Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Maximising Australian Industry Participation through Defence Contracting

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Department of Defence (Defence) is required to maximise Australian industry participation through contracted plans and schedules with its suppliers. Since 2019, these requirements have been primarily conveyed through the Defence Policy for Industry Participation (DPIP).

- This audit was conducted to provide assurance to the Parliament on the effectiveness of Defence’s approach to maximising Australian industry participation through its contracting activities.

Key facts

- Materiel and non-materiel procurements valued at or above $4 million are to include Australian industry schedules or plans.

- Construction services procurements valued at or above $7.5 million are to include Local Industry Capability Plans.

What did we find?

- Defence has not maximised Australian industry participation through the administration of its contracts.

- Defence’s administrative arrangements for maximising Australian industry participation through its procurement and contracting activities are partly fit for purpose.

- Defence did not effectively implement relevant industry contracting requirements with respect to the eight executed contracts examined.

- Defence has established partly appropriate governance, assurance and reporting arrangements to oversee the implementation of its contracting requirements.

What did we recommend?

- There were 9 recommendations to Defence aimed at improving governance, assurance and reporting arrangements.

- Defence agreed to all 9 recommendations.

$38.7 bn

Total value of Defence procurements in 2022–23.

$10.6 bn

Australian Bureau of Statistics estimation of the Australian defence industry’s contribution to the broader Australian economy 2022–23.

79%

Percentage of Defence spending that occurs in Australia.

Summary and recommendations

Background

1. For the financial year 2022–23, the Department of Defence (Defence) ranked as the Australian Government’s largest procurer with 51.7 per cent of Commonwealth entity contracting, valued at $38.69 billion.1 Successive Australian governments have encouraged the involvement of domestic industries in Defence procurement to develop and maintain the industrial base, secure supply chains, and promote employment and economic growth.

2. Defence initiatives to maximise the opportunities for domestic suppliers to participate in government procurement include the Australian Industry Capability (AIC) Program, launched in February 2008.2 The AIC Program required potential contractors to demonstrate how their tenders provide opportunities for Australian businesses.

3. On 28 March 2019, the Minister for Defence Industry released the Defence Policy for Industry Participation (DPIP) to improve consistency in Defence’s approach to maximising Australian industry’s opportunity to participate in Defence procurement. The DPIP requires Defence to consider AIC plans or schedules (or Local Industry Capability plans for construction projects) during procurement decision-making and to ensure the industry commitments in those plans are captured as contracted obligations in materiel and non-materiel procurements valued at or above $4 million, and construction procurements at or above $7.5 million.

Rationale for undertaking the audit

4. Defence’s implementation and delivery of contracted Australian industry requirements has been an area of focus for successive governments and an ongoing interest for the Parliament. The government intent to maximise Australian industry involvement in Defence procurement was reflected in the AIC Program in 2008 and reaffirmed in the 2016 Defence Industry Policy Statement and the 2018 Defence Industrial Capability Plan. This audit provides the Parliament with independent assurance on the effectiveness of Defence’s arrangements to deliver Australian industry policy outcomes through its contractual arrangements with its suppliers.

Audit objective and criteria

5. The objective of the audit was to examine the effectiveness of Defence’s administration of contractual obligations to maximise Australian industry participation.

6. To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria:

- Have fit-for-purpose administrative arrangements been established to maximise Australian industry participation in Defence procurement and contracting?

- Have applicable contracting requirements been implemented to maximise Australian industry participation?

- Has Defence implemented appropriate governance, assurance and reporting arrangements to support the objective of maximising Australian industry participation?

Conclusion

7. Defence has not maximised Australian industry participation through the administration of its contracts. Defence industry policy and contracting requirements were not applied to all relevant procurements, and — where supplier commitments have been contracted — Defence has not effectively monitored or ensured the delivery of those obligations.

8. Defence’s administrative arrangements for maximising Australian industry participation through its procurement and contracting activities are partly fit for purpose. Defence’s procurement framework has not been updated in a timely manner, and as at August 2024, did not fully reflect the requirements of the March 2019 DPIP. Guidance for Defence personnel in relevant tendering and contracting templates is incomplete, and in some cases outdated. Defence engages with industry through forums and other activities as well as through individual procurement processes to support the intent of government’s industry contracting policy.

9. Defence has not implemented applicable contracting requirements effectively. Of the eight contracts examined, each had one or more important shortcomings resulting from limitations in Defence’s advice to potential suppliers, weaknesses in Defence’s contracting of industry participation commitments, and ineffective monitoring of supplier compliance with those commitments.

10. Defence’s governance, assurance and reporting arrangements for industry participation are partly appropriate. Senior Defence committees have received reports on activities to support Australian industry policy objectives. Defence did not establish the Industry Policy Division working group to periodically review the policy in accordance with the DPIP. The AIC Plan assurance framework does not align with a professional standard-setting framework and activities conducted under that framework do not provide reasonable assurance over the matters examined. Defence reports on Australian industry expenditure and has undertaken to further develop its reporting as part of the 2024 Defence Industry Development Strategy.

11. As outlined in the 2024 Defence Industry Development Strategy, Defence was to update the DPIP in late 2024. This policy update follows the 2023 Defence Strategic Review and the 2024 National Defence Strategy. Effective implementation of the next iteration of Australian defence industry contracting policy will require appropriate administrative and IT support systems, including sound procurement controls and contract management activities.

Supporting findings

Administrative arrangements

12. Defence gives effect to its Australian industry contracting requirements through its internal policy framework. Defence’s framework is informed by requirements under the Public Governance, Performance and Accountability Act 2013, the Commonwealth Procurement Rules and government’s Defence industry policies, as set out by the 2016 Defence Industry Policy Statement and the 2018 Defence Industrial Capability Plan. Key elements of Defence’s established policy framework, such as the Defence Procurement Manual (DPM) and its contracting templates, were not updated in a timely manner following the release of the DPIP in March 2019. The DPM was not updated until 1 July 2020, 15 months after the DPIP’s release. Defence lacks arrangements to ensure that procurement documents and contracting templates are aligned with the DPIP requirements, and up to date. Automated system controls, which were established in 2022 and mandated in 2024 — to improve compliance with mandatory procurement policies — do not cover the requirements of the DPIP. (See paragraphs 2.2 to 2.41)

13. Guidance on the Australian Standard for Defence Contracting (ASDEFCON) and the Suite of Facilities tendering and contracting templates is incomplete, with additional guidance notes planned but not developed and released. Defence does not assess its personnel training data by role and therefore cannot provide assurance that its procurement and contracting staff have undertaken training relevant to their roles. The dedicated AIC training course announced in February 2019 is primarily focused on materiel procurements and was not implemented until September 2022. (See paragraphs 2.42 to 2.67)

14. Defence has undertaken a range of industry engagement activities to support the objective of maximising Australian industry participation in procurement. These activities have included the establishment of an Australian Industry Capability Forum and engagements with industry associations. In the absence of a communications strategy for the DPIP, Defence is unable to measure the effectiveness of the information and guidance it has provided to industry on the industry contracting policy requirements in place since 2019. (See paragraphs 2.68 to 2.80)

Implementation of requirements

15. Defence’s advice on Australian industry contracting requirements was provided to potential suppliers as part of the relevant tender processes. Each of the eight contracts examined contained one or more shortcomings with respect to this advice or in the contracting materials provided by Defence, including:

- Defence not considering industry contracting requirements during the early stage of the procurement and therefore not advising suppliers of all requirements;

- the rationale for exemptions from implementing Australian industry contracting requirements not being documented by Defence; and

- outdated or incorrect terminology and reference material being used by Defence or available to suppliers. (See paragraphs 3.6 to 3.15)

