Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Domestic and International Travel Requirements in Services Australia

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- In 2024–25, $953 million was spent on travel through the Whole of Australian Government Travel Arrangements (the WoAG Arrangements). All non-corporate Commonwealth entities must comply with the WoAG Arrangements.

- The approach of an entity to official travel can reflect whether staff within the entity are behaving with integrity.

- The audit was conducted to provide assurance to the Parliament as to whether Services Australia has effective arrangements to comply with domestic and international travel requirements.

Key facts

- Services Australia is a non-corporate Commonwealth entity and must comply with all elements of the WoAG Arrangements.

- The Department of Finance manages the WoAG Arrangements.

What did we find?

- Services Australia’s arrangements for compliance with domestic and international travel requirements were effective.

- Services Australia has appropriate arrangements for managing domestic and international travel in accordance with WoAG requirements.

- Services Australia has implemented largely effective controls for official travel.

What did we recommend?

- There was one recommendation to Services Australia to monitor its purchases of airline memberships for officials to ensure value for money.

- Services Australia agreed to the recommendation.

995

number of Services Australia officials with domestic travel plans between 1 July 2022 and 30 June 2025.

$30.5m

spent by Services Australia officials on domestic and international travel in 2024–25.

457

airline lounge membership purchases, including renewals, for Services Australia officials between 1 July 2022 and 30 June 2025.

Summary and recommendations

Background

1. Staff in Australian Government entities undertake domestic and international travel for the purpose of achieving the objectives of the entity. The Whole of Australian Government Travel Arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance. The WoAG Arrangements encompass five components: book; fly; stay; drive; and pay. The WoAG Arrangements are supported by resource management guides outlining the Australian Government policies for domestic and international air travel.

2. All non-corporate Commonwealth entities must comply with all elements of the WoAG Arrangements. Corporate Commonwealth entities and Commonwealth companies may elect to use some or all the arrangements. As a non-corporate Commonwealth entity, Services Australia must comply with the WoAG Arrangements.

Rationale for undertaking the audit

3. In 2024–25, $953 million was spent on travel through the WoAG Arrangements and Services Australia reported spending $30.5 million on travel. The purpose of the whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity by meeting the intent of the WoAG Arrangements. There has been parliamentary and public interest in relation to government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether Services Australia has effective arrangements to comply with domestic and international travel requirements.

4. This audit is part of a series of domestic and international travel compliance audits. The entities included in the ANAO’s travel compliance series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; Civil Aviation Safety Authority; Australian Criminal Intelligence Commission; and Services Australia.

Audit objective and criteria

5. The objective of the audit was to assess whether Services Australia has effective arrangements to comply with domestic and international travel requirements.

6. To form a conclusion against the objective, the ANAO adopted two high-level audit criteria.

- Did Services Australia develop appropriate arrangements to manage domestic and international travel in accordance with whole of Australian Government requirements?

- Did Services Australia implement effective controls and processes for domestic and international travel in accordance with its policies and procedures?

Conclusion

7. Services Australia has effective arrangements in place to comply with domestic and international travel requirements except for aspects of its monitoring and review of travel-related data. The agency could strengthen its monitoring and review, including of its airfare selections and airline lounge membership purchases, to identify related potential or emerging risks or improvement opportunities.

8. Services Australia has established appropriate arrangements for managing domestic and international travel in accordance with the WoAG Arrangements. The agency has policies and procedures that align with the WoAG Arrangements. Training relating to official travel is provided on an on-the-job basis to relevant staff. There is a wide range of guidance on official travel and helpdesk support available to staff to assist in promoting compliance.

9. Services Australia was largely effective in implementing controls and processes for domestic and international travel in accordance with its policies and procedures. Officials consistently selected the lowest practical fare for domestic travel and international best fare for overseas travel. Trips were not consistently acquitted on time — from a sample reviewed by the ANAO, 79 per cent of domestic trips and 67 per cent of international trips were acquitted on time. The agency had limited processes to support compliance with airline loyalty and lounge program arrangements. Airline lounge membership purchases for non-Senior Executive Service (SES) staff were not always supported by documented approvals showing consideration of a significant need for travel. The agency has processes to identify and respond to non-compliance, implemented across two separate teams and collects data about non-compliance but does not analyse it to inform continuous improvement initiatives.

Supporting findings

Arrangements for managing domestic and international travel

10. Services Australia has developed policies and procedures for domestic and international official travel that align with the WoAG Arrangements. Services Australia has identified an integrity-related enterprise risk that it has rated as ‘medium’ and within tolerance. The agency also identified an enterprise fraud risk involving five travel controls — it advised the ANAO in December 2025 that it had revised its control effectiveness ratings and rated four controls fully effective (relating to policies, procedures and compliance assessments) and one partially effective (IT system controls). (See paragraphs 2.2 to 2.21)

11. Services Australia requires all officials to complete mandatory training on the duties and responsibilities of officials under the Public Governance, Performance and Accountability Act 2013 (the PGPA Act), including on the appropriate use of public resources. This mandatory training largely does not cover travel — two courses include travel-related content for SES and non-SES staff. Most learning for travel bookers takes place on-the-job — the agency does not deliver a travel-specific training module. Services Australia has a range of travel policy, procedures and supporting detailed guidance documents available for staff on its intranet. Guidance did not consistently present steps from a traveller’s perspective. Further support is available through a helpdesk provided by the agency’s Travel Services team, and from a virtual travel network for agency staff. (See paragraphs 2.22 to 2.40)

Controls and processes for managing domestic and international travel

12. Services Australia has implemented controls for domestic travel across planning and approval, booking and acquittal of expenses. Officials may not approve their own travel and approval by a financial delegate is required to be recorded in the agency’s IT system, ESS, prior to travel. The ANAO reviewed a random sample of 73 domestic trips and found 86 per cent had a record in ESS of approval prior to travel. In relation to air travel, Services Australia officials consistently selected the lowest practical fare, in compliance with the Whole of Australian Government (WoAG) travel policy — the lowest fare was selected for 33 per cent of trips. A Travel Allowance, for meals and incidentals, is payable after a trip has been approved in ESS. Most domestic trips (73 per cent) were appropriately acquitted. (See paragraphs 3.3 to 3.37)

13. Services Australia has implemented controls for international travel. Between July 2022 and June 2025, agency staff undertook 64 official international trips. The Travel Services team centrally manages all international arrangements, including bookings and acquittals. Approval for one of 13 international trips reviewed by the ANAO was not supported by evidence, as required by Services Australia’s Travel Policy. All 13 international flights were booked using the International Best Fare, consistent with the WoAG travel policy. A Travel Allowance is payable to staff during official travel, and while overseas this is payable at a higher rate than for domestic travel. The Travel Allowance is manually calculated and was correct for 12 of the 13 international trips the ANAO reviewed. Acquittals were not consistently completed within the required 28 days or supported by complete documentation. (See paragraphs 3.38 to 3.60)

14. Services Australia does not collect information on officials’ memberships of airline loyalty programs. The agency does not assess whether officials are being influenced by preferences for airlines, lounge, reward or loyalty programs when planning and undertaking official travel. Under Services Australia’s gifts and benefits policy, officers are required to declare gifted airline lounge memberships and upgrades due to status credits accrued from official travel, within 28 days — the median time for reporting these gifts and benefits was 42 days. Approval for purchases of lounge memberships for non-SES officials was not consistently recorded and did not always reflect consideration of a significant need for travel. (See paragraphs 3.61 to 3.77)

15. Services Australia has processes in place to identify and respond to non-compliance, implemented across two separate teams. The agency collects data about non-compliance but does not analyse it to inform continuous improvement initiatives. A 2023 assessment of Services Australia’s fraud controls for official travel resulted in five recommendations to improve some of the agency’s processes. Services Australia has since implemented four of these recommendations and advised the ANAO that the fifth is no longer required. (See paragraphs 3.78 to 3.101)

16. Reporting of non-compliance with finance law, including section 23 of the PGPA Act, is provided to Services Australia’s Audit and Risk Committee, and contains information on official travel. More detailed official travel compliance reporting was limited to the Payroll and Corporate Operations Branch until January 2025, after which all non-compliance was recorded in Services Australia’s Financial Management Compliance System. Public reporting on official travel includes responses to Questions on Notice which have not always been timely. (See paragraphs 3.102 to 3.116)

Recommendation

Recommendation no. 1

Paragraph 3.70

Services Australia monitor, on a risk basis, that its purchases of airline memberships are in accordance with its policy and represent value for money.

