Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The audit sought to assess how well the Australian Taxation Office (ATO) manages aggressive tax planning. We did this by exploring the nature of aggressive tax planning and the ATO's approach to its management. In the latter context, we looked at:

- the ATO's previous experience with aggressive tax planning and action on previous significant external reviews, particularly dealing with mass marketed investment schemes;

- strategy and operations, intelligence gathering and use; and the identification and management of promoters given their significant role in aggressive tax planning.

The ANAO was invited to prepare a paper for an international conference on the role of supreme audit Institutions in combatting corruption for the advancement of transparency, public integrity, and good governance. The international conference formed part of the celebrations for the 30th anniversary of the establishment of the State Audit Office of Viet Nam and was held from 8-12 July 2024,

Please direct enquiries through our contact page.

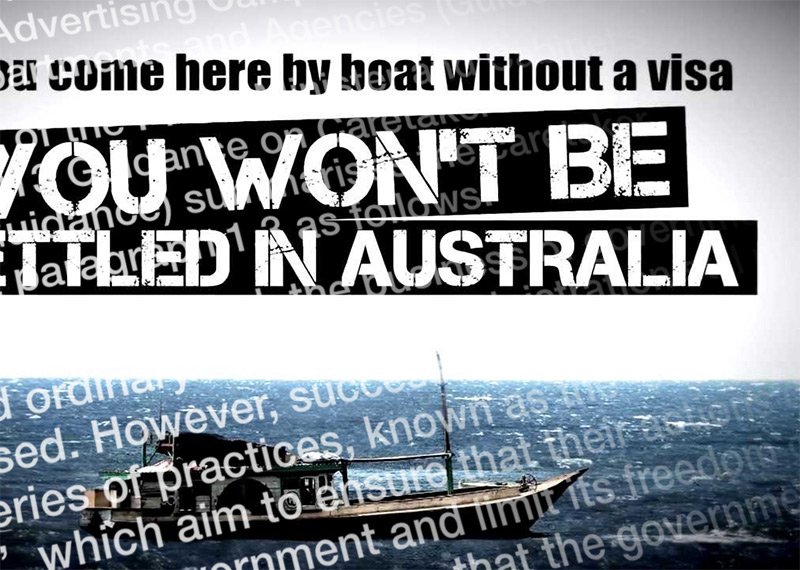

The Auditor-General responded on 1 August 2013 to correspondence from Senator Nick Xenophon of 22 July 2013 on the By boat, no visa advertising campaign.

Please direct enquiries relating to requests for audit through our contact page.

This audit is the thirteenth in a series of audits that have fulfilled the Senate’s request for the Auditor-General to provide an annual report on agencies’ compliance with the Order, since it was introduced in 2001. The audit objective was to assess the appropriateness of the use and reporting of confidentiality provisions in Australian Government contracts.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in May 2020. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2020.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the (former) Department of Industry’s administration of the Australian Apprenticeships Incentives Program.

Please direct enquiries relating to reports through our contact page.

The audit objectives were to examine the effectiveness of Defence’s management of the test and evaluation (T&E) aspects of its major capital equipment acquisition program; and to report on Defence’s progress in implementing T&E recommendations made in the Senate Foreign Affairs, Defence and Trade References Committee’s August 2012 report, Procurement procedures for Defence capital projects.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure and Regional Development’s design and implementation of the first funding round of the Bridges Renewal Programme.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine if Social Services and Human Services drive improvements in the Disability Support Pension program using data and information from multiple sources, including agreed Auditor-General and parliamentary committee recommendations.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of risk management, data monitoring and public reporting arrangements associated with the Australian Government's funding of public hospital services under the 2011 National Health Reform Agreement (NHRA).

Please direct enquiries through our contact page.

The objective of the audit was to assess whether Services Australia had effectively managed risks related to the rapid preparation for and delivery of COVID-19 economic response measures.

Please direct enquiries through our contact page.