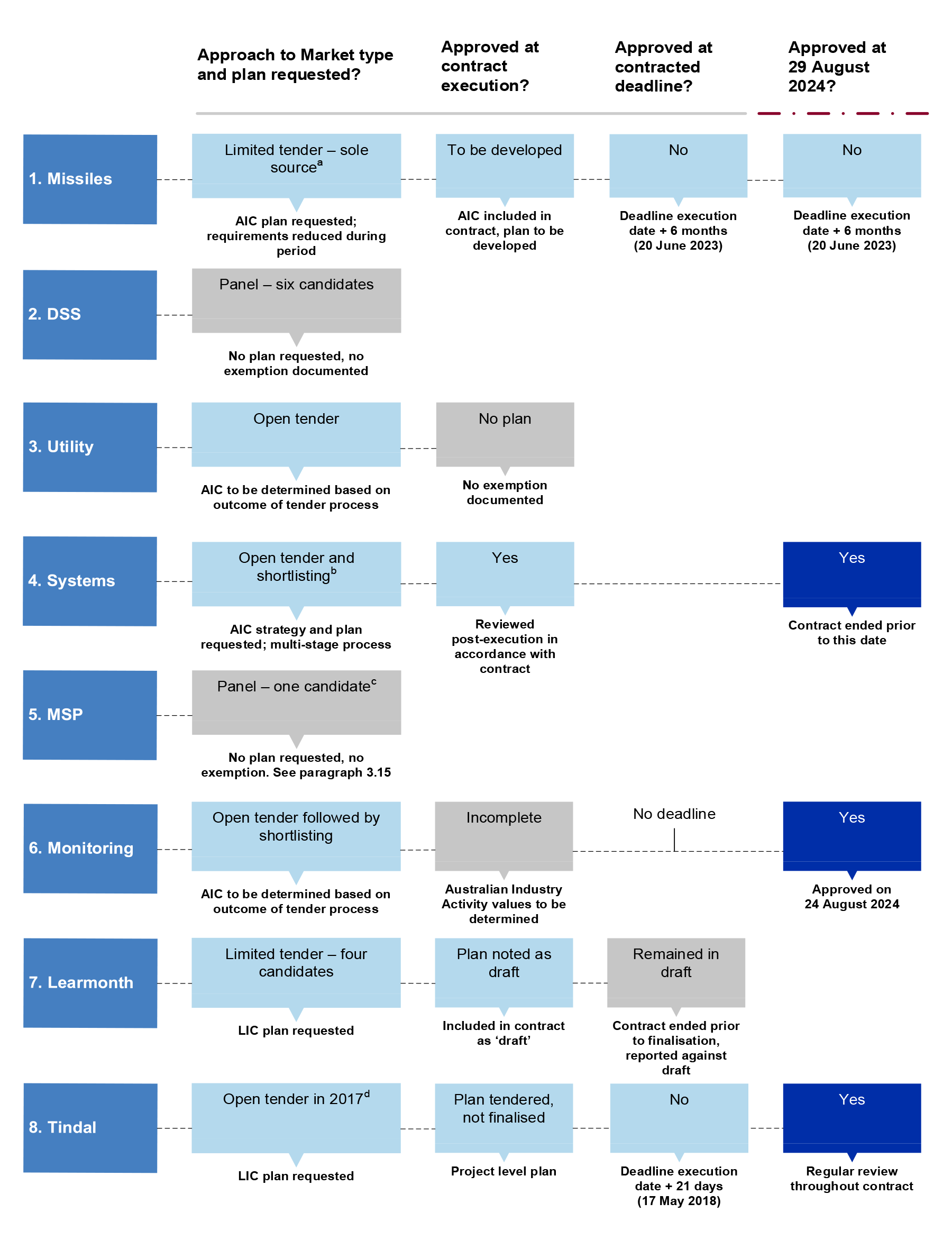

16. Of the eight contracts examined, the relevant suppliers for four had provided Defence with a project or industry plan (or schedule) in accordance with the procurement stage requirements of the DPIP. By 29 August 2024, one of these plans (or schedules) remained in draft and had not been further developed as required, and three had been finalised and approved by Defence. For the five contracts without finalised plans, Defence did not document the exemption from this requirement for three suppliers, provided one supplier with an extension to 20 June 2023, and did not finalise the draft plan for the remaining supplier.

17. For four examined contracts, additional AIC or LIC commitments were also within other contract documents. For the two examined contracts with no plans or schedules developed, AIC or LIC commitments were located in other contract artefacts such as a service management plan or statement of work. Unclear or imprecise clauses were included in the contract documentation for three contracts. Of the five that met the threshold for the publication of an AIC Plan, one was published on Defence’s website. Shortfalls in record keeping were observed in the documentation for each of the eight contracts. (See paragraph 3.16 to 3.33)

18. Defence undertakes limited monitoring to ensure the delivery of contracted Australian industry commitments. Where suppliers have reported against their DPIP-related commitments, this reporting has not been complete, with 12 of 59 relevant measures reported against. For four of the five contracts where supplier commitments have been contracted:

- the reporting to Defence indicated that these commitments were not being delivered. Defence undertook follow up action with respect to one of those contracts; and

- the DPIP-related terms in Defence’s contract with the head contractor are required to ‘flow down’ as requirements to the head contractor’s subcontractors. One of these four suppliers has reported to Defence on its engagement with subcontractors. (See paragraphs 3.34 to 3.46)

Governance, assurance and reporting

19. Senior Defence committees at the enterprise and group levels have received reports on the implementation of activities relevant to the DPIP, including the implementation of the ‘enhanced’ Australian industry capability (AIC) contractual framework announced in mid-2020. The policy oversight forum responsible for the periodic review and alignment of the policy with government’s defence industry policy objectives was not established as foreshadowed by the DPIP. In the absence of this forum, Defence has not regularly reported on the DPIP or monitored its implementation activities to ensure a unified approach at a whole-of-enterprise level, consistent with the intent of the DPIP. (See paragraphs 4.2 to 4.15)

20. Defence’s assurance framework does not prescribe the level of assurance to be obtained and does not align with an auditing standards framework. Defence’s ‘AIC Audit Program’ has provided limited insights on the extent to which Defence is implementing its DPIP obligations or whether suppliers are meeting their contracted DPIP-related commitments. Assurance activities conducted under Defence’s framework are limited to materiel contracts over $20 million in value, representing one-fifth of the procurement categories covered by the DPIP. The scope of Defence’s assurance program has included contracts that were executed prior to the March 2019 introduction of the DPIP. Of the 17 assurance activities conducted by Defence since July 2021, seven did not report the deficiencies identified in AIC plans as non-compliance, as the DPIP did not apply to those contracts.

21. Other assurance-related activities such as Defence’s self-reporting through compliance surveys under its Supplier Rating System indicate that Defence has not fully complied with its obligation to ensure supplier commitments are contracted in accordance with the DPIP. Of the 768 contract surveys conducted as at July 2024, 209 (27 per cent) reported that AIC obligations were ‘not applicable’. Other procurement and contracting compliance arrangements in Defence do not cover the DPIP’s requirements and have therefore not identified issues relating to its implementation. (See paragraphs 4.16 to 4.38)

22. Defence has established performance measures related to its engagement with Australian industry and provides quarterly reporting to the Minister for Defence. Defence’s administrative systems do not support reporting at the project level or ensure that AIC Plans are published where required. Defence has undertaken to further develop its reporting on defence industry as part of its implementation of the Defence Industry Development Strategy. (See paragraphs 4.39 to 4.57)

Recommendations

Recommendation no. 1

Paragraph 2.32

The Department of Defence establish arrangements to ensure that its contract template and guidance documents are up to date and aligned with Defence industry contracting and policy requirements.

Department of Defence response: Agreed.

Recommendation no. 2

Paragraph 2.40

The Department of Defence implement controls within relevant systems for its procurement, financial, and contract management activities to support and monitor compliance with its obligations to implement Australian industry participation and contracting requirements.

Department of Defence response: Agreed.

Recommendation no. 3

Paragraph 2.60

The Department of Defence complement the implementation of its new procurement and contract management training by:

- establishing measures to inform senior leadership of the extent to which role specific training is completed, such as by procurement and contract managers; and

- incorporating requirements for Defence policies, such as the DPIP, into mandatory training.

Department of Defence response: Agreed.

Recommendation no. 4

Paragraph 2.64

The Department of Defence extend the scope of the existing AIC Practitioners course to cover the needs of users of Defence contracting material beyond the ASDEFCON suite.

Department of Defence response: Agreed.

Recommendation no. 5

Paragraph 3.32

The Department of Defence implement measures to ensure that:

- where approval of industry commitments occurs after contract execution, this takes place within agreed timeframes and includes options for remediation and contract termination if this does not take place; and

- public AIC plans are prepared and published where required.

Department of Defence response: Agreed.

Recommendation no. 6

Paragraph 3.40

The Department of Defence improve its administrative arrangements for contracts to ensure that:

- contracts with industry participation-related requirements can be efficiently and effectively identified and managed; and

- contracted industry participation-related measures can be efficiently and effectively identified and monitored.

Department of Defence response: Agreed.

Recommendation no. 7

Paragraph 3.45

The Department of Defence:

- monitor subcontractor performance of industry participation commitments where there are contractual flow down requirements between head contractors and their subcontractors; and

- incorporate details on the potential for flow down industry participation requirements into relevant guidance for Defence personnel and industry.

Department of Defence response: Agreed.

Recommendation no. 8

Paragraph 4.14

The Department of Defence improve its oversight arrangements to monitor and drive appropriate consistency in its implementation of Australian industry policy in its procurement and contracting activities.

Department of Defence response: Agreed.

Recommendation no. 9

Paragraph 4.37

The Department of Defence review and revise its AIC assurance framework to:

- prescribe the level of assurance to be obtained through the assurance activities;

- cover the full scope of Defence industry contracting and policy requirements; and

- assess whether Defence industry contracting and policy requirements have been considered and addressed early in procurement processes as required, including the approval and documentation of exemptions.

Department of Defence response: Agreed.

Summary of entity response

23. The proposed audit report was provided to the Department of Defence. Defence’s summary response is provided below, and its full response is included at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Defence acknowledges the findings of the Auditor-General’s Performance Audit report: Maximising Australian industry participation through Defence contracting. Defence is committed to ensuring that Australian industry participation in Defence contracts is considered and optimised in the delivery of Defence capabilities.

Defence accepts the key findings and recommendations aimed at enhancing governance, assurance, reporting arrangements, relevant training and guidance when implementing Australian industry participation policy requirements in Defence procurements.

In alignment with the Defence Industry Development Strategy, Defence has commenced the process to update the Defence Policy for Industry Participation and procurement reform initiatives to ensure Defence and industry are better positioned to deliver the required capabilities within reduced timeframes. These reforms will directly support the implementation of the ANAO’s recommendations relating to improvement of administrative arrangements to enable identification and monitoring of Defence’s industry policies enabled through its contract frameworks.

Key messages from this audit for all Australian Government entities

24. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy design

1. Background

Introduction

1.1 The Department of Finance (Finance) has reported that in 2022–23, a total of 83,625 Australian Government contracts valued at $74.82 billion were notified on AusTender.3 Of this total, the Department of Defence (Defence) ranked as the Australian Government’s largest procurer with 51.7 per cent of Commonwealth entity contracting, valued at $38.69 billion.4

1.2 Successive Australian governments have encouraged the involvement of domestic industries in Defence procurement to develop and maintain the industrial base, secure supply chains, and promote employment and economic growth. A summary of initiatives to encourage domestic participation in procurement relevant to the Australian defence industry is outlined at Appendix 3. These initiatives include the Australian Industry Capability (AIC) Program, launched in February 2008, which required potential contractors to demonstrate how their tenders provide opportunities for Australian businesses.5

Defence Industry Policy Statement and Industrial Capability Plan

1.3 On 24 February 2016, the Australian Government released the Defence Industry Policy Statement (DIPS), along with the 2016 Integrated Investment Program and 2016 Defence White Paper. The 2016 Defence White Paper stated the following.

The Government recognises that Australian defence industry has faced major challenges as a result of underinvestment in Defence, and the accompanying volatility in Defence funding. This Defence White Paper, the Defence Industry Policy Statement and the Integrated Investment Program provide Australian defence industry with a comprehensive policy framework to inform the contribution industry will need to make to Australia’s long-term security, including the development of capability, infrastructure and skills for the future.6

1.4 The DIPS was developed following consultation with Australian industry on the Defence White Paper and stated the following.