Services Australia response: Agreed.

Summary of entity response

17. The proposed audit report was provided to Services Australia. Services Australia’s summary response is provided below. The full response from Services Australia is at Appendix 1. Improvements observed by the ANAO during the course of the audit are listed in Appendix 2.

Services Australia

Services Australia (the Agency) welcomes the report and notes the findings, including:

- The Agency’s arrangements for compliance with domestic and international travel requirements were effective

- The Agency has appropriate arrangements for managing travel in accordance with whole of Australian Government requirements; and

- The Agency was largely effective in implementing controls and processes for travel in accordance with its policies and procedures.

The Agency also acknowledges the one recommendation aimed at strengthening the monitoring of airline membership purchases to ensure they are in accordance with the Agency’s policy and represent value for money.

The Agency is committed to continually improving its compliance with domestic and international travel requirements and support our staff to ensure adherence with obligations.

The Agency would like to thank the ANAO for its cooperative and professional approach throughout the audit process.

Key messages from this audit for all Australian Government entities

18. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Staff in Australian Government entities undertake domestic and international travel for the purpose of achieving the objectives of the entity. Official travel is:

any travel where a Commonwealth entity is ultimately responsible for any of the direct or indirect costs associated with that travel … This includes travel by officials, contractors and consultants to undertake work duties at the direction of the employer to achieve one or more Commonwealth objectives.1

Australian Government framework for travel

1.2 The Commonwealth resource management framework governs how Australian Government entities use and manage public resources. The foundation of the framework is the Public Governance, Performance and Accountability Act 2013 (the PGPA Act). Under the PGPA Act, accountable authorities are required to promote the proper use and management of public resources.2

1.3 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance under section 105B of the PGPA Act. Compliance with the CPRs is mandatory for officials of non-corporate Commonwealth entities (NCEs). The CPRs require NCEs to use coordinated procurements where they exist.3 The Whole of Australian Government Travel Arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance (Finance). All NCEs must comply with all elements of the WoAG Arrangements.4 Corporate Commonwealth entities (CCEs) and Commonwealth companies may elect to use some or all of the arrangements.

1.4 Finance has published model accountable authority instructions (AAIs), which include model instructions for official travel (see Box 1).5

|

Box 1: Model accountable authority instructions for official travel — non-corporate Commonwealth entities |

|

You must:

Where the government has established coordinated procurements for a particular travel activity, you must use the arrangement established for that activity, unless:

You must:

|

Whole of Australian Government Travel Arrangements

1.5 The WoAG Arrangements commenced in 2010 and aim to:

- reduce travel costs by aggregating government buying power to secure competitive pricing and discounts;

- decrease administrative costs for suppliers and entities by removing procurement duplication;

- simplify processes by integrating technology, unifying pricing and aligning systems;

- optimise savings by promoting efficient booking behaviour and value for money choices; and

- support Australian Government policies.6

1.6 The WoAG Arrangements encompass five components as outlined in Table 1.1.

Table 1.1: Whole of Australian Government Travel Arrangements — services and suppliers, July 2025

|

Component |

Services |

Suppliers (as at November 2025) |

|

Booka |

|

Corporate Travel Management (CTM) |

|

Flyc |

|

Panel of 18 airlines

|

|

Staya |

|

CTM |

|

Drivee |

|

Hertz |

|

Payf |

|

National Australia Bank (NAB) |

Note a: Standing Offer Notice ID SON3979293, available from https://www.tenders.gov.au/Son/Show/b3e4c6ad-ab57-4d46-a3c6-d0ce7b083ac7 [accessed 30 June 2025].

Note b: The supplier of Travel Management Services is known as the Travel Management Company (TMC).

Note c: Standing Offer Notice ID SON3337469, available from https://www.tenders.gov.au/Son/Show/606ca6fd-c615-d94c-905e-491969f2a3ba [accessed 30 June 2025].

Note d: Given the panel is not exclusive, entities are permitted to book both domestic and international air travel with non-panel airlines. Domestic flights and international flights departing Australia must be booked through the TMS.

Note e: Standing Offer Notice ID SON35277487, available from https://www.tenders.gov.au/Son/Show/1545a9af-e0d4-bab4-60d4-e03aed0558db [accessed 30 June 2025].

Note f: Standing Offer Notice ID SON3637640, available from https://www.tenders.gov.au/Son/Show/ad2d8b17-c42e-4601-a757-72568eafa384 [accessed 30 June 2025].

Note g: A lodge card is the digital number stored in the Travel Management Services supplier user profile.

Source: Department of Finance, Whole of Australian Government Travel Arrangements, About the Travel Arrangements and Department of Finance, Whole of Australian Government Procurement.

Lowest Practical Fare

1.7 The WoAG Arrangements are supported by resource management guides (RMGs) outlining the Australian Government policies for domestic and international air travel. The policies require travellers to select the ‘Lowest Practical Fare’ (LPF) for domestic flights and the ‘International Best Fare’ (IBF) for international flights.

- The LPF is ‘the lowest fare available at the time the travel is booked on a regular service (not a charter flight), that suits the practical business needs of the traveller’.7

- The IBF is ‘the lowest fare on the day the travel is booked on a regular scheduled service (not a charter flight), that suits the practical business needs of the traveller and maximises overall value for money for the total cost of the trip’.8

1.8 The LPF and IBF policies allow officials to book flights which are not the lowest (cheapest) fare. Officials select a booking code to explain why the lowest fare has not been chosen (see Table 1.2). Booking codes 1 to 6 are compliant with LPF and IBF policies. If flights are not compliant, then code 7 (‘Outside of LPF policy’) is to be used.

Table 1.2: Policy booking codes for Lowest Practical Fare and International Best Fare

|

Policy booking code |

Requirement |

|

|

1 |

Lowest fare |

Domestic: This is the cheapest available fare taking into account the one-hour window.a International: This is the cheapest fare taking into account the 24-hour booking window.b |

|

2 |

Timing, routing, connection or baggage charges |

Domestic: Where the fare selected is not the lowest fare because it:

International: Where the fare selected is not the lowest fare because it:

|

|

3 |

Approval/entitlement to travel at a higher fare class |

Domestic: All air travel is to be at the lowest practical fare in economy class unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the lowest practical fare within the entitlement. International: All air travel is to be at the international best fare in the appropriate classc (having regard to internal travel policy) unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the international best fare within the entitlement. |

|

4 |

Health issues |

Health issues for officials requiring certain facilities. A medical certificate is required to support use of this code. |

|

5 |

Personal responsibilities |

Impact on personal responsibilities such as family. |

|

6 |

Require flexibility to change booking |

Where flexibility is required for air travel, travel bookers must consider selecting a semi-flexible fare type instead of a fully flexible fare. |

|

7 |

Outside of LPF policy |

Preference for particular aircraft or airlines, availability of access to airline lounges, accumulation of airline benefits such as reward or loyalty points (including status credits). |

Note a: According to RMG 404 – Domestic Travel Policy, the one hour ‘time window’ is used by the TMS supplier to ‘monitor whether the lowest practical fare has been selected and assess potential missed savings … For outbound flights, the window commences 1 hour prior to the booked flight … For inbound flights, the window commences 1 hour after the booked flight’.

Note b: According to RMG 405 – Official International Travel – Use of the best fare of the day, the TMS supplier ‘applies the 24-hour window to the booked flight time from the point of departure to monitor whether the international best fare has been selected.’

Note c: RMG 405 – Official International Travel – Use of the best fare of the day requires officials to select ‘business class or equivalent or lower class airfare’.

Source: RMG 404 – Domestic Travel Policy and RMG 405 – Official International Travel – Use of the best fare of the day.

