Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to determine whether:

- councils essentially met their objectives as stated in the IT Acquisition Council Guidelines;

- council members substantially fulfilled their roles and responsibilities, including providing advice regarding relevant government policy; and

- councils add value and assurance in meeting accountability requirements to the acquisition process.

The objective of the audit was to assess the effectiveness of DIAC’s management of the student visa program. Three key areas were examined in the audit: the processing of student visa applications; ensuring compliance with student visa conditions; and cooperation between DIAC and DEEWR.

The audit objective was to assess the effectiveness of AusAID’s management of infrastructure aid to Indonesia, with a particular focus on the Eastern Indonesia National Roads Improvement Project and the Indonesia Infrastructure Initiative.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Tax Office’s administration of the LCT, including aspects of the tax administered by Customs on behalf of the Tax Office.

The objective of this audit was to assess the effectiveness of DIAC’s administration of the character requirements of the Citizenship Act.

This audit would assess the effectiveness of the administration of grants awarded under the Safe Places Emergency Accommodation Program (Safe Places), including compliance with the Commonwealth Grants Rules and Principles, and management of the grants across the Safe Places program life cycle.

Safe Places is a capital works program funding the building, renovation or purchase of emergency accommodation for women and children experiencing family and domestic violence. There have been two rounds of funding. Under successive National Plans to Reduce Violence against Women and their Children, the Australian Government has committed over $170 million over seven years to Safe Places ($72.6 million for round 1 from 2020–21 to 2024–25, and $100 million for round 2 from 2022–23 to 2026–2027). The first round of grants, awarded in 2020, was intended to deliver new emergency and crisis accommodation for women and children experiencing domestic and family violence. The second round of grants, was awarded in 2024 and was designed to focus on improving access to appropriate emergency accommodation for First Nations women and children, women and children from culturally and linguistically diverse backgrounds, and women and children with disability.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether:

a) the AGD effectively manages the operation of the NSH; and

b) the AFP and ASIO have effective procedures in place to deal with incoming referrals from the NSH.

The audit objective is to assess the effectiveness of the Department of Defence's management of the Mulwala Redevelopment Project.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s (ATO’s) complaints and other feedback management systems in supporting service delivery.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the Department of Human Services’ management of the trials of intensive service delivery for customers with complex needs.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Environment’s administration of the Strengthening Basin Communities Program.

The audit objective was to assess the extent to which DEEWR and FaHCSIA have effectively managed the planning and consultation phases for the IBF program and the IBHP program. The audit scope included consideration of the issues likely to affect the ongoing operation and sustainability of the facilities.

Closing the books processes sometimes referred to as 'month-end or year-end processing' are those processes undertaken by organisations in order to generate periodic financial information. This audit focused on the monthly closing the books processes undertaken at six of the material Commonwealth organisations, in order to provide some generic conclusions on the operation and effectiveness of these periodic processes in the Commonwealth and to identify opportunities for improvement.

The objective of the audit was to assess the effectiveness of AusAID’s management of tertiary training assistance.

Personnel security, including the security clearance process, is a valuable and essential element of managing the risk inherent in allowing Commonwealth and other personnel access to sensitive information. This audit was designed to review security clearance and vetting policies and practices in a number of Commonwealth organisations and to consider if organisations were managing these processes effectively and efficiently and in accordance with Commonwealth policy, as outlined in the Protective Security Manual.

As part of the ANAO's role in reviewing proposed advertising campaigns for compliance with the June 2008 Guidelines, the Auditor–General advised the JCPAA that the ANAO would provide regular summary reports on its advertising review activities to Parliament. Section 25 of the Auditor General Act 1997 provides for the tabling of such reports.

The 30 per cent Private Health Insurance Rebate is a financial incentive for individuals to purchase health insurance cover. The rebate provides for a reimbursement or discount of 30 per cent of the cost of private health insurance. It is available to all Australians who are eligible for Medicare and have private health insurance. The objective of the audit was to determine the effectiveness of Commonwealth Government agencies administration of the rebate.

The audit objective was to assess the effectiveness of the Department of Education, Employment and Workplace Relation's administration of the Digital Education Revolution program, focusing on the major component of the program, the National Secondary Schools Computer Fund.

The Auditor-General responded on 11 December 2015 to correspondence from Senator the Hon Doug Cameron on 30 October 2015 regarding systems and processes within the Department of Human Services (DHS) that go to the security of citizens' identity.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Human Services' (DHS) administration of the shopfront co-location of DHS services.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the administrative effectiveness of Customs' Container Examination Facilities. Particular emphasis was given to the following areas: target selection processes; target development strategies; intervention processes; and facilities operation.

To assess the effectiveness of the Department of Broadband, Communications and the Digital Economy’s (DBCDE’s) administration of the Regional Backbone Blackspots Program (RBBP), involving the establishment and ongoing management of the program.

In November 1998, the Minister for Communications wrote to the Auditor-General requesting an assessment of the actual costs of Phase 1 digital conversion for the ABC and SBS, the sources of funds applied and the efficiency with which the funds had been used before the government considered further funding. The purpose of this limited scope performance audit was to assess a range of financial issues associated with the ABC and SBS conversion to digital broadcasting.

