Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Health, Disability and Ageing portfolio works towards achieving better health and wellbeing for all Australians, now and for future generations. A total of 19 entities make up the portfolio.

The Department of Health, Disability and Ageing is the lead entity in the portfolio. It is responsible for achieving the Australian Government’s health outcomes in the areas of health system policy, design and innovation; health access and support services; services and policy for the National Disability Insurance Scheme and foundational supports; individual health benefits; services and policy for carers; regulation, safety and protection; and ageing and aged care. This includes administering programs and services, such as Medicare and the Pharmaceutical Benefits Scheme, and forming partnerships with the states and territories, as well as other stakeholders. Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025, with subsequent amendments made on 26 June 2025, which transfers a number of areas of responsibility to the Health, Disability and Ageing portfolio.

The remaining 18 entities in the portfolio – excluding the National Disability Insurance Agency (NDIA) – are responsible for the delivery of programs, including aged care accreditation services, digital health reforms, the development and reporting of health and welfare data, nuclear safety, - funding medical research, managing blood supplies, cancer research, pricing and funding public hospitals, national safety and quality standards and clinical care standards, and food safety. Audit considerations for the portfolio entity NDIA are discussed in a separate overview.

In the 2025–26 Portfolio Budget Statements (PBS) for the Health, Disability and Ageing portfolio – excluding the NDIA – the aggregated budgeted expenses for 2025–26 total $127.1 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

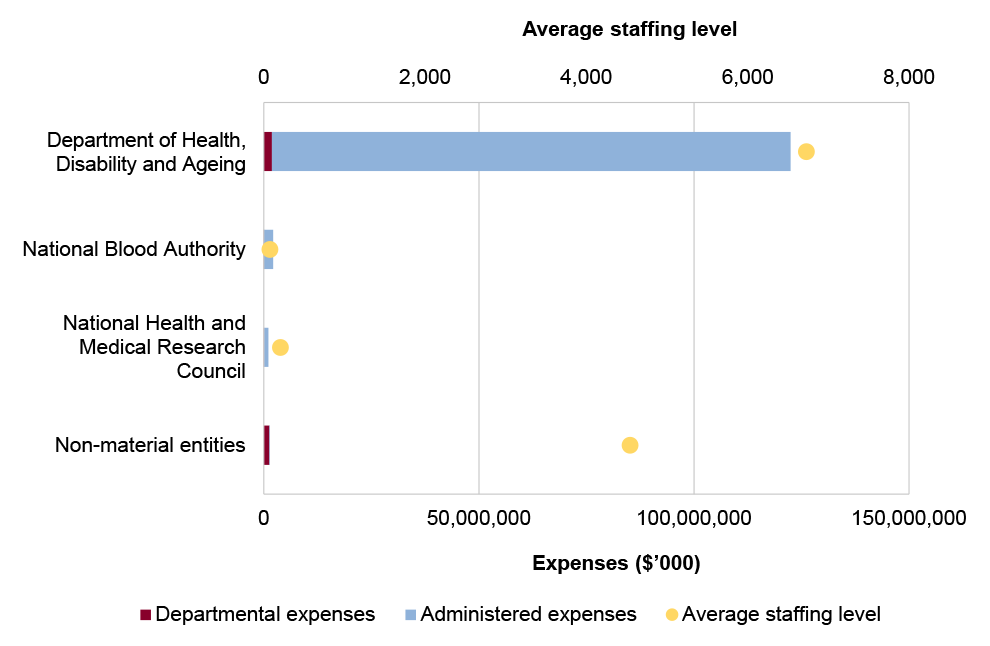

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Health, Disability and Ageing represents the largest proportion of portfolio expenses, and administered expenses of the department are the most material component, representing 97 per cent of the entire portfolio’s expenses.

Figure 1: Health, Disability and Ageing portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Department of Health, Disability and Ageing that was endorsed by the Australian Public Service Commissioner in July 2023.

The primary risks identified by the ANAO for the portfolio relate to establishing effective governance — including adherence to legal requirements, rules and frameworks — while delivering health, disability and aged care programs.

