Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Domestic and International Travel Requirements in the Department of Agriculture, Fisheries and Forestry

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- In 2024–25, $953 million was spent on travel through the whole of Australian Government travel arrangements (the WoAG Arrangements).

- Australian Government entities should have robust internal arrangements for official travel to: support compliance with the WoAG Arrangements; manage fraud and corruption risks; and foster a culture of integrity.

- The audit was conducted to provide assurance to the Parliament as to whether the Department of Agriculture, Fisheries and Forestry (DAFF) has effective arrangements to comply with domestic and international travel requirements.

Key facts

- DAFF’s expenditure on travel was within the top ten of non-corporate Commonwealth entities in 2023–24.

What did we find?

- DAFF has partly effective arrangements to comply with domestic and international travel requirements.

- DAFF has largely appropriate arrangements (policies, procedures, training and guidance) for travel. These align with the WoAG Arrangements.

- DAFF’s controls and processes for domestic and international travel are partly effective.

What did we recommend?

- There were two recommendations to DAFF to improve documentation of approval for travel and the acquittal process.

- DAFF agreed to the recommendations.

$29.9 m

spent by DAFF on domestic and international travel in 2024–25.

41 (57%)

of domestic travel expenses sampled did not sufficiently document approval and value for money consideration.

38 (100%)

of international travel expenses sampled sufficiently documented the business need and value for money consideration.

Summary and recommendations

Background

1. The whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance (Finance). The WoAG Arrangements encompass five components: book; fly; stay; drive; and pay (see Table 1.1). The WoAG Arrangements are supported by resource management guides outlining the Australian Government policies for domestic and international travel.

2. All non-corporate Commonwealth entities must comply with all elements of the WoAG Arrangements. Corporate Commonwealth entities and Commonwealth companies may elect to use some or all of the arrangements. As a non-corporate Commonwealth entity, the Department of Agriculture, Fisheries and Forestry (DAFF) must comply with the WoAG Arrangements.

Rationale for undertaking the audit

3. In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of whole of government policy for travel is to maximise value for money. The approach of an entity to official travel can indicate whether the entity is behaving with integrity by meeting the intent of the WoAG Arrangements. There has been parliamentary and public interest in relation to government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether DAFF has complied with domestic and international travel requirements.

4. This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; DAFF; Civil Aviation Safety Authority; Australian Criminal Intelligence Commission; and Services Australia.

Audit objective and criteria

5. The objective of the audit was to assess whether DAFF has effective arrangements to comply with domestic and international travel requirements.

6. To form a conclusion against the objective, the ANAO adopted two high-level audit criteria.

- Did DAFF have appropriate arrangements to manage domestic and international travel in accordance with whole of Australian Government requirements?

- Has DAFF implemented effective controls and processes for domestic and international travel in accordance with its policies and procedures?

Conclusion

7. DAFF has partly effective arrangements to comply with domestic and international travel requirements. The effectiveness of DAFF’s arrangements has been undermined by the inadequate recording of business need for travel and approvals to demonstrate value for money. DAFF has reported a range of issues in relation to the WoAG Arrangements to the Department of Finance. The Department of Finance has reported that it is implementing recommendations from the ‘Review of Australian Government Travel Policies’.

8. DAFF has established largely appropriate arrangements for managing domestic and international travel in accordance with the WoAG Arrangements. DAFF has developed policies and procedures, and provides training and guidance material to officials to assist in promoting compliance. The department is implementing recommendations from two internal audits which aim to address gaps in its control framework for travel, particularly in relation to approval arrangements.

9. DAFF’s controls and processes for domestic and international travel are partly effective.

- Data indicates that DAFF booked flights in accordance with the WoAG Arrangements related to ‘Lowest Practical Fare’ and ‘International Best Fare’.

- For domestic travel, there were insufficient records to clearly demonstrate consideration of value for money and records were not stored to allow for efficient assurance of the acquittal of travel-related expenses.

- DAFF did not have an overarching approach to checking compliance with the WoAG Arrangements and internal requirements for travel, including in relation to whether officials are being influenced by preferences for particular airlines and airline lounge and reward and loyalty point arrangements.

Supporting findings

Arrangements for managing domestic and international travel

10. DAFF has developed policies and procedures for domestic and international official travel that align with the WoAG Arrangements. Official travel is considered in the context of the department’s fraud and corruption risk assessment. DAFF has completed internal audits related to travel. Recommendations from these are being implemented to address gaps in relation to travel bookings and approvals, acquittal and monitoring and reporting activities. (See paragraphs 2.2 to 2.33)

11. DAFF requires all officials to complete training on the duties and responsibilities of officials under the Public Governance, Performance and Accountability Act 2013, including on the appropriate use of public resources. As of 30 June 2025, the compliance rate for the completion of mandatory training was 87 per cent. DAFF introduced non-mandatory travel-specific training in December 2024. Guidance material is available to officials through different channels. (See paragraphs 2.34 to 2.47)

Controls and processes for managing domestic and international travel

12. For domestic travel, there was insufficient documentation of the need to travel and appropriate approvals in the sample tested. This limits DAFF’s ability to demonstrate consideration of value for money. For all domestic flights, 99 per cent were recorded as complying with the lowest practical fare policy — 44 per cent were the ‘lowest fare’ (cheapest). Of the travel reviewed by the ANAO:

- 58 per cent did not have a travel request created in the department’s travel and credit card expense management system;

- 57 per cent were not approved in line with departmental policy;

- 96 per cent of bookings were made through the contracted supplier, as required;

- 43 per cent of accommodation expenses were above the subscription service rates without delegate approval; and

- 64 per cent of travel-related expenses were acquitted within 10 days, as required, and 36 per cent were not. (See paragraphs 3.3 to 3.28)

13. DAFF has implemented largely effective controls for international travel.

- Business reasons, risk assessment and approval for international travel are routinely documented in the International Travel Proposal form.

- Data indicated that international flights were booked in accordance with the International Best Fare requirement of the WoAG Arrangements, with 85 per cent of flights being booked as the ‘lowest fare’ (cheapest).

- When approving the acquittal of international travel expenditure, the delegate does not have visibility of the total approved cost of the travel, impacting their ability to provide informed approval.

- Thirty-three per cent of travel related expense reports were not acquitted within 14 days, as required. (See paragraphs 3.29 to 3.46)

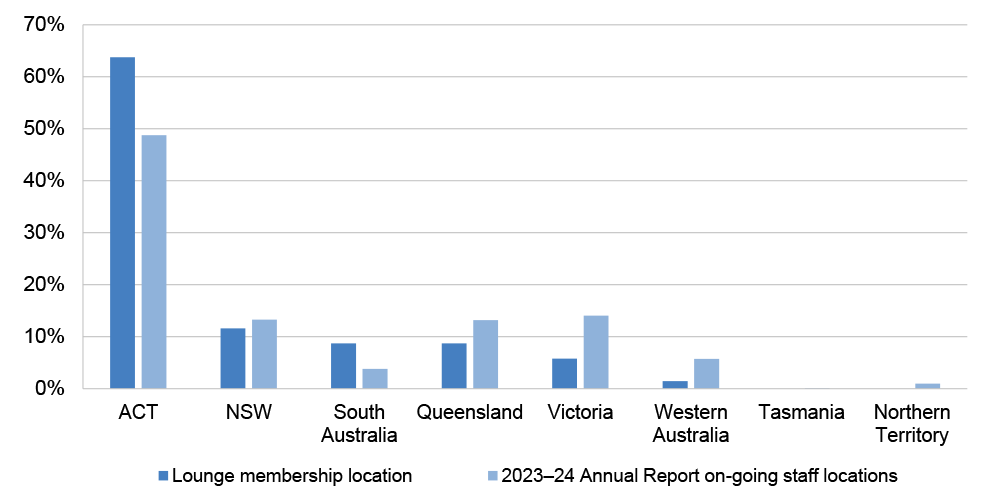

14. DAFF does not collect information on officials’ membership of airline loyalty programs and its conflict-of-interest policy does not provide guidance in relation to memberships of loyalty programs or lounges. DAFF is unable to assess whether officials are being influenced by preferences for particular airlines, and airline lounge and reward and loyalty point arrangements when planning and undertaking official travel. DAFF requires officers to declare gifted airline lounge memberships and upgrades as a result of status credits accrued for official travel. The average time for reporting gifts and benefits accepted by DAFF officials from Qantas and Virgin Australia was 90 days — between 1 July 2022 and 31 December 2024. DAFF officials declared 15 gifts and benefits from Qantas or Virgin Australia. Eight of these were invitation-only lounge memberships. The department purchases lounge memberships for officials who undertake ‘significant’ travel — approval, including value for money considerations, was not evident for 78 per cent of purchases reviewed by the ANAO. No lounge memberships were reported by DAFF’s SES officials in their declaration of material interests. (See paragraphs 3.49 to 3.74)

