Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Finance portfolio is responsible for a range of finance-related functions, including providing the Australian Government with budget policy advice, superannuation arrangements for government employees, deregulation policy, data and digital policy and services, insurance and risk management services, ministerial and parliamentary services and Australian Government asset management services.

The Department of Finance is the lead entity in the portfolio and is responsible for supporting the government’s budget process and the development and implementation of the government’s regulatory frameworks for public sector resource management, governance and accountability. The department is also responsible for the preparation of the consolidated financial statements of the Australian Government, which includes the whole-of-government and the general government sector financial statements and the Australian Government’s financial outcome. The department provides shared services through the Service Delivery Office. Further information is available from the department’s website.

On 26 June 2025, amendments were made to Administrative Arrangement Order (AAO) dated 13 May 2025, impacting areas of responsibility in the Finance portfolio. On 1 July 2025, the responsibilities for Services Australia moved from the Social Services portfolio to the Finance portfolio. Audit considerations for the portfolio entity Services Australia are discussed separately in the Services Australia overview. Services Australia budgeted amounts are not included in the Finance Portfolio Budget Statements (PBS).

In addition to the Department of Finance and Services Australia, there are ten entities (excluding subsidiaries) within the portfolio that are responsible for: electoral administration; digital transformation; supporting retirement and insurance benefits for members of Commonwealth superannuation schemes; managing the investment activities of the Future Fund and other funds; auditing and reporting of parliamentarians’ work expenses; supporting people affected by serious incidents or misconduct in the parliamentary workplace; and supporting Australia’s naval defence capability.

In the 2025–26 PBS for the Finance portfolio, the aggregated budgeted expenses for 2025–26 total $14.9 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

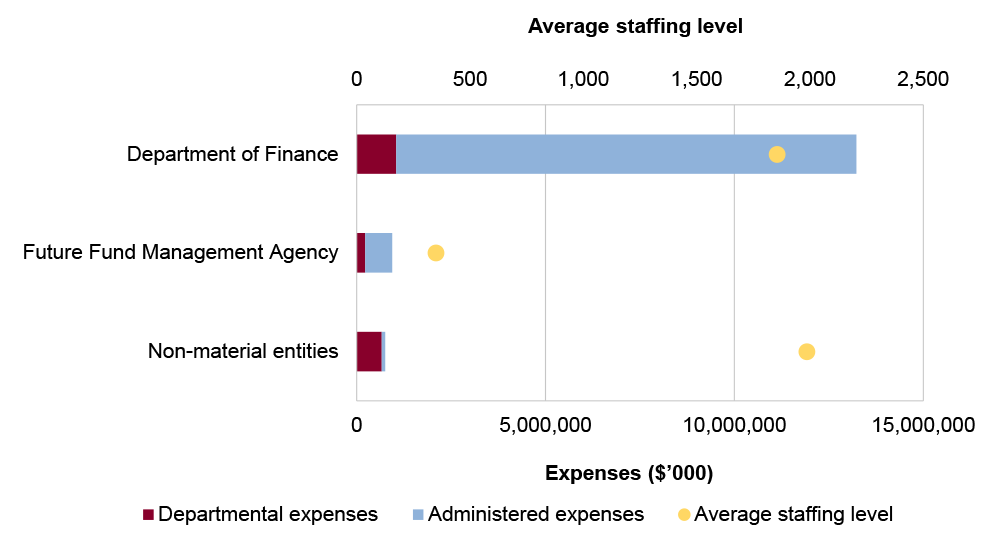

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Finance represents the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 87 per cent of the entire portfolio’s expenses.

Figure 1: Finance portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 annual audit work program (AAWP), the Australian National Audit Office (ANAO) considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified for the portfolio relate to stewardship of whole-of-government frameworks to achieve intended outcomes. In particular this relates to the effective administration of the finance law in the context of devolved arrangements, particularly the stewardship of policy frameworks intended to promote the efficient, effective, economical and ethical use of public resources by entities. Similarly, the portfolio has responsibility for frameworks relating to expenditure on digital and ICT investments within the sector and the use of new and emerging technologies within the public sector. The delivery of the National Security Office Precinct is also a risk for the portfolio.

