Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Climate Change, Energy, the Environment and Water portfolio is responsible for advising the government and implementing programs on: climate change; energy supply efficiency; the environment, biodiversity and heritage; meteorological services; water resources; and Australia’s interests in the Antarctic and Southern Ocean.

The Department of Climate Change, Energy, the Environment and Water is the lead entity in the portfolio. It is responsible for developing and implementing policies and initiatives to protect Australia’s environment, biodiversity and heritage; helping Australia respond to and address climate change; and managing Australia’s water and energy resources. Further information is available from the department’s website.

In addition to the Department of Climate Change, Energy, the Environment and Water, there are 11 entities within the portfolio that are responsible for: renewable energy regulation; financing the renewable energy sector; advice on climate change mitigation; meteorological services; Commonwealth national parks; managing Commonwealth lands around Sydney Harbour; and the Great Barrier Reef Marine Park.

In the 2025–26 Portfolio Budget Statements (PBS) for the Climate Change, Energy, the Environment and Water portfolio, the aggregated budgeted expenses for 2025–26 totalled $11.1 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

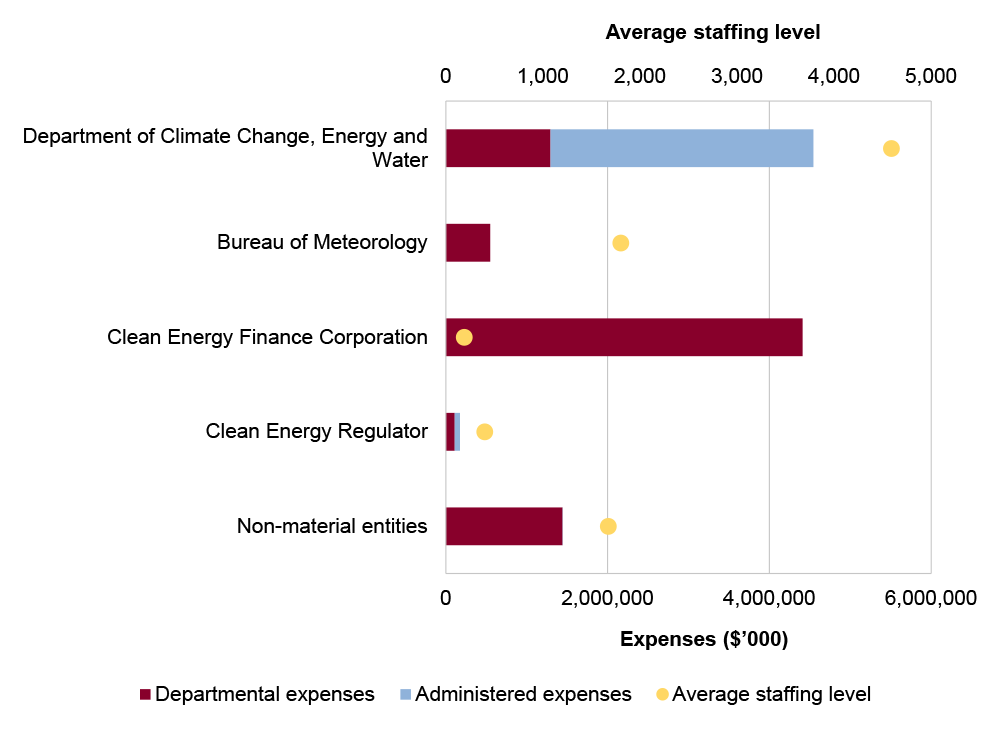

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Clean Energy Finance Corporation represents the largest proportion of the portfolio’s expenses, and departmental expenses of the portfolio are the most material component, representing 70 per cent of the entire portfolio’s expenses.

Figure 1: Climate Change, Energy, the Environment and Water portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified for the Climate Change, Energy, the Environment and Water portfolio relate to:

- the oversight of government investments, particularly those relating to equity, concessional loans and guarantees;

- the Department of Climate Change, Energy, the Environment and Water’s capacity to effectively implement risk based regulatory regimes; and

- limitations in monitoring and evaluation frameworks that reduce the department’s ability to demonstrate that initiatives are achieving outcomes.

The strategic risks in the Climate Change, Energy, the Environment and Water portfolio relate to governance, service delivery, grants administration, procurement, regulation, asset management and sustainment and financing government policies.

Governance

The portfolio includes functions in remote and unique operating environments such as national parks, Australia’s Antarctic presence and construction of Snowy 2.0. These activities present risks relating to culture and workforce management. Appropriate governance is required to establish and maintain a safe working environment and high performing teams.

