Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Entity overview

The National Disability Insurance Agency (NDIA) is part of the Health, Disability and Ageing portfolio. It was established under the National Disability Insurance Scheme Act 2013. The NDIA has responsibility for delivering the National Disability Insurance Scheme (the Scheme or NDIS). The Scheme is designed to support individuals with significant and permanent disability (participants) to be more independent and engage socially and economically by providing reasonable and necessary disability related supports. Further information is available from the National Disability Insurance Scheme website.

In the 2025–26 Portfolio Budget Statements (PBS) for the Social Services portfolio, the aggregated budgeted expenses for the NDIA for 2025–26 total $52.7 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

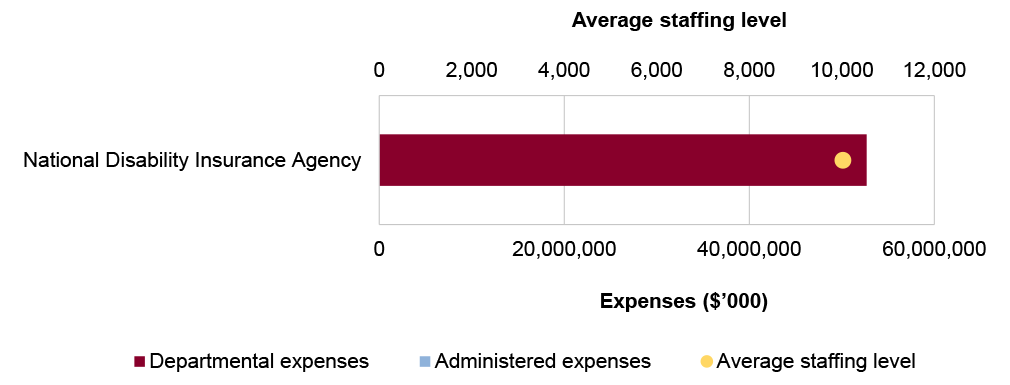

The level of budgeted departmental expenses, and the average staffing levels are shown in Figure 1. The NDIA only receives departmental appropriations.

Figure 1: National Disability Insurance Agency – total expenses and average staffing level

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The primary risks identified for the NDIA relate to its ability to maintain scheme integrity and financial sustainability in the context of achieving the Australian Government’s eight per cent growth target from 2026. Robust governance and risk management practices are required as it implements legislative and policy changes from recommendations accepted by the Australian Government from the Royal Commission into the Royal Commission into Violence, Abuse, Neglect and Exploitation of People with Disability and the Independent Review into the NDIS.

Specific risks in the NDIA relate to governance, service delivery, procurement and financial management, including fraud and payment compliance as well as implementation of its replacement client relationship management (CRM) system.

Governance

The Scheme represents a significant financial commitment by all Australian governments. The 2023–24 Annual Financial Sustainability Report indicated ‘projected Scheme expenses on an accrual basis are $46.9 billion in 2024–25, increasing to $92.7 billion in 2033–34’. The NDIA needs to manage the financial sustainability risks of the Scheme through effective decision-making controls, including ensuring supports approved in participant plans are reasonable and necessary. Audit work has also identified that there are no performance measures relating to the NDIA’s management of fraud and non-compliance, which is a key component of its purpose of delivering a financially sustainable National Disability Insurance Scheme (NDIS) and a legislative function under the National Disability Insurance Scheme Act 2013.

Audit work has identified that the NDIA’s risk-based business assurance practices for payments are still developing. The NDIA’s effective detection and prevention of fraud and non-compliance is integral to maintain scheme integrity and sustainability.

It is important for entities to have effective risk management practices for cyber security. This includes conducting assessments of the effectiveness of security controls, security awareness training, and adopting a risk-based approach to prioritise improvements to cyber security. Weaknesses in the implementation and operation of governance and monitoring processes relating to cyber security increase the risk of unauthorised access to systems and data held by entities.

The NDIA needs to work effectively with the NDIS Quality and Safeguards Commission in relation to monitoring and mitigating disability provider-related risks.

Outsourcing service delivery, such as the National Contact Centre and shared services arrangements with Services Australia, does not reduce accountability. The NDIA needs to ensure that service and quality control expectations and performance measures are agreed, documented in fit for purpose agreements and regularly monitored. The NDIA will need to closely monitor third party service delivery as it continues to implement its new ICT system, known as PACE, across its national operations.

Embedding robust governance policies and processes remains a risk in an organisation with significant Board and executive turnover.

Machinery of Government changes require close management to ensure continuity of business, management of risk and cost and support to the government, employees and stakeholders.

Service delivery

The NDIA needs to provide assurance that its systems, workforce and data capabilities are effectively supporting participants. Audit work has identified:

- deficiencies in the NDIA’s analysis of feedback and collected data to drive continuous improvement, particularly in relation to participant outcomes and complaints; and

- incomplete implementation of prior ANAO recommendations relating to decision making controls, particularly in relation to the development of participant plans.

