Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Cyber Security Strategies of Non-Corporate Commonwealth Entities

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Malicious cyber activity has been identified as one of the most significant threats affecting government entities, businesses and individuals.

- Previous ANAO audits have identified low levels of compliance with mandatory cyber security requirements under the Protective Security Policy Framework (PSPF). The Joint Committee of Public Accounts and Audit has expressed its concern about entity implementation of these requirements.

Key facts

- Policy 10 of the revised PSPF outlines the mandatory requirements for entities to safeguard information from cyber threats.

- Entities assess their maturity under the PSPF against four maturity levels representing their assessed level of implementation of the requirements: Ad hoc, Developing, Managing and Embedded.

- The Attorney-General’s Department (AGD), the Australian Signals Directorate (ASD) and the Department of Home Affairs have responsibilities in relation to cyber security policy and operational capability.

What did we find?

- The implementation of cyber security risk mitigation strategies by the selected entities was not fully effective, and did not fully meet the mandatory requirements of PSPF Policy 10.

- Two of three entities did not accurately self-assess implementation of one of the Top Four mitigation strategies for which they reported full implementation. None of these three entities were cyber resilient.

- The majority of the entities examined that had self-assessed a maturity level of ‘Ad hoc’ or ‘Developing’ have established strategies to progress toward a ‘Managing’ maturity level for PSPF Policy 10.

- AGD, ASD and Home Affairs could do more to improve support for the implementation of cyber security requirements.

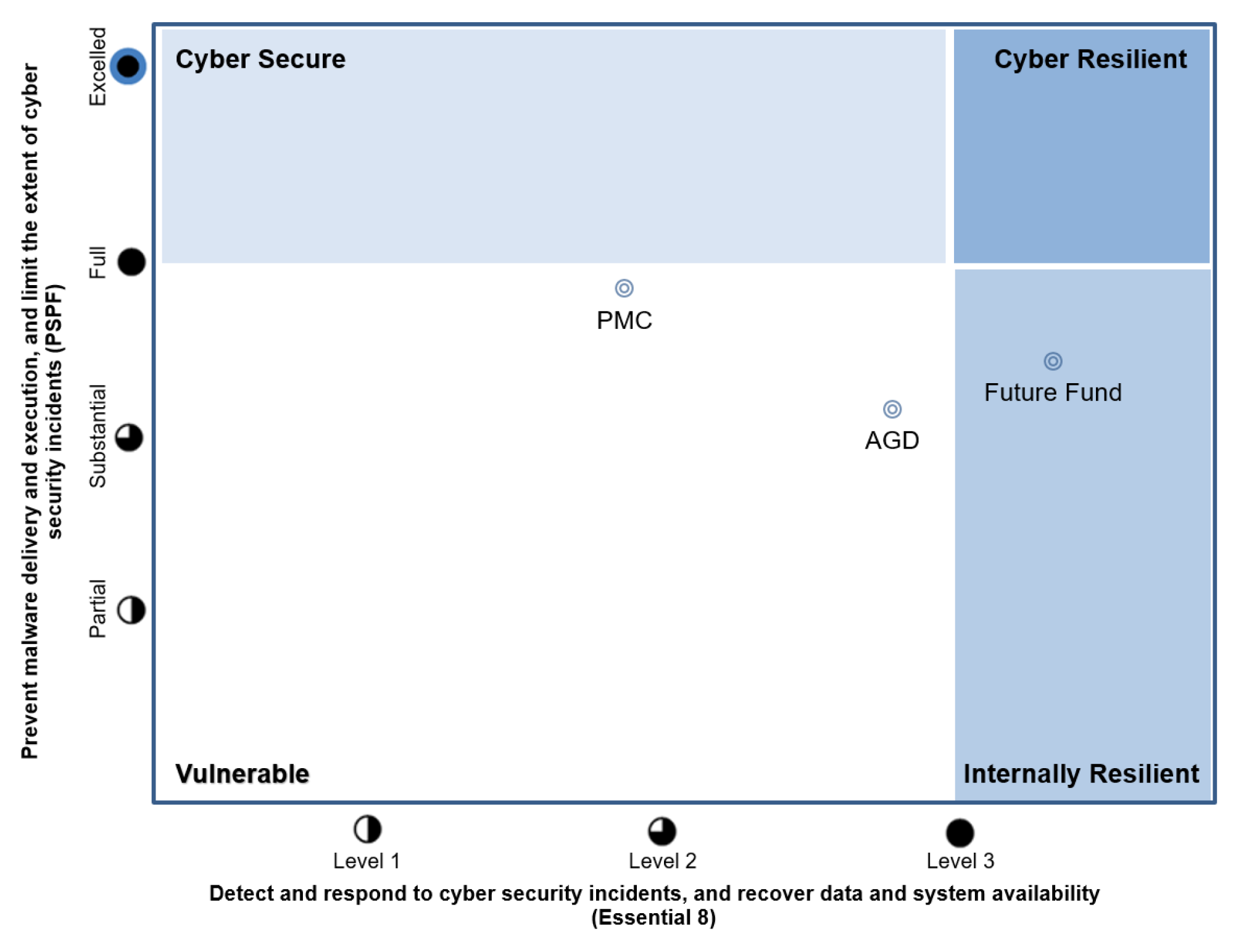

What did we recommend?

- The Auditor-General made 13 recommendations aimed at improving entities' cyber security maturity levels, and the support and assurance provided by the three cyber policy and operational entities.

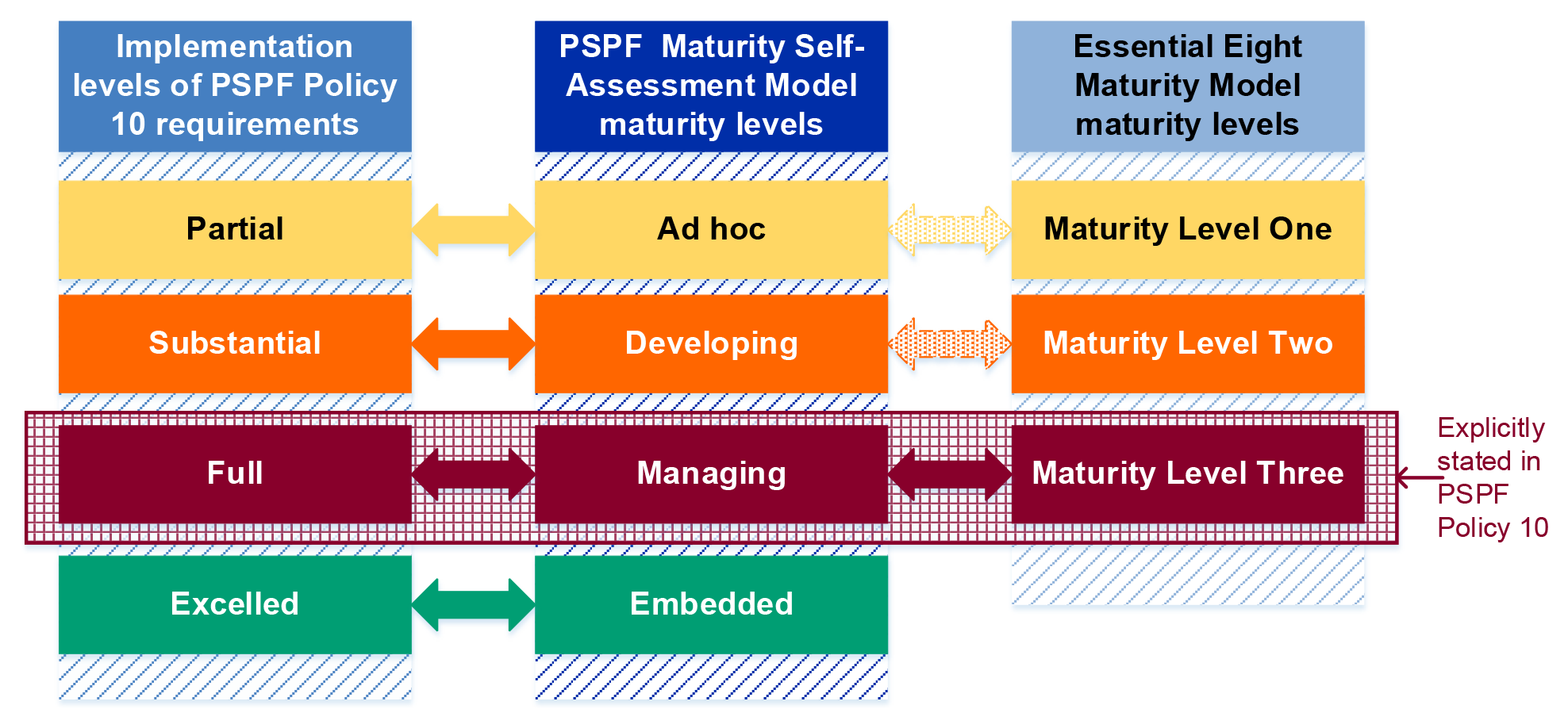

436

cyber security incidents reported by Australian Government entities to ASD in 2019–20.

