Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Home Affairs portfolio comprises a range of national security and national resilience functions including: managing Australia’s migration program; cyber security policy and protection of critical infrastructure; countering terrorism and foreign interference; law enforcement policy and operations; emergency management and disaster preparedness, response and recovery; border protection and the facilitation of legitimate trade and travel.

The Department of Home Affairs is the lead entity in the portfolio and is responsible for central coordination, strategy and policy in relation to: cyber and critical infrastructure resilience and security; immigration, border security and management; and counter-terrorism. It also deals with the management and delivery of the migration, humanitarian and refugee programs, along with multicultural programs, citizenship and settlement services. The department includes the Australian Border Force, which is responsible for border, investigatory, compliance, detention (facilities and centres) and enforcement functions, as well as Australia’s customs functions. Considering the portfolio’s focus on national security, maintaining a high-integrity culture, including compliance, is critical. Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025 which impacts areas of responsibility in the Home Affairs portfolio.

In addition to the Department of Home Affairs, there are six portfolio entities that are responsible for delivering programs and initiatives in relation to crime, national security and national resilience. The portfolio’s material entities are the Department of Home Affairs, the Australian Federal Police and the Australian Security Intelligence Organisation.

In the 2025–26 Portfolio Budget Statements (PBS) for the Home Affairs portfolio, the aggregated budgeted expenses for 2025–26 total $10.4 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

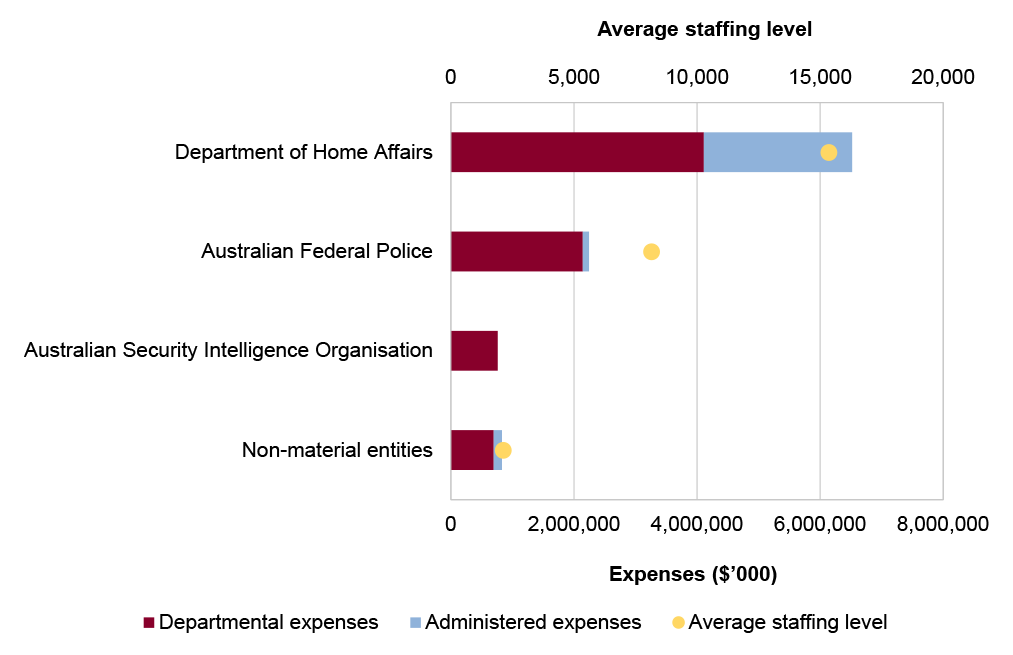

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Home Affairs represents the largest proportion of the portfolio’s expenses, and departmental expenses of the portfolio are the most material component, representing 74 per cent of the entire portfolio’s expenses.

Figure 1: Home Affairs portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Note a: The Australian Security Intelligence Organisation staffing levels are not for publication.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Department of Home Affairs that was endorsed by the Australian Public Service Commissioner in May 2024.

