Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Employment and Workplace Relations portfolio is responsible for: skills, vocational and employment pathways; workplace relations; work health and safety; and rehabilitation and compensation.

The Department of Employment and Workplace Relations is the lead entity in the portfolio and is responsible for ensuring Australians can experience the social well-being and economic benefits that training and employment provide. The department is also responsible for workplace relations and work health and safety, rehabilitation and compensation. Further information is available from the department’s website.

In addition to the Department of Employment and Workplace Relations, there are eight entities within the portfolio that are responsible for delivering programs and initiatives in relation to workplace relations and work health and safety. The portfolio’s material entities are the Department of Employment and Workplace Relations, the Coal Mining Industry (Long Service Leave Funding) Corporation and Comcare.

In the 2025–26 Portfolio Budget Statements (PBS) for the Employment and Workplace Relations portfolio, the aggregated budgeted expenses for 2025–26 total $6.6 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

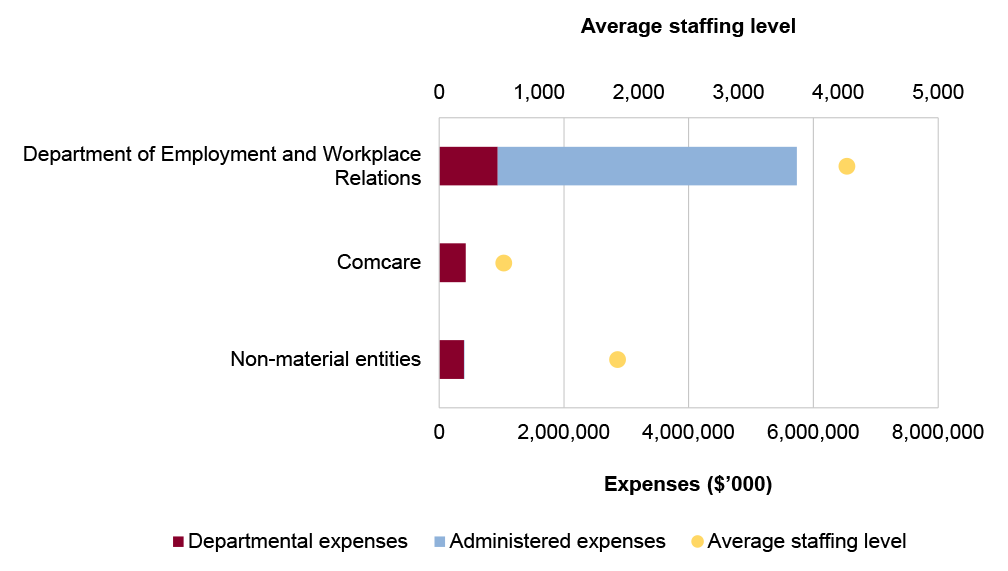

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Employment and Workplace Relations represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 73 per cent of the entire portfolio’s expenses.

Figure 1: Employment and Workplace Relations portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audits and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments, or changes in the operating environment and coverage across the sector.

The primary risk identified for the portfolio is the appropriate use and management of purchaser–provider arrangements within the Department of Employment and Workplace Relations (DEWR), specifically in the employment, skills and training program areas.

Specific risks in the Employment and Workplace Relations portfolio relate to service delivery and regulation.

Service delivery

Monitoring of performance through effective contract management is required to ensure programs are being delivered effectively and achieving intended outcomes. DEWR has a range of employment programs, including Workforce Australia implemented on 1 July 2022. Workforce Australia places a greater focus on online service provision for job seekers that have the capability to actively look for employment opportunities. It also has face-to-face and more intensive supports to assist disadvantaged jobseekers, including the long-term unemployed.

The accurate application of eligibility determination and lawful administration of payments and supports ensures that the correct person is paid the correct amounts, and the aim of the program is being achieved. Risk in this area are increased where there are complex legislative requirements and IT systems. DEWR’s role in Vocational Education and Training (VET) includes service arrangements for the delivery of the Australian Apprenticeships Incentive System, and the Australian Apprenticeships Support Network. DEWR also administers other financial supports for people undertaking training, such as VET Student Loans and scholarships.

Regulation

Maintaining effective regulation is critical to ensuring consistent, fair and accurate application of regulatory requirements and decision-making. The portfolio entities that have responsibility for regulatory functions are the Australian Skills Quality Authority, the Fair Work Commission, Office of the Fair Work Ombudsman, Comcare and Seacare Authority. Regulatory activities need to prioritise compliance, enforcement and assurance and be based on the identification of evidence-based risks. There are also two entities within the portfolio that are responsible for policy coordination and working alongside regulators — Safe Work Australia and the Asbestos and Silica Safety and Eradication Agency.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25, entities within the Employment and Workplace Relations portfolio were included in tabled ANAO performance audits 11 times. The conclusions directed toward entities within this portfolio were as follows:

- one was unqualified;

- five were qualified (largely positive);

- four were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for entities within the Employment and Workplace Relations portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Employment and Workplace Relations portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Employment and Workplace Relations portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Employment and Workplace Relations portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Employment and Workplace Relations (DEWR) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DEWR is in its first year of inclusion in the annual performance statements audit and the engagement has been assessed as moderate risk. This is due to:

- DEWR having an established and experienced centralised team to manage the production of key documents within their governance framework;

- constructive and effective engagement by DEWR during the audit to date; and

- previous audit coverage of some of DEWR’s functions.