The consultation process identified the need to develop Defence industry policy to reset and refocus the Defence and industry partnership for improved delivery of Defence capability, to ensure we are maximising opportunities for competitive Australian businesses and streamline the delivery of Defence industry programs.7

1.5 Four ‘key elements and initiatives of Defence Industry Policy’ were outlined in the DIPS.8 Among other things, these initiatives aimed to increase the depth of skills and diversification of the Australian defence industry, including through the establishment of a new Centre for Defence Industry Capability (CDIC)9, a virtual Defence Innovation Hub10, and the Next Generation Technologies Fund.11

1.6 Building upon the DIPS, the 2018 Defence Industrial Capability Plan (DICP) stated that the government’s goal was to ‘achieve an Australian defence industry that has the capability, posture and resilience to help meet Australia’s defence needs’ by 2028.12 The DICP stated that achievement of this goal would require Defence to ‘maximise Australian industry involvement in the acquisition, operation and sustainment of our defence capability’.13

1.7 With respect to the Defence industry contracting policy in place at the time, the DICP outlined that:

The Australian Industry Capability (AIC) Program is the most important initiative within Defence’s Capability Life Cycle for developing Australia’s defence industrial base and implementation of this Plan. The program supports our goals and strategic objectives by maximising Australian industry involvement in Defence major capital equipment projects of $20 million or more. It requires companies looking to supply capability to Defence to submit an AIC plan as part of the tender response.14

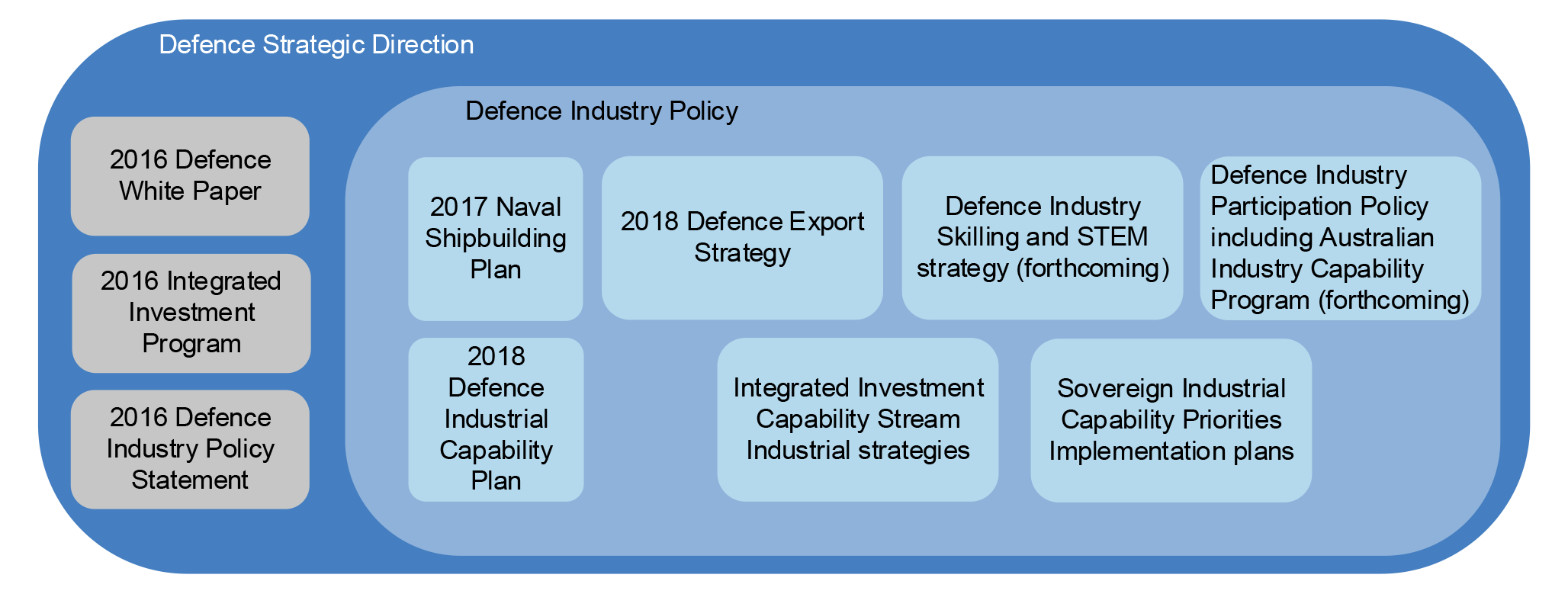

1.8 The DICP was released among a range of inter-related policy statements and strategies as outlined in Figure 1.1.

Figure 1.1: Defence Industry Policy Agenda 2018

Source: ANAO reproduction of figure in Department of Defence, 2018 Defence Industrial Capability Plan, 2018, p. 14.

Defence Policy for Industry Participation

1.9 On 28 March 2019, the Minister for Defence Industry released the Defence Policy for Industry Participation (DPIP) to give effect to the DICP and build on the existing Defence contracting arrangements required under the AIC Program. The minister’s forward to the policy stated that:

The purpose of the Defence Policy for Industry Participation is to provide greater consistency, unity and opportunity for Australian industry involvement in Defence procurement. We want companies across Australia to have the best possible opportunity to compete for Defence work, recognising that providing the best capability to Defence and value for money will continue to drive our decisions.

The Defence Policy for Industry Participation formalises consideration of Australian industry at the national and local level in procurements valued at or above $4 million for materiel and non-materiel procurements, and at or above $7.5 million for construction procurements. It does this through specific schedules or plans that will now form part of tender requirements depending on the nature and size of the procurement. Our direction in this Policy will make consideration of Australian industry in defence procurement simpler, easier and intrinsic to Defence business.15

1.10 The DPIP was designed to be implemented in alignment with Defence’s obligations under the Commonwealth Resource Management Framework.

Commonwealth Resource Management Framework

1.11 The use and management of public resources within the Australian Government public sector is governed by the Commonwealth Resource Management Framework, which is underpinned by the Public Governance, Performance and Accountability Act 2013 (PGPA Act).16 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance under subsection 105B(1) of the PGPA Act. Paragraph 4.4 of the CPRs states:

Achieving value for money is the core rule of the CPRs. Officials responsible for a procurement must be satisfied, after reasonable enquiries, that the procurement achieves a value for money outcome. [emphasis in original]17

1.12 The Secretary of Defence has issued Accountable Authority Instructions (AAIs) under section 20A of the PGPA Act to support compliance with the obligations of officials under the CPRs and PGPA Act. Defence’s policies for procurement and industry participation are governed by the AAIs. Key elements of the CPRs relevant to the implementation of the DPIP involve the consideration of broader benefits to the Australian economy and Australian Industry Participation (AIP) requirements.

Broader benefits to the Australian economy

1.13 Since 1 March 2017, the CPRs have required officials to ‘consider the economic benefit of the procurement to the Australian economy’ [emphasis in original] in addition to the value for money considerations outlined within the rule.18 The requirement to consider broader benefits to the Australian economy applied to procurements valued above $4 million until 1 July 2024 when that threshold was reduced to $1 million.19

1.14 Under the DPIP, Defence requires tenderers to ‘demonstrate appropriate formal consideration of Australian industry — locally and nationally — through a schedule or plan that forms part of their tender response.’20 The submitted plan or schedule is to be assessed by Defence as part of its overall value for money assessment. Following completion of procurement decision-making, the plan or schedule is to become a contracted deliverable for the selected supplier.

Australian Industry Participation requirements

1.15 Under the Australian Industry Participation National Framework and CPR Procurement Connected Policy – Australian Industry Participation (AIP) requirements, tenderers for Australian government funded projects are required to provide AIP plans when tendering for procurements valued $20 million and above. The CPR Procurement Connected Policy – Australian Industry Participation mandates these policy requirements for non-corporate Commonwealth entities.21 The Department of Industry, Science and Resources (DISR) is responsible for the review, approval and publication of AIP plan summaries.22

1.16 The DPIP states that: ‘The Defence Policy for Industry Participation addresses the requirements of the CPR Procurement Connected policy – Australian Industry Participation, and means that potential defence suppliers will not need to prepare a separate Australian Industry Participation Plan.’23

Defence procurements with DPIP requirements

1.17 The DPIP applies to three streams of Defence procurement:

- Materiel — for equipment that can be integrated into Defence platforms and systems or used by Defence personnel on operations. Materiel sustainment procurements are related to ongoing maintenance, upkeep, repair and other support of current Defence platforms and systems.

- Non-materiel — include goods and services such as base and garrison support and maintenance, health, logistics, professional support, childcare services, training, travel, information communications technology and corporate products.

- Construction services — covers the construction or maintenance of Defence facilities, establishments and training areas.24

