Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Annual Report 2024–25

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ended 30 June 2025. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013; the Public Governance, Performance and Accountability Rule 2014; the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s Portfolio Budget Statements 2024–25 and in the ANAO Corporate Plan 2024–25; and annual reporting requirements set out in other relevant legislation.

Part 1 — Foreword by the Auditor-General

I am pleased to present my first annual report to the Parliament as Auditor-General for Australia.

The Australian National Audit Office (ANAO) faced several transitions in 2024–25, with the election of the 48th Parliament of Australia in May 2025, my appointment as Auditor-General for Australia in November 2024, and new appointments to several ANAO senior leadership roles during the year.

Our work continued to be shaped by broader trends in the Australian public sector — from a focus on integrity and the delivery of government priorities, to the rapid emergence of new technologies, fiscal pressures, and policies to address climate change. Global developments during the year, including heightened economic uncertainty, shifts in the geopolitical landscape and increased cyber and national security threats, affected risk and activity in the public sector and, therefore, the ANAO in its work as the government’s auditor.

In this environment, the role of trusted, independent oversight of government sector activity is as important as ever. Since its establishment in 1901, the role of Auditor-General has contributed to transparency, accountability and improved performance in the Australian Government sector. The Audit Act 1901 envisaged audit as a way to safeguard ‘that the work of Government be properly carried on’. Effective audit services strengthen the integrity of government institutions and are an important part of Australia’s Westminster system of democracy. They build trust and confidence in the government sector, which is essential to addressing the challenges and opportunities Australia faces.

Our audit work

The 2024–25 reporting period saw the ANAO continue to fulfill the Auditor-General’s mandate under the Auditor-General Act 1997 through the delivery of high-quality reporting across financial and non-financial performance in Australian Government entities. As at 30 June 2025, the ANAO delivered:

- audit opinions for 244 annual financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries and for the consolidated 2023–24 financial statements;

- audit opinions for 14 annual performance statements and performance measures of material Commonwealth entities;

- 44 performance audits and one priority assurance review, the 2023–24 Major Projects Report;

- 51 other audit services as required by other legislation or allowed under section 20 of the Act;

- four reports summarising our audit activities across financial statements, performance statements and performance audits, drawing out themes and lessons for the sector; and

- one report summarising audit work undertaken by the ANAO on public sector delivery during the COVID-19 pandemic.

In 2024–25, the ANAO issued 243 unmodified opinions and one modified opinion in the 2023–24 financial statements audits. A total of 214 audit findings were reported to entities (2022–23: 196). These comprised six significant, 46 moderate, and 147 minor audit findings, as well as 15 legislative breaches. Weakness in IT controls continued to be the most prevalent finding, including deficiencies in IT security, change management and user access controls. The next most frequently observed category of findings related to compliance and quality assurance frameworks, including legal conformance, followed by accounting and control of non-financial assets.1

The results from the 2023–24 performance statements audits were mixed, with 9 of the 14 auditees receiving an unmodified audit opinion and 5 receiving a modified audit opinion. The two broad reasons underlying the modified opinions were a lack of completeness of performance information, and insufficient evidence.

Since the start of the performance statements audits four years ago, the ANAO has observed stronger compliance with legal requirements and greater reliability of measures. In entities with repeat audits, we saw fewer findings and growing measures of maturity in performance management systems, including improved governance and established and empowered central performance teams. There remains substantial opportunity for improvement in performance statements, including the need for more meaningful reporting, measurement of efficiency and productivity, and reporting on cross-entity measures.2

Across the 44 performance audits published in 2024–25, a continued theme was the need for the public sector to maintain its focus on integrity, including ‘getting the basics right’ by adhering to applicable policies, frameworks and laws. Opportunities for greater stewardship — by keeping governance and frameworks fit-for-purpose — as well as strengthening risk management, performance monitoring and management were also common themes.

Our performance audits have driven improvements in public sector performance. More than 96 per cent of ANAO recommendations were agreed to by audited entities, and more than 80 per cent of recommendations have been implemented within 24 months of reports being presented. Performance audits have also led to changes in frameworks that apply across the public sector. During 2024, for example, 22 per cent of changes in the Commonwealth Procurement Rules related to recommendations made by the ANAO.

Underpinning all our audit work is an enduring focus on quality, which is critical in supporting the integrity of our audit reports and maintaining the confidence of the Parliament, government entities and the public. In July 2024, we published the ANAO Quality Management Framework and Plan 2024–25, which sets out our system of quality management. This provides the Auditor-General with reasonable assurance that the ANAO complies with the ANAO Auditing Standards and applicable legal and regulatory requirements, and that the ANAO’s reports are appropriate. In November 2024, we reported on the implementation of the ANAO Quality Management Framework 2023–24 in the Audit Quality Report 2023–24. In that report the Acting Auditor-General concluded that the ANAO Quality Management Framework was operating effectively for the year ended 30 June 2024.

Engaging for impact

The Auditor-General’s reports and audit opinions are a source of evidence-based, independent information for the Parliament to draw upon in exercising its critical accountability and oversight functions. The ANAO’s key interaction with the Parliament is through the Joint Committee of Public Accounts and Audit (JCPAA). Based on our audit work, throughout 2024–25 the JCPAA commenced four inquiries and tabled seven reports. The ANAO also provided one submission to assist the committee in its inquiry into the use and governance of artificial intelligence systems by public sector entities, which is a rapidly evolving area of public sector activity and a priority focus for the ANAO.

Throughout the year, the ANAO continued to support the Parliament through briefings to Senate estimates committees and providing submissions on our work to other committees. Following the election of the 48th Parliament, the ANAO prepared briefings for new members of parliament and an incoming JCPAA, with a view to maintaining our trusted and constructive relationships with the Parliament to assist its scrutiny of public administration.

Engagement with the public sector is another important way for our work to have impact. During the year, the ANAO published six Audit Insights reports, which highlight good practices and common pitfalls we observe in audited entities to help them benefit from the lessons in our work. We also launched a new publication Audit Matters, which is a quarterly newsletter for key public sector stakeholders with updates on the ANAO’s work and insights on our findings. Our senior leaders presented our work at a range of public and private sector events and to audited entities, with positive feedback from participants. Our twice-yearly seminars for government entity audit committee chairs and finance and performance professionals were also well-attended and well-received — we use these as a way of sharing lessons from our audits.

The ANAO is respected and active in national and international audit circles. Engagement with peers provides an opportunity to benchmark our position, understand strengths and gaps in our audit capability and technologies, and inform how we might achieve greater impact. During the year, our participation in the International Organization of Supreme Audit Institutions (INTOSAI), and the Australasian Council of Auditors-General (ACAG) has been valuable in informing our approaches on shared interests such as audit office independence, auditing of climate change disclosures and the use of technology and AI in auditing. The ANAO has close working relationships with audit office partners in Indonesia and Papua New Guinea as part of government-funded capability programs. These relationships enable us to contribute to capability development and learn new approaches.

Our people

Our people have made everything we’ve achieved in 2024–25 possible. We are proud to be a highly professional workforce of curious, ethical and critical thinkers who share a strong commitment to our purpose. The 2024 APS Employee Census results indicate that 92 per cent of staff believe strongly in the purpose and objectives of the ANAO and 97 per cent agreed they understand how their role contributes to achieving an outcome for the Australian public. With a 93 per cent response rate we can rely on the results as truly representative.

Our Census Action Plan identified focus areas of improvement: supporting the health and wellbeing of our staff, and supporting diversity and inclusion to drive a more innovative and collaborative workforce. A range of initiatives were implemented in these areas, including establishment of the ANAO Diversity and Inclusion Council.

Across the year we made considerable progress in our workforce plan, including enhancements to the graduate development program, improvements to recruitment and onboarding processes, and expansion in our training and talent development offerings. Our staff attrition fell from 22.3 per cent at 30 June 2024 to 14.8 per cent at 30 June 2025.

Our culture is underpinned by our core values of integrity, excellence and respect — which are critical in sustaining the confidence of the Parliament, strengthening public trust in government and delivering quality audit products. The ANAO maintains an enduring focus on embedding our values in our work and culture and the behaviours of our people. In November 2024, the ANAO published the ANAO Integrity Framework 2024–25 and our report against the framework in the previous year. The framework serves to assist our people in ethical decision-making and risk, fraud and misconduct management, and strengthens our culture of integrity.

Independence

A key part of the success of the role of the Auditor-General is institutional settings that support independence. Independence of the Auditor-General to conduct and report on audit work without restriction is an important element of the democratic process, as it helps ensure that the Parliament is presented with frank and fearless audit opinions.

The JCPAA’s 2022 Report 491 Review of the Auditor-General Act 1997 recommended changes to preserve and enhance the Auditor-General’s independence and mandate. These included enabling the Auditor-General to undertake audits of performance statements and government business enterprises at their discretion, rather than upon executive or parliamentary request, and clarifying the scope of entities subject to audit by the Auditor-General. The legislation also does not currently support efficient access to some records in an increasingly digital world. Limitations such as these can undermine transparency and accountability of the executive government to the Parliament.

In 2024–25 the ANAO participated in an ACAG exercise to benchmark legislation in Australasian jurisdictions against INTOSAI principles of audit independence. I look forward to the results of this survey in 2025-26, as well as to the government’s response to the recommendations of the JCPAA to further protect the independence of my office and support efficiency and quality in the audit process.

Sustainable funding is also central to audit independence. The ANAO recorded a loss of $5.3 million in 2024–25, which is broadly in line with losses over the last five years. While losses have been supported by accumulated reserves, going forward the remaining reserves are required to fund employee liabilities.

During 2024–25 the ANAO acted to right-size our work within the budget available to us. We revised our target number of performance audits for 2024–25 from 48 — the number the Parliament has requested — to 44, and further reduced our target for 2025–26 to a range of 38 to 42. Using automation, streamlining our business processes and astutely applying risk to our audit processes are focus areas further developed through 2024–25 that will drive efficiency and performance in forward years.

In its 2025–26 Budget Day Statement, the JCPAA observed ‘the current funding model for ANAO is simply not sustainable due to the continuing and growing cost pressures it is facing from increasingly more expensive financial statements audits, essential technological upgrades, and increased compliance and regulatory demands’ and that it ‘has been concerned over many successive Parliamentary terms by the unsustainability of ANAO’s long term financial position and the risks that this poses to its operational independence and its ability to effectively perform its vital statutory roles.’ Achieving a sustainable funding model that supports the Parliament in exercising its accountability functions is a priority for the ANAO for 2025–26.

