Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Security in Government 2001 SES Seminar

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Committee for Economic Development of Australia, Sydney, 30 Sept

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Security in Government 95 Conference, Canberra

This edition of audit insights draws together key learnings from Australian National Audit Office (ANAO) performance audit reports tabled in the Parliament of Australia from July to September 2017. It provides insights into entities’ operational implementation of government policies and frameworks, drawing on a number of common findings and key learnings on policy and program design, governance, performance and impact measurement, and risk management.

Please direct enquiries through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the Conference on 'Surviving the Year 2000 Computer Crisis' Canberra

Mr Ian McPhee - Auditor-General for Australia, presented for a video-conference of the International Federation of Accountants

The objective of this follow-up audit is to assess the Tax Office's progress in implementing the recommendations of Audit Report No.59 2002–03, Administration of Australian Business Number Registrations, having regard to any changed circumstances, or new administrative issues, affecting the implementation of those recommendations.

This report, which informs the Parliament on the audits of financial statements of Commonwealth entities for 1995-96, aligns with the Government's policy for timely public reporting of financial information. It provides a summary of the opinions formed on those organisations' financial statements and the matters and recommendations raised. Matters reported relate primarily to issues on internal control structures and information technology.

The Auditor-General wrote to the Minister for Finance on 21 June 2024 to advise of the outcomes of the 2023–24 annual performance statements audit program, and a proposal for expanding the program of audits in 2024–25 and the following two financial years. The Minister for Finance responded on 2 July 2024 supporting the proposal. The Minister for Finance's full response is provided below.

Please direct enquiries through our contact page.

The Auditor-General wrote to the Minister for Finance on 25 October 2022 to advise of the outcomes of the 2021–22 annual performance statements audit program, and a proposal for expanding the program of audits in 2022–23 and the following two financial years. The Minister for Finance responded on 16 January 2023 supporting the proposal. The Minister for Finance's full response is provided below.

Please direct enquiries through our contact page.

The Auditor-General wrote to the Minister for Finance on 26 June 2023 to advise of the outcomes of the 2022–23 annual performance statements audit program, and a proposal for expanding the program of audits in 2023–24 and the following two financial years. The Minister for Finance responded on 18 July 2023 supporting the proposal. The Minister for Finance's full response is provided below.

Please direct enquiries through our contact page.

The objective of Phase Two of the audit was to examine the efficiency and effectiveness of operations of ATSIC Central, State and Regional Offices in relation to the administration of the Community Development Employment Projects Scheme. The ANAO established key criteria to assess progress against the implementation of the Phase One recommendations and further assess the efficiency and effectiveness of CDEP administration. The main areas examined were: planning, including reports of progress against plans and the development and use of performance information; monitoring, including client feedback and the review process at the Regional Office level; the implementation and effectiveness of management information systems in relation to CDEP; and the development and implementation of quality assuranced processes at State/Regional level.

Grant Hehir, Auditor-General for Australia, attended the Institute of Internal Auditors-Australia ‘Public Sector Internal Audit Conference’ on 31 July 2018, and presented an opening keynote session titled Strategic governance of risk: Lessons learnt from public sector audit. The accompanying paper to the speech, which was delivered against a conference theme of ‘internal auditor as a trusted advisor’, is available here.

Please direct enquiries through our contact page.

The objective of this audit was to examine the effectiveness of the Attorney-General’s Department’s implementation of the recommendations from Auditor-General Report No.27 of 2017–18, Management of the Australian Government’s Register of Lobbyists.

Please direct enquiries through our contact page.

The Auditor-General responded on 23 December 2022 to correspondence from Senator Malcolm Roberts dated 29 November 2022, enquiring about public contributions to the Administration of the Disaster Recovery Funding Arrangements performance audit.

Please direct enquiries through our contact page.

The Auditor-General has responded to correspondence received from Senator Griff dated 11 April 2019, requesting that the Auditor-General provide as much detail as possible regarding the negotiation and awarding of contracts in the audit of the procurement of garrison support and welfare services.

Please direct enquiries relating to requests for audit through our contact page.

This was a follow-up of Audit Report No. 29 2000-01, Review of Veterans' Appeals Against Disability Compensation Entitlement Decisions. That audit examined the Department of Veterans' Affairs (DVA's) and the Veterans' Review Board's (VRB's) management of the review of decisions for disability compensation. The objective of this audit was to assess the extent to which DVA and the VRB had implemented the four recommendations of Report No.29 2000-01, taking into account any changed circumstances, or new administrative issues, affecting implementation of these recommendations.

