Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Domestic and International Travel Requirements in the Civil Aviation Safety Authority

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- In 2024–25, $953 million was spent on travel through the whole of Australian Government travel arrangements (the WoAG Arrangements).

- Australian Government entities should have robust internal arrangements for official travel to support compliance with the WoAG Arrangements, manage fraud and corruption risks and foster a culture of integrity.

- The audit was conducted to provide assurance to the Parliament as to whether Civil Aviation Safety Authority (CASA) has effective arrangements to comply with domestic and international travel requirements.

Key facts

- CASA is a corporate Commonwealth entity (CCE) that regulates aviation safety in Australia.

- CASA establishes its own travel arrangements and can choose to adopt some or all elements of the WoAG Arrangements.

What did we find?

- CASA has largely effective arrangements to comply with official travel requirements.

- CASA has largely effective controls for domestic and international travel, and identification and management of non‑compliance.

- CASA has not monitored or documented whether its arrangements continue to remain appropriate and achieve value for money for the entity.

What did we recommend?

- There were two recommendations to CASA: to evaluate its travel arrangements, including where it adopts certain WoAG Arrangements; and improve its monitoring and reporting arrangements to provide oversight of travel booking practices.

- CASA agreed to the recommendations.

$7.4m

Total official travel expenditure for 2024–25.

31%

Proportion of total travel expenditure spent on international travel for 2024–25.

2,679

Total number of domestic and international trips for 2024–25.

Summary and recommendations

Background

1. Officials in Australian Government entities undertake domestic and international travel for the purpose of achieving the objectives of the entity. The whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated procurements established and managed by the Department of Finance (Finance). The WoAG Arrangements encompass five components: book; fly; stay; drive; and pay. The WoAG Arrangements are supported by resource management guides outlining the Australian Government policies for domestic and international air travel.

2. All non-corporate Commonwealth entities must comply with all elements of the WoAG Arrangements. Corporate Commonwealth entities (CCEs) and Commonwealth companies may elect to adopt some or all of the arrangements. As a CCE, Civil Aviation Safety Authority (CASA) has adopted elements of the WoAG Arrangements.

Rationale for undertaking the audit

3. In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of the whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity and meets the intent of the WoAG Arrangements. There has been parliamentary and public interest in government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether CASA has effective arrangements to comply with domestic and international travel requirements.

4. This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; CASA; Australian Criminal Intelligence Commission; and Services Australia.

5. Selecting CASA, as a CCE, allows the ANAO to assess a variety of arrangements across the sector.

Audit objective and criteria

6. The objective of the audit was to assess whether CASA has effective arrangements to comply with domestic and international travel legislative and entity requirements.

7. To form a conclusion against the objective, the ANAO adopted one high-level audit criteria.

- Has CASA implemented effective controls and processes to manage domestic and international travel in accordance with the whole of Australian Government requirements?

Conclusion

8. CASA has established largely effective arrangements to comply with policy requirements for domestic and international travel, although is not monitoring whether arrangements remain appropriate.

9. As a CCE, CASA has adopted some of the WoAG Arrangements. CASA has not evaluated if its existing arrangements represent value for money. CASA has established largely effective controls and processes for managing domestic and international travel in accordance with the WoAG Arrangements, where it has chosen to adopt these arrangements. Controls are in place across domestic and international travel and CASA is identifying travel non-compliance. Travel expenditure monitoring and reporting could be improved to identify emerging risks and provide assurance that travel expenditure and booking practices achieve value for money for CASA.

Supporting findings

Domestic and international travel management controls and processes

10. CASA has implemented controls for domestic travel in areas of demonstration of business need, delegate approval, airfare booking, travel allowance and acquittal. All sampled trips of CASA’s domestic trips were approved before they occurred. CASA officials selected the lowest practical fare (LPF) in all of the domestic trips reviewed by the ANAO with six per cent of those trips at the lowest (cheapest) fare. In 55 per cent of the trips reviewed by the ANAO, officials selected accommodation priced higher than the rate set by the Australian Taxation Office (ATO). CASA has not formalised and documented its approach to negotiating rates with preferred hotels. (See paragraphs 2.15 to 2.42)

11. CASA has implemented controls for international travel in areas of demonstration of business need, delegate approval, travel allowance, airfare booking and acquittal. These controls are operating effectively in the sample tested by the ANAO. (See paragraphs 2.43 to 2.56)

12. CASA travel policies do not clearly define arrangements for identifying, assessing and responding to non-compliance. CASA’s Centralised Travel Team (CTT) acquits travel related credit card expenses. The team is responsible for identifying and recording non-compliance in the register. The register is reviewed as part of the biannual Public Governance, Performance and Accountability (PGPA) compliance process and includes details on corrective actions. (See paragraphs 2.57 to 2.68)

13. CASA provides travel reporting to its executive management with non-compliance reporting provided to the Chief Executive Officer (CEO) and governance committees. Chief Financial Officer (CFO) travel expenditure reports are provided to the CASA Board Chair, the Board Audit and Risk Committee Chair and the Executive Committee. Existing monitoring and reporting arrangements do not enable the identification of emerging risks and the assessment whether domestic and international travel expenditure and booking practices represent value for money for CASA. Improving monitoring and reporting arrangements could assist with identification of risks and assure that value for money is being achieved. (See paragraphs 2.69 to 2.75)

Recommendations

Recommendation no. 1

Paragraph 2.9

The Civil Aviation Safety Authority:

- periodically reviews and documents whether its travel arrangements continue to represent value for money, including where CASA has adopted or has not adopted WoAG Arrangements; and

- formalises and documents the process of negotiating rates with preferred hotels to enable executive oversight of the process and its outcomes, including a value for money assessment.

Civil Aviation Safety Authority response: Agreed.

Recommendation no. 2

Paragraph 2.74

The Civil Aviation Safety Authority develops monitoring and reporting arrangements to assist with identification of emerging risks and assessment whether travel expenditure and booking practices represent value for money, including for airfare and accommodation bookings.

Civil Aviation Safety Authority response: Agreed.

Summary of entity response

14. The proposed audit report was provided to CASA. CASA’s summary response is provided below. The full response from CASA is at Appendix 1.

Civil Aviation Safety Authority

The Civil Aviation Safety Authority (CASA) acknowledges the ANAO’s report and accepts the two recommendations provided.

CASA is committed to being an exemplar of best practice when it comes to official travel within the Australian public sector and will enhance reporting and transparency to our Executive Committee regarding how the organisation fulfills our responsibility for achieving value for money.

CASA utilises the Whole of Australian Government Travel Arrangements (the WoAG Arrangements), managed by the Department of Finance, for: booking and management of trips, booking of flights and the hire of vehicles.

The Department of Finance has advised CASA that we are unable to adopt accommodation services under the WoAG Travel Arrangements, and as a result we seek best available rates possible at selected locations to enhance the value for money proposition. These rates are compared against others available for the same location and the best practical rate, providing value for money, is selected.

CASA has not adopted the WoAG Travel Arrangements payment solution as the current program utilised by the organisation continues to remain fit for purpose, is free of fees and charges and provides CASA with an annual rebate.

Since the audit commencement, CASA has assessed pricing of flights using a sample of 25 destinations against the WoAG Travel Arrangements and those available directly with airlines. It confirms the airline pricing under the WoAG Travel Arrangements are superior to those offered by the airlines directly.

