Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The objective of this audit was to assess the effectiveness of Finance’s administration of travel entitlements provided to Parliamentarians.

Please direct enquiries relating to reports through our contact page.

The Auditor-General responded on 6 February 2025 to correspondence from Dr Anne Webster MP dated 17 January 2025, requesting that the Auditor-General conduct an investigation to examine whether the Australian Government's Housing Support Program granted funds in accordance with stated criteria.

Please direct enquiries through our contact page.

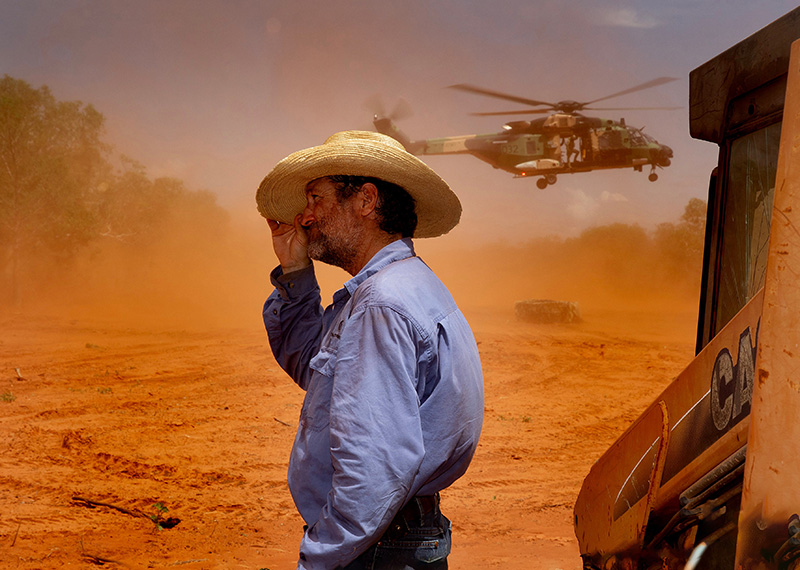

The Commonwealth has significant involvement in national emergency management arrangements through its roles in planning, coordination between agencies, operational response, financial support, education and training, public awareness and research activities. The objectives of this performance audit were to identify the Commonwealth's current emergency management arrangements; to provide assurance to Parliament concerning the adequacy of the arrangements; and to highlight areas for improvement.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending 30 June 2016. It addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 and the Auditor-General Act 1997, the performance measures set out in the outcome and programs framework in the ANAO’s 2015–16 Portfolio Budget Statements and the ANAO’s 2015–19 Corporate Plan and annual reporting requirements set out in other legislation.

Please direct enquiries relating to annual reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Human Services' (DHS) administration of the shopfront co-location of DHS services.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness of the evaluation of selected Australian Government pilot programs.

Please direct enquiries through our contact page.

The objective of the audit was to assess how effectively and efficiently the Australian Taxation Office managed contact centres as part of its overall service delivery.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether the Attorney-General’s Department’s conduct of the procurements relating to two of the new child sexual abuse-related national services employed open and effective competition and achieved value for money, consistent with the Commonwealth Procurement Rules (CPRs).

Please direct enquiries through our contact page.

The audit objective was to examine whether the selected entities have implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of the Environment’s regulation of proponents’ compliance with Part 9 of the Environment Protection and Biodiversity Conservation Act 1999.

Please direct enquiries relating to reports through our contact page.

This is the first of two audit reports concerning the Tax Office's administration of SMSFs pursuant to the provisions of the Superannuation Industry (Supervision) Act 1993.

This audit report examines the efficiency and effectiveness of the Tax Office's approach to regulating and registering self managed superannuation funds. Specifically the ANAO examined the:

- Environment in which SMSFs operate, including the Tax Office's regulatory roles and responsibilities;

- Tax Office's governance of its SMSF regulatory role; and

- Systems, processes and controls the Tax Office uses to register SMSFs, and enforce the lodgement of fund income tax and regulatory returns.

The ANAO regards integrity as a core value of the organisation — critical in sustaining the confidence of Parliament, strengthening public trust in government and delivering quality audit products. Maintaining strong institutional integrity is critical to the operations and reputation of the ANAO.

The ANAO Integrity Framework provides an overarching structure to the integrity control system, supporting our institution’s integrity. The framework serves to assist in ethical decision making and risk, fraud and misconduct management.

Beyond its control system, the ANAO maintains an enduring focus on promoting integrity as a value that is embedded in our work and culture. The ANAO recognises that integrity demands quality not only in our products but also in the behaviours of our people.

