Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented t the Australian Society of Certified Practising Accountants Annual Research Lecture - Canberra

Mr Ian McPhee - Auditor-General for Australia, presented at the Australian Corporate Lawyers Association (ACT Division) Conference

The audit highlighted a number of messages about program evaluation, including:

- Evaluation is a critical element of establishing accountability for program performance against objectives and providing insight to ensure ongoing improvement in program impact. Therefore, an evaluation framework needs to enable an assessment of achievement against objectives and sharing of evaluation outcomes.

- Entities should seek appropriate advice prior to making public announcements about procurements.

- Clear assessment and decision-making about business priorities can support appropriate reallocation of existing staff. Where feasible and necessary, reallocating existing staff to meet staffing needs leverages existing access to equipment, information and premises, and may reduce some training requirements, particularly for staff with relevant previous experience.

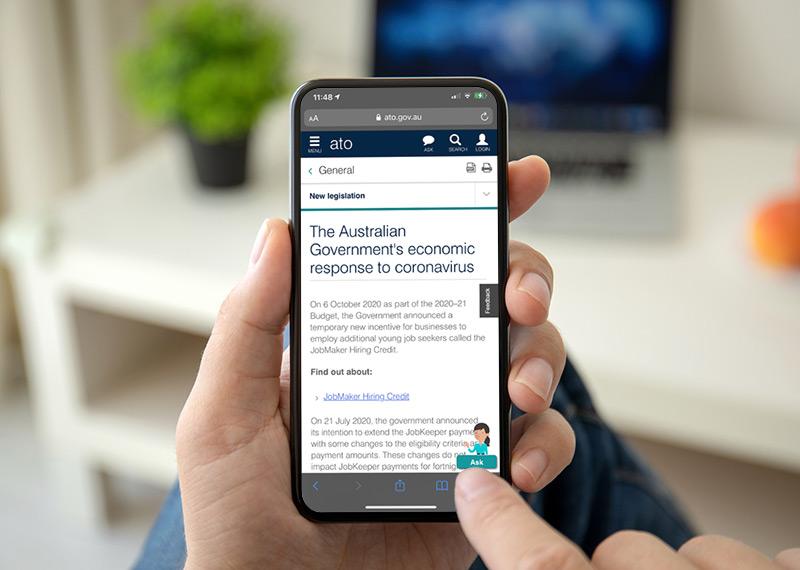

- When decisions are being taken about where to place a function, consideration should be given to the expertise and capability of potential delivery entities and which entity has the best fit of skills to administer the function. In the case of managing compliance with foreign investment in residential real estate, the function would have been best placed initially into the ATO rather than Treasury.

- The concept of risk tolerance assists entities to make informed decisions about whether mitigation strategies in addition to existing controls are required and, if so, the level of resourcing required to achieve desired outcomes. Articulating risk tolerance early in the implementation phase of new measures provides a sound basis on which to support effective risk management, including the best use of entity resources. The rationale for setting the risk tolerance for particular risks or categories of risk should be clearly documented, both to evidence entity decision-making and to support subsequent assurance activities.

- To enhance transparency the accountable authority should make an active decision about whether to seek Ministerial permission for the publication of campaign related research for each campaign. The basis of the decision should be documented.

- Transparency about value for money achieved in the implementation of government programs is increased when the indirect costs of delivering a program of activity are reported.

- Demonstrating value for money through open tender reveals more information about the market than limited tender. If a purchaser opts for limited tender, they should document their knowledge of the market so that a non-expert can understand how they achieved value for money.

- Debriefings of tenderers, and public statements about tender outcomes, should accurately reflect the results of the evaluation work that was undertaken.

- Make decisions about how and when to implement the four non-mandatory strategies in the Essential Eight mitigation strategies promulgated by the Australian Signals Directorate.

- Performance criteria should enable the Parliament and the public to form a view about how well an entity has performed in delivering on its purpose. This requires an entity to establish metrics relevant to the key activities it undertakes to achieve its purpose. Metrics should enable the entity to measure and report on performance over time.

- A well informed triage function aids organisational efficiency. This requires that decisions about which referrals to act upon take into account not only the particular merits of the referral, but also the entity’s existing workload and capacity to take on additional work.

- Complaints data should be analysed alongside other service delivery data to give entities comprehensive information about priority areas for continuous improvement activity.

The audit objective was to examine the effectiveness of the Australian Taxation Office's monitoring and implementation of recommendations about its administration made by the ANAO and parliamentary committees

Please direct enquiries relating to reports through our contact page.

- Entities should ensure program design accounts for the proper use of information about incorrectly made payments, to meet the obligation to pursue the recovery of debts owed to the Commonwealth.

- Setting a benchmark against which performance is assessed can improve organisational effectiveness and assist an entity to make decisions about when and how to deploy its resources. To ensure benchmarks are reliable, verifiable and free from bias, entities should regularly review performance measures (including targets and benchmarks) and amend if necessary to ensure they are fit for purpose.

The objective of the audit was to examine the effectiveness of Defence’s quarterly performance report as a mechanism to inform senior stakeholders about risks and issues in the delivery of capability to the Australian Defence Force.

Please direct enquiries through our contact page.

- Maintaining a current regulator Statement of Expectations and responding Statement of Intent enables the regulator to have clarity about government objectives relevant to the regulator, and the priorities the minister expects the regulator to pursue.

This edition of Audit Insights summarises key messages from Australian National Audit Office (ANAO) performance audits about the management of conflicts of interest by Australian Government entities in relation to procurement activity and grants programs.