15. DAFF has some processes in place to identify and respond to non-compliance, but it lacks an overarching approach to assessing compliance with both the requirements and the objectives of the WoAG Arrangements. DAFF has reported that it has implemented an internal audit recommendation to monitor areas of non-compliance relating to: domestic business class travel; attachment of the PGPA subsection 23(3) approval to travel expenditure approvals; and accommodation booked outside of the WoAG Arrangements. Travel-related non-compliance mostly involves the misuse of credit cards. (See paragraphs 3.76 to 3.89)

16. Reporting is provided to executive management on international travel. Reporting of non-compliance with subsection 23(3) of the PGPA Act is provided to governance committees, the Chief Finance Officer and division heads, and includes disaggregation for official travel. The department responded to 31 travel-related Questions on Notice between July 2022 and February 2025. Twenty-one (70 per cent) were responded to on time. There were mapping differences in reporting on travel expenditure in DAFF’s annual report for 2022–23 and 2023–24 which meant car hire and WoAG travel provider fees were not included in the overall travel costs. DAFF advised that it has reported a range of issues to the Department of Finance relating to the WoAG Arrangements. (See paragraphs 3.91 to 3.106)

Recommendations

Recommendation no. 1

Paragraph 3.14

The Department of Agriculture, Fisheries and Forestry document the business need and Public Governance, Performance and Accountability Act 2013 subsection 23(3) approval in order to support value for money with respect to domestic travel. This should be appropriately stored in the department’s records management system and expense management system.

Department of Agriculture, Fisheries and Forestry response: Agreed.

Recommendation no. 2

Paragraph 3.47

The Department of Agriculture, Fisheries and Forestry ensures that international travel approvals, including the Public Governance, Performance and Accountability Act 2013 subsection 23(3) or section 71 approval, are documented and retained in the department’s records management system and the expense management system to support the travel acquittal process and identification of any non-compliance.

Department of Agriculture, Fisheries and Forestry response: Agreed.

Summary of entity response

17. The proposed audit report was provided to DAFF. DAFF’s summary response is provided below. The full response from DAFF is at Appendix 1. Improvements observed by the ANAO during the course of the audit are listed in Appendix 2.

Department of Agriculture, Fisheries and Forestry

The department is committed to ensuring domestic and international travel arrangements comply with WoAG requirements and welcomes the ANAO’s observations that it has established largely appropriate arrangements for managing domestic and international travel in accordance with the WoAG arrangements.

The department acknowledges the two recommendations, which focus on improving domestic travel approval documentation and record keeping for domestic and international travel approvals, with work already underway to address these recommendations.

I can confirm the department has been methodically investing in its travel operations over the past 24 months. The audit testing conducted by the ANAO covered a period of unprecedented change for the department with major Machinery of Government changes fragmenting existing resourcing between agencies, and the mandated requirement to transition to the new WoAG travel provider. While managing these challenges, the department has taken the initiative to conduct two travel internal audits while concurrently uplifting processes, systems and resources to ensure we have a strong, compliant and accountable travel function.

Key messages from this audit for all Australian Government entities

18. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Australian Government officials undertake domestic and international travel for the purpose of achieving the objectives of their entities. Official travel is:

any travel where a Commonwealth entity is ultimately responsible for any of the direct or indirect costs associated with that travel … This includes travel by officials, contractors and consultants to undertake work duties at the direction of the employer to achieve one or more Commonwealth objectives.1

Australian Government framework for travel

1.2 The Commonwealth resource management framework governs how Australian Government entities use and manage public resources. The foundation of the framework is the Public Governance, Performance and Accountability Act 2013 (the PGPA Act) which requires accountable authorities to promote the proper use and management of public resources.2

1.3 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance under section 105B of the PGPA Act. Compliance with the CPRs is mandatory for officials of non-corporate Commonwealth entities (NCEs). The CPRs require NCEs to use coordinated procurements where they exist.3 The whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance (Finance). All NCEs must comply with all elements of the WoAG Arrangements. Corporate Commonwealth entities (CCEs) and Commonwealth companies may elect to use some or all of the arrangements.

1.4 Finance has published model accountable authority instructions, which include model instructions for official travel (see Box 1).4

|

Box 1: Model accountable authority instructions for official travel — non-corporate Commonwealth entities |

|

You must:

Where the government has established coordinated procurements for a particular travel activity, you must use the arrangement established for that activity, unless:

You must:

|

Whole of Australian Government travel arrangements

1.5 The WoAG Arrangements commenced in 2010 and aim to:

- reduce travel costs by aggregating government buying power to obtain discounted pricing;

- decrease administrative costs for suppliers and entities by removing procurement duplication;

- simplify processes by integrating technology, unifying pricing and aligning systems;

- optimise savings by promoting behavioural change; and

- support Australian Government policies.5

1.6 The WoAG Arrangements encompass five components as outlined in Table 1.1.

Table 1.1: Whole of Australian Government travel arrangements — services and suppliers, September 2025

|

Component |

Services |

Suppliers (as at November 2025) |

|

Booka |

The travel management services (TMS) supplierb provides booking services for air travel, hotel, bus, sea, rail, car rental, ground transport services, and charter flights. In addition, 24/7 support and entity travel reports are provided. |

Corporate Travel Management (CTM) |

|

Flyc |

Domestic and international air travel suppliers. The panel of airlines is not exclusive.d Airlines included in the panel provide ‘discounted fares and beneficial fare conditions’ to the Australian Government’. |

Panel of 18 airlines

|

|

Staya |

All domestic accommodation must be booked through the TMS supplier. Booking international accommodation through the TMS supplier is encouraged but is not required under the WoAG Arrangements. |

CTM |

|

Drivee |

Domestic vehicle rental services supplier. Bookings can be made via the TMS supplier or directly with the vehicle rental services supplier via a WoAG portal. |

Hertz |

|

Payf |

Travel and Procurement Payments Services. For official travel booked via the TMS supplier, entities are required to use a ‘lodge card’.g Commonwealth credit cards may be utilised for other expenses associated with travel such as meals and incidentals or overseas accommodation. |

National Australia Bank (NAB) |

Note a: Standing Offer Notice ID SON3979293, available from https://www.tenders.gov.au/Son/Show/b3e4c6ad-ab57-4d46-a3c6-d0ce7b083ac7 [accessed 30 June 2025].

Note b: The TMS supplier is known as the Travel Management Company (TMC).

Note c: Standing Offer Notice ID SON3337469, available from https://www.tenders.gov.au/Son/Show/606ca6fd-c615-d94c-905e-491969f2a3ba [accessed 30 June 2025].

Note d: Given the panel is not exclusive, entities are permitted to book both domestic and international air travel with non-panel airlines however this must be booked through the TMS supplier.

Note e: Standing Offer Notice ID SON35277487, available from https://www.tenders.gov.au/Son/Show/1545a9af-e0d4-bab4-60d4-e03aed0558db [accessed 30 June 2025].

Note f: Standing Offer Notice ID SON3637640, available from https://www.tenders.gov.au/Son/Show/ad2d8b17-c42e-4601-a757-72568eafa384 [accessed 30 June 2025].

Note g: A virtual card (lodge card) is the digital number stored in the TMS supplier user profile.

Source: Department of Finance, Whole of Australian Government Travel Arrangements, About the Travel Arrangements and Department of Finance, Whole of Australian Government Procurement.

Lowest Practical Fare and International Best Fare

1.7 The WoAG Arrangements are supported by resource management guides (RMGs) outlining the Australian Government policies for domestic and international air travel. The policies require travellers to select the ‘Lowest Practical Fare’ (LPF) for domestic flights and the ‘International Best Fare’ (IBF) for international flights.