Issues with measuring, evaluating and reporting on the contribution of activities to their intended outcomes and effectively managing risk to the achievement of outcomes continue to be identified across portfolio entities.

The governance of financial mechanisms, including equity investments, concessional loans and guarantees, require portfolio entities to monitor risk tolerance levels and implement risk mitigation actions.

Implementation of the sustainability reporting framework and assurance regime in Australia is progressing. Climate related disclosures under the Corporations Act 2001 apply to certain entities. Snowy Hydro Limited is required to prepare a sustainability report under these arrangements commencing the 2025–26 financial year. The sustainability report will require Snowy Hydro Limited to disclose information about climate-related risks and opportunities that could reasonably be expected to affect cash flows, access to finance or cost of capital. Sustainability reports will be subject to assurance and entities should review their preparedness to meet these requirements in order to support accurate and timely reporting and audit.

Deficiencies in record keeping arrangements limit entities’ ability to demonstrate the effective and ethical delivery of their activities. There are ongoing issues with the accuracy and completeness of records across the Climate Change, Energy, the Environment and Water portfolio.

Service delivery

Initiatives that have commenced in the portfolio over recent years include: the $20 billion Rewiring the Nation program; the $2 billion Hydrogen Headstart program; the $1.9 billion Powering the Regions Fund; and the $1.3 billion Household Energy Upgrades Fund. There is a risk that new initiatives may not achieve desired outcomes if they are not supported by sufficient and effective planning, a clear rationale of where intervention is required, use of the best available evidence to inform decision-making, and application of appropriate risk management and performance measurement frameworks.

Grants administration

There is a risk that the grant programs and funds may not achieve desired outcomes if they are not supported by effective grants administration. Documenting the basis for funding decisions in grants administration was identified as an area for improvement across a range of portfolios, including in the Climate Change, Energy, the Environment and Water portfolio. Effective grant administration also requires appropriate planning, implementation and monitoring arrangements.

Procurement

Previous performance audits have identified deficiencies in demonstrating value for money in the department’s procurement activities. Establishing and implementing effective arrangements to ensure value for money will remain important for procurement activities delivered by the department. A recent audit concluded that the department’s procurement of strategic water entitlements was largely effective; however, there is a risk that other areas of the department may not have improved performance in this area.

Regulation

Effective regulatory approaches are required to achieve the desired outcomes of regulation. Past audits have identified failures with regulation in portfolio entities relating to: the use of intelligence; establishment of a risk-based approach to regulation; implementation of effective regulatory plans and strategies; governance arrangements; compliance with procedural and legislative requirements, and performance measurement and evaluation. There is a risk that the portfolio entities have not improved their performance in this area and that the desired outcomes of regulation are not being met.

Asset management and sustainment

Portfolio entities manage a large number of physical assets, including: Snowy Hydro infrastructure used for energy generation activities and water services; an icebreaker vessel; national parks; and meteorological equipment and research stations. These assets require specific maintenance and sustainability planning unique to the nature and use of the asset. Planning should consider the full lifecycle of the asset including predicted costs that are considered in the context of the entity budget. It is also important that targets are set in asset management strategies, and that tracking and reporting against targets is undertaken, to provide a clear focus for performance and accountability for delivering on objectives.

Financing government policies

The department provides advice on financing arrangements for investment in climate change, energy, the environment and water including for delivery through portfolio bodies.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Climate Change, Energy, the Environment and Water portfolio were included in tabled ANAO performance audits 20 times. The conclusions directed toward entities within this portfolio were as follows:

- one was unqualified;

- eight were qualified (largely positive); and

- 11 were qualified (partly positive).

- none were adverse.

Figure 2 shows the number of audit conclusions for entities within the Climate Change, Energy, the Environment and Water portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Climate Change, Energy, the Environment and Water portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Climate Change, Energy, the Environment and Water portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Climate Change, Energy, the Environment and Water portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Climate Change, Energy, the Environment and Water (DCCEEW) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DCCEEW is in its first year of inclusion in the annual performance statements program and the engagement has been assessed as moderate risk. Factors contributing to this assessment include:

- DCCEEW having an established centralised team to manage the production of key documents within their governance framework;

- recent ANAO audit coverage of DCCEEW’s corporate planning arrangements and some of DCCEEW’s performance measures;

- constructive and effective engagement by DCCEEW during the audit to date;

- preliminary assessment of a risk of bias in several performance measures or targets;

- preliminary review of possible significant business of DCCEEW that does not have associated performance measures in place; and

- DCCEEW’s introduction of five new performance measures in its 2024–25 Corporate Plan.