Key messages from this audit for all Australian Government entities

15. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Australian Government entity officials undertake domestic and international travel for the purpose of achieving the objectives of the entity. Official travel is:

any travel where a Commonwealth entity is ultimately responsible for any of the direct or indirect costs associated with that travel… This includes travel by officials, contractors and consultants to undertake work duties at the direction of the employer to achieve one or more Commonwealth objectives.1

Australian Government framework for travel

1.2 The Commonwealth resource management framework governs how Australian Government entities use and manage public resources. The foundation of the framework is the Public Governance, Performance and Accountability Act 2013 (the PGPA Act). Under the PGPA Act, accountable authorities are required to promote the proper use and management of public resources.2

1.3 The Commonwealth Procurement Rules (CPRs) are issued by the Minister for Finance under section 105B of the PGPA Act. Compliance with the CPRs is mandatory for officials of non-corporate Commonwealth entities (NCEs). As the Civil Aviation Safety Authority (CASA) is a Corporate Commonwealth entity (CCEs) it is not required to comply with the CPRs.3 CASA is still required to meet its general obligations under the PGPA Act to promote the proper use and management of public resources.

1.4 The Whole of Australian Government travel arrangements (the WoAG Arrangements) are coordinated travel-related procurements established and managed by the Department of Finance (Finance).4 CCEs and Commonwealth companies may elect to adopt some or all of the arrangements. CASA has adopted the WoAG Arrangements for air travel and domestic car rental. CASA has established its own arrangements for accommodation and payment services as set out in Table 1.1.

Table 1.1: Whole of Australian Government travel arrangements — services and suppliers

|

Component |

Services |

Suppliers (as at July 2025) |

Has CASA adopted? |

|

Booka |

The Travel Management Services (TMS) supplierb provides booking services for air travel, hotel, bus, sea, rail, car rental, ground transport services, and charter flights. In addition, 24/7 support and entity travel reports are provided. |

Corporate Travel Management (CTM) |

Yes |

|

Flyc |

Domestic and international air travel suppliers. The panel of airlines is not exclusive.d Airlines included in the panel provide ‘discounted airfares and beneficial fare conditions’ to the Australian Government. |

Panel of 18 airlines

|

Yes |

|

Staya |

All domestic accommodation must be booked through the sole supplier. Booking international accommodation through the supplier is encouraged but is not required. |

CTM |

No |

|

Drivee |

Domestic vehicle rental services supplier. Bookings can be made via the TMS supplier or directly with the supplier via a WoAG portal. |

Hertz |

Yes |

|

Payf |

Travel and Procurement Payments Services (TAPPS). For official travel booked via the TMS supplier, entities are required to use a ‘lodge card’.g Commonwealth credit cards are utilised for other expenses associated with travel such as meals and incidentals. |

National Australia Bank (NAB) |

No |

Note a: Standing Offer Notice ID SON3979293, available from https://www.tenders.gov.au/Son/Show/b3e4c6ad-ab57-4d46-a3c6-d0ce7b083ac7.

Note b: The supplier of Travel Management Services is known as the Travel Management Company (TMC).

Note c: Standing Offer Notice ID SON3337469, available from https://www.tenders.gov.au/Son/Show/606ca6fd-c615-d94c-905e-491969f2a3ba.

Note d: Given the panel is not exclusive, entities are permitted to book both domestic and international air travel with non-panel airlines. Domestic flights and international flights departing Australia must be booked through the TMS supplier.

Note e: Standing Offer Notice ID SON3527487, available from https://www.tenders.gov.au/Son/Show/1545a9af-e0d4-bab4-60d4-e03aed0558db.

Note f: Standing Offer Notice ID SON3637640, available from https://www.tenders.gov.au/Son/Show/ad2d8b17-c42e-4601-a757-72568eafa384.

Note g: A Lodge Card is the digital number stored in the Travel Management Services Supplier User profile.

Source: Department of Finance, Whole of Australian Government Travel Arrangements, About the Travel Arrangements and Department of Finance, Whole of Australian Government Procurement.

Lowest fare

1.5 The WoAG Arrangements are supported by resource management guides (RMGs) outlining the Australian Government policies for domestic and international air travel. These policies require travellers to select the ‘Lowest Practical Fare’ (LPF) for domestic flights and the ‘International Best Fare’ (IBF) for international flights.

- The LPF is ‘the lowest fare available at the time the travel is booked on a regular service (not a charter flight), that suits the practical business needs of the traveller’.5

- The IBF is ‘the lowest fare on the day the travel is booked on a regular scheduled service (not a charter flight), that suits the practical business needs of the traveller and maximises overall value for money for the total cost of the trip’.6

1.6 Officials can book the flight that is not the cheapest available and still be compliant with the LPF and IBF policies. Officials need to select a booking code to support why the lowest fare flight has not been chosen (see Table 1.2). Booking codes 1 to 6 are compliant with LPF and IBF policies. If flights are not compliant, then code 7 (‘Outside of LPF policy’) is to be used.

Table 1.2: Policy booking codes for lowest practical fare and international best fare

|

Policy booking code |

Requirement |

|

|

1 |

Lowest fare |

Domestic: This is the cheapest available fare taking into account the 1-hour window.a International: This is the cheapest fare taking into account the 24-hour booking window.b |

|

2 |

Timing, routing, connection or baggage charges |

Domestic: Where the fare selected is not the lowest fare because it:

|

|

3 |

Approval/entitlement to travel at a higher fare class |

Domestic: All air travel is to be at the lowest practical fare in economy class unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the lowest practical fare within the entitlement. International: All air travel is to be at the international best fare in the appropriate classc (having regard to internal travel policy) unless there is a business case or entitlement to travel outside these guidelines. In these circumstances, officials are still required to obtain the international best fare within the entitlement. |

|

4 |

Health issues |

Health issues for officials requiring certain facilities. A medical certificate is required to support use of this code. |

|

5 |

Personal responsibilities |

Impact on personal responsibilities such as family. |

|

6 |

Require flexibility to change booking |

Where flexibility is required for air travel, travel bookers must consider selecting a semi-flexible fare type instead of a fully flexible fare. |

|

7 |

Outside of LPF policy |

Preference for a particular aircraft or airlines, availability of access to airline lounges, accumulation of airline benefits such as reward or loyalty points (including status credits). |

Note a: According to RMG 404 — Domestic Travel Policy, the one hour ‘time window’ is used by the TMS supplier to ‘monitor whether the lowest practical fare has been selected and assess potential missed savings…For outbound flights, the window commences 1 hour prior to the booked flight. For inbound flights, the window commences 1 hour after the booked flight’.

Note b: According to RMG 405 — Official International Travel — Use of the best fare of the day, the TMS supplier ‘applies the 24-hour window to the booked flight time from the point of departure to monitor whether the international best fare has been selected’.

Note c: RMG 405 — Official International Travel — Use of the best fare of the day requires officials to select ‘business class or equivalent or lower class airfare’.

Source: RMG 404 — Domestic Travel Policy and RMG 405 — Official International Travel — Use of the best fare of the day.

1.7 The RMGs set out additional guidance for travellers and approvers. Two key considerations for officials undertaking and approving domestic and international travel are ‘value for money’ and ‘necessity of travel’.

- Value for money requires: ‘the use of Commonwealth resources in an efficient, effective, economical and ethical manner that is consistent with the policies of the Commonwealth… Accordingly, when booking travel, officials must make decisions based on impartial consideration of fares available’.

- Delegates, in approving official travel, ‘must be satisfied there is a demonstrated business need for the travel’ and that ‘Air travel must only be undertaken where other communication tools, such as teleconferencing and videoconferencing, are ineffective’.

Civil Aviation Safety Authority

1.8 CASA’s purpose as set out in its corporate plan is to ‘establish a regulatory framework for maintaining, enhancing and promoting the safety of civil aviation, with particular emphasis on preventing aviation accidents and incidents’.

1.9 In 2024–25 CASA’s total expenses were $221.8 million, with an average staffing level (ASL) of 824.7 The CASA Board is the accountable authority for the purposes of the PGPA Act.