The Commonwealth has significant involvement in national emergency management arrangements through its roles in planning, coordination between agencies, operational response, financial support, education and training, public awareness and research activities. The objectives of this performance audit were to identify the Commonwealth's current emergency management arrangements; to provide assurance to Parliament concerning the adequacy of the arrangements; and to highlight areas for improvement.

The objective of the audit was to assess the effectiveness of the ATO's management of its interpretative assistance activities for SMSFs.

The audit objective was to assess the effectiveness of the Therapeutic Goods Administration’s (TGA) application of the Code of Good Manufacturing Practice (Code of GMP) for prescription medicines.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Indigenous Land Corporation’s administration of the Land Acquisition Program.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of DSEWPaC's administration of PIIOP, including the acquisition of water access entitlements and progress towards achieving the program's objectives.

The audit objective was to assess the effectiveness of FaHCSIA and DHS’ administration of New Income Management in the Northern Territory.

The objective of the audit was to provide an independent assurance on the effectiveness of Defence and DMO's management of the acquisition of the ASLAV capability to Army. The audit examined the initial capability requirements and approval process, the contract negotiation process, and the management of the Project and Contracts by DMO.

The Objective of the audit was to assess the administrative effectiveness of GPET's management of the general practice training programs, AGPT and PGPPP, the latter being a responsibility that GPET assumed in 2010.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s management of its property portfolio.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the services delivered through ATO shopfronts to individual and micro enterprise tax clients. Particular emphasis was given to the delivery of services to clients and planning and reporting processes for shopfront services.

The Shadow Minister for Health and Ageing, Mr Stephen Smith, wrote to the Auditor-General on 11 March 2002 formally requesting an investigation into certain matters in relation to the 'Co-Location of National General Practice Organisations', a message detailed in the Health Portfolio Additional Estimates Statements 2001-02. The Federal President of the Australian Medical Association (AMA) Limited wrote to the Auditor-General on 11 March 2002, requesting a comprehensive audit of funding decisions by the Minister for Health and Ageing. The Australian National Audit Office has undertaken a preliminary examination of relevant papers relating to the 'GP House' matter. The preliminary examination focussed on whether or not due process was followed in making the decision to transfer funds between Outcomes. The preliminary examination also considered the procedures adopted by the Department of Health and Aged Care in developing the funding proposal, the advisory role played by the Department of Finance and Administration and specific advice provided by both departments to their Ministers. The examination further considered the disclosure of the related budget measure.

This audit would examine the stand up and early implementation of Medicare Urgent Care Clinics (UCCs) to provide assurance that the Department of Health, Disability and Ageing (Health) has administered UCC funding appropriately and is monitoring and evaluating the performance of UCCs to ensure the model is meeting its objectives and achieving value for money. Health describes the purpose of UCCs as helping to reduce pressure on hospitals and emergency departments, through providing urgent care in a general practitioner setting that is open seven days a week, early and late.

The October 2022–23 Federal Budget included $235 million over four years to commence the roll-out of 50 Medicare Urgent Care Clinics (UCCs). In the 2023–24 Federal Budget, the Australian Government announced $358.5 million over five years to establish 58 UCCs. In the 2024–25 Federal Budget, the government announced a further $227.0 million to boost the capacity of UCCs including by establishing another 29 UCCs, for a total of 87. In March 2025, the Prime Minister and Minister for Health and Aged Care committed an additional $644 million to open another 50 UCCs, with more clinics planned in every state and territory.

Please direct enquiries through our contact page.

Justice reinvestment is a long-term, community-led approach that aims to prevent crime, address the drivers of contact with the justice system, and improve justice outcomes for First Nations peoples in a particular place or community. Justice reinvestment aligns with Outcomes 10 and 11 and the Priority Reforms under the National Agreement on Closing the Gap, to reduce the overrepresentation of young people and adults in the criminal justice system. In the October 2022 Budget $69 million was committed over 4 years (from 2022–23) to establish a National Justice Reinvestment Program to support up to 30 community-led justice reinvestment initiatives, with ongoing funding of $20 million per year from 2026–27. In the 2023–24 Budget, an additional $10 million was committed over 4 years to support place-based justice reinvestment initiatives in the Central Australia region of the Northern Territory. Funding was delivered through open, non-competitive grant funding rounds. As of May 2025, information in relation to 25 grant agreements had been published valued at $55.4 million across the two funding rounds (with two assessment cycles in each round). A potential audit would examine the award of funding was in accordance with the Commonwealth Grant Rules and Principles.

Please direct enquiries through our contact page.

The objective of the audit was to provide an independent assurance on the effectiveness of the management of the upgrade of the M113 fleet for the Australian Defence Force (ADF). The audit sought to identify the initial capability requirements and approval process; analyse the contract negotiation process; and examine the management of the project and contracts.

A Business Support Process audit of the administration of grants in small to medium organisations was undertaken across six Commonwealth organisations to assess whether agencies had implemented appropriate risk management strategies for grant programs; evaluate whether grants had been administered in accordance with the appropriate legislation, Commonwealth guidance, and other accepted internal controls; and to recommend improvements in the controls and practices relating to grants administration.

