Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio covers a number of policy areas, including safety across the civil aviation, maritime and transport sectors; air navigation services; developing and administering the national capital; road, rail and freight transport systems; communication services; digital technologies; and public access to the arts and culture.

The Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts is the lead entity in the portfolio and supports the Australian Government’s policies on transport connectivity; regional development, Northern Australia, and Territories; and also supports Australians’ access to communication connectivity, creativity and culture. Further information is available from the department’s website.

An Administrative Arrangement Order (AAO) was made on 13 May 2025 which impacts areas of responsibility in the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio.

In addition to the department, there are 32 entities within the portfolio with responsibility for matters such as maritime, transport and civil aviation safety; infrastructure planning and delivery, including development of the Western Sydney Airport, national broadband network infrastructure and the Inland Rail project; postal services; public broadcasting; access to cultural and sport activities and the arts; national archives and strategic planning for the national capital.

In the 2025–26 Portfolio Budget Statements (PBS) for the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio, the aggregated budgeted expenses for 2025–26 total $15.9 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

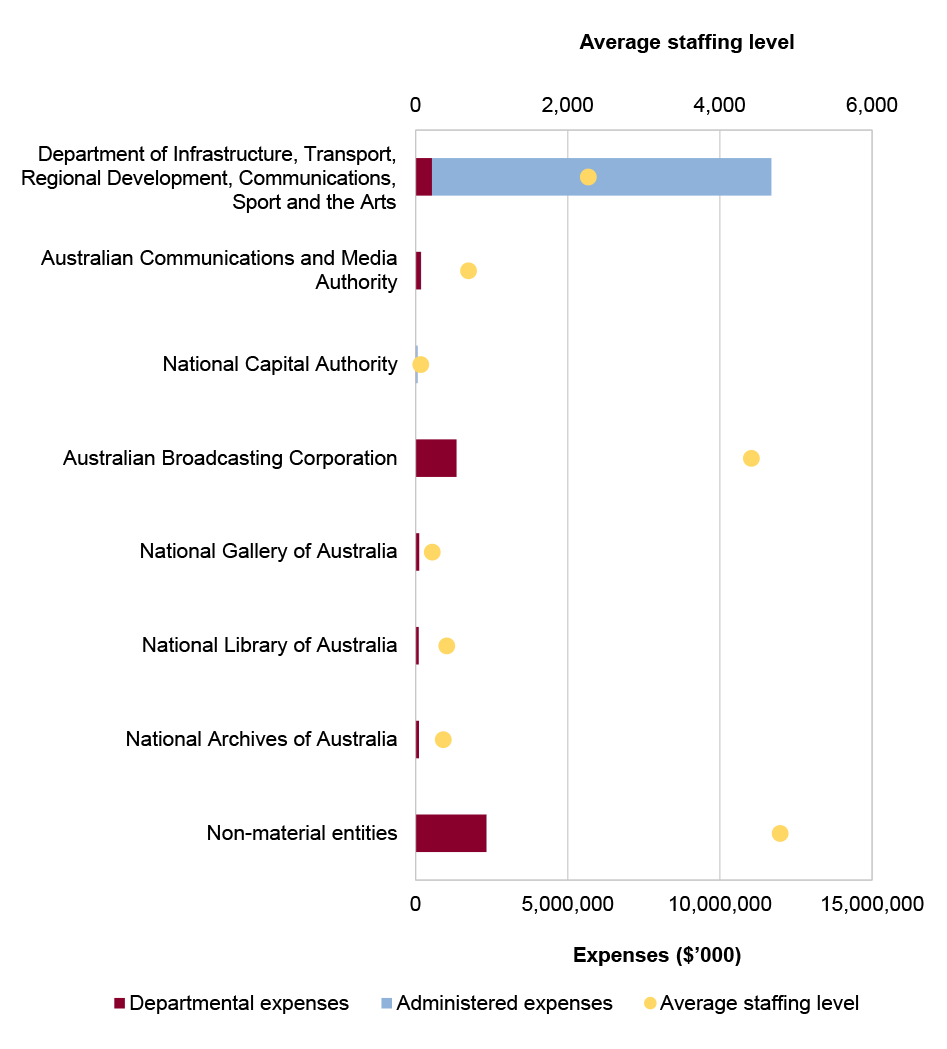

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts is the largest proportion of the portfolio’s expenses, and administered expenses of the portfolio are the most material component, representing 70 per cent of the entire portfolio’s expenses.