1.10 In 2024–25, CASA reported its expenditure on travel as $7.4 million compared to $8.2 million in 2023–24.8

Previous ANAO audit coverage

1.11 Previous ANAO audits have identified issues in other entities with credit card and travel compliance. In 2023–24, the ANAO conducted a series of audits assessing compliance with corporate credit card requirements.9 These reports identified:

- positional authority risks with expenditure on travel and credit cards being approved by officials who are junior to the traveller;

- approval of travel not being provided prior to travel being undertaken; and

- failure to identify, record or respond to instances of non-compliance with travel requirements.

Rationale for undertaking the audit

1.12 In 2024–25, Australian Government entities spent $953 million on travel through the WoAG Arrangements. The purpose of the whole-of-government policy for travel is to maximise value for money. An entity’s approach to official travel reflects whether the entity is behaving with integrity and meets the intent of the WoAG Arrangements. There has been parliamentary and public interest in government travel arrangements and expenditure. The audit was conducted to provide assurance to the Parliament as to whether CASA has effective arrangements to comply with domestic and international travel requirements.

1.13 This audit is part of a series of audits on compliance with the WoAG Arrangements. The entities included in the series are: Department of Industry, Science and Resources; Department of Agriculture, Fisheries and Forestry; CASA; Australian Criminal Intelligence Commission; and Services Australia.

1.14 Selecting CASA, as a CCE, allows the ANAO to assess a range of arrangements across the sector.

Audit approach

Audit objective, criteria and scope

1.15 The objective of the audit was to assess whether CASA has effective arrangements to comply with domestic and international travel legislative and entity requirements.

1.16 To form a conclusion against the objective, the ANAO adopted one high-level audit criteria.

- Has CASA implemented effective controls and processes to manage domestic and international travel in accordance with whole of Australian Government requirements?

1.17 The audit examined the management of domestic and international travel by CASA from 1 July 2022 to 30 June 2025.

Audit methodology

1.18 To address the audit objective, the audit methodology included:

- examining CASA’s policies, frameworks, procedures, travel management systems, assurance and reporting activities;

- meeting with CASA’s officials;

- testing the effectiveness of CASA’s travel control framework; and

- analysing travel data from CASA’s systems and entity-level data from the WoAG travel management system.

1.19 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $188,738.

1.20 The team members for this audit were Deniss Cirulis, Raza Gulani, Caitlin Williams, Fionan Dunne, Lachlan Rowe, Nathan Callaway and Anne Rainger.

2. Domestic and international travel management controls and processes

Areas examined

This chapter examines whether the Civil Aviation Safety Authority (CASA) has implemented effective controls and processes to manage domestic and international travel in accordance with the whole of Australian Government requirements.

Conclusion

As a corporate Commonwealth entity (CCE), CASA has adopted some of the whole of Australian Government travel arrangements (WoAG Arrangements). CASA has not evaluated if its existing travel arrangements represent value for money. CASA has established largely effective controls and processes for managing domestic and international travel in accordance with the WoAG Arrangements, where it has chosen to adopt these arrangements. Controls are in place across domestic and international travel and CASA is identifying travel non-compliance. Travel expenditure monitoring and reporting could be improved to identify emerging risks and provide assurance that travel expenditure and booking practices achieve value for money for CASA.

Areas for improvement

The ANAO made two recommendations for CASA to monitor and review its travel arrangements and booking practices to assess whether these achieve value for money for CASA.

2.1 Section 16 of the Public Governance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control.

2.2 Effectively implementing an appropriate process for the management of non-compliance is necessary to ensure officials comply with internal policies and legislative requirements and serves as a deterrent for future non-compliance by officials.

2.3 Entities should have appropriate arrangements for reporting to the accountable authority and executive management. Early identification of potential issues and risks, through regular monitoring and reporting, enables the accountable authority and executive management to refine existing arrangements, provide further training or guidance to officials, manage non-compliance and ensure arrangements are achieving value for money.

Civil Aviation Safety Authority travel arrangements as a corporate Commonwealth entity

2.4 As a CCE, CASA establishes its own travel arrangements. CASA may adopt some or all of the WoAG Arrangements. CASA uses the WoAG Arrangements for travel management (book), air travel (fly) and vehicle rental services (drive). CASA does not use the WoAG Arrangements for accommodation (stay) or travel and procurement payment services (pay) (see Table 1.1).

2.5 The WoAG Arrangements specify that to formalise WoAG participation, CCEs are required to make an agreement with the Department of Finance (Finance).

2.6 CASA signed the agreement with Finance in October 2023. The agreement outlines the terms and conditions of CASA’s participation in WoAG Arrangements including which WoAG arrangements CASA has adopted, the term of the agreement, termination and issues resolution. CASA or Finance can terminate the agreement or reduce the scope of services with one month’s notice.

2.7 CASA does not assess whether its travel arrangements remain appropriate and achieve value for money, including its decisions to adopt components of the WoAG Arrangements. On 18 September 2025, CASA advised the ANAO that CASA’s decision to adopt WoAG Arrangements was a decision made historically and that ‘CASA re-evaluates the agreement [with Finance] when conditions change’ based on discussions that are not documented.

2.8 As part of its travel arrangements, CASA has implemented a process for negotiating accommodation rates with preferred hotels (see paragraph 2.29). On 18 September 2025, CASA advised the ANAO that CASA regularly evaluates its preferred hotel rates, but these evaluations are not documented.

Recommendation no.1

2.9 The Civil Aviation Safety Authority:

- periodically reviews and documents whether its travel arrangements continue to represent value for money, including where CASA has adopted or has not adopted WoAG Arrangements; and

- formalises and documents the process of negotiating rates with preferred hotels to enable executive oversight of the process and its outcomes, including value for money assessment.

Civil Aviation Safety Authority response: Agreed.

2.10 CASA agrees with this recommendation. CASA is committed to exemplifying best practice in official travel requirements across the Australian Public Service and ensuring value for money.

2.11 Appreciating that CASA is not eligible to sign-up to the WoAG Travel Arrangements for accommodation, CASA will enhance visibility of the process in selecting preferred hotels by documenting processes and reporting results to CASA’s Executive Committee.

2.12 CASA will also implement regular reporting to the Executive Committee on accommodation charges, compared to the relevant ATO Determination documenting reasons for expenditure over rates listed in specific locations.

2.13 A report to CASA’s Executive Committee on the use of airfares under the WoAG Travel Arrangements will also be developed. This report will be produced utilising samples of both domestic and international flights comparing charges under the WoAG Travel Arrangements and prices available online.

Civil Aviation Safety Authority’s travel framework

2.14 CASA’s framework for domestic and international travel management is established through the policies and procedures summarised in Table 2.1.

Table 2.1: Civil Aviation Safety Authority’s travel policies and procedures

|

Framework documentation |

Summary |

|

Travel Directive 2023 |

Chief Executive Officer’s (CEO)a instructions for officials undertaking, approving and administering travel, including ensuring travel expenditure is economic, efficient, ethical, honest, and defensible. |

|

Financial Action Instrument 2024 |

Establishes a delegation for the power to approve expenditure for domestic and international travel, including maximum amounts and associated positions.b |

|

Enterprise Agreement (2023–2026) |

Sets out travel related conditions such as payment of travel allowance, accommodation, class of travel and incidental travel expenses (for example, taxi or parking). |

|

Finance Manual (credit card chapter) 2023 |

Sets out requirements for booking travel and credit card use, including acquittal. |

|

Domestic Travel Procedures (Standard Operating Procedure) 2025 |

Sets out requirements and obligations for officials undertaking, approving and administering domestic travel, their delegates and the Centralised Travel Team. |

|

International Travel Procedures (Standard Operating Procedure) 2025 |

Sets out requirements and obligations for officials undertaking, approving and administering international travel, their delegates and the Centralised Travel Team. |

Note a: On 18 August 2025, CASA advised the ANAO that the CEO role is also titled Director of Aviation Safety and the two titles are used interchangeably.