Specific risks in the Finance portfolio relate to governance, service delivery, policy development and stewardship and financing government policies.

Governance

Implementation of the sustainability reporting framework and assurance regime in Australia is progressing. Climate-related disclosures under the Corporations Act 2001 apply to certain entities. ASC Pty Ltd is required to prepare a sustainability report under these arrangements commencing in the 2025–26 financial year. The sustainability report will require these entities to disclose information about climate-related risks and opportunities that could reasonably be expected to affect cash flows, access to finance or cost of capital. Sustainability reports will be subject to assurance and entities should review their preparedness to meet these requirements in order to support accurate and timely reporting and audit.

Legal governance is an important risk area in the Finance portfolio in view of the complex social services legislation administered by the Department, with the support of Services Australia, for payment and compliance processes over personal benefits. Systems to facilitate the early identification and reporting of potentially significant legal risks across the portfolio are essential for the effective management of legal governance, accounting and external reporting processes.

Service delivery

Entities in the Finance portfolio are responsible for the delivery of effective public sector services, including electoral services and ministerial and parliamentary services. Ongoing considerations for effective service delivery include establishing appropriate governance arrangements, addressing risks, providing accurate and consistent advice, implementing processes in accordance with applicable procedures, and establishing fit-for-purpose assurance and evaluation frameworks.

The Department of Finance (Finance) is responsible for the delivery of major non-defence property for Commonwealth agencies. This includes the administration of procurement for the construction and development of the National Security Office Precinct in the ACT. The precinct is expected to accommodate up to 5,000 workers. On 12 February 2025, the Stage 1: John Gorton Campus Car Park opened.

Policy development and stewardship

As a central agency, Finance contributes to the review, development and implementation of Australian Government policies, including the delivery of the APS Net Zero Emissions by 2030 and the Data and Digital Government Strategy. Stewardship of these policies is critical to ensure they are fit-for-purpose. Previous audit activity has identified the importance of ensuring that policy development and advice is supported by appropriate evidence and analysis, whole-of-government co-ordination, and considers the views of stakeholders.

Entities in the Finance portfolio are the policy owners and stewards of whole-of-government frameworks, including the finance law and frameworks for procurement, grants administration, government advertising, risk management and digital policy. These frameworks are intended to: establish the governance, performance and accountability of Commonwealth entities; and promote the efficient, effective, economical and ethical use of public resources by the Commonwealth and Commonwealth entities. As stewards, Finance portfolio entities should have an approach to measuring the effectiveness of these frameworks and whether the frameworks remain fit-for-purpose and are achieving the policy intent.

As a framework policy owner and steward, Finance regularly receives recommendations as part of parliamentary committee inquiries and external audit activity. Recent audit activity has identified that central agencies can contribute to improved public sector performance by modelling the adoption of better practice in their own execution of functions under the frameworks they administer, and in so doing promote better practice across the sector.

Financing government policies

Under successive governments there has been a shift toward delivering more government policies using alternative financing arrangements, such as equity investments, concessional loans and guarantees, rather than direct payments. Transparency on the decision-making process that leads to the use of these alternative financing arrangements and the longer-term costs and risks of these types of arrangements remains an area that requires focus. Finance portfolio entities have a role in maximising financial outcomes for the Australian Government and the public and providing advice on financial management and appropriations. Effective decision-making, especially in relation to investments and the management of resources and assets, involves appropriate planning, calculation and analysis, execution, monitoring and evaluation. New investments for the Australian Government include acquisition of private entities and issuance of equity contributions and loans (e.g. CEA Technologies Pty Limited, Snowy Hydro Limited and Australian Naval Infrastructure).

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive; and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Finance portfolio were included in tabled ANAO performance audits 18 times. The conclusions directed toward entities within this portfolio were as follows:

- two were unqualified;

- seven were qualified (largely positive);

- five were qualified (partly positive); and

- six were adverse.