Specific risks in the Health, Disability and Ageing portfolio relate to governance, service delivery, grants administration, procurement, regulation, and asset management and sustainment.

Governance

There is a risk within the department of legislative non-compliance in its administration of approximately 60 health and aged care programs. Previous audits have identified that there is a risk within the department of non-compliance with public sector rules frameworks and finance law.

Recent audits in the department have highlighted shortfalls in evaluation, performance measurement, and performance reporting. There are risks that significant investments in delivery models for primary care, such as through urgent care clinics and Primary Health Networks, are implemented with limited evaluation. There have been insufficient data to demonstrate achievement of outcomes in major programs; annual performance statements that do not include sufficient performance information about key programs; a lack of clearly defined performance measures and methodologies; and limits in assurance over the completeness and accuracy of third-party data, upon which its annual performance statements are reliant.

The portfolio was subject to a machinery of government change on 13 May 2025, which transferred responsibility for disability and carers to the Health portfolio. Embedding robust governance for these new functions will need to be a focus. Machinery of government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Service delivery

The department is reliant on other Australian Government entities, such as Services Australia, for the delivery of programs, including for the administration of Medicare and aged care payments, the Pharmaceutical Benefits Scheme, grants and digital health services. There are risks associated with the coordination of activities.

The department jointly administers the public health system with the states and territories. The delivery of Australia’s health services requires collaboration with state and territory governments, private sector health systems and industry. Effective consultation and coordination with stakeholders is a key risk.

The department has responsibilities for supporting a skilled, diverse, well-distributed and sustainable primary care; aged care; mental health; regional, rural and remote; and First Nations health workforce. An insufficient and poorly distributed health workforce constrains the sector from achieving its objectives, including in implementing the recommendations of the Royal Commission into Aged Care Quality and Safety. A key risk is the department’s engagement and coordination with other Australian Government agencies and sectors in developing a strategic whole-of-government approach to the care and support workforce.

In delivering its services the department is responsible for accurately calculating refunds, entitlements and subsidies. There are risks to payment accuracy from multiple information technology systems, manual processes, reliance on information provided by recipients and complex regulatory requirements.

Information and communications technologies (ICT) maintenance and enhancements are critical for effective service delivery in the department, including for the implementation of the new Aged Care Act that commenced on 1 July 2025. The 2024–25 Federal Budget included $1.2 billion over five years (from 2023–24) for required digital systems. In February 2024, the Digital Transformation Agency gave three aged care ICT projects low to medium delivery confidence assessments, and identified issues and risks that had not been addressed.

Grants administration

Health, Disability and Ageing Care portfolio entities award and administer thousands of grants and grant-like arrangements annually across a diverse range of grant programs. Appropriate adherence to legal requirements, including the Commonwealth Grants Rules and Principles, the Federation Funding Agreements Framework, and the Commonwealth Fraud and Corruption Control Framework, is a risk to effective public administration in the portfolio.

Procurement

A key risk for the department and portfolio entities is achieving value for money and conducting procurements in accordance with the Commonwealth Procurement Rules. In the Health, Disability and Ageing Care portfolio, procurement is often characterised by sole or limited provider markets; urgency; substantial usage of Commonwealth Procurement Rules exemptions; and diverse procurement objectives including promoting national self-sufficiency and security. These characteristics heighten the risk that value for money is not achieved or cannot be demonstrated. Audits have highlighted issues with adherence to the Commonwealth Procurement Rules and quality of contract management.

Regulation

The department and other portfolio entities are responsible for ensuring service providers comply with requirements for funded programs. In the health sector, this includes compliance of health providers with the Medicare Benefits Schedule and Pharmaceutical Benefits Schedule, and of aged care providers with relevant legislation. There are risks associated with effective coordination between the department and independent regulators; regulatory capture; and maintaining robust investigation practices.

A key risk in the health, disability and aged care sectors is preventing, identifying and addressing health, disability and aged care provider non-compliance, such as incorrect claiming, inappropriate practice and fraud. There are risks to maintaining effective regulation in a period of significant sector reforms for the department and portfolio agencies such as the Aged Care Quality and Safety Commission and the NDIS Quality and Safeguards Commission.