This was a follow-up of Audit Report No. 40 of 1997-98, Purchase of Hospital Services from State Governments. That audit examined the administration by the Department of Veterans' Affairs of the Purchase of Hospital Services from State Governments. The objective of this audit was to assess the extent to which the Department had implemented the nine recommendations of Report No. 40, taking account of any changed circumstances or administrative issues that the Department identified as affecting their implementation; and to offer continued assurance to the Parliament on the management of the purchase of hospital services.

The next Audit Committee Chairs Forum is scheduled for Friday, 4 July 2025. Further information about the forum will be announced closer to the event date. If you have any questions regarding the upcoming forum, please contact External.Relations@anao.gov.au.

For any enquiries, please contact External.Relations@anao.gov.au

Mr Mr Ian McPhee - Auditor-General for Australia, presented to the Ginninderra Rotary Club

Response completed as a limited scope assurance review.

The Auditor-General responded on 30 July 2014 to questions raised on 26 May 2014 by Senator the Hon Penny Wong on the appointment of Mr Peter Crone as head of Secretariat for the National Commission of Audit.

Please direct enquiries relating to requests for audit through our contact page.

- Audit committee responsibilities for assurance over performance reporting can be supported by a structured assessment of both the individual performance measures and of the performance narrative as a whole.

This report presents the results of the interim phase of the 2009–10 financial statement audits of all portfolio departments and other major General Government Sector (GGS) agencies that collectively represent some 95 per cent of total GGS revenues and expenses.

The follow-up audit assessed the extent to which the Australian Taxation Office (ATO), Department of Health and Ageing (Health), and Medicare Australia had implemented the six recommendations from Audit Report No.47 2001–02, Administration of the 30 Per Cent Private Health Insurance Rebate. The audit also looked at: the implementation of some of the major suggestions for improvement in the original audit; and the current validity of some of the positive major findings from that audit. The audit found that the ATO, Health and Medicare Australia have acted upon the recommendations contained in Audit Report No.47 2001–02 and, overall, the administration of the Rebate is currently being undertaken effectively.

The objectives of this follow-up audit were to:

- examine the ATO's implementation of the ten recommendations in The Australian Taxation Office's Management of its Relationship with Tax Practitioners (Audit Report No.19, 2002–03), having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations; and

- identify scope for improvement in the ATO's management of its relationship with tax practitioners.

Follow up audits are recognised as an important element of the accountability processes of Commonwealth administration. Parliament looks to the Auditor General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow up audits keep Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

This report complements the interim phase report, Audit Report No.51 2006–07 Interim Phase of the Audit of Financial Statements of General Government Sector Entities for the Year Ending 30 June 2007, and provides a summary of the final audit results of the audits of the financial statements of all Australian Government entities, including the Consolidated Financial Statements for the Australian Government.

This report summarises audit and other related activities of the Australian National Audit Office in the period January to June 1998.

This report summarises audit and other related activities of the Australian National Audit Office in the period January to June 1999.

This report is an information document summarising the audit activities of the ANAO in the period January to June 1997.

In 2000, the ANAO tabled Audit Report No 49 1999-2000, Indigenous Land Corporation operations and performance. The 2000 audit made nine recommendations for improvement. This follow-up audit examined the Indigenous Land Corporation's implementation of the recommendations of the 2000 audit.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the Australian Society of CPAs, Canberra

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Public Seminar Series, Graduate Program in Public Policy, 'Democratic Governance: Improving the Institutions of Accountability', The Australian National University

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the ASCPA Annual Public Sector Accounting Convention, Canberra

This report complements the interim phase report released in June 2013 (Audit Report No.49 2012–13), and provides a summary of the final audit results of the audits of the financial statements of all Australian Government entities, including the Consolidated Financial Statements for the Australian Government.

Please direct enquiries relating to reports through our contact page.

Mr Ian McPhee - Auditor-General for Australia, presented at the World Bank Seminar, Washington DC By Teleconference

This page lists status updates about the ANAO's progress on recommendations from the Australian Securities and Investments Commission (ASIC) audit inspection reports

Please direct enquiries through our contact page.

The report summarises the final results of the audits of the financial statements of Australian Government entities, being the second report this year on financial statements for the period ended 30 June 2003. It complements Audit Report No.61 2002-2003 Control Structures as part of the Audit of Financial Statements of Major Commonwealth Entities for the Year Ending 30 June 2003.

This report provides a summary of the final audit results of the audits of the financial statements of all Australian government reporting entities, including the Consolidated Financial Statements for the Australian Government.