- The LPF is ‘the lowest fare available at the time the travel is booked on a regular service (not a charter flight), that suits the practical business needs of the traveller’.6

- The IBF is ‘the lowest fare on the day the travel is booked on a regular scheduled service (not a charter flight), that suits the practical business needs of the traveller and maximises overall value for money for the total cost of the trip’.7

1.8 The LPF and IBF policies allow officials to book flights which are not the lowest fare. Officials are to select a booking code to explain why the lowest fare has not been chosen (see Table 1.2). Booking codes 1 to 6 are compliant with LPF and IBF policies. If flights are not compliant, then code 7 (‘Outside of LPF policy’) is to be used.

Table 1.2: Policy booking codes for LPF and IBF

|

Booking code |

Requirement |

|

|

1 |

Lowest fare |

Domestic: This is the cheapest available fare taking into account the 1-hour window.a International: This is the cheapest fare taking into account the 24-hour booking window.b |

|

2 |

Timing, routing, connection or baggage charges |

Domestic: Where the fare selected is not the lowest fare because it: is the most direct route; ensures connections for further flights are met; or takes into account excess baggage fees. International: Where the fare selected is not the lowest fare because it: is the most direct route; ensures connections for further flights are met; includes baggage allowances or value-adds offered by WoAG contracted airlines; or takes into account excess baggage fees. |

|

3 |

Approval or entitlement to travel at a higher fare class |

Domestic: All air travel is to be at the LPF in economy class unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the lowest practical fare within the entitlement. International: All air travel is to be at the IBF in the appropriate classc (having regard to internal travel policy) unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the IBF within the entitlement. |

|

4 |

Health issues |

Health issues for officials requiring certain facilities. A medical certificate is required to support use of this code. |

|

5 |

Personal responsibilities |

Impact on personal responsibilities such as family. |

|

6 |

Require flexibility to change booking |

Where flexibility is required for air travel, travel bookers must consider selecting a semi-flexible fare type instead of a fully flexible fare. |

|

7 |

Outside of LPF policy |

Preference for particular aircraft or airlines, availability of access to airline lounges, accumulation of airline benefits such as reward or loyalty points (including status credits). |

Note a: According to Domestic Travel Policy (RMG 404), the one hour ‘time window’ is used by the TMS supplier to ‘monitor whether the lowest practical fare has been selected and assess potential missed savings … For outbound flights, the window commences 1 hour prior to the booked flight … For inbound flights, the window commences 1 hour after the booked flight’.

Note b: According to Official International Travel — Use of the best fare of the day (RMG 405), the TMS supplier ‘applies the 24-hour window to the booked flight time from the point of departure to monitor whether the international best fare has been selected.’

Note c: Official International Travel — Use of the best fare of the day (RMG 405), requires officials to select ‘business class or equivalent or lower class airfare’.

Source: Domestic Travel Policy (RMG 404) and Official International Travel — Use of the best fare of the day (RMG 405).

1.9 The RMGs set out additional guidance for travellers and approvers. Two key considerations for officials undertaking and approving domestic and international travel are ‘value for money’ and ‘necessity of travel’.

- Value for money requires ‘the use of Commonwealth resources in an efficient, effective, economical and ethical manner that is consistent with the policies of the Commonwealth … Accordingly, when booking travel, officials must make decisions based on impartial consideration of fares available’.

- Delegates, in approving official travel, ‘must be satisfied there is a demonstrated business need for the travel’ and that ‘Air travel must only be undertaken where other communication tools, such as teleconferencing and videoconferencing, are ineffective’.

Review of travel purchasing policies

1.10 The Australian Government published the Aviation White Paper in August 2024. The White Paper contains 56 new policy initiatives. Under the banner of a ‘competitive and efficient aviation sector’, Initiative 17 is:

Review government travel purchasing policies to consider whether changed policy settings could better support competition. The Department of Finance will conduct the review in 2024.8

1.11 Finance finalised the ‘Review of Australian Government Travel Policies’ in December 2024.9 The review made seven recommendations.

- Recommendation 1: Publish WoAG Arrangements usage and expenditure.

- Recommendation 2: Update policy to explicitly deal with flight upgrades.

- Recommendation 3: Return to market for a full re-tender of the Airline Panel following consultation with the market on the approach to status credits.

- Recommendation 4: Create one Government Travel Policy, including mandating economy class for flights under three hours, enhanced guidance on gifts and benefits and setting a two year review period.

- Recommendation 5: Booking codes for best value fare to be updated to include a justification for selecting the booking code for delegate consideration.

- Recommendation 6: Work with the contracted Travel Management Company to improve services.

- Recommendation 7: Remove the requirement for accountable authorities to seek Ministerial approval for international travel over a certain threshold.

1.12 The government’s response to the recommendations is detailed in the ‘Review of Australian Government Travel Policies — What We’re Doing’. The review and response were published on Finance’s website on 1 August 2025.10

Airline loyalty programs

1.13 Airline loyalty programs (also known as frequent flyer programs) are customer loyalty schemes. According to the Australian Competition and Consumer Commission, customer loyalty schemes offer points or discounts with the purpose of increasing repeat business. There are two types of points offered by Australian airlines through their airline loyalty programs.11

- Reward points (also known as frequent flyer points) are awarded to travellers who are members of the airline’s loyalty program for certain flights.

- Status credits are also awarded to members of the airline’s loyalty program on certain flights and contribute to the tier status of a loyalty program membership (e.g. silver or gold).

1.14 Reward points and status credits can be accrued by travellers who are members of an airline’s loyalty program. Since commencement of the WoAG Arrangements in 2010, government policy prohibits the accrual of reward points for official travel. The accrual of status credits is permitted for official travel.

Airline lounge access

1.15 Membership of an airline lounge is separate to membership of an airline loyalty program and membership to a loyalty program does not in itself provide access to airline lounges. Membership of an airline lounge alone does not entitle members to accrue reward points or status credits. Access to airline lounges is available to travellers based on the class of travel, i.e. business and first class.

1.16 Airline lounges can be accessed by officials who have purchased a membership. Both Qantas and Virgin Australia offer discounted lounge memberships as part of the WoAG Arrangements to Commonwealth officials. The discount is available if the entity purchases a membership for an official, or if the official purchases it themself in a personal capacity.

1.17 Qantas’ Chairmans Lounge and Virgin Australia’s Beyond are invitation-only memberships that provide access to premium airline lounges. Qantas and Virgin Australia may gift memberships of airline lounges, including invitation-only lounges, to senior officials. The Australian Public Service Commission requires the annual reporting of gifted airline lounge memberships by agency heads.12

Department of Agriculture, Fisheries and Forestry — official travel

1.18 The Department of Agriculture, Fisheries and Forestry (DAFF) is responsible for enhancing Australia’s ‘agricultural, fisheries and forestry industries’. DAFF creates new, and maintains existing, ‘agricultural export opportunities, to provide gains for Australian agriculture’. It ‘manage[s] biosecurity risks to protect Australia’s multi-billion dollar agricultural industries and way of life’.13

1.19 In 2024–25, DAFF’s total resourcing was $3.4 billion, and the average staffing level was 6,171. The Secretary is the accountable authority for the purposes of the PGPA Act and the agency head for the Public Service Act 1999.

1.20 DAFF is a non-corporate Commonwealth entity and it must comply with all elements of the WoAG Arrangements. In 2024–25, DAFF reported its expenditure on travel as $29.9 million compared to $26.2 million in 2023–24. Expenditure of this volume puts DAFF within the top ten travel expenditure by non-corporate Commonwealth entities in 2023–24.

Previous ANAO audit coverage

1.21 Previous ANAO audits have identified issues in other entities with respect to credit cards and travel. In 2023–24, the ANAO conducted a series of audits assessing compliance with corporate credit card requirements.14 These reports identified:

- positional authority risks with expenditure on travel and credit cards being approved by officials junior to the traveller;

- approval of travel not being provided prior to travel being undertaken; and

- failure to identify, record or respond to instances of non-compliance with travel requirements.

Rationale for undertaking the audit

1.22 In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of whole-of-government policy for travel is to maximise value for money. The approach of an entity to official travel can indicate whether the entity is behaving with integrity by meeting the intent of the WoAG Arrangements. There has been parliamentary and public interest in relation to government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament whether DAFF has complied with domestic and international travel requirements.