24%

of non-corporate Commonwealth entities were compliant with the mandatory Top Four mitigation strategies in ANAO performance audits since 2014.

72%

of non-corporate Commonwealth entities reported not fully implementing PSPF Policy 10 in 2018–19.

Summary and recommendations

Background

1. The security of government information communications technology (ICT) systems, networks and data supports Australia’s social, economic and national security interests as well as the privacy of its citizens. Malicious cyber activity has been identified as one of the most significant threats affecting Australians.1 The frequency, scale and sophistication of malicious cyber activity is reported to be increasing2, with cyber threats considered to be an increasing risk across Australian Government entities.3 The management of cyber security risk within the Australian Government public sector is the responsibility of individual entities.

2. Three Australian Government entities have responsibilities in relation to whole-of-government cyber security policy and operational support. In relation to cyber security:

- the Attorney-General’s Department (AGD) is responsible for administering the Protective Security Policy Framework (PSPF), which provides the framework for Australian Government entities to achieve four protective security outcomes — governance, information security, personnel security and physical security;

- the Australian Signals Directorate (ASD) developed the Top Four mitigation strategies mandated by the PSPF and is a technical operational agency that provides material, advice and other assistance to Australian governments, business, communities and individuals on matters relating to the security and integrity of information that is processed, stored or communicated by electronic or similar means4; and

- the Department of Home Affairs (Home Affairs) is responsible for the development and coordination of the Australian Government’s cyber security policy, and coordinating the implementation of Australia’s Cyber Security Strategy 2020.

3. In February 2017, ASD re-issued its Strategies to Mitigate Cyber Security Incidents, which outlines 37 prioritised mitigation strategies to help protect entities from cyber threats. ASD has recommended that entities implement eight of these mitigation strategies, known as the Essential Eight, as a cyber security baseline. ASD also developed the Essential Eight Maturity Model to provide guidance to entities on how to implement the Essential Eight mitigation strategies and how to self-assess the maturity of their Essential Eight implementation. There are three maturity levels in the current Essential Eight Maturity Model — ‘Maturity Level One’, ‘Maturity Level Two’ and ‘Maturity Level Three’. ASD recommends that entities should aim to reach ‘Maturity Level Three’ for each mitigation strategy as a baseline.

4. A revised PSPF commenced on 1 October 2018, outlining 16 core requirements that non-corporate Commonwealth entities must apply to achieve the four protective security outcomes. Non-corporate Commonwealth entities are to apply the revised PSPF using a security risk management approach. Policy 10 of the revised PSPF outlines the mandatory requirements for entities to safeguard information from common and emerging cyber threats. Policy 10 mandates the implementation of the Top Four mitigation strategies and that entities consider the implementation of the other mitigation strategies from ASD’s Strategies to Mitigate Cyber Security Incidents that are relevant to their operational and risk environment.5 While not mandatory under Policy 10, AGD strongly recommends that entities implement the remaining four strategies that comprise the Essential Eight mitigation strategies.

5. Nine non-corporate Commonwealth entities were included in this audit:

- Attorney-General’s Department;

- Australian Signals Directorate;

- Department of Home Affairs;

- Department of the Prime Minister and Cabinet (PM&C);

- Future Fund Management Agency (Future Fund);

- Australian Trade and Investment Commission (Austrade);

- Department of Education, Skills and Employment (DESE);

- Department of Health (Health); and

- IP Australia.

Rationale for undertaking the audit

6. Since 2013, the Australian Government has mandated the implementation of the Top Four mitigation strategies by non-corporate Commonwealth entities under the PSPF. The Australian Government has identified malicious cyber activity as one of the most significant threats affecting government entities, businesses and individuals. Previous ANAO audits have identified low levels of compliance with mandatory cyber security requirements under the PSPF. The Joint Committee of Public Accounts and Audit (JCPAA) has expressed its concern about entity implementation of mandatory cyber security requirements.

7. This audit seeks to address a recommendation made by the JCPAA in Report 467: Cybersecurity Compliance, for the Auditor-General to consider conducting an audit of the effectiveness of the PSPF self-assessment and reporting requirements for cyber security compliance. The audit also follows up on the recommendation made in Auditor-General Report No.53 2017–18 Cyber Resilience, for the responsible cyber policy and operational entities (AGD, ASD and Home Affairs) to work together to improve entities’ compliance with mandatory cyber security requirements under the PSPF.

Audit objective and criteria

8. The objective of the audit was to assess the effectiveness of cyber security risk mitigation strategies implemented by selected non-corporate Commonwealth entities to meet mandatory requirements under the PSPF, and the support provided by the responsible cyber policy and operational entities.

9. To form a conclusion against the audit objective, the ANAO adopted the following two high-level criteria:

- Have the selected entities fully implemented the Top Four cyber security risk mitigation strategies or otherwise adopted strategies and actions to progress towards full implementation?

- Have the entities responsible for cyber policy and operational capability worked together to support accurate self-assessment and reporting by non-corporate Commonwealth entities, and to improve those entities’ implementation of cyber security requirements under the PSPF?

Engagement with the Australian Signals Directorate

10. Independent timely reporting on the implementation of the cyber policy framework supports public accountability by providing an evidence base for the Parliament to hold the executive government and individual entities to account. Previous ANAO reports on cyber security have drawn to the attention of Parliament and relevant entities the need for change in entity implementation of mandatory cyber security requirements, at both the individual entity and framework levels.

11. In preparing audit reports to the Parliament on cyber security in government entities, the interests of accountability and transparency must be balanced with the need to manage cyber security risks. The Australian Signals Directorate has advised the ANAO that adversaries use publicly available information about cyber vulnerabilities to more effectively target their malicious activities.

12. The extent to which this report details the cyber security vulnerabilities of individual entities was a matter of careful consideration during the course of this audit. To assist in appropriately balancing the interests of accountability and potential risk exposure through transparent audit reporting, the ANAO engaged with the ASD to better understand the evolving nature and extent of risk exposure that may arise through the disclosure of technical information in the audit report. This report therefore focuses on matters material to the audit findings against the objective and criteria and contains less detailed technical information than previous audits. Detailed technical information flowing from the audit was provided to the relevant accountable authorities during the audit process to assist them to gain their own assurance that their remediation plans are focussed on improving cyber resilience as required and support reliable reporting through the existing cyber security framework.

Conclusion

13. The implementation of cyber security risk mitigation strategies by selected non-corporate Commonwealth entities under this audit was not fully effective. The selected entities have not met all mandatory requirements of PSPF Policy 10 in safeguarding information from cyber threats. While the three cyber policy and operational entities have provided more support to entities to meet the mandatory PSPF Policy 10 requirements following Auditor-General Report No.53 2017–18 Cyber Resilience, additional ongoing work will be required to assist entities in achieving a more mature and resilient cyber security posture.

14. None of the seven selected entities examined have fully implemented all the mandatory Top Four mitigation strategies.6 For the three entities that had self-assessed full implementation for one or more of the Top Four mitigation strategies in their 2018–19 PSPF assessment, two had not done so accurately. None of these three entities were cyber resilient. Five of six selected entities that had self-assessed to have not fully implemented any of the Top Four mitigation strategies have established strategies and implemented activities to manage their cyber risks and to progress toward a ‘Managing’ maturity level for PSPF Policy 10.

15. The cyber policy and operational entities have worked together to provide more guidance following Auditor-General Report No.53 2017–18 Cyber Resilience to support non-corporate Commonwealth entities’ self-assessment of their implementation of cyber security requirements under the PSPF. There is scope to further improve the accuracy of entities’ PSPF Policy 10 assessments and strengthen arrangements to hold entities to account for the implementation of cyber security mandatory requirements. Robust accountability arrangements are particularly important in absence of public accountability through reporting to the Parliament.

Supporting findings

Implementation of cyber security risk mitigation strategies

16. PM&C and AGD have each not accurately self-assessed their implementation of one of the Top Four mitigation strategies. PM&C has not fully implemented the mitigation strategy for restricting administrative privileges. AGD has not fully implemented the mitigation strategy for patching operating systems. Future Fund has accurately self-assessed the two Top Four mitigation strategies for which it reported full implementation. None of the three entities were assessed as cyber resilient. Under the cyber security framework, PM&C and AGD are categorised as vulnerable to cyber security incidents as they have not fully implemented all the Top Four mitigation strategies and are continuing to strengthen the controls for managing cyber security incidents. Future Fund has not fully implemented all of the Top Four mitigation strategies, but is internally resilient as it has effective controls in place to support its ability to detect and recover from a cyber security incident.