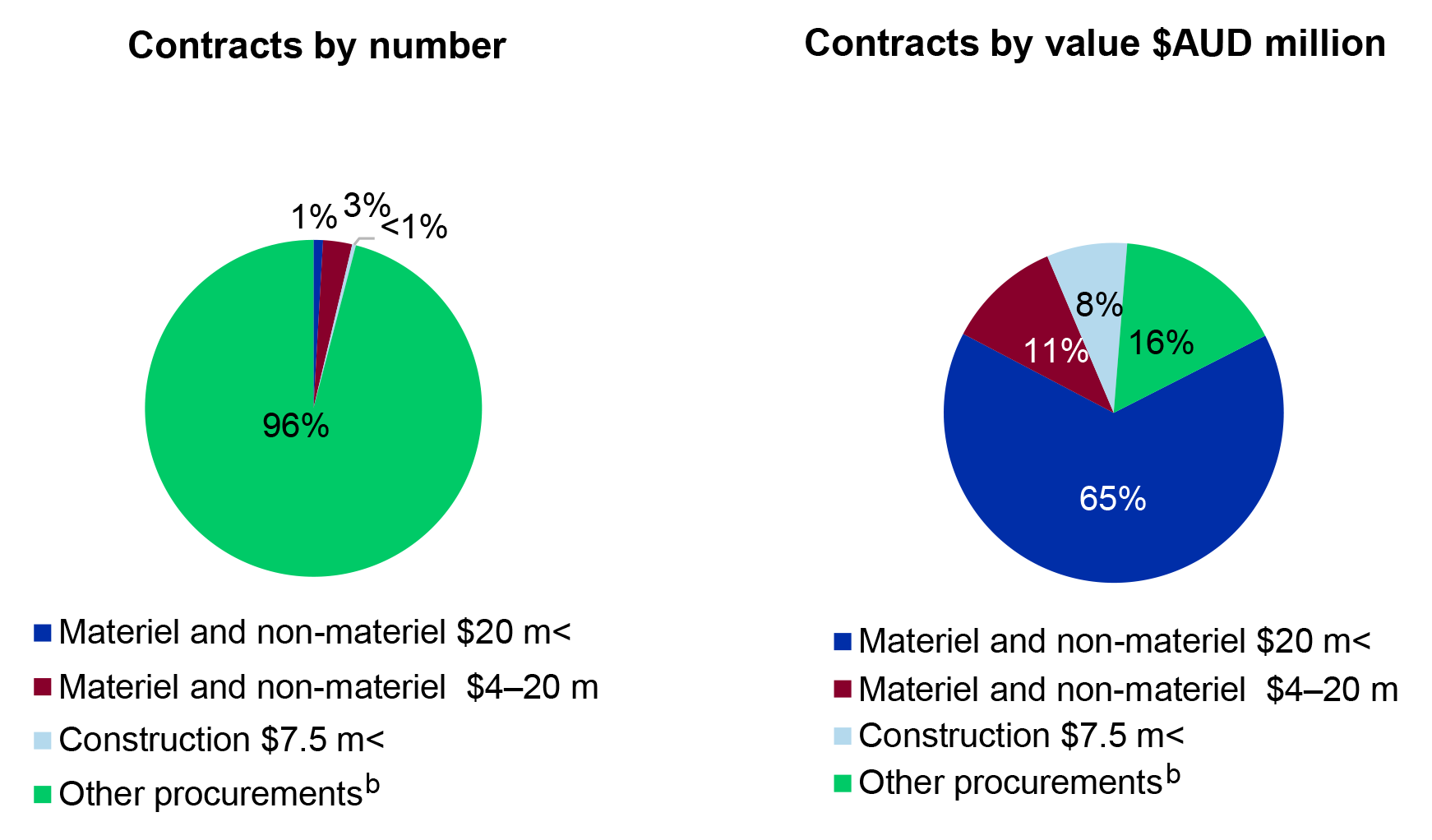

1.18 Defence contract data for the calendar year 2022 indicated that, of the approximately 15,000 procurements undertaken, over 600 met the DPIP threshold requirements — including over 400 materiel and non-materiel procurements between $4–20 million.25 Contracts with DPIP requirements made up 84 per cent of all contracts by value, as illustrated in Figure 1.2.

Figure 1.2: Proportion of contracts with DPIP requirements by number and value, 2022a

Note a: The ANAO did not provide assurance over this data (refer to paragraph 1.35 and respective footnotes).

Note b: Other procurements are those that did not meet the financial thresholds set out in the DPIP.

Source: ANAO analysis of Department of Defence data.

Administrative arrangements

1.19 The 2023–27 Defence Corporate Plan stated that: ‘Defence’s mission and purpose [is t]o defend Australia and its national interests in order to advance Australia’s security and prosperity.’26 Defence delivers on its mission and purpose through seven ‘key activities’. Of relevance to the DPIP, Key Activity 7 aims to contribute ‘to Australia’s prosperity through the inclusion of Australian businesses and enterprises in supply chains for capability and services.’ Defence’s Corporate Plan further states in this respect that:

The Government’s significant investment in Defence over the coming decade will advance Australia’s prosperity through expenditure on defence capabilities, support to new and existing defence industries and the creation of jobs.27

1.20 At November 2024, Defence’s administration of DPIP primarily resided within the Capability Acquisition and Sustainment Group (CASG):

- the Industry Engagement Division comprising of the Domestic Industry Domestic Policy Branch, the Office of Defence Industry Support and the Australian Industry Capability Delivery Branch — responsible for industry engagement and the development and implementation of the DPIP and related policy, including the 2024 Defence Industry Development Strategy and, as advised by Defence in November 2024, the forthcoming update to the DPIP; and

- the Commercial Division comprising of the Materiel Procurement Branch and the Non-materiel Procurement Branch — responsible for the maintenance of the Australian Standard for Defence Contracting (ASDEFCON) suite of tendering and contracting documents.

1.21 The Infrastructure Division within the Security and Estate Group (SEG) is responsible for DPIP with respect to construction procurements.28 This includes managing the following:

- Suite of Facilities contracts for the construction and maintenance of Defence facilities, including building and fixed plant and equipment maintenance29;

- Defence Infrastructure Panel (DIP) 2022–2027, established to provide streamlined access to high quality infrastructure related professional services30; and

- Defence Infrastructure Panel – Environment, Heritage and Estate Engineering (DIP-EHEE) 2020–2025, established to provide ongoing environment, heritage and engineering services.31

1.22 Additional DPIP related requirements may apply to procurements depending on the applicable Defence contracting suite of documents being used. For example, certain ASDEFCON templates require AIC plans to include Defence Sovereign Industrial Capability Priorities or Sovereign Defence Industrial Priorities32, and the contractor and subcontractor’s commitments for delivering Australian Industry Activities (including Defence-Required Australian Industrial Capabilities).33 In August 2021, Defence released Australian Contract Expenditure (ACE) Measurement Rules to standardise where ACE and Imported Contract Expenditure (ICE) apply and the way in which they are measured across relevant Defence procurements.34

Approach to implementation

1.23 The requirements outlined in the DPIP were to be implemented by Defence from 2019 and apply to new projects and new phases of existing projects.35 The implementation of the DPIP was to be supported by the development and roll out of guidance and reference materials.36

1.24 On 6 February 2020, the Minister for Defence Industry announced changes to the DPIP to strengthen contractual provisions and the establishment of an AIC audit program to assess whether contractual obligations had been met. On 15 February 2020, the Prime Minister wrote to the Ministers for Defence and Defence Industry requesting that prime contractors be given notice of the government’s intention to strengthen the AIC program.37 The Prime Minister’s letter noted:

The Government expects Defence and its prime contractors to ensure that commitments made to the Government on AIC are fully delivered through improved, fit-for-purpose contracts between Defence and prime contractors.

1.25 In November 2020, the government released Lead the Way: Defence Transformation Strategy, which stated the following:

Throughout the course of 2020, the Australian Government and Defence have undertaken significant improvements to the Australian Industry Capability Program and support for Australian defence industry. Defence is:

- strengthening requirements for Australian Industry Capability in Defence contracts through additional contractual and non-contractual measures;

- implementing an enduring Independent Australian Industry Capability Plan Audit Program;

- implementing recent changes to the Commonwealth Procurement Rules guidelines to strengthen Australian industry considerations; and

- introducing improvements to the Australian Standard for Defence Contracting (ASDEFCON) document suite to cut process times and costs for Australian businesses.38

1.26 The 2023 Defence Strategic Review noted that:

Australian industry content and domestic production must be balanced against timely capability acquisition. Previous government direction to meet mandated Australian industry content skewed the capability acquisition process so that capability outcomes were secondary to creating opportunities for Australian industry – even when a clear rationale was lacking.

To enable Australian defence industry to deliver capability, acquisition processes must minimise the burden of working with Defence, particularly for small and medium enterprises. This will have the advantage of faster capability delivery while building depth in Australian defence industry where required.

Defence must consider Australian industry content when it makes sense and delivers capability outcomes on time. It is essential to ensure Australian sovereign defence industry capability is supported where it makes strategic sense.39

1.27 On 29 February 2024, government released the 2024 Defence Industry Development Strategy (DIDS). The strategy committed Defence to 39 actions including simplifying the Defence contracting framework, implementing a new approach to engaging with industry, and updating the DPIP by the end of 2024.40 In relation to procurement reform, the Strategy stated:

We will simplify Defence’s approach to contracting, increase its risk appetite, and shorten the time it takes to receive project and contract approvals, to deliver capability at speed while maintaining appropriate levels of governance.41

Parliamentary interest

1.28 The involvement of Australian industry in Defence procurement and the achievement of contract policy objectives has been of interest to the Parliament, including through inquiries such as:

- Senate Foreign Affairs, Defence and Trade Legislation Committee, Performance of the Department of Defence in supporting the capability and capacity of Australia’s defence industry, November 2024 with an Interim Report including recommendations tabled in October 2023;

- House of Representatives Standing Committee on Infrastructure, Transport and Cities, Government Procurement: A sovereign security imperative, March 2022;

- Joint Standing Committee on Foreign Affairs, Defence and Trade, Inquiry into the implications of the COVID-19 pandemic for Australia’s foreign affairs, defence and trade, December 2020;

- Previous Joint Committee of Public Accounts and Audit (JCPAA) inquiries into ANAO performance audits and the Major Projects Reports (MPR)42; and

- Joint Standing Committee on Foreign Affairs, Defence and Trade, Principles and practice – Australian defence industry and exports: Inquiry of the Defence Sub-Committee, November 2015.

Rationale for undertaking the audit

1.29 Defence’s implementation and delivery of contracted Australian industry requirements has been an area of focus for successive governments and an ongoing interest for the Parliament. The government intent to maximise Australian industry involvement in the Defence procurement was reflected in the AIC Program in 2008, and reaffirmed in the 2016 Defence Industry Policy Statement and the 2018 Defence Industrial Capability Plan. This audit provides the Parliament with independent assurance of the effectiveness of Defence’s arrangements to deliver Australian industry policy outcomes through its contractual arrangements with its suppliers.

Audit approach

Audit objective, criteria and scope

1.30 The objective of the audit was to examine the effectiveness of Defence’s administration of contractual obligations to maximise Australian industry participation.

1.31 To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria:

- Have fit-for-purpose administrative arrangements been established to maximise Australian industry participation in Defence procurement and contracting?

- Have applicable contracting requirements been implemented to maximise Australian industry participation?

- Has Defence implemented appropriate governance, assurance and reporting arrangements to support the objective of maximising Australian industry participation?

1.32 The audit focussed primarily on Defence’s administration of the DPIP as it relates to contract management activities, internal and external communication, arrangements to ensure industry compliance with contracted requirements, and whether intended policy objectives are being achieved.

1.33 The audit scope did not include assessments against all requirements of the CPRs, suppliers’ arrangements for managing their contracted and subcontracted obligations, government-to-government acquisition agreements such as the Foreign Military Sales (FMS) program; and other activities that encourage the participation of Australian industry in Defence such as grants programs.43

Audit methodology

1.34 The audit methodology included:

- review of documentation held by Defence, including policies, procedures and contract artifacts;

- meetings with relevant departmental staff; and

- consideration of two public submissions to the audit.

