Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Domestic and International Travel Requirements in the Australian Criminal Intelligence Commission

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- In 2024–25, $953 million was spent on travel through the whole of Australian Government travel arrangements (the WoAG Arrangements).

- Australian Government entities should have robust internal arrangements for official travel to support compliance with the WoAG Arrangements, manage fraud and corruption risks and foster a culture of integrity.

- The audit was conducted to provide assurance to the Parliament as to whether the Australian Criminal Intelligence Commission (ACIC) has effective arrangements to comply with domestic and international travel requirements.

Key facts

- ACIC is a non-corporate Commonwealth entity and must comply with all elements of the WoAG Arrangements.

- ACIC protects Australia from crime threats through collection, assessment and sharing of intelligence information.

What did we find?

- ACIC has largely effective arrangements to comply with official travel requirements.

- ACIC has largely effective controls for domestic and international travel. It does not identify, record or manage all instances of non-compliance with its travel policy.

- ACIC provides regular financial and non-compliance reporting to its executive management. ACIC’s reporting does not provide a comprehensive view of whether its travel processes and procedures remain appropriate and achieve value for money for the entity.

What did we recommend?

- There were two recommendations to ACIC to improve its travel non-compliance management and enhance monitoring and reporting arrangements.

- ACIC agreed to recommendations.

$9.2m

Total official travel expenditure for 2024–25.

4,271

Total number of domestic and international trips for 2024–25.

242

Number of travel policy breaches between 1 July 2022 and 30 June 2025.

Summary and recommendations

Background

1. Officials in Australian Government entities undertake domestic and international travel for the purpose of achieving the objectives of the entity. The whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance (Finance). The WoAG Arrangements encompass five components: book; fly; stay; drive; and pay. The WoAG Arrangements are supported by resource management guides outlining the Australian Government policies for domestic and international air travel.

2. All non-corporate Commonwealth entities must comply with all elements of the WoAG Arrangements. Corporate Commonwealth entities and Commonwealth companies may elect to adopt some or all of the arrangements. As a non-corporate Commonwealth entity, the Australian Criminal Intelligence Commission (ACIC) must comply with the WoAG Arrangements.

Rationale for undertaking the audit

3. In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of the whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity and meets the intent of the WoAG Arrangements. There has been parliamentary and public interest in government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether ACIC has effective arrangements to comply with domestic and international travel requirements.

4. This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; Civil Aviation Safety Authority; ACIC; and Services Australia.

Audit objective and criteria

5. The objective of the audit was to assess whether ACIC has effective arrangements to comply with domestic and international travel legislative and entity requirements.

6. To form a conclusion against the objective, the ANAO adopted one high-level audit criterion.

- Has ACIC implemented effective controls and processes to manage domestic and international travel in accordance with whole of Australian Government requirements?

Conclusion

7. ACIC has established largely effective arrangements to comply with policy requirements for domestic and international travel. ACIC’s arrangements do not address all emerging risks, and improvements could be made in the ongoing monitoring of non-compliance and the appropriateness of the arrangements.

8. ACIC has implemented policies and procedures that align with the WoAG arrangements and requirements and has largely effective controls in place. Deficiencies have been identified in ACIC’s approach to capturing and managing travel non-compliance and ACIC does not have assurance over the policy settings within its travel arrangements. Travel monitoring and reporting could be further enhanced to assure executive management that risk is being addressed, policy settings are appropriate and travel expenditure achieves value for money for ACIC.

Supporting findings

Domestic and international travel management controls and processes

9. ACIC has implemented controls for domestic travel across planning and approval, booking and reconciliation and acquittal of expenses. ACIC updated its approval process in April 2025 in response to internal audit findings. Within trips reviewed by the ANAO, ACIC officials selected the lowest (cheapest) airfare for 30 per cent of trips and booked accommodation outside recommended rates without a documented reason or delegate’s approval for 21 per cent of trips. ACIC’s reconciliation and acquittal process is undertaken by a central team and is limited to travel approval confirmation. (See paragraphs 2.5 to 2.36)

10. ACIC has implemented controls for international travel. International trips reviewed by the ANAO aligned with ACIC’s travel policy requirements in most cases. (See paragraphs 2.37 to 2.58)

11. ACIC’s travel policy does not clearly define arrangements for identifying, assessing and managing non-compliance. ACIC has some processes in place to identify non-compliance, which is predominately focused on checking for travel approval as part of travel reconciliation and acquittal. ACIC has a non-compliance register that includes details on the identification and resolution of non-compliance incidents. However, ACIC is not capturing non-compliance against all travel policy requirements. Since the implementation of the SAP approval module in April 2025, ACIC has not reviewed its approach to detecting and managing travel non-compliance. (See paragraphs 2.59 to 2.77)

12. ACIC provides travel financial expenditure and non-compliance reporting to its governance committees on a regular basis. ACIC’s existing monitoring and reporting arrangements do not enable executive management to determine whether risk and policy settings are appropriate, or whether domestic and international travel expenditure and booking practices represent value for money for ACIC. (See paragraphs 2.78 to 2.80)

Recommendations

Recommendation no. 1

Paragraph 2.69

The Australian Criminal Intelligence Commission:

- strengthens its controls and approach for identifying, managing and reporting non-compliance to ensure all travel policy non-compliance is captured; and

- provides guidance to relevant officials on how to identify, assess and categorise potential non-compliance events.

Australian Criminal Intelligence Commission response: Agreed.

Recommendation no. 2

Paragraph 2.82

The Australian Criminal Intelligence Commission improves monitoring and reporting arrangements to provide assurance that travel risks are addressed, policy settings remain appropriate and that expenditure represents value for money.

Australian Criminal Intelligence Commission response: Agreed.

Summary of entity response

13. The proposed audit report was provided to ACIC. ACIC’s summary response is provided below. The full response from ACIC is at Appendix 1.

Australian Criminal Intelligence Commission

The ACIC acknowledges the recommendations from the audit, and commits to strengthening its processes and procedures to implement a more effective framework in its current environment. The future implementation of a Travel Management System as part of an Enterprise Resource Planning (ERP) solution will further strengthen and support our identification, management and reporting of non-compliance, address travel related risks and focus on expenditure representing value for money. ACIC would like to thank the ANAO for the collegiate and pragmatic approach to working with us during the audit.

Key messages from this audit for all Australian Government entities

14. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Australian Government entity officials undertake domestic and international travel for the purpose of achieving the objectives of the entity. Official travel is:

any travel where a Commonwealth entity is ultimately responsible for any of the direct or indirect costs associated with that travel… This includes travel by officials, contractors and consultants to undertake work duties at the direction of the employer to achieve one or more Commonwealth objectives.1

Australian Government framework for travel

1.2 The Commonwealth resource management framework governs how Australian Government entities use and manage public resources. The foundation of the framework is the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Under the PGPA Act, accountable authorities are required to promote the proper use and management of public resources.2

1.3 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance under section 105B of the PGPA Act. Compliance with the CPRs is mandatory for officials of non-corporate Commonwealth entities (NCEs). The CPRs require NCEs to use coordinated procurements when such arrangements exist. The Whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated travel-related procurements established and managed by the Department of Finance (Finance).3 All NCEs must comply with all elements of the WoAG Arrangements.4 Corporate Commonwealth entities (CCEs) and Commonwealth companies may elect to adopt some or all of the arrangements.5

1.4 Finance has published model accountable authority instructions (AAIs), which include requirements for official travel (see Box 1).6

|

Box 1: Model accountable authority instructions for official travel — non-corporate Commonwealth entities |

|

You must:

Where the government has established coordinated procurements for a particular travel activity, you must use the arrangement established for that activity, unless:

You must:

|

Whole of Australian Government travel arrangements

1.5 The WoAG Arrangements commenced in 2010 and aim to:

- reduce travel costs by aggregating government buying power to obtain discounted pricing;

- decrease administrative costs for suppliers and entities by removing procurement duplication;

- simplify processes by integrating technology, unifying pricing and aligning systems;