Looking ahead

In July 2025 we published the ANAO’s ‘strategy on a page’ in the ANAO Corporate Plan 2025–26. The strategy was developed in collaboration with staff through workshops and other input, and with consideration of stakeholder feedback.

Our purpose and the outcome we seek is enduring: to improve public sector performance and accountability through independent reporting on Australian Government administration to Parliament, the Executive, and the public. Over the next 4 years we aim to achieve this with three strategic priorities:

- Impact where it matters — keeping our purpose at the heart of all we do, and ensuring our work supports the Parliament and contributes to meaningful improvement across the public sector.

- Performance through innovation — focusing on how we improve by embracing change, using data and technology wisely, and finding smarter ways to deliver high-quality audit work.

- Inspire and develop our people — recognising that everything we achieve depends on the capability, diversity and wellbeing of our workforce.

In the year ahead we have an ambitious program to implement these priorities, while delivering on our core business and adapting to changes including new technologies, a tighter budget, requirements to audit climate disclosures and shifts in risk and performance in the public sector. I am confident that we will grasp the opportunities that this presents.

It is a privilege to lead the ANAO into the future. I am grateful to have come to an organisation that is highly professional and capable, and I pay tribute to past auditors-general and leaders of the ANAO for their stewardship. In particular, I thank Ms Rona Mellor PSM as the Acting Auditor-General prior to my appointment and the ANAO’s Executive Board of Management, for their leadership and support to me as I took up my appointment.

I look forward to working closely with our ANAO team, the Parliament, the public sector and our stakeholders throughout my term.

Dr Caralee McLiesh PSM

Auditor-General

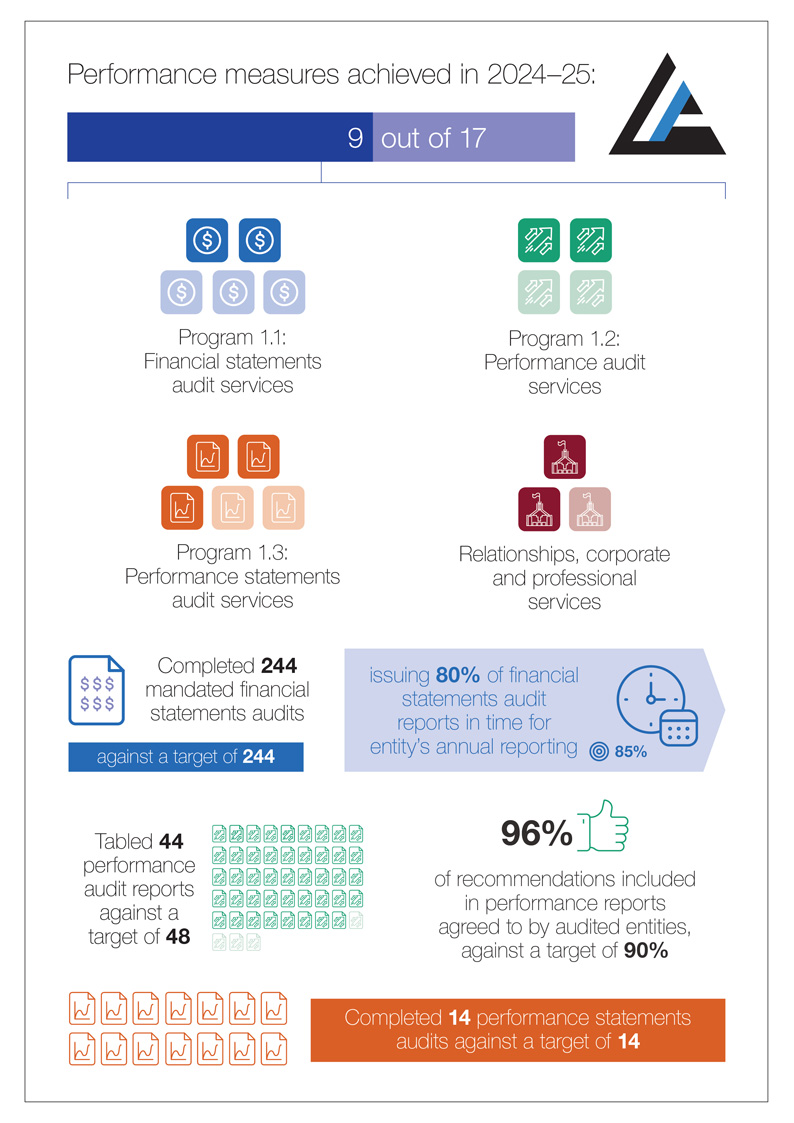

Summary of results against the ANAO’s 2024–25 performance measures

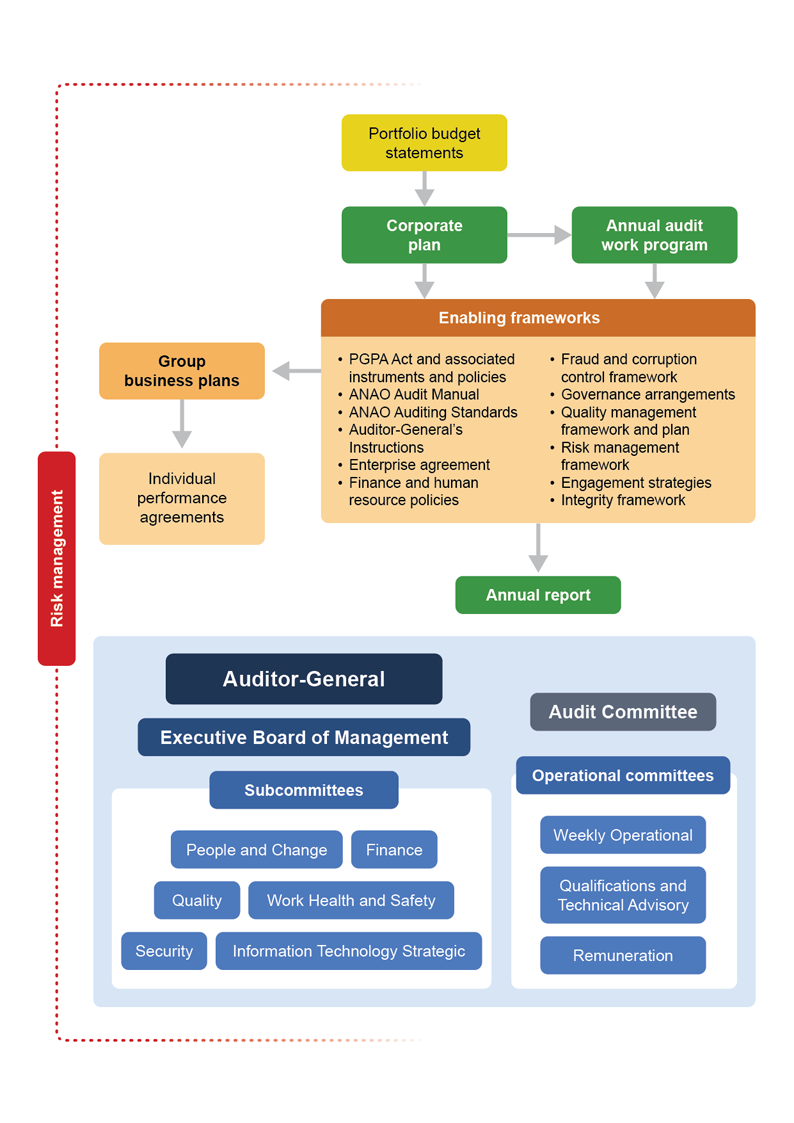

Part 2 — Overview of the ANAO

This part provides an overview of the ANAO’s purpose, role and values, our organisational structure, and our relationships with the Parliament and other national and international bodies.