1.35 Defence does not hold a complete and accurate list of contracts that include provisions to maximise Australian industry involvement, such as AIC requirements.44 As a consequence, the ANAO was unable to select a statistically valid sample of contracts to review. Based on the available contract data, the ANAO selected eight materiel, non-materiel and construction contracts commencing in 2022.45

1.36 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $1,161,000.

1.37 The team members for this audit were Mark Rodrigues, Marissa Lemmer, Fraser McEachan, Shane Madden, Finn Coverdale and Amy Willmott.

2. Administrative arrangements

Areas examined

This chapter examines whether the Department of Defence (Defence) has established fit-for-purpose administrative arrangements to maximise Australian industry participation in Defence procurement and contracting.

Conclusion

Defence’s administrative arrangements for maximising Australian industry participation through its procurement and contracting activities are partly fit for purpose. Defence’s procurement framework has not been updated in a timely manner, and as at August 2024, did not fully reflect the requirements of the March 2019 Defence Policy for Industry Participation (DPIP). Guidance for Defence personnel in relevant tendering and contracting templates is incomplete, and in some cases outdated. Defence engages with industry through forums and other activities as well as through individual procurement processes to support the intent of government’s industry contracting policy.

Areas for improvement

The ANAO made four recommendations aimed at ensuring the timeliness and consistency of contracting templates and strengthening procurement and contracting training.

2.1 The 2016 Defence Industry Policy Statement (DIPS) and the 2018 Defence Industrial Capability Plan (DICP) articulate the government’s objective to maximise Australian industry participation through Defence contracting, as outlined at paragraphs 1.3–1.8. To achieve this, Defence requires a procurement framework that clearly defines its Australian defence industry contracting requirements and contains fit for purpose guidance, training and information for Defence personnel and defence industry.

Does Defence have a framework that clearly defines Australian industry contracting requirements?

Defence gives effect to its Australian industry contracting requirements through its internal policy framework. Defence’s framework is informed by requirements under the Public Governance, Performance and Accountability Act 2013, the Commonwealth Procurement Rules and government’s Defence industry policies, as set out by the 2016 Defence Industry Policy Statement and the 2018 Defence Industrial Capability Plan. Key elements of Defence’s established policy framework, such as the Defence Procurement Manual (DPM) and its contracting templates, were not updated in a timely manner following the release of the Defence Policy for Industry Participation (DPIP) in March 2019. The DPM was not updated until 1 July 2020, 15 months after the DPIP’s release. Defence lacks arrangements to ensure that procurement documents and contracting templates are aligned with the DPIP requirements, and up to date. Automated system controls, which were established in 2022 and mandated in 2024 — to improve compliance with mandatory procurement policies — do not cover the requirements of the DPIP.

2.2 Since 2007, Defence has used its procurement policy framework to support the implementation of Australian industry capability requirements in its procurement and contracting activities. At October 2024, Defence’s framework to define procurement and contracting requirements comprises the 2019 Defence Policy for Industry Participation (DPIP), Defence’s Accountable Authority Instructions under the Public Governance and Performance Act 2013 (PGPA Act), the Defence Procurement Manual (DPM), Defence’s Procurement and Contracting Requirements document, and a range of contracting templates.46

Defence Policy for Industry Participation

2.3 Prior to the release of the DPIP in March 2019, existing government requirements to promote the involvement of Australian industry in Defence procurement were implemented through the Australian Industry Capability (AIC) Program. Under the AIC Program, potential contractors were required to demonstrate how their tenders would provide opportunities for Australian companies. The requirements applied to materiel contracts valued $50 million and over. In July 2011, that financial threshold was reduced to $20 million.

2.4 The 2018 DICP foreshadowed that the DPIP would be developed to:

provide a more consistent approach to Australian industry involvement in materiel and non-materiel procurement of $4 million and above. It will provide a clearer and stronger link between our defence industry policy and mechanisms for delivering capability to Defence, and build on mechanisms already in place to capture and assess the broader economic benefits on the Australian economy.47

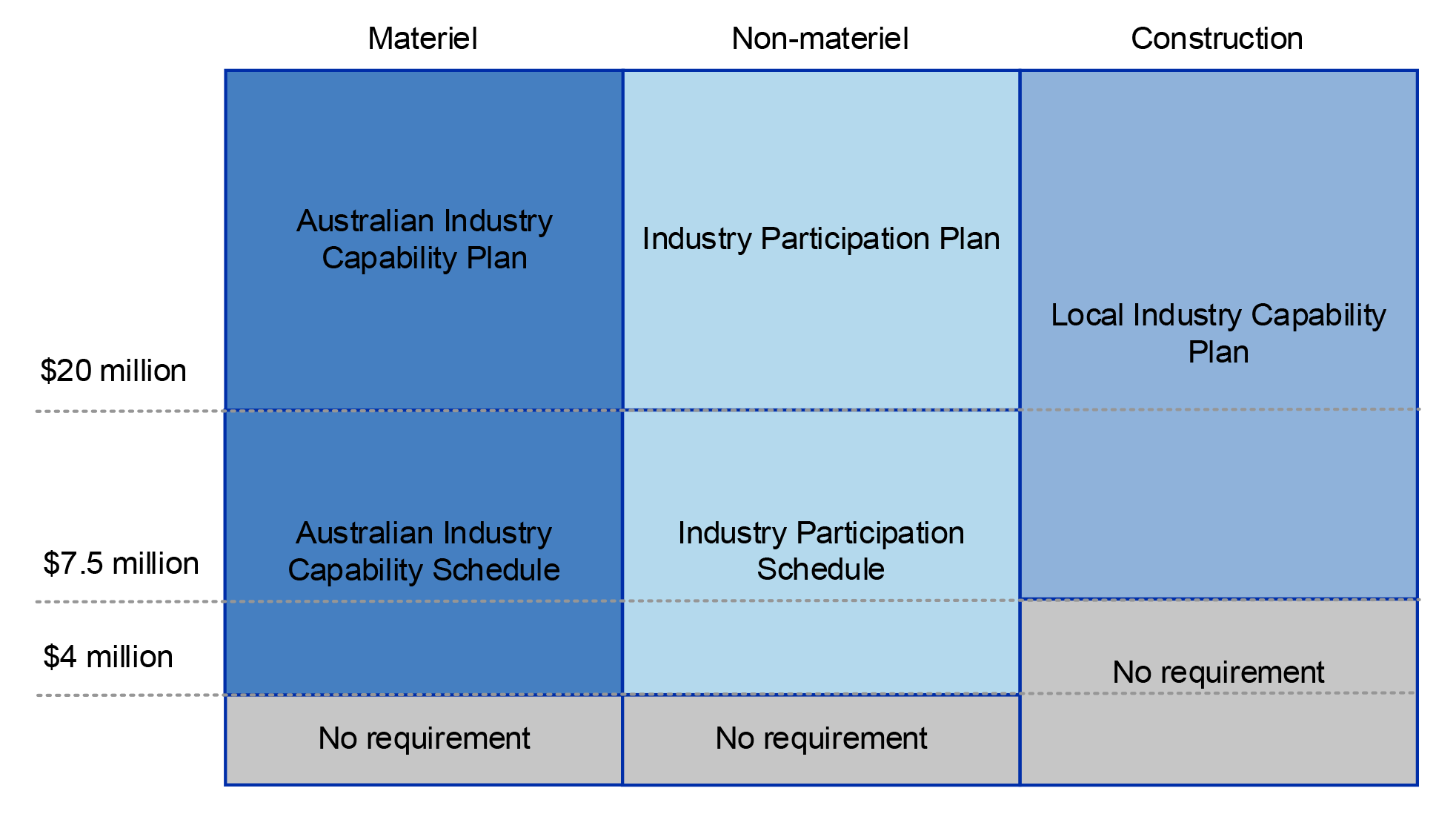

2.5 On 28 March 2019, the Minister for Defence Industry released the DPIP to give effect to the 2018 DICP commitment and build on existing AIC Program contracting arrangements in Defence. The DPIP streams and requirements by contract value are outlined at Figure 2.1.

Figure 2.1: DPIP streams and requirements by contract valuea

Note a: Following the release of the DPIP, Defence replaced the non-materiel procurement requirement for Industry Participation Schedules and Plans with the existing materiel procurement requirement for AIC Plans and Schedules. Other changes designed to strengthen the implementation of AIC in Defence procurement and contracting following the release of DPIP are discussed at paragraphs 2.20–2.22.

Source: Reproduction of figure in Department of Defence, Defence Policy for Industry Participation, 28 March 2019, p. 41, available from https://www.defence.gov.au/sites/default/files/2020-08/Defence-Policy-for-Industry-Participation.pdf [accessed 11 April 2025].