1.9 The RMGs set out additional guidance for travellers and approvers. Two key considerations for officials undertaking and approving travel are value for money and necessity of travel.9

- Value for money requires ‘the use of Commonwealth resources in an efficient, effective, economical and ethical manner that is consistent with the policies of the Commonwealth … Accordingly, when booking travel, officials must make decisions based on impartial consideration of fares available …’

- Delegates, in approving official travel, ‘must be satisfied there is a demonstrated business need for the travel’ and that ‘air travel must only be undertaken where other communication tools, such as teleconferencing and videoconferencing, are ineffective’.

Review of travel purchasing policies

1.10 In August 2024, the Australian Government published the Aviation White Paper to set out the ‘Australian Government’s vision for Australia’s aviation sector towards 2050 to ensure it remains safe, competitive, productive and sustainable.’ The White Paper contains 56 new policy initiatives. Under the banner of a ‘competitive and efficient aviation sector’, Initiative 17 is:

Review government travel purchasing policies to consider whether changed policy settings could better support competition. The Department of Finance will conduct the review in 2024.10

1.11 Finance finalised the ‘Review of Australian Government Travel Policies’ in December 2024.11 The review made seven recommendations.

- Publish WoAG Travel Arrangements usage and expenditure.

- Update policy to explicitly deal with flight upgrades.

- Return to market for a full re-tender of the Airline Panel following consultation with the market on the approach to status credits.

- Create one Government Travel Policy, including mandating economy class for flights under three hours, enhanced guidance on gifts and benefits and setting a two-year review period.

- Booking codes for best value fare to be updated to include a justification for selecting the booking code for delegate consideration.

- Work with the contracted TMS to improve services.

- Remove the requirement for accountable authorities to seek Ministerial approval for international travel over a certain threshold.

1.12 The Australian Government’s response to the recommendations is detailed in the ‘Review of Australian Government Travel Policies – What We’re Doing’, which stated ‘the Review found that the travel policies are generally fit for purpose and deliver significant savings for government.’12 Finance published the review and response on its website on 1 August 2025.

Airline loyalty programs

1.13 Airline loyalty programs (also known as frequent flyer programs) are customer loyalty schemes. According to the Australian Competition and Consumer Commission, customer loyalty schemes offer points or discounts with the purpose of increasing repeat business. There are two types of points offered by Australian airlines through their airline loyalty programs.13

- Reward points (also known as frequent flyer points) are awarded to travellers who are members of the airline’s loyalty program for certain flights.

- Status credits are also awarded to members of the airline’s loyalty program on certain flights and contribute to the tier status of a loyalty program membership (for example silver or gold).

1.14 Reward points and status credits can only be accrued by travellers who are members of an airline’s loyalty program. Since commencement of the WoAG Arrangements in 2010, government policy prohibits the accrual of reward points for official travel. The accrual of status credits is permitted for official travel.

Airline lounge access

1.15 Membership of an airline lounge is separate to membership of an airline loyalty program and membership to a loyalty program does not in itself provide access to airline lounges. Membership of an airline lounge alone does not entitle members to accrue reward points or status credits. Access to airline lounges is available to travellers based on the class of travel, i.e. business and first class.

1.16 Airline lounges can be accessed by officials who have purchased a membership. Both Qantas and Virgin Australia offer discounted lounge memberships as part of the WoAG Arrangements to Commonwealth officials. The discount is available if the entity purchases a membership for an official or if the official purchases it themselves in a personal capacity.

1.17 Qantas’ Chairman’s Lounge and Virgin Australia’s Beyond are by invitation-only memberships that provide access to premium airline lounges. Qantas and Virgin Australia may gift memberships of airline lounges, including invitation-only lounges, to senior officials. The Australian Public Service Commission (APSC) requires the annual reporting of gifted airline lounge memberships by agency heads.14

Services Australia

1.18 Services Australia (the agency) is an Australian Government agency that ‘supports Australians by efficiently delivering high-quality, accessible services and payments on behalf on the government.’15 These services include Medicare, Centrelink, Child Support and myGov. The Chief Executive Officer is the accountable authority for the purposes of the PGPA Act and the agency head for the purposes of the Public Service Act 1999. Services Australia is an NCE and it must comply with all elements of the WoAG Arrangements.

1.19 Official travel within Services Australia is arranged on a ‘self-service’ model for domestic trips, with bookings made either directly by travellers, or with the help of one of the agency’s 517 travel coordinators (often Executive Assistants). A central Travel Services team, within the Payroll and Corporate Operations Branch, is available to provide support, including a helpdesk. The Travel Services team also manages all international trip bookings. Every trip is required to be recorded in the agency’s IT system, SAP Essentials (ESS), which generates a unique trip number to assist the Travel Services team with monitoring trips and reconciling expenses.

1.20 In 2024–25 Services Australia’s total resourcing was $9.9 billion, departmental resourcing was $5.9 billion, and the average staffing level was 30,218. In 2024–25, Services Australia reported its expenditure on travel as $30.5 million, compared to $21.7 million in 2023–24 and $17.4 million in 2022–23. The agency is within the top ten of reported travel expenditure by NCEs in 2024–25.

1.21 Services Australia’s records indicate that between 1 July 2022 and 30 June 2025, nearly 1,000 officials planned over 42,000 official domestic trips16, with an average trip cost of $1,700. Over the same period, 48 officials completed 64 international trips, with an average trip cost of $12,500.

Previous ANAO audit coverage

1.22 Previous ANAO audits have identified issues in other entities with credit cards and travel. In 2023–24, the ANAO conducted a series of audits assessing compliance with corporate credit card requirements.17 These reports identified:

- positional authority risks with expenditure on travel and credit cards being approved by officials junior to the traveller;

- approval of travel not being provided prior to travel being undertaken; and

- failure to identify, record or respond to instances of non-compliance with travel requirements.

1.23 This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; Civil Aviation Safety Authority; Australian Criminal Intelligence Commission; and Services Australia.

Rationale for undertaking the audit

1.24 In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity by meeting the intent of the WoAG travel framework. There has been parliamentary and public interest in relation to government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether Services Australia has effective arrangements to comply with domestic and international travel requirements.

Audit approach

Audit objective, criteria and scope

1.25 The objective of the audit was to assess whether Services Australia has effective arrangements to comply with domestic and international travel requirements.

1.26 To form a conclusion against the objective, the ANAO adopted two high-level audit criteria.

- Did Services Australia develop appropriate arrangements to manage domestic and international travel in accordance with whole of Australian Government requirements?

- Did Services Australia implement effective controls and processes for domestic and international travel in accordance with its policies and procedures?

1.27 The audit examined the management of domestic and international travel by Services Australia officials from 1 July 2022 to 30 June 2025.

Audit methodology

1.28 To address the audit objective, the audit methodology included:

- reviewing legislative, policy and internal frameworks;

- examining Services Australia’s policies, procedures, travel management systems, assurance and reporting activities;

- meeting with Services Australia officials;

- testing the effectiveness of Services Australia’s control framework for travel; and

- analysing travel data from Services Australia’s systems and entity-level data from the WoAG travel management system.

1.29 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $363,555.

1.30 The team members for this audit were Barbara Das, Sonya Carter, Tim Fuller, Scott Lang, Steven Meyer, Danielle Page and Corinne Horton.

2. Arrangements for managing domestic and international travel

Areas examined

This chapter examines whether Services Australia (the agency) has appropriate arrangements in place to manage domestic and international travel in accordance with the Whole of Australian Government Travel Arrangements (WoAG Arrangements).

Conclusion

Services Australia has established appropriate arrangements for managing domestic and international travel in accordance with the WoAG Arrangements. The agency has policies and procedures that align with the WoAG Arrangements. Training relating to official travel is provided on an on-the-job basis to relevant staff. There is a wide range of guidance on official travel and helpdesk support available to staff to assist in promoting compliance.

Area for improvement

The ANAO suggested Services Australia could review its range of travel guidance to ensure it covers the process from a traveller’s perspective.

2.1 Entities need to establish arrangements for managing official travel in line with the requirements of the WoAG Arrangements. Entity policies and procedural guidance, as well as training, should be available, fit for purpose and easily accessible. Entity arrangements should be informed by an assessment of entity-specific risks.

Has Services Australia developed appropriate policies and procedures for domestic and international travel?