Figure 1: Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements and the 13 May 2025 AAO.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts that was endorsed by the Australian Public Service Commissioner in August 2023.

The primary risks identified by the ANAO for the portfolio relate to: the need for effective oversight of wide policy remit, including the large number of diverse portfolio entities and companies; and effective program delivery including supporting the implementation of large-scale infrastructure projects and programs.

Specific risks in the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio relate to governance, grants administration, procurement, regulation and financial management.

Governance

Government outcomes in this portfolio are largely delivered through corporate Commonwealth entities and government business enterprises established to operate under commercial principles. This creates a need to have a range of governance and oversight mechanisms in place to provide assurance that outcomes are being delivered appropriately and to ensure transparency of public policy related expenditure decisions and financial management.

Performance audits in the portfolio have demonstrated the importance of reviewing and updating risk policies, assessments and registers, implementing rigorous performance measurement and reporting, and conducting evaluations to ensure activities are meeting the intended objectives.

The department provides funding to state and territory government through Federation Funding Agreements for a range of programs. These arrangements should still follow appropriate processes and support sound funding decisions.

Implementation of the sustainability reporting framework and assurance regime in Australia is progressing. Climate-related disclosures under the Corporations Act 2001 apply to certain entities. NBN Co Limited and Australian Rail Track Corporation Limited is required to prepare a sustainability report under these arrangements commencing the 2025–26 financial year. The sustainability report will require these entities to disclose information about climate-related risks and opportunities that could reasonably be expected to affect cash flows, access to finance or cost of capital. Sustainability reports will be subject to assurance and entities should review their preparedness to meet these requirements in order to support accurate and timely reporting and audit.

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Grants administration

The portfolio awards and administers significant amounts of grant funding. In 2023–24 the department administered an total of $5.38 billion in grant funding expenditure. Audits into grant administration identified key risks around funding decisions and measuring performance that apply to future grants programs and other parts of the department’s business, for example:

- there are risks where assessment of grant applications does not verify the claims of applicants or ensures the assessment criteria are applied in full and in line with program guidelines.

- it is important to provide clear funding recommendations to the decision-maker that are consistent with assessment outcomes.

- to ensure the objectives of a grant program are being met and to assist with performance reporting against these objectives, it is essential that measurable targets are developed.

Procurement

Several portfolio policy and program outcomes are delivered through procurement activities — including to support large-scale implementation of infrastructure through portfolio bodies. Between 1 July 2024 and 28 April 2025 the department awarded 1106 contracts totalling $408.1 million. Audit work across the portfolio has highlighted risk around entities demonstrating value for money, complying with the Commonwealth Procurement Rules and managing contracts appropriately.

Regulation

A number of portfolio entities have regulatory responsibilities, predominantly in air, land and sea transport safety, as well as sport, media and communications. Regulation must remain fit for purpose and achieve intended outcomes to maintain public trust and achieve the desired outcomes. These entities also need to ensure they prioritise compliance, enforcement, and assurance activities where appropriate. These activities should be risk based and data driven.

Financial management

The Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts has a number of administered advances and loans receivables ($3.93 billion as at 30 June 2024) primarily which includes advances and loans to Northern Australia Infrastructure Facility ($1.64 billion) and WestConnex ($2.26 billion). The measurement of these administered loans and advances involves an increased level of judgement applied to determine the market interest rates and assessment of impairment.

The valuation of the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts’ administered investments ($41.6 billion as at 30 June 2024) encompasses the use of valuation and estimation techniques which are inherently complex due to the increased level of management judgement required to estimate key inputs and are sensitive to incremental changes in key assumptions. Additionally, there is increased estimation uncertainty for some income based discounted cash flow valuations, particularly cash flow forecasts applied in models.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio were included in tabled ANAO performance audits 33 times. The conclusions directed toward entities within this portfolio were as follows:

- one was unqualified;

- 18 were qualified (largely positive);

- nine were qualified (partly positive); and

- five were adverse.

Figure 2 shows the number of audit conclusions for entities within the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audit

The audit of the 2024–25 Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts (DITRDCSA) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DITRDCSA is in its third year of inclusion in the annual performance statements program and the engagement has been assessed as moderate risk. This is due to:

- The 2023–24 audit opinion was unqualified.

- Audit findings from 2023–24 are not yet resolved.

- DITRDCSA’s complex operating environment, including recent government reviews of the Infrastructure Investment Program.

