Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Attorney-General’s portfolio is responsible for: legal services; national security and criminal law; integrity and anti-corruption matters; the Commonwealth justice system including courts, tribunals, justice policy and legal assistance; regulation and reform; protecting and promoting human rights; and support for Commonwealth royal commissions.

The Attorney-General’s Department (AGD) is the lead entity in the portfolio and is responsible for Australia’s law and justice framework and providing legal services to the Commonwealth. Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025 which impacts areas of responsibility in the Attorney-General’s portfolio.

In addition to AGD and the High Court of Australia, there are 11 portfolio entities that are responsible for delivering programs and initiatives in relation to law and justice. The portfolio’s material entities are AGD and the High Court of Australia.

In the 2025–26 Portfolio Budget Statements (PBS) for the Attorney-General’s portfolio, the aggregated budgeted expenses for 2025–26 totalled $2.3 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

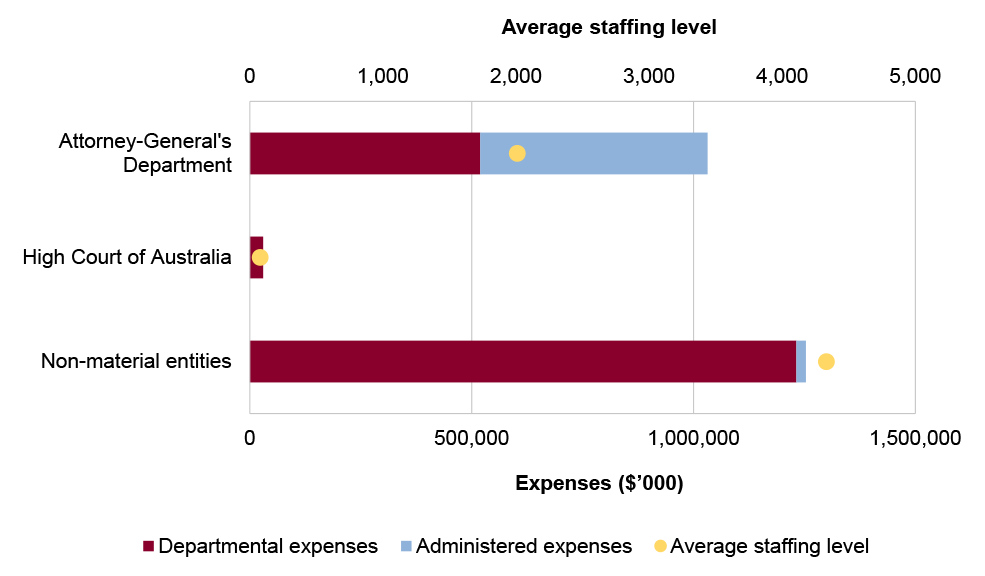

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. Non-material entities represent the largest proportion of portfolio expenses, and departmental expenses of the portfolio are the most material component, representing 77 per cent of the entire portfolio’s expenses.

Figure 1: Attorney-General’s portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified for the portfolio relate to supporting Australian Government entities to act lawfully in carrying out functions and managing the effectiveness and compliance risks for whole-of-government regulatory and policy frameworks such as lobbyists, fraud, freedom of information, privacy, anti-corruption and integrity.

Specific risks in the Attorney-General’s portfolio relate to governance, service delivery, grants administration, procurement and policy development and stewardship.

Governance

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Service delivery

The portfolio has important citizen-centric service delivery responsibilities including delivery of case management services through the Administrative Review Tribunal, Federal Court of Australia and the Federal Circuit and Family Court of Australia. A key risk is the timely and effective delivery of these services.

Grants administration

The Attorney-General’s Department’s grants administration responsibilities involved 1049 grants awarded to the value of $747.2 million in the 2023–24 financial year. Grant programs may be delivered through grant hub arrangements, an approach that does not diminish the department’s responsibility for program design and delivery including the standard of application assessments. It is also important that decision making on the award of grant funding be informed by appropriate advice.

Procurement

Procurement and contract management activity is important in a number of areas related to portfolio responsibilities including the new Federal Register of Legislation project and procurements to implement some of the measures under the National Strategy to Prevent and Respond to Child Sexual Abuse 2020–2031. It is important that procurement processes are timely and promote open and effective competition in order to achieve value for money for the Australian Government.