Please direct enquiries about audit insights through our contact page.

- Where price or scope of bids is well outside expectations, or there is a wide variation between tenders, this may indicate misunderstandings in industry about requirements. It is prudent in this situation to review scope and price expectations before progressing negotiations with a tenderer.

This page lists status updates about the ANAO's progress on recommendations from the Australian Securities and Investments Commission (ASIC) audit inspection reports

Please direct enquiries through our contact page.

This page lists status updates about the ANAO's progress on recommendations contained in the series of New Zealand Office of Auditor-General quality assurance review reports.

Please direct enquiries through our contact page.

- The use of paragraph 10.3b of the Commonwealth Procurement Rules to justify a limited tender should be in situations consistent with the condition (extreme urgency brought about by events unforeseen by the entity) and not in situations of poor or late planning.

- Tender evaluation reports should be objective, impartial and written to give the decision-maker all the information they need. This includes all relevant information, good and bad, about tenderers and not just the information that supports the selection of the preferred tenderer.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2009. It includes a foreword by the Auditor-General, an overview of the Office, a report on performance, details about management and accountability, and the financial results.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2012. It presents an overview including the role and vision of the Office, a report on performance, details about management and accountability, and the financial results.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2003. It includes a comment by the Auditor-General; an overview of the report; a report on performance; details about management and accountability, and the financial statement for the year.

In the light of the concerns raised by the Leader of the Opposition and some other Members of Parliament about the allocation of financial assistance approved under the NHT, it was decided to undertake preliminary inquiries. The inquiries focussed on the transparency and rigour of the decision-making process for projects approved for NHT funding.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2011. It includes a foreword by the Auditor-General, an overview including the role and vision of the Office, a report on performance, details about management and accountability, and the financial results.

The Auditor-General responded on 23 December 2022 to correspondence from Senator Malcolm Roberts dated 29 November 2022, enquiring about public contributions to the Administration of the Disaster Recovery Funding Arrangements performance audit.

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2010. It includes a foreword by the Auditor-General, an overview including the role and responsibilities and vision of the Office, a report on performance, details about management and accountability, and the financial results.

- All Australian Public Service employees are stewards. To support implementation of whole-of-government policies, Australian Government officials should work with each other across agencies to share knowledge, learn about good practice and innovate.

This edition of audit insights focuses on efficiency in the public sector. Find out more about what we think efficiency looks like, why we think efficiency is important in ensuring that public sector agencies remain sustainable, and some examples from recently tabled audits of what we can learn from others.

Please direct enquiries through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2005. It includes highlights and areas of focus for the year; a forward by the Auditor-General; an overview of the report; a report on performance; details about management and accountability, and the financial statement for the year.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2004. It includes highlights and areas of focus for the year; an introduction by the Auditor-General; an overview of the report; a report on performance; details about management and accountability, and the financial statement for the year.

The Auditor-General responded on 19 November 2021 to correspondence from Ms Alicia Payne MP dated 5 November 2021, requesting that the Auditor-General clarify some points of concern about the potential audit of the Australian War Memorial expansion (Management of the Australian War Memorial's development project).

Please direct enquiries relating to requests through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2007. It includes highlights and areas of focus for the coming year; a forward by the Auditor-General; an overview of the report; a report on performance; details about management and accountability, and the financial statement for the year.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2006. It includes highlights and areas of focus for the coming year; a forward by the Auditor-General; an overview of the report; a report on performance; details about management and accountability, and the financial statement for the year.

Provides an overview of the annual audit work program including the purpose and key features, and how the program is developed and delivered. Information about the development of the annual audit work program includes details of environmental scanning, topic development, coverage review, consultation, final review and audit selection.

Please direct enquiries relating to the annual audit work program (AAWP) through our contact page.

- Probity review and sign-off should be planned for and incorporated into processes, with review to incorporate all significant changes, and decision-makers accurately informed about what the probity review and any sign-off relates to (including which iteration of guidelines the sign-off is specific to).

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2002. It includes a comment by the Auditor-General on Audit independence and effectiveness; an overview of the Auditor-General’s role and responsibilities; a report on performance; details about management and accountability, and the financial statement for the year.

The objective of this audit was to assess the effectiveness of the ANAO’s internal budgeting and forecasting processes and practices. View the audit.

This page lists status updates about the ANAO's progress on recommendations contained in the audit.

Please direct enquiries through our contact page.

The objective of this audit is to examine DIAC's implementation of the nine recommendations made in the earlier audit. The audit has also taken into account changed circumstances since the original audit. These include a heightened security environment after 11 September 2001 and the results of other relevant ANAO performance audit and financial statement work. The audit also examined ETA decision-making processes to gain assurance about its robustness in a changing risk environment. This issue came to attention in recent audits of visa management processes.

The objective of the audit was to provide assurance about the Australian Taxation Office's risk management approach and to add value to its administration by analysing the economy, efficiency, administrative effectiveness, equity and accountability of the related processes employed within the organisation. The ANAO reviewed the formal risk management process that the ATO uses to deal with all sources of risk for the organisation.

Response completed as a limited scope assurance review.

The Auditor-General responded on 9 September 2016 to correspondence from the Hon Brendan O’Connor MP on 15 June 2016 regarding the appropriateness of arrangements concerning the Liberal Party of Australia entity Parakeelia Pty Ltd.