- A small number of new performance measures needing more detailed review.

Key risks for the department’s performance statements that the ANAO has highlighted include the:

- appropriateness of performance measures and targets, focusing on new measures and targets; and

- completeness and relevance of performance reporting.

Financial statements audits

Overview

Entities within the Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Infrastructure, Transport, Regional Development, Communications, Sport and the Arts portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts |

Non-corporate |

Moderate |

1 |

3 |

|

Airservices Australia |

Corporate |

Moderate |

2 |

3 |

|

Australian Broadcasting Corporation |

Corporate |

Moderate |

0 |

1 |

|

Australian Communications and Media Authority |

Non-Corporate |

Low |

1 |

0 |

|

Australian Postal Corporation |

Corporate |

Moderate |

3 |

0 |

|

Australian Rail Track Corporation Limited |

Company |

High |

3 |

3 |

|

National Archives of Australia |

Non-corporate |

Low |

1 |

0 |

|

National Capital Authority |

Non-corporate |

Low |

0 |

2 |

|

National Gallery of Australia |

Corporate |

Moderate |

1 |

1 |

|

National Intermodal Corporation Limited |

Company |

High |

1 |

6 |

|

National Library of Australia |

Corporate |

Low |

1 |

0 |

|

NBN Co Limited |

Company |

High |

3 |

3 |

|

WSA Co Limited |

Company |

Moderate |

1 |

1 |

|

Non-material entities |

||||

|

Creative Australia |

Corporate |

Low |

||

|

Australian Film, Television and Radio School |

Corporate |

Low |

||

|

Australian Maritime Safety Authority |

Corporate |

Low |

||

|

Australian National Maritime Museum |

Corporate |

Moderate |

||

|

Australian Sports Commission |

Corporate |

Moderate |

||

|

Australian Sports Foundation Limited |

Company |

Low |

||

|

Australian Transport Safety Bureau |

Non-corporate |

Low |

||

|

Sport Integrity Australia |

Non-corporate |

Low |

||

|

Bundanon Trust |

Company |

High |

||

|

Civil Aviation Safety Authority |

Corporate |

Low |

||

|

Infrastructure Australia |

Corporate |

Low |

||

|

High Speed Rail Authority |

Corporate |

Low |

||

|

National Film and Sound Archive of Australia |

Corporate |

Low |

||

|

National Museum of Australia |

Corporate |

Low |

||

|

National Portrait Gallery of Australia |

Corporate |

Low |

||

|

National Transport Commission |

Corporate |

Low |

||

|

Northern Australia Infrastructure Facility |

Corporate |

Moderate |

||

|

Old Parliament House |

Corporate |

Low |

||

|

Screen Australia |

Corporate |

Low |

||

|

Special Broadcasting Service Corporation |

Corporate |

Low |

||

|

Other audit engagements (including Auditor-General Act 1997 section 20 engagements) |

||||

|

Australia Post Services Pty Ltd – Australian financial services licence compliance |

||||

|

Australian Postal Corporation – half-year review |

||||

|

Australian Postal Corporation – prescribed performance standards |

||||

|

Australian Postal Corporation – key management personnel remuneration report – agreed-upon procedures |

||||

|

Australian Postal Corporation – highly paid staff remuneration report – agreed-upon procedures |

||||

|

Australian Rail Track Corporation – grant compliance audit |

||||

|

Bundanon Trust Charitable Fund Raising Act 1991 (NSW) – compliance audit |

||||

|

NBN Co Limited – half-year review |

||||

|

Norfolk Island Health and Residential Aged Care Service |

||||

Material entities

Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts

The Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts is responsible for improving infrastructure across Australia through funding coordination of transport and other infrastructure; providing an efficient, sustainable, competitive and safe transport system for all transport users; strengthening the sustainability, capacity and diversity of regional economies; providing advice on population policy; and promoting an innovative and competitive communications sector. The department also promotes participation in and access to Australia’s arts and culture through developing and supporting cultural expression and supports governance arrangements in the Australian territories.

The Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts’ total budgeted assets for 2025–26 are $55.1 billion, with investments and receivables representing 89 per cent and nine per cent, respectively, as shown in Figure 4. Grants expenses represent 55 per cent of total budgeted expenses.

Figure 4: Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts’ total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are four key risks for the Department of Infrastructure, Transport, Regional Development, Communications, Sport and the Arts’ 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including two risks that the ANAO considers potential key audit matters (KAMs).