This report complements the interim phase report, and provides a summary of the final audit results of the audits of the financial statements of all Australian Government entities, including the Consolidated Financial Statements for the Australian Government.

The ANAO is responsible for the audits of the financial statements of all Australian Government entities. This report provides a summary of the final audit results of these entities, including the Consolidated Financial Statements for the Australian Government.

The focus of this report is on the year end results of the financial statement audits of all general purpose reporting entities for the 2004–05 financial year. Financial management issues (where relevant) arising out of the audits and their relationship to internal control structures are also included in this report.

The focus of this report is on the year end results of the financial statement audits of all general purpose reporting entities for the 2005–06 financial year. Financial management issues (where relevant) arising out of the audits and their relationship to internal control structures are also included in this report.

This report summarises the final results of the audits of the financial statements of Commonwealth entities, forming the second report this year on financial statement audits for the period ended 30 June 2000. It complements Audit Report No.52 1999-2000 Control Structures as Part of the Audits of Financial Statements of Major Commonwealth Agencies for the Period Ended 30 June 2000. The report is in three parts:

- Part One of the report is a commentary on the structure and status of the new financial framework, focusing on the quality and timeliness of the preparation of the annual financial statements;

- Part Two discusses the summary final results of the audits of the financial statements, providing details regarding qualifications and any matters emphasised in audit reports; and

- Part Three provides the results of the individual financial statement audits and any additional significant control issues identified since Audit Report No.52.

This report summarises the final results of the audits of the financial statements of Commonwealth entities, forming the second report this year on financial statement audits for the period ended 30 June 2001. It complements Audit Report No.1 2001-2002 Control Structures as Part of the Audits of Financial Statements of Major Commonwealth Agencies for the Period Ended 30 June 2001. The report is in five parts:

- Part One of the report discusses Commonwealth financial management and reporting issues. It also provides ongoing commentary on the structure of the Commonwealth's financial framework. Related reporting issues include developments in relation to the outcomes and outputs costing and appropriation framework. Comment is also made on the quality and timeliness of the preparation of entities' annual financial statements;

- Part Two provides details of the audit of the Commonwealth's Consolidated Financial Statements for 2000-2001;

- Part Three provides an overview of the current control issues noted in the financial statement audits of Commonwealth entities;

- Part Four discusses the summary final results of the audits of the financial statements, providing details regarding qualifications and any matters emphasised in audit reports; and

- Part Five provides the results of the individual financial statement audits and any additional significant control matters identified since Audit Report No.1 2001-2002.

The ANAO is responsible for the audits of the financial statements of all Australian Government entities. This report provides a summary of the final audit results of these entities, including the Consolidated Financial Statements for the Australian Government.

The paragraphs numbered 5.213 to 5.216 in relation to Defence Housing Australia were tabled as an addendum to the Report.

A correction to the third bullet point of paragraph 5.120 was tabled as a corrigendum to the Report.

This report summarises the final results of the audits of the financial statements of Commonwealth entities and represents the second report of the year on financial statement audits for the period ended 30 June 2002. It complements Audit Report No.67 2001-2002 Control Structures as part of the Audit of Financial Statements of Major Commonwealth Entities for the Year Ending 30 June 2002. The report is in five parts:

- Part One provides ongoing commentary on the structure of and issues in relation to the Commonwealth's financial framework;

- Part Two provides details of the audit of the Commonwealth's Consolidated Financial Statements for 2001-2002;

- Part Three summarises the final results of the financial statements with particular details regarding qualifications and any other matters emphasised in the audit reports;

- Part Four provides an overview of the results of the year end substantiation of financial balances and a summary of continuing significant accounting issues; and

- Part Five provides the detailed results of the individual financial statement audits and any additional significant control matters identified since Audit Report No..67 2001-2002.

The Auditor-General Act 1997 establishes the mandate for the Auditor General to undertake financial statement audits of all Commonwealth entities including those of government agencies, statutory authorities and government business enterprises.

Financial statement audits are an independent examination of the financial accounting and reporting of public sector entities. The results of the examination are presented in an audit report, which expresses the auditor's opinion on whether the financial statements as a whole and the information contained therein fairly present each entity's financial position and the results of its operations and cash flows. The accounting treatments and disclosures reflected in the financial statements by the entity are assessed against relevant accounting standards and legislative reporting requirements.