Key risks for the department’s performance statements that the ANAO has highlighted include:

- the completeness of DEWR’s performance reporting;

- the appropriateness of DEWR’s performance measures and targets;

- reliance on third party data and use of surveys; and

- DEWR’s performance statements preparation processes.

Financial statements audits

Overview

Entities within the Employment and Workplace Relations portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Employment and Workplace Relations portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Employment and Workplace Relations |

Non-corporate |

Moderate |

2 |

0 |

|

Coal Mining Industry (Long Service Leave Funding) Corporation |

Corporate |

Moderate |

2 |

1 |

|

Comcare |

Corporate |

Moderate |

1 |

1 |

|

Non-material entities |

||||

|

Asbestos and Silica Safety and Eradication Agency |

Non-corporate |

Low |

||

|

Australian Skills Quality Authority (National Vocational Education and Training Regulator) |

Non-corporate |

Low |

||

|

Fair Work Commission |

Non-corporate |

Low |

||

|

Office of the Fair Work Ombudsman |

Non-corporate |

Low |

||

|

Safe Work Australia |

Non-corporate |

Low |

||

|

Seafarers Safety, Rehabilitation and Compensation Authority (Seacare Authority) |

Non-corporate |

Low |

||

Material entities

Department of Employment and Workplace Relations

The Department of Employment and Workplace Relations is responsible for ensuring Australians can experience the social well-being and economic benefits that training and employment provide. The department is also responsible for workplace relations and work health and safety, rehabilitation and compensation.

The Department of Employment and Workplace Relations’ total budgeted expenses for 2025–26 are $5.7 billion, with suppliers and subsidies representing 47 per cent and 18 per cent respectively, as shown in Figure 4. Trade and other receivables represent 74 per cent of total budgeted assets.

Figure 4: Department of Employment and Workplace Relations’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the Department of Employment and Workplace Relations 2024–25 financial statements that the ANAO has highlighted for specific audit coverage and that the ANAO considers potential key audit matters (KAMs).

- The accuracy of Workforce Australia program expenses, due to the complexities in implementing a relatively new program including new payment structure and compliance requirements. (KAM – Completeness and accuracy of Workforce Australia expenses)

- The estimation and valuation of the Vocational Student Loans program (VSL) and Australian Apprenticeship Support Loan (AASL) receivables, due to the complexity of the actuarial estimation process. (KAM – Valuation of VSL and AASL receivables)

Coal Mining Industry (Long Service Leave Funding) Corporation

The Coal Mining Industry (Long Service Leave Funding) Corporation (Coal LSL) collects levies from employers to fund long service leave payments made to employees in the Australian black coal mining industry. The levies collected are invested until the employee takes long service leave, at which point the employer makes a payment to the employee and seeks reimbursement from Coal LSL in accordance with legislative arrangements.

Coal LSL’s total actual assets for 2023–24 were $2.4 billion, with unit trusts attributable to 89 per cent, as shown in Figure 5. Total liabilities were $2.1 billion, with the majority of these liabilities attributable to the provision for reimbursements.

Figure 5: Coal LSL’s actual financial statements by category ($’000)

Source: ANAO analysis of Coal LSL’s 2023–24 Annual Report.

There are three key risks for the Coal LSL’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The complex valuation processes used to determine the fair values attributed to unlisted trust investments.

- Risks associated with the completeness and accuracy of investment holdings, its valuation as part of transition of custodians during 2024–25 for trust investments.

- The significant judgement required by management to estimate the value of the liability for reimbursement of employers’ long service leave obligations, due to a range of assumptions relied on to underpin the valuation methodology and estimation process.

Comcare

Comcare is the Commonwealth work health and safety regulator, a workers’ compensation scheme administrator and an insurer and claims manager. Comcare’s purpose is ’to promote and enable safe and healthy work’. Comcare’s strategic priorities are focused on the prevention of work-related injuries and delivering better return to work outcomes particularly in relation to psychological injuries.

Comcare’s total budgeted liabilities for 2025–26 are $2.7 billion, with other provisions representing 98 per cent as shown in Figure 6. Budgeted revenue is just over $424.4 million, with 66 per cent attributable to workers’ compensation premiums, 15 per cent attributable to other revenue and seven per cent attributable to regulatory contributions.

Figure 6: Comcare’s budgeted financial statements by category ($’000)

Note a: Amounts in Figure 6 represent departmental components of the PBS. Administered components relate to the Seafarers Safety, Rehabilitation and Compensation authority (Seacare Authority).

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for Comcare’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage:

- Valuation of Workers’ Compensation and Asbestos Claims Provision due to the judgements involved in the assumptions, calculations underpinning the actuarial assessment, and the availability, quality and completeness of data used to derive the valuation.

- Revenue recognition due to the complexity of legislation involved and the significance of the amounts involved in the ongoing operations of Comcare.