- Valuation of the Commonwealth’s investments in corporate Commonwealth entities and companies, particularly NBN Co Limited, Australian Postal Corporation, Australian Rail Track Corporation, Western Sydney Airport Co Limited and Airservices Australia, due to the complexity and sensitivity of the judgements applied to key inputs in the valuation process (particularly forecast cash flows, growth and discount factors), the impact of changing economic conditions on the valuation, and the significance of the investments balance to the financial statements. (KAM – Valuation of the administered investments)

- Valuation of advances and loans (particularly the loan facility to Northern Australia Infrastructure Facility and WestConnex), due to the judgements required in managing impairment and expected credit loss risks and when selecting the assumptions (particularly the selection of the market interest rate) used in the valuation models used for concessional loans. (KAM – Valuation of administered advances and loans)

- Management of, and accounting for, the department’s grant programs, due to the value, scale and diversity of these programs and their mode of delivery.

- Management of non-financial assets which includes a diverse range of non-financial assets which includes heritage and cultural items and regional broadband blackspot infrastructure. There are risks in accounting for these balances, given the sensitivity of inputs used to estimate fair value, specialisation, the age, location and condition of assets.

Airservices Australia

Airservices Australia is responsible for the provision of air navigation services across Australian and oceanic airspace, and the provision of aviation rescue firefighting services at major Australian airports. Supported by a national network of communications, surveillance and navigation facilities and infrastructure, Airservices Australia is funded through domestic charges levied on its customers and borrowings from debt markets.

Airservices Australia’s total actual revenues for 2023–24 were $1.1 billion, with 96 per cent of these revenues attributable to airways revenue, as shown in Figure 5. Assets under construction are attributable to 39 per cent of total assets, with property, plant and equipment attributable to 28 per cent.

Figure 5: Airservices Australia’s actual financial statements by category ($’000)

Source: ANAO analysis of Airservices Australia 2023–24 Annual Report.

Airservices Australia has five key risks for its 2024–25 financial statements.

- Completeness and accuracy of airways revenue, given the complexity of the flight traffic data and dependence on multiple information when generating customer invoices.

- Management of, and accounting for, assets under construction and existing, completed property, plant and equipment and intangibles. Capturing costs related to assets under construction and determining their appropriate treatment under relevant accounting standards is complex, due to the technical nature of those assets and the judgements involved in assessing whether costs can be capitalised. Valuation of completed asset infrastructure, which is a material balance, is sensitive to changes in the assumptions used in the valuation models.

- Valuation of defined benefit superannuation obligations and employee provisions. Judgement is applied by management in relation to the selection of long-term assumptions such as salary growth, discount and inflation rates.

- Valuation of provisions for legal obligations and associated contingencies associated with Aviation Rescue and Fire Fighting Services decontamination due to the uncertainty in remediation activities and judgement involved in determining cost inputs into the provision model.

- Recognition and measurement of Airservices Australia’s financial instruments, which require detailed disclosure that can be complex in nature.

Australian Broadcasting Corporation

The Australian Broadcasting Corporation (ABC) is primarily responsible for providing innovative and comprehensive broadcasting and digital media services of a high standard that contribute to a sense of national identity, inform and entertain audiences, and foster the performing arts.

ABC’s total budgeted assets for 2025–26 are $1.8 billion, with 40 per cent of these assets attributable to land and buildings, as shown in Figure 6.

Figure 6: Australian Broadcasting Corporation’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The ABC’s key risk for its 2024–25 financial statements is the accuracy and valuation of land and buildings, as the valuations are sensitive to changes in the assumptions used in the valuation models and contain highly specialised components.

Australian Communication and Media Authority

The Australian Communications and Media Authority (the ACMA) is Australia’s regulator for telecommunications, broadcasting, some online content and radiocommunications. The ACMA’s purpose is to maximise the economic and social benefits of communications infrastructure, services and content for Australia.

ACMA’s total budgeted revenues for 2025–26 are $1.6 billion, with 85 per cent of these revenues attributable to other taxes, as shown in Figure 7.

Figure 7: Australian Communication and Media Authority’s budgeted financial statements by category ($’000)

Note a: The ACMA’s budgeted financial statements include amounts pertaining to the operations of the eSatefy Commissioner, Australia’s independent regulator for online safety.

