Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The audit objective was to assess the effectiveness of the design process and monitoring arrangements for the National Innovation and Science Agenda by the relevant entities.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the design and administration of the VET FEE-HELP scheme.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness to date of the implementation of the Tourism 2020 strategy by the Australian Trade and Investment Commission (Austrade) and Tourism Australia.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Department of Health effectively procured services to operate a National Cancer Screening Register.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 10 November 2016 to correspondence from The Hon Joel Fitzgibbon MP on 13 October 2016 requesting the ANAO include the impact of the Australian Government’s proposed relocation of the Australian Pesticides and Veterinary Authority in its current performance audit of Pesticide and Veterinary Medicine (agvet) Regulatory Reform.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 23 December 2020 to correspondence from the Hon Dr Andrew Leigh MP dated 8 December 2020, requesting that the Auditor-General conduct an investigation to examine the JobKeeper scheme. The Auditor-General provided a follow-up response on 8 February 2021, advising the Hon Dr Andrew Leigh MP that a performance audit Administration of the JobKeeper Scheme has commenced.

The Auditor-General responded on 26 March 2021 to follow-up correspondence from the Hon Dr Andrew Leigh MP dated 2 March 2021, requesting that the Auditor-General explore specific aspects of the JobKeeper scheme.

Please direct enquiries relating to request for audit through our contact page.

The Auditor-General responded on 29 October 2019 to correspondence from the Hon Joel Fitzgibbon MP dated 1 October 2019, requesting that the Auditor-General conduct an examination of Federal Government drought funding measures. The Auditor-General provided a follow-up response to the Hon Joel Fitzgibbon MP on 24 July 2020.

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General (A/g) responded on 23 September 2015 to correspondence from Alannah MacTiernan MP on 7 September 2015 regarding the Perth Freight Link Project in Western Australia.

Please direct enquiries relating to requests for audit through our contact page.

This report focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2018–19 financial statements audits. It examines 26 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2017–18 Consolidated Financial Statements of the Australian Government (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Please direct enquiries through our contact page.

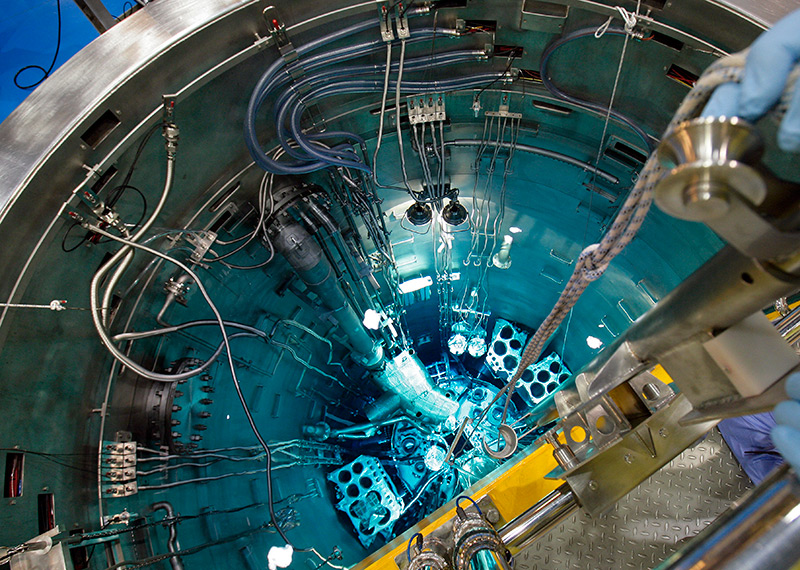

The audit examined the effectiveness of the Australian Nuclear Science and Technology Organisation’s management of assets involved in the manufacture, production and distribution of nuclear medicines.

Please direct enquiries through our contact page.

The Auditor-General (A/g) responded on 18 May 2016 to correspondence from the Hon Anthony Albanese MP on 16 January 2016 regarding the ANAO performance audit of the approval and administration of Commonwealth funding for the WestConnex Project.

Please direct enquiries relating to requests for audit through our contact page.

The fifteenth Commonwealth Auditor-General of Australia, Grant Hehir, has prepared a mid-term report reflecting on his first five years in the role. The report presents a description and analysis of the role and impact of audit, as well as analysis of the financial audit and performance audit work of the Australian National Audit Office (ANAO). The report concludes with coverage of ANAO continuous improvement activities across audit quality, better communication, transparency, efficiency and workforce capability.

Please direct enquiries through our contact page.

The Auditor-General responded on 20 September 2019 to correspondence from Mr Julian Hill MP dated 3 September 2019, requesting that the Auditor-General conduct an investigation to examine aspects of the family migration program. The Auditor-General provided a follow-up response to Mr Hill MP on 24 July 2020.

Please direct enquiries relating to requests for audit through our contact page.