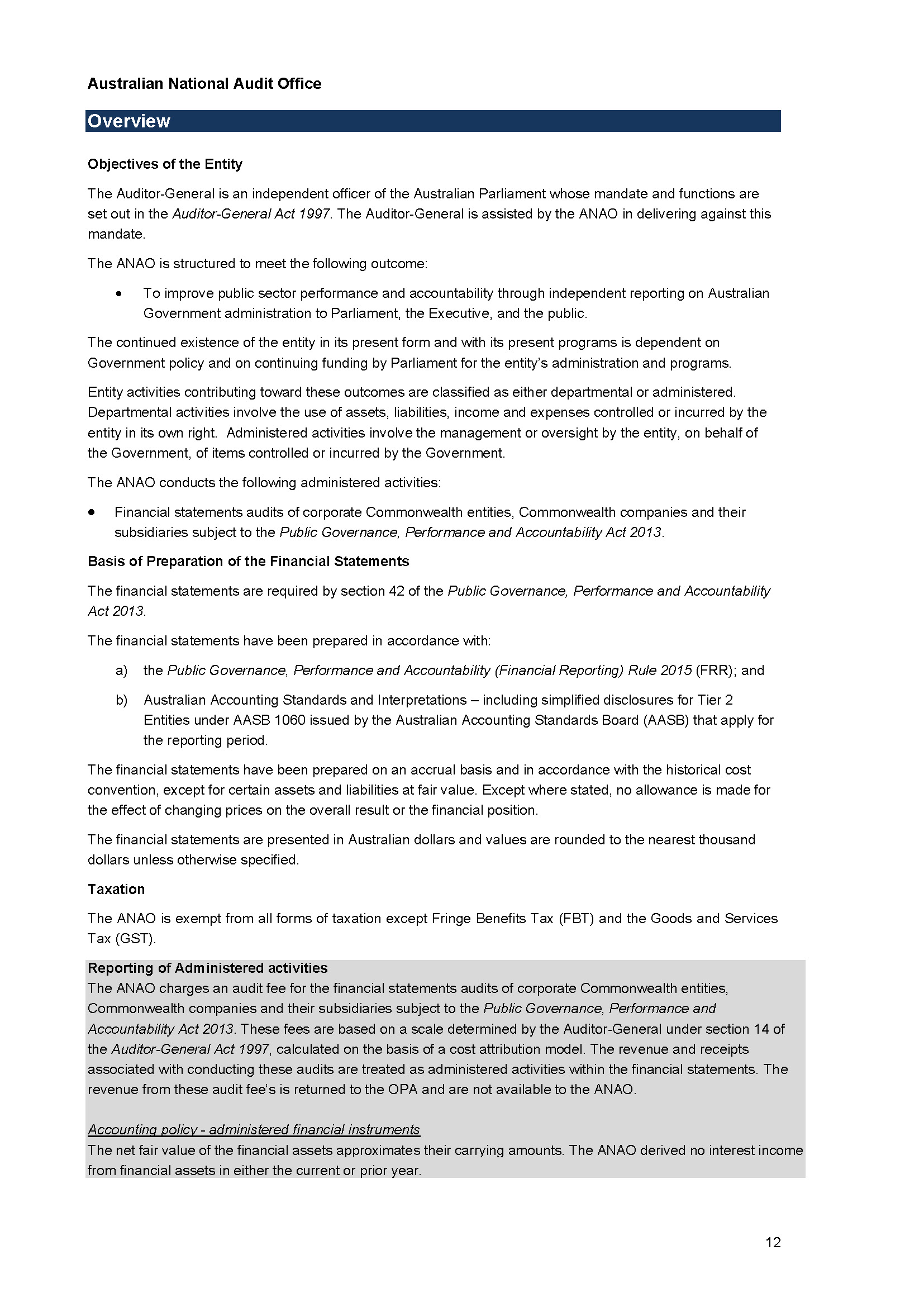

About the ANAO

The Australian National Audit Office (ANAO) is a specialist public sector agency providing a full range of audit and assurance services to the Parliament and entities within the Australian Government sector. The ANAO works to improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the executive government and the public.

The Auditor-General Act 1997 establishes the Auditor-General as an independent officer of the Parliament. Consistent with the core principles of independence, while the ANAO resides within the Prime Minister and Cabinet portfolio, the usual relationship between ministers and their portfolio agency heads does not apply to the work of the Auditor-General and the ANAO.

Role and functions

The Governor-General, on the recommendation of the Joint Committee of Public Accounts and Audit (JCPAA) and the Prime Minister, appoints the Auditor-General for a term of 10 years. As an independent officer of the Parliament, the Auditor-General has complete discretion in performing or exercising the functions or powers under the Auditor-General Act 1997. In particular, the Auditor-General is not subject to direction in relation to:

- whether a particular audit is to be conducted;

- the way a particular audit is to be conducted; or

- the priority given to any particular matter.

In exercising the functions or powers under the Act, the Auditor-General must have regard to the audit priorities of the Parliament, as determined by the JCPAA, and any reports made by the committee under the Public Accounts and Audit Committee Act 1951.

Under the Auditor-General Act 1997 (the Act), the Auditor-General’s functions include:

- auditing the annual financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries, and the consolidated financial statements;

- conducting performance audits and assurance reviews;

- auditing the annual performance statements and performance measures of Commonwealth entities and Commonwealth companies and their subsidiaries;

- conducting a performance audit of a Commonwealth partner as described in section 18B of the Act;

- providing other audit services as required by other legislation or allowed under section 20 of the Act; and

- reporting directly to the Parliament on any matter or to a minister on any important matter that comes to the attention of the Auditor-General.

The ANAO supports the Auditor-General in delivering the functions.

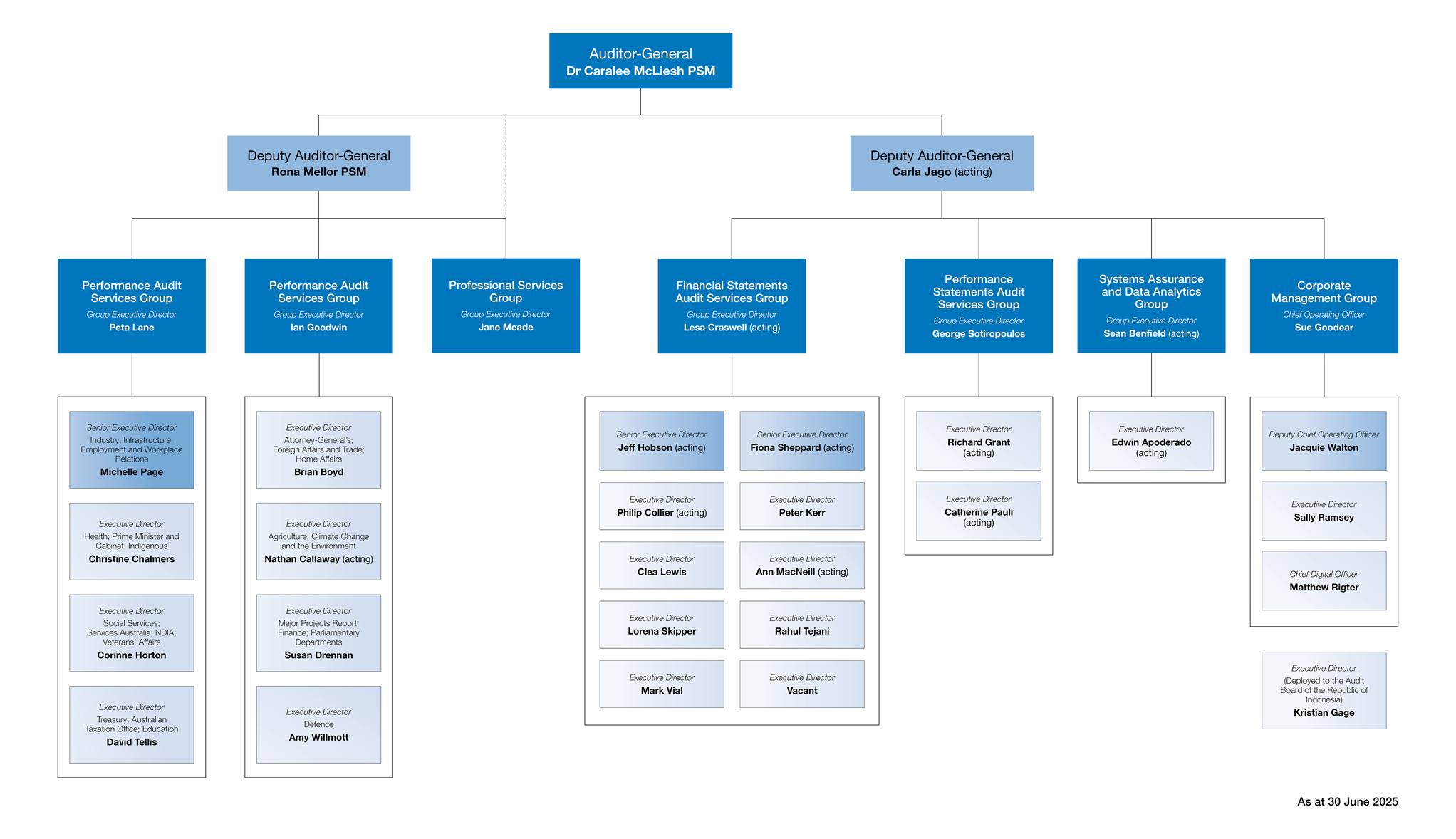

Organisational structure

To deliver on its purpose, the ANAO is organised into six functional areas:

- Corporate Management Group leads corporate strategy and operations for the ANAO. It provides enabling services based on specialised knowledge in the areas of finance, human resources, information technology, governance, communications, change management, legal support and the management of the ANAO’s external relations.

- Financial Statements Audit Services Group provides independent assurance on the financial statements and financial administration of all Australian Government entities. It also conducts assurance reviews.

- Performance Audit Services Group conducts performance audits and assurance reviews of Australian Government entities and their activities, and produces performance audit publications, including the annual Major Projects Report on Defence equipment acquisitions, and information reports.

- Performance Statements Audit Services Group conducts audits of Australian Government entities’ annual performance statements and performance measures.

- Professional Services Group provides technical accounting and audit advice and support to the Auditor-General; and establishes, manages and monitors the implementation of the quality management and integrity frameworks.

- Systems Assurance and Data Analytics Group provides IT data analytics support to the ANAO’s full range of audit work, develops automated solutions to improve audit delivery and undertakes IT auditing including security of entity IT controls.

The ANAO’s organisational structure at 30 June 2025 is shown in Figure 2.1.