Please direct enquiries relating to requests for audit through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 26 April 2016 to correspondence from Mr Pat Conroy MP on 16 February 2016 regarding the government advertising campaign Welcome to the Ideas Boom.

Please direct enquiries relating to requests for audit through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 14 January 2016 to correspondence from the Hon Catherine King MP on 22 October 2015, on the project agreement for the Health and Hospitals Fund – 2010 Regional Priority Round Project in Palmerston.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to form an opinion about DVA's management of the current and future demand for VHC services. To form an opinion, the Australian National Audit Office (ANAO) examined whether DVA:effectively planned the distribution of VHC resources; distributed VHC resources according to its planning; and monitored and evaluated how effectively it managed the demand for VHC services. To form an opinion against the audit objective, the ANAO interviewed DVA personnel, examined DVA documents, interviewed personnel at a selection of Agencies, Service Providers and stakeholders, and reviewed relevant literature.

The Auditor-General responded on 19 November 2021 to correspondence from Senator Malcolm Roberts dated 28 October 2021, requesting that the Auditor-General clarify issues relating to the Disaster Recovery Funding Arrangements.

The Auditor-General received further correspondence about this matter from the Chief Executive Officer of the Queensland Reconstruction Authority, Mr Brendan Moon on 6 June 2022.

Please direct enquiries through our contact page.

The review assessed the effectiveness of the ANAO’s methodology for conducting audits of other Australian Government entity’s performance statements. See the review.

This page lists status updates about the ANAO's progress on recommendations contained in the review.

Please direct enquiries through our contact page.

The Department of Defence spends some $2.4 billion a year on major equipment acquisition projects. The audit objective was to assess Defence's arrangements for higher-level management of major equipment acquisition projects. The principal aim was to formulate practical recommendations that would both enhance Defence's management of major acquisition projects and provide a degree of assurance about its ongoing apparent capacity to do so efficiently and effectively.

The audit reviewed the Australian Taxation Office's administration of the payment of tax by non-residents. The audit objectives were to:

- provide Parliament with assurance about how efficiently and effectively the ATO administers the payment of tax in respect of non-residents;

- identify any scope for more effective and efficient administration of the function; and

- identify any opportunities for the cost-effective collection of additional revenue.

Response completed as a limited scope assurance review.

The Auditor-General responded on 2 September 2015 to correspondence from Senator Nick Xenophon of 3 June 2015 on the Australian bid for the football World Cup.

Please direct enquiries relating to requests for audit through our contact page.

This audit would examine the effectiveness of the Department of Health, Disability and Ageing’s (Health’s) implementation of star ratings for residential aged care.

The star ratings system was introduced in December 2022. An overall star rating and star ratings in four categories (compliance, residents’ experience, staffing and quality measures) are assigned to residential aged care services on a public facing website (My Aged Care) operated by Health. The star rating system aims to help older Australians and their representatives make more informed choices about their care and to help aged care providers to see where they are performing well and how they can improve. In October 2024 the Commonwealth Ombudsman made a public statement expressing a view that star ratings were not sufficiently meaningful to help people make informed decisions about their aged care. From November to December 2024 Health ran a consultation process on planned design changes to star ratings. Health has stated that an evaluation report was expected to be provided to the Australian Government in early 2025.

Please direct enquiries through our contact page.

Response completed as a limited scope assurance review.

The Auditor-General responded on 30 July 2014 to questions raised on 26 May 2014 by Senator the Hon Penny Wong on the appointment of Mr Peter Crone as head of Secretariat for the National Commission of Audit.

Please direct enquiries relating to requests for audit through our contact page.

Simulators are devices that provide personnel with training and practice by reproducing the behaviour of operational equipment. Defence records indicate that since 1960 the Defence Organisation has spent about $1 billion on acquiring simulators for training purposes. Over the next five years Defence proposes to spend a further $1.1 billion on simulation. The objective of the audit was to assess whether Defence had developed appropriate policies to provide guidance to personnel in the acquisition and use of aerospace simulators and the effectiveness of its procedures in achieving best value for the Commonwealth in relation to aerospace simulators.

Welcome to the fourth edition of the ANAO’s Audit Matters newsletter. The purpose of Audit Matters is to provide updates on the ANAO’s work and provide insights on what we are seeing in the Australian Government sector.

Audit Matters complements the range of reports we table in the Parliament as well as our insights products and events and seminars. I hope you find it useful and please forward it on to your colleagues, and encourage them to sign-up for future editions.

Rona Mellor PSM, Deputy Auditor-General

Please direct enquiries through our contact page or subscribe to receive the email version of Audit Matters in the future.

Welcome to the third edition of the ANAO’s Audit Matters newsletter. The purpose of Audit Matters is to provide updates on the ANAO’s work and provide insights on what we are seeing in the Australian Government sector.

Audit Matters complements the range of reports we table in the Parliament as well as our insights products and events and seminars. I hope you find it useful and please forward it on to your colleagues, and encourage them to sign-up for future editions.

Rona Mellor PSM, Deputy Auditor-General

Please direct enquiries through our contact page or subscribe to receive the email version of Audit Matters in the future.

The issues examined by the ANAO were considered on two levels. First, legal and ethical processes that focus on whether there are any impediments to the Government and public service implementing the CEIP in the way they have. The public interest issues turn largely on the question of whether the CEIP was for Government or party-political purposes. The other level on which these issues were considered is that of public accountability and the way in which decisions to spend public money are made. In turn, these issues raise questions about the relationship between, and authority of, the Government and Parliament. They may also involve consideration of what might be regarded as proper or responsible conduct by governments and the public service.

