Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The audit objective was to assess the effectiveness of agencies' contract management by determining if they had sound practices and systematic approaches to this activity. Particular attention was given to each agency's:

- day-to-day management of individual contracts; and

- approach to managing its contract population.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2017. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act); the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule); the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s 2016–17 Portfolio Budget Statements (PBS) and the ANAO 2016–20 Corporate Plan and annual reporting requirements set out in other relevant legislation.

Please direct enquiries relating to annual reports through our contact page.

The objective of the audit was to assess the extent to which the Department of the Treasury and the Australian Taxation Office (ATO) have improved the management of tax expenditure estimates by implementing the six recommendations in the 2008 ANAO audit and the three recommendations made by the Joint Committee of Public Accounts and Audit (JCPAA) following its inquiry.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether DEWR had implemented ESC3 and its computer system EA3000, efficiently and effectively. The primary focus is on the period of change from the previous employment services contract to ESC3 and the first full year of its operation, 2003-04. The scope of the audit was limited to the implementation of Job Network services under ESC3, the introduction of the supporting computer application, EA3000, and DEWR's use of modelling to estimate the effects of the APM. The audit did not test the effectiveness of the APM. DEWR has a plan to evaluate the new model. A separate, concurrent ANAO audit assessed DEWR's oversight of Job Network services to job seekers.

The objective of the audit was to examine the Tax Office's administration of the Lost Members Register. In particular, the audit examined the Tax Office's governance arrangements for the LMR; its strategies for managing data quality; and its provision of access to LMR data. The audit also considered how the Tax Office's administration of the LMR has responded to recommendations made in the ANAO's earlier review (Audit Report No.17, 2005–06 Administration of the Superannuation Lost Members Register), relevant changes in funding and legislation supporting the LMR, as well as the Change Program.

The ANAO Corporate Plan 2018–19 is the ANAO's key strategic planning document. It guides our operating environment and sets out how we will deliver on our purpose. The corporate plan is complemented by the annual audit work program which reflects the ANAO's audit strategy and deliverables for the coming year.

Please direct enquiries about our corporate plan through our contact page.

The objective of this audit was to examine the effectiveness of the design and implementation of the Department of the Prime Minister and Cabinet’s (PM&C’s) evaluation framework for the Indigenous Advancement Strategy (IAS), in achieving its purpose to ensure that evaluation is high quality, ethical, inclusive and focused on improving outcomes for Indigenous Australians.

Please direct enquiries through our contact page.

The objective of the audit was to examine the quality and integrity of DVA's income support records and to report on the effectiveness of the department's management of the data and how it impacts on service delivery.

The objective of this audit was to assess the effectiveness of the Department of Finance and selected entities’ implementation of the Australian Government’s campaign advertising framework.

Please direct enquiries through our contact page.

The objective of this audit was to assess the Private Health Insurance Administration Council's (PHIAC's) administrative effectiveness as a regulator of private health insurance. In making this assessment, the Australian National Audit Office (ANAO) addressed the following criteria: whether PHIAC monitored compliance with its legislative requirements and analysed related data; whether PHIAC addressed and managed non-compliance with its legislative requirements; and whether PHIAC's governance and organisation supported the performance of its legislative functions. Although the Department of Health and Ageing (Health) also has a role in the regulation of the private health insurance industry under the National Health Act 1953 (Health Act), Health's regulatory activities were outside the scope of this audit.

The objective of the audit was to assess the effectiveness of the Tax Office's administration of the Superannuation Co-contribution Scheme.

The audit reviewed five key areas: governance arrangements; information technology systems and controls; co-contribution processing; compliance approaches; and communication with clients.

The objective of the audit was to assess the effectiveness of CSIRO’s development and administration of selected National Research Flagships. In assessing CSIRO’s performance, the ANAO examined whether:

- mechanisms were in place to develop and implement the Flagships, within the context of the broader CSIRO change program;

- governance arrangements for Flagships incorporated sound oversight, planning and reporting arrangements; and

- periodic review activities were used to assess and improve the operation of the Flagships.

The overall objective of the audit was to assess CrimTrac's progress in achieving the key deliverables it was established to provide, given that the agency had been in operation for some three years. The Australian Government provided $50 million for the implementation of CrimTrac, with an expectation that significant progress would be made within the first three years. The audit further examined whether CrimTrac had progressed the key deliverables efficiently and effectively, and whether the data either held by CrimTrac, or accessed through CrimTrac, for matching purposes is secure.