Figure 2.1: Organisational structure, at 30 June 2025

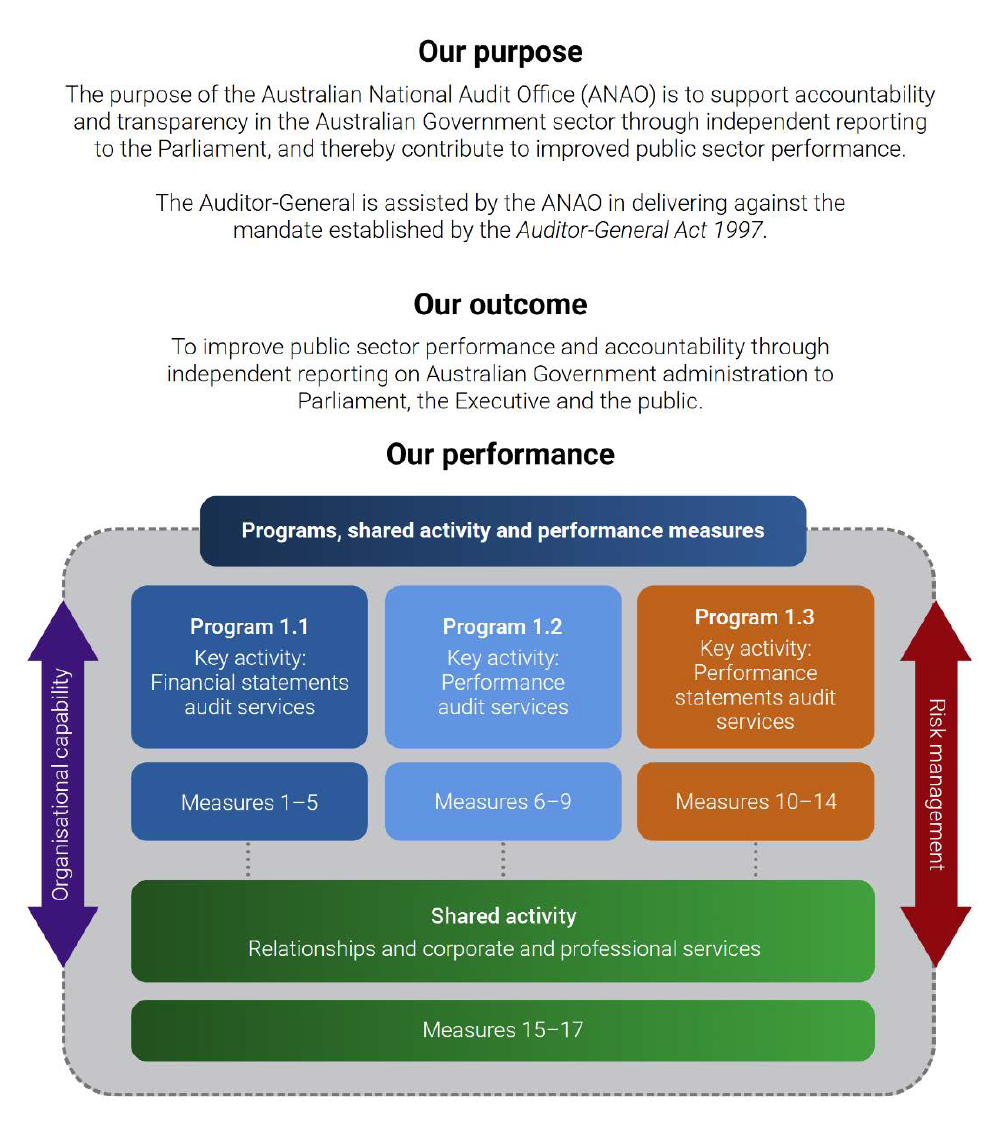

Outcomes and programs

The Australian National Audit Office has one outcome:

To improve public sector performance and accountability through independent reporting on Australian Government administration to Parliament, the Executive and the public.

The three programs (comprising three activities) and one area of shared activity that contribute to achieving our purpose are:

- Program 1.1 — Financial statements audit services;

- Program 1.2 — Performance audit services;

- Program 1.3 — Performance statements audit services; and

- Relationships and corporate and professional services.

The deliverables and achievements for these programs are supported by shared enabling activities — relationships, corporate and professional services — discussed in detail in Part 3.

Purpose

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

The ANAO delivers its purpose under the Auditor-General’s mandate in accordance with the Auditor-General Act 1997, the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Service Act 1999.

The executive arm of government is accountable to the Parliament for its use of public resources and the administration of legislation passed by the Parliament. The Auditor-General provides independent assurance as to whether the executive is operating and accounting for its performance in accordance with the Parliament’s intent.

Figure 2.2: Our purpose

Accountable authority

The Auditor-General is the accountable authority for the Australian National Audit Office.

During 2024–25:

- Ms Rona Mellor PSM was the Acting Auditor-General for Australia from 1 July 2024 to 3 November 2024; and

- Dr Caralee McLiesh PSM commenced as the Auditor-General for Australia on 4 November 2024.

Supporting the Parliament

In pursuing its purpose, the ANAO maintains key relationships with the Parliament, as described below. The ANAO’s engagement strategies detail our approach to key relationships with the Parliament.

The ANAO website contains further information about the ANAO’s relationship with the Parliament.

Parliament

The ANAO’s primary relationship is with the Parliament, and the ANAO’s key interaction with the Parliament is through the Joint Committee of Public Accounts and Audit (JCPAA). The Auditor-General’s reports assist the Parliament to hold government to account and to drive improvements in public administration. The Auditor-General and ANAO support the work of the Parliament by providing independent reporting, assurance and assistance — in the form of submissions and information, appearances before parliamentary committees, and briefings to parliamentarians. The Parliament and its committees also scrutinise the work and administration of the ANAO.

Joint Committee of Public Accounts and Audit

Among its responsibilities, the JCPAA considers the operations and resources of the ANAO, including the ANAO draft budget estimates, about which it makes recommendations to both houses of parliament. The JCPAA is required to review all ANAO reports that are tabled in the Parliament and to report the results of its deliberations to both houses of Parliament. The committee’s functions in relation to the ANAO are specified in the Public Accounts and Audit Committee Act 1951. The JCPAA of the 47th Parliament commenced on 26 July 2022 and was dissolved on 28 March 2025 with the proroguing of the Parliament.

The JCPAA commenced four inquiries reviewing Auditor-General reports throughout 2024–25 and tabled seven reports. An outline of inquiries and JCPAA reports is provided in Table 3A.2.

On 2 September 2020, the JCPAA resolved to undertake a review of the Auditor-General Act 1997. The JCPAA tabled Report 491: Review of the Auditor-General Act 1997 on 31 March 2022. The report included 27 recommendations (six directed to the ANAO) going to matters related to independence and interaction of the Auditor-General Act 1997 with other legislation. At 30 June 2025, the ANAO had completed addressing five of the six recommendations directed to it. The final recommendation was addressed by the ANAO in an update to the ANAO Audit Manual approved by the Auditor-General in July 2025. At 30 June 2025, the government had not yet presented its response to other recommendations made in this review.

In 2024–25, ANAO officers provided a total of five private briefings, attended 12 public hearings and made one submission to assist the committee in undertaking its functions.

Part 3 — Report on performance

Annual performance statements

As the Accountable Authority of the Australian National Audit Office (ANAO), I present the 2024–25 annual performance statements as required under paragraph 39(1)(a) and (b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and section 16F of the Public Governance, Performance and Accountability Rule 2014.

In my opinions, these annual performance statements are based on properly maintained records, accurately present the ANAO’s performance in the reporting period and comply with subsection 39(2) of the PGPA Act.

Dr Caralee McLiesh

Auditor-General for Australia

20 August 2025

Analysis of our performance in achieving our purpose

The purpose of the ANAO is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

The ANAO recognises that good performance information should provide insight into not only what we do, and the efficiency and quality of our work, but also its impact. These performance statements report against a set of measures that are outlined in the ANAO’s Portfolio Budget Statements (PBS) 2024–25 and the ANAO’s 2024–25 Corporate Plan. This set of measures is intended to tell a story of the ANAO’s achievement against its purpose for the 2024–25 financial year.

Overall, in 2024–25, the ANAO achieved nine performance measures out of 17, a decrease from the number of performance outcomes achieved in 2023–24 (12 measures):

- For Program 1.1: Financial Statements Audit Services, two out of five measures were met.

- For Program 1.2: Performance Audit Services, two out of four measures were met.

- For Program 1.3: Performance Statements Audit Services, three out of five measures were met.

- For relationships, corporate and professional services, two out of three measures were met.

The ANAO carried out its annual audit work program for 2024–25 having regard to the priorities and interests of the Parliament and providing a balanced program of activity that was informed by risk and ANAO resourcing.

The Auditor-General Act 1997 (the Act) establishes mandatory and non-mandatory audit functions. Mandatory audit work includes auditing the annual financial statements of Commonwealth entities, and Commonwealth companies and their subsidiaries (section 11 of the Act) and auditing the annual consolidated financial statements in accordance with the PGPA Act (section 12 of the Act). All mandatory audits were delivered by the ANAO.

The ANAO also issued auditor’s reports on the annual performance statements of 14 Commonwealth entities in accordance with section 40 the PGPA Act. This program of work was delivered as requested by the Minister for Finance.

In 2024–25, the ANAO presented 44 performance audits for tabling in the Parliament. This was short of the target of 48 performance audits set out in the 2024–25 Corporate Plan and 2024–25 PBS. During 2024–25, the ANAO determined that to appropriately target the ANAO’s available resources to the areas of highest priority this target could not be met. The ANAO identified in its 2025–26 PBS that the 2024–25 target of 48 performance audits being presented to the Parliament would not be achieved and that the ANAO expected to present 44 performance audit reports for tabling in 2024–25, with the target for 2025–26 and future years set at between 38 and 42.

One way in which the ANAO contributes to public sector performance is through the provision of audit findings and recommendations to entities based on insights during the conduct of audits. Across all audit products (programs 1.1, 1.2 and 1.3) the ANAO met the targets for entities agreeing with audit findings and recommendations. Programs 1.2 and 1.3 also met the target for the timeliness of the implementation of findings and recommendations by entities across performance audit and performance statements audits. The target for implementation was not met for financial statements audits. Of the 13 significant and moderate findings raised in the 2021–22 financial statements audit cycle (that was finalised in 2022–23), six had been addressed within the 24-month window. In addition, there were 22 significant and moderate findings raised in the 2022–23 audit cycle and four significant and moderate findings raised in the 2023–24 audit cycle for material entities that were addressed by the conclusion of the 2023–24 audit cycle.

There were two common areas across three programs where we did not meet five targets. These areas relate to the issuance of audit reports in time to meet entity annual reporting timeframes (programs 1.1 and 1.3) and the average cost of audits not increasing from the prior year (programs 1.1, 1.2 and 1.3). Factors that contributed to not achieving these targets included the following:

- There were delays in entities providing the ANAO with auditable financial statements and/or performance statements within the agreed timeframe, resulting in the delayed issuance of auditor’s reports.

- The timeliness of financial statements auditor’s reports was also impacted by an increase in the number of audit findings and legislative breaches identified by the ANAO, as well as limitations on the available resources within the ANAO in order to undertake additional audit procedures in response to these findings.

- The average cost of financial statements audits was impacted by the need to conduct additional audit work as a result of ongoing weaknesses in entity IT system controls and rising market costs for contracted audit work and specialists.

- The increase in the average cost of performance statements audits reflects the additional resources and start-up effort required for the four first-year audits finalised in 2024–25 as well as the size and complexity of the four new audited entities, being the Australian Taxation Office, the Department of Foreign Affairs and Trade, the Department of Home Affairs and the National Disability Insurance Agency.

- The increase in the average cost of a performance audit can be primarily attributed to the complexity of the audits and a new topic not previously covered in the emerging field of artificial intelligence requiring additional senior staff time.

During 2025–26, the ANAO will be reviewing its audit approaches and methodologies to assess whether efficiencies in conduct of audits can be achieved, to support both the timeliness and cost of audits. Areas of particular focus will be the continuing evolution of the ANAO’s methodology and audit approach for performance statements auditing, supporting staff to apply a risk-based approach to auditing and considering whether there are more efficient approaches to resourcing our audit products.