Audit approach

Audit objective, criteria and scope

1.23 The objective of the audit was to assess whether DAFF has effective arrangements to comply with domestic and international travel requirements.

1.24 To form a conclusion against the objective, the ANAO adopted two high-level audit criteria.

- Did DAFF have appropriate arrangements to manage domestic and international travel in accordance with whole of Australian Government requirements?

- Has DAFF implemented effective controls and processes for domestic and international travel in accordance with its policies and procedures?

1.25 The audit primarily examined DAFF’s management of domestic and international travel from 1 July 2022 to 31 December 2024.

Audit methodology

1.26 To address the audit objective, the audit methodology included:

- reviewing legislative, policy and internal frameworks;

- examining DAFF’s policies, procedures, travel management systems, assurance and reporting activities;

- meeting with DAFF officials;

- testing the effectiveness of DAFF’s control framework for travel;

- analysing whole of Australian Government and DAFF level data from the WoAG travel management system; and

- reviewing citizen contributions to the audit.

1.27 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $452,102.

1.28 The team members for this audit were Wendy Preston, Megan Cook, Sky Lo, Liset Campos Manrique, Sung-Hoon Jun, Nathan Daley and Nathan Callaway.

2. Arrangements for managing domestic and international travel

Areas examined

This chapter examines whether the Department of Agriculture, Fisheries and Forestry (DAFF) has developed appropriate arrangements for the management of domestic and international travel in accordance with the whole of Australian Government arrangements (WoAG Arrangements).

Conclusion

DAFF has established largely appropriate arrangements for managing domestic and international travel in accordance with the WoAG Arrangements. DAFF has developed policies and procedures, and provides training and guidance material to officials to assist in promoting compliance. The department is implementing recommendations from two internal audits which aim to address gaps in its control framework for travel, particularly in relation to approval arrangements.

2.1 Entities need to establish arrangements for managing official travel in line with the requirements of the WoAG Arrangements. Policies and procedural guidance, as well as training, should be available and easily accessible to all officials. These arrangements should be informed by entity-specific risks.

Has the Department of Agriculture, Fisheries and Forestry developed appropriate policies and procedures for domestic and international travel?

DAFF has developed policies and procedures for domestic and international official travel that align with the WoAG Arrangements. Official travel is considered in the context of the department’s fraud and corruption risk assessment. DAFF has completed internal audits related to travel. Recommendations from these are being implemented to address gaps in relation to travel bookings, including approvals, acquittal and monitoring and reporting activities.

Assessment of risk

Enterprise risks

2.2 DAFF’s Risk Management Accountable Authority Instructions and Enterprise Risk Management Framework and Policy (October 2024) set the department’s ‘approach, expectations and provides guidance for effective risk management’. DAFF has nine enterprise risks in its 2025–26 Corporate Plan.15 None of the enterprise risks are directly relevant to official travel.

Fraud and corruption risks

2.3 The Public Governance, Performance and Accountability Fraud and Corruption Rule establishes a requirement for an accountable authority to take all reasonable measures to prevent, detect and deal with fraud relating to the entity.16

2.4 DAFF’s fraud and corruption control framework is made up of two components:

1. The Control Plan, which provides the framework and associated guidance for identifying, deterring, detecting, investigating, and reporting fraud and corruption.

2. The Risk Assessment, which identifies areas within the department that are potentially at risk of fraudulent and corrupt practices and provides an assessment on the effectiveness of existing controls.

2.5 As of August 2025, DAFF’s fraud and corruption control plan (control plan) and its fraud and corruption risk assessment (fraud risk assessment) were last updated in June 2024. In the fraud risk assessment, 61 fraud risks were assessed. The ANAO identified five fraud risks as being relevant to travel:

- ‘fraudulent claim for leave and/or other entitlements’ rated medium but outside the tolerance of low for this risk category;

- ‘fraudulently claim travel’ rated low and within tolerance;

- ‘fraudulent approval of travel allowance’ rated low and within tolerance;

- ‘fraudulent claim for travel allowance’ rated low and within tolerance; and

- ‘fraudulent use of digital cab charge voucher(s)’ rated low and within tolerance.17

2.6 The DAFF fraud risk assessment includes existing risk controls and identified control weaknesses for these risks. A key division for each risk is identified.18 The fraud risk assessment does not identify any treatments, treatment owners, implementation timeframes for treatments or a plan for monitoring and review.

Divisional risks

2.7 DAFF’s Finance and Investment Division is responsible for the department’s framework for official travel. The division’s risk register (July 2025) identifies risks of ‘Inadequate management of financial resources to achieve the departments strategic objectives’ and ‘Lack of understanding from departmental staff on the financial systems and processes in place’.

2.8 For these risks, the ANAO identified the following controls as having relevance to travel:

- Maintain and invest in fit-for-purpose infrastructure, systems and digital technology.

- Ensure ongoing awareness, compliance, and alignment with relevant departmental frameworks and policies.

- Fit for purpose tools and guidance material are made available to all staff at all levels on the Source [DAFF’s intranet].

2.9 As of July 2025, the Finance and Investment Division had assessed each of these controls as ‘partially effective’. No further information is provided about the rationale for this assessment of control effectiveness. It is not evident the extent to which the department’s framework for official travel is incorporated into these controls.

2.10 The risk ratings for these risks, as of July 2025, were ‘medium’ and within acceptable tolerance.

Framework for official travel

2.11 DAFF defines official travel as ‘Secretary approved travel away from the employee’s usual work locality including travel between an employee’s usual locality and a temporary alternative locality. It does not apply to travel undertaken in the course of an employee’s usual or assigned activities at the employee’s usual or temporary alternative locality’.19

2.12 Within the Finance and Investment Division, a team is responsible for policies and oversight for travel and credit cards. DAFF’s framework for domestic and international travel is established through:

- instructions in the DAFF Accountable Authority Instructions (AAIs);

- DAFF’s financial delegations instrument;

- the DAFF Enterprise Agreement (2024–27); and

- policy documents including the Travel Policy, the Travel Regulation Manual, the International Travel Handbook and the Commonwealth Credit Card Policy.

Accountable authority instructions

2.13 DAFF’s AAIs (August 2024) set out the Secretary’s instructions related to official travel:

Official travel should only be undertaken when there is a demonstrated business need and when other communication tools, such as teleconferencing and videoconferencing, are an ineffective option.

2.14 With respect to official travel, DAFF’s AAIs are consistent with the model AAIs issued by the Department of Finance. DAFF’s AAIs provide entity-specific instructions in relation to approval of travel, application of the Commonwealth Procurement Rules, use of established coordinated procurement arrangements, use of a virtual (lodge) card, and not accruing reward or loyalty points. The AAIs link to other relevant material such as: legislative requirements; Australian Government policies and guidance; related AAIs; and other internal material.20

2.15 The AAIs were updated four times during the period 1 July 2022 to 31 December 2024: in January 2023; August 2023; August 2024 and November 2024. While all AAIs were approved by the accountable authority, they did not record the date of effect, have version control or document the accountable authority approval. The AAIs released in July 2025 include the date of effect, but do not document approval by the accountable authority.

Financial delegations instrument

2.16 The DAFF PGPA (Accountable Authority) Delegations and Sub-Delegations (October 2024) establishes a delegation in line with subsection 23(3) of the of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) for the power to approve expenditure for procurements.21

- Delegations for domestic travel apply to APS 5 and 6 officers to a limit of $80,000, then EL1 to SES Band 3 officers to the limit of available funds.

- International travel is limited to $49,999 and to all SES Band 3 officers and three other SES officers.22

2.17 The department’s previous financial delegations instruments (1 December 2020 and 1 September 2022) enabled approval for domestic travel expenditure by APS 4 officers and above. DAFF advised the ANAO on 10 June 2025 that delegation changes in October 2024 were as a result of ‘a general review of financial delegations’.

Department of Agriculture, Fisheries and Forestry Enterprise Agreement 2024–27

2.18 DAFF’s enterprise agreement includes travel and location-based conditions.

Employees required to travel for official work purposes will have their accommodation, meals, and other incidental expenses met by the department. The department currently utilises a range of facilities to meet the travel costs of employees including booking systems, credit or travel cards and employee allowances and payments.