Policy development and stewardship

AGD has a policy development and implementation role in areas that include: the implementation of a National Anti-Corruption Commission; the government’s response to the recommendations outlined by the Australian Human Rights Commission’s Respect@Work Report; implementing actions in response to the Royal Commission into Institutional Responses to Child Sexual Abuse; and exploring opportunities to reform statutory appointment processes. Risks include those relating to whether policy design and implementation adequately addresses the objectives.

AGD is responsible for: uplifting fraud and corruption control capability and supporting Commonwealth entities to meet obligations under the Commonwealth Fraud and Corruption Control Framework; privacy legislation; and the lobbying code of conduct and register of lobbyists. The department is also responsible for assisting Australian Government entities to comply with the Legal Services Directions (through a compliance framework, guidance notes and education program) and supporting Australian Government entities to act lawfully in carrying out their functions. As stewards, AGD portfolio entities should have an approach to assessing the effectiveness of these frameworks and whether the frameworks remain fit-for-purpose and are achieving the policy intent.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Attorney-General’s portfolio were included in tabled ANAO performance audits seven times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- three were qualified (largely positive);

- five were qualified (partly positive); and

- one was adverse.

Figure 2 shows the number of audit conclusions for entities within the Attorney-General’s portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Attorney General’s portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Attorney-General’s portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Attorney-General’s portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024-25 Attorney-General’s Department (AGD) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

AGD has been included in the annual performance statements audit program since the commencement of the pilot in 2019–20.

The ANAO considers the risk associated with AGD’s performance statements audit as low. This is due to no unresolved significant or moderate audit findings from prior performance statements and no significant changes to AGD’s operating environment or its performance measures.

The key risk for AGD’s performance statements that the ANAO has highlighted is the appropriateness of performance measures and targets (moderate risk) – in particular how AGD is improving its approach to performance reporting in order to reflect the maturity of its policies and programs to ensure measures remain fit-for-purpose.

Financial statements audits

Overview

Entities within the Attorney-General’s portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Attorney-General’s portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Attorney-General’s Department |

Non-corporate |

Low |

0 |

2 |

|

High Court of Australia |

- |

Low |

0 |

1 |

|

Non-material entities |

||||

|

Administrative Review Tribunal |

Non-corporate |

Moderate |

||

|

Australian Human Rights Commission |

Corporate |

Low |

||

|

Australian Law Reform Commission |

Non-corporate |

Low |

||

|

Federal Court of Australia |

Non-corporate |

Low |

||

|

National Anti-Corruption Commission |

Non-corporate |

Moderate |

||

|

Office of the Australian Information Commissioner |

Non-corporate |

Low |

||

|

Office of the Commonwealth Ombudsman |

Non-corporate |

Low |

||

|

Office of the Director of Public Prosecutions |

Non-corporate |

Low |

||

|

Office of the Inspector-General of Intelligence and Security |

Non-corporate |

Low |

||

|

Office of Parliamentary Counsel |

Non-corporate |

Low |

||

|

Office of the Special Investigator |

Non-corporate |

Low |

||

Material entities

Attorney-General’s Department

The Attorney-General’s Department (AGD) supports the Attorney-General through the provision of expert advice and services on a range of law, justice, integrity and national security issues.

AGD’s total budgeted revenues for 2025–26 are $539.8 million, with sales of goods and services representing 40 per cent, as shown in Figure 4. Grants expense represent 43 per cent of total budgeted expenses.

Figure 4: Attorney-General’s Department total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the AGD’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The completeness and accuracy of revenue and related balances from rendering of legal services, which is material to AGD’s financial statements and subject to judgements on revenue recognition.

- The management of AGD’s grant programs due to complexity arising from differing legislative and policy requirements.

High Court of Australia

The High Court of Australia is responsible for interpreting and applying the law of Australia; deciding on cases of special federal significance, including challenges to the constitutional validity of laws; and hearing appeals, by special leave, from federal, state and territory courts.

The High Court of Australia’s total budgeted assets for 2025–26 are $259.0 million, with 88 per cent of these assets attributable to land and buildings, as shown in Figure 5.

Figure 5: High Court of Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The key risk for the High Court’s 2024–25 financial statements is the valuation of land and buildings, as these are special-purpose assets with numerous unique features.