Welcome to the inaugural edition of the ANAO’s quarterly Audit Matters newsletter. The purpose of Audit Matters is to inform external audiences — primarily those working in Commonwealth entities — of updates on the ANAO’s work and provide insights on what we are seeing in the Australian Government sector.

Audit Matters complements the range of reports we table in the Parliament as well as our Insights products and events and seminars. I hope you find it useful and please forward it on to your colleagues, and encourage them to sign-up for future editions.

Carla Jago, Acting Deputy Auditor-General

Please direct enquiries through our contact page or subscribe to receive the email version of Audit Matters in the future.

The objective of the audit was to assess whether, in relation to appeals to the SSAT and the AAT, Centrelink undertakes its role effectively, so as to support the timely implementation of the Tribunals' decisions about customers' entitlements. In assessing Centrelink's performance, the ANAO examined whether:

- the information provided by Centrelink, in relation to appeals to the SSAT and the AAT, effectively supported customers' and Tribunals' decision-making;

- the relationships and administrative arrangements between Centrelink, DEEWR and FaHCSIA supported the effective management of the appeal process and the capture of issues that may have broader implications for legislation, policy and service delivery; and

- Centrelink implemented SSAT and AAT decisions in an effective and timely manner.

The audit focused on the external review and appeal mechanisms and completes the cycle of audits on Centrelink's review and appeal system. The audit examined those appeals where an implementation action was required and did not consider SSAT and AAT appeals that were dismissed, withdrawn or were not within the Tribunals' jurisdiction.

This benchmarking study surveyed the roles and functions of CFOs from 15 Commonwealth organisations in 2000-2001. It also involved the CFOs providing self-assessments in response to questions about their role, responsibilities, priorities and challenges. In particular the study sought to identify: ·

- the skills, qualifications and experience of Commonwealth CFOs; ·

- the CFOs perceptions of their roles, responsibilities and priorities, and how these may have changed in relation to previous studies and available Andersen Global Best Practices (from the Andersen Global Best Practices® knowledge base); and ·

- how Commonwealth CFOs viewed and used information technology to achieve their financial management objectives.

The Australian National Audit Office (ANAO) 2016-20 Corporate Plan is the primary strategic planning document, and outlines how the ANAO intends to deliver against the purpose over the coming four years.

Please direct enquiries relating to reports through our contact page.

Welcome to the second edition of the ANAO’s quarterly Audit Matters newsletter. The purpose of Audit Matters is to provide updates on the ANAO’s work and provide insights on what we are seeing in the Australian Government sector.

Audit Matters complements the range of reports we table in the Parliament as well as our insights products and events and seminars. I hope you find it useful and please forward it on to your colleagues, and encourage them to sign-up for future editions.

It’s no secret that a federal election is due to happen. No doubt your minds will turn to your entities’ preparedness for this event now or in the near future. At the time the election is called, I’ll write out to entities to help people understand how the ANAO operates during an election period.

Rona Mellor PSM, Deputy Auditor-General

Please direct enquiries through our contact page or subscribe to receive the email version of Audit Matters in the future.

On 3 February 2010, Senator Christine Milne wrote to the Auditor General raising concerns about DEWHA's administration of the Green Loans program and requesting a performance audit of the program. Issues raised included: uncapped assessor numbers; problems with the delivery of the program; the quality of assessor training and assessments provided to households; the lack of an audit facility within the program; and equitable access to work under the program.

In light of Senator Milne's request and other concerns in relation to the administration of the program, the Auditor-General agreed on 25 February 2010 to conduct a performance audit of the program. The objective of the audit was to examine key aspects of the establishment and administration of the Green Loans program by DEWHA and the program's transition to DCCEE. Particular emphasis was given to the program's three main elements:

- training, registration and contracting of assessors;

- scheduling, conduct, and reporting of home sustainability assessments, and the associated payments to assessors; and

- provision of green loans to householders, and the associated payments to participating financial institutions.

The audit also examined the extent to which steps had been taken by DEWHA and DCCEE to assess whether the Green Loans program was achieving its objectives.

The Auditor-General undertook a limited assurance review of the Department of Finance’s reporting and administration of the Advances to the Finance Minister (AFM) for the Period 1 July 2019 to 24 April 2020.

Please direct enquiries through our contact page.

The objective of the audit was to report to Parliament on the progress Defence has made since June 2001 in implementing appropriate strategies for recruiting, developing and retaining skilled IT personnel. The audit focused on management of specialist information system skills and did not examine skills needed by users of information systems, although the latter is of obvious importance for overall performance. In June 2001, the Joint Committee of Public Accounts and Audit (JCPAA), after reviewing the ANAO's Audit Report No. 11 Knowledge System Equipment Acquisition Projects in Defence, commented that its major concern about Defence's ability to develop a knowledge edge with adequate coherence, centred on Defence's ability to recruit, develop and retain skilled individuals needed in all parts of the DIE. The JCPAA recommended that the ANAO conduct an audit of Defence's strategies for recruiting, developing and retaining skilled IT personnel.

The Australian National Audit Office (ANAO) is hosting the 21st Pacific Association of Supreme Audit Institutions (PASAI) Congress 28–30 August 2018.

This audit would assess the effectiveness of the design and implementation of the Consumer Data Right (CDR).

