to ASIC’s regulatory interventions. In April 2025, ASIC advised the ANAO:

ASIC does not assess audit quality at the population level directly [i.e. across the whole population]. Our surveillance work tests the quality of a small sample of audit files and the surveillance work of the Strategic Surveillance and Data team tests the compliance of a sample of auditors with their independence and conflict of interest obligations.

2.62 ASIC publicly reports on its regulatory activities for registered company auditors annually in its annual report and through other publications intended to inform the regulated population (see paragraph 3.56). The performance metrics included in these reports from 2019–20 to 2023–24 are summarised in Appendix 4. These performance metrics provide activity and output-based performance information, which do not assist a reader to evaluate whether ASIC’s activities and outputs are resulting in improvements in the quality of financial reporting or improvements and maintenance of audit quality.

Recommendation no.2

2.63 The Australian Securities and Investments Commission develop measures to report on the performance of regulatory outcomes for registered company auditors.

Australian Securities and Investments Commission response: Agreed.

2.64 ASIC will develop measures to report on how we are achieving our outcomes for registered company auditors.

3. Effectiveness of regulatory approach

Areas examined

This chapter examines if the Australian Securities and Investments Commission (ASIC) has an effective approach to the regulation of registered company auditors.

Conclusion