- optimise savings by promoting behavioural change; and

- support Australian Government policies.7

1.6 The WoAG Arrangements encompass five components outlined in Table 1.1.

Table 1.1: Whole of Australian Government travel arrangements — services and suppliers

|

Component |

Services |

Suppliers (as at July 2025) |

|

Booka |

The Travel Management Services (TMS) supplierb provides booking services for air travel, hotel, bus, sea, rail, car rental, ground transport services, and charter flights. In addition, 24/7 support and entity travel reports are provided. |

Corporate Travel Management (CTM) |

|

Flyc |

Domestic and international air travel suppliers. The panel of airlines is not exclusived. Airlines included in the panel provide ‘discounted fares and beneficial fare conditions’ to the Australian Government’. |

Panel of 18 airlines

|

|

Staya |

All domestic accommodation must be booked through the sole supplier. Booking international accommodation through the supplier is encouraged but is not required. |

CTM |

|

Drivee |

Domestic vehicle rental services supplier. Bookings can be made via the TMS or directly with the supplier via a WoAG portal. |

Hertz |

|

Payf |

Travel and Procurement Payments Services (TAPPS). For official travel booked via the TMS, entities are required to use a ‘lodge card’g. Commonwealth credit cards are utilised for other expenses associated with travel such as meals and incidentals. |

National Australia Bank (NAB) |

Note a: Standing Offer Notice ID SON3979293, available from https://www.tenders.gov.au/Son/Show/b3e4c6ad-ab57-4d46-a3c6-d0ce7b083ac7.

Note b: The supplier of Travel Management Services is known as the Travel Management Company (TMC).

Note c: Standing Offer Notice ID SON3337469, available from https://www.tenders.gov.au/Son/Show/606ca6fd-c615-d94c-905e-491969f2a3ba.

Note d: Given the panel is not exclusive, entities are permitted to book both domestic and international air travel with non-panel airlines.

Note e: Standing Offer Notice ID SON35277487, available from https://www.tenders.gov.au/Son/Show/1545a9af-e0d4-bab4-60d4-e03aed0558db.

Note f: Standing Offer Notice ID SON3637640, available from https://www.tenders.gov.au/Son/Show/ad2d8b17-c42e-4601-a757-72568eafa384.

Note g: A Lodge Card is the digital number stored in the Travel Management Services User profile.

Source: Department of Finance, Whole of Australian Government Travel Arrangements, About the Travel Arrangements and Department of Finance, Whole of Australian Government Procurement.

Lowest fare

1.7 The WoAG Arrangements are supported by resource management guides (RMGs) outlining the Australian Government policies for domestic and international air travel. These policies require travellers to select the ‘Lowest Practical Fare’ (LPF) for domestic flights and the ‘International Best Fare’ (IBF) for international flights.

- The LPF is ‘the lowest fare available at the time the travel is booked on a regular service (not a charter flight), that suits the practical business needs of the traveller’.8

- The IBF is ‘the lowest fare on the day the travel is booked on a regular scheduled service (not a charter flight), that suits the practical business needs of the traveller and maximises overall value for money for the total cost of the trip’.9

1.8 Officials can book the flight that is not the cheapest available and still be compliant with the LPF and IBF policies. Officials need to select a booking code to support why the lowest fare flight has not been chosen (see Table 1.2). Booking codes one to six are compliant with the LPF and IBF policies. If flights are not compliant, then code 7 (‘Outside of LPF policy’) is to be used.

Table 1.2: Policy booking codes for lowest practical fare and international best fare

|

Policy booking code |

Requirement |

|

|

1 |

Lowest fare |

Domestic: This is the cheapest available fare taking into account the 1-hour window.a International: This is the cheapest fare taking into account the 24-hour booking window.b |

|

2 |

Timing, routing, connection or baggage charges |

Domestic: Where the fare selected is not the lowest fare because it:

International: Where the fare is selected is not the lowest fare because it:

|

|

3 |

Approval/entitlement to travel at a higher fare class |

Domestic: All air travel is to be at the lowest practical fare in economy class unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the lowest practical fare within the entitlement. International: All air travel is to be at the international best fare in the appropriate classc (having regard to internal travel policy) unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the international best fare within the entitlement. |

|

4 |

Health issues |

Health issues for officials requiring certain facilities. A medical certificate is required to support use of this code. |

|

5 |

Personal responsibilities |

Impact on personal responsibilities such as family. |

|

6 |

Require flexibility to change booking |

Where flexibility is required for air travel, travel bookers must consider selecting a semi-flexible fare type instead of a fully flexible fare. |

|

7 |

Outside of LPF policy |

Preference for a particular aircraft or airlines, availability of access to airline lounges, accumulation of airline benefits such as reward or loyalty points (including status credits). |

Note a: According to RMG 404 — Domestic Travel Policy, the one hour ‘time window’ is used by the TMS supplier to ‘monitor whether the lowest practical fare has been selected and assess potential missed savings…For outbound flights, the window commences 1 hour prior to the booked flight. For inbound flights, the window commences 1 hour after the booked flight’.

Note b: According to RMG 405 — Official International Travel — Use of the best fare of the day, the TMS supplier ‘applies the 24-hour window to the booked flight time from the point of departure to monitor whether the international best fare has been selected.’

Note c: RMG 405 — Official International Travel — Use of the best fare of the day requires officials to select ‘business class or equivalent or lower class airfare’.

Source: RMG 404 — Domestic Travel Policy and RMG 405 — Official International Travel – Use of the best fare of the day.

1.9 The RMGs set out additional guidance for travellers and approvers. Two key considerations for officials undertaking and approving domestic and international travel are ‘value for money’ and ‘necessity of travel’.

- Value for money requires: ‘the use of Commonwealth resources in an efficient, effective, economical and ethical manner that is consistent with the policies of the Commonwealth… Accordingly, when booking travel, officials must make decisions based on impartial consideration of fares available’.

- Delegates, in approving official travel, ‘must be satisfied there is a demonstrated business need for the travel’ and that ‘Air travel must only be undertaken where other communication tools, such as teleconferencing and videoconferencing, are ineffective’.

Review of travel purchasing policies

1.10 In 2024, the Australian Government published the Aviation White Paper to set out the ‘Australian Government’s vision for Australia’s aviation sector towards 2050 to ensure it remains safe, competitive, productive and sustainable.’ The White Paper contains 56 new policy initiatives. Under the banner of a ‘competitive and efficient aviation sector’, initiative 17 is:

Review government travel purchasing policies to consider whether changed policy settings could better support competition. The Department of Finance will conduct the review in 2024.10

1.11 Finance finalised the ‘Review of Australian Government Travel Policies’ in December 2024.11 The review made seven recommendations:

- publish the WoAG Arrangements usage and expenditure;

- update policy to explicitly deal with flight upgrades;

- return to market for a full re-tender of the Airline Panel following consultation with the market on the approach to status credits;

- create one Government Travel Policy, including mandating economy class for flights under three hours, enhanced guidance on gifts and benefits and setting a two-year review period;

- booking codes for best value fare to be updated to include a justification for selecting the booking code for delegate consideration;

- work with the contracted TMS to improve services; and

- remove the requirement for accountable authorities to seek Ministerial approval for international travel over a certain threshold.

1.12 The Australian Government’s response to the recommendations is detailed in the ‘Review of Australian Government Travel Policies — What We’re Doing’, which stated ‘the Review found that the travel policies are generally fit for purpose and deliver significant savings for government.’12 Finance published the review and response on its website on 1 August 2025.

Australian Criminal Intelligence Commission

1.13 The Australian Criminal Intelligence Commission’s (ACIC) purpose as set out in its corporate plan is to ‘protect Australia from serious criminal threats by collecting, assessing and disseminating intelligence and policing information’.13

1.14 In 2024–25, ACIC’s total expenses were $326.5 million, with an average staffing level (ASL) of 826.14 The Chief Executive Officer (CEO) is the accountable authority and the agency head for the purposes of the PGPA Act and the Public Service Act 1999.