The ANAO Integrity Advisor supports the effective and ongoing application of the Integrity Framework by providing advice to staff regarding integrity matters. The Integrity Advisor is responsible for increasing integrity awareness across the organisation and for reporting annually to the ANAO Executive Board of Management on actions taken under the Framework. The Auditor-General has published the ANAO Integrity Framework and Report for 2022–23 to provide increased transparency of the measures we undertake to maintain a high-integrity culture in the ANAO.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the administration of grants for the Try, Test and Learn Fund transition projects.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Human Services' administration of the Financial Information Service.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine the effectiveness of the design and implementation of the Department of the Prime Minister and Cabinet’s (PM&C’s) evaluation framework for the Indigenous Advancement Strategy (IAS), in achieving its purpose to ensure that evaluation is high quality, ethical, inclusive and focused on improving outcomes for Indigenous Australians.

Please direct enquiries through our contact page.

The audit examined whether the Department of Home Affairs implemented all agreed recommendations from parliamentary committee and Auditor-General reports within the scoped timeframe.

Please direct enquiries through our contact page.

The objective of this audit was to assess whether the National Disability Insurance Agency (NDIA) is effectively managing the use of corporate credit cards for official purposes in accordance with legislative and entity requirements.

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2010. It includes a foreword by the Auditor-General, an overview including the role and responsibilities and vision of the Office, a report on performance, details about management and accountability, and the financial results.

The Performance Audit Services Group (PASG) volume of the ANAO Audit Manual applies to the performance audit activity performed by PASG in collaboration with the Systems Assurance and Data Analytics (SADA) group. Relevant policies and guidance from the PASG volume are also applied to assurance reviews performed by PASG. Policies and guidance in the PASG volume address the planning, execution and reporting stages of the performance audit process.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance of the Northern Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976, the Native Title Act 1993 and the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether Services Australia had effectively managed risks related to the rapid preparation for and delivery of COVID-19 economic response measures.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness to date of the Department of Defence’s implementation of its Pathway to Change — Evolving Defence Culture 2017–2022 cultural reform strategy.

Please direct enquiries through our contact page.

The objective of the audit was to assess the establishment of the National Offshore Petroleum Safety and Environmental Management Authority and the effectiveness of its regulatory function.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of annual Certificate of Compliance processes for FMA Act agencies. To form a conclusion against the audit objective, the audit considered: Finance’s administration of the Certificate process at a whole-of-government level; selected agencies’ annual Certificate processes; and, the design and impact of the Certificate.

The objective of this performance audit was to assess whether DIMIA's information systems and business processes are effective in supporting APP to meet its border security and streamlined clearance objectives. In particular, the audit focused on the following: Mandatory APP - Stage 1 (MAPP1) project management; MAPP1 IT development and system performance; APP performance reporting; contract management; and financial management.

The objective of the follow-up audit was to assess how well the ATO has implemented the recommendations of Audit Report No.3 of 2001-2002, The Australian Taxation Ofiice's Administration of Taxation Rulings. As part of the audit we also considered the ATO's progress in addressing the JCPAA's suggestions resulting from its review of Report No.3 of 2001-2002.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presentation to Macquarie University

The objectives of this audit were to:

- assess the current status of BCM and EM arrangements in Centrelink and identify opportunities for improvement; and

- review Centrelink's response to the recommendations.

The primary objective of the audit was to assess whether the Department of Communications, Information Technology and the Arts (DCITA) and the Department of Transport and Regional Services (DOTARS) were administering a number of grant programs that are designed to enhance telecommunications infrastructure and services in regional, rural and remote areas of Australia according to better practice. The audit was also aimed at determining whether DCITA had implemented the recommendations of an earlier audit of Networking the Nation.

The objective of the performance audit was to review the progress in the delivery of contractual commitments for Industry Development (ID) for the five contracts awarded under the IT Outsourcing Initiative. In particular, the audit examined the effectiveness of the monitoring by DCITA of achievement against contractual commitments for ID; assessed the impact of changes to the IT outsourcing environment on the management and monitoring of ongoing ID obligations; and identified practices that have improved administrative arrangements.

The objective of this follow-up audit was to assess Austrade's implementation of the recommendations contained in ANAO Report No. 4 of 1998-99 (Client Service Initiatives - Australian Trade Commission (Austrade)), and whether the implementation of the recommendations or appropriate alternative measures has improved the management and delivery of Austrade's client service.

The audit is a follow-up to Audit Report 12, 1995-96 Risk Management by Commonwealth Consumer Product Safety Regulators. The objectives of this follow-up audit were to determine the extent to which ANZFA had implemented the agreed recommendations contained in the 1995 Audit Report, and to determine the effectiveness of the implemented recommendations in improving food safety regulation.