The CDR is a secure online system that enables consumers to get value from data that is collected about them through the provision of specific goods and services by consenting to that data being shared with trusted accredited third parties. CDR is an economy-wide reform that will be rolled out sector by sector. The CDR has already been rolled out to banking and energy, with non-bank lending to follow as the third sector. The Treasury, Australian Competition and Consumer Commission (ACCC), and Office of the Australian Information Commissioner (OAIC) are the key agencies leading the CDR initiative. The Treasury leads policy development and determines which sectors should be included in the CDR, while the ACCC focuses on accreditation and compliance of data recipients, and the OAIC handles privacy and data breach notifications. The Data Standards Body develops the technical standards for how data is shared under the CDR, working closely with the Treasury, ACCC, and OAIC.

Please direct enquiries through our contact page.

This audit would assess the effectiveness of Services Australia’s processes to ensure that payments are made in accordance with the law.

Services Australia delivers a wide range of services and payments on behalf of other Australian Government entities, including social security, child support, student payments, family assistance, aged care, and health programs. Services Australia operates under a legal framework that includes various pieces of legislation and regulatory commitments including the Human Services (Centrelink) Act 1997, Child Support (Registration and Collection) Act 1988, Child Support (Assessment) Act 1989, Public Governance, Performance and Accountability Act 2013, and the Commonwealth Fraud Control Framework. Services Australia operates a compliance program that aims to maintain the integrity of Australia’s welfare system and ensure that all operations are conducted within the legal framework. Components of the approach include payment reviews, data-matching and data mining, investigations, and various compliance activities, including identity checks and educating customers about their rights and obligations to support voluntary compliance.

Please direct enquiries through our contact page.

The objective of this audit was to assess the effectiveness of NBN Co’s service continuity operations relating to the migration of telecommunication services to the National Broadband Network (NBN).

Please direct enquiries through our contact page.

The audit will examine the effectiveness of the Workplace Gender Equality Agency’s (WGEA’s) management of compliance with the Workplace Gender Equality Act 2012 (the Act).

The Act requires non-public sector employers with 100 or more employees to submit an annual report containing data on workplace gender equality to the WGEA. Employers with 500 or more employees must also comply with minimum standards for gender equality. Employers that fail to comply with the Act may be publicly named by the WGEA and may be excluded from tendering for Australian Government contracts, receiving Australian Government grants, or tendering for contracts with some state governments. On 30 March 2023, the Workplace Gender Equality Amendment (Closing the Gender Pay Gap) Bill 2023 was passed, which requires the WGEA to publish employer gender pay gaps for private sector and Commonwealth public sector employers, and from 2024, employees will have access to information about their employer’s performance on pay parity.

The audit may examine the WGEA’s use and assurance of data, identification and monitoring of non-compliant employers, and certification of compliance. The audit may also examine whether non-compliant employers have been awarded Australian Government contracts and grants.

Please direct enquiries through our contact page.

The audit was undertaken following advice from the Joint Committee of Public Accounts and Audit (JCPAA) to the Auditor-General that assurance that ABC programming adequately reflects the ABC's Charter was an audit priority of Parliament. The objective of the audit is to provide Parliament with this assurance. The focus of the audit was on the governance arrangements of the ABC Board and management that enable the ABC to demonstrate the extent to which it is achieving its' Charter obligations, and other related statutory requirements, efficiently and effectively. The scope of the audit was as follows:

- Review the ABC's corporate governance framework against better practice models. The ANAO had regard to the ABC's unique role as a national public broadcaster established as a budget funded Commonwealth statutory authority subject to the Commonwealth Authorities and Companies Act 1997.

- Examine the ABC Board's approach to the interpretation of the Charter requirements of the ABC and the setting of strategic directions, and management's administrative arrangements for implementing the strategic directions established by the Board.

- Examine the ABC's performance information framework, the development, documentation and use of performance measures in relation to targets and/or objectives, the monitoring and reporting of performance and its' inter-relationship with the corporate planning and budgetary processes, particularly in relation to the strategic directions set by the Board.

The audit did not examine the overall management of the ABC. In keeping with the audit scope, the audit examined ways in which the ABC aligns its' strategic directions with its' Charter requirements for programs broadcast on radio, television and on-line and assures itself, and Parliament, about the achievement of its' Charter obligations. Further, the audit did not examine the operations of ABC Enterprises or symphony orchestras that operate as ABC-owned subsidiary companies.

The purpose of the Australian National Audit Office is to support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, and thereby contribute to improved public sector performance.

The ANAO adopts a range of communication practices to strengthen the impact of its work and facilitate the sharing of audit insights. Communication practices had included the publication of better practice guides on aspects of Commonwealth administration, for the information of Australian Government entities.

The independent Review of Whole-of-Government Internal Regulation recommended that the ANAO take the opportunity to review whether there is a continuing need to develop and maintain separate guidance, where regulators and policy owners have developed or are developing policy guidance material. The ANAO consulted the Australian Parliament and public sector entities, including audit committees within these entities, about the future of better practice guides. The feedback received was that where another entity has produced, or will produce, a similar resource and has committed to continue to do so, the ANAO could add more value by monitoring the effectiveness of this resource. On this basis, the ANAO decided to discontinue and cease distribution of a range of better practice guides from 1 July 2017. Refer to our previously published message from July 2017 (below) for more information about the guides that were removed at this time.