Key risks for the department’s performance statements that the ANAO has highlighted include the:

- appropriateness of performance measures and targets;

- completeness of performance reporting;

- performance statements preparation processes; and

- reliance on third party data and analysis.

Financial statements audits

Overview

Entities within the Climate Change, Energy, the Environment and Water portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Climate Change, Energy, the Environment and Water portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Climate Change, Energy, the Environment and Water |

Non-corporate |

Moderate |

3 |

2 |

|

Bureau of Meteorology |

Non-corporate |

Low |

3 |

1 |

|

Clean Energy Finance Corporation |

Corporate |

Moderate |

3 |

3 |

|

Clean Energy Regulator |

Non-corporate |

Moderate |

0 |

2 |

|

Snowy Hydro Limited |

Company |

Moderate |

5 |

0 |

|

Non-material entities |

||||

|

Australian Institute of Marine Science |

Corporate |

Low |

||

|

Australian Renewable Energy Agency |

Corporate |

Low |

||

|

Climate Change Authority |

Non-corporate |

Low |

||

|

Director of National Parks |

Corporate |

Moderate |

||

|

Great Barrier Reef Marine Park Authority |

Non-corporate |

Low |

||

|

Murray-Darling Basin Authority |

Corporate |

Low |

||

|

Sydney Harbour Federation Trust |

Corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Commission for the Conservation of Antarctic Marine Living Resources |

||||

|

Natural Heritage Trust of Australia Account – financial statements audit |

||||

|

Snowy Hydro Limited – Australian financial services licence compliance |

||||

|

Snowy Hydro Limited – half-year review |

||||

Material entities

Department of Climate Change, Energy, the Environment and Water

The Department of Climate Change, Energy, the Environment and Water is responsible for developing and implementing a national response to climate change and improving Australia’s energy supply, efficiency, quality, performance and productivity; conserving, protecting and sustainably managing Australia’s biodiversity, ecosystems, environment and heritage; advancing Australia’s interests in the Antarctic region; and improving the health of rivers and freshwater ecosystems and water use efficiency.

The department’s total budgeted assets for 2025–26 are $59.0 billion, with other investments representing 46 per cent as shown in Figure 4. Other provisions represents 51 per cent of total budgeted liabilities and grants and subsidies expense represents 40 per cent of total budgeted expenses.

Figure 4: Department of Climate Change, Energy, the Environment and Water’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The financial statements audit of the Department of Climate Change, Energy, the Environment and Water has been classified by the ANAO as a moderate risk engagement. This engagement risk rating reflects the department’s broad strategic direction across several diverse functions, which carry heightened public interest and parliamentary scrutiny, the complexity of some financial statements balances that impact the Australian Government’s consolidated financial statements, and the department’s system of internal control and governance which has matured since establishment in 2022–23.

There are five key risks for the department’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- KAM – Valuation of water entitlement assets, due to the estimation and judgement involved in the valuation methodology, and given the trading of water assets is conducted in a developing market;

- KAM – Valuation of Snowy Hydro Limited, due to complexities and judgement associated with the discounted cash flow valuation methodology adopted, and the significance of the fair value of Snowy Hydro Limited to the Australian Government’s consolidated financial statements;

- KAM – Valuation of the Antarctic restoration provision, due to the complexity of the model used to determine the provision, which requires judgement for the input of several variables and assumptions;

- The valuation of the investment in Marinus Link Pty Ltd, due to the nature of the company’s core project delivering an electricity and telecommunications interconnector between Tasmania and Victoria and complexities associated with the choice of assumptions and judgements which are applied in the valuation model.

- The management of, and accounting for, the department’s administered grants programs, due to the value, scale and diversity of these programs and the range of modes of delivery.

Bureau of Meteorology

The Bureau of Meteorology (the Bureau) is responsible for providing weather, water, climate and ocean services for Australia.

The Bureau’s total budgeted assets for 2025–26 are $1.3 billion, with 40 per cent attributable to property, plant and equipment and 34 per cent attributable to intangible assets, as shown in Figure 5. Sales of goods and services represent 29 per cent of total budgeted revenue.

Figure 5: Bureau of Meteorology budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for the Bureau’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The valuation of non-financial assets, particularly specialised weather and observing plant and equipment, due to the complexity of the valuation process which involves judgement and estimation.

- The valuation of intangible assets, particularly computer software, given the judgement applied by the Bureau in confirming that they are capitalised and valued appropriately.