The audit addressed administration of migrant settlement services by DIMA, in particular:

- strategic management, including corporate planning, performance measurement and reporting arrangements; and

- operational management of some of the individual schemes operated by DIMA (the Adult English Migrant Program and Translating Interpreting Services were not covered as part of this audit).

The sale raised gross proceeds of $95.4 million, which was at the upper end of the Business Advisor's estimate for the mid-1997 sale. In addition, it should be noted that the principal financial effect for the Commonwealth was not in the proceeds of the sale but in the termination of ongoing revenue supplements and financial losses. The Commonwealth's direct costs of selling the businesses are estimated to be $9.3 million, or 9.7% of gross proceeds. In addition, the Australian National's financial liabilities totalling $1393 million have been or are being repaid or assumed by the Commonwealth.

The audit surveyed a wide range of Commonwealth agencies' Year 2000 preparedness, their management of the problem and their application of core corporate governance principles, including risk management disciplines. The scope of the audit reflected the wide ranging ramifications of the Year 2000 problem for agencies' overall functions (whole-of-business) internally as well as in terms of external interactions. The audit objectives were to:

- assess the adequacy of agencies' planning in relation to achieving Year 2000 compliance;

- review and assess agencies' implementation, management and monitoring of Year 2000 compliance strategies;

- review agencies' strategic risk assessments in relation to the Year 2000 changeover; and

- raise surveyed agencies' and other Commonwealth agencies' awareness of the various aspects of the Year 2000 problem.

The objective of the audit was to determine the extent to which the new Commonwealth services delivery arrangements were implemented efficiently and effectively. The audit focussed on the establishment of Centrelink to deliver services on behalf of purchaser departments and the development of associated purchaser/provider arrangements.

The objectives for the audit were to examine Commonwealth guarantees, indemnities and letters of comfort in relation to:

- the potential size of the Commonwealth's exposure to these instruments;

- the extent to which the overall exposures of the Commonwealth are managed and monitored;

- the adequacy of administrative reporting arrangements;

- areas of better administrative practice relating to their management; and

- to raise agencies' awareness of appropriate risk management and accountability practices in relation to these instruments.

The audit set out to quantify the Commonwealth's exposure to guarantees, indemnities and letters of comfort.

The audit sought to assess how well the Australian Taxation Office (ATO) manages aggressive tax planning. We did this by exploring the nature of aggressive tax planning and the ATO's approach to its management. In the latter context, we looked at:

- the ATO's previous experience with aggressive tax planning and action on previous significant external reviews, particularly dealing with mass marketed investment schemes;

- strategy and operations, intelligence gathering and use; and the identification and management of promoters given their significant role in aggressive tax planning.

The audit objective was to examine the effectiveness to date of the Department of Defence’s administration of the Enterprise Resource Planning (ERP) program, with a focus on ERP Tranche 1 activities.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the implementation of procurement reforms by the DTA and Finance following on from Auditor-General Report No.5 2022–23 Digital Transformation Agency’s Procurement of ICT-related services.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office's activities in addressing Superannuation Guarantee non-compliance.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the management of conflicts of interest by Aboriginal Hostels Limited (AHL), Aboriginal Investment NT and Outback Stores.

Please direct enquiries through our contact page.

Quality in the delivery of the ANAO’s audit services is critical in supporting the integrity of our audit reports and maintaining the confidence of the Parliament and public sector entities. The ANAO Corporate Plan is the ANAO’s primary planning document. It outlines our purpose; the dynamic environment in which we operate; our commitment to building capability; and the priorities, activities and performance measures by which we will be held to account. The ANAO Quality Management Framework and Plan complements the Corporate Plan. It describes the ANAO’s system of quality management and reflects the ANAO’s responses to identified quality risks.

The ANAO Quality Management Framework is the ANAO’s established system of quality management to provide the Auditor-General with reasonable assurance that the ANAO complies with the ANAO Auditing Standards and applicable legal and regulatory requirements, and reports issued by the ANAO are appropriate in the circumstances.

This Audit Quality Report sets out the Auditor-General’s evaluation on the implementation and operating effectiveness of the ANAO Quality Management Framework. The report:

- provides transparency in respect of the processes, policies, and procedures that support each element of the ANAO Quality Management Framework;

- outlines ANAO performance against benchmarks on audit quality indicators; and

- outlines the ANAO’s performance against the quality assurance strategy and deliverables set out in the Quality Management Framework and Plan 2024-25.

Please direct enquiries through our contact page.

