Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

This page lists completed performance audit reports. View all performance audits in-progress.

The Senate Order of 20 June 2001, required all FMA agencies to list contracts over $100 000 on the Internet. FMA agencies were to indicate, amongst other things, whether the contracts contained provisions requiring the parties to maintain confidentiality of any of its provisions or whether any provisions of the contract were regarded by the parties as confidential. The Senate Order also requested the ANAO to conduct an examination of a number of such contracts, and indicate whether any inappropriate use of confidentiality provisions was detected in that examination. The Government agreed that agencies would comply with the spirit of the Order because it was committed to transparency of Commonwealth contracts. The Government also indicated that agencies' compliance with the Order would be progressive as agencies refine arrangements and processes to meet the requirements

The objectives in auditing the sale were to assess the extent to which the Government's sale objectives were achieved; review the efficiency of the management of the sale process; assess whether the sale arrangements adequately protected the Commonwealth's interests, including minimising ongoing Commonwealth risk; and identify principles of sound administrative practice to facilitate improved arrangements for future trade sales, particularly the later phases of airport sales.

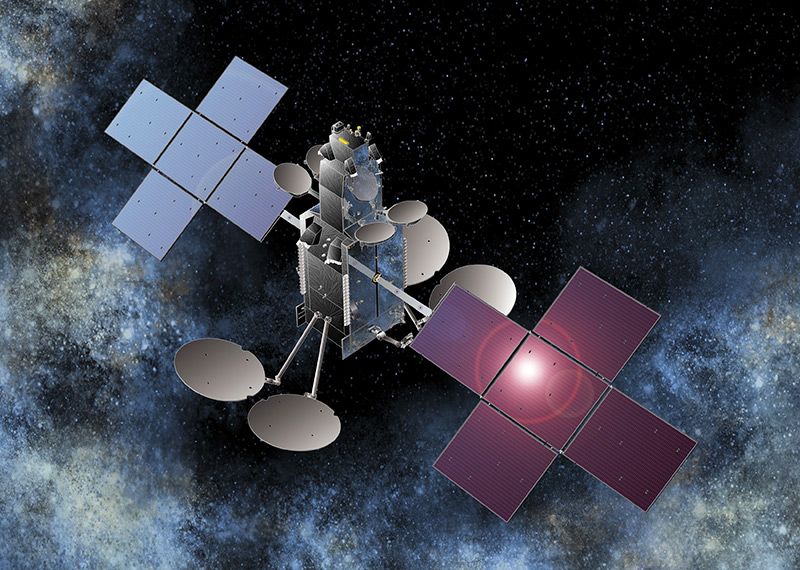

The audit objective was to assess whether nbn co limited effectively administered the National Broadband Network Satellite Support Scheme.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the National Health and Medical Research Council’s fraud control arrangements.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the National Disability Insurance Agency’s (NDIA’s) management of complaints.

Please direct enquiries through our contact page.

The audit objective is to assess the effectiveness of the Department of Defence's management of the Mulwala Redevelopment Project.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess progress in implementing the corporate plan requirement under the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether Tourism Australia’s procurement and contract management activities are complying with the Commonwealth Procurement Rules and demonstrating the achievement of value for money.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of the Department of Defence’s arrangements for the management of contractors.

Please direct enquiries through our contact page.

The objective of the audit was to assess the ATO's administration of the Surcharge. Specifically, the audit sought to: report on the environment into which the Surcharge was introduced, including the legislative intent behind the Surcharge, and the current Surcharge environment; examine and report on aspects of Surcharge governance; assess the systems, processes and controls the ATO uses to: match Member Contributions Statements (MCS) data with income tax return data using Tax File Numbers (TFNs); process Surcharge information; and issue Surcharge liability assessments. assess the mechanisms the ATO uses to assess, classify, manage and rectify existing Surcharge exceptions, and prevent future exceptions from occurring; and examine the mechanisms and strategies the ATO uses to provide assurance that members and holders of contributions are complying with their Surcharge obligations.