17. Of the six entities that had reported not fully implementing all the Top Four mitigation strategies, five have established strategies and activities to progress their PSPF Policy 10 maturity level to ‘Managing’. The five entities have also included the implementation of the remaining four strategies that comprise the Essential Eight in their cyber security improvement programs. Three of the six entities had not set a corresponding timeframe to improve their PSPF Policy 10 maturity level to ‘Managing’. There is scope for four of the entities to improve monitoring of the implementation progress of their cyber security program to ensure that the entity is meeting the timeframe to improve its cyber security maturity.

Support provided by the cyber policy and operational entities

18. The revised PSPF maturity assessment model has incorporated more guidance to support entities’ self-assessment of their implementation of Policy 10 cyber security requirements. The AGD-developed PSPF Policy 10 guidance cross-references to multiple technical guidance developed by ASD, including guidance on the implementation of the Essential Eight mitigation strategies and the underlying security controls within the Australian Government Information Security Manual. There is scope to further improve the alignment of the maturity models for the PSPF and Essential Eight, and the clarity of the guidance to ensure more accurate PSPF Policy 10 self-assessments.

19. The cyber policy and operational entities have not developed processes to verify the accuracy of entities’ PSPF Policy 10 self-assessed reporting. ASD has commenced the development of software tools that provide technical reporting to support entities in performing more accurate self-assessments of their Essential Eight implementation. While AGD and ASD have been sharing the results of the PSPF self-assessment reports and the ASD’s ACSC Cyber Security Survey, the sharing of data has not yet resulted in obtaining assurance on the accuracy of the self-assessments and facilitating policy and technical assistance for entities.

20. With the release of the whole-of-government PSPF assessment reports by AGD and the annual Australian Government’s cyber security posture report by ASD, there has been increased public reporting on non-corporate Commonwealth entities’ implementation and maturity level of the Essential Eight mitigation strategies. However, the status of entities’ cyber security posture is not transparent due to the policy and operational entities’ concerns about increasing security risks following the disclosure of individual entities’ cyber security maturity level. The cyber policy and operational entities have not established processes to improve the accountability of entities’ cyber security posture. The current framework to support responsible Ministers in holding entities accountable within Government is not sufficient to drive improvements in the implementation of mandatory requirements.

Recommendations

Recommendation no.1

Paragraph 2.13

The Department of the Prime Minister and Cabinet strengthens its validation of privileged user access, specifically documenting the confirmation of the requirement for access from those that are responsible for approving privileged access.

Department of the Prime Minister and Cabinet response: Agreed.

Recommendation no.2

Paragraph 2.18

The Attorney-General’s Department performs and documents risk assessments for any patches not implemented in accordance with the requirements of the Australian Government Information Security Manual and its policies, including defining an action plan for managing the risks associated with not implementing those patches.

Attorney-General’s Department response: Agreed.

Recommendation no.3

Paragraph 2.28

The Department of the Prime Minister and Cabinet:

- improve its risk assessment of security events; and

- improve testing of security configurations and reviews of user access to ensure that the configurations are operating as intended.

Department of the Prime Minister and Cabinet response: Agreed.

Recommendation no.4

Paragraph 2.34

The Attorney-General’s Department improves the processes for documenting risk assessments and monitoring cyber security events, to assure itself that actions taken against cyber security events are performed consistently and appropriately.

Attorney-General’s Department response: Agreed.

Recommendation no.5

Paragraph 2.53

The Australian Trade and Investment Commission:

- sets a timeframe to improve its cyber security maturity to the ‘Managing’ level for PSPF Policy 10; and

- monitors the progress of the projects within its Cyber Security Work Program against the timeframe set for improving its PSPF Policy 10 maturity level.

Australian Trade and Investment Commission response: Agreed.

Recommendation no.6

Paragraph 2.62

The Department of Education, Skills and Employment:

- sets a timeframe to improve its cyber security maturity to the ‘Managing’ level for PSPF Policy 10; and

- monitors the progress of its Cyber Security Essential Eight Work Plan against the timeframe set for improving its PSPF Policy 10 maturity level.

Department of Education, Skills and Employment response: Agreed.

Recommendation no.7

Paragraph 2.84

The Attorney-General’s Department:

- develops a strategy and sets a timeframe to improve its cyber security maturity to the ’Managing’ level for PSPF Policy 10;

- provides clear reporting to its governance committees to enable oversight on the progress of its work to improve its Essential Eight maturity; and

- monitors the progress of its work to improve its Essential Eight maturity against the set timeframe and through appropriate governance structures.

Attorney-General’s Department response: Agreed.

Recommendation no.8

Paragraph 2.92

The Future Fund Management Agency monitors the progress of its Essential Eight improvement activities against the timeframe set for improving its PSPF Policy 10 maturity level.

Future Fund Management Agency response: Agreed.

Recommendation no.9

Paragraph 3.37

The Attorney-General’s Department reviews the existing maturity levels under the PSPF maturity assessment model to determine if the maturity levels are fit-for-purpose and effectively aligned with the Essential Eight Maturity Model, having regard to the Australian Signals Directorate’s proposed update to the Essential Eight Maturity Model.

Attorney-General’s Department response: Agreed.

Recommendation no.10

Paragraph 3.45

The Attorney-General’s Department further improves the guidance on PSPF Policy 10 to clarify:

- the correlation of the maturity levels in the PSPF and Essential Eight maturity models, and their implementation requirements;

- the scope of the maturity level calculation suggested by the reporting portal and how entities can more accurately determine their selected PSPF maturity level; and

- the assessment against the requirement to consider the implementation of the remaining 29 mitigation strategies, and the merit of its inclusion in the PSPF Policy 10 maturity level calculation.

Attorney-General’s Department response: Agreed.

Recommendation no.11

Paragraph 3.66

The Attorney-General’s Department implements arrangements to obtain an appropriate level of assurance on the accuracy of entities’ PSPF Policy 10 self-assessment results.

Attorney-General’s Department response: Agreed in principle.

Recommendation no.12

Paragraph 3.83

As part of its technical advice and assistance to the Attorney-General’s Department, the Australian Signals Directorate draw on its technical tools in addition to its existing capabilities to support the Attorney-General’s Department’s assurance processes on entities’ PSPF Policy 10 self-assessment results.

Australian Signals Directorate response: Agreed.

Recommendation no.13

Paragraph 3.115

The Australian Government strengthens arrangements to hold entities to account for the implementation of mandatory cyber security requirements.

Attorney-General’s Department response: Noted.

Australian Signals Directorate response: Noted.

Department of Home Affairs response: Noted.

Summary of entity responses

21. The proposed audit report was provided to the Attorney-General’s Department, which administers the PSPF and the Australian Signals Directorate, which developed the Top Four mitigation strategies mandated by the PSPF. Extracts of the proposed report were also provided to the other seven selected entities involved in the audit. Summary responses provided by each of the nine selected entities are provided below.

Attorney-General’s Department

The Attorney-General’s Department (AGD) acknowledges ANAO’s findings and welcomes the opportunity to comment on the Audit Report on Cyber Security Strategies of Non-Corporate Commonwealth Entities.

The Attorney-General’s Department places a high priority on cyber security through its responsibility for administering the Protective Security Policy Framework (PSPF), and its own implementation of the framework.

The department remains committed to setting robust protective security standards for non-corporate Commonwealth entities. AGD has commenced review of the maturity model to ensure it is fit-for-purpose and aligned with Australian Signals Directorate (ASD) proposed update to the Essential 8 maturity model. AGD will continue to support entities to accurately self-assess and report on their implementation of cyber security requirements under the PSPF.

In relation to the department’s own implementation of cyber security strategies, the department considers that it has a robust framework in place to manage cyber security risks. Implementation of the Top 4 mitigation strategies is part of a broader range of strategies implemented by the department. The department will continue to undertake activity to progressively uplift AGD’s maturity level, with a view to achieving ‘Managing’ level for PSPF Policy 10. AGD also agrees to improve its processes for documenting ICT security risk assessments and related management processes.

AGD has accepted the majority of the 7 recommendations and is working towards implementation.