The primary risk identified by the ANAO for the portfolio relates to the conduct of procurements and management of the resulting contracts.

Other risks in the Home Affairs portfolio relate to governance, service delivery, grants administration, procurement, regulation and policy stewardship and financial management.

Governance

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Service delivery

The portfolio has important service delivery responsibilities including in relation to facilitating the flow of travellers through the international border, migration, policing services to the Australian Capital Territory through the Australian Federal Police and emergency management and disaster response. Audits of service delivery, including in the Home Affairs portfolio, highlight the importance of implementing plans in order to deliver consistent and timely performance. The importance of an appropriate emphasis on resource and workforce planning has also been evident in audits of the crewing of patrol boats and intelligence collection, assessment and advice.

Grants administration

The portfolio is responsible for significant grant programs, with more than $1 billion in grant agreements being managed as at March 2025 that had been awarded by the National Emergency Management Agency and the Department of Home Affairs. Grant programs may be delivered through grant hub arrangements, an approach that does not diminish the program owning entity’s responsibility for program design and delivery including the standard of application assessments. It is also important that decision making on the award of grant funding be informed by appropriate advice.

Procurement

Substantial procurement and contract management activity takes place across the portfolio, with the Department of Home Affairs responsible for a significant proportion of the amount contracted by the Australian Government. Across the portfolio, more than 2500 contracts valued at $23.8 billion were reported on AusTender as being in place as at March 2025. Audits have identified shortcomings in the conduct of procurement processes and the management of the resulting contracts.

Regulation and policy stewardship

The department is responsible for critical infrastructure policy, regulatory and strategy functions. Its regulatory responsibilities also include: the Protective Security Policy Framework;the registration of migration agents; and regulating certain business activities in the financial, bullion and gambling sectors that have been identified as posing a risk for money laundering and terrorism financing. Audit work has identified that the department’s administration and regulation of migration agents was not effective, with appropriate arrangements not in place to support the regulation of migration agents, an absence of regulatory action to monitor the activities of registered agents and complaints not actioned in a timely and effective manner. As stewards, Home Affairs portfolio entities should have an approach to measuring the effectiveness of these frameworks and whether the frameworks remain fit-for-purpose and are achieving the policy intent.

Financial management

The Department of Home Affairs is the largest collector of revenue for the Australian Government after the Australian Taxation Office. Its large and widely distributed information and communications technology environment to support revenue collection activities means there are associated risks in achieving completeness and accuracy of activities such as customs duty and visa fees.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Home Affairs portfolio were included in tabled ANAO performance audits 27 times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- 18 were qualified (largely positive);

- five were qualified (partly positive); and

- four were adverse.

Figure 2 shows the number of audit conclusions for entities within the Home Affairs portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Home Affairs portfolio compared with all audits tabled

Source: ANAO data

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Home Affairs portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Home Affairs portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024-25 Department of Home Affairs’ annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

The Department of Home Affairs is in its second year of inclusion in the annual performance statements audit program.

The ANAO considers the risk associated with the Department of Home Affairs’ performance statements audit as high. This is due to the complex operating environment and risks associated with measuring performance across the scale and breadth of functions administered by the department and the complex IT environment with ageing and bespoke systems. There are six significant and three moderate unresolved findings from the 2023–24 performance statements audit.

Key risks for Home Affairs’ performance statements that the ANAO has highlighted include:

- the maturity of data governance and management to provide appropriate assurance over data flows and the completeness and accuracy of performance results

- the appropriateness of individual performance measures and targets and the reliability and verifiability of data sources and methodologies for a number of performance measures

- the completeness and balance of performance measures which include improving the quality of targets to reflect the maturity of the policy or program being measured, the full scope of the policy or program and accurately reflecting the department’s role

- the maturity of the performance statements preparation process to provide timely and complete audit evidence and improve the readability of the performance statements.