2.6 Under the DPIP, plans are required to:

describe how the tenderer has engaged with Australian industry at the national and local levels (where applicable) to deliver the required goods, works or services. This includes the specific commitments by the tenderer to maximise opportunities for competitive Australian industry to participate in the supply chain and to support development of Australian industry capability. The plans will also describe how the tenderer will monitor and report on its commitments once in contract.48

2.7 Schedules are required to include ‘a breakdown of the value of the planned expenditure in Australia in terms of companies, nature and value of work.’ Schedules are required to be included in plans (where plans are required). Local Industry Capability Plans are required to ‘reflect the specific nature and requirements of construction-related procurement.’ For these procurements, tenderers are expected to ‘adopt a common sense approach based on reasonable geographic proximity to the location where the work is to be performed.’ Local industry considerations are also to be incorporated into AIC schedules and plans for all procurements with DPIP requirements, except for materiel acquisition procurements that are ‘predominantly location agnostic’.49

Accountable Authority Instructions

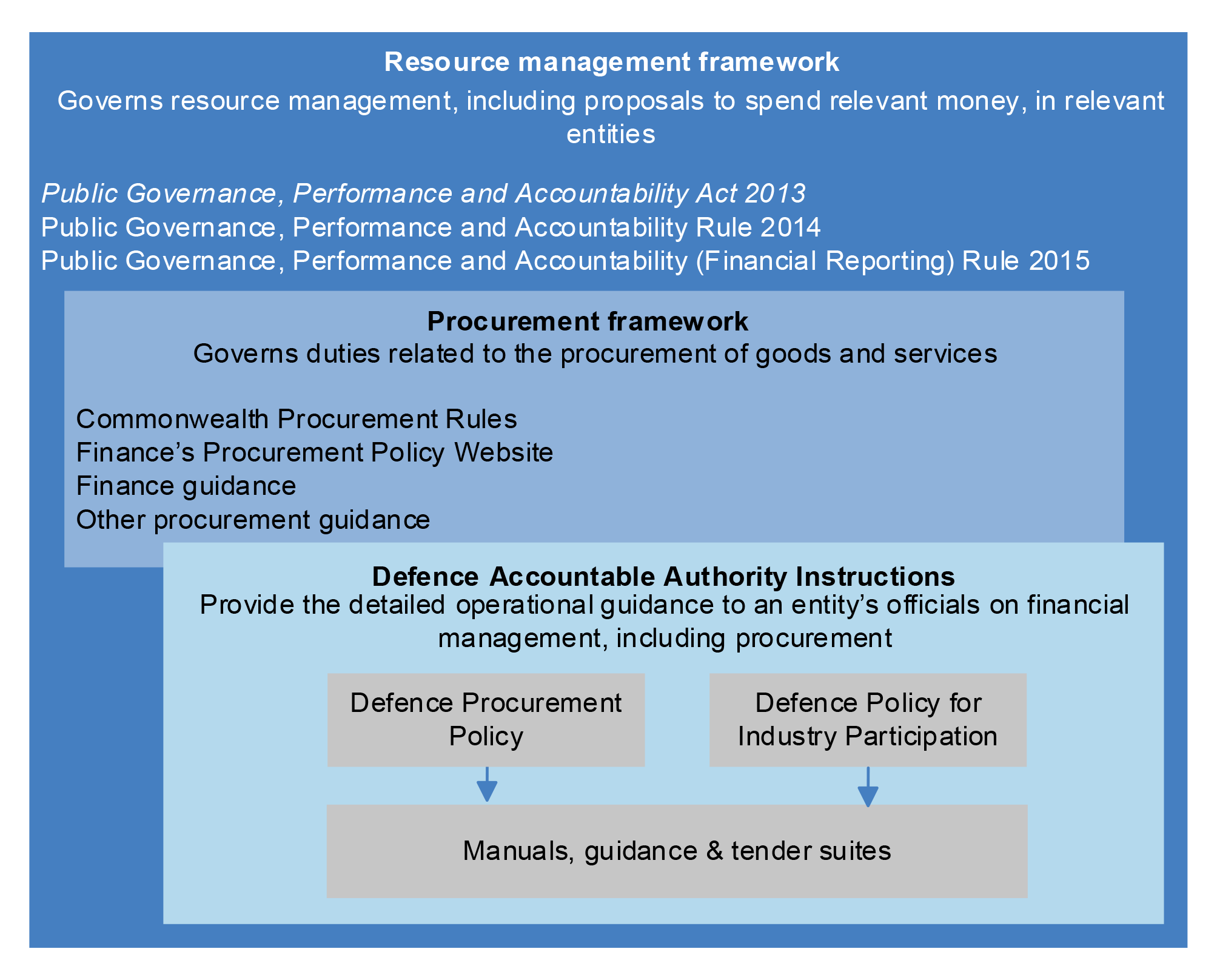

2.8 As set out at paragraph 1.12, the Secretary of Defence has issued Accountable Authority Instructions (AAIs) under section 20A of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) to support compliance with the obligations of officials under the Commonwealth Procurement Rules (CPRs) and PGPA Act. Defence’s policies for procurement and industry participation reside under the AAIs, as illustrated in Figure 2.2.

Figure 2.2: Commonwealth Resource Management Framework and Defence procurement and industry participation policy

Source: Reproduction of figure in Department of Defence, Defence Policy for Industry Participation, p. 28.

2.9 In relation to Australian industry contracting policy, AAI 2 Spending Defence Money states:

Defence will maximise the opportunities for competitive Australian industry to compete on merit to meet Defence’s capability needs. This applies to materiel, non-materiel and construction procurements that meet the relevant thresholds. Refer to the mandatory Defence industry policy [50] requirements and relevant thresholds specified in the Defence Procurement Manual (DPM), including in respect of the Australian Industry Capability Program, when planning for and undertaking procurement.

…

you must … comply with the Defence industry policy requirements including relevant thresholds specified in the DPM [Defence Procurement Manual]. [emphasis in original]

2.10 The Defence AAI 2 was first updated to include industry participation requirements on 1 July 2020. At that time, the AAI referred to the AIC program — the primary Defence industry participation policy prior to the release of the DPIP.

2.11 In addition to the DPM, Defence’s ‘Procurement and Contracting Requirements’ (PCR) policy gives effect to Defence industry policy requirements. Specific requirements in the PCR with respect to the DPIP include:

Defence officials must consider at the early stages of the Defence Capability Life Cycle[51] and during the planning stage of the procurement the requirement or potential opportunities for Australian industry in the procurement, consistent with the Government’s Defence industry policy.

…

Defence officials must comply with the Defence industry policy requirements as incorporated into Defence’s contracting templates. If Defence’s contracting templates are not used, Defence officials must comply with the Defence industry policy requirements, consistent with the Defence templates.

…

Defence officials do not need to comply with the Australian Industry Participation National Framework administered by the Department of Industry, Science, Energy and Resources, as the Defence industry policies satisfy the Australian Industry Participation National Framework requirements. [emphasis in original]

Defence Procurement Manual

2.12 The DPM is ‘the primary reference document for all Defence officials involved in conducting a procurement’. The January 2019 (version 1.3) DPM was not updated with the release of DPIP in March 2019. Guidance contained within this document referred to previous AIC Program requirements with no reference to the updated policy.52 The subsequent version of the DPM, issued on 20 April 2019 (version 1.4), was not amended to refer to the DPIP and did not include relevant updates to requirements, such as the new financial thresholds. The DPM was not updated to include the new DPIP requirements until version 1.6, issued on 1 July 2020 — 15 months after the release of the DPIP.

2.13 Defence has undertaken to improve its procurement and contract management activities following internal audits in 2023 and ANAO performance audit reports.53 One of those internal audits, on Defence’s procurement assurance activities, found that the design and usability of the DPM was not fit for purpose:

Internal Audit found that Defence’s policies and rules for procurement are difficult [to] interpret and do not currently support efficient understanding of the requirement for users. The DPM structure and content does not support efficient, effective execution of key procurement requirements for business users. For example:

- Mandatory requirements are difficult to pinpoint and prioritise …

- Extensive links to other guidance is [sic] not fully contextualised or explained …

- DPM Guidance on process steps for simple versus complex procurements cannot be put into practice …

2.14 In its November 2023 response to another of these internal audits, Defence advised that an existing program ‘to restructure and review the Defence Commercial Framework’ (including the DPM) was already underway and expected to be completed in May 2025. This program was to include the introduction of revised training and guidance for Defence officials and the implementation of a procurement and contracting assurance framework from June 2024. These activities are discussed at paragraphs 2.54–2.63 and 4.34–4.35.

Procurement and contracting templates

2.15 Defence AAI 2 provides that:

Defence’s contracting templates incorporate provisions that give effect to Defence industry policy. If Defence’s contracting templates are not used, Defence officials must ensure that Defence industry policy requirements are considered and incorporated in request documentation where required.

2.16 Tendering and contracting templates relevant to the DPIP are primarily covered by:

- the Australian Standard for Defence Contracting (ASDEFCON) suite of tendering and contracting documents — managed by the Capability Acquisition and Sustainment Group (CASG) and applicable to materiel and non-materiel procurements; and

- the Defence Suite of Facilities templates (Facilities suite) — managed by Infrastructure Division, Security and Estate Group (SEG) and applicable to construction procurements.

2.17 The DPM also states that the approved panel templates should be used where a procurement is undertaken using an existing panel arrangement.

2.18 Defence manages updates to its ASDEFCON contracting templates in its electronic filing system (called ‘Objective’). Defence does not maintain a register of templates or a process management system to help ensure all ASDEFCON templates are reviewed and updated at regular intervals and as required. Templates within the Facilities suite are managed through a series of quality assurance registers.

Review of Defence’s contractual provisions to maximise Australian industry involvement

2.19 In response to an update on the implementation of the DICP provided to government in October 2019, the government agreed that the Minister for Defence would consult with the Attorney-General to review provisions in Defence contracts. The Minister for Defence would then return to government with a plan to ensure that Defence has effective contractual provisions to maximise Australian industry involvement. In December 2019, Defence returned to government with a preliminary review conducted by the Australian Government Solicitor (AGS) focusing on eight materiel contracts.54 The government was advised that:

- Defence’s contracting templates generally give effect to industry participation policy55, although they were not updated to reflect current Australian industry policy requirements; and

- AIC Plans were generally aligned with policy requirements although only some commitments within those plans were specific and measurable. As a consequence, Defence may not be able to legally enforce a contracted AIC Plan in the event of a breach or non-delivery.

2.20 A supplementary review also conducted by the AGS covered 54 prime contracts including those related to the ANAO 2018–19 Major Projects Report projects.56 AGS described the findings of the supplementary review as ‘broadly consistent’ with those of the preliminary review. Following government consideration of the supplementary review on 24 August 2020, the Minister for Defence Industry approved Defence’s plan to develop and implement an ‘enhanced’ contractual framework for AIC, intended to strengthen the contractual terms with specific and measurable commitments to enable greater accountability and enforceability.57 On 24 September 2020, the Minister for Defence Industry announced ‘AIC changes in the contractual framework for future contracts from January 2021’.

2.21 Defence’s implementation of the contracting changes involved progressively updating and releasing revised contract templates with updated AIC provisions to be applied prospectively in new contracts. The Defence Enterprise Business Committee (EBC) monitored the implementation of the roll out, as part of its oversight of the 2020 Lead the Way: Defence Transformation Strategy.58

2.22 On 6 December 2021, Defence advised the Minister for Defence Industry that ‘[a]ll of the major acquisition and sustainment templates have been published to incorporate the ‘enhanced’ framework’.59 The advice to the minister did not contain information about the department’s progress on implementing the AIC changes to other contracting suites, such as the Facilities suite. The advice to the minister did not note that, at that time, two templates were yet to incorporate the ‘enhanced AIC framework’.60 In February 2022, the EBC reported to the Defence Committee (DC) that the ‘enhanced’ AIC contracting framework was complete. The information provided to the DC did not include details on the extent of the updates that had been made across Defence’s contracting suites.