Financial statement audits are an independent examination of the financial accounting and reporting of public sector entities. The results of the examination are presented in an audit report, which expresses the auditor's opinion on whether the financial statements as a whole and the information contained therein fairly present each entity's financial position and the results of its operations and cash flows. The accounting treatments and disclosures reflected in the financial statements by the entity are assessed against relevant accounting standards and legislative reporting requirements.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the Senior Staff of the Board of Audit - Tokyo, Japan

Consistent with the ANAO's practices, and in response to a request from AusAID, a follow-up audit was conducted in the period May to November 1998 to assess the extent of implementation of the recommendations of a 1996 audit into the Management of Funding to Non-Government Organisations (NGOs)and whether the implementation of recommendations has effectively improved the management of funding to NGOs. The ANAO examined AusAID's key funding accountability documentation, tested the revised accountability arrangements and consulted a number of key stakeholders, including NGO representatives.

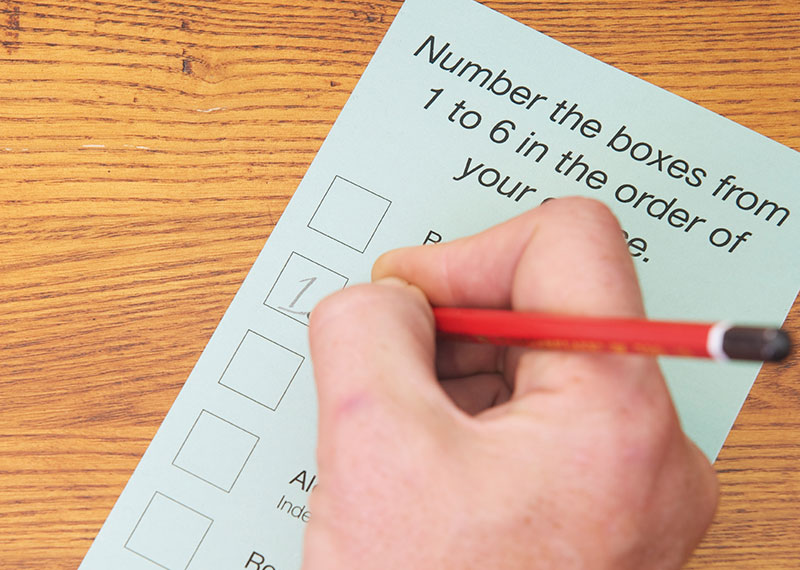

The objective of this audit was to assess the adequacy and effectiveness of the Australian Electoral Commission’s implementation of those recommendations relating to improving the accuracy and completeness of the electoral roll and other matters from Audit Report No.28 2009–10 that have not previously been followed-up by the ANAO.

Please direct enquiries relating to reports through our contact page.

This Report brings together the results of the audits of the financial statements of all Commonwealth organisations (that is, agencies and statutory authorities), including the Commonwealth Government of Australia consolidated financial statements for the period ended 30 June 1999.

The objective of the audit was to assess the adequacy and effectiveness of the Australian Electoral Commission’s implementation of those recommendations made in Report No. 28 2009–10 relating to:

- a more strategic approach to election workforce planning;

- the suitability and accessibility of polling booths and fresh scrutiny premises; and

- the transport and storage of completed ballot papers, in respect to matters not fully addressed in ANAO Audit Report No.31 2013–14.

Please direct enquiries relating to reports through our contact page.

The audit reviewed the extent to which the Department of Health and Ageing (Health) had implemented the recommendations of Audit Report No. 13 of 1998-1999, Aboriginal and Torres Strait Islander Health Program, taking account of any changed circumstances or new administrative issues identified as impacting the implementation of these recommendations.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the CPA Congress '96 - Profit from our Experience - Melbourne

The objective of this performance audit was to assess the effectiveness of the conduct of the first National Infrastructure Audit and development of the Infrastructure Priority List.

The objective of the audit was to assess the extent to which the Department of the Environment and Energy has implemented the recommendations from ANAO Report No. 43 2013–14 and strengthened its framework for the delivery of its regulatory activities.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 17 January 2017 to correspondence from the Hon. Linda Burney MP on 5 January 2017 requesting that the Auditor-General conduct an audit of the Centrelink debt recovery and welfare integrity programs.

Please direct enquiries relating to requests for audit through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the National Public Sector Convention, Perth WA

This report presents the results of the interim phase of the 2007-08 financial statement audits of all portfolio departments and other major General Government Sector (GGS) agencies that collectively represent some 95 per cent of total GGS revenues and expenses. The results of the final audits of these departments and agencies will be included in a second report to be tabled in the Parliament in December 2008 following completion of the financial statement audits of all entities for 2007-08.