Australian Signals Directorate

As highlighted in the report, the Australian Signals Directorate (ASD) continues to support the whole of economy, including Commonwealth entities, to make Australia the safest place to connect online. We continue to enhance our capabilities to automate threat detection and intelligence sharing arrangements across the Commonwealth, coupled with our ongoing technical uplift program and engagements to harden Commonwealth entity networks against malicious cyber activity.

Cyber espionage remains a substantial threat to Australia’s economic prosperity and the confidentiality, integrity and availability of key networks and data across government. Adversaries are constantly adapting their tradecraft to exploit vulnerabilities and avoid detection.

Department of Home Affairs

The Department welcomes the ANAO conclusion that cyber policy entities have worked together to support the implementation of cyber security requirements under the Protective Security Policy Framework.

Under the Minister for Home Affairs, the Department is responsible for national cyber security policy and overseeing the implementation of Australia’s Cyber Security Strategy 2020 (the Strategy). The Strategy outlines a range of initiatives to uplift Australia’s cyber security, including hardening government IT systems. This initiative is led by the Digital Transformation Agency and supported by the Australian Signals Directorate, the Department of Home Affairs and the Attorney-General’s Department.

The Hardening Government IT Program involves the development of a new operating model to address the varying levels of cyber security maturity across Commonwealth entities, and through centralised ‘cyber hubs’ unifying the level of cyber resilience provided to all users of the hub.

While this initiative aims to strengthen Government’s cyber security posture across Commonwealth entities, it is still under development. Any increase in accountability or transparency of mandatory cyber security requirements can be measured once this capability is operational.

The Department notes recommendation 13, and will brief the Government on the ANAO’s findings and recommendations as they relate to national cyber security policy and implementation of Australia’s Cyber Security Strategy 2020.

Department of the Prime Minister and Cabinet

At the Department of the Prime Minister and Cabinet (PM&C) we work very hard to maintain the highest standards in cyber security, underpinned by strong privacy and security protections, particularly as threats and targets rapidly evolve and shift. We work collaboratively with our staff to enhance the cyber security culture, constantly making sure our staff are cyber aware and vigilant, embedding behaviours as standard work practices.

With regard to the findings generally, we note that the Australian Cyber Security Centre (ACSC) provides broad guidance through the Information Security Manual (ISM) on control mechanisms that entities should put in place. We recognise agencies are encouraged to take a risk-based approach regarding the implementation of ACSC’s security controls based on the agency’s risk framework. On this basis, PM&C considers that it is compliant with all Top 4 Cyber Mitigations as effective risk controls are in place.

The ANAO assessed in its audit that PM&C is non-compliant with one of the Top 4 Cyber Mitigations. PMC does not agree with the ANAO’s assessment.

Specifically, the ANAO proposed additional processes regarding the detailed implementation of certain security controls, and on that basis considered PM&C non-compliant with one of the Top 4 Cyber Mitigations. PM&C has validation processes in place which adhere to the recommendations of the Information Security Manual and believes that this meets the requirement of the ISM and ACSC guidance.

We note that we will continue to make every effort to improve our processes and it is with this context I provide our response to the draft report. I accept recommendation 1 and 3 as they apply to the Department.

ANAO comment on Department of the Prime Minister and Cabinet summary response

22. As noted in paragraph 1.33, to meet the requirement of the PSPF, the ACSC’s Essential Eight Maturity Model requires a minimum set of security controls be implemented to achieve ‘Maturity Level Three’. PM&C was unable to provide evidence of the effective implementation of one of the security controls.

Future Fund Management Agency

The Future Fund Management Agency (“Agency”) is committed to providing a secure cyber environment to safeguard the assets of the Commonwealth. Underpinning this is the full implementation of the Top Four of the Essential Eight mitigation strategies. The Agency expects to achieve full implementation of the Top Four mitigation strategies by the end of calendar year 2021.

Australian Trade and Investment Commission (Austrade)

Austrade agrees with the ANAO’s findings.

Austrade will continue to run the Cyber Security Program of work that commenced in 2018 and will continue to review and evolve that work to address the broader cyber security risks to the organisation as well as those specific to the PSPF Policy 10.

Austrade acknowledges and appreciates the work being undertaken by the Australian Government entities with responsibilities in relation to whole-of-government cyber security policy and operational support and welcome their ongoing enhancements to the compliance framework.

Department of Education, Skills and Employment

The Department of Education, Skills and Employment (‘the department’) welcomes the ANAO’s report on Cyber Security Strategies of Non-corporate Commonwealth Entities.

The department notes the key messages to all Australian Government entities in the audit report and agrees with the one recommendation provided to it.

The department is committed to managing cyber security risks and building a resilient cyber security posture. The department notes that, building on its Protective Security Policy Framework (PSPF) 2019-20 self-assessment report and associated external assessment, a workplan with timeframes for improving security maturity and achieving a ‘Managing’ maturity rating for PSPF Policy 10 has been developed and endorsed by the department’s Executive Board. The department has implemented arrangements to monitor progress of the workplan.

Department of Health

The Department of Health (department) acknowledges the methodology and approach taken by the Australian National Audit Office (ANAO).

The department’s Essential Eight Program is underway to uplift the maturity levels of its Essential Eight mitigation strategies by December 2021.

The department has a governance framework in place that ensures appropriate visibility of the Essential Eight program by the Senior Executive and the Audit and Risk Committee.

The department continues to work closely with the Australian Cyber Security Centre (ACSC) to improve its ability to detect and respond to a cyber-security incident.

IP Australia

IP Australia welcomes the report and its findings and the key messages for all Australian Government entities. We are committed to reaching our target maturity in line with the requirements of the Protective Security Policy Framework.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Policy design

1. Background

Introduction

1.1 Australian Government entities deliver a wide range of digital services to Australian businesses and the community. Australian Government entities also hold increasingly large volumes of data, some of which is highly sensitive, within information communications technology (ICT) systems and across their networks. Maintaining the security of government ICT systems, networks and data will support Australia’s social, economic and national security interests, as well as the privacy of its citizens.

1.2 The Australian Government has identified malicious cyber activity as one of the most significant threats affecting government entities, businesses and individuals.7 The frequency, scale, and sophistication of malicious cyber activity is reported to be increasing.8 Among all Australian organisations, based on the visibility of the Australian Cyber Security Centre (ACSC), government entities are regularly targeted by malicious cyber actors. In the period July 2019 to June 2020, there were 436 cyber security incidents9 reported to the ACSC by Australian Government entities.10 Cyber threats11 are an increasing risk across Australian Government entities.12

Responsibilities of Australian Government entities

1.3 Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), accountable authorities of Australian Government entities must establish and maintain an appropriate system of risk oversight and management for the entity, and an appropriate system of internal control for the entity.13 The management of cyber security risk is the responsibility of individual entities. Entities are responsible for maintaining the security of their own ICT systems, networks and information holding.

1.4 There are three Australian Government entities with responsibilities for the policy framework and technical operational capability on cyber security:

- the Attorney-General’s Department (AGD);

- the Australian Signals Directorate (ASD); and

- the Department of Home Affairs (Home Affairs).

Attorney-General’s Department

1.5 In relation to cyber security, AGD is responsible for administering the Protective Security Policy Framework (PSPF), which provides the framework for Australian Government entities to achieve the following four protective security outcomes. Safeguarding an entity’s information from cyber threats is a PSPF requirement under the information security outcome.

- Governance — each entity manages security risks and supports a positive security culture in an appropriately mature manner ensuring: clear lines of accountability; sound planning, investigation and response, assurance and review processes; and proportionate reporting.

- Information security — each entity maintains the confidentiality, integrity and availability of all official information.

- Personnel security — each entity ensures its employees and contractors are suitable to access Australian Government resources, and meet an appropriate standard of integrity and honesty.

- Physical security — each entity provides a safe and secure physical environment for their people, information and assets.

1.6 A revised PSPF commenced on 1 October 2018 following the Independent Review of Whole-of-Government Internal Regulation (Belcher Review). The revised PSPF outlines 16 core requirements that entities must apply to achieve the four protective security outcomes.14 The revised PSPF also includes changes to improve clarity and foster a strengthened security culture across government entities to effectively engage with risk.15 The revised PSPF also has an ‘increased focus on cyber security matters’ to support the achievement of the information security outcome.16

1.7 Policies 9, 10 and 11 of the revised PSPF reflect the broader cyber security requirements for entities to achieve the information security outcome. Policy 10 of the PSPF outlines the mandatory requirements for entities to safeguard information from common and emerging cyber threats.17 Policy 9 and Policy 11 define security requirements for mitigating general security risks to ICT systems and information.18 While the security requirements under Policies 9, 10 and 11 contribute to the mitigation of cyber security incidents, the implementation of the mitigation strategies under Policy 10 has the potential to mitigate the majority of cyber security incidents. As an Australian Government policy, the PSPF applies to non-corporate Commonwealth entities subject to the PGPA Act.19 Entities are to apply the revised PSPF using a security risk management approach.