Figure 2 shows the number of audit conclusions for entities within the Finance portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Finance portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Finance portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Finance portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Finance (Finance) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audits are conducted under section 15 of the Auditor-General Act 1997.

The 2024–25 reporting period marks the first year in which Finance will be included in the annual performance statements audit program.

The ANAO considers the risk associated with Finance’s performance statements audit as moderate. Key risks for Finance’s performance statements that the ANAO has highlighted include:

- the effectiveness of the enterprise-wide performance framework through which the Department plans, monitors and reports its performance;

- the completeness of the department’s key activities, performance measures and targets;

- the appropriateness of the department’s performance measures and targets against the requirements of the PGPA Rule; and

- performance statements preparation processes.

Financial statements audits

Overview

Entities within the Finance portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Finance portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Finance |

Non-corporate |

Moderate |

3 |

2 |

|

ASC Pty Ltd |

Company |

Moderate |

1 |

1 |

|

Australian Naval Infrastructure Pty Ltd |

Company |

Moderate |

2 |

1 |

|

CEA Technologies Pty Ltd |

Company |

Moderate |

1 |

0 |

|

Future Fund Management Agency |

Non-corporate |

Moderate |

1 |

1 |

|

Non-material entities |

||||

|

Australian Electoral Commission |

Non-corporate |

Low |

||

|

Commonwealth Superannuation Corporation (CSC) |

Corporate |

Moderate |

||

|

Digital Transformation Agency |

Non-corporate |

Low |

||

|

Independent Parliamentary Expenses Authority |

Non-corporate |

Low |

||

|

ITC Technologies Pty Ltd |

Company |

Low |

||

|

Parliamentary Workplace Support Service |

Non-corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Administered Investment Funds |

||||

|

Advances to the Finance Minister |

||||

|

ASC Pty Ltd – agreed upon procedures – remuneration report |

||||

|

Australian Defence Force Superannuation Scheme |

||||

|

Australian Defence Force Superannuation Scheme – limited assurance report on Australian Prudential Regulation Authority (APRA) reporting forms and on controls and compliance |

||||

|

Australian Defence Force Superannuation Scheme – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

Australian Reward Investment Alliance Alternative Assets Trust |

||||

|

Australian Reward Investment Alliance Co. Pty Ltd |

||||

|

Australian Reward Investment Alliance Investment Trust |

||||

|

Australian Reward Investment Alliance Investment Trust – limited assurance report on APRA reporting forms and on controls and compliance |

||||

|

Australian Reward Investment Alliance Investment Trust – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

Australian Reward Investment Alliance Property Fund |

||||

|

Commonwealth Superannuation Corporation – Australian financial services licence compliance and registrable superannuation entity licence compliance |

||||

|

Commonwealth Superannuation Corporation Treasury Trust |

||||

|

Commonwealth Superannuation Scheme (CSS) |

||||

|

Commonwealth Superannuation Scheme – limited assurance report on APRA reporting forms and on controls and compliance |

||||

|

Commonwealth Superannuation Scheme – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

Future Fund Investment Company No. 1 Pty Ltd |

||||

|

Future Fund Investment Company No. 2 Pty Ltd |

||||

|

Future Fund Investment Company No. 3 Pty Ltd |

||||

|

Future Fund Investment Company No. 4 Pty Ltd |

||||

|

Future Fund Investment Company No. 5 Pty Ltd |

||||

|

Military Superannuation and Benefits Scheme |

||||

|

Military Superannuation and Benefits Scheme – limited assurance report on APRA reporting forms and on controls and compliance |

||||

|

Military Superannuation and Benefits Scheme – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

MRFF Investment Company No. 1 Pty Ltd |

||||

|

MRFF Investment Company No. 2 Pty Ltd |

||||

|

Property Management Trust |

||||

|

Public Sector Superannuation Scheme (PSS) |

||||

|

Public Sector Superannuation Scheme – limited assurance report on APRA reporting forms and on controls and compliance |

||||

|

Public Sector Superannuation Scheme – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