Asset management and sustainment

A risk for the department and portfolio entities relates to the management of inventories and other assets, including intangible assets. The 2023–24 financial statements audit included moderate findings related to the department’s inventory and other asset management, including a need to strengthen its controls around stock taking, capitalisation, impairment and valuation processes.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Health, Disability and Ageing portfolio were included in tabled ANAO performance audits 25 times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- 16 were qualified (largely positive);

- eight were qualified (partly positive); and

- two were adverse.

Figure 2 shows the number of audit conclusions for entities within the Health, Disability and Ageing portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Health, Disability and Ageing portfolio compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Health, Disability and Ageing portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Health, Disability and Ageing portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Health, Disability and Ageing annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

The Department of Health, Disability and Ageing is in its third year of inclusion in the annual performance statements audit program and the engagement risk has been assessed as high.

The ANAO considers the risk associated with the Department of Health, Disability and Ageing’s performance statements audit as high.

Key risks for the Department of Health, Disability and Ageing’s performance statements that the ANAO has highlighted include:

- the appropriateness and completeness of key activities, performance measures and targets;

- the lack of clear alignment between the Department of Health, Disability and Ageing’s key documents including Portfolio Budget Statements, Corporate Plan and Annual Report; and

- the maturity of performance statements preparation processes.

Financial statements audits

Overview

Entities within the Health, Disability and Ageing portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Health, Disability and Ageing portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Health, Disability and Ageing |

Non-corporate |

High |

5 |

5 |

|

National Blood Authority |

Non-corporate |

Low |

0 |

3 |

|

National Health and Medical Research Council |

Non-corporate |

Low |

0 |

2 |

|

Australian Hearing Services (Hearing Australia) |

Corporate |

Low |

2 |

0 |

|

Non-material entities |

||||

|

Aged Care Quality and Safety Commission |

Non-corporate |

Low |

|

|

|

Australian Commission on Safety and Quality in Health Care |

Corporate |

Low |

||

|

Australian Digital Health Agency |

Corporate |

Moderate |

||

|

Australian Institute of Health and Welfare |

Corporate |

Low |

||

|

Australian National Preventive Health Agency |

Non-corporate |

Low |

||

|

Australian Radiation Protection and Nuclear Safety Agency |

Non-corporate |

Low |

||

|

Cancer Australia |

Non-corporate |

Low |

||

|

Food Standards Australia New Zealand |

Corporate |

Low |

||

|

Independent Health and Aged Care Pricing Authority |

Corporate |

Low |

||

|

National Health Funding Body |

Non-corporate |

Low |

||

|

NDIS Quality and Safeguards Commission |

Non-corporate |

Low |

||

|

Office of the Inspector-General of Aged Care |

Non-corporate |

Low |

||

|

Organ and Tissue Authority |

Non-corporate |

Low |

||

|

Professional Services Review |

Non-corporate |

Low |

||

Material entities

Department of Health, Disability and Ageing

The Department of Health, Disability and Ageing is responsible for achieving the Australian Government’s health and ageing policy priorities through evidence-based policy, program administration, research, regulatory activities, and partnerships with other government entities, consumers and stakeholders.

The Department of Health, Disability and Ageing’s budgeted personal benefits and subsidies for 2025–26 account for around 83 per cent of total budgeted expenses and 70 per cent of total liabilities. The total budgeted assets are $11.3 billion, 21 per cent attributable to receivables, as shown in Figure 4.

Figure 4: Department of Health, Disability and Ageing’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The Department of Health, Disability and Ageing has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as the: complexity of the environment in which the Department operates; the broad range and complex nature of the programs administered; and the high number of enterprise risks that impact the financial statements.

