Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Australian government entities and the Consolidated Financial Statements (CFS) of the Australian Government to provide Parliament an independent examination of the financial accounting and reporting of public sector entities. This report focuses on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2016–17 financial statements audits of 25 entities including all departments of state and a number of major Australian government entities.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Trade Commission’s administration of the Export Market Development Grants scheme, in providing incentives to small and medium Australian enterprises for the development of export markets.

Please direct enquiries relating to reports through our contact page.

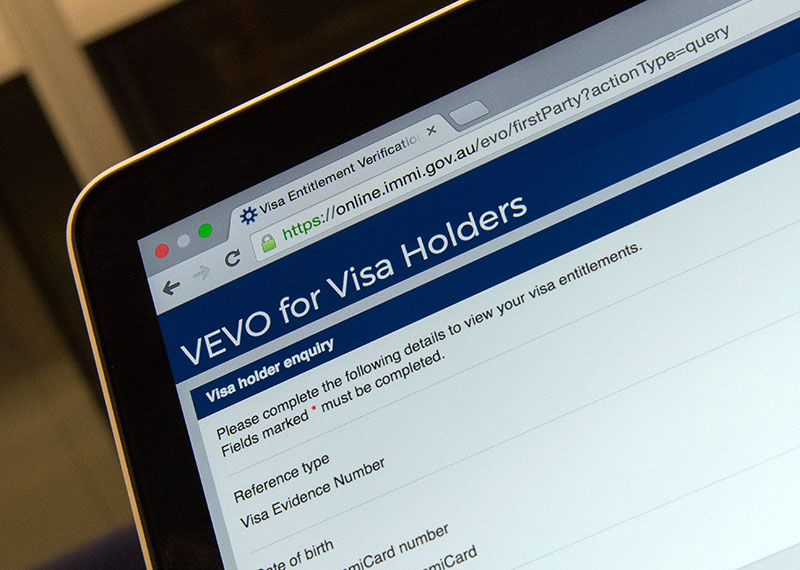

The objective of the audit was to assess the effectiveness of the Department of Immigration and Border Protection’s (DIBP) management of compliance with visa conditions. To form a conclusion against this objective, the ANAO assessed whether DIBP:

- effectively manages risk and intelligence related to visa holders’ non-compliance with their visa conditions;

- promotes voluntary compliance through targeted campaigns and services that are appropriate and accessible to the community;

- conducts onshore compliance activities that are effective and appropriately targeted; and

- has effective administrative arrangements to support visa holders’ compliance with their visa conditions.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether the National Disability Insurance Agency (NDIA) is effectively managing the use of corporate credit cards for official purposes in accordance with legislative and entity requirements.

Please direct enquiries through our contact page.

The Australian National Audit Office (ANAO) Corporate Plan is the ANAO’s key strategic planning document. It guides our operating environment and sets out how we will deliver on our purpose.

The Quality Assurance Framework and Plan complements the Corporate Plan. The ANAO Quality Assurance Framework is the system of quality control that the ANAO has established to provide the Auditor-General with reasonable assurance that the ANAO complies with the ANAO standards and applicable legal and regulatory requirements and reports issued by the ANAO are appropriate in the circumstances.

This Audit Quality Report demonstrates the ANAO assessment of the implementation and operating effectiveness of the elements of the ANAO Quality Assurance Framework. The report provides transparency in respect of the processes, policies, and procedures that support each element of the ANAO Quality Assurance Framework, and reports audit quality indicators measuring ANAO performance against target benchmarks.

This report also includes the achievement of the quality assurance strategy and deliverables set out in the Quality Assurance Framework and Plan 2020–21.

Please direct enquiries through our contact page.

The objective of the audit was to assess the ATO's administration of activity statement HRRs. Specifically the audit sought to: examine aspects of ATO governance relevant to its administration of activity statement HRRs. This includes: ATO planning, the integration between Lines to administer HRRs; corporate risk management processes; and performance management; assess the ATO's methodology and practice to identify and, if necessary, correct activity statement HRRs; and identify and assess the Information Technology (IT) and manual systems, processes and controls used by the ATO to process HRRs resulting from the lodgement of activity statements.

The objective of the audit was to assess the effectiveness of the transition of the Remote Jobs and Communities Programme to the Community Development Programme, including whether the Community Development Programme is well designed and administered effectively and efficiently.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the Australian National University’s governance and control framework.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Securities and Investments Commission’s administration of enforceable undertakings.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine the Department of Foreign Affairs and Trade’s (DFAT’s) achievement of value for money objectives in the delivery of Official Development Assistance (aid) through facility arrangements.

Please direct enquiries through our contact page.