Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Industry, Science and Resources portfolio is responsible for contributing to a productive, resilient, and sustainable economy through science and technology. It does this by encouraging the development of innovative and competitive business, industries and regions, investing in science and technology and supporting the resources sector. The department also operates a Business Grants Hub, with further information available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025 which impacts areas of responsibility in the Industry, Science and Resources portfolio.

In addition to the Department of Industry, Science and Resources, there are seven entities within the portfolio (excluding subsidiaries), with responsibilities for nuclear medicine, geoscience, innovations in science and technology, Australia’s intellectual property rights system, offshore petroleum safety and environmental management, facilitating the achievement of Australia’s greenhouse gas emissions targets, and to provide increased flows of finance into priority areas of the Australian economy.

In the 2025–26 Portfolio Budget Statements (PBS) for the Industry, Science and Resources portfolio, the aggregated budgeted expenses for 2025–26 total $6.4 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

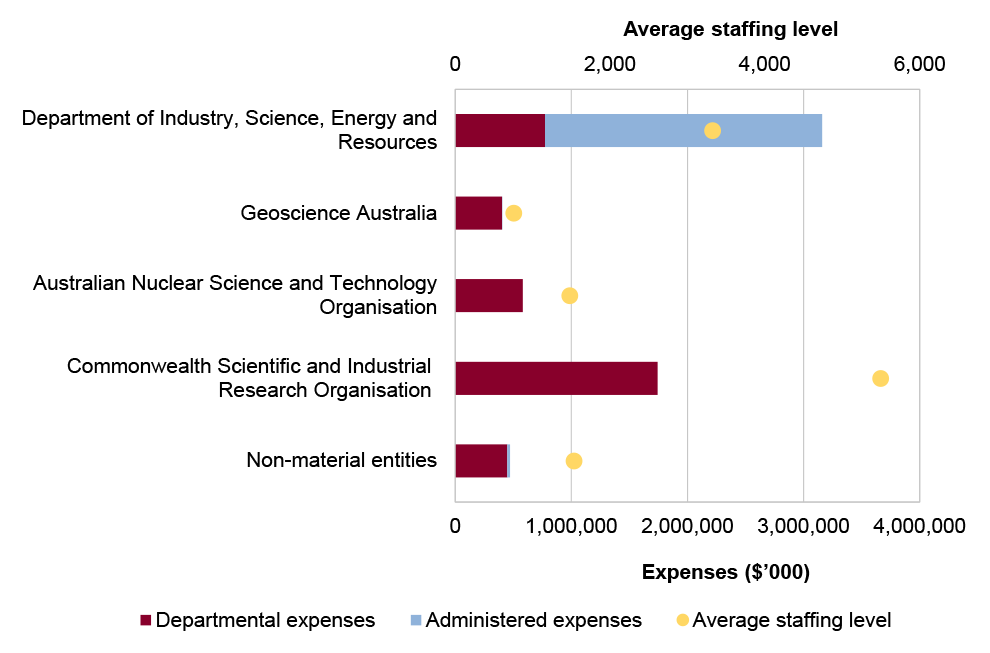

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Industry, Science and Resources represents the largest proportion of the portfolio’s expenses, and departmental expenses of the portfolio are the most material component, representing 62 per cent of the entire portfolio’s expenses.

Figure 1: Industry, Science and Resources portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified for the portfolio relate to the delivery of key activities in a complex and changing domestic and global environment and significant government investment that requires oversight and appropriate administration to achieve objectives and value for money.

Specific risks in the Industry, Science and Resources portfolio relate to grants administration as administrator of the Business Grants Hub, procurement, regulation, asset management and sustainment, and financing government policies.

Grants administration

The department’s Business Grants Hub assists government agencies to achieve the government’s policy objectives through designing and implementing grants programs. Risks in this area relate to the accuracy, occurrence and completeness of grant payments.

Procurement

The portfolio’s procurement practices are relied upon by the Australian Government to support a range of industry-related policies. Compliance with the Commonwealth Procurement Rules in design and conduct, and the achievement of value for money in procurement are key risks, along with effective contract management.

Regulation

Rapid and disruptive technology change and the use of artificial intelligence by Australian Government entities impacts this portfolio in its role supporting science, commercialisation, business investment and capability, as well as regulating industry, science and resources and its whole-of-government oversight of emerging technologies.

Asset management and sustainment

The portfolio has a range of nuclear, scientific and resource assets in the portfolio. Environmental and financial risks are associated with the sustainment, decommissioning and rehabilitation of these assets.

Financing government policies

The department provides advice on financing arrangements for investment in industry, science, resources and innovation including for delivery through portfolio bodies.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 and 2024–25 entities within the Industry, Science and Resources portfolio were included in tabled ANAO performance audits 19 times. The conclusions directed toward entities within this portfolio were as follows:

- one was unqualified;

- nine were qualified (largely positive);

- seven were qualified (partly positive); and

- two were adverse.

Figure 2 shows the number of audit conclusions for entities within the Industry, Science and Resources portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Industry, Science and Resources portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Industry, Science and Resources portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Industry, Science and Resources portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Industry, Science and Resources (DISR) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DISR is in its third year of inclusion in the annual performance statements audit program. Five findings, four moderate and one minor, have been carried over from the 2023–24 audit.

The ANAO has assessed the overall risk of material misstatement in the 2024–25 performance statements as low due to DISR’s:

- commitment to addressing unresolved audit findings from the prior performance statements audit, including fully implementing its Enterprise Performance Framework; and

- maturity in its performance reporting processes as demonstrated in the 2023–24 audit.

Key risks identified by the ANAO for DISR’s 2024-25 annual performance statements include:

- the completeness and appropriateness of performance measures and targets; and

- DISR’s processes supporting preparation of its annual performance statements.