The objective of the audit was to assess the effectiveness of the administration of the Smart Grid, Smart City Program, including the establishment, implementation and ongoing management of the program.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to review the efficiency and administrative effectiveness of the Commercial Compliance Branch's risk management processes and to establish whether the approach provided a sound foundation for the development and application of risk management across the Australian Customs Service. The ANAO also examined the wider risk management context across ACS in order to appreciate how risk management processes in the Branch related to the agency as a whole.

The Auditor-General (A/g) responded on 24 September 2015 to correspondence from the Hon Warren Truss MP on 18 September 2015 regarding probity and conflict of interest arrangements in place for the OneSKY Australia programme being led by Airservices Australia.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Ms Julie Collins MP on 1 September 2015 regarding parliamentary entitlements paid to Liberal MPs and Senators.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of Agriculture’s and Customs’ arrangements for the targeting and screening of incoming international mail to identify prohibited and restricted goods.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of AGD's administration of grants provided under the Respondents Scheme. The audit considered the context within which the Respondents Scheme operates and focused on assessing the administration of the scheme including its financial management within AGD.

The Auditor-General (A/g) responded on 6 October 2015 to correspondence from the Hon Richard Marles MP on 30 August 2015 regarding training that has been provided to officials within Australian Border Force (ABF) since its inception on 1 July.

Please direct enquiries relating to requests for audit through our contact page.

To examine the effectiveness of the Department of Health and Ageing’s administration of the Access to Allied Psychological Services Program.

The objective of the audit was to assess the effectiveness of the administration of the Australian Prudential Regulation Authority (APRA) financial industry levies.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of DoHA’s administration in supporting the creation and development of health infrastructure from the HHF, including DoHA’s support for the Health Minister and the HHF Advisory Board.

The audit objective was to assess the effectiveness of DoHA's management of CACPs in fulfilling the legislated objectives of the program.

The objective of the audit was to assess the effectiveness of FaHCSIA’s administration of Communities for Children under the Family Support Program.

The objective of this report is to provide comprehensive information on the status of selected Major Projects, as reflected in the Project Data Summary Sheets prepared by the DMO, and the Statement by the Chief Executive Officer (CEO) of the DMO, and including the ANAO’s review of the preparation of the PDSSs by the DMO.

The objective of the audit was to examine the application of the Australian Taxation Office's Compliance Effectiveness Methodology in evaluating the effectiveness of key compliance activities and shaping the development of strategies to promote voluntary compliance.

Please direct enquiries relating to reports through our contact page.

The audit examined the management of computer software assets at four Commonwealth bodies. It focused on the capitalisation of software for the purposes of annual financial reporting. The specific objectives were to: determine whether the selected bodies had established effective internal control frameworks for the capitalisation of externally acquired and internally developed software; and assess whether software costs were capitalised in accordance with organisational policy, accounting standards and relevant legislation.

The objective of the audit was to assess the effectiveness of the ATO’s administration of DGR endorsements and associated arrangements.

The objective of the audit was to assess the administrative effectiveness of AGD's management of the Northern Territory Night Patrols Program.

The objective of the audit was to assess the effectiveness of the Department of Education, Employment and Workplace Relations’ (DEEWR) role in the delivery of the Children and Family Centre (CFC) component of the National Partnership Agreement on Indigenous Early Childhood Development (IECD NP).

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 8 March 2016 to correspondence from the Hon Dr Sharman Stone MP on 18 February 2016 regarding Goulburn Murray Water Connections Project 2 (GMWCP2).

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the Commonwealth Environmental Water Office’s administration of environmental water holdings.

Please direct enquiries relating to reports through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 26 April 2016 to correspondence from Mr Pat Conroy MP on 16 February 2016 regarding the government advertising campaign Welcome to the Ideas Boom.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess how well EMA is meeting its objective of providing national leadership in the development of measures to reduce risk to communities and manage the consequences of disasters.

The Auditor-General responded on 14 December 2016, and followed-up on 19 July 2017, to correspondence from Senator Kakoschke-Moore on 14 November 2016 requesting that the Auditor-General conduct an audit of the National Affordable Housing Agreement (NAHA).

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to determine whether Australian Government entities were implementing effective strategies to support increased Indigenous employment.

Please direct enquiries relating to reports through our contact page.

The objective of this report is to provide a formal conclusion on the review of the Project Data Summary Sheets by the Auditor-General, including comprehensive information on the status of projects as reflected in the PDSSs prepared by the DMO.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Mr Tim Watts MP on 28 August 2015 regarding Liberal Party misappropriation of parliamentary entitlements.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to determine the effectiveness of DoHA's administration of the MoU between the Government and the pathology profession, including monitoring whether the MoU is achieving its objectives

The Auditor-General responded on 22 August 2016 to correspondence from Senator Nick Xenophon on 20 May 2016 requesting a performance audit of the Command and Control System selection for the SEA 1000 Future Submarine Project.

Please direct enquiries relating to requests for audit through our contact page.

The Department of Defence spends some $2.4 billion a year on major equipment acquisition projects. The audit objective was to assess Defence's arrangements for higher-level management of major equipment acquisition projects. The principal aim was to formulate practical recommendations that would both enhance Defence's management of major acquisition projects and provide a degree of assurance about its ongoing apparent capacity to do so efficiently and effectively.