It was also determined in July 2017 that the ANAO would retain three guides and withdraw three guides following a transition period:

Guides to be retained | Guides to be withdrawn following a transition period |

Successful Implementation of Policy Initiatives | Public Sector Financial Statements |

Public Sector Audit Committees | Developing and Managing Contracts |

Public Sector Governance | Administering Regulation |

Since July 2017, the ANAO has continued to work with policy owners as they have developed or revised their guidance material in relation to the six remaining guides.

In April 2018 we sought feedback from the accountable authorities of policy-owning entities on our intention to withdraw the six remaining guides. All relevant entities supported the removal of the guides, although the Department of the Prime Minister and Cabinet raised that the outcome of the work being conducted by the APS Reform Committee may lead to new guidance which supersedes the Successful Implementation of Policy Initiatives guide.

In May 2018 the Auditor-General wrote to the Joint Committee of Public Accounts and Audit (JCPAA) seeking the Committee’s feedback on the proposal to withdraw the remaining better practice guides. The Committee advised:

the JCPAA has no overall objection to the withdrawal of the Better Practice Guides from the ANAO website. We note the ANAO’s commitment to continue to monitor the effectiveness of the replacement guidance material, as appropriate, under its audit program. We further appreciate that the ANAO’s Audit Insights now provide information on audit issues and examples of good practice, as identified through financial statement and performance audit work, by way of shared learnings for all Commonwealth entities.

Considering the feedback from the JCPAA and policy-owning entities’ support, the remaining guides have now been removed from the ANAO website:

- Successful Implementation of Policy Initiatives

- Public Sector Audit Committees

- Public Sector Governance

- Public Sector Financial Statements

- Developing and Managing Contracts

- Administering Regulation

In 2017-18 the ANAO developed audit insights, a new product which identifies and discusses common recurring issues, shortcomings and good practice examples, identified through our financial statement and performance audit work. The objective of audit insights is consistent with the objective of better practice guides: improved public sector administration.

The ANAO will continue to monitor the effectiveness of guidance material, as appropriate, under our audit program.

If you require access to the withdrawn better practice guides listed above, you can find them through the National Library of Australia’s Australian Government Web Archive.

Please direct enquiries through our contact page.

This edition of Audit Insights is targeted at Australian Government officials who have responsibility for overseeing or conducting procurements, including those who only do procurement occasionally. The aim is to communicate lessons from our audit work to make it easier for people working within the Australian public sector to apply those lessons. It is drawn from audit reports tabled in 2020–21, 2021–22 and 2022–23 into Australian Government procurements.

Please direct enquiries through our contact page.

The audit objectives were to assess the effectiveness of:

- selected agencies’ administration in developing advertising campaigns and implementing key processes against the requirements of the Australian Government’s campaign advertising framework, and other key legal and administrative requirements; and

- the ongoing administration of the campaign advertising framework.

Please direct enquiries relating to reports through our contact page.

The objective of this audit is to examine the effectiveness of the TGA’s administration of complementary medicines regulation in Australia. The primary focus is on listed complementary medicines, which comprise about 98 per cent of these medicines.

The objective of the audit was to assess the effectiveness of the Australian Taxation Office’s (ATO’s) complaints and other feedback management systems in supporting service delivery.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the administration of the Australian Prudential Regulation Authority (APRA) financial industry levies.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess the effectiveness of DIAC’s administration of the character requirements of the Citizenship Act.

The audit objective was to assess the extent to which DEEWR and FaHCSIA have effectively managed the planning and consultation phases for the IBF program and the IBHP program. The audit scope included consideration of the issues likely to affect the ongoing operation and sustainability of the facilities.

The audit objective was to assess the effectiveness of the Parliamentary Budget Office in conducting its role since being established in July 2012.

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine the effectiveness of the department's establishment of the P21 element of the BER program. The focus of the audit was on: the establishment of administrative arrangements for BER P21 in accordance with government policy; the assessment and approval of funding allocations; and the arrangements to monitor and report BER P21 progress and achievement of broader program outcomes. An examination of individual BER P21 projects was outside the scope of the audit.

The objective of this audit was: to form an opinion on the adequacy of selected agencies' approaches to monitoring and evaluation of government programs and services delivered on the Internet; and to identify better practices and opportunities for improvement. In order to achieve this objective, the audit examined the websites and Internet-delivered services of five agencies.

The objective of the audit was to assess the effectiveness of AusAID’s management of tertiary training assistance.

The objective of the audit was to assess if DBCDE had effectively managed the ABG program, and the extent to which the program was achieving its stated objectives. The audit examined DBCDE's activities supporting the planning, implementation, monitoring and performance reporting for the ABG program from its commencement in April 2007 to June 2010.

The objective of the audit was to examine the effectiveness of CSP’s feedback management system. CSP’s performance was assessed against the following criteria:

- CSP has appropriate channels to collect customer feedback;

- CSP effectively manages and resolves complaints; and

- CSP accurately reports on customer feedback, and analyses the information to improve aspects of child support administration.

The objective of the audit was to assess whether DEWR's management and oversight of Job Placement and matching services is effective, in particular, whether: DEWR effectively manages, monitors and reports the performance of JPOs in providing Job Placement services; DEWR effectively manages the provision of matching services (including completion of vocational profiles and provision of vacancy information through auto-matching) to job seekers; Job seeker and vacancy data in DEWR's JobSearch system is high quality and is managed effectively; and DEWR effectively measures, monitors and reports Job Placement service outcomes.

The audit objective was to assess the Department of Employment’s management of the effectiveness and quality of employment services delivered by Job Services Australia providers.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Human Services' arrangements for engaging and managing External Collection Agencies to recover debts arising from Centrelink payments.