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

ACMA’s key risk for its 2024–25 financial statements relates to the accounting for revenue relating to radio communications and telecommunication levies, fees and charges and spectrum auctions. Revenue recognition involves the application of professional judgement in determining when to recognise revenue, in particular: the Regional Broadband Scheme tax levy charge is based on a carrier’s relevant internet connections per month, reported as part of an annual return to ACMA for assessment; and spectrum management is technically complex and involves licensing, auctions and trading.

Australian Postal Corporation

The Australian Postal Corporation (Australia Post) is a government business enterprise responsible for supplying postal services to Australia, including the distribution of letters and parcels in Australia and internationally.

Australia Post’s total actual liabilities for 2023–24 were $4.0 billion, with trade and other payables (encompassing unearned revenue) attributable to 35 per cent, as shown in Figure 8. Total actual assets are just over $6.1 billion, with 10 per cent of these attributable to the net superannuation asset.

Figure 8: Australian Postal Corporation’s actual financial statements by category ($’000)

Source: ANAO analysis the Australian Postal Corporation’s 2023–24 Annual Report.

There are three key risks for Australia Post’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, all of which the ANAO considers potential key audit matters (KAMs).

- The significant judgement required in estimating the amount of postage products sold which are still unused at balance sheet date. Revenue is recognised over time and requires an estimation of the expected timing and amount of future utilisation of those unused postage products. (KAM – Valuation of unearned revenue liability)

- The complexity of the valuation of the Australia Post Superannuation Scheme. The valuation of the net superannuation asset is sensitive to movements in the long-term assumptions. Judgement is applied by management in relation to the selection of long-term assumptions such as salary growth, discount and inflation rates. (KAM – Valuation of the net superannuation asset)

- The significant judgement applied in relation to the selection of assumptions such as the discount rate and cash flow forecasts supporting the valuation of goodwill. (KAM – Valuation of goodwill)

Australian Rail Track Corporation Limited

The Australian Rail Track Corporation (ARTC) is responsible for the development, maintenance, management and delivery of some of Australia’s major rail networks, including the national interstate rail network, the Hunter Valley coal rail network, and the construction of the Inland Rail network. In May 2017, the Australian Government announced it would invest substantial equity funding into ARTC for the company to deliver the Inland Rail. A commitment of further equity funding to deliver the project was announced by the Australian Government in October 2020. Inland Rail is a 1,700-kilometre rail line that will link Brisbane and Melbourne through regional Australia. On 1 July 2023, ARTC renamed its wholly owned subsidiary to Inland Rail Pty Ltd (IRPL). The purpose was to facilitate clear segregation between the construction of Inland Rail and ARTC operations. Operational separation was achieved on 1 May 2024 with operations for Inland Rail transferring to IRPL following ministerial approval.

ARTC’s total actual assets for 2023–24 were $4.3 billion, with 83 per cent of these assets attributable to property, plant and equipment, as shown in Figure 9. ARTC’s total actual revenues for 2023–24 were just over $1.0 billion, with 78 per cent of this revenue attributable to rail access charges.

Figure 9: Australian Rail Track Corporation Limited’s actual financial statements by category ($’000)

Source: ANAO analysis of the Australian Rail Track Corporation’s 2023–24 Annual Report.

The Australian Rail Track Corporation Ltd has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number of key areas of financial statement risk that will be in focus of the audit, that are subject to considerable judgement and significance of the use of estimate processes to determine key financial balances; and ongoing scrutiny by Parliament and the public particularly around the governance changes associated with the delivery of the Inland Rail project.

ARTC has six key risks for its 2024–25 financial statements:

- Valuation of the infrastructure rail network assets. This is a material balance for ARTC, is sensitive to changes in the assumptions used in the valuation models adopted and involves highly specialised components and forecasts. The ARTC have identified two distinct infrastructure asset groupings, being the National network and the Heavy Haul network, these replaced the previous groupings Interstate and Hunter Valley.

- Recognition of capital costs of expenditure on the Inland Rail network (under construction), given the scale of construction, complexity, and sensitivity of the judgments applied in the model used to determine impairment and capitalisation of these assets.

- Recognition and measurement of revenue for a number of income streams, as there are significant judgements exercised by management in estimating the amount of revenue to be recognised, especially for part of the Heavy Haul network that is regulated by the Australian Consumer and Competition Commission.

- Recognition and disclosure of transactions between ARTC and IRPL as governed by the arrangements between the two entities on a standalone and consolidated basis, including the impact on established assumptions.