The overall objective of the audit was to assess whether the RSS Programme is effective and efficient in providing assurance on the levels of payment error and the resultant risks to the integrity of Australian Government outlays for payments administered by Centrelink. Specifically, the audit assessed whether: the RSS Programme meets the objectives outlined for it in the Portfolio Budget Statements under which funding was provided; there is an adequate methodology underpinning the RSS reviews; the RSS reviews are conducted effectively and efficiently, and adequate quality assurance mechanisms exist to assure the results obtained from the RSS reviews; and reporting by the agencies of the results of the RSS Programme is adequate and takes into consideration the issues identified in Audit Report No. 44 2002–03 Review of the Parenting Payment Single Program, and Audit Report No. 17 2002–03 Age Pension Entitlements.

The objective of this report was to provide the Auditor-General’s independent assurance over the status of the selected major projects. The status of the selected major projects is reported in the Statement by the Secretary of Defence and the Project Data Summary Sheets (PDSSs) prepared by Defence. Assurance from the ANAO’s review is conveyed in the Independent Assurance Report by the Auditor-General.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of the Department of Defence's planning and administrative arrangements to support the provision of emergency Defence Assistance to the Civil Community (DACC).

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Parliamentary Services’ management of assets and contracts to support the operations of Parliament House.

Please direct enquiries relating to reports through our contact page.

The Auditor-General undertook a limited assurance review of the Department of Agriculture and Water Resources’ assessment of the performance of New South Wales under the National Partnership Agreement on Implementing Water Reform in the Murray-Darling Basin relevant to the protection and use of environmental water for the 2014–15 and 2015–16 financial years.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the Department of Defence’s arrangements to manage the security authorisation of its ICT systems.

Please direct enquiries through our contact page.

The objective of this audit was to the examine action taken by the ATO to improve TFN integrity, particularly through the implementation of the recommendations made in:Report No.37, taking into account any changed circumstances, or new administrative issues, affecting the implementation of those recommendations; and Numbers on the Run, taking into account that the Government has not formally responded to the report at this time.The audit also aimed to identify further opportunities for the ATO to improve the effectiveness and efficiency of the TFN system. The report of this audit is necessarily detailed as it considers each of the recommendations and the extent to which they have been implemented.

The Commonwealth has significant foreign exchange risk exposures including $A8.4 billion of foreign currency transactions with the Reserve Bank of Australia in 1998-99. Under the Financial Management and Accountability Act and its associated Regulations, all agencies are required to assess and, where possible, manage, foreign exchange risk. The audit reviewed four agencies that have substantial foreign currency payment exposures namely:

- the Department of Defence;

- the Australian Agency for International Development;

- the Department of Foreign Affairs and Trade; and

- the Department of Finance and Administration.

The objective of the audit was to identify and assess the efficiency and cost effectiveness of the management of foreign exchange risk across the selected agencies, also to identify opportunities to improve the management of foreign exchange risk, including any associated potential financial savings that could accrue to the Commonwealth.

The objective of the audit was to determine the extent to which the new employment services market had been implemented effectively and efficiently in accordance with announced Government policy and timeframe.

The audit reviewed the application by the Department of Finance and the portfolio departments of the 1993 Accountability and Ministerial Oversight Arrangements for Government Business Enterprises and any statutory monitoring and reporting requirements applying to the selected GBEs provided under their own establishing legislation. The objectives of the audit were to examine:

- the effectiveness of the GBE monitoring arrangements in providing appropriate performance information to the Government;

- the extent to which agencies and the selected GBEs comply with the monitoring arrangements and legislative requirements; and

- whether the GBE monitoring system provides an effective level of accountability to Ministers and to the Parliament.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the FINEST User Network Annual Conference 1996, Leura, NSW

Mr Ian McPhee - Auditor-General for Australia, presented at the 20th Commonwealth Auditors-General Conference

The objective of the audit was to assess whether the Australian Taxation Office has effective arrangements in place to support the adoption of Artificial Intelligence.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the administration of the Australian Prudential Regulation Authority (APRA) financial industry levies.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the extent to which the Department of the Treasury and the Australian Taxation Office (ATO) have improved the management of tax expenditure estimates by implementing the six recommendations in the 2008 ANAO audit and the three recommendations made by the Joint Committee of Public Accounts and Audit (JCPAA) following its inquiry.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of OPO's management of the overseas owned estate. In particular, the audit examined whether:

- sound arrangements are in place to effectively plan and oversight the management of the overseas estate;

- OPO effectively manages owned property on a day-to-day basis;

- the condition of the overseas owned estate is adequately maintained by structured and systematic repair and maintenance arrangements; and

- OPO has appropriate information to facilitate the effective management of the owned estate, and appropriately consults with stakeholders.

The audit reviewed the Australian Taxation Office's fraud prevention and contol arrangements in relation to the Goods and Services Tax. The audit objective was to assess whether the ATO has implemented administratively effective GST fraud control arrangements, consistent with the Commonwealth Fraud Control Guidelines.