ASDEFCON review

2.23 During the period of review and change to the AIC contractual provisions discussed above, Defence commenced an internal review of the ASDEFCON contracting suite. This review commenced following a request from the Minister for Defence Industry. The scope of the review did not include Defence’s implementation of AIC requirements. The purpose of the review was to identify ‘opportunities to strengthen and refine Defence procurement contracting processes … including simplifying and streamlining the ASDEFCON contracting templates.’ The review was informed by an online survey with 144 Defence industry and 106 Defence internal responses.

2.24 With respect to Defence’s overall approach to procurement, Defence advised the Minister for Defence Industry that:

While the Review focus was the ASDEFCON template suite, commentary received with regard to the broader Review topic of Defence procurement revealed a disparate approach between the ASDEFCON suite and other contracting templates in relation to “boiler-plate” commercial and legal principles. The Review Team found that a One Defence approach to such principles, including consistency in template text, would assist both Defence and Defence Industry.

2.25 The final report of the review made 16 high-level recommendations for incremental improvements in procurement practices that would be implemented through business-as-usual activities.61 The Minister for Defence Industry agreed to all recommendations. Defence advised the ANAO on 27 November 2023 that no changes were made that relate to CPRs or the administration of AIC as a consequence of the review.

Facilities suite updates

2.26 As part of an update of the Facilities suite in April and June 2024, Defence ensured that all contract templates with a requirement for a Local Industry Capability Plan (LICP) also contained clauses requiring reporting against local industry capability at a monthly meeting.62 Prior to this date, nine of the eleven templates with an local industry component did not include a clause requiring reporting against local industry capability at a monthly meeting. In eight of these nine templates, clauses relating to a monthly meeting included provision for reporting any other information requested.

Consistency of contracting templates

2.27 The DPIP requires that a consistent approach to consideration of Australian industry be applied to procurement. As part of the procurement process, tenderers are required to provide industry schedules or plans to demonstrate their engagement with industry and how they will maximise opportunity for industry participation during the project. Industry schedules (or plans) are to include information that allows Defence tender evaluation teams to identify the planned expenditure in Australia in terms of: subcontracting companies, nature and value of work. As noted at paragraphs 2.5 to 2.7 tenderers are required to provide this information as part of a schedule if the procurement is valued over $4 million. For construction procurements, this threshold is $7.5 million.

2.28 At 26 September 2024, the Defence website hosted a total of 41 templates within its ASDEFCON, Facilities and panel suites. Within these templates, 32 require that an AIC Plan or Schedule be developed for contracts above the $4 million threshold. Of these 32; seven templates (22 per cent) requested information regarding the subcontracting company’s business number, the nature of the work and value of the work; nine templates (28 per cent) contained one or two of those requirements; and 16 (50 per cent) required none.63

2.29 Of the 21 ASDEFCON templates, 13 are contract templates that require compliance with the DPIP due to their potential value meeting the $4 million threshold.64 Six of the 13 contract templates required contractors to provide all information specified by the DPIP. Of the 13 templates examined in the ASDEFCON suite, two used identical sets of clauses with the remaining 11 using unique sets of clauses. In August 2024, Defence advised the ANAO that differences in terminology within the ASDEFCON suite are due to individual templates being at varying stages of the update cycle.

2.30 Of the five panels templates examined, one included specific guidance embedded for contractors to provide Australian industry information. The Information Communication Technology Provider Arrangement (ICTPA) deed contained a schedule similar to that found in ASDEFCON and required information regarding companies, nature and value of work. Two further templates included general guidance without specifying which information was required.65 The Defence Infrastructure Panel and the Defence Infrastructure Panel – Environment, Heritage and Estate Engineering (EHEE) did not contain guidance on AIC requirements.

2.31 At September 2024, the Defence website listed 15 Facilities suite templates that may be used for contracts above $7.5 million. To meet DPIP requirements, Facilities suite templates are to collect information in the form of a Local Industry Capability Plan (LICP). LICPs are to include the same information as the schedules in the ASDEFCON suites, with an additional requirement for contractors to describe how local industry commitments will be monitored and reported on. None of the templates required contractors to provide a breakdown of planned expenditure in terms of subcontracting companies in the LICP. Five of the 15 templates examined used uniform language requiring that contractors provide a breakdown of the nature and value of work.66

Recommendation no.1

2.32 The Department of Defence establish arrangements to ensure that its contract template and guidance documents are up to date and aligned with Defence industry contracting and policy requirements.

Department of Defence response: Agreed.

2.33 Defence agrees with the recommendation.

Automated procurement workflow

My Procurements system

2.34 In 2022, Defence implemented a web-based workflow application called My Procurements to assist Defence personnel by automatically applying mandatory requirements and policies to Defence procurements.67 The functionality was designed to support compliance, consistency and efficiencies in the procurement process and includes the ability to generate reports to track non-compliance with requirements.68 Defence mandated the use of the My Procurements application from 1 July 2024 to improve compliance with mandatory procurement policy.

2.35 The My Procurements system includes a prompt to alert personnel of DPIP considerations when the expected value of the procurement falls within the thresholds prescribed by the DPIP. The alert is intended to make personnel aware of DPIP requirements but does not function as a control to ensure compliance or capture DPIP information. As a consequence, data from My Procurements is not able to provide insight on the extent to which DPIP requirements are being implemented.

2.36 On 3 April 2024, Defence approved a My Procurements Enhancement Plan to address issues identified in audits of procurement and contract management practices.69 The intent of the plan was to provide additional controls to improve compliance with mandatory procurement requirements. DPIP related elements were not included in the plan as one of the changes to be made. As noted at paragraph 1.15, Defence is required under finance law to comply with the CPR Procurement Connected Policy – Australian Industry Participation. Defence relies on its implementation of the DPIP to comply with this requirement.

My Finance (MyFi) system

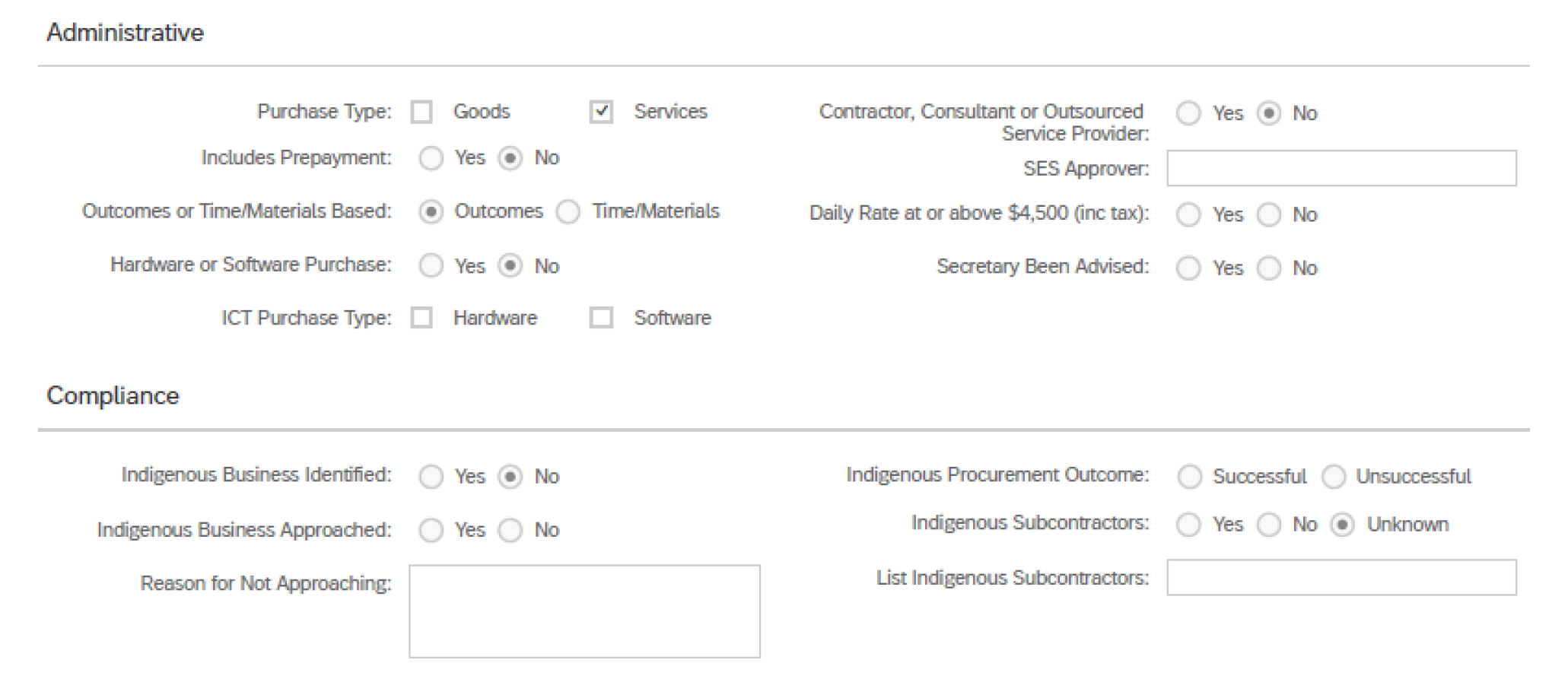

2.37 Implemented in 2019, Defence’s My Finance (MyFi) system is used to record certain aspects of a procurement from supplier selection and through the life of the contract. The MyFi system is not a contract management system. Details recorded in the system include, for example, whether the procurement was for goods or services, how many quotes were sought and whether the required approvals have been obtained.70 As shown by Figure 2.3, Defence also uses the MyFi system to document compliance with Indigenous Procurement Policy considerations.

Figure 2.3: Example of details recorded by Defence for individual procurements in the MyFi system

Source: Extract from the Department of Defence’s MyFi system.

2.38 The sort of information captured in the MyFi system suggests that it could be configured to record whether individual procurements have applied or incorporated DPIP requirements. As this has not occurred, data from MyFi is not able to provide insight on the extent to which DPIP requirements are being implemented.