Services Australia has developed policies and procedures for domestic and international official travel that align with the WoAG Arrangements. Services Australia has identified an integrity-related enterprise risk that it has rated as ‘medium’ and within tolerance. The agency also identified an enterprise fraud risk involving five travel controls — it advised the ANAO in December 2025 that it had revised its control effectiveness ratings and rated four controls fully effective (relating to policies, procedures and compliance assessments) and one partially effective (IT system controls).

Framework for official travel

2.2 Services Australia’s framework for managing domestic and international travel is established through its:

- Accountable Authority Instructions (AAIs);

- Public Governance, Performance and Accountability (PGPA) Act 2013 (Chief Executive Officer, Services Australia) Delegation 2022;

- Services Australia Enterprise Agreement 2024–202718; and

- collective policy documents including a Travel Policy, Domestic Travel Procedure, International Travel Procedure, Travel Compliance Framework, Commonwealth Credit Card Policy and Gifts and Benefits Policy.

Accountable Authority Instructions

2.3 Services Australia’s AAIs, effective 31 January 2025, set out the Chief Executive Officer’s (CEO’s) instructions related to official travel:

Official travel is any travel where a Commonwealth entity is ultimately responsible for any of the direct or indirect costs associated with that travel (noting the exceptions for using the coordinated travel procurements). This includes travel by officials, contractors and consultants to undertake work duties, at the direction of the employer, to achieve one or more Commonwealth objectives.

Official travel should only be undertaken when there is a demonstrated business need and when other communication tools, such as teleconferencing and videoconferencing, are an ineffective option.

Arrangements for the purpose of official travel will generally be entered into under section 23 of the PGPA Act.

2.4 The Official Travel section of Services Australia’s AAIs is consistent with model AAIs issued by the Department of Finance. Three prior versions of the AAIs were in place between 1 July 2022 and 30 June 2025 — all versions issued reflected the model AAIs’ official travel content.

2.5 Services Australia’s AAIs include instructions for approval of travel and reflect the WoAG travel requirements to apply the Commonwealth Procurement Rules, use established coordinated procurement arrangements and not accrue reward or loyalty points.19 The AAIs include links to Services Australia’s various travel policy documents, contact information for the Travel Services team and related Australian Government guidance for the WoAG Arrangements.

PGPA Act 2013 (Chief Executive Officer, Services Australia) Delegation 2025

2.6 The PGPA Act 2013 (Chief Executive Officer, Services Australia) Delegation, dated 31 January 2025 establishes delegations in line with subsection 23(3) of the PGPA Act for the power to approve expenditure for procurements.20

Services Australia Enterprise Agreement 2024–27

2.7 Services Australia’s Enterprise Agreement for 2024–27 includes provisions for work-related travel, including a Travel Allowance to cover officials’ meals and incidentals. Additional expenses incurred due to the travel may be reimbursed with supporting evidence. For official international travel, the enterprise agreement states Services Australia ‘will meet reasonable costs of accommodation, meals and incidentals incurred on official travel overseas, either through the provision of a Corporate Credit Card or by payment of relevant components of a daily travel allowance …’.21

Travel policy

Domestic travel

2.8 Services Australia’s domestic travel policy is set out in its Travel Policy and detailed in the Domestic Travel Procedure. Between 1 July 2022 and 30 June 2025, an earlier version of the Travel Policy applied until it was reviewed in June 2024.22 The Domestic Travel Procedure issued in July 2021 was reviewed and updated in March 2025.

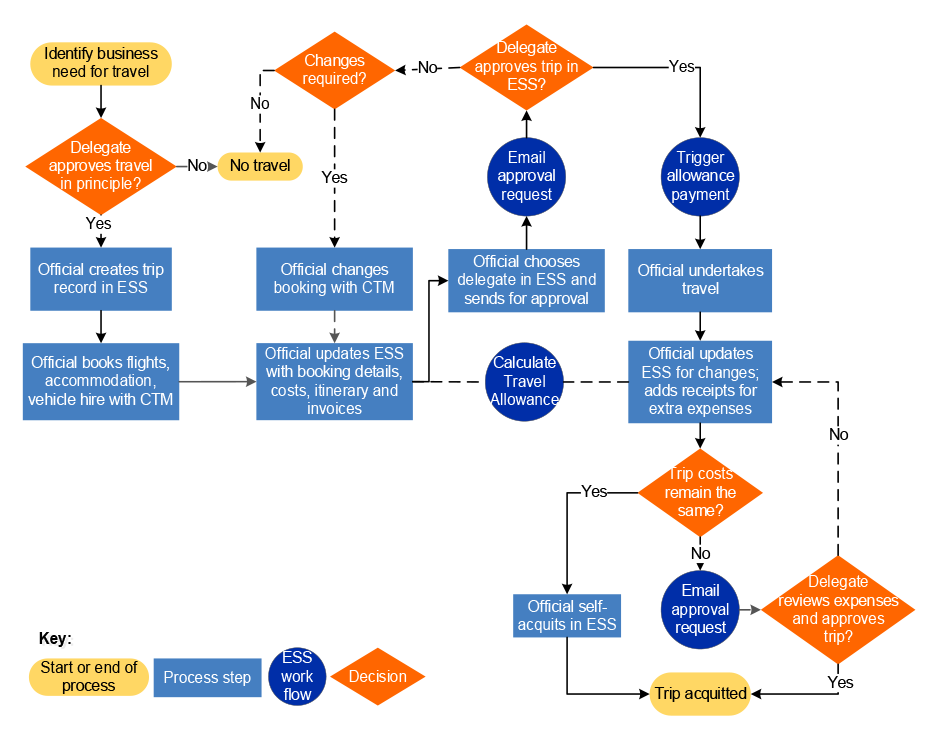

2.9 Travel policy updates reflected changes in broader WoAG Arrangements and a new enterprise agreement. Minor changes were also made to action advice from a Fraud Intelligence review in January 2023. Figure 2.1 below, sets out the agency’s domestic travel process during audit fieldwork in October 2025.

Figure 2.1: Domestic travel process at Services Australia

Note: All trips are required to be recorded in Services Australia’s IT system, SAP ESSentials (ESS). To create a trip record in ESS, officials enter basic trip details, including travel dates, destination, reason and business case.

The ‘delegate’ is the travel approver (generally the traveller’s manager) recognised by ESS as having sufficient financial delegation to authorise the trip.

Source: ANAO, based on Services Australia documentation.

2.10 The ANAO’s assessment of Services Australia’s domestic travel policy alignment with requirements of the WoAG Arrangements and Resource Management Guide (RMG) 404 is set out in Table 2.1.

Table 2.1: Alignment of Services Australia’s domestic travel policy with the Whole of Australian Government Travel Arrangements

|

WoAG requirement |

ANAO assessment of Services Australia’s policy |

|

|

Select lowest practical fare — the lowest fare available, that suits the practical business needs. |

◆ |

Officials are required to select the lowest practical fare and are given guidance to do so in the Travel Policy and the Domestic Travel Procedure. |

|

Value for money — use of resources in an efficient, effective, economical and ethical manner that is consistent with Australian Government policies.a |

◆ |

The Travel Policy states, ‘Your official travel must represent value for money and the efficient use of Commonwealth resources.’ The Travel Policy and AAIs require compliance with Australian Government policy. |

|

Necessity of travel — air travel must only be undertaken where other communication tools are ineffective. |

◆ |

Services Australia staff may undertake official travel where there is an essential business need. Reason and business case are mandatory fields for all trips to be recorded in the travel IT system, ESSentials. |

|

Diligence — officials must act in accordance with travel policies and with the Code of Conduct. |

◆ |

The requirement to comply with the APS Values, Code of Conduct and travel policies is set out in the Travel Policy and AAIs. |

|

Use contracted travel management services (TMS)b to book domestic flights and accommodation. |

◆ |

Services Australia’s AAIs and Domestic Travel Procedure set out requirements to use the TMS. |

|

Use the contracted hire car provider for car rental. |

◆ |

The AAIs and Domestic Travel Procedure require use of the contracted hire car provider. |

|

Domestic airfares must be economy class unless there is a reason or entitlement to travel business class. |

◆ |

The Travel Policy and Domestic Travel Procedure set economy as the standard class of domestic air travel. Exceptions are discussed in paragraph 2.11. |

|

Airline reward and loyalty points. |

◆ |

Services Australia’s policy aligns with the WoAG Arrangements. |

|

Use of virtual travel card (lodge card) when booking in the TMS supplier portal. |

N/A |

While Services Australia’s policy does not document this requirement, its practice is consistent with it. The agency has two credit lodge cards: one for air and accommodation purchases; and one for vehicle hire. The Travel Services team manages these to pay WoAG travel suppliers on behalf of all agency staff. The minority of staff with corporate credit (purchase) cards may not use them to pay WoAG travel suppliers.c |

Key: ◆ Fully aligned ▲ Partly aligned ■ Not aligned N/A Not applicable

Note a: Officials must make decisions based on an impartial consideration of the fares available and not on a personal preference for a particular airline, aircraft, airline lounges or airline reward and loyalty program.