Measure 15, which was met, provides feedback on the ANAO’s key relationship — our relationship with the Parliament. This measure helps to assess whether we are supporting the Parliament to effectively carry out its functions on the operations of the Australian Government sector. This area of activity contributes to achieving the ANAO’s purpose through facilitating dissemination of the ANAO’s findings to members of parliament, the executive and the public.

Measure 16, which was not met, is focused on additional activities and services that the ANAO delivers, other than audits, to support the Australian Government sector to improve public sector performance. In 2024–25, the ANAO met four of the five mechanisms that comprise measure 16, including presenting reports to the Parliament on the results of ANAO financial and performance statements audit work, the publication of four Insights ‘audit lessons’ publications, the observation of improvements in entities’ administrative and management processes during audit work, and positive feedback from entities on the impact of audits. Reporting mechanism 2 was not met, and therefore the overall measure was not achieved, because one audit of the 52 audits or reviews the ANAO agreed to undertake under section 20 of the Auditor-General Act 1997 — the audit of the Norfolk Island Health and Residential Aged Care Service — could not be completed as the financial statements were not available for audit.

In 2024–25, the ANAO met measure 17, which helps us to assess whether the ANAO’s work is being delivered in accordance with defined quality standards. Quality is a key area of management focus as quality in the delivery of the ANAO’s audit services is critical in supporting the integrity and reliability of audit reports and maintaining the confidence of the Parliament and public sector entities.

Changes to our performance framework

The ANAO Corporate Plan 2024–25 was updated after its initial publication to amend measure 1 to report on the percentage of audit reports issued rather than the number issued. This was to reflect that the number of entities can change during the reporting period based on decisions of the Australian Government. The original target included in the ANAO Corporate Plan 2024–25 was the delivery of 245 mandated financial statement audits. The target was amended to the delivery of 100 per cent of mandated audits.

In 2024–25 the ANAO reviewed its set of performance measures. Our focus has been on how we move from largely measuring outputs and counting our achievements to demonstrating our effectiveness and impact, with the aim of improving the performance story we can provide to the Parliament. The ANAO Corporate Plan 2025–26 sets out how we have initially redefined our performance framework to better measure and assess the impact of our work. The corporate plan also sets out revised targets as foreshadowed in the ANAO’s PBS 2025–26.

Further consideration of our framework of performance measures is anticipated for future reporting periods.

The following sections provide more detailed analysis of the ANAO’s performance results for Program 1.1: Financial Statements Audit Services, Program 1.2: Performance Audit Services, Program 1.3: Performance Statements Audit Services and ANAO-wide activities relating to relationships and corporate and professional services.

Performance results for Program 1.1: Financial Statements Audit Services

The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial performance and position. In the public sector, the users of financial statements include ministers, the Parliament, and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of an entity’s financial management, which fosters confidence in an entity on the part of users.

The ANAO’s financial statements audits, undertaken in accordance with the ANAO Auditing Standards, provide an independent examination of the financial accounting and reporting of public sector entities. They provide independent assurance that financial statements have been prepared in accordance with the Australian Government’s financial reporting framework and Australian accounting standards and present fairly the financial performance of the entity. The ANAO’s financial statements audits contribute to improvements in the financial administration of Australian Government entities.

The Auditor-General presents information reports on audits of financial statements to the Parliament twice a year. The first of these reports, Interim Report on Key Financial Controls of Major Entities, reports on ANAO coverage of key financial systems and controls in major Commonwealth entities. The second report, Audits of the Financial Statements of Australian Government Entities, provides the results of the financial statements audits of all Commonwealth entities. The independent reporting to the Parliament on this activity supports accountability and transparency in the Australian Government sector.

Performance measures

To assess performance against our purpose in relation to financial statements audit activities, the ANAO measures:

- percentage of mandated financial statements audit reports issued as required;

- percentage of mandated financial statements audit reports issued in time to meet entity annual reporting timeframes;

- average cost of a financial statements audit does not increase from the prior year;

- percentage of moderate or significant findings from mandated financial statements audit reports agreed to by audited entities; and

- percentage of moderate or significant findings that are addressed by mandated audited entities within 24 months of reporting.

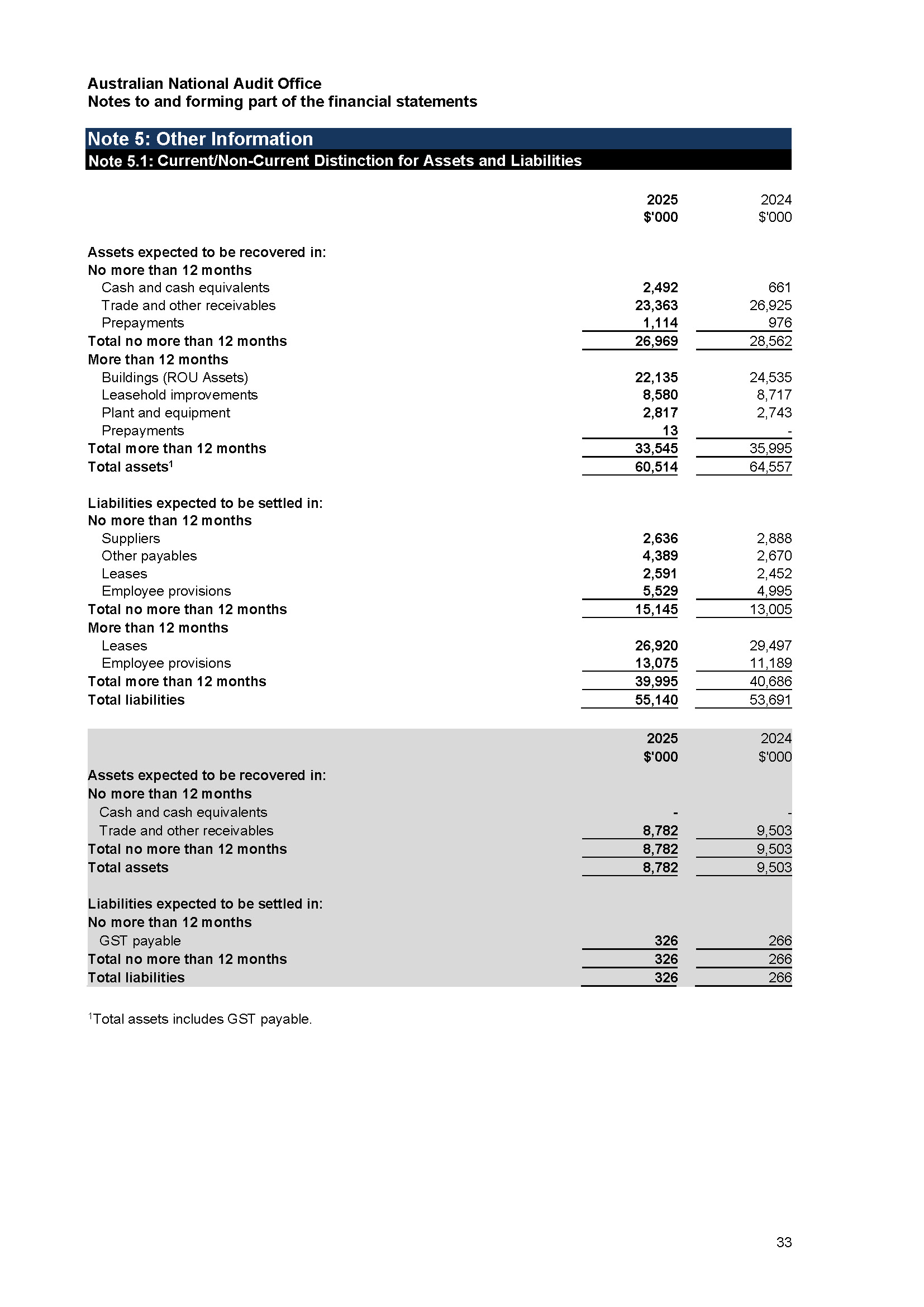

|

Measure 1 |

Percentage of mandated financial statements audit reports issued as required |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.1, p. 96 |

|

|

Result |

Achieved a result of 100% against a target of 100% |

MET |

The percentage of financial statements auditor’s reports issued is a key measure of the ANAO’s core business in achieving its purpose. Under the Auditor-General Act 1997, the Auditor-General’s functions include the mandatory auditing of the annual financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries, and the consolidated financial statements. This measure reports on the percentage of those reports issued.

During 2024–25, the ANAO completed all of the 244 mandated financial statements audits for the year ended 30 June 20243. This included the consolidated financial statements of the Australian Government. The corporate plan was updated after its initial publication to amend this measure to report on the percentage of audit reports issued rather than a number issued, to reflect that the number of entities can change during the period based on decisions of the Australian Government. The original target included in the ANAO Corporate Plan 2024–25 was the delivery of 245 mandated financial statement audits. The target was amended to the delivery of 100 per cent of mandated audits.

Details of issues identified during the financial statements audits are included in Auditor-General Report No. 22 2024–25 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2024.

|

Measure 2 |

Percentage of mandated financial statements audit reports issued in time to meet entity annual reporting timeframes |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.1, p. 96 |

|

|

Result |

Achieved a result of 80.33% against a target of 85% |

NOT MET |

In order to support timely reporting of entities’ financial performance to the Parliament through annual reports, the ANAO aims to issue 85 per cent of auditor’s reports within three months of the financial year-end reporting date.

Providing timely auditor’s reports also supports entities in meeting requirements to provide audit cleared financial information to the Department of Finance in accordance with deadlines that are set to assist the Australian Government to prepare the Final Budget Outcome by 30 September for the financial statements with a 30 June year end, and the consolidated financial statements (CFS) by 30 November each year. These deadlines for audit-cleared information are 15 August for entities classified by the Department of Finance as material to the CFS and 30 August for entities that are classified as not material to the CFS. The CFS present whole-of-government financial results, inclusive of all Australian Government-controlled entities.

Achievement of this measure relies on entities providing the ANAO with auditable financial statements within the required timeframe. The ANAO reported in the end of year report that 71 per cent of entities delivered financial statements in line with an agreed timetable. The timeliness of auditor’s reports was impacted by an increase in the number of audit findings and legislative breaches identified by the ANAO, as well as limitations on the available resources within the ANAO to undertake additional audit procedures in response to these findings.