1.15 ACIC is a non-corporate commonwealth entity (NCE) and must comply with all elements of the WoAG Arrangements. In 2024–25, ACIC reported its expenditure on travel as $9.2 million compared to $8.4 million in 2023–24.15

Previous ANAO audit coverage

1.16 Previous ANAO audits have identified issues in other entities with credit card and travel compliance. In 2023–24, the ANAO conducted a series of audits assessing compliance with corporate credit card requirements.16 These reports identified:

- positional authority risks with expenditure on travel and credit cards being approved by officials who are junior to the traveller;

- approval of travel not being provided prior to travel being undertaken; and

- failure to identify, record or respond to instances of non-compliance with travel requirements.

Rationale for undertaking the audit

1.17 In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of the whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity and meets the intent of the WoAG Arrangements. There has been parliamentary and public interest in government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether ACIC has effective arrangements to comply with domestic and international travel requirements.

1.18 This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; Civil Aviation Safety Authority; ACIC; and Services Australia.

Audit approach

Audit objective, criteria and scope

1.19 The objective of the audit was to assess whether ACIC has effective arrangements to comply with domestic and international travel legislative and entity requirements.

1.20 To form a conclusion against the objective, the ANAO adopted one high-level audit criterion.

- Has ACIC implemented effective controls and processes to manage domestic and international travel in accordance with whole of Australian Government requirements?

1.21 The audit examined the management of domestic and international travel by ACIC from 1 July 2022 to 30 June 2025.

Audit methodology

1.22 To address the audit objective, the audit methodology included:

- examining ACIC’s policies, frameworks, procedures, travel management systems, assurance and reporting activities;

- meeting with ACIC’s officials;

- testing the effectiveness of ACIC’s travel control framework; and

- analysing travel data from ACIC’s systems and entity-level data from the WoAG travel management system.

1.23 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $188,738.

1.24 The team members for this audit were Deniss Cirulis, Raza Gulani, Caitlin Williams, Fionan Dunne, Lachlan Rowe, Nathan Callaway and Anne Rainger.

2. Domestic and international travel management controls and processes

Areas examined

This chapter examines whether the Australian Criminal Intelligence Commission (ACIC) has implemented effective controls and processes to manage domestic and international travel in accordance with whole of Australian Government requirements.

Conclusion

ACIC has implemented policies and procedures that align with the whole of Australian Government travel arrangements (WoAG Arrangements) and requirements and has largely effective controls in place. Deficiencies have been identified in ACIC’s approach to capturing and managing travel non-compliance and ACIC does not have assurance over policy settings within its travel arrangements. Travel monitoring and reporting could be further enhanced to assure the executive management that risk is being addressed, policy settings are appropriate and travel expenditure achieves value for money for ACIC.

Area for improvement

The ANAO made two recommendations for ACIC to improve its travel non-compliance management and enhance its monitoring and reporting arrangements.

2.1 Section 16 of the Public Governance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control.

2.2 Effectively implementing an appropriate process for the management of non-compliance is necessary to ensure officials comply with internal policies and legislative requirements and serves as a deterrent for future non-compliance by officials.

2.3 Entities should have appropriate arrangements for reporting to the accountable authority and executive management. Early identification of potential issues and risks, through regular monitoring and reporting, enables the accountable authority and executive management to refine existing arrangements, provide further training or guidance to officials, manage non-compliance and ensure arrangements are achieving value for money.

Australian Criminal Intelligence Commission’s travel framework

2.4 ACIC’s Accountable Authority Instructions (AAIs) define official travel as ‘any travel where a Commonwealth entity is responsible for any of the direct or indirect costs associated with that travel’. ACIC’s framework for travel management is established through a range of enterprise-wide policies and procedures summarised in Table 2.1.

Table 2.1: Australian Criminal Intelligence Commission’s travel policies and procedures

|

Framework documentation |

Travel management related content |

|

AAIs |

ACIC’s AAIs set out the Chief Executive Officer’s (CEO) instructions for conducting official travel, including ensuring there is a business need and that travel expenses represent value for money. |

|

Financial Delegation 2025 |

Establish a delegation for the power to approve expenditure for domestic and international travel, including maximum amounts and corresponding positions.a |

|

Enterprise Agreement (2024–2027) |

Sets out travel related conditions such as payment of travel allowance, travel expenses (airfares and accommodation) and class of travel. |

|

Corporate credit card policy and procedure (2024) |

Sets out requirements for booking travel and credit card use for travel (for example, taxis or parking) including reconciliation and acquittal of expenditure. |

|

Travel policy and procedure (2025)b |

Sets out requirements and obligations for officials undertaking, approving and administering domestic and international travel. The policy aligns with the WoAG Arrangements and Resource Management Guide (RMG) 404 and 405. |

Note a: The Financial Delegation 2025 sets out specific arrangements for ACIC officials in line with section 23 of the PGPA Act. All staff can spend money on incidental travel expenses up to $200 (for example taxis, parking). Officials from EL1 to SES Band 3 level can spend money up to their delegation varying between $25,000 for the EL1 and $5 million for the SES Band 3.

Note b: Within the audit period (1 July 2022 to 30 June 2025), there have been two versions of ACIC’s Travel Policy and Procedure (ACIC’s travel policy). The first version was effective from January 2022 and was superseded by the updated version in March 2025 to incorporate the inclusion of system-based travel approval (see paragraph 2.8).

Source: ANAO’s analysis of ACIC’s travel policy documentation.

Has the Australian Criminal Intelligence Commission implemented effective controls for domestic travel?

ACIC has implemented controls for domestic travel across planning and approval, booking and reconciliation and acquittal of expenses. ACIC updated its approval process in April 2025 in response to internal audit findings. Within trips reviewed by the ANAO, ACIC officials selected the lowest (cheapest) airfare for 30 per cent of trips and booked accommodation outside recommended rates without a documented reason or delegate’s approval for 21 per cent of trips. ACIC’s reconciliation and acquittal process is undertaken by a central team and is limited to travel approval confirmation.

Domestic travel overview

2.5 ACIC’s domestic travel expenditure and total trips between 2022–23 and 2024–25 are set out in Table 2.2.

Table 2.2: Australian Criminal Intelligence Commission’s domestic travel airfare, accommodation and travel allowance expenditure

|

Financial year |

Number of trips |

Total expenditure $m |

Average cost per tripa $ |

|

2022–23 |

4,425 |

5.7 |

1,279 |

|

2023–24 |

4,139 |

5.6 |

1,342 |

|

2024–25 |

4,175 |

5.9 |

1,417 |

Note a: Calculated by the ANAO.

Note: The combined domestic and international travel expenditure value for a given year (see Table 2.2 and Table 2.4) varies from the value reported in ACIC’s annual report (see paragraph 1.15) as the annual report figure includes costs such as hire vehicles, taxi/car service, lounge membership, deployment related costs and operational accommodation.

Source: ACIC’s domestic travel expenditure data.

Domestic travel management process summary

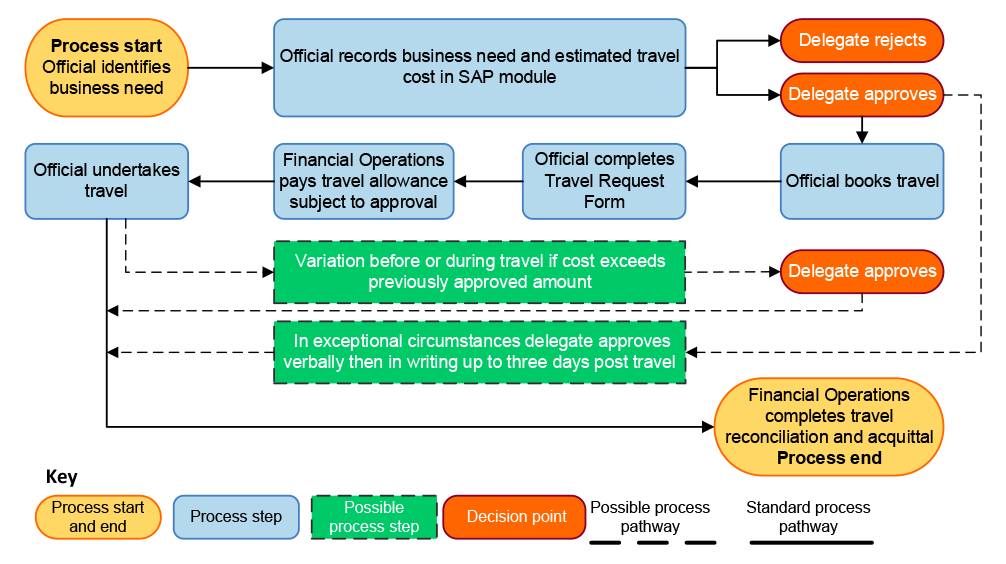

2.6 At ACIC, the booking and documentation of domestic travel is completed by the individual official who is travelling. Prior to booking the travel, officials seek approval from the delegate via a SAP travel approval module (the SAP module).17 The Financial Operations, Reporting and Compliance section (Financial Operations) administers travel allowance and completes travel reconciliation and acquittal.18 ACIC’s domestic travel management process is illustrated in Figure 2.1.