Note b: The instrument is made under and for the purposes of subsections 73(1) and 94(1) of the Civil Aviation Act 1988. For domestic travel, officials above the Aviation Safety Regulator Level 2 (EL 1 equivalent) position can approve domestic travel operational expenditure to the limit mentioned in the approved budget.

Source: ANAO analysis of CASA’s travel policy documentation.

Has the Civil Aviation Safety Authority implemented effective controls for domestic travel?

CASA has implemented controls for domestic travel in areas of demonstration of business need, delegate approval, airfare booking, travel allowance and acquittal. All sampled trips of CASA’s domestic trips were approved before they occurred. CASA officials selected the lowest practical fare (LPF) in all of the domestic trips reviewed by the ANAO with six per cent of those trips at the lowest (cheapest) fare. In 55 per cent of the trips reviewed by the ANAO, officials selected accommodation priced higher than the rate set by the Australian Taxation Office (ATO). CASA has not formalised and documented its approach to negotiating rates with preferred hotels.

Domestic travel overview

2.15 CASA’s domestic travel expenditure and total trips between 2022–23 and 2024–25 financial years are set out in Table 2.2.

Table 2.2: Civil Aviation Safety Authority’s domestic travel trips and expenditure

|

Financial year |

Number of tripsa |

Total expenditure $m |

Average cost per tripb $ |

|

2022–23 |

2,698 |

5.0 |

1,871 |

|

2023–24 |

2,880 |

5.9 |

2,034 |

|

2024–25 |

2,502 |

5.1 |

2,057 |

Note a: The number of domestic trips excludes cancelled trips.

Note b: Calculated by the ANAO.

Source: CASA’s domestic travel expenditure data.

Domestic travel management process summary

2.16 CASA’s domestic travel is arranged by the Centralised Travel Team (CTT) and managed and documented through the ‘Travel and Expense’ module of TechnologyOne (TechOne), CASA’s Financial Management Information System (FMIS).10 Trip details are recorded by the official within a ‘travel document’11, with each trip getting a unique travel document identification number. The travel document includes information about the destination, travel dates, reason the trip, flights, accommodation, general expenses, travel allowance, taxis and car hire.

2.17 The completed travel document is submitted to the CTT in TechOne. The CTT undertakes a review of the travel document against CASA’s travel policy before forwarding the travel document to the official’s delegate called a Financial Authorising Officer (FAO) for approval. The approval, including the date it was obtained, is recorded against the individual travel document in TechOne.

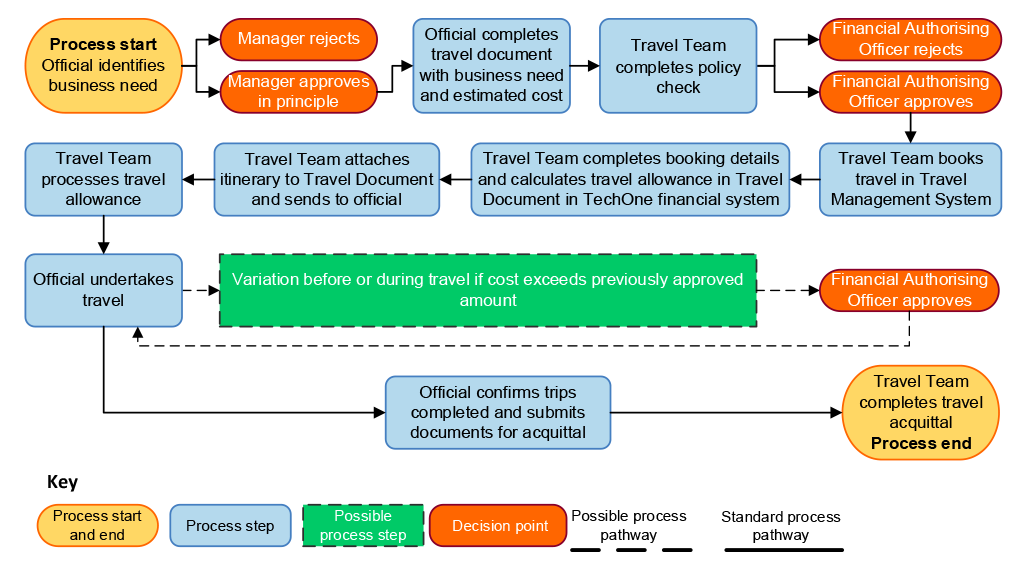

2.18 CASA has prepared ‘task cards’ for the CTT on how to record, book and acquit travel. These task cards provide step by step travel process instructions with descriptions and screenshots. CASA’s domestic travel management process is illustrated in Figure 2.1.

Figure 2.1: Civil Aviation Safety Authority’s domestic travel management process

Source: ANAO analysis of CASA’s domestic travel processes.

Travel planning and approval

Business need

2.19 CASA’s Domestic Travel Procedures (CASA’s domestic travel policy) specify that officials need to obtain ‘in principle’ approval from their relevant section head or manager prior to booking travel.

2.20 Following manager’s ‘in principle’ approval, the official completes the travel document. The travel document includes a ‘primary travel reason’ field with a drop-down list which the official uses to record reason for travel. Examples of ‘primary travel reason’ codes include ‘130 - Mgmt CASA only meet’, ‘135 - Surveillance’, ‘128 - Conferences/Events’ and ‘141 - Mandatory Profession’. The ANAO reviewed 36 randomly selected domestic trips, all trips included a ‘primary travel reason’ code. Officials are also required to complete the free text reason field to provide additional information to explain the selection of the travel code. All 36 trips tested by the ANAO had this field completed.

Approval requirement

2.21 CASA’s domestic travel policy states that all domestic travel requires FAO’s approval prior to travel, which is recorded within the travel document. FAO is responsible for the approval of all aspects of the travel with re-approval required if the variation is above the previously approved budget.12 On 22 October 2025, CASA advised the ANAO that TechOne has built-in automated functionality to detect instances when actual travel cost exceeds the approved expenditure amount and it prompts the official to re-approve with FAO. In limited situations, where TechOne cannot be accessed, cost variation is approved by FAO via email with the approval subsequently saved on file.

2.22 CASA’s domestic travel policy also specifies that, before approving travel, FAO needs to be satisfied that the trip contributes to the achievement of CASA’s business and that it represents an efficient and effective use of funds. CASA’s Travel Directive states that FAO should ‘have as a major consideration CASA’s policy on Lowest Practical Fare’ and consider:

- Needs of employees, including family responsibilities, personal circumstances, safety and security and other relevant factors that may affect their ability to travel; and

- Most appropriate and relevant application of these policy requirements to ensure that employees can undertake their official travel in the most effective and efficient manner possible.

2.23 All domestic trips tested by the ANAO had documented approval in the travel document prior to travel.

Travel booking

Lowest practical fare

2.24 The WoAG Arrangements require officials to book flights at the lowest practical fare (LPF) (see paragraph 1.5). The LPF is the lowest fare available that suits the practical business need. When the lowest (cheapest) economy class fare is not selected for the booking, officials are required to choose the ‘booking code’ from a drop-down list within the TMS system, which includes seven code options (refer to Table 1.2). Bookings codes between two and six are compliant with the LPF WoAG policy.

2.25 CASA’s internal travel policy requires the CTT to select the lowest practical fare when booking airfares and choose the LPF booking code in the TMS system.

2.26 Within the 36 trips tested by the ANAO, 33 trips included air travel. Within these, officials chose:

- code 2 ‘Unsuitable due to time routing connections or baggage charges’ for 31 trips (94 per cent); and

- code 1 ‘Lowest Fare’ (cheapest) for two trips (six per cent).