The audit was undertaken following advice from the Joint Committee of Public Accounts and Audit (JCPAA) to the Auditor-General that assurance that ABC programming adequately reflects the ABC's Charter was an audit priority of Parliament. The objective of the audit is to provide Parliament with this assurance. The focus of the audit was on the governance arrangements of the ABC Board and management that enable the ABC to demonstrate the extent to which it is achieving its' Charter obligations, and other related statutory requirements, efficiently and effectively. The scope of the audit was as follows:

- Review the ABC's corporate governance framework against better practice models. The ANAO had regard to the ABC's unique role as a national public broadcaster established as a budget funded Commonwealth statutory authority subject to the Commonwealth Authorities and Companies Act 1997.

- Examine the ABC Board's approach to the interpretation of the Charter requirements of the ABC and the setting of strategic directions, and management's administrative arrangements for implementing the strategic directions established by the Board.

- Examine the ABC's performance information framework, the development, documentation and use of performance measures in relation to targets and/or objectives, the monitoring and reporting of performance and its' inter-relationship with the corporate planning and budgetary processes, particularly in relation to the strategic directions set by the Board.

The audit did not examine the overall management of the ABC. In keeping with the audit scope, the audit examined ways in which the ABC aligns its' strategic directions with its' Charter requirements for programs broadcast on radio, television and on-line and assures itself, and Parliament, about the achievement of its' Charter obligations. Further, the audit did not examine the operations of ABC Enterprises or symphony orchestras that operate as ABC-owned subsidiary companies.

The audit objective was to assess whether nbn co limited effectively administered the National Broadband Network Satellite Support Scheme.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the management practices undertaken by APS agencies to achieve value for money and transparency in dealing with contracts for non-APS workers. The focus of the audit was on circumstances where agencies had a significant reliance on a non-APS workforce to assist in achieving their core functions. Regular reporting by agencies of expenditure on non-APS workers was outside the scope of this audit.

The objective of the audit was to assess the effectiveness of agencies’ arrangements for monitoring and implementing ANAO performance audit recommendations.

Please direct enquiries relating to reports through our contact page.

The objectives for the audit of the third tranche sale of Telstra shares were to:

- assess the extent to which the Government's sale objectives were achieved, including maximising overall value for money;

- assess the effectiveness of the management of the sale; and

- identify principles of sound administrative practice to facilitate potential improvements in any future asset sales.

The objective of the audit was to assess the effectiveness of DoHA's management of the planning and allocation of aged care places and capital grants, in accordance with the Aged Care Act 1997.

The objective of the audit was to assess the effectiveness of the administration of the Defence Home Ownership Assistance Scheme by the Department of Defence and the Department of Veterans’ Affairs.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the implementation and administration of the Small Business Superannuation Clearing House.

The objectives of the follow-up audit were to assess DFAT's implementation of the six recommendations made by the ANAO in the previous audit. It also sought to determine whether implementation of these recommendations, or alternative action, had improved DFAT's administration of consular services. The audit focused on management processes and supporting systems for the delivery of consular services. It also reviewed DFAT's implementation of recommendations of the Senate Foreign Affairs, Defence and Trade References Committee that were outstanding from the previous audit.

The audit objective was to assess the effectiveness of the Department of Health and Ageing and the Australian National Preventive Health Agency in fulfilling the Commonwealth’s role in implementing the Council of Australian Government’s National Partnership Agreement on Preventive Health, to achieve the Agreement’s objectives, outcomes and outputs, including supporting all Australians to reduce their risk of chronic disease.

The objective of this audit was to assess the effectiveness of the governance of the Northern Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976, Native Title Act 1993 and Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the governance of the Northern Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976, the Native Title Act 1993 and the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

The audit objective was to examine the effectiveness to date of the Department of Defence’s administration of the Enterprise Resource Planning (ERP) program, with a focus on ERP Tranche 1 activities.

Please direct enquiries through our contact page.

The audit objective was to assess the adequacy of the Commonwealth's administration of three key components of the Agriculture - Advancing Australia package: the FarmBis II program, the Farm Help program and the Farm Management Deposits scheme. Broadly, the audit examined the areas of strategic management, managing compliance, program promotion, performance monitoring and evaluation, and performance results.

