Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The campaign's objectives are to raise awareness of the harms and costs to young people, their families, communities and society associated with drinking to intoxication, to encourage young people and their parents to question the acceptability and impact of intoxicated behaviour, to highlight the influence that parental attitudes to alcohol misuse and adult behaviour and drinking to intoxication can have on others and provide referral and support information for those who recognise a need to seek help.

The objective of the Liquids Aerosols and Gels (LAGS) Trials is to assess the capability of various screening technologies to detect explosives in LAGs, with the ultimate objective of providing information to the Australian Government on the effectiveness and efficiency of the screening technology (in aviation security). The proposed public awareness strategy aims to raise awareness of the Trials amongst the travelling public, encourage their participation, and inform them of their rights and obligations during the Trials.

The objective of the Liquids Aerosols and Gels (LAGS) Trials is to assess the capability of various screening technologies to detect explosives in LAGs, with the ultimate objective of providing information to the Australian Government on the effectiveness and efficiency of the screening technology (in aviation security). The proposed public awareness strategy aims to raise awareness of the Trials amongst the travelling public, encourage their participation, and inform them of their rights and obligations during the Trials.

The objectives of the campaign are to increase knowledge and awareness of the Education Tax Refund, the need to keep receipts, eligibility requirements, and how to claim the refund, with the overall objective of encouraging eligible Australians to make a claim for a rebate.

This phase of the campaign (phase two) is designed to communicate information and raise awareness about the First Home Owners Boost amongst potential first home buyers, through limited media (print/ radio/ digital/ outdoor advertisement) supported by marketing collateral.

The Economic Security Strategy (ESS) campaign is intended to inform the community of aspects of the Australian Government's response to the global financial crisis. This campaign is designed to raise awareness of the financial assistance, in the form of lump sum payments, including access and eligibility requirements. Phase One is targeted at over five million pensioners, carers, seniors, people with a disability, veterans and families.

The ABHI campaign is an information campaign, largely in cooperation with other states (excl Victoria) which promotes improved public health and reduced incidence of chronic disease. The campaign aims to update public perceptions on lifestyle choices and risk factors leading to obesity and resultant disease. It is anticipated that people will take positive action to be more active and modify their diet, leading to a reduction in instances of diseases.

The objective of the audit was to assess the effectiveness and value for money of Defence’s acquisition of a Battle Management System and a Tactical Communications Network through Land 200 Tranche 2 Work Packages B–D.

Please direct enquiries through our contact page.

The Auditor-General responded on 17 June 2021 to correspondence from the Hon Mark Dreyfus QC, MP dated 21 May 2021, requesting that the Auditor-General conduct an investigation to examine how part-time members of the Social Services and Child Support Division and “sessional part-time members” in the Migration and Refugee Division of the Administrative Appeals Tribunal are being remunerated.

The Auditor-General provided a follow-up response to the Hon Mark Dreyfus QC, MP on 17 December 2021.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General is responsible for managing the ANAO within the arrangements of the broader Australian Public Service. These obligations are met by being transparent and reporting on the ANAO activities and operations.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of Indigenous Business Australia’s management and implementation of the Indigenous Home Ownership Program.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office in achieving revenue commitments established under specific Budget-funded compliance measures.

Please direct enquiries relating to reports through our contact page.

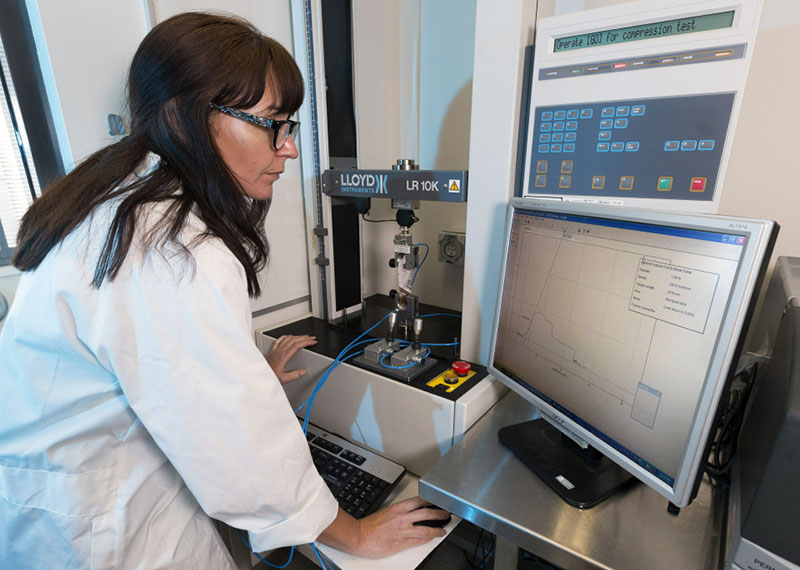

The objective of this audit was to assess how effectively the Defence Science and Technology Group (DSTG) administers the science and technology work it undertakes for the Australian Defence Organisation.

Please direct enquiries relating to reports through our contact page.

Medicare is Australia's universal health insurance scheme. Underpinning Medicare is one of Australia's largest and more complex computer databases the Medicare enrolment database. At the end of 2004 the Medicare enrolment database contained information on over 24 million individuals. This audit examines the quality of data stored on that database and how the Health Insurance Commission (HIC) manages the data.