2.19 DAFF pays meal and incidental allowances to officials. It uses the Commonwealth Allowance Subscription Service rates to determine daily maximum meal and incidental rates.23

2.20 The enterprise agreement provides for a private accommodation allowance to cover reasonable expenses incurred while staying at non-commercial accommodation. There is provision for private vehicle allowance when utilising a private vehicle while on official business.

Departmental travel framework

2.21 DAFF’s Travel Policy (March 2023) and Travel Regulation Manual (March 2025) set out the department’s requirements with respect to official travel to achieve compliance with the WoAG Arrangements.

Domestic travel

2.22 DAFF’s process for domestic travel is illustrated in Figure 2.1.

Figure 2.1: Domestic travel process in the Department of Agriculture, Fisheries and Forestry (December 2024)

Note a: DAFF’s system for creation of travel requests and acquittal of travel expenses is called Concur.

Note b: This step is compulsory if officials want to receive a meal and incidental allowance prior to travel.

Source: ANAO analysis of DAFF domestic travel policies.

2.23 The ANAO’s assessment of the alignment of DAFF’s Travel Policy and Travel Regulation Manual with the WoAG Arrangements for domestic travel is presented in Table 2.1. As of August 2025, DAFF was making changes to internal policies aimed at improving records of subsection 23(3) approvals (see paragraph 3.28).

Table 2.1: Alignment of DAFF’s travel framework to whole of Australian Government arrangements for domestic travel

|

WoAG Arrangements |

Assessment of DAFF’s policies |

|

|

Select lowest practical fare — the lowest fare available, that suits the practical business needs. |

◆ |

Officers are required to utilise the lowest practical fare under the Travel Policy and the Travel Regulation Manual. |

|

Value for money — use of resources in an efficient, effective, economical and ethical manner that is consistent with Australian Government policies.a |

◆ |

Expenditure must be in accordance with the PGPA Act, as set out in the Travel Policy and the Travel Regulation Manual. |

|

Necessity of travel — air travel must only be undertaken where other communication tools are ineffective. |

◆ |

The Travel Policy and the Travel Regulation Manual require decisions to consider the necessity of the travel. The Travel Policy provides a list of alternatives to travel, such as using videoconferencing facilities. |

|

Diligence — officials must act in accordance with travel policies and with the Code of Conduct. |

◆ |

The Travel Regulation Manual explicitly requires that officials act in accordance with the Code of Conduct while on official travel. |

|

Use of contracted travel management services (TMS) supplier to book air travel and accommodation. |

◆ |

DAFF requires the use of the TMS supplier to make domestic air travel and accommodation bookings unless they are unable to provide the service required. |

|

Use of the contracted hire car provider for car rental. |

◆ |

DAFF requires the use of the TMS supplier for car hire unless the TMS supplier is unable to provide the service required. |

|

Domestic airfares must be economy class unless there is a reason or entitlement to travel business class. |

◆ |

The Travel Regulation Manual permits SES officials to fly business class on domestic flights where the flight exceeds 4 hours. |

|

Airline reward and loyalty points. |

◆ |

The Travel Regulation Manual aligns with the WoAG Arrangements. |

|

Personal travel — WoAG Arrangements must not be used for stand-alone personal or leisure travel. |

◆ |

The Travel Regulation Manual aligns with the WoAG Arrangements. |

|

Use of virtual card (lodge card) when booking in the TMS system. |

◆ |

The Travel Regulation Manual mandates the use of a virtual card (lodge card) when booking. |

Key: ◆ Fully aligned with the WoAG Arrangements ▲ Partly aligned ■ Not aligned.

Note a: Officials must make decisions based on an impartial consideration of the fares available and not on a personal preference for a particular airline, aircraft, airline lounges or airline reward and loyalty program.

Source: ANAO analysis.

International travel

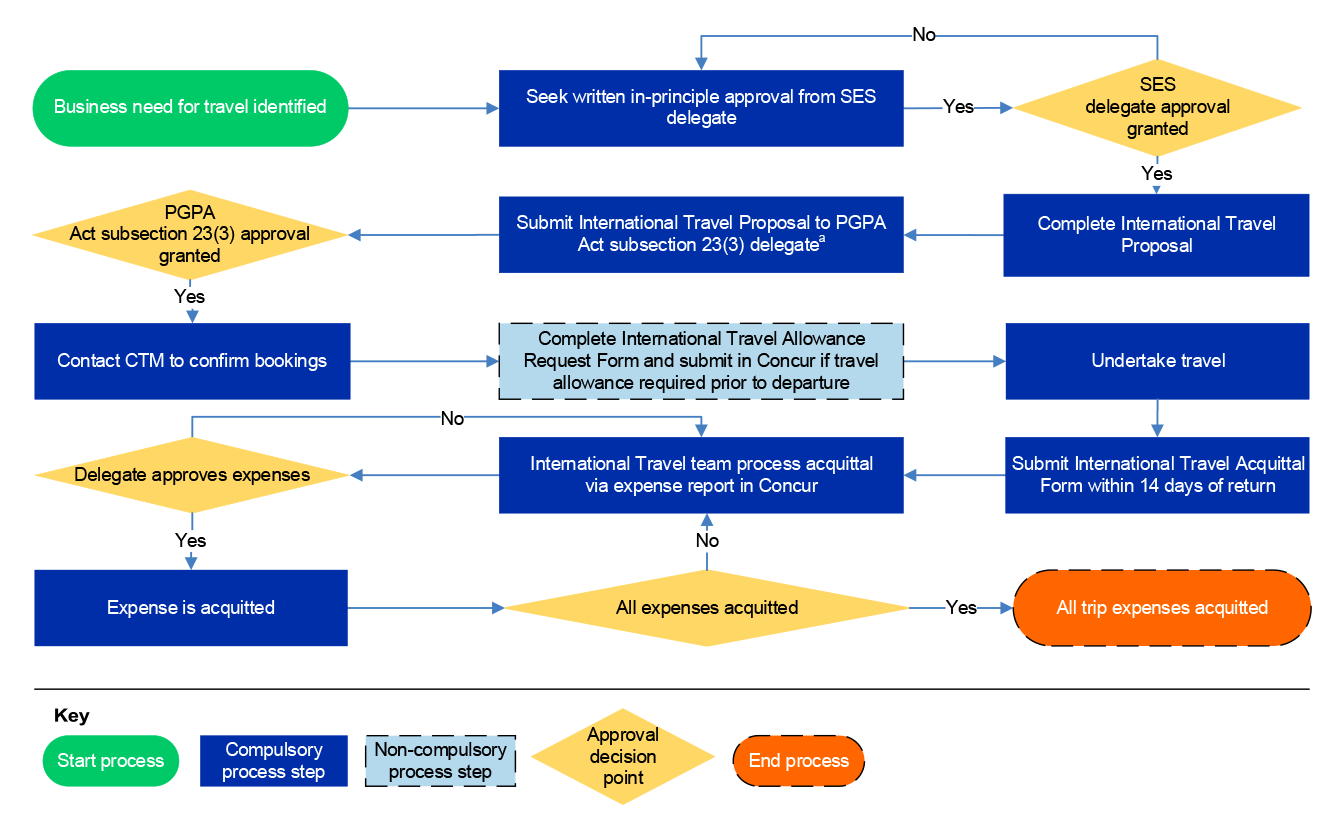

2.24 In addition to the Travel Policy and Travel Regulation Manual, DAFF has developed the International Travel Handbook (November 2024) to set out the process and advice for international travel. DAFF’s process for international travel is depicted in Figure 2.2.

Figure 2.2: International travel process in the Department of Agriculture, Fisheries and Forestry

Note a: For travel which is up to and including $49,999 and not politically sensitive, documents must be submitted no less than three weeks before travel. For travel which is $50,000 or over and/or is politically sensitive, allow at least six to eight weeks for Ministerial consultation and approval.

Source: ANAO analysis of DAFF’s international travel policies.

2.25 The ANAO’s assessment of the alignment of DAFF’s travel policies with the WoAG Arrangements for international travel is presented in Table 2.2.