Australian Signals Directorate

1.8 In relation to cyber security, ASD developed the Top Four mitigation strategies mandated by PSPF Policy 10 and is responsible for providing better practice guidance and assistance to Australian governments, business, communities and individuals.20 ASD’s role includes providing material, advice and other assistance on matters relating to the security and integrity of information that is processed, stored or communicated by electronic or similar means.21 The ACSC is a group within ASD that leads the Australian Government’s efforts to improve national cyber security.22

1.9 Since February 2017, ASD has outlined a list of 37 prioritised mitigation strategies in its published guidance on Strategies to Mitigate Cyber Security Incidents, designed to help protect entities from cyber threats.23 ASD has recommended that entities implement eight of these mitigation strategies, known as the Essential Eight, as a cyber security baseline.24 According to ASD, implementation of the Essential Eight baseline as outlined in Table 1.1, will make it more difficult for adversaries to compromise entities’ systems.

Table 1.1: Essential Eight mitigation strategies recommended by ASD

|

Mitigation strategy |

About the strategy |

Why implement the strategy? |

|

Strategies to prevent malware delivery and execution |

||

|

Application controla |

Application control to prevent execution of unapproved/malicious programs including.exe, DLL, scripts (e.g. Windows Script Host, PowerShell and HTA) and installers. |

All non-approved applications (including malicious code) are prevented from executing. |

|

Patch applications |

Patch applications such as Flash, web browsers, Microsoft Office, Java and PDF viewers. Patch/mitigate computers with ‘extreme risk’ vulnerabilities within 48 hours. Use the latest version of applications. |

Security vulnerabilities in applications can be used to execute malicious code on systems. |

|

Configure Microsoft Office macro settings |

Configure Microsoft Office macro settings to block macros from the internet, and only allow vetted macros either in ‘trusted locations’ with limited write access or digitally signed with a trusted certificate. |

Microsoft Office macros can be used to deliver and execute malicious code on systems. |

|

User application hardening |

Configure web browsers to block Flash (ideally uninstall it), ads and Java on the internet. Disable unneeded features in Microsoft Office (e.g. OLE), web browsers and PDF viewers. |

Applications such as Flash, ads and Java are popular ways to deliver and execute malicious code on systems. |

|

Strategies to limit the extent of cyber security incidents |

||

|

Restrict administrative privileges |

Restrict administrative privileges to operating systems and applications based on user duties. Regularly revalidate the need for privileges. Don’t use privileged accounts for reading email and web browsing. |

Administration accounts are the ‘keys to the kingdom’. Adversaries use these accounts to gain full access to information and systems. |

|

Patch operating systems |

Patch/mitigate computers (including network devices) with ‘extreme risk’ vulnerabilities within 48 hours. Use the latest operating system version. Don’t use unsupported versions. |

Security vulnerabilities in operating systems can be used to further the compromise of systems. |

|

Multi-factor authentication |

Multi-factor authentication including for VPNs, RDP, SSH and other remote access, and for all users when they perform a privileged action or access an important (sensitive/high-availability) data repository. |

Stronger user authentication will make it harder for adversaries to access sensitive information and systems |

|

Strategies to recover data and system availability |

||

|

Daily backups |

Daily backups of important new/changed data, software and configuration settings, stored disconnected, retained for at least three months. Test restoration initially, annually and when IT infrastructure changes. |

To ensure information can be accessed following a cyber security incident (such as a ransomware incident). |

Note a: The April 2020 updates to the Australian Government Information Security Manual included the renaming of ‘application whitelisting’ to ‘application control’ to reflect industry accepted terminology.

Source: Adapted from ASD’s guidance on Essential Eight Explained.

1.10 According to ASD, entities can protect their systems and information from cyber threats through applying the principles of govern, protect, detect and respond. The four principles involve identifying cyber security risks (govern), implementing security controls to reduce risks (protect), detecting cyber security incidents (detect), and responding to and recovering from cyber security incidents (respond). The Australian Government Information Security Manual defines cyber resilience as follows:

Cyber resilience is the ability to adapt to disruptions caused by cyber security incidents while maintaining continuous business operations. This includes the ability to detect, manage and recover from cyber security incidents.25

1.11 The 2019–20 Federal Budget included a measure on Whole-of-Government – Cyber Uplift for Federal Government Systems and for the 2019 Federal Election (Cyber Uplift Program) to strengthen the cyber security of Australian Government networks and mitigate potential cyber threats through enhanced monitoring and response capabilities.26

1.12 The Cyber Uplift Program included the conduct of Essential Eight+ Sprints by ASD, which aimed to baseline and improve the maturity of Australian Government entities’ Essential Eight mitigation strategies. ASD conducted the Essential Eight+ Sprint program between April 2019 and December 2019 in 25 Australian Government entities. ASD applied a standardised data-driven assessment methodology to all 25 Commonwealth entities to consistently assess and rate the entities’ maturity in implementing the Essential Eight mitigation strategies using the Essential Eight Maturity Model (see paragraphs 1.34 and 1.35).

Department of Home Affairs

1.13 With respect to cyber security, the role of Home Affairs is to lead the development of the Australia-wide cyber security policy. It is responsible for cyber security policy coordination and setting the strategic direction of the Australian Government’s cyber security effort. It is also responsible for coordinating the implementation of Australia’s Cyber Security Strategy 2020.27

1.14 Australia’s Cyber Security Strategy 2020 was launched on 6 August 2020. According to the strategy, the Australian Government plans to invest $1.67 billion over 10 years in cyber security, including:

- protecting the critical infrastructure that Australians depend on;

- stronger defences for Australian Government networks and data;

- increased situational awareness and improved sharing of threat information;

- advice for small and medium enterprises to increase their cyber resilience;

- stronger partnerships with industry through the Joint Cyber Security Centre program; and

- improved community understanding of cyber security threats.28

Whole-of-government cyber security oversight committees

1.15 There are four whole-of-government governance committees with responsibilities in overseeing PSPF and cyber security initiatives for the improvement of Australian Government entities’ cyber security posture:

- Government Security Committee;

- Cyber Security Band 3 Inter-Departmental Committee;

- Cyber Security Strategy Delivery Board; and

- Secretaries Board.

Government Security Committee

1.16 The role of the Government Security Committee is to provide oversight of the PSPF. The Government Security Committee is chaired by the Deputy Secretary of AGD, with ASD and Home Affairs as members. The Government Security Committee’s terms of reference set its responsibilities as:

- providing strategic oversight of whole-of-government protective security policy;

- promoting the consistent, efficient and effective application of security policies in Australian Government entities;

- coordinating strategic level policy and operational responses to emerging protective security threats and issues, and;

- providing advice to the Secretaries Board, Secretaries Committee on National Security, Cyber Security Band 3 Inter-Departmental Committee and the Government on significant security matters where appropriate.

1.17 The Government Security Committee oversees reporting to government by AGD on the maturity and capability of entities’ to achieve security outcomes, and issues arising from specific or aggregated risks impacting on government security outcomes.

Cyber Security Band 3 Inter-Departmental Committee

1.18 The role of the Cyber Security Band 3 Inter-Departmental Committee is to improve whole-of-government information sharing and coordination of cyber security issues across the Australian Government, as well as to improve Australia Government’s cyber security capability. The committee’s responsibilities also include providing strategic oversight and guidance on the development, implementation and evaluation of Australia’s Cyber Security Strategy 2020, and monitoring entities’ implementation of whole-of-government cyber security measures. The committee discusses the management of cyber security risks through education, workplace skills and technical considerations. Home Affairs co-chairs this committee with the Department of the Prime Minister and Cabinet. AGD and ASD are members of the committee. The committee may raise significant issues to the Secretaries Committee on National Security or the Secretaries Board where appropriate.

Cyber Security Strategy Delivery Board

1.19 The Cyber Security Strategy Delivery Board was set up following the release of Australia’s Cyber Security Strategy 2020 to drive the implementation of the strategy. Membership of the Cyber Security Strategy Delivery Board comprises Senior Executive Service Band 1 level representatives. Home Affairs chairs the Cyber Security Strategy Delivery Board, with AGD and ASD as members.