2.27 Table 2.3 sets out the LPF booking codes selected in the TMS system for CASA’s domestic flights booked between 1 July 2022 and 30 June 2025.

Table 2.3: Civil Aviation Safety Authority’s domestic travel booking codes summary — 1 July 2022 to 30 June 2025

|

Booking code |

Numbera |

|

|

2 |

Unsuitable due to time routing connections or baggage charges |

6,743 (84%) |

|

1 |

Lowest fare |

1,304 (16%) |

|

3 |

Approval/Entitlement to travel at a higher fare class |

84 (1%) |

|

6 |

Require flexibility to change booking |

60 (1%) |

|

|

Otherb |

5 (0%) |

|

4 |

Health issues |

2 (0%) |

|

5 |

Personal responsibilities |

0 (0%) |

|

7 |

Outside of LPF Policy |

0 (0%) |

Note a: Multiple booking codes can be attributed to a booking which may impact the total numbers and percentages.

Note b: Other was blank or had no booking code.

Source: TMS system data.

Accommodation

2.28 CASA does not participate in the WoAG accommodation arrangement (see paragraph 2.4). Instead, CASA uses the TMS system to book accommodation, for which it has implemented two processes to secure hotel rates:

- the CTT negotiating rates directly with some hotels that are located close to CASA’s offices around Australia (preferred hotels); and

- the CTT accessing ‘government rates’ that hotels upload into the TMS system available for all government officials to use.

Negotiated rates with hotels

2.29 To negotiate rates with hotels, the CTT team leader conducts a desktop review of the area around certain CASA’s offices and selects hotels to approach for negotiated rates based on their online ‘star rating’ and published reviews. The CTT team leader liaises with the hotel’s sales team, arranges a site inspection, and, if the hotel meets required standards, obtains the rate proposal and checks that proposed rate is competitive. The CTT team leader then signs an agreement, the hotel registers these rates in the TMS system and CASA adds the hotel to the preferred hotel list it maintains. This process is not documented.

2.30 This list of preferred hotels is also available on CASA’s intranet and is embedded in TechOne. This list has been updated seven times between 1 July 2022 and 30 June 2025. The CTT completes annual inspections of hotels (one location per year) to ensure hotels are fit for purpose.13

2.31 On 24 October 2025, CASA advised the ANAO that CASA’s management does not have oversight over the process of negotiating rates with preferred hotels and that this process is managed by the CTT. The absence of formal documentation and endorsement of the process and regular executive oversight limit CASA’s ability to assess whether the process is appropriate, has sufficient controls and achieves value for money for CASA (see Recommendation no. 1 at paragraph 2.9).

2.32 Within the ANAO’s sample of 36 trips, 33 trips contained commercial accommodation:

- 16 trips (48 per cent) used preferred hotels;

- nine trips (27 per cent) used non-preferred hotels;

- five trips (15 per cent) used accommodation at locations where CASA did not have any preferred hotels (for example, regional locations);

- two trips (6 per cent) contained a booking with a preferred hotel and accommodation at a location where CASA did not have any preferred hotels (for example, regional locations); and

- one trip (3 per cent) contained a booking with a preferred hotel and a booking with a non-preferred hotel.

Booking accommodation

2.33 CASA’s domestic travel policy states that domestic accommodation should be booked within the Australian Taxation Office (ATO) recommended rates ‘where possible’ without providing further guidance or examples of possible exemptions.14 CASA does not require officials to document a reason for why ATO recommended rates were not followed. The lack of documentation limits the effectiveness of monitoring and assurance activities in determining whether accommodation bookings represent value for money.

2.34 Within the ANAO’s sample of 36 trips, of the 33 trips which contained commercial accommodation:

- 18 trips (55 per cent) included accommodation priced higher than the maximum limit of the ATO recommended rates; and

- 15 trips (45 per cent) included accommodation priced within the maximum limit of the ATO recommended rates.

2.35 CASA does not have assurance over its airfare and accommodation booking practices to determine if these represents value for money for CASA. Enhanced monitoring and reporting of airfare and accommodation booking trends and documentation of reasons for exceeding ATO recommended rates for accommodation would assist CASA in evaluating whether travel expenditure and booking practices represents value for money (see Recommendation no. 2 at paragraph 2.74).

Travel allowance

2.36 CASA’s Enterprise Agreement 2023–2026 and domestic travel policy sets out that officials will have meals and incidental costs paid or reimbursed through the payment of travel allowance.15 Travel allowance is automatically calculated within TechOne based on departure and arrival dates and is processed by the CTT for payment to the official after travel is approved and booked. CASA reviews and adjusts the travel allowance limits in TechOne annually in accordance with the ATO recommended rates.16

2.37 Of the 36 domestic trips sampled by the ANAO, 35 trips included a record of the travel allowance value in TechOne. One trip did not include a record of the travel allowance value in TechOne.17 The ANAO found that all travel allowances for domestic trips were paid only after written delegate approval.

Travel acquittal

2.38 CASA’s domestic travel policy specifies that officials should confirm travel expenses and submit domestic travel documents to the CTT within five business days of returning to work. The CTT identifies relevant travel expenses against the credit card and acquits airfares, hotels, the TMS supplier fees and credit card incidental expenses (for example, taxis and parking). The CTT must acquit the travel documents within five business days. On 22 October 2025, CASA advised the ANAO that FAO does not participate in or have visibility of the travel acquittal process after the initial approval of the trip.

Travel benefits as a regulator

2.39 As a government aviation safety regulator, it is important for CASA to set and maintain appropriate risk and policy thresholds for dealing with potential benefits and hospitality from airlines (including airline lounge memberships, reward and loyalty point programs and flight upgrades). Maintaining independence is crucial for regulators to effectively perform their functions and prevent the negative impact of regulatory capture.18

2.40 CASA identifies regulatory capture in one strategic and four operational risks within its enterprise risk register. The risk register lists risk owners and corresponding controls. CASA’s Risk Management Manual sets out that risks are to be reviewed between one to 24 months in frequency depending on their risk rating.

2.41 CASA has implemented a conflict of interest framework as set out within the ‘Conflict of Interest CEO Instruction’ consisting of numerous policy requirements and associated controls, which include requirements for:

- prospective CASA officials to declare conflicts of interest at the time of applying for a job and subsequently upon commencement;

- officials to complete conflict of interest training at the start of their employment;

- officials to declare conflicts of interest when conducting recruitment and procurement activities; and

- managers to develop procedures for ‘the regular rotation of officials to avoid regulatory capture,’ and where this is ‘not possible or practicable’ consider ‘peer review or other mitigation strategies.’

2.42 From a travel perspective CASA’s policies and procedures set out that:

- officials may accrue status credits but may not accrue loyalty points (WoAG policy);

- officials must not be influenced when selecting LPF or IBF19 (WoAG policy);

- officials must not accept any free flight upgrades or other benefits in relation to official travel 20 (CASA policy);

- officials must not accept gifts from entities ‘subject to regulatory oversight by CASA’ and explicitly identifies that gifts from aviation industry members should be considered carefully before accepting (CASA policy);

- CASA will not purchase airline lounge memberships for any officials and officials ‘must be conscious of the perception of a conflict of interest when purchasing airline lounge memberships’ (CASA policy)21; and

- bookings must be made by the CTT (CASA policy).

Has the Civil Aviation Safety Authority implemented effective controls for international travel?

CASA has implemented controls for international travel in areas of demonstration of business need, delegate approval, travel allowance, airfare booking and acquittal. These controls are operating effectively in the sample tested by the ANAO.

International travel overview

2.43 CASA’s international expenditure and total trips between 2022–23 and 2024–25 financial years are set out in Table 2.4.