Figure 2.1: Australian Criminal Intelligence Commission’s domestic travel management process

Source: ANAO analysis of ACIC’s domestic travel process after April 2025.

Planning and approval

Business need

2.7 ACIC’s travel policy requires officials to:

- demonstrate the business need to conduct official travel;

- demonstrate that the travel is an effective, economical, efficient and ethical use of public resources, and achieves value for money; and

- provide sufficient justification to allow a delegate to make an informed decision with respect to effectiveness, efficiency and economy of the trip.

2.8 When seeking delegate’s approval, the travelling official completes the mandatory ‘Purpose of Travel’ free text field in the SAP module to document the travel business need. It is the responsibility of the delegate to assess the business need when they approve the travel request in the SAP module.

2.9 The ANAO reviewed 47 randomly selected domestic trips. Of the 47 trips tested by the ANAO, all trips had the travel business need included in the travel request with varying levels of detail recorded, for example: ‘operational activity’; ‘ACIC offsite examination series’; ‘meeting’; and ‘training’. Insufficient information on the purpose of travel potentially reduces the delegate’s ability to assess the business need of the trip and limits ACIC’s ability to conduct future compliance monitoring.

Approval requirement

2.10 ACIC’s travel policy specifies that officials intending to ‘undertake official travel must first obtain approval from an appropriate delegate’ and that:

in exceptional circumstances where SAP pre-approval is not possible, verbal approval can be obtained. This must be documented in writing as soon as practicable (s18 of the PGPA Act). As soon as practicable means at the next available opportunity of the staff member to have access to email or SAP, and no later than three days after verbal approval has been granted.

2.11 ACIC’s travel policy does not define or provide examples of exemptional circumstances to guide officials or delegates on when exceptional circumstances apply for travel approval.

2.12 Delegate approval (referred to in ACIC’s travel policy as pre-approval) is recorded in the SAP module. Approval is provided prior to the official making the booking based on the estimated total travel cost, itemised by costs for airfare, accommodation, hire car and travel allowance. ACIC’s advice to staff includes a recommendation that officials ‘add a reasonable buffer amount to … pre-approval quote’ without providing further guidance of what a reasonable amount might be. The reference to a ‘reasonable buffer’ is subjective and may be applied inconsistently, increasing the risk that officials may book higher-cost travel while remaining within the approved estimate, in particular as the delegate does not see the actual booking costs.

2.13 Travel expenditure re-approval is required after booking when the actual travel cost exceeds the previously approved estimated cost. It is a responsibility of the travelling official to document all changes in writing, obtain re-approval and inform Financial Operations of the changes.

2.14 Following travel approval, the travelling official books travel and completes the Travel Request Form (TRF). The TRF includes details of booked airfares; accommodation cost; whether recommended accommodation rates are exceeded; selected Lowest Practical Fare (LPF) code; and a total amount of travel allowance to be paid. The TRF is saved in ACIC’s record management system.

2.15 The use of the SAP module for approval was introduced in April 2025 following a 2023 internal travel audit that found deficiencies in ACIC’s travel approval process (see paragraph 2.74). To support the implementation, ACIC held two targeted training sessions and published fact sheets on its intranet for officials to use when booking travel.

2.16 Prior to April 2025:

- verbal approval was required prior to booking; and

- written delegate approval, including recording business need, was required to be documented in the TRF after booking.19

2.17 Of the 47 trips tested by the ANAO, 36 trips occurred before the April 2025 travel process and policy changes. Three of the 36 trips (six per cent) had not been approved by the delegate prior to travel or within three days of the commencement of travel. These trips were not included in ACIC’s non-compliance register (see paragraph 2.59). On 16 September 2025, ACIC advised the ANAO of additional information related to the three trips.

- For the trip that was approved six days after travel had concluded, ‘Travel was undertaken at short notice to meet operational requirements, the number of days over the policy requirement was only two days, thus it was decided to not include as a breach’.

- For the trip that was approved 12 days after travel had concluded, ‘Flight changes were made close to when travel was undertaken, thus delayed obtaining the approval on time’.

- For the trip that was approved 29 days after travel had concluded, ‘Verbal approval was provided by delegate on 19 Dec 2023, prior to undertaking travel on 20 Dec 2023, thus this does not amount to a breach’.

2.18 Of the 11 trips that occurred after the April 2025 change, all eleven trips were approved in the SAP module prior to departure.

2.19 While the new approval process has improved travel approval rates, it has diminished oversight of the actual bookings and the cost. ACIC should consider what other compliance or monitoring mechanisms it has in place and if these are sufficient to detect potential issues and non-compliance following the change in the process (see Recommendations no. 1 at paragraph 2.69 and no. 2 at paragraph 2.82).

Travel booking

2.20 Once the delegate approves the trip in the SAP module, the official books travel (flights, accommodation and car hire) through the WoAG Travel Management Services system (CTM).

Lowest practical fare

2.21 The WoAG Arrangements require officials to book flights using LPF (see paragraph 1.7). When the lowest (cheapest) economy class fare is not selected for the booking, officials are required to choose the ‘booking code’ from a drop-down list within the TMS system, which includes seven code options (see Table 1.2). Bookings codes between one and six are compliant with the LPF WoAG policy.

2.22 ACIC’s travel policy states that ‘staff must have regard to the lowest practical fare based on impartial consideration of the fares available’ and that ‘reasons must be provided on the travel request form where any fare booked is not the lowest practical fare’.

2.23 Within the 47 trips tested by the ANAO, 44 trips included booked air travel. Within these, officials chose:

- code 6 ‘Require flexibility to change booking’ for 22 trips (50 per cent);

- code 1 ‘Lowest Fare’ (cheapest) for 13 trips (30 per cent); and

- code 2 ‘Unsuitable due to time routing connections or baggage charges’ for nine trips (20 per cent).

2.24 Table 2.3 sets out the LPF booking codes selected in the TMS system for ACIC’s domestic flights booked between 1 July 2022 and 30 June 2025.

Table 2.3: Australian Criminal Intelligence Commission’s domestic travel booking code summary — 1 July 2022 to 30 June 2025

|

Booking code |

Numbera |

|

|

6 |

Require flexibility to change booking |

5,912 (49%) |

|

1 |

Lowest fare |

3,802 (31%) |

|

2 |

Unsuitable due to time routing connections or baggage charges |

2,234 (18%) |

|

3 |

Approval/Entitlement to travel at a higher fare class |

269 (2%) |

|

5 |

Personal responsibilities |

60 (<1%) |

|

7 |

Outside of LPF policy |

41 (<1%) |

|

4 |

Health issues |

7 (<1%) |

|

|

Otherb |

9 (<1%) |

Note a: Multiple booking codes can be attributed to a booking which may impact the total numbers and percentages.

Note b: Other was blank on booking code.

Source: TMS system data.

Accommodation

2.25 ACIC’s travel policy states that:

- accommodation should be booked in line with recommended rates20;

- the official must balance the need for the cheapest accommodation with the distance from the destination; and

- the official must include reasons in the TRF to explain instances where booked accommodation exceeds the recommended rates and seek delegate’s approval to book above the rates.

2.26 Following the introduction of the SAP module, the delegate does not have visibility of the TRF and therefore where the accommodation cost exceeds the recommended rates and its associated rationale.