Secretaries Board

1.20 The role of the Secretaries Board includes identifying strategic priorities for and considering issues that affect the Australian Public Service. The Secretaries Board also has responsibility for developing and implementing strategies to improve the Australian Public Service. The Secretary of the Department of the Prime Minister and Cabinet chairs the Secretaries Board.29

Cyber security framework

1.21 The key elements of the Australian Government cyber security framework are outlined in:

- PSPF Policy 10: Safeguarding information from cyber threats;

- PSPF Policy 5: Reporting on security (sets out the PSPF maturity self-assessment model);

- Essential Eight Maturity Model;

- Australian Government Information Security Manual;

- Strategies to Mitigate Cyber Security Incidents;

- PSPF Policy 9: Access to information; and

- PSPF Policy 11: Robust ICT systems.

PSPF Policy 10: Safeguarding information from cyber threats

1.22 In April 2013, the Australian Government mandated the implementation of the Top Four of the ASD prioritised mitigation strategies by non-corporate Commonwealth entities under the PSPF. The Top Four mitigation strategies — application whitelisting, patching applications, restricting administrative privileges, patching operating systems — were part of INFOSEC-4, which was one of the mandatory requirements in the previous PSPF under the information security outcome. The previous PSPF INFOSEC-4 set out the requirements for implementing cyber and ICT system security.

1.23 As discussed in paragraph 1.6, there is increased prominence of cyber security matters in the October 2018 revised PSPF. Policy 10 in the revised PSPF replaces the cyber security requirements in the previous INFOSEC-4 policy.30 Policy 10 in the revised PSPF sets out the mandatory requirement for safeguarding information against cyber threats, as shown in Box 1.31

|

Box 1: Mandatory requirements of PSPF Policy 10 |

|

Each entity must mitigate common and emerging cyber threats by:

|

Source: Adapted from PSPF Policy 10: Safeguarding information from cyber threats.

1.24 Policy 10 refers to ASD’s Strategies to Mitigate Cyber Security Incidents and explicitly mandates the Top Four mitigation strategies. The Top Four strategies are part of the ASD’s Essential Eight mitigation strategies as outlined in Table 1.1. In addition to the Top Four mitigation strategies, Policy 10 also mandates that entities consider the implementation of the other mitigation strategies from ASD’s Strategies to Mitigate Cyber Security Incidents that are relevant to their operational and risk environment.32 While not mandatory under Policy 10, AGD strongly recommends that entities implement the remaining four strategies that comprise the ASD’s Essential Eight baseline mitigation strategies.

PSPF maturity self-assessment model

1.25 Since 2013, non-corporate Commonwealth entities have been required to undertake an annual self-assessment against the mandatory requirements of the PSPF. Entities report their overall compliance with mandatory requirements to AGD. According to the consolidated PSPF compliance reports published by AGD, INFOSEC-4 had the highest rate of self-assessed non-compliance from 2014–15 to 2017–18 compared to the other mandatory requirements in the previous PSPF. In 2018–19, only 28 per cent of non-corporate Commonwealth entities reported full implementation of the mandatory requirements of PSPF Policy 10.

1.26 From 2018–19, entities are required to report on their security capability using a maturity assessment model instead of a compliance assessment model. PSPF Policy 5: Reporting on security sets out the new maturity self-assessment model for annual PSPF reporting. Under the maturity self-assessment model, entities assess and report on their level of implementation and management of the requirements under the PSPF and the maturity of their security capability. The annual PSPF assessment report is to show the extent to which an entity has:

- achieved the security outcomes for governance, information, personnel and physical security;

- implemented and managed the mandatory and supporting requirements that it must meet to achieve the four protective security outcomes;

- identified the key security risks to its people, information and assets; and

- implemented strategies and timeframes to manage identified and unmitigated risks.

1.27 AGD has developed an online PSPF reporting portal to support the implementation of the new maturity self-assessment model. The PSPF reporting portal allows entities to complete and submit their annual PSPF assessment online, access benchmarking and assessment reports from previous reporting periods.33 The accountable authority of an entity is responsible for approving the entity’s self-assessment.

1.28 Entities are required to provide their PSPF assessment report to the relevant portfolio Minister and AGD each financial year. The due date of entities’ PSPF assessment report is 31 August each year. Due to the impacts of the COVID-19 pandemic, the submission date for the 2019–20 PSPF assessment report was initially extended to 30 September 2020. Following requests from entities, AGD further extended the submission due date to 15 October 2020.

Assessment of implementation and maturity levels under the PSPF

1.29 The maturity self-assessment model requires entities to assess their security capability and implementation of the requirements in the PSPF policies within the context of their specific risk environment and risk tolerances. To assess the maturity of the implementation of each PSPF policy, entities are to consider their effectiveness in implementing the mandatory and supporting requirements for each policy. Entities assess the effectiveness of their implementation of the PSPF requirements against four different levels — ‘Partial’, ‘Substantial’, ‘Full’ and ‘Excelled’. Descriptions for each implementation level are outlined in Table 1.2.

Table 1.2: Implementation levels of PSPF requirements

|

Implementation level |

Description |

|

Partial |

Requirement is not implemented, is partially progressed or is not well-understood across the entity. |

|

Substantial |

Requirement is largely implemented but may not be fully effective or integrated into business practices. |

|

Full |

Requirement is fully implemented and effective and is integrated, as applicable, into business practices. |

|

Excelled |

Requirement and relevant better-practice guidance are proactively implemented in accordance with the entity’s risk environment, are effective in mitigating security risk and are systematically integrated into business practices. |

Source: Adapted from PSPF Policy 5: Reporting on security.

1.30 Based on entities’ assessment of their implementation of the requirements for each PSPF policy, the PSPF reporting portal calculates and suggests a maturity level for each policy.34 There are four maturity levels under the PSPF maturity self-assessment model — ‘Ad hoc’, ‘Developing’, ‘Managing’ and ‘Embedded’. The description for each PSPF maturity level is outlined in Table 1.3.

Table 1.3: Maturity levels of the PSPF maturity self-assessment model

|

Maturity level |

Description |

|

|

|

Partial or basic implementation and management of PSPF mandatory and supporting requirements. |

|

|

|

Substantial, but not fully effective implementation and management of PSPF mandatory and supporting requirements. |

|

|

|

Complete and effective implementation and management of PSPF mandatory and supporting requirements. |

|

|

|

Comprehensive and effective implementation and proactive management of PSPF mandatory and supporting requirements and excelling at implementation of better-practice guidance. |

|

Source: Adapted from PSPF Policy 5: Reporting on security.

1.31 Entities can confirm the suggested maturity level, or select a higher or lower maturity level for each PSPF policy, to reflect the assessment of their individual risk environment and risk tolerances. Entities must include a rationale to support their selected maturity level for a PSPF policy. If the selected maturity level is different to the suggested maturity level, entities should provide a justification in the rationale.35

1.32 The PSPF specifies that the ‘Managing’ maturity level provides the minimum required level of protection of an entity’s people, information and assets. If an entity’s self-assessed maturity level for a PSPF policy is ‘Ad hoc’ or ‘Developing’, the entity is required to provide information in its assessment regarding the proposed strategies or implementation activities to improve the entity’s maturity level to ‘Managing’. The entity is also required to provide the associated timeframe for each strategy to achieve ‘Managing’ maturity.

1.33 PSPF Policy 10 includes guidance to entities on achieving PSPF maturity level of ‘Managing’. Policy 10 states that:

To achieve a PSPF maturity rating of Managing for each of the four mandatory mitigation strategies from the Strategies to Mitigate Cyber Security Incidents, implement the maturity level three requirements as set out in the Essential Eight Maturity Model.36 [Emphasis in original, the maturity levels are introduced at paragraph 1.29.]

Essential Eight Maturity Model

1.34 The Essential Eight Maturity Model was developed by ASD to provide guidance to entities on how to implement the Essential Eight mitigation strategies (see Table 1.1) in a phased approach and how to self-assess the maturity of their Essential Eight implementation. The Essential Eight Maturity Model was first published in June 2017, with five maturity levels. Changes had been made to the model since its publication. There are three maturity levels in the Essential Eight Maturity Model, as defined in Table 1.4.

Table 1.4: Maturity levels of the Essential Eight Maturity Model (as at October 2020)

|

Maturity level |

Description |

|

Maturity Level One |

Partly aligned with the intent of the mitigation strategy. |

|

Maturity Level Two |

Mostly aligned with the intent of the mitigation strategy. |

|

Maturity Level Three |

Fully aligned with the intent of the mitigation strategy. |

Source: Adapted from the ACSC’s Essential Eight Maturity Model.

1.35 The Essential Eight Maturity Model outlines the criteria for entities to achieve a specific maturity level with respect to entities’ implementation of the Essential Eight mitigation strategies. ASD recommends that entities should aim to reach Maturity Level Three for each mitigation strategy as a baseline.