The major projects report (MPR) is an annual review of the Department of Defence’s major defence equipment acquisitions, undertaken at the request of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA).

The purpose of the MPR is to provide information and assurance to the Parliament on the performance of selected acquisitions as at 30 June 2021. This is the 14th MPR since its commencement in 2007–08.

Please direct enquiries through our contact page.

The ANAO’s performance audit program is one of the main assurance functions of the Auditor-General. The purpose of this information report was to provide analysis of 2023–24 performance audits.

Please direct enquiries through our contact page.

The Australian National Audit Office, in partnership with the Australian Capital Territory Audit Office hosted the 12th Meeting of the Pacific Association of Supreme Audit Institution’s (PASAI) Regional Working Group on Environmental Auditing. The meeting was held from 17-19 September 2024 in Canberra, Australia.

For any enquiries, please contact External.Relations@anao.gov.au

The Auditor-General responded on 22 October 2021 to correspondence from Senator Mehreen Faruqi dated 27 September 2021, requesting that the Auditor-General conduct an investigation to examine the administration of the Australian Research Council's funding application processes.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Prudential Regulation Authority's processes for the prudential regulation of superannuation entities.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the adequacy and effectiveness of the Australian Electoral Commission’s implementation of those recommendations relating to improving the accuracy and completeness of the electoral roll and other matters from Audit Report No.28 2009–10 that have not previously been followed-up by the ANAO.

Please direct enquiries relating to reports through our contact page.

This report is the first in the series of reports for the 2020–21 financial year and focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2020–21 financial statements audits. This report examines 25 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2019–20 Consolidated Financial Statements.

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of Navy’s strategy for recruiting and retaining personnel with specialist skills. The effective delivery of Navy capability depends on Navy having available sufficient numbers of skilled personnel to operate and maintain its fleet of sea vessels and aircraft, and conduct wide‑ranging operations in dispersed locations. Without the right personnel, Navy capability is reduced. Navy’s budget for 2014–15 included $1.86 billion in employee expenses.

The audit concluded that, in its strategic planning, Navy had identified its key workforce risks and their implications for Navy capability. To address these risks Navy had continued to adhere to its traditional ‘raise, train and sustain’ workforce strategy; developed a broad range of workforce initiatives that complemented its core approach; and sought to establish contemporary workforce management practices. However, long‑standing personnel shortfalls in a number of ‘critical’ employment categories had persisted, and Navy had largely relied on retention bonuses as a short‑ to medium‑term retention strategy.

Navy had developed a broad range of workforce initiatives, some designed specifically to address workforce shortages in its critical employment categories. To date, Navy had primarily relied on paying retention bonuses and other financial incentives; recruiting personnel with prior military experience to work in employment categories with significant workforce shortfalls; and using Navy Reserves in continuous full time roles. Ongoing work was required for Navy to firmly establish a range of promising workforce management practices, including providing the right training at the right time; more flexible approaches to managing individuals’ careers; and improving workplace culture, leadership and relationships. More flexible and tailored workforce management practices could help address the underlying causes of workforce shortfalls, particularly when the traditional approaches were not gaining sufficient traction.

The ANAO made two recommendations aimed at Navy: drawing on external human resource expertise to inform the development and implementation of its revised workforce plan; and evaluating the impact of retention bonuses on the Navy workforce to determine their future role within its overall workforce strategy.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Office of the Registrar of Indigenous Corporations (ORIC) supports good governance in Indigenous corporations consistent with the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI).

Please direct enquiries relating to reports through our contact page.

This audit focuses on the NBA’s role in managing the nations blood supply, bearing in mind the NBA’s legislative responsibilities, national policy objectives and ongoing blood sector reforms.

The objective of this follow-up audit was to examine Centrelink's progress in implementing the recommendations of the 2004–05 audit and the subsequent JCPAA inquiry.

The audit objective was to examine the efficiency of the Office of the Commonwealth Director of Public Prosecutions' (CDPP's) case management.

Please direct enquiries through our contact page.

The Auditor-General responded on 18 June 2025 to correspondence from Senator David Shoebridge dated 23 May 2025, requesting that the Auditor-General conduct a review of the expenditure and disclosures of the Federal Court.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Export Finance and Insurance Corporation (Efic).

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Broadcasting Corporation’s (ABC’s) management of complaints.

Please direct enquiries relating to potential audits through our contact page.

This report focuses on the results of the interim financial statements audits, including an assessment of entities’ key internal controls, supporting the 2019–20 financial statements audits. This report examines 24 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2018–19 Consolidated Financial Statements (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Please direct enquiries through our contact page.

The Auditor-General responded on 17 June 2021 to correspondence from the Hon Mark Dreyfus QC, MP dated 21 May 2021, requesting that the Auditor-General conduct an investigation to examine how part-time members of the Social Services and Child Support Division and “sessional part-time members” in the Migration and Refugee Division of the Administrative Appeals Tribunal are being remunerated.