The objectives in auditing the sale were to assess the extent to which the Government's sale objectives were achieved; review the efficiency of the management of the sale process; assess whether the sale arrangements adequately protected the Commonwealth's interests, including minimising ongoing Commonwealth risk; and identify principles of sound administrative practice to facilitate improved arrangements for future trade sales, particularly the later phases of airport sales.

The goal of the $250 million Emerging Markets Impact Investment Fund (EMIIF) is to help address access to finance challenges for small and medium-sized enterprises (SMEs) in South and South East Asia. It invests in funds and other financial intermediaries that in turn invest in early and growth stage SMEs with investments in the range of USD5,000 to USD2 million. The May 2023–24 Federal Budget measure that increased the size of the EMIIF stated that the majority of assistance would be provided via equity and loans (rather than grants), the cost of which will be met from Australia’s existing Official Development Assistance (ODA) funding.

EMIIF is an investment trust with DFAT as the sole beneficiary. Day to day management is undertaken by the investment manager appointed by DFAT and investment decision making is undertaken by the investment committee appointed by DFAT, as well as representatives from the investment manager. The design of EMIIF was intended to enable appropriate DFAT oversight by a DFAT delegate for the EMIIF being responsible for making any contractual and strategic decisions, who would be advised by an SES-level Impact Investing Advisory Group to provide advice, guidance and support regarding the overall direction and implementation of EMIIF and DFAT’s other impact investing programs. In addition, a Secretariat within DFAT is responsible for the day-to-day management of EMIIF, including interaction with counterparties to monitor ongoing performance, disseminate information and prepare relevant reporting to the advisory group or decision-makers. The audit would examine DFAT’s establishment and oversight of the EMIIF.

Please direct enquiries through our contact page.

The objective of this report is to provide the Auditor-General’s independent assurance over the status of selected Major Projects, as reflected in the Project Data Summary Sheets (PDSSs) prepared by the DMO, and the Statement by the Chief Executive Officer (CEO) DMO. Assurance from the ANAO’s review of the preparation of the PDSSs by the Defence Materiel Organisation (DMO) is conveyed in the Auditor-General’s Independent Review Report, prepared pursuant to the endorsed Guidelines, contained in Part 3.

Michael White, Executive Director, Phone: (02) 6203 7393

The objective of the audit was to assess the effectiveness of the Bureau of Meteorology’s implementation of the Improving Water Information Program.

Please direct enquiries relating to reports through our contact page.

The audit was structured to provide an overview of the administration of Commonwealth assistance to the agrifood industry. In particular, the ANAO sought to form a view on the extent to which four key agencies (Agriculture, Fisheries and Forestry-Australia, the Department of Foreign Affairs and Trade, the Department of Transport and Regional Services and Austrade) are able to demonstrate their success in achieving the Government's objectives for the Australian agrifood industry by assessing agencies' agrifood-related: planned outcomes; performance information; and reporting.

Response completed as a limited scope assurance review.

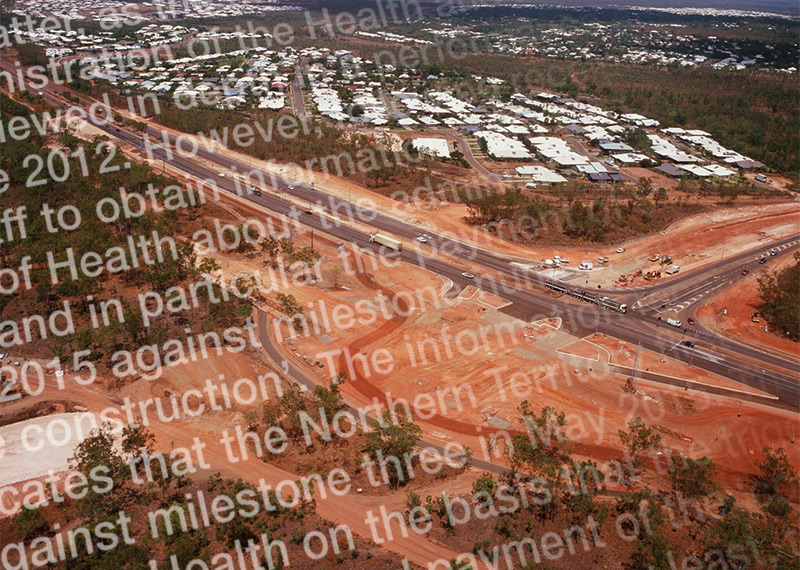

The Auditor-General responded on 14 January 2016 to correspondence from the Hon Catherine King MP on 22 October 2015, on the project agreement for the Health and Hospitals Fund – 2010 Regional Priority Round Project in Palmerston.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this follow-up audit was to assess whether the department had taken appropriate action in response to the recommendations in Audit Report No.35 1993-94, titled The Compliance Function, Department of Immigration and Ethnic Affairs. The recommendations of the 1993-94 report, which formed the criteria for the audit, were primarily concerned with compliance after entry to Australia had been gained.