2.27 ACIC’s travel policy also allows officials to stay at private accommodation with friends or family (instead of commercial accommodation) and claim a private accommodation allowance. For each night officials will be paid an allowance of $60.

2.28 Of the 47 trips tested by the ANAO, 42 trips included accommodation expenses.

- 18 trips (43 per cent) included accommodation booked within the recommended rates;

- 15 trips (36 per cent) included accommodation booked above the recommended rates and with a reason provided in the TRF; and

- nine trips (21 per cent) included accommodation booked above the recommended rates, did not provide a reason in the TRF and did not have delegate approval to book above the rates, which is not in line with ACIC’s travel policy.

2.29 For the nine trips that exceeded recommended rates and did not have a documented reason, ACIC advised the ANAO on 18 September 2025 that:

- for three accommodation bookings ‘this occurred during the early stages of non-compliance monitoring and reporting program’;

- for two accommodation bookings ‘variance is immaterial’;

- for two accommodation bookings ‘unable to find support to why it exceeded the recommended rate’;

- for one accommodation booking ‘due to insufficient information we could not determine whether the individuals’ accommodation cost exceeded the recommended rate’; and

- for one accommodation booking ‘rates were noted as being above the recommended rate due to availability, duration of stay and proximity to course venue’. The TRF for the booking that ACIC provided to the ANAO did not include this explanation.

2.30 ACIC did not record these nine trips in the non-compliance register.

Travel allowance

2.31 ACIC’s travel policy and Enterprise Agreement 2024–27 specify that all officials who travel on ACIC business are entitled to travel allowance payments to cover the cost of meals and incidental expenses.21

2.32 ACIC’s travel policy outlines that the payment of the travel allowance to the official occurs after the TRF has been correctly completed and the delegate has provided written approval for the trip. If written approval has not been provided until after the travel (noting ACIC allows this in exceptional circumstances), the travel allowance is paid after the travel has concluded.

2.33 After the official makes the booking and records travel details in the TRF, Financial Operations uses the TRF to calculate the total amount of travel allowance payable based on the length of the trip and the destination. Financial Operations checks the TRF and the SAP module to confirm travel approval and processes the payment to the official.

2.34 Of the 47 trips tested by the ANAO, 39 trips included a record of travel allowance value and payment in the TRF; six trips were arranged for contractors or guests who are not entitled to travel allowance; one trip was cancelled without travel allowance paid; and one trip did not include a record of travel allowance as the trip was cancelled and a TRF was not created.

2.35 In all of the trips reviewed by the ANAO, travel allowance was paid only after written travel approval by the delegate. In the three instances where written approval was recorded after travel, the travel allowance was paid after the trip was completed in line with ACIC’s travel policy.

Reconciliation and acquittal

2.36 ACIC’s travel reconciliation and acquittal consists of two components.

- Monthly reconciliation and acquittal of airfares, accommodation and the TMS system fees. Financial Operations reconciles bank charges against the data from the TMS system and SAP, checks supporting documentation for travel approval if there are variances in the data and resolves any variances. This review is only conducted if the total charge from the TMS system is not the same as that on the financial management system and is conducted without delegate’s involvement or oversight.

- Monthly reconciliation and acquittal of incidental travel expenses (for example, taxis and parking). Travelling official completes credit card reconciliation monthly as part of the general credit card acquittal process and submits to the delegate for approval, after which it is provided to Financial Operations for review and finalisation.

Has the Australian Criminal Intelligence Commission implemented effective controls for international travel?

ACIC has implemented controls for international travel. International trips reviewed by the ANAO aligned with ACIC’s travel policy requirements in most cases.

International travel overview

2.37 ACIC’s international travel expenditure and total trips between 2022–23 and 2024–25 financial years are set out in Table 2.4.

Table 2.4: Australian Criminal Intelligence Commission’s International travel airfare, accommodation and travel allowance expenditure

|

Financial year |

Number of trips |

Total expenditure $m |

Average cost per tripa $ |

|

2022–23 |

127 |

0.7 |

5,399 |

|

2023–24 |

178 |

0.8 |

4,654 |

|

2024–25 |

96 |

0.6 |

6,436 |

Note a: Calculated by the ANAO.

Note: The combined domestic and international travel expenditure value for a given year (see Table 2.2 and Table 2.4) varies from the value reported in ACIC’s annual report (see paragraph 1.15) as the annual report figure includes costs such as hire vehicles, taxi/car service, lounge membership, deployment related costs and operational accommodation.

Source: ACIC’s international travel expenditure data provided.

International travel management process summary

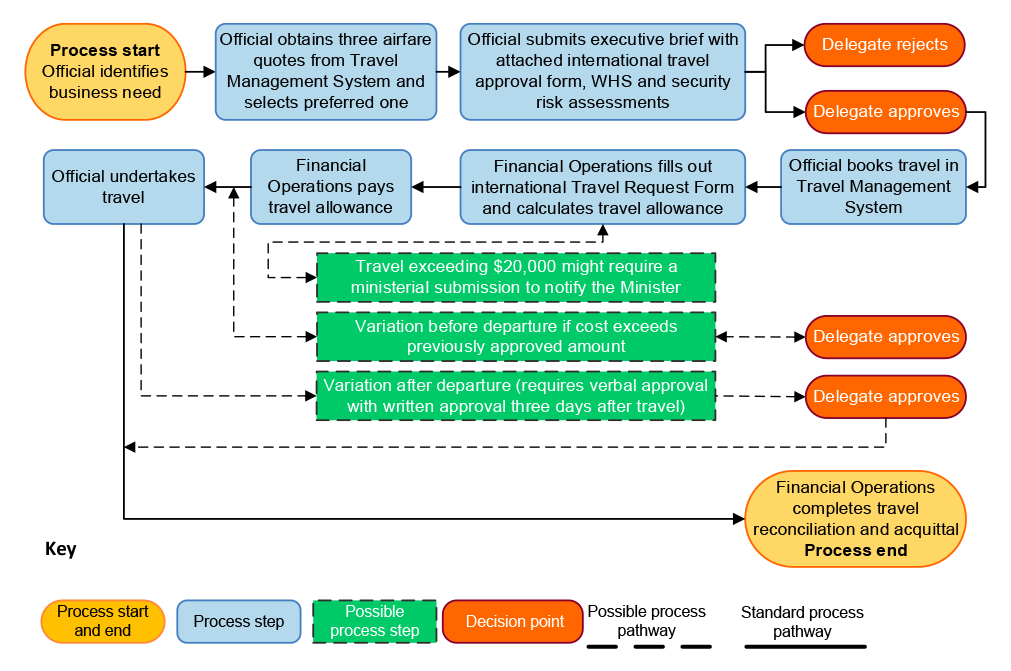

2.38 For international travel, the official submits the international travel brief that includes the travel approval form (approval form) to the delegate for approval. Following the approval, the official obtains quotes, selects the preferred option and books travel. Financial Operations then completes the international Travel Request Form (international TRF), saves it in the record management system, processes travel allowance and reconciles and acquits travel.22 ACIC’s international travel management process is illustrated in Figure 2.2.

Figure 2.2: Australian Criminal Intelligence Commission’s international travel management process

Source: ANAO analysis of ACIC’s international travel process.

Planning and approval

Business need

2.39 The policy requirement to demonstrate the business need for travel is the same for both international and domestic travel (see paragraph 2.7). The approval form is used by officials to record the travel business need for international travel and estimated travel costs for delegate’s approval.

2.40 Of the 16 international trips tested by the ANAO, 15 trips had the travel business need included in the approval form, with varying level of detail provided, for example: ‘Conference’, ‘Meetings’, ‘Attend Global Coalition meetings …’ and ‘Working group and side visits’. One approval form did not include a business need and was signed by the delegate. Similar to domestic travel, insufficient information on the purpose of travel potentially reduces the delegate’s ability to assess the necessity and relevance of the trip and limits ACIC’s ability to conduct future compliance monitoring (see paragraph 2.9).