Note b: Since 1 July 2023, the contracted TMS supplier has been Corporate Travel Management (CTM). Previously it was QBT. See Table 1.1.

Note c: Purchasing cards are physical cards issued to officials to make purchases of goods and services, while travel cards are ‘virtual’ cards only used for bookings made through the travel management system.

Source: ANAO analysis.

2.11 Under Services Australia’s Travel Policy, non-SES staff may only travel business class in exceptional circumstances, with evidence of a relevant disability or medical condition and prior written approval. SES employees may fly business class for single-leg trips of over two hours, or multi-leg trips. Prior to 17 March 2024, SES officials were only required to fly economy class on single-leg journeys between Canberra and Sydney and between Canberra and Melbourne.

International travel

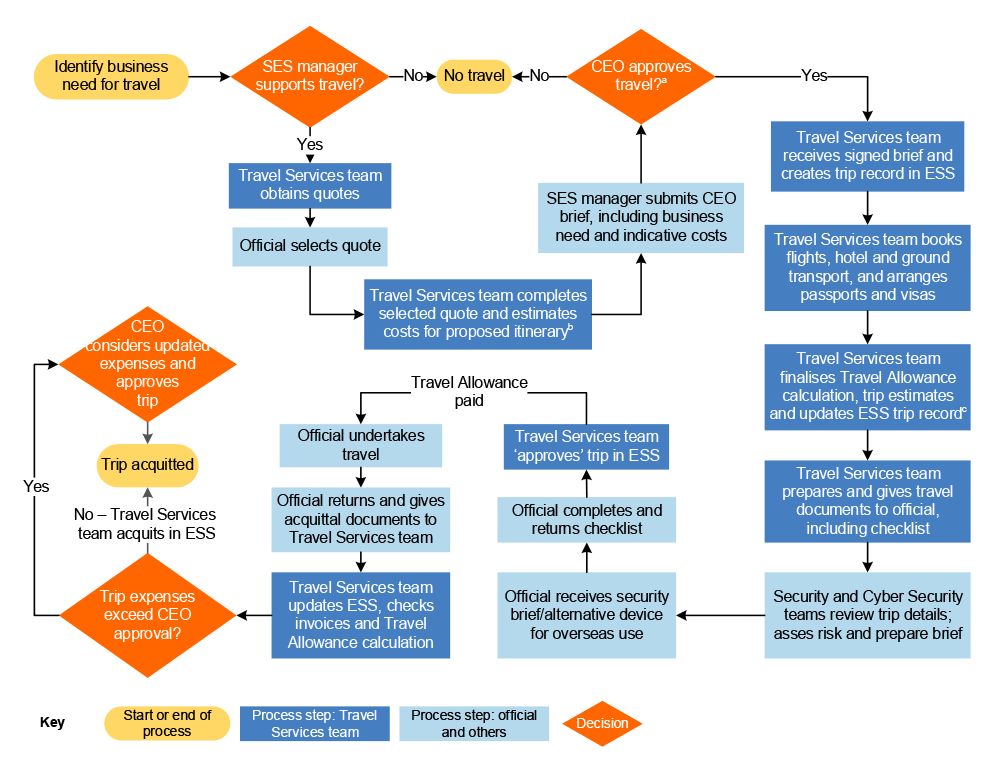

2.12 Services Australia’s requirements for international travel are set out in its Travel Policy and expressed in more detail in its International Travel Procedure. During the period 1 July 2022 to 30 June 2025, the International Travel Procedure was reviewed and updated twice, in November 2022 and March 2025.23 Unlike domestic travel, which is booked directly by travellers across Services Australia, the central Travel Services team arranges all international trips. Figure 2.2 below, shows the agency’s international travel process during audit fieldwork in October 2025.

Figure 2.2: International travel process at Services Australia

Note a: In some instances, the Executive Committee may approve travel without a brief. Since April 2025, Services Australia has required a detailed CEO brief to follow Executive Committee approval (see paragraph 2.15).

Note b: The Travel Services team estimates all costs for the proposed itinerary, including flights, accommodation, ground transport, Travel Allowance and equipment allowance. Indicative costs in the CEO brief include a 10 per cent allowance for potential variation above estimated costs.

Note c: Overseas Travel Allowance is calculated manually and paid at a higher rate than for domestic travel — the amount payable depends on the country visited.

Source: ANAO, based on Services Australia documentation.

2.13 The ANAO’s assessment of Services Australia’s international travel policy alignment with requirements of the WoAG Arrangements and Resource Management Guide (RMG) 405 is set out in Table 2.2.

Table 2.2: Alignment of Services Australia’s international travel policy with Whole of Australian Government Travel Arrangements

|

WoAG requirement |

ANAO assessment of Services Australia’s policy |

|

|

International Best Fare (IBF) — the lowest fare at the time of booking considering business needs, to maximise value for money. |

◆ |

Services Australia’s Travel Policy states that for international travel, officials must choose the IBF. The International Travel Procedure sets out the IBF in more detail and links to RMG 405. |

|

Value for money. |

◆ |

Official travel is required to represent value for money and efficient use of Commonwealth resources. The International Travel Procedure includes considerations for travellers to maximise value for money. |

|

Necessity of travel. |

◆ |

Services Australia’s employees may undertake official travel where there is an essential business need. |

|

Approval of the need to travel — officials are to use the entity’s internal controls for the approval requirements that apply to international travel. |

◆ |

International travel must be approved by the CEO, informed by a brief that includes indicative costs, prior to arranging travel. In some instances, the Executive Committee may approve travel without a brief.a |

|

Use of contracted TMS to book international air travel departing Australia. |

◆ |

Services Australia’s AAIs and Travel Policy set out requirements to use the TMS. Full procedural requirements are not set out as international flights are only booked by the central Travel Services team. |

|

Class of travel — officials must select a business class or equivalent, or lower-class airfare. |

◆ |

Officials may travel overseas in business class (or equivalent). If business class is not available, they may travel in premium economy or economy class. |

|

Airline reward and loyalty points. |

◆ |

Policy documents align with the WoAG Arrangements. |

|

Safety |

◆ |

Safety guidance is in the International Travel Procedure and travellers are instructed to subscribe to the Smartraveller website.b A security briefing is to be provided and a security risk assessment undertaken. |

|

Use of virtual Travel card (lodge card) when booking in the TMS supplier portal. |

N/A |

The Travel Services team manages Services Australia’s two lodge cards to pay WoAG travel suppliers on behalf of the whole agency. WoAG suppliers are booked by this team, rather than individual officials. The minority of staff with corporate credit cards (not lodge cards) may not use them to pay WoAG travel suppliers. |

Key: ◆ Fully aligned ▲ Partly aligned ■ Not aligned N/A Not applicable

Note a: Since April 2025, Services Australia has required a detailed CEO brief to follow Executive Committee approval (paragraph 2.15). Until June 2024, the agency’s Travel Policy stated that minister approval was required for trips with total cost of over $30,000. The agency assessed the requirement as outdated and corrected it when updating its Travel Policy in June 2024. The requirement was not in the International Travel Procedure.

Note b: The Department of Foreign Affairs and Trade’s website is at https://www.smartraveller.gov.au/ [accessed September 2025].

Source: ANAO analysis.