The total number of adjusted and unadjusted audit differences decreased during the 2023–24 audits that were finalised in 2024–25, although 38 per cent of audit differences remained unadjusted. The quantity and value of adjusted and unadjusted audit differences indicate there remains an opportunity for entities to improve quality assurance frameworks over financial statements processes.

Timeliness of tabling of entity annual reports improved. Department of Finance guidance indicates ‘Normally annual reports are tabled on or before 31 October and it is expected annual reports are tabled prior to the October Estimates Hearings. This ensures annual reports are available for scrutiny by the relevant Senate standing committee’. 4 Ninety-three per cent (2022–23: 66 per cent) of entities that are required to table an annual report in Parliament tabled prior to the date that the portfolio’s supplementary budget estimates hearing commenced. Supplementary estimates hearings were held one week later in 2023–24 than in 2022–23. Fifty-seven per cent of entities tabled annual reports one week or more before the hearing (2022–23: 12 per cent). Of the entities required to table an annual report, four per cent (2022–23: six per cent) had not tabled an annual report as at 9 December 2024.

|

Measure 3 |

Average cost of a financial statements audit does not increase from the prior year |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.1, p. 96 |

|

|

Result |

Achieved a result of 5.86% against a target of 0% |

NOT MET |

Delivering cost-effective audits is one way the ANAO can demonstrate the efficient use of public money in our work. This measure captures the average cost of delivering mandated financial statements audits and allows comparison over time. The cost of an audit is calculated by multiplying the hours that each level of staff worked on that audit by a charge-out rate that is set for each staffing level, and then adding any direct supplier costs. The charge-out rates are set to recover the direct costs of those staff working on the audit and the overhead cost of supporting those staff.

The average cost of a financial statements audit for the 2023–24 audit cycle completed in 2024–25 was $187,212. The average cost for the 2022–23 audit cycle completed in 2023–24 was $176,842, representing a 5.86 per cent increase in 2024–25 (Table 3.1). The increase was mainly driven by:

- the complexity of audits, particularly in relation to complex financial transactions including loan and equity arrangements and asset valuations;

- the increase in the number of audit findings and the effort involved in undertaking additional audit procedures to address the identified risk and to assess the resolution of the findings; and

- an increase in the identification of prior period errors.

Table 3.1: Cost of financial statements audits, 2021–22 to 2023–24 audit cycles

|

Audit cycle |

Percentage increase Target (%) |

Average cost per mandated audit ($)a |

Range of audit fees charged ($) |

Actual result (%) |

|

2023–24 |

0 |

187,212 |

2,000–3,890,000 |

+5.86 |

|

2022–23 |

0 |

176,842 |

2,000–3,500,000 |

+4.42 |

|

2021–22 |

0 |

169,350 |

5,500–3,675,000 |

+4.97 |

Note a: Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 4 |

Percentage of moderate or significant findings from mandated financial statements audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.1, p. 96 |

|

|

Result |

Achieved a result of 100% against a target of 90% |

MET |

The ANAO provides entities with audit findings and recommendations to improve internal controls and business processes based on observations noted during the conduct of financial statements audits. These matters are reported to the accountable authority and copied to the chair of the audit committee and the chief financial officer via an interim management letter, a closing report or a final management letter. The ANAO seeks to confirm all factual observations concerning the audit findings with entities before finalising these reports. Included in the measure of agreed recommendations are situations where the audited entity agrees with the ANAO’s factual observations, but the entity may suggest an alternative method to resolve the issue.

The audit findings and recommendations are reported using a rating scale whereby all identified issues are reported to each audited entity, significant and moderate risk issues are reported individually to the relevant minister and the Parliament, and lower-risk issues are reported in aggregate in the ANAO’s reports to the Parliament.5

A total of 57 findings were reported to entities as a result of the 2023–24 financial statements audits and these were all agreed to by audited entities. This total includes new findings and those carried over from the prior year. These comprised six significant (2022–23: 9) and 46 moderate (2022–23: 36) findings that were open at the end of the 2023–24 audit cycle in addition to five moderate findings that were both opened and closed during the 2023–24 audit cycle. The highest number of findings were in the categories of:

- IT control environment, including security, change management and user access;

- compliance and quality assurance frameworks, including legal conformance; and

- accounting and control of non-financial assets.

All audit findings and recommendations are followed up as part of the audit of the following year’s financial statements.

|

Measure 5 |

Percentage of moderate or significant findings that are addressed by mandated audited entities within 24 months of reporting |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.1, p. 96 |

|

|

Result |

Achieved a result of 82.05% against a target of 90% |

NOT MET |

The ANAO measures the percentage of moderate and significant findings that are addressed by entities as an indication of the impact that the ANAO’s audit work has on public administration. This measure captures findings (moderate and significant) that are addressed by audited material entities within 24 months. ‘Addressed’ means that the entity has responded to and actioned the audit finding. The ANAO reviews all findings during the interim and/or final phases of the annual financial statements audit process. The ANAO reports on entities’ actions in response to findings in the Interim Report on Key Financial Controls of Major Entities and in an end-of-year report on the final results of the financial statements audits.

Audit findings are reported to entities at the conclusion of each year’s financial statements audit. To determine whether these findings have been addressed by entities within 24 months of reporting, a full 24-month period is required from the audit cycle when the findings were raised. The audit cycle generally runs from October to September. Therefore, this performance measure for 2024–25 considers whether the audit findings in the 2021–22 and later audit cycles had been addressed by material entities within 24 months of reporting, which was up to the conclusion of the 2023–24 audit cycle that was completed in 2024–25. This is a change to the methodology adopted in the previous financial year. The results reported against this measure in 2023–24 considered only whether the audit findings raised in the 2020–21 audit cycle had been addressed by entities within 24 months of reporting, which was up to the conclusion of the 2022–23 audit cycle.

During the 2021–22 audit cycle there were 13 significant and moderate findings raised in material entity audits and, of these, six had been addressed by the conclusion of the 2023–24 audit cycle. In addition, there were 22 significant and moderate findings raised in the 2022–23 audit cycle and four significant and moderate findings raised in the 2023–24 audit cycle for material entities that were addressed by the conclusion of the 2023–24 audit cycle.

Performance results for Program 1.2: Performance Audit Services

The ANAO conducts performance audits in accordance with the ANAO Auditing Standards. These performance audits examine common aspects of public administration, by reviewing the operations of public sector entities. Audits identify areas where improvements can be made and often make specific recommendations to assist entities to improve performance. Performance audits may involve multiple entities, including where a program or service is jointly administered. An assurance review of the Department of Defence’s major defence equipment acquisitions is also undertaken annually. On completion, the ANAO’s performance audits are presented to the Parliament.

The 2024–25 financial year saw the continuation of a program of audits of general compliance with legislative and policy requirements, such as compliance with gifts, benefits and hospitality rules, fraud control arrangements and management of conflicts of interest. These audits were aimed at identifying issues in broad areas of integrity, as the public sector continues to build stronger systems of integrity in operations. In addition, there was a continuation of programs of audits on procurements by the Australian Government, including major Defence procurements, Indigenous service delivery, and entity governance.

In response to ongoing parliamentary interest, the ANAO continued its audit focus on the implementation of parliamentary committee and Auditor-General recommendations. In 2024–25, the Auditor-General tabled four performance audits that either followed up on an entity’s progress in implementing recommendations or followed on from other related audits.

Performance measures

To assess performance against our purpose in relation to performance audit activities, the ANAO measures the:

- number of performance audits presented to the Parliament;

- cost of these audits (our efficiency); and

- percentage of recommendations agreed to and the status of their implementation by entities (our impact and effectiveness).

|

Measure 6 |

Number of performance audit reports presented to Parliament |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 44 against a target of 48 |

NOT MET |

In 2024–25, the Auditor-General tabled 44 performance audits in the Parliament (Table 3.2) against a target of 48 performance audits. The ANAO identified in its 2025–26 Portfolio Budget Statements that the 2024–25 target of 48 performance audits being presented to the Parliament would not be achieved. This was a result of targeting the ANAO’s available resources to the areas of highest priority, and that the ANAO expected to present 44 performance audit reports for tabling in 2024–25.

In addition to the 44 performance audits tabled in the Parliament, the ANAO tabled Auditor-General Report No. 20 2024–25 2023–24 Major Projects Report in December 2024. This annual publication provides assurance on the progress of major Defence specialised military acquisition projects. The ANAO also publishes Insights products relating to Audit Lessons, Audit Practice and Audit Opinions, as detailed further in Measure 16, reporting mechanism 3.

Further, in October 2024 the ANAO tabled two information reports in the Parliament that consolidated lessons, analysis and themes from performance audit work. These were:

- Auditor-General Report No. 6 2024–25 COVID-19 Pandemic — ANAO Audit Activity which summarised and consolidated the lessons from the audits and reviews undertaken by the ANAO under its COVID-19 audit strategy; and

- Auditor-General Report No. 8 2024–25 2023–24 Performance Audit Outcomes which included an analysis of performance audits from 2019–20 to 2023–24 and the themes from 2023–24 performance audits.

Table 3.2: Number of performance audit reports, 2017–18 to 2024–25

|

Year |

Target |

Result |

|

2024–25 |

48 |

44 |

|

2023–24 |

45 |

45 |

|

2022–23 |

42 |

40 |

|

2021–22 |

40 |

40 |

|

2020–21 |

42 |

42 |

|

2019–20 |

48 |

42 |

|

2018–19 |

48 |

48 |

|

2017–18 |

48 |

47 |

|

Measure 7 |

Average cost of a performance audit does not increase from the prior year |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 14.98% increase against a target of 0% |

NOT MET |

The average cost of audits delivered in 2024–25 increased compared to audits delivered in 2023–24 (Table 3.3). This increase was largely due to audit complexity and a new topic not previously covered in the emerging field of artificial intelligence. Audit complexity and entering new fields of inquiry require additional senior staff time.

The cost of an audit is calculated by multiplying the hours that each level of staff worked on that audit by a charge-out rate that is set for each staffing level. The charge-out rates are set to recover the direct costs of those staff working on the audit and the overhead cost of supporting those staff.