The Service Chiefs of Navy, Army and Air Force are accountable to the Chief of the Defence Force for the way that equipment is used by their Service. They are also accountable for the safety, fitness for service and environmental compliance of the equipment. The audit report deals with the way that the Service Chiefs are assured of the safety and suitability for service of the Australian Defence Force's (ADF's) ordnance systems. Ordnance systems include munitions such as missiles, shells and mines, and the auxiliary material necessary to aim, launch and guide munitions.

Fedlink was to comprise two elements: a high capacity telecommunications infrastructure (phase 1) and information technology applications which support Internet and Intranet communication, and transactions in a secure environment (phase 2) [which never went ahead]. OGIT sought the services of the ANAO to provide an opinion on the probity of the methodology and procedures applied in the evaluation process for phase 1. Therefore the objectives of this audit were to assist OGIT in the timely identification of any deficiencies in the evaluation of responses from suppliers and options for addressing the deficiencies.

The objectives of the audit were to: assess compliance with the Stevedoring Levy (Collection) Act 1998 and Stevedoring Levy (Imposition) Act 1998 and other relevant legislation; assess the effectiveness of the administrative and financial controls regarding the collection of the Stevedoring Levy by DoTRS and the provision of redundancy payments to eligible employees of stevedoring companies and the management of the funding of those payments by way of borrowings by MIFCo; and review the administrative efficiency of the redundancy payment and Stevedoring Levy collection aspects of the waterfront redundancy scheme.

The objectives for the audit were to assess the:

- economy, administrative effectiveness, and accountability of DVA's management of the purchase of hospital services from State and Territory governments; and

- strategies adopted by DVA to manage change associated with its purchase of hospital care services from State and Territory governments.

The twin aims were to provide assurance to stakeholders and to identify any area in which improvements could be made to achieve better results.

The ANAO's purpose was to report on:

- the HIC's management of approaches to minimise medifraud and inappropriate practice;

- HIC's reporting of its performance on these matters to stakeholders;

- the methodology used by the HIC to estimate the extent of fraud and inappropriate practice, including comment on the reliability of the estimates; and

- the HIC's implementation of the major recommendations from Medifraud and Excessive Servicing - Audit Report No.17 1992-93.

The audit reviewed six budget-funded agencies (Australian Customs Service, Australian Taxation Office, Centrelink, Department of Defence, Department of Education, Training and Youth Affairs, and Department of Immigration and Multicultural Affairs) and two off-budget entities (Airservices Australia and Reserve Bank of Australia). The ANAO also examined the Office for Government Online's (OGO, formerly the Office of Government Information Technology, or OGIT) whole-of-government coordination of the Commonwealth's Year 2000 efforts.

This audit reviewed:

- the methods used by the Department of Social Security (DSS) to determine and allocate staff numbers to Regional Offices. It sought to ascertain whether the allocations resulting from these methods met the demands placed on Regional Offices and the scope for improvement to these methods; and

- the scope for improvements to the benefit delivery process and other aspects of Regional Office operations that could lead to significant productivity gains or client service benefits.

The audit reviewed the broadcasting planning and licensing operations of the Australian Broadcasting Authority, which is responsible for planning the availability of segments of the broadcasting services bands used by radio and television for analogue and digital broadcasting. The objective was to assess the ABA's management of licence area planning and the subsequent issue of broadcasting licences, focussing on analogue radio planning and identifying improved administrative practices, where possible, together with the main factors that have contributed to the delays to date in achieving the planning timetable.

The Auditor-General responded on 6 April 2016 to correspondence from Senator Hanson-Young on 30 March 2016 regarding Refugee resettlement deal established between the Commonwealth Government of Australia and the Kingdom of Cambodia in September of 2014.

Please direct enquiries relating to requests for audit through our contact page.

The ANAO’s work will examine Australian National University financial management as it relates to Renew ANU.

Please direct enquiries through our contact page.

Special Benefit is a social security income support payment for people who are unable to support themselves or their dependents, and who are not otherwise entitled to any other income support payment. Its objective is to ensure that such people have adequate levels of income. The objective of the audit was to assess the extent to which new claims for Special Benefit had been determined in compliance with the Social Security Act, the Guide to the Act and other relevant guidelines, and whether Centrelink and FaCS had appropriate procedures to help ensure such compliance.

The objectives of the audit was to examine the effectiveness and efficiency of DIMIA's decision-making processes and management systems for delivering the parent and partner aspects of the family stream of the Migration Program.

The family stream of Australia's Migration Program enables the reunion of immediate family members of Australian citizens, permanent residents or eligible New Zealand citizens. It consists of four main categories;

- Partner;

- Child;

- Parent; and

- Other family.

The audit objective was to assess the effectiveness of the Department of Social Services' administration of Early Intervention Services for Children with Disability.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to examine the effectiveness of the management and control of program evaluation in the Australian Public Service. The ANAO made an assessment against criteria which were designed to test whether agencies were undertaking evaluations in a way which would enhance their overall effectiveness. The main issues examined were:

- approaches to evaluation planning;

- the conduct of individual evaluations;

- the quality of evaluation reports; and

- the impact of evaluations.

The objective of the audit was to assess the effectiveness of the Torres Strait Regional Authority’s administration of its program and service delivery functions.