Approval requirements

2.41 ACIC’s travel policy sets out that, as part of arranging international travel, the travelling official is required to obtain written approval from the delegate and the delegate must assess the trip for value for money before committing the expenditure of public resources under subsection 23(3) of the PGPA Act. The official is required to submit the approval form as part of the travel brief to the delegate. The approval form includes the travel business need, travel details, estimated travel allowance, estimated total travel cost, class of air travel and itinerary.

2.42 Prior to international travel, the official also needs to submit Work Health and Safety (WHS) risk assessments, engage with security and IT teams and alert the Communications Intelligence Security Officer (COMSO) about their travel.

2.43 ACIC’s travel policy and Financial Delegation set out that the:

- CEO must approve all non-operational international travel and operational travel over $20,000; and

- that the relevant Deputy CEO approves all operational international travel under $20,000.23

2.44 If there are changes prior to departure, including additional costs, officials are required to obtain written re-approval from their delegate. Once changes have been approved by the delegate, officials must advise Financial Operations.

2.45 All 16 international trips tested by the ANAO included a signed approval form.

2.46 According to ACIC’s travel policy, the relevant minister must be notified in a brief about non-operational travel above $20,000. Prior to the Machinery of Government change on 13 May 2025, the relevant minister for ACIC was the Attorney General and after this date it was the Minister for Home Affairs. Within the ANAO sample, ACIC notified relevant ministers for all relevant international trips.

2.47 ACIC’s travel policy still refers to the Attorney General and not the Minister for Home Affairs. On 19 September 2025, ACIC advised the ANAO that references to Attorney General in ACIC’s travel policy are outdated and that the reporting threshold has increased to $50,000. On 21 October 2025, ACIC advised the ANAO that it intends to update its travel policy to be released in February–March 2026.

Travel booking

Estimated costs

2.48 RMG 405 specifies that officials need to contact the TMS supplier to obtain three quotes for airfares from at least two different airlines for the same or equivalent fare class, unless one or two airlines service a particular route.24

2.49 ACIC’s travel policy directs officials to contact the TMS supplier to obtain three airfare quotes ‘dependant on availability’ and select the preferred one. Once the preferred quote is selected, the official includes it in the approval form together with the total estimated travel cost for delegate approval. Once the delegate approves the travel and the estimated total travel cost, the official books airfares in the TMS system and provides details to Financial Operations to complete the international TRF. As part of this process, the delegate does not see the three quotes or which airfares and accommodation are booked after the approval of the estimated travel costs.

2.50 Of the 16 international trips in the ANAO sample:

- 13 trips included three quotes;

- one trip included two quotes;

- one trip included one quote, with a documented reason as to why only one quote was received; and

- one trip included one quote, without a documented reason — ACIC advised the ANAO on 21 October 2025 that there was no record on why only one quote was obtained.

International best fare

2.51 The WoAG Arrangements require flights to be booked in line with the international best fare of the day (IBF) (see paragraph 1.8). The international best fare is the lowest fare available on the day of travel that suits the practical business needs. When the lowest (cheapest) fare is not selected for the booking, officials are required to choose the ‘booking code’ from a drop-down list (within the TMS system), which includes seven code options (see Table 1.2). Booking codes between one and six are compliant with the IBF WoAG policy.

2.52 All 16 trips tested by the ANAO included booked air travel. Within these, officials chose:

- code 1 ‘Lowest Fare’ (cheapest) for 15 trips (94 per cent); and

- code 2 ‘Unsuitable due to time routing connections or baggage charges’ for one trip (six per cent).

2.53 Table 2.5 sets out the IBF booking codes selected by officials for ACIC’s international flights booked between 1 July 2022 and 30 June 2025.

Table 2.5: Australian Criminal Intelligence Commission’s international travel booking code summary — 1 July 2022 to 30 June 2025

|

Booking code |

Numbera |

|

|

1 |

Lowest fare |

291 (78%) |

|

2 |

Unsuitable due to time routing connections or baggage charges |

54 (14%) |

|

6 |

Require flexibility to change booking |

37 (10%) |

|

3 |

Approval/Entitlement to travel at a higher fare class |

2 (1%) |

|

7 |

Outside of LPF policy |

1 (<1%) |

|

4 |

Health issues |

0 (0%) |

|

5 |

Personal responsibilities |

0 (0%) |

|

|

Otherb |

0 (0%) |

Note a: Multiple booking codes can be attributed to one booking which may impact the total numbers and percentages.

Note b: Other was blank or had no booking code.

Source: TMS system data.

2.54 Because the delegate approves the estimated total travel cost as part of the travel approval process and airfares are booked following the approval, the delegate does not have visibility of which airfare was booked and which IBF code was selected.

Accommodation

2.55 RMG 405 recommends officials select ‘the most cost effective accommodation … that is, a room rather than a suite’. ACIC’s travel policy requires officials to balance selecting the cheapest accommodation available with the need to be located near the place of work, and to record the cost of the accommodation in the international TRF. There is no policy requirement for the travelling official to provide a rationale and for their delegate to assess how this balance is achieved.

Travel allowance

2.56 ACIC’s Enterprise Agreement 2024–27 states that all officials who travel on ACIC business are entitled to the international travel allowance to cover the cost of meals and incidental expenses. Financial Operations calculates the international travel allowance in the international TRF by applying Australian Taxation Office (ATO) recommended rates for each country.

2.57 All 16 international travel trips tested by the ANAO included a record of the travel allowance value in the international TRF. The ANAO found that travel allowances for 15 international trips were paid only after written delegate approval and one travel allowance was not paid as the trip was cancelled after booking.

Reconciliation and acquittal

2.58 The travel reconciliation and acquittal process for international travel is the same as domestic travel and is discussed in paragraph 2.36.

Has the Australian Criminal Intelligence Commission implemented effective assurance processes, including for managing identified instances of non-compliance?

ACIC’s travel policy does not clearly define arrangements for identifying, assessing and managing non-compliance. ACIC has some processes in place to identify non-compliance, which is predominately focused on checking for travel approval as part of travel reconciliation and acquittal. ACIC has a non-compliance register that includes details on the identification and resolution of non-compliance incidents. However, ACIC is not capturing non-compliance against all travel policy requirements. Since the implementation of the SAP approval module in April 2025, ACIC has not reviewed its approach to detecting and managing travel non-compliance.

Non-compliance

Defining non-compliance

2.59 ACIC’s travel policy does not describe arrangements for identifying or reporting travel non-compliance or how instances of identified travel non-compliance will be managed. On 18 August 2025, ACIC advised the ANAO that ‘ACIC does not have a specific compliance policy, but the non-compliance are monitored against general policy that exists within ACIC’ (see Table 2.6). ACIC’s travel, integrity and credit card policies contain a general requirement directing officials to comply with relevant policy controls and state that:

All members of the staff of the ACIC are directed to and must comply with the ‘must’ or ‘must not’ controls as well as any legislative controls outlined within this Policy.

Table 2.6: Australian Criminal Intelligence Commission’s policies and procedures that include non-compliance

|

Document |

Relevant content |

|

Accountable Authority Instructions – 2.8 Official travel – Instructions to all officials |

Directs all officials to act in accordance with AAIs, the agency’s financial delegations and, to the extent consistent with the AAIs, any documented processes, procedures and policies of the agency. |

|

Integrity policy |

Outlines the integrity standards applicable to ACIC employees and notes the Integrity Policy is ‘supported by procedural level documents, instructions and guidelines which provide detailed information on how staff are to demonstrate compliance’. |

|

Travel policy and procedure |

The travel policy and procedure define non-compliance as any instance where an accommodation booking constitutes a breach of the WoAG travel requirements and does not define other possible instances of non-compliance. |

|

Corporate credit card policy and procedure |

The corporate credit card policy and procedure outlines:

|

Source: ANAO analysis of ACIC policy documentation.

Identifying non-compliance

2.60 Between 1 July 2022 and 30 June 2025, a total of 242 travel-related entries were recorded in the non-compliance registers as set out in Table 2.7. The main area of non-compliance was travel approval, consistent with the internal audit findings (see paragraph 2.74) and ANAO testing of the period prior to changes to ACIC’s approval process in April 2025 (see paragraph 2.17).