Table 3.3: Cost of performance audits, 2017–18 to 2024–25

|

|

Percentage increase |

|

Cost per performance audit ($’000)a |

Actual result |

|

Year |

Target (%) |

Average |

Range |

(%) |

|

2024–25 |

0 |

571 |

237–1320 |

+15.0 |

|

2023–24 |

0 |

496 |

197–869 |

-5.0 |

|

2022–23 |

0 |

522 |

196–949 |

+7.50 |

|

2021–22 |

0 |

486 |

159–1,106 |

-6.6 |

|

2020–21 |

0 |

520 |

234–984 |

+18.0 |

|

2019–20 |

0 |

439 |

186–904 |

+5.0 |

|

2018–19 |

0 |

419 |

131–670 |

-0.7 |

|

2017–18 |

0 |

422 |

159–786 |

-9.8 |

Note a: Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Measure 8 |

Percentage of recommendations included in performance audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 96.4% against a target of 90% |

MET |

The ANAO makes recommendations in performance audit reports to support the Parliament in its role in holding entities to account for their use of public money, and to seek to improve public administration. Throughout a performance audit, the ANAO keeps entities informed of findings and discusses potential recommendations to ensure entities understand the basis and intention of recommendations. Table 3.4 provides a breakdown of audited entities’ responses to the ANAO’s recommendations against the total number of recommendations made. Only recommendations that were agreed without qualification are included as ‘agreed’ recommendations in the result for this measure, unless the qualification did not contradict the overall recommendation.

In 2024–25, 213 recommendations were counted as ‘agreed’ (this includes three recommendations that were agreed with qualification and assessed to be ‘agreed’). Six were agreed with qualification and assessed to be ‘not agreed’ and one that was not agreed, and one was noted.

Table 3.4: Agreement to recommendations in performance audit reports 2017–18 to 2024–25

|

|

Recommendations |

||||

|

Year |

Total number |

Fully agreed (%) |

Agreed with qualifications (%) |

Not agreed (%) |

Noted or no response by entities (%) |

|

2024–25a |

221 |

95.0 |

1.4 |

3.2 |

0.5 |

|

2023–24 |

254b |

94.1 |

5.1 |

0.8 |

0.0 |

|

2022–23 |

194 |

91.2 |

2.6 |

2.6 |

3.6 |

|

2021–22a |

161 |

95.7 |

2.5 |

1.9 |

0.0 |

|

2020–21 |

165 |

92.1 |

6.1 |

1.2 |

0.6 |

|

2019–20 |

141 |

90.8 |

1.4 |

2.8 |

5.0 |

|

2018–19a |

146 |

89.7 |

6.8 |

0.7 |

2.7 |

|

2017–18 |

126 |

84.9 |

9.5 |

2.4 |

3.2 |

Note a: The percentages for 2024–25, 2021–22 and 2018–19 do not total 100 per cent due to rounding.

Note b: This figure has been corrected from 255 to 254 as a recommendation was double counted in the 2023–24 ANAO Annual Report.

|

Measure 9 |

Percentage of ANAO recommendations implemented within 24 months of a performance audit report being presented |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.2, p. 97 |

|

|

Result |

Achieved a result of 80.4% against a target of 70% |

MET |

The ANAO monitors entities’ implementation of performance audit recommendations by attending entity audit committees and conducting audits that follow up on entity progress in implementing previously made recommendations. The ANAO also seeks advice annually from all relevant entities on progress in implementing audit recommendations over a two-year implementation period.

The self-reported data for audit recommendations made in 2022–23 suggests that entities are implementing ANAO recommendations largely within 24 months of the recommendation being agreed (Table 3.5). For those recommendations that have not yet been implemented, the majority of entities have advised that work is underway.

This measure is based on entity self-reporting on implementation of recommendations. The ANAO has undertaken a series of performance audits on entities’ implementation of parliamentary and ANAO recommendations.6 These audits have shown that some entities have reported ANAO recommendations as being implemented when the evidence has shown that they have not actually been implemented. These performance audits of the implementation of recommendations do not cover all entities and the results may not be representative of the whole population. The audits undertaken to date in this series have identified that 29 per cent of recommendations that entities had reported as implemented were assessed by the ANAO as not implemented.7

Table 3.5: Percentage of performance audit recommendations implemented within 24 months

|

|

Recommendations |

|||

|

Year in which recommendations made |

Recommendations (number) |

Implemented (%) |

Not implemented (%) |

No response provided (%) |

|

2022–23 |

194 |

80 |

20 |

0 |

|

2021–22 |

161 |

80 |

20 |

0 |

|

2020–21 |

165 |

77 |

21 |

2 |

|

2019–20a |

141 |

84 |

7 |

8 |

|

2018–19 |

146 |

79 |

19 |

2 |

|

2017–18 |

126 |

81 |

19 |

0 |

Note a: The percentages for 2019–20 do not total 100 per cent due to rounding.

Performance results for Program 1.3: Performance Statements Audit Services

Section 39 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires the accountable authority of a Commonwealth entity to prepare annual performance statements that provide information about the entity’s performance in achieving its purposes and include a copy of the statements in the entity’s annual report. Section 40 of the PGPA Act provides that the responsible minister for a Commonwealth entity or the Minister for Finance may request the Auditor-General to examine and report on the entity’s annual performance statements.

On 26 June 2023, the Minister for Finance requested that the Auditor-General undertake assurance audits of 14 entities’ 2023–24 performance statements under section 40 of the PGPA Act. The Auditor-General conducted the 14 audits under section 15 of the Auditor-General Act 1997.

The intent of performance statements audits is to drive improvements in the transparency and quality of entities’ performance reporting, and, in turn, increase entities’ accountability to the Parliament and public.

Performance measures

To assess performance against our purpose in relation to performance statements audit activities, the ANAO measures the:

- number of performance statements audit reports issued;

- percentage of performance statements audit reports issued in time to meet entity annual reporting timeframes;

- average cost of a performance statements audit does not increase from the prior year;

- percentage of moderate or significant findings, and recommendations, from performance statements audit reports agreed to by audited entities; and

- percentage of agreed moderate or significant findings that are addressed by audited entities within 24 months of reporting.

In 2024–25, the ANAO reports on audits of performance statements from the 2023–24 audit cycle.

|

Measure 10 |

Number of performance statements audit reports issued |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.3, p. 98 |

|

|

Result |

Achieved a result of 14 against a target of 14 |

MET |

In 2024–25, the ANAO completed the 14 audits of entity 2023–24 performance statements that were requested by the Minister for Finance as part of the annual performance statements audit program. The ANAO audited the performance statements of the Attorney-General’s Department (AGD), the Australian Taxation Office (ATO), Department of Agriculture, Fisheries and Forestry (DAFF), Department of Education, Department of Foreign Affairs and Trade (DFAT), Department of Health and Aged Care (Health), Department of Home Affairs, Department of Industry, Science and Resources (DISR), Department of Infrastructure, Transport, Regional Development, Communications and the Arts (DITRDCA), Department of Social Services (DSS), Department of the Treasury, Department of Veterans’ Affairs (DVA), National Disability Insurance Agency (NDIA) and Services Australia.

The Minister for Finance tabled all 14 audit reports in the Senate on 29 November 2024. These are available at finance.gov.au/publications/reports.

Details of the lessons identified during the 2023–24 performance statements audit cycle are included in Auditor-General Report No. 25 2024–25 Performance Statements Auditing in the Commonwealth – Outcomes from the 2023–24 Audit Program. The report was tabled in Parliament on 19 February 2025.

|

Measure 11 |

Percentage of performance statements audit reports issued in time to meet entity annual reporting timeframes |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.3, p. 99 |

|

|

Result |

Achieved a result of 43% against a target of 100% |

NOT MET |

The ANAO aims to issue performance statements audit reports within three months of the end of the financial year. While including audited annual performance statements in annual reports to the Parliament is not a mandatory requirement for entities under the PGPA Act, the timely completion of audit reports encourages this practice.

Six audit reports were issued within three months of the end of the financial year, producing a result of 43 per cent. Reports for the remaining eight entities were issued outside this timeframe.

Achievement of this measure relies on entities providing the ANAO with auditable and signed annual performance statements within the required timeframe. There were delays in providing the ANAO with auditable statements from several of the entities that contributed to the late issue of the audit reports.

The audits of ATO, DAFF, DISR, Health, Home Affairs, and NDIA encountered challenges in obtaining sufficient and appropriate audit evidence, which contributed to delays in meeting the planned audit timeframes. Five of these audits were completed within seven days of the reporting timeframe.

The accountable authority of each of DSS and Services Australia decided to sign the 2023–24 financial statements and performance statements on the same date. The finalisation of the preparation of each of these entity’s financial statements was delayed, to enable identified issues to be addressed. As a result, the signing of the performance statements for DSS and Services Australia was also delayed, which impacted the timing of the issuance of the performance statements auditor’s reports.

|

Measure 12 |

Average cost of a performance statements audit does not increase from the prior year |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.3, p. 99 |

|

|

Result |

Achieved a result of 14.2% increase against a target of 0% |

NOT MET |

The average cost of audits in 2022–23 was $539,253.08 for 10 audits. The average cost of audits in 2023–24 was $615,849.43 for 14 audits, representing a 14.2 per cent increase from the previous audit cycle (Table 3.6). The increase was primarily driven by the integration of four new entities into the program and supporting a larger cohort of new performance statement auditors in preparation for a further increase in performance statements audits to 21 entities for the 2024–25 audit cycle. This expansion necessitated an increased focus on building audit practice capacity and capabilities.

A comparative analysis of the average audit cost for the same 10 entities audited in both 2022–23 and 2023–24, shows that there was a 1.3 per cent decrease in the average cost for those audits. This result was impacted by the audit cost for one entity, which increased by 37.6 per cent year on year. There were several qualifications in this audit in 2022–23. The increase in audit cost in 2023–24 was due to investment by the ANAO to support the entity to address and remove these qualifications. Removal of this entity from the comparative analysis shows that for the other nine entities the average audit cost was 5.9 per cent lower in 2023–24 compared to 2022–23. This reduction aligns with expectations that audit costs for second year and repeat audits will be lower than in the first year. This is due to, among other things, the fact that the foundational knowledge required to audit repeat entities has already been established by the ANAO and that the audited entities are more familiar with the audit process.

The average audit cost for the four new entities audited for the first time in 2023–24 was $822,061.21 reflecting the additional resources and start-up effort required for first-year audits as well as the size and complexity of the four new audited entities, being the Australian Taxation Office, the Department of Foreign Affairs and Trade, the Department of Home Affairs and the National Disability Insurance Agency.