- Valuation of the provision for incidents associated with damage caused by derailments, force majeure events etc. As the frequency and severity of these events increases, we focus on this area due to the level of judgement involved in estimating the provision.

- The taxation-related balances, as there is complexity and judgement involved in accounting for deferred tax balances.

National Archives of Australia

The National Archives of Australia is an Australian Government entity established under the Archives Act 1983. It sets information and data management policy and standards for Australian Government entities to meet in creating, retaining, maintaining, securing, preserving, appropriately disposing of, and providing appropriate access to trusted government information and data. The National Archives collects records of government decisions and actions.

The National Archives of Australia’s total budgeted assets for 2025–26 are $2.1 billion, with heritage and cultural assets representing 79 per cent, as shown in Figure 10.

Figure 10: National Archives of Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The key risk for the National Archives’ 2024–25 financial statements is the valuation of the national archival collection, due to its complex and unique nature.

National Capital Authority

The National Capital Authority (NCA) performs the role of trustee and manager of areas in Canberra and the Australian Capital Territory (ACT) that are designated as National Land for the special purpose of Canberra as Australia’s National Capital. The NCA shapes the future of Canberra for all Australians through the National Capital Plan and related planning and development work. The NCA also manages much of the National Estate such as Lake Burley Griffin, the National Triangle and Anzac Parade and encourages citizens and visitors to explore Canberra’s unique characteristics and special role as the National Capital.

The NCA’s total budgeted assets for 2025–26 are $1.6 billion, with 48 per cent of these assets attributable to land and buildings and 49 per cent attributable to property, plant and equipment, as shown in Figure 11.

Figure 11: National Capital Authority’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two moderate risks for the NCA’s 2024–25 financial statements.

- Valuation of Administered Non-Financial Assets, which involves judgement and expertise due to the unique nature of these items.

- Construction work in progress, which involves judgement and expertise, as works are often between defined construction milestones and therefore professional judgement is required to assess the value of works completed.

National Gallery of Australia

The National Gallery of Australia (the Gallery) is responsible for developing and maintaining a national collection of works of art to exhibit or to make available for others to exhibit and making the most advantageous use of the national collection in the national interest.

The Gallery’s total budgeted assets for 2025–26 are $7.6 billion, with 91 per cent of these assets attributable to heritage and cultural assets and seven per cent attributable to land and buildings, as shown in Figure 12.

Figure 12: National Gallery of Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are two key risks for the Gallery’s 2024–25 financial statements.

- Valuation of the heritage and cultural collection, which due to its unique nature, involves significant estimates and judgement requiring specialist expertise.

- Valuation of the Gallery land and building, as this is a specialised and restricted use asset with unique features requiring complex judgements.

National Intermodal Corporation Limited

National Intermodal Corporation Limited (National Intermodal) was originally established to oversee the development and future operation of the Moorebank Intermodal Precinct in Sydney’s south-west. Once completed the Moorebank Intermodal Precinct will have an import and export rail terminal with a direct link to Port Botany, as well as an interstate and regional facility to connect to the national rail freight network.

In February 2022, National Intermodal’s mandate was expanded to include the planning, delivery and operation of open access intermodal freight precincts in Melbourne and Brisbane in support of the Australian Government’s Inland Rail project with the objective of facilitating the development and operation of a modern and efficient freight network that improves productivity.

National Intermodal’s total actual assets for 2023–24 were just over $1.0 billion, with equity accounted investments and property plant and equipment accounting for 33 per cent and 31 per cent of the total respectively as shown in Figure 13. Total actual liabilities for 2023–24 were $154.3 million, with 94 per cent of these liabilities attributable to provisions.

Figure 13: National Intermodal Corporation Limited’s actual financial statements by category ($’000)

Source: ANAO analysis of the National Intermodal Corporation’s 2023–24 Annual Report.

There are seven key risks for National Intermodal’s 2024–25 financial statements:

- Valuation of provisions related to Moorebank Avenue works at the Moorebank Logistics Park, particularly due to the stage of development, work required for the completion of the project and judgement involved in determining cost inputs into the provision model.

- Valuation of the investment in Moorebank Precinct Land Trust (equity accounted investment). The investment is measured using a discounted cash flow valuation model which includes a number of sensitive assumptions and estimates.

- Capitalisation and recoverability of assets under construction for Beveridge Intermodal Freight Terminal and recoverability of assets under construction.

- Valuation and recoverability of non-financial assets, due to the judgement applied to determine the value of capitalised costs.

