Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objectives of this performance audit were to provide assurance that there were effective measures in place to safeguard the national collections and that institutions had processes in place to provide access to them. The ANAO also examined the extent to which the national cultural institutions have implemented the eleven recommendations from the previous report, Safeguarding Our National Collections (Audit Report No.8 1998-99).

The objective of the audit was to assess the effectiveness of Industry Innovation and Science Australia's, the Department of Industry, Science, Energy and Resources', and the Australian Taxation Office's administration of the Research and Development Tax Incentive program.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the administration of the Australian Business Register.

Please direct enquiries relating to reports through our contact page.

The Senate Order of 20 June 2001, required all FMA agencies to list contracts over $100 000 on the Internet. FMA agencies were to indicate, amongst other things, whether the contracts contained provisions requiring the parties to maintain confidentiality of any of its provisions or whether any provisions of the contract were regarded by the parties as confidential. The Senate Order also requested the ANAO to conduct an examination of a number of such contracts, and indicate whether any inappropriate use of confidentiality provisions was detected in that examination. The Government agreed that agencies would comply with the spirit of the Order because it was committed to transparency of Commonwealth contracts. The Government also indicated that agencies' compliance with the Order would be progressive as agencies refine arrangements and processes to meet the requirements

The objective of the audit was to assess the effectiveness of the Australian Transaction Reports and Analysis Centre's (AUSTRAC) arrangements for processing financial intelligence, to assist domestic partner agencies and international counterparts in their operations and investigations.

Please direct enquiries relating to reports through our contact page.

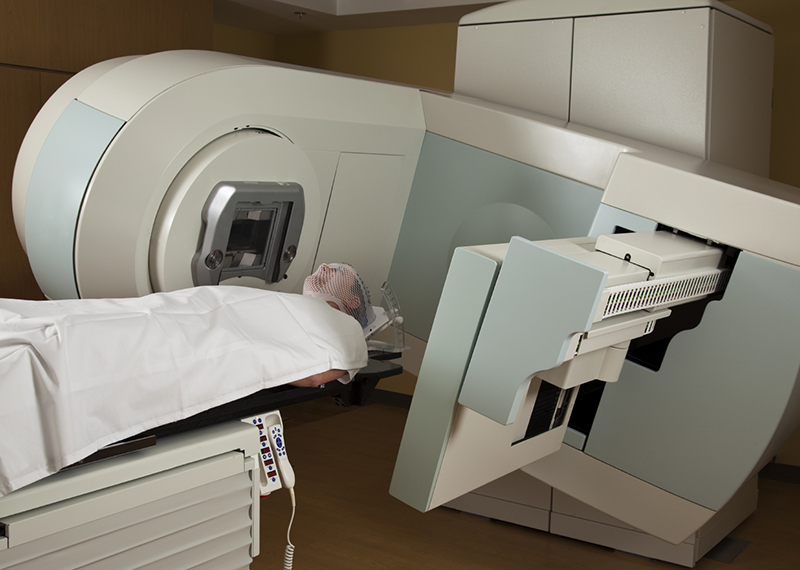

The audit objective was to assess the effectiveness of the Department of Health's and the Department of Human Services' administration of the Radiation Oncology Health Program Grants Scheme.

Please direct enquiries relating to reports through our contact page.

The Australian Customs Service (Customs) is responsible for managing the integrity of Australia's border. The Australian maritime border is the 200 nautical mile Exclusive Economic Zone (EEZ) around Australia's 37 000 kilometre coastline. The National Marine Unit (NMU) contributes to customs' Civil Maritime Surveillance and Response program. It has eight 35 - metre Bay Class vessels (known as Australian Customs Vessels or ACVs) that are capable of maintaining a strategic presence around the Australian coast. The audit examined the administrative effectiveness of the NMU's surveillance and response operations. Particular emphasis was given to the following areas:

- strategic and tactical taskings;

- crew operations;

- crew training;

- asset management; and

- governance arrangements.

The objective of the audit was to assess the effectiveness of the Department of Agriculture, Fisheries and Forestry’s administration of EC measures and the implementation of the pilot of new drought reform measures.

The objective of this audit was to assess whether selected regulatory entities effectively apply the cost recovery principles of the Australian Government’s cost recovery framework. The selected regulatory entities were the Department of Agriculture and Water Resources, the Australian Maritime Safety Authority, and the Department of Health (Therapeutic Goods Administration).

Please direct enquiries through our contact page.

The objective of the audit was to assess the ATO's strategies to address tax evasion in the cash economy, with emphasis on: the ATO's strategic focus; aspects of governance, management processes and compliance activities; and responses to the ANAO Report No.35 2001–02 ATO Progress in Addressing the Cash Economy.