Table 2.4: Civil Aviation Safety Authority’s international travel trips and expenditure

|

Financial year |

Number of trips |

Total expenditure $m |

Average cost per tripa $ |

|

2022–23 |

136 |

1.9 |

13,371 |

|

2023–24 |

177 |

2.4 |

13,498 |

|

2024–25 |

177 |

2.3 |

12,938 |

Note a: Calculated by the ANAO.

Source: CASA’s international travel expenditure data.

International travel management process summary

2.44 CASA’s international travel is arranged by the CTT and managed and documented through the ‘Travel and Expense’ module in TechOne. Trip details are recorded within a travel document (see paragraph 2.16). The official is required to also prepare an international travel justification form and attach it in TechOne. The CTT then books the travel.

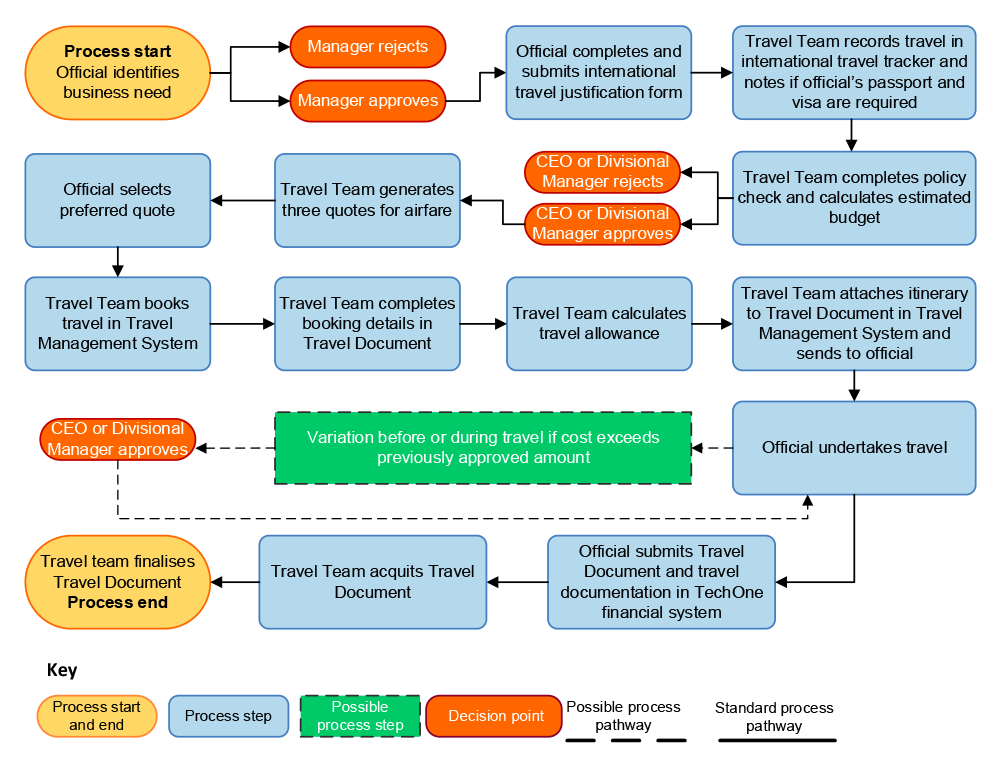

2.45 CASA’s international travel management process is illustrated in Figure 2.2.

Figure 2.2: Civil Aviation Safety Authority’s international travel management process

Source: ANAO analysis of CASA’s international travel process.

Travel planning and approval

Business need

2.46 CASA’s International Travel Procedures (CASA’s international travel policy) specifies that international travel needs to prioritise efficiency and cost effectiveness. Business need is documented in CASA’s international travel justification form, which requires a detailed description of the reason for travel. This form is submitted in TechOne when the official is requesting international travel. Similar to domestic travel, officials are required to select a ‘primary travel reason’ code and provide additional information in the free text reason field within the travel document in TechOne (see paragraph 2.20).

2.47 The ANAO reviewed 16 randomly selected international trips. Of the 16 trips tested by the ANAO, all trips included a primary travel reason code and had a free text reason field completed. All trips had a completed international travel justification form with the completed reason for travel attached to the travel document. One trip was for a guest traveller and had an alternate document provided for justification.

Approval requirement

2.48 All international travel must be approved prior to travel by the CEO or the Divisional Executive Managers (DEM) and recorded in TechOne. The DEM (SES Band 2 equivalent) approves travel requests from those officials reporting to them and the CEO approves travel requests from the DEMs. All international requests must have costs estimated before approval and it is the responsibility of the delegate to approve travel budget, destination and business need. If a variation of a trip occurs after approval and it is within the approved budget, no further approval is required. All 16 international trips sampled by the ANAO were approved prior to travel.

2.49 CASA’s international travel policy stipulates that international travel by officials is contingent on an acceptable level of risk, which is based on the Department of Foreign Affairs and Trade’s (DFAT) advisory levels.22 Officials are required to register with SmartTraveller and International SOS prior to travel. Within the international travel justification form officials also complete the ‘Travel Risk Assessment’ to confirm they are medically fit to travel.

Travel booking

Estimated costs

2.50 RMG 405 specifies that officials are to obtain three quotes for airfares from at least two different airlines for the same or equivalent fare class, unless a limited number of airlines (one or two) service a particular route. CASA’s international travel policy reflects this requirement and states that, following the estimated budget approval by the CEO or the DEM, the CTT will engage the TMS supplier to obtain ‘three return airfare quotes (where available) to the international destination’. The CTT will then pass the quotes to the official. Of the 16 international trips sampled by the ANAO:

- 11 trips (69 per cent) included three quotes;

- Two trips (12.5 per cent) included two quotes;

- Two trips (12.5 per cent) included one quote but contained explanations why; and

- One trip (6 per cent) had the travel document completed incorrectly and the document could not be located.

International best fare

2.51 The WoAG Arrangements require flights to be booked at the international best fare (IBF). The international best fare is the lowest fare available on the day travel is booked that suits the practical business needs of the official. When the lowest (cheapest) fare is not selected for the booking, officials are required to choose the ‘booking code’ from a drop-down list (within the TMS system), which includes seven code options (refer to Table 1.2). Booking codes between one and six are compliant with the IBF WoAG policy.

2.52 All 16 trips tested by the ANAO included air travel. Within these, officials chose:

- code 2 ‘Unsuitable due to time routing connections or baggage charges’ for 10 trips (48 per cent); and

- code 1 ‘Lowest Fare’ (cheapest) for 6 trips (38 per cent).

2.53 Table 2.5 sets out the WoAG booking codes selected in the TMS system for CASA’s international flights booked between 1 July 2022 and 30 June 2025.

Table 2.5: Civil Aviation Safety Authority’s international WoAG travel booking code summary — 1 July 2022 to 30 June 2025

|

Booking code |

Numbera |

|

|

2 |

Unsuitable due to time routing connections or baggage charges |

276 (51%) |

|

1 |

Lowest fare |

267 (50%) |

|

3 |

Approval/Entitlement to travel at a higher fare class |

2 (0%) |

|

6 |

Require flexibility to change booking |

1 (0%) |

|

4 |

Health issues |

0 (0%) |

|

5 |

Personal responsibilities |

0 (0%) |

|

7 |

Outside of LPF Policy |

0 (0%) |

|

|

Otherb |

0 (0%) |

Note a: Multiple booking codes can be attributed to a booking which may impact the total numbers and percentages.

Note b: Other was blank or had no booking code.

Source: TMS system data.

Travel allowance

2.54 CASA Enterprise Agreement 2023–2026 and CASA International Travel Procedure set out that officials will have meals and incidental costs paid or reimbursed through travel allowance. Travel allowance is automatically calculated within TechOne based on the departure and arrival dates and is processed by the CTT after travel is booked. CASA reviews and adjusts daily travel allowance limits in TechOne annually in accordance with the ATO recommended rates.