- Valuation of deferred tax assets due to judgement applied in determining recoverability of these assets against future taxable profits and nature of the judgement applied related to the apportionment of deductible costs.

- Valuation of the investment in Moorebank Interstate Terminal Pty Ltd. The investment is recognised as a joint venture, the performance thereof is measured using a discounted cash flow valuation model which includes a number of sensitive assumptions and estimates.

- Continued use of the going concern assumption, given the costs required to fulfil contractual commitments on remaining capital works may exceed funds provided by the Commonwealth or through debt facilities.

National Library of Australia

The National Library of Australia (NLA) is responsible for developing and maintaining a national collection of library material, including a comprehensive collection of material relating to Australia and the Australian people, and for making this material available to the public.

NLA’s total budgeted assets for 2025–26 are $1.7 billion, with 68 per cent of these assets attributable to heritage and cultural assets, as shown in Figure 14.

Figure 14: National Library of Australia’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The NLA’s key risk for its 2024–25 financial statements is the valuation of the national collection, land and buildings, due to the materiality of the balance and the judgement required in selecting the assumptions used in determining the fair value of cultural and heritage assets.

NBN Co Limited

The primary objective of NBN Co Limited is to provide wholesale services to internet service providers. NBN Co is a government business enterprise incorporated under the Corporations Act 2001.

NBN’s total actual revenues for 2023–24 were $5.7 billion, with 97 per cent attributable to telecommunications revenue, as shown in Figure 15. Property, plant and equipment and intangible assets attributed to 91 per cent of total assets, with the associated depreciation and amortisation attributable to 48 per cent of total expenses.

Figure 15: NBN Co Limited’s actual financial statements by category ($’000)

Source: ANAO analysis of NBN Co Limited’s 2023–24 Annual Report.

NBN Co Limited has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as the ongoing investment in network upgrades; the regulated nature of the industry in which NBN Co operates; NBN Co’s financial position as a highly leveraged organisation with exposure to external debt markets and a Singapore Exchange listing; and the risk of technological change to NBN Co’s business.

There are six key risks for NBN Co’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, including two risks that the ANAO considers potential key audit matters (KAMs).

- Management of, and accounting for, telecommunications revenue, which consists of a high volume of transactions and use of multiple systems. Further, fraud risk in revenue recognition is a presumed significant risk under the auditing standards. (KAM – accuracy and occurrence of telecommunications revenue)

- Estimation of useful lives and cost allocations in the depreciation and amortisation calculations for non-financial assets involves significant judgement and the use of complex depreciation models. (KAM – Accuracy and completeness of depreciation and amortisation expense)

- Valuation of property, plant and equipment (including network assets) and intangible assets as this is the most significant balance in the financial statements, and the accounting for network assets is subject to a high degree of judgement and complexity.

- Accounting for derivative financial instruments, due to the volume, quantum and complexity of the derivative arrangements entered into by NBN Co. Valuation of these derivative instruments remains complex due to the key assumptions involved in the calculation, including benchmark curves and credit adjustments. There are also complexities associated with financial statements disclosures around NBN Co’s derivatives.

- Management of, and accounting for, non-telecommunications revenue which relies on the use of manual processes and judgement to determine the recognition of revenue based on the contractual terms of each project.

- The completeness and valuation of construction liabilities, due to the reliance on manual processes supporting the calculation.

WSA Co Limited

WSA Co Limited was established to construct and operate Western Sydney International (Nancy-Bird Walton) Airport in Badgerys Creek, in south-western Sydney, to the functional specifications determined by the Australian Government. WSA Co Limited is a government business enterprise wholly owned by the Australian Government, represented by the Minister for Finance and the Minister for Infrastructure, Transport, Regional Development and Local Government as shareholder ministers.

WSA’s total actual assets for 2023–24 were $3.1 billion, with 92 per cent attributable to property plant and equipment, as shown in Figure 16.

Figure 16: WSA Co Limited’s actual financial statements by category ($’000)

Source: ANAO analysis of WSA’s 2023–24 Annual Report.

WSA Co Limited has two key risks for its 2024–25 financial statements.

- The recognition and measurement of capital expenditure that will be incurred in developing the airport, particularly the valuation of work in progress recognised during airport construction activities.

- The effectiveness of policies and processes for procurement, particularly relating to management of contracts for the delivery and cost management of runway, terminal and landside works packages given the material values of construction contracts and complexity of services delivered.