Previous audits and JCPAA inquiries

1.36 Since 2013–14, the Auditor-General has tabled a series of performance audits on Australian Government entities’ cyber security and cyber resilience. Four of the audits examined cyber security and cyber resilience of non-corporate Commonwealth entities. One audit examined Government Business Enterprises and corporate Commonwealth entities.

- Auditor-General Report No.50 2013–14 Cyber Attacks: Securing Agencies’ ICT Systems.

- Auditor-General Report No.37 2015–16 Cyber Resilience.

- Auditor-General Report No.42 2016–17 Cybersecurity Follow-up Audit.

- Auditor-General Report No.53 2017–18 Cyber Resilience.

- Auditor-General Report No.1 2019–20 Cyber Resilience of Government Business Enterprises and Corporate Commonwealth Entities.

1.37 The five performance audits found that Australian Government entities’ compliance with mandatory requirements of the PSPF was generally low37, and that the regulatory framework had not driven sufficient improvement in entities’ cyber security. Only six of 17 entities examined (35 per cent) were compliant with the mandatory requirements for implementing all the Top Four cyber security risk mitigation strategies. Of these 17 entities, the ANAO also found that only six — the same six entities that were compliant with the Top Four requirements — were cyber resilient.38

1.38 Auditor-General Report No.53 2017–18 Cyber Resilience included a recommendation that the three entities responsible for cyber policy and operational capability (AGD, ASD and Home Affairs) work together to improve compliance with the revised PSPF framework by strengthening: the technical guidance that support entities’ PSPF self-assessment, the processes for verifying the accuracy of entities’ self-assessment, and the transparency and accountability of entities’ compliance with the framework.39

1.39 Auditor-General Report No.38 2019–20 Interim Report on Key Financial Controls of Major Entities included a review of the self-assessed level of compliance with the mandatory requirements of PSPF Policy 10 for 18 non-corporate Commonwealth entities. The review was undertaken to confirm the accuracy of the entities’ reporting and identify cyber security risks that may impact the preparation of the entities’ 2019–20 financial statements. Of the 18 entities reviewed by the ANAO, only one achieved the required PSPF Policy 10 maturity level of ‘Managing’.

1.40 The Joint Committee of Public Accounts and Audit (JCPAA) published Report 467: Cybersecurity Compliance in October 2017. The report followed a JCPAA inquiry based on Auditor-General Report No.42 2016–17 Cybersecurity Follow-up Audit. The JCPAA made two recommendations for the ANAO in Report 467:

- Recommendation 4 — The Committee recommends that the Auditor-General consider conducting an audit of the effectiveness of the self-assessment and reporting regime under the Protected Security Policy Framework;

- Recommendation 6 — The Committee recommends that in future audits on cyber security compliance, the ANAO outline the behaviours and practices it would expect in a cyber resilient entity, and assess against these.40

1.41 In February 2020, the JCPAA commenced an inquiry to consider the cyber resilience of government entities and examined two Auditor-General’s reports as part of the inquiry.41 One of these reports is Auditor-General Report No.1 2019-20 Cyber Resilience of Government Business Enterprises and Corporate Commonwealth Entities.42 The JCPAA concluded its inquiry and published Report 485: Cyber Resilience in December 2020, after fieldwork for this audit was completed.

Rationale for undertaking the audit

1.42 Since 2013, the Australian Government has mandated the implementation of the Top Four mitigation strategies by non-corporate Commonwealth entities under the PSPF. The Australian Government has identified malicious cyber activity as one of the most significant threats affecting government entities, businesses and individuals. Previous ANAO audits have identified low levels of compliance with mandatory cyber security requirements under the PSPF. The JCPAA has expressed its concern about entity implementation of mandatory cyber security requirements.

1.43 This audit seeks to address a recommendation made by the JCPAA in Report 467: Cybersecurity Compliance, for the Auditor-General to consider conducting an audit of the effectiveness of the PSPF self-assessment and reporting requirements for cyber security compliance. The audit also follows up on the recommendation made in Auditor-General Report No.53 2017–18 Cyber Resilience, for the responsible cyber policy and operational entities (AGD, ASD and Home Affairs) to work together to improve entities’ compliance with mandatory cyber security requirements under the PSPF.

Audit approach

1.44 The following nine non-corporate Commonwealth entities were selected for this audit:

- Attorney-General’s Department;

- Australian Signals Directorate;

- Department of Home Affairs;

- Department of the Prime Minister and Cabinet;

- Future Fund Management Agency;

- Australian Trade and Investment Commission (Austrade);

- Department of Education, Skills and Employment;

- Department of Health; and

- IP Australia.

1.45 AGD, the ASD and Home Affairs were included in this audit due to their roles and responsibilities in relation to cyber security policy and operational capability in the Australian Government.

1.46 The remaining entities were included in this audit to provide coverage across each maturity category of ‘Managing’, ‘Developing’ and ‘Ad hoc’.43 The entities selected for the ANAO’s review of cyber security risk mitigation strategies under this audit and their 2018–19 PSPF Policy 10 self-assessed maturity rating are outlined in Table 1.5.

Table 1.5: Selected entities and their 2018–19 PSPF Policy 10 self-assessed maturity rating

|

Entity |

Policy 10 maturity rating |

|

|

Attorney-General’s Department |

|

|

|

Department of the Prime Minister and Cabinet |

|

|

|

Future Fund Management Agency |

|

|

|

IP Australia |

|

|

|

Australian Trade and Investment Commission (Austrade) |

|

|

|

Department of Educationb |

|

|

|

Department of Health |

|

|

Note a: The Attorney-General’s Department informed its accountable authority in June 2020 that an error was identified by the ANAO during fieldwork relating to the Department’s overall rating for Policy 10: Safeguarding information from cyber threats in its 2018–19 PSPF self-assessment. Its overall maturity rating for PSPF Policy 10 was reported as ‘Managing’. This should have been reported as ‘Developing’.

Note b: The ANAO had selected the Department of Education, Skills and Employment based on the 2018–19 PSPF self-assessment of the former Department of Education. An Administrative Arrangements Order made on 5 December 2019 consolidated the former Department of Education and the former Department of Employment, Skills, Small and Family Business to create the current Department of Education, Skills and Employment (DESE) with effect from 1 February 2020.

Source: Reported 2018–19 PSPF Policy 10 maturity rating for selected entities.

Audit objective, criteria and scope

1.47 The objective of the audit was to assess the effectiveness of cyber security risk mitigation strategies implemented by selected non-corporate Commonwealth entities to meet mandatory requirements under the PSPF, and the support provided by the responsible cyber policy and operational entities.

1.48 To form a conclusion against the audit objective, the ANAO adopted the following two high-level criteria:

- Have the selected entities fully implemented the Top Four cyber security risk mitigation strategies or otherwise adopted strategies and actions to progress towards full implementation?

- Have the entities responsible for cyber policy and operational capability worked together to support accurate self-assessment and reporting by non-corporate Commonwealth entities, and to improve those entities’ implementation of cyber security requirements under the PSPF?

1.49 The audit scope included the maturity self-assessments, the strategies, plans and activities adopted by selected entities that have not fully implemented mandatory requirements, and the implementation of recommendation made to the three cyber policy and operational entities (AGD, ASD and Home Affairs) in Auditor-General Report No.53 2017–18 Cyber Resilience.

1.50 The audit did not examine whether the selected entities met the supporting requirement of PSPF Policy 10, which requires entities to avoid exposing the public to unnecessary cyber security risks when they transact with government entities online. The audit also did not examine entities’ implementation of the mandatory requirements under PSPF Policy 9 and Policy 11, which relate to appropriate access to official information and secure operation of ICT systems respectively.

1.51 Previous ANAO reports on cyber security included assessments of entities against a list of behaviours and practices developed by the ANAO that may assist entities in building a strong culture of cyber resilience.44 The October 2018 revised PSPF requires accountable authorities to ensure that entity personnel and contractors are aware of their collective responsibility to foster a positive security culture.45 PSPF Policy 2 outlines ten characteristics of a positive security culture, including recommendations that entities establish appropriate metrics to measure the security culture maturity. The ANAO noted that the selected entities were in the process of establishing these metrics at the time of audit fieldwork. The audit did not assess security culture given the recent updates and maturity of metrics.

1.52 In December 2020, the JCPAA published Report 485: Cyber Resilience and recommended that a dedicated section be created within the annual PSPF self-assessment questionnaire addressing the 13 behaviours and practices of a strong cyber resilience culture assessed in Auditor-General Report No.1 2019–20 Cyber Resilience of Government Business Enterprises and Corporate Commonwealth Entities.46 The JCPAA also recommended that the ANAO consider conducting an annual limited assurance review into the cyber resilience of Commonwealth entities, which would assess entities against the 13 behaviours and practices.47 The ANAO will consider the JCPAA’s recommendation in the development of its future audit work plan.