- The recognition of the Bureau’s own source revenue due to the value of revenue from rendering of services. Given the number of revenue contracts administered by the Bureau, there is increased complexity in determining performance obligations under contract which provide the criteria for recognition of revenue.

- Accounting for leases, due to the significance of lease liabilities and right-of-use assets in the Bureau’s financial statements and the key judgments required by management regarding the appropriate recognition of these balances.

Clean Energy Finance Corporation

The Clean Energy Finance Corporation (CEFC) is responsible for facilitating increased flows of finance into the clean energy sector and facilitating the achievement of Australia’s greenhouse gas emissions reduction targets.

CEFC’s total budgeted revenues for 2025–26 are $530.1 million, with 70 per cent of this revenue attributable to interest, as shown in Figure 6. Advances and loans, investments in shares and investments in other interest-bearing securities represent 52 per cent, 18 per cent and 17 per cent, respectively, of total budgeted assets.

Figure 6: Clean Energy Finance Corporation budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are six key risks for the CEFC’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The measurement of interest and fee income from the CEFC’s loans and deposits, which is a significant portion of the CEFC’s revenue.

- The accounting for complex financing arrangements, due to the bespoke nature of CEFC’s investment transactions.

- The adequacy of the impairment provision relating to loans, due to the complexity of the transactions, the concentration of sectoral exposure and the degree of management judgement required to estimate the provisions.

- The valuation and accounting for direct unlisted equity investments, which are required to be recognised at fair value. CEFC applies a range of valuation methodologies and exercise increased levels of judgement and estimation in determining an appropriate fair value for these investments.

- The verification of the carrying value of the CEFC’s investment in its associates – entities that the CEFC does not control but has significant influence over.

- The accuracy of key management personnel remuneration calculation and disclosures, due to their material nature.

Clean Energy Regulator

The Clean Energy Regulator (CER) is responsible for the administration of market-based mechanisms that incentivise reduction in greenhouse gas emissions and the promotion of additional renewable electricity generation. In achieving these objectives, the CER is responsible for the administration of the Australian Carbon Credit Unit Scheme and the programs and regulation supporting the Renewable Energy Target.

CER’s total budgeted expenses for 2025–26 are $174.7 million, with other expenses attributable to 35 per cent, as shown in Figure 7. Other provisions represent 95 per cent of total budgeted liabilities.

Figure 7: Clean Energy Regulator budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the CER’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage.

- The occurrence and valuation of expenses and liabilities for the Australian Carbon Credit Unit Scheme, due to the complexity of the program and judgement required by CER to determine the provision for payments.

- The recognition of shortfall charges under the Renewable Energy (Electricity) Act 2000 and associated refund provision, due to the significance and complexity of the program judgement required by CER in determining the refund provision.

Snowy Hydro Limited

Snowy Hydro Limited (Snowy Hydro) is a government business enterprise responsible for energy generation activities to supply the National Electricity Market as well as operating as a retail energy provider through the Red Energy and Lumo Energy brands.

Snowy Hydro’s total actual total assets for 2023–24 were $12.8 billion, with property, plant and equipment contributing to 79 per cent and other financial assets (encompassing other financial assets including energy derivatives) contributing to 7 per cent, as shown in Figure 8. Snowy Hydro’s total liabilities were just over $6.4 billion, with interest bearing liabilities (including debt) contributing 74 per cent.

Figure 8: Snowy Hydro Limited actual financial statements by category ($’000)

Source: ANAO analysis of Snowy Hydro Limited’s 2023–24 Annual Report.

There are five higher risks for Snowy Hydro’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including three risks that the ANAO considers potential key audit matters (KAMs).

- The valuation of derivative financial instruments, reflecting the complexity of the valuation processes and models for Snowy Hydro Limited’s various financial instruments which include hedging instruments, forward contracts and swaps. The valuation of these derivative instruments require a high level of judgement from management to determine inputs into the valuation model, particularly for unobservable inputs. (KAM – Valuation, existence and completeness of financial instruments – energy derivatives)

- The capitalisation of Snowy 2.0, which reflects the complexity of the underlying project and the judgement that needs to be applied to meet the requirements of the accounting standards. (KAM – Valuation of property, plant and equipment (‘PPE’) – construction in progress)

- The recoverability of retail debtors, due to the level of judgement applied by management in determining the estimate of expected lifetime credit loss on trade and other receivables. (KAM – Valuation of allowance for doubtful debts)

- The capitalisation of Hunter Power Project costs, which reflects the complexity of the project and the judgement that needs to be applied to meet the requirements of the accounting standards.

- Debt facilities and covenant compliance, due to the requirements and conditions of debt arrangements.