Table 2.7: Australian Criminal Intelligence Commission’s travel non-compliance data (1 July 2022 – 30 June 2025)

|

Breach details/descriptions |

Number of breaches |

|

‘Travel Request Form (TRF) not approved’ |

78 |

|

‘Travel cost not included in Travel Request Form (TRF)’ |

42 |

|

‘Trip charged for. No approved TRF’ |

38 |

|

‘Trip charged for, no TRF submitted/’ |

22 |

|

‘Trip charged for/ No approved TRF’ |

22 |

|

‘Trip charged for, TRF submitted but not approved/’ |

17 |

|

‘Travel amended, no TRF re-approval’ |

6 |

|

‘Additional amended flights charged for, not included for approval within TRF’ |

4 |

|

‘Second CTM booking charged for, not included for approval within TRF’ |

4 |

|

‘Accomodation [sic] charged for. No approval’ |

2 |

|

‘Cancelled trip charged fro [sic]. No approved TRF’ |

2 |

|

‘Trip charged for, no approved TRF submitted/’ |

2 |

|

‘Cancelled trip charged for, TRF submitted but not approved/’ |

1 |

|

‘Trip charged for. No approved TRF Visibility of the prior approval 22/222707 wasn’t available for the travel team until requested 15.11.22.’ |

1 |

|

‘Trip undertaken before TRF submission & approval to travel’ |

1 |

|

Total |

242 |

Source: ANAO summary of ACIC’s non-compliance registers.

2.61 ACIC’s main mechanisms for identifying travel non-compliance are part of the travel reconciliation and acquittal process (see paragraph 2.36), and include:

- confirmation there is written delegate approval of the estimated total travel cost;

- confirmation the actual total travel cost does not exceed the approved estimated total travel cost;

- confirmation there is a re-approval in instances where estimated total travel cost was exceeded; and

- investigation of financial variances for airfares, accommodation and incidental expenses at the time of travel reconciliation and acquittal.

2.62 Identification of non-compliance with credit card policy primarily occurs during the credit card reconciliation and acquittal processes. ACIC’s Corporate Credit Cards Policy and Procedure sets out that the cardholder and reviewer must ensure that:

- transactions are consistent with ACIC policies, procedures and AAIs;

- sufficient descriptions and documentation are provided; and

- expenses are coded to the correct general ledger and cost centre.

2.63 All cardholders are required to report all instances of credit card misuse. ACIC’s Corporate Credit Cards Policy and Procedure requires misuse incidents to be resolved within 30 days of staff becoming aware of the incident. Failure to do so will constitute a breach of the credit card policy and procedure.

2.64 The following instances of non-compliance against ACIC’s travel policy are not being identified or recorded in the non-compliance register:

- delayed travel approval (pre-April 2025) (see paragraph 2.17);

- no documented reason for accommodation booked above recommended rates (see paragraph 2.28); and

- no delegate approval for accommodation booked above recommended rates (see paragraphs 2.29).

Response to non-compliance/corrective actions

2.65 There is no guidance for officials responsible for identifying and managing non-compliance on how to assess and categorise non-compliance notifications.

2.66 Instances of non-compliance with requirements for travel are recorded by ACIC in the non-compliance register. Entries in the register include the name of the official(s), the date of the breach, the date the breach was detected and the description of the breach. During 2022–23 ACIC had a separate travel non-compliance register. From 2023–24, ACIC introduced a combined register which included travel non-compliance.

2.67 ACIC’s non-compliance register entries did not record corrective actions or their resolution status prior to July 2023. Since July 2023, corrective actions and their resolution status have been recorded. Between 1 July 2023 and 30 June 2025, all 120 entries had a corrective action or comment, of which:

- 54 entries had a ‘referred’ action, which means it was sent back to the official and/or travel arranger(s);

- 30 entries had a ‘non-compliance email sent’ action; and

- 36 entries had no recorded action with the comment ‘Due to timing no action to be taken’.

2.68 In managing non-compliance, ACIC should have arrangements to identify, capture and report on all instances of non-compliance to ensure accurate and complete representation of its entity-wide compliance culture. Incomplete information and data can misrepresent the effectiveness of existing policies and procedures and have a negative impact on decision-making and risk management over time.

Recommendation no.1

2.69 The Australian Criminal Intelligence Commission:

- strengthens its controls and approach for identifying, managing and reporting non-compliance to ensure all travel policy non-compliance is captured; and

- provides guidance to relevant officials on how to identify, assess and categorise potential non-compliance events.

Australian Criminal Intelligence Commission response: Agreed.

2.70 ACIC acknowledges the recommendation and has commenced implementing the following action plan to address this recommendation.

2.71 We have developed an updated compliance regime which encompasses testing compliance across a number of legislative and policy requirements relating to travel. The new process is being implemented in December 2025 and will include regular reporting to the ACIC’s Commission Executive Committee. Travel compliance will be assessed against a number of criteria to ensure all aspects of the travel policy requirements are met.

2.72 Future non-compliance reporting to the ACIC’s Commission Executive Committee will also be amended to address gaps in the travel management and monitoring non-compliance process. Reporting will allow for identification of areas that require improvement.

2.73 As part of our ERP approach to market and the implementation of a Travel Management System, key requirements will include approval workflows, reporting functions (including non-compliance reporting) and auditing and monitoring capabilities.

Australian Criminal Intelligence Commission’s review of travel arrangements

2.74 In June 2022, ACIC conducted a review of purchase and travel cards in one of its offices and made two high-risk findings relating to at-risk behaviour by individuals and issues with compliance with travel arrangements, such as missing or inadequate approvals; instances of uneconomical purchases; and making bookings outside the WoAG Arrangements. The review recommended ACIC include travel management in its annual internal audit work program. In March 2023, ACIC conducted the internal audit on its travel process. The internal audit made three findings and four corresponding recommendations.

- One high risk finding focused on multiple instances of non-compliance with travel policy by officials and approval delegates. The internal audit recommended ACIC redesign its travel approval process ‘to facilitate better supporting information required so that delegates can make informed approval decisions in line with travel policy requirements (i.e. the total cost is reasonable, represents value for money etc.)’, including relevant communication and training for officials (recommendation one).

- The other two medium and low risk findings focused on taxi/car administration and management and some RMG 405 requirements not being in ACIC’s travel policy. The internal audit recommended a review of taxi/car services processes and procedures (recommendations two and three) and an update of the ACIC’s travel policy (recommendation four).

2.75 The Chief Financial Officer recommended the Audit and Risk Committee (ARC) endorse the closure of recommendations two and three in July 2023 and recommendations one and four in April 2025. To support the closure of recommendations one and four, ACIC’s management commented:

Complete – The Travel policy has been endorsed and published. The policy went live on 1 April 2025. The Accountable Authority Instruction & Financial delegation Instrument have been amended to reflect the policy changes.

2.76 On 1 May 2025, the ARC endorsed the closure of recommendations one and four.

2.77 ACIC’s response to recommendation one resulted in implementation of the new approval process in the SAP module. In September 2025, internal reporting to ACIC’s Compliance and Risk Committee (CRC) indicated that the new process has improved travel approval compliance (see paragraph 2.79). The ANAO observes that despite the closure of recommendation one, the new process has resulted in some non-compliance no longer being detected and reduced the ability for ACIC to determine if value for money is being achieved in booking practices post travel approval.

Has the Australian Criminal Intelligence Commission developed appropriate arrangements for reporting to executive management on travel requirements?

ACIC provides travel financial expenditure and non-compliance reporting to its governance committees on a regular basis. ACIC’s existing monitoring and reporting arrangements do not enable executive management to determine whether risk and policy settings are appropriate, or whether domestic and international travel expenditure and booking practices represent value for money for ACIC.

Travel reporting

2.78 There are three reports provided to ACIC executive management that include travel related information.

- Non-compliance report — provided to CRC twice a year (bi-annual non-compliance report). The report includes travel non-compliance data from the non-compliance register as well as reporting on other types of non-compliance such as mandatory training and credit cards (see Table 2.8).25

- Bimonthly finance report — provided to the Commission Executive Committee for noting and includes a summary of key financial issues, organisational expenditure by category (including travel) and other financial information.26

- Financial report — provided to the ARC for noting including an overview of enterprise level non-compliance as part of ACIC preparing its annual financial statements.27

2.79 From 1 July 2022, ACIC prepared five bi-annual non-compliance reports (as summarised in Table 2.8). Over this period, the reporting focused on the total numbers of travel approval breaches and the system and policy changes in travel management process through implementation of the SAP module.