Table 2.2: Alignment of DAFF’s travel framework to whole of Australian Government arrangements for international travel

|

WoAG Arrangements |

Assessment of DAFF’s policies |

|

|

Value for money. |

◆ |

The Travel Policy and the Travel Regulation Manual require expenditure to be in accordance with the PGPA Act. |

|

Necessity of travel. |

◆ |

The Travel Policy and the Travel Regulation Manual state that official travel decisions take into consideration the necessity of the travel. |

|

Safety — under no circumstances are officials required to use airlines with a poor industry reputation for safety. |

◆ |

The International Travel Handbook requires officials to complete risk and security assessments for each trip. |

|

Approval of the need to travel — officials are to use the entity’s internal controls for the approval requirements that apply to international travel. |

◆ |

DAFF has appropriate delegation instruments in place. Approval is documented in an International Travel Proposal. |

|

International Best Fare (IBF) — the lowest fare at the time of booking, that suits the practical business needs, to maximise value for money. |

◆ |

DAFF’s policy states that all bookings must be consistent with IBF. Three quotes must be obtained from at least two carriers where there are at least three potential carriers for a service. |

|

Use of contracted TMS supplier to book international air travel departing Australia. |

◆ |

DAFF requires the use of the TMS supplier to make international air travel bookings. |

|

Class of travel — for international travel and travel within an international country, officials are required to select a business class or equivalent class, or lower class airfare. |

◆ |

The Travel Regulation Manual requires all international travel to be booked as business or economy class. It notes that if airlines only offer only first or economy class, that first class should be considered to be business class. |

|

Use of virtual card (lodge card) when booking in the TMS system. |

◆ |

The Travel Regulation Manual mandates the use of a virtual card (lodge card) when booking via the TMS supplier. |

|

Airline reward and loyalty points. |

◆ |

The Travel Regulation Manual aligns with the WoAG Arrangements relating to airline reward and loyalty points. |

|

Personal travel — WoAG Arrangements must not be used for stand-alone personal or leisure travel. |

◆ |

The Travel Regulation Manual aligns with the WoAG Arrangements. |

Key: ◆ Fully aligned with the WoAG Arrangements ▲ Partly aligned ■ Not aligned.

Source: ANAO analysis.

Departmental policy — Commonwealth corporate credit card

2.26 DAFF’s Commonwealth Corporate Credit Card Policy (December 2024) sets out the ‘compliance and regulatory framework for use and acquittal of expenditure on a Commonwealth Corporate Credit Card (credit card) and virtual credit card (lodge card)’. Credit cards are physical cards issued to officials to make purchases of goods and services, while lodge cards are ‘virtual’ cards used for bookings made through the travel management system.24

2.27 Credit cards issued to officials must not be used for the following purposes:

- personal expenses;

- services that can be arranged through the department’s travel service provider (airline flights, domestic accommodation, domestic car rentals);

- any procurement that is covered by a WoAG arrangement such as ICT, stationary, office supplies, legal service etc;

- meals or incidental items for which travel allowance has been or should be paid;

- cash withdrawal (unless approved by the Chief Finance Officer);

- partial deliveries against contracts or purchase orders;

- traffic or parking infringements;

- tipping of any kind (e.g.: taxis, uber, waiters etc);

- purchases made using Administered funding; and

- purchasing software, web-based tools or online hosted service as a subscription, and/or software as a subscription.

2.28 Acquitting travel expenditure, including expenditure on the lodge card, is outlined in the DAFF Travel Regulation Manual. Domestic travel expenses must be acquitted within 10 days of return, and international travel within 14 days of return.25 For domestic travel, receipts or invoices are mandatory for all charges over $82.5026 and for all international expenses regardless of value.27 The International Travel Handbook states ‘All allowances and expenditure related to international travel are acquitted and submitted by the International Travel team’.28

Continuous improvement — internal audit

2.29 DAFF undertook two internal audits relating to travel in 2024:

- ‘Travel support and efficiency of expenditure acquittal methodologies’ (October 2024); and

- ‘International Travel’ (November 2024).

2.30 The ‘Travel support and efficiency of expenditure acquittal methodologies’ internal audit assessed the appropriateness of support and guidance for staff in acquitting travel expenditure, and whether the department’s two acquittal methodologies (domestic and international) were efficient. The overall conclusion was:

whilst the support and guidance provided to staff relating to travel arrangements is somewhat effective, there is a need to strengthen the control framework around travel bookings and monitoring and reporting activities, which will lead to efficiencies that can be made with a more streamlined approach to travel arrangements.

The travel acquittal processes are also considered to be largely efficient however if there is further consideration around streamlining of the acquittal processes to a single process for all staff, this decision should be risk based and data informed.

2.31 The ‘International Travel’ internal audit assessed compliance with the policy on international travel, and assessed whether DAFF’s International Travel Proposal Form was fit for purpose. The overall conclusion was:

the department’s travel framework as it relates to International Travel is compliant with legislation and Whole of Australian Government policy requirements. The recent introduction of the Lighthouse International Travel Proposal Form (ITP) was found to be largely functional noting that internal audit has made recommendations to improve both usability and efficiency of the form.

2.32 The internal audits included five recommendations each.

- The ‘Travel support and efficiency of expenditure acquittal methodologies’ report made:

- two high risk recommendations relating to system integration for approvals;

- one medium risk recommendation relating to establishing a framework for monitoring compliance; and

- two low risk recommendations relating to training and continuous improvement through monitoring of systemic travel issues.

- The ‘International Travel’ report made:

- two medium risk recommendations — one relating to compliance checking against departmental and WoAG Arrangements, the other in relation to the system functionality of the International Travel Proposal form; and

- three low risk recommendations relating to: the control framework for contingencies; timeliness between travel approvals and booking impacting on costs for flights and accommodation; and formal review of the electronic International Travel Proposal form.

2.33 As at 14 August 2025, DAFF was implementing the recommendations. Implementation of the recommendations for ‘Travel support and efficiency of expenditure acquittal methodologies’ is expected to be completed by November 2025. Recommendations made in the International Travel internal audit are expected to be implemented by June 2026.

Has the Department of Agriculture, Fisheries and Forestry developed appropriate training and education arrangements to promote compliance with domestic and international travel requirements?

DAFF requires all officials to complete training on the duties and responsibilities of officials under the Public Governance, Performance and Accountability Act 2013, including on the appropriate use of public resources. As of 30 June 2025, the compliance rate for the completion of mandatory training was 87 per cent. DAFF introduced non-mandatory travel-specific training in December 2024. Guidance material is available to officials through different channels.

2.34 The Australian Public Service Commissioner’s Directions 2022 mandates integrity training for all employees of the Australian Public Service, with entities to provide a range of additional mandatory training and education to officials.29 The PGPA Act requires accountable authorities to establish and maintain measures to ensure officials comply with the finance law. Failure to comply with the finance law is a breach of the APS Code of Conduct.

2.35 While there is no requirement for entities to provide travel-specific training or education to officials, the WoAG Arrangements form part of the Commonwealth Procurement Rules which are part of the finance law. Providing training and education on the WoAG Arrangements supports officials to comply with finance law.

Mandatory training

2.36 DAFF has a mandatory training package with nine courses known as the Essentials Suite that includes training on: diversity and inclusion; emergency and lockdown; integrity; privacy; record keeping; safety; security; obligations as an APS employee; and finance. Departmental officials register for training via LearnHub, the department’s internal learning and development system, with new starters automatically enrolled.

2.37 Officials engaged for three months or longer must complete the Essentials Suite within three months of commencing employment. Officials engaged for three months or less must complete the Essentials Suite within two weeks of commencing employment. This suite of courses must be completed every 12 months. Non-completion of mandatory learning by due dates is recorded as non-compliant. Supervisors will receive completion and overdue notifications for their staff.

2.38 Of the mandatory modules, three reference official travel in their content: Security Essentials; Integrity Essentials; and Finance Essentials.

- The Security Essentials module provides an overview of DAFF’s protective security arrangements. There is a section on travel security threats. The training advice is consistent with the Travel Policy, Travel Regulation Manual and the International Travel Handbook.30

- The Integrity Essentials course covers the APS Values and Code of Conduct. The course material is consistent with the requirements in the Travel Regulation Manual and highlights additional security risks when travelling internationally.

- The Finance Essentials course references travel including DAFF policies and WoAG Arrangements and highlights that in approving travel there must be a ‘demonstrated business need for the travel’.