The audit objective was to examine the effectiveness to date of the Department of Defence’s administration of the Enterprise Resource Planning (ERP) program, with a focus on ERP Tranche 1 activities.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of Defence’s implementation of reforms to capability development since the introduction of the two-pass process for government approval of capability projects and government’s acceptance of the reforms recommended by the Mortimer Review. The scope of this audit included the requirements phase and, to a limited extent, the acquisition phase of major capability development projects, focusing upon changes flowing from the major reforms.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine whether the Department of Defence provides an efficient and effective security vetting service for Australian Government entities through the Australian Government Security Vetting Agency.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Department of Defence’s Projects of Concern regime is effective in managing the recovery of underperforming projects.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the award of funding under the Safer Communities Fund was effective and consistent with the Commonwealth Grant Rules and Guidelines.

Please direct enquiries through our contact page.

The objective of the audit was to assess the completeness and reliability of the estimates reported in Tax Expenditures Statement 2006 (TES 2006). That is, the audit examined the development and publication of the detailed statement of actual tax expenditures required by Division 2 of Part 5 of the CBH Act. The development and publication of aggregated information on projected tax expenditures included in the Budget Papers pursuant to Division 1 of Part 5 of the CBH Act was not examined.

The objective of the audit was to assess the administrative effectiveness of the ATO's management of GST compliance in the large business market segment. In conducting the audit the ANAO examined three key areas: governance - ILEC's corporate planning and reporting arrangements relevant to the management of GST compliance in the large business market segment; assessing and identifying compliance risks- how ILEC collects information relating to the large business market segment and how it uses this information to support risk identification and assessment; and managing compliance- compliance planning and the products and processes used by ILEC to manage GST compliance in the large business market segment and evaluating compliance outcomes to support future compliance planning and the targeting of GST compliance risks. In undertaking the audit, the ANAO took account of the findings of previous reviews, in particular the LCCP Review.

The objective of the audit was to assess the adequacy of selected Australian Government entities’ practices and procedures to manage business continuity. To conclude against this objective, the ANAO adopted high-level criteria relating to the entities’ establishment, implementation and review of business continuity arrangements.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of Defence’s administration of industry support and skill development programs.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the governance board in the Australian Film, Television and Radio School.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance board in the Commonwealth Superannuation Corporation.

Please direct enquiries through our contact page.

The objective of the audit was to assess the appropriateness of the use and reporting of confidentiality provisions in a sample of Australian Government contracts.

Please direct enquiries relating to reports through our contact page.

The audit examined the efficiency and effectiveness of the Department of Employment and Workplace Relations' implementation and subsequent management of the Indigenous Employment Policy. The audit sought to determine whether, in relation to the Indigenous Employment Policy, the department had:

- developed appropriate planning processes and performance measures;

- monitored and reported performance results;

- implemented appropriate evaluation and review mechanisms;

- conducted effective marketing and promotion; and

- identified enhancements and addressed performance issues.

The objective of this audit was to assess whether DFAT had effective processes for issuing passports in Australia. In particular, the audit focussed on whether DFAT had effective strategies for managing passport services; provided quality client service; and had effective and secure processes for passport issue to entitled persons.

This report complements the Interim Report on Key Financial Controls of Major Entities financial statement audit report published in June 2021. It provides a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities for the period ended 30 June 2021.

Please direct enquiries through our contact page.

The audit objective was to assess Defence’s implementation of the five recommendations in ANAO Report No.19 2014-15 Management of the Disposal of Specialist Military Equipment and the related recommendation in JCPAA Report 449 Review of Auditor-General's Reports Nos. 1-23 (2014-15).

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Prime Minister and Cabinet’s management of the Australian Government’s Register of Lobbyists.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance of the Board of the National Disability Insurance Agency.

Please direct enquiries through our contact page.

The objective of the audit was to assess how effectively and efficiently the Australian Taxation Office managed contact centres as part of its overall service delivery.

Please direct enquiries relating to reports through our contact page.