Audit methodology

1.53 In undertaking the audit, the ANAO:

- reviewed the selected entities’ 2018–19 and 2019–20 PSPSF self-assessments for Policy 10: Safeguarding information from cyber threats;

- reviewed PSPF Policy 5: Reporting on security;

- assessed the security controls in selected systems of entities that have self-assessed as having fully implemented any of the Top Four mitigation strategies to verify the accuracy of their 2018–19 PSPF self-assessment. The ANAO also assessed whether these entities were cyber resilient based on the ACSC’s prescribed strategies relating to detecting and responding to cyber security incidents;

- examined documentation collected from the selected entities relating to their cyber security strategies and activities, including: security risk assessments undertaken, project plans for cyber security improvement programs established, and records of minutes for any governance forums established for cyber security;

- interviewed relevant staff from the selected entities regarding their approaches in mitigating cyber security risks; and

- reviewed the guidance and processes developed by, and interviewed relevant staff from, the cyber policy entities to examine the approaches adopted to support accurate PSPF self-assessment and reporting.

1.54 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of $639,385.

1.55 Team members for this audit were Esther Barnes, Edwin Apoderado, David Willis, Jason Ralston, Carissa Chen, Kelvin Le, Lesa Craswell and Mark Rodrigues.

2. Implementation of cyber security risk mitigation strategies

Areas examined

This chapter examines whether the selected entities have fully implemented the mandatory Top Four mitigation strategies or otherwise adopted strategies and actions to progress towards full implementation. The chapter also examines whether those entities that reported full implementation of any of the Top Four mitigation strategies are cyber resilient.

Conclusion

None of the seven selected entities examined have fully implemented all the mandatory Top Four mitigation strategies. For the three entities that had self-assessed full implementation for one or more of the Top Four mitigation strategies in their 2018–19 PSPF assessment, two had not done so accurately. None of these three entities were cyber resilient. Five of six selected entities that had self-assessed to have not fully implemented any of the Top Four mitigation strategies have established strategies and implemented activities to manage their cyber risks and to progress toward a ‘Managing’ maturity level for PSPF Policy 10.

Areas for improvement

The ANAO made the following recommendations aimed at:

- the Department of the Prime Minister and Cabinet strengthening controls in relation to validating and assessing the security configurations for user access, and improving its event logging process;

- the Attorney-General’s Department improving its processes for documenting risk assessments for implementation of patches and monitoring of cyber security events; and

- selected entities that had self-assessed a PSPF Policy 10 maturity level of ‘Ad hoc’ and ‘Developing’ to set a timeframe to improve its maturity level, have clear reporting to governance committees, and monitoring of the progress of the entity’s cyber security program against the set timeframe.

2.1 Policy 10 under the revised Protective Security Policy Framework (PSPF) specifies how non-corporate Commonwealth entities can safeguard their information assets from cyber threats. PSPF Policy 10 sets out that entities must implement four of the Essential Eight mitigation strategies (the Top Four) to mitigate common and emerging cyber threats. The Top Four mitigation strategies mandated by PSPF Policy 10 are application control, patching applications, restricting administrative privileges and patching operating systems.

2.2 In undertaking their annual self-assessments under the PSPF maturity assessment model, entities assess the effectiveness of their implementation of the Top Four mitigation strategies against four grading levels — ‘Partial’, ‘Substantial’, ‘Full’ and ‘Excelled’.48 The description for each implementation level is outlined in Table 1.2. If an entity’s self-assessed maturity level for PSPF Policy 10 is ‘Ad hoc’ or ‘Developing’, which means that it has not fully implemented all the Top Four mitigation strategies, the entity is required to detail the proposed strategies and associated timeframes to improve its PSPF maturity level to ‘Managing’ (which requires full implementation of all the Top Four).

2.3 To assess the effectiveness of the selected entities’ implementation of cyber security risk mitigation strategies to meet mandatory PSPF requirements, the ANAO:

- tested the security controls of three entities — the Department of the Prime Minister and Cabinet (PM&C), the Attorney-General’s Department (AGD), and the Future Fund Management Agency (Future Fund) — that had reported full implementation of one or more of the Top Four mitigation strategies in their 2018–19 PSPF self-assessment to verify the accuracy of the assessment;

- assessed whether PM&C, AGD and Future Fund are cyber resilient; and

- reviewed the strategies and plans as well as the corresponding timeframes to reach full implementation of the Top Four mitigation strategies in selected entities that had self-assessed in their 2018–19 PSPF assessment report as not having full implementation of all the Top Four. The six entities are:

- Australian Trade and Investment Commission (Austrade);

- Department of Education, Skills and Employment (DESE)49;

- Department of Health (Health);

- IP Australia;

- AGD; and

- Future Fund.

Have the entities that reported full implementation of any of the Top Four cyber security risk mitigation strategies done so accurately?

PM&C and AGD have each not accurately self-assessed their implementation of one of the Top Four mitigation strategies. PM&C has not fully implemented the mitigation strategy for restricting administrative privileges. AGD has not fully implemented the mitigation strategy for patching operating systems. Future Fund has accurately self-assessed the two Top Four mitigation strategies for which it reported full implementation. None of the three entities were assessed as cyber resilient. Under the cyber security framework, PM&C and AGD are categorised as vulnerable to cyber security incidents as they have not fully implemented all the Top Four mitigation strategies and are continuing to strengthen the controls for managing cyber security incidents. Future Fund has not fully implemented all of the Top Four mitigation strategies, but is internally resilient as it has effective controls in place to support its ability to detect and recover from a cyber security incident.

2.4 PM&C, AGD and Future Fund each reported in their 2018–19 PSPF self-assessment that they had fully implemented one or more of the mandatory Top Four mitigation strategies. The three entities’ self-assessment of their implementation of the Top Four mitigation strategies for 2018–19 is presented in Table 2.1.

Table 2.1: Entities’ self-assessed implementation levels for the Top Four mitigation strategies in their 2018–19 PSPF assessment report

|

Mitigation strategy |

Self-assessed implementation level |

||

|

|

PM&C |

AGD |

Future Fund |

|

Application control |

Full |

Substantial |

Substantial |

|

Patching applications |

Full |

Substantial |

Substantial |

|

Patching operating systems |

Full |

Full |

Full |

|

Restricting administrative privileges |

Full |

Full |

Full |

Source: Entities’ 2018–19 PSPF self-assessments for Policy 10: Safeguarding information from cyber threats.

2.5 The ANAO verified the accuracy of the three entities’ PSPF Policy 10 self-assessments through an assessment of their implementation level of the Top Four mitigation strategies, for which they had reported full implementation. To achieve full implementation for each of the Top Four mitigation strategies under PSPF Policy 10, entities are required to implement the ‘Maturity Level Three’ requirements set by the ACSC (see paragraphs 1.33 and 3.21). As outlined in Table 1.4, the ACSC defines ‘Maturity Level Three’ as ‘fully aligned with the intent of the mitigation strategy’. To reach ‘Maturity Level Three’ for each of the Top Four, entities are required to:

- implement application control50 on all workstations and servers to restrict execution of unapproved or malicious programs and Microsoft’s latest recommended block rules to prevent application control bypasses;

- patch security vulnerabilities assessed as extreme risks in applications and operating systems51 48 hours from vendor release; use an automated mechanism to confirm and record that patches have been installed; and update or replace unsupported applications and operating systems; and

- restrict administrative access52 to that required for personnel to undertake their duties; validate privileged access when first requested and revalidate on an annual or more frequent basis; and prevent privileged users from accessing email and Internet.

2.6 The ANAO also assessed whether the three entities are cyber resilient. As noted in paragraph 1.10, the Australian Government Information Security Manual (ISM) defines cyber resilience to include the ability to detect and recover from cyber security incidents. The ACSC’s guidance on Strategies to Mitigate Cyber Security Incidents includes prioritised mitigation strategies for detecting and responding to cyber security incidents, and for recovering data and system availability. The ANAO assessed the three entities’ cyber resilience based on the entities’ implementation and operating effectiveness of relevant ISM requirements relating to:

- the Top Four mitigation strategies, assessed against the implementation levels of the PSPF maturity assessment model; and

- mitigation strategies for continuous incident detection and response53, and daily backups54, assessed against the Essential Eight Maturity Model.55

Accuracy of entities’ PSPF Policy 10 self-assessments

Department of the Prime Minister and Cabinet