Monitoring of mandatory training completion

2.39 Reporting on completion of mandatory training has been provided to DAFF’s Executive Board on a quarterly basis. The compliance rate was discussed quarterly between 1 July 2022 and 31 August 2025 by the Executive Board. Minutes from meetings reflected a focus on lifting the compliance rates, having SES lead by example, and staff messaging around awareness of education and training to ensure compliance with policy and legislation.

2.40 The compliance rates for DAFF as at 31 December 2022, 31 December 2023, 31 December 2024 and 30 June 2025 are shown in Table 2.3.

Table 2.3: Reporting on mandatory training compliance

|

Module |

Compliance as at 31 December 2022 (%)a |

Compliance as at 31 December 2023 (%)a |

Compliance as at 31 December 2024 (%)a |

Compliance as at 30 June 2025 (%) a |

|

Security |

78 |

88 |

88 |

90 |

|

Integrity |

77 |

88 |

87 |

89 |

|

Finance |

79 |

88 |

87 |

89 |

|

Overall Essentials Suite |

73 |

82 |

83 |

87 |

Note a: The compliance rate includes APS staff and contractors. A person is compliant if they have completed the course within the required period. The overall compliance rate for the Essentials Suite is not an average, it is the percentage of people who have completed all nine Essentials Suite courses within the required period.

Source: DAFF reporting.

Travel-specific training

2.41 DAFF has three training modules directly related to travel: International Travel — Defensive Security Briefing31; Travelling with DAFF32; and Concur — General User.33 The International Travel — Defensive Security Briefing is mandatory for staff travelling internationally if it has not been undertaken in the 12-months prior to the submission of the International Travel Proposal. The other two modules are not mandatory and are completed at the discretion of officials.

2.42 The Travelling with DAFF training was introduced following the ‘Travel support and efficiency of expenditure acquittal methodologies’ internal audit which identified a need for strengthened communication through training programs. Eighteen officials attended the first course in December 2024 — feedback on the course was positive. Seven sessions have been held since December 2024 with 149 officials attending. Feedback on the course has generally been positive.

Guidance material

2.43 Communication to officials regarding policy requirements can occur through other mechanisms. DAFF provides news and messaging across the department via its intranet. There are intranet pages for domestic travel, international travel and Commonwealth credit cards which contain links to policy documents and additional guidance material. Material includes instructions describing how to undertake tasks in Concur, the CTM portal and Lighthouse34 such as creating travel requests and acquitting travel expenses.

2.44 The Business Bulletin is posted to the intranet and emailed to staff every Friday, containing information on key projects, IT, finance and human resources activities, including travel when relevant. Business Bulletins contain a ‘Training and events’ section, which includes:

- reminders to complete mandatory training;

- notices of training opportunities;

- monthly updates of training through the APS Academy;

- notices on departmental events.

2.45 The intranet, Business Bulletin and messages from the Secretary have been used to update officials on procedural changes or provide reminders of requirements for travel.

2.46 Fifteen information sessions were held between August 2022 and November 2024 on using Concur. One hundred and sixty-two officials attended the training during this time.

2.47 DAFF advised the ANAO on 30 June 2025 that there is not a systematic approach to tracking and evaluating the guidance provided on the intranet, in the Business Bulletin or via email. Without a systematic approach, there is a risk of contradictory information being provided, or failing to identify whether messaging is having the desired effect.

3. Controls and processes for managing domestic and international travel

Areas examined

This chapter examines whether the Department of Agriculture, Fisheries and Forestry (DAFF) has effectively implemented controls and processes for domestic and international travel in accordance with its policies and procedures.

Conclusion

DAFF’s controls and processes for domestic and international travel are partly effective.

- Data indicates that DAFF booked flights in accordance with the whole of Australian Government travel arrangements (the WoAG Arrangements) related to ‘Lowest Practical Fare’ and ‘International Best Fare’.

- For domestic travel, there were insufficient records to clearly demonstrate consideration of value for money and records were not stored to allow for efficient assurance of the acquittal of travel-related expenses.

- DAFF did not have an overarching approach to checking compliance with the WoAG Arrangements and internal requirements for travel, including in relation to whether officials are being influenced by preferences for particular airlines and airline lounge and reward and loyalty point arrangements.

Areas for improvement

The ANAO made two recommendations aimed at improving records of business need, approval and acquittal of expenditure in order to demonstrate value for money.

The ANAO suggested that DAFF could:

- reference its guidelines on gifts and benefits policy in its Travel Regulation Manual;

- establish an appropriate expense code for airline membership purchases and better document need and approval for these purchases;

- check that travel-related expenditure is in line with the PGPA subsection 23(3) approval and DAFF policies as part of compliance activities; and

- consider if the overarching travel approval and associated expenditure meets the definition of ‘significant’ non-compliance with finance law for reporting to the Minister and in the department’s annual report.

3.1 Section 16 of the Public Governance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control. Entities should have an effective, evidence-based assurance framework in place to validate control effectiveness and monitor compliance with policy requirements for the purposes of continuous improvement.

3.2 DAFF’s expenditure on domestic and international travel between 2022–23 and 2024–25 is presented in Table 3.1.

Table 3.1: Department of Agriculture, Fisheries and Forestry travel expenses

|

Year |

Domestic travela ($) |

International travelb ($) |

WoAG fees ($) |

Otherc ($) |

Total ($) |

|

2022–23 |

18,873,393 |

5,387,827 |

477,658 |

1,930,054 |

26,668,932 |

|

2023–24 |

18,202,915 |

4,771,186 |

736,021 |

2,136,720 |

25,846,842 |

|

2024–25 |

19,223,781 |

6,002,790 |

2,055,680 |

2,242,917 |

29,525,169 |

|

Total |

56,300,090 |

16,161,803 |

3,269,359 |

6,309,692 |

82,040,944 |

Note a: Domestic travel includes accommodation, airfares, other domestic travel expenses, incidentals and travel allowance.

Note b: Not included in these figures is expenditure on travel by DAFF officers based overseas. Expenditure of this nature was $1.26 million across the three years. International travel includes accommodation, airfares, other international travel expenses, incidentals and travel allowance.

Note c: Other includes car hire, COVID-19 vaccines for travel and taxis.

Source: ANAO analysis.

Has the Department of Agriculture, Fisheries and Forestry effectively implemented controls for domestic travel?

For domestic travel, there was insufficient documentation of the need to travel and appropriate approvals in the sample tested. This limits DAFF’s ability to demonstrate consideration of value for money. For domestic flights, 99 per cent were recorded as complying with the lowest practical fare policy — 44 per cent were the ‘lowest fare’ (cheapest). Of the travel reviewed by the ANAO:

- 58 per cent did not have a travel request created in the department’s travel and credit card expense management system;

- 57 per cent were not approved in line with departmental policy;

- 96 per cent of bookings were made through the contracted supplier, as required;

- 43 per cent of accommodation expenses were above the subscription service rates without delegate approval; and

- 64 per cent of travel-related expenses were acquitted within 10 days, as required, and 36 per cent were not.

Records of domestic travel

3.3 DAFF’s approach to record keeping for domestic travel does not: clearly demonstrate that it follows its policies and processes for domestic travel (as illustrated in Figure 2.1); inform decision-making; and clearly demonstrate value for money.35

- DAFF does not require officials to create a ‘domestic travel request’ for each instance of travel in the department’s expense management system for travel and credit card purchases, Concur. Even if a request is created, all expenses related to the travel may not be linked to the relevant request. Travel-related expenses are recorded in the department’s financial management system, TechnologyOne, as individual expense items rather than by instance of travel. The implications of not requiring the creation of a ‘domestic travel request’ are discussed throughout this section.

- The ANAO identified limitations with data from the travel management services (TMS) system which mean that the data could not be relied upon to identify the number of trips undertaken (trip population). There were limitations in identifying unique trips including: instances where a trip could have multiple records; staff with bookings made with slight differences in their name resulting in double counting; and incomplete or inaccurate employee identification numbers.

3.4 Due to these issues, the ANAO was not able to reliably identify all trips undertaken by DAFF officials between 1 July 2022 and 31 December 2024.