Table 3.6: Average cost of performance statements audits — 2020–21 to 2023–24

|

Audit cycle |

Percentage increase Target (%) |

Average cost per audit cycle ($) |

Actual result (%) |

|

2023–24 |

0 |

615,849 |

14.20 per cent increase |

|

2022–23 |

0 |

539,253 |

17.87 per cent decrease |

|

2021–22 |

0 |

656,649 |

4.77 per cent increase |

|

2020–21 |

|

626,730 |

|

|

Measure 13 |

Percentage of moderate or significant findings, and recommendations, from performance statements audit reports agreed to by audited entities |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.3, p. 99 |

|

|

Result |

Achieved a result of 95% against a target of 90% |

MET |

The ANAO provides entities with audit findings and recommendations based on observations during the conduct of performance statements audits. These findings and recommendations are aimed at assisting entities to improve their performance reporting, internal controls, and business processes. Entities are more likely to fully address findings and implement recommendations that are agreed to without qualification. Significant or moderate findings are Category A or B findings.8

Audit findings and recommendations are reported to the accountable authority and copied to the chair of the audit committee via an interim management letter, a closing report or a final management letter. The ANAO seeks to confirm all factual observations concerning the audit findings with entities before finalising these reports. Included in the measure of agreed recommendations are situations where the audited entity agrees with the ANAO’s factual observations, but the entity may suggest an alternative method to resolve the issue.

In the 2023–24 performance statements audit cycle, 39 moderate or significant findings were made across the 14 audits. Of the findings, 35 were agreed to (without qualification) by entities, two were agreed in part and two were not agreed, resulting in 95 per cent of findings agreed.

All audit findings and recommendations are followed up as part of the audit of the following year’s performance statements.9

|

Measure 14 |

Percentage of agreed moderate or significant findings that are addressed by audited entities within 24 months of reporting |

|

|

Source |

ANAO Corporate Plan 2024–25 Portfolio Budget Statements 2024–25, Program 1.3, p. 99 |

|

|

Result |

Achieved a result of 92% against a target of 70% |

MET |

To measure the impact that the ANAO’s audit work has on public administration, the ANAO measures the percentage of agreed moderate or significant findings that are addressed by audited entities. This measure captures findings (moderate or significant) that are addressed by audited entities within 24 months, resulting in improvements to the public sector control environment. ‘Addressed’ means that the entity has agreed to and actioned the audit finding. The ANAO reviews all findings during the interim and/or final phases of the annual financial statements audit process.

Audit findings are reported to entities at the conclusion of each year’s performance statements audit. In order to determine whether these findings have been addressed by entities within 24 months of reporting, a full 24-month period is required from the audit cycle when the findings were raised. The audit cycle generally runs from October to September. Therefore, this performance measure for 2024–25 considers whether the audit findings since the 2021–22 audit cycle had been addressed by entities within 24 months of reporting which was up to the conclusion of the 2023–24 audit cycle.

For 2024–25, only AGD, DAFF, DSS, DVA, Education and Treasury were included in the result of this measure, as they are the only entities who have undergone audits over a 24-month period (2021–22 to 2023–24).

Up to the conclusion of the 2023–24 performance statements audit cycle, 25 moderate or significant findings were agreed to by entities at the conclusion of the 2021–22 audit cycle with 23 of those findings addressed in the 24-month period across the six audits.

Shared performance criteria for programs 1.1, 1.2 and 1.3: The ANAO supports the Australian Government sector to improve public sector performance

A number of performance measures are shared across different areas of the ANAO. These areas of activity contribute to achieving the ANAO’s purpose through:

- facilitating dissemination of the ANAO’s findings to members of parliament, the executive and the public;

- providing organisation-wide enabling services for the ANAO, based on specialised knowledge, professional practice and technology; and

- ensuring ANAO audits are of high quality and compliant with auditing standards.

Performance measures

To assess performance against our purpose in relation to ANAO-wide activities, the ANAO measures performance in delivering audit services through our key relationship with the Parliament, and our support of the Australian Government to improve public sector performance.

The ANAO also evaluates whether the independent quality assurance program indicates that audit conclusions are appropriately supported by evidence.

|

Measure 15 |

The ANAO supports the Parliament to carry out its functions on the operations of the Australian Government sector. |

|

|

Source |

ANAO Corporate Plan 2023–24 Portfolio Budget Statements 2023–24, shared by programs 1.1, 1.2, and 1.3, p. 100 |

|

|

Result |

Achieved a result of 4 reporting mechanisms met against a target of 4 |

MET |

|

Reporting mechanism 1 |

Percentage of appearances for private briefings and public hearings undertaken at the request of parliamentary committees |

|

|

Result |

Achieved a result of 100% against a target of 100% |

MET |

|

Reporting mechanism 2 |

Percentage of private briefings undertaken at the request of parliamentarians |

|

|

Result |

Achieved a result of 100% against a target of 100% |

MET |

|

Reporting mechanism 3 |

Percentage of inquiries and audit requests from parliamentarians responded to within 28 days |

|

|

Result |

Achieved a result of 100% against a target of 90% |

MET |

|

Reporting mechanism 4 |

Feedback from the Joint Committee of Public Accounts and Audit (JCPAA) indicates the ANAO has contributed to improved public sector accountability and transparency and public sector administration through its reports and services to the Parliament. |

|

|

Result |

Achieved a result of six Agreed ratings against a target of six Agreed ratings |

MET |

The ANAO has identified four reporting mechanisms (with defined targets) to assess the level of support provided to the Parliament.

The ANAO supports the work of the Parliament by providing private briefings on request, making appearances before, and submissions to committee inquiries, and responding to inquiries and audit requests from Parliamentarians. This effort is based on audit reports tabled in Parliament.

The relationship with the JCPAA remains the ANAO’s key parliamentary engagement. To support the work of the Parliament more broadly, the ANAO focused on proactively seeking opportunities to engage with the Parliament to improve the utilisation of audit reports in parliamentary proceedings. Engagement activities included:

- reviewing all Senate, House and joint committee inquiries and making submissions, and being available to appear at hearings where there was audit coverage relevant to the committee inquiry terms of reference; and

- providing a summary to each estimates committee, prior to estimates hearings, which includes information about all audit reports tabled since the last estimates hearings and highlighting which audits are relevant to a committee’s portfolio of responsibilities.

For 2024–25, four of the four reporting mechanisms for Measure 15 have been met. Therefore, Measure 15 has been met overall.

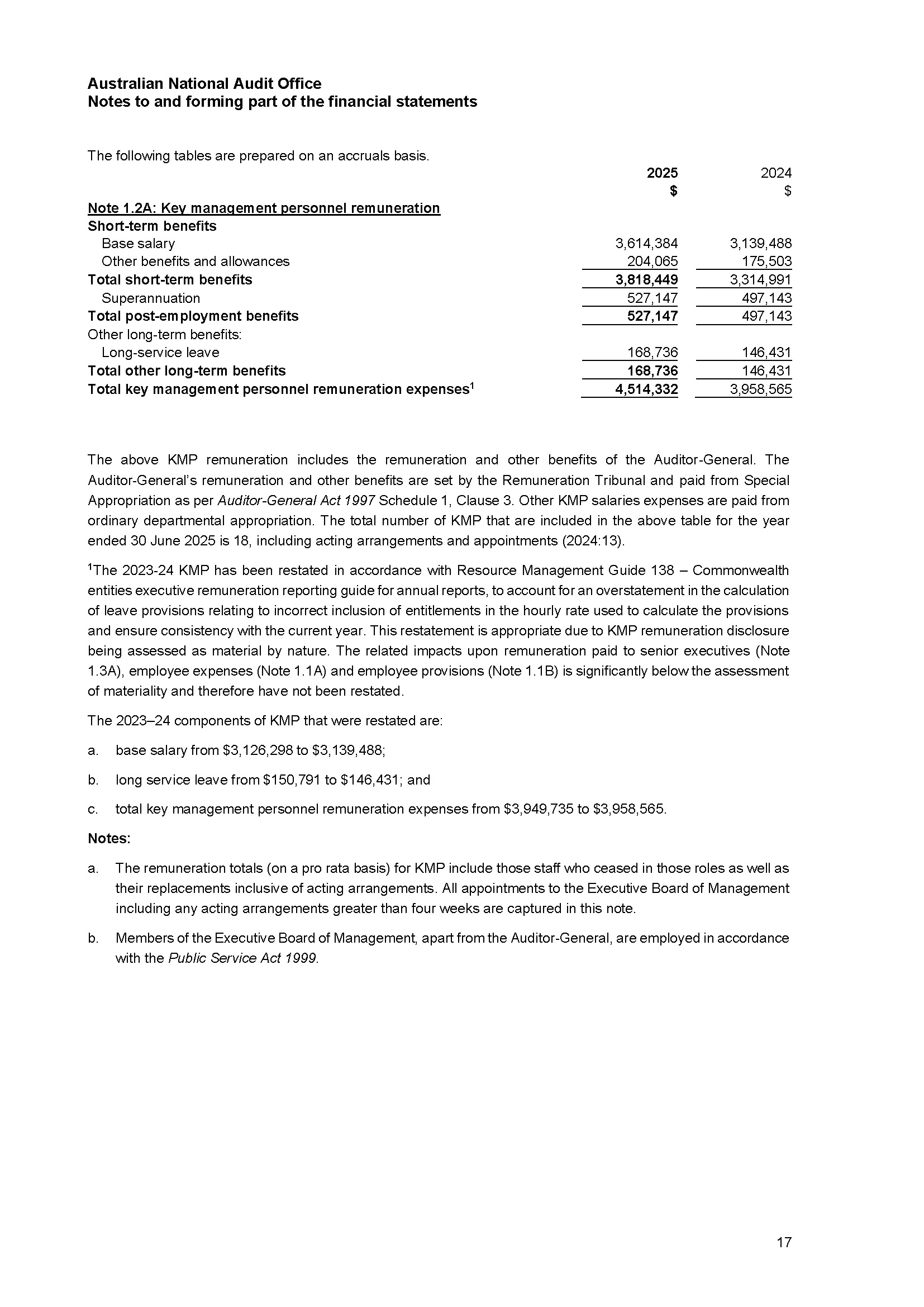

Reporting mechanism 1 – Appearances for private briefings and public hearings undertaken at the request of parliamentary committees