Procurement

The ‘Independent Review of Services Australia and NDIA Procurement and Contracting’ report published in March 2023 contains 12 recommendations for the NDIA relating to the use of limited tenders, transparency, conflict of interest, documentation of the rationale for decisions, use of probity and legal advisors, ministerial briefings and procurement training. The Joint Committee of Public Accounts and Audit tabled its report from its inquiry into procurement at Services Australia and NDIA on 26 June 2024. This report contained three recommendations directed to the NDIA. The NDIA reported in December 2024 that one recommendation remained outstanding — relating to implementing a new records management solution.

Delivery of the Scheme is supported by Local Area Coordinators and early childhood partners who are engaged through the Partners in the Community Program. The total value of the 28 Partners in the Community Program contracts reported to December 2024 was $2.76 billion. Procurement of service delivery partners needs to demonstrate value for money and comply with the relevant framework.

Financial management

Actuarial forecasts for the scheme have been variable and usually adjusted upwards, above original estimates. There is considerable growth in the cost attributable to higher volumes of participants and the rate of plan costs year on year. Reliable measurement and monitoring of assumptions and calculations underpinning the costs of the Scheme will be critical to meeting the Australian Government’s growth target for the NDIS of no more than eight per cent by 2026.

Risks in the preparation of financial statements arise from the volume and complexity of payments made to participants and providers, the valuation of participant plan provisions and the accounting for in-kind contributions provided by the Commonwealth or state and territory governments.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 the National Disability Insurance Agency was included in seven performance audits. The conclusions directed toward the National Disability Insurance Agency were as follows:

- none were unqualified;

- two were qualified (largely positive);

- five were qualified (partly positive); and

- none were adverse.

Figure 2 shows the number of audit conclusions for the National Disability Insurance Agency that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: the National Disability Insurance Agency compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving the National Disability Insurance Agency.

Figure 3: Audit conclusions by activity for audits involving the National Disability Insurance Agency, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audits

The audit of the 2024–25 National Disability Insurance Agency (NDIA) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997. The NDIA is in its second year of inclusion in the annual performance statements audit program.

The ANAO considers the risk associated with the NDIA’s performance statements audit as high. This is due to the number and quantum of key areas of performance statements risk that will be a focus of the audit, as well as, the: level of external scrutiny of the National Disability Insurance Scheme (the Scheme); changes to the NDIA’s purposes and performance measures; recent amendments to the NDIS Act and associated rules including changes to its legislative functions; and the complex decision-making required in the operation of the Scheme, which is supported by a complex and partially outsourced IT environment. Key risks for the NDIA’s performance statements that the ANAO has highlighted include:

- data governance and management;

- completeness of performance measures and targets;

- appropriateness of performance measures; and

- the maturity of performance statements preparation processes.

Financial statements audits

Overview

The National Disability Insurance Agency is part of the Health, Disability and Ageing portfolio. The National Disability Insurance Agency’s risk profile is shown in Table 1.

Table 1: National Disability Insurance Agency risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entity |

||||

|

National Disability Insurance Agency |

Corporate |

High |

3 |

1 |

Material entities

National Disability Insurance Agency

The NDIA was established under the National Disability Insurance Scheme Act 2013. The NDIA has responsibility for delivering the Scheme. The Scheme is designed to support individuals with a significant and permanent disability (participants) to be more independent and engage socially and economically by providing reasonable and necessary disability related supports.

The NDIA’s total budgeted expenses for 2025–26 are $52.7 billion, with 95 per cent of these attributable to participant plan expenses, as shown in Figure 4. Participant plan provisions account for 72 per cent of total liabilities.

Figure 4: National Disability Insurance Agency’s budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The National Disability Insurance Agency has been classified by the ANAO as a higher risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as, the: level of external scrutiny of the National Disability Insurance Scheme (the Scheme); recent amendments to the NDIS Act and associated rules; and the complex decision-making required in the operation of the Scheme, which is supported by a complex and partially outsourced IT environment. There are four key risks for the National Disability Insurance Agency’s 2024–25 financial statements that the ANAO has highlighted for specific audit coverage and consideration, including three as potential key audit matters (KAMs).

- The volume and complexity of payments made to participants and providers. (KAM – Accuracy and occurrence of participant plan expenses)

- The significant judgement and assumptions required in the actuarial estimate of outstanding claims at year-end. (KAM – Valuation of participant plan provisions)

- The recognition of in-kind contributions due to reliance on data from the States and Territories around agreed services provided to people with a disability. Contributions are accounted for as revenue received free of charge at the date the services are provided. The use of these services is also recognised as an equivalent expense. Terms and conditions for determining the cash and in-kind contributions for the funding of the Scheme are set out in the bilateral agreements between each State and Territory and the Commonwealth. (KAM – Completeness, occurrence and accuracy of in-kind revenue and expenses)

- Completeness and accuracy of data transitioned from SAP customer relationship management system to PACE (a new Salesforce-based customer relationship management system). The risk relates to whether the NDIA has controls over the transition of data and established systemised controls in line with business requirements.