Financial statements audits

Overview

Entities within the Industry, Science and Resources portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Industry, Science and Resources portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Industry, Science and Resources |

Non-corporate |

Moderate |

2 |

1 |

|

Australian Nuclear Science and Technology Organisation |

Corporate |

Moderate |

1 |

1 |

|

Commonwealth Scientific and Industrial Research Organisation |

Corporate |

Moderate |

2 |

1 |

|

Geoscience Australia |

Non-corporate |

Moderate |

1 |

2 |

|

Non-material entities |

||||

|

IP Australia |

Non-corporate |

Low |

||

|

Net Zero Economy Authority |

Non-corporate |

Low |

||

|

National Offshore Petroleum Safety and Environmental Management Authority |

Corporate |

Low |

||

|

National Reconstruction Fund Corporation |

Corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

CSIRO Custodial Services Pty Ltd – Australian financial services licence compliance and registrable superannuation entity licence compliance |

||||

|

CSIRO Financial Services Pty Ltd – Australian financial services licence compliance and registrable superannuation entity licence compliance |

||||

Material entities

Department of Industry, Science and Resources

The Department of Industry, Science and Resources is responsible for supporting a productive, resilient, and sustainable economy that is enriched by science and technology. It does this by growing innovative and competitive businesses, industries and regions, and supporting a strong resources sector.

The department’s total budgeted revenues for 2025–26 are $1.6 billion, with royalties representing 44 per cent, as shown in Figure 4. The rehabilitation provision represents 82 per cent of total budgeted liabilities, and grants expenses represent 17 per cent of total budgeted expenses.

Figure 4: Department of Industry, Science and Resource’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for the department’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including two risks that the ANAO considers potential key audit matters (KAMs).

- The completeness and accuracy of Administered Royalty Revenue given the significant value of royalty revenue and the reliance on data reporting and administrative functions performed by third parties including State governments and other federal government entities. (KAM – completeness and accuracy of royalty revenue)

- The valuation of the Ranger Rehabilitation and the Northern Endeavour Decommissioning Provision given the size of the balance and the judgement involved in estimating the value of the rehabilitation provision. (KAM – valuation of the rehabilitation provision)

- The occurrence, completeness, and accuracy of grants expenses and payables given the significant value and the number and diversity of grants programs managed by the Department.

Australian Nuclear Science and Technology Organisation

The Australian Nuclear Science and Technology Organisation (ANSTO) is Australia’s national nuclear research and development organisation. ANSTO operates Australia’s only nuclear multi-purpose reactor and the Australian Synchrotron, contributes to radiopharmaceutical production and supply, and conducts research into areas of national priority, including human health, the environment and the nuclear fuel cycle. ANSTO also provides advice to government and other stakeholders on matters relating to nuclear science, technology and engineering.

As shown in Figure 5, ANSTO’s total budgeted liabilities are $778.8 million, with 84 per cent attributable to other provisions (decommissioning and nuclear waste management). Total budgeted assets are just over $2.1 billion, with 81 per cent attributable to property, plant and equipment and land and buildings.

Figure 5: ANSTO budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for ANSTO’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation of the decommissioning and nuclear waste management provisions, due to the complexity of the calculation, judgement required to determine key inputs into the valuation and the unique nature of the operations and industry to which the provisions relate.

- The valuation and subsequent depreciation of non-financial assets, due to the unique nature of property, plant and equipment held by ANSTO, materiality of the balances and the exercise of significant judgement to determine the key inputs into the estimation of fair value.

Commonwealth Scientific and Industrial Research Organisation

The primary functions of the Commonwealth Scientific and Industrial Research Organisation (CSIRO), as set out in the Science and Industry Research Act 1949, are to carry out scientific research and facilitate the application or utilisation of the results of such research. CSIRO is responsible for delivering innovative scientific and technology solutions to benefit industry, the environment and the community through scientific research and capability development, services and advice.

The CSIRO’s total budgeted assets for 2025–26 are $3.9 billion, with 63 per cent of these assets attributable to: land and buildings; and property, plant and equipment, as shown in Figure 6. Sales of goods and services contribute to 34 per cent of total budgeted revenue, with other revenue streams contributing to 7 per cent.

Figure 6: CSIRO’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for CSIRO’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The completeness and accuracy of research project revenue, due to the degree of judgement involved across a number of revenue streams from a variety of sources and funding models.

- The valuation of unlisted companies, including within the CSIRO innovation funds, due to their diverse nature, early-stage development and funding arrangements.

- The valuation of CSIRO’s property, plant and equipment, and properties held for investment. These are material balances sensitive to movements in assumptions adopted in the underlying valuation models and are subject to possible impairment.

Geoscience Australia

Geoscience Australia delivers information and advice on Australia’s geology and geography to support government, industry and community decision-making. The agency develops applications and solutions in response to Australia’s challenges by bringing together observations, data and knowledge from across geoscience disciplines.

Geoscience Australia’s total budgeted revenues for 2025–26 are $375.3 million, with the sales of goods and rendering of services contributing to 8 per cent. Total budgeted assets are just over $674.7 million, with 41 per cent of these attributable to property, plant and equipment, as shown in Figure 7.

Figure 7: Geoscience Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key risks for the Geoscience Australia 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The accounting and disclosures of the Southern Positioning Augmentation Network (SouthPAN), which is undertaken as a Joint Operation with the New Zealand Government and involves complex accounting considerations.

- The valuation of Geoscience Australia’s collections of minerals and fossils, and other assets which require estimation and judgement from management.

- The recognition of revenue related to long-term contracts and the relevant deferred revenue at year end, as it is a complex process that involves judgement.