The audit reviewed the construction of facilities for the Australian Defence Force and the Department of Defence by the Defence Estate Organisation. The objective of the audit was to assess the efficiency and administrative effectiveness of the Organisation's project delivery function, highlighting effective practice and, where appropriate, making practical recommendations to enhance facilities project management. The main projects examined were the facilities required for the Army Presence in the North and the Russell Hill Redevelopment.

The objective of this audit was to assess the effectiveness of the governance of the Tiwi Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

The objective of this audit is to assess the effectiveness of the governance of the Anindilyakwa Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013.

Please direct enquiries through our contact page.

Mr Ian McPhee - Auditor-General for Australia, presented at the Canberra Evaluation Forum

The objective of this audit was to assess the effectiveness of the administration of the mandatory minimum requirements for Aboriginal and Torres Strait Islander participation in major government procurements in achieving policy objectives.

Please direct enquiries through our contact page.

The objective of this audit was to examine the effectiveness of Medicare Australia's administration of the PBS. In assessing the objective, the audit considered three key areas:

- Medicare Australia's relationship with the PBS policy agency (DoHA) and service delivery policy agency (Department of Human Services (DHS));

- the management arrangements and processes underpinning Medicare Australia's delivery of the PBS (including the means by which Medicare Australia gains assurance over the integrity of the PBS); and

- how Medicare Australia undertakes its three main responsibilities relating to the delivery of the PBS, namely: approving pharmacies; approving authority prescriptions; and processing PBS claims.

The audit objective was to assess the effectiveness of the Australian Organ and Tissue Donation and Transplantation Authority's administration of community awareness, professional education and donor family support activities intended to increase organ an

Please direct enquiries relating to reports through our contact page.

The audit objective was to examine the effectiveness of the Department of Human Services’ administration of the Australian Childhood Immunisation Register.

Please direct enquiries relating to reports through our contact page.

The objectives of the audit were to: assess whether financial delegations associated with the expenditure of public monies were determined, applied and managed in accordance with applicable legislation, Government policy and applicable internal controls; and identify better practices and recommend improvements as necessary to current practices.

The objective of the audit was to assess the awarding of funding under the Supported Accommodation Innovation Fund against the requirements of the Commonwealth’s grants administration framework.

Please direct enquiries relating to reports through our contact page.

Mr Mr Ian McPhee - Auditor-General for Australia, presented at the Leadership Development Network Breakfast Seminar

The objective of the audit was to assess the effectiveness of the Department of Immigration and Border Protection's (DIBP’s) management of the Central Movement Alert List (CMAL) system, having particular regard to the recommendations contained in Audit Report No. 35 of 2008–09.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Infrastructure, Transport, Regional Development and Communications’ design and implementation of measures to support the aviation sector in response to the COVID-19 pandemic.

Please direct enquiries through our contact page.

Given the significant expenditure associated with the Super Seasprites, and the problems that the Project had encountered over some time, the ANAO had commenced this performance audit prior to the Government's decision to cancel the Project. The focus of the audit was on Defence's and DMO's administration of the Project. In light of the Government's decision to cancel the Project, the objective of the audit was revised to place greater emphasis on those issues that resulted in the failure of the Project to provide the required capability, and highlighting project management lessons for major Defence acquisitions going forward.Accordingly the audit objective was to:

- identify those factors that contributed to the on-going poor performance of the Project;

- outline measures taken by Defence and DMO in seeking to overcome issues encountered by the Project, and key lessons arising from this project for the benefit of major acquisitions projects generally; and

- determine the capability and cost implications of a project that failed to deliver to expectations.

The objective of the audit was to assess the effectiveness of the Australian Pesticides and Veterinary Medicines Authority’s (APVMA’s) implementation of reforms to agvet regulation and the extent to which the authority has achieved operational efficiencies and reduced the cost burden on regulated entities.

Please direct enquiries relating to reports through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending 30 June 2016. It addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 and the Auditor-General Act 1997, the performance measures set out in the outcome and programs framework in the ANAO’s 2015–16 Portfolio Budget Statements and the ANAO’s 2015–19 Corporate Plan and annual reporting requirements set out in other legislation.

Please direct enquiries relating to annual reports through our contact page.