Please direct enquiries relating to reports through our contact page.

The Age Pension is a social security income support payment available to Australian residents and eligible Australians residing overseas who have reached Age Pension age and whose income and assets are under certain limits. In 1999-2000, approximately $14 billion was paid to approximately 1.7 million Age Pension recipients. Payment of Age Pension is made under the Social Security Law and in accordance with the Guide to the Social Security Law prepared by the Department of Family and Community Services (FaCS). FaCS has contracted Centrelink under a Business Partnership Agreement (BPA) to administer the payment of Age Pension to eligible customers. The objective of the audit was to assess the extent to which new claims for Age Pension had been assessed in compliance with the legislation and other relevant guidelines developed by Centrelink, and whether Centrelink employed appropriate mechanisms to help ensure such compliance. In particular, the ANAO sought evidence with respect to: payment at the right rate, from the right date, to the right person with the right product, for new claims assessed during the audit sample period (that is, in accordance with the working definition of accuracy within Centrelink); the accuracy of Centrelink?s own reporting on compliance, as reported to FaCS under the BPA; and the application of appropriate mechanisms to help ensure such compliance.

The Australian Prudential Regulation Authority (APRA) was established on 1 July 1998 as the prudential regulator of banks and other authorised deposit-taking institutions (ADIs), life insurance companies (including friendly societies), general insurance companies, superannuation funds and retirement savings accounts. ANAO's objectives for this audit were to assess the efficiency and effectiveness of APRA's prudential supervision of banks. Prudential supervision aims to protect depositors by ensuring that financial institutions adopt prudent risk management practices designed to ensure their continuing solvency and liquidity. APRA is a relatively new organisation, established in July 1998 and becoming responsible for prudential supervision of all ADIs from July 1999. ANAO concluded that there are steps APRA can take in a number of areas to improve its supervisory practices, including improving the administration of the ADI supervisory levy; strengthening its risk management approach; and maintaining closer adherence to international standards for prudential supervision issued by the Basle Committee on Banking Supervision. ANAO made five recommendations concerning administration of levies, risk-based supervision and supervision of cross-border banking. APRA agreed, or agreed with qualifications, to all recommendations, as well as agreeing with the overall audit conclusions.

The Acting Auditor-General responded on 31 May 2017, and the Auditor-General followed-up on 19 July 2017, to correspondence from Mr Stephen Jones MP dated 15 May 2017. Mr Jones MP had requested that the Auditor-General conduct an audit of the Community Development Grants Programme, administered by the Department of Infrastructure and Regional Development, to provide an independent assessment of its administration.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 24 September 2015 to correspondence from Senator Glenn Lazarus on 10 September 2015 regarding National Stronger Regions Fund.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this report is to provide comprehensive information on the status of projects as reflected in the Project Data Summary Sheets (PDSSs) prepared by DMO, and a review by the ANAO.

The objective of this report is to provide information, prepared by both the ANAO and DMO, on the performance of major projects as well as providing the Auditor-General’s formal conclusion on the review of the Project Data Summary Sheets (PDSSs) prepared by DMO and contained in this report.

The Australian Diplomatic Communications Network was developed to provide a secure communication and automation capability for domestic offices and overseas posts. The audit focussed on project management of the ADCNET project, and in particular:

- how effectively the ADCNET project was managed;

- how effectively project risks were managed; and

- the extent to which project management processes have established whether ADCNET meets the specifications set by, and the expectations held by, DFAT, as well as any lessons to be learnt for this and other future projects.

Simulators are devices that provide personnel with training and practice by reproducing the behaviour of operational equipment. Defence records indicate that since 1960 the Defence Organisation has spent about $1 billion on acquiring simulators for training purposes. Over the next five years Defence proposes to spend a further $1.1 billion on simulation. The objective of the audit was to assess whether Defence had developed appropriate policies to provide guidance to personnel in the acquisition and use of aerospace simulators and the effectiveness of its procedures in achieving best value for the Commonwealth in relation to aerospace simulators.

Although the audit examined broader aspects of the ATO's administration (such as, tobacco excise governance arrangements, intelligence capability and compliance and investigations activities), we placed particular emphasis on the strategies used by the ATO to address the proliferation of chop-chop (Australian grown tobacco sold illicitly in a chopped up form for $80 to $100 per kilogram. In comparison, 50 grams of legal roll-you-own tobacco costs around $16 i.e. $320 per kilogram) in the Australian markets, as it is an area of major risk to tobacco excise revenue.

The objective of the audit was to assess the framework and systems that DHAC has in place to prevent, control, monitor, detect and investigate fraud. The ANAO concluded that DHAC had taken appropriate steps to protect Commonwealth resources under its administration from fraudulent misappropriation by developing a sound fraud control framework, the effectiveness of which is illustrated by the relatively low incidence of reported fraud in the department over the last few years. The framework also includes key elements for preventing and dealing with fraud in line with the Commonwealth's Fraud Control Policy.

The audit assessed the effectiveness of the governance framework for the management of the transition from the existing red meat industry structures to new structures which increased industry's role in self determination and self regulation and minimised the involvement of Government. Matters considered included the effectiveness of:

- planning for the implementation of the new arrangements;

- management of the risks associated with the implementation of the new arrangements;

- management structures used in the transition arrangements; and

- accountability arrangements for ongoing Commonwealth involvement.