The audit objective was to review the effectiveness of the Department of Defence’s (Defence) arrangements for delivering selected non-platform sustainment.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether the Department of Veterans’ Affairs is efficiently delivering services to veterans and their dependents.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of DEEWR's administration of Job Network service fees. The ANAO examined DEEWR's arrangements to:

- specify the nature and level of services to be supplied by JNMs and to communicate this to the JNMS;

- calculate and pay service fees in accordance with the Employment Services Contract (ESC) 2006–2009 it has with JNMs; and

- obtain assurance that JNMs have delivered services in accordance with the contract.

The objectives of this information report are to provide transparency of, and insights on, government grants expense and Commonwealth entities’ self-reporting of grants on GrantConnect.

Please direct enquiries through our contact page.

The objective of this information report is to provide transparency and insights on the governing boards of Commonwealth entities and companies and the membership of these boards.

Please direct enquiries through our contact page.

The Auditor-General (A/g) responded on 18 May 2016 to correspondence from the Hon Anthony Albanese MP on 16 January 2016 regarding the ANAO performance audit of the approval and administration of Commonwealth funding for the WestConnex Project.

Please direct enquiries relating to requests for audit through our contact page.

This is a follow-up audit to Audit Report No. 16, 1995-1996, Assessable Government Industry Assistance. This audit examined whether the Australian Taxation Office (ATO) had implemented the appropriate balance of compliance strategies to ensure that Australian Government Industry Assistance (AGIA) is adequately identified, disclosed to the ATO, and the revenue collected in an efficient and administratively effective manner. The objective of this audit was to report on the action taken by the Australian Taxation Office in addressing the recommendations of the 1996 Audit Report.

The audit reviewed the operation of the payment of accounts function in 8 Commonwealth organisations against their internal control framework. The main objectives of the audit were to determine whether organisations had implemented appropriate risk management strategies for the processing of accounts and whether payment for goods ans services had been properly authorised. The audit also reviewed progress since the payment of accounts audit undertaken in 1996 ( Audit Report No. 16, 1996-97, Financial Control and Administration Audit, Payment of Accounts).

The objective of the audit was to assess the performance of the Child Support Agency in the administration of key aspects of the Child Support Scheme. The ANAO previously audited the CSA in 1993-94 and identified scope for improvement in the management and administration of the Child Support Scheme. Particular areas of audit concern included client service, staff training and debt management. The current audit has reviewed the CSA's progress in improving Agency performance since that time. The audit focused initially on the areas identified in the previous audit, but also sought to identify further opportunities for improvement where appropriate.

The audit reviewed the High Wealth Individuals Taskforce, a comprehensive compliance program with the Australian Taxation Office. The objective of the audit was to examine and report on the management and operations of the taskforce. In doing so, the audit reviewed the Australian Taxation Office's own evaluation of the taskforce and assessed whether, and to what extent, the taskforce delivered the outcomes specified by the Government.

The audit was conducted as a joint financial statement and performance audit of HIC's IT systems. The objective of the financial statement component of the audit was to express an opinion on whether HIC could rely on its IT systems to support production of a reliable set of balances for the financial statements. The objective of the performance audit component was to determine whether HIC's IT systems' outputs met quality and service delivery targets.

This audit was a follow-on to Audit Report No.21 1997-98 Protective Security, which reviewed, among other things, information security other than computer and communications security, against the policy and procedures outlined in the 1991 PSM. That audit found inconsistencies in the identification and marking of classified information and weaknesses in the handling and storage of classified information, as well as other breakdowns impacting on information security.

The objective of the audit was to report to Parliament on the economy, efficiency and administrative effectiveness of the risk management process in the Small Business Income business line. It follows Audit Report No.37 1996-97 and entitled Risk Management - Australian Taxation Office. That audit focused on broad strategic issues relevant to risk management in the Australian Taxation Office (ATO) as a whole. This audit follows the issues identified in that report into the day-to-day management of the Small Business Income as an example of how risk management operates in a significant element of the ATO.

The objective of the audit was to assess whether the disposal of 'infrastructure, plant and equipment' assets was being carried out in accordance with Government policy, relevant aspects of the asset management principles, and applicable internal controls. The scope of the audit covered all aspects of the disposal process from initial planning through to the receipt of proceeds and evaluation of the outcome. The audit examined eight organisations, which are not named in the report.

The audit was undertaken in the Training and Youth Division TYD) of the Department of Education, Training and Youth Affairs. The objective of the audit was to determine whether the application of Business Processing Reengineering(BPR) principles would identify improvements to the business processes of the TYD. The TYD was used in this audit to illustrate the application of BPR as a tool for agencies to identify efficiencies and enhance program effectiveness.

The audit reviewed the fraud control arrangements in the Department of Family and Community Services (FaCS), a policy formulation, and advising body and major purchaser of social welfare services from Centrelink. The objective was to assess whether FaCS had:

- implemented appropriate fraud control arrangements in line with the Fraud Control Policy of the Commonwealth and that these arrangements operated effectively in practice; and

- fulfilled its responsibilities as a purchaser of services in relation to fraud control.

This audit is one in a series of fraud control audit and is complemented by a similar audit of Centrelink, a major provider of services on behalf of FaCS.