There are ten key risks for the Department of Health, Disability and Ageing’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- The payment of personal benefit health care entitlements are based on information provided by the payment recipients and may be significantly impacted by delays in recipients providing correct or updated information and/or provision of incorrect information resulting in invalid payments. (KAM – Accuracy of personal benefit health care entitlements)

- The calculation of payables and provisions for outstanding claims for medical services and pharmaceuticals and pharmaceutical services due to the uncertainty associated with claim experience and patterns. (KAM – Valuation of personal benefit provisions)

- The payment of aged care subsidies are calculated by multiple, complex information technology systems and are underpinned by complex regulatory requirements. (KAM – Accuracy of aged care subsidies)

- The governance of legal and other matters having implications on the financial statements. Weaknesses in the governance relating to the assessment and reporting of legal matters increases the risk that the financial statements are materially misstated and/or payments made or receipts collected on behalf of the government are not supported by legislative authority.

- The management of grant payments due to diversity of the grant programs administered by the department with differing eligibility and reporting requirements.

- The estimation of subsidy provisions and payables due to the significant professional judgement applied in the selection and application of key assumptions related to the nature of claims, claim patterns and experience.

- Accounting for transactions related to the National Medical Stockpile due to the nature, size and complexity of the inventory transactions and the judgement applied in determining impairment losses.

- The complexity of pharmaceutical benefit scheme drug recoveries due to the diversity of the risk sharing arrangements entered into with pharmaceutical companies. The risk sharing arrangements differ in respect to the entitlements for recovery and the calculation of the amount recoverable.

- Accounting for revenue from the Therapeutic Goods Administration activities due to the judgement involved in relation to revenue recognition due to timing issues.

- Addressing the risk of management override of controls.

National Blood Authority

The National Blood Authority is responsible for securing the supply of safe and affordable blood products, including through national supply arrangements and coordination of best practice standards within agreed funding policies under the national blood arrangements.

The National Blood Authority’s total budgeted assets for 2025–26 $660.9 million, with 22 per cent of these attributable to inventories, as shown in Figure 5.

Figure 5: National Blood Authority’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for the National Blood Authority’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The significant judgements and assumptions involved in the valuation of blood and blood products, which are reported as assets.

- The accuracy of the reported expenses for the supply of blood and blood products and services, under the National Blood Agreement.

- The management of the National Blood Authority’s special account, the National Blood Account.

National Health and Medical Research Council

The National Health and Medical Research Council is the Australian Government’s key entity for managing investment in, and integrity of, health and medical research. The National Health and Medical Research Council is also responsible for developing health advice for the Australian community, health professionals and governments, and for providing advice on ethical practice in health care and in the conduct of health and medical research.

The National Health and Medical Research Council’s total budgeted expenses for 2025–26 are $1.1 billion, with 94 per cent of these expenses attributable to grants, as shown in Figure 6. Budgeted intangible assets are $16.5 million, accounting for around five per cent of total budgeted assets.

Figure 6: National Health and Medical Research Council’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the National Health and Medical Research Council’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The management of, and accounting for, a range of grant payments, which constitute a significant expense reported in the National Health and Medical Research Council’s financial statements and are susceptible to fraud.

- The judgements and assumptions involved in the assessing the impairment of internally generated intangible assets relating to the National Health and Medical Research Council’s new grants management system.

Australian Hearing Services

Australian Hearing Services (Hearing Australia) is a corporate Commonwealth entity established under the Australian Hearing Services Act 1991. Hearing Australia is responsible for the provision of research and hearing services through a network of 189 hearing centres and community visits. Services provided include subsidised hearing services to eligible clients under the Australian Government’s Hearing Services Program.

Hearing Australia’s total actual revenue for 2023–24 was $257.6 million, with 91 per cent attributable to revenue from contracts with customers, as shown in Figure 5.

Figure 7: Australian Hearing Services’ actual financial statements by category ($’000)

Source: ANAO analysis of Australian Hearing Services 2023–24 annual report.

The key risks for Hearing Australia 2024–25 financial statements that the ANAO has highlighted for specific audit coverage are:

- The revenue recognition from contracts with customers due to complexity and significant judgement applied by management in determining these balances.

- Completeness and accuracy of transactional data within the recently implemented financial management system, Microsoft Dynamics.