Tactical fighter operations (TFOs) form the basis of Australia's current military capability to ensure air superiority. Air superiority over the Australian territory and maritime approaches is an essential element in Australia's defence strategy. The audit objectives were to:

- assess whether the resources used to provide the F/A-18 tactical fighter force operational capability are managed cost-effectively; and

- identify areas for improvement in the coordination, planning and practices employed in administration of tactical fighter operations.

The objectives of the audit were to:

- evaluate the extent to which the Government's sale objectives were achieved, with a focus on those objectives relating to the optimisation of sale proceeds and minimisation of risk to the Commonwealth;

- examine the effectiveness of the management of the sale process to ensure the Commonwealth received fair value; and

- within the context of broader Commonwealth debt management considerations, assess the application of the sale proceeds to repaying Commonwealth debt and the extent to which public debt interest payments may be reduced.

The Auditor-General responded on 9 December 2015 to correspondence from the Hon Shayne Neumann MP on 7 September 2015 regarding Indigenous Advancement Strategy.

Please direct enquiries relating to requests for audit through our contact page.

Major capital equipment contributes importantly to the capabilities of the Australian Defence Force (ADF) to achieve the Defence mission, that is, the defence of Australia and its national interests. The Defence Materiel Organisation (DMO) is the relatively new Defence organisation responsible for the acquisition and through-life support of Defence equipment and systems. DMO's stated purpose is to equip and sustain the ADF. In 2001-02, it will spend $2.9 billion on progressing some 270 major capital equipment acquisition projects. This preliminary study for the audit focused on DMO reporting on the status of major equipment acquisition projects.

The objectives of this audit were to assess, with respect to guarantees, indemnities and letters of comfort:

- changes in the size and nature of the Commonwealth's reported exposure since 30 June 1995;

- the extent of improvement in agencies' management and monitoring of the Commonwealth's exposure to these instruments;

- the approach of agencies to effective risk management and control of Commonwealth exposures to these instruments; and

- whether current reporting practices provide a sufficiently comprehensive coverage for public accountability purposes, at both the agency and whole of government levels.

Industry levies play a significant role in the provision of many public services and fund a range of activities undertaken by regulatory bodies such as the Australian Prudential Regulation Authority (APRA), through to financing reform of the Australian waterfront labour force. The objectives of this audit were to assess:

- the coverage, revenue and expenses of non-primary industry levies;

- the effectiveness of selected entities' financial management of non-primary industry levies; and

- areas of better administrative practice relating to the financial management of non-primary industry levies.

The objective of the performance audit was to assess the administrative effectiveness of DIMA's business entry program against the background of the Business and Temporary Entry program objective, with particular regard to whether:

- the existing performance management mechanisms and compliance monitoring strategies support the achievement of program outcomes and outputs;

- the quality of decision-making;

- business processes facilitate prompt visa decision-making consistent with program objectives; and

- decision-making support mechanisms promote robust and timely decision-making.

The audit examined the administrative effectiveness of arrangements between Health and HIC, in relation to the management and administration of the Medicare Benefits Scheme and the Pharmaceutical Benefits Scheme. Health predominantly exercises a policy and leadership role within the health portfolio - HIC delivers a range of health services directly to the public and members of the health industry. Both agencies have stated that they recognise the importance of working together, as partners in their respective roles, to maximise their performance in the achievement of health portfolio outcomes and to discharge their respective responsibilities. This joint commitment is embodied in a written agreement - called the Strategic Partnership Agreement (SPA).

The audit objective was to assess the effectiveness of DHS’ implementation of initiatives to support the delivery of services to Indigenous Australians.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to ascertain and report to the Parliament on the ATO's administration of PPS and to identify opportunities for improvement. Four key compliance issues were identified: reporting PPS income, claiming PPS credits, remitting PPS income, claiming PPS credits, remitting PPS deductions, and managing PPS exemptions and variations. In addition, the following key aspects were considered: PPS risk assessments, coordination of PPS administration between the Small Business Income and Withholding & Indirect Taxes business lines, and PPS compliance project performance information.

The purpose of the audit was to examine how efficiently and effectively the ATO managed its collection of outstanding tax debt. A framework for analysing the ATO's approach to collecting outstanding debt was established by the ANAO. This framework reflected five key criteria in the collection process as they apply to managing outstanding debt, namely:

- initiatives to promote timely payment;

- identification of outstanding debt;

- setting priorities for collecting outstanding debt;

- management of collection practices; and

- collection results.

The purpose of the audit was to ascertain the extent to which financial management arrangements helped the department to achieve its objectives and the way that these could be improved in the light of the department's management reforms generally.

Elements of the Financial Management Improvement Program, and the accrual reporting framework, were at an evolutionary stage in the department. The audit therefore focused on quite fundamental financial management issues, including:

- the ability of financial management systems to provide information that was timely, accurate and relevant to the needs of management and other users; and

- the extent of coordination and control of financial management across departmental programs and between National and State Offices.

This audit would assess the effectiveness (including cost effectiveness) of efforts to grow the care and support workforce, including the coordination of workforce strategies across the Australian Government.