The Auditor-General provided a follow-up response to the Hon Mark Dreyfus QC, MP on 17 December 2021.

Please direct enquiries relating to requests for audit through our contact page.

The audit examined whether the COVID-19 National Medical Stockpile (NMS) procurement requirement was met through effective planning and governance arrangements.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the management of underperformance in the Australian Public Service (APS) and identify opportunities for improvement.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine whether the Australian Postal Corporation (Australia Post) is meetings its Community Service and International obligations efficiently and the effectiveness of Commonwealth shareholders in monitoring value for money.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the arrangements established by the Australian Antarctic Division (AAD), a division of the Department of the Environment, to support Australia’s Antarctic Program.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the management of Machinery of Government (MoG) changes by the selected Australian Government entities.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the Australian Public Service Commission’s and selected entities’ implementation of the Australian Government’s Workplace Bargaining Framework.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Prime Minister and Cabinet’s management of initiatives to supply low aromatic fuel to Indigenous communities.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether appropriate steps were taken to protect the Commonwealth's interests and obtain value for money in respect to the $3.5 billion in Commonwealth funding committed to the NSW Government for the WestConnex project.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of Defence’s design and implementation of the Base Services contracts.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine whether value for money is being delivered by the Australian Rail Track Corporation’s (ARTC’s) management of the Inland Rail pre‑construction program.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 18 March 2019 to correspondence from the Hon. Shayne Neumann MP dated 19 February 2019 and 14 March 2019. The Auditor-General further responded on 1 April 2019. The correspondence from Mr Neumann requested that the Auditor-General conduct an audit into the circumstances surrounding the Department of Home Affairs' procurement of garrison support and welfare services in Papua New Guinea.

Please direct enquiries relating to requests for audit through our contact page.

The audit objective was to examine whether the Department of Defence has effective and efficient sustainment arrangements for the Royal Australian Navy’s fleet of eight ANZAC class frigates.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the award of funding under the Community Sport Infrastructure Grant Program was informed by an appropriate assessment process and sound advice.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the Australian Bureau of Statistics (ABS) has established effective risk management arrangements to support the implementation of the Statistical Business Transformation Program.

Please direct enquiries through our contact page.

The Auditor-General responded on 18 November 2019 to correspondence from Mr Andrew Giles MP, requesting that the Auditor-General conduct an investigation to examine the effectiveness of the procurement to deliver a new global visa processing system.

Please direct enquiries relating to requests for audit through our contact page.

The objective of this audit was to assess the effectiveness of controls being implemented and/or developed by the National Disability Insurance Agency (NDIA) to ensure National Disability Insurance Scheme (NDIS) access decisions are consistent with legislative and other requirements.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 26 April 2023 to correspondence from the Hon David Coleman MP dated 29 March 2023 and 12 April 2023, requesting that the Auditor-General conduct a full investigation into the design and administration of Round 6 of the Mobile Black Spot Program.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to examine the effectiveness of the Department of Social Services' administration of the Cashless Debit Card program, including implementation of the recommendations made in Auditor-General Report No.1 2018–19, The Implementation and Performance of the Cashless Debit Card Trial.

Please direct enquiries through our contact page.

The Auditor-General responded on 18 May 2018 to correspondence from Senator Whish-Wilson dated 24 April 2018, requesting that the Auditor-General conduct an audit of the implementation of declaration of interest and conflict of interest policies by the Australian Securities and Investments Commission (ASIC).

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Australian Taxation Office's (ATO) strategies and activities to address the cash and hidden economy.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the management of cyber risks by the Department of the Treasury, National Archives of Australia and Geoscience Australia.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of FaHCSIA’s administration of Communities for Children under the Family Support Program.

The audit objective was to assess the Australian Taxation Office’s effectiveness in managing complaints.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Veterans' Affairs and Department of Defence's administration of rehabilitation services under the Military Rehabilitation and Compensation Act 2004.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine the effectiveness of the Australian Skills Quality Authority’s planning and implementation of reform to the regulation of the vocational education and training sector.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Communications and Media Authority’s regulation of unsolicited communications.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the extent to which the Department of Agriculture and Water Resources (Agriculture) has addressed the recommendations from ANAO Audit Report No. 46 of 2011–12, Administration of the Northern Australia Quarantine Strategy (NAQS).

Please direct enquiries through our contact page.

The audit objective is to assess the effectiveness of the Department of Defence's management of the Mulwala Redevelopment Project.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the design and early implementation of the Australian Government’s response to Recommendation 86 of the Royal Commission into Aged Care Quality and Safety has been effective.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Australian Organ and Tissue Donation and Transplantation Authority's administration of community awareness, professional education and donor family support activities intended to increase organ an

Please direct enquiries relating to reports through our contact page.