Table 2.8: Bi-annual non-compliance reports provided to the Compliance and Risk Committee

|

Committee meeting date |

Report information related to travel |

|

21 September 2023 |

|

|

4 June 2024 |

|

|

8 August 2024 |

|

|

19 March 2025 |

|

|

3 September 2025 |

|

Source: ANAO analysis of ACIC Compliance and Risk Committee meeting minutes.

2.80 ACIC’s existing monitoring and reporting arrangements do not enable executive management to determine whether travel-related risk and policy settings are appropriate, or whether domestic and international travel expenditure and booking practices represents value for money for ACIC.

2.81 On 21 October 2025, ACIC advised the ANAO that it was considering the implementation of a new Enterprise Resource Planning system that will assist with automation of travel management process and improve its ability to collect and analyse data related to travel.

Recommendation no.2

2.82 The Australian Criminal Intelligence Commission improves monitoring and reporting arrangements to provide assurance that travel risks are addressed, policy settings remain appropriate and that expenditure represents value for money.

Australian Criminal Intelligence Commission response: Agreed.

2.83 ACIC acknowledges the recommendation and has commenced strengthening relevant arrangements as reported under Recommendation 1.

Appendices

Appendix 1 Entity response

Appendix 2 Improvements observed by the ANAO

1. The existence of independent external audit, and the accompanying potential for scrutiny improves performance. Improvements in administrative and management practices usually occur: in anticipation of ANAO audit activity; during an audit engagement; as interim findings are made; and/or after the audit has been completed and formal findings are communicated.

2. The Joint Committee of Public Accounts and Audit (JCPAA) has encouraged the ANAO to consider ways in which the ANAO could capture and describe some of these impacts. The ANAO’s corporate plan states that the ANAO’s annual performance statements will provide a narrative that will consider, amongst other matters, analysis of key improvements made by entities during a performance audit process based on information included in tabled performance audit reports.

3. Performance audits involve close engagement between the ANAO and the audited entity as well as other stakeholders involved in the program or activity being audited. Throughout the audit engagement, the ANAO outlines to the entity the preliminary audit findings, conclusions and potential audit recommendations. This ensures that final recommendations are appropriately targeted and encourages entities to take early remedial action on any identified matters during the course of an audit. Remedial actions entities may take during the audit include:

- strengthening governance arrangements;

- introducing or revising policies, strategies, guidelines or administrative processes; and

- initiating reviews or investigations.

4. During the course of the audit, the ANAO did not observe changes in the Australian Criminal Intelligence Commission’s approach to audit topic.

Footnotes

1 Department of Finance, RMG 206 — Accountable authority instructions (AAIs), Finance, Canberra, 28 April 2023, available from https://www.finance.gov.au/government/managing-commonwealth-resources/managing-risk-internal-accountability/risk-internal-controls/accountable-authority-instructions-aais-rmg-206 [accessed 7 January 2025].

2 Public Governance, Performance and Accountability Act 2013, paragraph 15(1)(a).

3 Coordinated procurements are whole-of-government arrangements for procuring goods and services.

4 Section 4 of the CPRs mandates all NCE’s that are subject to the PGPA Act to participate in all elements of coordinated procurements. Finance’s website lists mandatory co-ordinated procurements for NCEs, including the WoAG Arrangements.

5 Section 4 of the CPRs allows corporate Commonwealth entities to opt-in to coordinated procurements.

6 AAIs are ‘written instruments that may be issued by the accountable authority to instruct officials on matters relating to the finance law…AAIs include instructions that the accountable authority expects officials to follow when exercising powers and carrying out functions and duties under the PGPA Act.’ Department of Finance, Accountable Authority Instructions (AAIs) – (RMG 206), available from https://www.finance.gov.au/government/managing-commonwealth-resources/managing-risk-internal-accountability/risk-internal-controls/accountable-authority-instructions-aais-rmg-206 [accessed 7 May 2025].

7 Department of Finance, Whole of Australian Government Travel Arrangements, About the Travel Arrangements, Finance, 5 July 2024, available from https://www.finance.gov.au/government/travel-arrangements/about-travel-arrangements [accessed 7 May 2025].

8 Department of Finance, RMG 404 — Domestic Travel Policy, Finance, Canberra, 16 November 2023, available from https://www.finance.gov.au/publications/resource-management-guides/domestic-travel-policy-rmg-404 [accessed 7 May 2025].

9 Department of Finance, RMG 405 — Official International Travel — Use of the best fare of the day, Finance, Canberra, 16 November 2023, available from https://www.finance.gov.au/publications/resource-management-guides/official-international-travel-use-best-fare-day-rmg-405 [accessed 7 May 2025].

10 Australian Government, Aviation White Paper - Towards 2050, August 2024, p1 4, available from https://www.infrastructure.gov.au/infrastructure-transport-vehicles/aviation/aviation-white-paper [accessed 7 May 2025].

11 Department of Finance, Report of the Review of Australian Government Travel Policies, 24 December 2024, available from https://www.finance.gov.au/publications/reviews/report-review-australian-government-travel-policies [accessed 1 August 2025].

12 Department of Finance, Review of Australian Government Travel Policies – What We’re Doing, undated, available from https://www.finance.gov.au/publications/reviews/report-review-australian-government-travel-policies [accessed 1 August 2025].

13 ACIC Corporate Plan 2024–25, available from https://www.acic.gov.au/publications/corporate-documents/corporate-plan [accessed 3 September 2025].

14 ASL is the full-time equivalent staffing level averaged over a financial year.

15 ACIC 2023–24 and 2024–25 Annual Reports, available from https://www.acic.gov.au/publications/annual-reports [accessed 5 November 2025].

16 The ANAO developed the Audit Lessons — Management of Corporate Credit Cards to share lessons from these audits, available from https://www.anao.gov.au/work/insights/management-of-corporate-credit-cards [accessed 16 April 2025].

17 SAP is an enterprise resource planning software package to support processes of an entity’s core corporate business, such as human resources and finance and accounting.

18 Financial Operations, Reporting and Compliance section is part of the Finance and Enterprise Support Branch and consists of three teams: Financial Operations Team — responsible for management of domestic and international travel, credit card management and payment of accounts; Financial Reporting Team — provides enterprise-wide financial reporting; and Compliance team — responsible for financial compliance monitoring. In ACIC’s travel policy and process documentation Financial Operations Team is referred to as the Travel Team, the International Travel Team or the Credit Card team.

19 Prior to April 2025, written approval was required to be provided ‘prior to travelling, or, in exceptional circumstances, within 3 days of the commencement of travel’.

20 ACIC’s recommended rates were based on the accommodation rates provided by the Australian Public Service Commission (APSC) until October 2022. From October 2022, the recommended rates have been based on the rates provided by the Australian Taxation Office (ATO), which was reflected in ACIC’s travel policy update in March 2025. These recommended rates are included in the TRF for Adelaide, Darwin, Melbourne, Brisbane, Hobart, Perth, Canberra and Sydney. The ATO’s reasonable accommodation rates are published in Taxation Determinations. The 2024–25 income year determination is available from https://www.ato.gov.au/law/view/pdf/pbr/td2024-003.pdf [accessed 3 May 2025].

21 For travel without an overnight stay, same day travel allowance is provided. For travel with an overnight stay, travel allowance is calculated in accordance with the Australian Public Service Commission (APSC) rates.

22 Because ACIC has the internal travel approval form, the international travel request does not serve as a request form, but functions as a record of travel.

23 Operational travel is defined in ACIC travel policy as an activity directly targeting the criminal environment.

24 Department of Finance, RMG 405 – Official International Travel – Use of the best fare of the day, Finance, Canberra, 16 November 2023, available from https://www.finance.gov.au/publications/resource-management-guides/official-international-travel-use-best-fare-day-rmg-405 [accessed 7 May 2025].