Public Sector Superannuation Scheme Accumulation Plan |

||||

|

Public Sector Superannuation Scheme Accumulation Plan – limited assurance report on APRA reporting forms and on controls and compliance |

||||

|

Public Sector Superannuation Scheme Accumulation Plan – reasonable assurance report on APRA reporting forms and on compliance |

||||

|

Public Sector Superannuation Scheme Investments Trust |

||||

|

Public Sector Superannuation Scheme Property Trust A |

||||

|

Public Sector Superannuation Scheme Property Trust B |

||||

Sourced from Public Governance, Performance and Accountability Act 2013 (Flipchart of PGPA Act) Commonwealth entities and companies (Department of Finance) as at 14 May 2025.

Material entities

Department of Finance

The Department of Finance is responsible for supporting the government’s budget process and oversight of public sector resource management, and for governance and accountability frameworks. In addition, the Department of Finance is responsible for the production of the Australian Government’s consolidated financial statements. The Department of Finance also provides shared services through the Service Delivery Office.

The Department of Finance’s total budgeted liabilities for 2025–26 are $177.6 billion, with superannuation liabilities representing 96 per cent, and outstanding insurance claims representing one per cent as shown in Figure 4. Investments represent 87 per cent of total budgeted assets, while employee benefits represent five per cent of total budgeted expenses.

Figure 4: Department of Finance’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are five key risks for the Department of Finance’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including four risks that the ANAO considers potential key audit matters (KAMs).

- The complex assumptions and calculations underpinning the actuarial assessment of the public sector superannuation liability. (KAM – Valuation of superannuation provisions)

- The estimation of the outstanding claims liability for the Australian Government’s self-managed general insurance fund, due to the complex calculation of the liability that involves assumptions requiring significant judgement. (KAM – Valuation of, and accounting for, outstanding insurance claims)

- The valuation of the property portfolio, which consists of a large number of properties with unique characteristics. The process is complex and involves the use of different valuation methods that require significant judgement on the selection of assumptions within the valuation models. (KAM – Valuation of properties)

- The valuation of private market investments, due to the inherent subjectivity and significant judgements and estimates required where market data is not available to determine the fair value of these investments. (KAM – Valuation of private market investments)

- The accuracy of employee expenses and valuation of provisions relating to members of Parliament and their staff.

ASC Pty Ltd

ASC Pty Ltd (ASC) is a proprietary company limited by shares registered under the Corporations Act 2001. The Minister for Finance is the sole shareholder Minister on behalf of the Commonwealth of Australia.

ASC and its subsidiaries – including ASC AWD Shipbuilder Pty Ltd and ASC OPV Shipbuilder Pty Ltd – support Australia’s naval capabilities. ASC was the builder of Australia’s fleet of Collins class submarines for the Royal Australian Navy. ASC is responsible for the ongoing design enhancement, maintenance, and support of Australia’s fleet of Collins class submarines.

On 22 March 2024, the government announced ASC Pty Ltd had been selected for the sustainment of nuclear-powered submarines as well as ASC Pty Ltd and BAE Systems to build Australia’s SSN-AUKUS submarines though an incorporated joint venture arrangement within Australia.

As part of the incorporated joint venture, ASC Pty Ltd and BAE Systems will be accountable and responsible for the delivery of SSN-AUKUS submarines, as well as ensuring safety, security, and regulatory compliance throughout the build program.

ASC’s total actual revenue for 2023–24 was $843.6 million, with the majority attributable to revenue from contracts with customers, as shown in Figure 5.

Figure 5: ASC Pty Ltd actual financial statements by category ($’000)

Source: ANAO analysis of ASC Pty Ltd’s 2023–24 Annual Report.

There are two risks for the ASC Pty Ltd 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- Revenue recognition for accounting of In-Service Support Contract (ISSC) is a high risk. This is primarily due to the magnitude of the revenue which is derived by a model which involves significant assumptions and data to estimate revenue.

- Revenue recognition for accounting for Sovereign Shipbuilding Talent Pool (SSTP), Life of Type Extension (LoTE), SSN Sustainment and the AUKUS Build Mobilisation programs are recognised as a moderate risk. This is primarily due to the magnitude of the programs, complexity of judgements and estimates used in estimating revenue.