2.39 Defence advised the ANAO in November 2024 that ‘any future development in MyFi would not be supported’ as it will be ‘decommissioned and subsumed into [the] Enterprise Resource Planning (ERP)’ system. The ERP program is a major ICT reform initiative of strategic importance to Defence.71 As of February 2025, Defence expects Tranche 1B of the ERP program to be rolled out in May 2025. A contract management system is not being delivered as part of that tranche.72

Recommendation no.2

2.40 Department of Defence implement controls within relevant systems for its procurement, financial, and contract management activities to support and monitor compliance with its obligations to implement Australian industry participation and contracting requirements.

Department of Defence response: Agreed.

2.41 Defence agrees with the recommendation.

Has Defence provided fit-for-purpose guidance and training to relevant Defence personnel?

Guidance on the Australian Standard for Defence Contracting (ASDEFCON) and the Facilities suite of tendering and contracting templates is incomplete, with additional guidance notes planned but not developed and released. Defence does not assess its personnel training data by role and therefore cannot provide assurance that its procurement and contracting staff have undertaken training relevant to their roles. The dedicated AIC training course announced in February 2019 is primarily focused on materiel procurements and was not implemented until September 2022.

Factsheets and guidance for personnel

2.42 The DPIP noted that ‘a suite of resources will be available to support Defence officials and industry to implement’ requirements. This included a Defence Policy for Industry Participation Guide (to be made available publicly) and ‘a suite of internal reference materials’ on DPIP implementation.73 Discussion of the guide is at paragraph 2.70.

2.43 Defence has established a range of guidance documents designed to support the implementation of AAI 2 and the DPM including 25 factsheets covering topics such as the ‘Endorsement to Proceed’ (approvals under section 23 of the PGPA Act), ‘Due Diligence in Procurement’ and ‘Mandatory Defence Industry Security Requirements in Contracts’. The factsheets do not include guidance on the implementation of DPIP requirements.

2.44 The DPIP states that exemptions from requirements are to be ‘considered case-by-case and require the approval of the Defence official signing the Endorsement to Proceed’. DPIP advised guidance on exemptions would ‘be set out in guidance materials for Defence officials.’74 Guidance on the Endorsement to Proceed process and in the Endorsement to Proceed Template form does not include consideration of DPIP requirements.

2.45 Policy guidance on the implementation of DPIP is available to Defence personnel on the Defence Industry Domestic Policy intranet page ‘Australian industry Capability Program Requirements’, which includes links to key industry policy publications and policy focused factsheets on DPIP elements such as Australian Contract Expenditure. Personnel can also access frequently asked questions.75 A policy factsheet on DPIP exemptions was drafted by the Industry Policy Division in November 2020 but not finalised. Defence’s intranet guidance on exemptions states that personnel should ‘[c]ontact the DSIP [Defence Strategic Industry Policy] Directorate to discuss the process for considering exemptions.’

ASDEFCON guidance

2.46 The selection of a contract template is a manual process where personnel must navigate both the Defence intranet and website. The Defence Contract Template Selection and Tailoring Guide was designed ‘to provide guidance to personnel conducting procurements.’ An April 2016 version (version 2.1) of the guide was available on Defence’s website until it was replaced with a new version in May 2024 (version 3). Version 2.1 of the guide focused on the ASDEFCON contracting suite, predated the DPIP, and referred to 2015 templates maintained by the former Defence Materiel Organisation.76 As a consequence, version 2.1 of the guide noted a $20 million threshold for procurements to include AIC requirements. The DPIP changed that threshold in 2019 to $4 million for materiel and non-materiel procurements and $7.5 million for construction services procurements.77

2.47 Both versions of the guide state that specialist advice may be required to address any doubts regarding template selection. The scope of the 2024 guidance covers Defence and Commonwealth contracting templates and primarily focuses on the ASDEFCON suite of templates. The guidance provides information and context for the factors to be considered when tailoring a template for a procurement. The guidance refers to mandatory requirements outlined in AAI 2 and the DPM. With respect to DPIP, the guidance refers to the Australian Industry Participation National Framework, administered by the Department of Industry, Science and Resources (DISR). The guidance does not refer readers to the DPIP or state that the DPIP requirements address the requirements of the Australian Industry Participation National Framework or CPR Procurement Connected Policy – Australian Industry Participation.

2.48 The Defence website contains additional guidance on the ASDEFCON contracting suite, of which five guidance documents are directly relevant to DPIP requirements. Four of these guidance documents are either incomplete or out of date, as noted in Table 2.1.

Table 2.1: AIC related ASDEFCON guidance materiel on Defence’s website

|

Guidance document |

Purpose |

ANAO observation |

|

Australian Industry Capability (AIC) Guide for ASDEFCON Version 0.9 (Exposure Draft), September 2021 |

Developed to ‘assist template users to understand, develop, request and implement an effective AIC program to achieve AIC Objectives, using the enhanced AIC contractual framework.’ |

Exposure draft. Two chapters and seventeen guidance notes yet to be included. |

|

Australian Contract Expenditure (ACE) Guide for ASDEFCON Version 0.9 (Exposure Draft), September 2021 |

Developed to complement the ACE Measurement Rules, introduced as part of the ‘enhanced’ AIC contractual framework for ASDEFCON. |

Exposure draft. Ten guidance notes to be included. |

|

Acquisition Pricing Workbook Guide for ASDEFCON Version 1.1 April 2024 |

Developed to ‘support the Microsoft Excel® workbooks that collect tendered pricing data and form part of the price and payments schedule for a resultant contract.’ |

Refers to the ACE Guide for ASDEFCON for further guidance. This document is an exposure draft. |

|

Australian Contract Expenditure (ACE) Measurement Rules Version 1.1, October 2021 |

Developed to ‘standardise the way in which Australian Contract Expenditure and Imported Contract Expenditure (ICE) are measured across relevant Defence procurements.’ |

ACE rules not required for all ASDEFCON and no Facilities and panel contracting templates. |

|

ASDEFCON (Strategic Materiel) V4.0 Statement of Work Tailoring Guide July 2019 |

Developed to guide drafters tailoring the Statement of Work, for use with Version 4.0 of the ‘ASDEFCON (Strategic Materiel) template.’ |

This guidance is out of date. ASDEFCON templates no longer require draft AIC Plans to be tendered or for the AIC Plan to be attached prior to Contract signature. |

Source: ANAO analysis of Department of Defence documents as at 5 August 2024.

Facilities guidance

2.49 The Defence Procurement Manual version 1.5 (2024) refers to a ‘Suite of Facilities Contracts User Guide’ on the Defence website. This user guide was removed from the Defence website in early 2022 and replaced with template-specific manuals.78 Of the nine facilities templates for projects at or above the $7.5 million threshold, accompanying manuals have been published for five.

DPIP guidance and panel templates

2.50 Having chosen a contract template, the Defence contract manager must ensure the procurement is using the current version of the template. Defence’s contracting templates contain guidance notes to assist officials in tailoring the contract material to the specific requirements of the procurement.79 The contract manager is responsible for manually deleting and removing any guidance material found within in the template.

2.51 Defence’s approach to contracting DPIP requirements under panel arrangements relies on the work order request process established in panel deeds. Requirements in Defence’s five highest value panels are set out below80:

- Managed by CASG, the Defence Support Services (DSS) panel and the Major Service Provider (MSP) panel both state that an AIC Plan ‘may’ be required by the Commonwealth as part of future work orders.

- Managed by SEG, the Infrastructure Panel and the Infrastructure Panel – Environment, Heritage and Estate Engineering do not include DPIP requirements in the respective deeds.

- Managed by the Chief Information Officer Group, the Deed of Standing Offer for the ICT Provider Arrangement (ICTPA) refers to a possible need for an industry plan or schedule as part of future work orders. Supporting documents are available on the ICTPA panel intranet page. These documents provide guidance on when a schedule or a plan is required.

Other intranet guidance

2.52 As outlined at Figure 2.1, at the introduction of the DPIP in 2019, Industry Participation Schedules and Industry Participation Plans were required for non-materiel procurements. At some point following the release of the DPIP, and as at 4 September 2024, the Defence intranet webpage for the ‘Australian Industry Capability (AIC) Program’ stated:

The 2019 Defence Policy for Industry Participation refers to Industry Participation Schedules and Industry Participation Plans for non-materiel procurements. Since the release of this Policy, the terminology has been changed to align non-materiel requirements with materiel requirements.

2.53 Defence did not retain a record of the date and reason for this internal change to implementation of the DPIP. Defence did not communicate this change externally.

Training

2.54 In addition to appropriate guidance, the provision of relevant training to procurement and contract managers supports the effective and consistent implementation of policy requirements. As stated in the Defence Contract Management Handbook:

[c]ontract management personnel should have, at a minimum, a broad understanding of the legislative and policy framework, as well as a practical working knowledge of Defence procurement, contracting and contract management practice.

General procurement and contract management training

2.55 General procurement and contract management training offered by Defence consists of optional courses including ASDEFCON Foundations, Certificate IV in Procurement and Contracting, Simple procurement, Contract Risk Training, Effective Contract Management, Support Procurement Strategy (that is, procurement planning), and Tender Evaluation Skills. These training courses are offered throughout the year and delivered in person and online.81 Between 2018 and 2022, an AIC awareness session formed part of the ASDEFCON Foundation Course. No information on CPR Procurement Connected Policy – Australian Industry Participation or AIC was included in other general procurement training.

2.56 The completion of relevant procurement training is not a prerequisite or mandatory requirement for Defence’s procurement officers. In 2019–20, 606 participants completed the Certificate IV in Procurement and in 2022–23 there were 98 completions. Participants for the Simple Procurement training totalled 1587 and 590 in 2019–20 and 2022–23 respectively. While Defence collects data on the completion of training, it does not assess how many of the participants are in procurement and contract management roles.

2.57 A 2023 internal audit on Defence’s procurement assurance processes (referred to at footnote 41 and paragraphs 2.13–2.14) found that:

training courses on Defence’s CAMPUS learning system are not sufficiently aligned to the centralised guidance material available on the intranet, [and are] therefore ineffective in supporting officers to manage contracts and drive financial accountability.