The audit objective was to assess the effectiveness of DEEWR’s and FaHCSIA’s administration of the Australian Government’s responsibilities under Element 1 of the National Partnership Agreement on Indigenous Economic Participation (including the NT Jobs Package).

The objective of this audit was to examine the effectiveness of the Australian Electoral Commission’s management of financial disclosures required under Part XX of the Commonwealth Electoral Act 1918, including the extent to which the AEC is achieving accurate and complete financial disclosures.

Please direct enquiries through our contact page.

The objective of this audit was to evaluate whether selected Australian Government agencies were effectively managing security risks arising from the use of contractors. To address this objective, the audit evaluated relevant policies and practices in the audited agencies against a series of minimum requirements in the management of security issues in procurement and contracting activity. These minimum requirements were developed from the guidance and standards contained in the PSM and also from the ANAO's previous protective security audits.

The audit focused on two broad types of contracting arrangements: contracting of security functions; and contracting of any service or business function that requires, or which has the potential to require, contractors to access sensitive or security classified information.

The following Australian Government agencies were involved in this audit:

- Australian Customs Service (Customs);

- Commonwealth Superannuation Administration (ComSuper);

- Department of Finance and Administration (Finance); and

- Department of Foreign Affairs and Trade (DFAT).

In addition, the Attorney-General's Department, which is responsible for the maintenance of the PSM and for providing advice on contemporary protective security policies and practices, was consulted during the audit.

The objective of this audit was to assess the effectiveness of arrangements for implementing and monitoring the implementation of ANAO performance audit recommendations in the Department of Agriculture and the Department of Human Services.

Please direct enquiries relating to reports through our contact page.

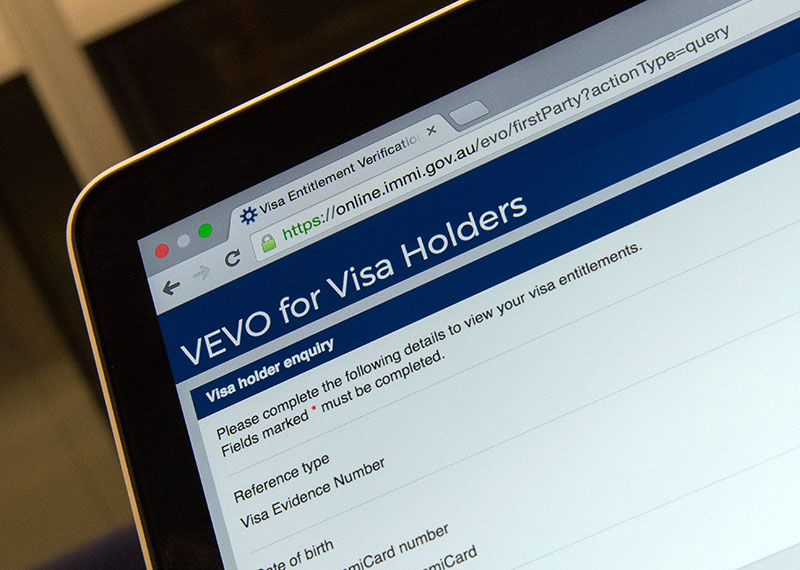

The objective of the audit was to assess the effectiveness of the Department of Immigration and Border Protection’s (DIBP) management of compliance with visa conditions. To form a conclusion against this objective, the ANAO assessed whether DIBP:

- effectively manages risk and intelligence related to visa holders’ non-compliance with their visa conditions;

- promotes voluntary compliance through targeted campaigns and services that are appropriate and accessible to the community;

- conducts onshore compliance activities that are effective and appropriately targeted; and

- has effective administrative arrangements to support visa holders’ compliance with their visa conditions.

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess whether selected entities effectively implemented agreed recommendations from Auditor-General Report No. 25 2019–20 Aboriginal and Torres Strait Islander Participation Targets in Major Procurements.

Please direct enquiries through our contact page.