Australian Naval Infrastructure Pty Ltd

Australian Naval Infrastructure Pty Ltd (ANI) is responsible for supporting the Commonwealth’s continuous naval shipbuilding program by being the owner, developer and manager of infrastructure and related facilities.

The infrastructure held by ANI at Osborne in South Australia is used by Luerssen Australia Pty Ltd for the construction of two offshore patrol vessels, ASC Shipbuilding Pty Ltd for the Hunter Class Frigate program, and ASC Pty Ltd (ASC) for maintenance of the Collins class submarines under contract arrangements with the Commonwealth, represented by the Department of Defence.

ANI is a proprietary company limited by shares registered under the Corporations Act 2001. The Commonwealth, represented jointly by the Minister for Finance and Minister for Defence as Shareholder Ministers, wholly own all of ANI’s share capital.

ANI’s total assets for 2023–24 were $1.8 billion, with 95 per cent attributable to property, plant and equipment, as shown in Figure 6. Total revenue is just under $93.9 million, with 53 per cent attributable to lease income.

Figure 6: Australian Naval Infrastructure Pty Ltd actual financial statements by category ($’000)

Source: ANAO analysis of the Australian Naval Infrastructure Pty Ltd’s 2023–24 Annual Report.

There are three key risks for ANI’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation of property, plant and equipment due to the value and complexity of assets held by ANI. This includes judgements undertaken by ANI to assess asset remaining useful lives.

- The recognition of capital works in progress due to the high level of activity in relation to the nuclear-powered submarine yard. Significant management oversight over capital work in progress is required to ensure assets are appropriately capitalised or impaired.

- The accounting for, and reporting of, ANI’s revenue from properties which includes a number of revenue streams, the volume and complexity of transactions, and the impact of the application of Australian accounting standard AASB 15 Revenue from Contracts with Customers on revenue recognition, measurement and disclosure.

CEA Technologies Pty Limited

CEA Technologies Pty Limited (CEA Technologies) is a non-wholly owned Australian Commonwealth company, limited by shares for the Public Governance, Performance and Accountability Act 2013 (PGPA Act) from 28 January 2025. CEA Technologies was prescribed as a Government Business Enterprise on 14 March 2025.

CEA Technologies designs, develops, manufactures and sustains advanced active electronically scanned array radar systems. The company’s technology is used by the Australian Defence Force and the United States Department of Defense.

There is one key risk for CEA Technologies’ 2024–25 financial report that the ANAO has highlighted for specific audit coverage.

- Revenue recognition across multiple types of commercial contracts with variable and complex requirements under AASB 15 Revenue from Contracts with Customers.

CEA Technologies’ 2024–25 financial report will be publicly available when finalised.

Future Fund Management Agency

The Future Fund Board of Guardians, supported by the Future Fund Management Agency (together the Future Fund), is responsible for investing the assets of the Future Fund under the Future Fund Act 2006, and other investment funds, managed on behalf of the Department of Finance. The investment of the funds is managed under the DisabilityCare Australia Fund Act 2013; the Medical Research Future Fund Act 2015; the Aboriginal and Torres Strait Islander Land and Sea Future Fund Act 2018; the Future Drought Fund Act 2019; the Disaster Ready Fund Act 2019; and the Housing Australia Future Fund Act 2023 as a means to provide financing sources for substantial future investments in the Australian economy.

The Future Fund’s total budgeted assets for 2025–26 are $265.3 billion with 99 per cent of these assets attributable to other investments, as shown in Figure 7.

Figure 7: Future Fund Management Agency’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the Future Fund 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including one risk that the ANAO considers to be a potential key audit matter (KAM).

- The valuation of private market investments, due to the inherent subjectivity and significant judgements and estimates required where market data is not available to determine the fair value of these investments. (KAM – Valuation of collective investment vehicles held at fair value through profit or loss)

- The valuation of public market investments undertaken by the custodian of the Future Fund, due to the size of the investments.