In September 2021, the National Skills Commission released a report which noted that multiple federal and state and territory government program areas (aged care, disability support, veteran care and mental health care) draw upon a common pool of care and support workers, and that multiple workforce strategies exist in relation to this pool. In 2023, the Australian Government established a Care and Support Economy Taskforce and a draft National Care and Support Economy Strategy (the draft Strategy). The draft Strategy notes that the care and support economy is one of the fastest growing parts of the Australian economy and faces enormous projected demand. The draft Strategy states that it complements the substantial work already being undertaken in each of the aged care, disability support, veterans’ care and early childhood education and care sectors, by developing whole-of-system solutions.

The draft Strategy notes that ‘More nuanced approaches to market stewardship are required in thin markets, and across the care and support economy, to ensure people have access to the care and support they need’. The capability review of the Department of Health and Aged Care (endorsed in July 2023) found that systemic consideration of the health and aged care workforce is an area for improvement. The 2023 National Disability Insurance Scheme (NDIS) Review made 26 recommendations, including to the Australian Government to develop an integrated approach to workforce development in the care and support sector.

In the 2024–25 Budget, funding was allocated to the Department of the Prime Minister and Cabinet to help deliver on reforms relating to the care and support economy. As at April 2025, the draft national Strategy has not been finalised, the Taskforce has been disbanded and a Care and Support and Aged Care Branch has been established in the Department of the Prime Minister and Cabinet. The Department of Health, Disability and Ageing published a National Nursing Workforce Strategy in December 2024.

Please direct enquiries through our contact page.

Defence has long provided housing assistance for members of the Australian Defence Force (ADF) and their families. In 1988, this function passed to the Defence Housing Authority (DHA), which was established to provide suitable housing to meet Defence's operational needs. In 2000, Defence and DHA signed a Services Agreement valued at $3.5 billion over 10 years. The objective of the audit was to assess whether Defence's management of its housing and relocation services provided for ADF members meets specified requirements; and to make practical recommendations for more efficient, effective and economical use of public resources provided for this purpose.

The objective was to assess the extent to which staff reductions have been managed in a sound strategic and cost-effective manner consistent with the Government's guidelines and the ANAO's 1996 better practice guide Managing APS Staff Reductions. The audit focussed on 3 agencies - the Australian Taxation Office, the former Department of Primary Industry and Energy, and the former Department of Transport and Regional Development. The ANAO found that the majority of staff reductions were achieved through retrenchment rather than natural attrition; and that decisions on the number of retrenchments were not always supported by an assessment of the impact of the reductions on the agencies' abilities to conduct their business.

The objective of this audit was to assess the administration of internal fraud control arrangements in the ATO and to identify areas with potential for improvement as well as identified better practice. To achieve this objective the ANAO focussed on five key areas. These were:

- the application of the ATO's corporate governance processes to the internal fraud control activities;

- the prevention of internal fraud within the ATO;

- the related use of information technology to minimise fraud risks;

- the detection of internal fraud within the ATO; and

- ATO fraud investigation procedures and practices.

In a military context, individual readiness refers to the ability of an individual member to be deployed, within a specified notice period, on operations, potentially in a combat environment, to perform the specific skills in which he or she has been trained. Individual readiness is the foundation on which military preparedness is built. Maintenance of a specified level of individual readiness in peacetime (along with other factors such as equipment readiness and collective training) influences the speed with which personnel can deploy on operations. The objective of this audit is to ensure that members can be deployed on operations, potentially in a combat environment, to perform their specific skills within a notice period of 30 days.

The audit reviewed the effectiveness of HIC's approach to customer service delivery to the Australian public as customers of Medicare. The primary issues examined were whether: . HIC manages its customer service delivery performance effectively;

- HIC's approach to people management adequately supports customer service delivery;

- HIC obtains adequate information from customers on their needs, expectations, and perceptions of HIC's service delivery; and

- HIC provides adequate information to customers on its services and on the service standards that customers should expect.

Taxation rulings are a key mechanism used by the Australian Taxation Office (ATO) to disseminate the Commissioner of Taxation's interpretative advice on Australian taxation law. The objective of the audit was to:

report to Parliament on the operation of the ATO's administration of taxation rulings (public, private and oral rulings); and where appropriate, make recommendations for improvements, having regard to considerations of: efficiency and effectiveness of the ATO's administration of the rulings system, particularly in relation to the achievement of the objectives set by Parliament for the rulings system; the ATO's systems' capacity to deliver consistency and fairness for taxpayers; and good corporate governance, including the control framework.

Networking the Nation was established with effect from 1 July 1997 to support activities and projects designed to meet a range of telecommunications needs in regional, rural and remote Australia. Funding is provided by the Regional Telecommunications Infrastructure Fund. The program provides total support of $250 million, of which $50 million was to be allocated annually for the five year period from 1997-98. Funding decisions for grants are the responsibility of an independent Board appointed by the Minister for Communications, Information Technology and the Arts. The objectives of the audit were to examine the administration of the program with a view to ascertaining the scope for improving administration and to provide assurance on the equity, efficiency and effectiveness of the management and administrative processes applied in the administration of grants under the program.