Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of the audit was to assess whether the WHM programme is administered effectively and in accordance with relevant laws and policies. In particular, the ANAO focused on four key areas: the implementation of eWHM visa; authority for the WHM programme; decision-making for WHM visas; and programme performance information. A feature of the audit was the computer-aided scrutiny of over 300 000 visa application records to test DIMA's decision-making processes.

The objective of this report is to provide comprehensive information on the status of projects as reflected in the Project Data Summary Sheets (PDSSs) prepared by DMO, and a review by the ANAO.

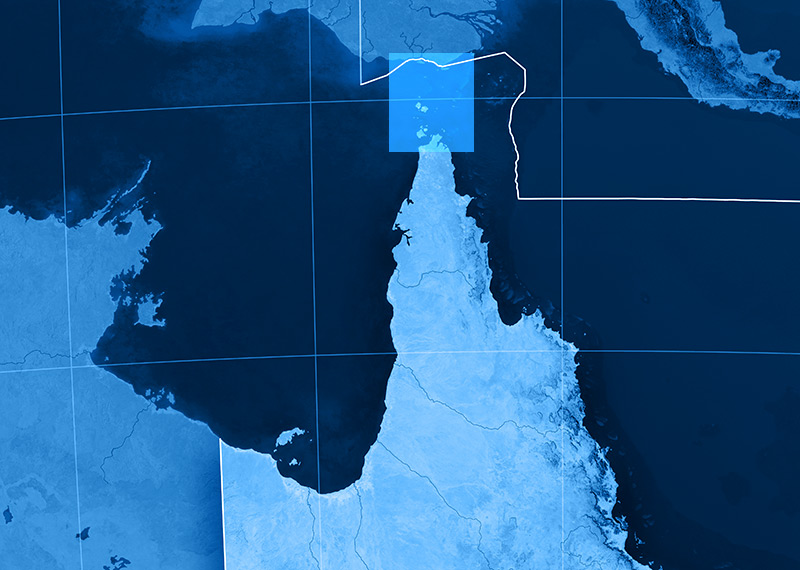

The objective of the audit was to assess the effectiveness of the Department of Agriculture, Fisheries and Forestry’s administration of the Northern Australia Quarantine Strategy. The ANAO examined whether the department had established effective:

- administrative and governance arrangements to support NAQS;

- processes for identifying biosecurity risks and conducting scientific activities to address identified risks;

- arrangements for managing the quarantine aspects of Torres Strait border movements; and

- public awareness activities that reflect identified biosecurity risks and support the program’s objectives.

The objective of the audit was to assess the effectiveness of the coordination arrangements of key Australian Government entities operating in Torres Strait.

Please direct enquiries through our contact page.

The objective of this follow-up audit was to examine the ATO's implementation of the 20 recommendations in: The Administration of Petroleum Excise Collections (Audit Report No.17, 2001(02); and The Administration of Tobacco Excise (Audit Report No. 55, 2001(02), having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations. The audit also aimed to identify scope for improvement in the ATO's administration of petroleum and tobacco excise. Follow-up audits are recognised as an important element of the accountability processes of Commonwealth administration. The Parliament looks to the Auditor-General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow-up audits keep the Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

The objective of the audit was to examine the effectiveness of the Australian Taxation Office’s use of settlements to resolve taxpayer disputes.

Please direct enquiries relating to reports through our contact page.

The objectives of the audit were to:

- determine the extent to which government entities complied with the requirement to publish and maintain documents online that were presented to the Parliament;

- evaluate selected government entities' policies and practices regarding online publishing; and

- assess AGIMO's policy and guidance in support of online publishing.

To address this objective the audit was conducted in three parts. Firstly, we reviewed a sample of papers tabled between 2000 and 2008 in order to assess their availability online. Next, we examined the online publishing practices of five government entities. These were the: Australian Federal Police (AFP); Department of the House of Representatives (DHR); Department of Infrastructure, Transport, Regional Development and Local Government (Infrastructure); Department of the Treasury (Treasury); and National Archives of Australia (NAA). Finally, we reviewed AGIMO's role in supporting government entities in their online publishing practices.

The audit focussed on performance information reporting by the submarine System Program Offices on reliability, safety systems and logistic support services. In the context of the sustainability arrangements, the audit considered combat system upgrades and personnel escape and rescue systems. Any arrangements that the Commonwealth may be considering regarding the potential sale of ASC were not within the scope of this audit.

Although the audit examined broader aspects of the ATO's administration (such as, tobacco excise governance arrangements, intelligence capability and compliance and investigations activities), we placed particular emphasis on the strategies used by the ATO to address the proliferation of chop-chop (Australian grown tobacco sold illicitly in a chopped up form for $80 to $100 per kilogram. In comparison, 50 grams of legal roll-you-own tobacco costs around $16 i.e. $320 per kilogram) in the Australian markets, as it is an area of major risk to tobacco excise revenue.

The audit reviewed the Defence Materiel Organisation's management of the $3.43 billion Wedgetail Airborne Early Warning and Control (AEW&C) project. The Wedgetail project is to provide the Australian Defence Force with an AEW&C capability based on four Boeing 737 AEW&C aircraft and associated supplies and logistic support. At the time of the audit the AEW&C systems were still in their early development phase, and by November 2003, Defence had spent $1.107 billion on the project.