2.14 Services Australia’s travel policy largely reflects the contents of RMG 405 (international travel), and the International Travel Procedure includes links to RMG 405. As the Travel Services team centrally arranges all international travel, the following procedural statements from RMG 405 are not directly included in the agency’s travel policy:

- including WoAG transaction/administration fees in the IBF calculation;

- obtaining three airline quotes;

- booking strategies detail, such as considering different routes and ‘through’ fares; and

- identifying the IBF policy code for the fare chosen.

2.15 From April 2025, Services Australia has required Executive Committee approvals of international trips to be followed by a formal CEO brief, with full trip details, costs, dates and risks.

Services Australia’s credit card policy

2.16 Services Australia’s ‘Commonwealth Credit Card Policy’ sets out the rules officials must follow when using and managing Commonwealth credit cards. Credit card transactions must be acquitted within 28 days within ESS, with supporting documentation. While the credit card policy does not set out requirements for acquitting purchases made during overseas travel, the International Travel Procedure instructs officials to retain receipts of expenditure on incidental official travel related items to validate expense claims.

Assessment of risk

2.17 Services Australia’s Corporate Plan 2024–25 sets out nine enterprise risks. Official travel is a component of enterprise risk three, ‘Organisational integrity: We fail to maintain the governance, processes and training that support the integrity of our people and contracted third parties.’ In August 2025, Services Australia reported to its Audit and Risk Committee that it assessed the risk as ‘medium’24, and within tolerance.

2.18 Within the 2022–23 Enterprise Fraud and Corruption Risk Management Plan (EFCRMP), official travel was one of multiple contributing causes identified for Risk 2 — ‘theft, misdirection or misuse of agency funds and/or assets.’ One of the 16 identified causes of Risk 2, was ‘The agency fails to prevent, detect or respond to staff and/or contractors fraudulently claiming pay, travel and other employee entitlements.’ Four agency-wide controls were identified for Risk 2 that relate to travel.

2.19 Services Australia’s EFCRMP dated 31 July 2024 includes travel as a cause against the same risks, and identified the same controls, as the previous plan. Services Australia’s assessment of control effectiveness as at 31 July 2024 is in Table 2.3.

Table 2.3: Services Australia’s assessment of the effectiveness of travel-related fraud-risk controls — as at 31 July 2024

|

Control description |

Control effectiveness rating 31 July 2024 |

|

ACL215 — Travel Compliance Framework. |

◑a |

|

C3 — The agency manages travel, leave, pay, allowance, overtime, reimbursement and workplace injury and illness in accordance with Commonwealth legislation. The agency maintains, reviews and promotes a suite of policies that are available on the intranet. |

● |

|

C53 — The agency conducts regular compliance checks to ensure official travel that is undertaken complies with travel policy, travel information sheets and the travel compliance framework. |

◑a |

|

C55 — The agency provides staff with procedural instructions and guidelines in line with current legislation and/or policy that they are required to follow to enable consistent processes for travel, leave, pay, allowance, overtime, reimbursement and workplace injury and illness. |

● |

|

C100 — Staff use the ESSentials system to record, report and approve all HR activities, including leave requests and travel. |

◑a |

Key: ● Fully effective ◑ Partially effective ◯ Not effective

Note a: Services Australia advised the ANAO in December 2025 that it has since updated its assessment of controls ALC215 and C53 to ‘fully effective’ (see paragraph 2.20). Services Australia also advised that it had assessed control EFC100 as partially effective due to risks with both travel and non-travel uses of ESS.

Source: Services Australia documentation.

2.20 In 2025, Services Australia reviewed its EFCRMP, including its approach to documenting and reporting risks and controls. The agency advised the ANAO in December 2025 that, as part of the review, it had updated its assessment of travel-related controls ALC215 and C53 (see Table 2.3) to ‘fully effective’. As at January 2026, the 2024–25 EFCRMP was yet to be formally approved. Services Australia advised:

The majority of documented fraud controls and treatments were reassessed by the relevant control owners in the last quarter of 2025 as an interim refresh of content, and control owners’ confirmation of content accuracy is in the final stages and due for completion by end January 2026. Following this Security Committee will be given visibility of the EFCRMP review outcomes and any fraud and corruption risk issues requiring escalation through the agency’s regular quarterly Fraud and Corruption Control reporting (next report due March 2026).

2.21 The agency’s Travel Compliance Framework’s purpose is to provide the information necessary to evaluate the agency’s internal controls for travel policy and procedural compliance. The framework also outlines travel risks — that non-compliance with the Travel Policy, and associated policies, would result in increased travel costs, including from unnecessary travel, negative public perception of official travel and unethical use of public money. The Travel Compliance Framework is further discussed from paragraph 3.79.

Has Services Australia developed appropriate training and education arrangements to promote compliance with travel requirements?

Services Australia requires all officials to complete mandatory training on the duties and responsibilities of officials under the PGPA Act, including on the appropriate use of public resources. This mandatory training largely does not cover travel — two courses include travel-related content for SES and non-SES staff. Most learning for travel bookers takes place on-the-job — the agency does not deliver a travel-specific training module. Services Australia has a range of travel policy, procedures and supporting detailed guidance documents available for staff on its intranet. Guidance did not consistently present steps from a traveller’s perspective. Further support is available through a helpdesk provided by the Travel Services team, and from a virtual travel network for agency staff.

2.22 The Australian Public Service Commissioner’s Directions 2022 mandates integrity training for all employees of the Australian Public Service, with entities to provide a range of additional mandatory training and education to officials. The PGPA Act requires accountable authorities to establish and maintain measures to ensure officials comply with the finance law. Failure to comply with the finance law is a breach of the APS Code of Conduct.

2.23 While there is no requirement for entities to provide travel-specific training or education to officials, the WoAG Arrangements form part of the Commonwealth Procurement Rules, which are part of the finance law. Providing training and education to officials to support compliance with the WoAG Arrangements is a measure to support officials to comply with the finance law.

Mandatory training at Services Australia

2.24 Services Australia provides the following Enterprise Mandatory Training for staff in its Learning Management System (LMS), accessed through ESSentials:

- Mandatory Induction Program (MIP) — five modules to be completed within a week of commencement that cover values and integrity, Work, Health and Safety (WHS), security, privacy, and fraud and corruption.

- Five courses covering records management, child safety, family and domestic violence, Indigenous cultural learning and building multicultural awareness — to be completed within three months of commencement.25

- Mandatory Refresher Program — one course covering core elements of the above courses that staff are required to complete annually.

2.25 The Values and Integrity and Fraud and Corruption MIP modules, and the Mandatory Refresher Program, cover behaviours and examples relevant to supporting compliance with travel requirements. The Values and Integrity and Fraud and Corruption modules were updated within the past 12 months.

2.26 Services Australia advised the ANAO that SES officials must complete the following:

- SES Mandatory Induction training on commencement — including Values and Integrity; WHS; Security; Privacy; Fraud; Child Safety — General Awareness; Indigenous Cultural Learning; Building Multicultural Awareness; Privacy Fundamentals.

- SES Mandatory training — SES Procurement and Contract Management; Conflict of Interest; Safety Leadership; Due Diligence Information Pack; Records Management; Exploring our Culture; Multicultural Awareness SES; SES Changing Mindsets: Direct Management Program; and SES WHS Annual Due Diligence.

The Security module included travel-related cyber-security guidance, and the Fraud module included travel-related examples.

2.27 Services Australia also delivers two courses that include content relevant to official travel requirements:

- Finance Essentials — which covers the Commonwealth Resource Management Framework, Services Australia’s Financial Framework, including guidance on spending agency money, and relevant travel policies, including how staff can comply with key travel requirements.

- Corporate Credit Card Training — intended to help card holders perform their roles and responsibilities under the PGPA Act and Services Australia’s Financial Framework. This training is relevant to staff who may have to use a corporate credit card for purchase of non-WoAG travel services (e.g. taxi or overseas accommodation).

2.28 While the Finance Essentials and Corporate Credit Card Training courses are not mandatory for all agency officials, the Corporate Credit Card Training is mandatory for cardholders — 1,167 staff held a credit card between 1 July 2022 and 30 June 2025. As at 30 June 2025, there were 808 active credit cards.