Financial statements audits

Overview

Entities within the Home Affairs portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Home Affairs portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Home Affairs |

Non-corporate |

High |

1 |

3 |

|

Australian Federal Police |

Non-corporate |

Moderate |

1 |

0 |

|

Australian Security Intelligence Organisation |

Non-corporate |

Moderate |

0 |

2 |

|

Non-material entities |

||||

|

Australian Crime Commission (Australian Criminal Intelligence Commission) |

Non-corporate |

Low |

|

|

|

Australian Institute of Criminology |

Non-corporate |

Low |

||

|

Australian Transaction Reports and Analysis Centre (AUSTRAC) |

Non-corporate |

Low |

||

|

National Emergency Management Agency |

Non-corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

ACT Community Policing statement of financial performance |

||||

|

ACT Community Policing statement of performance |

||||

Material entities

Department of Home Affairs

The Department of Home Affairs coordinates policy and operations for Australia’s national and transport security, cyber security, immigration, border security, multicultural affairs, counter-terrorism and customs-related functions.

The Department of Home Affairs total budgeted revenues for 2025–26 are $21.4 billion, with customs duty and other taxes accounting for 53 per cent and 28 per cent, respectively, as shown in Figure 4. Supplier expenses represent 56 per cent of total budgeted expenses, and buildings and property, plant and equipment account for 50 per cent and 21 per cent, respectively, of total budgeted assets.

Figure 4: Department of Home Affairs’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The Department of Home Affairs has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as the: high value of customs revenue; geographically dispersed operations; and level of reliance on IT systems in managing programs and collecting revenue. In addition the Department manages a number of high value contracts, including detention centres and regional processing centres which requires management of people and goods across Australia’s borders.

There are four key risks for the Department of Home Affairs 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- The accuracy of customs duty collections and refunds, due to the self-assessment regime and complexity of the related information technology (IT) systems, processes and inputs. (KAM – Accuracy of customs duty)

- The accuracy of visa revenue, which is collected through numerous domestic and international locations, by both departmental staff and third parties under service level agreements using various IT systems. (KAM – Accuracy of visa application charges)

- The accuracy and valuation of non-financial assets which is a significant balance, geographically dispersed around Australia and internationally across several different asset classes. This diversity of asset classes, including specialised asset such as vessels which are subject to judgement and estimation (KAM – Accuracy, valuation and allocation of non-financial assets)

- The management of the onshore and offshore detention network and processing centres. Third-party providers are engaged for health services and centre management under a variety of complex service delivery contract arrangements to undertake services on behalf of the department.

Australian Federal Police

The Australian Federal Police is responsible for the provision of police services in relation to laws of the Commonwealth, the provision of policing services to the Australian Capital Territory and external territories, combatting transnational serious organised crime and terrorism, disrupting crime offshore, supporting regional security, and protecting Australian interests and assets.

The Australian Federal Police’s total budgeted expenses for 2025–26 are $2.2 billion, with 53 per cent of these expenses attributable to employee benefits, as shown in Figure 5.

Figure 5: Australian Federal Police budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The key risk for the Australian Federal Police’s 2023–24 financial statements that the ANAO has highlighted for specific audit coverage is the recognition and measurement of payroll expenses including underpayment of superannuation obligations.

Australian Security Intelligence Organisation

The Australian Security Intelligence Organisation (ASIO) is responsible for protecting Australia, its people and its interests from threats to security through intelligence collection, assessment and advice to the government.

ASIO’s total budgeted expenses for 2025–26 are $759.5 million, as shown in Figure 6. Included in this amount is employee expenses, among other expenses. Non-financial assets are just over $917.3 million, representing 81 per cent of total budgeted assets.

Figure 6: Australian Security Intelligence Organisation’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the Australian Security Intelligence Organisation’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The accuracy and completeness of employee expenses and provisions due to reliance on manual calculations because of limitations in the current payroll system.

- The accuracy and valuation of non-financial assets which is a significant balance.