The objective of this audit is to assess the effectiveness of the Department of Finance’s and selected entities’ implementation of the Australian Government’s campaign advertising framework.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Bureau of Meteorology’s implementation of the Improving Water Information Program.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the ATO's administration of CGT compliance in the individuals market segment. The focus of the audit was the ATO's administration of compliance by individuals with respect to the two most common CGT events: real property and share disposals. The Australian National Audit Office (ANAO) identified three key areas for review:

- governance – the corporate planning and reporting arrangements relevant to the administration of CGT compliance in the individuals market segment, including how these are integrated with the ATO's overall approach to managing CGT;

- identifying and assessing compliance risks – the mechanisms and strategies used to identify and assess CGT compliance risks in the individuals market segment; and

- compliance activities – the products and processes used to manage CGT compliance in the individuals market segment.

The objectives of the Australian National Audit Office's (ANAO) performance audit were to: examine the efficiency and effectiveness of agencies' procurement and management of legal services arrangements; determine adherence to Australian Government policy requirements; examine the effectiveness of the OLSC's monitoring of agencies' compliance with Government policy requirements; examine the OLSC's role in assisting agencies to comply with Government policy.

The audit objective was to assess whether the early stages of DIAC's preparations for the re-tendering of the detention and health services contracts were consistent with sound practice. The audit focused on governance arrangements, in particular the recordkeeping arrangements, roles and responsibilities of personnel, expert advisors and the probity auditor—matters raised in the previous audit report. The audit did not examine the RFT, which is not due to be issued until April 2007.

The objective of the audit was to examine the effectiveness of Navy’s strategy for recruiting and retaining personnel with specialist skills. The effective delivery of Navy capability depends on Navy having available sufficient numbers of skilled personnel to operate and maintain its fleet of sea vessels and aircraft, and conduct wide‑ranging operations in dispersed locations. Without the right personnel, Navy capability is reduced. Navy’s budget for 2014–15 included $1.86 billion in employee expenses.

The audit concluded that, in its strategic planning, Navy had identified its key workforce risks and their implications for Navy capability. To address these risks Navy had continued to adhere to its traditional ‘raise, train and sustain’ workforce strategy; developed a broad range of workforce initiatives that complemented its core approach; and sought to establish contemporary workforce management practices. However, long‑standing personnel shortfalls in a number of ‘critical’ employment categories had persisted, and Navy had largely relied on retention bonuses as a short‑ to medium‑term retention strategy.

Navy had developed a broad range of workforce initiatives, some designed specifically to address workforce shortages in its critical employment categories. To date, Navy had primarily relied on paying retention bonuses and other financial incentives; recruiting personnel with prior military experience to work in employment categories with significant workforce shortfalls; and using Navy Reserves in continuous full time roles. Ongoing work was required for Navy to firmly establish a range of promising workforce management practices, including providing the right training at the right time; more flexible approaches to managing individuals’ careers; and improving workplace culture, leadership and relationships. More flexible and tailored workforce management practices could help address the underlying causes of workforce shortfalls, particularly when the traditional approaches were not gaining sufficient traction.

The ANAO made two recommendations aimed at Navy: drawing on external human resource expertise to inform the development and implementation of its revised workforce plan; and evaluating the impact of retention bonuses on the Navy workforce to determine their future role within its overall workforce strategy.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to report on the progress of the current phase of the Air Warfare Destroyer (AWD) Program, which is known as SEA 4000 Phase 3–Build. This phase commenced in June 2007, and covers the finalisation of the detailed design, the signing of the Alliance and Platform System Design contracts, and the construction and delivery of the ships by the Industry Participants to the Defence Materiel Organisation (DMO).

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess the effectiveness of AGD's administration of grants provided under the Respondents Scheme. The audit considered the context within which the Respondents Scheme operates and focused on assessing the administration of the scheme including its financial management within AGD.

The objective of this audit was to assess the effectiveness of the Department of Education, Skills and Employment’s arrangements in administering wage subsidies linked to employment programs.

Please direct enquiries through our contact page.

The audit objective was to assess whether the Department of Health is effectively managing financial assistance under the Medical Research Future Fund.

Please direct enquiries through our contact page.

The objective of the audit was to assess whether entities properly accounted for software assets, and adopted an integrated planning approach to inform software asset investment decisions.

The main focus of the audit was on whether entities accounted for software costs in accordance with relevant accounting standards and the FMOs, paying particular attention to the standard elements of an internal control framework and accounting practices. In addition, in the context of software asset planning, the audit considered whether entities assessed the risks associated with software assets, used life-cycle costing approaches, and aligned ICT and capital management plans, to inform decision-making on software asset investments.