Please direct enquiries relating to reports through our contact page.

The audit reviewed the efficiency and effectiveness of the Department of Health and Ageing's (Health's) planning and conduct of the review undertaken to determine the recommendation to the Government on whether or not to exercise the extension option available to the Commonwealth under the Plasma Fractionation Agreement with CSL Limited. The audit was undertaken in response to a recommendation of the Joint Committee of Public Accounts and Audit.

The objective of this audit was to determine the extent to which selected agencies have implemented the two recommendations of the previous audit; and the appropriateness of advice provided by Finance and the ATO. To address this audit objective, the audit assessed:

- the roles of Finance and the ATO in clarifying: the interaction of the PB and SG Act; the ongoing role of the PB Act; and mechanisms to monitor Australian Government organisations' compliance with the PB Act;

- the extent to which Finance and the ATO have provided guidance and other support to assist Australian Government organisations manage and meet statutory superannuation obligations for eligible contractors; and

- whether Australian Government organisations have managed and met statutory superannuation obligations for contractors in past and current contracts.

The audit objective was to assess the effectiveness of monitoring arrangements (by the Accreditation Agency) and compliance activities (by DoHA) put in place to achieve residential aged care homes’ compliance with the Accreditation Standards and their other, related, responsibilities under the Act and its associated instruments.

The ANAO’s assessment considered whether:

— a sector-wide compliance strategy was in place and aligned with effective monitoring and compliance activities at the operational level;

— there was a clear articulation of the separat but complementary roles and responsibilities of DoHA and the Accreditation Agency; and

— performance information gathered by both agencies to support public reporting and business improvements was useful and enabled comparison of performance over time.

The objective of this audit was to assess whether DEWR's oversight of the Job Network ensures that job seekers are provided with high quality services. In particular, the ANAO examined whether DEWR had: an appropriate strategic approach to, and focus on, service quality across the Job Network; appropriate specification of the services to be provided to eligible job seekers, and of the quality of service provision; provided job seekers with a high quality of service at key Job Network service points; and appropriately monitored and reported the quality of service delivery, and appropriately managed service performance. As well, the ANAO examined whether the Job Network has appropriate mechanisms for identifying, assessing and implementing improvements to service delivery.

The objective of this audit was to form an opinion on the Australian Research Council's (ARC's) management of research grants. To achieve this, ANAO centred the audit around the following aspects of ARC's grants administration: governance and structure, particularly the roles and responsibilities of those parties involved in administering ARC's grants (Chapter 2); the processes for assessing and selecting ARC grants (Chapter 3);post-award management of grants under the Funding Agreements (Agreements) between ARC and those universities that receive and administer the ARC grants to researchers (Chapter 4); and ARC's monitoring of its grant programs for management, performance improvement and reporting (Chapter 5). In its assessment, ANAO considered ARC's compliance with relevant sections of the Australian Research Council Act 2001 (ARC Act) and the Financial Management and Accountability Act 1997 (FMA Act). The assessment also took account of the ANAO's Better Practice Guides, particularly the Better Practice Guide—Administration of Grants. The audit focused mainly on ARC's administration of Discovery Projects, the largest scheme in ARC's National Competitive Grants Program (NCGP).

The objective of the audit was to assess whether APS agencies had sound approaches to recruitment, to assist in providing the workforce capability to deliver government programs effectively. Sound approaches to recruitment involve agencies:

- establishing and implementing strategic approaches to recruitment to address current and future workforce priorities and goals;

- managing and supporting recruitment activities through the provision of expert advice and support, legislative and procedural guidance material, and training for staff involved in recruitment activities;

- conducting recruitment activities effectively and in compliance with legislative and administrative requirements; and

- systematically monitoring and evaluating the effectiveness and efficiency of recruitment strategies, policies and activities.

The audit assessed whether FaCS effectively undertakes its coordination, monitoring and other roles according to the CSTDA. The audit examined all disability services provided for under the CSTDA, except for disability employment services. The ANAO met relevant officers from FaCS' national office and State and Territory offices, and with 22 stakeholder organisations including: advocacy groups; peak national and State bodies representing the interests of disability service providers and people with disabilities; members of national and State Disability Advisory Bodies funded by FaCS; State and Territory governments; relevant Australian Government agencies; In particular, the Department of Health and Ageing and the Australian Institute of Health and Welfare. and local government bodies. Fieldwork for the audit was primarily undertaken during the period September 2004 to February 2005.

The audit objective was to determine whether DIAC's biometrics program had appropriate:

- business review processes (including a business case);

- authorisation;

- business and IT governance arrangements; and

- IT project management and systems development arrangements.

The audit objective was to assess the effectiveness of the Department of Social Services' administration of Early Intervention Services for Children with Disability.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Immigration and Citizenship's management of the Settlement Grants Program. The ANAO assessed DIAC's performance in terms of how effectively it planned for funding rounds, assessed and allocated grants, monitored and evaluated the program, and managed relationships with its stakeholders. In doing so, the ANAO focused on SGP projects that received funding in the 2007–08.

The audit objective was to assess the effectiveness of FWO’s administration of education and compliance services in relation to the Fair Work Act 2009.

The audit objective was to assess the effectiveness of DoHA's management of CACPs in fulfilling the legislated objectives of the program.