Monitoring of mandatory training completion

2.29 Services Australia advised the ANAO that compliance against Enterprise Mandatory Training requirements is reported monthly to General Managers and quarterly to its People Committee through a Learning Update report. From 1 July 2022 to 30 June 2025:

- 24,617 individuals completed the online Values and Integrity course, and 23,530 passed; and

- 23,461 individuals completed the online Fraud and Corruption course, and 22,558 passed.

2.30 Services Australia advised the ANAO in November 2025 that additional staff completed equivalent mandatory training in person, bringing the total number of staff who completed the Values and Integrity training to 28,905 and the Fraud and Corruption training to 28,064.

2.31 In relation to SES mandatory training with some travel-related content, Services Australia advised the ANAO that:

- 48 individuals completed the Security induction training; and

- 41 individuals completed the Fraud induction training.

2.32 Services Australia records but does not monitor or report completion rates for the Financial Essentials and Credit Card training packages.

- From 1 July 2023 to 30 June 2025, 473 staff undertook and passed the Financial Essentials Training.

- From 1 July 2022 to 30 June 2025, 733 staff undertook and passed the Credit Card Training — equivalent to 91 per cent of all staff with a credit card at 30 June 2025.

Travel-specific training

2.33 Services Australia advised the ANAO that travel-related training includes on-the-job training provided to the Travel Services team, Executive Assistants and other travel coordinators across the agency. Services Australia does not offer staff training packages specific to official travel.

Guidance material

2.34 A range of travel guidance is available for Services Australia officials through the agency’s intranet, including:

- policy documents — Travel Policy, Domestic Travel Procedure, and International Travel Procedure;

- a travel page that sets out key elements of the overall travel process, with links to further detail on specifics, such as allowances, airline lounge memberships, and Frequently Asked Questions (FAQs); and

- links to user guidance for ESS and CTM’s online travel-booking portal.

2.35 Additional guidance and support are available through the following:

- ESS includes guided procedures and a workflow that prompts steps such as acquittal after travel dates have passed and automatically generates template emails with advice to travellers and spending approvers. The CTM portal also includes built-in guidance, automatically identifying airfare and accommodation options within allowable rates.

- The Travel Services team provides a help desk for all staff for domestic travel and directly manages all international travel bookings.

- Viva Engage — an IT communication platform — provides a virtual network for staff across the agency to share advice on travel.

2.36 The guidance is consistent with WoAG policy and between 1 July 2022 and 30 June 2025, relevant guidance was updated to reflect changes in WoAG Arrangements (suppliers and booking fees) and introduction of a new Enterprise Agreement. The majority of the guidance documents have not required significant change since 1 July 2022. Services Australia advised the ANAO that additional updates to guidance, including FAQs, were also informed by:

- IT system enhancements;

- policy changes (such as to SES business class travel, discussed at Table 2.1);

- recommendations from a January 2023 review of the Travel Compliance Framework, by Services Australia’s Fraud intelligence team (paragraph 3.99);

- patterns identified from quarterly compliance and operational dashboard reporting, discussed from paragraphs 3.104 and 3.109; and

- recurring questions to the Travel helpdesk.

2.37 ANAO analysis identified, across the suite of guidance material:

- Requirements for international trip approval (a CEO brief) in the Travel Policy were not also in the International Travel Procedure.

- Guidance was not updated to reflect an April 2025 change requiring a CEO brief follow Executive Committee approval of international travel (paragraph 2.15).

- The travel procedure intranet page did not include a summary of the steps for making bookings with CTM, referring instead to external CTM user guidance.

- International travel guidance explains entitlement to an overseas travel allowance while overseas; it does not clarify a traveller’s entitlement to domestic travel allowance while travelling within Australia as part of the same trip.

Opportunity for improvement

2.38 Services Australia could review its range of documented travel guidance to ensure it provides current end-to-end process direction from a traveller’s perspective.

Communicating changes

2.39 Changes related to travel policy, procedure or broader WoAG supplier arrangements or issues are communicated across Services Australia through its intranet, using all-staff notices (‘huddle messages’), Viva Engage posts and entries on the HR Policy Hub. Cytric, the CTM online portal, also includes updates relevant to travellers making bookings.

2.40 In June 2024, the Department of Finance issued a WoAG Travel Advice to participating entities advising them of a Qantas remediation program for passengers impacted by past Qantas flight cancellations. Entities were advised to ensure officials impacted did not claim a refund under the program for cancelled official travel, paid for under WoAG Arrangements, to ensure they met their APS Code of Conduct obligations. Services Australia shared this advice with its staff in June 2024 through a post on Viva Engage.

3. Controls and processes for managing domestic and international travel

Areas examined

This chapter examines whether Services Australia’s (the agency’s) controls and processes for domestic and international travel were implemented effectively in accordance with its policies and procedures.

Conclusion

Services Australia was largely effective in implementing controls and processes for domestic and international travel in accordance with its policies and procedures. Officials consistently selected the lowest practical fare for domestic travel and international best fare for overseas travel. Trips were not consistently acquitted on time — from a sample reviewed by the ANAO, 79 per cent of domestic trips and 67 per cent of international trips were acquitted on time. The agency had limited processes to support compliance with airline loyalty and lounge program arrangements. Airline lounge membership purchases for non-Senior Executive Service (SES) staff were not always supported by documented approvals showing consideration of a significant need for travel. The agency has processes to identify and respond to non-compliance, implemented across two separate teams and collects data about non-compliance but does not analyse it to inform continuous improvement initiatives.

Areas for improvement

The ANAO made one recommendation, that Services Australia monitor airline lounge memberships that it purchases for its staff. The ANAO also identified opportunities for improvement relating to the agency reinforcing the scope of allowed travel purchases in its credit card policy and undertaking periodic qualitative reviews of its travel compliance data to inform continuous improvement initiatives.

3.1 Section 16 of the Public Governance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control. Entities should have an effective, evidence-based assurance framework in place to validate control effectiveness and monitor compliance with policy requirements for the purposes of continuous improvement.

3.2 Effectively implementing an appropriate process for management of non-compliance is necessary to ensure entities’ adherence to both internal policies and legislative requirements and serves as a deterrent for future non-compliance by officials. Responding to identified instances of non-compliance allows an entity to demonstrate that its officials are discharging their duties and facilitates continuous improvement and refinement in the entity’s control framework.

Has Services Australia implemented effective controls for domestic travel?

Services Australia has implemented controls for domestic travel across planning and approval, booking and acquittal of expenses. Officials may not approve their own travel and approval by a financial delegate is required to be recorded in the agency’s IT system, ESS, prior to travel. The ANAO reviewed a random sample of 73 domestic trips and found 86 per cent had a record in ESS of approval prior to travel. In relation to air travel, Services Australia officials consistently selected the lowest practical fare, in compliance with the Whole of Australian Government (WoAG) travel policy — the lowest fare was selected for 33 per cent of trips. A Travel Allowance, for meals and incidentals, is payable after a trip has been approved in ESS. Most domestic trips (73 per cent) were appropriately acquitted.

Records of domestic travel

3.3 Domestic travel by Services Australia staff is required to be recorded, approved, acquitted and reconciled within its IT systems, using SAP software, ESSentials (ESS). ESS has a ‘Trips & Expenses’ module and is structured to store travel information relevant for demonstrating policy compliance and includes automated workflow steps and template emails. Officials (traveller or travel arranger)26 are required to create a trip record in ESS including travel dates, first destination, trip reason and business case. Officials separately book flights, accommodation and vehicle hire with Corporate Travel Management (CTM) before returning to ESS to update the trip record with booking details and costs and seek approval. After travel, officials receive an automated system email prompting them to update the ESS record for any changes and complete acquittal.

Business need

3.4 ESS includes mandatory fields for a travel ‘reason’ and ‘business case’, consistent with the RMG 404 requirement that official travel take place where there is a necessity, and the approving delegate is satisfied there is a demonstrated business need for the travel. Within ESS, the following guidance appears on screen for staff when their cursor sits above the relevant field:

- ‘Reason’ field — ‘specific reason for trip eg meeting with Fairfield CSC, training for Call staff, conference for social work.’

- ‘Business Case’ field — ‘The business case must include number of people travelling, why video or teleconferencing was not suitable and why the trip is necessary.’

