Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The parliamentary departments support the operation of the Parliament of Australia, its committees and members. There are four parliamentary entities: the Department of Parliamentary Services; the Department of the Senate; the Department of the House of Representatives; and the Parliamentary Budget Office.

The Department of Parliamentary Services (DPS) is responsible for supporting the operation of the Parliament through the provision of a range of services, including library, research, Hansard, broadcasting, Information, Communication & Technology (ICT) services, physical and cyber security services, visitor services, catering, and building and landscape management. The departments of the House of Representatives and Senate support and provide advice to their respective chambers and parliamentary committees. The Parliamentary Budget Office is responsible for providing independent analysis of the budget cycle, fiscal policy and the financial implications of proposals. Further information about the parliamentary entities is available from the Parliament of Australia’s website.

In the 2025–26 Portfolio Budget Statements (PBS) for the parliamentary departments, the aggregated budgeted expenses for 2025–26 total $351.9 million. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

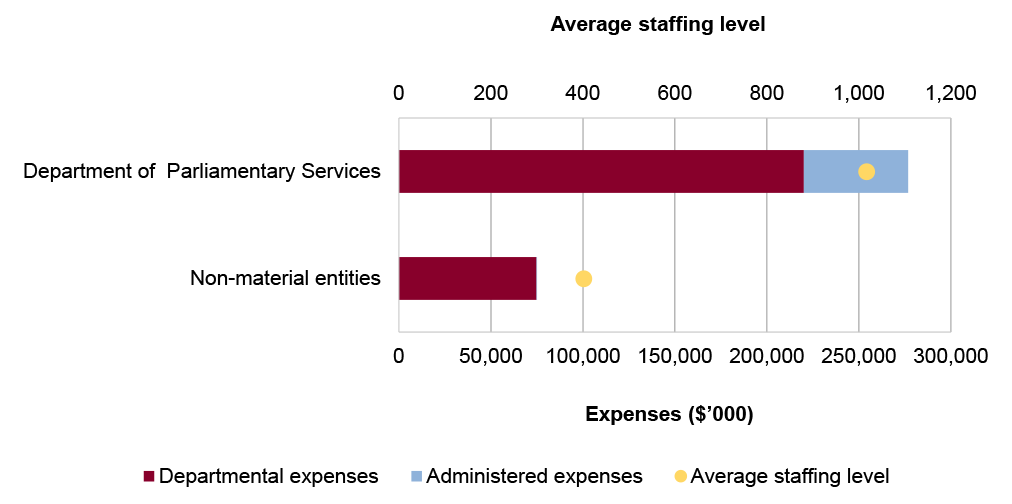

The level of budgeted departmental and administered expenses, and the average staffing levels for entities in the GGS within the parliamentary departments are shown in Figure 1. DPS represents the largest proportion of the parliamentary departments’ expenses, and departmental expenses of the parliamentary departments are the most material component, representing 84 per cent of the entire parliamentary departments’ expenses.

Figure 1: Parliamentary Departments – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 annual audit work program (AAWP), the Australian National Audit Office (ANAO) considers prior-year audit and other review findings to indicate the portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments and/or changes in the operating environment.

The primary risk identified relates to appropriate asset management arrangements and workplace health and safety to support effective delivery of services at Parliament House.

Specific risks in the parliamentary departments relate to service delivery, procurement, and asset management and sustainment.

Service delivery

The parliamentary departments are responsible for providing advisory and support services, including administrative, physical and cyber security services, building and grounds services, ICT products and services, physical and cyber security services, budget and costing services, library and research services and visitor services, to the Australian Parliament and parliamentarians. Service delivery arrangements should be fit for purpose and appropriately designed to reflect the desired outcomes of the arrangements. This includes establishing appropriate governance arrangements, addressing risks, providing accurate and consistent advice, implementing processes in accordance with applicable procedures, and establishing fit-for-purpose assurance and evaluation frameworks.

Procurement

The parliamentary departments are responsible for supporting the function of the Australian Parliament, which includes procurement activities to maintain property and provide services to parliamentarians. A risk for parliamentary departments is achieving value for money in accordance with the Commonwealth Procurement Rules and ensuring processes and practices comply with associated finance laws.

Asset management and sustainment

Effective management of assets at Parliament House involves ensuring a safe and secure environment while maintaining accessibility to parliamentarians, building occupants and visitors. Ongoing considerations for the parliamentary departments include effective risk management, especially in relation to physical, information and personnel security, and appropriate contract management and workforce planning.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 the parliamentary departments were included in one performance audit. The conclusion for this audit was largely positive.

Figure 2 shows the number of audit conclusions for the parliamentary departments that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 and 2024–25: Parliamentary Departments compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity.

From the ANAO performance audits between 2020-21 and 2024-25, one service delivery audit activity was tabled with the conclusion that it was qualified (largely positive).

Performance statements audit

The audit of the 2024-25 Department of Parliamentary Services (DPS) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DPS is in its first year of inclusion in the annual performance statements audit program.

The ANAO considers the risk associated with DPS’ performance statements audit as low. This is due to:

- A non-complex environment in relation to performance reporting;

- Centralised preparation process for the performance statements;

- Senior executive engagement in the development of performance measures and annual sign-off accountability; and

- Review of progress against performance measures during the reporting year.

Key risks for DPS’ performance statements that the ANAO has highlighted include:

- DPS’ framework to plan and report its performance;

- The completeness of DPS’ performance measures and accompanying narrative analysis;

- The appropriateness of some performance measures; and

- DPS’ performance statements preparation processes, including the maintenance of records that explain its performance information and the availability of data source to support appropriate reporting.

Financial statement audits

Overview

Entities within the parliamentary departments, and the risk profile of each entity, are shown in Table 1.

Table 1: Parliamentary Departments entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Parliamentary Services |

Non-corporate |

Low |

1 |

0 |

|

Non-material entities |

||||

|

Department of the House of Representatives |

Non-corporate |

Low |

|

|

|

Department of the Senate |

Non-corporate |

Low |

||

|

Parliamentary Budget Office |

Non-corporate |

Low |

||

Material entities

Department of Parliamentary Services

The Department of Parliamentary Services (DPS) is responsible for supporting the Parliament through the provision of a range of services, including library, research, Hansard, broadcasting, Information, Communication & Technology, physical and cyber security services, visitor services, catering, and building and landscape management.

DPS’s total budgeted assets for 2025–26 are $3.4 billion, with land and buildings representing 88 per cent of the department’s total budgeted assets, as shown in Figure 4.

Figure 3: Department of Parliamentary Services’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The key risk for DPS’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, and that the ANAO considers a potential key audit matter (KAM), is the valuation of Parliament House. The significant value and the unique nature of Parliament House increases the judgement required and associated risk of accurately estimating the fair value. (KAM – Valuation of Parliament House)