Directly after the collapse of Ansett in September 2001, most of its estimated 15 000 employees faced the possibility of retrenchment The Government immediately announced the introduction of the Special Employee Entitlements Scheme for Ansett group employees (SEESA) to address two risks facing the employees:

- the risk-to a certain limit - of a shortfall in their payments of accrued employee entitlements from Ansett and,

- the risk of delay in their being paid.

The objective of the audit was to determine how efficiently and effectively the two key elements of SEESA were managed: DEWR's management of the mechanism for making SEESA payments and DOTARS' management of the associated Air Passenger Ticket Levy.

The Australian National Audit Office has undertaken a pilot project to assess the status of the Australian Government performance measurement and reporting framework as a basis for implementation of a future program of audits of entities’ key performance indicators, and to develop a suitable audit methodology. This report presents a summary of the work completed to date.

The objective of the audit was to assess the effectiveness of Centrelink’s QOL control, which supports the integrity of payments administered by DHS on behalf of the Australian Government.

The audit examined the range of support made available to ADF personnel making the transition from military to civilian life, the extent to which the assistance is utilised, the cost to Defence of such assistance and the relevant responsibilities of those who deliver assistance.

The audit objectives were to assess the appropriateness of the use of confidentiality provisions in Australian Government contracts and whether selected agencies had compiled Internet listings of contracts, as required by the Senate Order and agreed to by the Government.

The audit objective was to assess the effectiveness of the Department of Veterans’ Affairs management of complaints and other feedback to support service delivery. The audit criteria were that DVA has:

- a well-designed framework for managing complaints and other feedback;

- effective processes and practices to manage complaints; and

- appropriately analysed complaints to inform service delivery.

The audit objective was to examine how effectively the Department of Agriculture, Fisheries and Forestry (DAFF) manages the importation of live animals into Australia.

The objective of the audit was to assess the administrative effectiveness of FaHCSIA's management of the GBM initiative, and the extent to which the initiative has contributed to improvements in community engagement and government coordination in the Northern Territory.

The audit focused on FaHCSIA's management of the GBM initiative under the NTER. The audit scope did not include additional functions assigned to some GBMs in the Northern Territory under the National Partnership Agreement on Remote Service Delivery (the National Partnership Agreement), or to Australian Government staff with similar roles and functions supporting the implementation of the National Partnership Agreement in Queensland and Western Australia.

The objective of the audit was to assess the effectiveness of the Project Wickenby taskforce in making Australia unattractive for international tax fraud and evasion by detecting, deterring and dealing with the abusive use of secrecy havens by Australian taxpayers.

The objective of the audit was to assess the effectiveness of FaHCSIA’s administration of the HAF. To address this objective, the Australian National Audit Office (ANAO) assessed FaHCSIA’s administration against a range of audit criteria, including the extent to which:

- assessment and approval processes were soundly planned and implemented, and were consistent with the requirements of the overarching financial management framework;

- appropriately structured funding agreements were established and managed for each approved grant; and

- the performance of the HAF, including each of the funded projects, was actively monitored and reported.

The objectives of this follow-up audit were to:

- examine the ATO's implementation of the ten recommendations in The Australian Taxation Office's Management of its Relationship with Tax Practitioners (Audit Report No.19, 2002–03), having regard to any changed circumstances, or new administrative issues, affecting implementation of those recommendations; and

- identify scope for improvement in the ATO's management of its relationship with tax practitioners.

Follow up audits are recognised as an important element of the accountability processes of Commonwealth administration. Parliament looks to the Auditor General to report, from time to time, on the extent to which Commonwealth agencies have implemented recommendations of previous audit reports. Follow up audits keep Parliament informed of progressive improvements and current challenges in areas of Commonwealth administration that have previously been subject to scrutiny through performance audits.

The objective of the audit were to assess the extent to which agencies' performance management systems, strategies and plans are consistent with the strategic framework set out in the Managment Advisory Committee Report; provide assurance that the administration of performance managment is being implemented efficiently and effectively in accordance with better practice principles; provide assurance that performance linked remuneration reported in anual reports complies with the Department of Prime Minister and Cabinet Requirements for Annual Reports; and quantify the cost of performance linked remuneration, both performance bonuses and performance linked advancements (salary increments), across the APS.

The objective of the audit was to assess the effectiveness of the Department of Agriculture, Fisheries and Forestry’s administration of EC measures and the implementation of the pilot of new drought reform measures.

The objective of the audit was to assess the effectiveness of the ATO's management of its interpretative assistance activities for SMSFs.

The objective of the performance audit was to report to Parliament our assessment as to how well the ATO manages and uses the AIIR data in taxation administration. The ANAO considered the following four key areas in addressing the audit objective. 1. Governance arrangements within the ATO, focussing on whole of ATO and whole-of-government aspects of the AIIR data, as distinct from solely business line applications. 2. Receipt of AIIR data and how well the ATO facilitates the collection of complete and valid AIIR data from investment bodies 3. Management of AIIR data through the construction by the ATO of valid entity records by using the AIIR data in conjunction with existing ATO client identification master files. 4: Use of the AIIR data on a systematic basis to inform active compliance activities.

The objective of the audit was to examine the Tax Office's administration of the Lost Members Register. In particular, the audit examined the Tax Office's governance arrangements for the LMR; its strategies for managing data quality; and its provision of access to LMR data. The audit also considered how the Tax Office's administration of the LMR has responded to recommendations made in the ANAO's earlier review (Audit Report No.17, 2005–06 Administration of the Superannuation Lost Members Register), relevant changes in funding and legislation supporting the LMR, as well as the Change Program.