3.5 Between 1 July 2022 and 30 June 2025, nearly 1,000 Services Australia staff had over 42,000 official domestic trip records in ESS. The ANAO selected and reviewed a random sample of 73 domestic trips with a departure date between 1 July 2022 and 30 June 2025. Trip reasons are recorded in a free-text field in ESS rather than set categories. Across the 73 domestic trips the ANAO reviewed, reasons for travel often related to attending a meeting or conference (58 per cent), public-facing service delivery (19 per cent), training (14 per cent), and office relocation or refurbishment (10 per cent).

3.6 While the mandatory business case was entered in ESS for all 73 trips reviewed, most entries repeated the trip ‘reason’ without explaining why options such as video or teleconferencing were not suitable. Of the 73 sampled trips, 32 (44 per cent) included a business case with a clear rationale for the travel, in accordance with Services Australia’s guidance.

Booking

3.7 Once travellers have set up initial trip details in ESS, it generates a unique trip number. Travellers then make their flight, accommodation, or vehicle hire bookings with the Travel Management Services (TMS) supplier (CTM, previously QBT), either online or by phone. By agreement with CTM, Services Australia staff are required to include their trip number and Australian Government Service number (staff number) in the CTM booking record. This supports reconciliation of ESS trip details with WoAG travel supplier invoices and payment, managed centrally by the Travel Services team.

3.8 CTM’s online portal automatically identifies for staff which fares for their selected dates and routes are consistent with WoAG travel policy and which accommodation options are within allowed rates. Once bookings are made, the traveller receives an itinerary from CTM with trip costs and details. The traveller returns to ESS to complete the trip record, adding details for each element of the trip (flights, accommodation, vehicle hire or taxi/Uber), and attaching the itinerary.27 The value of air fares and accommodation for the trip are manually transcribed into ESS by the official after being booked through CTM.

3.9 ESS calculates the proposed total cost of the trip, by combining the costs of air fares, accommodation, vehicle hire, taxis/Uber and CTM fees with an automated calculation of Travel Allowance payable (see paragraph 3.31). To obtain spending delegate approval for the trip, the traveller then selects the ‘Ready for Approval’ button in ESS. Text displayed next to this button informs the traveller that by selecting it they are ‘declaring that you have read & understood the Travel Policy & that, to the best of your knowledge, all details entered are true & correct.’ The domestic trip then ‘workflows’ to the travel approver for review and approval.

3.10 CTM bookings are not reviewed directly by the travel approver although staff are instructed to save the CTM itinerary in ESS before requesting approval — where this occurs, the travel approver can access the itinerary and see the fare class and details as booked with CTM. If the itinerary is not attached to the trip record, the only details visible to the travel approver (including policy booking codes for LPF and reason codes for over-rate accommodation booked) are those entered in ESS by the traveller. The details entered in ESS do not include the class of air travel. Trip approval is further discussed from paragraph 3.26.

3.11 Of the 73 sampled trips reviewed, 64 included a CTM (or QBT) booking reference number. The remaining nine trips were either cancelled, did not involve flights, accommodation or vehicle hire (for example, the trip involved a claim for a private motor vehicle allowance only), or booking detail was unable to be viewed.28 Of the 64 trips with a booking reference, an itinerary was saved in ESS for 51 (80 per cent).

3.12 As part of its ongoing compliance monitoring under Services Australia’s Travel Compliance Framework, the Travel Services team routinely checks trips with selected characteristics. For travel between October 2022 and June 2025, the team identified 10 instances of flights, and a further 10 instances of accommodation, booked directly by travellers outside of the WoAG travel arrangements (the WoAG Arrangements). Non-compliance is further discussed from paragraph 3.78.

Lowest Practical Fare and fare class

3.13 The WoAG Arrangements require officials to book flights at the lowest practical fare (LPF) for domestic travel and the international best fare (IBF) for overseas travel. If a flight is booked that is not the lowest fare in the appropriate class (usually economy for domestic travel), officials are required to select the ‘booking code’ from a drop-down list within the TMS, which includes six options other than ‘lowest fare’ (see Table 1.2).

3.14 The distribution of LPF and IBF codes across all air travel by Services Australia officials between 1 July 2022 and 30 June 2025 is at Table 3.1.

Table 3.1: Lowest practical fare and international best fare policy booking codes for Services Australia — 2022–23 to 2024–25a

|

Booking code |

Domestic (%)b |

International (%)b |

|

Lowest fare |

51.43 |

89.92 |

|

Require flexibility to change booking |

27.74 |

8.4 |

|

Unsuitable due to time routing connections or baggage charges |

17.65 |

1.68 |

|

Approval or entitlement to travel at a higher fare class |

3.22 |

0.00 |

|

Personal responsibilities |

1.04 |

0.00 |

|

Outside of LPF/IBF policy |

0.34 |

0.00 |

|

Health issues |

0.08 |

0.00 |

|

Blankc |

0.05 |

0.00 |

Note a: The data is based on LPF or IBF code for each booking reference. The Department of Finance advised the ANAO that booking references are not unique.

Note b: Booking references may include multiple flights for the same instance of travel, each associated with a different LPF or IBF code. Where this occurs, the booking reference will be included under multiple booking codes meaning results will not add to 100 per cent. Bookings may also contain both domestic and international flights.

Note c: Blank refers to records where an LPF or IBF code has not been recorded in the TMS.

Source: ANAO presentation of LPF and IBF data extracted from the contracted TMS. The ANAO was unable to provide assurance over the data in the report from the TMS due to a lack of information captured during the individual bookings and anomalies in the aggregated data.

3.15 Services Australia includes combined CTM summary data on LPF and IBF booking codes in Travel Reporting Quarterly Operational Dashboards (see paragraph 3.109). Table 3.2 shows the policy codes selected for Services Australia’s domestic and international flights, as reported quarterly by its Travel Services team using CTM data for travel from 1 July 2022 to 30 June 2025.

Table 3.2: Whole of Australian Government booking codes for Services Australia— 1 July 2022 to 30 June 2025a

|

Code |

Number (percentage) of tickets |

|

Lowest fare |

67,633 (53.4%) |

|

Require flexibility to change booking |

33,002 (26.1%) |

|

Timing, routing, connection or baggage charges |

20,407 (16.2%) |

|

Approval or entitlement to travel at higher fare class |

3,968 (3.1%) |

|

Personal responsibilities |

1,144 (0.9%) |

|

Outside of LPF/IBF policy |

392 (0.3%) |

|

Health issues |

64 (0.1%) |

Note a: As CTM booking code data is based on number of tickets, it does not match Services Australia’s booking code data, which is based on number of trips (and can include multiple tickets) and does not sum to 100. For example, one trip could include a departing flight with Virgin and a returning flight with Qantas, which would be two tickets.

Source: CTM data reported by Services Australia in its Travel Reporting Quarterly Operational Dashboards.

3.16 Of the 73 domestic trips sample reviewed by the ANAO, 57 involved air travel. For all 57 trips (100 per cent), the traveller had reported (in ESS) that they had selected the fare in compliance with the LPF policy, and for 18 of the trips (33 per cent), reported selecting the lowest fare. None reported selecting a fare outside of LPF policy. The ANAO also reviewed CTM data for the 57 trips and found all fares were recorded as LPF. For six trips (11 per cent) the traveller’s record in ESS of using the lowest fare was not matched by CTM reporting, which reflected a higher fare having been selected.29

3.17 While Services Australia monitors CTM summary data on LPF and IBF booking codes (paragraph 3.15) it does not analyse the use of different policy codes through its Travel Compliance Framework (see paragraph 3.79). The agency could strengthen its oversight of risks and opportunities for improvement by undertaking periodic analysis of this data. The ANAO identified a related opportunity for improvement at paragraph 3.106.

3.18 Services Australia routinely monitors whether airfares are booked in the correct class (see Table 3.3). Between October 2022 and June 2025, the agency identified 29 instances of non-compliance relating to travellers selecting a higher fare class than permitted by policy or entitlement (non-compliance is discussed further from paragraph 3.78). Of the 57 trips sampled by the ANAO involving air travel, flights were booked in economy class for 54 trips. The three trips involving business class fares were booked for SES travellers in circumstances that complied with Services Australia’s Travel Policy.

Accommodation