3.5 Within Concur, expenses related to travel are categorised to certain expense codes. Using these codes, the ANAO identified expenses listed in Concur that related to official travel. The ANAO selected a random sample of 72 expense reports36 where travel-related expenses were acquitted between 1 July 2022 and 31 December 2024 out of a total of 54,513 expenses reports. From these expense reports, the ANAO assessed the effectiveness of DAFF’s controls for domestic travel.

Planning and approval

3.6 DAFF policy requires officials planning to undertake travel to:

- identify a business need for travel, and develop a travel plan in conjunction with their managers; and

- then seek subsection 23(3) PGPA Act approval (subsection 23(3) approval).

3.7 The Travel Regulation Manual states that ‘a travel plan will normally be developed between an employee and manager to address business and operational requirements with the most appropriate mode of transport and any work health and safety obligations’. For 42 (58 per cent) of 72 expense reports reviewed by the ANAO, the business need was not documented in travel plans and information held within Concur did not document any consideration of the most appropriate mode of transport or any work health and safety obligations. There was an appropriate record for 30 (42 per cent) of the expense reports.

3.8 DAFF policy states that delegates must provide subsection 23(3) approval before any travel is booked. DAFF’s Travel Regulation Manual (April 2024) outlines that ‘PGPA Act s23(3) approvals require the approving delegate to satisfy themselves that the official travel complies with Australian Government Travel Policies’.

3.9 Under subsection 23(3), a delegate is required to provide approval for travel prior to any expenses being incurred and the approval must be documented. This may be completed outside of Concur (for example in email) and can be attached to a domestic travel request in Concur. Of the 72 expense reports reviewed by the ANAO:

- 41 (57 per cent) did not have approval recorded in line with DAFF policy; and

- 31 (43 per cent) were approved appropriately.

3.10 On 3 July 2025, DAFF advised the ANAO that one SES Band 1 officer had provided overarching subsection 23(3) approval for all travel within their branch at the commencement of each financial year from at least 1 July 2022 until May 2025. DAFF was unable to locate the overarching approvals for 2022–23 and 2023–24. DAFF provided the overarching approval dated 5 July 2024 for 2024–25.

3.11 Providing an overarching approval for travel in this context does not meet Department of Finance guidance. This guidance indicates that overarching subsection 23(3) approvals should not be provided for travel where expenditure cannot be reasonably estimated. It notes that there are a range of factors that can influence the need and cost of individual travel proposals.37 In addition, the overarching approval provided by DAFF did not document the subsection 23(3) approval in line with creation of an appropriate record because the approval did not quantify any monetary limits on the amount to be approved, including the upper limits of the approval.

3.12 This approval was relevant for 22 (31 per cent) of the 72 travel expense reports reviewed by the ANAO. On 20 August 2025, DAFF advised the ANAO that it was not able to provide information about the total number and value of trips undertaken between 1 July 2022 and 31 December 2024 that were covered by an overarching approval. DAFF noted that there were ‘in excess of 10,000 travel requests’ processed with expenses of approximately $20 million in the SES Band 1 officer’s branch between 1 July 2022 and 31 December 2024.

3.13 DAFF’s records relating to domestic travel between 1 July 2022 to 31 December 2024 do not sufficiently demonstrate business need and consideration of value for money. Records in Concur do not provide assurance that officers have complied with subsection 23(3) relating to approval of expenditure.

Recommendation no.1

3.14 The Department of Agriculture, Fisheries and Forestry document the business need and Public Governance, Performance and Accountability Act 2013 subsection 23(3) approval in order to support value for money with respect to domestic travel. This should be appropriately stored in the department’s records management system and expense management system.

Department of Agriculture, Fisheries and Forestry response: Agreed

3.15 The department has taken a range of steps to further strengthen and document compliance with the PGPA Act including the upcoming rollout of the use of forms to capture the business need and demonstrate the value for money for travel.

3.16 The department acknowledges that the majority of travel approvals considered non-compliant by the ANAO were supported by an overarching s23(3) approval. This overarching approval process was supported by a centralised team who oversaw individual travel bookings and acquittals. The department considers this travel had a genuine business need as it supported the provision of critical cost recovered export services to industry. The department has since amended this approval process to ensure the travel expenditure is considered compliant with the PGPA Act.

3.17 The department is currently considering a systematised way of storing travel documentation in a single location. This will further strengthen the department’s compliance policies and procedures for domestic travel, including the ability to better identify potential non-compliance.

Booking

3.18 Once a delegate provides subsection 23(3) approval, bookings of domestic travel (flights, accommodation and car hire) must be completed through the TMS system (Figure 2.1).38 Of the 72 expense reports reviewed by the ANAO, 55 required bookings through the TMS system. For these, 53 (96 per cent) were booked through the TMS system. Two expenses were for hotels that were booked outside of the TMS system.

Lowest practical fare

3.19 The WoAG Arrangements require officials to book flights at the lowest practical fare (LPF) (see paragraphs 1.7 and 1.8). If a flight is booked that is not the lowest fare in economy class, officials are required to select the ‘booking code’ from a drop-down list (within the TMS system) which includes six options (refer to Table 1.2).

3.20 Table 3.2 shows the policy codes selected for all of DAFF’s domestic flights booked between 1 July 2022 and 31 December 2024.

Table 3.2: Whole of Australian Government booking codes — 1 July 2022 to 31 December 2024a

|

Booking code |

Domestic (%)b |

|

|

1 |

Lowest fare |

44 |

|

6 |

Require flexibility to change booking |

39 |

|

2 |

Timing, routing, connection or baggage charges |

14 |

|

3 |

Approval or entitlement to travel at higher fare class |

4 |

|

5 |

Personal responsibilities |

1 |

|

7 |

Outside of LPF Policy |

<1 |

|

4 |

Health issues |

<1 |

|

– |

Otherc |

<1 |

Note a: The data is based on LPF code per booking reference. The Department of Finance advised the ANAO that booking references are not unique.

Note b: Booking references may include multiple flights for the same instance of travel, each associated with a different LPF code. Where this occurs, the booking reference will be included under multiple booking codes meaning results will not add to 100 per cent. Bookings may also contain both domestic and international flights.

Note c: ‘Other’ refers to records where an LPF code has not been recorded in the TMS system.

Source: ANAO presentation of LPF data extracted from the contracted TMS supplier. The ANAO has not tested the data as part of this audit.

3.21 Booking codes are not required to be recorded in Concur and are not available at the time of seeking approval from a delegate. As such, delegates may not be fully informed when making a decision as to how the travel complies with the WoAG Arrangements.

Accommodation, meal allowances and incidentals

3.22 DAFF adopts the Commonwealth Allowance Subscription Service (subscription service) rates as a guide for ‘reasonable costs’ for accommodation.39 Under DAFF’s Travel Regulation Manual, delegates can provide approval for expenditure on accommodation at a higher rate. Approval must be written. Of the 72 expense reports reviewed by the ANAO, 37 included accommodation expenses. Sixteen (43 per cent) accommodation expenses were above the subscription service rates without delegate approval. Delegate approval should be a key control in confirming value for money where accommodation expenses are above the subscription service rates. On average, accommodation expenses were $30 per night over the subscription service rates.

3.23 Meal and incidental allowances can be paid in advance or claimed during the acquittal of travel expenses. With the exception of SES officials, corporate credit cards were not to be used for meals and incidentals. Prior to March 2025, SES officials were to pay for meals and incidentals while on official travel using their corporate credit card rather than receiving a travel allowance. In response to the ‘Travel support and efficiency of expenditure acquittal methodologies’ internal audit, SES officials now receive a travel allowance. The rationale for this change was to increase the efficiency of processes and to reduce the risk of non-compliance. Thirty-two (44 per cent) of the 72 expense reports tested by the ANAO included meal and incidental allowances. All meal and incidental allowances were paid in accordance with subscription service rate, as required by DAFF policies.

Delegate authorises travel request

3.24 As outlined in paragraph 3.3, officials are able to create a ‘domestic travel request’ in Concur. This is not mandatory. DAFF’s guidance outlines that a domestic travel request allows for ‘airfare, accommodation, car hire and other anticipated expenses’, travel allowances and travel advances to be captured. Officials are required to create a request if meal and incidental allowances are to be paid in advance of the travel. Once a travel request is created, it workflows to a delegate for approval.