2.55 Of the 16 international trips sampled by the ANAO, 15 trips included a record of the travel allowance value in TechOne. One trip did not include a record of the travel allowance value in TechOne because the traveller was a guest and was not entitled to travel allowance. The ANAO found that all travel allowances for international trips were paid only after written approval.

Travel acquittal

2.56 The international travel acquittal process has the same arrangements to domestic travel (see paragraph 2.38).

Has the Civil Aviation Safety Authority implemented effective assurance processes, including for managing identified instances of non-compliance?

CASA travel policies do not clearly define arrangements for identifying, assessing and responding to non-compliance. CASA’s Centralised Travel Team (CTT) acquits travel related credit card expenses. The team is responsible for identifying and recording non-compliance in the register. The register is reviewed as part of the biannual Public Governance, Performance and Accountability (PGPA) compliance process and includes details on corrective actions.

Travel non-compliance

Defining non-compliance

2.57 CASA’s policies that set out requirements for officials related to travel non-compliance are outlined in Table 2.6.

Table 2.6: Civil Aviation Safety Authority’s policies and procedures that include travel non-compliance

|

Source |

Relevant content |

|

Travel Directive |

Outlines the general principles to be observed when undertaking ‘travel for official business’ and directs all CASA officials to ‘observe and comply’ with the travel procedures which support this directive. |

|

Domestic Travel Procedures & International Travel Procedures |

The travel procedures define non-compliance only in the context of interactions of officials with airline upgrades, where it states breaches of the requirements regarding airline upgrades will be handled in accordance with ‘CASA’s code of conduct framework’. |

|

Financial Management Policy |

Notes CASA must ensure compliance with relevant legislation listed in the policy and the associated Finance Manual, which is designed to allow employees to appropriately carry out financial obligations. |

|

Financial Manual — Corporate Credit Cards |

Includes requirements on cardholders to ensure transactions are properly approved/authorised, and in line with CASA and government ‘policies, legislation and ethics’ and are ‘only related to official business.’ The manual also outlines the responsibility of the ‘Credit Card Administrator or Team Leader - Accounts Payable may identify instances where it appears that there may have been a breach of CASA policies in a credit card transaction’, which includes travel transactions. |

Source: ANAO presentation of CASA’s documentation.

Identifying non-compliance

2.58 Neither domestic nor international travel policy describes arrangements for identifying and reporting non-compliance or how instances of identified non-compliance should be managed. CASA does not require officials to report instances of travel non-compliance when these are identified.

2.59 Potential non-compliance with CASA’s travel policies is identified when the CTT review the initial travel request (see paragraph 2.17).

2.60 Identification of non-compliance with the credit card policy (for travel expenses such as taxi and parking) primarily occurs during the acquittal and review process. For travel related credit card transactions, individual cardholders must provide invoices for expenses within five days of returning to work for the CCT to acquit these transactions. As noted in paragraph 2.38, cardholders are responsible for confirming their expenses.

2.61 The credit card policy identifies the responsibility of the ‘Credit Card Administrator or Team Leader — Accounts Payable’ to identify, investigate and escalate possible breaches of CASA’s policies.

Response to non-compliance

2.62 CASA’s travel non-compliance is primarily related to accidental credit card misuse by officials. All potential instances of non-compliance, including travel, are recorded within CASA’s non-compliance register. The non-compliance register provides the summary and date of the breach, the date the breach was identified, name of the official, their supervisor and the dollar value. Each instance of reported non-compliance includes additional assessment details:

- requirement breached (for example the relevant section of the PGPA Act);

- category (for example ‘unintentional personal use of official credit card’); and

- corrective action(s).

2.63 CASA undertakes a bi-annual compliance survey of PGPA Act compliance to ‘identify potential procedural weaknesses’ and to provide executive assurance over ‘CASA’s obligation with complying to the Public Governance, Performance and Accountability (PGPA) framework’ (see paragraph 2.70). On 18 August 2025, CASA advised the ANAO that following the completion of the PGPA compliance surveys, finance branch officials meet with the legal branch officials to classify breaches (based on seriousness and repetitiveness of the breach) and discuss whether further investigation is warranted. Instances of non-compliance (including travel) that have been confirmed as ‘reportable’ at the meeting are reported to the CEO and governance committees (see paragraph 2.71).

2.64 CASA provided the ANAO with all non-compliance registers between 1 July 2022 and 30 June 2025. A total of 97 instances of potential non-compliance were identified, of which 29 unique entries related to travel. Travel related non-compliance was categorised by CASA as consisting of:

- 18 instances of ‘Misuse of official credit card’;

- seven instances of ‘Unintentional personal use of official credit card’;

- two instances of failing to exercise ‘Care and diligence’;

- one instance of ‘Travel policy non-compliance’; and

- one instance of ‘Procurement’ non-compliance.

2.65 Of these 29 entries related to travel non-compliance identified by the ANAO in the non-compliance register, CASA identified nine of these entries as breaches of the travel policy.

Corrective actions

2.66 When an entry is made in the non-compliance register, the entry includes the ‘corrective actions’ to be taken in response to the breach. There is no policy identifying responsibility for the implementation of these corrective actions. On 18 August 2025, CASA advised the ANAO that the corrective actions include a referral to the relevant team for ‘further investigation as necessary’ where the non-compliance is considered to have the potential for fraud.

2.67 For the 29 entries identified by the ANAO as relevant to travel:

- the official was counselled in 27 instances;

- the official was invoiced for reimbursement in 25 instances;

- the instance was referred to the legal team for ‘further investigation as necessary’ in 17 instances; and

- the corrective action included ‘other’ in 2 instances.

2.68 The actions recorded in the register indicates escalation is being appropriately implemented in circumstances where officials are responsible for multiple instances of non-compliance.

Has the Civil Aviation Safety Authority developed appropriate arrangements for reporting to executive management on domestic and international travel requirements?

CASA provides travel reporting to its executive management with non-compliance reporting provided to the Chief Executive Officer (CEO) and governance committees. Chief Financial Officer (CFO) travel expenditure reports are provided to the CASA Board Chair, the Board Audit and Risk Committee Chair and the Executive Committee. Existing monitoring and reporting arrangements do not enable the identification of emerging risks and the assessment whether domestic and international travel expenditure and booking practices represent value for money for CASA. Improving monitoring and reporting arrangements could assist with identification of risks and assure that value for money is being achieved.

Travel reporting

2.69 CASA has three main governance bodies that have visibility of CASA’s travel arrangements and compliance as set out below.

- The CASA Board (the Board) — is responsible for CASA’s strategic direction, risk management and corporate planning.

- The Board Audit and Risk Committee (BARC) — is established by the Board. It provides assurance and independent advice to assist the Board in performing its duties in line with the Civil Aviation Act 1988 and the PGPA Act.

- The Executive Committee — oversees CASA’s performance through implementation of strategies and initiatives and review of organisational priorities.

2.70 To monitor compliance, CASA conducts a biannual compliance survey to:

…identify potential procedural weakness in the organisation as well as to provide CASA’s Board and Board Audit and Risk Committee (BARC) with assurance of CASA’s obligation with complying to the Public Governance, Performance and Accountability (PGPA) Framework.

2.71 Table 2.7 sets out compliance survey results related to travel that were classified to be in breach of the PGPA Act by the legal branch. CASA provides survey results to the CEO, the BARC and the Executive Committee.

Table 2.7: Civil Aviation Safety Authority’s biannual compliance survey results for travel

|

Compliance survey period |

Number of breaches related to travel policy |

Details |

|

1 July 2022 – 31 January 2023 |

1 |

Credit card used to book travel without an approved travel document and approval. |

|

1 July 2022 – 30 June 2023 |

1 |

Credit card used to book travel without an approved travel document and approval. |

|

1 July 2023 – 31 January 2024 |

0 |

N/A |

|

1 July 2023 – 30 June 2024 |

1 |

No travel or travel allowance was approved due to the nature of the trip, but a meal was still purchased without approval. |

|

1 July 2024 – 31 January 2025 |

0 |

N/A |

Source: Documentation provided by CASA.

2.72 CASA’s Chief Financial Officer (CFO) provides:

- monthly expenditure travel reports to the Board Chair to endorse the expenditure made by the Board, the BARC and the CEO (expenditure made by the Board Chair being separately endorsed by the BARC Chair)23; and

- monthly reports to the Executive Committee to provide budget, revenue and expenditure outlook, including the Travel Report spreadsheet showing travel booked in the previous and current months.

2.73 CASA’s existing monitoring and reporting arrangements do not enable the identification of emerging risks, the assessment of whether travel expenditure and booking practices represent value for money for CASA and if policy settings remain appropriate (see paragraphs 2.24 to 2.35).

Recommendation no.2

2.74 The Civil Aviation Safety Authority develops monitoring and reporting arrangements to assist with identification of emerging risks and assessment whether travel expenditure and booking practices represent value for money, including for airfare and accommodation bookings.

Civil Aviation Safety Authority response: Agreed.

2.75 CASA agrees with this recommendation. It is CASA’s view that the additional documentation on selecting preferred hotels in specific locations, combined with the additional reporting on value for money on airfares and accommodation expenditure will provide the required visibility to CASA’s Executive Committee to assure the appropriate expenditure on official travel and highlight potential emerging risks in this sector.

Appendices

Appendix 1 Entity response

Appendix 2 Improvements observed by the ANAO

1. The existence of independent external audit, and the accompanying potential for scrutiny improves performance. Improvements in administrative and management practices usually occur: in anticipation of ANAO audit activity; during an audit engagement; as interim findings are made; and/or after the audit has been completed and formal findings are communicated.

2. The Joint Committee of Public Accounts and Audit (JCPAA) has encouraged the ANAO to consider ways in which the ANAO could capture and describe some of these impacts. The ANAO’s corporate plan states that the ANAO’s annual performance statements will provide a narrative that will consider, amongst other matters, analysis of key improvements made by entities during a performance audit process based on information included in tabled performance audit reports.

3. Performance audits involve close engagement between the ANAO and the audited entity as well as other stakeholders involved in the program or activity being audited. Throughout the audit engagement, the ANAO outlines to the entity the preliminary audit findings, conclusions and potential audit recommendations. This ensures that final recommendations are appropriately targeted and encourages entities to take early remedial action on any identified matters during the course of an audit. Remedial actions entities may take during the audit include:

- strengthening governance arrangements;

- introducing or revising policies, strategies, guidelines or administrative processes; and

- initiating reviews or investigations.

4. During the course of the audit, the ANAO did not observe changes in the Civil Aviation Safety Authority’s approach to audit topic.

Footnotes

1 Department of Finance, RMG 206 — Accountable authority instructions (AAIs), Finance, Canberra, 28 April 2023, available from https://www.finance.gov.au/government/managing-commonwealth-resources/managing-risk-internal-accountability/risk-internal-controls/accountable-authority-instructions-aais-rmg-206 [accessed 6 May 2025].

2 Public Governance, Performance and Accountability Act 2013, paragraph 15(1)(a).

3 The Commonwealth Procurement Rules apply to non-corporate Commonwealth entities and Commonwealth entities prescribed under the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). As at October 2025, CASA is not prescribed as per section 30 of the PGPA Rule.

4 Coordinated procurements are whole-of-government arrangements for procuring goods and services.

5 Department of Finance, RMG 404 — Domestic Travel Policy, Finance, Canberra, 16 November 2023, available from https://www.finance.gov.au/publications/resource-management-guides/domestic-travel-policy-rmg-404 [accessed 7 May 2025].

6 Department of Finance, RMG 405 — Official International Travel — Use of the best fare of the day, Finance, Canberra, 16 November 2023, available from https://www.finance.gov.au/publications/resource-management-guides/official-international-travel-use-best-fare-day-rmg-405 [accessed 7 May 2025].

7 ASL is the full-time equivalent staffing level averaged over a financial year.

8 CASA 2023–24 and 2024–25 Annual Reports, available from https://www.casa.gov.au/resources-and-education/publications/corporate-publications [accessed 7 November 2025].

9 The ANAO developed the Audit Lessons — Management of Corporate Credit Cards to share lessons from these audits, available from https://www.anao.gov.au/work/insights/management-of-corporate-credit-cards [accessed 16 April 2025].

10 The TechnologyOne system was first implemented by CASA in 2013.

11 A travel document is a record of travel within TechOne.

12 The CTT manages the travel re-approval approval process and re-submits to FAO.

13 For example, CASA has established preferred arrangements with six hotels in Adelaide since April 2022 to July 2025.

14 The Australian Taxation Office’s (ATO) reasonable accommodation rates are published in Taxation Determinations. The 2024–25 income year determination is available from https://www.ato.gov.au/law/view/pdf/pbr/td2024-003.pdf [accessed 3 May 2025].

15 CASA applies the ATO recommended rates to determine the value of travel allowance. The ATO’s reasonable meal and expenditure rates are published in Taxation Determinations. The 2024–25 income year determination is available from https://www.ato.gov.au/law/view/pdf/pbr/td2024-003.pdf [accessed 3 May 2025].

16 On 22 October 2025, CASA advised the ANAO that it records travel allowance as a debt in its system until official declares that travel occurred as planned. In circumstances where travel allowance is paid to the official and trip is subsequently cancelled, the allowance amount remains as debt at the time of acquittal and is collected through CASA accounts receivable process.

17 The travelling official was an external board member. External board members are entitled to their own allowances that are paid through the payroll system.

18 The Parliamentary Joint Committee on Corporations and Financial Services, in its 2019 report on Statutory Oversight of the Australian Securities and Investments Commission, the Takeovers Panel and the Corporations Legislation, defined regulatory capture as:

instances where regulators are excessively influenced or effectively controlled by the industry they are supposed to be regulating.

Joint Committee on Corporations and Financial Services, Statutory Oversight of the Australian Securities and Investments Commission, the Takeovers Panel and the Corporations Legislation, Report No. 1 of the 45th Parliament, February 2019, p. 31, paragraph 3.24, available from https://www.aph.gov.au/Parliamentary_Business/Committees/Joint/Corporations_and_Financial_Services/No1of45thParliament/Report [accessed 29 September 2025].

19 ‘Influenced’ is specified under CASA’s policy as an official considering a preference for an airline, access to an airline lounge, or accumulating loyalty benefits.

20 Except where failure to do so would cause them to forfeit their seat or would result in a delay requiring overnight accommodation. For international flights, the policy further requires staff must not under any circumstance accept an upgrade to first class.

21 CASA’s CEO is a member of Qantas’ Chairman’s Lounge and Virgin Australia Beyond as declared on CASA’s website. Civil Aviation Safety Authority, Gifts and benefits register, available from https://www.casa.gov.au/about-us/reporting-and-accountability/gifts-and-benefits-register [accessed 8 October 2025].

22 Officials are not permitted to travel to DFAT Level 4 countries and are only permitted to travel to DFAT Level 3 countries if the risk is deemed acceptable (following a documented travel risk assessment conducted by the CTT).

23 On 22 October 2025, CASA advised the ANAO that CASA has implemented a process to ensure expenditure incurred by the Board members, the BARC members, the CEO or the Board Chair was independently reviewed. In instances where the expenditure is not appropriate, it would be discussed and referred for further investigation if warranted.